Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||

| For the fiscal year ended June 30, 2010 | |||

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT | ||

| For the transition period from _________ to ________ | |||

| Commission file number: 000-27645 |

| Ivany Nguyen, Inc. | ||||

| (Exact name of registrant as specified in its charter) |

|

Delaware

|

88-0258277

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

7 Ingram Drive, Suite 128

Toronto, Ontario, Canada

|

M6M 2L7

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number: (888) 648-9366 EXT 2

|

|

Securities registered under Section 12(b) of the Exchange Act:

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|

None

|

not applicable

|

|

Securities registered under Section 12(g) of the Exchange Act:

|

|

|

Title of each class

|

|

|

None

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceeding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. [ ]

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. Approx. $2,830,315 as of December 31, 2009.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 39,506,877as of September 27, 2010.

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

||

| 3 | ||

| 8 | ||

| 8 | ||

| 9 | ||

| 11 | ||

| 11 | ||

|

PART II

|

||

| 11 | ||

| 13 | ||

| 14 | ||

| 17 | ||

| 18 | ||

| 19 | ||

| 19 | ||

| 19 | ||

|

PART III

|

||

| 20 | ||

| 22 | ||

| 25 | ||

| 27 | ||

| 28 | ||

|

PART IV

|

||

| Item 15. | Exhibits, Financial Statement Schedules | 29 |

PART I

Item 1. Business

Principal Place of Business

Our principal offices are located at 7 Ingram Drive, suite 128 Toronto, Ontario, Canada M6M 2L7.

Overview

Description of Business

Ivany Nguyen, Inc. was formed as a Delaware corporation on July 13, 1999. Our principal executive offices are located at 7 Ingram Drive, suite 128 Toronto, Ontario, Canada M6M 2L7. Our telephone number is 1-888 648-9366 EXT 2.

Since the inception of our current operations, we have been in the business of mineral exploration and development. We have acquired certain mineral claims in Canada and have been focused on the strategic acquisition and development of uranium, diamond, base metals, and precious metal properties on a worldwide basis. Further exploration of our mineral claims is required before a final determination as to their viability can be made. The existence of commercially exploitable mineral deposits in our mineral claims is unknown at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our exploration programs.

More recently, we have been seeking to diversify our operations by identifying opportunities in Asia to enter the agricultural sector, with a particular focus on bamboo. We are planning to identify and lease land from which we can harvest bamboo poles to be sold both as raw material and potentially processed into paper pulp. In addition, we plan to identify and review at other agricultural opportunities in South East Asia.

Mineral Properties

Zama Lake Pb-Zn Property

The Zama Lake Pb-Zn property consists of 6 sections of a metallic permit with each section covering approximately 256 hectares for a total of 1536 hectares located 700 km north northwest of Edmonton Alberta. The property previously consisted of 10 metallic permits covering an area of approximately 92,160 hectares. The property is a grass roots Pb-Zn play staked as the result of the discovery of anomalous sphalerite and galena grains found in till samples collected during diamond exploration. The property area is forested and hosts parts of the Zama Lake Oil and Gas field. Zama Lake and Zama City are oil industry support bases and are located within the property.

Exploration on the Zama Lake property consisting of till sampling, examination of indicator mineral concentrates and silt geochemistry indicates the likely proximal presence of Pb-Zn mineralization near surface. The best potential likely exists along structural breaks (faults), collapse structures, porous zones (tuffs), and proximal or up dip of petroleum zones. This potential likely exists beyond the carbonates at depth and into the shale. Further work is required to evaluate the Zama Lake property.

The property that is the subject of the Zama Lake property is undeveloped and does not contain any open-pit or underground mines which can be rehabilitated. There is no commercial production plant or equipment located on the property that is the subject of the mineral claim. Our exploration program has been exploratory in nature and there is no assurance that mineral reserves will be found. After completing the initial minimum $400,000 exploration program required to maintain our metallic permits in good standing until May 2010, and conducting an airborne geophysical survey, our consulting geologist recommended that we keep 3840 acres which will lower our minimum expenditures required to maintain the mineral permits. In order to maintain the metallic mineral permits in good standing until May 2012, and to evaluate the potential of the Zama Lake property further, an exploration program costing approximately $30,000 will be required.

Potential Bamboo Property License

Recently, we have successfully concluded the first stage of negotiations to acquire bamboo assets suitable for commercial exploitation in South East Asia. Our management recently concluded a month long visit to Attapeu province in Laos PDR, where they conducted on site due diligence and met with local and provincial government representatives. At the conclusion of our management’s visit, the local and provincial government representatives agreed to support a plan for our licensing of 10,000 hectares (24,700 acres) of mature harvestable bamboo plantations in the province. A feasibility report has been prepared for submittal to the federal government in Laos. Federal approval of the proposed project will be the final step in the licensing process.

Under the proposed acquisition, the company will license approximately 10,000 hectares of mature harvestable bamboo in production-forest areas where development of non-timber products is highly encouraged by the government to bring economic growth and employment to the area. The quality of the bamboo is such that we are planning to harvest it for multiple downstream products. The proposed licensed areas are in close proximity to electrical grids and are accessible by paved roads. Local communities are nearby where production facilities can be located and where skilled labor can be readily accessed. Upon successful conclusion of the licensing process for the bamboo properties in Attapeu province, we will release additional details.

We are also conducting additional negotiations and due diligence in regards to acquiring other agricultural commodity properties and products in areas in South East Asia. In the event that we are able to commence our proposed bamboo-harvesting operations, we expect that they will become the primary focus of the company.

Competition

The mineral exploration industry, in general, is intensely competitive and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves.

Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims. We have only recently acquired or entered into agreements to acquire our mineral claims and our operations are not well-established. Our resources at the present time are limited. We may exhaust all of our resources and be unable to complete full exploration of the Zama Lake mineral claims or our other properties. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and entered into production of the mineral claim if a commercial viable deposit is found to exist.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result our not receiving an adequate return on invested capital.

Compliance with Government Regulation

The Metallic Minerals and Industrial Minerals Permits (“Permits”) which comprise the Zama Lake Property were staked under the terms of the Mines and Minerals Act – Metallic and Industrial Minerals Tenure Regulation (AR 145/2005). The permits grants the holder:

(a) the non-exclusive right to explore for metallic and industrial minerals on the surface of the location,

(b) the exclusive right to explore for metallic and industrial minerals in the subsurface strata within and under the location, and

(c) the right to remove samples of metallic and industrial minerals from the location for the purposes of assaying and testing and of metallurgical, mineralogical and other scientific studies. (AR 145/2005)

The regulations require that the recorded holder of permits shall perform, or have performed, exploration and development work (assessment work) on the permits to a per hectare value of $5 in the first assessment period. A permit assessment period is two years. In the second and third assessment periods this increases to $10 per hectare. In the fourth to seventh assessment period this increases to $15 per hectare. No filing fees are associated with filing assessment work. These assessment work requirements are calculated from the date of issue of the current permit.

