Attached files

Table of Contents

As filed with the Securities and Exchange Commission on October 5, 2010

Registration No. 333-169031

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ORAGENICS, INC.

(Exact name of registrant as specified in its charter)

| Florida | 2836 | 59-3410522 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

3000 Bayport Drive, Suite 685

Tampa, Florida 33607

(813) 286-7900

(Address, including zip code, and telephone number, including area code, of principal executive offices)

David Hirsch

Chief Executive Officer and President

Oragenics, Inc.

3000 Bayport Drive, Suite 685

Tampa, Florida 33607

(813) 286-7900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Darrell C. Smith, Esq. | Michael D. Maline, Esq. | |

| Mark A. Catchur, Esq. | Thomas S. Levato, Esq. | |

| Shumaker, Loop & Kendrick, LLP | Goodwin Procter LLP | |

| 101 East Kennedy Boulevard | The New York Times Building | |

| Suite 2800 | 620 Eighth Avenue | |

| Tampa, Florida 33602 | New York, New York 10018 | |

| Telephone: (813) 229-7600 | Telephone: (212) 813-8800 | |

| Facsimile: (813) 229-1660 | Facsimile: (212) 355-3333 |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | |||

| Non-accelerated filer ¨ | (Do not check if a smaller reporting company) | Smaller reporting company x |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Explanatory note

Pursuant to Item 10(f) of Regulation S-K promulgated under the Securities Act of 1933, as amended, we have elected to comply with the scaled disclosure requirements applicable to “smaller reporting companies” throughout this registration statement and prospectus. Except as specifically included in this registration statement and prospectus, items not required by the scaled disclosure requirements have been omitted.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED OCTOBER 5, 2010 |

|

|

3,000,000 Shares

Common Stock

$ per Share |

We are offering 3,000,000 shares of our common stock.

Our common stock is currently traded on the OTC Bulletin Board under the symbol “ORNID.OB.” Our common stock has been approved for listing on the NASDAQ Capital Market under the proposed symbol “OGEN” subject to notice of issuance. On September 24, 2010 we effected a reverse stock split on a 20-to-1 basis. On September 28, 2010, the last sale price for our common stock as reported on the OTC Bulletin Board was $6.60 per share on an immediate post-split basis.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||

| Public offering price |

$ | $ | ||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||

| Proceeds, before offering expenses, to us(2) |

$ | $ | ||||

| (1) | Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering (or $ ) payable to the underwriters. |

| (2) | We estimate that the total expenses of this offering will be approximately $1,000,000, consisting of approximately $200,000 for the underwriters’ non-accountable expense allowance (equal to 1% of the gross proceeds of this offering) and approximately $800,000 for legal, accounting, printing costs and various fees associated with the registration and listing of our shares of common stock. |

We have granted the underwriters a 45-day option to purchase up to an additional 450,000 shares of common stock to be offered by us solely to cover over-allotments, if any.

The underwriters expect to deliver our shares of common stock to purchasers in this offering on or about , 2010.

| ThinkEquity LLC | ||

| Caris & Company, Inc. |

The date of this prospectus is , 2010

Table of Contents

Table of Contents

| 1 | ||

| 9 | ||

| 28 | ||

| 29 | ||

| 30 | ||

| 32 | ||

| 33 | ||

| Management’s discussion and analysis of financial condition and results of operations |

35 | |

| 50 | ||

| 74 | ||

| 83 | ||

| 91 | ||

| Security ownership of management and certain beneficial owners |

95 | |

| 97 | ||

| 100 | ||

| 101 | ||

| 104 | ||

| 104 | ||

| 104 | ||

| F-1 |

Unless the context otherwise requires, all references to “Oragenics,” “we,” “us,” “our,” “our company,” or “the Company” in this prospectus refer to Oragenics, Inc., a Florida corporation, and its subsidiaries. You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. For further information, please see the section of this prospectus entitled “Where You Can Find More Information.”

