Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TAYLOR CAPITAL GROUP INC | d8k.htm |

Exhibit 99.1 |

2

Forward-Looking Statement

Forward-Looking Statements. Certain statements made throughout this document

that are not historical facts may contain forward-looking statements

regarding the Company’s future plans, objectives and future performance. Any

statements about our expectations, beliefs, plans, predictions, forecasts,

objectives, assumptions or future events or performance are not historical

facts and may be forward-looking. These statements are often, but not always,

made through the use of words or phrases such as “anticipate,”

“believes,”

“can,”

“could,”

“may,”

“predicts,”

“potential,”

“should,”

“will,”

“estimate,”

“plans,”

“projects,”

“continuing,”

“targeting,”

“ongoing,”

“expects,

“contemplates”, “intends”

and similar words or phrases. These statements are predictions and involve

estimates, known and unknown risks, assumptions and uncertainties that could

cause actual results to differ materially from those expressed or implied by

such forward-looking statements. All forward-looking statements are necessarily only

estimates of future results, and there can be no assurance that actual results will

not differ materially from expectations, and, therefore, you are cautioned

not to place undue reliance on any such statements. Any forward- looking

statements are qualified in their entirety by reference to the risk factors and other information discussed

throughout the private placement memorandum.

Data. The market data, information and opinions that are contained herein

have been compiled or arrived at by us from third party sources. Information

with respect to other financial institutions has been drawn from publicly

available sources. We have not independently verified any the data obtained

from these sources, and we cannot assure you of the accuracy or completeness

of the data. All information is subject to change without notice. This

presentation is for the assistance of recipients only, but is not to be

relied upon as authoritative and is not to be substituted for the exercise of one's own judgment. We accept

no responsibility for any use of this information. |

3

Agenda

Summary and Questions & Answers

Results of Operations and Balance Sheet Highlights: Randy

Conte, CFO and COO

Third Quarter 2010 Highlights: Progress on ‘Fix and Grow’

Strategy: Mark Hoppe, President and CEO |

|

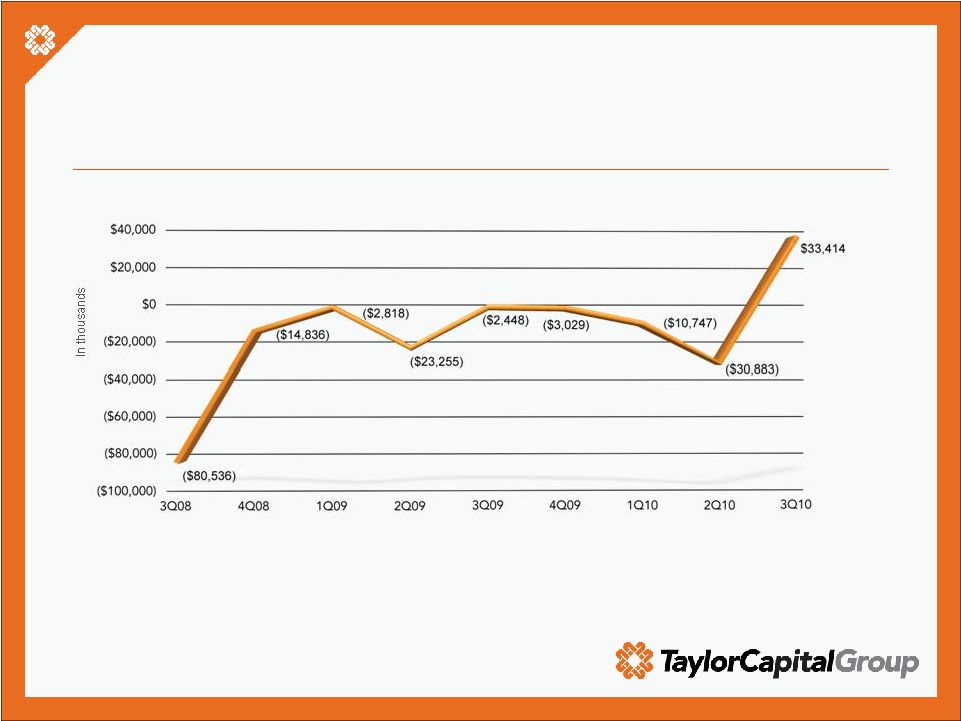

Taylor

Capital Group posted net income of $33.4 million in 3Q 2010

»

Results due to:

•

Securities

gains

of

$32.8

million:

minimized

prepayment

risk

and

interest

rate

sensitivity

•

Income before income taxes excluding gains on the sale of investment securities

was $931,000

Net Income (Loss)

