Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Breitburn Energy Partners LP | v199628_ex23-2.htm |

| EX-31.2 - EX-31.2 - Breitburn Energy Partners LP | v199628_ex31-2.htm |

| EX-31.1 - EX-31.1 - Breitburn Energy Partners LP | v199628_ex31-1.htm |

| EX-23.3 - EX-23.3 - Breitburn Energy Partners LP | v199628_ex23-3.htm |

| EX-99.2 - EX-99.2 - Breitburn Energy Partners LP | v199628_ex99-2.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10-K/A

Amendment

No. 1

R Annual Report Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31,

2009

or

¨ Transition Report Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

For

the transition period from ___ to ___

Commission

file number 001-33055

BreitBurn

Energy Partners L.P.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

74-3169953

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

Identification

No.)

|

|

515

South Flower Street, Suite 4800

|

|

|

Los

Angeles, California

|

90071

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (213) 225-5900

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which

registered

|

|

|

Common

Units Representing Limited Partner Interests

|

The

NASDAQ Stock Market LLC

|

Securities

registered pursuant to section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the

Act. Yes ¨ No þ

Indicate

by check mark whether registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes þ No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes ¨ No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will

not be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K.

¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange

Act. Large accelerated

filer ¨ Accelerated

filer þ

Non-accelerated

filer ¨ (Do

not check if a smaller reporting company) Smaller reporting

company ¨

Indicate

by check-mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Act). Yes ¨ No þ

The

aggregate market value of the Common Units held by non-affiliates was

approximately $399,969,000 on June 30, 2009, the last business day of the

registrant’s most recently completed second fiscal quarter, based on

$7.68 per unit, the last reported sales price of the Common Units on the

Nasdaq Global Select Market on such date. The calculation of the aggregate

market value of the Common Units held by non-affiliates of the registrant is

based on an assumption that Quicksilver Resources Inc., which owned 21,347,972

Common Units on such date, representing 40 percent of the outstanding Common

Units, was a non-affiliate of the registrant on such

date.

As of

March 10, 2010, there were 53,294,012 Common Units

outstanding.

Documents

Incorporated By Reference: None

EXPLANATORY

NOTE

BreitBurn

Energy Partners L.P. (the “Partnership,” “we,” “us” or “our”) is filing this

Amendment No. 1 on Form 10-K/A (this “Amendment”) to amend its Annual Report on

Form 10-K for the year ended December 31, 2009, filed with the Securities and

Exchange Commission (the “SEC”) on March 10, 2010 (the “Original

10-K”).

This

Amendment is being filed to amend the Original 10-K solely to:

|

(a)

|

Revise

the Developed and Undeveloped Acreage table and the expiring acreage table

in Item 1 of Part I to correctly state the Michigan gross and net

developed and undeveloped acreage, which was overstated in the Original

10-K due to a computational error. This error does not affect

any operations, production or reserves information previously

reported. In addition, there was not any acreage which we

believed we held that we did not. Our prospective

Collingwood-Utica acreage of over 120,000 net acres in Michigan is correct

and unchanged.

|

|

(b)

|

Replace

Exhibit 99.2 “Report of Schlumberger Technology Corporation,” included in

Item 15 of Part IV, with a revised report received from Schlumberger

Technology Corporation – the only revisions to this report

were:

|

|

|

(i)

|

The

deletion of the following language that could suggest either a limited

audience or a limit on potential investor reliance: “This report was

prepared solely for the use of the party to whom it is addressed and any

disclosure made of this report and/or the contents by said party thereof

shall be solely the responsibility of said party and shall in no way

constitute any representation of any kind whatsoever of the undersigned

with respect to the matters being

addressed.”

|

|

|

(ii)

|

Replacement

of the following sentence, “In our opinion the above-described estimates

of BreitBurn’s proved reserves and supporting data are, in the aggregate,

reasonable and have been prepared in accordance with generally accepted

petroleum engineering and evaluation.” with this sentence “In our opinion

the above-described estimates of BreitBurn’s proved reserves and

supporting data are, in the aggregate, reasonable and have been prepared

in accordance with generally accepted petroleum engineering evaluation

methods and procedures.”

|

This

Amendment includes new certifications by our Principal Executive Officer and

Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of

2002, filed as Exhibits 31.1 and 31.2 hereto. Each certification was

true and correct as of the date of the filing of the Original 10-K.

Pursuant

to interpretation 246.14 in the Regulation S-K section of the SEC’s “Compliance

& Disclosure Interpretations,” we are filing Parts I and IV of the Original

10-K in their entirety as part of this Amendment. Such Other

Information was complete and correct as of the date of the filing of the

Original 10-K.

Except as

described above, we have not modified or updated other disclosures contained in

the Original 10-K. Accordingly, this Amendment, with the exception of

the foregoing, does not reflect events occurring after the date of filing of the

Original 10-K, or modify or update those disclosures affected by subsequent

events. Consequently, all other information not affected by the

corrections described above is unchanged and reflects the disclosures and other

information made at the date of the filing of the Original 10-K and should be

read in conjunction with our filings with the SEC subsequent to the filing of

the Original 10-K, including amendments to those filings, if

any.

BREITBURN

ENERGY PARTNERS L.P. AND SUBSIDIARIES

TABLE

OF CONTENTS

|

Page

|

||

|

No.

|

||

|

PART

I

|

||

|

Item

1.

|

Business.

|

1

|

|

Item

1A.

|

Risk

Factors.

|

21

|

|

Item

1B.

|

Unresolved

Staff Comments.

|

42

|

|

Item

2.

|

Properties.

|

42

|

|

Item

3.

|

Legal

Proceedings.

|

42

|

|

Item

4.

|

(Removed

and Reserved).

|

43

|

|

PART

IV

|

||

|

Item

15.

|

Exhibits

and Financial Statement Schedules.

|

44

|

|

Signatures.

|

49

|

|

PART

I

Item

1. Business.

Overview

We are an

independent oil and gas partnership focused on the acquisition, exploitation and

development of oil and gas properties in the United States. Our objective is to

manage our oil and gas producing properties for the purpose of generating cash

flow and making distributions to our unitholders. Our assets consist primarily

of producing and non-producing crude oil and natural gas reserves located

primarily in the Antrim Shale in Michigan, the Los Angeles Basin in California,

the Wind River and Big Horn Basins in central Wyoming, the Sunniland Trend in

Florida and the New Albany Shale in Indiana and Kentucky. Our assets are

characterized by stable, long-lived production and proved reserve life indexes

averaging greater than 16 years. We have high net revenue interests in our

properties.

We are a

Delaware limited partnership formed on March 23, 2006. Our general partner is

BreitBurn GP, a Delaware limited liability company, also formed on March 23,

2006, and our wholly owned subsidiary since June 17, 2008. The board of

directors of our General Partner (the “Board”) has sole responsibility for

conducting our business and managing our operations. We conduct our operations

through a wholly owned subsidiary, BOLP, and BOLP’s general partner, BOGP. We

own all of the ownership interests in BOLP and BOGP.

Our

wholly owned subsidiary, BreitBurn Management, manages our assets and performs

other administrative services for us such as accounting, corporate development,

finance, land administration, legal and engineering. See Note 8 to the

consolidated financial statements in this report for more information regarding

our relationship with BreitBurn Management.

Ownership

and Structure

In 2006,

we completed our initial public offering of 6,000,000 common units representing

limited partner interests in us (“Common Units”) and completed the sale of an

additional 900,000 Common Units to cover over-allotments in the initial public

offering at $18.50 per unit, or $17.21 per unit after payment of the

underwriting discount. In connection with our initial public offering, BreitBurn

Energy Company L.P. (“BEC”), our Predecessor, contributed to us certain fields

in the Los Angeles Basin in California, including its interests in the Santa Fe

Springs, Rosecrans and Brea Olinda Fields, and the Wind River and Big Horn

Basins in central Wyoming.

