Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GEORESOURCES INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - GEORESOURCES INC | dex991.htm |

GeoResources, Inc

Corporate Profile

October 2010

Exhibit 99.2 |

2

Forward-Looking Statements

Information

herein

contains

forward-looking

statements

that

involve

significant

risks

and

uncertainties,

including

our

need

to

replace

production

and

acquire

or

develop

additional

oil

and

gas

reserves,

intense

competition

in

the

oil

and

gas

industry,

our

dependence

on

our

management,

volatile

oil

and

gas

prices

and

costs,

with

hedging

activities

and

uncertainties

of

our

oil

and

gas

estimates

of

proved

reserves

and

reserve

potential,

all

of

which

may

be

substantial.

In

addition,

all

statements

or

estimates

made

by

the

Company,

other

than

statements

of

historical

fact,

related

to

matters

that

may

or

will

occur

in

the

future

are

forward-looking

statements.

Readers

are

encouraged

to

read

our

December

31,

2009

Annual

Report

on

Form

10-K

and

Form

10-K/A

and

any

and

all

of

our

other

documents

filed

with

the

SEC

regarding

information

about

GeoResources

for

meaningful

cautionary

language

in

respect

of

the

forward-looking

statements

herein.

Interested

persons

are

able

to

obtain

free

copies

of

filings

containing

information

about

GeoResources,

without

charge,

at

the

SEC’s

internet

site

(http://www.sec.gov).

There

is

no

duty

to

update

the

statements

herein. |

3

Key Investment Highlights

Value Creation

Significant Bakken and Eagle Ford upside

Strategically located in high Rate of Return Resource plays

High Level of operating control

Significant Bakken Exposure

24,000 net operated acres

13,000 net non-op acres

37,000 TOTAL ACRES

Rapidly expanding Eagle Ford Position

11,000 net acres

Commitment for additional leases

Solid Proved Reserve and Production

Base

24 Mmboe proved reserves (as of 7/1/10)

are 56% oil

5,158 BOE/d average 1H:2010 |

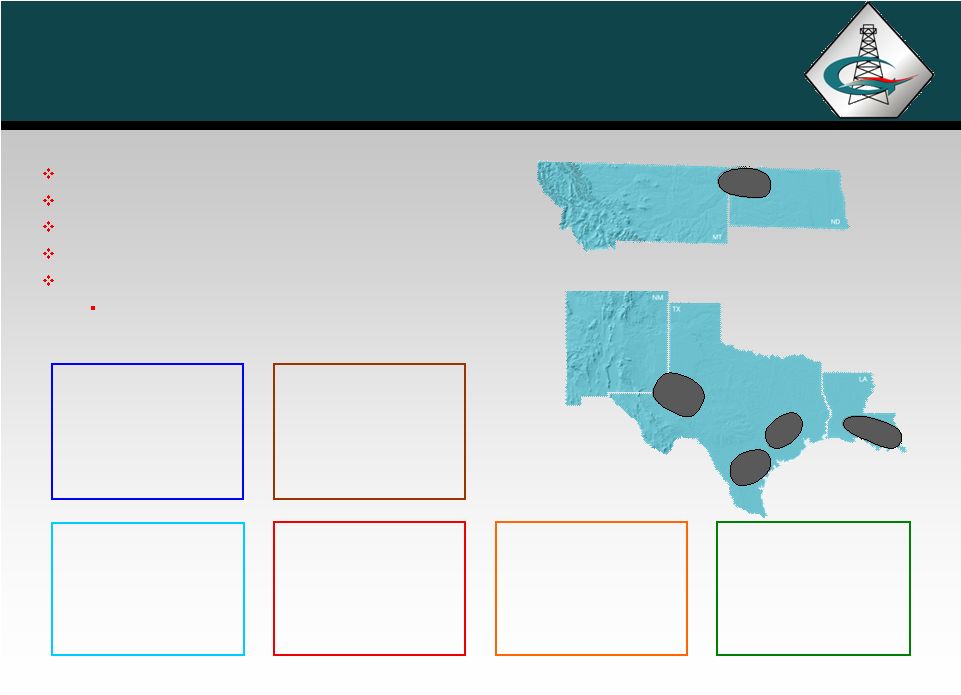

4

Geographic

Overview

(1)

Represents the Company’s average production rate YTD June 30,

2010. (2)

Acreage information estimated as of June 30, 2010.

(3)

Map depicts focus areas and excludes minor value properties.

.

