Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCCIDENTAL PETROLEUM CORP /DE/ | form8k-20101019.htm |

| EX-99.2 - EXHIBIT 99.2 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_2-20101019.htm |

| EX-99.5 - EXHIBIT 99.5 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_5-20101019.htm |

| EX-99.1 - EXHIBIT 99.1 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_1-20101019.htm |

| EX-99.3 - EXHIBIT 99.3 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_3-20101019.htm |

EXHIBIT 99.4

Occidental Petroleum Corporation

Third Quarter 2010 Earnings Conference Call

October 19, 2010

Third Quarter 2010 Earnings Conference Call

October 19, 2010

1

2

Third Quarter 2010 Earnings - Highlights

Third Quarter 2010 Earnings - Highlights

• Core Results - $1.2 Billion vs. $929 Million in 3Q09

– Core EPS $1.47 (diluted) vs. $1.14 in 3Q09.

• Net Income - $1.2 Billion vs. $927 Million in 3Q09

– EPS $1.46 (diluted) vs. $1.14 in 3Q09.

2

3

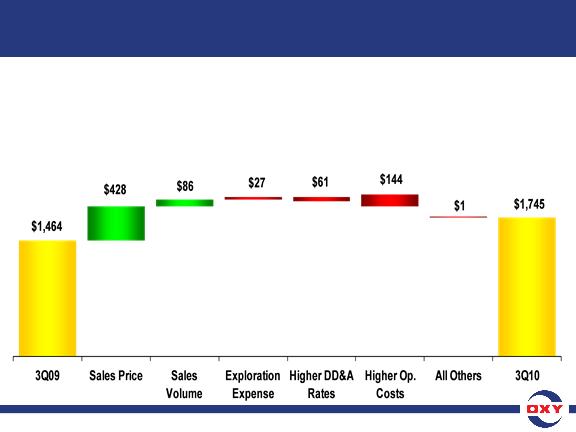

($ in millions)

• Core Results for 3Q10 of $1.745 B vs. $1.464 B in 3Q09

– Improvement in 2010 driven mostly by higher commodity prices with additional contributions

from higher volumes. Partially offsetting these gains were higher DD&A rates and higher

operating expenses, partly resulting from fully expensing CO2 costs in 2010.

from higher volumes. Partially offsetting these gains were higher DD&A rates and higher

operating expenses, partly resulting from fully expensing CO2 costs in 2010.

Third Quarter 2010 Earnings - Oil & Gas

Segment Variance Analysis - 3Q10 vs. 3Q09

Segment Variance Analysis - 3Q10 vs. 3Q09

3

4

3Q10 3Q09

Reported Segment Earnings ($ mm) $1,745 $1,464

WTI Oil Price ($/bbl) $76.20 $68.30

NYMEX Gas Price ($/mcf) $4.53 $3.60

Oxy’s Realized Prices

Worldwide Oil ($/bbl) $70.71 $62.79

US Natural Gas ($/mcf) $4.20 $3.04

Third Quarter 2010 Earnings - Oil & Gas Segment

4

5

Third Quarter 2010 Earnings - Oil & Gas Segment

3Q10 3Q09

Oil and Gas Production Volumes (mboe/d) 751 705

Oil and Gas Sales Volumes (mboe/d) 749 702

– Year-over-year increases of over 6.5%.

• Most of the year-over-year production increases came from the

Middle East / North Africa region, with smaller increases in Argentina

and the US.

Middle East / North Africa region, with smaller increases in Argentina

and the US.

• Sales volume differs from the production volumes above due mainly

to the timing of a lifting in Argentina.

to the timing of a lifting in Argentina.

• Exploration expense was $83 million in 3Q10.

5

6

Third Quarter 2010 Earnings - Oil & Gas

Segment - Cash Production Costs and Taxes

Segment - Cash Production Costs and Taxes

Third Quarter 2010 Earnings - Oil & Gas

Segment - Cash Production Costs and Taxes

Segment - Cash Production Costs and Taxes

• Oil and gas cash production costs, excluding production

and property taxes, were $10.25 per boe for YTD 2010.

and property taxes, were $10.25 per boe for YTD 2010.

– Full-year 2009 costs were $9.37 a boe.

– The nine-month increase reflects $0.35 a barrel higher CO2 costs,

due to our decision to expense 100% of injected CO2 beginning

in 2010, and higher field support operations, workovers and

maintenance costs.

due to our decision to expense 100% of injected CO2 beginning

in 2010, and higher field support operations, workovers and

maintenance costs.

