Attached files

Table of Contents

As filed with the Securities and Exchange Commission on October 8, 2010

Registration No. 333-168504

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

HORIZON PHARMA, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 27-2179987 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1033 Skokie Boulevard, Suite 355 Northbrook, Illinois 60062

(224) 383-3000

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Timothy P. Walbert

Chairman, President and Chief Executive Officer

Horizon Pharma, Inc.

1033 Skokie Boulevard, Suite 355 Northbrook, Illinois 60062

(224) 383-3000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Lynda Kay Chandler, Esq. Barbara L. Borden, Esq. Cooley LLP 4401 Eastgate Mall San Diego, California 92121 (858) 550-6000 |

Cheston J. Larson, Esq. Divakar Gupta, Esq. Matthew T. Bush, Esq. Latham & Watkins LLP 12636 High Bluff Drive Suite 400 San Diego, California 92130 (858) 523-5400 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1) |

Amount of registration fee |

|||||

| Common Stock, $0.0001 par value per share |

$ | 86,250,000 | $ | 6,149.63 | (2) | ||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Includes the offering price of shares that the underwriters have the option to purchase to cover overallotments, if any. |

| (2) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 8, 2010

Preliminary Prospectus

Shares

Common Stock

We are offering shares of our common stock. This is our initial public offering, and no public market currently exists for our common stock. We expect the initial public offering price to be between $ and $ per common share. We have applied to list our common stock on The NASDAQ Global Market under the symbol “HZNP.”

Investing in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| PER SHARE | TOTAL | |||

| Public Offering Price |

$ | $ | ||

| Underwriting Discounts and Commissions |

$ | $ | ||

| Proceeds to Horizon (Before Expenses) |

$ | $ |

Delivery of the shares of common stock is expected to be made on or about , 2010. We have granted the underwriters an option for a period of 30 days to purchase, on the same terms and conditions set forth above, up to an additional shares of our common stock to cover overallotments, if any. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ and the total proceeds to us, before expenses, will be $ .

| Jefferies & Company | Piper Jaffray | |

| JMP Securities | Lazard Capital Markets | |

Prospectus dated , 2010

Table of Contents

Table of Contents

| Page | ||

| 1 | ||

| 9 | ||

| 38 | ||

| 39 | ||

| 39 | ||

| 39 | ||

| 40 | ||

| 42 | ||

| Unaudited Pro Forma Condensed Consolidated Financial Information |

44 | |

| 53 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

55 | |

| 76 | ||

| 100 | ||

| 106 | ||

| 123 | ||

| 130 | ||

| 134 | ||

| 139 | ||

| 141 | ||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders |

144 | |

| 147 | ||

| 147 | ||

| 147 | ||

| F-1 |

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus is only accurate on the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

Until , 2010 (25 days after the date of this prospectus), all dealers that buy, sell, or trade in our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to unsold allotments or subscriptions.

For investors outside the United States: We have not and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors” as well as our consolidated financial statements and the related notes appearing at the end of this prospectus, before making an investment decision.

Our Company

We are a biopharmaceutical company that is developing and commercializing innovative medicines to target unmet therapeutic needs in arthritis, pain and inflammatory diseases. We have two lead product candidates, HZT-501 and LODOTRA®, which have both successfully completed multiple Phase 3 clinical trials. In 2006, we reached agreement with the U.S. Food and Drug Administration, or FDA, on a special protocol assessment, or SPA, with respect to the clinical development plan for HZT-501. We submitted a new drug application, or NDA, for HZT-501, a novel tablet formulation containing a fixed-dose combination of ibuprofen and high-dose famotidine in a single pill, to the FDA in March 2010. We intend to submit a Marketing Authorization Application, or MAA, for HZT-501 in the United Kingdom, the Reference Member State, through the Decentralized Procedure in the fourth quarter of 2010. LODOTRA is a proprietary programmed release formulation of low-dose prednisone that is currently marketed in Europe by our distribution partners, Merck Serono GmbH, or Merck Serono, and Mundipharma International Corporation Limited, or Mundipharma. We intend to submit an NDA for LODOTRA to the FDA in the fourth quarter of 2010. We have worldwide marketing rights for HZT-501 and have retained exclusive marketing rights for all of our products in the U.S.

HZT-501 is a novel combination of 800 mg ibuprofen and 26.6 mg famotidine in a single pill. Ibuprofen is one of the most widely prescribed non-steroidal anti-inflammatory drugs, or NSAIDs, worldwide and famotidine is a well-established gastrointestinal, or GI, agent used to treat dyspepsia, gastroesophageal reflux disease, or GERD, and active ulcers, and to reduce the risk of NSAID-induced upper GI ulcers. We have completed two pivotal Phase 3 clinical trials of HZT-501 under an SPA with the FDA in a total of over 1,500 patients with mild to moderate pain or arthritis that demonstrated a statistically significant reduction in the incidence of NSAID-induced upper GI ulcers when treated with HZT-501 versus ibuprofen alone. Based on these results, we submitted an NDA to the FDA in March 2010 requesting approval to market HZT-501 for reducing the risk of developing NSAID-induced upper GI ulcers in patients with mild to moderate pain and arthritis that require use of an NSAID. The FDA notified us in May 2010 that it had accepted the NDA for review and subsequently assigned a Prescription Drug User Fee Act, or PDUFA, goal date of January 21, 2011 for its review of the NDA.

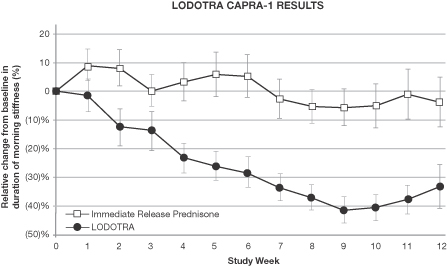

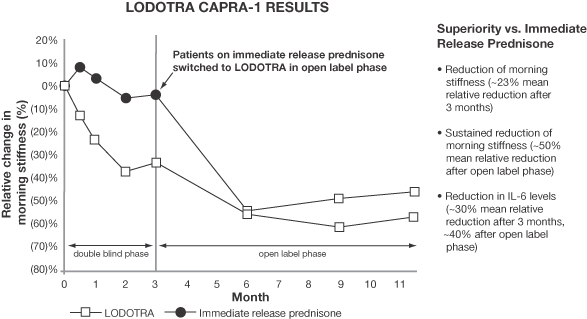

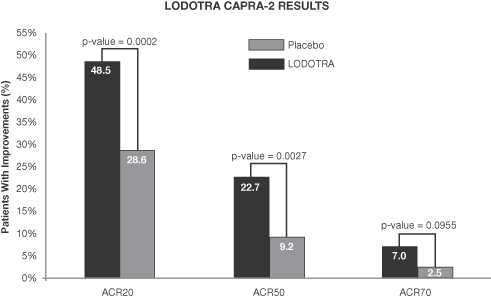

LODOTRA, a proprietary programmed release formulation of low-dose prednisone, has received regulatory approval in Europe for the reduction of morning stiffness associated with rheumatoid arthritis, or RA. Prednisone is a drug used to inhibit the production of various pro-inflammatory cytokines, which are proteins associated with joint inflammation in RA. We have completed two pivotal Phase 3 clinical trials of LODOTRA in a total of over 600 patients with RA. The first pivotal Phase 3 trial supported the approval of LODOTRA in Europe in March 2009 where it is currently approved for marketing in 13 European countries. The second pivotal Phase 3 clinical trial was designed to support an NDA submission for U.S. marketing approval. LODOTRA achieved statistically significant results and met the primary endpoint in each of the two pivotal Phase 3 clinical trials.

