Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

mLight Tech, Inc.

-----------------

(Exact name of registrant as specified in its charter)

Florida

-------

(State or other jurisdiction of incorporation or organization)

7372

----

(Primary Standard Industrial Classification Code Number)

27-3436055

----------

(I.R.S. Employer Identification Number)

Edward Sanders

9694 Royal Palm Blvd, Coral Springs, FL 33065

954-856-5718

---------------------------------------------

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

As soon as practicable after the effective date of this registration statement

------------------------------------------------------------------------------

(Approximate date of commencement of proposed sale to the public)

This is the initial public offering of the Company's common stock.

If any of the securities being registered on this Form are to be offered on a

delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant

to Rule 462(b) under the Securities Act, please check the following box and list

the Securities Act registration statement number of the earlier effective

registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under

the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under

the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting Company. See

the definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting Company" in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting Company [X]

(Do not check if a smaller reporting Company)

CALCULATION OF REGISTRATION FEE

Title of Each Proposed Proposed

Class of Amount Maximum Maximum Amount of

Securities to to be Offering Price Aggregate Registration

be Registered Registered(1) Per Unit(2) Offering Price Fee(3)

------------- ------------- -------------- -------------- ------------

Common Stock

by Company 3,000,000 $0.01 $30,000 $2.14

(1) The Company may not sell all of the shares, in fact it may not sell any of

the shares. For example, if only 50% of the shares are sold, there will be

1,500,000 shares sold and the gross proceeds will be $15,000.

(2) The offering price has been arbitrarily determined by the Company and bears

no relationship to assets, earnings, or any other valuation criteria. No

assurance can be given that the shares offered hereby will have a market value

or that they may be sold at this, or at any price.

(3) Estimated solely for the purpose of calculating the registration fee based

on Rule 457(o).

The registrant hereby amends this registration statement on such date or dates

as may be necessary to delay its effective date until the Registrant shall file

a further amendment which specifically states that this Registration Statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the registration statement shall become

effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

ii

PROSPECTUS

----------

3,000,000 SHARES OF COMMON STOCK

MLIGHT TECH, INC.

$0.01 PER SHARE

This registration statement constitutes the initial public offering of mLight

Tech, Inc. (the "Company", "us", or "mLight") common stock. mLight is

registering 3,000,000 shares of common stock at an offering price of $0.01 per

share for a total amount of $30,000. The Company will sell the securities in

$500 increments. There are no underwritings or broker dealers involved with the

offering.

The Company will offer the securities on a best efforts basis and there will be

no minimum amount required to close the transaction. The Company's sole officer

and director, Mr. Edward Sanders, will be responsible to market and sell these

securities.

Currently, Mr. Sanders owns 100% of the Company's common stock. After the

offering, Mr. Sanders will retain a sufficient number of shares to continue to

control the operations of the Company.

If all the shares are not sold, there is the possibility that the amount raised

may be minimal and might not even cover the costs of the offering which the

Company estimates at $5,000. The proceeds from the sale of the securities will

be placed directly into the Company's account and there will not be an escrow

account. Since there is no escrow account, any investor who purchases shares

will have no assurance that any monies besides themselves will be subscribed to

the prospectus. All proceeds from the sale of the securities are non-refundable,

except as may be required by applicable laws. The Company will pay all expenses

incurred in this offering. There has been no public trading market for the

common stock of mLight.

The offering shall terminate on the earlier of (i) the date when the sale of all

3,000,000 shares is completed or (ii) ninety (90) days from the date of this

prospectus becomes effective. The Company will not extend the offering period

beyond the ninety (90) days from the effective date of this prospectus.

This investment involves a high degree of risk. You should purchase shares only

if you can afford the complete loss of your investment. See the section titled

"Risk Factors" herein.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK AND SHOULD BE

CONSIDERED ONLY BY PERSONS WHO CAN AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT.

PLEASE REFER TO "RISK FACTORS" BEGINNING ON PAGE 5.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE

ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENSE.

The information in this prospectus is not complete and may be changed. mLight

Tech, Inc. may not sell these securities until the registration statement filed

with the U.S. Securities and Exchange Commission is deemed "effective". This

prospectus is not an offer to sell these securities and it is not soliciting an

offer to buy these securities in any state where the offer or sale is not

permitted.

The date of this prospectus is October __, 2010

TABLE OF CONTENTS

Page No.

--------

Part I

------

SUMMARY OF OUR OFFERING................................................. 3

SUMMARY OF OUR COMPANY................................................. 4

SUMMARY OF FINANCIAL DATA............................................... 4

DESCRIPTION OF PROPERTY................................................. 5

RISK FACTORS............................................................ 5

USE OF PROCEEDS......................................................... 12

DETERMINATION OF OFFERING PRICE......................................... 13

DILUTION OF THE PRICE YOU PAY FOR YOUR SHARES........................... 13

THE OFFERING BY THE COMPANY............................................. 14

PLAN OF DISTRIBUTION.................................................... 14

LEGAL PROCEEDINGS....................................................... 17

BUSINESS................................................................ 17

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND PLAN OF

OPERATION............................................................. 24

CODE OF BUSINESS CONDUCT AND ETHICS..................................... 29

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS............ 29

DIRECTOR AND OFFICER COMPENSATION....................................... 29

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.......... 30

DESCRIPTION OF SECURITIES............................................... 31

REPORTING............................................................... 32

STOCK TRANSFER AGENT.................................................... 32

STOCK OPTION PLAN....................................................... 32

LITIGATION.............................................................. 32

LEGAL MATTERS........................................................... 32

EXPERTS................................................................. 33

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND CORPORATE GOVERNANCE. 33

INDEMNIFICATION FOR SECURITIES ACT LIABILITIES.......................... 33

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS................ 34

CHANGES AND DISAGREEMENTS WITH ACCOUNTANTS AND FINANCIAL DISCLOSURE..... 35

WHERE TO FIND ADDITIONAL INFORMATION.................................... 35

FINANCIAL STATEMENTS.................................................... F-1

Part II

-------

ITEM 13. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION ................... II-1

ITEM 14. INDEMNIFICATION OF DIRECTORS AND OFFICERS ..................... II-1

ITEM 15. RECENT SALES OF UNREGISTERED SECURITIES ....................... II-1

ITEM 16. EXHIBITS ...................................................... II-2

ITEM 17. UNDERTAKINGS .................................................. II-3

SIGNATURES ............................................................. II-5

2

SUMMARY OF OUR OFFERING

The following summary is not complete and does not contain all of the

information that may be important to you. You should read the entire prospectus

before making an investment decision to purchase our Common Stock.

THE ISSUER: mLight Tech, Inc. a Florida corporation

SECURITIES BEING OFFERED: 3,000,000 shares of our Common Stock, par value

$0.0001 per share.

OFFERING PRICE: $0.01 per share.

MINIMUM NUMBER OF SHARES TO None

BE SOLD IN THIS OFFERING:

COMPANY CAPITALIZATION: Common Stock: 300,000,000 shares authorized;

9,000,000 shares outstanding as of the date of

this prospectus.

Preferred Stock: No shares authorized; no shares

outstanding and no series of preferred stock

designated.

COMMON STOCK OUTSTANDING 9,000,000 Shares of our Common Stock are issued

BEFORE AND AFTER THE and outstanding as of the date of this prospectus.

