Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Deerfield Resources, Ltd. | exhibit31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Deerfield Resources, Ltd. | exhibit31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Deerfield Resources, Ltd. | exhibit32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Deerfield Resources, Ltd. | exhibit32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A

(Amendment No. 1)

[ X

] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the quarterly period ended: March 31, 2010

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from ____________ to _____________

Commission File No. 333-139660

CHINA TMK BATTERY SYSTEMS INC.

(Name of Small Business Issuer in Its

Charter)

|

Nevada |

98-0506246 |

|

(State or other jurisdiction of |

(I.R.S. Employer Identification No.) |

|

incorporation or organization) |

|

Sanjun Industrial Park

No. 2 Huawang Rd., Dalang Street

Bao'an District, Shenzhen 518109

People's Republic of China

(Address of principal executive

offices)

(86) 755 28109908

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ] |

Accelerated filer [ ] |

|

|

|

|

Non-accelerated filer [ ] |

Smaller reporting company[ X ] |

|

(Do not check if a smaller reporting company) |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [ X ]

The number of shares outstanding of each of the issuer’s classes of common equity, as of May 17, 2010 is as follows:

|

Class of Securities |

Shares Outstanding |

|

Common Stock, $0.001 par value |

34,171,000 |

TABLE OF CONTENTS

|

PART I FINANCIAL INFORMATION |

|

|

|

|

|

ITEM 1. FINANCIAL STATEMENTS. |

3 |

|

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

17 |

|

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. |

25 |

|

ITEM 4. CONTROLS AND PROCEDURES. |

25 |

|

|

|

|

PART II OTHER INFORMATION |

|

|

|

|

|

ITEM 1. LEGAL PROCEEDINGS. |

26 |

|

ITEM 1A. RISK FACTORS. |

26 |

|

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS. |

26 |

|

ITEM 3. DEFAULTS UPON SENIOR SECURITIES. |

26 |

|

ITEM 4. (REMOVED AND RESERVED). |

26 |

|

ITEM 5. OTHER INFORMATION. |

26 |

|

ITEM 6. EXHIBITS. |

26 |

2

Explanatory Note

On August 23, 2010, the board of directors of China TMK Battery Systems Inc. (the “Company”), after consultation with and upon recommendation from management of the Company, determined that the Company’s previously issued unaudited financial statements for the quarter ended March 31, 2010 included in its Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 24, 2010 (the “Original Filing”) should no longer be relied upon and that disclosure should be made and action should be taken to prevent future reliance.

The Company has restated its financial statements for the quarter ended March 31, 2010 due to issues raised by its independent accountants, MaloneBailey, LLP ("MaloneBailey"), regarding the accounting treatment of certain reset provisions in warrants to purchase 3,401,320 shares of the Company’s common stock (the “Warrants”), previously issued to investors in a February 10, 2010 private placement (the “Private Placement”). The Warrants issued in the Private Placement include an anti-dilution provision for adjustment if the Company issues or sells any shares of common stock or securities convertible into common stock for a consideration per share of common stock less than the then current exercise price, which is currently $1.60 per share. Because of the reset provision, the Warrants are not considered to be indexed to the Company’s stock and therefore the Warrants were determined to be derivative liability under ASC 815-15 and ASC 815-20. The question was raised in light of EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) Is Indexed to an Entity’s Own Stock” (FASB ASC 815-40-15-5) (“ASC 815”) effective as of January 1, 2009, which outlines new guidance for being indexed to an entity’s own stock and the resulting liability or equity classification based on that conclusion. Reset provisions reduce the exercise price of a warrant or convertible instrument if a company either issues new warrants or convertible instruments that have a lower exercise price.

The board of directors of the Company has performed a complete assessment of the Warrants and has concluded that they are within the scope of ASC 815 due to the reset provisions included in the terms of the agreements. Accordingly, ASC 815 should have been adopted as of January 1, 2009 by classifying the Warrants as liability measured at fair value with changes in fair value recognized in earnings each reporting and recording a cumulative-effect adjustment to the opening balance of retained earnings. The Company has calculated the fair value of the Warrants at the date of inception, as well as at the March 31, 2010 reporting period, utilizing multinomial lattice models. Based on its calculations and assessment of the materiality, the Company concluded that its financial statements for the quarter ended March 31, 2010 included in the Original Filing required restatement and that the Original Filing should be amended.

Except as described above and corresponding changes under the heading Management’s Discussion and Analysis of Financial Condition and Results of Operations, no additions or modifications will be made to reflect facts or events occurring subsequent to the date of the Original Filing.

PART I

FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CHINA TMK BATTERY SYSTEMS INC.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2010 AND 2009

|

Contents |

Page(s) |

|

Consolidated Balance Sheets as of March 31, 2010 (unaudited) and December 31, 2009 |

4 |

|

Consolidated Statements of Income and Other Comprehensive Income for the three months ended March 31, 2010 and 2009 (unaudited) |

5 - 6 |

|

Consolidated Statements of Changes in Equity (unaudited) |

7 |

|

Consolidated Statements of Cash Flows for the three months ended March 31, 2010 and 2009 (unaudited) |

8 |

|

Notes to the Consolidated Financial Statements (unaudited) |

9 |

3

China TMK Battery Systems Inc. and Subsidiaries

Consolidated Balance Sheets

| March 31, | December 31, | |||||

| 2010 | 2009 | |||||

| (Unaudited) | ||||||

| (Restated) | ||||||

| Assets | ||||||

| Current Assets | ||||||

| Cash and cash equivalents | $ | 289,361 | $ | 185,590 | ||

| Trade receivables, net | 5,554,914 | 2,909,234 | ||||

| Advances to suppliers | 346,342 | 215,689 | ||||

| VAT recoverable | 115,938 | 34,660 | ||||

| Inventories, net | 3,680,244 | 3,973,697 | ||||

| Due from related parties | 15,213 | 15,204 | ||||

| Prepaid expenses and other receivables | 1,007,486 | - | ||||

| Restricted cash | 438,840 | 438,780 | ||||

| Total current assets | 11,448,338 | 7,772,854 | ||||

| Property, equipment and construction in progress, net | 11,241,793 | 11,039,703 | ||||

| Advances for property and equipment purchase | 19,292,743 | 16,930,020 | ||||

| Restricted cash | 263,304 | 263,268 | ||||

| Other assets | 109,323 | 50,804 | ||||

| Deposit for business acquisition | 3,172,656 | - | ||||

| Total Assets | $ | 45,528,157 | $ | 36,056,649 | ||

| Liabilities and Shareholders' Equity | ||||||

| Current Liabilities | ||||||

| Accounts payable | $ | 3,342,730 | $ | 1,832,737 | ||

| Accrued liabilities and other payable | 308,204 | 519,129 | ||||

| Customer deposits | 271,143 | 179,272 | ||||

| Wages payable | 505,334 | 556,189 | ||||

| Corporate tax payable | 235,207 | 216,443 | ||||

| Short-term bank loan | 3,688,371 | 4,722,660 | ||||

| Current portion of long-term bank loans | 1,843,165 | 2,451,700 | ||||

| Deferred revenue | 27,644 | 36,854 | ||||

| Due to related parties | 1,120,611 | 17,691 | ||||

| Total current liabilities | 11,342,409 | 10,532,675 | ||||

| Long-term bank loans | 9,969,611 | 9,236,953 | ||||

| Deferred tax liabilities | 594,058 | 593,977 | ||||

| Derivative liability | 2,943,977 | - | ||||

| Total Liabilities | 24,850,055 | 20,363,605 |

| Stockholders' Equity | ||||||

| Preferred stock, $0.001 par value, 10,000,000 shares authorized, none issued and outstanding at March 31, 2010 and December 31, 2009 | - | - | ||||

| Common stock, $0.001 par value, 300,000,000 shares authorized, 34,171,000 and 25,250,000 shares issued and outstanding at March 31, 2010 and December 31, 2009, respectively | 34,171 | 25,250 | ||||

| Common stock subscribed, 2,717,250 shares at March 31, 2010 | 2,717 | - | ||||

| Additional paid-in capital | 10,518,662 | 1,193,591 | ||||

| Accumulated other comprehensive income | 397,405 | 365,187 | ||||

| Subscription receivables | (1,406,502 | ) | - | |||

| Statutory reserves | 1,038,988 | 1,038,988 | ||||

| Retained earnings (unrestricted) | 10,092,661 | 13,070,028 | ||||

| Total stockholders' equity | 20,678,102 | 15,693,044 | ||||

| Total Liabilities & Stockholders' Equity | $ | 45,528,157 | $ | 36,056,649 |

The accompanying notes are an integral part of these consolidated financial statements.