This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. If it is against the law in any state to make an offer to sell these securities, or to solicit an offer from someone to buy these securities, then this prospectus does not apply to any person in that state, and no offer or solicitation is made by this prospectus to any such person.

Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus. You should not assume that the information appearing in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

We obtained statistical data, market data and other industry data and forecasts used throughout this prospectus from market research, publicly available information and industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Similarly, while we believe that the statistical data, industry data and forecasts and market research are reliable, we have not independently verified the data, and we do not make any representation as to the accuracy of the information. We have not sought the consent of the sources to refer to their reports appearing in this prospectus.

We own, have rights to or have applied for the trademarks, trade names, service marks and service names that we use in conjunction with our business, including our logo. EVORAPLUS®, TEDDY’S PRIDE® and PROBIORA3® are registered trademarks of ours. We currently use the following unregistered trademarks: SMaRT Replacement Therapy™, MU1140™, PCMAT™, LPT3-04™ and DPOLT™. Oragenics™ is among our non-registered trademarks. We currently have pending with the U.S. Patent and Trademark Office applications for registration of our principal brands, including the marks for EVORAKIDS™, EVORAPRO™, PROBIORA™, KJ2™, KJ3™ and JH145™. All other trademarks, trade names, service marks and service names appearing in this prospectus are the property of their respective holders.

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. You should read this summary together with the more detailed information, including our financial statements and the related notes, contained elsewhere in this prospectus. You should carefully consider, among other things, the matters discussed in “Risk Factors.”

Unless otherwise indicated, all historical and pro forma common stock and per share data in this prospectus have been restated to the earliest period presented to account for the 20-to-1 reverse stock split effectuated by the filing of an amendment to our articles of incorporation on September 24, 2010.

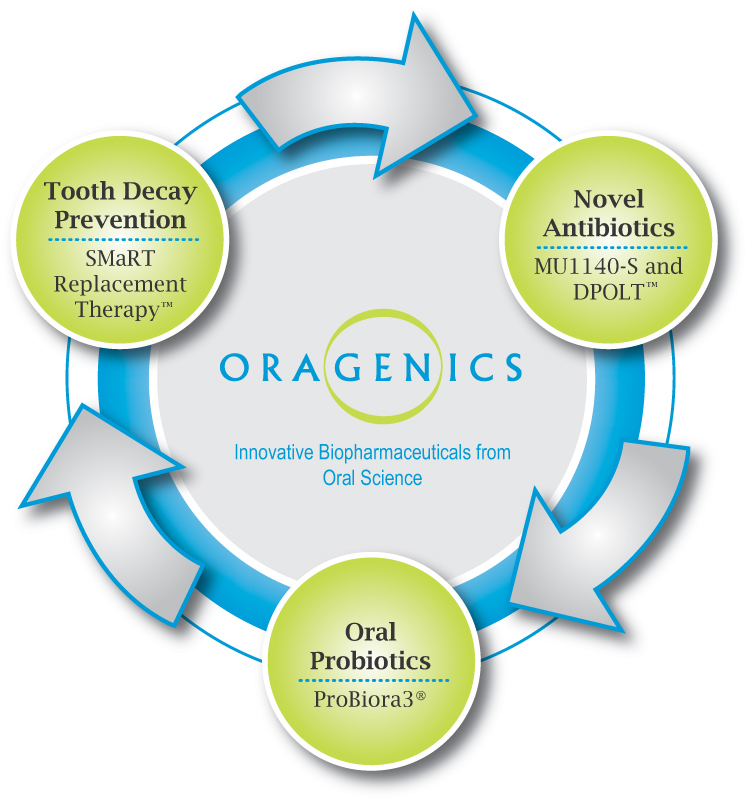

Overview

We are a biopharmaceutical company focused primarily on oral health products and novel antibiotics. Within oral health, we are developing our pharmaceutical product candidate, SMaRT Replacement Therapy, and we are also commercializing our oral probiotic blend, ProBiora3. Within antibiotics, we are developing our pharmaceutical product candidate, MU1140-S, and we intend to use our patented, novel organic chemistry platform to create additional antibiotics for therapeutic use.