4

Company

Highlights

37,000 net

acres in Bakken

11,000 net

acres in Eagle

Ford

Proved Reserves (MMBOE)

24.0

Oil

56%

Proved Developed

73%

PV 10% (millions)

$384

Production (BOEpd)

(1)

5,158

Oil

54%

Operated

80%

Gross Acreage

(2)

526,374

Net Acreage

(2)

239,770 |

5

Proved

Reserves

(MMBOE)

(2)

Average

Daily

Production

(BOEpd)

Reserves

and Production

Current

Proved

Reserves

–

24.0

MMBOE

(1)

(1) Excludes partnership interests. (2) 2006 –

2009 proved reserves based on SEC guidelines.

(3) 2008 Reserves reflect lower prices and divestitures. (4)

7/1/10 strip prices based on NYMEX strip as of 6/30/10. |

Oil Weighted

Development

GeoResources

Asset Overview

6 |

7

Bakken Shale Overview

150,000 (37,000 net) acres in the Bakken Shale

50,000 (24,000 net) operated acres

100,000 (13,000 net) non-operated acres

Bakken Operated Project

50,000 acres in Williams County, ND

Retained 47.5% WI and operations

24,000 net acres

Drilling started in September 2010

Bakken Non-Operated Project

Partnered with Slawson Exploration

100,000 acres in Mountrail Co., ND

10-18% WI

13,000 net acres

Currently three rigs operating by Slawson

72 Slawson-operated wells drilled to date

Plan to drill 100 wells in the next 2 years

CANADA

ND

MT

50 miles

Williams

County

Parshall

Sanish

7 |

Bakken

Shale Operated

Williams County, ND Acreage

8

24,000 Net Acres with 47.5% WI

and Operations

Drilling Carlson #1-11H (640 ac

unit) as the 1

st

of 3 wells to be

drilled in 2010

Impressive Offsetting Activity

•

7 nearest southern offsets

have NDIC-reported initial

rates of 1,181-1,947

BOPD

•

5 rigs drilling within or

immediately south of AMI

8 |

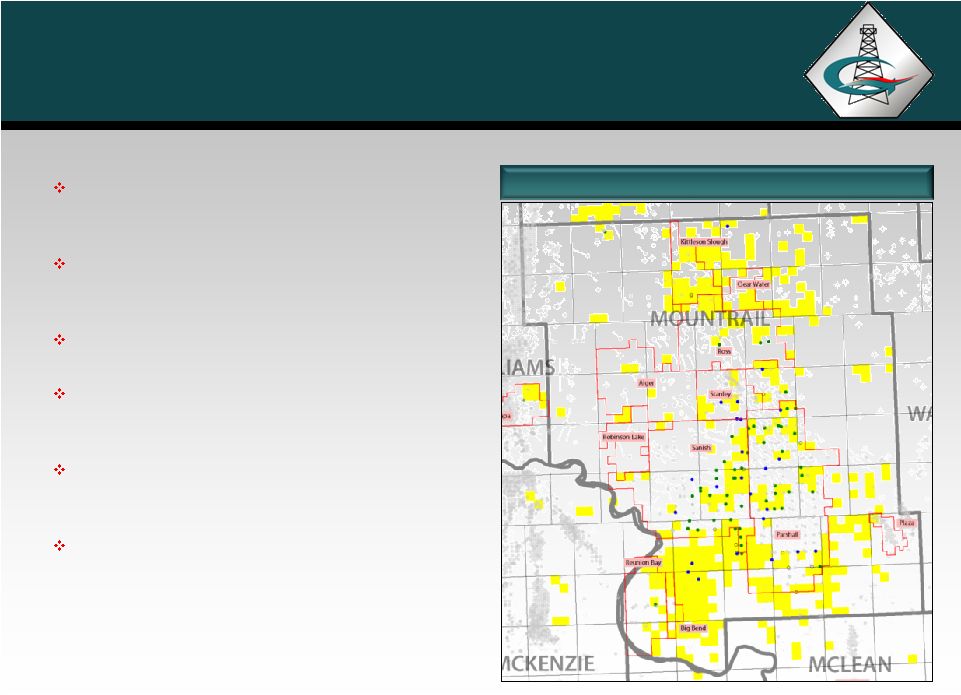

9

Bakken Shale

Non-operated

Bakken Shale

Note: Yellow-highlighted areas represent the Company’s acreage

position. Partnered with experienced operator -

Slawson Exploration

Working interests ranging from 10% to 18%

in 100,000 acres

13,000 net acres

Slawson has three rigs running currently and

has drilled 72 wells

Slawson drilling Three Forks well with

encouraging offset results by EOG & Whiting

Slawson plans to drill 100 wells in the next 24

months

9 |

Eagle

Ford 10

Eagle Ford AMI

140,000 acre AMI

22,000 acres (11,000 net)