4

China TMK Battery Systems Inc. and Subsidiaries

Consolidated Statements of Income

(Unaudited)

| For the Three Months Ended | ||||||

| March 31, | ||||||

| 2010 | 2009 | |||||

| (Restated) | ||||||

| Revenue | $ | 13,264,472 | $ | 9,900,656 | ||

| Cost of Goods Sold | (10,105,697 | ) | (7,488,805 | ) | ||

| Gross Profit | 3,158,775 | 2,411,851 | ||||

| Operating Costs and Expenses | ||||||

| Selling expenses | 234,718 | 191,388 | ||||

| Depreciation | 17,505 | 52,780 | ||||

| General and administrative | 1,822,979 | 269,126 | ||||

| Research and development | 165,244 | 112,009 | ||||

| Total operating expenses | 2,240,446 | 625,303 | ||||

| Income from operations | 918,329 | 1,786,548 | ||||

| Other income (expenses): | ||||||

| Interest expense, net | (241,907 | ) | (219,252 | ) | ||

| Other expense, net | (60,381 | ) | (597 | ) | ||

| Change in fair value of embedded derivative | (1,725,233 | ) | ||||

| Total other expenses | (2,027,521 | ) | (219,849 | ) | ||

| Income (loss) before income taxes | (1,109,192 | ) | 1,566,699 | |||

| Income taxes | (358,175 | ) | (235,053 | ) | ||

| Net income (loss) | $ | (1,467,367 | ) | $ | 1,331,646 | |

| Earnings (loss) per share - basic | $ | ( 0.05 | ) | $ | 0.05 | |

| Weighted-average shares outstanding, basic | 30,206,111 | 25,250,000 | ||||

| Earnings (loss) per share - diluted | $ | (0.05 | ) | $ | 0.05 | |

| Weighted-average shares outstanding, diluted | $ | 31,310,314 | 25,250,000 |

The accompanying notes are an integral part of these consolidated financial statements.

5

China TMK Battery Systems Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(Unaudited)

| For the Three Months Ended | ||||||

| March 31, | March 31, | |||||

| 2010 | 2009 | |||||

| (Restated) | ||||||

| Net income (loss) | $ | (1,467,367 | ) | $ | 1,331,646 | |

| Other comprehensive income, net of tax: | ||||||

| Unrealized gain on foreign currency translation | 32,218 | 19,432 | ||||

| Comprehensive income (loss) | $ | (1,435,149 | ) | $ | 1,351,078 | |

The accompanying notes are an integral part of these consolidated financial statements.

6

China TMK Battery Systems Inc.

and Subsidiaries

Consolidated Statement of Changes in Stockholders' Equity

For the

Three Months Ended March 31, 2010 (Unaudited)

| Common Stock | Accumulated | |||||||||||||||||||||||||||||

| Common Stock | Subscribed | Additional | Other | Retained | Total | |||||||||||||||||||||||||

| Paid-in | Subscription | Comprehensive | Statutory | Earnings | Stockholders' | |||||||||||||||||||||||||

| Share | Amount | Share | Amount | Capital | Receivables | Income | Reserves | (Unrestricted) | Equity | |||||||||||||||||||||

| Balance at December 31, 2009 | 25,250,000 | $ | 25,250 | - | $ | - | $ | 1,193,591 | $ | - | $ | 365,187 | $ | 1,038,988 | $ | 13,070,028 | $ | 15,693,044 | ||||||||||||

| Retained of 2,750,000 shares by original shell shareholders | 2,750,000 | $ | 2,750 | - | $ | - | $ | (2,750 | ) | $ | - | $ | - | $ | - | $ | - | - | ||||||||||||

| Issuance of 560,000 shares for acquisition fee | 560,000 | 560 | 699,440 | - | - | - | - | 700,000 | ||||||||||||||||||||||

| Issuance of 125,000 shares for consulting services | 125,000 | 125 | 156,125 | - | - | - | - | 156,250 | ||||||||||||||||||||||

| Issuance of 5,486,000 shares at 1.25 per share in private placement, net of offering costs | 5,486,000 | 5,486 | 6,297,467 | - | - | - | - | 6,302,953 | ||||||||||||||||||||||

| Common stock subscribed | - | - | 2,717,250 | 2,717 | 3,393,533 | - | - | - | - | 3,396,250 | ||||||||||||||||||||

| Share subscription receivables | - | - | - | - | - | (1,406,502 | ) | - | - | - | (1,406,502 | ) | ||||||||||||||||||

| Distribution to owners - share purchase from former owners | - | - | - | - | - | - | - | - | (1,510,000 | ) | (1,510,000 | ) | ||||||||||||||||||

| Embedded feature of equity | (1,218,744 | ) | (1,218,744 | ) | ||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | - | - | 32,218 | - | - | 32,218 | ||||||||||||||||||||

| Net income (loss) for the three months ended March 31, 2010 | - | - | - | - | - | - | - | - | (1,467,367 | ) | (1,467,367 | ) | ||||||||||||||||||

| Balance at March 31, 2010 - Restated | 34,171,000 | $ | 34,171 | 2,717,250 | $ | 2,717 | $ | 10,518,662 | $ | (1,406,502 | ) | $ | 397,405 | $ | 1,038,988 | $ | 10,092,661 | $ | 20,678,102 | |||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