OFFERING: Upon the completion of this offering, 12,000,000

shares will be issued and outstanding assuming all

of the shares offered are sold.

TERMINATION OF THE The offering will conclude at the earlier of when

OFFERING: all 3,000,000 shares of common stock have been

sold or 90 days after this registration statement

is declared effective by the Securities and

Exchange Commission.

USE OF PROCEEDS: We intend to use the proceeds to further develop

and continue our business operations and other

general working capital and expenses incurred

relating to this registration statement. See "Use

of Proceeds" section for more information.

RISK FACTORS: See "Risk Factors" and the other information in

this prospectus for a discussion of the factors

you should consider before deciding to invest in

shares of our Common Stock. An investment in our

Company should be considered high risk, and an

investment suitable only for those who can afford

to lose the entirety of their investment.

You should rely only upon the information contained in this prospectus. mLight

has not authorized anyone to provide you with information different from that

which is contained in this prospectus. mLight is offering to sell shares of

common stock and seeking offers to buy shares of common stock only in

jurisdictions where offers and sales are permitted. The information contained in

this prospectus is accurate only as of the date of this prospectus, regardless

of the time of delivery of this prospectus, or of any sale of the common stock.

3

SUMMARY INFORMATION ABOUT MLIGHT

mLight Tech, Inc. was founded in September 2010 to provide software solutions

that simplify the management of networked personal computers. mLight plans to

develop products to automate network inventory and reporting, diagramming and

documentation, problem identification and resolution, and compliance.

The number of personal computers and local area networks installed in commercial

enterprises has grown rapidly over the last several years, making it difficult

for an organization to track and manage its personal computer hardware and

software assets. The problem is compounded by the geographic and physical

distribution of these assets. mLight will provide a unique solution to this

problem. The Company's products will help design, discover, document and manage

distributed personal computer networks. Through a combination of integrated

functionality and powerful data management capability, mLight products will

allow organizations to better manage their PC networks, thereby reducing their

total cost of ownership. mLight products will be specifically targeted at small

to medium size networks in medium to large companies.

Our business and registered office is located at 9694 Royal Palm Blvd, Coral

Springs, FL, 330654. Our contact number is 954-856-5718.

As of September 30, 2010, mLight has $8,900 of cash on hand in the corporate

bank account. The Company currently has incurred liabilities of $2,900. The

Company anticipates incurring costs associated with this offering totaling

approximately $5,000. As of the date of this prospectus, we have not generated

any revenue from our business operations. The following financial information

summarizes the more complete historical financial information found in the

audited financial statements of the Company filed with this prospectus.

SUMMARY FINANCIAL DATA

The following summary financial data should be read together with our financial

statements and the related notes and "Management's Discussion and Analysis or

Plan of Operation" appearing elsewhere in this prospectus. The summary financial

data is not intended to replace our financial statements and the related notes.

Our historical results are not necessarily indication of the results to be

expected for any future period.

BALANCE SHEET AS OF SEPTEMBER 30, 2010

------------- ------------------------

Total Assets $ 8,900

Total Liabilities $ 2,900

Total Shareholder's Equity $ 6,000

OPERATING DATA SEPTEMBER 3, 2010 THROUGH SEPTEMBER 30, 2010

-------------- --------------------------------------------

Revenue $ 0

Net Loss $ 3,000

Net Loss Per Share * $ 0

* Diluted loss per share is identical to basic loss per share as the Company has

no potentially dilutive securities outstanding.

As indicated in the financial statements accompanying this prospectus, mLight

has had no revenue to date and has incurred only losses since inception. The

Company has had no operations and has been issued a "going concern" opinion from

their auditors, based upon the Company's reliance upon the sale of our common

stock as the sole source of funds for our future operations.

4

AVAILABLE INFORMATION

Upon the effectiveness of the Company's registration statement on Form S-1, of

which this prospectus is a part, with the Securities and Exchange Commission

("SEC"), the Company will be subject to the reporting and information

requirements of the Securities Exchange Act of 1934, as amended (the "Exchange

Act"), and will therefore be required to file annual and quarterly reports and

other reports and statements with the SEC. Such reports and statements will be

available free of charge on the SEC's website, www.sec.gov.

DIVIDEND POLICY

We have never paid or declared dividends on our securities. The payment of cash

dividends, if any, in the future is within the discretion of our Board and will

depend upon our earnings, our capital requirements, financial condition and

other relevant factors. We intend, for the foreseeable future, to retain future

earnings for use in our business.

DESCRIPTION OF PROPERTY

The company's office is located at 9694 Royal Palm Blvd, Coral Springs, FL

33065. The business office is located at the office of Edward Sanders, the sole

officer and director of the company at no charge.

RISK FACTORS

An investment in our Common Stock involves a high degree of risk. In addition to

the other information in this prospectus, you should carefully consider the

following risk factors in evaluating the Company and our business before

purchasing the shares of Common Stock offered hereby. This prospectus contains,

in addition to historical information, forward-looking statements that involve

risks and uncertainties. Our actual results could differ materially. Factors

that could cause or contribute to such differences include, but are not limited

to, those discussed below, as well as those discussed elsewhere in this

prospectus, including the documents incorporated by reference.

RISKS RELATED TO OUR BUSINESS

-----------------------------

WE ARE NOT CURRENTLY PROFITABLE AND MAY NOT BECOME PROFITABLE.

At September 30, 2010, we had $8,900 cash on-hand and our stockholder's equity

was $6,000 and there is substantial doubt as to our ability to continue as a

going concern. We have incurred operating losses since our formation and expect

to incur losses and negative operating cash flows for the foreseeable future,

and we may not achieve profitability. We expect to incur substantial losses for

the foreseeable future and may never become profitable. We also expect to

experience negative cash flow for the foreseeable future as we fund our

operating losses and capital expenditures. As a result, we will need to generate

significant revenues in order to achieve and maintain profitability. We may not

be able to generate these revenues or achieve profitability in the future. Our

failure to achieve or maintain profitability could negatively impact the value

of our business.

WE ARE DEPENDENT UPON THE PROCEEDS OF THIS OFFERING TO FUND OUR BUSINESS. IF WE

DO NOT SELL ENOUGH SHARES IN THIS OFFERING TO CONTINUE OPERATIONS, OUR SOLE

OFFICER AND DIRECTOR HAS VERBALLY AGREED TO FUND OUR OPERATIONS, WHICH COULD END

AT ANY TIME, WHICH COULD HAVE A NEGATIVE EFFECT ON YOUR COMMON STOCK.

5

As of September 30, 2010, mLight Tech, Inc. has $8,900 in assets and limited

capital resources. In order to continue operating through 2010, we must raise

approximately $25,000 in gross proceeds from this offering. To date, our

operations have been funded by our sole officer and director pursuant to a

verbal, non-binding agreement. Mr. Edward Sanders has agreed to personally fund

the Company's overhead expenses, including legal, accounting, and operational

expenses until the Company can achieve revenues sufficient to sustain its

operational and regulatory requirements. The Company does not currently owe Mr.

Edward Sanders any money as of the date of this registration statement, as Mr.

Edward Sanders' monetary funding to the Company as of the date hereof has not

been categorized as loans made to the Company, but as contributions for which

she has received founders stock. Future contributions by Mr. Edward Sanders to

the Company, pursuant to the verbal and non-binding agreement, will be reflected

on the financial statements of the Company as liabilities.