Our SMaRT Replacement Therapy product candidate is designed to be a painless, one-time, five-minute topical treatment applied to the teeth that has the potential to offer lifelong protection against dental caries, or tooth decay. Dental diseases are the most prevalent chronic infectious diseases in the world, affecting up to 90% of schoolchildren and the vast majority of adults. In 2009, Popular Mechanics magazine named SMaRT Replacement Therapy as the “#1 New Biotech Breakthrough That Will Change Medicine.” In the United States alone, the annual cost to treat tooth decay is estimated to be $40 billion. Our SMaRT Replacement Therapy is based on the creation of a genetically modified strain of bacteria that colonizes in the oral cavity and replaces native decay-causing bacteria. We are commencing a second Phase 1 clinical trial for our SMaRT Replacement Therapy, which we expect to conclude in the first half of 2011.

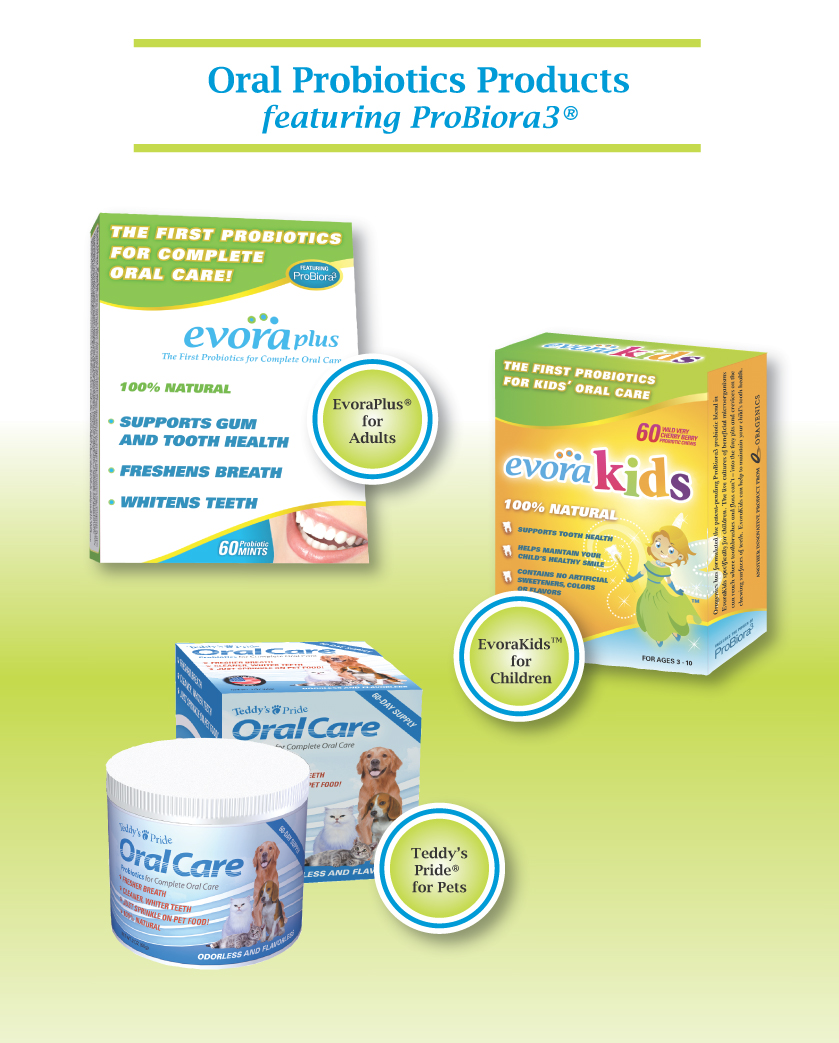

We have also developed and are commercializing a variety of products that contain our active ingredient ProBiora3, a patent-pending blend of oral probiotics that promote fresher breath, whiter teeth and support overall oral health. The global probiotics market is expected to be $31.2 billion by 2014, representing a compound annual growth rate, or CAGR, of 12.6% from 2009. We have conducted extensive scientific studies on ProBiora3 in order to market our products under self-affirmed Generally Recognized As Safe status, or GRAS. We sell our ProBiora3 products through multiple distribution channels, and our customers include Walgreens, Rite Aid, and Garden of Life, among others.