A permit may be held for fourteen years and can vary in size from a minimum of 16 hectares to a maximum of 9,216 hectares. Permit boundaries are defined by the Alberta Township Survey system. Permit locations are therefore defined by a township, range, section, and legal subdivision. A township is 9,216 hectares in size while a section is 256 hectares. A legal survey division (“LSD”) is 16 hectares in size. Permits may be grouped for application of assessment work provided they are contiguous.

The holder of a permit may after two years apply for a lease provided the first year’s rent for the lease is paid in advance and the Minister of Energy has been provided evidence that a deposit exists on the location applied for. The lease has a term of fifteen years and may be extended a further fifteen years upon approval of the Minister of Energy. The lease permits the holder to hold the ground fee simple without further assessment work requirements.

Prospecting for Crown minerals using hand tools is permitted throughout Alberta without a license, permit, or regulatory approval, as long as there is no surface disturbance (AR 213, 1998). Prospecting on privately owned land or land under lease is permitted without any departmental approval, however, the prospector must obtain consent from the landowner or leaseholder before starting to prospect. Unoccupied public lands may be explored without restriction, but as a safety precaution prospectors working in remote areas should inform the local Sustainable Resource Development (forestry) office of their location.

When prospecting, the prospector can use a vehicle on existing roads, trails and cut line. If the work is on public land, the prospector can live on the land in a tent, trailer, or other shelter for up to fourteen days. For periods longer than fourteen days, approval should be obtained from the Land Administration Division. If the land is privately owned or under lease, the prospector must make arrangements with the landowner or leaseholder. Exploration approval is not needed for aerial surveys or ground geophysical and geochemical surveys, providing they do not disturb the land or vegetation cover.

If mechanized exploration equipment is to be used and/or the land surface disturbed, the prospector or company must obtain the appropriate approvals and permits, as required under the Metallic and Industrial Minerals Exploration Regulation. Most projects require an Exploration License, Exploration Permit and Exploration Approval. The following sections describe the criteria and procedures for each of these.

An Exploration License must be obtained before a person or company can apply for, or carry out an exploration program. The license holder is then accountable for all work done under this exploration program. However, the licensee cannot carry out any actual exploration activity until the Department of Environmental Protection issues an Exploration Approval for each program submitted under that license. A fee of $50 must accompany the license application. The license is valid throughout Alberta and remains in effect as long as the company is operating in the province. If a license holder wants to use exploration equipment, such as a drilling rig, an Exploration Permit must be obtained. A fee of $50 must accompany the license application. The permit is valid throughout Alberta and remains in effect as long as the company is operating in the province.

Approval must be obtained if an exploration project involves environmental disturbance such as drilling, trenching, bulk sampling or the cutting of grids that involves more than limbing trees and removing underbrush. Samples up to 20 kg in size may be taken for assay and testing purposes, but larger samples must be authorized by the Department of Energy. The licensee does not need to hold the mineral rights for an area to apply for an Exploration Approval.

Project approval is through the Land and Forest Service of Alberta Environmental Protection. If an application has been completed and the appropriate field staff has copies of the program, approval can usually be obtained in about ten working days. Each application for exploration approval must be accompanied by a fee of $100. After receiving exploration approval, the prospector or exploration company may conduct the approved activity. However, if they modify their program, the designated field officer must be contacted to review and approve the changes. A final report must be submitted to Land and Forest Service of Alberta Environmental Protection within sixty days following completion of the exploration program. The report must show the actual fieldwork, and include a map showing the location of drilling, test pits, excavations, constructed roads, existing trails utilized and all other land disturbances.

Competition and Market for Our Products and Services

The mineral exploration industry, in general, is intensely competitive and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves.

Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims. We have only recently acquired or entered into agreements to acquire our mineral claims and our operations are not well-established. Our resources at the present time are limited. We may exhaust all of our resources and be unable to complete full exploration of the Zama Lake mineral claims or our other properties. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and entered into production of the mineral claim if a commercial viable deposit is found to exist.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result our not receiving an adequate return on invested capital.

Employees

We have no employees as of the date of this prospectus. We conduct our business largely through agreements with consultants and other independent third party vendors.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

Subsidiaries

We have neither formed, nor purchased any subsidiaries since our incorporation.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

Item 1A. Risk Factors.

A smaller reporting company is not required to provide the information required by this Item.

Item 1B. Unresolved Staff Comments

A smaller reporting company is not required to provide the information required by this Item.

Item 2. Properties

Zama Lake Property

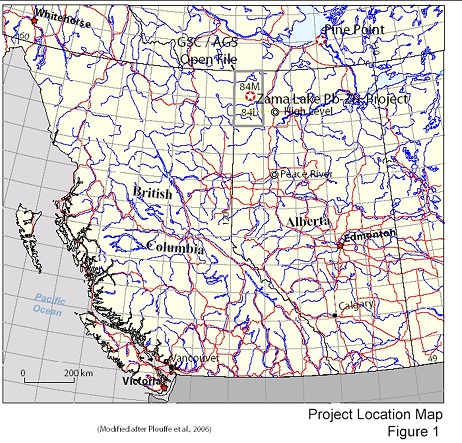

The property is located in the Bistcho Lake Area of northern Alberta within the Municipal District of Mackenzie No. 23, approximately 700 km (435 miles) north northwest of Edmonton (Figure 1). The property lies on the southern margin of the Cameron Hills in N.T.S. 84M and is centered on 57° 28' N 127° 22' W. The nearest supply point to the project is the town of High Level, which is 130 km to the southeast.

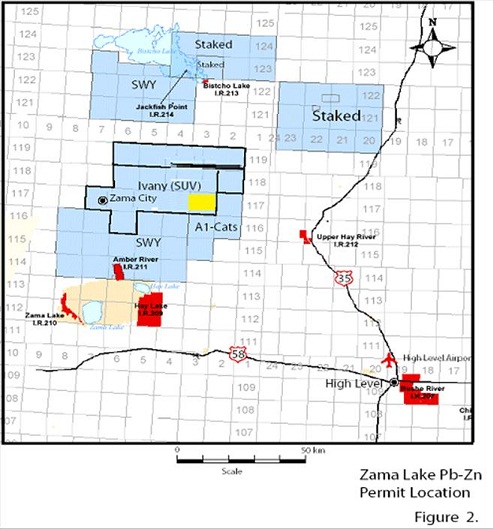

The original ten permits which make up the property are shown on Figure 2. The yellow portion ( in diagram below ) within the original ten permits represents the currently-held 6 sections totaling 1536 hectares of the Zama Lake Pb, Zn Metallic permit property

Our Executive Offices

Our principal executive offices are located at, Ingram Drive, suite 128 Toronto, Ontario, Canada M6M 2L7. Our mailing address is the same. Our telephone number is 1-888-648-9366 EXT 2.