Unless the Company begins to generate sufficient revenues to finance operations

as a going concern, the Company may experience liquidity and solvency problems.

Such liquidity and solvency problems may force us to cease operations if

additional financing is not available.

In the event our Company does not have adequate proceeds from this offering, our

sole Officer and Director, Mr. Edward Sanders, has verbally agreed to fund the

Company for an indefinite period of time. The funding of the Company by Mr.

Edward Sanders will create a further liability of the Company to be reflected on

the Company's financial statements. Mr. Edward Sanders' commitment to personally

fund the Company is not contractual and could cease at any moment in his sole

and absolute discretion.

Also, as a public company, we will incur professional and other fees in

connection with our quarterly and annual reports and other periodic filings the

SEC. Such costs can be substantial and we must generate enough revenue or raise

money from offerings of securities or loans in order to meet these costs and our

SEC filing requirements.

THE PC DESKTOP SOFTWARE MARKET IS A VERY COMPETITIVE MARKET AND QUALIFIED

RESOURCES ARE REQUIRED TO ATTRACT CUSTOMERS. WITHOUT THESE RESOURCES, WE FACE A

HIGH RISK OF BUSINESS FAILURE.

The Company expects that attracting, building and managing a customer base is

difficult to accomplish, especially considering the PC software market is very

competitive. This is critical to ensure revenue to the Company. Accordingly, the

Company must retain qualified and experienced personnel to build and maintain a

customer Base. Without these resources, our future sales and operating results

will be negatively impacted and our business could fail.

MLIGHT MAY BE UNABLE TO MANAGE ITS FUTURE GROWTH. IF THE COMPANY CAN NOT

SUCCESSFULLY MANAGE THE GROWTH, THE COMPANY MAY RUN OUT OF MONEY AND FAIL.

Any extraordinary growth may place a significant strain on management, finance,

operating and technical resources. Failure to manage this growth effectively

could have a materially adverse effect on the Company's financial condition or

the results of its operations.

AS OUR BUSINESS GROWS, WE WILL NEED TO ATTRACT ADDITIONAL MANAGERIAL EMPLOYEES

WHICH WE MIGHT NOT BE ABLE TO DO.

We have one officer and director, Mr. Edward Sanders, the President and sole

director. In order to grow and implement our business plan, we would need to add

managerial talent to support our business plan. There is no guarantee that we

will be successful in adding such managerial talent.

6

THE COMPANY'S SOLE OFFICER AND DIRECTOR MAY NOT BE IN A POSITION TO DEVOTE A

MAJORITY OF HIS TIME TO THE COMPANY, WHICH MAY RESULT IN PERIODIC INTERRUPTIONS

AND EVEN BUSINESS FAILURE.

Mr. Edward Sanders, our sole officer and director, has other business interests

and currently devotes approximately 30-35 hours per week to our operations. He

currently works at Staples Technology Solutions, a division of Staples. In

addition, the Company is entirely dependent on the efforts of its sole officer

and director, therefore his departure could have a materially adverse effect on

the business. His industry and technical expertise are critical to the success

of the business. The loss of this resource would have a significant impact on

our business. The Company does not maintain key person life insurance on its

sole officer and director.

SINCE OUR SOLE OFFICER AND DIRECTOR CURRENTLY OWNS 100% OF THE OUTSTANDING

COMMON STOCK, INVESTORS MAY FEEL THAT HIS DECISIONS ARE CONTRARY TO THEIR

INTERESTS

The Company's sole officer and director, Mr. Edward Sanders, owns 100% of the

outstanding shares and will own no less than 75% after this offering is

completed. For example, if 50% of the offering is sold, Mr. Sanders will retain

85.7% of the shares outstanding. As a result, he will maintain control of the

Company and be able to choose all of our directors. His interests may differ

from those of other stockholders. Factors that could cause his interests to

differ from the other stockholders include the impact of corporate transactions

on the timing of business operations and his ability to continue to manage the

business given the amount of time he is able to devote to the Company.

IF, AFTER DEMONSTRATING PROOF-OF-CONCEPT, WE ARE UNABLE TO ESTABLISH PROFITABLE

RELATIONSHIPS WITH CUSTOMERS AND GENERATE REVENUES, THE BUSINESS WILL FAIL.

Because there may be a substantial delay between the completion of this

offering, and creating a proof-of-concept we can use to attract customers, it

may take us longer to generate revenues. If the Company's efforts are

unsuccessful or take longer than anticipated, the Company may run out of capital

and if Mr. Edward Sanders does not fund the Company, the business will fail.

WE WILL RELY ON STRATEGIC RELATIONSHIPS TO PROMOTE OUR PRODUCTS SERVICES AND IF

WE FAIL TO DEVELOP, MAINTAIN OR ENHANCE THESE RELATIONSHIPS, OUR ABILITY TO

SERVE OUR CUSTOMERS AND DEVELOP NEW SERVICES AND APPLICATIONS COULD BE HARMED.

Our ability to provide our products to small and medium businesses(SMB) depends

significantly on our ability to develop, maintain or enhance our strategic

relationships with these potential customers. In the beginning of operations,

there will be a marketing challenge for mLight. The Company and identity will be

newly formed; therefore, the company will be relatively unknown in the

marketplace. Although the founder has significant experience and many contacts

within the technology industry, he has worked mainly as a consultant during the

course of his career. Therefore, mLight won't benefit from immediate name

recognition.

THE COMPANY MAY RETAIN INDEPENDENT RESOURCES OR CONSULTANTS DUE TO CAPITAL

CONSTRAINTS TO HELP GROW THE BUSINESS. IF THESE RESOURCES DO NOT PERFORM, THE

COMPANY MAY HAVE TO CEASE OPERATIONS AND YOU MAY LOOSE YOUR INVESTMENT.

The company's management may decide due to economic reasons to retain

independent contractors to provide services to the company. Those independent

individuals and organizations have no fiduciary duty to the shareholders of the

company and may not perform as expected.

7

WE MAY NOT BE ABLE TO COMPETE SUCCESSFULLY WITH CURRENT AND FUTURE COMPETITORS.

mLight Tech, Inc. has many potential competitors in the technology (ex.

networking of personal computers) industry. We will compete, in our current and

proposed businesses, with other companies, some of which have far greater

marketing and financial resources and experience than we do. We cannot guarantee

that we will be able to penetrate our intended market and be able to compete

profitably, if at all. In addition to established competitors, there is ease of

market entry for other companies that choose to compete with us. Effective

competition could result in price reductions, reduced margins or have other

negative implications, any of which could adversely affect our business and

chances for success. Competition is likely to increase significantly as new

companies enter the market and current competitors expand their services. Many

of these potential competitors are likely to enjoy substantial competitive

advantages, including: larger staffs, greater name recognition, larger customer

bases and substantially greater financial, marketing, technical and other

resources. To be competitive, we must respond promptly and effectively to the

challenges of financial change, evolving standards and competitors' innovations

by continuing to enhance our services and sales and marketing channels. Any

pricing pressures, reduced margins or loss of market share resulting from

increased competition, or our failure to compete effectively, could fatally

damage our business and chances for success.

