Attached files

| file | filename |

|---|---|

| 8-K - Gulf United Energy, Inc. | gulfunited8k.htm |

Project Areas

• Colombia

– Block CPO-4 (12.5% non-operated

working interest)

working interest)

• 345,592 gross acres

• Llanos Basin

• Operated by SK Energy of South Korea

– Net Risked Prospective Resource =

appx 65 MMBO (internal estimate

based on Corcel Trend only)

appx 65 MMBO (internal estimate

based on Corcel Trend only)

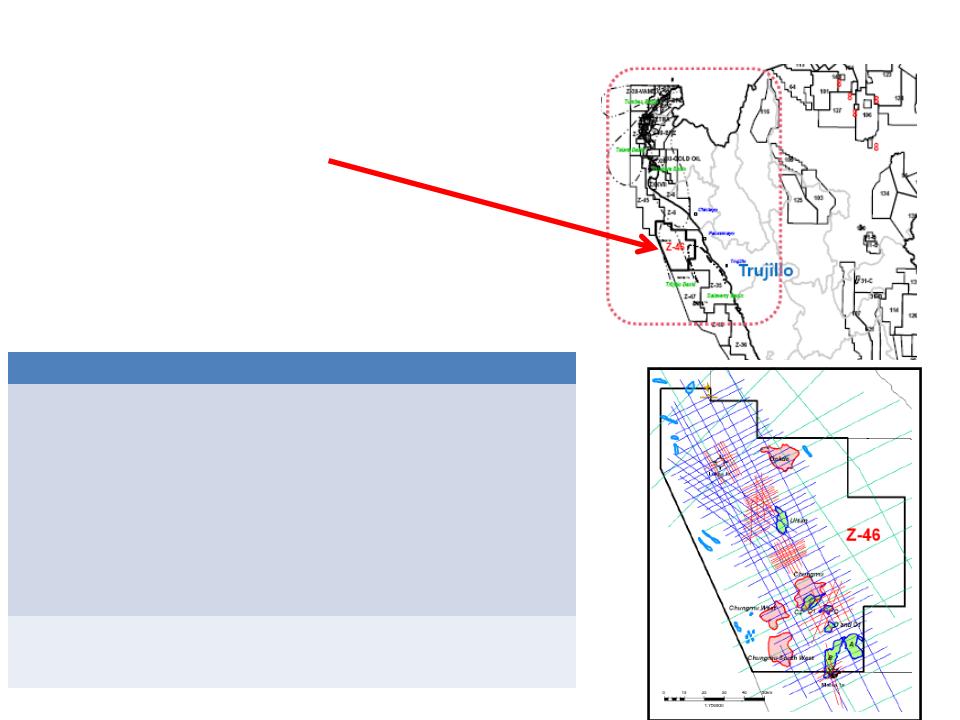

• Peru

– Block Z-46 (40% non-operated

working interest)

working interest)

• 2,803,411 gross acres

• Trujillo Basin

• Operated by SK Energy of South Korea

– Multi-billion barrel potential based on

reprocessed 2D data

reprocessed 2D data

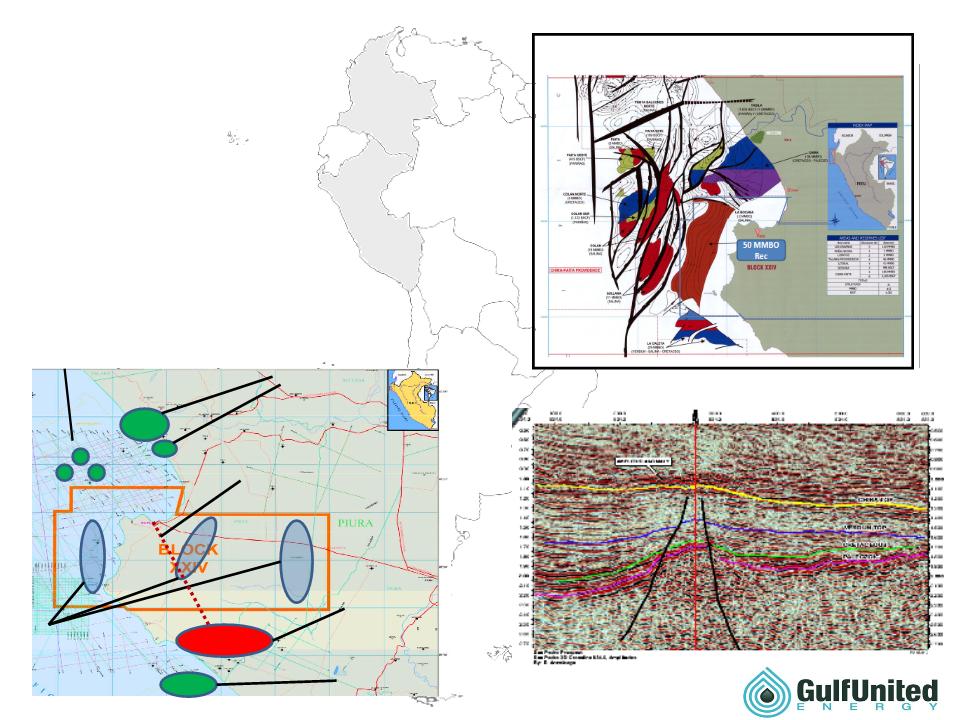

• Peru

– Block 24 (negotiating up to 15%

non-operated working

interest)