Item 3. Legal Proceedings

We are not currently a party to any legal proceedings. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Our agent for service of process in Delaware is Corporation Service Company, 2711 Centerville Rd., Suite 400, Wilmington, DE 19808.

Item 4. Removed and Reserved

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is sponsored by FINRA. The OTCBB is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current "bids" and "asks", as well as volume information. Our shares are quoted on the OTCBB under the symbol “IVNG.OB.”

The following table sets forth the range of high and low bid quotations for our common stock for each of the periods indicated as reported by the OTCBB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

Fiscal Year Ended June 30, 2010

|

||||

|

Quarter Ended

|

High $

|

Low $

|

||

|

September 30, 2009

|

0.40

|

0.05

|

||

|

December 31, 2009

|

0.30

|

0.05

|

||

|

March 31, 2010

|

0.29

|

0.15

|

||

|

June 30, 2010

|

0.23

|

0.17

|

||

|

Fiscal Year Ended June 30, 2009

|

||||

|

Quarter Ended

|

High $

|

Low $

|

||

|

September 30, 2008

|

0.91

|

0.19

|

||

|

December 31, 2008

|

.08

|

.02

|

||

|

March 31, 2009

|

0.19

|

.05

|

||

|

June 30, 2009

|

0.25

|

0.12

|

||

On October 6, 2010, the last sales price per share of our common stock was $0.20.

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Holders of Our Common Stock

As of September 27, 2010, we had 39,506,877 shares of our common stock issued and outstanding, held by 106 shareholders of record, as well as other stockholders who hold shares in street name.

Dividends

There are no restrictions in our articles of incorporation or bylaws that restrict us from declaring dividends. The Delaware General Corporation Law (the “DGCL”) provides that a corporation may pay dividends out of surplus, out the corporation's net profits for the preceding fiscal year, or both provided that there remains in the stated capital account an amount equal to the par value represented by all shares of the corporation's stock raving a distribution preference.

We have not declared any dividends, and we do not plan to declare any dividends in the foreseeable future.

Securities Authorized for Issuance under Equity Compensation Plans

On October 18, 2007, our Board of Directors approved the adoption of the 2007 Stock Option Plan of Ivany Mining, Inc. (the “Plan”). On July 24, 2008, we filed a Registration Statement on Form S-8 to register with the Securities and Exchange Commission (the “Commission”) 5,000,000 shares of our common stock, par value $0.001 per share, which may be issued by us upon the exercise of options granted, or other awards made, pursuant to the terms of the Plan. A copy of the Plan was filed as an exhibit with the Form S-8 on July 24, 2008. Options to purchase total of 2,500,000 shares have been granted under the plan. These options expired unexercised on in June of 2010. A total of 5,000,000 shares are therefore currently authorized but not awarded under the Plan.

Recent Sales of Unregistered Securities

On July 10, 2009, we closed a private offering of Units sold at a price of $0.05 per Unit. Each Unit consists of one share of common stock, par value $0.001, and one warrant to purchase one share of common stock at a price of $0.10, exercisable for three (3) years. A total of 11,180,000 Units were sold to a total of ten (10) purchasers, resulting in total proceeds to the Company of $559,000 for the Units sold. The Units were offered exclusively to accredited investors and the offering and sale of the Units was exempt from registration under Rule 506 of Regulation D.

On March 16, 2010, we issued 750,000 shares of common stock to Arclight Capital, LLC pursuant to the shareholder’s exercise of warrants to purchase 750,000 shares of common stock at a price of $0.10 per share. Proceeds of $75,000 were received.

On March 29, 2010, we issued 1,500,000 shares of common stock to Spectra Capital Management, LLC pursuant to the shareholder’s exercise of warrants to purchase 1,500,000 shares of common stock at a purchase price of $0.10 per share. Proceeds of $150,000 were received.

On April 19, 2010, we issued 225,000 shares of common stock to CityVac IR Services as compensation paid pursuant to the terms of our Public Relations, Promotion and Marketing Letter Agreement with that company.

On September 30, 2010, we issued 750,000 shares of common stock to General Research GmbH as compensation pursuant to the terms of our Investor Relations Agreement with that company.

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those safe-harbor provisions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Further information concerning our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC.

Strategic Plan

Zama Lake Properties

Our immediate business plan for the Zama Lake property is to proceed with the minimum exploration program necessary to maintain the property in good standing with the Alberta Geological Survey. We will attempt to find strategic joint venture partners and or a buyer for the property. The minimum required to maintain the Zama Lake property in good standing until May 2012 will be approximately $30,000.00. We have reduced the size of the Zama Lake property to approximately 1536 hectares from 92,160 hectares. Our consulting geologist will determine the scope of the $30,000.00 exploration that will be carried out until May 2012. We intend to proceed with the $30,000.00 exploration program as recommended by our consulting geologist and by the agreement under which we have acquired the property. At a later time, but prior to May 2012, our consulting geologist will recommend a minimum $30,000.00 exploration program.

Our plan of operations for the current fiscal year is to continue the recommended exploration program on the Zama Lake property. In order to fully complete our planned exploration programs, however, we may need to raise additional capital. We anticipate that additional funding will be required in the form of equity financing from the sale of our common stock. We cannot provide investors with any assurance, however, that we will be able to raise sufficient funding from the sale of our common stock if and when needed to fund expenses. We believe that outside debt financing will not be an alternative for funding exploration programs. The risky nature of this enterprise and lack of tangible assets other than our mineral claims places debt financing beyond the credit-worthiness required by most banks or typical investors in corporate debt until such time as economically viable mines can be demonstrated.

Potential Bamboo Property License

Recently, we have successfully concluded the first stage of negotiations to acquire bamboo assets suitable for commercial exploitation in South East Asia. Our management recently concluded a month long visit to Attapeu province in Laos PDR, where they conducted on site due diligence and met with local and provincial government representatives. At the conclusion of our management’s visit, the local and provincial government representatives agreed to support a plan for our licensing of 10,000 hectares (24,700 acres) of mature harvestable bamboo plantations in the province. A feasibility report has been prepared for submittal to the federal government in Laos. Federal approval of the proposed project will be the final step in the licensing process.

Under the proposed acquisition, the company will license approximately 10,000 hectares of mature harvestable bamboo in production-forest areas where development of non-timber products is highly encouraged by the government to bring economic growth and employment to the area. The quality of the bamboo is such that we are planning to harvest it for multiple downstream products. The proposed licensed areas are in close proximity to electrical grids and are accessible by paved roads. Local communities are nearby where production facilities can be located and where skilled labor can be readily accessed. Upon successful conclusion of the licensing process for the bamboo properties in Attapeu province, we will release additional details.

