Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JONES LANG LASALLE INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - JONES LANG LASALLE INC | dex991.htm |

Supplemental Information

Third Quarter

Earnings Call

2010

Exhibit 99.2 |

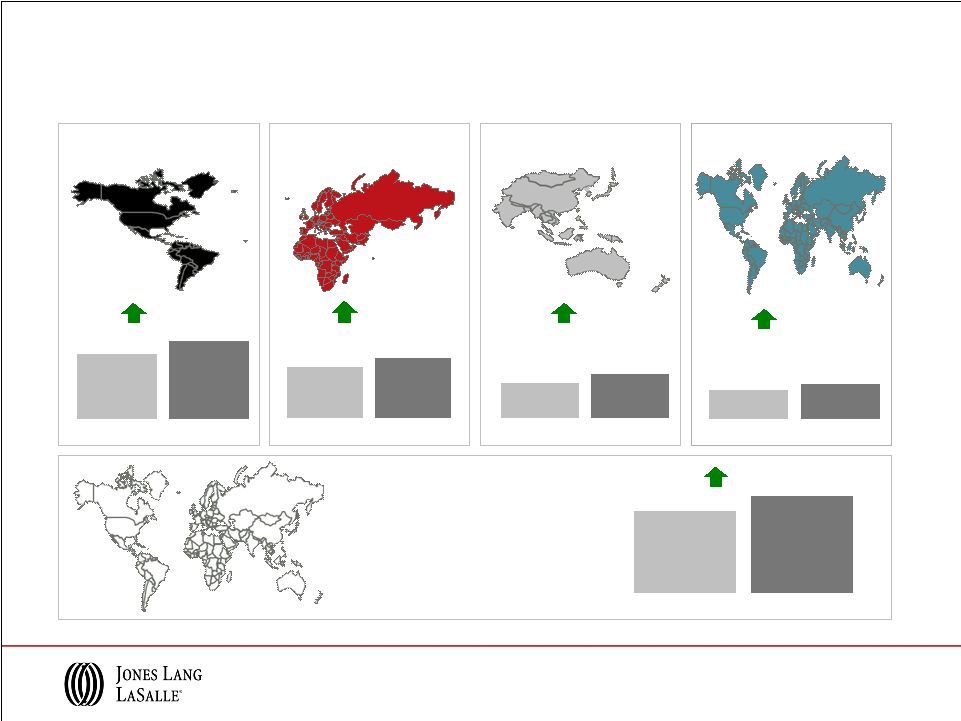

Market & Financial Overview |

London,

Washington DC

Paris,

Seoul

Hong Kong,

Shanghai

Beijing

Capital Value

growth slowing

Capital Value

growth

accelerating

Capital Value

bottoming out

Capital Value

falling

Americas

EMEA

Asia Pacific

Hong Kong

Detroit

Brussels,

Dallas

Shanghai

Capital Values

Q3 2009

Q3 2010

Capital Value

growth slowing

Capital Value

falling

Capital Value

growth

accelerating

Capital Value

bottoming out

Singapore, Toronto

As of Q3 2010

The

Jones

Lang

LaSalle

Property

Clocks

SM

Amsterdam, Milan, Sao Paulo,

Sydney

Berlin,

Mumbai,

New

York,

San

Francisco

Stockholm

Brussels, Moscow,

Paris,

Washington

DC

Amsterdam,

Milan,

Mumbai,

Sydney

Moscow,

New York,

Sao Paulo

Chicago, San Francisco,

Singapore,

Toronto

Beijing,

London,

Seoul

Berlin,

Philadelphia,

Stockholm,

Tokyo

Detroit, Philadelphia

Chicago, Dallas

Tokyo

3 |

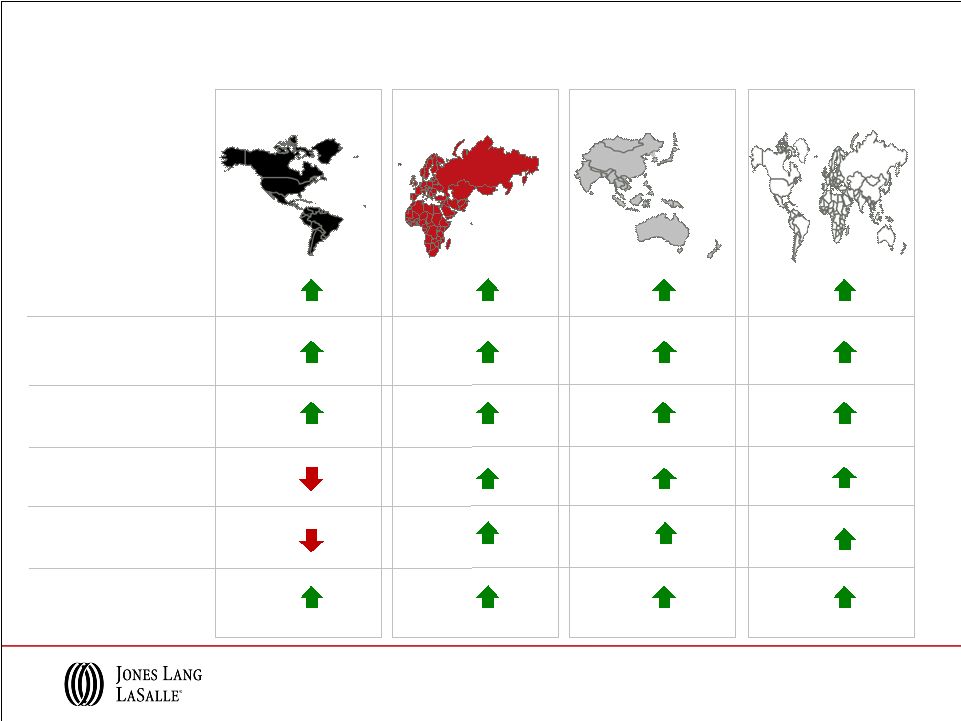

Paris,

Stockholm Rental growth

slowing

Rental growth

falling

Rental

growth

accelerating

Rents

bottoming

out

Americas

EMEA

Asia Pacific

Leasing Market Fundamentals

Q3 2009

London, Sydney

Amsterdam, Berlin,

Dallas,

Milan,

San Francisco

Los Angeles, New York

Hong Kong,

Mumbai

Atlanta, Detroit, Seoul

Shanghai

Q3 2010

Beijing,

Hong Kong

London

,

Shanghai

Milan

Chicago,

Rome,

Seoul

Rental growth

slowing

Rental growth

falling

Rental

growth

accelerating

Rents

bottoming

out

Detroit

Los Angeles,

New York

As of Q3 2010

The

Jones

Lang

LaSalle

Property

Clocks

SM

Brussels

Amsterdam,

Atlanta,

Dallas

Berlin, Mumbai,

San Francisco,

Sydney, Tokyo

Moscow,

Singapore,

Washington DC

Chicago,

Rome

Stockholm,

Washington DC

Brussels,

Singapore

Beijing,

Paris

Moscow,

Tokyo

4 |

Demonstrating Competitive Strength

5

Achieving Results on 2010 Priorities

•

Grow market share

–

Leasing

momentum

continues;

Q3

revenue

up

>

20%

in

local

currency

across

all

regions

–

