Attached files

| file | filename |

|---|---|

| EX-7.1 - CATALYST GROUP HOLDINGS CORP. | ex5-1.htm |

| EX-5.2 - CATALYST GROUP HOLDINGS CORP. | ex5-2.htm |

| EX-23.1 - CATALYST GROUP HOLDINGS CORP. | ex23-1.htm |

As filed with the Securities and Exchange Commission on October __, 2010 Registration No. 333-164888

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CATALYST GROUP HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

6719

|

26-3142811

|

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification No.)

|

CATALYST GROUP HOLDINGS CORP.

1739 Creekstone Circle

San Jose, California 95133

(408) 691-0806

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

COPIES OF ALL COMMUNICATIONS TO:

Michael A. Littman, Attorney at Law

7609 Ralston Road, Arvada, CO, 80002 phone 303-422-8127 / fax 303-431-1567

Bob Bates, CPA HP Accounting

1819 Polk St. #314 San Francisco, CA 94109

617-549-9220 617-208-2968 fax

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

o

|

Smaller reporting company

|

x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities

To Be Registered

|

Amount to Be Registered

|

Proposed Maximum

Aggregate Offering Price Per Unit (1)

|

Proposed Maximum

Aggregate Offering Price

|

Amount of

Registration Fee (2)

|

||||

|

Common Stock, $0.001 par value per share

|

5,000,000 shares

|

$.50

|

$2,500,000

|

$178.25 (3)

|

|

(1)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933.

|

|

(2)

|

Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

|

| (3) | The registration fee of has been previously paid in connection with the initially filed registration statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

(SUBJECT TO COMPLETION)

CATALYST GROUP HOLDINGS CORP

PRELIMINARY PROSPECTUS

5,000,000 Shares of Common Stock to the Public

We are registering 5,000,000 shares of our common stock, par value $0.001 per share (“Common Stock”) by Catalyst Group Holdings Corp. (“Catalyst”, the “Company”, “we”, or “us”). We propose to sell the stock offered in this prospectus for $.50 per share. We intend to offer the 5,000,000 shares on behalf of our Company to the public on a best efforts basis, for up to 9 months after the effectiveness of the offering, thereafter deregistering any shares of such 5,000,000 shares remaining unsold to the public.

There is no market price for the stock and our pricing is arbitrary with no relation to market value, liquidation value, earnings or dividends. The price was arbitrarily set at $.50 per share, based on speculative concept unsupported by any other comparables. We have set the initial fixed prices as follows:

|

Title

|

Per Security

|

|

|

Common Stock

|

$.50

|

At any time after a market develops, our security holders may sell their securities at market prices or at any price in privately negotiated transactions.

Investing in our Common Stock involves risks. See “Risk Factors” starting on page 4.

These securities have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”) or any state or provincial securities commission, nor has the SEC or any state or provincial securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

We intend to have an application filed on our behalf by a market maker for approval of common stock for quotation on the Over-the Counter/Bulletin Board quotation system tradable separately, subject to effectiveness of the Registration Statement. It has not yet been filed, nor is there any selected broker/dealer as yet. Our common stock is presently not listed on any national securities exchange or the NASDAQ Stock Market or any other venue.

We are conducting this offering as a "self-underwriting" through our officers and directors, and therefore, we will pay no underwriting fees or commissions

1. We are not using an underwriter for this offering of shares.

2. We have no arrangement to place the proceeds from this offering in an escrow, trust or similar account. Any funds raised from sales of shares to the public pursuant to this offering will be immediately available to us for our use and retained by us regardless of whether or not there are any additional sales under this offering.

This offering will be on a continuous and best efforts basis. Shares offered by us, to the public, up to 5,000,000 shares will only be offered for a period for up to 9 months after the effectiveness of the offering with any unsold shares from such 5,000,000 offered, being deregistered. The offering does not have a minimum or maximum purchase.

We will receive proceeds at $.50 per share from sale of up to 5,000,000 shares to be offered for the first 9 months after the effectiveness of the offering.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the date that the registration statement relating to these securities, which has been filed with the Securities and Exchange Commission, becomes effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this Prospectus is October __, 2010.

|

Page

|

|

|

Prospectus Summary

|

1

|

|

Special Note Regarding Forward-Looking Statements

|

4

|

|

Risk Factors

|

4

|

|

Use of Proceeds

|

11

|

|

Determination of Offering Price

|

13

|

|

Plan of Distribution

|

14 |

|

Common Stock

|

15

|

|

Experts

|

15 |

|

Description of Business

|

16

|

|

Description of Property

|

21

|

|

Dividend Policy

|

22

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

23

|

|

Management

|

29

|

|

Executive Compensation

|

30

|

|

Principal Stockholders

|

32

|

|

Certain Relationships and Related Party Transactions

|

33

|

|

Real Estate Promotional Services Financial Statements: January 1, 2009-November 16, 2009

|

F-1 |

|

Catalyst Group Holdings Financial Statements: August 31, 2009 and 2008

|

|

|

Catalyst Group Holdings Financial Statements: February 28, 2010

|

Securities offered through this prospectus will not be sold through dealers, but will be sold on a direct participation basis only.

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Common Stock. You should read this entire prospectus carefully, especially the “Risk Factors” section beginning on page 9 and our consolidated financial statements and the related notes appearing at the end of this prospectus, before making an investment decision. Unless the context otherwise requires, we use the terms “Catalyst,” “Company,” “we,” “us” and “our” in this prospectus to refer to Catalyst Group Holdings Corp. and its consolidated subsidiaries.

Some of the statements contained or incorporated by reference in this prospectus are “forward-looking statements.” These statements are based on the current expectations, forecasts, and assumptions of our management and are subject to various risks and uncertainties that could cause our actual results to differ materially from those expressed or implied by the forward-looking statements. Forward-looking statements are sometimes identified by language such as “believe,” “may,” “could,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “appear,” “future,” “likely,” “probably,” “suggest,” “goal,” “potential” and similar expressions and may also include references to plans, strategies, objectives, and anticipated future performance as well as other statements that are not strictly historical in nature. The risks, uncertainties, and other factors that could cause our actual results to differ materially from those expressed or implied in this prospectus include, but are not limited to, those noted under the caption “Risk Factors” beginning on page 5 of this prospectus. Readers should carefully review this information as well as the risks and other uncertainties described in other filings we may make after the date of this prospectus with the Securities and Exchange Commission.

Readers are cautioned not to place undue reliance on forward-looking statements. They reflect opinions, assumptions, and estimates only as of the date they were made, and we undertake no obligation to publicly update or revise any forward-looking statements in this prospectus, whether as a result of new information, future events or circumstances, or otherwise.