7

China TMK Battery Systems Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

For the Three Months Ended |

|

|||

|

|

|

March 31, |

|

|||

|

|

|

2010 |

|

|

2009 |

|

|

|

|

(Restated) |

|

|

|

|

|

Cash Flows From Operating Activities |

|

|

|

|

|

|

|

Net income (loss) |

$ |

(1,467,367) |

|

$ |

1,331,646 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation expense |

|

17,505 |

|

|

52,780 |

|

|

Common stocks for services provided |

|

856,250 |

|

|

- |

|

|

Deferred income |

|

(9,238 |

) |

|

- |

|

|

Change in fair value of embedded derivative |

|

1,725,233 |

|

|

- |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Trade receivables |

|

(2,645,680 |

) |

|

(258,247 |

) |

|

Advance to suppliers |

|

(130,653 |

) |

|

(118,660 |

) |

|

Inventories, net |

|

295,135 |

|

|

(431,414 |

) |

|

Account payable - trade |

|

1,509,993 |

|

|

1,172,094 |

|

|

Accrued liabilities and other payables |

|

(210,925 |

) |

|

486,490 |

|

|

Customer deposits |

|

91,871 |

|

|

220,668 |

|

|

Other assets |

|

(58,519 |

) |

|

|

|

|

Prepaid expenses and other receivables |

|

(1,007,486 |

) |

|

(20,550 |

) |

|

Wages payable |

|

(50,855 |

) |

|

43,966 |

|

|

Various taxes payable |

|

(62,514 |

) |

|

186,568 |

|

|

Net cash provided by (used in) operating activities |

|

(1,147,250 |

) |

|

2,665,341 |

|

|

|

|

|

|

|

|

|

|

Cash Flows From Investing Activities |

|

|

|

|

|

|

|

Change in restricted cash |

|

(96 |

) |

|

(298,360 |

) |

|

Purchases and advances of property and equipment |

|

(2,701,485 |

) |

|

(5,257,505 |

) |

|

Deposit for Hualian acquisition |

|

(3,172,656 |

) |

|

- |

|

|

Collection of advances/loans - related parties |

|

- |

|

|

10,806 |

|

|

Advances/loans - related parties |

|

- |

|

|

(153,277 |

) |

|

Collection of short-term loan receivable |

|

- |

|

|

747,697 |

|

|

Net cash used in investing activities |

|

(5,874,237 |

) |

|

(4,950,639 |

) |

|

|

|

|

|

|

|

|

|

Cash Flows From Financing Activities |

|

|

|

|

|

|

|

Borrowing from bank notes |

|

- |

|

|

2,930,200 |

|

|

Repayment of bank notes |

|

- |

|

|

(1,069,523 |

) |

|

Borrowing from bank loans |

|

1,973,161 |

|

|

7,206,677 |

|

|

Repayment of bank loans |

|

(2,887,878 |

) |

|

(3,925,527 |

) |

|

Common stock subscribed |

|

1,989,748 |

|

|

- |

|

|

Net proceeds from share issuance |

|

6,302,953 |

|

|

- |

|

|

Distribution to former owners |

|

(1,510,000 |

) |

|

(1,476,622 |

) |

|

Proceeds from related parties |

|

1,120,611 |

|

|

- |

|

|

Repayment to related parties |

|

(17,691 |

) |

|

- |

|

|

Net cash provided by financing activities |

|

6,970,904 |

|

|

3,665,205 |

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash |

|

154,354 |

|

|

(276,092 |

) |

|

Net increase in cash and cash equivalents |

|

103,771 |

|

|

1,103,815 |

|

|

Cash and cash equivalents, beginning of period |

|

185,590 |

|

|

186,463 |

|

|

Cash and cash equivalents, end of period |

$ |

289,361 |

|

$ |

1,290,278 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure information: |

|

|

|

|

|

|

|

Income taxes paid |

$ |

339,411 |

|

$ |

460 |

|

|

Interest paid |

$ |

241,907 |

|

$ |

219,252 |

|

The accompanying notes are an integral part of these consolidated financial statements.

8

China TMK Battery System, Inc.

and Subsidiaries

Notes to Consolidated Financial Statements

(Unaudited)

NOTE 1: DESCRIPTION OF BUSINESS AND ORGANIZATION

China TMK Battery System Inc. (“TMK US”, or “the Company”) (formerly Deerfield Resource, Ltd.) was incorporated under the laws of the State of Nevada on June 21, 2006. On February 10, 2010, we entered into and closed the Share Exchange Agreement with Leading Asia, a BVI company, and its sole stockholder, Unitech, a BVI company, pursuant to which we acquired 100% of the issued and outstanding capital stock of Leading Asia in exchange for 25,250,000 shares of our common stock, par value $0.001, which constituted 90.18% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the transactions contemplated by the Share Exchange Agreement.

In connection with the reserve acquisition of Leading Asia, Deerfield also entered into the Cancellation Agreement with United Fertilisers, its controlling stockholder, whereby United Fertilisers agreed to the cancellation of 272,250,000 shares of China TMK's common stock owned by it. As a condition precedent to the consummation of the Share Exchange Agreement, on February 10, 2010, China TMK also entered into a termination and release agreement with ASK Prospecting & Guiding Inc., pursuant to which Deerfield terminated that certain Mineral Claim Purchase Agreement, dated as of October 10, 2006. On February 10, 2010, Deerfield Resources, Ltd. changed its name to "China TMK Battery Systems Inc." to more accurately reflect its new business operations.

The transaction has been treated as a recapitalization of Leading Asia and its subsidiaries, with China TMK Battery Systems Inc. (the legal acquirer of Leading Asia and its subsidiaries, including the consolidation of the TMK Power Industries Ltd.) considered the accounting acquiree, and Leading Asia whose management took control of China TMK Battery Systems Inc. (the legal acquiree of Leading Asia) considered the accounting acquirer. The Company did not recognize goodwill or any intangible assets in connection with the transaction. All costs related to the transaction are being charged to operations as incurred. The 25,250,000 shares of common stock issued to the shareholders and designees of China TMK BVI in conjunction with the Share Exchange have been presented as outstanding for all periods. The historical consolidated financial statements include the operations of the accounting acquirer for all periods presented.

TMK US, through its wholly-owned subsidiary in the People’s Republic of China (“PRC”), is engaged in the research, development, production, marketing and sales of environment-friendly batteries including nickel metal hydride batteries.

TMK US and its subsidiaries - Leading Asia Pacific Investment Limited, Good Wealth Capital Investment Limited, TMK Power Industries (SZ) Co., Ltd., and Borou Industrial Co., Ltd – are collectively referred to as the “Company.”

NOTE 2: RESTATEMENT

The financial statements for the quarter ended March 31, 2010 filed with the SEC on May 24, 2010 contained an error related to the accounting treatment of certain reset provisions in warrants to purchase 3,401,320 shares of the Company’s common stock (the “Warrants”), previously issued to investors in a February 10, 2010 private placement (the “Private Placement”). The Warrants issued in the Private Placement include an anti-dilution provision for adjustment if the Company issues or sells any shares of common stock or securities convertible into common stock for a consideration per share of common stock less than the then current exercise price, which is currently $1.60 per share for private placement investors and $1.25 per share for Hudson Securities, Inc. and SHP Securities LLC. Because of the reset provision, the Warrants are not considered to be indexed to the Company’s stock and therefore the Warrants were determined to be derivative liability under ASC 815-15 and ASC 815-20. The question was raised in light of EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) Is Indexed to an Entity’s Own Stock” (FASB ASC 815-15) effective as of January 1, 2009, which outlines new guidance for being indexed to an entity’s own stock and the resulting liability or equity classification based on that conclusion.

At March 31, 2010, the derivative liability had a fair value of $2,943,977, which was determined using the Multinomial Lattice models. The multinomial lattice models that value the derivative liability within the warrants are based on a probability weighted discounted cash flow model. The warrants were valued with the following assumptions: at February 10, 2010: annual volatility of 73%; term of 5 years; risk free rate of 2.39%; target exercise price of $2.50 for the $1.25 warrants and $3.00 for the $1.60 warrants; at March 31, 2010: annual volatility of 61%; term of 4.87 years; risk free rate of 2.34%; target exercise price of $2.50 for the $1.25 warrants and $3.00 for the $1.60 warrants.

In addition, the weighted average number of common shares outstanding is being restated to correct a clerical error.

The impact of the error on the March 31, 2010 financial statements is reflected in the following tables:

| Originally | |||||||||

| Filed | Adjustment | Restated | |||||||

| March 31, 2010 | |||||||||

| Derivative liability | $ | - | 2,943,977 | $ | 2,943,977 | ||||

| Total Liabilities | 21,906,078 | 2,943,977 | 24,850,055 | ||||||

| Stockholders' Equity | |||||||||

| Additional paid-in capital | 11,737,406 | (1,218,744 | ) | 10,518,662 | |||||

| Retained earnings (unrestricted) | 11,817,894 | (1,725,233 | ) | 10,092,661 | |||||

| Total stockholders' equity | 23,622,079 | (2,943,977 | ) | 20,678,102 | |||||

| Total Liabilities & Stockholders' Equity | $ | 45,528,157 | $ | 45,528,157 |

| Originally | |||||||||

| Filed | Adjustment | Restated | |||||||

| Three Months Ended March 31, 2010 | |||||||||

| Other income (expenses): | |||||||||

| Change in fair value of embedded derivative | - | (1,725,233 | ) | (1,725,233 | ) | ||||