We are focusing our efforts and capital resources on obtaining approval for and commercializing HZT-501 and LODOTRA. In addition to those product candidates, we have a pipeline of earlier stage product candidates to treat pain-related diseases and chronic inflammation. We are currently evaluating the development pathway for these product candidates, but do not intend to develop them further until such time as we generate sufficient cash from our operations or other sources.

1

Table of Contents

Our Product and Product Candidates

Our current product portfolio consists of the following:

| Product |

Disease |

Phase of Development |

Marketing Rights |

Territory | ||||

| HZT-501 | Mild to moderate pain, osteoarthritis and rheumatoid arthritis | NDA submitted March 2010; PDUFA goal date January 21, 2011; MAA submission planned for Q4 2010 | Horizon | Worldwide | ||||

| LODOTRA |

Rheumatoid arthritis | Approved and marketed in Europe; NDA submission planned for Q4 2010 | Horizon

Merck Serono

Mundipharma |

Worldwide, excluding Europe

Germany and Austria

Europe, excluding Germany and Austria | ||||

| Severe asthma | Phase 2a | Horizon | Worldwide, excluding Europe | |||||

| TRUNOC™ | Pain-related diseases | Phase 1 | Horizon | Worldwide | ||||

| HZN-602 | Mild to moderate pain and arthritis | Phase 1 | Horizon | Worldwide | ||||

Our Markets

Pain is a serious and costly public health concern affecting more people in the U.S. than diabetes, heart disease and cancer combined. In 2006, the U.S. National Center for Health Statistics reported that an estimated 76.5 million people 20 years of age or over in the U.S. have experienced pain that persisted for more than 24 hours. Some of the most common and debilitating chronic inflammation and pain-related diseases are osteoarthritis, or OA, RA and acute and chronic pain. According to the Arthritis Foundation, a leading non-profit arthritis research advocacy group, arthritis affects nearly 46 million people in the U.S. With the aging of the U.S. population, the prevalence of arthritis is expected to rise by approximately 40% by 2030, impacting 67 million people in the U.S. We believe that the large and growing population afflicted with pain and arthritis and the limitations of current treatment options create a growing market opportunity for us.

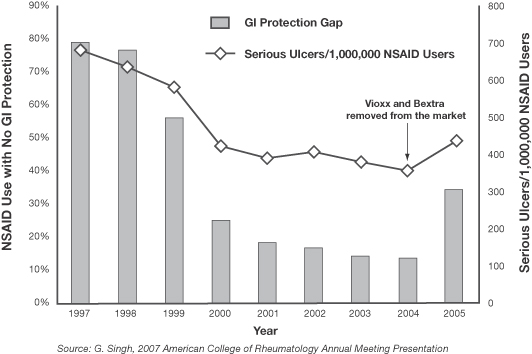

NSAIDs are very effective at providing pain relief, including pain associated with OA and RA; however, there are significant upper GI-associated adverse events which can result from such treatments. According to a 2004 article published in Aliment Pharmacology & Therapeutics, significant GI side effects, including serious ulcers, afflict up to approximately 25% of all chronic arthritis patients treated with NSAIDs for three months, and OA and RA patients are two to five times more likely than the general population to be hospitalized for NSAID-related GI complications. It is estimated that NSAID-induced GI toxicity causes over 16,500 related deaths in OA and RA patients alone, and over 107,000 hospitalizations for serious GI complications each year in the U.S. We believe that there is a serious need for a drug that provides the proven benefits of an NSAID with increased GI protection.

Common agents for the treatment of RA include NSAIDs, disease modifying antirheumatic drugs, or DMARDs, biologic agents and corticosteroids, a class of drugs based on hormones formed in the adrenal gland used to reduce inflammation. Physicians are increasingly supportive of prescribing combination therapy as some RA patients are able to achieve a clinical remission with a combination of treatments. A Medical Marketing Economics May 2008 study of 150 RA patients in the U.S., which we sponsored, showed that despite the use of a combination of currently available treatments for RA, over 90% of the patients reported suffering from morning stiffness.

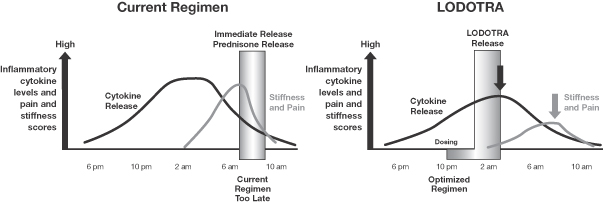

2

Table of Contents

According to Datamonitor, approximately 50% of RA patients in the U.S., Japan, France, Italy, Spain, Germany and the United Kingdom are prescribed combination therapy which often includes corticosteroids, with prednisone being one of the most common. While corticosteroids are potent and effective agents to treat patients with RA, they are usually used at high doses which can lead to long-term adverse side effects. An additional limitation of existing RA treatment with corticosteroids is related to the time of their administration in the morning hours (approximately 8:00 am), which does not synchronize with patients’ pro-inflammatory cytokines achieving peak levels in the early morning hours (approximately 2:00 am). It is impractical to expect patients to wake up every night at that hour to take prednisone. Therefore, we believe an optimal treatment would provide prednisone in the early morning hours without awakening a patient to reduce cytokine levels when they are at their peak.

Our Products

We believe that our product and product candidates address unmet therapeutic needs in arthritis, pain and inflammatory diseases. We have developed HZT-501 and LODOTRA to provide significant advantages over existing therapies.

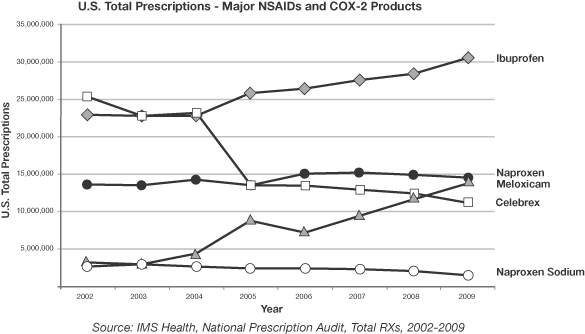

HZT-501

HZT-501 is a novel combination of 800 mg ibuprofen and 26.6 mg famotidine in a single pill. We believe that by combining ibuprofen and famotidine in a single pill, HZT-501 provides effective pain relief while decreasing stomach acidity, thus reducing the risk of NSAID-induced upper GI ulcers. According to IMS Health, in the U.S. alone, there were over 30 million prescriptions written for ibuprofen in 2009, and the high-dose prescriptions, 600 mg and 800 mg doses, accounted for approximately 90% of these prescriptions. In addition, ibuprofen’s flexible three times daily dosing allows it to be used for both chronic conditions such as OA, RA and chronic back pain as well as acute conditions such as sprains and strains. Famotidine, a potent antacid, was chosen as the ideal GI protectant to be combined with ibuprofen as it is a well studied drug with over 20 million patients treated worldwide.

Fixed-dose combination therapy can reduce the number of pills that each patient is taking, thereby increasing compliance and ensuring that the correct dosage of each component is taken at the correct time, and is often associated with better treatment outcomes. HZT-501 has been formulated to provide an optimal dosing regimen of ibuprofen and famotidine together in the convenience of a single pill.

LODOTRA

LODOTRA is a proprietary programmed release formulation of low-dose prednisone, a well-established drug used to inhibit the production of various pro-inflammatory cytokines, which are proteins associated with joint inflammation in RA. Prednisone is a corticosteroid that effectively reduces joint swelling and inflammation, but at high doses has the potential to cause significant long-term adverse side effects, such as osteoporosis, cardiovascular disease and weight gain. In addition, we believe current formulations, which are administered in the morning hours, are suboptimal because they fail to deliver prednisone at the time of most need to RA patients.