5 |

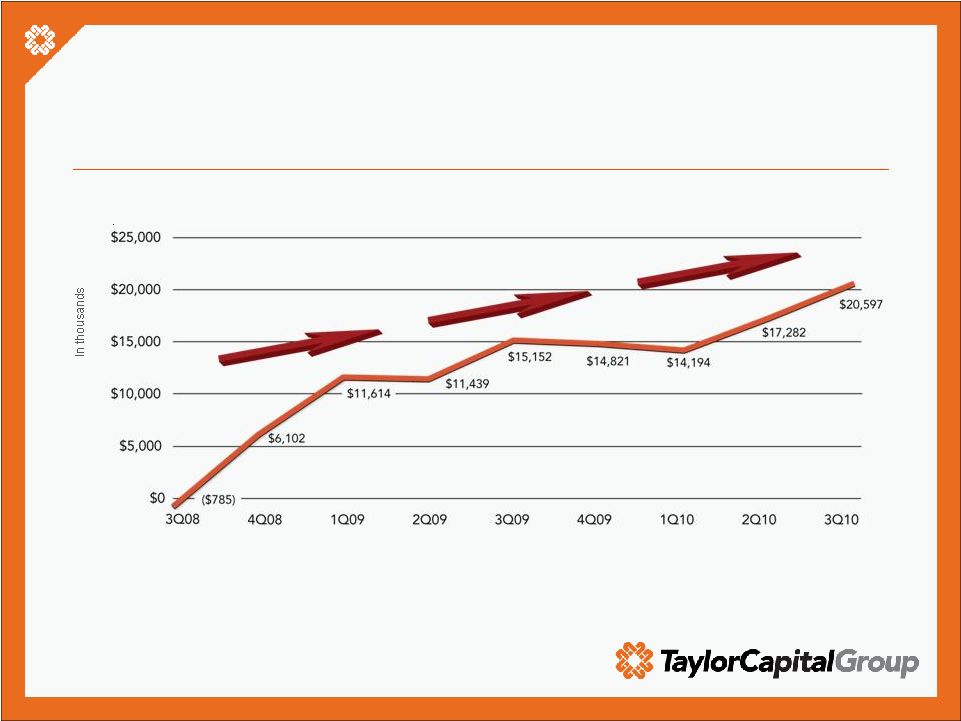

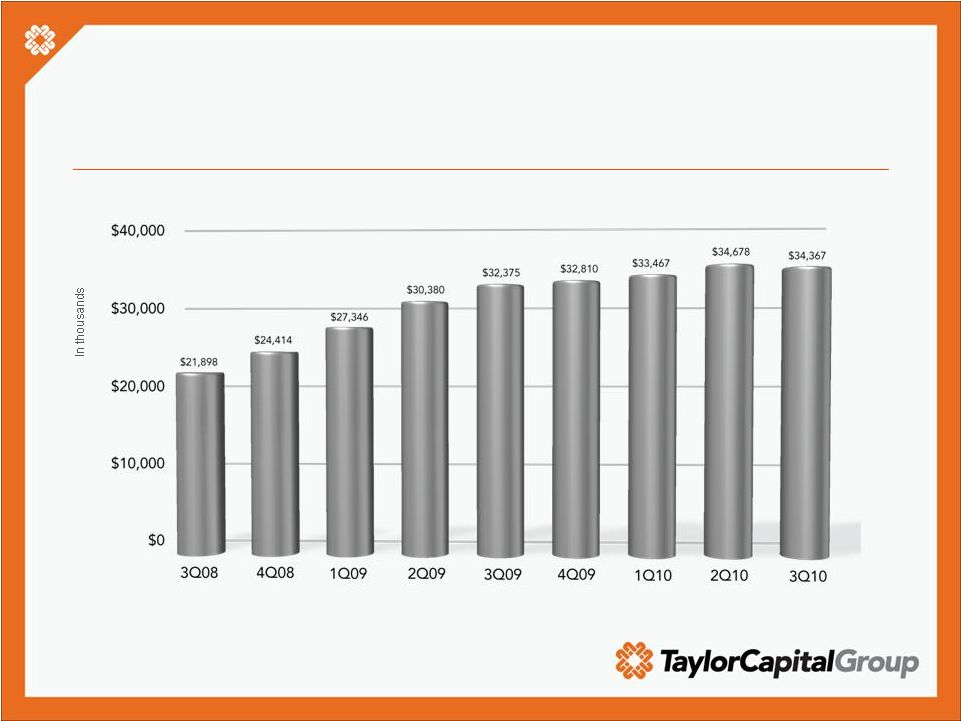

Pre-tax, pre-provision earnings from core

operations increased 19.2% in Q3 2010

Pre-tax, Pre-provision Earnings from Core Operations*

6

*For a reconciliation to GAAP measures of pre-tax, pre-provision earnings

from core operations, please see page 23 of this presentation.