| Total other expenses | (302,288 | ) | (1,725,233 | ) | (2,027,521 | ) | |||

|

Income (loss) before income taxes |

|

616,041 |

|

|

(1,725,233 |

) |

|

(1,109,192 |

) |

|

Net income (loss) |

$ |

257,866 |

|

|

(1,725,233 |

) |

$ |

(1,467,367 |

) |

|

Comprehensive income (loss) |

$ |

290,084 |

|

|

(1,725,233 |

) |

$ |

(1,435,149 |

) |

| Weighted average shares outstanding | |||||||||

| Basic | 26,472,055 | 3,734,056 | 30,206,111 | ||||||

| Diluted | 26,849,979 | 4,460,335 | 31,310,314 | ||||||

| Earnings (loss) per share - Basic | $ | 0.01 | (0.06 | ) | (0.05 | ) | |||

| Earnings (loss) per share - Diluted | $ | 0.01 | (0.06 | ) | (0.05 | ) |

| Originally | |||||||||

| Filed | Adjustment | Restated | |||||||

| Three Months Ended March 31, 2010 | |||||||||

| Cash Flows From Operating Activities | |||||||||

| Net income (loss) | $ | 257,866 | $ | (1,725,233 |

) |

$ | (1,467,367 |

) | |

| Adjustments to reconcile net income to net cash | |||||||||

| provided by operating activities: | |||||||||

| Change in fair value of embedded derivative | - | 1,725,233 | 1,725,233 | ||||||

| Net cash provided by (used in) operating activities | (1,147,250 | ) | (1,147,250 | ) | |||||

| Net cash used in investing activities | (5,874,237 | ) | (5,874,237 | ) | |||||

| Net cash provided by financing activities | 6,970,904 | 6,970,904 | |||||||

| Effect of exchange rate changes on cash | 154,354 | 154,354 | |||||||

| Net increase in cash and cash equivalents | 103,771 | 103,771 | |||||||

| Cash and cash equivalents, beginning of period | 185,590 | 185,590 | |||||||

| Cash and cash equivalents, end of period | $ | 289,361 | $ | 289,361 |

NOTE 3: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a. Basis of preparation

The consolidated financial statements have been prepared in accordance with U.S. GAAP for interim financial information and the instructions to Form 10-Q and Article 10 of Regulation SX. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. These consolidated financial statements should be read in conjunction with the consolidated financial statements of the Company for the year ended December 31, 2009 and notes thereto contained in our Registration Statement on Form S-1 filed with the United States Securities and Exchange Commission (the “SEC”) on May 24, 2010. Interim results are not necessarily indicative of the results for the full year.

b. Foreign currency translation

The functional currency of the Company is Renminbi (“RMB”). The Company maintains its financial statements using the functional currency. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency at rates of exchange prevailing at the balance sheet dates. Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Exchange gains or losses arising from foreign currency transactions are included in the determination of net income (loss) for the respective periods.

9

For financial reporting purposes, the financial statements of TMK Shenzhen and Borou, which are prepared in RMB, are translated into the Company’s reporting currency, United States Dollars (“USD”). Balance sheet accounts are translated using the closing exchange rate in effect at the balance sheet date and income and expense accounts are translated using the average exchange rate prevailing during the reporting period. Adjustments resulting from the translation, if any, are included in accumulated other comprehensive income (loss) in stockholder’s equity.

The exchange rates used for foreign currency translation were as follows (USD$1 = RMB):

|

Period Covered |

|

Balance Sheet Date Rates |

|

|

Average Rates |

|

|

|

|

|

|

|

|

|

|

Year ended December 31, 2009 |

|

6.83720 |

|

|

6.82082 |

|

|

Quarter ended March 31, 2009 |

|

6.84556 |

|

|

6.82547 |

|

|

Quarter ended March 31, 2010 |

|

6.83620 |

|

|

6.81896 |

|

The exchange rates used for foreign currency translation were as follows (USD$1 = HKD):

|

Period Covered |

|

Balance Sheet Date Rates |

|

|

Average Rates |

|

|

|

|

|

|

|

|

|

|

Year ended December 31, 2009 |

|

7.80000 |

|

|

7.80000 |

|

|

Quarter ended March 31, 2009 |

|

7.80000 |

|

|

7.80000 |

|

|

Quarter ended March 31, 2010 |

|

7.80000 |

|

|

7.80000 |

|

c. Reclassifications

Certain amounts in the consolidated financial statements for the prior year have been reclassified to conform to the presentation of the current year for the comparative purposes.

NOTE 4: Acquisition

In January 4, 2010, the Company entered into a Memorandum of Understanding (MOU) with Hong Shenzhen DongFang Hualian Technology Ltd. (“Hualian”). The Company paid overall $3.2 million as deposit during January through March 2010, which shall be withdrawn based upon the MOU if Hualian fails the due diligence and external auditing which are currently under process and are expected to be completed by the end of the third quarter of 2010. In addition, the Company can withdraw the $3.2million deposit if the 2009 net profit of Hualian is less than RMB 28 million (approximately $4,105,080).

NOTE 5: ADVANCES FOR PROPERTY AND EQUIPMENT PURCHASE

Advances for property and equipment purchase consist of the following:

|

|

|

March 31, 2010 |

|

|

December 31, 2009 |

|

|

Advances for Property Purchase (1 unit located in Shihao Mansion) |

$ |

3,024,522 |

|

$ |

3,024,108 |

|

|

Advances for Equipment Purchase (5 vendors in Q1 2010 and 2 vendors in 2009) |

|

4,619,233 |

|

|

2,989,816 |

|

|

Advances for Property Purchase (3rd, 5th and 6th floor located in Jinli Building) |

|

11,648,988 |

|

|

10,916,096 |

|

|

Total Advances for Property Purchase |

$ |

19,292,743 |

|

$ |

16,930,020 |

|

The Company entered into two agreements to purchase equipment from two vendors in 2009 and three agreements to purchase equipment from three vendors during first quarter of 2010. Based on the agreements, the Company is required to pay certain deposits prior to equipment delivery date. The remaining price is to be paid after trial-run of the equipment within certain acceptance period. The ownership of equipment will be transferred to the Company upon the receipt of full purchase price.

10

The Company is in the process of acquiring several properties and has entered into various property purchase agreements starting year 2009. These agreements generally require the Company to make installment payments and the title and possession transfers to the Company upon the final payment. For the properties listed in the table above, the final payment had not been made by March 31, 2010 and December 31, 2009 and as a result, the payments made through those respective dates were not recorded as properties. No depreciation was recorded related to these advances.

NOTE 6: SHORT-TERM BANK LOANS

Short term bank loans consist of the following:

|

|

|

March 31, 2010 |

|

|

December 31, 2009 |

|

|

Bank Loans borrowed by TMK Shenzhen |

$ |

|

|

$ |

|

|

|

Bank of China Shenzhen Branch |

|

1,717,605 |

|

|

2,382,500 |

|

|

Bank of Ningbo Shenzhen Branch |

|

1,151,598 |

|

|

1,170,080 |

|

|

|

|

|

|

|

|

|

|

Bank Loans borrowed by Borou |

|

|

|

|

|

|

|

Bank of Ningbo Shenzhen Branch |

|

819,168 |

|

|

1,170,080 |

|

|

Short-term loans |

$ |

3,688,371 |

|

$ |

4,722,660 |

|

On August 24, 2009, Borou obtained a one-year term loan in the amount of RMB 8,000,000 (or approximately $1,170,080) from Bank of Ningbo Shenzhen Branch ("BN") bearing interest at approximately 6.37% with maturity date on August 23, 2010. The loan is personally guaranteed by Mr. Wu, Henian and Mr. Tu Jun and secured by Mr. Zhuang, Zehao's personal property. According to the loan agreement, BN has right to request Borou to repay the outstanding debt in full immediately if the Company does not meet any of the following: (a) Borou should repay 30% of principal within 6 months of receipt of the first borrowing; (b) Within term of loan, Borou should maintain certain amounts of cash deposits and cash withdrawals with the bank on monthly basis of not less than 30% of its revenue; (c) The Company as a whole (Borou and TMK Shenzhen)’s total loans should not exceed $19,013,800 (RMB 130,000,000); (d) The Company as a whole (Borou and TMK Shenzhen)'s total revenue including VAT tax should not be less than $51,191,000 (RMB 350,000,000); (e) Borou cannot distribute any dividend or pledge using its assets, cannot add any additional borrowing within loan period; (f) Borou's total revenue including VAT tax should be maintained at not less than $51,191,000 (approximately RMB 350,000,000. Borou has met all of the above requirements and has repaid principal and interests due through March 2010, except item (f). BN has not requested Borou to pay off this loan, however, Borou was not able to obtain a waive letter from BN.