We are also conducting additional negotiations and due diligence in regards to acquiring other agricultural commodity properties and products in areas in South East Asia. In the event that we are able to commence our proposed bamboo-harvesting operations, we expect that they will become the primary focus of the company.

We do not have plans to purchase any significant equipment or change the number of our employees during the next twelve months.

Results of Operations for the years ended June 30, 2010 and 2009

We have not earned any revenues since the inception of our current business operations. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our mineral properties, or if such resources are discovered, that we will enter into commercial production.

We incurred operating expenses and net losses in the amount of $863,858 for the year ended June 30, 2010, compared to $520,690 for the year ended June 30, 2009. We have incurred total operating expenses and net losses of $10,413,874 from inception through June 30, 2010. Our losses are attributable to operating expenses together with a lack of any revenues. We anticipate our operating expenses will increase as we continue with our plan of operations. The increase will be attributable to continuing with the geological exploration programs for our mineral claims and for the potential acquiring of bamboo property license.

Liquidity and Capital Resources

As of June 30, 2010, we had cash in the amount of $69,461 and a working capital deficit of $8,961. We have not attained profitable operations and are dependent upon obtaining financing to pursue significant exploration and development activities. We do not anticipate earning revenues until such time that we are into commercial production of our current and/or potential resources properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our mineral properties, or if such resources are discovered, that we will enter into commercial production. In addition, we can provide no firm assurance that our efforts to license bamboo properties in Laos will be successful or that our contemplated harvesting operations can be successfully commenced.

In the event that our proposed bamboo property lease in Laos obtains federal government approval, significant additional capital will be required in order to construct a bamboo processing plant (management estimates that construction of the physical plant will require approximately $1 million) and to undertake commercial bamboo harvesting operations. Accordingly, our ability to undertake our proposed bamboo operations in Laos will be dependent upon our ability to raise substantial additional equity capital. Although we are engaged in efforts to raise additional equity capital, we currently do not have any firm arrangements for the required equity financing and we may not be able to obtain such financing when required, in the amount necessary under to fund the planned bamboo operation, or on terms that are financially feasible.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue significant exploration activities. We have incurred cumulative net losses of $10,413,874 since our inception and require capital for our contemplated operational and marketing activities to take place. Our ability to raise additional capital through the future issuances of the common stock is unknown. The obtainment of additional financing, the successful development of our contemplated plan of operations, and our transition, ultimately, to the attainment of profitable operations are necessary for us to continue operations. For these reasons, our auditors stated in their report that they have substantial doubt we will be able to continue as a going concern.

Purchase or Sale of Equipment

We do not expect to purchase or sell any plant or significant equipment.

Personnel

Mr. Derek Ivany, our President and Director, and Mr. Victor Cantore, our Chief Financial Officer and Director, are currently each working approximately 30 to 40 hours per week to meet our needs, together with additional assistance from our Vice President and Director, Sam Nguyen. As demand requires, Mr. Ivany, Mr. Cantore, and Mr. Nguyen will devote additional time. We currently have no other employees. We do not expect to increase our number of employees during the next twelve months.

Research and Development

We will not be conducting any product research or development during the next 12 months.

Off Balance Sheet Arrangements

As June 30, 2010, there were no off balance sheet arrangements.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

A smaller reporting company is not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data

Index to Financial Statements Required by Article 8 of Regulation S-X:

|

Audited Financial Statements:

|

|

18

Silberstein Ungar, PLLC CPAs and Business Advisors

Phone (248) 203-0080

Fax (248) 281-0940

30600 Telegraph Road, Suite 2175

Bingham Farms, MI 48025-4586

www.sucpas.com

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Boards of Directors

Ivany Nguyen, Inc.

Toronto, Ontario, Canada

We have audited the accompanying balance sheets of Ivany Nguyen, Inc. (formerly Ivany Mining, Inc.), as of June 30, 2010 and 2009, and the related statements of operations, stockholders’ equity (deficit), and cash flows for the years then ended and the period from inception through June 30, 2010. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company has determined that it is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Ivany Nguyen, Inc. (formerly Ivany Mining, Inc.), as of June 30, 2010 and 2009 and the results of their operations and cash flows for the years then ended and the period from inception through June 30, 2010, in conformity with accounting principles generally accepted in the United States.

The accompanying financial statements have been prepared assuming that Ivany Nguyen, Inc. (formerly Ivany Mining, Inc.) will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has incurred losses from operations, has negative working capital and is in need of additional capital to grow its operations so that it can become profitable. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans with regard to these matters are described in Note 2. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Silberstein Ungar, PLLC

Silberstein Ungar, PLLC

Bingham Farms, Michigan

October 12, 2010

IVANY NGUYEN, INC.

(An Exploration Stage Company)

Balance Sheets

| ASSETS |

June 30,

2010 |

June 30,

2009 |

|||

|

CURRENT ASSETS

|

|||||

|

Cash

|

$ | 69,461 | $ | 455,263 | |

|

Total Current Assets

|

69,461 | 455,263 | |||

|

EQUIPMENT, net

|

1,266 | 3,286 | |||

|

TOTAL ASSETS

|

$ | 70,727 | $ | 458,549 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | |||||

|

CURRENT LIABILITIES

|

|||||

|

Accounts payable

|

$ | 53,422 | $ | 53,653 | |

|

Loans due to shareholders

|

- | 46,983 | |||

|

Total Current Liabilities

|

53,422 | 100,636 | |||

|

STOCKHOLDERS' EQUITY (DEFICIT)

|

|||||

|

Preferred stock; 10,000,000 shares authorized, at $0.001 par value,

none issued or outstanding and outstanding

|

- | - | |||

|

Common stock; 200,000,000 shares authorized, at $0.001 par value,

39,506,877 and 36,051,877 shares issued and outstanding, respectively

|

39,507 | 36,052 | |||

|

Additional paid-in capital

|

10,391,672 | 9,852,877 | |||

|

Stock subscription (receivable) payable

|

- | 19,000 | |||

|

Deficit accumulated during the exploration stage

|

(10,413,874) | (9,550,016) | |||

|

Total Stockholders' Equity (Deficit)

|

17,305 | 357,913 | |||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

|

$ | 70,727 | $ | 458,549 | |

The accompanying notes are an integral part of these financial statements.

IVANY NGUYEN, INC.