|

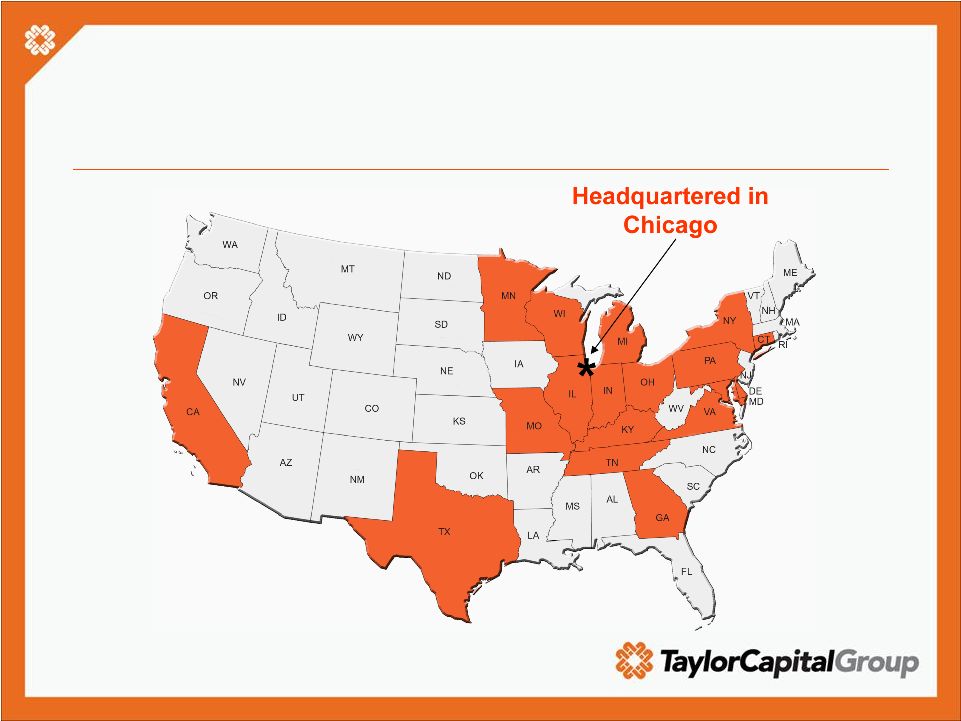

Grow: key

business lines driving earnings power and diversification of revenue

•

For 2010, through 3Q, added 67 new relationships

•

Commitments as of 3Q 2010 are $2.1 billion and fundings are

$1.5 billion

7

Cole Taylor

Bank

Commercial

Banking

•

For 2010, through 3Q, added 26 new relationships

•

As of September 30, 2010, commitments are $653.6 million and

fundings are $317.6 million

•

Total loan fees collected through 3Q 2010 are $5.1 million

Cole Taylor

Business

Capital

•

Generated revenues of $6.3 million in 3Q 2010

•

Originated $242.2 million in mortgages in 3Q 2010

•

Hired 119 FTEs through

September 30, 2010

•

Qualified in 17 states, with retail offices in 5 of those states

Cole Taylor

Mortgage |

Through

Cole

Taylor

Business

Capital

and

Cole

Taylor

Mortgage,

the

Bank

operates

in

18

states

8 |

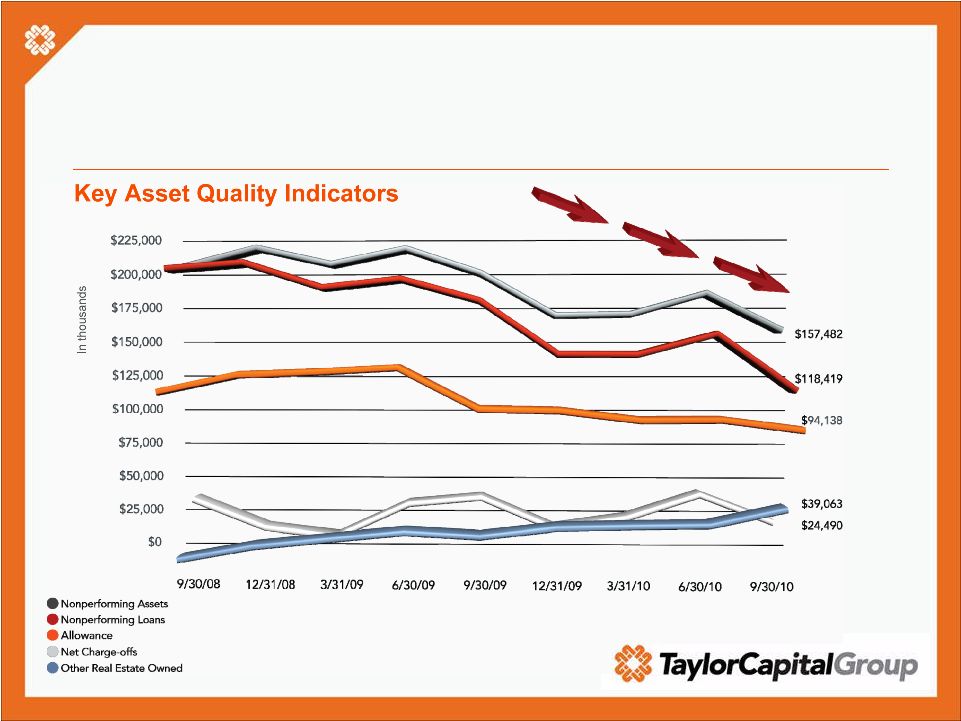

Fix:

Priority

continues

to

be

nonperforming

loan

reduction while pursuing best economic

outcome; credit dynamics remain challenging

9 |

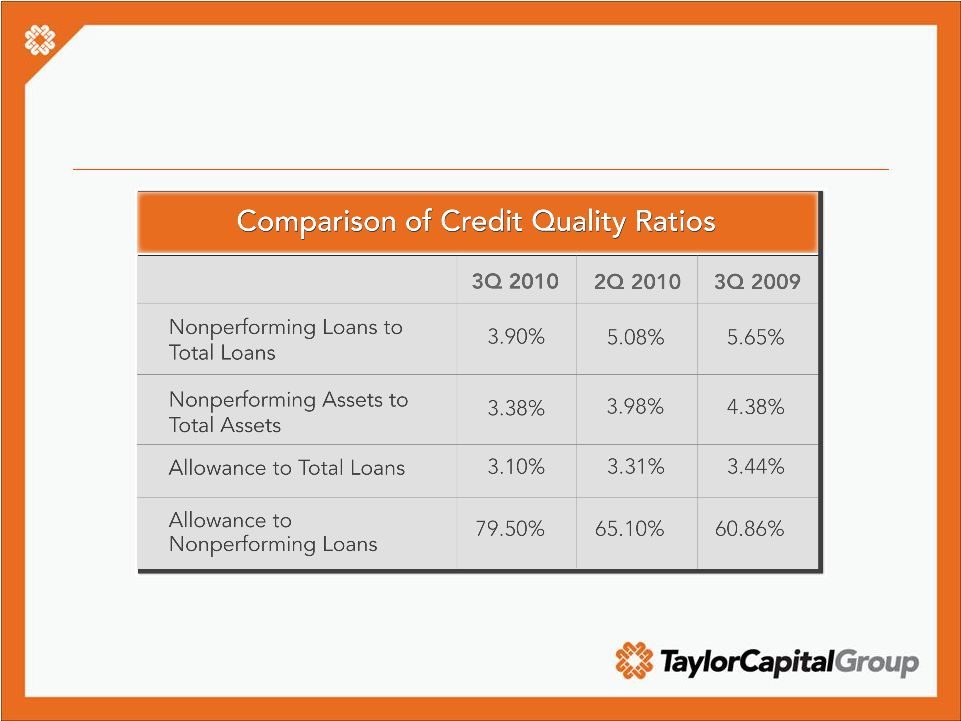

Solid

improvement in credit quality, compared to 2Q 2010 and 3Q 2009

10 |

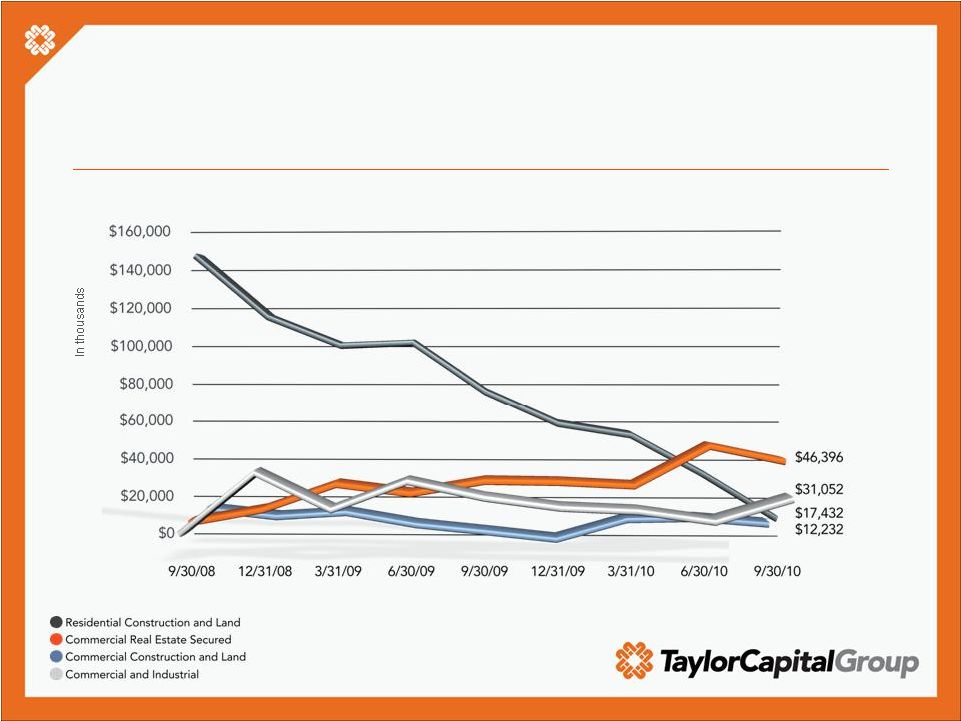

Significant nonaccrual reduction in residential

construction and land; other portfolios stable

11

Nonaccrual Loans by Category |

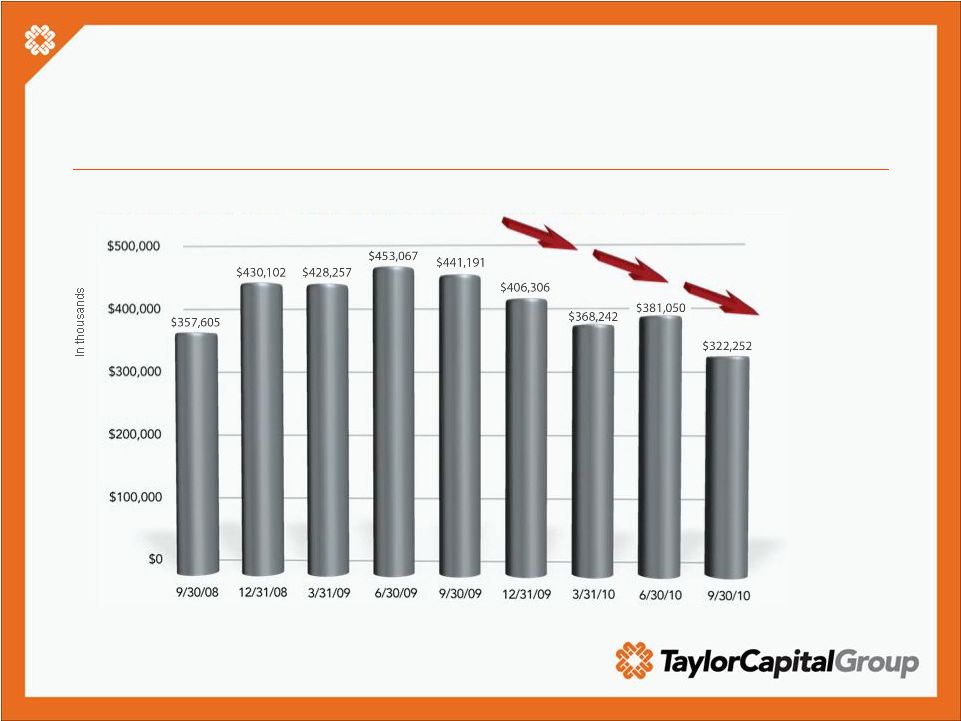

Commercial

watch list* down more than $130MM from peak at 6/30/2009

*Commercial watch list of all criticized and classified loans (includes special

mention, substandard, and nonaccrual loans) in commercial & industrial,

