Attached files

| file | filename |

|---|---|

| EX-32 - Wave Sync Corp. | v198759_ex32.htm |

| EX-23.1 - Wave Sync Corp. | v198759_ex23-1.htm |

| EX-23.2 - Wave Sync Corp. | v198759_ex23-2.htm |

| EX-31.1 - Wave Sync Corp. | v198759_ex31-1.htm |

| EX-31.2 - Wave Sync Corp. | v198759_ex31-2.htm |

| EX-10.12 - Wave Sync Corp. | v198759_ex10-12.htm |

| EX-10.11 - Wave Sync Corp. | v198759_ex10-11.htm |

| EX-10.10 - Wave Sync Corp. | v198759_ex10-10.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the Fiscal Year Ended June 30, 2010

Commission

File Number 001-34113

CHINA

INSONLINE CORP.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

74-2559866

|

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

|

incorporation

or organization)

|

Identification

No.)

|

Flat/Room

42, 4F, New Henry House, 10 Ice House Street, Central, Hong Kong

(Address,

including zip code, of principal executive offices)

(011)

852-25232986

(Registrants’

telephone number, including area code)

Securities

Registered Under Section 12(b) of the Exchange Act:

Title

of each class Common Stock, par value $0.001 per share. Name of

exchange on which registered: The NASDAQ Capital Market.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No

x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange

Act. Yes ¨ No

x

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes x No

¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes ¨ No

¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

Large

accelerated filer ¨ Accelerated

filer ¨

Non-accelerated filer ¨ Smaller Reporting

Company x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes x No

¨

The

aggregate market value of voting stock (which consists solely of shares of

common stock) held by non-affiliates of the registrant (excludes outstanding

shares beneficially owned by directors and officers and treasury shares) as of

December 31, 2009 and June 30, 2010 was approximately $13,097,728 and

$7,382,080, respectively, based upon the closing price of the common stock as

quoted by The NASDAQ Capital Market on such dates.

The

number of outstanding shares of the registrant’s Common Stock on September 30,

2010 was 46,000,000.

CHINA

INSONLINE CORP.

ANNUAL

REPORT ON FORM 10-K

FOR

THE YEAR ENDED JUNE 30, 2010

Index

TABLE OF

CONTENTS

|

PART

I

|

1

|

||

|

ITEM

1.

|

Business

|

1

|

|

|

ITEM

1A.

|

Risk

Factors

|

5

|

|

|

ITEM

1B.

|

Unresolved

Staff Comments

|

5

|

|

|

ITEM

2.

|

Properties

|

5

|

|

|

ITEM

3.

|

Legal

Proceedings

|

6

|

|

|

ITEM

4.

|

(Removed

and Reserved)

|

6

|

|

|

PART

II

|

7

|

||

|

ITEM

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

7

|

|

|

ITEM

6.

|

Selected

Financial Data

|

8

|

|

|

ITEM

7.

|

Management‘s

Discussion and Analysis of Financial Condition and Results of

Operations

|

8

|

|

|

ITEM

7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

10

|

|

|

ITEM

8.

|

Financial

Statements and Supplementary Data

|

10

|

|

|

ITEM

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosures

|

10

|

|

|

ITEM 9A.

|

Controls

and Procedures

|

11

|

|

|

ITEM

9B.

|

Other

Information

|

12

|

|

|

PART

III

|

13

|

||

|

ITEM

10.

|

Directors,

Executive Officers, and Corporate Governance

|

13

|

|

|

ITEM

11.

|

Executive

Compensation

|

15

|

|

|

ITEM

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

17

|

|

|

ITEM

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

17

|

|

|

ITEM

14.

|

Principal

Accountant Fees and Services

|

18

|

|

|

PART

IV

|

18

|

||

|

ITEM

15.

|

Exhibits

and Financial Statement Schedules

|

18

|

PART

I

ITEM

1. Business

Forward

Looking Statements

Statements

contained in this Annual Report on Form 10-K of China INSOnline Corp. (the

“Company” or

“CHIO”) that

are not purely historical are forward-looking statements and are being provided

in reliance upon the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. Words such as “anticipates”, “expects”,

“intends”, “plans”, "believes", "seeks", "estimates" or similar expressions

identify forward-looking statements. These forward-looking statements include

but are not limited to statements regarding the Company’s expectations of our

future liquidity needs, our expectations regarding our future operating results

including our planned increase in our revenue levels and the actions we expect

to take in order to maintain our existing customers and expand our operations

and customer base. All forward-looking statements are made as of the date of

filing this Report and are based on current management expectations and

information available to us as of such date. We assume no obligation to update

any forward-looking statement. It is important to note that actual results could

differ materially from historical results or those contemplated in the

forward-looking statements. Forward-looking statements involve a number of risks

and uncertainties, and include risks associated with our target markets and

risks pertaining to competition, other trend information and our ability to

successfully enhance our operations. All references to “China INSOnline Corp.”,

“us”, “we,” “our” or the “Company” in this Annual Report mean China INSOnline

Corp., a Delaware corporation, and all entities owned or controlled by China

INSOnline Corp., except where it is made clear that the term means only the

parent company. All tabular amounts are stated in US dollars.

History

of the Company

China

INSOnline Corp. was initially incorporated on December 23, 1988 as Lifequest

Medical, Inc. (“DEXT”) as a Delaware

corporation and commenced operations on January 1, 1989 as a distributor of

instruments, equipment and surgical supplies used in hand-assisted laparoscopic

surgery (“HALS”). In

August 1992, we completed our initial public offering of our common stock, par

value $0.001 per share (“Common

Stock”). In March 1999, we acquired Dexterity Incorporated, a

Delaware corporation (“Dexterity”), which

was located in the Philadelphia, Pennsylvania and had the exclusive rights to

the Dexterity Pneumo Sleeve and Dexterity Protractor proprietary instruments,

equipment and supplies used in HALS. In connection with this acquisition, we

changed our name from LifeQuest Medical, Inc. to Dexterity Surgical,

Inc.

On April

19, 2004, DEXT filed a voluntary petition for relief for reorganization (the

“Reorganization”)

under Chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”) in

the United States Bankruptcy Court for the Southern District of Texas Houston

Division. We underwent numerous operating changes and operated our business as a

“debtor-in-possession” under the jurisdiction of the Bankruptcy Court. On

March 2, 2005, the Bankruptcy Court entered an Order confirming its First

Amended Plan of Liquidation. In connection with that Plan, DEXT’s assets

were scheduled to be auctioned, which auction culminated in the sale of

substantially all of DEXT’s assets as approved by the Bankruptcy Court on March

17, 2006. The First Amended Plan of Liquidation was subsequently

amended on March 2, 2006, by an order titled “Order Approving Modification of

the First Amended Plan” (the “Order”). The

amendments provided for in the Order included the Bankruptcy Court’s

authorization of a $50,000 Debtor-In-Possession Loan (the “DIP Loan”) for

payment of administrative expenses of the bankruptcy, which converted into

6,000,000 shares of Common Stock (the “Section 1145 Shares”)

and 3,000,000 warrants (the “Section 1145

Warrants”) under Section 1145 of the U.S. Bankruptcy Code at the option

of the holder(s) of the DIP Loan. Immediately prior to the Exchange (as defined

and discussed in detail herein below), the Section 1145 Warrants were cancelled.

