Attached files

| file | filename |

|---|---|

| 8-K - MultiCell Technologies, Inc. | v199271_8k.htm |

| EX-24.1 - MultiCell Technologies, Inc. | v199271_ex24-1.htm |

| EX-10.1 - MultiCell Technologies, Inc. | v199271_ex10-1.htm |

| EX-99.1 - MultiCell Technologies, Inc. | v199271_ex99-1.htm |

| EX-10.3 - MultiCell Technologies, Inc. | v199271_ex10-3.htm |

FORECLOSURE

SALE AGREEMENT

This

FORECLOSURE SALE AGREEMENT (the “Agreement”)

is entered into as of September ___, 2010 by and among Venture

Lending & Leasing IV, Inc. (“VLL4”),

Venture Lending & Leasing V, Inc. (“VLL5”),

Silicon Valley Bank (“SVB”)

and Xenogenics Corporation, a Nevada corporation (“Purchaser”). VLL4,

VLL5 and SVB are sometimes referred to hereinafter collectively, as “Sellers”

and individually as a “Seller”

and VLL5, in its capacity as collateral agent for the Sellers under the Loan

Agreement (as defined below) is sometimes referred to herein as “Agent.”

RECITALS

On

March 18, 2008, Bioabsorbable Therapeutics, Inc., a Delaware corporation

(“Debtor”),

Agent and Sellers entered into that certain Loan and Security Agreement (as

amended from time to time collectively referred to as the “Loan

Agreement”) pursuant to which Sellers made term loans to

Debtor.

In order

to secure the prompt payment and performance of all obligations owing by Debtor

to Agent and Sellers under the Loan Agreement (all of such obligations with

respect to the loans and under the Loan Agreement and related documents are

collectively referred to herein as the “Obligations”),

Debtor granted to each Seller and to Agent for the benefit of Sellers blanket

security interests in all of Debtor’s property (the “Collateral”). Sellers’

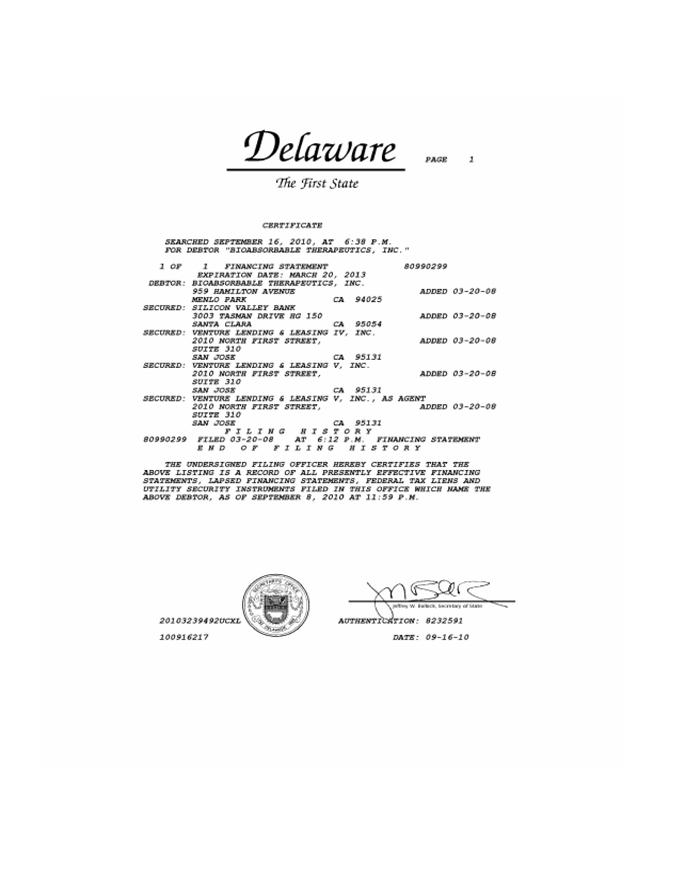

and Agent’s security interests in the Collateral were perfected by the filing of

UCC Financing Statement with the Delaware Secretary of State recorded on

March 20, 2008 as file number 80990299.

On

September 2, 2009, Sellers notified Debtor that an Event of a Default had

occurred under the Loan Agreement. As a result of the occurrence of

such Event of Default Sellers accelerated the Obligations and such Obligations

are now due and payable.

Pursuant

to the terms of the Loan Agreement, the loan documents executed and delivered in

connection therewith and applicable law, after the occurrence and during the

continuance of an Event of Default, Sellers have the right to enforce all of

their remedies against Debtor and the Collateral, and Sellers have elected to

conduct a private foreclosure sale of certain items of the

Collateral.

Pursuant

to that certain Repossession Agreement for Peaceable Foreclosure, dated as of

September 29, 2009, a true, correct and complete copy of which is attached

hereto as Exhibit “A” (the

“Peaceful

Foreclosure Agreement”), Debtor waived its rights to notice of any

private sale under Section 9611 of the California Commercial Code (“CUCC”),

waived its right to redeem the Collateral under Section 9623 of the CUCC

and waived its rights to any further notice of sale or other disposition to the

extent permitted under applicable law, and agreed that Agent and Sellers are not

required to give Debtor notice of any proposed sale or other disposition of the

Collateral.

Pursuant

to the Peaceful Foreclosure Agreement, Sellers exercised their post defaults

rights under the CUCC with respect to the Collateral and subject to the terms

and conditions of this Agreement, Sellers have agreed to sell to Purchaser, all

of Debtor’s right, title and interest in the Collateral described on Exhibit “B” (the

items Collateral described on Exhibit “B” are

hereinafter referred to as the “Transferred

Assets”).

AGREEMENT

NOW

THEREFORE, for good and valuable consideration, the receipt and sufficiency of

which are hereby acknowledged, Purchaser and Sellers hereby agree as

follows:

1. Sale of Transferred

Assets. Upon the terms and subject to the conditions of this

Agreement, in consideration of and in exchange for Sellers’ receipt of the

consideration described in Section 2 hereof, Sellers agree, on the Closing

Date (as defined herein), to irrevocably sell, transfer, assign, convey, and set

over to Purchaser, and Purchaser agrees to purchase from Sellers, all of

Debtor’s right, title and interest in the Transferred Assets, “as is”, “where

is”, and without recourse, and (except as set forth in Section 7 below)

without representations or warranties of any kind, express or implied,

including, without limitation, any warranties as to title, possession, quiet

enjoyment, merchantability, value, useful life, fitness for intended use,

physical condition, non-infringement, or similar representations and warranties.

Moreover, Sellers make no representation or warranty and have no liability

whatsoever on behalf of Debtor or any third parties with regard to the

operation, performance, nonperformance, quality, availability, completeness,

validity, or accuracy of any of the Transferred Assets or the delay, error, or

interruption of the flow of information in connection with use of any of the

foregoing. In addition, notwithstanding anything to the contrary

contained herein or in the Bill of Sale, the Transferred Assets shall not,

except to the extent permitted by applicable law, include, to the extent

prohibited by any license or other agreement, any software or other licensed

products that may be installed on or attached to the Transferred

Assets. On the Closing Date, Sellers and Purchaser shall execute and

deliver to each other a Bill of Sale, substantially in the form attached hereto

as Exhibit “C” (the

“Bill of

Sale”), a Patent Transfer Statement (as contemplated by 9619 of the

CUCC), substantially in the form attached hereto as Exhibit “D” (the

“Patent

Transfer Statement”), and a Trademark Transfer Statement (as contemplated

by 9619 of the CUCC), substantially in the form attached hereto as Exhibit “E” (the

“Trademark Transfer

Statement”), each executed by Sellers and Purchaser. The sale

and transfer of the Transferred Assets to Purchaser hereunder shall be made

pursuant to Section 9610 of the CUCC and shall constitute a “disposition”

under the CUCC. Purchaser shall constitute and have the rights of a

“transferee” under the provisions of the CUCC, including without limitation, the

provisions of Section 9617 of the CUCC.