non-operated working

interest)

• 276,137 gross acres

– 80,000 offshore

– 196,000 onshore

• Operated by Upland Energy

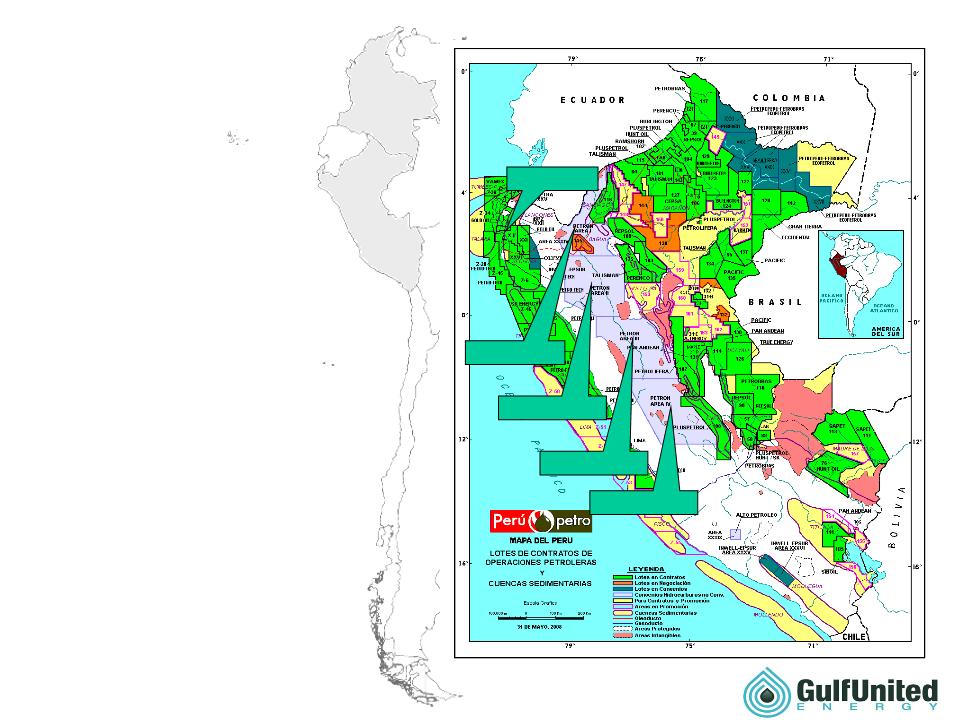

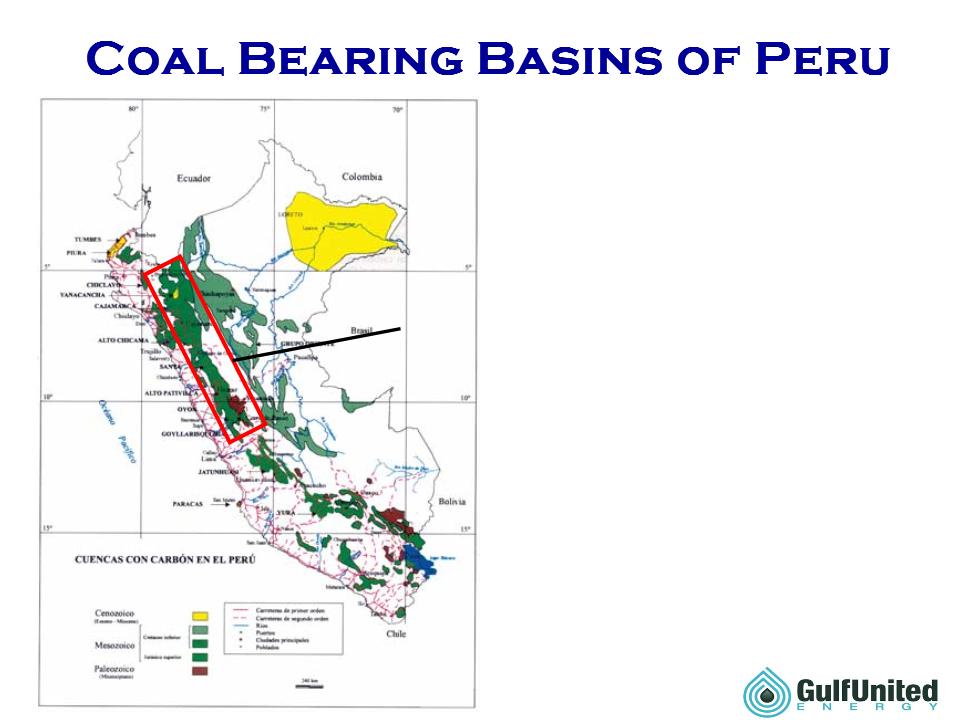

• Peru

– TEA Area I, II, III, IV (negotiating up

to 10% non- operated working

interest)

to 10% non- operated working

interest)

• Comprises 40,000,000 gross acres

– Onshore, western flank of Andes

• Operated by Upland Energy

HELD BY DEFINITIVE AGREEMENT

UNDER NEGOTIATION

The undiscovered prospective resources shown in this report represent exploration opportunities and

development potential in the event a commercial discovery is made

development potential in the event a commercial discovery is made

UNDISCOVERED RESOURCES: Undiscovered resources are defined as those quantities of oil and gas

estimated on a given date to be contained in accumulations yet to be discovered

estimated on a given date to be contained in accumulations yet to be discovered