For an additional $125,000, the Bankruptcy Court authorized the sale of

25,000,000 restricted shares of Common Stock to an investor for the payment of

both administrative claims and creditor claims. The Bankruptcy Court also

provided as follows:

|

·

|

All

of the old shares of the Company’s preferred stock, stock options and

warrants shall be (and have been)

cancelled;

|

|

·

|

The

Company shall issue (and did issue) 29,800 new shares of Common Stock

under Section 1145 of the U.S. Bankruptcy

Code;

|

|

·

|

The

Company shall issue up to 25,000 shares of Common Stock under Section 1145

of the U.S. Bankruptcy Code to those persons deemed appropriate by the

Directors (it was not necessary to issue these shares and therefore they

have been cancelled); and

|

1

|

·

|

Appoint

new Board members, amend the Certificate of Incorporation to increase the

authorized shares of Common Stock to 100,000,000, amend the Bylaws, change

the fiscal year, execute a share exchange agreement and issue shares in

which effective control or majority ownership is given, all without

stockholder approval.

|

Pursuant

to the Bankruptcy Court Order, by filing a Certificate of Amendment to the

Certificate of Incorporation, the Company increased its authorized Common Stock,

and effected a 1-for-500 reverse split of all issued and outstanding Common

Stock. Immediately following the Exchange, there were 35,706,250 shares of

Common Stock issued and outstanding and 4,293,750 Section 1145 Shares issuable

pursuant to the Reorganization. As of September 30, 2010, all of the 4,293,750

Section 1145 Shares have been issued and 46,000,000 shares are now issued and

outstanding.

On

December 18, 2007 (the “Closing Date”), the

Company entered into a Share Exchange Agreement (the “Exchange Agreement”)

with Rise and Grow Limited, a Hong Kong limited company (“Rise & Grow”) and

Newise Century Inc., a British Virgin Islands company and sole stockholder of

Rise & Grow (the “Stockholder”). As a

result of the share exchange, DEXT acquired all of the issued and outstanding

securities of Rise & Grow, an inactive holding company, from the Stockholder

in exchange for Twenty-Six Million Four Hundred Thousand (26,400,000)

newly-issued shares of Common Stock, representing 73.94% of DEXT’s issued and

outstanding Common Stock (the “Exchange”) as of the

Closing Date and sixty-six percent (66%) of the total number of issued and

outstanding shares of Common Stock after the issuance of the remaining 4,293,750

“Section 1145” shares. As a result of the Exchange, Rise & Grow became our

wholly-owned and chief operating subsidiary.

On

October 28, 2008, the Company, through its subsidiary, acquired 100% ownership

of Guang Hua Insurance Agency Company Limited (“GHIA”), a limited

liability company organized under the laws of the PRC, in exchange for

US$5,846,244 (RMB40,000,000). GHIA is an insurance agent company

which operates in the PRC.

June

2010 Sale of Subsidiaries

On June

30, 2010, the Company entered into a Share Purchase Agreement (the “Share Purchase

Agreement”) with Hong Kong Jing Nuo International Limited, a Hong Kong

limited company (the “Buyer”), a third

party not affiliated with the Company or any of the Company’s

subsidiaries. Pursuant to the terms of the Share Purchase Agreement,

the Company sold to the Buyer, and the Buyer purchased from the Company (the

“Transaction”)

all of the issued and outstanding ownership shares of Rise & Grow, for

a purchase price equal to US$100,000. As a result of the Transaction, the

Company sold all of its interests in (1) Rise & Grow, (2) New Fortune

Associate (Beijing) Information Technology Co., Ltd. (“NFA”), a limited

liability company organized under the laws of the People’s Republic of China

(the “PRC”) and

a wholly owned subsidiary of R&G, and (3) Beijing ZYTX Technology Co., Ltd

(“ZYTX”), a

Variable Interest Entity (“VIE”) and a limited

liability company organized under the laws of PRC. ZYTX was wholly

controlled by R&G through NFA, through a series of contractual

agreements.

In

anticipation of the Transaction, the Company engaged in an earlier transaction

on June 23, 2010 whereby all the issued and outstanding ownership interest of

Guang Hua Insurance Agency Company Limited (“GHIA”), a limited

liability company organized under the laws of the PRC, which was then a

wholly-owned subsidiary of Rise & Grow through ZYTX acting as its

legal owner in the PRC, were transferred and sold, for consideration received,

to Ever Trend Investment Limited (“ETI”), a Hong Kong

limited company and a wholly owned subsidiary of the Company, and Beijing San

Teng Da Fei Technology Development Co., Ltd. (“STDF”), a company

organized under the laws of the PRC and a VIE controlled by ETI through its

wholly-owned PRC subsidiary Run Ze Yong Cheng (Beijing) Technology Co., Ltd., a

limited liability company organized under the laws of the PRC, pursuant to that

certain Share Purchase Agreement dated as of June 23, 2010 (the “Purchase Agreement”)

by and among Rise & Grow and ZYTX, together as the GHIA seller, and ETI and

STDF, together as the GHIA purchaser. The terms of the Purchase Agreement

allowed the Company to retain its ownership interest in GHIA notwithstanding the

Transaction consummated on June 30, 2010. As a result of the transaction

consummated on June 23, 2010, GHIA became a wholly-owned subsidiary of ETI

through STDF acting as its legal owner in the PRC.

2

A

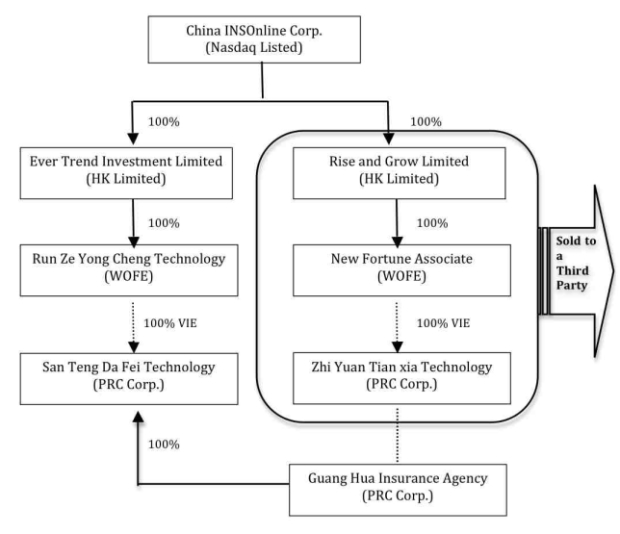

graphical depiction of the Transaction and the transactions under the Purchase

Agreement is as follows:

Also in

connection with the Transaction, the Company’s subsidiary ZYTX entered into a

Tri-party Creditor’s Rights Transfer Agreement (“Creditor’s

Agreement”) with the Company’s subsidiary STDF and a third party, Beijing

Yingtong Jixun Sci-Tech Development Co., Ltd. (“YTJX”), a limited

liability company organized under the laws of the PRC. At the time,

the Company had prepaid approximately US$20.5 million, to YTJX for wireless

Internet terminal products. Pursuant to the Creditor’s Agreement,

ZYTX transferred and sold, for consideration received, a portion of its prepaid

account with YTJX to STDF, with YTJX’s express approval of the transfer.

Concurrently, ZYTX entered into a Software Copyright Transfer Agreement (“Software Agreement”)

with STDF, pursuant to which ZYTX transferred and sold, for consideration

received, certain software, copyright and intellectual property rights to STDF.

As a result of the Creditor’s Agreement and the Software Agreement, the Company

retained the certain assets of ZYTX, whose equity was subsequently sold to a

third party in the Transaction.

3

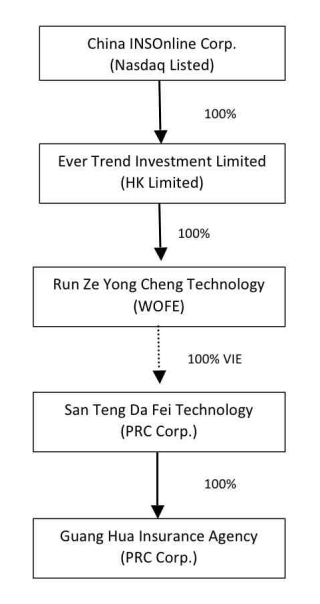

The

structure of the Company after the June 2010 transactions is illustrated as

follows:

Winding

Down of Operations

During

the quarter ended June 30, 2010, the Company began winding down its

operations. During the fourth quarter ended June 30, 2010, the

Company did not have any operating income. The weak economic market,

which resulted in a significant decline in revenues of all areas of the

Company’s business, led to the Company’s decision to wind down its

operations. Thus, the Company currently has no business operations

and is considered a shell company. Management is currently looking to

either sell shares of the Company to a third party through a reverse acquisition

or complete a business combination or other similar transaction.