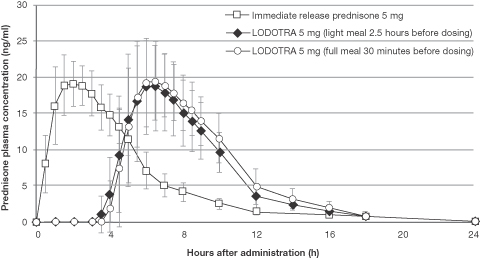

LODOTRA was developed utilizing a proprietary formulation technology enabling a programmed release of low-dose prednisone and is comprised of an active core containing prednisone, which is encapsulated by an inactive porous shell. The inactive shell acts as a barrier between the product’s active core and a patient’s GI fluids. At approximately four hours following bedtime administration of LODOTRA, water in the digestive tract diffuses through the shell, causing the active core to expand, which leads to a weakening and breakage of the shell and allows the release of prednisone from the active core. By synchronizing the prednisone delivery time with the patient’s peak cytokine levels in the early morning hours, LODOTRA exerts its effect at a physiologically optimal point to inhibit cytokine production and thus significantly reduces the signs and symptoms of RA. We believe that being able to deliver safe, low-dose prednisone at the time during which patients can recognize the greatest benefit represents a significant competitive advantage over existing therapies.

Our Strategy

Our strategy is to build a fully-integrated U.S.-focused biopharmaceutical company to successfully execute the commercial launches of HZT-501 and LODOTRA in the U.S. market following FDA approval. We retain all U.S.

3

Table of Contents

commercialization rights for our products and plan to build internally or retain through a third party a sales and marketing organization to market these products in the U.S. to key specialists, such as rheumatologists, orthopedic surgeons and pain specialists, and top prescribing primary care physicians. Over time, we plan to expand this sales force and/or establish relationships with companies that have appropriate commercial platforms in our key markets. We intend to enter into partnering, co-promotion or other distribution arrangements for commercialization of our products outside the U.S., such as our relationships with Merck Serono and Mundipharma for the commercialization of LODOTRA in Europe. As part of our longer-term strategy, we anticipate we will further develop our product candidates and selectively in-license or acquire additional products and/or late stage product candidates that are synergistic with our commercial strategy.

Our Strategic Partnerships

We have entered into several strategic partnerships with respect to the manufacturing, distribution and marketing of LODOTRA. We entered into a transfer, license and supply agreement with Merck Serono for the commercialization of LODOTRA in Germany and Austria. We also entered into a distribution agreement with Mundipharma for the exclusive distribution and marketing rights pertaining to LODOTRA for Europe, excluding Germany and Austria, and a manufacturing and supply agreement with Mundipharma Medical Company, pursuant to which we supply LODOTRA to Mundipharma. We have also entered into a manufacturing and supply agreement with Jagotec AG, an affiliate of SkyePharma AG, from whom we purchase LODOTRA.

Risks Associated with Our Business

Our business is subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary, beginning on page 9. You should read these risks before you invest in our common stock. We may be unable, for many reasons, including those that are beyond our control, to implement our business strategy. In particular, risks associated with our business include:

| • | We are highly dependent on the success of HZT-501 and LODOTRA, which are subject to extensive regulation, and we may not be able to successfully obtain marketing approval in the U.S. or successfully commercialize these product candidates. |

| • | Even if we obtain regulatory approval to commercialize our product candidates, our ability to generate revenues from any resulting products will be subject to attaining significant market acceptance among physicians, patients and healthcare payors. |

| • | Our current business plan is highly dependent upon our ability to successfully execute on our sales and marketing strategy for the commercialization of HZT-501 and LODOTRA. If we are unable to execute on our sales and marketing strategy, we may not be able to generate significant product revenues or execute on our business plan. |

| • | We face significant competition from other biotechnology and pharmaceutical companies, including those marketing generic products, and our operating results will suffer if we fail to compete effectively. |

| • | Our limited operating history makes evaluating our business and future prospects difficult, and may increase the risk of your investment. |

| • | Reimbursement may not be available, or may be available at only limited levels, for HZT-501, LODOTRA or any other product candidates that we develop, which could make it difficult for us to sell our products profitably. |

| • | We have incurred significant operating losses since our inception, including an accumulated deficit of $85.8 million as of June 30, 2010, and anticipate that we will continue to incur losses for the foreseeable future. |

| • | We may not be able to successfully obtain or protect intellectual property rights related to our product and product candidates, and we may be subject to claims that we infringe the intellectual property of third parties. |

| • | We rely on third parties to manufacture commercial supplies of LODOTRA, and we intend to rely on third parties to manufacture commercial supplies of any approved product candidates. Our commercialization of any of our product candidates could be stopped, delayed or made less profitable if those third parties fail to provide us with sufficient quantities of drug product or fail to do so at acceptable quality levels or prices. |

4

Table of Contents

Recapitalization and Nitec Acquisition

Prior to April 1, 2010, we operated as Horizon Therapeutics, Inc. On April 1, 2010, we effected a recapitalization pursuant to which we formed a holding company, Horizon Pharma Inc., and all of the shares of capital stock of Horizon Therapeutics, Inc. were converted into shares of Horizon Pharma, Inc. Horizon Therapeutics, Inc. survived as our wholly-owned subsidiary and changed its name to Horizon Pharma USA, Inc. Also on April 1, 2010, we acquired all of the shares of Nitec Pharma AG, or Nitec, in exchange for newly-issued shares of our capital stock. As a result of the acquisition, Nitec became our wholly-owned subsidiary and changed its name to Horizon Pharma AG. Following the recapitalization and acquisition of Nitec, we are organized as a holding company that operates through our wholly-owned subsidiaries, Horizon Pharma USA, Inc. (formerly Horizon Therapeutics, Inc.) and Horizon Pharma AG (formerly Nitec).

Corporate Information

We were incorporated as Horizon Pharma, Inc. in Delaware on March 23, 2010. As described above, on April 1, 2010, we became a holding company that operates primarily through our two wholly-owned subsidiaries, Horizon Pharma USA, Inc., a Delaware corporation, and Horizon Pharma AG, a company organized under the laws of Switzerland. Horizon Pharma AG owns all of the outstanding share capital of its wholly-owned subsidiary, Horizon Pharma GmbH, a company organized under the laws of Germany and formerly known as Nitec Pharma GmbH, through which Horizon Pharma AG conducts most of its European operations.

Our principal executive offices are located at 1033 Skokie Boulevard, Suite 355, Northbrook, Illinois 60062, and our telephone number is (224) 383-3000. Our website address is www.horizonpharma.com. The information contained in or that can be accessed through our website is not part of this prospectus.

Unless the context indicates otherwise, as used in this prospectus, the terms “Horizon,” “Horizon Pharma,” “we,” “us” and “our” refer to Horizon Pharma, Inc., a Delaware corporation, and its subsidiaries taken as a whole. Also, unless the context indicates otherwise, for historical periods prior to April 1, 2010, the terms “Horizon,” “Horizon Pharma USA,” “we,” “us” and “our” refer to Horizon Therapeutics, Inc.

“Horizon Therapeutics,” a stylized letter “H,” and “LODOTRA” are registered trademarks in the U.S. and certain other countries. We have applied for registration of the trademark “Horizon Pharma” with the U.S. Patent and Trademark Office. This prospectus also includes references to trademarks and service marks of other entities, and those trademarks and service marks are the property of their respective owners.