Project & Development Services revenue up 25% in Q3

•

Improve operating income margins and maintain cost discipline

–

Adjusted operating income margin of 7.2% YTD, 4.3% in 2009

–

Compensation as a % of revenue is 65.4% YTD, 66.3% in 2009

–

Operating, administration and other as a % of revenue decreased 1.5% in Q3 and 1.0%

YTD •

Continue to build annuity revenue

–

Expand

corporate

outsourcing

leadership;

81

new

wins,

expansions

and

renewals

YTD

–

Property & Facility Management revenue up 10% in Q3 driven by 20% growth in

Americas •

LaSalle Investment Management: leverage global scale and market reputation

–

Strong pace of capital raised, $5.3 billion in net new capital commitments YTD

–

Well-positioned for emerging opportunities; $2.5 billion of investments made YTD,

$1.7 billion in Q3 •

Maintain strong financial position

–

Renewed bank credit facility, capacity increased to $1.1 billion; maturity extended to

September 2015 –

New pricing at LIBOR + 2.25% (all in ~ 2.50%)

–

Increased capacity provides strength, liquidity to meet current commitments and

capitalize on new opportunities |

Q3 Selected Business Wins and Expansions

MULTI-

REGIONAL

Sony Electronics 6M sf

Citi 28M sf

Senate Square, Washington DC $78M

International Paper 18M sf

Royal Palm, South Beach FL $126M

BBVA Compass 6M sf

Dassault Systèmes, Waltham MA 320k sf

Ally Financial 5M sf

Verisign, Reston VA 221k sf

Sheraton Chicago Hotel $158M

Southern Union Company, Houston TX 193k sf

Stanley Black & Decker 8M sf

The Lutetia, Paris €145M

O'Parinor Shopping Centre, Paris €223M

Turkish Retail

Grand Buildings, London £173M

Liber/Linklaters/Episerver, Sweden 101k sf

Bicocca, Milan €62M

Australian Federal Police 430k sf

Courtyard by Marriott, Gold Coast Australia $46M

Tyco Electronics, Shanghai 127k sf

HiTi Digital, Taiwan 420k sf

Direct Factory Outlets, Australia $473M

King & Wood PRC Lawyers, Beijing 97k sf

Galaxy Department Store, Taipei $95M

MARG, Chennai 116k sf

IBIS Bencoolen, Singapore

Agriculture Bank of China 328M sf

6 |

Third Quarter Financial Information |

8

Q3 2010 Revenue Performance

Note: Equity losses of $5.0M and $2.0M in 2009 and 2010, respectively, are included in

segment results, however, are excluded from Consolidated totals.