The

Company currently has some nominal office equipment remaining on the

books. The Company is currently looking for a buyer to purchase these

assets.

Going

Concern

We

received a report from our independent registered public accountants, relating

to our June 30, 2010 audited consolidated financial statements, containing an

explanatory paragraph regarding our ability to continue as a going

concern.

As a

company with no operating business, management believes that the Company will

not be able to generate operating cash flows sufficient to fund its operations

in the next twelve months . Based upon our current limited cash resources and

without the infusion of additional capital, management does not believe the

Company can operate as a going concern beyond one year.

4

Our

consolidated financial statements have been prepared in accordance with

accounting principles generally accepted in the United States of America on a

going concern basis, which contemplates the realization of assets and the

satisfaction of liabilities in the normal course of business. Accordingly, our

consolidated financial statements do not include any adjustments relating to the

recoverability of assets and classification of liabilities that might be

necessary should we be unable to continue as a going concern.

Since

winding down our operations in the quarter ended June 30, 2010, we have had no

continuing business operations. Accordingly, the results of our operations for

years ended June 30, 2010 and 2009 are not comparable.

Business

Operations Prior to Winding Down

Prior to

winding down our operations during the quarter ended June 30, 2010, we were an

Internet services and media company focused on the PRC insurance industry. The

Company primarily offered a network portal through its industry website, www.soobao.cn

(hereinafter also referred to as “Soobao”), to

insurance companies, agents and consumers for advertising, online inquiry, news

circulation, online transactions, statistic analysis and software

development. This primarily entailed the offer of online insurance

products and services in China including (a) a network portal for the Chinese

insurance industry (www.soobao.cn),

offering industry professionals a forum for the advertising and promotion of

products and services, (b) website construction for marketing teams and others

in the insurance industry, (c) software development, (d) insurance agency

services whereby the Company generated sales commissions on motor vehicle

insurance, property insurance and life insurance and (e) accompanying client

support services.

Employees

As of

September 30, 2010, the Company had 7 full-time employees. None of

our employees are covered by a collective bargaining

agreement.

Intellectual

Property

We

currently do not own any trademarks or patents. In April 2007, the Company filed

for its website (www.soobao.cn) with

the Beijing Industrial Commercial Bureau.

Government

Regulation

Because

we currently have no business operations, produce no products nor provide any

services, we are not presently subject to any governmental regulation in this

regard. However, in the event that we complete a business combination

transaction, we will become subject to all governmental approval requirements to

which the reorganized, merged or acquired entity is subject or may become

subject.

ITEM

1A. Risk

Factors

Not

applicable

ITEM

1B. Unresolved

Staff Comments

Not

applicable.

ITEM

2. Properties

GHIA had

one (1) office during the year ended June 30, 2010 at Room 508 Shangdu

International Center, No.8 Dongdaqiao Road, Chaoyang District, Beijing,

China. This was GHIA’s operating office, which consisted of

approximately one hundred and sixty seven (167) square

meters. GHIA paid RMB 18,000 (US$2,698) per month to lease this

office during the fiscal year ended June 30, 2010. At September 30,

2010, GHIA continues to use this same location as its office.

5

ITEM

3. Legal

Proceedings

In the

normal course of business, we are named as defendant in lawsuits in which claims

are asserted against us. In our opinion, the liabilities, if any, which may

ultimately result from such lawsuits, are not expected to have a material

adverse effect on our financial position, results of operations or cash flows.

As of the date of filing this Report, there is no outstanding

litigation.

On March

15, 2010, the Wall Street Transcript Corp. (the “Plaintiff”) filed complaint

against China INSOnline Corp. regarding an invoice of $1,450 that was

outstanding since July 23, 2008, for certain webcasting services provided to the

Company at Collins Stewart Fourth Annual Growth Conference on July 8-10, 2008.

The Company settled with plaintiff on April 26, 2010.

ITEM

4. (Removed and Reserved)

None.

6

PART

II

|

ITEM

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

Our

Common Stock is quoted on the NASDAQ Capital Market under the symbol “CHIO”. The

following table sets forth on a per share basis for the periods shown, the high

and low sales prices of our Common Stock. The quotations reflect inter-dealer

prices, without retail mark-up, mark-down or commission and may not represent

actual transactions.

|

Fiscal Year Ended June 30, 2009

|

Fiscal Year Ended June 30, 2010

|

|||||||||||||||

|

Low

|

High

|

Low

|

High

|

|||||||||||||

|

First

Quarter ended

September 30

|

$ | 3.00 | $ | 4.74 | $ | 0.87 | $ | 1.92 | ||||||||

|

Second

Quarter ended December 31

|

$ | 1.09 | $ | 3.69 | $ | 0.62 | $ | 1.64 | ||||||||

|

Third

Quarter ended

March 31

|

$ | 0.17 | $ | 1.69 | $ | 0.40 | $ | 0.95 | ||||||||

|

Fourth

Quarter ended June 30

|

$ | 0.42 | $ | 2.17 | $ | 0.33 | $ | 0.42 | ||||||||

On

September 30, 2010, the closing price for our common stock, as reported by the

NASDAQ Capital Market, was $0.23 per share

Holders

of Common Equity

As of

September 30, 2010, we have an aggregate of 46,000,000 shares of our Common

Stock issued and outstanding and 251 stockholders of

record.

Dividends

We have

never declared or paid any cash dividends or distributions on our Common Stock.

We currently intend to retain our future earnings to support operations and to

finance future growth and expansion and, therefore, do not anticipate paying any

cash dividends on our Common Stock in the foreseeable future.

Securities

Authorized for Issuance under Equity Compensation Plans

The

following table discloses information as of June 30, 2010 with respect to

compensation plans (including individual compensation arrangements) under

which our equity securities are authorized for issuance.

|

|

|

(a)

|

|

|

(b)

|

|

|

(c)

|

|

|||

|

Plan Category

|

|

Number of securities to

be issued upon exercise of

outstanding options,

warrants and rights

|

Weighted-average

exercise price of

outstanding options,

warrants and rights

|

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a)

|

|

|||||||

|

Equity

Compensation plans approved by security holders

|

-

|

-

|

6,000,000

|

(1) | ||||||||

|

Equity

Compensation plans not approved by security holders

|

-

|

-

|

-

|

|||||||||

|

Total

|

-

|

-

|

6,000,000

|

|||||||||

(1) In

June 2010, the Company’s shareholders approved and adopted the 2010 Stock Option

Plan, which authorized the potential issuance of up to 6,000,000 shares of the

Company’s common stock to employees, directors and

consultants. Options granted under the 2010 Stock Option Plan

generally have a term of ten years from the date of grant unless otherwise

specified in the option agreement. The 2010 Stock Option Plan expires in June

2020.

7

Options

and Warrants

As of

June 30 and September 30, 2010, we had no outstanding options or

warrants.

Transfer

Agent and Registrar

Our

transfer agent is Corporate Stock Transfer, located at 3200 Cherry Creek Drive

South, Suite 430, Denver, Colorado 80209. Their telephone number is (303)

282-4800.