On May

24, 2007, we sold 4,062,500 Common Units in a private placement at $32.00 per

unit, resulting in proceeds of approximately $130 million. The net proceeds of

this private placement were used to acquire certain interests in oil leases and

related assets from Calumet Florida L.L.C. and to reduce indebtedness under

our credit facility.

On May

25, 2007, we sold 2,967,744 Common Units in a private placement at $31.00 per

unit, resulting in proceeds of approximately $92 million. The net proceeds of

this private placement were partially used to acquire interests in the Sawtelle

and East Coyote Fields in California, through the purchase of a 99 percent

limited partner interest in BEPI from TIFD and to terminate existing hedges

related to future production from BEPI.

On

November 1, 2007, we sold 16,666,667 Common Units in a third private placement

at $27.00 per unit, resulting in proceeds of approximately $450 million. The net

proceeds from this private placement were used to fund a portion of the cash

consideration for the acquisition of certain assets and equity interests in

certain entities from Quicksilver Resources Inc. (“Quicksilver”) (the

“Quicksilver Acquisition”). Also on November 1, 2007, we issued 21,347,972

Common Units to Quicksilver as partial consideration for the Quicksilver

Acquisition.

On June

17, 2008, we purchased 14,404,962 Common Units from subsidiaries of Provident at

$23.26 per unit, for a purchase price of approximately $335 million (the “Common

Unit Purchase”). These units have been cancelled and are no longer

outstanding.

1

On June 17, 2008, we also

purchased Provident’s 95.55 percent limited liability company interest in

BreitBurn Management, which owned the General Partner, for a purchase price of

approximately $10

million (the “BreitBurn Management Purchase”). See Note 4 to the

consolidated financial statements in this report for the purchase price

allocation for this transaction. Also on June 17, 2008, we entered into a

contribution agreement with the General Partner, BreitBurn Management and

BreitBurn Energy Corporation (“BreitBurn

Corporation”), which is wholly owned by the Co-Chief Executive Officers

of the General Partner, Halbert S. Washburn and Randall H. Breitenbach, pursuant

to which BreitBurn Corporation contributed its 4.45 percent limited liability

company interest in BreitBurn Management to us in exchange for 19,955 Common

Units, the economic value of which was equivalent to the value of their combined

4.45 percent interest in BreitBurn Management, and BreitBurn Management

contributed its 100 percent limited liability company interest in the General

Partner to us. On the same date, we entered into Amendment No. 1 to the First

Amended and Restated Agreement of Limited Partnership of the Partnership,

pursuant to which the economic portion of the General Partner’s 0.66473 percent

general partner interest in us was eliminated and our limited partners holding

Common Units were given a right to nominate and vote in the election of

directors to the Board of Directors of the General Partner. As a result of these

transactions (collectively, the “Purchase, Contribution and Partnership

Transactions”), the General Partner and BreitBurn Management became our

wholly owned subsidiaries.

On June

17, 2008, in connection with the Purchase, Contribution and Partnership

Transactions, we and our wholly owned subsidiaries entered into the First

Amendment to Amended and Restated Credit Agreement, Limited Waiver and Consent

and First Amendment to Security Agreement (“Amendment No. 1 to the Credit

Agreement”), with Wells Fargo Bank, National Association, as administrative

agent. Amendment No. 1 to the Credit Agreement increased the borrowing base

available under the Amended and Restated Credit Agreement dated November 1, 2007

from $750 million to $900 million. We used borrowings under Amendment No. 1 to

the Credit Agreement to finance the Common Unit Purchase and the BreitBurn

Management Purchase. As of December 31, 2009, our borrowing base was $732

million and our outstanding debt was $559 million.

On June

17, 2008, in connection with the Purchase, Contribution and Partnership

Transactions, the Omnibus Agreement, dated October 10, 2006, among us, the

General Partner, Provident, Pro GP and BEC was terminated in all

respects.

Our

Predecessor, BEC, was a 96.02 percent owned indirect subsidiary of Provident

until August 26, 2008, when members of our senior management, in their

individual capacities, together with Metalmark Capital Partners (“Metalmark”),

Greenhill Capital Partners (“Greenhill”) and a third-party institutional

investor, completed the acquisition of BEC, our Predecessor. This transaction

included the acquisition of a 96.02 percent indirect interest in BEC, previously

owned by Provident, and the remaining indirect interests in BEC, previously

owned by Randall H. Breitenbach, Halbert S. Washburn and other members

of the our senior management. BEC was a separate U.S. subsidiary of Provident

and was our Predecessor.

In connection with the acquisition of

Provident’s ownership in BEC by members of senior management, Metalmark,

Greenhill and a third party institutional investor, BreitBurn Management entered

into a five-year Administrative Services Agreement to manage BEC's properties.

In addition, we entered into an Omnibus Agreement with BEC detailing rights with

respect to business opportunities and providing us with a right of first offer

with respect to the sale of assets by BEC.

On June

1, 2009, BreitBurn Finance Corporation was incorporated under the laws of the

State of Delaware. BreitBurn Finance Corporation is wholly owned by us, and has

no assets or liabilities. Its activities are limited to co-issuing debt

securities and engaging in other activities incidental thereto.

2

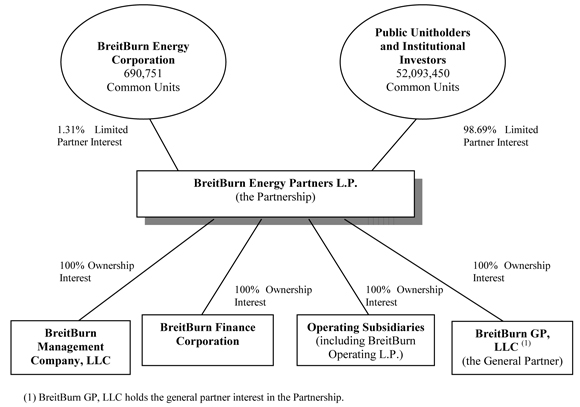

The

following diagram depicts our organizational structure as of December 31,

2009:

As of

December 31, 2009, the public unitholders, the institutional investors in our

private placements and Quicksilver owned 98.69 percent of the outstanding Common

Units. BreitBurn Corporation owned 690,751 Common Units, representing a 1.31

percent limited partner interest. We own 100 percent of the General Partner,

BreitBurn Management and BOLP.

In

January 2010, 496,194 Common Units were issued to employees under our 2006

Long-Term Incentive Plan and 13,617 Common Units were issued to outside

directors for phantom units and distribution equivalent rights that were granted

in 2007 and vested in January 2010. These issuances increased our outstanding

Common Units to 53,294,012.

Unit

Purchase Rights Agreement

On

December 22, 2008, we entered into a Unit Purchase Rights Agreement, dated as of

December 22, 2008 (the “Rights Agreement”), between us and American Stock

Transfer & Trust Company LLC, as Rights Agent. Under the Rights

Agreement, each holder of Common Units at the close of business on December 31,

2008 automatically received a distribution of one unit purchase right (a

“Right”), which entitles the registered holder to purchase from us one

additional Common Unit at a price of $40.00 per Common Unit, subject to

adjustment. We entered into the Rights Agreement to increase the likelihood that

our unitholders receive fair and equal treatment in the event of a takeover

proposal.