You should read this Prospectus Summary together with the more detailed information contained in this prospectus, including the risk factors and financial statements and the notes to the financial statements. This prospectus contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those discussed in the forward-looking statements. Factors that might cause such a difference include those discussed in the Risk Factors section and elsewhere in this prospectus.

History

We were incorporated in the State of Delaware in August, 2008. Before September 9, 2009, our corporate name was Pop Starz Ventures 3, Inc. We had only nominal assets and operations and were therefore classified as a shell and blank check company. On September 9, 2009, Catalyst Financial Group, Inc. paid $19,000 for 945,000 shares of common stock. This represented 90.4% of the total shares outstanding. Immediately following the closing of this purchase, Michelle Tucker resigned her position as director and President of the Company and Ken Green was appointed sole director and sole officer of the Company.

Our principal executive offices are located at 1739 Creekstone Circle, San Jose, California 95133. Our phone number is (408) 691 – 0806. Our fiscal year end is August 31st.

We intend to operate as a holding company. We intend to seek, investigate and, if such investigation warrants, acquire an interest in business opportunities presented to us by persons or firms which desire to seek the advantages of an issuer that is registered with the Securities and Exchange Commission (SEC) under the Securities Act of 1934 (the “1934 Act”). We believe that being a 1934 Act Company will provide greater liquidity to potential business opportunities and will allow us a measurement of flexibility in the structure of the transactions with potential business opportunities that a private company does not have. We intend to acquire either 100% interest or a majority interest in any potential acquisition. We do not intend to acquire minority interests in any firms. We intend to closely monitor our activities to assure that we do not acquire any equity holdings that are greater than 40% of our cash and assets, in order to assure that do not become classified as an Investment Company under the Investment Act of 1940. We intend to investigate those firms in related industries and market segments as our wholly-owned subsidiary, REPS. We anticipate that we may be able to participate in only one potential business venture because of our lack of financial resources. At this time of this filing we have not identified any possible acquisitions or entered into any agreements with any potential acquisition candidates.

-1-

On November 16, 2009, we entered into an agreement (the “Agreement”) with Real Estate Promotional Services, Inc., (“REPS”), a Florida corporation, whereby we agreed to purchase all of the issued and outstanding shares of common stock of REPS in consideration for the issuance of a convertible debenture in the amount of $250,000. The convertible note provides for interest at the rate of 10% per annum and was originally due and payable 12 months from the closing date of the transaction on November 16, 2009. The debenture may be converted into shares of the Company’s common stock at the conversion rate of $1.00 per share at the option of either the Company or by, Jeff Crowe, the Chief Executive Officer of REPS. Mr. Crowe has entered into a conversion agreement that provides for the note to be converted into 250,000 shares of common stock upon the effectiveness of this filing. The historical operations of the Company were conducted in a sole-proprietorship called REPS. The note was originally due on November 12, 2009. On May 12, 2010, the holder of the note agreed to extend the due date to November 12, 2010. The holder agreed to an extension, as the Company did not have adequate cash to pay the note and the holder was amendable to extending the due date of the note rather than converting the note into the Company’s common stock at that time.

As part of this transaction, in September 2009, we amended our Articles of Incorporation to change our name from Pop Starz Ventures 3, Inc. to Catalyst Group Holdings Corp. REPS is a subsidiary of the Company.

REPS

Real Estate Promotional Services, Inc., (“REPS”), was incorporated in November 2009 in the State of Florida. Through the convertible debenture offering, we purchased and own 100% of the issued and outstanding common stock of REPS.

REPS is a printing company that designs and delivers marketing collateral for the real estate industry and individual/small businesses. Our products include postcards, brochures, business cards, and web site development.

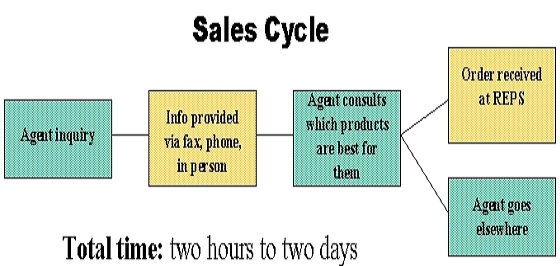

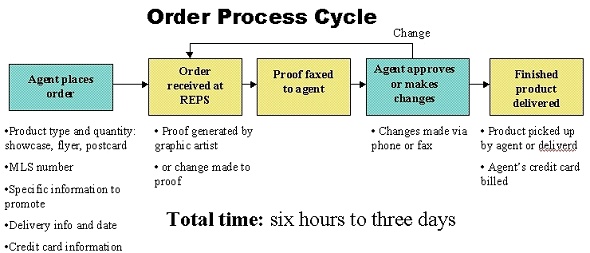

A large percentage of REPS’ revenue comes from real estate agents. REPS intends to diversify its client base to more individuals and small businesses. The sales cycle for REPS is very rapid; most orders are produced and sold in two days. As a result, REPS’ business is scalable.

The revenue for the nine months ended May 31, 2010 was $151,013 with ($152,903) in net losses (revenues of $82,851 and net losses of ($87,343) during the three months ended May 31, 2010). During the year ended August 31, 2009, the shell recognized a net loss of ($67,881).

Our Auditors have issued a going concern opinion and the reasons noted for issuing the opinion are our lack of revenues and modest capital.

Factors that make this offering highly speculative or risky are:

|

·

|

There is no market for any securities;

|

|

·

|

We have had moderate revenues or sales;

|

Summary of Financial Information

|

As at May 31, 2010

|

||||

|

Total Assets

|

$ | 351,974 | ||

|

Total Liabilities

|

$ | 385,447 | ||

|

Stockholders’ Deficit

|

$ | (33,473 | ) | |

|

For the Three Months Ended May 31, 2010

|

||||

|

Revenues

|

$ | 82,851 | ||

|

Net Loss

|

$ | (87,343 | ) | |

|

For the Nine Months Ended May 31, 2010

|

||||

|

Revenues

|

$ | 151,013 | ||

|

Net Loss

|

$ | (152,903 | ) | |

-2-

As of May 31, 2010, accumulated deficit for our business was ($223,638). We anticipate that we will operate in a deficit position and continue to sustain net losses for the foreseeable future.

Offering

In this offering, we are offering for sale to the public 5,000,000 shares of our common stock, $0.001 par value per share, for $.50 per share. We are selling these shares on a self-underwritten, best efforts basis. We intend to complete the sale of the 5,000,000 shares being offered to the public for up to 9 months after the effectiveness of the offering, subject to the filing of post-effective amendments with any unsold shares from such 5,000,000 offered, being deregistered after such time.

|

Shares of Common Stock issued and outstanding as of September 30, 2010

|

1,775,771

|

|||

|

Total shares of Common Stock offered

|

5,000,000

|

|||

|

Total shares of Common Stock to be outstanding after the Offering (assuming all New Warrants have been exercised in cash)

|

6,775,771

|

A total of $2,500,000 may be raised by us if all shares offered by us are sold. The proceeds from this sale will be used for general working capital for Catalyst and REPS.