Recent

Sales of Unregistered Securities

On

December 18, 2007 (the “Closing Date”), the

Company entered into a Share Exchange Agreement with Rise & Grow and

Newise Century Inc., a British Virgin Islands company and sole stockholder of

Rise & Grow. As a result of the share exchange, the Company acquired all of

the issued and outstanding securities of Rise & Grow from Newise in exchange

for 26,400,000 newly-issued shares of the Company’s common stock, representing

73.9% of the Company’s issued and outstanding Common Stock as of the Closing

Date. We relied upon the exemption from registration under Rule 506

of Regulation D and Section 4(2) of the Securities Act of 1933, as amended

(“Section 4(2)”), in connection

with this issuance.

On July

8, 2010, the Company issued to two engineering consultants, options to purchase

an aggregate of up to 3,000,000 shares of the Company’s common stock as

compensation for IT consulting and advisory

services. The options had an exercise price of $0.001 per

share and were scheduled to expire on July 8, 2020. On July 19, 2010,

the consultants exercised the options for 3,000,000 shares of the Company’s

common stock. We relied upon the exemption from registration under

Section 4(2) in connection with these issuances.

On July

15, 2010, the Company issued to two financial consultants, options to purchase

an aggregate of up to 3,000,000 shares of the Company’s common stock as

compensation to provide public relationship services in (1) referring the

investment banks, funds, investors and potential merger and acquisition targets

to the Company and assisting the Company in negotiating the contractual terms,

(2) assisting the Company to make a marketing and investor relations plan to

improve the liquidity of stock, (3) arranging road shows for the Company and

meeting with potential investors and potential merger and acquisition targets,

and (4) providing other financial advisory and services as may be agreed upon by

the Consultant and the Company. The options had an

exercise price of $0.001 per share and were scheduled to expire on July 15,

2020. On July 21, 2010, the financial consultants exercised the

options for 3,000,000 shares of the Company’s common stock. We relied

upon the exemption from registration under Section 4(2) in connection with these

issuances.

ITEM

6. Selected Financial Data

Not

applicable.

ITEM

7. Management‘s Discussion and Analysis of Financial Condition and Results

of Operations

Forward

Looking Statements

The

following is management’s discussion and analysis of certain significant factors

which have affected our financial position and operating results during the

periods included in the accompanying consolidated financial statements, as well

as information relating to the plans of our current management. This report

includes forward-looking statements. Generally, the words “ believes ” “

anticipates ”, “ may ”, “ will ”, “ should ”, “ expect ”, “ intend ”, “ estimate

”, “ continue ” and similar expressions or the negative thereof or comparable

terminology are intended to identify forward-looking statements. Such statements

are subject to certain risks and uncertainties, including the matters set forth

in this report or other reports or documents we file with the SEC from time to

time, which could cause actual results or outcomes to differ materially from

those projected. Undue reliance should not be place on these forward-looking

statements which speak only as of the date of filing this Report. We undertake

no obligation to update these forward-looking statements.

The

following discussion and analysis should be read in conjunction with our

consolidated financial statements and the related notes thereto and other

financial information contained elsewhere in this Annual

Report.

8

Overview

China

INSOnline Corp. was incorporated on December 23, 1988 as a Delaware corporation

and commenced operations on January 1, 1989.

During

the quarter ended June 30, 2010, the Company began winding down its

operations.

Sale

of Subsidiaries

On June

30, 2010, the Company entered into a Share Purchase Agreement (the “Share Purchase

Agreement”) with Hong Kong Jing Nuo International Limited, a Hong Kong

limited company (the “Buyer”), a third

party not affiliated with the Company or any of the Company’s

subsidiaries. Pursuant to the terms of the Share Purchase Agreement,

the Company sold to the Buyer, and the Buyer purchased from the Company (the

“Transaction”)

all of the issued and outstanding ownership shares of Rise & Grow, for

a purchase price equal to US$100,000. As a result of the Transaction, the

Company sold all of its interests in (1) Rise & Grow, (2) New Fortune

Associate (Beijing) Information Technology Co., Ltd. (“NFA”), a limited

liability company organized under the laws of the People’s Republic of China

(the “PRC”) and

a wholly owned subsidiary of R&G, and (3) Beijing ZYTX Technology Co., Ltd

(“ZYTX”), a

Variable Interest Entity (“VIE”) and a limited

liability company organized under the laws of PRC. ZYTX was wholly

controlled by R&G through NFA, through a series of contractual

agreements.

In

anticipation of the Transaction, the Company engaged in an earlier transaction

on June 23, 2010 whereby all the issued and outstanding ownership interest of

Guang Hua Insurance Agency Company Limited (“GHIA”), a limited

liability company organized under the laws of the PRC, which was then a

wholly-owned subsidiary of Rise & Grow through ZYTX acting as its

legal owner in the PRC, were transferred and sold, for consideration received,

to Ever Trend Investment Limited (“ETI”), a Hong Kong

limited company and a wholly owned subsidiary of the Company, and Beijing San

Teng Da Fei Technology Development Co., Ltd. (“STDF”), a company

organized under the laws of the PRC and a VIE controlled by ETI through its

wholly-owned PRC subsidiary Run Ze Yong Cheng (Beijing) Technology Co., Ltd., a

limited liability company organized under the laws of the PRC, pursuant to that

certain Share Purchase Agreement dated as of June 23, 2010 (the “Purchase Agreement”)

by and among Rise & Grow and ZYTX, together as the GHIA seller, and ETI and

STDF, together as the GHIA purchaser. The terms of the Purchase Agreement

allowed the Company to retain its ownership interest in GHIA notwithstanding the

Transaction consummated on June 30, 2010. As a result of the transaction

consummated on June 23, 2010, GHIA became a wholly-owned subsidiary of ETI

through STDF acting as its legal owner in the PRC.

Also in

connection with the Transaction, the Company’s subsidiary ZYTX entered into a

Tri-party Creditor’s Rights Transfer Agreement (“Creditor’s

Agreement”) with the Company’s subsidiary STDF and a third party, Beijing

Yingtong Jixun Sci-Tech Development Co., Ltd. (“YTJX”), a limited

liability company organized under the laws of the PRC. At the time,

the Company had prepaid approximately US$20.5 million, to YTJX for wireless

Internet terminal products. Pursuant to the Creditor’s Agreement,

ZYTX transferred and sold, for consideration received, a portion of its prepaid

account with YTJX to STDF, with YTJX’s express approval of the transfer.

Concurrently, ZYTX entered into a Software Copyright Transfer Agreement (“Software Agreement”)

with STDF, pursuant to which ZYTX transferred and sold, for consideration

received, certain software, copyright and intellectual property rights to STDF.

As a result of the Creditor’s Agreement and the Software Agreement, the Company

retained the certain assets of ZYTX, whose equity was subsequently sold to a

third party in the Transaction.

Winding

Down of Operations

During

the quarter ended June 30, 2010, the Company began winding down its

operations. During the fourth quarter ended June 30, 2010, the

Company did not have any operating income. The weak economic market,

which resulted in a significant decline in revenues of all areas of the

Company’s business, led to the Company’s decision to wind down its

operations. Thus, the Company currently has no business operations

and is considered a shell company. Management is currently looking to

either sell shares of the Company to a third party through a reverse acquisition

or complete a business combination or other similar transaction.

The

Company currently has some nominal office equipment remaining on the

books. The Company is currently looking for a buyer to purchase these

assets.

9

Going

Concern

We

received a report from our independent registered public accountants, relating

to our June 30, 2010 audited consolidated financial statements, containing an

explanatory paragraph regarding our ability to continue as a going

concern.

As a

company with no operating business, management believes that the Company will

not be able to generate cash flows sufficient for the next twelve months. Based

upon our current limited cash resources and without the infusion of additional

capital, management does not believe the Company can operate as a going concern

beyond one year.

Our

consolidated financial statements have been prepared in accordance with

accounting principles generally accepted in the United States of America on a

going concern basis, which contemplates the realization of assets and the

satisfaction of liabilities in the normal course of business. Accordingly, our

consolidated financial statements do not include any adjustments relating to the

recoverability of assets and classification of liabilities that might be

necessary should we be unable to continue as a going concern.