The

issuance of the Rights was not taxable to the holders of the Common Units, had

no dilutive effect, will not affect our reported earnings per Common Unit, and

will not change the method of trading of the Common Units. The Rights will not

trade separately from the Common Units unless the Rights become exercisable. The

Rights will become exercisable if a person or group acquires beneficial

ownership of 20 percent or more of the outstanding Common Units or commences, or

announces its intention to commence, a tender offer that could result in

beneficial ownership of 20 percent or more of the outstanding Common Units. If

the Rights become exercisable, each Right will entitle holders, other than the

acquiring party, to purchase a number of Common Units having a market value of

twice the then-current exercise price of the Right. Such provision will not

apply to any person who, prior to the adoption of the Rights Agreement,

beneficially owns 20 percent or more of the outstanding Common Units until such

person acquires beneficial ownership of any additional Common

Units.

3

The

Rights Agreement has a term of three years and will expire on December 22, 2011,

unless the term is extended, the Rights are earlier redeemed or we terminate the

Rights Agreement.

Available

Information

Our

internet website address is www.breitburn.com. We make available, free of charge

at the “Investor Relations” portion of our website, our Annual Report on Form

10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all

amendments to those reports filed or furnished pursuant to Section 13(a) or

15(d) of the Securities Exchange Acts of 1934, as amended, as soon as reasonably

practicable after such reports are electronically filed with, or furnished to,

the SEC. The information contained on our website does not constitute part of

this report.

Long-Term

Business Strategy

Our

long-term goals are to manage our oil and gas producing properties for the

purpose of generating cash flow and making distributions to our unitholders. In

order to meet these objectives, we plan to continue to follow our core

investment strategy, which includes the following principles:

|

|

·

|

Acquire

long-lived assets with low-risk exploitation and development

opportunities;

|

|

|

·

|

Use

our technical expertise and state-of-the-art technologies to identify and

implement successful exploitation techniques to optimize reserve

recovery;

|

|

|

·

|

Reduce

cash flow volatility through commodity price and interest rate

derivatives; and

|

|

|

·

|

Maximize

asset value and cash flow stability through our operating and technical

expertise.

|

2010

Outlook

In

February 2010, we announced our intention to reinstate quarterly cash

distributions to our unitholders at the rate of $0.375 per quarter, beginning

with the first quarter of 2010. We intend to pay the first quarter distribution

on or before May 15, 2010. In February 2010, we also agreed to settle all claims

with respect to the litigation filed by Quicksilver in October 2008. With the

settlement of this lawsuit, we will be able to focus on growth strategies in

2010 including acquisition opportunities consistent with our long-term

goals.

With the

improvement in commodity prices during 2009, we accelerated our capital spending

in the second half of the year. In 2010, our crude oil and natural gas capital

spending program is expected to be in the range of $72 million to $78 million,

compared with approximately $29 million in 2009. We anticipate spending

approximately 60 percent in California, Florida and Wyoming and approximately 40

percent in Michigan, Indiana and Kentucky. We expect to drill or redrill

approximately 40 wells, with 59 percent of our total capital spending focused on

drilling, 21 percent on mandatory projects and 20 percent on optimization

projects. As a result of our accelerated capital spending, but without

considering potential acquisitions, we would expect production to be

approximately 6.3 MMBoe to 6.7 MMBoe in 2010.

Commodity

hedging remains an important part of our strategy to reduce cash flow

volatility. We use swaps, collars and options for managing risk relating to

commodity prices. As of March 10, 2010, we have hedged (including physical

hedges) approximately 80 percent of our 2010 expected production. In 2010, we

have 47,275 MMBtu/d of natural gas and 6,580 Bbls/d of oil hedged at average

prices of approximately $8.26 and $81.81, respectively. In 2011, we have

41,971 MMBtu/d of natural gas and 6,103 Bbls/d of oil hedged at average prices

of approximately $7.92 and $77.54, respectively. In 2012, we have 38,257

MMBtu/d of natural gas and 5,016 Bbls/d of oil hedged at average prices of

approximately $8.05 and $88.35, respectively. In 2013, we have 27,000 MMBtu/d of

natural gas and 4,000 Bbls/d of oil hedged at average prices of approximately

$6.92 and $76.82, respectively. In 2014, we have 748 Bbls/d of oil hedged at an

average price of approximately $88.65.

4

We will

continue to consider alternatives for increasing our liquidity on terms

acceptable to us which may include additional hedge monetizations, asset sales,

issuance of new equity or debt securities and other transactions. We continue to

believe that maintaining our financial flexibility by reducing our bank debt

should remain a priority. Maintaining financial flexibility in 2010 supports our

stated long-term goals of providing stability and growth and following our core

investment strategies.

On

October 31, 2008, Quicksilver instituted a lawsuit naming us, among others, as a

defendant. As discussed above, in February 2010, we and Quicksilver agreed to

settle all claims with respect to the litigation. See “—Item 3. —Legal

Proceedings” for a detailed description of the settlement.

Properties

BreitBurn

Management manages all of our properties. BreitBurn Management employs

production and reservoir engineers, geologists and other specialists, as well as

field personnel. On a net production basis, we operate approximately 82 percent

of our production. As operator, we design and manage the development of wells

and supervise operation and maintenance activities on a day-to-day basis. We do

not own drilling rigs or other oilfield services equipment used for drilling or

maintaining wells on properties we operate. We engage independent contractors to

provide all the equipment and personnel associated with these

activities.

In October 2006, certain properties,

which include fields in the Los Angeles Basin in California and the Wind River

and Big Horn Basins in central Wyoming, were contributed to us by our

Predecessor. In 2007, we acquired the Lazy JL Field in Texas, five fields

in Florida’s Sunniland Trend, a limited partnership interest in a partnership

that owns the East Coyote and Sawtelle fields in the Los Angeles Basin in

California, and natural gas, oil and midstream assets in Michigan, Indiana and

Kentucky, including fields in the Antrim Shale in Michigan and New Albany Shale

in Indiana and Kentucky, transmission and gathering pipelines, three gas

processing plants and four NGL recovery plants. On July 17, 2009, we sold the

Lazy JL Field.

Reserves

and Production

In

December 2008, the SEC issued SEC Release No. 33-8995,

“Modernization of Oil and Gas Reporting” (“Release 33-8995”). This release revised the

calculation of total estimated proved reserves. Prospectively beginning with

this report, the revised calculation is based on unweighted average

first-day-of-the-month pricing for the past 12 fiscal months rather than the

end-of-the-year pricing, which was used for calculation of total estimated

proved reserves for 2008. As of December 31, 2009, our total estimated proved

reserves were 111.3 MMBoe, of which approximately 65 percent were natural gas

and 35 percent were crude oil. As of December 31, 2008, our total estimated

proved reserves were 103.6 MMBoe, of which approximately 75 percent were natural

gas and 25 percent were crude oil. The increase in estimated proved reserves in

2009 due to economic factors was 9.8 MMBoe, which was primarily due to higher

unweighted average first-day-of-the-month crude oil prices during 2009 ($61.18

per Bbl except Wyoming properties for which $51.29 per Bbl was used) compared to

end-of -the-year pricing for 2008 ($44.60 per Bbl except Wyoming properties for

which $20.12 was used), partially offset by lower unweighted average

first-day-of-the-month natural gas prices during 2009 ($3.87 per Mcf) compared

to end-of -the-year pricing for 2008 ($5.71 per Mcf). We also added 7.0 MMBoe

from drilling, recompletions and workovers. The reserve additions were partially

offset by 2009 production of 6.5 MMBoe, negative technical revisions of 1.5

MMBoe and the sale of the Lazy JL Field, which reduced reserves by 1.1

MMBoe.

See Note

22 to the consolidated financial statements in this report for a discussion of

Release 33-8995. See “Results of Operations” in Part II—Item 7

“—Management’s Discussion and Analysis

of Financial Condition and Results of Operations” in this report for oil,

NGL and natural gas production, average sales price per Boe and per Mcf and

average production cost per Boe for 2009, 2008 and 2007.