PROSPECTIVE RESOURCES: Prospective resources are defined as those quantities of oil and gas estimated on

a given date to be potentially recoverable from undiscovered accumulations.

a given date to be potentially recoverable from undiscovered accumulations.

2

3

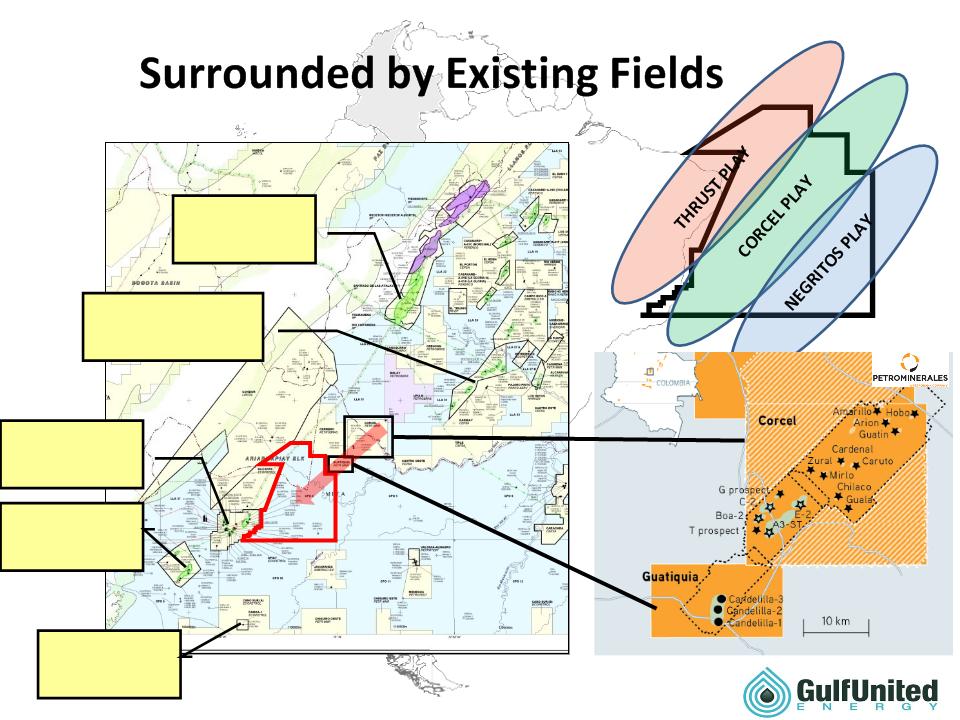

Trend Characteristics

• Adjacent to existing fields

• Multiple Stacked Reservoirs

• Trap Type : Up thrown fault closures on trend with Corcel/Guatiquia development

• High Quality Oil (30 - 45 API)

• Favorable Reservoir Characteristics: 30% Porosity. 2d Permeability

• 17 structures mapped on 3D seismic (as of 10/15/10) on multiple intervals in Corcel Trend

• Appx 65 MMBbl GLFE Risked Prospective Resource (Corcel Trend only - see assumptions on page 9)

Excellent Working Environment

• ~ 25 Km from pumping station on 26 inch pipeline

• Ease of Access Roads

• No Indigenous Reservation Area

Drilling Success

• Petrominerales has had 100% success drilling on 3D seismic on the adjacent block