While developing SMaRT Replacement Therapy, members of our scientific team discovered that the SMaRT bacterial strain produces MU1140, a molecule belonging to the novel class of antibiotics known as lantibiotics. MU1140 has proven active preclinically against Gram positive bacteria responsible for a number of healthcare-associated infections, or HAIs. The direct cost to the U.S. healthcare system from HAIs is estimated to be up to $45 billion annually. We are in the process of scaling up production of our synthetic form of MU1140, or MU1140-S, and expect to commence preclinical testing during the second half of 2010 and to file an Investigational New Drug, or IND, application with the U.S. Food and Drug Administration, or FDA, in mid-2011. The key technology behind the production of MU1140-S is our Differentially Protected Orthogonal Lanthionine Technology platform, or DPOLT, which is a patented, novel organic chemistry platform that we believe will enable the first ever commercial scale, cost-effective production of any of the 50 known lantibiotics. We intend to use DPOLT to create a pipeline of lantibiotics for therapeutic use.

Our core product portfolio is protected by eight issued U.S. patents and eight filed U.S. patent applications. We are the exclusive worldwide licensee to the patents for SMaRT Replacement Therapy and MU1140, which are owned by the University of Florida Research Foundation, Inc. We have retained worldwide commercialization rights to each of these product candidates. Additionally, we believe that our SMaRT Replacement Therapy will qualify for a 12-year exclusivity period in the United States under the recently passed Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act.

1

Table of Contents

|

Product/Candidate |

Description |

Application |

Status | |||

| SMaRT Replacement Therapy |

Genetically modified strain of S. mutans that does not produce lactic acid | Tooth decay | Second Phase 1 clinical trial | |||

| ProBiora3 |

Blend of three beneficial oral probiotic bacteria | Oral health, teeth whitening, breath freshening (humans, companion pets) | Commercial (GRAS) | |||

| MU1140-S |

Member of lantibiotic class of antibiotics | Healthcare-associated infections | Preclinical testing | |||

Oragenics was founded in 1996 to commercialize the results of more than 30 years of research in oral biology by our principal founder and Chief Scientific Officer, Dr. Jeffrey Hillman. Dr. Hillman earned a DMD from Harvard School of Dental Medicine and a PhD in Molecular Genetics from Harvard University. He began his research career at the Harvard-affiliated Forsyth Institute in Boston, Massachusetts, where he introduced the concept of replacement therapy to prevent tooth decay by using a genetically modified strain of Streptococcus mutans, or S. mutans, to replace the decay-causing strains of S. mutans that are present on human teeth. He subsequently continued this research, now called SMaRT Replacement Therapy, at the University of Florida College of Dentistry. Under Dr. Hillman’s leadership, our scientific team has also developed other technologies such as ProBiora3, MU1140 and our DPOLT platform. Additionally, we are developing non-core technologies that originated from the discoveries of our scientific team, including LPT3-04, which is a potential weight loss product, and PCMAT, which is a biomarker discovery platform, both of which we believe could provide significant potential opportunities for us.

Since our inception, we have incurred operating losses and generated negative cash flow from operating activities as a result of our product development and commercialization efforts. We expect to incur losses for the foreseeable future as we expand our sales and marketing capabilities for our ProBiora3 products and continue our preclinical testing, clinical trials and research and development activities. Net losses totaled $3,757,421 for the six months ended June 30, 2010 and $5,519,348 and $6,021,742 for the years ended December 31, 2009, and 2008, respectively, and we have an accumulated deficit of $29,269,304 as of June 30, 2010. In light of our recurring losses, accumulated deficit and negative cash flow, the report of our independent registered public accounting firm on our financial statements for the fiscal year ended December 31, 2009 contains an explanatory paragraph raising substantial doubt about our ability to continue as a going concern. However, with the net proceeds from this offering we believe we will have sufficient working capital to avoid such an explanatory paragraph on our financial statements for the fiscal period ending December 31, 2010. The net proceeds from this offering will allow us to strengthen our focus on current and future commercialization of our products and product candidates, which we believe will position us for future profitability and positive cash flows.