5

The

following table summarizes estimated proved developed and undeveloped oil and

gas reserves based on average fiscal-year prices:

|

Summary of Oil and Gas Reserves as of December 31, 2009

|

||||||||||||

|

Based on Average Fiscal Year Prices

|

||||||||||||

|

Total

(MMBoe)

|

Oil

(MMBbl)

|

Gas

(Bcf)

|

||||||||||

|

Proved

|

||||||||||||

|

Developed

|

101.0 | 34.4 | 399.2 | |||||||||

|

Undeveloped

|

10.3 | 4.4 | 35.5 | |||||||||

|

Total

proved

|

111.3 | 38.8 | 434.7 | |||||||||

During

2009, we incurred $5.8 million in capital expenditures and drilled 11 wells to

convert 568 MBbl of oil and 484 MMcf of natural gas from proved undeveloped to

proved developed reserves. As of December 31, 2009, we had no material proved

undeveloped reserves that have remained undeveloped for more than five years. As

of December 31, 2009, proved undeveloped reserves were 10.3 MMBoe compared to

8.0 MMBoe as of December 31, 2008. The increase in proved undeveloped reserves

during 2009 was primarily due to the economic effect of higher 2009 SEC pricing

on properties previously deemed uneconomical as well as revisions of estimates,

partially offset by the conversion of proved undeveloped reserves to proved

developed reserves.

Of our

total estimated proved reserves as of December 31, 2009, 68 percent were located

in Michigan, 14 percent in California, ten percent in Wyoming and seven percent

in Florida with the remaining one percent in Indiana and Kentucky. As of

December 31, 2009, the total standardized measure of discounted future net cash

flows was $760 million. During 2009, we filed estimates of oil and gas reserves

as of December 31, 2008 with the U.S. Department of Energy, which were

consistent with the reserve data reported for the year ended December 31, 2008

in Note 22 to the consolidated financial statements in this report.

The

following table summarizes estimated proved reserves and production for our

properties by state:

|

As of December 31, 2009

|

2009

|

|||||||||||||||||||

|

Estimated

|

Estimated

|

Average

|

||||||||||||||||||

|

Proved

|

Percent of Total

|

Proved Developed

|

Daily

|

|||||||||||||||||

|

Reserves (a)

|

Estimated Proved

|

Reserves

|

Production

|

Production

|

||||||||||||||||

|

(MMBoe)

|

Reserves

|

(MMBoe)

|

(MBoe)

|

(Boe/d)

|

||||||||||||||||

|

Michigan

|

76.2 | 68.4 | % | 69.2 | 3,801.1 | 10,414 | ||||||||||||||

|

California

|

15.1 | 13.6 | % | 14.6 | 1,151.2 | 3,154 | ||||||||||||||

|

Wyoming

|

11.5 | 10.3 | % | 10.3 | 805.0 | 2,205 | ||||||||||||||

|

Florida

|

7.3 | 6.6 | % | 5.7 | 503.5 | 1,380 | ||||||||||||||

|

Kentucky

|

0.9 | 0.8 | % | 0.9 | 70.6 | 194 | ||||||||||||||

|

Indiana

|

0.3 | 0.3 | % | 0.3 | 141.7 | 388 | ||||||||||||||

|

Total

|

111.3 | 100 | % | 101.0 | 6,473.1 | 17,735 | ||||||||||||||

|

Texas

(b)

|

44.3 | 245 | ||||||||||||||||||

|

Total

Production including six months of Lazy JL Field

production

|

6,517.4 | 17,980 | ||||||||||||||||||

|

(a)

|

Our

estimated proved reserves were determined using $3.87 per MMBtu for gas

and $61.18 per Bbl of oil forMichigan and California and $51.29 per Bbl of

oil for Wyoming. For additional estimated proved reserves details,see Note

22 to the consolidated financial statements in this

report.

|

|

(b)

|

We

sold the Lazy JL Field in Texas effective July 1, 2009. Lazy JL Field

production and average daily productionare provided for the first six

months of 2009.

|

6

Uncertainties

are inherent in estimating quantities of proved reserves, including many factors

beyond our control. Reserve engineering is a subjective process of estimating

subsurface accumulations of oil and gas that cannot be measured in an exact

manner, and the accuracy of any reserve estimate is a function of the quality of

available data and its interpretation. As a result, estimates by different

engineers often vary, sometimes significantly. In addition, physical factors

such as the results of drilling, testing and production subsequent to the date

of an estimate, as well as economic factors such as changes in product prices or

development and production expenses, may require revision of such estimates.

Accordingly, oil and gas quantities ultimately recovered will vary from reserve

estimates. See Part I—Item 1A “—Risk Factors” in this report, for a

description of some of the risks and uncertainties associated with our business

and reserves.

The information in this

report relating to our estimated oil and gas proved reserves is based upon

reserve reports prepared as of December 31, 2009. Estimates of our proved

reserves were prepared by Netherland, Sewell & Associates, Inc. and

Schlumberger Data & Consulting Services, independent petroleum engineering

firms. Netherland, Sewell & Associates, Inc. provides reserve data

for our California, Wyoming and Florida properties, and Schlumberger Data &

Consulting

Services provides reserve data for our Michigan, Kentucky and Indiana

properties. The reserve estimates are reviewed and approved by members of our

senior engineering staff and management. The process performed by Netherland,

Sewell & Associates, Inc. and Schlumberger Data & Consulting

Services to prepare reserve amounts included their estimation of reserve

quantities, future producing rates, future net revenue and the present value of

such future net revenue. Netherland, Sewell & Associates, Inc. and

Schlumberger Data & Consulting

Services also prepared estimates with respect to reserve categorization,

using the definitions for proved reserves set forth in Regulation S-X Rule

4-10(a) and subsequent SEC staff interpretations and guidance. In the conduct of

their preparation of the reserve estimates, Netherland, Sewell & Associates,

Inc. and Schlumberger Data & Consulting

Services did not independently verify the accuracy and completeness of

information and data furnished by us with respect to ownership interests, oil

and gas production, well test data, historical costs of operation and

development, product prices or any agreements relating to current and future

operations of the properties and sales of production. However, if in the course

of their work, something came to their attention which brought into question the

validity or sufficiency of any such information or data, they did not rely on

such information or data until they had satisfactorily resolved their questions

relating thereto.

Our

Reserves and Planning Manager, who reports directly to our Chief Operating

Officer, maintains our reserves databases, provides reserve reports to

accounting based on SEC guidance and updates production forecasts. He

provides access to our reserves databases to Netherland, Sewell &

Associates, Inc. and Schlumberger Data & Consulting Services

and oversees the compilation of and reviews their reserve reports. He is a

Registered Texas Professional Engineer with Masters Degrees in Engineering and

Business and thirty-five years of oil and gas experience, including experience

as a senior officer with international engineering consulting

firms.

See exhibits 99.1 and 99.2

for the estimates of proved reserves provided by Netherland, Sewell &

Associates, Inc. and Schlumberger Data & Consulting Services. We only

employ large, widely known, highly regarded, and reputable engineering

consulting firms. Not only the firms, but the technical persons that sign

and seal the reports are licensed and certify that they meet all professional

requirements. Licensing requirements formally require mandatory continuing

education and professional qualifications. They are independent petroleum

engineers, geologists, geophysicists and petrophysicists.

Michigan

As of

December 31, 2009, our Michigan operations comprised approximately 68 percent of

our total estimated proved reserves. For the year ended December 31, 2009, our

average production was approximately 10.4 MBoe/d or 62 MMcfe/d. Estimated proved

reserves attributable to our Michigan properties as of December 31, 2009 were

76.2 MMBoe. Our integrated midstream assets enhance the value of our Michigan

properties as gas is sold at MichCon prices, and we have no significant reliance

on third party transportation. We have interests in 3,368 productive wells in

Michigan.