Interest

• 12.5% non-operating working interest in the block

• Drilling expected Q2 2011

CPO-4 Corcel Trend

Summary

Summary

4

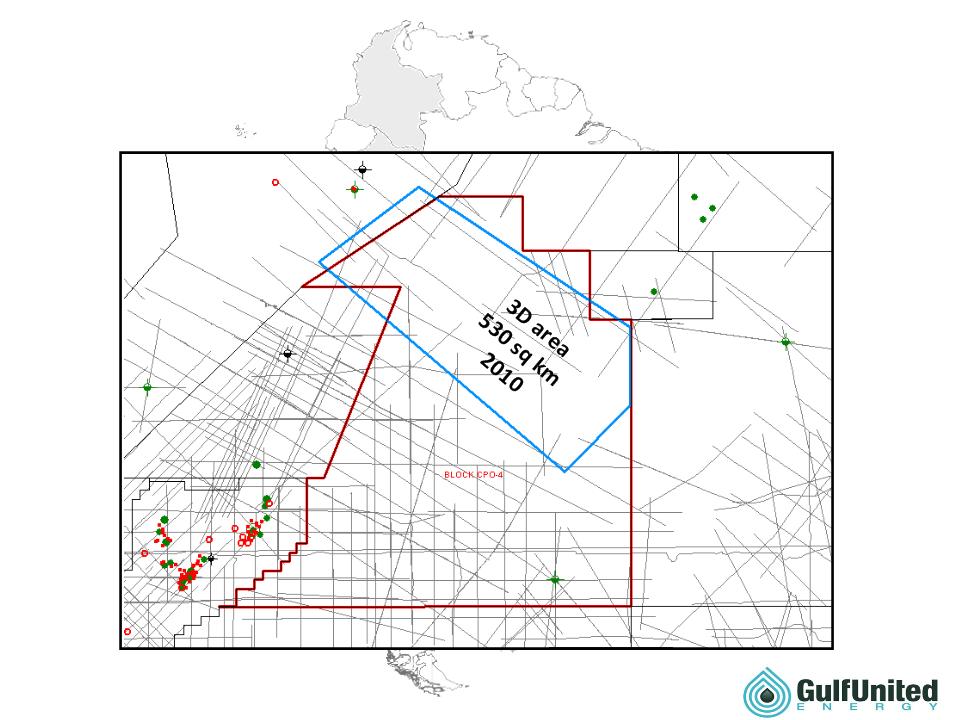

CPO-4 Overview

Location : Onshore, Central Colombia

Basin : Western Llanos Basin

Gross Area : 345,592 acres

Effective Date : December 18, 2008

Participants

• SK Energy : 50 % (Operator)

• Houston American Energy : 37.5%

• Gulf United Energy : 12.5%

Exploration Period & Work Obligation

|

PHASE

|

PERIOD

|

WORK OBLIGATION

|

|

Phase 1

|

Jun 18 ‘09 - Jun

17 ‘12 (3 yrs.)

|

• 1350 km 2-D Seismic

Reprocessing (completed) • 530 km2 3-D New Seismic

Acquisition (completed) • 2 Exploration Wells (2nd qtr.

2011) |

|

Phase 2

|

Jun 18 ‘12 - Jun

17 ‘15 |

• 3 Exploration Wells

|

5

Cupiagua

1.3 BBIOP

45 API

Apiay

610 MMBOIP

25~33 API

Castilla

2.2 BBOIP

14~16 API

Camoa

5.5 MMBOIP

14 API

Santiago Complex

>150 MMBOIP

24~28 API

6

Petrominerales Guatiquia -

Candelilla Wells

Candelilla Wells

Guatiquia Block is located directly adjacent to the CPO-4 Block, with the Candelilla- 1

& 2 wells located approximately 3 kilometers away from the CPO-4 block

& 2 wells located approximately 3 kilometers away from the CPO-4 block

• Candelilla-1

• Spud November 9, 2009

• Total vertical depth of 11,681 feet (December 16, 2009).

• Commenced production in late December of 2009 at over 11,500 barrels of oil per day of

44 degree API oil with less then 1% water cut.

44 degree API oil with less then 1% water cut.

• Candelilla-2

• Spud December 26, 2009

• Total vertical depth of 11,740 feet (January 31, 2010).

• Commenced production February 2010 at 15,800 barrels of oil per day of 43 degree API

light oil at less than 1% water cut.

light oil at less than 1% water cut.

• Candelilla-3

• Spud February 18, 2010

• Total measured depth of 12,162 feet (March 15, 2010)

• Commenced production in mid-March 2010 at 15,600 barrels of oil per day a 43 degree

API oil.

API oil.