As a

result of winding down all our core operations during the quarter ended June 30,

2010, we have classified the results of our operations as discontinued

operations for all periods presented. Accordingly, the results of our operations

for years ended June 30, 2010 and 2009 are not comparable.

LIQUIDITY

AND CAPITAL RESOURCES

As of

June 30, 2010, the Company had approximately $92,092 in cash and cash

equivalents. Since the Company ceased all business operations, in

order for us to continue as a going concern, we hope to obtain necessary

financing by ways of capital injection from potential investors as well as

seeking other growth opportunities by way of merger or acquisition. There can be

no assurance that we will be able to secure additional funding or that, if we

are successful in any of those actions, those actions will produce adequate cash

flow to enable us to meet all our future obligations.

Related

Party Transactions

During

the years ended June 30, 2010 and 2009, the Chairman of the Company, Mr. Wang

Zhenyu, made advances to the Company for working capital purposes. At

June 30, 2010 and 2009, the amount outstanding was $403,600 and $253,506,

respectively. As of September 30, 2010, the amount outstanding was

$317,506. The outstanding amounts are non-interest bearing, unsecured

and have no fixed repayment terms.

Off-balance

Sheet Arrangements

None.

ITEM

7A. Quantitative

and Qualitative Disclosures about Market Risk

Not

applicable.

ITEM

8. Financial Statements and Supplementary Data

Reference

is made to pages F-1 through F-18 comprising a portion of this Annual

Report on Form 10-K.

ITEM

9. Changes in and Disagreements with Accountants on Accounting and

Financial Disclosures

On August

4, 2010 (the “Dismissal Date”),

the Company notified Weinberg & Company, P.A. (“Weinberg”) that it was dismissing

Weinberg as its independent registered public accounting firm, effective

immediately. The Company's Board of Directors approved the dismissal of Weinberg

as the its independent registered public accounting firm. Weinberg

audited the Company's financial statements for the fiscal years ended June 30,

2009 and 2008 and reviewed the subsequent interim quarters through the Dismissal

Date. Weinberg's reports on the Company's financial statements did

not contain an adverse opinion or a disclaimer of opinion, nor were such reports

qualified or modified as to uncertainty, audit scope or accounting principles.

On August 5, 2010, the Company, with the Board's approval, engaged Friedman LLP

(“Friedman”) to serve as its

independent registered public accounting firm to audit the Company’s

consolidated financial statements for the fiscal year ended June 30, 2010 and to

issue a report on the Registrant’s financial statements for such fiscal

year.

10

During

the Company’s most recent two (2) fiscal years, as well as the subsequent

interim period through the Dismissal Date, there were no disagreements on any

matter of accounting principles or practices, financial statement disclosure, or

auditing scope or procedures, which disagreements if not resolved to the

satisfaction of Weinberg would have caused Weinberg to make reference in

connection with its opinion to the subject matter of the

disagreement.

Aside

from the matter identified below, during the Company’s most recent two (2)

fiscal years, as well as the subsequent interim period through the Dismissal

Date, Weinberg did not advise the Company of any of the matters identified in

Item 304(a)(1)(v)(A) - (D) of Regulation S-K. During the most recent

two (2) fiscal years and during the subsequent interim period through the

Dismissal Date, there was one “reportable event,” as defined in Regulation S-K

Item 304(a)(1)(v). In performing the audit of the Company’s consolidated

financial statements for the fiscal year ended June 30, 2009, Weinberg advised

the Company’s management and the Board of Directors that it had identified the

following material weakness: there was a lack of sufficient accounting staff

which resulted in a lack of effective controls necessary for a good system of

internal control for financial reporting and there was a weakness in the

internal controls relating to the financial statement closing process which

resulted primarily from the fact that certain parts of the work of the Company’s

accounting staff may not be monitored or reviewed correctly. The material

weakness described above existed on June 30, 2009 and continued to exist as of

June 30, 2010. For a further discussion of the foregoing material

weakness please refer to Item 9A of this Report.

ITEM

9A. Controls

and Procedures

Evaluation

of Disclosure Controls and Procedures

Our

management, principally our chief financial officer and chief executive officer,

evaluated the effectiveness of our disclosure controls and procedures as of the

end of June 30, 2010. Based on that evaluation, our management

concluded that our disclosure controls and procedures as of June 30, 2010 were

not effective such that the information required to be disclosed by us in

reports filed under the Securities Exchange Act of 1934 was not recorded,

processed, summarized and reported within the time periods specified in the

SEC’s rules and forms. Thus, our disclosure controls and procedures

did not include, without limitation, controls and procedures designed to ensure

that information required to be disclosed by us in reports that we file or

submit under the Securities Act were accumulated and communicated to our

management, including our chief executive officer and chief financial officer,

as appropriate to allow timely decisions regarding disclosure. In

particular, we have identified the following material weakness of our internal

controls:

|

|

·

|

There

is a lack of sufficient accounting staff which results in a lack of

effective controls necessary for a good system of internal control on

financial reporting.

|

|

|

·

|

There

was a weakness in the internal control of the financial statements closing

system. This resulted primarily from the fact that certain

parts of the work of our accounting staff and consultant may not be

monitored or adequately reviewed.

|

|

|

·

|

Our

company’s accounting staff does not have sufficient technical accounting

knowledge relating to accounting for complex U.S. GAAP

matters.

|

Management’s

Annual Report on Internal Control over Financial Reporting

Our

management is responsible for establishing and maintaining adequate “internal

control over financial reporting” (as defined in Rules 13a-15(f) and 15d-15(f)

under the Securities and Exchange Act of 1934, as amended) for the

Company.

In order

to determine whether our internal control over financial reporting is effective,

management has assessed such internal control over financial reporting as of

June 30, 2010. This assessment was based on criteria for effective

internal control over financial reporting described in Internal Control –

Integrated Framework issued by the Committee of Sponsoring Organizations of the

Treadway Commission (“COSO”).

In

performing this assessment, management has identified the following material

weaknesses as of June 30, 2010:

|

|

·

|

There

is a lack of sufficient accounting staff which results in a lack of

effective controls necessary for a good system of internal control on

financial reporting.

|

11

|

|

·

|

There

was a weakness in the internal control of the financial statements closing

system. This resulted primarily from the fact that certain

parts of the work of our accounting staff and consultant may not be

monitored or adequately reviewed.

|

|

|

·

|

Our

company’s accounting staff does not have sufficient technical accounting

knowledge relating to accounting for complex US GAAP

matters.

|

As a

result of the material weakness in our internal control over financial

reporting, our management concluded that our internal control over financial

reporting as of June 30, 2010, was not effective based on the criteria set forth

by COSO in Internal Control – Integrated Framework. A material

weakness in internal control over financial reporting is a deficiency, or a

combination of deficiencies, in internal control over financial

reporting. This control deficiency could result in a misstatement of

the presentation and disclosure of our statement of operations that would result

in a material misstatement in our annual or interim financial statements that

would not be prevented or detected. Accordingly, management

determined that this control deficiency constitutes a material weakness in our

internal control over financial reporting as of June 30,

2010. Notwithstanding the existence of such material weakness in our

internal controls over financial reporting, our management, including our Chief

Executive Officer, believe that the financial statements included in this report

fairly present in all material respects our financial condition, results of

operations and cash flows for the periods presented.

This

annual report does not include an attestation report of the company's registered

public accounting firm regarding internal control over financial

reporting. Management's report was not subject to attestation by the

company's registered public accounting firm pursuant to rules of the

Securities and Exchange Commission that permit the company to provide only

management's report in this annual report.

Changes

in Internal Control Over Financial Reporting

There

have been no changes in our internal control over financial reporting during the

quarter ended June 30, 2010 that has materially affected, or is reasonably

likely to materially affect, our internal controls over financial

reporting.