5

Table of Contents

The Offering

| Common stock offered by us |

shares |

| Overallotment option |

We have granted the underwriters an option for a period of 30 days to purchase up to an additional shares of common stock. |

| Common stock to be outstanding after this offering |

shares |

| Use of proceeds |

We intend to use the net proceeds from this offering to fund the development, regulatory approval and U.S. commercialization of HZT-501 and LODOTRA and for working capital, capital expenditures and general corporate purposes. Please read “Use of Proceeds” on page 39. |

| Risk factors |

You should read the “Risk Factors” section of this prospectus beginning on page 9 and all of the other information set forth in this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| Proposed NASDAQ Global Market symbol |

We have applied for listing of our common stock on The NASDAQ Global Market under the symbol “HZNP.” |

The number of shares of our common stock that will be outstanding after this offering is based on 29,771,443 shares outstanding as of June 30, 2010, and excludes:

| • | 3,115,855 shares of common stock issuable upon the exercise of outstanding options under our 2005 stock plan as of June 30, 2010, having a weighted average exercise price of $5.82 per share; |

| • | shares of common stock reserved for future issuance under our 2010 equity incentive plan and 2010 employee stock purchase plan, each of which will become effective upon the signing of the underwriting agreement for this offering (including shares of common stock reserved for future issuance under our 2005 stock plan which will be added to the shares reserved under our 2010 equity incentive plan upon its effectiveness); and |

| • | 821,564 shares of common stock issuable upon the exercise of outstanding warrants as of June 30, 2010, having a weighted average exercise price of $3.92 per share. |

Unless otherwise noted, the information in this prospectus assumes:

| • | a 1-for- reverse stock split of our common stock to be effected prior to the completion of this offering; |

| • | the issuance by us of 1,271,520 shares of common stock upon the completion of this offering upon an assumed conversion of outstanding convertible promissory notes in the aggregate principal amount of $10.0 million (plus interest accrued thereon) that we issued in July 2010, or the 2010 notes, assuming a conversion price of $7.968 per share and assuming a conversion date of August 29, 2010; |

| • | the conversion of all of our outstanding shares of preferred stock into an aggregate of 24,961,340 shares of common stock upon the completion of this offering; |

| • | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws upon the completion of this offering; and |

| • | no exercise of the underwriters’ overallotment option. |

6

Table of Contents

Summary Consolidated Financial Information

The following tables summarize our consolidated financial data. We have derived the following summary of our statement of operations data for the years ended December 31, 2007, 2008 and 2009 from our audited financial statements appearing elsewhere in this prospectus. The statement of operations data for the six months ended June 30, 2009 and 2010 and the balance sheet data as of June 30, 2010 have been derived from our unaudited financial statements appearing elsewhere in this prospectus. The unaudited interim financial statements have been prepared on the same basis as the audited financial statements and reflect all adjustments necessary to fairly state our financial position as of June 30, 2010 and results of operations for the six months ended June 30, 2009 and 2010. Our historical results are not necessarily indicative of the results that may be expected in the future. The summary of our financial data set forth below should be read together with our financial statements and the related notes to those statements, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Unaudited Pro Forma Condensed Consolidated Financial Information” appearing elsewhere in this prospectus.

| Actual | Pro Forma | Actual | Pro Forma | |||||||||||||||||||||||||

| Year Ended December 31, | Six Months Ended June 30, | |||||||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2009 | 2009 | 2010 | 2010 | ||||||||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||||

| Revenues |

||||||||||||||||||||||||||||

| Sales of goods |

$ | — | $ | — | $ | — | $ | 2,694 | $ | — | $ | 1,694 | $ | 1,972 | ||||||||||||||

| Contract revenue |

— | — | — | 429 | — | — | 175 | |||||||||||||||||||||

| Total revenues |

— | — | — | 3,123 | — | 1,694 | 2,147 | |||||||||||||||||||||

| Cost of goods sold |

— | — | — | 8,333 | — | 2,519 | 4,082 | |||||||||||||||||||||

| Gross profit (loss) |

— | — | — | (5,210 | ) | — | (825 | ) | (1,935 | ) | ||||||||||||||||||

| Operating expenses |

||||||||||||||||||||||||||||

| Research and development |

24,483 | 22,295 | 10,894 | 22,710 | 5,085 | 7,159 | 9,203 | |||||||||||||||||||||

| Sales and marketing |

617 | 1,337 | 2,072 | 5,789 | 969 | 1,668 | 3,904 | |||||||||||||||||||||

| General and administrative |

1,640 | 3,235 | 5,823 | 11,197 | 2,905 | 9,893 | 15,513 | |||||||||||||||||||||

| Total operating expenses |

26,740 | 26,867 | 18,789 | 39,696 | 8,959 | 18,720 | 28,620 | |||||||||||||||||||||

| Loss from operations |

(26,740 | ) | (26,867 | ) | (18,789 | ) | (44,906 | ) | (8,959 | ) | (19,545 | ) | (30,555 | ) | ||||||||||||||

| Interest income |

934 | 340 | 25 | 1,837 | 23 | 13 | 303 | |||||||||||||||||||||

| Interest expense |

(6 | ) | (869 | ) | (2,214 | ) | (4,693 | ) | (1,048 | ) | (814 | ) | (1,667 | ) | ||||||||||||||

| Other income (expense), net |

(35 | ) | (503 | ) | 478 | 468 | 209 | 14,481 | 14,481 | |||||||||||||||||||

| Foreign exchange gain |

— | — | — | — | — | 40 | 40 | |||||||||||||||||||||

| Loss before income tax |

(25,847 | ) | (27,899 | ) | (20,500 | ) | (47,294 | ) | (9,775 | ) | (5,825 | ) | (17,398 | ) | ||||||||||||||

| Income tax expense |

— | — | — | (57 | ) | — | (14 | ) | (31 | ) | ||||||||||||||||||

| Net loss |

$ | (25,847 | ) | $ | (27,899 | ) | $ | (20,500 | ) | $ | (47,351 | ) | $ | (9,775 | ) | $ | (5,839 | ) | $ | (17,429 | ) | |||||||

| Capital contribution |

— | — | 3,489 | 3,489 | — | — | — | |||||||||||||||||||||

| Net loss attributed to common stockholders |

$ | (25,847 | ) | $ | (27,899 | ) | $ | (17,011 | ) | $ | (43,862 | ) | $ | (9,775 | ) | $ | (5,839 | ) | $ | (17,429 | ) | |||||||

| Net loss per share, basic and diluted |

$ | (27.92 | ) | $ | (28.51 | ) | $ | (17.12 | ) | $ | (12.40 | ) | $ | (9.85 | ) | $ | (2.31 | ) | $ | (4.93 | ) | |||||||

| Weighted average number of shares outstanding |

925,685 | 978,439 | 993,569 | 3,538,583 | 992,169 | 2,526,459 | 3,538,583 | |||||||||||||||||||||

| Pro forma net loss per share, basic and diluted (unaudited)(1) |

$ | (2.15 | ) | $ | (0.28 | ) | ||||||||||||||||||||||

| Weighted average pro forma shares outstanding, basic and diluted (unaudited)(1) |

8,148,259 | 20,787,563 | ||||||||||||||||||||||||||

| (1) | Please see Note 2 to our consolidated financial statements for an explanation of the method used to calculate the pro forma basic and diluted net loss per share and the number of shares used in the computation of the per share amounts. |