On August 21, 2009, TMK Shenzhen obtained a one-year term loan in the amount of RMB 8,000,000 (appropriately $1,170,080) from Bank of Ningbo Shenzhen Branch ("BON") bearing interest at approximately 6.37% with maturity date on August 20, 2010. The loan is personally guaranteed by Mr. Wu, Henian and secured by Mr. Zhuang, Zehao's personal property. According to the loan agreement, BN has right to request TMK Shenzhen to repay the outstanding debt in full immediately if the Company does not meet any of the following: (a) the Company cannot distribute any bonus or dividend; (b) The total financing amount cannot exceed $19,013,800 (RMB 130,000,000) and the total revenue should not be less than $51,191,000 (RMB 350,000,000), the revenue defined here includes VAT tax). As of the filing date, the Company is not in violation of any requirements stated above.

The unused line of credit amounted to $1,061, 715 and $403,957 at March 31, 2010 and December 31, 2009, respectively.

11

NOTE 7: LONG-TERM BANK LOANS

Long term bank loans consist of the following:

|

|

|

March 31, 2010 |

|

|

December 31, 2009 |

|

|

DBS Bank |

$ |

2,012,016 |

|

$ |

2,181,753 |

|

|

China Construction Bank Shenzhen Branch |

|

3,949,560 |

|

|

4,387,800 |

|

|

Bank of China Shenzhen Branch |

|

5,851,200 |

|

|

5,119,100 |

|

|

Less current portion |

|

(1,843,165 |

) |

|

(2,451,700 |

) |

|

Long -term portion |

$ |

9,969,611 |

|

$ |

9,236,953 |

|

On November 13, 2009, TMK Shenzhen obtained a 3-year term loan from DBS Bank (China) Limited Shenzhen Branch (“DBS”) in the amount of RMB 15,300,000 (approximately $2,237,778) bearing interest at approximately 130% of the prevailing prime rate at the time of the loan (approximately 7.02% per annum) paid monthly. The loan can only be used for equipment purchase (RMB 11,318,500) and working capital purpose (RMB 3,981,500). DBS requires the Company to deposit RMB 3,000,000 (approximately $438,780) as security (will be refunded to the Company in 6 months if payments are made on timely basis). Based on agreement, DBS has right to request the Company to repay the outstanding balance immediately if the Company does not meet any of the following: (a) the Company should provide audited financial within six months of year-end; (b) the Company cannot pledge its account receivables to any other third parties without DBS permission; (c) the Company's account receivable settlements (cash collections) should be maintained at RMB 40,000,000 (approximately $5,850,400) annually and RMB 10,000,000 (approximately $1,462,600) quarterly. The Company did not violate any of the above covenants at March 31, 2010.

On August 05, 2009, Borou obtained a 3-year term loan from Bank of China Shenzhen Branch (“BOC”) in the amount of RMB 40,000,000 (approximately $5,850.400) bearing interest at approximately 110% of the prevailing prime rate at the time of the loan (approximately 5.94% per annum) paid monthly. As of December 31, 2009, RMB 35,000,000 (approximately$5,119,100) was received in August 2009 and the remaining RMB 5,000,000 (approximately $731,100) was received in January 2010. Pursuant to the loan agreement, the loan can only be used for working capital purpose (RMB 20,000,000) and fixed asset purchase purpose (RMB 20,000,000). If violated, a penalty will be charged at 100% of interest rate on the violated amount. The loan is guaranteed by TMK Shenzhen and secured by Mr. Wu Henian, Mr. Huang Junbiao, and Mr. Wang Zongfu's ownerships in TMK Shenzhen. In addition, the loan is secured by property owned by Deli Investment Limited Co. with fair value of RMB 20,000,000 (approximately $2,925,200) and one of Borou’s properties with fair value of RMB 20,000,000 (approximately $2,925,200). Based on loan agreement, BOC also has right to request the Company to repay the outstanding balance immediately if Borou does not meet any of the following: (a) Borou cannot distribute any bonus or dividend if it incurs an after-tax loss, or its pretax net income is not significant enough to pay for its prior year' loss. Any pretax net income should be used to pay off principal and interests; (b) Borou should pay off the Bank before it pays off borrowing from its shareholders and other debt; (c) Fixed assets purchase loan can only be used for equipment purchase. The proceeds will be sent to equipment vendor directly. Any new equipment purchased under the loan should be added to bank collateral 30 days after payment is made; (d) Prior to loan payoff date, Borou should maintain monthly purchase settlements of not less than RMB 8,000,000 (approximately $1,170,080) with the bank (note purchase settlements are accounted for as the total of each cash-in and cash-out transaction amounts). Borou did not violate any of the above covenants as at March 31, 2010. In accordance with the loan agreement, Borou also agreed to pay RMB 1,200,000 (approximately $175,512) of bank charge in 3 years with annual bank charge of RMB 400,000 made prior to August 30 each year.

On December 30, 2008, TMK Shenzhen obtained a three-year term loan from China Construction Bank Shenzhen Branch (“CCB”) in the amount of RMB 30,000,000 (approximately $4,400,698) bearing interest at approximately 105% of the prevailing prime rate at the time of the loan (approximately 5.67% per annum and subject to adjustment every 12 months) paid monthly. Pursuant to the loan agreement, the principal needs to be made at a fixed amount of RMB 1,000,000 (approximately $146,260) starting from the 13th month until maturity date. In the event the Company defaulted on the loan, the interest rate will be increased to 150% of prime rate. In addition, the loan should be used for working capital purpose only. If violated, the interest rate will be increased to 200% of prime rate and the penalty will be computed at 11.34% of violated amount. The terms of the loan also called for a deposit of RMB 1,800,000 (approximately $263,268) to Shenzhen General Chamber of Commerce to secure the loan until the term loan repaid in full. The loan with CCB is personally guaranteed by Mr. Wang, Zongfu and Mr. Huang, Junbiao and secured by Ms. Tu, Lanzhen (CEO’s Wife)'s personal property with fair value of RMB 3,000,000 (approximately $440,070) and the Company's equipment with fair value of RMB 20,030,700 (approximately $2,938,302). The Company did not violate any of the above covenants as of March 31, 2010.

12

The terms of the long-term bank loans require the Company to maintain a deposit at the bank to secure the loans as follows:

|

|

|

March 31, 2010 |

|

|

December 31, 2009 |

|

|

|

|

|

|

|

|

|

|

DBS Bank |

$ |

438,840 |

|

$ |

438,780 |

|

|

Total Current Portion |

$ |

438,840 |

|

$ |

438,780 |

|

|

|

|

|

|

|

|

|

|

China Construction Bank |

$ |

263,304 |

|

$ |

263,268 |

|

|

Total Non-current Portion |

$ |

263,304 |

|

$ |

263,268 |

|

NOTE 8: RELATED PARTY TRANSACTIONS

The related parties consist of the following:

|

Wu, Henian |

Chairman |

|

Wang, Zongfu |

Vice President and Director |

|

Huang, Junbiao |

R&D Director and Director |

|

Liu, Xiangjun |

Chief Executive Officer |

|

Tu, Lanzhen |

Wu, Henian's wife |

|

Tu, Jun |

Borou's chairman |

|

Q-Lite Industrial Co., Ltd. |

Yu, Zhengfei (Wang Zongfu's wife) holds 25% of ownership |

|

Li, Guifang |

Owner of Unitech |

Due from related parties

Due from related parties consists of the following:

|

|

|

March 31, 2010 |

|

|

December 31, 2009 |

|

|

Liu, Xiangjun |

$ |

15,213 |

|

$ |

15,204 |

|

The above amounts are advances to various individuals for regularly business expensed to be paid by the individual on behalf of the Company. These amounts are non-secured, non-interest bearing, and are considered to be short-term. As of the date of this filing, in anticipation of being a U.S. public company, the due from balance has been repaid and no loans to Liu, Xiangjun are outstanding.