2. Consideration. As

consideration for the sale, transfer, and conveyance of all the Transferred

Assets by Sellers, Purchaser agrees:

(a) to

pay Four Hundred Thousand Dollars ($400,000) in cash (the “Purchase

Price”). The Purchase Price shall be divided into three (3)

tranches in the following amounts (i) One Hundred Thirty-Five Thousand

Dollars ($135,000), which shall be referred to herein as the “First

Tranche” of the Purchase Price, (ii) One Hundred Thirty-Five

Thousand Dollars ($135,000), which shall be referred to herein as the “Second

Tranche” of the Purchase Price, and (iii) One Hundred Thirty

Thousand Dollars ($130,000), which shall be referred to herein as the “Third

Tranche” of the Purchase Price. The First Tranche of the

Purchase Price shall be paid at Closing (as defined below), the Second Tranche

of the Purchase Price shall be due and payable on the earlier of

November 15, 2010 and the closing of a Change in Control (as defined

below), and the Third Tranche of the Purchase Price shall be due and payable on

the earlier of December 31, 2010 and the closing of a Change in

Control. Each Tranche of the Purchase Price shall be paid by wire

transfer pursuant to the wire instructions listed on Exhibit “F” or

such other instructions as have been provided to Purchaser by

Sellers;

-2-

(b) at

Closing, each of VLL4, VLL5 and SVB shall be issued a warrant instrument,

substantially in the form of Exhibit “G”

attached hereto (each a “Warrant”

and together the “Warrants”);

(c) upon

the earliest to

occur of (i) commencement of pivotal Generation 2 stent human clinical

trial, or (ii) the execution of any agreement between Purchaser and any

Person (as defined below) anywhere in the world where Purchaser grants either

exclusive, co-exclusive or non-exclusive rights to the Debtor’s bioabsorbable

stent and related technology and intellectual property acquired by Purchaser

pursuant to this Agreement and the documents and instruments executed and

delivered in connection herewith, including but not limited, to development

rights, marketing and sales rights, manufacturing rights, geographic

distribution rights, or commercialization rights (as applicable, a “Partnership

Agreement”) of at least $3 million in Total Value (as defined below), or

(iii) the closing of a Change in Control (such earliest event being the

“First

Milestone”) to pay Three Hundred Thousand Dollars ($300,000) in cash (the

“First

Milestone Payment”) by wire transfer pursuant to the wire instructions

listed on Exhibit “F” or

such other instructions as have been provided to Purchaser by Sellers. Purchaser

agrees to notify Sellers promptly after the First Milestone occurs (but no later

than five (5) days thereafter), and to make the First Milestone Payment as soon

as practical following the occurrence of the First Milestone (but no later than

five (5) days thereafter);

(d) upon

the earliest to

occur of (i) the first (1st)

regulatory approval by any regulatory authority in a European Union (EU) member

country, or (ii) the execution of a Partnership Agreement of at least $5

million in Total Value, or (iii) the closing of a Change in Control (such

earliest event being the “Second

Milestone”) to pay One Million Dollars ($1,000,000) in cash (the “Second

Milestone Payment”) by wire transfer pursuant to the wire instructions

listed on Exhibit “F” or

such other instructions as have been provided to Purchaser by Sellers. Purchaser

agrees to notify Sellers promptly after the Second Milestone occurs (but no

later than five (5) days thereafter) and to make the Second Milestone Payment as

soon as practical following the occurrence of the Second Milestone (but no later

than five (5) days thereafter); and

(e) upon

the earliest to

occur of (i) the first (1st)

regulatory approval by the U.S. Food and Drug Administration, or (ii) the

execution of a Partnership Agreement of at least $5 million in Total Value, or

(iii) the closing of a Change in Control (such earliest event being the

“Third

Milestone”) to pay Three Million Dollars ($3,000,000) in cash (the “Third

Milestone Payment”

and together with First Milestone Payment and the Second Milestone Payment, the

“Milestone

Payments”) by wire transfer pursuant to the wire instructions listed on

Exhibit “F” or

such other instructions as have been provided to Purchaser by Sellers. Purchaser

agrees to notify Sellers promptly after the Third Milestone occurs (but no later

than five (5) days thereafter) and to make the Third Milestone Payment as soon

as practical following the occurrence of the Third Milestone (but no later than

five (5) days thereafter).

-3-

As used

herein, the term “Total

Value” means all up-front monies received upon signing of the Partnership

Agreement described in Section 2(c)(ii) and Sections 2(d)(ii) and

2(e)(ii), as applicable, plus the net present value of all future milestone

payments and royalties.

As used

herein, the term “Change in

Control” means the first to occur of: (i)(A) except in the event

Purchaser’s majority shareholder dividends its ownership position to its

shareholders, the closing of any consolidation or merger of Purchaser with or

into any other corporation or other entity or person, or any other corporate

reorganization, other than any such consolidation, merger or reorganization in

which the stockholders of Purchaser immediately prior to such consolidation,

merger or reorganization, continue to hold a majority of the voting power of the

surviving entity in substantially the same proportions (or, if the surviving

entity is a wholly owned subsidiary, its parent) immediately after such

consolidation, merger or reorganization, or (B) except in the case of an

equity financing of the Purchaser within six (6) months of the Closing Date

where gross proceeds received by Purchaser are less than $10 million, the

closing of any transaction or series of related transactions to which Purchaser

is a party in which in excess of fifty percent (50%) of Purchaser’s voting power

is transferred; (ii) the closing of a transaction in which Purchaser sells,

leases, assigns, transfers, conveys or disposes of all or substantially all of

its assets. As used herein, the term “Person”

means any individual, sole proprietorship, partnership, joint venture, trust,

unincorporated organization, association, corporation, limited liability

company, institution, public benefit corporation, other entity or government

(whether federal, state, county, city, municipal, local, foreign, or otherwise,

including any instrumentality, division, agency, body or department

thereof).

3. Closing. Subject

to satisfaction of the conditions precedent set forth in Sections 5 and 6

below, the closing of the sale of the Transferred Assets (the “Closing”)

will be held immediately following satisfaction or waiver (by the party for

whose benefit such condition exists) of the conditions set forth in

Sections 5 and 6. The date on which the Closing is consummated

is referred to herein as a “Closing

Date.”

4. Delivery of

Possession. Sellers shall use their commercially reasonable

efforts to cause delivery of control or possession of the Transferred Assets to

Purchaser as soon as practicable following Closing.

5. Sellers’ Conditions

Precedent. Sellers’ obligations to consummate the Closing

shall be conditioned upon the satisfaction or waiver of the

following:

(a) The

representations, warranties, and covenants of Purchaser made herein shall have

been true in all material respects when made and at all times after the date

when made, to and including the Closing Date, with the same force and effect as

if made on and as of each such times, including the Closing Date.

(b) As

of the Closing Date, neither the sale of the Transferred Assets by Sellers nor

any of the transactions contemplated hereby is prohibited by any stay or

injunction in any litigation, governmental action, or other proceeding,

including, without limitation, the “automatic stay” under 11 U.S.C. § 362

in any pending case under title 11 of the United States Code by or against

Debtor.

-4-

(c) Purchaser

shall have paid the First Tranche of the Purchase Price.

(d) Original

counterparts of the Warrants shall have been duly executed and delivered by

Purchaser, shall have been delivered to Agent or its counsel, shall be in full

force and effect and shall be in form and substance satisfactory to

Sellers.

(e) There

has not occurred any material adverse change in Purchaser.

(f) The

Closing occurs on or before October 31, 2010.

6. Purchaser’s Conditions

Precedent. Purchaser’s obligations to consummate the Closing

shall be conditioned upon the satisfaction or waiver of the

following:

(a) The

representations, warranties, and covenants of Sellers made herein shall have

been true in all material respects when made and at all times after the date

when made, to and including the Closing Date, with the same force and effect as

if made on and as of each such times, including the Closing Date.

(b) As

of the Closing Date, neither the sale of the Transferred Assets by Sellers nor

any of the transactions contemplated hereby is prohibited by any stay or

injunction in any litigation, governmental action, or other proceeding,

including, without limitation, the “automatic stay” under 11 U.S.C. § 362

in any pending case under title 11 of the United States Code by or against

Debtor.

(c) Sellers

and Purchaser shall have executed and delivered to Purchaser the Bill of Sale,

the Patent Transfer Statement and the Trademark Transfer Statement.

(d) Third

party consents to the assignment of any material contracts have been

obtained.

(e) Purchaser

has successfully renegotiated the Rutgers’ licenses on terms satisfactory to

Purchaser.

(f) There

has not occurred any material adverse change in the Transferred

Assets.