AUDITOR'S GOING CONCERN - SUBSTANTIAL UNCERTAINTY ABOUT THE ABILITY OF MLIGHT,

INC. TO CONTINUE ITS OPERATIONS AS A GOING CONCERN

In their audit report for the period ending September 30, 2010 and dated October

6, 2010; our auditors have expressed an opinion that substantial doubt exists as

to whether we can continue as an ongoing business. Because our sole officer may

be unwilling or unable to loan or advance any additional capital to mLight Tech,

Inc. we believe that if we do not raise additional capital within 12 months of

the effective date of this registration statement, we may be required to suspend

or cease the implementation of our business plans. Due to the fact that there is

no minimum investment and no refunds on sold shares, you may be investing in a

Company that will not have the funds necessary to develop its business

strategies. As such we may have to cease operations and you could lose your

entire investment. See the September 30, 2010 Audited Financial Statements -

Auditors' Report". Because the Company has been issued an opinion by its

auditors that substantial doubt exists as to whether it can continue as a going

concern it may be more difficult to attract investors.

RISKS RELATED TO THIS OFFERING

------------------------------

BECAUSE THERE IS NO PUBLIC TRADING MARKET FOR OUR COMMON STOCK, YOU MAY NOT BE

ABLE TO SELL YOUR STOCK

There is currently no public trading market for our common stock. Therefore,

there is no central place, such as a stock exchange or electronic trading

system, to resell your shares. If you do want to resell your shares, you will

have to locate a buyer and negotiate your own sale. The offering price and other

terms and conditions relative to the Company's shares have been arbitrarily

determined by the Company and do not bear any relationship to assets, earnings,

book value or any other objective criteria of value. Additionally, as the

Company was formed recently and has only a limited operating history and no

earnings, the price of the offered shares is not based on its past earnings and

no investment banker, appraiser or other independent third party has been

consulted concerning the offering price for the shares or the fairness of the

offering price used for the shares.

8

INVESTING IN OUR COMPANY WILL RESULT IN AN IMMEDIATE LOSS BECAUSE BUYERS WILL

PAY MORE FOR OUR COMMON STOCK THAN THE PRO RATA PORTION OF THE ASSETS ARE WORTH

The Company has only been recently formed and has only a limited operating

history and no earnings, therefore, the price of the offered shares is not based

on any data. The offering price and other terms and conditions regarding the

Company's shares have been arbitrarily determined and do not bear any

relationship to assets, earnings, book value or any other objective criteria of

value. No investment banker, appraiser or other independent third party has been

consulted concerning the offering price for the shares or the fairness of the

offering price used for the shares.

The offering price of $0.01 per common share as determined herein is

substantially higher than the net tangible book value per share of the Company's

common stock. mLight's assets do not substantiate a share price of $0.01. This

premium in share price applies to the terms of this offering and does not

attempt to reflect any forward looking share price subsequent to the Company

obtaining a listing on any exchange, or becoming quoted on the OTC Bulletin

Board.

THERE IS NO MINIMUM AMOUNT REQUIRED TO BE RAISED IN THIS OFFERING, AND IF WE

CANNOT GENERATE SUFFICIENT FUNDS FROM THIS OFFERING, THE BUSINESS WILL FAIL.

There is not a minimum amount of shares that need to be sold in this Offering

for the Company to access the funds. Therefore, the proceeds of this Offering

will be immediately available for use by us and we don't have to wait until a

minimum number of Shares have been sold to keep the proceeds from any sales. We

can't assure you that subscriptions for the entire Offering will be obtained. We

have the right to terminate the offering of the Shares at any time, regardless

of the number of Shares we have sold since there is no minimum subscription

requirement. Our ability to meet our financial obligations, cash needs, and to

achieve our objectives, could be adversely affected if the entire offering of

Shares is not fully subscribed for.

BECAUSE THE COMPANY HAS 300,000,000 AUTHORIZED SHARES, MANAGEMENT COULD ISSUE

ADDITIONAL SHARES, DILUTING THE CURRENT SHAREHOLDERS' EQUITY

The Company has 300,000,000 authorized shares, of which only 9,000,000 are

currently issued and outstanding and an up to a maximum amount of 12,000,000

will be issued and outstanding after this offering terminates if the full

offering is subscribed. The Company's management could, without the consent of

the existing shareholders, issue substantially more shares, causing a large

dilution in the equity position of the Company's current shareholders.

Additionally, large share issuances would generally have a negative impact on

the Company's share price. It is possible that, due to additional share

issuance, you could lose a substantial amount, or all, of your investment.

THE COMPANY DOES NOT ANTICIPATE PAYING DIVIDENDS IN THE FORESEEABLE FUTURE

We do not anticipate paying dividends on our common stock in the foreseeable

future, but plan rather to retain earnings, if any, for the operation growth and

expansion of our business. Therefore, the only way to liquidate your investment

is to sell your stock.

THE FAILURE TO COMPLY WITH THE INTERNAL CONTROL EVALUATION AND CERTIFICATION

REQUIREMENTS OF SECTION 404 OF SARBANES-OXLEY ACT COULD HARM OUR OPERATIONS AND

OUR ABILITY TO COMPLY WITH OUR PERIODIC REPORTING OBLIGATIONS.

9

Our Company is subject to the reporting requirements of the Securities Exchange

Act of 1934, as amended, or the Exchange Act. We are also required to comply

with the internal control evaluation and certification requirements of Section

404 of the Sarbanes-Oxley Act of 2002. We are in the process of determining

whether our existing internal controls over financial reporting systems are

compliant with Section 404. This process may divert internal resources and will

take a significant amount of time, effort and expense to complete. If it is

determined that we are not in compliance with Section 404, we may be required to

implement new internal control procedures and reevaluate our financial

reporting. If we are unable to implement these changes effectively or

efficiently, it could harm our operations, financial reporting or financial

results and could result in our being unable to obtain an unqualified report on

internal controls from our independent auditors, which could adversely affect

our ability to comply with our periodic reporting obligations under the Exchange

Act and the rules of the NASDAQ Global Market.

AS WE DO NOT HAVE AN ESCROW OR TRUST ACCOUNT WITH SUBSCRIPTIONS FOR INVESTORS,

IF WE FILE FOR OR ARE FORCED INTO BANKRUPTCY PROTECTION, THEY WILL LOSE THE

ENTIRE INVESTMENT

Invested funds for this offering will not be placed in an escrow or trust

account and if we file for bankruptcy protection or a petition for involuntary

bankruptcy is filed by creditors against us, your funds will become part of the

bankruptcy estate and administered according to the bankruptcy laws. As such,

you will lose your investment and your funds will be used to pay creditors.

BLUE SKY LAWS MAY LIMIT YOUR ABILITY TO SELL YOUR SHARES. IF THE STATE LAWS ARE

NOT FOLLOWED, YOU WILL NOT BE ABLE TO SELL YOUR SHARES

State Blue Sky laws may limit resale of the Shares. The holders of our shares of

common stock and persons who desire to purchase them in any trading market that

might develop in the future should be aware that there may be significant state

law restrictions upon the ability of investors to resell our shares.