(An Exploration Stage Company)

Statements of Operations

|

For the Year Ended

June 30, |

From Inception

Through |

|||||||||

|

2010

|

2009

|

2010

|

||||||||

|

|

||||||||||

|

REVENUES

|

$ | - | $ | - | $ | - | ||||

|

OPERATING EXPENSES

|

||||||||||

|

Exploration

|

- | 31,276 | 170,873 | |||||||

|

Professional fees

|

645,223 | 180,314 | 1,114,112 | |||||||

|

General and administrative

|

216,615 | 289,927 | 2,180,966 | |||||||

|

Impairment of mining properties

|

- | 17,153 | 545,221 | |||||||

|

Depreciation

|

2,020 | 2,020 | 4,798 | |||||||

|

Total Operating Expenses

|

863,858 | 520,690 | 4,015,970 | |||||||

|

LOSS FROM OPERATIONS

|

(863,858 | ) | (520,690 | ) | (4,015,970) | |||||

|

INCOME TAX EXPENSE

|

- | - | - | |||||||

|

LOSS FROM CONTINUING OPERATIONS

|

(863,858 | ) | (520,690 | ) | (4,015,970) | |||||

|

DISCONTINUED OPERATIONS

|

- | - | (6,397,904) | |||||||

|

NET LOSS

|

$ | (863,858 | ) | $ | (520,690 | ) | $ | (10,413,874) | ||

|

BASIC LOSS PER SHARE

|

$ | (0.02 | ) | $ | (0.02 | ) | ||||

|

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING

|

36,980,594 | 25,994,069 | ||||||||

The accompanying notes are an integral part of these financial statements.

IVANY NGUYEN, INC.

(An Exploration Stage Company)

Statements of Stockholders' Equity (Deficit)

|

Common Stock

|

Additional

Paid-In |

Stock

Subscription |

Deficit

Accumulated |

Total

Stockholders'Equity

|

|||||||||||||

|

Shares

|

Amount

|

Capital

|

Payable

|

Stage

|

(Deficit)

|

||||||||||||

|

Balance, June 30, 2005

|

246,032 | $ | 246 | $ | 6,215,095 | $ | - | $ | (6,330,697) | $ | (115,356) | ||||||

|

Net loss for the year ended June 30, 2006

|

- | - | - | - | (28,518) | (28,518) | |||||||||||

|

Balance, June 30, 2006

|

246,032 | 246 | 6,215,095 | - | (6,359,215) | (143,874) | |||||||||||

|

Net loss for the year ended June 30, 2007

|

- | - | - | - | (38,689) | (38,689) | |||||||||||

|

Balance, June 30, 2007

|

246,032 | 246 | 6,215,095 | - | (6,397,904) | (182,563) | |||||||||||

|

Mineral properties acquired for common stock

|

20,150,000 | 20,150 | 77,958 | - | - | 98,108 | |||||||||||

|

Common stock issued for cash

|

5,055,845 | 5,056 | 1,273,191 | - | - | 1,278,247 | |||||||||||

|

Value of options granted

|

- | - | 1,528,233 | - | - | 1,528,233 | |||||||||||

|

Net loss for the year ended June 30, 2008

|

- | - | - | - | (2,631,422) | (2,631,422) | |||||||||||

|

Balance, June 30, 2008

|

25,451,877 | 25,452 | 9,094,477 | - | (9,029,326) | 90,603 | |||||||||||

|

Common stock issued for services at $0.91

|

300,000 | 300 | 272,700 | - | - | 273,000 | |||||||||||

|

Common stock issued for exercised options at $0.05 per share

|

100,000 | 100 | 4,900 | - | - | 5,000 | |||||||||||

|

Common stock issued for cash at $0.05 per share

|

10,200,000 | 10,200 | 480,800 | 19,000 | - | 510,000 | |||||||||||

|

Net loss for the year ended June 30, 2009

|

- | - | - | - | (520,690) | (520,690) | |||||||||||

|

Balance, June 30, 2009

|

36,051,877 | 36,052 | 9,852,877 | 19,000 | (9,550,016) | 357,913 | |||||||||||

|

Common stock issued for stock subscription payable

|

380,000 | 380 | 18,620 | (19,000) | - | - | |||||||||||

|

Common stock issued for cash at $0.05 per share

|

600,000 | 600 | 29,400 | - | - | 30,000 | |||||||||||

|

Common stock issued for exercised options at $0.10 per share

|

2,250,000 | 2,250 | 222,750 | - | - | 225,000 | |||||||||||

|

Common stock issued for services at $0.17 per shared

|

225,000 | 225 | 38,025 | - | - | 38,250 | |||||||||||

|

Fair value of warrants issued for services

|

- | - | 230,000 | - | - | 230,000 | |||||||||||

|

Net loss for the year ended June 30, 2010

|

- | - | - | - | (863,858) | (863,858) | |||||||||||

|

Balance, June 30, 2010

|

39,506,877 | $ | 39,507 | $ | 10,391,672 | $ | - | $ | (10,413,874) | $ | 17,305 | ||||||

The accompanying notes are an integral part of these financial statements.

|

For the Year Ended

June 30, |

From Inception

Through |

|||||||||

|

2010

|

2009

|

2010

|

||||||||

|

OPERATING ACTIVITIES

|

||||||||||

|

Net loss

|

$ | (863,858 | ) | $ | (520,690 | ) | $ | (10,413,874) | ||

|

Adjustments to reconcile net loss to net cash used by operating activities:

|

||||||||||

|

Discountinued operations

|

- | - | 6,215,341 | |||||||

|

Value of options granted

|

230,000 | - | 1,758,233 | |||||||

|

Common stock issued for services

|

38,250 | 273,000 | 311,250 | |||||||

|

Depreciation

|

2,020 | 2,020 | 4,798 | |||||||

|

Impairment of mining properties

|

- | 17,153 | 545,221 | |||||||

|

Changes in operating assets and liabilities:

|

||||||||||

|

Change in accounts payable

|

(231 | ) | 35,967 | 53,422 | ||||||

|

Net Cash Used in Operating Activities

|

(593,819 | ) | (192,550 | ) | (1,525,609) | |||||

|

INVESTING ACTIVITIES

|

||||||||||

|

Purchase of mineral properties

|

- | (17,153 | ) | (447,113) | ||||||

|

Purchase of computer equipment

|

- | - | (6,064) | |||||||

|

Net Cash Used in Investing Activities

|

- | (17,153 | ) | (453,177) | ||||||

|

FINANCING ACTIVITIES

|

||||||||||

|

Proceeds from common stock

|

255,000 | 515,000 | 2,048,247 | |||||||

|

Repayment of notes payable

|

- | - | (40,247) | |||||||

|

Proceeds from notes payable

|

- | - | 40,247 | |||||||

|

Repayment to shareholder

|

(46,983 | ) | - | (160,962) | ||||||

|

Borrowings from shareholder

|

- | 46,983 | 160,962 | |||||||

|

Net Cash Provided by Financing Activities

|

208,017 | 561,983 | 2,048,247 | |||||||

|

NET INCREASE (DECREASE) IN CASH

|

(385,802 | ) | 352,280 | 69,461 | ||||||

|

CASH AT BEGINNING OF PERIOD

|

455,263 | 102,983 | - | |||||||

|

CASH AT END OF PERIOD

|

$ | 69,461 | $ | 455,263 | $ | 69,461 | ||||

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

|

||||||||||

|

CASH PAID FOR:

|

||||||||||

|

Interest

|

$ | - | $ | - | $ | - | ||||

|

Income Taxes

|

$ | - | $ | - | $ | - | ||||

|

NON CASH FINANCING ACTIVITIES:

|

||||||||||

|

Common stock issued for mineral properties

|

$ | - | $ | - | $ | 98,108 | ||||

The accompanying notes are an integral part of these financial statements.