7

In 2009,

we completed 19 recompletions and workovers and 12 line twinning projects and

compression optimization projects. These projects targeted casing pressure

reduction in the pressure sensitive Antrim Shale. Line twinning converts a

single line gathering system, where natural gas and water are transported from

the well to the central processing facility in one line, to a dual line system

where the water and gas each have their own line to the central processing

facility. As a result, the casing pressure at the well can be lowered thus

increasing production. Our capital

spending in Michigan for the year ended December 31, 2009 was approximately $12

million.

|

As of December 31, 2009

|

||||||||||||

|

Estimated

|

||||||||||||

|

Proved Reserves

|

% Proved

|

|||||||||||

|

(MMBoe)

|

% Gas

|

Developed

|

||||||||||

|

Antrim

Shale

|

62.5 | 100 | % | 95 | % | |||||||

|

Non-Antrim

Fields

|

13.7 | 63 | % | 73 | % | |||||||

|

All

Michigan Formations

|

76.2 | 93 | % | 91 | % | |||||||

Antrim

Shale

The

Antrim Shale underlies a large percentage of our Michigan acreage; wells tend to

produce relatively predictable amounts of natural gas in this reservoir. Over

9,000 wells have been drilled by various companies with greater than 95 percent

drilling success over its history. On average, Antrim Shale wells have a proved

reserve life of more than 20 years. Since reserve quantities and production

levels over a large number of wells are fairly predictable, maximizing per well

recoveries and minimizing per unit production costs through a sizeable

well-engineered drilling program are the keys to profitable Antrim development.

Growth opportunities include infill drilling and recompletions, horizontal

drilling and bolt-on acquisitions. Our estimated proved reserves attributable to

our Antrim Shale interests as of December 31, 2009 were 62.5 MMBoe or 375

Bcfe, of which 95 percent was proved developed. In 2009, capital was spent to

complete 11 line twinning and compression optimization projects.

Non-Antrim

Fields

Our

non-Antrim interests are located in several reservoirs including the Prairie du

Chien (“PdC”), Richfield (“RCFD”), Detroit River Zone III (“DRRV”) and

Niagaran (“NGRN”) pinnacle reefs. Our estimated proved reserves attributable to

our non-Antrim interests as of December 31, 2009 were 13.7 MMBoe or 82

Bcfe.

The PdC

will produce dry gas, gas and condensate or oil with associated gas, depending

upon the area and the particular zone. Our PdC production is well established,

and there are some proved non-producing zones in existing well bores that

provide recompletion opportunities, allowing us to maintain or, in some cases,

increase production from our PdC wells as currently producing reservoirs

deplete.

The vast

majority of our RCFD/DRRV wells are located in Kalkaska and Crawford counties in

the Garfield and Beaver Creek fields. Potential exploitation of the Garfield

RCFD/DRRV reservoirs either by secondary waterflood and/or improved oil recovery

with CO2 injection

is under evaluation; however, because this concept has not been proved, there

are no recorded reserves related to these techniques. Production from the Beaver

Creek RCFD/DRRV reservoirs consists of oil with associated natural gas. In the

fall of 2008, we received permission from the Michigan Department of

Environmental Quality to co-mingle the RCFD and DRRV formations in the Garfield

project. This co-mingling has enabled us to add the DRRV formation to existing

and future RCFD wells at minimal cost as opposed to drilling a separate well for

the DRRV.

Our NGRN

wells produce from numerous Silurian-age Niagaran pinnacle reefs located in

the northern part of the lower peninsula of Michigan. Depending upon the

location of the specific reef in the pinnacle reef belt of the northern shelf

area, the NGRN pinnacle reefs will produce dry natural gas, natural gas and

condensate or oil with associated natural gas.

In 2009,

capital was spent to complete 19 recompletions or workovers and one compression

optimization project.

8

California

Los

Angeles Basin, California

Our

operations in California are concentrated in several large, complex oil fields

within the Los Angeles Basin. For the year ended December 31, 2009, our

California average production was approximately 3.2 MBoe/d. Estimated proved

reserves attributable to our California properties as of December 31, 2009

were 15.1 MMBoe. Our four largest fields, Santa Fe Springs, East Coyote,

Rosecrans and Sawtelle, made up approximately 90 percent of our production in

2009 and 88 percent of our estimated proved reserves in California as of

December 31, 2009. In 2009, we drilled four productive development wells and no

dry development wells in California. Our capital spending in California for the

year ended December 31, 2009 was approximately $8 million.

Santa Fe Springs Field – Our

largest property in the Los Angeles Basin, measured by estimated proved

reserves, is the Santa Fe Springs Field. We operate 104 productive wells in the

Santa Fe Springs Field and own a 99.5 percent working interest. Santa Fe Springs

has produced to date from up to ten productive zones ranging in depth from 3,000

feet to more than 9,000 feet. The five largest producing zones are the Bell,

Meyer, O'Connell, Clark and Hathaway. In 2009, our average production from the

Santa Fe Springs Field was approximately 1.6 MBoe/d, and our estimated proved

reserves as of December 31, 2009 were 6.8 MMBoe, of which 93 percent was

proved developed.

East Coyote Field – Our

interest in this field was acquired on May 25, 2007. BEC operates 43 productive

wells in the East Coyote Field. We own a 95 percent working interest. The East

Coyote Field has producing zones ranging in depth from 2,500 feet to 4,000 feet.

Our average production from the East Coyote Field for the year ended December

31, 2009 was approximately 538 Boe/d, and our estimated proved reserves as of

December 31, 2009 were 3.1 MMBoe.

Sawtelle Field – Our interest

in this field was acquired on May 25, 2007. BEC operates 11 productive wells in

the Sawtelle Field. We own a 95 percent working interest in most of the field,

with a lesser interest in certain areas. The Sawtelle Field has produced from

several productive sands ranging in depth from 9,000 feet to 10,500 feet. Our

average production from the Sawtelle Field was approximately 350 Boe/d, and our

estimated proved reserves as of December 31, 2009 were 1.6

MMBoe.

Rosecrans Field – We operate

37 productive wells in the Rosecrans Field and own a 100 percent working

interest. The Rosecrans Field has produced from several productive sands ranging

in depth from 4,000 feet to 8,000 feet. The producing zones are the Padelford,

Maxwell, Hoge, Zins and the O’dea. In 2009, our average production from the

Rosecrans Field was approximately 353 Boe/d, and our estimated proved reserves

as of December 31, 2009 were 1.7 MMBoe.

Other California Fields – Our

other fields include the Brea Olinda Field, which has 74 productive wells. Brea

Olinda produced approximately 188 Boe/d on average in 2009 and had estimated

proved reserves as of December 31, 2009 of 1.1 MMBoe; the Alamitos lease of

the Seal Beach Field, which has nine productive wells, produced approximately 79

Boe/d on average in 2009 from the McGrath and Wasem zones at approximately 7,000

feet and had estimated proved reserves as of December 31, 2009 of less than 0.1

MMBoe; and the Recreation Park lease of the Long Beach Field, which has seven

productive wells, produced approximately 50 Boe/d on average in 2009 from the

same zones as the Alamitos lease, but approximately 1,000 feet deeper, and had

estimated proved reserves as of December 31, 2009 of 0.7 MMBoe. We have a

100 percent working interest in Brea Olinda and Alamitos and a 60 percent

working interest in Recreation Park.