– The higher domestic workover activity is mostly in the Permian.

• Taxes - other than on income were $1.76 per boe for the

first nine months of 2010 compared to $1.60 per boe for

all of 2009. These costs, which are sensitive to product

prices, reflect the effect of higher crude oil and gas prices

in 2010.

first nine months of 2010 compared to $1.60 per boe for

all of 2009. These costs, which are sensitive to product

prices, reflect the effect of higher crude oil and gas prices

in 2010.

6

7

($ in millions)

*Lower feedstock costs

• Core Results for 3Q10 of $189 mm vs. $108 mm in 2Q10

– Results reflect improvement from 2Q10 in both volumes and margins across most product

lines. Export markets have improved more rapidly than domestic markets due in part to the

favorable feedstock costs in North America versus Europe and Asia.

lines. Export markets have improved more rapidly than domestic markets due in part to the

favorable feedstock costs in North America versus Europe and Asia.

Third Quarter 2010 Earnings - Chemical

Segment Variance Analysis - 3Q10 vs. 2Q10

Segment Variance Analysis - 3Q10 vs. 2Q10

7

8

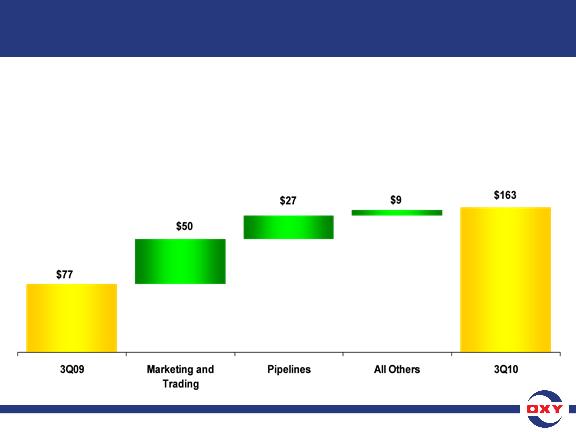

($ in millions)

• Core Results for 3Q10 of $163 mm vs. $77 mm in 3Q09

– The increase in earnings was mainly due to trading and marketing income and higher

margins in the pipeline businesses.

margins in the pipeline businesses.

Third Quarter 2010 Earnings - Midstream

Segment Variance Analysis - 3Q10 vs. 3Q09

Segment Variance Analysis - 3Q10 vs. 3Q09

8

9

Third Quarter 2010 Earnings -

Nine Months Results & Capital Spending

Nine Months Results & Capital Spending

Third Quarter 2010 Earnings -

Nine Months Results & Capital Spending

Nine Months Results & Capital Spending

YTD2010 YTD2009

• Net Income ($ mm) $3,318 $1,977

• EPS (diluted) $4.07 $2.43

• Core Income ($ mm) $3,336 $2,025

• EPS (diluted) $4.09 $2.48

• Capital spending for 3Q10 was about $1.1 billion and $2.8 billion for

YTD 2010.

YTD 2010.

– Year to-date capital expenditures by segment were 82% in Oil and Gas, 13% in

Midstream with the remainder in Chemicals.

Midstream with the remainder in Chemicals.

– Our total year capital is expected to be about $4.4 billion.

– The capital spending rate will increase in 4Q10 largely in our domestic operations

and in Iraq.

and in Iraq.

9

10

Third Quarter 2010 Earnings -

Shares Outstanding and Debt

Shares Outstanding and Debt

Shares Outstanding (mm) YTD10 9/30/10

Weighted Average Basic 812.4

Weighted Average Diluted 813.8

Basic Shares Outstanding 812.6

Diluted Shares Outstanding 814.0

9/30/10 12/31/09

Debt/Capital 7% 9%

10

11

Cash Flow

From

Operations

$6,600

From

Operations

$6,600

Beginning

Cash $1,200

12/31/09

Cash $1,200

12/31/09

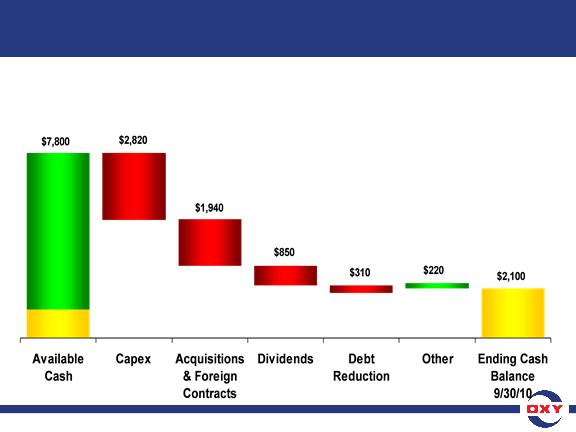

($ in millions)