commercial real estate, residential land and construction and commercial

land and construction federal collateral codes. Excludes consumer

loans. 12

Commercial Watch List of Criticized and Classified Loans*

|

|

Net

interest income down slightly due to the sale of investment securities

Net Interest Income

14 |

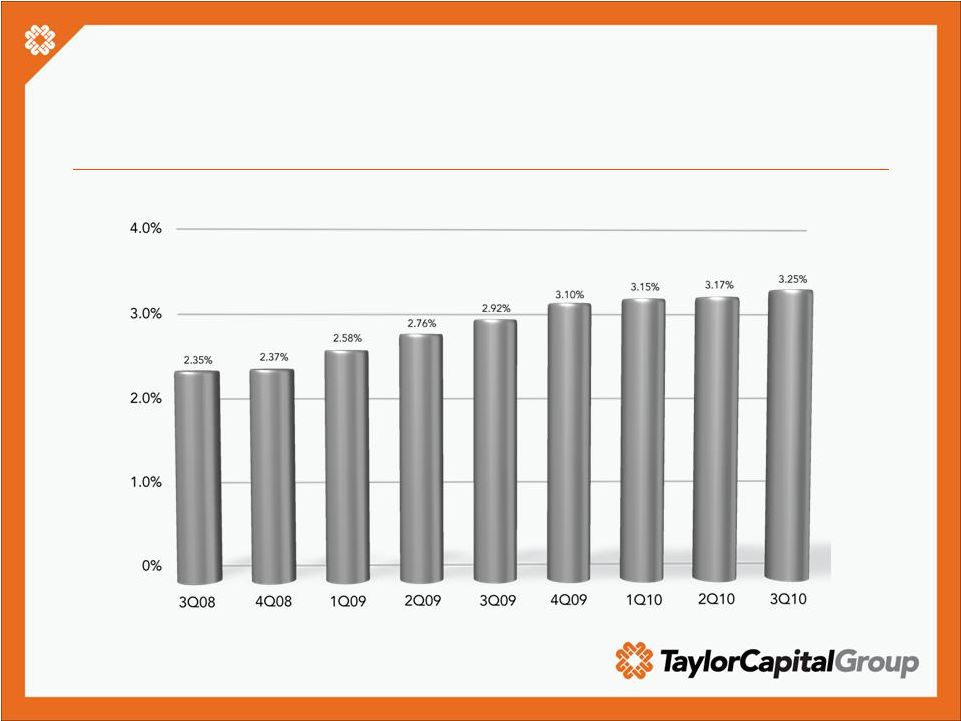

Net

interest margin increased 8 bps over 2Q 2010; up 90 bps from low at 3Q 2008

15

Net Interest Margin (Tax Equivalent)*

*Adjustment reflects tax-exempt interest income on an equivalent

before-tax basis assuming a tax rate of 35%. |

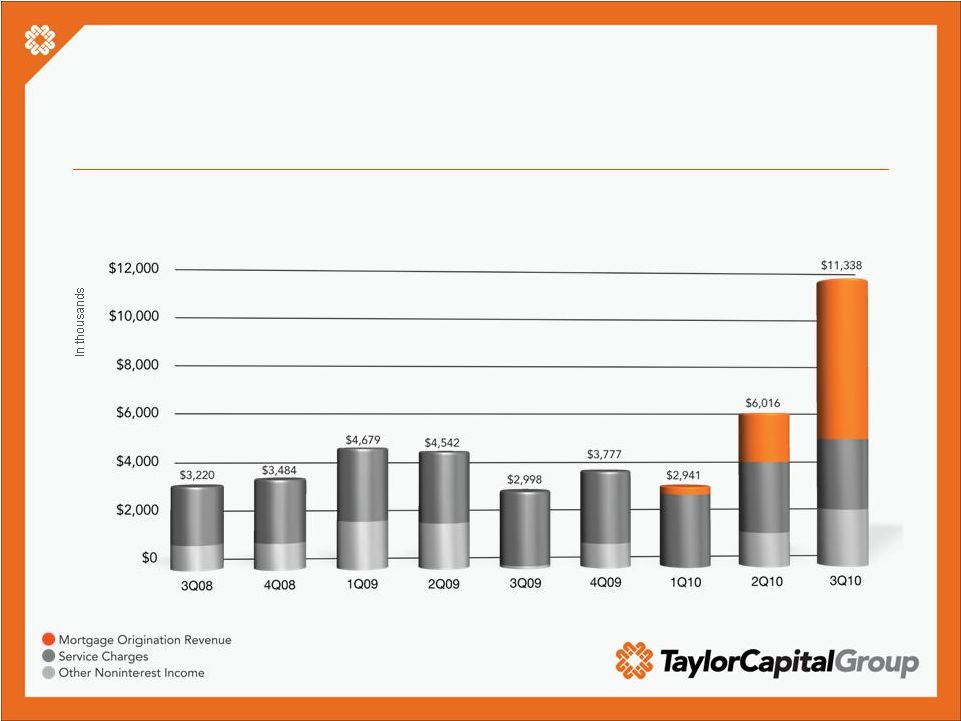