Wyoming

Wind

River and Big Horn Basins, Wyoming

For the

year ended December 31, 2009, our average production from our Wyoming fields was

approximately 2.2 MBoe/d, and estimated proved reserves at December 31, 2009

totaled 11.5 MMBoe. Four fields - Black Mountain, Gebo, North Sunshine and

Hidden Dome - made up 86 percent of our 2009 production and 91 percent of our

2009 estimated proved reserves in Wyoming.

In 2009,

we drilled four new productive development wells and two deepenings of existing

productive wells in Wyoming. Additionally, a total of six workovers, resulting

in an incremental 142 Boe/d of production, were performed in Wyoming during

2009. Our capital spending in Wyoming for the year ended December 31, 2009 was

approximately $5 million.

9

Black Mountain Field – We

operate 46 productive wells in the Black Mountain Field and hold a 98 percent

working interest. Production is from the Tensleep formation with producing zones

as shallow as 2,500 feet and as deep as 3,900 feet. Our average production from

the Black Mountain Field was approximately 447 Boe/d in 2009, and our estimated

proved reserves as of December 31, 2009 were 3.2 MMBoe, of which 90 percent

was proved developed.

Gebo Field – We operate 46

productive wells in the Gebo Field and hold a 100 percent working interest.

Production is from the Phosphoria and Tensleep formations with producing zones

as shallow as 4,500 feet and as deep as 5,300 feet. In 2009, our average

production from the Gebo Field was approximately 640 Boe/d, and our estimated

proved reserves as of December 31, 2009 were 3.0 MMBoe.

North Sunshine Field – We

operate 31 productive wells in the North Sunshine Field and hold a 100 percent

working interest. Production is from the Phosphoria at 3,000 feet and the

Tensleep at about 3,900 feet. In 2009, our average production from the North

Sunshine Field was approximately 444 Boe/d, and our estimated proved reserves as

of December 31, 2009 were 2.5 MMBoe, of which 91 percent was proved

developed. In 2009, we drilled two successful crude oil wells and one redrill in

this field.

Hidden Dome Field – We

operate 16 productive wells in the Hidden Dome Field and hold a 100 percent

working interest. Production is from the Frontier, Tensleep and Darwin

formations with the producing zones as shallow as 1,200 feet and as deep as

5,000 feet. In 2009, our average production from the Hidden Dome Field was

approximately 366 Boe/d, and our estimated proved reserves as of

December 31, 2009 were 1.9 MMBoe.

Other Wyoming Fields – Our

other fields include the Sheldon Dome Field and Rolff Lake Field in Fremont

County, where we operate 26 productive wells in the Frontier to the Tensleep

formations at depths up to 7,300 feet. In 2009, our Sheldon Dome and Rolff Lake

fields produced on average approximately 112 Boe/d and 65 Boe/d, respectively.

We also operate six productive wells in the Lost Dome Field in Natrona County

(outside the Wind River and Big Horn Basin) producing from the Tensleep

formation at approximately 5,000 feet. In 2009, our average production from the

Lost Dome Field was approximately 53 Boe/d. The other two fields that we operate

are the West Oregon Basin and Half Moon fields in Park County, where we operate

nine productive wells. In 2009, we produced on average approximately 79 Boe/d

between the two Park County fields from the Frontier and Phosphoria formations

at depths from 1,200 to 4,000 feet. Rolff Lake Field and Sheldon Dome Field had

estimated proved reserves as of December 31, 2009 of 0.3 MMBoe and 0.4

MMBoe, respectively, and Lost Dome Field, West Oregon Basin and Half Moon Fields

together had 0.2 MMBoe. We hold a 90 percent working interest in the Sheldon

Dome Field and 100 percent working interests in the Rolff Lake, West Oregon

Basin and Half Moon fields.

Florida

Our five

Florida fields were acquired in May 2007. We operate 13 productive wells.

Production is from the Cretaceous Sunniland Trend of the South Florida Basin at

11,500 feet. The South Florida Basin is one of the largest proven and sourced

geological basins in the United States. The Sunniland Trend has produced in

excess of 115 million barrels of oil from seven fields. Our fields are 100

percent oil and oil quality averaged 24 degrees API. As of December 31, 2009, we

had estimated proved reserves of approximately 7.3 MMBbls. In 2009, our average

production from our Florida fields was approximately 1.4 MBbls/d. Production

from the Raccoon Point field currently accounts for more than half of our

Florida production. We hold a 100 percent working interest in our Florida

fields.

Our

capital spending in Florida for the year ended December 31, 2009 was

approximately $3 million.

Indiana/Kentucky

We

acquired our operations in the New Albany Shale of southern Indiana and northern

Kentucky in November 2007. Our operations include 21 miles of high pressure gas

pipeline that interconnects with the Texas Gas Transmission interstate pipeline.

The New Albany Shale has over 100 years of production history.

10

We

operate 227 producing wells in Indiana and Kentucky and hold a 100 percent

working interest. In 2009, our production for our Indiana and Kentucky

operations was approximately 388 Boe/d and 194 Boe/d, respectively, or 2,329

Mcf/d and 1 MMcfe/d, respectively. Our estimated proved reserves in Indiana and

Kentucky as of December 31, 2009 were 0.3 MMBoe and 0.9 MMBoe,

respectively, or 1.7 Bcf and 5.4 Bcf, respectively. Our capital spending in

Indiana and Kentucky for the year ended December 31, 2009 was approximately $1

million.

Productive

Wells

The

following table sets forth information for our properties at December 31,

2009 relating to the productive wells in which we owned a working interest.

Productive wells consist of producing wells and wells capable of production.

Gross wells are the total number of productive wells in which we have an

interest, and net wells are the sum of our fractional working interests owned in

the gross wells. None of our productive wells have multiple

completions.

|

Oil Wells

|

Gas Wells

|

|||||||||||||||

|

Gross

|

Net

|

Gross

|

Net

|

|||||||||||||

|

Operated

|

600 | 580 | 1,796 | 1,269 | ||||||||||||

|

Non-operated

|

84 | 61 | 1,598 | 586 | ||||||||||||

| 684 | 641 | 3,394 | 1,855 | |||||||||||||

Developed

and Undeveloped Acreage

The

following table sets forth information for our properties as of

December 31, 2009 relating to our leasehold acreage. Developed acres are

acres spaced or assigned to productive wells. Undeveloped acres are acres on

which wells have not been drilled or completed to a point that would permit the

production of commercial quantities of gas or oil, regardless of whether such

acreage contains proved reserves. A gross acre is an acre in which a working

interest is owned. The number of gross acres is the total number of acres in

which a working interest is owned. A net acre is deemed to exist when the sum of

the fractional ownership working interests in gross acres equals one. The number

of net acres is the sum of the fractional working interests owned in gross acres

expressed as whole numbers and fractions thereof.

|

Developed Acreage

|

Undeveloped Acreage

|

Total Acreage

|

||||||||||||||||||||||

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

|||||||||||||||||||

|

Michigan

|

396,267 | 215,606 | 21,574 | 19,183 | 417,841 | 234,789 | ||||||||||||||||||

|

California

|

1,686 | 1,611 | - | - | 1,686 | 1,611 | ||||||||||||||||||

|

Wyoming

|

13,610 | 12,014 | 400 | 400 | 14,010 | 12,414 | ||||||||||||||||||

|

Florida

|

34,402 | 33,322 | - | - | 34,402 | 33,322 | ||||||||||||||||||

|

Indiana

|

49,973 | 45,560 | 85,294 | 84,377 | 135,267 | 129,937 | ||||||||||||||||||

|

Kentucky

|

3,152 | 3,151 | 20,135 | 19,363 | 23,287 | 22,514 | ||||||||||||||||||

| 499,090 | 311,264 | 127,403 | 123,323 | 626,493 | 434,587 | |||||||||||||||||||