Currently,

the Company’s lack of income and finances has limited its ability to implement

any changes to its internal control over financial reporting and remedy the

material weaknesses that have been identified as of June 30,

2010. However, in the future, if its financial position allows it,

the Company may consider changing its internal control over financial reporting

to improve the situation.

ITEM

9B. Other

Information

On May 1,

2010, Mr. William Han resigned as the President of the Company due to personal

reasons. Mr. Han’s resignation was not a result of any disagreement with the

Company or any other matter.

12

PART

III

ITEM

10. Directors,

Executive Officers, and Corporate Governance

Directors

and Executive Officers

As of

September 30, 2010, set forth below in the table as well as in the subsection

entitled “Biographies” are the names of our directors and officers, their ages,

all positions and offices that they hold with the Company, the period during

which they have served as such, and their business experience during at least

the last five (5) years. The Company has no “significant

employees.”

|

Name

|

|

Age

|

|

Position(s)

|

|

Zhenyu

Wang

|

40

|

Chairman

of the Board and Chief Executive Officer

|

||

|

Mingfei

Yang

|

27

|

Chief

Financial Officer

|

||

|

Yuefeng

Wang

|

42

|

Director

|

||

|

Yinan

Zhang

|

29

|

Director

|

||

|

Xiaoshuang

Chen

|

46

|

Director

|

||

|

Renbin

Yu

|

47

|

Director

|

||

|

Yong

Bian

|

37

|

Director

|

Family

Relationships

There are

no family relationships between or among the members of the Board of Directors

or other executives. None of our directors and officers are directors or

executive officers of any company that files reports with the

SEC.

Biographies

(Business Experience)

Zhenyu Wang. Mr. Wang has

served as Chairman of the Board of the Company since January 4, 2008 and as its

Executive Director since September 2010. From 2007 through 2010, Mr.

Wang served as the Chairman and Chief Executive Officer of ZYTX. From

2004 through 2009, Mr. Wang also served as Chairman of Huayuan Runtong (Beijing)

Science and Technology Co., Ltd., General Manager of Huayuan Kaituo (Beijing)

Science and Technology Co., Ltd., Chairman of Beijing Putaika Guarding

Technology Co., Ltd. From 2001 through 2009, Mr. Wang served as Chairman of

Beijing Jinzheng Wantong Network Technology Development Co., Ltd. Prior to this,

Mr. Wang served as Chairman of Kaixin Jiye Investment Management Co., Ltd. from

November 1994 through July 2001. Mr. Wang earned a master’s degree (EMBA) from

Peking University. The Company believes that Mr. Wang has the

qualifications and skills to serve as a Director based upon his technological

and business expertise and his years of experience in executive and managerial

positions with the Company and previous positions.

Mingfei Yang. Mr. Yang has

served as Chief Financial Officer of the Company since January 4, 2008 and has

served as Financial Department Manager of ZYTX since May 2007. Prior to that,

Mr. Yang worked as an accountant for Hua Yuan Run Tong (Beijing) Technology Co.,

Ltd. from June 2005 through May 2007, for Mongolia Guo Li Industries Co., Ltd.

from April 2003 through June 2005 and for Mongolia Xiao Fei Yang Food Chain Co.,

Ltd. from September 2002 through March 2003. Mr. Yang earned his Academic Degree

in Finance and Tax at Inner Mongolia Financial Institute.

Yuefeng Wang. Mr. Wang has

served as a Director of the Company since January 4, 2008 and he has served as

Chairman of Hua Yuan Run Tong (Beijing) Technology Co., Ltd. since February

2007. From March 2005 through January 2007 Mr. Wang served as Chairman,

Assistant and HR Director of Hua Yuan Run Tong (Beijing) Technology Co., Ltd.

Prior to that, Mr. Wang served as the HR Supervisor of Beijing Panasonic &

Putian Communications Equipment Co., Ltd. from August 2004 through February

2005. Prior to that, Mr. Wang served as President, Assistant and Manager of the

HR Department at BaoDing Chang An Car Manufacturing Co., Ltd. from July 1997

through August 2002. Mr. Wang earned his MBA at Tsinghua

University. The Company believes that Mr. Wang has the qualifications

and skills to serve as a Director based upon his accounting and finance

expertise; his more than 15 years experience in the industry; and his experience

in executive and managerial positions.

13

Yinan Zhang. Ms. Zhang has

served as a Director of the Company since January 4, 2008 and currently serves

as president of Nautilus Creative Co., Ltd since June 2007. Prior to that, Ms.

Zhang served as Editor of Travel & Leisure Magazine, Chinese Edition from

October, 2006 through June, 2007, Prior to that, Ms. Zhang served as Editor of

Shanghai Weekly from October,2002 through September, 2003. Ms. Zhang earned her

masters degree in Arts et Sciences de l’enregistrement at the Université de

Marne-la-Vallée, France. The Company believes that Ms. Zhang has the

qualifications and skills to serve as a Director based upon her significant

business experience, including a diversified background of managing and

directing insurance related companies.

Xiaoshuang Chen. Mr. Chen has

served as a Director of the Company since July 16, 2009. Mr. Chen

recently served as Vice President of China Information Technology Development

Ltd., a Hong Kong listed company, since August 2008. Prior to that,

from September 2006 to July 2008, Mr. Chen served as Deputy General Manager of

the Henan Lantian Group in the Henan Province of China. From July

2001 to August 2006, Mr. Chen was employed by the XinAo Group to work for a

number of its subsidiaries. During this time, Mr. Chen served as Director and

Deputy General Manager of Hebei Veyong Bio-Chemical Co. Ltd., Chief Human

Resources Director of the XinAo Group, and Deputy General Manager of XinAo Gas

Holdings Limited. Mr. Chen earned a master’s degree (EMBA) from

Peking University. The Company believes that Mr. Chen has the

qualifications and skills to serve as a Director based upon his significant

business experience, including managing an insurance related technology

company.

Renbin Yu. Mr. Yu has served

as a Director of the Company since July 16, 2009. Mr. Yu recently

served as Chairman of the Dalian Wanshan Golf Club since October

2006. Prior to that, from July 2005 to October 2006, Mr. Yu has

served as General Manager of Dalian Water Sports Tourism Co. From

September 1983 to July 2005, Mr. Yu served as Deputy Director of the Urban

Construction Bureau of Dalian. Mr. Yu is Business Administration

graduate from Tsinghua University. The Company believes that Mr. Yu

has the qualifications to serve as a Director based upon his education, along

with his wide range of business expertise, including a diversified background of

managing and directing insurance technology related companies.

Yong Bian. Mr. Bian

has served as a Director of the Company since June 29, 2010. Since

2009, Mr. Bian also served as the Deputy General Manager of New Fortune

Associate (Beijing) Information Technology Co., Ltd., formerly a wholly owned

subsidiary of our Company. Prior to that, from July 2007 to August 2009, Mr.

Bian was a Business Development Director at Beijing Holdings Information

Development Co., Ltd. and from July 2004 to July 2007 as a Senior Consultant at

Beijing Ninesage Consulting Co., Ltd. Mr. Bian earned a Bachelor of Science

degree from Da Lian University of Technology in 1993 and a MBA degree from

TsingHua University in 2004. The Company believes that Mr. Bian has the

qualifications and skills to serve as a Director based upon his significant

business experience, including managing an insurance technology related

company.

Section

16(a) Beneficial Ownership Reporting Compliance

Based

solely on a review of the copies of such forms furnished to us, we believe that

during the fiscal year ended June 30, 2010 all officers, directors and ten

percent (10%) beneficial owners who were subject to the provisions of Section

16(a) complied with all of the filing requirements during the year with the

exception of: (1) Xiaoshuang Chen failed to timely file one Form 3,

(2) Renbin Yu failed to timely file one Form 3, and (3) Yong Bian failed to

timely file one Form 3.