7

Table of Contents

| As of June 30, 2010 | ||||||||||

| Actual | Pro Forma | Pro Forma as Adjusted | ||||||||

| (in thousands) | ||||||||||

| Balance Sheet Data: |

||||||||||

| Cash and cash equivalents |

$ | 13,266 | $ | 23,266 | ||||||

| Working capital |

1,703 | 11,703 | ||||||||

| Total assets |

170,822 | 180,822 | ||||||||

| Long-term debt, net of current portion |

7,576 | 7,576 | ||||||||

| Accumulated deficit |

(85,826 | ) | (85,826 | ) | ||||||

| Total stockholders’ equity |

118,966 | 128,966 | ||||||||

The summary unaudited pro forma condensed consolidated statement of operations data for the year ended December 31, 2009 and the six months ended June 30, 2010 are based on the historical statements of operations of Horizon Pharma USA and Nitec, giving effect to our acquisition of Nitec in April 2010 as if the acquisition and related transactions had occurred on January 1, 2009. The unaudited pro forma condensed consolidated statement of operations data for the six months ended June 30, 2010 include the results of operations for Nitec for the three months ended March 31, 2010. The summary unaudited pro forma condensed consolidated balance sheet data as of June 30, 2010 give effect to our issuance of the 2010 notes and accrued interest thereon as well as 1,271,520 shares of common stock upon the completion of this offering upon an assumed conversion of the 2010 notes and accrued interest, assuming a conversion price of $7.968 per share and assuming a conversion date of August 29, 2010. The unaudited pro forma condensed consolidated statement of operations data are based on the estimates and assumptions set forth in the notes to the unaudited pro forma condensed consolidated financial information. See “Unaudited Pro Forma Condensed Consolidated Financial Information” beginning on page 44 of this prospectus. These estimates and assumptions are preliminary and subject to change, and have been made solely for the purposes of developing this pro forma information. The summary unaudited pro forma condensed consolidated statement of operations data are presented for illustrative purposes only and are not necessarily indicative of the combined results of operations to be expected in any future period or the results that actually would have been realized had the entities been a single entity during these periods.

The June 30, 2010 pro forma as adjusted balance sheet reflects the pro forma balance sheet data at June 30, 2010, as adjusted for the sale by us of shares of common stock in this offering at an assumed initial public offering price of $ per share, the mid-point of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

8

Table of Contents

Investing in our common stock involves a high degree of risk. Before you decide to invest in our common stock, you should consider carefully the risks described below, together with the other information contained in this prospectus, including our financial statements and the related notes thereto. We believe the risks described below are the risks that are material to us as of the date of this prospectus. If any of the following risks comes to fruition, our business, financial condition, results of operations and future growth prospects would likely be materially and adversely affected. In these circumstances, the market price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

We are highly dependent on the success of our HZT-501 and LODOTRA product candidates, and we may not be able to successfully obtain marketing approval in the U.S. or successfully commercialize these product candidates.

To date, we have expended significant time, resources, and effort on the development of HZT-501 and LODOTRA, and a substantial majority of our resources are now focused on seeking marketing approval for and planning for potential commercialization of these product candidates in the U.S. Our ability to generate significant product revenues in the near term will depend almost entirely on our ability to successfully obtain U.S. marketing approval for and commercialize these product candidates. HZT-501 is not approved for marketing in any jurisdiction and therefore, unless it obtains regulatory approval, it may never be commercialized. Although LODOTRA is approved for marketing in 13 European countries, to date it has only been marketed in Belgium, Denmark, Finland, Germany and Norway. While we anticipate that LODOTRA will be marketed in additional European countries as our distribution partners formulate their reimbursement strategy, the ability to market LODOTRA in additional European countries will depend on our distribution partners’ ability to obtain regulatory and reimbursement approvals in these countries. Even if we obtain additional marketing and reimbursement approvals, our product revenues in Europe are entirely dependent upon the marketing efforts of our exclusive distribution partners, over which we have no control. LODOTRA is not approved for marketing in the U.S., which we believe represents its largest commercial opportunity. Before we can market and sell these product candidates in a particular jurisdiction, we will need to obtain necessary regulatory approvals (from the Food and Drug Administration, or FDA, in the U.S. and from similar foreign regulatory agencies in other jurisdictions) and in some jurisdictions, reimbursement authorization. There are no guarantees that we will obtain the required regulatory approvals we are seeking for these product candidates. Because we believe the U.S. represents the largest market opportunity for our product candidates, if we are unable to obtain FDA approval to market our product candidates in the U.S., we will likely not be able to generate significant revenues from commercial sales of our product candidates. Even if we obtain the required regulatory approvals, we may never generate significant revenues from any commercial sales of these product candidates. If we fail to successfully commercialize either of these product candidates, we may be unable to generate sufficient revenues to sustain and grow our business, and our business, financial condition and results of operations will be adversely affected.

Our product candidates are subject to extensive regulation, and we may not obtain required regulatory approvals for HZT-501 or obtain additional regulatory approvals for LODOTRA.

The clinical development, manufacturing, labeling, packaging, storage, recordkeeping, advertising, promotion, export, marketing and distribution, and other possible activities relating to our product candidates are, and any resulting drugs will be, subject to extensive regulation by the FDA and other regulatory agencies. Failure to comply with FDA and other applicable regulatory requirements may, either before or after product approval, subject us to administrative or judicially imposed sanctions.

We are not permitted to market HZT-501, LODOTRA or any of our other product candidates in the U.S. until we obtain regulatory approval from the FDA. To market a new drug in the U.S., we must submit to the FDA and obtain FDA approval of a new drug application, or NDA. To market a new drug in Europe, we must submit to the applicable regulatory authority in the designated Reference Member State and obtain approval of, a Marketing Authorization Application, or MAA. An NDA or MAA must be supported by extensive clinical and preclinical data, as well as extensive information regarding chemistry, manufacturing and controls, or CMC, to demonstrate the safety and effectiveness of the applicable product candidate.

9

Table of Contents

Regulatory approval of an NDA or an MAA is not guaranteed. The number and types of preclinical studies and clinical trials that will be required for NDA or MAA approval varies depending on the product candidate, the disease or the condition that the product candidate is designed to target and the regulations applicable to any particular product candidate. Despite the time and expense associated with preclinical and clinical studies, failure can occur at any stage, and we could encounter problems that cause us to repeat or perform additional preclinical studies, CMC studies or clinical trials. The FDA and similar foreign authorities could delay, limit or deny approval of a product candidate for many reasons, including because they:

| • | may not deem a product candidate to be adequately safe and effective; |

| • | may not find the data from preclinical studies, CMC studies and clinical trials to be sufficient to support a claim of safety and efficacy; |

| • | may interpret data from preclinical studies, CMC studies and clinical trials significantly differently than we do; |

| • | may not approve the manufacturing processes or facilities associated with our product candidates; |

| • | may conclude that we have not sufficiently demonstrated long-term stability of the formulation for which we are seeking marketing approval; |

| • | may change approval policies (including with respect to our product candidates’ class of drugs) or adopt new regulations; or |

| • | may not accept a submission due to, among other reasons, the content or formatting of the submission. |

For example, the FDA has scheduled a meeting of its Gastrointestinal Drugs Advisory Committee on November 4, 2010. The committee will discuss the adequacy of endoscopically documented gastric ulcers as an outcome measure to evaluate drugs intended to prevent complications of NSAIDs. The endpoint under discussion is the primary endpoint in our Phase 3 trials of HZT-501. We cannot predict the outcome of this meeting or whether any decisions made at the meeting would impact the FDA’s review of our NDA for HZT-501.

Obtaining approval of an NDA can be a lengthy, expensive and uncertain process. As part of the U.S. Prescription Drug User Fee Act, or PDUFA, the FDA has a goal to review and act on a percentage of all submissions in a given time frame. The general review goal for a drug application is 10 months for a standard application and six months for a priority review application. The FDA’s review goals are subject to change, and it is unknown whether the review of our NDA filing for HZT-501, or an NDA filing for any of our other product candidates, will be completed within the FDA’s review goals or will be delayed. Moreover, the duration of the FDA’s review may depend on the number and types of other NDAs that are submitted to the FDA around the same time period.