Accordingly, even if we are successful in having the Shares available for

quoting on the OTCBB, investors should consider any secondary market for the

Company's securities to be limited. We intend to seek coverage and publication

of information regarding the Company in an accepted publication which permits a

"manual exemption". This manual exemption permits a security to be distributed

in a particular state without being registered if the company issuing the

security has a listing for that security in a securities manual recognized by

the state. However, it is not enough for the security to be listed in a

recognized manual. The listing entry must contain (1) the names of issuers,

officers, and directors, (2) an issuer's balance sheet, and (3) a profit and

loss statement for either the fiscal year preceding the balance sheet or for the

most recent fiscal year of operations. Furthermore, the manual exemption is a

non issuer exemption restricted to secondary trading transactions, making it

unavailable for issuers selling newly issued securities. Most of the accepted

manuals are those published in Standard and Poor's, Moody's Investor Service,

Fitch's Investment Service, and Best's Insurance Reports, and many states

expressly recognize these manuals. A smaller number of states declare that they

recognize securities manuals' but do not specify the recognized manuals. The

following states do not have any provisions and therefore do not expressly

recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana,

Montana, South Dakota, Tennessee, Vermont and Wisconsin.

OUR COMMON STOCK WILL BE SUBJECT TO THE "PENNY STOCK" RULES OF THE SEC AND THE

TRADING MARKET IN OUR SECURITIES IS LIMITED, WHICH MAKES TRANSACTIONS IN OUR

STOCK CUMBERSOME AND MAY REDUCE THE VALUE OF AN INVESTMENT IN OUR STOCK.

10

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes

the definition of a "penny stock," for the purposes relevant to us, as any

equity security that has a market price of less than $5.00 per share or with an

exercise price of less than $5.00 per share, subject to certain exceptions. For

any transaction involving a penny stock, unless exempt, the rules require:

o that a broker or dealer approve a person's account for transactions in

penny stocks; and

o the broker or dealer receives from the investor a written agreement to the

transaction, setting forth the identity and quantity of the penny stock to

be purchased.

In order to approve a person's account for transactions in penny stocks, the

broker or dealer must:

o obtain financial information and investment experience objectives of the

person; and

o make a reasonable determination that the transactions in penny stocks are

suitable for that person and the person has sufficient knowledge and

experience in financial matters to be capable of evaluating the risks of

transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny

stock, a disclosure schedule prescribed by the Commission relating to the penny

stock market, which, in highlight form:

o sets forth the basis on which the broker or dealer made the suitability

determination; and

o that the broker or dealer received a signed, written agreement from the

investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities

subject to the "penny stock" rules. This may make it more difficult for

investors to dispose of our Common Stock and cause a decline in the market value

of our stock. Disclosure also has to be made about the risks of investing in

penny stocks in both public offerings and in secondary trading and about the

commissions payable to both the broker-dealer and the registered representative,

current quotations for the securities and the rights and remedies available to

an investor in cases of fraud in penny stock transactions. Finally, monthly

statements have to be sent disclosing recent price information for the penny

stock held in the account and information on the limited market in penny stocks.

THE PRICE OF OUR SHARES OF COMMON STOCK IN THE FUTURE MAY BE VOLATILE.

If a market develops for our Common Stock, of which no assurances can be given,

the market price of our Common Stock will likely be volatile and could fluctuate

widely in price in response to various factors, many of which are beyond our

control, including, but not limited to: additions or departures of key

personnel; sales of our Common Stock; new technology, products and services; our

ability to execute our business plan; operating results below expectations; loss

of any strategic relationship; economic and quarter to quarter fluctuations in

our financial results. Because we have a very limited operating history with

limited to no revenues to date, you may consider any one of these factors to be

material.

11

FORWARD-LOOKING STATEMENTS

This prospectus contains certain forward-looking statements regarding

management's plans and objectives for future operations, including plans and

objectives relating to our planned entry into our service business. The

forward-looking statements and associated risks set forth in this prospectus

include or relate to, among other things, (a) our projected profitability, (b)

our growth strategies, (c) anticipated trends in our industry, (d) our ability

to obtain and retain sufficient capital for future operations, and (e) our

anticipated needs for working capital. These statements may be found under

"Management's Discussion and Analysis or Plan of Operation" and "Description of

Business," as well as in this prospectus generally. Actual events or results may

differ materially from those discussed in these forward-looking statements as a

result of various factors, including, without limitation, the risks outlined

under "Risk Factors" and matters described in this prospectus generally. In

light of these risks and uncertainties, the forward-looking statements contained

in this prospectus may not in fact occur.

The forward-looking statements herein are based on current expectations that

involve a number of risks and uncertainties. Such forward-looking statements are

based on the assumptions that we will be able to continue our business

strategies on a timely basis, that we will attract customers, that there will be

no materially adverse competitive conditions under which our business operates,

that our sole officer and director will remain employed as such, and that our

forecasts accurately anticipate market demand. The foregoing assumptions are

based on judgments with respect to, among other things, future economic,

competitive and market conditions, and future business decisions, all of which

are difficult or impossible to predict accurately and many of which are beyond

our control. Accordingly, although we believe that the assumptions underlying

the forward-looking statements are reasonable, any such assumption could prove

to be inaccurate and therefore there can be no assurance that the results

contemplated in forward-looking statements will be realized. In addition, as

disclosed elsewhere in this "Risk Factors" section of this prospectus, there are

a number of other risks inherent in our business and operations, which could

cause our operating results to vary markedly and adversely from prior results or

the results contemplated by the forward-looking statements. Increases in the

cost of our services, or in our general or administrative expenses, or the

occurrence of extraordinary events, could cause actual results to vary

materially from the results contemplated by these forward-looking statements.

Management decisions, including budgeting, are subjective in many respects and

subject to periodic revisions in order to reflect actual business conditions and

developments. The impact of such conditions and developments could lead us to

alter our marketing, capital investment or other expenditures and may adversely

affect the results of our operations. In light of the significant uncertainties

inherent in the forward-looking information included in this prospectus, the

inclusion of such information should not be regarded as a representation by us

or any other person that our objectives or plans will be achieved.

USE OF PROCEEDS

Our offering is being made on a self-underwritten basis: no minimum number of

shares must be sold in order for the offering to proceed. The offering price per

share is $0.01. The following table sets forth the potential net proceeds and

the uses of proceeds assuming the sale of 25%, 50%, 75% and 100%, respectively,

of the securities offered for sale by the Company.

IF 25% OF IF 50% OF IF 75% OF IF 100% OF

SHARES SOLD SHARES SOLD SHARES SOLD SHARES SOLD

----------- ----------- ----------- -----------

NET PROCEEDS FROM

THIS OFFERING $2,500 $10,000 $17,500 $25,000

12

Our offering is being made on a self-underwritten basis: no minimum number of

shares must be sold in order for the offering to proceed. The offering price per

share is $0.01. The net proceeds in the table above assume $5,000 in costs

associated with this offering.

The funds raised through this offering will be used to complete the business and

financial plan. If less than the maximum offering funds are raised, the proceeds

will first be used for essential business operations such as SEC filings, legal,

and accounting with the remaining amount allocated to completing the business

and financial plan and the first product prototype.

The above tables represent our intended uses of proceeds based on our ability to

raise certain amounts of the contemplated offering. To the extent that we cannot

raise the entire amount contemplated by this offering, our sole Officer and

Director, Edward Sanders, has verbally agreed to fund the Company for an

indefinite period of time. The funding of the Company by Mr. Edward Sanders will

create a further liability to the Company to be reflected on the Company's

financial statements. Mr. Edward Sanders' commitment to personally fund the

Company is not contractual and could cease at any moment in her sole and

absolute discretion.