7

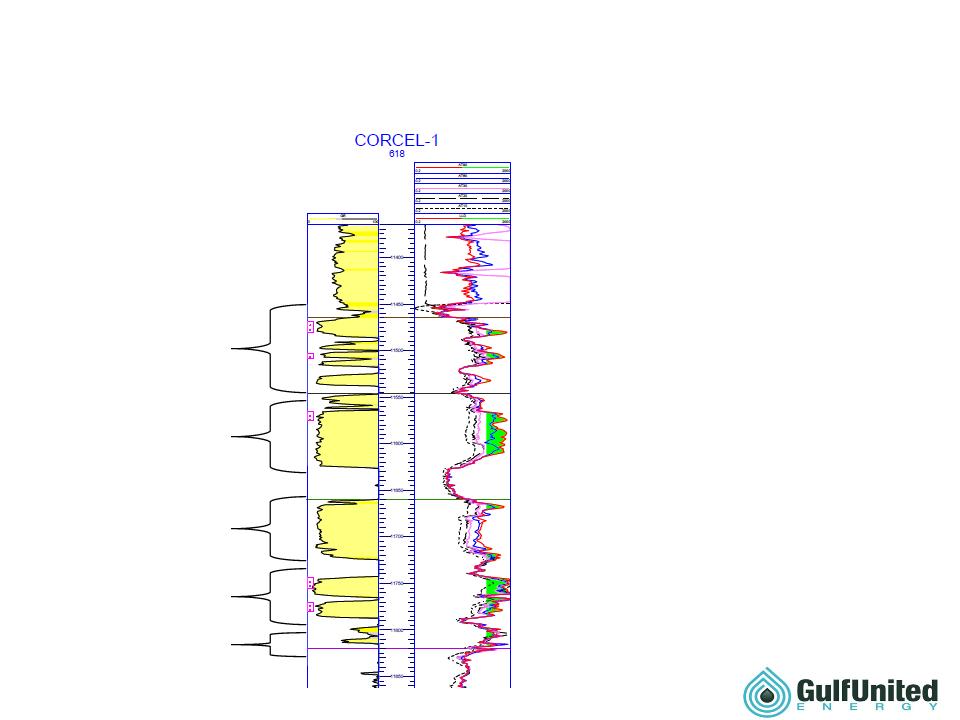

Corcel Sand Package

11450

11550

11600

11400

11500

11650

11700

11750

11800

11850

MIRADOR

65’ NET SAND

TOTAL CRETACEOUS &

EOCENE INTERVAL

EOCENE INTERVAL

440 FT. GROSS

INTERVAL

INTERVAL

270 FT. Net Sand

LOWER MIRADOR

85’ NET SAND

UPPER GUADALUPE

65’ NET SAND

LOWER GUADALUPE

35’ NET SAND

UNE

20’ NET SAND

8

New 3D Area on CPO-4

9

• 17 structures mapped from new 3D data indicate

appx 6,400 acres of cumulative closure

appx 6,400 acres of cumulative closure

– Closures range from appx 100 ac. - 700+ ac.

• Assumptions

– 165 feet net sand (Corcel #1 log shows 270 ft. net

sand)

sand)

– 500 Bbl/ac. ft. recovery factor (based on high

permeability and porosity in offset wells)

permeability and porosity in offset wells)

• Based upon 6400 ac. cumulative closure,

assumptions yield appx 65 MMBbls risked

Prospective Resources to GLFE interest

assumptions yield appx 65 MMBbls risked

Prospective Resources to GLFE interest

3D Mapping

Results & Assumptions

(as of 10/15/10)

Results & Assumptions

(as of 10/15/10)

10

• SK Energy -

– A subsidiary of SK Group, one of South Korea's top

five industrial conglomerates.

five industrial conglomerates.

• The company has about 40 affiliated companies, with

operations ranging from energy, telecommunications,

finance, and construction.

operations ranging from energy, telecommunications,

finance, and construction.

– SK Energy, is Korea's largest petroleum refiner.

– Active in 34 Blocks in 19 Countries

• 5 Exploration Blocks in Colombia (4 operated)

• 4 Producing Blocks in Peru (including Camisea pipeline &

LNG

LNG

• 1 Exploration Block (Z-46) in Peru

SK Energy - Operator

11

• Evidence of active hydrocarbon system

• Relatively shallow water depth in prospective area

• Similar characteristics and potential as Perdido Fold

Belt in Gulf of Mexico

Belt in Gulf of Mexico

– Trend potential ranges between 3 - 15 Billion Barrels

Recoverable

Recoverable

• 1st discovery in 2001

– Tertiary targets similar age as Z-46 (Eocene)

• Turbidite fan systems

– Shell, Exxon, Chevron active

• Multi-billion barrel potential based on reprocessed 2D

data

data

Block Z-46 (Offshore Peru)