The

following table lists the total number of net undeveloped acres as of December

31, 2009, the number of net acres expiring in 2010, 2011 and 2012, and, where

applicable, the number of net acres expiring that are subject to extension

options.

|

2010 Expirations

|

2011 Expirations

|

2012 Expirations

|

||||||||||||||||||||||||||

|

Net Undeveloped

Acreage

|

Net

Acreage

|

Net Acreage

with Ext. Opt.

|

Net

Acreage

|

Net Acreage

with Ext. Opt.

|

Net

Acreage

|

Net Acreage

with Ext. Opt.

|

||||||||||||||||||||||

|

Michigan

|

19,183 | 1,267 | 1,207 | 1,884 | 1,501 | 1,278 | 349 | |||||||||||||||||||||

|

Wyoming

|

400 | - | - | - | - | - | - | |||||||||||||||||||||

|

Indiana

|

84,377 | 16,338 | 2,100 | 21,948 | 1,600 | 1,589 | - | |||||||||||||||||||||

|

Kentucky

|

19,363 | - | - | 12,360 | 1,236 | 1,874 | 187 | |||||||||||||||||||||

| 123,323 | 17,605 | 3,307 | 36,192 | 4,337 | 4,741 | 536 | ||||||||||||||||||||||

11

Drilling

Activity

Drilling

activity and production optimization projects are on lower risk, development

properties. The following table sets forth information for our properties with

respect to wells completed during the years ended December 31, 2009, 2008

and 2007. Productive wells are those that produce commercial quantities of oil

and gas, regardless of whether they produce a reasonable rate of return. No

exploratory wells were drilled during the periods presented.

|

2009

|

2008

|

2007

|

||||||||||

|

Gross

development wells:

|

||||||||||||

|

Productive

|

23 | 129 | 22 | |||||||||

|

Dry

|

3 | 2 | 2 | |||||||||

| 26 | 131 | 24 | ||||||||||

|

Net

development wells:

|

||||||||||||

|

Productive

|

21 | 116 | 21 | |||||||||

|

Dry

|

3 | 2 | 2 | |||||||||

| 24 | 118 | 23 | ||||||||||

Of the 13

productive wells drilled in Michigan during 2009, 11 were recompletion wells. Of

the six productive wells drilled in Wyoming, two were recompletion wells. Of the

four productive wells drilled in California during 2009, two were recompletion

wells. We had one well in progress as of December 31, 2009, which is excluded

from the table above.

Delivery

Commitments

As of

December 31, 2009, we had no delivery commitments.

Sales

Contracts

We have a

portfolio of crude oil and natural gas sales contracts with large, established

refiners and utilities. Because our products are commodity products sold

primarily on the basis of price and availability, we are not dependent upon one

purchaser or a small group of purchasers. During 2009, our largest purchasers

were ConocoPhillips in California and Michigan, which accounted for 30 percent

of total net sales, Marathon Oil Company in Wyoming, which accounted for 16

percent of total net sales, and Plains Marketing, L.P. in Florida, which

accounted for 11 percent of total net sales.

Crude

Oil and Natural Gas Prices

We

analyze the prices we realize from sales of our oil and gas production and the

impact on those prices of differences in market-based index prices and the

effects of our derivative activities. We market our oil and natural gas

production to a variety of purchasers based on regional pricing. The WTI price

of crude oil is a widely used benchmark in the pricing of domestic and imported

oil in the United States. The relative value of crude oil is determined by two

main factors: quality and location. In the case of WTI pricing, the crude oil is

light and sweet, meaning that it has a higher specific gravity (lightness)

measured in degrees API (a scale devised by the American Petroleum Institute)

and low sulfur content, and is priced for delivery at Cushing, Oklahoma. In

general, higher quality crude oils (lighter and sweeter) with fewer

transportation requirements result in higher realized pricing for

producers.

Crude oil

produced in the Los Angeles Basin of California and Wind River and Big Horn

Basins of central Wyoming typically sells at a discount to NYMEX WTI crude oil

due to, among other factors, its relatively heavier grade and/or relative

distance to market. Our Los Angeles Basin crude oil is generally medium gravity

crude. Because of its proximity to the extensive Los Angeles refinery market, it

trades at only a minor discount to NYMEX WTI. Our Wyoming crude oil, while

generally of similar quality to our Los Angeles Basin crude oil, trades at a

significant discount to NYMEX WTI because of its distance from a major refining

market and the fact that it is priced relative to the Bow River benchmark for

Canadian heavy sour crude oil, which has historically traded at a significant

discount to NYMEX WTI. Our Florida crude oil also trades at a significant

discount to NYMEX primarily because of its low gravity and other characteristics

as well as its distance from a major refining market.

12

In 2009,

the NYMEX WTI spot price averaged approximately $62 per barrel, compared with

about $100 a year earlier. Monthly average crude-oil prices fluctuated widely

during 2009, from a low of $39 per barrel for February to a high of $78 per

barrel for November. For the year ended December 31, 2009, the average

discount to NYMEX WTI for our California and Wyoming-based production was $0.53

and $8.08, respectively, and $18.71 for our Florida-based production, including

approximately $7.50 in transportation costs per barrel.

Our

Michigan properties have favorable natural gas supply/demand characteristics as

the state has been importing an increasing percentage of its natural gas. We

have entered into derivative contracts for approximately 80 percent of our

expected 2010 natural gas production. To the extent our production is not

hedged, we anticipate that this supply/demand situation will allow us to sell

our future natural gas production at a slight premium to industry benchmark

prices. Prices for natural gas have historically fluctuated widely and in many

regional markets are aligned with supply and demand conditions in regional

markets and with the overall U.S. market. Fluctuations in the price for natural

gas in the United States are closely associated with the volumes produced in

North America and the inventory in underground storage relative to customer

demand. U.S. natural gas prices are also typically higher during the winter

period when demand for heating is greatest. During 2007, the monthly average

NYMEX wholesale natural gas price ranged from a low of $6.14 per MMBtu for

August to a high of $7.82 per MMBtu for May. During 2008, the monthly average

NYMEX wholesale natural gas price ranged from a low of $5.79 per MMBtu for

December to a high of $12.78 per MMBtu for June. During 2009, the average NYMEX

wholesale natural gas price ranged from a low of $3.31 per MMBtu for August to a

high of $5.34 per MMBtu for December.

Our

operating expenses are responsive to changes in commodity prices. We experience

pressure on operating expenses that is highly correlated to commodity prices for

specific expenditures such as lease fuel, electricity, drilling services and

severance and property taxes.

Derivative

Activity

Our

revenues and net income are sensitive to oil and natural gas prices. We enter

into various derivative contracts intended to achieve more predictable cash flow

and to reduce our exposure to adverse fluctuations in the prices of oil and

natural gas. We currently maintain derivative arrangements for a significant

portion of our oil and gas production. Currently, we use a combination of fixed

price swap and option arrangements to economically hedge NYMEX crude oil and

natural gas prices. By removing the price volatility from a significant portion

of our crude oil and natural gas production, we have mitigated, but not

eliminated, the potential effects of changing crude oil and natural gas prices

on our cash flow from operations for those periods. While our commodity price

risk management program is intended to reduce our exposure to commodity prices

and assist with stabilizing cash flow and distributions, to the extent we have

hedged a significant portion of our expected production and the cost for goods

and services increases, our margins would be adversely affected. For a more

detailed discussion of our derivative activities, see Part II—Item 7

“—Management's Discussion and Analysis of Financial Condition and Results of

Operations—Overview,” Part II—Item 7A “—Quantitative and Qualitative Disclosures

About Market Risk” and Note 16 to the consolidated financial statements included

in this report.