Our Business Strategy

Our goal is to develop and commercialize our product portfolio in order to maximize the value of each product or product candidate therein. In order to achieve this goal, we intend to:

| Ø | Develop our SMaRT Replacement Therapy through Phase 1 clinical trials. The SMaRT strain has been extensively and successfully preclinically tested. We concluded our first Phase 1 clinical trial early due to low enrollment, which we believe resulted from the trial’s highly cautious inclusion and exclusion criteria. We are in the process of commencing a second Phase 1 clinical trial, which will examine the safety and genetic stability of an attenuated version of the SMaRT strain during administration to ten healthy adult male subjects over a two-week period. We expect the second Phase 1 clinical trial, including a three-month follow-up examination of subjects, to be concluded in the first half of 2011, and, if successful, we anticipate conducting a third Phase 1 clinical trial using the non-attenuated SMaRT strain shortly thereafter. |

2

Table of Contents

| Ø | Utilize a comprehensive marketing effort to increase sales of our ProBiora3 products across multiple channels. We intend to use a portion of the net proceeds from this offering to drive increased sales of our ProBiora3 products in the mass retail channel by utilizing nationwide marketing efforts. We believe that ProBiora3 is the most comprehensive oral probiotic technology currently available in the oral care market. Our marketing for ProBiora3 includes the cosmetic claims of teeth whitening and breath freshening, along with the general structure-function claim that ProBiora3 supports oral health. We market products containing ProBiora3 under our own house brand names, including EvoraPlus, EvoraKids, Teddy’s Pride and EvoraPro, and have also branded ProBiora3 as an active ingredient for licensing and private labeling. We have selected our distribution channels by focusing on our potential channel impact, as well as the expected potential return on our marketing expenditures. We have experienced early success in our marketing efforts despite limited marketing resources, including nationwide product placements with Walgreens, Rite Aid, GNC and Kroger during the first three quarters of 2010. |

| Ø | Commence the manufacturing and clinical testing of our lantibiotic MU1140-S. We have retained a leading contract manufacturer to refine and scale-up Good Manufacturing Practice, or GMP, production of MU1140-S. We expect to conclude the preclinical testing of MU1140-S, including toxicity testing in rodent and non-rodent animal models, during the first half of 2011. We then intend to file an IND application with the FDA in mid-2011. |

| Ø | Utilize our proprietary novel organic chemistry platform, DPOLT, to synthesize additional lantibiotics of interest. We believe that DPOLT will allow us to synthetically produce any of the 50 known lantibiotics due to the shared chemical structure features of this class of molecule. Analysis of the lantibiotic class suggests that there are possibly six to ten subclasses of lantibiotics as classified by known mechanisms of action, spectra of activity, or structural characteristics. We intend to use DPOLT to create a pipeline of lantibiotics for therapeutic use. |

| Ø | Develop our additional technologies, discovered by our scientific team, including LPT3-04, our weight loss product, and PCMAT, our biomarker discovery platform. Our current product development efforts in LPT3-04 are focused on incorporating the compound into bars, milkshakes, and other food delivery mechanisms. These food products will be used in a blinded placebo-controlled study scheduled to begin in the second half of 2010. Additionally, we intend to use our PCMAT platform to identify protein targets for several widespread disease states. We believe our PCMAT platform rapidly identifies proteins that are expressed when a cell undergoes change, and such proteins may be useful for medical diagnostics and therapeutic strategies. |