13

Due to related party

Due to related party consists of the following:

|

|

|

March 31, 2010 |

|

|

December 31, 2009 |

|

|

|

|

|

|

|

|

|

|

Wu, Henian |

|

474,141 |

|

|

- |

|

|

Wang, Zongfu |

|

363,676 |

|

|

- |

|

|

Huang, Junbiao |

|

180,570 |

|

|

- |

|

|

Li, Guifang |

|

385 |

|

|

- |

|

|

Q-Lite Industrial Co., Ltd |

|

101,839 |

|

|

17,691 |

|

|

|

$ |

1,120,611 |

|

$ |

17,691 |

|

Ms. Yu, Zhengfei, Mr. Wang, Zongfu’s wife, holds 25% ownership of Q-Lite Industrial Co., Ltd. (“Q-Lite”). During the three months ended March 31, 2010 and for the year ended December 31, 2009, the Company sold products to Q-Lite in the amounts of $40,707 and $346,047 respectively.

NOTE 9: INCOME TAX

Leading Asia is registered in BVI and under the current laws of the BVI, is not subject to income taxes.

Good Wealth is a holding company registered in Hong Kong and has no operating profit for tax liabilities.

TMK Shenzhen is registered in PRC and has tax advantages granted by local government for corporate income taxes and sales taxes commencing 2005.

Borou is registered in PBC and is subject to regular corporate income tax rate. The assessment of its tax liabilities is combined with that of TMK Shenzhen.

The effective tax rate for the Company for the three months ended March 31, 2010 and 2009 was 32% and 15%, respectively.

Various Taxes

The Company is subject to pay various taxes such as Value Added Tax (VAT), City Development Tax, and Education tax to the local government tax authorities. The VAT collected on sales is netted against the taxes paid for purchases of cost of goods sold to determine the amounts payable and refundable. The City Development Tax and Education Tax are expensed as general and administrative expense.

NOTE 10 - PRIVATE PLACEMENT

On February 10, 2010, concurrently with the close of the Share Exchange, the Company conducted a private placement transaction (the “Private Placement”) pursuant to which the Company sold an aggregate of 5,486,000 shares of common stock at $1.25 per share (the shares were sold in 54.86 units, each of which included 100,000 shares of common stock and 50,000 detachable common stock warrants with a five year maturity). As a result, the Company received gross proceeds in the amount of approximately $6.9 million. Hudson Securities, Inc. (“Hudson”) and its designees were paid a placement agent commission equal to 6.5% of the gross proceeds from the financing and the Company incurred an additional $108,810 in other fees and costs. In addition, the Company issued to Hudson and its designees 560,000 shares of common stock as partial consideration for advisory services provided in connection with the RTO transaction and a five-year warrant for the purchase of an amount of shares equal to 8% of the number of securities issued in the private placement, exercisable at an initial exercise price of $1.25 per share as partial consideration for placement agent services provided. In connection with the private placement, the Company also issued to Hayden Communications International, Inc. (“Hayden”), an investor relations consulting firm, 125,000 shares of Common Stock as partial consideration for the consulting services provided by Hayden.

In addition, the Company evaluated the warrants under ASC 815 to determine whether there is embedded feature included in the warrant agreements that should be recorded as derivative liability, see Note 13 for further discussion.

14

NOTE 11- COMMON STOCK WARRANTS

In connection with the private placement, the Company had 2,743,000 shares of common stock issuable upon the exercise of five-year warrants issued to the investors in the private placement. In addition, the Company granted Hudson and SHP Securities LLC a five-year warrant for the purchase of an amount of shares equal to 8% of the number of securities issued in the private placement. The warrants have an exercise price of $1.25 per share, are currently exercisable and expire on February 9, 2015. The Company agreed to register the 3,401,320 shares of common stock underlying the warrants in a Registration Statement. The Registration Statement was filed on May 24, 2010.

A summary of the Company’s warrant activities for the three months ended March 31, 2010 is as follows:

|

|

|

|

|

|

Weighted average |

|

|

|

|

Warrants |

|

|

Exercise Price |

|

|

Balance December 31, 2009 |

|

- |

|

$ |

N/A |

|

|

Private placement investors |

|

2,743,000 |

|

$ |

1.60 |

|

|

Hudson Securities, Inc. |

|

553,020 |

|

$ |

1.25 |

|

|

SHP Securities LLC |

|

105,300 |

|

|

1.25 |

|

|

Balance March 31, 2010 |

|

3,401,320 |

|

$ |

1.53 |

|

NOTE 12 - COMMON STOCK SUBSCRIPTION

The Company entered into common share subscription agreements with multiple employees to raise around $3.4 million capital in exchange for 2.7 million shares of common stock (at par value $0.001) . By March 31, 2010, approximately $2.0 million had been collected. These shares are not registered as of March 24, 2010.

NOTE 13 – DERIVATIVE LIABILITIES

In June 2008, the FASB finalized ASC 815-15, "Determining Whether an Instrument (or Embedded Feature) is indexed to an Entity's Own Stock". The EITF lays out a procedure to determine if an equity-linked financial instrument (or embedded feature) is indexed to its own common stock. The EITF is effective for fiscal years beginning after December 15, 2008. Pursuant to the Subsequent Equity Sales section under warrant agreement the Company granted, if and whenever on or after the date of inception and through the earlier to occur of (i) eighteen months from the date hereof and (ii) date that there is an effective registration statement on file with the Securities and Exchange Commission covering the resale of all of the Warrant Stock and all of the shares of common stock issued in the offering, the Company issues or sells any shares of common stock or securities convertible into common stock for a consideration per share of common stock less than the then current Exercise Price, then, the Exercise Price shall be multiplied by a fraction. Because of the reset provision, the warrant agreement is considered not indexed to the Company’s stock and therefore the 3,401,320 warrants were determined to be derivative liability under ASC 815-15 and ASC 815-20. The fair value of these warrants at the inception of the private placement was $1,218,744.

At March 31, 2010, the derivative liability was valued at $2,943,977 using the Multinomial Lattice models. The $1,725,233 change in fair value is reported in the Company’s consolidated statement of operations as a loss on derivatives.

The fair value hierarchy for the Company’s derivative liability accounted for at fair value was:

|

|

March 31, 2010 |

|

December 31, 2009 |

||||||||

|

|

|

Level 1 |

Level 2 |

Level 3 |

Total |

|

|

Level 1 |

Level 2 |

Level 3 |

Total |

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Derivative liability - embedded feature of equity |

$ |

- |

2,943,977 |

- |

2,943,977 |

|

$ |

- |

- |

- |

- |

|

|

|||||||||||

|

Total liabilities |

$ |

- |

2,943,977 |

- |

2,943,977 |

|

$ |

- |

- |

- |

- |

NOTE 14: REVENUE INFORMATION AND GEOGRAPHIC INFORMATION

The Company believes that it operates in one business segment (research, development, production, marketing and sales of electronic products) and in one geographical segment (China), as all of the Company’s current operations are carried out in China.