IVANY NGUYEN, INC.

Notes to the Financial Statements

June 30, 2010 and 2009

NOTE 1 – DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES

Description of Business

Ivany Mining, Inc. (referred to as the “Company”) was previously involved in the e-business industry. It provided end-to-end, e-business solutions to businesses interested in doing e-tailing (selling of retail goods on the Internet). As of June 30, 2007 the Company determined to focus on the strategic acquisition and development of uranium, diamond, base metals, and precious metals properties on a worldwide basis. Accordingly, it was reclassified as an exploration stage company and its prior operations were reclassified to discontinued operations.

History

The Company was incorporated in Nevada on April 23, 1990, as Investor Club of the United States. The name was changed to Noble Financing Group Inc. (in 1992), then to Newman Energy Technologies Incorporated (1998), then World Star Asia, Inc. (1998), Comgen Corp. (1998) and then to Planet411.com Corporation on February 11, 1999 to reflect its then current business objectives. Planet411.com Inc. was incorporated on July 13, 1999. Planet411.com Corporation was merged with and into Planet411.com Inc. (referred to as the “Company”) on October 6, 1999 for the sole purpose of changing the Company's jurisdiction of incorporation to Delaware. On July 18, 2007, the Company filed a Certificate of Merger with the Secretary of State of Delaware in order to effectuate a merger whereby the Company (as Planet411.com Inc.) would merge with its wholly-owned subsidiary, Ivany Mining Inc., as a parent/ subsidiary merger with the Company as the surviving corporation. This merger, which became effective as of July 18, 2007, was completed pursuant to Section Title 8, Section 251(c) of the Delaware General Corporation Law. Upon completion of this merger, the Company's name has been changed to "Ivany Mining Inc." and the Company's Articles of Incorporation have been amended to reflect this name change. On February 16, 2010 the Company’s name was changed to Ivany Nguyen, Inc.

Definition of Fiscal Year

The Company’s fiscal year end is June 30.

Use of Estimates

The preparation of audited financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Reclassification of Financial Statement Accounts

Certain amounts in the June 30, 2009 financial statements have been reclassified to conform to the presentation in the June 30, 2010 financial statements.

Cash and Cash Equivalents

For purposes of financial statement presentation, the Company considers all highly liquid investments with a maturity of three months or less, from the date of purchase, to be cash equivalents.

Concentration of Risk

Financial instruments, which potentially subject us to concentrations of credit risk, consist principally of cash. Our cash balances are maintained in accounts held by major banks and financial institutions located in the United States. The Company occasionally maintains amounts on deposit with a financial institution that are in excess of the federally insured limits . The risk is managed by maintaining all deposits in high quality financial institutions.

Property and Equipment

Property and equipment is recorded at cost less accumulated depreciation. Depreciation and amortization is calculated using the straight-line method over the expected useful life of the asset, after the asset is placed in service.

Fair Value of Financial Instruments

The Company has adopted ASC 805, “Disclosure About Fair Value of Financial Instruments”, which requires the Company to disclose, when reasonably attainable, the fair market values of its assets and liabilities which are deemed to be financial instruments. The carrying amounts and estimated fair values of the Company’s financial instruments approximate their fair value due to the short-term nature.

Revenue Recognition Policy

The Company will determine its revenue recognition policies upon commencement of its mining operations.

Advertising Costs

The Company expenses all costs of advertising as incurred. There were no advertising costs included in selling and marketing expenses during the reported periods.

IVANY NGUYEN, INC.

Notes to the Financial Statements

June 30, 2010 and 2009

NOTE 1 – DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES (CONTINUED)

Share-Based Compensation

The Company follows the provisions of ASC 718, “Share-Based Payment” which requires all share-based payments to employees, including grants of employee stock options, to be recognized in the income statement based on their fair values. The Company uses the Black-Scholes pricing model for determining the fair value of stock based compensation.

Equity instruments issued to non-employees for goods or services are accounted for at fair value and are marked to market until service is complete or a performance commitment date is reached, whichever is earlier.

Earnings (loss) per Share

Basic earnings (loss) per share exclude any dilutive effects of options, warrants and convertible securities. Basic earnings (loss) per share is computed using the weighted-average number of outstanding common stocks during the applicable period. Diluted earnings per share is computed using the weighted-average number of common and common stock equivalent shares outstanding during the period. Common stock equivalent shares are excluded from the computation if their effect is antidilutive.

Income Taxes

The Company provides for income taxes under ASC 740 which requires the use of an asset and liability approach in accounting for income taxes. Deferred tax assets and liabilities are recorded based on the differences between the financial statement and tax bases of assets and liabilities and the tax rates in effect when these differences are expected to reverse. The Company’s predecessor operated as entity exempt from Federal and State income taxes.

ASC 740 also requires the reduction of deferred tax assets by a valuation allowance if, based on the weight of available evidence, it is more likely than not that some or all of the deferred tax assets will not be realized.

The provision for income taxes differs from the amounts which would be provided by applying the statutory federal income tax rate of 39% to net loss before provision for income taxes for the following reasons:

|

June 30,

2010

|

June 30,

2009

|

||||

|

Income tax expense at statutory rate

|

$ | (336,905) | $ | (203,069) | |

|

Common stock issued for services

|

14,918 | 106,470 | |||

|

Fair value of stock options issued for services

|

89,700 | - | |||

|

Valuation allowance

|

232,287 | 96,599 | |||

|

Income tax expense per books

|

$ | - | $ | - | |

Net deferred tax assets consist of the following components as of:

|

June 30,

2010

|

June 30,

2009

|

||||

|

NOL carryover

|

$ | 3,254,312 | $ | 3,033,441 | |

|

Valuation allowance

|

(3,254,312) | (3,033,441) | |||

|

Net deferred tax asset

|

$ | - | $ | - | |

Due to the change in ownership provisions of the Tax Reform Act of 1986, net operating loss carry forwards of $8,344,391 for federal income tax reporting purposes are subject to annual limitations. Should a change in ownership occur net operating loss carry forwards may be limited as to use in future years.

Recent Accounting Pronouncements

Below is a listing of the most recent accounting pronouncements issued since through May 27, 2010. The Company has evaluated these pronouncements and their adoption has not had or is not expected to have a material impact on the Company’s financial position, or statements.