| Ø | Selectively establish strategic collaborations to advance and maximize the commercial potential of our product portfolio and potential pipeline. We believe that our product portfolio will be of significant interest to major pharmaceutical and medical diagnostics companies. If SMaRT Replacement Therapy and MU1140-S successfully complete Phase 1 trials, we believe that their respective values will substantially increase, and we would then seek to license these products or partner with one or more major pharmaceutical companies. In addition, if we are able to discover protein targets with sufficient degrees of sensitivity and specificity using our PCMAT biomarker discovery platform, we intend to license these targets to one or more major pharmaceutical or medical diagnostics companies. |

| Ø | Use third-party manufacturers to produce our SMaRT and ProBiora3 products under GMPs. The manufacturing methods for producing the SMaRT strain are commonplace and readily available within the pharmaceutical industry. For our first Phase 1 clinical trial, we engaged a contract manufacturer to produce our SMaRT strain, using a standard operating procedure provided by us that we believe is readily transferable to outside contract manufacturers with fermentation capabilities. We have contracted with multiple manufacturers to produce our active ingredient, ProBiora3, as well as blend, tablet, and package our products. Each of our contract manufacturers for ProBiora3 products has the ability to scale production as needed. We have qualified and used at least two contract manufacturers for each step in our manufacturing process. |

3

Table of Contents

Selected Risk Factors

Our business, our common stock and this offering are subject to numerous risks which are set forth in the section entitled “Risk Factors” beginning on page 9 of this prospectus. Principal risks include the following:

| Ø | Our success will depend on our ability to obtain regulatory approval and achieve successful commercialization of our SMaRT Replacement Therapy and MU1140-S product candidates, as well as our ability to significantly increase sales of our ProBiora3 products, which have only generated modest revenues to date; |

| Ø | Since our inception, while focusing primarily on discovery and development of our commercial products and product candidates, we have experienced significant losses and expect to continue to experience losses for the foreseeable future, and our auditor has expressed substantial doubt about our ability to continue as a going concern; |

| Ø | Our agreements with large national mass retailers with respect to our ProBiora3 products may be delayed, terminated or reduced in scope with little or no notice, and sales of our ProBiora3 products may be adversely affected by fluctuations in and terms and conditions of buying decisions and future returns of our retailers and consolidation among retailers; |

| Ø | We are subject to government regulation of the processing, formulation, packaging, labeling and advertising of our product candidates, and if we are unable to obtain regulatory approval for our product candidates we will be unable to generate revenues; |

| Ø | If we fail to comply with our obligations in the agreements with the University of Florida Research Foundation, Inc., under which we license our rights to SMaRT Replacement Therapy and MU1140, our licenses to these product candidates may be terminated and we will be unable to commercialize these product candidates; |

| Ø | We depend on third-party manufacturers for our ProBiora3 products. The loss of any manufacturer or any interruptions in the supply of our ProBiora3 products, including if our manufacturers in general fail to meet our requirements and the requirements of regulatory authorities, would have a negative impact on our revenues and profitability; |

| Ø | The Koski Family Limited Partnership, or KFLP, together with members of the Koski family, have a controlling interest in our outstanding shares of common stock; and |

| Ø | We have effected a reverse stock split, which may cause the liquidity of our common stock and market capitalization to be materially adversely affected. |

Recent Developments

On September 24, 2010 the amendment to our articles of incorporation that we filed with the Florida Department of State became effective with respect to a 20-to-1 reverse stock split of our authorized and outstanding shares of common stock.

On July 5, 2010, we entered into a common stock purchase agreement (the “July 2010 Financing Transaction”) with the KFLP. At the closing of this financing transaction on July 30, 2010 we issued 250,000 shares of our common stock to the KFLP at a price of $8.00 per share. The $2,000,000 aggregate consideration paid by the KFLP consisted of (i) $1,000,000 cash and (ii) the exchange and cancellation of the $1,000,000 unsecured promissory note (the “May 2010 Note”) issued to the KFLP on May 24, 2010. Accrued interest on the May 2010 Note through closing was waived by the KFLP. Concurrent with the July 2010 Financing Transaction and as part thereof, we entered into an unsecured revolving credit agreement (the “Credit Facility”) with the KFLP. Pursuant to the Credit Facility, we are able to borrow up to $2,000,000 from the KFLP at LIBOR plus 6.0%. The term of the Credit Facility is for 12 months commencing August 1, 2010. As of the date of this prospectus, we have drawn $1,000,000 on this Credit Facility.