7. Representations and

Warranties of Sellers. Except as to each Seller’s

representations and warranties as to due authority and the like as expressly

provided below, the Transferred Assets are being sold “as is,” and “where is”

with no express or implied representation and warranties of any kind, nature, or

type whatsoever from, or on behalf of, such Seller. Notwithstanding

the foregoing, each Seller severally, but not jointly, represents and warrants

to Purchaser, as follows:

(a) Such

Seller (i) is duly incorporated or organized, validly existing, and in

good

standing under the laws of its jurisdiction of incorporation or organization, as

applicable; and (ii) has all requisite power and authority to execute,

deliver, and perform the transactions contemplated hereby.

-5-

(b) The

execution, delivery, and performance by such Seller of this Agreement

and the consummation of the transaction contemplated hereby are within the power

of such Seller and have been duly authorized by all necessary actions on the

part of such Seller. The execution of this Agreement by such Seller

constitutes, or will constitute, a legal valid and binding obligation of such

Seller, enforceable against such Seller in accordance with its terms, except as

limited by bankruptcy, insolvency, or other laws of general application relating

to or affecting the enforcement of creditors’ rights generally and general

principles of equity.

(c) To

such Seller’s knowledge, no consent, approval, authorization or order

of, or

registration or filing with, or notice to, any court or governmental agency or

body having jurisdiction or regulatory authority over such Seller (or any of its

properties) is required for (i) such Seller’s execution and delivery of

this Agreement (and each agreement executed and delivered by it in connection

herewith) or (ii) the consummation by such Seller of the transactions

contemplated by this Agreement (and each agreement executed and delivered by it

in connection herewith) or, to the extent so required, such consent, approval,

authorization, order, registration, filing or notice has been obtained, made or

given (as applicable) and is still in full force and effect.

(d) No

person or entity acting on behalf of such Seller or any of its affiliates

or under

the authority of any of them is or will be entitled to any brokers’ or finders’

fee or any other commission or similar fee, directly or indirectly, from Seller

or any of its affiliates in connection with any of the transactions contemplated

hereby, except for Emmes Group.

(e) Such

Seller holds a security interest in the Transferred Assets, and to such

Seller’s

knowledge, based solely upon the results of Uniform Commercial Code search

requests of the offices of the Secretary of State of the States of Delaware and

California, both certified on September 16, 2010, there are no outstanding

security interests of record that are superior to the security interests of such

Seller in the Transferred Assets.

(f) Debtor

is in default of its obligations to such Seller, and such Seller is entitled

to sell the Transferred Assets under the terms of the Loan Agreement, the

provisions of the CUCC, and other applicable laws.

(g) The

disposition of the Transferred Assets effected by this Agreement and

the other

documents and instruments executed and delivered in connection herewith transfer

to Purchaser all of Debtor’s rights therein, discharges such Seller’s security

interest therein (except for new security interests granted by Purchaser as set

forth in Section 13 of this Agreement), and discharges any security

interests or liens subordinate to the security interest of such

Seller.

(h) Such

Seller has complied in all material respects with the relevant provisions

of the CUCC, including without limitation the requirements of Chapter 6 thereof,

to transfer Debtor’s right, title and interest in and to the Transferred Assets

to Purchaser in accordance with the provisions of this Agreement.

8. Representations and

Warranties of Purchaser. Purchaser represents and warrants to

Sellers, as follows:

-6-

(a) Purchaser

(i) is a duly organized, validly existing, and in good standing

under the

laws of its jurisdiction of organization; and (ii) has all requisite power

and authority to execute, deliver, and perform the transactions contemplated

hereby.

(b) The

execution, delivery, and performance by Purchaser of this

Agreement and the

consummation of the transaction contemplated hereby are within the power of

Purchaser and have been duly authorized by all necessary actions on the part of

Purchaser. The execution of this Agreement by Purchaser constitutes,

or will constitute, a legal valid and binding obligation of Purchaser,

enforceable against Purchaser in accordance with its terms, except as limited by

bankruptcy, insolvency, or other laws of general application relating to or

affecting the enforcement of creditors’ rights generally and general principles

of equity.

(c) No

consent, approval, authorization or order of, or registration or filing

with, or

notice to, any court or governmental agency or body having jurisdiction or

regulatory authority over Purchaser (or any of its properties) is required for

(i) Purchaser’s execution and delivery of this Agreement (and each

agreement executed and delivered by it in connection herewith) or (ii) the

consummation by Purchaser of the transactions contemplated by this Agreement

(and each agreement executed and delivered by it in connection herewith) or, to

the extent so required, such consent, approval, authorization, order,

registration, filing or notice has been obtained, made or given (as applicable)

and is still in full force and effect.

(d) No

person or entity acting on behalf of Purchaser or Seller or any of its

affiliates

or under the authority of any of them is or will be entitled to any brokers’ or

finders’ fee or any other commission or similar fee, directly or indirectly,

from Purchaser or any of its affiliates in connection with any of the

transactions contemplated hereby.

(e) Purchaser

has inspected and evaluated the Transferred Assets and is aware of and relies

solely on the representations and warranties of Sellers contained herein and

Purchaser’s knowledge of the value and condition of the Transferred

Assets. Purchaser is familiar and sophisticated with respect to the

Transferred Assets. Purchaser has conducted all inspections, reviews

and/or other due diligence deemed to be necessary and appropriate by Purchaser

with respect to the Transferred Assets (including with respect to any pending

litigation, threatened or potential inquiry, claim, investigation, litigation,

proceeding or decree by any federal, state or local authority, or administrative

agency, or any private party against or relating to the Transferred Assets,

including with respect to any claim that the Transferred Assets infringe any

third party’s intellectual property rights), and has made an informed and

independent decision with respect to this Agreement.

(f) Sellers

have not made any representation, warranty, statement of fact, or expression of

opinion to Purchaser with regard to the Transferred Assets, except as stated

herein, and Sellers are not now and were not previously under any duty to do

so.

9. Expenses. Except

as set forth in Section 10, each party to this Agreement shall be

responsible for all costs and expenses incurred or expended in connection with

the transactions contemplated by this Agreement.

-7-

10. Transfer

Taxes. Purchaser shall be responsible for the payment of all

sales, use, value-added, gross receipts, excise, registration, stamp, duty,

transfer and other similar taxes or governmental fees relating to the transfer

of the Transferred Assets contemplated by this Agreement. In

addition, Purchaser shall be responsible for the payment of all costs and

expenses relating to the transfer to Purchaser of the Transferred Assets (e.g.,

packaging, shipping, freight, delivery and the like); provided, however, that

Purchaser shall not be responsible for any costs or expenses relating to the

storage of the Transferred Assets or for the transfer of the Transferred Assets

prior to Closing. On the Closing Date, Purchaser shall remit to

Sellers any sales tax due as a result of the transactions contemplated by this

Agreement. Sellers hereby agree to file all necessary documents with

respect to such amounts in a timely manner.

11. Notices. Any

notice or other communication provided for herein or given hereunder to a party

hereto shall be in writing, and shall be deemed given when personally delivered

to a party set forth below or when sent by facsimile providing a transmission

confirmation (provided that such notice is immediately sent by a recognized

overnight delivery service), or three (3) days after mailed by first class mail,

registered, or certified, return receipt requested, postage prepaid, or when

delivered by nationally-recognized overnight delivery service, with proof of

delivery, delivery charges prepaid, in any case addressed as

follows:

|

To

VLL4 & VLL5:

|

Venture

Lending & Leasing IV, Inc.

|

|

Venture

Lending & Leasing V, Inc.

|

|

|

2010

North First Street, Suite 310

|

|

|

San

Jose, CA 95131

|

|

|

Attention:

Chief Financial Officer

|

|

|

Fax:

(408) 436-8625

|

|

|

To

SVB:

|

Silicon

Valley Bank

|

|

2400

Hanover Street

|

|

|

Palo

Alto, CA 94304

|

|

|

Attention:

Bellet Eliasnia

|

|

|

Fax:

(650) 320-0016

|

|

|

To

Purchaser:

|

Xenogenics

Corporation

|

|

68

Cumberland Street, Suite 301

|

|

|

Woonsocket,

RI 02895

|

|

|

Tel.:

(401) 762-0045

|

|

|

FAX:

(401) 762-0098

|

|

|

Attention:

W. Gerald Newmin, Chairman &

CEO

|

-8-

12. Covenants of

Purchaser. Purchaser shall exercise, and shall require that

all its affiliates, sub-licensees, partners, and acquirers use, Good Faith

Reasonable Efforts (as defined below) in developing and commercializing Debtor’s

bioabsorbable stent and related technology and intellectual property acquired by

Purchaser pursuant to the terms of this Agreement and the documents and

instruments executed and delivered in connection with this

Agreement. “Good

Faith Reasonable Efforts” shall mean: (i) those efforts that are

similar to the efforts used by medical device companies generally in relation to

other products under similar commercial circumstances that have similar

commercial value, status, and potential to the bioabsorbable stent of Debtor

acquired by Purchaser; and, (ii) achieving the following development

milestones for the Generation 2 device included in the Transferred Assets:

(a) restart manufacturing and produce a device within 12 months from date

of execution of this Agreement; (b) initiate an animal study within 18

months from date of execution of this Agreement; (c) make a regulatory

submission to support a human use clinical trial within 24 months from date of

execution of this Agreement; (d) initiate a human use clinical trial within

36 months from date of execution of this Agreement; and (e) make a regulatory

submission or equivalent for marketing approval for use in humans within 48

months from date of execution of this Agreement. Purchaser agrees to promptly

notify Agent after Purchaser achieves or fails to achieve each of the preceding

development milestones within the specified time periods. Upon

reasonable prior notice at reasonable times during normal business hours,

Purchaser hereby authorizes Agent and each Seller’s officers, employees,

representatives and agents to inspect the Transferred Assets and to discuss the

Transferred Assets and the records relating thereto with Purchaser’s

officers.

Notwithstanding

anything to the contrary contained in this Agreement, Purchaser’s failure at any

time to exercise Good Faith Reasonable Efforts shall result in all Milestone

Payments not already paid by Purchaser to become immediately due and payable to

Sellers; provided, however, that in the

event Purchaser or its affiliates, sublicensees, partners or acquirers fails to

use Good Faith Reasonable Efforts developing and commercializing the

bioabsorbable stent and related technology and intellectual property of Debtor

acquired by Purchaser due to Technical Difficulties (as defined below) or

Financial Hardship (as defined below), Purchaser or its affiliates,

sublicensees, partners or acquirers can elect to: (i) pay all remaining

Milestone Payments due to Sellers and continue commercialization efforts, or

(ii) assign all Intellectual Property (as defined below) in favor of

Sellers and cease all development and commercialization efforts. As used herein

the term “Technical

Difficulties” shall mean (i) reasons of force majeure, or

(ii) the uncovering of an unforeseen technical problem not the result of a

lack of technical skill due to the hiring of personnel inexperienced in the

design, development and commercialization of stents used in interventional

cardiology and peripheral vasculature applications; the term “Financial

Hardship” shall mean the failure by Purchaser or its affiliates,

sublicensees, partners or acquirers to maintain at all times at least $250,000

net cash; and the term “Intellectual

Property” shall relate to Debtor’s stent, and related technology and

intellectual property and any improvements thereof, and shall mean and include,

without limitation, all: (i) copyrights, trademarks, patents, patent

applications, including all issues, reissues, amendments divisions,

continuations, continuations-in-part, and corresponding foreign counterparts;

and (ii) product designs, documentation, drawings, schematics,

formulations, SOPs, product concepts, manufacturing processes, custom

manufacturing equipment designs, quality standards, clinical trial data, trade

secrets, technical information relating to ongoing research and development,

business strategies, marketing plans, customer lists, and financial

data.

-9-

13. Security

Interest. To secure Sellers’ rights to receive the Second

Tranche of the Purchase Price and the Third Tranche of the Purchase Price, as

well as Sellers’ rights to receive the First Milestone Payment, the Second

Milestone Payment and the Third Milestone Payment, Purchaser hereby grant to

each Seller and Agent for the benefit of Sellers continuing security interests

in all of the Transferred Assets and the Proceeds (as such terms is defined in

the CUCC) thereof. In connection with the foregoing, Purchaser

authorizes Agent and/or Sellers to prepare and file any financing statements

describing the Transferred Assets. Purchaser agrees that Purchaser

will do all things reasonably necessary to maintain, preserve, protect and keep

the Transferred Assets in good working order, ordinary wear and tear excepted,

utilize the Transferred Assets for their intended use (as the same may be

modified), and use the Transferred Assets lawfully and, to the extent

applicable, only as permitted by Purchaser’s insurance policies. In

addition, Purchaser agrees to (a) not create, incur, assume or permit to

exist any lien, or grant any other Person a negative pledge, on any of the

Transferred Assets, (b) maintain, or cause to be maintained, complete and

accurate records relating to the Transferred Assets, and (c) obtain and

keep in force insurance in such amounts and types as is usual in the type of

business conducted by Purchaser, such insurance policies must be in form and

substance satisfactory to Sellers, and shall list each Seller as an additional

insured or loss payee, as applicable, on endorsement(s) in form reasonably

acceptable to Sellers. Purchaser shall furnish to Sellers such endorsements, and

upon Sellers’ request, copies of any or all such policies. If an

Insolvency Proceeding (as defined below) occurs with respect to Purchaser (or

any successor), or Purchaser fails to timely pay the Second Tranche of the

Purchase Price or the Third Tranche of the Purchase Price when due, or Purchaser

fails to timely pay the First Milestone Payment or the Second Milestone Payment

when due then any of the foregoing shall constitute a default and Agent and

Sellers shall be entitled to exercise any or all of the rights and remedies

available to a secured party under the CUCC or any other applicable law. As used

herein, the term “Insolvency

Proceeding” means with respect to Purchaser (or any successor)

(a) any case, action or proceeding before any court or other governmental

authority relating to bankruptcy, reorganization, insolvency, liquidation,

receivership, dissolution, winding up or relief of debtors with respect to

Purchaser (or any successor), or (b) any general assignment for the benefit

of creditors, composition, marshalling of assets for creditors, or other,

similar arrangement in respect of Purchaser’s (or any successor’s) creditors

generally or any substantial portion of its creditors, undertaken under U.S.

Federal, state or foreign law, including the Federal Bankruptcy Reform Act of

1978 (11 U.S.C. §101, et seq.), as

amended.

14. Miscellaneous.

(a) Entire

Agreement. This Agreement, together with the schedules and

exhibits attached hereto, constitutes the entire agreement of the parties hereto

regarding the purchase and sale of the Transferred Assets, and all prior

agreements, understandings, representations and statements, oral or written, are

superseded hereby.

(b) Captions. Section captions

used in this Agreement are for convenience only, and do not affect the

construction of this Agreement.

(c) Counterpart

Execution. This Agreement may be executed in one or more

counterparts, each of which shall be deemed an original and all of which shall

together constitute one and the same instrument. Delivery of an

executed counterpart of a signature page to this Agreement by facsimile or other

means of electronic transmission shall be effective as delivery of a manually

executed counterpart thereof and shall be deemed an original signature for all

purposes

(d) Severability. If

any provision of this Agreement shall for any reason be held to be invalid or

unenforceable, such invalidity or unenforceability shall not affect any other

provision of this Agreement, but this Agreement shall be construed as if such

invalid or unenforceable provision had never been contained in this

Agreement.

-10-

(e) Further

Assurances. At any time or from time to time after the

Closing, Sellers shall, at the request and expense of Purchaser, execute and

deliver such further instruments and documents as Purchaser may reasonably

request as may be reasonably necessary to evidence or effect the consummation of

the transactions contemplated by this Agreement.

(f) Amendments and

Waivers. No amendment of any provision of this Agreement shall

be valid unless the same shall be in writing and signed by Purchaser and

Sellers. No waiver by any party hereto of any default,

misrepresentation, or breach of warranty or covenant hereunder, whether

intentional or not, shall be deemed to extend to any prior or subsequent

default, misrepresentation, or breach of warranty or covenant hereunder or

affect in any way any rights arising by virtue of any prior or subsequent such

occurrence.

(g) Governing

Law. This Agreement shall be governed by and interpreted in

accordance with the internal laws of the State of California (without reference

to conflicts of law principles).