GEOI retains 50% WI and

operations

Strong industry partner

purchased 50% of acreage

Will fund six horizontal

wells

Joint commitment for

additional leasing |

Eagle

Ford AMI 11

Eagle Ford AMI

•

Volatile oil / gas condensate window

•

On strike with Gonzales Co. activity

•

Could spud first well before yr-end

2010

•

Offset operator activity

•

Magnum Hunter recently frac’d

their 1

st

well in Gonzales Co.

•

EOG has multiple completions in

Gonzales Co. with Initial Rates

up to 2000 bopd

/ 1.8 MMCFPD

•

Clayton Williams has completed

2 wells to the NE in Burleson Co. |

Additional Assets |

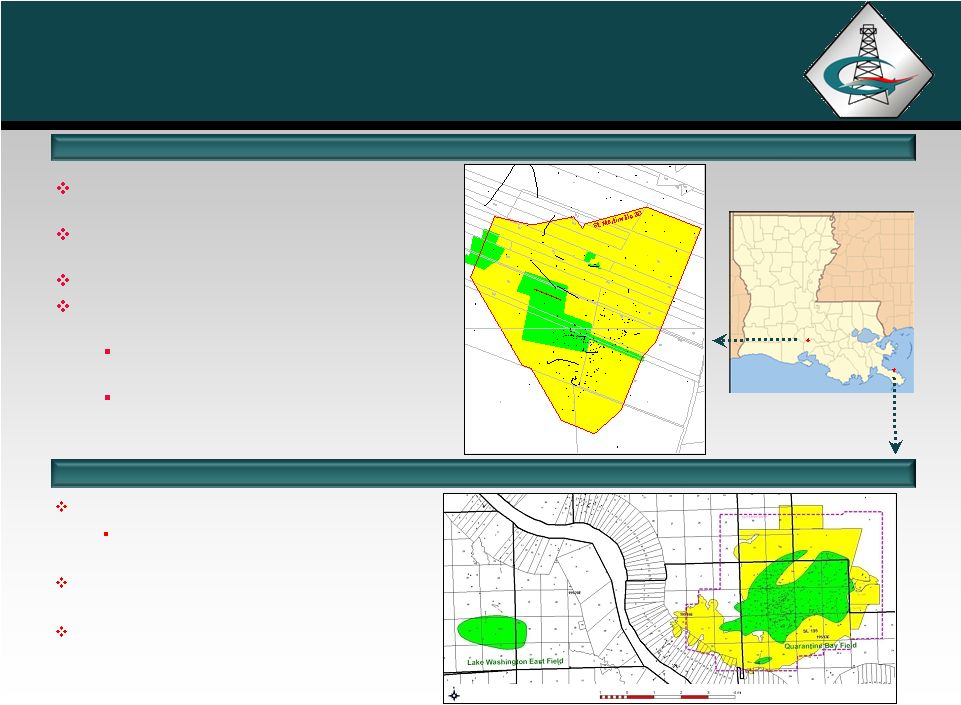

13

Giddings Field –

Austin Chalk

68,000 Acres (29,000 net acres)

16 wells drilled –

100% success

20 additional drilling locations

WI ranges from 37% -

53%

Operate majority of Giddings asset

Majority of acreage Held-by-

Production

Eastern Giddings Development Area

Eastern acreage in Grimes and

Montgomery Counties is dry gas

Western acreage is liquids-rich gas

and condensate

Longstreet 1H Produced 1.0 BCFG

in 67 days

Additional Upside Includes:

Yegua and Georgetown potential

Rate increase potential from slick

water fracture stimulations

Eagle Ford AMI announced SW of

Giddings acreage

13

APACHE

APACHE

APACHE

APACHE

APACHE

CWEI

CWEI

MAGNUM-HUNTER

Lee

Washington

Waller

Fayette

Austin

Colorado

Milam

Brazos

Grimes

Burleson

Giddings Field Acreage

Eagle Ford AMI |

14

Louisiana -

Louisiana -

St. Martinville & Quarantine Bay

St. Martinville & Quarantine Bay

534 net acres of owned minerals

(green)

2,585 net acres of HBP or leased

(yellow)

Average WI 97% & NRI 91%

Main objectives Miocene age multi-

sand oil, from 3,000’

–

7,000’

Cumulative shallow production of

15.2 MMBO and 16.6 BCFG

Most recent STD of Kansas #7 is

250 MBO with well cost of $1.0

million.