To date, our operations have been funded by our sole officer and director

pursuant to a verbal, non-binding agreement. Mr. Edward Sanders has agreed to

personally fund the Company's overhead expenses, including legal, accounting,

and operational expenses until the Company can achieve revenues sufficient to

sustain its operational and regulatory requirements. The Company does not

currently owe Mr. Edward Sanders any money as of the date of this registration

statement, as Mr. Edward Sanders' monetary funding to the Company as of the date

hereof has not been categorized as loans made to the Company, but as

contributions for which she has received founders stock. Future contributions by

Mr. Edward Sanders to the Company, pursuant to the verbal and non-binding

agreement, will be reflected on the financial statements of the Company as

liabilities.

DETERMINATION OF OFFERING PRICE

As there is no established public market for our shares, the offering price and

other terms and conditions relative to our shares have been arbitrarily

determined by mLight and do not bear any relationship to assets, earnings, book

value, or any other objective criteria of value. In addition, no investment

banker, appraiser, or other independent third party has been consulted

concerning the offering price for the shares or the fairness of the offering

price used for the shares.

The price of the current offering is fixed at $0.01 per share. This price is

significantly greater than the price paid by the company's sole officer and

director for common equity since the company's inception on September 3, 2010.

The company's sole officer and director paid $0.0001 per share, a difference of

$0.0099 per share lower than the share price in this offering.

DILUTION OF THE PRICE YOU PAY FOR YOUR SHARES

Dilution represents the difference between the offering price and the net

tangible book value per share immediately after completion of this offering. Net

tangible book value is the amount that results from subtracting total

liabilities and intangible assets from total assets. Dilution arises mainly as a

result of our arbitrary determination of the offering price of the shares being

offered. Dilution of the value of the shares you purchase is also a result of

the lower book value of the shares held by our existing stockholders. The

following tables compare the differences of your investment in our shares with

the investment of our existing stockholders.

13

This table represents a comparison of the prices paid by purchasers of the

Common Stock in this offering and the individual who received shares in mLight

Tech, Inc. previously:

If 25% of If 50% of If 75% of If 100% of

Shares Sold Shares Sold Shares Sold Shares Sold

----------- ----------- ----------- -----------

Book value per share before offering ..... $ 0.0006 $ 0.0006 $ 0.0006 $ 0.0006

Book value per share after offering ...... $ 0.0008 $ 0.0015 $ 0.0020 $ 0.0025

Net increase to original shareholders .... $ 0.0002 $ 0.0009 $ 0.0014 $ 0.0019

Decrease in investment to new shareholders $ 0.0092 $ 0.0085 $ 0.0080 $ 0.0075

Dilution to new shareholders ............. 92% 85% 80% 75%

THE OFFERING BY THE COMPANY

mLight is registering 3,000,000 shares of its common stock for offer and sale.

There is currently no active trading market for our common stock, and such a

market may not develop or be sustained. If and when we become effective with the

SEC, we plan to develop a trading market. In order to do so, we have to retain

an authorized OTC Bulletin Board market maker. If we are successful in securing

a market maker, they will file Form 211 with FINRA (Financial Industry

Regulatory Authority). If FINRA approves the Company's 211, our stock will be

quoted on the OTCBB.

There can be no assurances that we will be able to retain an authorized OTCBB

market maker and furthermore, there are no assurances that we will be approved

by FINRA. At the date hereof, we are not aware that any market maker has any

such intention.

All of the shares registered herein will become effective for sale to investors.

The Company will not offer the shares through a broker-dealer or anyone

affiliated with a broker-dealer.

NOTE: As of the date of this prospectus, our sole officer and director, Mr.

Edward Sanders, owns 9,000,000 common shares, which are subject to Rule 144

restrictions. There is currently one (1) shareholder of our common stock.

The company is hereby registering 3,000,000 common shares. The price per share

is $0.01.

In the event the company receives payment for the sale of their shares, mLight

will receive all of the proceeds from such sales. mLight is bearing all expenses

in connection with the registration of the shares of the company.

PLAN OF DISTRIBUTION

We are offering the shares on a "self-underwritten" basis directly through Mr.

Sanders our executive officer and director named herein, who will not receive

any commissions or other remuneration of any kind for selling shares in this

offering, except for the reimbursement of actual out-of-pocket expenses incurred

in connection with the sale of the common stock. The offering will conclude at

the earlier of (i) when all 3,000,000 shares of common stock have been sold, or

(ii) 90 days after this registration statement becomes effective with the

Securities and Exchange Commission.

14

This offering is a self-underwritten offering, which means that it does not

involve the participation of an underwriter to market, distribute or sell the

shares offered under this prospectus. We will sell shares on a continuous basis.

We reasonably expect the amount of securities registered pursuant to this

offering to be offered and sold within ninety (90) days from this initial

effective date of this registration.

In connection with his selling efforts in the offering, Mr. Sanders will not

register as broker-dealer pursuant to Section 15 of the Exchange Act, but rather

will rely upon the "safe harbor" provisions of Rule 3a4-1 under the Exchange

Act. Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer

registration requirements of the Exchange Act for persons associated with an

issuer that participate in an offering of the issuer's securities. Edward

Sanders is not subject to any statutory disqualification, as that term is

defined in Section 3(a)(39) of the Exchange Act. Edward Sanders will not be

compensated in connection with his participation in the offering by the payment

of commissions or other remuneration based either directly or indirectly on

transactions in our securities. Mr. Sanders is not and has not been within the

past 12 months, a broker or dealer, and is not within the past 12 months, an

associated person of a broker or dealer. At the end of the offering, Mr. Sanders

will continue to primarily perform substantial duties for us or on our behalf.

Mr. Sanders has not participated in selling an offering of securities for any

issuer more than once every 12 months other than in reliance on Exchange Act

Rule 3a4-1(a)(4)(i) or (iii).

9,000,000 common shares are issued and outstanding as of the date of this

prospectus. The company is registering an additional 3,000,000 shares of its

common stock at the price of $0.01 per share.

mLight will receive all proceeds from the sale of the shares by the company. The

price per share is $0.01. However, mLight common stock may never be quoted on

the OTCBB or listed on any exchange.

Penny Stock Rules

The Securities and Exchange Commission has adopted rules that regulate

broker-dealer practices in connection with transactions in penny stocks. Penny

stocks are generally equity securities with a price of less than $5.00 (other

than securities registered on certain national securities exchanges or quoted on

the Nasdaq system, provided that current price and volume information with

respect to transactions in such securities is provided by the exchange or

system).

A purchaser is purchasing penny stock which limits the ability to sell the

stock. The shares offered by this prospectus constitute penny stock under the

Securities and Exchange Act. The shares will remain penny stocks for the

foreseeable future. The classification of penny stock makes it more difficult

for a broker-dealer to sell the stock into a secondary market, which makes it

more difficult for a purchaser to liquidate his/her investment. Any

broker-dealer engaged by the purchaser for the purpose of selling his or her

shares in us will be subject to Rules 15g-1 through 15g-10 of the Securities and

Exchange Act. Rather than creating a need to comply with those rules, some

broker-dealers will refuse to attempt to sell penny stock.