(h) Waiver of Trial by

Jury. SELLERS, AGENT AND PURCHASER HEREBY EXPRESSLY WAIVE ANY

RIGHT TO TRIAL BY JURY OF ANY CLAIM, DEMAND, ACTION, CAUSE OF ACTION, OR

PROCEEDING ARISING UNDER OR WITH RESPECT TO THIS AGREEMENT, OR IN ANY WAY

CONNECTED WITH, OR RELATED TO, OR INCIDENTAL TO, THE DEALINGS OF THE PARTIES

HERETO WITH RESPECT TO THIS AGREEMENT OR THE TRANSACTIONS RELATED HERETO OR

THERETO, IN EACH CASE WHETHER NOW EXISTING OR HEREAFTER ARISING, AND

IRRESPECTIVE OF WHETHER SOUNDING IN CONTRACT, TORT, OR

OTHERWISE. SELLERS, AGENT AND PURCHASER HEREBY AGREE THAT ANY SUCH

CLAIM, DEMAND, ACTION, CAUSE OF ACTION, OR PROCEEDING SHALL BE DECIDED BY A

COURT TRIAL WITHOUT A JURY AND THAT ANY PARTY HERETO MAY FILE AN ORIGINAL

COUNTERPART OR A COPY OF THIS SECTION WITH ANY COURT AS WRITTEN EVIDENCE OF THE

CONSENT OF THE OTHER PARTY OR PARTIES HERETO TO WAIVER OF ITS OR THEIR RIGHT TO

TRIAL BY JURY.

(i) Submission to Jurisdiction;

Selection of Forum. EACH PARTY HERETO (A) AGREES THAT IT

SHALL BRING ANY ACTION OR PROCEEDING IN RESPECT OF ANY CLAIM ARISING OUT OF OR

RELATED TO THIS AGREEMENT OR THE TRANSACTIONS CONTAINED IN OR CONTEMPLATED BY

THIS AGREEMENT, WHETHER IN TORT OR CONTRACT OR AT LAW OR IN EQUITY, EXCLUSIVELY

IN (I) THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF CALIFORNIA,

SAN JOSE DIVISION, OR IN THE EVENT THAT SUCH COURT LACKS SUBJECT MATTER

JURISDICTION OVER THE ACTION OR PROCEEDING, (II) IN AN APPROPRIATE CALIFORNIA

STATE COURT IN SAN JOSE, CALIFORNIA (SUCH FEDERAL OR STATE COURT IN SAN JOSE,

CALIFORNIA IS HEREAFTER REFERRED TO AS THE “CHOSEN COURT”) AND

(B) IRREVOCABLY SUBMITS TO THE EXCLUSIVE JURISDICTION OF THE CHOSEN COURT,

(C) WAIVES, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ANY OBJECTION TO

LAYING VENUE IN ANY SUCH ACTION OR PROCEEDING IN THE CHOSEN COURT,

(D) WAIVES ANY ARGUMENT THAT THE CHOSEN COURT IS AN INCONVENIENT FORUM OR

DOES NOT HAVE JURISDICTION OVER ANY PARTY THERETO, AND (E) AGREES THAT SERVICE

OR PROCESS UPON ANY PARTY IN ANY SUCH ACTION OR PROCEEDING SHALL BE EFFECTIVE IF

NOTICE IS GIVEN IN ACCORDANCE WITH SECTION 11 OF THIS

AGREEMENT.

-11-

(j) WITHOUT

INTENDING IN ANY WAY TO LIMIT THE PARTIES’ AGREEMENT TO WAIVE THEIR RESPECTIVE

RIGHT TO A TRIAL BY JURY, if the above waiver of the right to a trial by jury is

not enforceable, the parties hereto agree that any and all disputes or

controversies of any nature between them arising at any time shall be decided by

a reference to a private judge, mutually selected by the parties (or, if they

cannot agree, by the Presiding Judge of the Santa Clara County, California

Superior Court) appointed in accordance with California Code of Civil Procedure

Section 638 (or pursuant to comparable provisions of federal law if the

dispute falls within the exclusive jurisdiction of the federal courts), sitting

without a jury, in Santa Clara County, California; and the parties hereby submit

to the jurisdiction of such court. The reference proceedings shall be conducted

pursuant to and in accordance with the provisions of California Code of Civil

Procedure §§ 638 through 645.1, inclusive. The private judge

shall have the power, among others, to grant provisional relief, including

without limitation, entering temporary restraining orders, issuing preliminary

and permanent injunctions and appointing receivers. All such

proceedings shall be closed to the public and confidential and all records

relating thereto shall be permanently sealed. If during the course of

any dispute, a party desires to seek provisional relief, but a judge has not

been appointed at that point pursuant to the judicial reference procedures, then

such party may apply to the Santa Clara County, California Superior Court for

such relief. The proceeding before the private judge shall be

conducted in the same manner as it would be before a court under the rules of

evidence applicable to judicial proceedings. The parties shall be

entitled to discovery which shall be conducted in the same manner as it would be

before a court under the rules of discovery applicable to judicial

proceedings. The private judge shall oversee discovery and may

enforce all discovery rules and order applicable to judicial proceedings in the

same manner as a trial court judge. The parties agree that the

selected or appointed private judge shall have the power to decide all issues in

the action or proceeding, whether of fact or of law, and shall report a

statement of decision thereon pursuant to the California Code of Civil Procedure

§ 644(a). Nothing in this paragraph shall limit the right of any

party at any time to obtain provisional remedies. The private judge

shall also determine all issues relating to the applicability, interpretation,

and enforceability of this paragraph.

(k) Construction. The

parties hereto have participated jointly in the negotiation

and drafting of this Agreement. In the event an ambiguity or question

of intent or interpretation arises, this Agreement shall be construed as if

drafted jointly by the parties and no presumption or burden of proof shall arise

favoring or disfavoring any party by virtue of the authorship of any of the

provisions of this Agreement. Any reference to any federal, state,

local, or foreign statute or law shall be deemed also to refer to all rules and

regulations promulgated thereunder, unless the context requires

otherwise. The word “including” shall mean “including without

limitation”.

(l) No Third-Party

Beneficiaries. This Agreement shall not confer any rights or

remedies upon any person or entity other than the parties hereto and their

respective successors and permitted assigns.

-12-

(m) Successor and

Assigns. This Agreement shall be binding upon and inure to the

benefit of the parties named herein and their respective successors and

permitted assigns. Purchaser may not assign its rights or interests

under this Agreement, or delegate all or any of its obligations or duties

hereunder, without the prior written consent of Sellers. Sellers may

assign their rights and interests under this Agreement and may delegate all or

any of their obligations or duties hereunder by providing Purchaser with written

notice thereof.

(n) Confidentiality. Disclosure

of the terms of this Agreement shall be governed by the Confidentiality

Agreement executed prior to the date here among Purchaser and

Sellers.

(o) No Assumption of

Liabilities. For avoidance of doubt, Purchaser shall not

assume any liabilities in connection with the acquisition of the Transferred

Assets contemplated by this Agreement, including, without limitation, any of

Debtor’s existing debts or any liabilities of Debtor arising prior to

Closing.

(p) IN

NO EVENT WILL ANY PARTY BE LIABLE TO ANY OTHER PARTY, OR ANY CUSTOMER OF

PURCHASER OR OTHERS FOR ANY INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL,

EXEMPLARY OR SIMILAR DAMAGES (INCLUDING WITHOUT LIMITATION, LOSS OF DATA,

GOODWILL, REVENUE, PROFITS, LATENT DEFECTS, LOSS OF CAPITAL, CLAIMS FOR SERVICE

INTERRUPTION, COSTS AND EXPENSES INCURRED IN THE REMOVAL OF TRANSFERRED ASSETS),

ARISING OUT OF OR IN CONNECTION WITH PURCHASER’S OR ITS CUSTOMERS’ OR ANY OTHER

PARTY’S USE, MAINTENANCE OR OPERATION OF ANY OF THE TRANSFERRED ASSETS,

IRRESPECTIVE OF THE CAUSE OF ACTION OR THEORY UPON WHICH LIABILITY FOR SUCH

DAMAGES MIGHT BE ALLEGED, INCLUDING BUT NOT LIMITED TO, INFRINGEMENT,

MISAPPROPRIATION, NEGLIGENCE, OR OTHER TORT, BREACH OF CONTRACT OR WARRANTY

(EXPRESS OR IMPLIED), STRICT LIABILITY OR OTHERWISE, WHETHER AT LAW, IN EQUITY

OR OTHERWISE, EVEN IF THAT PARTY HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH

CLAIM FOR DAMAGES.