– 2010 YTD free cash flow after capex and dividends but before

acquisition activity and debt retirements was about $3.1 billion.

acquisition activity and debt retirements was about $3.1 billion.

Third Quarter 2010 Earnings - Cash Flow 2010 YTD

11

12

Third Quarter 2010 Earnings - Acquisitions

Third Quarter 2010 Earnings - Acquisitions

• Our acquisition costs in 3Q10 were $1.1 billion and we expect to

spend about $300 million in the first part of 4Q10.

spend about $300 million in the first part of 4Q10.

– Through these acquisitions we expect to add about 10 mboe/d average

production in 4Q10.

production in 4Q10.

– These acquisitions have a run rate of about 12 mboe/d.

– Of this production about a third will be liquids and the balance will be gas.

– Over the medium-term, we expect these acquisitions to add at least 25

mboe/d of production.

mboe/d of production.

– This increase will come largely from oil production.

• In addition to these acquisitions, we expect to add an additional

380,000 acres to our California acreage position and interests in

100,000 acres in other producing areas.

380,000 acres to our California acreage position and interests in

100,000 acres in other producing areas.

– Our California acreage will now reach approximately 1.6 million acres, an

overwhelming portion of which consists of mineral interests.

overwhelming portion of which consists of mineral interests.

• We don't contemplate any more sizeable acquisitions of acreage

in California.

in California.

12

13

Third Quarter 2010 Earnings - Rig Activity

Third Quarter 2010 Earnings - Rig Activity

• Drilling rigs

– At the beginning of 2010 we were running 11 development rigs in

California and 5 rigs in the Permian.

California and 5 rigs in the Permian.

– We are currently running 16 drilling rigs in California and 9 in the

Permian and expect our year-end exit rate rig count to reach 19 rigs in

California and 14 in the Permian.

Permian and expect our year-end exit rate rig count to reach 19 rigs in

California and 14 in the Permian.

– Next year, we anticipate working 21 rigs in California and 15 rigs in the

Permian.

Permian.

– In the current environment, we are cautious about natural gas drilling

and may reevaluate our 2011 US natural gas drilling program.

and may reevaluate our 2011 US natural gas drilling program.

13

14

Third Quarter 2010 Earnings - Rig Activity

Third Quarter 2010 Earnings - Rig Activity

• Workover rigs

– In the Permian, we are currently running 94 workover rigs, compared

with the 57 rigs we had at the beginning of the year.

with the 57 rigs we had at the beginning of the year.

– We currently expect to be operating 110 rigs at the end of 2010.

– A portion of workover expenditures are expensed as opposed to being

capitalized depending on their nature.

capitalized depending on their nature.

– Our operating costs have recently increased due to higher workover

activity to $10.94 per boe in 3Q10 and further increases are expected in

4Q10.

activity to $10.94 per boe in 3Q10 and further increases are expected in

4Q10.

14

15

Third Quarter 2010 Earnings -

Oil and Gas Production - 4Q10 Outlook

Oil and Gas Production - 4Q10 Outlook

• We expect oil and gas production and sales volumes to be

in the range of 760 to 770 mboe/d at 3Q10 average oil

prices.

in the range of 760 to 770 mboe/d at 3Q10 average oil

prices.

– Volume increases in 4Q10 are expected to come from California,

Oman's Mukhaizna field and the acquisitions.

Oman's Mukhaizna field and the acquisitions.

– An increase in oil prices of $5.00 per barrel from 3Q10 levels would

result in about 4 mb/d lower production due to the impact of higher

prices affecting our production sharing and similar contracts.

result in about 4 mb/d lower production due to the impact of higher

prices affecting our production sharing and similar contracts.

• Based on the development plan at the Zubair field in Iraq,

we believe we should have a small amount of production

in 4Q10.

we believe we should have a small amount of production

in 4Q10.