15

The geographic information for revenue is as follows:

|

|

|

Three Months Ended March 31, |

|

|||

|

|

|

2010 |

|

|

2009 |

|

|

United States |

$ |

69,178 |

|

$ |

57,900 |

|

|

Ukraine |

|

32,439 |

|

|

- |

|

|

Sweden |

|

67,517 |

|

|

- |

|

|

Korea |

|

5,257 |

|

|

- |

|

|

Japan |

|

1,712 |

|

|

913 |

|

|

Germany |

|

- |

|

|

143,021 |

|

|

Australia |

|

7,489 |

|

|

13,171 |

|

|

Taiwan |

|

31,654 |

|

|

34,605 |

|

|

Hong Kong |

|

238,157 |

|

|

88,405 |

|

|

China |

|

12,811,069 |

|

|

9,562,641 |

|

|

Total |

$ |

13,264,472 |

|

$ |

9,900,656 |

|

NOTE 15 - RECONCILIATION OF EARNINGS PER SHARE

|

|

|

Three Months Ended March 31, |

|

|||

|

|

|

2010 |

|

|

2009 |

|

|

Net income |

$ |

(1,467,367) |

|

$ |

1,331,646 |

|

|

Denominator: |

|

|

|

|

|

|

|

Weighted-average shares outstanding for basic earnings per share |

|

30,206,111 |

|

|

25,250,000 |

|

|

Effect of dilutive securities: |

|

|

|

|

|

|

|

Common stock warrants |

|

1,104,203 |

|

|

- |

|

|

Weighted-average shares outstanding for diluted earnings per share |

|

31,310,314 |

|

|

25,250,000 |

|

|

Net income per share: |

|

|

|

|

|

|

|

Basic |

$ |

(0.05) |

|

$ |

0.05 |

|

|

Net income per share: |

|

|

|

|

|

|

|

Diluted |

$ |

(0.05) |

|

$ |

0.05 |

|

NOTE 16: SUBSEQUENT EVENT

The Company planned to expand production capacity and signed an agreement with Shenzhen Xutang Economics and Business Ltd. (“Xutang”) at the end of March, 2010 to lease the A3 plant building (a four-storey building), A5 plant building (a four-storey building), C1 dorm (a six-storey building), and office building (a three-storey) located in Zhongcheng Industry Park, Shenzhen. The lease term is for five years from April 1, 2010 to March 31, 2015; the leased premises are currently under remodeling and are expected to be completed in the third quarter of 2010.

16

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Special Note Regarding Forward Looking Statements

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management's Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” of our Current Report on Form 8-K filed on February 12, 2010. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Terms

Except where the context otherwise requires and for the purposes of this report only:

-

the “Company,” “we,” “us,” and “our” refer to the combined business of China TMK Battery Systems Inc., a Nevada corporation (formerly, Deerfield Resources, Ltd.), and its wholly owned subsidiaries, Leading Asia Pacific Investment Limited, or “Leading Asia,” a BVI company, Good Wealth Capital Investment Limited, or “Good Wealth,” a Hong Kong company, and Shenzhen TMK Power Industries Ltd., or “TMK,” a PRC limited company, as the case may be;

-

“BVI” refers to the British Virgin Islands;

-

“Exchange Act” refers the Securities Exchange Act of 1934, as amended;

-

“Hong Kong” refers to the Hong Kong Special Administrative Region of the People's Republic of China;

-

“PRC,” “China,” and “Chinese,” refer to the People's Republic of China;

-

“Renminbi” and “RMB” refer to the legal currency of China;

-

“SEC” refers to the Securities and Exchange Commission;

-

“Securities Act” refers to the Securities Act of 1933, as amended; and

-

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States. Throughout this report, we have converted RMB to USD as follows:

|

March 31, 2010 |

|

|

Balance sheet |

RMB 6.83620 to US$1.00 |

|

Statement of income and comprehensive income |

RMB 6.81896 to US$1.00 |

|

|

|

|

March 31, 2009 |

|

|

Balance sheet |

RMB 6.84556 to US$1.00 |

|

Statement of income and comprehensive income |

RMB 6.82547 to US$1.00 |

17

Overview

We were incorporated under the laws of the State of Nevada on June 21, 2006. We were originally formed as an exploration stage company to engage in the search for mineral deposits or reserves. From inception through September 2007, we conducted preliminary exploration activities on certain properties in White Bay, Newfoundland, Canada, on which we held six gold mining claims, pursuant to the Claim Purchase Agreement. Our activities included the conduct of preliminary geological mapping and trenching on the properties, which determined that there were no economic quantities of minerals or reserves whatsoever on any of the properties. From September 2008 through to the date of our reverse acquisition, discussed below, we were a shell company with no operations and our sole purpose was to locate and consummate a merger or acquisition with a private entity. As a result of the reverse acquisition transaction, discussed below, we terminated the Claim Purchase Agreement and are now engaged in the design, development, manufacture and sale of environmentally-friendly nickel-metal hydride cell, or Ni-MH, rechargeable batteries in China, through our wholly owned PRC subsidiary, TMK.

We produce and sell high-rate SC, C, D, and F Ni-MH batteries primarily to manufacturers that produce mechanical devices, such as Siemens, LG, Electrolux, Bosch, Venom, and Changhong. Our products are commonly used to power vacuum cleaners and other household electrical appliances; cordless power tools; medical devices; light electric vehicles, such as bicycles, electric vehicles and hybrid electric vehicles; light fittings, battery-operated toys, telecommunications, traffic control, and traffic lighting applications; and personal portable electronic devices, such as digital cameras, portable media players, portable gaming devices and PDAs. We are actively seeking opportunities to expand into the Lithium-Ion battery space through leveraging our lithium battery patent and those of our customers who purchase both nickel-metal hydride and Lithium-Ion batteries, and opportunities to design and distribute batteries for use in telecommunications, traffic control, and traffic lighting applications. We have developed and sent working prototypes of both nickel-metal hydride battery and Lithium-Ion battery to some of our customers for testing and expect to roll out new products before the end of 2010. More recently, we have developed a working prototype of a hybrid electric vehicle battery pack and are producing sample cells for testing for an electric vehicle battery pack. To expand our business into the hybrid electric vehicle and electric vehicle markets, we plan to establish an advanced power battery research and development center, set up a battery-production base for small scale testing and production and establish a cooperation application demonstration point with 1-3 vehicle producers to lay a solid foundation for the approval of the project and for the support of the government. To date, we have entered into letters of intent with two automobile companies in China for the sale of our hybrid electric vehicle battery packs.

We conduct all of our operations in Shenzhen City, China, in close proximity to China's electronics manufacturing base and its rapidly growing market. Our access to China's supply of low-cost skilled labor, raw materials, machinery and facilities enables us to price our products competitively in an increasingly price-sensitive market. In addition, we have automated key stages of our manufacturing process to be able to produce high-quality battery cells that consistently meet the stringent requirements of our customers.

Recent Developments

On February 10, 2010, we entered into and closed a share exchange agreement with Leading Asia, a BVI company, and its sole shareholder, Unitech, a BVI company, pursuant to which we acquired 100% of the issued and outstanding capital stock of Leading Asia in exchange for 25,250,000 shares of our common stock, par value $0.001, which constituted 90.18% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the transactions contemplated by the share exchange agreement. The share exchange transaction with Leading Asia was treated as a reverse acquisition, with Leading Asia as the acquirer and China TMK Battery Systems Inc. as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Leading Asia and its consolidated subsidiaries. Immediately following closing of the reverse acquisition of Leading Asia, Unitech transferred 10,524,600 of the 25,250,000 shares issued to it under the share exchange to 22 individuals and entities, pursuant to a share allocation agreement that Unitech entered into with these people on February 10, 2010.

On February 10, 2010, we also completed a private placement transaction with a group of accredited investors, pursuant to which we issued to the investors an aggregate of 5,486,000 shares of our common stock, for a purchase price $1.25 per share, and warrants to purchase up to 2,743,000 shares of our common stock. The warrants have a term of 5 years, bear an exercise price of $1.60 per share, as adjusted from time to time pursuant to anti-dilution and other customary provisions, and are exercisable by investors at any time after the closing date. As a result of this private placement we raised $6,857,500 in gross proceeds, which left us with $5,392,151 in net proceeds after the deduction of offering expenses in the amount of $1,465,349.