We submitted an NDA to the FDA in March 2010 requesting approval to market HZT-501 for reducing the risk of developing non-steroidal anti-inflammatory drug-, or NSAID-, induced upper gastrointestinal, or GI, ulcers in patients with mild to moderate pain and arthritis that require use of an NSAID. In connection with our NDA for HZT-501, we are requesting the FDA to, and intend to request the Medicines and Healthcare products Regulatory Agency in the United Kingdom in connection with the HZT-501 MAA to, approve a formulation that is different from the formulation used in our Phase 3 clinical trials, which we determined had inadequate stability characteristics to be suitable for commercialization. As a result, we were required to demonstrate the bioequivalence of famotidine between the new and old formulations in addition to the other NDA and MAA requirements. We successfully completed this bioequivalence study prior to submitting the NDA for HZT-501. We also demonstrated the bioequivalence of ibuprofen between the two formulations of HZT-501 and the reference labeled drug (RLD) ibuprofen as part of the NDA submission. We continue to complete CMC studies with the new formulation, and we cannot assure you that we will not have additional formulation issues related to HZT-501 or any of our other product candidates. As part of the ongoing review of our NDA for HZT-501, the FDA has asked for data from incremental lots of manufactured material. We expect to submit this requested data to the FDA in the fourth quarter of 2010. The FDA notified us in May 2010 that it had accepted the NDA for review and subsequently assigned a PDUFA goal date of January 21, 2011 for its review of the NDA. There can be no assurance that the FDA will meet this goal date. We anticipate submitting an NDA to the FDA for LODOTRA for the treatment of rheumatoid arthritis, or RA, in the fourth quarter of 2010. We also anticipate submitting an MAA for HZT-501 in the United Kingdom, the Reference Member State, through the Decentralized Procedure in the fourth

10

Table of Contents

quarter of 2010. There are no guarantees that any of these future events will take place on our anticipated timeline, if at all.

With the exception of our recently submitted HZT-501 NDA, we have not previously submitted NDAs to the FDA. In addition, we have never obtained FDA approval for any drug. This lack of experience may impede our ability to obtain FDA approval in a timely manner, if at all, for HZT-501, LODOTRA or our other product candidates. Even if we believe that data collected from our preclinical studies, CMC studies and clinical trials of our product candidates are promising and that our information and procedures regarding CMC are sufficient, our data may not be sufficient to support marketing approval by the FDA or any other U.S. or foreign regulatory authority, or regulatory interpretation of these data and procedures may be unfavorable. In addition, the FDA’s regulatory review of NDAs for product candidates intended for widespread use by a large proportion of the general population is becoming increasingly focused on safety. Even if approved, product candidates may not be approved for all indications requested and such approval may be subject to limitations on the indicated uses for which the drug may be marketed, restricted distribution methods or other limitations. Our business and reputation may be harmed by any failure or significant delay in obtaining regulatory approval for the sale of any of our product candidates. As a result, we cannot predict when or whether regulatory approval will be obtained for any product candidate we develop.

To market any drugs outside of the U.S., we and current or future collaborators must comply with numerous and varying regulatory requirements of other countries. Approval procedures vary among countries and can involve additional product testing and additional administrative review periods, including obtaining reimbursement approval in select markets. The time required to obtain approval in other countries might differ from that required to obtain FDA approval. The regulatory approval process in other countries may include all of the risks associated with FDA approval as well as additional, presently unanticipated, risks. Regulatory approval in one country does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one country may negatively impact the regulatory process in others, including the risk that our product candidates may not be approved for all indications requested and that such approval may be subject to limitations on the indicated uses for which the drug may be marketed. While we anticipate that LODOTRA will be marketed in additional European Union countries as our distribution partners formulate their reimbursement strategy, the ability to market LODOTRA in additional European Union countries will depend on our distribution partners’ ability to obtain regulatory and reimbursement approvals in these countries.

Even if we obtain regulatory approval to commercialize our product candidates, our ability to generate revenues from any resulting products will be subject to attaining significant market acceptance among physicians, patients and healthcare payors.

HZT-501, LODOTRA and our other product candidates, if approved, may not attain market acceptance among physicians, patients, healthcare payors or the medical community. To date, LODOTRA has only been sold in a limited number of European countries. Sales in these markets have been limited to date and sales in Europe may not grow to expected levels, in part because we depend on our distribution partners, Merck Serono GmbH, or Merck Serono, and Mundipharma International Corporation Limited, or Mundipharma, for commercialization of LODOTRA in these markets. We believe that the degree of market acceptance and our ability to generate revenues from any products for which we obtain marketing approval will depend on a number of factors, including:

| • | timing of market introduction of our products as well as competitive drugs; |

| • | efficacy and safety of our products; |

| • | continued projected growth of the arthritis, pain and inflammation markets; |

| • | prevalence and severity of any side effects; |

| • | acceptance by patients, primary care physicians and key specialists, including rheumatologists, orthopedic surgeons and pain specialists; |

| • | potential or perceived advantages or disadvantages of our products over alternative treatments, including cost of treatment and relative convenience and ease of administration; |

| • | strength of sales, marketing and distribution support; |

| • | the price of our products, both in absolute terms and relative to alternative treatments; |

| • | the effect of current and future healthcare laws; |

11

Table of Contents

| • | availability of coverage and adequate reimbursement and pricing from government and other third-party payors; and |

| • | product labeling or product insert requirements of the FDA or other regulatory authorities. |

With respect to HZT-501, studies indicate that physicians do not commonly co-prescribe GI protective agents to high-risk patients taking NSAIDs. We believe this is due in part to a lack of awareness among physicians prescribing NSAIDs of the risk of NSAID-induced upper GI ulcers, in addition to the inconvenience of prescribing two separate medications and patient compliance issues associated with multiple prescriptions. If physicians remain unaware of, or do not otherwise believe in, the benefits of combining GI protective agents with NSAIDs, our market opportunity for HZT-501 will be limited. Some physicians may also be reluctant to prescribe HZT-501 due to the inability to vary the dose of ibuprofen or if they believe treatment with NSAIDs or GI protectants other than ibuprofen and famotidine, including those of our competitors, would be more effective for their patients. With respect to both HZT-501 and LODOTRA, their higher cost compared to the generic forms of their active ingredients alone may limit adoption by physicians, patients and healthcare payors. If our product candidates are approved and fail to attain market acceptance, we may not be able to generate significant revenue to achieve or sustain profitability, which would have a material adverse effect on our business, results of operations, financial condition and prospects.

Our current business plan is highly dependent upon our ability to successfully execute on our sales and marketing strategy for the commercialization of HZT-501 and LODOTRA. If we are unable to successfully execute on our sales and marketing strategy, we may not be able to generate significant product revenues or execute on our business plan.

Our strategy is to build a fully-integrated U.S.-focused biopharmaceutical company to successfully execute the commercial launches of HZT-501 and LODOTRA in the U.S. market following FDA approval. Even if we are able to obtain U.S. regulatory approval for HZT-501 and LODOTRA, we may not be able to successfully commercialize either product candidate in the U.S. We currently do not have a commercial organization for the sales, marketing and distribution of pharmaceutical products, and as a company, we do not have any experience commercializing pharmaceutical products on our own. LODOTRA, our only currently marketed product, was commercially launched in Europe by our exclusive distribution partners Merck Serono and Mundipharma. In order to commercialize any approved products, we must build our sales, marketing, distribution, managerial and other non-technical capabilities or make arrangements with third parties to perform these services. We currently have limited resources and the establishment and development of our own commercial organization to market these products and any additional products we may develop will be expensive and time-consuming and could delay any product launch, and we cannot be certain that we will be able to successfully develop this capability. We will also have to compete with other pharmaceutical and biotechnology companies to recruit, hire, train and retain sales and marketing personnel. We also face competition in our search for collaborators and potential co-promoters of our products. To the extent we rely on additional third parties to commercialize any approved products, we are likely to receive less revenues than if we commercialized these products ourselves. In addition, we may have little or no control over the sales efforts of any third parties involved in our commercialization efforts. In the event we are unable to develop our own commercial organization or collaborate with a third-party sales and marketing organization, we would not be able to commercialize our product candidates and execute on our business plan. If we are unable to successfully implement our commercial plans and drive adoption by patients and physicians of any approved products through our sales, marketing and commercialization efforts, or if our partners fail to successfully commercialize our products, then we will not be able to generate sustainable revenues from product sales which will have a material adverse effect on our business and prospects.