We are authorized to issue 100,000,000 shares of common stock. Our current shareholders, officers and directors collectively own 1,775,771 shares of restricted common stock. These shares were issued at prices of $.001 to $.01 per share for 1,775,771 shares.

There is currently no public market for our shares as they are not presently traded on any market or securities exchange.

An investment in our common stock is subject to significant risks. You should carefully consider the information set forth in the "Risk Factors" section of this prospectus as well as other information set forth in this prospectus, including our financial statements and related notes.

There is no minimum purchase requirement for prospective stockholders and no arrangement to place funds in an escrow, trust, or similar account. Because the funds are being placed in a general corporate account rather than an escrow account, creditors of the Company could try to attach, and ultimately be successful in obtaining or attaching the funds before the offering closes.

-3-

This prospectus contains forward-looking statements. All statements other than statements of historical facts contained in this prospectus, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. In many cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words.

These forward-looking statements are only predictions. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to materially differ from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. We have described in the “Risk Factors” section and elsewhere in this prospectus the principal risks and uncertainties that we believe could cause actual results to differ from these forward-looking statements. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as guarantees of future events.

The forward-looking statements in this prospectus represent our views as of the date of this prospectus. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we undertake no obligation to update any forward-looking statement to reflect events or developments after the date on which the statement is made or to reflect the occurrence of unanticipated events except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date after the date of this prospectus.

This prospectus also contains estimates and other statistical data prepared by independent parties and by us relating to market size and growth and other data about our industry. These estimates and data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates and data. We have not independently verified the statistical and other industry data generated by independent parties and contained in this prospectus. We believe and act as if all third-party data included in the prospectus is reliable. However, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk.

The following is a summary of certain material risks facing our business that should be carefully considered along with the other information contained or incorporated by reference in this prospectus. If any other material risks of which we are unaware later occur or become material, our business, financial condition, and operating results could be materially harmed.

Risks Related to our Business

We intend to operate as a holding company and do not have operations other than administrative activities and minimal capital available to fund potential acquisition activities.

Catalyst intends to operate as a holding company. At the time of this filing, our sole subsidiary is REPS with its operations in the printing industry. Catalyst’s operational activities are solely administrative in nature. We do intend in the future to identify other potential acquisitions, but have not at this time due to our limited capital resources. We do not intend nor have any plans for REPS to declare cash dividends to Catalyst in order to cover the Company’s operating expenses. Our administrative activities to date have been funded by the sale of our common stock and debt financing. We cannot make any assurances that we will be able to continue to fund our activities in such manner.

We intend to seek, investigate and, if such investigation warrants, acquire an interest in business opportunities presented to us by persons or firms which desire to seek the advantages of an issuer that is registered with the Securities and Exchange Commission (SEC) under the Securities Act of 1934 (the “1934 Act”). We believe that being a 1934 Act Company will provide greater liquidity to potential business opportunities and will allow us a measurement of flexibility in the structure of the transactions with potential business opportunities that a private company does not have. We intend to acquire either 100% interest or a majority interest in any potential acquisition. We do not intend to acquire minority interests in any firms. We intend to closely monitor our activities to assure that we do not acquire any equity holdings that are greater than 40% of our cash and assets, in order to assure that do not become classified as an Investment Company under the Investment Act of 1940. We intend to investigate those firms in related industries and market segments as our wholly-owned subsidiary, REPS, and various other service segments.

-4-

Funds raised in this offering are available for immediate use and at the discretion of our management.

The funds raised from this offering of our common stock will be available to the Company for immediate use and such uses as to be determined by our management. Only Ken Green and Bob Bates, our officers and directors, will have access to the funds raised. You will not have the right to withdraw your funds during the offering.

We cannot provide any assurances that existing creditors of the Company will not garnish any such funds for payment of amounts owed to them.

Our revenues and profitability are heavily dependent on prevailing prices for our products and raw materials; if we are unable to pass cost increases along to our customers our margins and operating income may decrease.

REPS’ revenue, gross margins and cash flow from operations are substantially dependent on the prevailing prices we receive for our products and the cost of our raw materials, neither of which we control. The factors influencing the sales price of printed materials include the supply price of paper and demand of our products and competition.

The price of paper, our principal raw material, is subject to market volatility as a result of numerous factors including, but not limited to, general economic conditions, weather, transportation delays and other uncertainties that are beyond our control. Due to such market volatility, we generally do not, nor do we expect to, have long-term contracts with our suppliers. As a result, we cannot assure you that the necessary raw materials will continue to be available to us at prices currently in effect or acceptable to us. In the event raw material prices increase materially, we may not be able to adjust our product prices, especially in the short-term, to recover such cost increases. If we are not able to effectively pass these cost increases along to our customers, our margins will decrease and our operating income will suffer accordingly.

Our inability to continue to market our existing products and develop new products to satisfy our consumers’ changing preferences could materially adversely affect our operations and revenues.

The printing industry is subject to changing consumer preferences. Increase in use of Internet marketing and other shifts in consumer preferences may adversely affect us if we misjudge such preferences. In addition, sales are substantially dependent upon awareness and market acceptance of our products and brand by our targeted consumers. We may be unable to achieve volume growth through product and packaging initiatives. We also may be unable to penetrate new markets. If our revenues decline, our business, financial condition and results of operations will be adversely affected.

The recent downturn in the real estate industry has had and may continue to have an adverse effect on our business

Approximately 80% of REPS’ revenues come from sales to real estate agents in the San Francisco Bay area. The real estate industry in general, and in California in particular, has been significantly affected by the recent economic downturn. The decline in sales volume in the San Francisco Bay area has led to a decline in sales for REPS’ products. If these economic conditions continue, then REPS’ revenues could continue to decrease.

We have a minimal operating history, so investors have no way to gauge our long term performance.

REP’S was formed in 1998. During the nine months ended May 31, 2010, we recognized revenues of $151,103 from REP’s operational activities ($82,851 during the three months ended May 31, 2010.) During the nine months ended May 31, 2010, we recognized a net loss of ($152,903) on a consolidated basis ($87,343 during the three months ended May 31, 2010). We must be regarded as a development venture with all of the unforeseen costs, expenses, problems, and difficulties to which such ventures are subject. Our venture must be considered highly speculative.

-5-

Our success depends substantially on the continued retention of certain key personnel and our ability to hire and retain qualified personnel in the future to support our growth.

If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions, we may not be able to replace them easily or at all. As a result, our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. While we depend on the abilities and participation of our current management team generally, we have a particular reliance upon Mr. Jeffrey Crowe, Chief Executive Officer of REPS. The loss of the services of Mr. Crowe for any reason could significantly impact our business and results of operations.