Noninterest Income Excluding Gains or Losses on the Sale

of Investment Securities

16

Noninterest income excluding securities gains

up largely due to mortgage origination revenue |

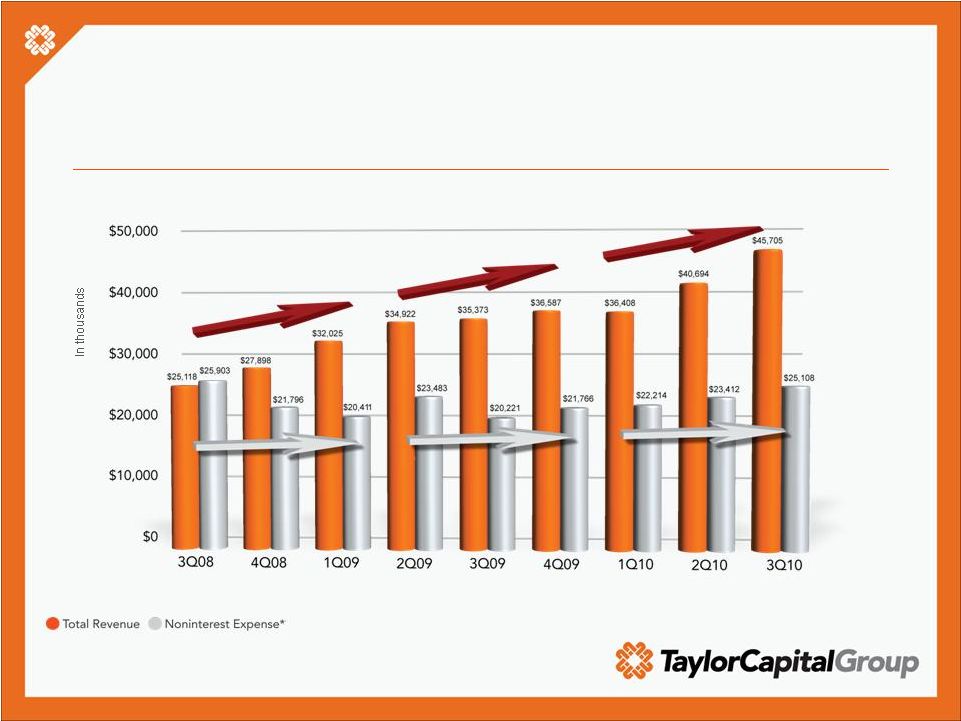

Core

earnings strengthened through business line growth and tight expense control

17

*For a reconciliation of revenue to GAAP measures, please see

page 23 of this presentation; Noninterest expense quoted above is

normalized for NPA expense.

Total Revenue* and Noninterest Expense Trends |

|

Most

significant change in the balance sheet was sale of investment securities

»

Sold approximately $700 million of investment securities, largely