Our limited operating history makes evaluating our business and future prospects difficult, and may increase the risk of your investment.

We were recently incorporated as Horizon Pharma, Inc. on March 23, 2010. On April 1, 2010, we effected a recapitalization and acquisition pursuant to which we became a holding company that operates through our two wholly-owned subsidiaries, Horizon Pharma USA, Inc. (formerly known as Horizon Therapeutics, Inc.) and Horizon Pharma AG (formerly known as Nitec Pharma AG, or Nitec). Horizon Pharma USA began its operations in 2005 and Nitec began its operations in 2004. We face considerable risks and difficulties as a recently formed holding company with limited operating history, particularly as a consolidated entity with operating subsidiaries that also have limited operating history. If we do not successfully address these risks, our business, prospects, operating results and financial condition will be materially and adversely harmed. Our limited operating history makes it particularly difficult for us to predict our

12

Table of Contents

future operating results and appropriately budget for our expenses. In the event that actual results differ from our estimates or we adjust our estimates in future periods, our operating results and financial position could be materially affected. Moreover, we have only one product, LODOTRA, approved for commercial sale and only in select countries within Europe, and for which our distribution partners have only recently commenced marketing. We have no products approved for sale in the U.S., which we believe represents the largest commercial opportunity for our product candidates. To date, we have been primarily focused on the development of our product candidates and have only recently increased our commercialization activities to include product sales. This limited history of commercial sales also makes evaluating our business and future prospects difficult, and may increase the risk of your investment. We have limited experience as a consolidated operating entity, particularly with commercialization activities, and have not yet demonstrated an ability to successfully overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields, particularly in the pharmaceutical or biotechnology areas.

We may not realize the benefits we expected from our recapitalization and acquisition of Nitec.

We recently completed our recapitalization and acquisition of Nitec pursuant to which Horizon Pharma USA and Horizon Pharma AG became our wholly-owned subsidiaries. The integration of the businesses of our subsidiaries will be complex, time-consuming and expensive and may cause disruptions in the combined business. We will need to overcome significant challenges in order to realize any benefits or synergies from the acquisition of Nitec. These challenges include the timely, efficient and successful execution of a number of tasks, including the following:

| • | integrating the business, operations and technologies of the companies; |

| • | retaining and assimilating the key personnel of each company; |

| • | managing the regulatory and reimbursement approval processes, intellectual property protection strategies and commercialization activities of the companies, including compliance with the laws of a number of different jurisdictions; |

| • | retaining strategic partners of each company and attracting new strategic partners; |

| • | creating uniform standards, controls, procedures, policies and information systems, including with respect to disclosure controls and procedures and internal control over financial reporting; |

| • | managing international operations; and |

| • | meeting the challenges inherent in efficiently managing an increased number of employees over large geographic distances, including the need to implement appropriate systems, policies, benefits and compliance programs. |

Many of these challenges are exacerbated by the fact that Horizon Pharma USA is a U.S.-based company and Horizon Pharma AG is a company based in Switzerland, with most of its European operations occurring through its subsidiary, Horizon Pharma GmbH, in Germany.

We may encounter difficulties successfully managing a substantially larger and internationally diverse organization and may encounter significant delays in achieving successful management of our organization. Integration of our subsidiaries’ operations will involve considerable risks and may not be successful. These risks include the following:

| • | the potential disruption of ongoing business and distraction of our management; |

| • | the potential strain on our financial and managerial controls and reporting systems and procedures; |

| • | our inability to manage the research and development, regulatory and reimbursement approval, both in the U.S. and in Europe, and commercialization activities of our subsidiaries; |

| • | unanticipated expenses and potential delays related to integration of the operations, technology and other resources of two subsidiaries; |

| • | the impairment of relationships with employees and suppliers as a result of any integration of new management personnel or other activities; |

| • | greater than anticipated costs and expenses related to the integration of our subsidiaries’ businesses; and |

| • | potential unknown liabilities associated with the strategic combination and the combined operations. |

We may not succeed in addressing these risks or any other problems encountered in connection with the integration of our subsidiaries’ businesses. The inability to integrate successfully the operations, technology and personnel of our businesses, or any significant delay in achieving integration, could have a material adverse effect on our business, results of operations and prospects, and on the market price of our common stock.

13

Table of Contents

We have experienced recent growth and expect to continue to grow the size of our organization, and we may experience difficulties in managing this growth.

As of December 31, 2009, we employed 12 full-time employees as Horizon Therapeutics, Inc., and our subsidiary Horizon Pharma AG employed 23 full-time employees as Nitec. As of September 30, 2010, we employed 38 full-time employees as a combined entity.

We expect this growth to continue and accelerate in the near term. As our commercialization plans and strategies develop, and as we transition into operating as a public company, we will need to recruit and train a substantial number of sales and marketing personnel and expect to need to expand the size of our employee base for managerial, operational, financial and other resources. Our ability to manage our planned growth effectively will require us to do, among other things, the following:

| • | manage the FDA review process for HZT-501 and submission and review process for LODOTRA; |

| • | build or retain through a third party an appropriate commercial organization and manage the sales and marketing efforts for HZT-501 and LODOTRA, subject to receipt of applicable regulatory approvals; |

| • | enhance our operational, financial and management controls, reporting systems and procedures; |

| • | expand our international resources; |

| • | successfully identify, recruit, hire, train, maintain, motivate and integrate additional employees; |

| • | establish and increase our access to commercial supplies of our product candidates; |

| • | expand our facilities and equipment; and |

| • | manage our internal development efforts effectively while complying with our contractual obligations to licensors, licensees, contractors, collaborators, distributors and other third parties. |

Our management may also have to divert a disproportionate amount of its attention away from day-to-day activities and towards managing these growth activities. Our future financial performance and our ability to execute on our business plan will depend, in part, on our ability to effectively manage any future growth and our failure to effectively manage growth could have a material adverse effect on our business, results of operations, financial condition and prospects.

We face significant competition from other biotechnology and pharmaceutical companies, including those marketing generic products, and our operating results will suffer if we fail to compete effectively.

The biotechnology and pharmaceutical industries are intensely competitive. We have competitors both in the U.S. and international markets, including major multinational pharmaceutical companies, biotechnology companies and universities and other research institutions. Many of our competitors have substantially greater financial, technical and other resources, such as larger research and development staff, experienced marketing and manufacturing organizations and well-established sales forces. Additional mergers and acquisitions in the biotechnology and pharmaceutical industries may result in even more resources being concentrated in our competitors. Competition may increase further as a result of advances in the commercial applicability of technologies and greater availability of capital for investment in these industries. Our competitors may succeed in developing, acquiring or in-licensing on an exclusive basis products that are more effective and/or less costly than HZT-501 and LODOTRA or any product candidates that we are currently developing or that we may develop.