4

Table of Contents

We have continued our efforts to broaden the distribution of our ProBiora3 products through the following business development activities:

| Ø | American Dental Association: From October 9-12, 2010, we will exhibit EvoraPro to dental professionals at their Annual Session and World Marketplace Exhibition. |

| Ø | Best Supplies: On September 30, 2010, we announced that Teddy’s Pride will be available in Taiwan through a distribution agreement with The Best Supplies LTD, which has 70 pet supply retail shops across Taiwan. |

| Ø | Rolf C. Hagen, Inc.: On September 23, 2010, we announced the distribution of Teddy’s Pride in Canada through Rolf C. Hagen, Inc., one of the largest privately held pet product manufacturers in the world. |

| Ø | Benelux Cosmetics: On September 21, 2010, we announced that our line of ProBiora3 products will be distributed in Belgium, the Netherlands and Luxembourg through Benelux Cosmetics. |

| Ø | Vetcom: On September 20, 2010, we announced that Teddy’s Pride will be distributed to veterinarians in Korea through Vetcom Korea, Inc. Vetcom Korea is a leading national distributor of products for the veterinarian industry. |

| Ø | Fred Meyer: On September 16, 2010, we announced an initial order of EvoraPlus from Fred Meyer, which operates 129 multi-department stores in four western states. |

| Ø | SuperZoo: From September 14-16, 2010, we introduced Teddy’s Pride to SuperZoo, an annual pet trade show and seminar by the World Pet Association, which was attended by over 9,000 pet professionals from around the world. |

| Ø | Kroger: On September 14, 2010, we announced the expansion of the retail distribution of EvoraPlus through an initial order from Kroger Co. Kroger is the nation’s largest traditional grocery retailer with approximately 2,500 stores in 31 states. We anticipate that EvoraPlus will be available in select Kroger grocery stores beginning in October 2010. |

| Ø | Harris Teeter: On September 10, 2010, we announced an initial order of EvoraPlus and EvoraKids from Harris Teeter. Harris Teeter is a food market chain that operates in eight states with 196 stores. |

| Ø | GNC: On September 7, 2010, we announced that EvoraPlus will be available in corporate-owned GNC stores nationwide and EvoraKids will be available in its concept stores and on GNC.com. GNC is a leading global specialty retailer of nutritional products with over 7,000 locations. |

Corporate History and Structure

We were incorporated in Florida in 1996 and commenced operations in 1999. We amended our articles of incorporation in 2002 in order to change our name from Oragen, Inc. to Oragenics, Inc., and consummated our initial public offering in June 2003. Our executive office is located at 3000 Bayport Drive, Suite 685, Tampa, Florida, 33607 and our research facilities are located at 13700 Progress Boulevard, Alachua, Florida 32615. Our telephone number is (813) 286-7900 and our website is http://www.oragenics.com. Information on, or that can be accessed through, our website is not part of this prospectus and should not be relied on in connection with this offering.

5

Table of Contents

Summary financial information

In the table below we provide you with historical financial data for the six month periods ended June 30, 2010 and 2009 and the years ended December 31, 2009 and 2008, derived from our audited and unaudited financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of the results that may be expected for any future period. When you read this historical selected financial data, it is important that you read along with it the appropriate historical financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

Statement of Operations

| Six months ended June 30, |

Years ended December 31, |

|||||||||||||||

| 2010 | 2009 | 2009 | 2008 | |||||||||||||

| (unaudited) |

||||||||||||||||

| Net revenues |

$ | 646,179 | $ | 166,167 | $ | 641,285 | $ | 233,539 | ||||||||

| Cost of goods sold |

326,321 | 35,384 | 221,198 | 14,864 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Research and development |