Competition

The oil

and gas industry is highly competitive. We encounter strong competition from

other independent operators and from major oil companies in all aspects of our

business, including acquiring properties and oil and gas leases, marketing oil

and gas, contracting for drilling rigs and other equipment necessary for

drilling and completing wells and securing trained personnel. Many of these

competitors have financial and technical resources and staffs substantially

larger than ours. As a result, our competitors may be able to pay more for

desirable leases, or to evaluate, bid for and purchase a greater number of

properties or prospects than our financial or personnel resources

permit.

In

regards to the competition we face for drilling rigs and the availability of

related equipment, the oil and gas industry has experienced shortages of

drilling rigs, equipment, pipe and personnel in the past, which has delayed

development drilling and other exploitation activities and has caused

significant price increases. We are unable to predict when, or if, such

shortages may occur or how they would affect our development and exploitation

program. Competition is also strong for attractive oil and gas producing

properties, undeveloped leases and drilling rights, which may affect our ability

to compete satisfactorily when attempting to make further acquisitions. See Item

1A “—Risk Factors” — “Risks Related to Our Business — We may be unable to

compete effectively with other companies, which may adversely affect our ability

to generate sufficient revenue to allow us to pay distributions to our

unitholders.” in this report.

13

Title

to Properties

As is

customary in the oil and gas industry, we initially conduct only a cursory

review of the title to our properties on which we do not have proved reserves.

Prior to the commencement of drilling operations on those properties, we conduct

a thorough title examination and perform curative work with respect to

significant defects. To the extent title opinions or other investigations

reflect title defects on those properties, we are typically responsible for

curing any title defects at our expense. We generally will not commence drilling

operations on a property until we have cured any material title defects on such

property. Prior to completing an acquisition of producing oil leases, we perform

title reviews on the most significant leases and, depending on the materiality

of properties, we may obtain a title opinion or review previously obtained title

opinions. As a result, we believe that we have satisfactory title to our

producing properties in accordance with standards generally accepted in the oil

and gas industry. Under our credit facility, we have granted the lenders a lien

on substantially all of our oil and gas properties. Our oil properties are also

subject to customary royalty and other interests, liens for current taxes and

other burdens which we believe do not materially interfere with the use of or

affect our carrying value of the properties.

Some of

our oil and gas leases, easements, rights-of-way, permits, licenses and

franchise ordinances require the consent of the current landowner to transfer

these rights, which in some instances is a governmental entity. We believe that

we have obtained sufficient third-party consents, permits and authorizations for

us to operate our business in all material respects. With respect to any

consents, permits or authorizations that have not been obtained, we believe that

the failure to obtain these consents, permits or authorizations have no material

adverse effect on the operation of our business.

Seasonal

Nature of Business

Seasonal

weather conditions, especially freezing conditions in Michigan, and lease

stipulations can limit our drilling activities and other operations in certain

of the areas in which we operate and, as a result, we seek to perform the

majority of our drilling during the summer months. These seasonal anomalies can

pose challenges for meeting our well drilling objectives and increase

competition for equipment, supplies and personnel during the spring and summer

months, which could lead to shortages and increase costs or delay our

operations.

Environmental

Matters and Regulation

General. Our operations are

subject to stringent and complex federal, state and local laws and regulations

governing environmental protection as well as the discharge of materials into

the environment. These laws and regulations may, among other

things:

|

·

|

require

the acquisition of various permits before exploration, drilling or

production activities commence;

|

|

·

|

prohibit

some or all of the operations of facilities deemed in non-compliance with

regulatory requirements;

|

|

·

|

restrict

the types, quantities and concentration of various substances that can be

released into the environment in connection with oil and natural gas

drilling, production and transportation

activities;

|

|

·

|

limit

or prohibit drilling activities on certain lands lying within wilderness,

wetlands and other protected areas;

and

|

|

·

|

require

remedial measures to mitigate pollution from former and ongoing

operations, such as requirements to close pits and plug abandoned

wells.

|

These

laws, rules and regulations may also restrict the rate of oil and natural gas

production below the rate that would otherwise be possible. The regulatory

burden on the oil and gas industry increases the cost of doing business in the

industry and consequently affects profitability. Additionally, Congress and

federal and state agencies frequently revise environmental laws and regulations,

and the clear trend in environmental regulation is to place more restrictions

and limitations on activities that may affect the environment. Any changes that

result in more stringent and costly waste handling, disposal and cleanup

requirements for the oil and gas industry could have a significant impact on our

operating costs.

14

The

following is a summary of some of the existing laws, rules and regulations to

which our business operations are subject.

Waste

Handling. The Resource Conservation and Recovery Act, or RCRA,

and comparable state statutes, regulate the generation, transportation,

treatment, storage, disposal and cleanup of hazardous and non-hazardous wastes.

Under the auspices of the federal Environmental Protection Agency, or EPA, the

individual states administer some or all of the provisions of RCRA, sometimes in

conjunction with their own, more stringent requirements. Drilling fluids,

produced waters, and most of the other wastes associated with the exploration,

development, and production of crude oil or natural gas are currently regulated

under RCRA’s non-hazardous waste provisions. However, it is possible that

certain oil and natural gas exploration and production wastes now classified as

non-hazardous could be classified as hazardous wastes in the future. Any such

change could result in an increase in our costs to manage and dispose of wastes,

which could have a material adverse effect on our results of operations and

financial position. Also, in the course of our operations, we generate some

amounts of ordinary industrial wastes, such as paint wastes, waste solvents, and

waste oils that may be regulated as hazardous wastes.

Comprehensive Environmental

Response, Compensation and Liability Act. The Comprehensive

Environmental Response, Compensation and Liability Act, or CERCLA, also known as

the Superfund law, imposes joint and several liability, without regard to fault

or legality of conduct, on classes of persons who are considered to be

responsible for the release of a hazardous substance into the environment. These

persons include the current and past owner or operator of the site where the

release occurred, and anyone who disposed or arranged for the disposal of a

hazardous substance released at the site. Under CERCLA, such persons may be

subject to joint and several liability for the costs of cleaning up the

hazardous substances that have been released into the environment, for damages

to natural resources and for the costs of certain health studies. In addition,

it is not uncommon for neighboring landowners and other third-parties to file

claims for personal injury and property damage allegedly caused by the hazardous

substances released into the environment.

We

currently own, lease, or operate numerous properties that have been used for oil

and natural gas exploration and production for many years. Although we believe

that we have utilized operating and waste disposal practices that were standard

in the industry at the time, hazardous substances, wastes, or hydrocarbons may

have been released on or under the properties owned or leased by us, or on or

under other locations, including off-site locations, where such substances have

been taken for disposal. In addition, some of our properties have been operated

by third parties or by previous owners or operators whose treatment and disposal

of hazardous substances, wastes, or hydrocarbons was not under our control. In

fact, there is evidence that petroleum spills or releases have occurred in the

past at some of the properties owned or leased by us. These properties and the

substances disposed or released on them may be subject to CERCLA, RCRA, and

analogous state laws. Under such laws, we could be required to remove previously

disposed substances and wastes, remediate contaminated property, or perform

remedial plugging or pit closure operations to prevent future

contamination.

Water

Discharges. The Federal Water Pollution Control Act, or the

Clean Water Act, and analogous state laws, impose restrictions and strict

controls with respect to the discharge of pollutants, including spills and leaks

of oil and other substances, into waters of the United States. The discharge of

pollutants into regulated waters is prohibited, except in accordance with the

terms of a permit issued by EPA or an analogous state agency. The Clean Water

Act also imposes spill prevention, control, and countermeasure requirements,

including requirements for appropriate containment berms and similar structures,

to help prevent the contamination of navigable waters in the event of a

petroleum hydrocarbon tank spill, rupture, or leak. Federal and state regulatory