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

Our management team lacks public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”). Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately respond to the increased legal, regulatory and reporting requirements associated with being a publicly traded company. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties and distract our management from attending to the growth of our business.

Our officers and directors may have conflicts of interest which may not be resolved favorably to us.

Certain conflicts of interest may exist between us and our officers and directors. Our Officers and Directors have other business interests to which they devote their attention and may be expected to continue to do so although management time should be devoted to our business. As a result, conflicts of interest may arise that can be resolved only through exercise of such judgment as is consistent with fiduciary duties to us.

We have agreed to indemnification of officers and directors as is provided by Delaware Statute.

Delaware Statutes provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney’s fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person’s promise to repay us therefore if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us that we will be unable to recoup.

Our directors’ liability to us and shareholders is limited

Delaware Statutes exclude personal liability of our directors and our stockholders for monetary damages for breach of fiduciary duty except in certain specified circumstances. Accordingly, we will have a much more limited right of action against our directors that otherwise would be the case. This provision does not affect the liability of any director under federal or applicable state securities laws.

We may depend upon outside advisors, who may not be available on reasonable terms and as needed.

To supplement the business experience of our officers and directors, we may be required to employ accountants, technical experts, appraisers, attorneys, or other consultants or advisors. Our Board without any input from stockholders will make the selection of any such advisors. Furthermore, we anticipate that such persons will be engaged on an “as needed” basis without a continuing fiduciary or other obligation to us. In the event we consider it necessary to hire outside advisors, we may elect to hire persons who are affiliates, if they are able to provide the required services.

-6-

We may not have adequate or effective internal accounting controls.

We are constantly striving to improve our internal accounting controls. We hope to develop adequate internal accounting controls to budget, forecast, manage and allocate our funds and account for them. There is no guarantee, however, that any such improvements will be adequate or successful or that such improvements will be carried out on a timely basis. REPS has historically had a basic, loosely controlled bookkeeping system. As a result of these factors, we may experience difficulty in establishing accounting and financial controls, collecting financial data, budgeting, managing our funds and preparing financial statements, books of account and corporate records and instituting business practices that meet the standards required by Generally Accepted Accounting Practices (“GAAP”) and the Securities and Exchange Commission (“SEC”).

SEC rules adopted pursuant to Section 404 of Sarbanes-Oxley require annual assessment of our internal control over financial reporting, by our management. The requirement that management perform an assessment of internal controls over financial reporting first applied to our Annual Report on Form 10-K for the fiscal year ending August 31, 2009 and the attestation requirement of management’s assessment by our independent registered public accountants will first apply to our Annual Report on Form 10-K for the fiscal year ending August 31, 2010. The standards that must be met for management to assess the internal control over financial reporting as effective are relatively new and complex, and require significant documentation, testing and possible remediation to meet the detailed standards. Our lack of budget to cover the costs associated with Section 404 implementation may cause us to declare an adverse opinion on the internal controls audit. If, in the future, management identifies one or more material weaknesses in our internal controls over financial reporting, or our external auditors are unable to attest that our management’s report is fairly stated or to express an opinion on the effectiveness of our internal controls, this could result in a loss of investor confidence in our financial reports, have an adverse effect on our stock price and/or subject us to sanctions or investigation by regulatory authorities.

Our operating history may not serve as an adequate basis to judge our future prospects and results of operations.

Although REPS revenues have grown since its inception, we cannot guarantee that we will maintain profitability or that we will not incur net losses in the future. We will continue to encounter risks and difficulties including the potential failure to:

|

•

|

obtain sufficient working capital to support our expansion;

|

|

•

|

expand our product offerings and maintain the high quality of our products;

|

|

•

|

manage our expanding operations and continue to fill customers’ orders on time;

|

|

•

|

maintain adequate control of our expenses allowing us to realize anticipated revenue growth;

|

|

•

|

implement our product development, marketing, sales, and acquisition strategies and adapt and modify them as needed;

|

|

•

|

Anticipate and adapt to changing conditions in the industry resulting from changes in mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics.

|

If we are not successful in addressing any or all of the foregoing risks, our business may be materially and adversely affected.

We will encounter substantial competition in our business and any failure to compete effectively could adversely affect our results of operations.

There are currently a number of well-established companies producing products that compete directly with our product offerings, and some of those competitors have significantly more financial and other resources than we possess. We anticipate that our competitors will continue to improve their products and to introduce new products with competitive price and performance characteristics. Aggressive marketing or pricing by our competitors or the entrance of new competitors into our markets could have a material adverse effect on our business, results of operations and financial condition.

-7-

We may not be able to successfully introduce new products, which could decrease our profitability.

Our future business and financial performance depends, in part, on our ability to successfully respond to consumer preference by introducing new products and improving existing products. We incur significant development and marketing costs in connection with the introduction of new products. Successfully launching and selling new products puts pressure on our sales and marketing resources, and we may fail to invest sufficient funds in order to market and sell a new product effectively. If we are not successful in marketing and selling new products, our results of operations could be materially adversely affected.

We may need additional capital to fund our future operations and, if it is not available when needed, we may need to reduce our planned development and marketing efforts, which may reduce our sales revenues.

We have limited funds, and such funds may not be adequate to carry out our business plan. Our ultimate success depends upon our ability to generate revenue. We currently have funds to complete our Registration Statement on Form S-1 and required funds to support limited short-term operational activities for the next three months. We anticipate that we will require capital of at least $50,000 to cover public reporting costs and financing efforts for the next 12 months, based on historical performance. We conserve our cash position by management not taking salaries and limiting our operational activities. Our subsidiary, REPS does generate revenue and is able to support its operations. The Company has no intentions, at this time, to use the capital of REPS to support its operations.

However, if cash from future operations is insufficient, or if cash is used for other currently unanticipated uses, we may need additional capital from outside sources. Our ability to raise capital in the future will depend on a number of factors, including our financial condition and results of operations and the conditions in the relevant financial markets. We cannot assure you that additional capital, if required, will be available on acceptable terms, or at all. If we are unable to obtain financing on a timely basis and on acceptable terms, we may be required to reduce the scope of our planned expansions, product development and marketing efforts, and in turn our financial position, competitive position, growth and profitability may be adversely affected.

To the extent that we do raise additional capital through the sale of equity or convertible debt securities, the issuance of such securities would result in dilution of the shares held by existing stockholders and could provide purchasers certain rights, preferences and privileges senior to our Common Stock.

We will incur expenses in connection with our SEC Filing Requirements and we may not be able to meet such costs, which could jeopardize our filing status with the SEC.