The penny stock rules require a broker-dealer, prior to a transaction in a penny

stock not otherwise exempt from those rules, to deliver a standardized risk

disclosure document, which:

- Contains a description of the nature and level of risk in the market for

penny stock in both Public offerings and secondary trading;

15

- Contains a description of the broker's or dealer's duties to the customer

and of the rights and remedies available to the customer with respect to a

violation of such duties or other requirements of the Securities Act of

1934, as amended;

- Contains a brief, clear, narrative description of a dealer market,

including "bid" and "ask" price for the penny stock and the significance

of the spread between the bid and ask price;

- Contains a toll-free number for inquiries on disciplinary actions;

- Defines significant terms in the disclosure document or in the conduct of

trading penny stocks; and

- Contains such other information and is in such form (including language,

type, size and format) as the Securities and Exchange Commission shall

require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a

penny stock, to the customer:

- The bid and offer quotations for the penny stock;

- The compensation of the broker-dealer and its salesperson in the

transaction;

- The number of shares to which such bid and ask prices apply, or other

comparable information relating to the depth and liquidity of the market

for such stock; and

- Monthly account statements showing the market value of each penny stock

held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a

penny stock not otherwise exempt from those rules; the broker-dealer must make a

special written determination that the penny stock is a suitable investment for

the purchaser and receive the purchaser's written acknowledgement of the receipt

of a risk disclosure statement, a written agreement to transactions involving

penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements will have the effect of reducing the trading

activity in the secondary market for our stock because it will be subject to

these penny stock rules. Therefore, stockholders may have difficulty selling

their securities.

The company's shares may be sold to purchasers from time to time directly by,

and subject to, the discretion of the company. Further, the company will not

offer their shares for sale through underwriters, dealers, or agents or anyone

who may receive compensation in the form of underwriting discounts, concessions

or commissions from the company and/or the purchasers of the shares for whom

they may act as agents. The shares sold by the company may be sold occasionally

in one or more transactions, at an offering price that is fixed at $0.01.

The shares may not be offered or sold in certain jurisdictions unless they are

registered or otherwise comply with the applicable securities laws of such

jurisdictions by exemption, qualification or otherwise. We intend to sell the

shares only in the states in which this offering has been qualified or an

exemption from the registration requirements is available, and purchases of

shares may be made only in those states.

16

In addition and without limiting the foregoing, the company will be subject to

applicable provisions, rules and regulations under the Exchange Act with regard

to security transactions during the period of time when this Registration

Statement is effective.

mLight will pay all expenses incidental to the registration of the shares

(including registration pursuant to the securities laws of certain states).

LEGAL PROCEEDINGS

We are not a party to any material legal proceedings and to our knowledge; no

such proceedings are threatened or contemplated by any party.

BUSINESS

COMPANY SUMMARY

mLight Tech, Inc. is a development stage company which plans to provide software

solutions that simplify the management of networked personal computers. mLight

products will automate network inventory and reporting, diagramming and

documentation, problem identification and resolution, and the assessment of IT

compliance.

The number of personal computers and local area networks installed in commercial

enterprises has grown rapidly over the last several years, making it difficult

for an organization to track and manage its personal computer hardware and

software assets. The problem is compounded by the geographic and physical

distribution of these assets. mLight plans to provide a unique solution to this

problem. The Company's products help design, discover, document and manage

distributed personal computer networks. mLight products will allow organizations

to better manage their PC networks, thereby reducing their total cost of

ownership. mLight products will be specifically targeted at small to medium size

networks in medium to large companies. Enterprise network administration suites,

with their complex installations and time consuming administration, are

generally not cost effective for the Company's target market. This fragmented

market, with no established leader, provides a significant opportunity for

mLight.

mLight products will provide the essential tools for effective management for PC

networks. Leveraging unique data discovery and documentation capabilities, the

Company's products will feature:

o Automated inventory and documentation of hardware and software assets;

o Automated network discovery;

o An intuitive visual mapping interface;

o Web based publishing and management;

o Extensive query and reporting capabilities;

o Customizable user-defined enhancements and features;

o Configuration management and problem resolution; and

o Simple installation and ease of use.

17

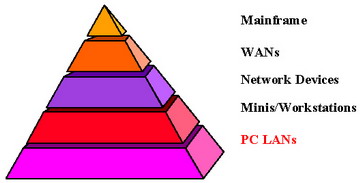

These capabilities will provide the documentation and reporting needed to support network design, mapping, inventory and asset management functions; elements that are critical for appropriate financial and management control. And mLight will deliver the benefits of asset management and network documentation in an integrated cost-effective solution. The market for mLight products has grown at a rapid pace. According to Gartner, the PC management market is over $2 Billion this year. MARKET OVERVIEW IT managers face an increasingly complex array of computer, communications and networking equipment that is constantly evolving due to changing business requirements, improved technologies and new software applications. Technology demands, combined with pressure to increase productivity and a continued shortage of qualified IT personnel, have resulted in a growing demand for systems and network management tools. The Systems and Network Management Market covers many sectors, both software and hardware related. The diagram below shows some of the physical components, where the entity as a whole is typically referred to as the "Enterprise". Some vendors target particular sectors, others the complete enterprise. Within any sector there are many functional areas - managing computer systems and software, managing the physical network, traffic analysis, error alerts, simulations, load and traffic balancing, configuration management, diagramming and documentation, remote monitoring, and management reporting.

mLight's solutions will focus on the PC LAN segment, and address the following

key market needs:

o Network diagramming and documentation - Documenting the logical network

configuration

o Inventory and asset management - Identifying and tracking PC hardware and

software assets

18

o Configuration management - Managing changes to PC hardware and software

configurations

o Remote troubleshooting and problem solving - Identifying and resolving

problems without physically visiting the PC

o Management reporting - Querying and reporting tools to analyze and

communicate information on the network and management activities

o IT ISO compliance - Managing compliance for PC hardware, software and data

MARKET OPPORTUNITY / PRODUCT POSITIONING

Simplifying the management of networked PC's. The Company intends to capitalize

on the simplicity of mLight Professional's planned integrated functionality,

unique data access and manipulation capabilities, and graphical user interface

by targeting network professionals responsible for desktop management in small

to medium sized networks in medium to large sized corporations.

Network administration suites from companies such as Intel, Microsoft, Novell,

Seagate, and Network Associates offer varied, often disparate, and increasingly

sophisticated functionality that spans from the desktop, to devices, and then to

network optimization. The complexity of installation, learning and usage of

these products render them very costly and sometimes ineffective to deploy. As a

result, mLight Professional plans to co-exists and/or displaces the network

management suite products.

mLight Professional will create the synergistic value proposition that inventory

and network documentation are two sides of the same coin; each essential for

managing the hardware and software assets of a PC network. Inventory will

provide the discovery and auditing, while diagramming will provide the logical,

visual representation and user interface to access the inventory data. Together

they will provide the essential foundation for effective management. mLight

Professional will combine these elements in an integrated, easy-to-use product

offering designed for the "middle market". Organizations using mLight

Professional will experience increased financial and management control over

their PC assets with more complete and up-to-date information about their

networks and configurations.

Supplementing these inventory and network documentation capabilities is a set of

utilities to help LAN administrators manage the health and configurations of

their PCs. LAN administrators are able to leverage the documented information on

their network and PC configurations as data to drive their diagnostics and

troubleshooting efforts with the remote control features of the product. The

inventory and configuration data, as well as navigation, security and the

ability to remotely control any machines on their network will be all accessed

through mLight Professional's visual interface, network diagram. Future software

features of the product will facilitate configuration management and change

control for the PCs on the network. Working with the documented inventory of

software configurations, administrators will be able to identify machines

needing updated configurations, and automatically distribute and install

software to these machines over the network.