15. Purchaser’s Right of

Setoff. Upon notice to Sellers specifying in reasonable detail

the basis for setoff, Purchaser may setoff any amount to which it may be

entitled as a result of (i) the inaccuracy of any representation or the

breach of any warranty made by Sellers herein or (ii) any failure by

Sellers to conduct the private disposition of the Transferred Assets in

substantial compliance with Section 9610 of the CUCC, in each case, against

the remaining payments due under Sections 2(a), 2(c), 2(d) and 2(e) hereof,

with such setoffs to be applied ratably to the remaining payments due to Sellers

at the time of such setoff. The foregoing right of setoff shall be

the exclusive monetary remedy of Purchaser with respect to claims for damages in

connection with the inaccuracy of any representation or the breach of any

warranty made by Sellers herein or any failure by Sellers to conduct the private

disposition of the Transferred Assets in substantial compliance with

Section 9610 of the CUCC. The remedy provided in this

Section 15 shall terminate on the date that is eighteen (18) months from

the date hereof.

(The

remainder of this page is intentionally left blank. The signature

page follows.)

-13-

IN

WITNESS WHEREOF, Purchaser, Agent and Sellers have caused this Agreement to be

executed as of the day and year first above written.

|

SELLERS:

|

||

|

VENTURE

LENDING & LEASING IV, INC.

|

||

|

By:

|

||

|

Name:

|

||

|

Its:

|

||

|

VENTURE

LENDING & LEASING V, INC.,

|

||

|

as

Agent and as a Seller

|

||

|

By:

|

||

|

Name:

|

||

|

Its:

|

||

|

SILICON

VALLEY BANK

|

||

|

By:

|

||

|

Name:

|

||

|

Its:

|

||

|

PURCHASER:

|

||

|

XENOGENICS

CORPORATION

|

||

|

By:

|

||

|

Name:

W. Gerald Newmin

|

||

|

Its:

Chairman &

CEO

|

||

EXHIBIT

“A”

COPY

OF PEACEFUL FORECLOSURE AGREEMENT

September 29,

2009

VIA

EMAIL

Bioabsorbable

Therapeutics, Inc.

Re: Repossession of

Collateral

Ladies

and Gentlemen:

Reference

is made to the Loan and Security Agreement and Supplement thereto, both dated as

of March 18, 2008 (referred to herein together, and as the same have been

amended, restated, supplemented and modified from time to time, as the “Loan

Agreement”), among Bioabsorbable Therapeutics, Inc. (“Borrower”),

Venture Lending & Leasing IV, Inc. (“VLL4”),

Venture Lending & Leasing V, Inc. (“VLL5”)

and Silicon Valley Bank (“SVB”). VLL4,

VLL5 and SVB are sometimes referred to hereinafter collectively, as the “Lenders”

and VLL5, in its capacity as collateral agent for the Lenders under the Loan

Agreement is sometimes referred to herein as “Agent.” All

capitalized terms not otherwise defined in this letter have the meanings

ascribed to them in the Loan Agreement

Under the

terms of the Loan Documents, Borrower granted to each Lender and Agent for the

benefit of the Lenders security interests in all existing and after acquired

personal property of Borrower, including, but not limited to, all accounts,

contract rights, general intangibles, intellectual property, inventory,

equipment, fixtures, securities, investment property, cash, deposit accounts,

goods and any interests therein and all proceeds of the foregoing (defined in

the Loan Agreement as the “Collateral”),

as security for Borrower’s obligations and indebtedness under the Loan Agreement

and the other Loan Documents (the “Obligations”).

This

agreement for peaceful re-possession and foreclosure is entered into with

respect to the Loan Agreement, under which Borrower is presently in

default. In the course of discussions among Borrower and Lenders over

the past several months, Borrower has indicated that it has made extensive

efforts, without success, to find an acquirer for Borrower or its assets and to

raise additional capital, and that Borrower’s existing investors are unwilling

to provide any new financing. Due to the inability to obtain

additional equity or debt financing, Borrower has ceased

operations. Borrower does not have the ability to pay all of its

Obligations to Lenders under the Loan Agreement or to its trade

creditors. Borrower’s Board of Directors has determined that there is

not likely to be any value for equity holders, and that it is in the best

interest of Borrower’s creditors to wind down operations and minimize further

expenses.

In

consideration of the foregoing, the parties hereto agree as

follows:

1. Borrower

is now in default of its Obligations to Lenders, including defaults under

Sections 7.1(a) and 7.1(c) of the Loan Agreement, and as a result of such

defaults all Obligations of Borrower to each Lender are now due and payable in

full. Without limiting the effect of prior notices of default and

acceleration to Borrower, each Lender hereby confirms and declares such Events

of Default exist, and accelerates all of the Obligations.

2. As

of the date hereof, the aggregate outstanding amount of Borrower’s Obligations

to VLL4 is approximately $1,219,628.10, the aggregate outstanding amount of

Borrower’s Obligations to VLL5 is approximately $1,219,628.10, and the aggregate

outstanding amount of Borrower’s Obligations to SVB is approximately

$946,168.56. Such amounts exclude any interest, costs, expenses, and

professional fees which may have been incurred or may hereafter

accrue. Borrower and Lenders have reason to believe, based on

Borrower’s having engaged the services of an investment banker to find an

acquirer for Borrower or its assets, that the aggregate value realizable for the

Collateral is substantially less than the aggregate amount of the Obligations

presently due and owing to Lenders under the Loan Documents.

3. Pursuant

to the provisions of the Loan Documents and Division 9 of the California

Commercial Code (“CUCC”),

Borrower shall immediately, following demand from Agent or the Lenders, either

make available or deliver to Agent and Lenders, as secured parties:

(i) custody and possession of all of the Collateral whether located at 959

Hamilton Ave., Menlo Park, CA 94025 (the “Premises”) or elsewhere,

including receivables collections, cash on hand and on deposit in banks, all

securities (including share certificates for each subsidiary of Borrower, if

any), and all equipment, software, source code and related documentation; and

(ii) all books and records pertaining to the Collateral of all types,

wherever located, including any computer records (including passwords and source

codes) and books concerning accounts receivable, for the purpose of collecting

and holding the same, preparing the Collateral for collection, sale or other

disposition, and conducting such sale or disposition, provided that Borrower,

upon reasonable notice and for a proper purpose, shall have access to, and the

ability to make copies of, such records and books.

4. Borrower

hereby authorizes Agent and each Lender, directly or through their agents, to

obtain possession of all inventory, goods, fixtures, equipment and other

Collateral for the purposes of: (a) taking custody and possession of the

Collateral; (b) operating and using the Collateral to finish work in

progress, and to convert raw materials to finished goods; (c) operating the

Collateral for the purpose of maintaining and preserving its value and physical

condition; and (d) preparing the Collateral for sale or other disposition,

and conducting such sale or other disposition pursuant to such Lender’s rights

under the Loan Agreement and applicable law. In furtherance of the foregoing,

Borrower authorizes Agent and each Lender, directly or through their agents, to

enter into and use any business premises, subject to the terms of any lease

therefor, but without any payment to Borrower for use and

occupancy. Agent and Lenders may contact the landlord/agent/operator

for the Premises or any other location at which the Collateral is located in

order to work with such person to secure the Collateral.

5. Borrower

authorizes Agent and Lenders (but only to the extent that Borrower has the right

to do so), in their sole discretion, to change the locks on any business

premises, to inform any security or burglar alarm system agency of its right to

use the Premises, to post a guard on the Premises, to arrange for such fire and

other insurance coverages as any one of them deems appropriate, to remove the

Collateral from any premises, to move the Collateral to a safe location, to do

such other acts as they reasonably deems necessary to protect the Collateral

from damage or waste, and to secure their possession and custody thereof, all as

reasonable expenses of retaking and preparing the Collateral for sale or

disposition.

-2-

6. Borrower

acknowledges that, except as otherwise expressly agreed herein, Agent and

Lenders have no other duty with respect to custody and care of the Collateral

other than their duty under applicable law to use reasonable care in the custody

and preservation of the same, and that Agent and each Lender has no

responsibility for any tangible Collateral until physical possession thereof has

been taken. Agent and Lenders shall have no obligation to maintain or

preserve the rights of Borrower in the Collateral against the claims of third

parties.