We expect to incur operational expenses as a result of becoming a public company in order to meet the filing requirements of the SEC. We may see an increase in our legal and accounting expenses as a result of such requirements. We estimate such costs on an annualized basis to be approximately $25,000, which includes both the annual audit and the review of the quarterly reports by our auditors. These costs can increase significantly if the Company is subject to comment from the SEC on its filings and/or we are required to file supplemental filings for transactions and activities. If we are not compliant in meeting the filing requirements of the SEC, we could lose our status as a 1934 Act Company, which could compromise our ability to raise funds and to apply for trading status on the public markets.

We may not be able to effectively control and manage our growth in order to meet demand, and a failure to do so could adversely affect our operations and financial condition.

If our business and markets continue to grow and develop, it will be necessary for us to finance and manage our growth effectively in order to meet demand. In addition, we may face challenges in expanding our current facilities, integrating acquired businesses with our own, and managing expanding product offerings. We may not respond quickly enough to the increased demands caused by such growth on our existing management, workforce and facilities. Failure to effectively deal with such increased demands could interrupt or adversely affect our operations and cause production backlogs, longer product development time frames and administrative inefficiencies.

-8-

We may not be able to raise sufficient capital to grow our business or continue operations.

We hope to raise $2,500,000 in this offering. However, even if we are able to sell the entire offering, this amount may not be enough to grow our business and fund our operations.

Risks Related to Our Common Stock

Our officers, directors and their relatives control us through their positions and stock ownership, and their interests may differ from other stockholders.

Ken Green is the President of Catalyst. As of September 30, 2010, Mr. Green beneficially owned 945,000 shares of our Common Stock or 53.2% of the issued and outstanding common stock. As a result, our officers and directors and their relatives are generally able to control the outcome of stockholder votes on various matters, including the election of directors and extraordinary corporate transactions, such as business combinations. The interests of our directors and officers may differ from other stockholders. Furthermore, the current ratios of ownership of our Common Stock reduce the public float and liquidity of our Common Stock which can, in turn, affect the market price of our Common Stock.

Assuming the sale of the shares of Common Stock offered herein, Mr. Green and entities related to him (Catalyst Financial Group) would see reductions of their percentage ownership as follows:

|

Pre-Offering(1)

|

25% Sold

(1,250,000 shares)

|

50% Sold

(2,500,000 shares)

|

75% Sold

(3,750,000 shares)

|

100% Sold

(5,000,000 shares)

|

|

|

Ken Green – 945,000 shares

|

53.2%

|

31.2%

|

22.1%

|

17.1%

|

13.9%

|

|

(1)

|

Based upon 1,775,771 shares of common stock issued and outstanding at the time of this filing.

|

If all of the sales offered hereby were sold, Mr. Green would no longer be able to exert significant control over the outcome of shareholder votes, including the election of directors and such corporate transactions as business combinations.

Funds from this Offering will be used to pay the salary of Mr. Green, an officer and director of the Company.

Mr. Green will be compensated by the Company, upon sufficient cash flow in the Company, as to be determined by the Board of Directors. At this time, it is anticipated that Mr. Green would receive an annual salary as set forth below, depending on the success of the Offering.

| 25% | 50% | 75% | 100% | |||||||||

|

Funds received

|

$ | 625,000 | $ | 1,250,000 | $ | 1,875,000 | $ | 2,500,000 | ||||

|

Mr. Green’s Annual Salary

|

$ | -0- | $ | 50,000 | $ | 75,000 | $ | 100,000 |

In addition, Mr. Green is a director of the Company and its majority shareholder and may be able to exert significant influence on not only on the terms of employment and service with the Company, this includes the amount of his salary and when he receives such salary.

No public market exists for our common stock at this time, and there is no assurance of a future market.

There is no public market for our common stock, and no assurance can be given that a market will develop or that a shareholder ever will be able to liquidate his investment without considerable delay, if at all. If a market should develop, the price may be highly volatile. Factors such as those discussed in the “Risk Factors” section may have a significant impact upon the market price of the shares offered hereby. Due to the low price of our securities, many brokerage firms may not be willing to effect transactions in our securities. Even if a purchaser finds a broker willing to effect a transaction in our shares, the combination of brokerage commissions, state transfer taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of our shares as collateral for any loans.

-9-

We are not likely to pay cash dividends in the foreseeable future.

We currently intend to retain any future earnings for use in the operation and expansion of our business. Additionally, we may not issue any preferred stock or convertible debt. Accordingly, we do not expect to pay any cash dividends in the foreseeable future, but will review this policy as circumstances dictate. Should we determine to pay dividends in the future, our ability to do so will depend upon the generation of excess cash flows that are not re-invested in the business.

Our Common Stock may be thinly traded, so you may be unable to sell at or near asking prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.

We intend to apply to have our Common Stock quoted on the Over-the-Counter-Bulletin Board (“OTCBB”) market by a market maker. The trading volume of our Common Stock may be limited by the fact that many major institutional investment funds, including mutual funds, as well as individual investors follow a policy of not investing in OTCBB stocks and certain major brokerage firms restrict their brokers from recommending OTCBB stocks because they are considered speculative, volatile and thinly traded. The OTCBB market is an inter-dealer market that is much less regulated than the major exchanges and our Common Stock is subject to abuses, volatility and shorting. As a result, there is currently no broadly followed or established trading market for our Common Stock and an established trading market may never develop or be maintained. The quoted price for our Common Stock on the OTCBB may not necessarily be a reliable indicator of its fair market value. Further, if we cease to be quoted, holders would find it more difficult to dispose of, or to obtain accurate quotations as to the market value of our Common Stock and as a result, the market value of our Common Stock likely would decline. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders. Absence of an active trading market reduces the liquidity of the shares traded.

Our Common Stock is currently subject to the “penny stock” rules which require delivery of a schedule explaining the penny stock market and the associated risks before any sale.

Our Common Stock may be subject to regulations prescribed by the SEC and FINRA (Financial Industry Regulation Authority) relating to “penny stocks.” The SEC has adopted regulations that generally define a penny stock to be any equity security that has a market price (as defined in such regulations) of less than $5.00 per share, subject to certain exceptions. These regulations impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 and individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 (individually) or $300,000 (jointly with their spouse)). For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of these securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction other than exempt transactions involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the SEC relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

Our Common Stock is illiquid and subject to price volatility unrelated to our operations.

The market price of our Common Stock, if listed, could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our Common Stock, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. In addition, the stock market is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our Common Stock.

-10-

We may in the future issue more shares which could cause a loss of control by our present management and current stockholders.

We may issue further shares as consideration for the cash or assets or services out of our authorized but unissued common stock that would, upon issuance, represent a majority of the voting power and equity of our Company. The result of such an issuance would be those new stockholders and management would control our Company, and persons unknown could replace our management at this time. Such an occurrence would result in a greatly reduced percentage of ownership of our Company by our current shareholders, which could present significant risks to investors.