In January 2010, the FASB issued Accounting Standards Update 2010-02, Consolidation (Topic 810): Accounting and Reporting for Decreases in Ownership of a Subsidiary. This amendment to Topic 810 clarifies, but does not change, the scope of current US GAAP. It clarifies the decrease in ownership provisions of Subtopic 810-10 and removes the potential conflict between guidance in that Subtopic and asset derecognition and gain or loss recognition guidance that may exist in other US GAAP. An entity will be required to follow the amended guidance beginning in the period that it first adopts FAS 160 (now included in Subtopic 810-10). For those entities that have already adopted FAS 160, the amendments are effective at the beginning of the first interim or annual reporting period ending on or after December 15, 2009. The amendments should be applied retrospectively to the first period that an entity adopted FAS 160.

IVANY NGUYEN, INC.

Notes to the Financial Statements

June 30, 2010 and 2009

NOTE 1 – COMPANY BACKGROUND AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Recent Accounting Pronouncements (continued)

In January 2010, the FASB issued Accounting Standards Update 2010-01, Equity (Topic 505): Accounting for Distributions to Shareholders with Components of Stock and Cash (A Consensus of the FASB Emerging Issues Task Force). This amendment to Topic 505 clarifies the stock portion of a distribution to shareholders that allows them to elect to receive cash or stock with a limit on the amount of cash that will be distributed is not a stock dividend for purposes of applying Topics 505 and 260. Effective for interim and annual periods ending on or after December 15, 2009, and would be applied on a retrospective basis.

In December 2009, the FASB issued Accounting Standards Update 2009-17, Consolidations (Topic 810): Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities. This Accounting Standards Update amends the FASB Accounting Standards Codification for Statement 167.

In December 2009, the FASB issued Accounting Standards Update 2009-16, Transfers and Servicing (Topic 860): Accounting for Transfers of Financial Assets. This Accounting Standards Update amends the FASB Accounting Standards Codification for Statement 166.

In October 2009, the FASB issued Accounting Standards Update 2009-15, Accounting for Own-Share Lending Arrangements in Contemplation of Convertible Debt Issuance or Other Financing. This Accounting Standards Update amends the FASB Accounting Standard Codification for EITF 09-1.

In October 2009, the FASB issued Accounting Standards Update 2009-14, Software (Topic 985): Certain Revenue Arrangements That Include Software Elements. This update changed the accounting model for revenue arrangements that include both tangible products and software elements. Effective prospectively for revenue arrangements entered into or materially modified in fiscal years beginning on or after June 15, 2010. Early adoption is permitted.

In October 2009, the FASB issued Accounting Standards Update 2009-13, Revenue Recognition (Topic 605): Multiple-Deliverable Revenue Arrangements. This update addressed the accounting for multiple-deliverable arrangements to enable vendors to account for products or services (deliverables) separately rather than a combined unit and will be separated in more circumstances that under existing US GAAP. This amendment has eliminated that residual method of allocation. Effective prospectively for revenue arrangements entered into or materially modified in fiscal years beginning on or after June 15, 2010. Early adoption is permitted.

In September 2009, the FASB issued Accounting Standards Update 2009-12, Fair Value Measurements and Disclosures (Topic 820): Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent). This update provides amendments to Topic 820 for the fair value measurement of investments in certain entities that calculate net asset value per share (or its equivalent). It is effective for interim and annual periods ending after December 15, 2009. Early application is permitted in financial statements for earlier interim and annual periods that have not been issued.

In July 2009, the FASB ratified the consensus reached by EITF (Emerging Issues Task Force) issued EITF No. 09-1, (ASC Topic 470) "Accounting for Own-Share Lending Arrangements in Contemplation of Convertible Debt Issuance" ("EITF 09-1"). The provisions of EITF 09-1, clarifies the accounting treatment and disclosure of share-lending arrangements that are classified as equity in the financial statements of the share lender. An example of a share-lending arrangement is an agreement between the Company (share lender) and an investment bank (share borrower) which allows the investment bank to use the loaned shares to enter into equity derivative contracts with investors. EITF 09-1 is effective for fiscal years that beginning on or after December 15, 2009 and requires retrospective application for all arrangements outstanding as of the beginning of fiscal years beginning on or after December 15, 2009. Share-lending arrangements that have been terminated as a result of counterparty default prior to December 15, 2009, but for which the entity has not reached a final settlement as of December 15, 2009 are within the scope. Effective for share-lending arrangements entered into on or after the beginning of the first reporting period that begins on or after June 15, 2009.

NOTE 2 - GOING CONCERN

The Company's financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenues sufficient to cover its operating costs and allow it to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease operations.

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management's plan is to obtain such resources for the Company by obtaining capital from management and significant shareholders sufficient to meet its minimal operating expenses and seeking equity and/or debt financing. However management cannot provide any assurances that the Company will be successful in accomplishing any of its plans.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually secure other sources of financing and attain profitable operations. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

NOTE 3 – RELATED PARTY TRANSACTIONS

As of June 30, 2010 and 2009, the Company had an unsecured, non interest bearing demand loans due to a shareholder of the Company totaling $-0- and $46,983, respectively. During the years ended June 30, 2010 and 2009 the Company received advances of $-0- and made repayments of $46,983 and $-0-, respectively.

The Company currently has consulting agreements with two of the Company’s officers. Each agreement authorizes each member to receive $6,000 per month in consulting fees along with reimbursement of expenses incurred on the Company’s behalf. During the year ended June 30, 2010 the Company paid $296,929 in combined fees and expense reimbursements to these two officers.

NOTE 4 – PROPERTY AND EQUIPMENT

The Company’s property and equipment are comprised of the following on June 30, 2010 and 2009:

|

2010

|

2009

|

||||

|

Computer Equipment

|

$ | 6,064 | $ | 6,064 | |

|

Accumulated Depreciation

|

(4,798) | (2,778) | |||

|

Net Property and Equipment

|

$ | 1,266 | $ | 3,286 | |

Depreciation expense for the years ended June 30, 2010 and 2009 was $2,020 and $2,020, respectively.

NOTE 5 – CAPITAL STOCK TRANSACTIONS

Preferred stock

The authorized preferred stock is 10,000,000 shares with a par value of $0.001. As of June 30, 2010, the Company has no shares of preferred stock issued or outstanding.

Common stock

The authorized common stock is 200,000,000 shares with a par value of $0.001. As of June 30, 2010 and 2009, 39,506,877 and 36,051,877 shares were issued and outstanding, respectively.

During the year ended June 30, 2007, the Company completed a reverse split on its common stock from 500 shares to 1 share. The reverse stock split is reflected on a retroactive basis.