Americas

EMEA

Asia Pacific

$238.8

$309.1

2009

2010

29%

$154.2

$169.3

2009

2010

18%

$136.4

$165.0

2009

2010

15%

$63.0

$60.9

2009

2010

3%

Consolidated

$595.3

$708.4

2009

2010

20%

($ in millions; % change in local currency )

LIM |

Asia

Pacific 9

Q3 2010 Real Estate Services Revenue

Americas

EMEA

Leasing

Capital Markets &

Hotels

Property & Facility

Management

Project &

Development Services

Advisory, Consulting

& Other

Total RES

Operating Revenue

$152.6

$25.2

$62.6

$40.7

$28.0

$309.1

38%

127%

20%

16%

6%

29%

$47.8

$31.1

$32.6

$29.2

$28.6

$169.3

42%

11%

6%

20%

8%

18%

$35.2

$18.3

$75.6

$19.2

$16.7

$165.0

21%

13%

5%

69%

8%

15%

$235.6

$74.6

$170.8

$89.1

$73.3

$643.4

36%

34%

10%

25%

22%

Total RES

Revenue

2%

($ in millions; % change in local currency over Q3 2009)

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). |

10

YTD 2010 Revenue Performance

Note: Equity losses of $56.2M and $10.9M in 2009 and 2010, respectively, are included

in segment results, however, are excluded from Consolidated totals.

($ in millions; % change in local currency

)

Americas

EMEA

Asia Pacific

$686.9

$833.1

2009

2010

21%

$417.9

$491.4

2009

2010

21%

$360.5

$455.3

2009

2010

17%

$178.7

$144.1

2009

2010

21%

Consolidated

$1,665.6

$1,969.4

2009

2010

17%

LIM |

Asia

Pacific 11

YTD 2010 Real Estate Services Revenue

($ in millions; % change in local currency over YTD 2009)

Americas

EMEA

Leasing

Capital Markets &

Hotels

Property & Facility

Management

Project &

Development Services

Advisory, Consulting

& Other

Total RES

Operating Revenue

$410.2

$49.0

$182.7

$110.8

$80.1

$832.8

27%

97%

24%

4%

1%

21%

$133.4

$89.3

$102.3

$82.8

$83.6

$491.4

34%

34%

13%

16%

5%

20%

$97.1

$52.3

$214.4

$44.7

$46.8

$455.3

32%

55%

3%

33%

7%

16%

$640.7

$190.6

$499.4

$238.3

$210.5

$1,779.5

29%

52%

12%

8%

3%

19%

Total RES

Revenue

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). |

Separate

Account Management

(Firm’s co-investment =

$17.0M)

•

$19.0 billion of assets

under management

(16% increase from 2009)

(1)

AUM data reported on a one quarter lag

Fund Management

(Firm’s co-investment =

$160.0M)

•

$14.1 billion of assets

under management

(13% decline from 2009)

Public Securities

(Firm’s co-investment =

$0.1M)

•

$7.1 billion of assets

under management

(42% increase over 2009)

Q3 2010 Statistics

(1)

Q3 2010

YTD 2010

New Separate Accounts Mandates

$500

$4,200

Net New Equity for Funds and Public Securities

500

1,100

Net New Capital Commitments

$1,000

$5,300

Total AUM

$40.2 billion

Operating Revenue

LaSalle Investment Management

Premier global investment manager

1%

5%

Capital Raising Summary

($ in millions; % change in local currency )

12 |

Solid Cash Flows and Balance Sheet Position

•

Strong cash from earnings growth

•

Paid first deferred Staubach obligation

of

$76

million

(2)

•

Renewed and extended credit facility

-

Capacity increased to $1.1 billion,

previously $840 million

-

Maturity extended to September 2015

•

Investment grade ratings affirmed:

Standard & Poor’s:

BBB-

(Outlook: Stable)

Moody’s Investor Services:

Baa2

(Outlook: Stable)

YTD 2010 Highlights

Cash Flows

Q3 2010

YTD

Q3 2009

YTD

Cash from Earnings

$192

$135

Working Capital

(84)

(91)

Cash from Operations

$108

$44

Primary Uses

Capital Expenses

(1)

(23)

(31)

Acquisitions & Deferred Payment Obligations

(113)

(15)

Co-Investment

(25)

(26)

Dividends

(4)

(4)

Net Cash Outflows

($165)

($76)

Net Share Activity & Other Financing

(27)