Peru Block Z-46

• Location

– Offshore Peru (water depth 50m - 1,000m)

– Basin - Trujillo Basin

– Area - 2,803,411 acres

• Contract

– Effective Date: January 2008

– Participants

• SK Energy - 60% (operator)

• Gulf United Energy - 40%

|

Exploration Period Work Obligation

|

|

|

Phase 1

|

• Existing 2D Data reprocessed

– 5684 km completed

• Sea bed Coring

– MET method (Microbial Exploration Technology) (1st Stage

Completed) • New 2D seismic

– Acquisition

• 56 lines: 2904 km (Permitted)

– Processing (Q1 2011)

– Interpretation (Q2 2011)

|

|

Phase 2

|

• Focused 3D based on 2D interpretation to identify well location

• 1st Exploration Well

|

12

Prospects Summary

Tertiary

Paleozoic/Cretaceous

• Multiple tertiary prospects and

multiple Cretaceous/Paleozoic

Prospects were identified from

recently reprocessed 2D data.

multiple Cretaceous/Paleozoic

Prospects were identified from

recently reprocessed 2D data.

• Two Repsol wells (1999) on the

block had oil shows

block had oil shows

• Recently reprocessed 2D data

indicates sand rich fan deposition

that was previously undetected

indicates sand rich fan deposition

that was previously undetected

13

Source: SK Energy

14

• GLFE negotiating for up to 15%

working interest

working interest

• Block 24 is comprised of 276,137

acres

acres

– approximately 80,000 acres offshore

– 196,000 acres are on shore.

• Attractive Exploration Target

– Recent gas and oil discoveries by

Olympic (onshore, north and south

of Block 24) and off shore oil

discoveries in Petrotech’s San Pedro

Field to the south

Olympic (onshore, north and south

of Block 24) and off shore oil

discoveries in Petrotech’s San Pedro

Field to the south

Block 24

Oil Fields

>6000 BOPD

(Mercantile & Olympic)

Gas Field (Olympic)

20 MMcfd capacity

Pipeline to Paita

GLFE

Prospective

Areas

Oil Field (Petrotech)

3000 BOPD

Recent Oil Discoveries

15

Peru - Block 24

Offshore Seismic Line

Oil Fields

>6000 BOPD

(Mercantile & Olympic)

Oil Field (Petrotech)

3000 BOPD

Gas Field (Olympic)

20 MMcfd capacity

GLFE

Prospective Areas

Pipeline to Paita

OFFSHORE PLAY

• Operator estimates offshore risked

Prospective Resource = 50 MMBO

Prospective Resource = 50 MMBO

• Going Forward

– Further evaluate large offshore potential

• Reprocess and integrate existing 2D

and 3D seismic data

and 3D seismic data

• Acquire additional seismic if necessary

• Drill exploratory well

Recent Oil Discoveries

16

Block 24

TEA Area I

TEA Area II

TEA Area III

TEA Area IV

Peru TEA

Areas I, II, III, IV

Areas I, II, III, IV

• GLFE negotiating up to 10%

interest in the TEA’s

interest in the TEA’s

• 40,321,163 total acres

• Perform a Technical

Evaluation Assessment (TEA)

within the four areas.

Evaluation Assessment (TEA)

within the four areas.

17

• Indicate the presence of

hydrocarbon systems

hydrocarbon systems

• The initial plan is to

perform satellite imaging,

aero-magnetic & gravity

surveys, geological

sampling & analyses, and

feasibility studies to high-

grade certain areas for

further scrutiny.

perform satellite imaging,

aero-magnetic & gravity

surveys, geological

sampling & analyses, and

feasibility studies to high-

grade certain areas for

further scrutiny.

TEA Area

Gulf United Energy

Personnel

19

• John B. Connally III - Chairman and Chief Executive Officer/President

Independent oil and gas producer. Former Partner in the law firm of Baker & Botts,

specializing in corporate finance and mergers and acquisitions for energy and oil field service

companies. Founding Director of Nuevo Energy, a Houston based oil and gas exploration and

production company listed on the NYSE. Founder, former Director and Chief Executive

Officer of Pure Energy and Pure Gas Partners, private oil and gas exploration and production

entities operating in the state of New Mexico. Partner, Back Nine Energy Partners, engaged

in oil and gas exploration in the state of New Mexico. Partner, Pin Oak Energy partnerships,

investing in leasing, seismic operations and drilling on the Texas Gulf Coast. Partner,

Commodore Energy Partners, investing in leasing, seismic and drilling operations on the

Texas Gulf Coast. Founding Director of Endeavour International Corporation, a public

company listed on the New York Stock Exchange AMEX and on the London Stock Exchange,

engaged in oil and gas exploration and production in the U.K. North Sea and in the domestic