mortgage backed securities, in the third quarter of 2010

•

Total investment portfolio reduced $257.8 million as of 9/30/10

»

Minimized prepayment risk that threatened unrealized gains

»

Augmented Tier 1 capital by realizing the gains

»

Other assets and other liabilities increased due to the timing of

investment securities sale and purchase transactions, respectively

19 |

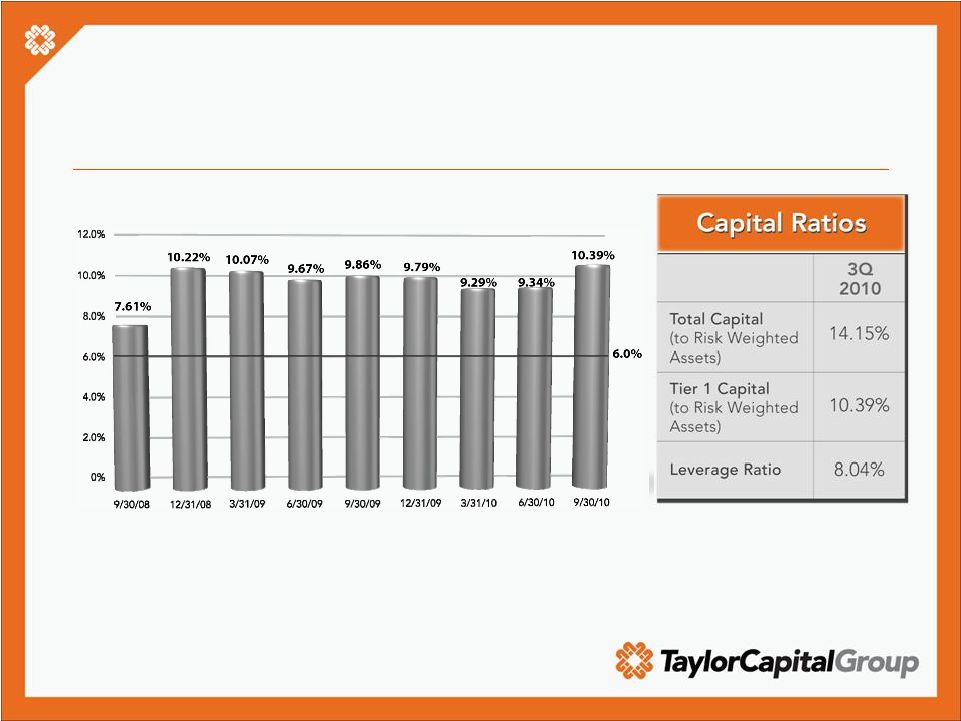

Tier

1 Total Risk Based Capital Ratio Trends 20

Capital ratios remain above regulatory

definition for ‘well-capitalized’ banks |

|

Net income

of $33.4 million; core earning and asset quality continuing to show

improvement »