During the year ended June 30, 2008, the Company issued 5,055,845 shares of its common stock for cash of $1,278,247. The Company also issued 20,150,000 shares of its common stock for mineral properties valued at $98,108. The Company issued 2,500,000 options valued at $1,528,233.

During the year ended June 30, 2009, the Company issued 10,200,000 shares of its common stock for $510,000 cash. Of this, $19,000 was recorded as a stock subscription payable because the shares were not issued until after the end of the fiscal year. During this year the Company also issued 100,000 common shares for options exercised at $0.05 per share. An additional 300,000 shares of common stock were issued for services at $0.91 per share based on the market value of the stock on the date of issuance.

IVANY NGUYEN, INC.

Notes to the Financial Statements

June 30, 2010 and 2009

NOTE 5 – CAPITAL STOCK TRANSACTIONS (CONTINUED)

During the year ended June 30, 2010, the Company issued 600,000 shares of common stock for $30,000 cash. During this year the Company also issued 380,000 in fulfillment of the $19,000 stock subscription payable recorded in the previous year and 2,225,000 shares of common stock for options exercised at $0.10 per share. The Company also issued 225,000 common shares to a public relations and marketing firm as compensation for services performed valued at $0.17 per share based on the stock price on the date of issuance. During the 2010 fiscal year the Company issued 1,000,000 warrants with a fair value of $230,000 in exchange for services. The fair value of the warrants was determined using the Black-Scholes valuation model under the assumptions detailed in Note 7.

NOTE 6 – MINERAL PROPERTIES

On September 10, 2007, the Company entered into a Mining Claims Purchase Agreement (the “Purchase Agreement”) with Derek Ivany, Victor Cantore, and Anna Giglio. Under the terms of the Purchase Agreement, Mr. Ivany, Mr. Cantore, and Ms. Giglio have each transferred to the Company certain mining claims owned by them and located in the province of Quebec, Canada.

The mining claims acquired under the Purchase Agreement cover a total of approximately 27,277.27 hectares. In exchange for the mining claims transferred to us under the Purchase Agreement, Mr. Ivany, Mr. Cantore, and Ms. Giglio were issued a total of 20,000,000 shares of common stock.

On September 11, 2007, the Company entered into a Letter of Intent Purchase Agreement (the “Purchase Agreement”) with Star Uranium Corp. (“Star Uranium”). Under the terms of the Purchase Agreement, Star Uranium has agreed to transfer to the Company ten mining claims located in the Zama Lake area of northern Alberta, Canada. Under the Purchase Agreement, the Company paid Star Uranium a purchase price of $100,000 on or before October 31, 2007. Also, the Company delivered to Star Uranium 150,000 shares of our common stock as additional consideration for the purchased mining claims. The mining claims transferred under the Purchase Agreement cover a total of approximately 92,160 hectares.

Under the Purchase Agreement, the Company has also agreed to invest certain minimum amounts in the development of the mineral properties. Subject to any negotiated adjustments which may be made by the parties based on future geological evaluation, the Company is required to spend a minimum of $400,000 toward exploration of the properties before May 16, 2008 and an additional $1,000,000 toward exploration and development before May 16, 2010. Star Uranium has retained a 2% smelter royalty on the properties and has retained all diamond rights.

The Company has the option to buy-down the retained net smelter royalty to 1% by making an additional payment of $1,000,000 to Star Uranium at any time.

On September 12, 2007, the Company entered into an Alberta Mining Claims Purchase Agreement (the “Purchase Agreement”) with Derek Ivany and Royal Atlantis Group, Inc. (“Royal Atlantis”). Under the terms of the Purchase Agreement, Mr. Ivany and Royal Atlantis have transferred to the Company a total of six mining claims located in the province of Alberta, Canada. In exchange for the mining claims transferred to the Company under the Purchase Agreement, the Company paid total of $20,000 CAD ($10,000 each) to Mr. Ivany and Royal Atlantis.

At the close of the fiscal year ended June 30, 2008, the Company recognized an impairment charge of $528,068 on the value of its mining property, primarily due to the facts that the Company is an exploration stage company and future cash flow is unpredictable due to a lack of operating history, the future required minimum expenditures that the Company is uncertain of funding, and the uncertainty of the prospects of the land.

At the close of the fiscal year ended June 30, 2009 the Company again performed an impairment analysis in regards to the carrying value of the mineral properties held by the Company. Due to the same reasons noted above, the Company impaired the value of its mining properties. This resulted in an impairment expense of $17,153 for the year ended June 30, 2009.

IVANY NGUYEN, INC.

Notes to the Financial Statements

June 30, 2010 and 2009

NOTE 7 – STOCK OPTIONS AND WARRANTS

The estimated value of the compensatory common stock purchase warrants granted to non-employees in exchange for services and financing expenses is determined using the Black-Scholes evaluation model.

On June 10, 2010, the Company entered into an Investor Relations Agreement for investor and public relations services. The services will include organizing presentations in several European cities, assistance with coverage in the German financial media, and certain shareholder relations matters. Under the Agreement, the Company agreed to compensate the consultant with options to purchase 1,000,000 shares of our common stock at an exercise price of $0.20 per share.

During the year ended June 30, 2009 no compensatory common stock purchase options were granted.

During the years ended June 30, 2010 and 2009, the estimated value of the compensatory common stock purchase warrants granted to non-employees in exchange for services and financing expenses was determined using the Black-Scholes pricing model and the following assumptions: expected term of 2-5 years, a risk free interest rate of 2.05-3.35%, a dividend yield of 0% and volatility of 90-907%. The amount of the expense charged to operations for compensatory options and warrants granted in exchange for services was $1,758,233.

Changes in stock options issued to during the years ended June 30, 2010 and 2009 are as follows:

|

Number

of Options |

Weighted

Average |

||||

|

Outstanding, June 30, 2008

|

2,500,000 | $ | 0.10 | ||

|

Granted

|

- | - | |||

|

Exercised

|

100,000 | 0.01 | |||

|

Cancelled

|

- | - | |||

|

Outstanding, June 30, 2009

|

2,400,000 | 0.10 | |||

|

Exercisable, June 30, 2009

|

2,400,000 | 0.10 | |||

|

Granted

|

1,000,000 | 0.20 | |||

|

Exercised

|

(2,250,000) | 0.10 | |||

|

Cancelled

|

- | - | |||

|

Outstanding, June 30, 2010

|

1,150,000 | $ | 0.19 | ||

|

Exercisable, June 30, 2010

|

1,150,000 | $ | 0.19 | ||

NOTE 8 – COMMITMENTS AND CONTINGENCIES

The Company neither owns nor leases any real or personal property. An officer has provided office services without charge. There is no obligation for the officer to continue this arrangement. Such costs are immaterial to the financial statements and accordingly are not reflected herein. The officers and directors are involved in other business activities and most likely will become involved in other business activities in the future.