– We do not expect to report any sales from Iraq until 1Q11.

– The field development plan is on track for us to meet next year's

production targets.

production targets.

15

16

Third Quarter 2010 Earnings - 4Q10 Outlook

• Commodity Price Sensitivity - Earnings

– At current market prices, a $1.00 per barrel change in oil prices impacts oil

and gas quarterly earnings before income taxes by about $39 mm;

and gas quarterly earnings before income taxes by about $39 mm;

– A swing of $0.50 per mm BTU in domestic gas prices has a $27 mm impact

on quarterly pretax income; the current NYMEX gas price is around $3.90

p/mcf.

on quarterly pretax income; the current NYMEX gas price is around $3.90

p/mcf.

• We expect 4Q10 exploration expense to be about $110 mm

for seismic and drilling for our exploration programs.

for seismic and drilling for our exploration programs.

16

17

Third Quarter 2010 Earnings - 4Q10 Outlook

Third Quarter 2010 Earnings - 4Q10 Outlook

• The Chemical segment is expected to provide earnings

for 4Q10 of $100 to $120 million.

for 4Q10 of $100 to $120 million.

– The fourth quarter is usually the weakest quarter for the

business.

business.

– We expect that continued margin improvements will be offset by

the typical seasonal slowdown in the housing, construction,

bleach and fertilizer markets.

the typical seasonal slowdown in the housing, construction,

bleach and fertilizer markets.

• We expect our combined worldwide tax rate in 4Q10 to

be about 41 percent.

be about 41 percent.

17

18

Third Quarter 2010 Earnings - Century Plant

Third Quarter 2010 Earnings - Century Plant

• The Century Plant has just started operations and will be

providing additional CO2 to support growth in our

Permian operations.

providing additional CO2 to support growth in our

Permian operations.

– We expect that the plant will yield about 180 mmcf/d of CO2 next

year to support our Permian EOR operations.

year to support our Permian EOR operations.

– We are in the process of contracting additional CO2 from other

sources and will use penalty payments due from the operator for

under production to support these activities.

sources and will use penalty payments due from the operator for

under production to support these activities.

– We expect to have sufficient CO2 to meet the needs of our

previously disclosed expansion of flooding activities.

previously disclosed expansion of flooding activities.

18

19

Third Quarter 2010 Earnings - California Update

Third Quarter 2010 Earnings - California Update

• Exploration Activity:

– During the first nine months of 2010, we drilled 7 conventional

exploration and extension wells in California.

exploration and extension wells in California.

– Of these, 5 were outside of the Kern County Discovery area.

– Two of these wells are currently being tested.

– We also drilled 12 unconventional exploration wells in the first nine

months of 2010, of which 3 were successful and 5 are being tested.

months of 2010, of which 3 were successful and 5 are being tested.

– In 4Q10, we expect to drill 10 exploration wells of which 2 will be

conventional and the remaining 8 wells will be non-conventional.

conventional and the remaining 8 wells will be non-conventional.

– Our 4Q10 exploration program will target smaller prospects until permits

are obtained for larger ones.

are obtained for larger ones.

• Exploitation Activity:

– We have drilled 13 conventional exploitation wells in the Kern County

Discovery area and 15 unconventional exploitation wells in California in

the first nine months.

Discovery area and 15 unconventional exploitation wells in California in

the first nine months.

– Due to delays in permitting, we've reduced our exploitation plans for the

second half of the year by about 10 wells.

second half of the year by about 10 wells.

19

20

Third Quarter 2010 Earnings - California Update

Third Quarter 2010 Earnings - California Update

• We are continuing to have problems with our gas processing

and gathering infrastructure at Elk Hills.

and gathering infrastructure at Elk Hills.

• As a result, we expect our gas and related NGL production to

be about flat in 4Q10.

be about flat in 4Q10.

• We have ordered and commenced construction of the first

new processing plant and will order the second plant shortly.

new processing plant and will order the second plant shortly.

• Once complete, the new processing plants will increase

productive capacity, improve yields, enhance netbacks and

lower operating costs.

productive capacity, improve yields, enhance netbacks and

lower operating costs.

• We are also actively working to optimize and debottleneck our

existing facilities to improve performance.

existing facilities to improve performance.

• In addition, we are shifting our drilling to oil wells, which we

expect will result in higher oil production in 4Q10.

expect will result in higher oil production in 4Q10.

20

21

21