Net income for 3Q 2010 was $33.4 million, compared to 2Q 2010 net

loss of $30.9 million; results due to:

•

$32.8 million of securities gains undertaken to minimize prepayment risk

•

Increased pre-tax, pre-provision income over 2Q 2010

•

Reduced provision and NPA expense over 2Q 2010

»

Solid improvement in the earnings power of the core business:

•

19.2% increase in pre-tax, pre-provision earnings from core operations

quarter over quarter

•

Income before income taxes excluding securities gains was $931,000

»

Asset quality improved

•

Priority remains nonperforming loan reduction while pursuing best economic

outcome

•

Residential

construction

and

land

–

most

challenged

portfolio

down

18.6%

from 2Q 2010 to 3Q 2010

22 |

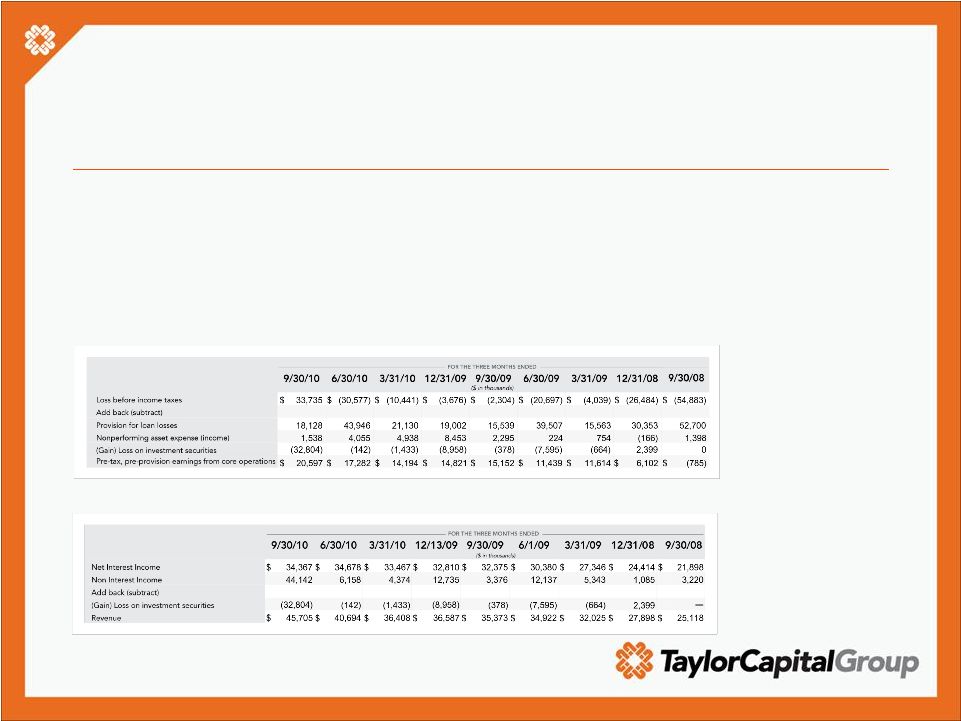

23

Non-GAAP Measures

of Performance

The Company's accounting and reporting policies conform to U.S. generally accepted accounting

principles ("GAAP") and general practice within the banking industry. Management uses

certain non-GAAP financial measures to evaluate the Company’s financial performance and

has provided the non-GAAP measure of pre-tax, pre-provision earnings from core operations and the non-GAAP measure of

revenue. For the non-GAAP financial measure of pre-tax, pre-provision earnings from core

operations, the provision of loan losses, nonperforming asset expense and certain

non-recurring items, such as gains and losses on investment securities, are excluded from the

determination of operating results. The non-GAAP measure of revenue is calculated as the sum

of net interest income and noninterest income less securities gains and losses. Management

believes that these measures are useful because they provide a more comparable basis for

evaluating financial performance from core operations period to period. Schedules reconciling

earnings in accordance with GAAP to the non-GAAP measurement of pre-tax, pre-provision earnings from core

operations and revenue are provided below. |