U.S. market. Chairman of the Compensation Committee and member of the Audit

Committee of Endeavour.

specializing in corporate finance and mergers and acquisitions for energy and oil field service

companies. Founding Director of Nuevo Energy, a Houston based oil and gas exploration and

production company listed on the NYSE. Founder, former Director and Chief Executive

Officer of Pure Energy and Pure Gas Partners, private oil and gas exploration and production

entities operating in the state of New Mexico. Partner, Back Nine Energy Partners, engaged

in oil and gas exploration in the state of New Mexico. Partner, Pin Oak Energy partnerships,

investing in leasing, seismic operations and drilling on the Texas Gulf Coast. Partner,

Commodore Energy Partners, investing in leasing, seismic and drilling operations on the

Texas Gulf Coast. Founding Director of Endeavour International Corporation, a public

company listed on the New York Stock Exchange AMEX and on the London Stock Exchange,

engaged in oil and gas exploration and production in the U.K. North Sea and in the domestic

U.S. market. Chairman of the Compensation Committee and member of the Audit

Committee of Endeavour.

• Ernest B. Miller IV

Ernie Miller has 18 years of experience in energy development, operations, and finance with

public and private companies based in the US, Canada, and United Kingdom. Mr. Miller was

a partner in Rodeo Development Limited, a private company that developed the Logbaba

Natural Gas & Condensate block in Douala, Cameroon, which the company sold in late 2008.

Prior to his work in Cameroon, Mr. Miller was Director of Finance with Calpine Corporation

(NYSE) responsible for project financing for the construction of new combined cycle power

plants as well as the acquisition of natural gas reserves. After leaving Calpine, Mr. Miller

provided consulting services to BPZ Energy (NYSE) in arranging their IFC financing package,

and was a principal in Tiger Midstream Development.

public and private companies based in the US, Canada, and United Kingdom. Mr. Miller was

a partner in Rodeo Development Limited, a private company that developed the Logbaba

Natural Gas & Condensate block in Douala, Cameroon, which the company sold in late 2008.

Prior to his work in Cameroon, Mr. Miller was Director of Finance with Calpine Corporation

(NYSE) responsible for project financing for the construction of new combined cycle power

plants as well as the acquisition of natural gas reserves. After leaving Calpine, Mr. Miller

provided consulting services to BPZ Energy (NYSE) in arranging their IFC financing package,

and was a principal in Tiger Midstream Development.

20

• Jim D. Ford

Jim Ford has over 30 years’ experience in the energy sector most recently with Rodeo

Development Ltd, a private company that developed the Logbaba Natural Gas & Condensate block

in Douala, Cameroon, and is now a wholly owned subsidiary of Victoria Oil Gas (London AIM). Mr.

Ford is a director of Rodeo Development Limited. Previously, Mr. Ford was President of Riata

Resources Corp and is currently a Director. Mr. Ford was President of Intercap Resource

Management Corp, a publically traded company active in Yemen and Colombia. Mr. Ford was

Santa Fe Energy’s Senior International Negotiator and President of a number of international

subsidiaries including Santa Fe Energy (Colombia) Ltd and Petrolera Santa Fe (Ecuador). Mr. Ford

was directly involved in South America, Africa, the FSU and Asia including the People’s Republic of

China where he was responsible for negotiating the first ever production sharing agreement in

onshore China.

Development Ltd, a private company that developed the Logbaba Natural Gas & Condensate block

in Douala, Cameroon, and is now a wholly owned subsidiary of Victoria Oil Gas (London AIM). Mr.

Ford is a director of Rodeo Development Limited. Previously, Mr. Ford was President of Riata

Resources Corp and is currently a Director. Mr. Ford was President of Intercap Resource

Management Corp, a publically traded company active in Yemen and Colombia. Mr. Ford was

Santa Fe Energy’s Senior International Negotiator and President of a number of international

subsidiaries including Santa Fe Energy (Colombia) Ltd and Petrolera Santa Fe (Ecuador). Mr. Ford

was directly involved in South America, Africa, the FSU and Asia including the People’s Republic of

China where he was responsible for negotiating the first ever production sharing agreement in

onshore China.

• James C. Fluker III

Jim Fluker is a professional geophysicist and geologist with over 30 years of experience in

petroleum exploration. Mr. Fluker has a proven record of accomplishment of finding oil in

petroleum exploration in South America, Gulf of Mexico, North Africa, and the Middle East. Mr.

Fluker was previously with Exxon specializing in the Gulf Coast region of Texas. He later served as

Exploration Manager for Tenneco Oil Co. in Ecuador which was purchased by British Gas. Mr.