For details regarding the share exchange agreement and the private placement transaction see our Current Report on Form 8-K filed on February 12, 2010.

18

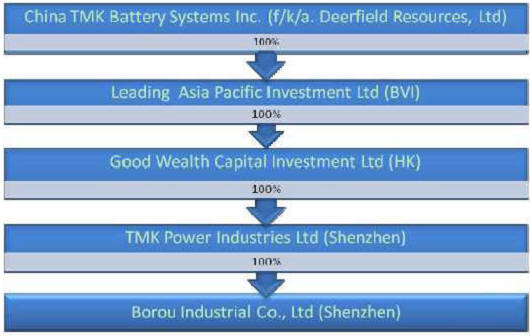

On February 10, 2010, we changed our name to “China TMK Battery Systems Inc.” to more accurately reflect our new business operations. Our common stock will be quoted on the Over-the-Counter Bulletin Board maintained by the Financial Industry Regulatory Authority, or FINRA, under the symbol “DFEL” until FINRA assigns a new symbol to our common stock in connection with our name change. The chart below presents our corporate structure:

Our principal executive offices are located at Sanjun Industrial Park, No. 2 Huawang Rd., Dalang Street, Bao'an District, Shenzhen, 518109, People's Republic of China. The telephone number at our principal executive office is (+86) 755 28109908.

Results of Operations

The following table sets forth key components of our results of operations during the three month periods ended March 31, 2010 and 2009, respectively, both in dollars and as a percentage of our net sales. As the acquisition of Leading Asia, Good Wealth and TMK was entered into on February 10, 2010 and acquisition of Borou on July 14, 2009 and during the periods indicated such entities were the only entities in our combined business that had operations, the results of operations below refer only to that of Leading Asia, Good Wealth, Borou and TMK.

|

|

|

For Three Months Ended |

|

|||||||||

|

|

|

March 31, |

|

|||||||||

|

|

|

2010 |

|

|

2009 |

|

||||||

|

|

|

|

|

|

(as |

|

|

|

|

|

(as |

|

|

|

|

(in |

|

|

percent of |

|

|

(in |

|

|

percent of |

|

|

|

|

thousands) |

|

|

revenue) |

|

|

thousands) |

|

|

revenue) |

|

|

|

|

(all amounts are in thousands except percentages, share and per share amounts) |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

13,264 |

|

|

100.0% |

|

$ |

9,901 |

|

|

100.0% |

|

|

Cost of Goods Sold |

|

(10,105 |

) |

|

-76.2% |

|

|

(7,489 |

) |

|

-75.6% |

|

|

Gross Profit |

|

3,159 |

|

|

23.8% |

|

|

2,412 |

|

|

24.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling Expenses |

|

235 |

|

|

1.8% |

|

|

191 |

|

|

1.9% |

|

19

|

Depreciation |

|

18 |

|

|

0.1% |

|

|

53 |

|

|

0.5% |

|

|

General and administrative |

|

1,823 |

|

|

13.7% |

|

|

269 |

|

|

2.7% |

|

|

Research and development |

|

165 |

|

|

1.2% |

|

|

112 |

|

|

1.1% |

|

|

Total operating expenses |

|

2,241 |

|

|

16.9% |

|

|

625 |

|

|

6.3% |

|

|

Income (loss) from operations |

|

918 |

|

|

6.9% |

|

|

1,787 |

|

|

18.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(242 |

) |

|

-1.8% |

|

|

(219 |

) |

|

-2.2% |

|

|

Other expenses, net |

|

(60 |

) |

|

-0.5% |

|

|

(1 |

) |

|

0.0% |

|

|

Change in fair value of embedded derivative |

|

(1,725 |

) |

|

-13.0% |

|

|

0 |

|

|

0.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other expenses |

|

(2,027 |

) |

|

-15.3% |

|

|

(220 |

) |

|

-2.2% |

|

|

Income (loss) before income taxes |

|

(1,109 |

) |

|

-8.4% |

|

|

1,567 |

|

|

15.8% |

|

|

Income taxes |

|

(358 |

) |

|

-2.7% |

|

|

(235 |

) |

|

-2.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (loss) |

$ |

(1,467 |

) |

|

-11.1% |

|

|

1,332 |

|

|

13.5% |

|

Sales Revenue. Our sales revenue increased to $13.3 million in the three months ended March 31, 2010 from $9.9 million in the same period in 2009, representing a 34.0% increase period-over-period. . The increase in revenue was attributed mainly to the increased demand for our products, which we believe is a result of our market expansion efforts.

Cost of Sales. Our cost of sales increased $2.6million, or 34.9%, to $10.1 million in the three months ended March 31, 2010 from $7.5 million in the same period in 2009. The increase was primarily a result of the increase in sales and was relatively consistent with the increase in our net revenue.

Gross Profit and Gross Margin. Our gross profit increased $0.8 million, or 31.0%, to $3.2 million in the three months ended March 31, 2010 from $2.4million in the same period in 2009. The increase was primarily a result of the increase in sales and was relatively consistent with the increase in our net revenue. Our gross margin is 23.8% in first quarter of 2010 compared to 24.4% in the same period last year. The decrease in gross margin is mainly due to increase in the production cost.

Operating Expense Operating expense was $2.2 million in the three months ended March 31, 2010 compare to $0.6 million in the same period last year. It is mainly due to one-time merger cost of $1.77 million in the first quarter of 2010.

Change in Fair Value of Embedded Derivative We granted a total of 3,401,320 warrants in connection with our private placement in February 2010. Due to the reset provision included in our warrant agreements, warrants are classified as derivative liability. The loss from change in fair value of derivative liability represents the difference of fair value between February 10, 2010 (inception) and March 31, 2010.

Income (Loss) Before Income Taxes. Our income before income taxes decreased by $2.68 million, or 170.8%, to -$1.1 million in the three months ended March 31, 2010 from $1.6 million in the same period in 2009. The decrease in income before income tax is primarily due to increase in the one-time merger cost and loss of $1.73 million from change in fair value of derivative liability.

Income Taxes. We incurred $.4 million income tax expenses in the three months ended March 31, 2010, as compared to $.2 million in the same period in 2009. The income taxes increased in the three months ended March 31, 2010 vs. same period in 2009 even though income before income taxes decreased in the three months ended March 31, 2010 vs. same period in 2009. The reason was that merger cost of $1.77 million and loss of $1.73 million from change in fair value of derivative liability were incurred on US shell company level which was not subject to any income taxes.

Net Income (Loss). In the three months ended March 31, 2010, we incurred a net loss of $1.5 million, a decrease of $2.8 million, or 210.2%, from $1.3 million in the same period in 2009.

Liquidity and Capital Resources

As of March 31, 2010, we had cash and cash equivalents of $.29 million, primarily consisting of cash on hand and demand deposits. The following table provides detailed information about our net cash flow for all financial statement periods presented in this report. To date, we have financed our operations primarily through cash flows from operations, augmented by short-term bank borrowings and equity contributions by our stockholders.

20

The following table sets forth a summary of our cash flows for the periods indicated:

Cash Flow

(all amounts in U.S. dollars)

|

|

|

March 31, 2010 |

|

|

March 31, 2009 |

|

|

Net cash provided by (used in) operating activities |

$ |

(1,147,250 |

) |

$ |

2,665,341 |

|

|

Net cash used in investing activities |

|

(5,874,237 |

) |

|

(4,950,639 |

) |

|

Net cash provided by (used in) financing activities |

|

6,970,904 |

|

|

3,665,205 |

|

|

Effects of exchange rate change in cash |

|

154,354 |

|

|

(276,092 |

) |

|

Net increase in cash and cash equivalents |

|

103,771 |

|

|

1,103,815 |

|

|

Cash and cash equivalent at beginning of the quarter |

|

185,590 |

|

|

186,463 |

|

|

Cash and cash equivalent at end of the quarter |

$ |

289,361 |

|

$ |

1,290,278 |

|