We have determined an arbitrary offering price of our shares.

Our offering price of our shares has been determined arbitrarily by us with no established criteria of value. There is no direct relationship between these prices and our assets, book value, lack of earnings, shareholder’s equity, or any other recognized standard of value of our business.

The effect of the conversion of REPS’s $250,000 promissory note into shares of common stock.

The holder of the $250,000 convertible note, has entered into a conversion agreement that provides upon effectiveness of this filing that convertible note will be converted into 250,000 shares of our common stock. The note has a conversion rate of $1.00 per share.

Assuming the sale of the shares of Common Stock offered herein and the conversion of the convertible note for 250,000 shares our ownership structure would be:

|

Pre-Offering(1)

|

25% Sold

(1,500,000 shares)(2)

|

50% Sold

(2,750,000 shares)(2)

|

75% Sold

(4,000,000 shares)(2)

|

100% Sold

(5,250,000 shares)(2)

|

|

|

Ken Green – 945,000 shares

|

53.2%

|

28.8%

|

20.8%

|

16.3%

|

13.4%

|

|

Lincoln Ong – 106,800 shares

|

6.0%

|

3.2%

|

2.3%

|

1.8%

|

1.5%

|

|

Bob Bates – 68,000 shares

|

3.8%

|

2.07%

|

1.50%

|

1.1%

|

0.9%

|

|

Jeffrey Crowe – 4,600 shares(3)

|

0.3%

|

7.7%

|

5.6%

|

4.4%

|

3.6%

|

|

Existing Non-affiliate stockholders(4)

|

36.7%

|

19.8%

|

14.3%

|

11.2%

|

9.2%

|

|

(1)

|

Based upon 1,775,771 shares of common stock issued and outstanding at the time of this filing.

|

|

(2)

|

Assumes the conversion of the $250,000 convertible note for 250,000 shares.

|

|

(3)

|

Mr. Crowe is the holder of the $250,000 convertible note and after the conversion will hold 254,600 shares of common stock.

|

|

(4)

|

Existing Non-affiliate shareholders, as a group hold 651,371 shares of common stock.

|

USE OF PROCEEDS

If all $2,500,000 in shares offered hereunder are sold, we will receive approximately $2,460,000 (net) after deducting expenses of the offering currently estimated at $40,000.

We intend to operate as a holding company. We intend to seek, investigate and, if such investigation warrants, acquire interests in revenue generating business opportunities in the continental United States, related to our current REPS business, within our limited financing abilities. We intend to acquire either 100% interest or a majority interest in any potential acquisition. We do not intend to acquire minority interests in any firms. We intend to closely monitor our assets to assure that we do not acquire any equity holdings that are greater than 40% of our cash and assets, in order to assure that do not become classified as an Investment Company under the Investment Act of 1940. We intend to investigate those firms in revenue generating related industries and market segments as our wholly-owned subsidiary, REPS. We anticipate that we may be able to participate in only one potential business venture, other than REPS, because of our lack of financial resources. At this time of this filing we have not identified any possible acquisitions or entered into any agreements with any potential acquisition candidates. Our ability to expand any operations will be limited by availability of any financing required to buy or expand new operations. We have no financing for acquisitions or any type, arranged or committed to at the time.

-11-

The net proceeds of our Offering will be applied to general corporate funds and potential acquisitions not yet identified. Our management will have complete discretionary control over the actual utilization of said funds and there can be no assurance as to the manner or time in which said funds will be utilized.

Although we reserve the right to reallocate the funds according to changing events, we believe that the net proceeds from this Offering will be sufficient to fund our initial general and administrative and capital requirements for a period of twelve months. The foregoing assumes our Offering will be fully subscribed. We can assure that we will require additional funds to carry out our business plan. The availability and terms of any future financing will depend on market and other conditions. Our use of proceeds is based upon the projections by our Management, which may also change according to unforeseen future events and market changes.

If less than the maximum offering is sold, we will have inadequate working capital and funds to fund any expansion of operations or any acquisition in an industry segment related to REPS. This lack of funds could and would severely limit our operations, and might render us unable to carry out our business plan with resulting business failure.

| 25% | 50% | 75% | 100% | ||||||||

|

Funds received

|

$ | 625,000 | $ | 1,250,000 | $ | 1,875,000 | $ | 2,500,000 | |||

|

Proposed Use of Funds:

|

|||||||||||

|

Offering Costs

|

40,000 | 40,000 | 40,000 | 40,000 | |||||||

|

Expense Category:

|

|||||||||||

|

Acquisition Capital

|

385,000 | 759,800 | 1,305,000 | 1,687,400 | |||||||

|

Acquisition Expenses:

|

|||||||||||

|

Due Diligence Costs

|

25,000 | 50,000 | 75,000 | 100,000 | |||||||

|

Legal

|

25,000 | 50,000 | 75,000 | 100,000 | |||||||

|

Accounting

|

25,000 | 75,000 | 75,000 | 125,000 | |||||||

|

Capital Assets/Goodwill

|

25,000 | 75,000 | 75,000 | 125,000 | |||||||

|

Expansion Capital

|

25,000 | 75,000 | 75,000 | 125,000 | |||||||

|

General & Administrative

Expense

|

|||||||||||

|

Salaries

|

50,000 | 75,000 | 100,000 | 100,000 | |||||||

|

Additional Public Costs*

|

10,000 | 12,500 | 15,000 | 25,000 | |||||||

|

Additional Rent

|

12,600 | 12,600 | 12,600 | 12,600 | |||||||

|

Marketing

|

- | 15,100 | 17,400 | 50,000 | |||||||

|

Additional Office Expenses

|

2,400 | 10,000 | 10,000 | 10,000 |

*Public costs include those costs associated with being a public company, including legal and auditing fees.

If less than the maximum offering is sold, we will have inadequate working capital and funds to fund any expansion of operations or multiple acquisitions in an industry segment related to REPS. This lack of funds could and would severely limit our operations, and might render us unable to carry out our business plan.

IF ONLY 25% OF THE MAXIMUM SHARES ARE SOLD, we will continue with current operations. We anticipate that approximately $625,000 along with the expectation of limited revenue from modest sales will allow for limited expansion of operations during the short-term. Expansion of operations includes such items marketing expenditures and, if available, a small acquisition.

If less than $2,500,000 were made available, we will restrict expenditures to a minimum budget based on priorities determined by the officers and directors. The acquisition activities or some of the portions of the marketing plans will be deferred or reduced. We will cover ongoing legal and accounting costs.

IN THE EVENT THAT ONLY 50% OF THE MAXIMUM SHARES ARE SOLD (APPROXIMATELY $1,250,000), we will be able to further the plan of operation; however, our activities will continue to be restricted, in the types of acquisitions we may enter into and as to the expansion of our operations. If 50% of the Maximum shares are sold, we would be able to expand our operations to the hiring of staff and the beginnings of a marketing plan.