7. Borrower

hereby acknowledges that Agent and each Lender has not made any commitment with

respect to its method of disposing of the Collateral other than their

obligations under California law to do so in a commercially reasonable manner to

the extent required under the CUCC. Borrower hereby waives its rights to

notice of any private sale under Section 9611 of the CUCC, and waives its

right to redeem the Collateral under Section 9623 of the

CUCC. Notwithstanding any other provision of the Loan Documents with

respect to notice, Borrower hereby waives any further notice of sale or other

disposition to the extent permitted under applicable law, and agrees that Agent

and Lenders shall not be required to give Borrower notice of any proposed sale,

lease, election to retain, or other disposition of the

Collateral.

8. This

agreement shall in no way impair or limit any rights or remedies which Agent and

Lenders may have under the Loan Documents or applicable law, all of which are

cumulative and not alternative, including, without limitation, rights and

remedies which they may have against the Collateral. Agent and each

Lender hereby reserves all of its rights described in the preceding

sentence. Nothing in

this agreement shall limit Agent’s and each Lender’s rights to take possession

of, or any of Agent’s and such Lender’s other rights with respect to, the

Collateral, including Collateral covered by any financing statement filed

pursuant to the CUCC or the Uniform Commercial Code adopted in any

jurisdiction. Agent, Lenders and Borrower agree that all cash

from collections and realizations upon Collateral shall be applied to payment

and satisfaction of the Obligations in the manner prescribed in the Loan

Agreement and by applicable law, and that if and to the extent Lenders receive

upon sale or other disposition of the Collateral any noncash consideration, such

as promissory notes or illiquid securities of a purchaser, it shall not be

commercially unreasonable for Lenders to hold such noncash consideration until

the same can be reduced to cash in a commercially reasonable manner, at which

time Lenders shall apply such proceeds to the remaining outstanding Obligations

and pay over the excess, if any, to Borrower or such other person(s) as may be

entitled thereto in accordance with applicable law.

9. Borrower

hereby agrees that, in consideration of the facts recited herein, the

forbearances previously provided to Borrower and mutual covenants contained

herein, and for other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, in the event that:

(a) Borrower

(i) hereafter files with any bankruptcy court of competent jurisdiction or

becomes the subject of any petition under Title 11 of the United States

Code, as amended, (ii) becomes the subject of any order for relief issued

under such Title 11 of the United States Code, as amended, (iii) files

or becomes the subject of any petition seeking any reorganization, arrangement,

composition, readjustment, liquidation, dissolution or similar relief under any

present or future federal or state act or law relating to bankruptcy, insolvency

or other relief for debtors, (iv) seeks or consents to or acquiesces in the

appointment of any trust, receiver or liquidater for itself or for any

substantial portion of its assets, (v) becomes the subject of any order,

judgment or decree entered by any court of competent jurisdiction approving a

petition filed against such party for any reorganization, arrangement,

composition, readjustment, liquidation, dissolution or similar relief under any

present or future federal or state act or law relating to bankruptcy, insolvency

or relief for debtors; and

-3-

(b) as

a result of any of the matters set forth in (a) above, Agent’s and Lenders’

ability to repossess and/or compete a private sale or sale at foreclosure or

other conveyance of the Collateral or to exercise or enforce any of its or their

rights or remedies under the Loan Documents at law or in equity is interfered

with, impeded or otherwise impaired because of a stay of such repossession, sale

or conveyance in such proceeding, then in any such event Borrower agrees that

Agent and Lenders have good cause for relief from any automatic stay imposed by

Section 362 of Title 11 of the United States Code, as amended, or

otherwise, on or against the exercise of the rights and remedies otherwise

available to Agent and Lenders as provided in the Loan Documents or as otherwise

provided by law, and in the event of the occurrence of any of the events

described in clauses (a)(i) through (a)(v) above, Borrower will not take any

action to impede, restrain or restrict Agent’s and Lenders’ rights and remedies

under this agreement or otherwise, whether under Sections 105 or 362 of

Title 11 of the United States Code or otherwise. In addition, Borrower

waives the right to extend the one hundred twenty (120) day period under which a

debtor has the exclusive right to file a plan of reorganization in any case

involving it as debtor under Title 11 of the United States

Code.

10. If

at any time after the deemed payment or performance of the Obligations, or any

part thereof, is, pursuant to applicable law, avoided, rescinded or reduced in

amount, or must otherwise be restored or returned by any Lender, whether as a

“voidable preference,” “fraudulent conveyance,” or otherwise then Borrower’s

Obligations under the Loan Agreement shall be reinstated and revived, all as

though such acceptance, foreclosure, payment or performance had not been

made.

11. In

consideration of the forbearances previously provided to Borrower, Borrower

hereby, for itself, its affiliates, partners, agents, successors, administrators

and assigns, releases, acquits and forever discharges Agent and each such

Lender, their past or present directors, managers, officers, employees, agents,

affiliates, attorneys, shareholders, successors and assigns (“Released

Parties”), and each of them, separately and collectively, of and from any

and all claims, actions, causes of action, counterclaims, liabilities, suits,

debts, offsets, setoffs, losses, liens, demands, rights, obligations, defenses,

damages, costs, attorneys’ fees, interest, loss of service, expenses and

compensation, known or unknown, fixed or contingent, and defenses of every

nature and kind whatsoever existing as of the date hereof (“Claims”), which Borrower might

have had in the past, or now has, including, without limitation, any Claims

relating to and in any way connected with: the Loan Agreement, the Loan

Documents, the related agreements thereto, and the lending relationship between

Borrower and the Released Parties as of the date hereof, but excluding any

claims relating to Agent’s or such Lender’s breach of this agreement or claims

arising after the date of this agreement.

Furthermore,

Borrower further agrees never to commence, aid or participate in, either

directly or indirectly (except to the extent required by order or legal process

issued by a court or governmental agency of competent jurisdiction) any legal

action, defense or other proceeding based in whole or in part on the Claims

being waived hereunder.

-4-

Borrower

expressly understands and acknowledges that it is possible that unknown losses

or Claims exist or that present losses or Claims may have been understated in

amount or severity, and it explicitly took that into account in determining the

consideration to be given for this release, and a portion of said consideration

and the mutual covenants contained herein, having been bargained for between the

parties with the knowledge of the possibility of such unknown Claims, were given

in exchange for a full accord, satisfaction and discharge of all such Claims.

Consequently, in furtherance of this general release, Borrower acknowledges and

waives the benefits of California Civil Code section 1542 (and all similar

ordinances and statutory, regulatory, or judicially created laws or rules of any

jurisdiction) which provides:

A GENERAL RELEASE DOES NOT EXTEND TO

ANY CLAIM WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXISTS IN HIS FAVOR AT

THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM MUST HAVE MATERIALLY

AFFECTED HIS SETTLEMENT WITH THE DEBTOR.

Borrower

agrees that the agreements contained herein are intended to be in full

satisfaction of any alleged injuries or damages of Borrower. Borrower

has consulted with legal counsel prior to signing this release or has had an

opportunity to obtain such counsel and knowingly chose not to do so, and execute

such release voluntarily with the intention of fully and finally extinguishing

all disputes between the parties hereto.

Borrower

acknowledges that it is relying on no written or oral agreement, representation

or understanding of any kind made by Agent and Lenders or any employee, attorney

or agent of Agent or Lenders.

12. Borrower

hereby represents and warrants to Agent and the Lenders that: Borrower has full

corporate power and authority to execute and deliver this agreement, and to

perform the obligations of its part to be performed hereunder; Borrower has

taken all necessary action, corporate or otherwise, to authorize the execution

and delivery of this agreement; no consent, approval or authorization of any

person or entity (other than any of the foregoing as has been obtained by

Borrower) is or will be required in connection with the execution or delivery by

Borrower of this agreement; and this agreement is, or upon delivery hereof to

Lenders will be, the legal, valid and binding obligation of Borrower,

enforceable against Borrower in accordance with its terms, except as such

enforceability may be limited by bankruptcy, insolvency, reorganization or

similar laws affecting creditors’ rights generally. Each of Agent and

Lenders hereby represents and warrants to Borrower that: it has full corporate

power and authority to execute and deliver this agreement, and to perform the

obligations of its part to be performed hereunder; it has taken all necessary

action, corporate or otherwise, to authorize the execution and delivery of this

agreement; no consent, approval or authorization of any person or entity (other

than any of the foregoing as has been obtained by it) is or will be required in

connection with the execution or delivery by it of this agreement; and this

agreement is, or upon delivery hereof to Borrower will be, its legal, valid and

binding obligation, enforceable against it in accordance with its terms, except

as such enforceability may be limited by bankruptcy, insolvency, reorganization

or similar laws affecting creditors’ rights generally.