LOUISIANA

Quarantine Bay Field

St. Martinville Field

14,000 gross acres

7% WI above 10,500’

and a 33% WI

below 10,500’

Cumulative production of 180 MMBO and

285 BCF

Shallow zone behind pipe potential

(<10,500’) and significant deeper exploration

potential (11-23,000’)

14

126

1

1

1

2

3

4

5

3-1

2

1

1

2

1

1

2

1

2

3

3

3ST1

2

1

1

2

1

1

1

1

1

2

1

1

1

2

3

1

5

3

4

1

1

41

211

1

1

1

³

2

1

2

1

1

1

1B

6A

1211

33

2

4

1

1

4

1

5

3

2

¹

1

11

9A

14A

15A

11A32A

10A

13A

12A

3A

5A

4A

16A24A

17A

7A

2

1

4C

1

2

1

3

1

2

2

1

1

1

5

7D

6D

8A

6

1

2

1

3

7

5

4

1C

1

1D

1

1

1

1A

2A

18A31A

19A

1

20A

21A

22A

1

1

2

23A

1

8

9

3

2

10

11

1

3

¹1²

12

13

1

1

25A

1

2

3

1

14

4

15

16

1

1

2

17

6

13

6

2

18

1

21²3

3

19

1E

20

4

26A

2

27A

¹

28A

1

23

5E

21

2

1

29A

8D

1

1

2

30A

1

1D

2

9D

33A

6

22

1

34A

35A

7

8

1

10D

4

37A

38A

41A

36A

39A

40A

1

5

7

42A

43A

1

1

1

7

8

9

2E

44A

1

1

1

45A

4

5

1

1

1

46A

47A(2)

1

6

48A

49A

50A

54

1

51A

52A

1

2

7

53

1

A-53 |

Financial Overview |

16

2H:2010 Development Program

Project

Budgeted

Comments

$(Millions)

Bakken

Operated

$6.9

3 wells

Non-Operated

10.3

18 -

20 wells

Rip-Rap

1.3

Initial well Montana

St. Martinville

4.2

4 wells

$22.7

2H:2010 Drilling Budget

Project Inventory Allows Flexibility

Weighted towards oil and liquids

Oil and gas projects in inventory

Exploration and development

projects in inventory

Held by long-term leases or

production

Current Allocations Favors Lower-

Risk, High Cash Flow Oil Projects

Capital Allocations

16 |

17

EBITDAX

Debt / EBITDAX

Can fund current CapEx

with cash flow and debt capacity

Conservative use of leverage to maintain strong balance sheet

$145 Million borrowing base

EBITDAX :

2

nd

Quarter = $17.7 Million

YTD 2010 = $35.6 Million

Annualized = $71.2 Million

Total debt of $65.0 million proforma

October 2010

Strong Financial Position |

APPENDIX |

19

Net Asset Value

Net Asset Value

(1)

Nymex

strip pricing at June 30, 2010.

(2)

At June 30, 2010, excluding derivative financial instruments.

(3)

Assumed $2,000 per net acre for Bakken

& Eagle Ford acreage plus book value at 6/30/10 for other areas.

(4)

Proforma

–

October 2010.

($ in millions)

PV-10

(1)

% of Total

Proved Reserves:

Proved Developed Producing

246.0

$

64.1%

Proved Developed Non-Producing

63.0

16.4%

Proved Undeveloped

74.8

19.5%

Total Proved PV-10 Value

383.8

$

100.0%

Plus:

Working Capital

(2)

18.4

$

Unproved Property

(3)

96.2

Partnership Value

16.8

Less:

Total Debt

(4)

(65.0)

Total Net Asset Value

450.2

$

Shares Outstanding (thousands)

19,713

Net Asset Value Per Share

22.84

$

June 30, 2010

19 |

20

Management History

2004-2007

Southern Bay Energy, LLC

Gulf Coast, Permian Basin

REVERSE MERGED INTO

GEORESOURCES, INC.

2000-2007

Chandler Energy, LLC

Williston Basin, Rockies

ACQUIRED BY

GEORESOURCES, INC.