Code

of Ethics

We have

adopted a Code of Ethics, as required by the rules of the SEC and NASDAQ. Our

Code of Ethics is referenced as Exhibit 14.1 hereto, and applies to all of our

directors, officers and employees. We will provide to any person upon

request, without charge, a copy of the Code of Ethics. Such request is to be

submitted in writing to us at: China INSOnline Corp., Attention: Zhenyu Wang,

Room 42, 4F, New Henry House, 10 Ice House Street, Central, Hong

Kong.

Nomination

Procedures

There

were no material changes to the procedures by which security holders may

recommend nominees to our board of directors since filing the proxy statement on

Schedule 14A with the SEC on June 15, 2010.

Audit

Committee

We have

an audit committee established by and amongst our board of directors for the

purpose of overseeing our accounting and financial reporting processes and

audits of our financial statements. This Audit Committee is comprised of Mr.

Yuefeng Wang, Mr. Yinan Zhang and Mr. Xiaoshuang Chen. Our Board of Directors

has determined that Yuefeng Wang qualifies as an audit committee financial

expert. This qualification is based upon his education and experience, more

fully described above in his biography. Mr. Wang is independent as defined for

audit committee members under the NASDAQ Marketplace Rules.

14

|

ITEM 11.

|

Executive

Compensation

|

Summary

Compensation Table

The

following table sets forth compensation information for services rendered by our

chief executive officer during the last two (2) completed fiscal years (ended

June 30, 2010 and 2009). No other officer received more than $100,000 in total

compensation during those years.

Summary Compensation

Table

|

Name And

Principal

Function

|

Year

|

Salary

|

Bonus

|

Stock

Awards

|

Option

Awards

|

Non-Equity

Incentive

Plan

Compensation

|

Nonqualified

Deferred

Compensation

Earnings

|

All Other

Compensation

|

Total

|

|||||||||||||||||||||||||

|

(a)

|

(b)

|

($)

(c)

|

($)

(d)

|

($)

(e)

|

($)

(f)

|

($)

(g)

|

($)

(h)

|

($)

(i)

|

($)

(j)

|

|||||||||||||||||||||||||

|

Junjun

Xu,

Chief

Executive

Officer(1)

|

2009

|

37,554 | -0- | -0- | -0- | -0- | -0- | -0- | 37,554 | |||||||||||||||||||||||||

|

2010

|

14,155 | -0- | -0- | -0- | -0- | -0- | -0- | 14,155 | (2) | |||||||||||||||||||||||||

|

(1)

|

Ms.

Xu resigned from her positions as Chief Executive Officer and as a

director on September 1, 2010.

|

|

(2)

|

The

disparity in Ms. Xu’s compensation between fiscal 2009 and 2010 is the

result of a voluntary pay cut, which was taken in response to the

Company’s declining financial

status.

|

Outstanding

Equity Awards At Fiscal Year End

None.

15

Compensation

of Directors

The

Registrant’s directors received compensation for their services as directors for

the years ended June 30, 2010 and June 30, 2009 are shown as table

below. In addition, all directors are reimbursed for out-of-pocket

expenses in connection with attendance at Board’s and/or committee

meetings.

|

DIRECTOR COMPENSATION

|

||||||||||||||||||||||||||||

|

Name

|

Fees

Earned

or Paid in

Cash

|

Stock

Awards

|

Option

Awards

|

Non-Equity

Incentive Plan

Compensation

|

Nonqualified

Deferred

Compensation

Earnings

|

All Other

Compensation

|

Total

|

|||||||||||||||||||||

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

||||||||||||||||||||||

|

EXISTING:

|

||||||||||||||||||||||||||||

|

Zhenyu

Wang

|

||||||||||||||||||||||||||||

|

2009

|

14,641 | - 0 - | - 0 - | - 0 - | - 0 - | - 0 - | 14,641 | |||||||||||||||||||||

|

2010

|

-0- | -0- | -0- | -0- | -0- | -0- | -0- | (1) | ||||||||||||||||||||

|

Yuefeng

Wang

|

||||||||||||||||||||||||||||

|

2009

|

14,641 | - 0 - | - 0 - | - 0 - | - 0 - | - 0 - | 14,641 | |||||||||||||||||||||

|

2010

|

-0- | -0- | -0- | -0- | -0- | -0- | -0- | (1) | ||||||||||||||||||||

|

Yinan

Zhang

|

||||||||||||||||||||||||||||

|

2009

|

14,641 | - 0 - | - 0 - | - 0 - | - 0 - | - 0 - | 14,641 | |||||||||||||||||||||

|

2010

|

-0- | -0- | -0- | -0- | -0- | -0- | -0- | (1) | ||||||||||||||||||||

|

Xiaoshuang

Chen

|

||||||||||||||||||||||||||||

|

2009

|

- 0 - | - 0 - | - 0 - | - 0 - | - 0 - | - 0 - | - 0 - | |||||||||||||||||||||

|

2010

|

-0- | -0- | -0- | -0- | -0- | -0- | -0- | (1) | ||||||||||||||||||||

|

Renbin

Yu

|

||||||||||||||||||||||||||||

|

2009

|

- 0 - | - 0 - | - 0 - | - 0 - | - 0 - | - 0 - | - 0 - | |||||||||||||||||||||

|

2010

|

-0- | -0- | -0- | -0- | -0- | -0- | -0- | (1) | ||||||||||||||||||||

|

Yong

Bian

|

||||||||||||||||||||||||||||

|

2009

|

- 0 - | - 0 - | - 0 - | - 0 - | - 0 - | - 0 - | - 0 - | |||||||||||||||||||||

|

2010

|

-0- | -0- | -0- | -0- | -0- | -0- | -0- | (1) | ||||||||||||||||||||

|

RESIGNED:

|

||||||||||||||||||||||||||||

|

Junjun

Xu

|

||||||||||||||||||||||||||||

|

2009

|

14,641 | - 0 - | - 0 - | - 0 - | - 0 - | - 0 - | 14,641 | |||||||||||||||||||||

|

2010

|

-0- | -0- | -0- | -0- | -0- | -0- | -0- | (1) | ||||||||||||||||||||

|

Chunsheng

Zhou

|

||||||||||||||||||||||||||||

|

2009

|

14,641 | - 0 - | - 0 - | - 0 - | - 0 - | - 0 - | 14,641 | |||||||||||||||||||||

|

2010

|

-0- | -0- | -0- | -0- | -0- | -0- | -0- | (1) | ||||||||||||||||||||

(1) Due

to the Company’s declining financial status during the fiscal year ended June

30, 2010, each of the directors agreed to serve on the Company’s board without

receipt of any compensation.

Employment

Agreements

On

September 1, 2010, pursuant to his appointment as chief executive officer, the

Company and Mr. Wang entered into an employment agreement whereby Mr. Wang will

receive an annual salary of $240,000. In return Mr. Wang will devote his full

time and attention to the Company and during his employment will not engage in

any other business activities. (The employment agreement does not prohibit Mr.

Wang from investing in other businesses, provided that, such investments do not

require his active involvement in such companies’ operations.) In addition Mr.

Wang agreed that during his employment he will not disclose confidential

information, including trade secrets, outside the Company. The Company may

terminate Mr. Wang’s employment upon 30 days prior written notice, thereupon the

Company must provide Mr. Wang a severance payment of $20,000 at termination. Mr.

Wang may also terminate his employment upon 30 days prior written notice,

however, in such event a severance payment will not be made. The Company may

also terminate Mr. Wang’s employment upon 30 days prior written notice if the

Company undergoes a change of control, dissolution or bankruptcy

event.

16

|

ITEM

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

The

following table sets forth each person known by us to be the beneficial owner of

five (5%) percent or more of the Common Stock of the Company, all directors

individually and all directors and officers as a group as of September 30, 2010.