If approved, HZT-501 would face competition from Celebrex®, marketed by Pfizer Inc., Vimovo®, developed by Pozen Inc. and marketed by AstraZeneca AB, and Arthrotec®, marketed by Pfizer. In addition, HZT-501 would face significant competition from the separate use of NSAIDs for pain relief and GI protective medications to reduce the risk of NSAID-induced upper GI ulcers. Both NSAIDs and GI protective medications are available in generic form and will be less expensive to use separately than HZT-501. In addition, other product candidates that contain ibuprofen and famotidine in combination, while not currently known to us, may be developed and compete with HZT-501 in the future.

We expect LODOTRA will compete with a number of pharmaceuticals on the market to treat RA, including corticosteriods, such as prednisone, disease modifying antirheumatic drugs, or DMARDs, such as methotrexate, and biologic agents such as HUMIRA® , marketed by Abbott Laboratories, and Enbrel®, marketed by Amgen Inc. and Pfizer.

14

Table of Contents

It is typical for an RA patient to take a combination of a DMARD, an oral glucocorticoid, an NSAID and/or a biologic agent. Therefore, we expect that LODOTRA’s principal competition will be prednisone, the active pharmaceutical ingredient in LODOTRA, or other oral corticosteriods, which, while they may be suboptimal, are or are expected to be less expensive than LODOTRA. In addition, other product candidates that contain prednisone or other oral corticosteriods in alternative delayed release forms, while not currently known to us, may be developed and compete with LODOTRA in the future.

The availability and price of our competitors’ products could limit the demand, and the price we are able to charge, for HZT-501 and LODOTRA. We will not successfully execute on our business objectives if the market acceptance of HZT-501 or LODOTRA is inhibited by price competition, if physicians are reluctant to switch from existing products to HZT-501 or LODOTRA, or if physicians switch to other new products or choose to reserve HZT-501 or LODOTRA for use in limited patient populations.

In addition, established pharmaceutical companies may invest heavily to accelerate discovery and development of novel compounds or to in-license and develop novel compounds that could make our products obsolete. Our ability to compete successfully with these companies and other potential competitors will depend largely on our ability to leverage our experience in drug discovery and development to:

| • | discover and develop medicines that are superior to other products in the market; |

| • | attract qualified scientific, product development and sales and marketing personnel; |

| • | obtain patent and/or other proprietary protection for our products and technologies; |

| • | obtain required regulatory approvals; and |

| • | successfully collaborate with pharmaceutical companies in the discovery, development and commercialization of new product candidates. |

In addition, any new product that competes with an approved product must demonstrate compelling advantages in efficacy, convenience, tolerability and safety in order to be approved and overcome price competition and to be commercially successful. Accordingly, our competitors may succeed in obtaining patent protection, obtaining FDA approval or discovering, developing and commercializing medicines before we do, which would have a material adverse impact on our business. The inability to compete with existing products or subsequently introduced products would have a material adverse impact on our business, financial condition and prospects.

A variety of risks associated with operating our business and marketing our product candidates internationally could materially adversely affect our business.

In addition to our U.S. operations, we have operations in Switzerland and Germany. Moreover, LODOTRA is currently being marketed in a limited number of European countries, and our distribution partners are in the process of obtaining pricing and reimbursement approval for, and preparing to market, LODOTRA in other European countries. We face risks associated with our international operations, including possible unfavorable regulatory, pricing and reimbursement, political, tax and labor conditions, which could harm our business. We are subject to numerous risks associated with international business activities, including:

| • | compliance with differing or unexpected regulatory requirements for our products; |

| • | difficulties in staffing and managing foreign operations; |

| • | in certain circumstances, including with respect to the commercialization of LODOTRA in Europe, increased dependence on the commercialization efforts of our distributors or strategic partners; |

| • | compliance with Swiss laws with respect to our Horizon Pharma AG subsidiary, including laws requiring maintenance of cash in the subsidiary to avoid overindebtedness, which requires Horizon Pharma AG to maintain assets in excess of its liabilities; |

| • | compliance with German laws with respect to our Horizon Pharma GmbH subsidiary through which Horizon Pharma AG conducts most of its European operations; |

| • | foreign government taxes, regulations and permit requirements; |

15

Table of Contents

| • | U.S. and foreign government tariffs, trade restrictions, price and exchange controls and other regulatory requirements; |

| • | economic weakness, including inflation, natural disasters, war, events of terrorism or political instability in particular foreign countries; |

| • | fluctuations in currency exchange rates, which could result in increased operating expenses and reduced revenues, and other obligations related to doing business in another country; |

| • | compliance with tax, employment, immigration and labor laws, regulations and restrictions for employees living or traveling abroad; |

| • | workforce uncertainty in countries where labor unrest is more common than in the U.S.; |

| • | production shortages resulting from any events affecting raw material supply or manufacturing capabilities abroad; |

| • | changes in diplomatic and trade relationships; and |

| • | challenges in enforcing our contractual and intellectual property rights, especially in those foreign countries that do not respect and protect intellectual property rights to the same extent as the U.S. |

These and other risks associated with our international operations may materially adversely affect our business, financial condition and results of operations.

If we are not successful in attracting and retaining highly qualified personnel, we may not be able to successfully implement our business strategy.

Our ability to compete in the highly competitive biotechnology and pharmaceuticals industries depends upon our ability to attract and retain highly qualified managerial, scientific and medical personnel. We are highly dependent on our management, scientific and medical personnel, including our Chairman, President and Chief Executive Officer, Timothy P. Walbert, our Executive Vice President and Chief Financial Officer, Robert J. De Vaere, and our Executive Vice President, Development, Regulatory Affairs and Chief Medical Officer, Dr. Jeffrey W. Sherman. In order to retain valuable employees at our company, in addition to salary and cash incentives, we provide incentive stock options that vest over time. The value to employees of stock options that vest over time will be significantly affected by movements in our stock price that are beyond our control, and may at any time be insufficient to counteract more lucrative offers from other companies.

Our scientific team in particular has expertise in many different aspects of drug discovery, development and commercialization, and may be difficult to retain or replace. We conduct our operations at our facilities in Northbrook, Illinois, Reinach, Switzerland and Mannheim, Germany, and may face challenges recruiting personnel to these geographic locales. Moreover, these regions are headquarters to many other biopharmaceutical companies and many academic and research institutions, and therefore we face increased competition for personnel in those geographies. Competition for skilled personnel in our markets is very intense and competition for experienced scientists may limit our ability to hire and retain highly qualified personnel on acceptable terms.

Despite our efforts to retain valuable employees, members of our management and scientific and development teams may terminate their employment with us on short notice. Although we have written employment arrangements with all of our employees, these employment arrangements generally provide for at-will employment, which means that our employees can leave our employment at any time, with or without notice. The loss of the services of any of our executive officers or other key employees and our inability to find suitable replacements could potentially harm our business, financial condition and prospects. We do not maintain “key man” insurance policies on the lives of these individuals or the lives of any of our other employees. Our success also depends on our ability to continue to attract, retain and motivate highly skilled junior, mid-level, and senior managers as well as junior, mid-level, and senior scientific and medical personnel.

Many of the other biotechnology and pharmaceutical companies with whom we compete for qualified personnel have greater financial and other resources, different risk profiles and longer histories in the industry than we do. They also may provide more diverse opportunities and better chances for career advancement. Some of these characteristics may be more appealing to high quality candidates than that which we have to offer. If we are unable to continue to attract and retain high quality personnel, the rate and success at which we can develop and commercialize product candidates will be limited.

16

Table of Contents

If we fail to obtain and maintain approval from regulatory authorities in international markets for HZT-501 and LODOTRA and any future product candidates for which we have rights in international markets, our market opportunities will be limited and our business will be adversely impacted.