-12-

IF 75% OF THE MAXIMUM SHARES ARE SOLD (APPROXIMATELY $1,875,000), there will be sufficient funds to continue to fund growth and expansion of additional staff and increasing marketing and acquisition identification. If 75% of the Maximum shares are sold, the Company is better situated and not as limited in it acquisition activities.

Both the amount we are able to spend on acquisitions and the type of acquisitions we will be able to complete is dependent upon the amount of shares that we are able to sell in this offering. If only 25% of the maximum shares are raised, we will be sorely limited in the type of acquisition we are able to make. The potential acquisition would most likely be a smaller size company, with a limited operational history and limited revenues, if any. In addition, at the most, we would be able to complete a single acquisition. Further, with limited cash funds, we may have to consider the use of either equity or debt to secure the acquisition.

As the funds available to us increases, as a result of the funds raised, the type, size and number of acquisitions we contemplate and complete changes. If 50% to 100% of the maximum shares are raised, we are able to possibly complete more than one acquisition and can complete acquisitions of one or more smaller companies, as described above or one acquisition of a larger company. These acquisitions could possibly be companies that have both a longer operational history and larger revenue streams. Such acquisitions would possibly be looking for an infusion of capital for growth and would be synergistic to our existing operations. In addition, at these levels, we would be less likely to have to use equity or debt to secure the acquisition.

Potential Shareholders should be aware that there are no guarantees that we will find a business related to REPS to acquire with any of the above mentioned limited or reduced percentages of share sale proceeds or even with maximum proceeds. Any acquisition will be subject to the availability of adequate financing at the time, and there is no assurance whatsoever that any financing will be available under acceptable, or any terms.

The monies we have raised thus far from selling stock to our current Shareholders is anticipated to be sufficient to pay all expenses of this offering, which is estimated to be $40,000. The total amount of the money raised from the sale of the Shares will be used for the purpose of furthering our plan of operation, as detailed under the heading "PLAN OF OPERATION" below.

We have no established market for our common stock.

We have arbitrarily determined our offering price for shares to be sold pursuant to this offering at $.50. The major factors that were included in determining the initial sales price to our founders and private investors were the lack of liquidity since there was no present market for our stock and the high level of risk considering our lack of operating history.

The share price bears no relationship to any criteria of goodwill value, asset value, market price or any other measure of value and were arbitrarily determined in the judgment of our Board of Directors.

DILUTION

We are registering 5,000,000 shares of our common stock for sale to the public.

-13-

Comparative Data

The following table sets forth with respect to existing shareholders and new investors, a comparison of the number of our shares of common stock purchased the percentage ownership of such Shares, the total consideration paid, the percentage of total consideration paid and the average price per Share. All percentages are computed based upon cumulative shares and consideration assuming sale of all shares in the line item as compared to maximum in each previous line.

|

|

Shares Purchased(1)

|

Total Consideration

|

Average

|

|||||||||||||

|

|

Number

|

Percent (2)

|

Amount

|

Percent (3)

|

Price/Share

|

|||||||||||

|

1) Existing Shareholders

|

1,775,771

|

100%

|

$

|

150,000

|

100%

|

$

|

.08

|

|||||||||

|

2) New Shareholders

|

5,000,000

|

74%

|

$

|

2,500,000

|

96%

|

$

|

.50

|

|||||||||

“Net tangible book value” is the amount that results from subtracting the total liabilities and intangible assets from the total assets of an entity. Dilution occurs because we determined the offering price based on factors other than those used in computing book value of our stock. Dilution exists because the book value of shares held by existing stockholders is lower than the offering price offered to new investors.

|

(1)

|

1,775,771 shares were issued at $.08 per share average.

|

|

(2)

|

Percentage relates to total percentage of shares sold up to such increment.

|

|

(3)

|

Percentage relates to total percentage of capital raised post offering.

|

Following is a table detailing dilution to investors if 25%, 50%, 75%, or 100% of the shares in the offering are sold.

|

25%

|

50%

|

75%

|

100%

|

|||||||||

|

Net tangible book value per share prior to stock sale

|

$

|

(0.20)

|

$

|

(0.20)

|

$

|

(0.20)

|

$

|

(0.20)

|

||||

|

Net tangible book value per share after stock sale (1)

|

$

|

0.07

|

$

|

0.20

|

$

|

0.27

|

$

|

0.31.

|

||||

|

Average cost of shares owned by current stockholders per share

|

$

|

0.47

|

$

|

0.49

|

$

|

0.49

|

$

|

0.49

|

|

(1)

|

Computation of net tangible book value per share after stock sale includes the deduction of offering costs of $40,000.

|

As at May 31, 2010, the net tangible book value of our stock was $(0.20) per share. If we are successful in achieving selling shares at the offering price, the pro forma net tangible book value of our stock after deducting the offering costs of $40,000 would be as shown in chart above. That would represent an immediate increase in net tangible book value per share and per share dilution to new investors as shown in chart above, assuming the shares are sold at the offering price of $0.50 per share. Our existing stockholders have purchased a total of 1,775,771 shares at an average cost of $0.08 per share. The book value of the stock held by our existing stockholders will increase per share, while new purchaser’s book value will decrease from purchase price of $0.50 per share, as shown in chart above, to the net tangible book value.

Upon effectiveness of the registration statement, of which this prospectus is a part, we will conduct the sale of shares on a self-underwritten basis. There will be no underwriters used on sales of the 5,000,000 shares to the public, no dealers' commissions paid on sales of the 5,000,000 shares to the public, and no passive market making.

There will be no underwriters used on sales of the 5,000,000 shares to the public, no dealers' commissions paid on sales of the 5,000,000 shares to the public, and no passive market making. Our officer and director, Kenneth Green, will sell securities on our behalf in this offering. Mr. Green is not subject to a statutory disqualification as such term is defined in Section 3(a)(9) of the Securities Exchange Act of 1934. He will rely on Rule 3a4-1 to sell our securities without registering as a broker-dealer. Mr. Green intends to offer the shares to personal contacts and thru licensed Broker-Dealers, through written materials. Mr. Green intends to provide potential investors with the Company’s current annual report and interim quarterly reports, as filed with the SEC, along with this filing.

Messrs. Green, Bates and Ong will not offer any of their shares for sale until the offering to the public of our shares has been closed, pursuant to Lock Up Agreements, which they have entered into. They are serving as our officers and directors otherwise than in connection with transactions in securities and will continue to do so at the conclusion of this offering. They have not been a broker or dealer, or an associated person of a broker or dealer, within the preceding 12 months, and have not nor will not participate in the sale of securities for any issuer more than once every twelve months. Our officers and directors will not receive commissions or other remuneration in connection with their participation in this offering based either directly or indirectly on transactions in securities. We will only use this prospectus in connection with this offering and no other sales materials.