1988-2000

Chandler Company

Rockies, Williston Basin

MERGED INTO

SHENANDOAH THEN SOLD

TO QUESTAR

1992-1996

Hampton Resources Corp

Gulf Coast

SOLD TO BELLWETHER

EXPLORATION

Preferred investors –

30% IRR

Initial investors –

7x return

1997-2001

Texoil

Inc.

Gulf Coast, Permian Basin

SOLD TO OCEAN ENERGY

Preferred investors –

2.5x return

Follow-on investors –

3x return

Initial investors –

10x return

2001-2004

AROC Inc.

Gulf Coast, Permian Basin, Mid-Con.

DISTRESSED ENTITY LIQUIDATED

FOR BENEFIT OF INITIAL

SHAREHOLDERS

Preferred investors –

17% IRR

Initial investors –

4x return

Track record of profitability and liquidity

Extensive industry and financial relationships

Significant technical and financial experience

Long-term repeat shareholders

Cohesive management and technical staff

Team has been together for up to 21

years through multiple entities |

21

Proved Reserves

Proved Reserves by Category

Proved Reserves by Area

Partnership

Proved

% of

Interests

Total Proved

% of Total

Area

MMBOE

Proved

MMBOE

MMBOE

Reserves

Central and South Texas

9.1

37.9%

1.5

10.6

41.4%

Williston

6.7

27.9%

0.0

6.7

26.2%

Louisiana

3.8

15.8%

0.0

3.8

14.8%

Other

4.4

18.4%

0.1

4.5

17.6%

Total

24.0

100.0%

1.6

25.6

100.0%

($ in millions)

Oil

Gas

Total

% of

Corporate Interests

MMBO

BCF

MMBOE

Total

PV-10

PDP

8.3

37.4

14.6

60.8%

$246.0

PDNP

2.1

5.4

3.0

12.5%

63.0

PUD

3.1

20.3

6.4

26.7%

74.8

Total Proved Corporate Interests

13.5

63.1

24.0

100.0%

383.8

Partnership Interests

0.1

9.1

1.6

16.8

Total Proved Corporate and Partnerships

13.6

72.2

25.6

$400.6

21 |

22

Production and operating costs

Historical Production Data

Historical Operating Netback Data

YTD 2010

(1)

2nd

Qtr 2010

2009

2008

Oil Production (MBbls)

504

255

851

743

Gas Production (MMCF)

2,580

1,300

4,944

2,962

Total Production (Mboe)

934

472

1,675

1,237

Avg. Daily Production (Boe/d)

5,158

5,184

4,589

3,388

YTD 2010

(1)

2nd

Qtr 2010

2009

2008

($ per BOE)

Revenue

$56.72

$55.94

$48.01

$76.50

Less:

LOE

$10.94

11.00

$11.20

$18.53

G&A

4.13

4.32

5.07

5.80

Other Field Level Opex

(2)

4.10

3.80

3.84

8.92

Total Field Level Operating Costs

$19.17

$19.12

$20.11

$33.25

Field Level Operating Netback

$37.55

$36.82

$27.90

$43.25

22

(1)

June 30, 2010.

(2)

Represents severance tax expense and re-engineering and workover expense.

|

23

Income Statement

Historical Operating Data

($ in millions except per share data)

YTD 2010

2nd Qtr. 2010

2009

2008

Key Data:

Average realized oil price ($/Bbl)

70.55

$

70.48

$

61.09

$

82.42

$

Avg. realized natural gas price ($/Mcf)

5.25

$

4.90

$

3.97

$

8.12

$

Oil production (MBbl)

504

255

851

743

Natural gas production (MMcf)

2,580

1,300

4,944

2,962

Total revenue

53.0

$

26.4

$

80.4

$

94.6

$

Net income before tax

17.2

$

7.3

$

14.8

$

21.3

$

Net income after tax

10.5

$

4.4

$

9.8

$

13.5

$

Net income per share (basic)

0.53

$

0.23

$

0.59

$

0.87

$

EBITDAX

35.6

$

17.7

$

48.2

$

54.2

$

23 |

24

Hedging Strategy

Oil Hedges

GEOI uses commodity price risk management in order to execute its business plan

throughout commodity price cycles.

Overall, about 67% of production is hedged for 2010 and 58% is hedged for

2011. Natural

gas

hedges

include

hedge

volumes

intended

to

cover

GEOI’s

share

of

partnership

production.

Term of hedges is July 1, 2010 through December 31, 2012.

Natural Gas Hedges

24 |

25

Additional Disclosures

25 |