Fluker served 11 years with Nippon Oil Exploration working South America. Mr. Fluker has

consulted for companies including Teikoku Oil Co., CCC in the Middle East and SK E&P Company in

Colombia providing his expertise in areas including acquisition and interpretation of seismic data

for onshore and offshore projects and international and domestic operations. Prime areas of

interest in South America for Teikoku Oil and SK E&P were Colombia, Peru and Venezuela.

Overseas assignments include living and working in Quito, Ecuador and London, UK. Mr. Fluker

speaks, reads and writes Spanish fluently.

petroleum exploration. Mr. Fluker has a proven record of accomplishment of finding oil in

petroleum exploration in South America, Gulf of Mexico, North Africa, and the Middle East. Mr.

Fluker was previously with Exxon specializing in the Gulf Coast region of Texas. He later served as

Exploration Manager for Tenneco Oil Co. in Ecuador which was purchased by British Gas. Mr.

Fluker served 11 years with Nippon Oil Exploration working South America. Mr. Fluker has

consulted for companies including Teikoku Oil Co., CCC in the Middle East and SK E&P Company in

Colombia providing his expertise in areas including acquisition and interpretation of seismic data

for onshore and offshore projects and international and domestic operations. Prime areas of

interest in South America for Teikoku Oil and SK E&P were Colombia, Peru and Venezuela.

Overseas assignments include living and working in Quito, Ecuador and London, UK. Mr. Fluker

speaks, reads and writes Spanish fluently.

21

This presentation may contain forward-looking statements about the business, financial condition and

prospects of the Company. Forward-looking statements, can be identified by the use of forward-looking

terminology such as “believes,” “projects,” “expects,” “may,” “goal,” “estimates,” “should,” “plans,” “targets,”

“intends,” “could,” or “anticipates,” or the negative thereof, or other variations thereon, or comparable

terminology, or by discussions of strategy or objectives. Forward-looking statements relate to anticipated or

expected events, activities, trends or results. Because forward-looking statements relate to matters that have

not yet occurred, these statements are inherently subject to risks and uncertainties. Forward-looking

statements in this presentation include, without limitation, the Company’s expectations of the oil initially in

place, undiscovered resources, gross prospective barrels of oil equivalent, net prospective barrels of oil

equivalent, net risked prospective barrels of oil equivalent, drilling success rates, resource information and

other performance results. These statements are made to provide the public with management’s current

assessment of the Company’s business, and it should not be assumed that these reserves are proven

recoverable as defined by SEC guidelines or that actual drilling results will prove these statements to be correct.

Although the Company believes that the expectations reflected in forward-looking statements are reasonable,

there can be no assurances that such expectations will prove to be accurate. Security holders are cautioned that

such forward-looking statements involve risks and uncertainties. The forward-looking statements contained in

this presentation speak only as of the date of this presentation, and the Company expressly disclaims any

obligation or undertaking to report any updates or revisions to any such statement to reflect any change in the

Company’s expectations or any change in events, conditions or circumstances on which any such statement is

based. Certain factors may cause results to differ materially from those anticipated by some of the statements

made in this presentation. Please carefully review our filings with the SEC as we have identified many risk

factors that impact our business plan.

prospects of the Company. Forward-looking statements, can be identified by the use of forward-looking

terminology such as “believes,” “projects,” “expects,” “may,” “goal,” “estimates,” “should,” “plans,” “targets,”

“intends,” “could,” or “anticipates,” or the negative thereof, or other variations thereon, or comparable

terminology, or by discussions of strategy or objectives. Forward-looking statements relate to anticipated or

expected events, activities, trends or results. Because forward-looking statements relate to matters that have

not yet occurred, these statements are inherently subject to risks and uncertainties. Forward-looking

statements in this presentation include, without limitation, the Company’s expectations of the oil initially in

place, undiscovered resources, gross prospective barrels of oil equivalent, net prospective barrels of oil

equivalent, net risked prospective barrels of oil equivalent, drilling success rates, resource information and

other performance results. These statements are made to provide the public with management’s current

assessment of the Company’s business, and it should not be assumed that these reserves are proven

recoverable as defined by SEC guidelines or that actual drilling results will prove these statements to be correct.

Although the Company believes that the expectations reflected in forward-looking statements are reasonable,

there can be no assurances that such expectations will prove to be accurate. Security holders are cautioned that

such forward-looking statements involve risks and uncertainties. The forward-looking statements contained in

this presentation speak only as of the date of this presentation, and the Company expressly disclaims any

obligation or undertaking to report any updates or revisions to any such statement to reflect any change in the

Company’s expectations or any change in events, conditions or circumstances on which any such statement is

based. Certain factors may cause results to differ materially from those anticipated by some of the statements

made in this presentation. Please carefully review our filings with the SEC as we have identified many risk

factors that impact our business plan.

Cautionary Statement

October 2010