-14-

There is no market for the securities at this time and our pricing is arbitrary with no relation to market value, liquidation value, earnings or dividends. Until a public market develops, we are registering our shares for sale at the following price:

|

Title

|

Per Share

|

|

Common Stock

|

$.50

|

At any time after a market develops, our shareholders may sell their securities at market prices or at any price in privately negotiated transactions.

The prices for sale of shares were arbitrarily set at $.50 per share, and bear no relationship to any quantification of value.

DESCRIPTION OF SECURITIES TO BE REGISTERED

As of September 30, 2010, there were 1,775,771 shares of our Common Stock issued and outstanding. Our shares of Common Stock are held by 51 stockholders of record. The number of record holders was determined from the records of our transfer agent and does not include beneficial owners of Common Stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies.

In addition, 156,750 shares of Catalyst stock may be issued to Watkins Worldwide LLC, a consulting firm, as a finder’s fee. However, there is a dispute with Watkins related to his contract performance. The contract was setup for Watkins to deliver acquisition targets and prepare them and have them audited to be included with the S-1. His contract was for 1 year with a monthly retainer of $8,000 but he also took monies from potential targets and didn’t complete his obligations. The Company has terminated the contract; it has not been determined if the company will pursue Watkins to get the monies back.

All shares are equal to each other with respect to voting, liquidation, and dividend rights. Special shareholders' meetings may be called by the officers or director, or upon the request of holders of at least one-tenth (1/10th) of the outstanding shares. Holders of shares are entitled to one vote at any shareholders' meeting for each share they own as of the record date fixed by the board of directors. There is no quorum requirement for shareholders' meetings. Therefore, a vote of the majority of the shares represented at a meeting will govern even if this is substantially less than a majority of the shares outstanding. Holders of shares are entitled to receive such dividends as may be declared by the board of directors out of funds legally available therefore, and upon liquidation are entitled to participate pro rata in a distribution of assets available for such a distribution to shareholders. There are no conversions, pre-emptive or other subscription rights or privileges with respect to any shares. Reference is made to our Articles of Incorporation and our By-Laws as well as to the applicable statutes of the State of Delaware for a more complete description of the rights and liabilities of holders of shares. It should be noted that the board of directors without notice to the shareholders may amend the By-Laws. Our shares do not have cumulative voting rights which means that the holders of more than fifty percent (50%) of the shares voting for election of directors may elect all the directors if they choose to do so. In such event, the holders of the remaining shares aggregating less than fifty percent (50%) of the shares voting for election of directors may not be able to elect any director.

Preferred shares

We have no preferred shares authorized.

Transfer Agent

The transfer agent for our securities is American Registrar & Transfer 342 E. 900 South St., Salt Lake City, UT 84111.

-15-

INTEREST OF NAMED EXPERTS AND COUNSEL

We have not hired or retained any experts or counsel on a contingent basis, who would receive a direct or indirect interest in us, or who is, or was, our promoter, underwriter, voting trustee, director, officer or employee.

Catalyst Group Holdings Corp. (“Catalyst”) is a holding company with one subsidiary, REPS, which is a printing company based in Campbell, California.

Catalyst was originally incorporated as Pop Starz Ventures 3, Inc. in the State of Delaware on August 7, 2008. Pop Starz Ventures was a shell company with no operation and only nominal assets. We have retained an August 31st year end.

On September 9, 2009, Catalyst Financial Group, Inc. purchased 945,000 shares of Pop Starz Ventures for $19,000. This represented 90.4% of the total shares outstanding. Immediately following the closing of this purchase, Michelle Tucker resigned her position as director and Ken Green was appointed sole director and sole officer of the Company. As part of the transaction, the following were cancelled:

(a) Any employment agreements, stock purchase agreements, stock option agreements, convertible instruments and outstanding warrants of any kind whatsoever, by and between, or among, the Seller and the Company; and

(b) Any loan agreements, expense reimbursement agreements, payment agreements, or monetary agreements of any kind whatsoever, by and between the Seller and the Company.

On September 29, 2009, the Company amended its Articles of Incorporation to change its name to Catalyst Group Holdings Corp.

We intend to operate as a holding company. We intend to seek, investigate and, if such investigation warrants, acquire an interest in business opportunities presented to us by persons or firms which desire to seek the advantages of an issuer that is registered with the Securities and Exchange Commission (SEC) under the Securities Act of 1934 (the “1934 Act”). We believe that being a 1934 Act Company will provide greater liquidity to potential business opportunities and will allow us a measurement of flexibility in the structure of the transactions with potential business opportunities that a private company does not have. We intend to acquire either 100% interest or a majority interest in any potential acquisition. We do not intend to acquire minority interests in any firms. We intend to closely monitor our activities to assure that we do not acquire any equity holdings that are greater than 40% of our cash and assets, in order to assure that do not become classified as an Investment Company under the Investment Act of 1940. We intend to investigate those firms in related industries and market segments as our wholly-owned subsidiary, REPS. We anticipate that we may be able to participate in only one potential business venture because of our lack of financial resources. At this time of this filing we have not identified any possible acquisitions or entered into any agreements with any potential acquisition candidates.

On November 17, 2009, Catalyst acquired 100% of the common stock of Real Estate Promotional Services, Inc. (a Florida corporation) for $250,000 subject to delivery of audited financial statements and compliance with other conditions set forth in the stock purchase agreement. The $250,000 purchase price was paid via a 6-month convertible debenture that bears an interest rate of 10% and has a conversion ratio of 1 share of common stock for every $1 outstanding. At the time of this filing, $250,000 of the Convertible Debenture are issued and outstanding. The Convertible Debentures are convertible at the option of the Company or by Jeff Crowe, the Chief Executive Officer of REPS. Mr. Crowe has entered into a conversion agreement that provides for the note to be converted into 250,000 shares of common stock upon the effectiveness of this filing. The note was originally due on November 12, 2009; on May 12, 2010 the holder of the note agreed to extend the due by another 12 months to November 12, 2010. The holder agreed to an extension, as the Company did not have adequate cash to pay the note and the holder was amendable to extending the due date of the note rather than converting the note into the Company’s common stock at that time. At this time, the Company does not intend to use the proceeds of this offering to pay the note. Rather, the Company anticipates that the note will be converted after this offering.

Products

REPS’s core products are postcards, brochures, related mailing services and web site development.

-16-

The table below shows the breakdown by product of revenues recognized during the nine months ended May 31, 2010 :

|

Postcards

|

$ | 44,396 | ||

|

Showcase Flyers

|

45,997 | |||

|

Other parts

|

- | |||

|

Printing

|

37,246 | |||

|

Mail

|

23,374 | |||

|

Other Service

|

- | |||

|