Each person named below has sole voting and investment power with respect to the

shares shown unless otherwise indicated.

|

Name and Address of

Beneficial Owner(1)

|

Amount of

Direct

Ownership

|

Amount of

Indirect

Ownership

|

Total

Beneficial

Ownership

|

Percentage of

Class(2)

|

||||||||||||

|

Zhenyu

Wang, Chairman of the Board

|

16,008,960 | - | 16,008,960 | 34.8 | % | |||||||||||

|

Mingfei

Yang, Chief Financial Officer

|

- | - | - | - | % | |||||||||||

|

Yuefeng

Wang, Director

|

- | - | - | - | % | |||||||||||

|

Yinan

Zhang, Director

|

- | - | - | - | % | |||||||||||

|

Xiaoshuang

Chen, Director

|

- | - | - | - | % | |||||||||||

|

Renbin

Yu, Director

|

- | - | - | - | % | |||||||||||

|

Yong

Bian, Director

|

- | - | - | - | % | |||||||||||

|

All

directors and officers as a group (7 persons)

|

16,008,960 | 16,008,960 | 34.8 | % | ||||||||||||

|

5%

Shareholders

|

||||||||||||||||

|

Yanling

Chen

Room

704, Zhenxing District Yijing Street, 33# No.2,

Dandong

City, Liaoning Province, China

|

2,999,040 | - | 2,999,040 | 6.5 | % | |||||||||||

|

Junjun

Xu

|

5,280,000 | - | 5,280,000 | 11.5 | % | |||||||||||

|

Room

807, Block A, Ding Xiu Xin Yuan

No

1.Nanli Shiliu Yuan, Fengtai District

Beijing,

100075 , China

|

||||||||||||||||

(1) Unless

otherwise noted, each beneficial owner has the same address as the

Company.

(2) Beneficial

ownership is determined in accordance with the rules of the Securities and

Exchange Commission. Under those rules and for purposes of the table above (a)

if a person has decision making power over either the voting or the disposition

of any shares, that person is generally deemed to be a beneficial owner of those

shares; (b) if two or more persons have decision making power over either the

voting or the disposition of any shares, they will be deemed to share beneficial

ownership of those shares, in which case the same shares will be included in

share ownership totals for each of those persons; and (c) if a person held

options to purchase shares that were exercisable on, or became exercisable

within 60 days of September 30, 2010, that person will be deemed to be the

beneficial owner of those shares and those shares (but not shares that are

subject to options held by any other stockholder) will be deemed to be

outstanding for purposes of computing the percentage of the outstanding shares

that are beneficially owned by that person.

|

ITEM 13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

Transactions

With Related Persons

During

the years ended June 30, 2010 and 2009, the Chairman of the Company, Mr. Wang

Zhenyu, made advances to the Company for working capital purposes. At

June 30, 2010 and 2009, the amount outstanding was $403,600 and $253,506,

respectively. As of September 30, 2010, the amount outstanding was

$317,506. The outstanding amounts are non-interest bearing, unsecured

and have no fixed repayment terms.

17

Director

Independence

The

following directors are independent pursuant to NASDAQ rules and the rules of

the SEC: Yinan Zhang, Yuefeng Wang, Renbin Yu and Xiaoshuang Chen. The following

directors are not independent: Zhenyu Wang and Yong Bian. All of the members of

our Audit Committee, Compensation Committee and Nominating Committee are

independent pursuant to the NASDAQ rules.

|

ITEM 14.

|

Principal

Accountant Fees and Services

|

The

following is a summary of the fees billed to us by Friedman LLP and Weinberg

& Company, P.A. for services rendered to us with respect to the fiscal years

ended June 30, 2010 and 2009, respectively:

|

Friedman LLP

|

Weinberg & Company, P.A.

|

Weinberg & Company, P.A.

|

||||||||||

|

Fee Category

|

Fiscal Year Ended June 30, 2010

|

Fiscal Year Ended June 30, 2010

|

Fiscal Year Ended June 30, 2009

|

|||||||||

|

Audit

Fees

|

$ | 110,000 | $ | 75,000 | $ | 182,000 | ||||||

|

Audit-related

fees

|

- | - | - | |||||||||

|

Tax

fees

|

- | - | - | |||||||||

|

All

other fees

|

- | - | - | |||||||||

|

Total

Fees

|

$ | 110,000 | $ | 75,000 | $ | 182,000 | ||||||

Audit Fees. The fees for

services rendered by Friedman LLP were for the audit of our consolidated

financial statements included in our Annual Report on Form 10-K for the year

ended June 30, 2010. Weinberg & Company, P.A.’s fees for services were for

the audit of our consolidated financial statements included in our Annual Report

on Form 10-K for the year ended June 30, 2009, and reviews of our interim

condensed consolidated financial statements included in our three Quarterly

Reports on Form 10-Q during each of the years ended June 30, 2010 and 2009.

Audit fees for both firms included services that are normally provided by them

in connection with regulatory filings or engagements, including consents

provided with respect to registration statements we filed with the Securities

and Exchange.

Audit

Committee Pre-Approval

The

policy of the Audit Committee is to pre-approve all audit and non-audit services

provided by the independent accountants. These services may include audit

services, audit-related services, tax fees, and other services. Pre-approval is

generally provided for up to one year and any pre-approval is detailed as to the

particular service or category of services. The Audit Committee has delegated

pre-approval authority to certain committee members when expedition of services

is necessary. The independent accountants and management are required to

periodically report to the full Audit Committee regarding the extent of services

provided by the independent accountants in accordance with this pre-approval

delegation, and the fees for the services performed to date. All of the services

described above in this Item 14 were approved in advance by the Audit Committee

during the fiscal year ended June 30, 2010.

PART

IV

|

ITEM 15.

|

Exhibits

and Financial Statement Schedules

|

|

|

(a)

|

Financial

Statements and Schedules

|

The

financial statements are set forth under Item 8 of this Annual Report.

Financial statement schedules have been omitted since they are either not

required, not applicable, or the information is otherwise included.

18

|

|

(b)

|

Exhibits

|

|

EXHIBIT

NO.

|

|

DESCRIPTION

|

|

LOCATION

|

|

3.1

|

Certificate

of Incorporation (as amended) of Dexterity Surgical, Inc.

|

Incorporated

by reference to the Company’s Current Report on Form 8-K as filed with the

SEC on December 20, 2007

|

||

|

3.2

|

Certificate

of Amendment to the Company’s Certificate of Incorporation, dated February

26, 2008

|

Incorporated

by reference to the Company’s Quarterly Report on Form 10-Q for the period

ended March 31, 2008

|

||

|

3.3

|

Amended

and Restated Bylaws of the Company

|

Incorporated

by reference to the Company’s Quarterly Report on Form 10-Q for the period

ended March 31, 2008

|

||

|

3.4

|

Certificate

of Incorporation of Rise and Grow Limited

|

Incorporated

by reference to the Company’s Current Report on Form 8-K as filed with the

SEC on December 20, 2007

|

||

|

3.5

|

Certificate

of Incorporation of ZBDT (Beijing) Technology Co., Ltd.

|

Incorporated

by reference to the Company’s Current Report on Form 8-K as filed with the

SEC on December 20, 2007

|

||

|

3.6

|

Company

Charter of ZBDT (Beijing) Technology Co., Ltd.

|

Incorporated

by reference to the Company’s Current Report on Form 8-K as filed with the

SEC on December 20, 2007

|

||

|

10.1

|

Share

Exchange Agreement, dated December 17, 2007, by and among Dexterity

Surgical, Inc., Rise and Grow Limited and Newise Century

Inc.

|

Incorporated

by reference to the Company’s Current Report on Form 8-K as filed with the

SEC on December 20, 2007

|

||

|