-5-

13. This

agreement contains the entire agreement between the parties relating to the

subject matter hereof and supersedes all oral statements and prior writings with

respect thereto. This agreement may be executed in two or more

counterparts, each of which shall be deemed an original, but all of which

together shall constitute one and the same instrument. Any party may

execute this agreement by facsimile signature or scanned signature in PDF

format, and any such facsimile signature or scanned signature, if identified,

legible and complete, shall be deemed an original signature and each of the

parties is hereby authorized to rely thereon. This agreement shall be

governed by the laws of the State of California, excluding those laws that

direct the application of the laws of another jurisdiction.

remainder

of this page intentionally left blank; signature page follows

-6-

If you

agree to the terms of this agreement, please indicate your agreement by signing

and returning the enclosed copy of this letter.

|

Very

truly yours,

|

||

|

VENTURE

LENDING & LEASING IV, INC.

|

||

|

By:

|

/s/

|

|

|

Name:

Maurice Werdegar

|

||

|

Title:

President

|

||

|

VENTURE

LENDING & LEASING V, INC.

|

||

|

By:

|

/s/

|

|

|

Name:

Maurice Werdegar

|

||

|

Title:

President

|

||

|

SILICON

VALLEY BANK

|

||

|

By:

|

||

|

Name:

|

||

|

Title:

|

||

|

ACKNOWLEDGED

AND AGREED:

|

||

|

BIOABSORBABLE

THERAPEUTICS, INC.

|

||

|

By:

|

||

|

Name:

|

||

|

Title:

|

||

If you

agree to the terms of this agreement, please indicate your agreement by signing

and returning the enclosed copy of this letter.

|

Very

truly yours,

|

||

|

VENTURE

LENDING & LEASING IV, INC.

|

||

|

By:

|

||

|

Name:

|

||

|

Title:

|

||

|

VENTURE

LENDING & LEASING V, INC.

|

||

|

By:

|

||

|

Name:

|

||

|

Title:

|

||

|

SILICON

VALLEY BANK

|

||

|

By:

|

/s/

|

|

|

Name:Bellet

Elirsnia

|

||

|

Title:

Advisor

III

|

||

|

ACKNOWLEDGED

AND AGREED:

|

||

|

BIOABSORBABLE

THERAPEUTICS, INC.

|

||

|

By:

|

||

|

Name:

|

||

|

Title:

|

||

If you

agree to the terms of this agreement, please indicate your agreement by signing

and returning the enclosed copy of this letter.

|

Very

truly yours,

|

||

|

VENTURE

LENDING & LEASING IV, INC.

|

||

|

By:

|

||

|

Name:

|

||

|

Title:

|

||

|

VENTURE

LENDING & LEASING V, INC.

|

||

|

By:

|

||

|

Name:

|

||

|

Title:

|

||

|

SILICON

VALLEY BANK

|

||

|

By:

|

||

|

Name:

|

||

|

Title:

|

||

|

ACKNOWLEDGED

AND AGREED:

|

||

|

BIOABSORBABLE

THERAPEUTICS, INC.

|

||

|

By:

|

/s/

|

|

|

Name:

|

Patrick Rivelli

|

|

|

Title:

|

President and CEO

|

|

EXHIBIT

“B”

TRANSFERRED

ASSETS

The term

“Transferred

Assets” is defined on Exhibit A to the Bill of Sale attached as

Exhibit “C” to

this Agreement.

Bioabsorbable

Therapeutics, Inc.

|

Matter

Number

|

Country

|

Case

Type

|

Status

|

Application

No.

|

Filing

Date

|

Title

|

Remarks

|

Inventors

|

||||||||||||

|

589318001/00

|

European

Patent Convention

|

PCT

|

Published

|

7753611.8

|

20-Mar-2007

|

IMPROVED

POLYANHYDRIDE POLYMERS AND THEIR USES IN BIOMEDICAL

DEVICES

|

This

application is based on PCT/US2007/007001 filed 03/20/2007 which is based

on USSN 11/389,434 filed 03/23/2006.

07/23/09-

CPA’s confirmation of payment/renewal certificate

[5/28/09]

|

Varshney,

Sunil K.; Hnojewyj, Olexander; Zhang, Jianxin; Rivelli, Patrick

A.

|

||||||||||||

|

Action

Due

|

DueDate

|

|||||||||||||||||||

|

Annuity

Due

|

20-Mar-2010

|

|||||||||||||||||||

|

589318001/00

|

Patent

Cooperation Treaty

|

ORD

|

National

|

PCT/US2007/007001

|

20-Mar-2007

|

IMPROVED

POLYANHYDRIDE POLYMERS AND THEIR USES IN BIOMEDICAL

DEVICES

|

EPO

Allotted Application No. 07753611.8 This application is based on USSN

11/389,434 filed 03/23/2006.

|

Varshney,

Sunil K.; Hnojewyj, Olexander; Zhang, Jianxin; Rivelli, Patrick

A.

|

||||||||||||

|

589318001/

|

United

States of America

|

ORD

|

Abandoned

|

11/389,434

|

23-Mar-2006

|

IMPROVED

POLYANHYDRIDE POLYMERS AND THEIR USES IN BIOMEDICAL

DEVICES

|

Allow

to lapse in favor of CON 12/484,102 filed 06/12/2009 -

06/16/2009.

|

Varshney,

Sunil K.; Hnojewyj, Olexander; Zhang, Jianxin; Rivelli, Patrick

A.

|

||||||||||||

|

Assignment

Date: June 19, 2006

Reel/Frame: 017819/0451

|

||||||||||||||||||||

|

589318001/00

|

United

States of America

|

CON

|

Pending

|

12/484,102

|

12-Jun-2009

|

IMPROVED

POLYANHYDRIDE POLYMERS AND THEIR USES IN BIOMEDICAL

DEVICES

|

The

US examiner has indicated the claims have been allowed.

This

application is a CON of USSN 11/389,434 filed 03/23/2006.

|

Varshney,

Sunil K.; Hnojewyj, Olexander; Zhang, Jianxin; Rivelli, Patrick

A.

|

||||||||||||

|

589318002/00

|

|

Patent

Cooperation Treaty

|

|

ORD

|

|

Expired

|

|

PCT/US2007/015811

|

|

10-Jul-2007

|

|

DRUG

DELIVERY POLYANHYDRIDE COMPOSITION AND METHOD

|

|

Rec’d

client instructions to wait for the 31- Months (Feb. 14, 2009) for further

instruction - 01/12/2009.

This

application is based on USSN 11/486,501 filed 07/14/2006.

|

|

Hnojewyj,

Olexander; Rivelli Jr., Patrick; Shaffer, Tony B.

|

|

|

||

|

Matter

Number

|

Country

|

Case

Type

|

Status

|

Application

No.

|

Filing

Date

|

Title

|

Remarks

|

Inventors

|

||||||||||||

|

589318002/

|

United

States of America

|

ORD

|

Published

|

11/486,501

|

14-Jul-2006

|

DRUG

DELIVERY POLYANHYDRIDE COMPOSITION AND METHOD

|

Hnojewyj,

Olexander; Rivelli Jr., Patrick; Shaffer, Tony B.

|

|||||||||||||

|

ActionDue

|

DueDate

23-Sep-2009 23-Oct-2009 23-Nov-2009

|

|||||||||||||||||||

|

File

Response [PTA]

|

||||||||||||||||||||

|

File

Response (1st ext) [PTA]

|

||||||||||||||||||||

|

File

Response (2nd ext) [PTA]

|

||||||||||||||||||||

|

File

Resp (2-wk adv to Final)

|

09-Dec-2009

|

|||||||||||||||||||

|

File

Response [PTA] LD

|

23-Dec-2009

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

File

Pet. to Revive (1-mo adv)

|

|

23-Aug-2010

|

|

Matter

Number

|

Country

|

Case

Type

|

Status

|

Application

No.

|

Filing

Date

|