192

Net Debt (Borrowings) / Repayments

($84)

$160

Balance Sheet

Q3 2010

Q3 2009

Cash

$72

$57

Short Term Borrowings

29

57

Credit Facilities

253

292

Net Bank Debt

$210

$292

Deferred Business Obligations

299

392

Total Net Debt

$509

$684

(1)

YTD Capital Expenditures for 2010 and 2009 net of tenant improvement allowances

received were $22 million and $25 million, respectively (2)

$78 million due less $2 million deferred in accordance with the merger agreement

13

($ in millions; % change in local currency ) |

Appendix |

15

Q3 2010 Adjusted EBITDA

*

Performance

Americas

EMEA

Asia Pacific

LIM

$38.9

$46.0

2009

2010

$1.4

$7.4

2009

2010

$10.4

$11.0

2009

2010

$14.5

$15.6

2009

2010

Consolidated

$66.2

$78.7

2009

2010

*

Refer

to

slide

18

for

Reconciliation

of

GAAP

Net

Income

(Loss)

to

EBITDA

and

adjusted

EBITDA

for

the

three

months

ended

September

30,

2010,

and

2009,

for

details

relative

to

these

adjusted

EBITDA

calculations.

Segment

adjusted

EBITDA

is

calculated

by

adding

the

segment’s

Depreciation

and

amortization

and

non-cash

co-investment

charges

to

its

reported

Operating

income

(loss),

which

excludes

Restructuring

charges.

Consolidated

adjusted

EBITDA

is

the

sum

of

the

adjusted

EBITDA

of

the

four

segments

less

net

income

attributable

to

non-controlling

interests

and

dividends

on

unvested

common

stock.

($ in millions) |

16

YTD 2010 Adjusted EBITDA

*

Performance

Americas

EMEA

Asia Pacific

$81.6

$105.2

2009

2010

($9.4)

$12.7

2009

2010

$15.4

$33.7

2009

2010

$42.6

$39.5

2009

2010

Consolidated

$126.4

$193.7

2009

2010

*

Refer

to

slide

18

for

Reconciliation

of

GAAP

Net

Income

(Loss)

to

EBITDA

and

adjusted

EBITDA

for

the

nine

months

ended

September

30,

2010,

and

2009,

for

details

relative

to

these

adjusted

EBITDA

calculations.

Segment

adjusted

EBITDA

is

calculated

by

adding

the

segment’s

Depreciation

and

amortization

and

non-cash

co-investment

charges

to

its

reported

Operating

income

(loss),

which

excludes

Restructuring

charges.

Consolidated

adjusted

EBITDA

is

the

sum

of

the

adjusted

EBITDA

of

the

four

segments

less

net

income

attributable

to

non-controlling

interests

and

dividends

on

unvested

common

stock.

($ in millions)

LIM |

17

($ in millions)

Reconciliation of GAAP Net Income (Loss) to

Adjusted Net Income

Note:

Basic

shares

outstanding

are

used

in

the

calculation

of

GAAP

EPS

for

the

nine

months

ending

September

30,

2009,

as

the

use

of

dilutive

shares

outstanding

would

cause

that

EPS

calculation

to

be

anti-dilutive.

2010

2009

2010

2009

GAAP net income (loss)

37.1

$

19.8

$

69.1

$

(56.1)

$

Shares (in 000's)

44,089

43,300

44,064

37,432

GAAP earnings (loss) per share

0.84

$

0.46

$

1.57

$

(1.50)

$

GAAP net income (loss)

37.1

$

19.8

$

69.1

$

(56.1)

$

Restructuring, net of tax

0.3

3.6

4.2

31.1

Non-cash co-investment charges, net of tax

0.7

3.2

7.4

40.4

Adjusted net income

38.1

$

26.6

$

80.7

$

15.4

$

Shares (in 000's)

44,089

43,300

44,064

38,880

Adjusted earnings per share

0.86

$

0.61

$

1.83

$

0.40

$

Three Months Ended

September 30,

Nine Months Ended

September 30, |

18

($ in millions)

Reconciliation of GAAP Net Income (Loss) to

EBITDA and Adjusted EBITDA

2010

2009

2010

2009

Net income (loss)

37.1

$

19.8

$

69.1

$

(56.1)

$

Interest expense, net of interest income

11.5

16.3

35.7

43.6

Provision (benefit) for income taxes

11.1

3.5

20.8

(9.8)

Depreciation and amortization

17.7

18.7

53.0

64.6

EBITDA

77.4

$

58.3

$

178.6

$

42.3

$

Non-cash co-investment charges

0.9

3.7

9.6

47.5

Restructuring

0.4

4.2

5.5

36.6

Adjusted EBITDA

78.7

$

66.2

$

193.7

$

126.4

$

Three Months Ended

September 30,

September 30,

Nine Months Ended |