19

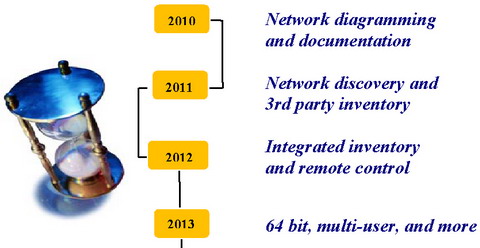

mLight Professional will be a natural extension of mLight's data discovery and documentation capabilities. The demand for remediation tools is growing exponentially, providing the Company with a unique opportunity to broaden its reach in the market. The Company intends to leverage its' mLight Advanced installed base with additional products beyond the year 2010. mLight Professional and mLight Advanced will be specifically designed and positioned to meet the needs of the "middle market". They will provide targeted functionality at a lower cost in an integrated, easy to use product offerings. PRODUCT OVERVIEW The Company plans to launched its first product mLight Professional 1.0, which will perform network diagramming and documentation.

mLight Professional will be an integrated application that automatically

collects, analyzes and reports on all of the PC and Mac desktop information in

your network. mLight Professional will automatically create an accurate,

up-to-date network diagram and documentation, will provide automated network

inventory and asset management, and will enable remote problem identification

and resolution.

mLight Advanced, an IT desktop compliance tool, will reduce the time and

resources required to identify and evaluate IT compliance readiness in a PC LAN

network. It will automatically review the network inventory for IT compliance

and will provide comprehensive reporting on compliance status.

20

mLight Professional

mLight Professional will simplify the process of network diagramming,

inventorying PC desktops, remote problem resolution, management of PC desktops

and report generation. mLight Professional will provide the following benefits:

Automatic Network Diagrams

mLight Professional will automatically create an accurate diagram of the

network by recognizing current network segments, structuring the

multi-level map, and placing workstations on their respective segments.

mLight Professional will enable customization to enhance the network map

with easy-to-use graphic editing capabilities and will support "what-if"

analyses to determine the impact of projected changes.

Automatic Inventory of PC Desktops

mLight Professional's inventory capability automatically will gather and

generate a database of all networked PC's and installed software. This

will provide essential asset management and will simplify problem

diagnosis, allowing IT professionals to better manage, maintain and grow

the network.

Universal PC Remote Control

mLight Professional's remote control capability will allows IT

professionals to resolve end-user problems from a remote location, which

provides better and cost reduced customer support. Using the remote

control feature, network administrators can "chat" with their customer in

order to resolve problems and update systems, without leaving their

workstation.

Ready-to-Run Report Suite

mLight Professional will include pre-defined reports covering software

license compliance, financial analysis, asset deployment, and others.

mLight Advanced

mLight Advanced will be a dynamic Web-based tool for desktop IT compliance.

mLight Advanced will provide up-to-date BIOS and software compliance

information, including currently available patches, upgrades and IT compliant

alternatives. mLight Advanced will leverage the desktop PC inventory data

discovered by mLight Professional to generate a comprehensive compliance

information profile specific to each organization.

Identify IT Compliance Status

mLight Advanced will significantly reduce the time and resources required

to identify and evaluate compliance issues. It also provides access to a

centralized resource center for IT compliance related information. mLight

Advanced will provide access to a dynamic resource center containing the

most current compliance information, as provided by the original software

vendors. The information will be updated annually.

Develop and Execute a Compliance Plan

mLight Advanced will help automate the planning process. By cross-checking

the system against the compliance database, debugging efforts and

resources can be prioritized and focused on business-critical systems and

applications.

21

Generate Status Reports on Compliance Software

mLight Advanced will generate status reports on forthcoming compliant

software versions. Reports will include dates when publishers provide

patches, updated versions, corrective action advice, or final

determination of compliance for the indicated software products.

PRODUCT SUMMARY

LIST PRICE AND

PRODUCT KEY FEATURES KEY BENEFITS LICENSING

------------------- ----------------------------- -------------------------- ------------------------

mLight Professional o Automatic network diagram o Simplified management o Licenses will be sold

Professional o Automatic software and and tracking of PC LAN on a per-node basis

hardware inventory assets o Priced from $9-$12 per

o Remote control o Remote administration of node, depending on the

o Management reports PC desktops from a number of nodes

central location purchased.

------------------- ----------------------------- -------------------------- ------------------------

mLight Advanced o IT compliance status for PC o Automated analysis of IT o Web-based license

LAN hardware and software compliance o Licenses sold on a

o Management reports on IT o Dynamic knowledge based per-node bases

compliance insures up-to-date IT o Priced at $15 per

o Corrective options for IT compliance status on node as an add-on to

compliance issues hardware and software mLight Professional.

o Vendor-specific IT

compliance information

o Access to Web-based IT

knowledge base

SALES & DISTRIBUTION

mLight's products and services will be marketed throughout the USA through

indirect business partners and a direct sales force. Much of mLight's market

success will occur through direct mail marketing.

mLight's targeted customers include leading companies in a broad range of

industry segments such as manufacturing, high technology, financial services and

consulting. The Company will also seek a partner program, targeted at key

resellers and system integrators. This program will include special pricing,

training and dedicated technical support for partners who achieve and maintain

certain minimum sales volumes.

COMPETITION

The competition for mLight Professional and mLight Advanced comes from both

standalone software products and management suites. mLight plans to offer a

compelling value proposition to differentiate itself from its competitors. These

products will offer targeted functionality at a lower price point.

Standalone Solutions

The Company believes that mLight Professional's strength in the standalone

market will come from its focused solutions and lower price point. IDC notes

that users "do not want to pay for unused functionality" and hence choose

standalone offerings over the more expensive suites. mLight will compete with a

diffuse array of vendors of standalone solutions offering network diagramming,

remote control and inventory functions. Vendors include Visio, Symantec,

Traveling Software, BindView, Tally Systems, and others. None of the standalone

solution vendors have offerings in more than one of these categories. Our

competitive advantage will arise from offering the additional capabilities in

the other areas of our product, at a price equal to or lower than the price of

the competing standalone solution.

22

Primary competitors in each category are listed below:

o Diagramming - Manual diagrams (i.e., no software solution) and Visio are

the two largest competitors. When displacing manual diagramming, users are

often using PowerPoint, Corel Draw or some other tool that is not well

suited to the task and offers no automation or specialized network drawing

features or network device images.

o Remote Control - The remote control market has a number of entrenched

vendors, including Symantec PC Anywhere, Compaq Carbon Copy, Stac ReachOut

and Traveling Software Laplink.

o Inventory - Prominent competitors in this segment are BindView

Development's NETInventory and Tally Systems' NetCensus.

Management Suites

The Company believes that the management suite market is fragmented, has no

dominant vendor, and has less than 50% total market penetration. Major

competitors in the suite space include Intel LANDesk, Network Associates ZAC,

Novell ManageWise, and Microsoft SMS. Other players include Seagate, Tally

Systems, and Hewlett Packard. Although there is no uniform set of capabilities

all suites provide, there are four commonly expected functional offerings:

network inventory, software distribution, software license metering, and remote

control. Most offerings include other functions such as server management,