909,838 | 979,975 | 1,833,746 | 1,955,488 | ||||||||||||

| Selling, general and administrative |

3,167,626 | 2,718,172 | 4,917,844 | 4,312,246 | ||||||||||||

| Total operating expenses |

4,077,464 | 3,698,147 | 6,751,590 | 6,267,734 | ||||||||||||

| Loss from operations |

(3,757,606 | ) | (3,567,364 | ) | (6,331,503 | ) | (6,049,059 | ) | ||||||||

| Other income (expense): |

||||||||||||||||

| Interest income |

2,535 | 522 | 922 | 32,511 | ||||||||||||

| Interest expense |

(885 | ) | (1,504 | ) | (44,292 | ) | (10,054 | ) | ||||||||

| Gain on sale of property and equipment |

— | 11,274 | 22,743 | 4,860 | ||||||||||||

| Gain on extinguishment of payables |

— | 707,674 | 832,959 | — | ||||||||||||

| Local business tax |

(1,465 | ) | — | (177 | ) | — | ||||||||||

| Total other income, net |

185 | 717,966 | 812,155 | 27,317 | ||||||||||||

| Loss before income taxes |

(3,757,421 | ) | (2,849,398 | ) | (5,519,348 | ) | (6,021,742 | ) | ||||||||

| Net loss |

$ | (3,757,421 | ) | $ | (2,849,398 | ) | $ | (5,519,348 | ) | $ | (6,021,742 | ) | ||||

| Basic and diluted net loss per share |

$ | (0.70 | ) | $ | (1.48 | ) | $ | (1.70 | ) | $ | (3.43 | ) | ||||

| Shares used to compute basic and diluted net loss per share |

5,398,941 | 1,930,207 | 3,244,188 | 1,753,463 | ||||||||||||

6

Table of Contents

Balance Sheet

| June 30, 2010 | |||||||

| Actual | Pro forma as adjusted(1)(2) | ||||||

| (unaudited) | |||||||

| Cash(3) |

$ | 959,434 | $ | 20,375,434 | |||

| Working capital (deficit)(3) |

(140,223 | ) | 19,275,777 | ||||

| Total assets |

1,677,877 | 21,093,877 | |||||

| Total liabilities |

1,759,600 | 1,759,600 | |||||

| Total shareholders’ equity (deficit) |

(81,723 | ) | 19,334,277 | ||||

| (1) | As adjusted to give effect to the sale by us of 3,000,000 shares of common stock at an assumed public offering price of $6.60 per share (the last sale price for our common stock as reported on the OTC Bulletin Board on September 28, 2010 immediately after our reverse stock split) and our receipt of the estimated net proceeds from the offering of $17,416,000 after deducting underwriting discounts and commissions and estimated offering expenses payable by us, including the underwriters’ non-accountable expense allowance. |

| (2) | As adjusted to give effect to the July 2010 Financing Transaction pursuant to which we (i) issued 250,000 shares of common stock through the payment of $2,000,000 in aggregate consideration consisting of (a) $1,000,000 in cash and (b) exchange and cancellation of the May 2010 Note, and (ii) entered into the Credit Facility for $2,000,000, on which we drew down $1,000,000 in September 2010. |

| (3) | Includes $742,682 of cash we have reserved for DPOLT research. |

7

Table of Contents

The offering

Set forth below is a description of the offering. Except as otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their over-allotment option and no exercise of any outstanding options and warrants; and gives effect to a 20-to-1 reverse split of our common stock.

| Common stock offered by us |

3,000,000 shares |

| Common stock to be outstanding immediately after this offering |

8,663,157 shares |

| Use of proceeds |

We expect the net proceeds from this offering will be approximately $17,416,000 (or $20,178,100 if the underwriters exercise their over-allotment option in full) based upon an assumed public offering price of $6.60 per share (the last sale price of our common stock as reported on the OTC Bulletin Board on September 28, 2010 immediately after our reverse stock split) after deducting underwriting discounts and commissions and estimated offering expenses. We intend to use the net proceeds from this offering primarily for working capital and general corporate purposes, which include, but are not limited to, commercialization of our ProBiora3 products, clinical development of SMaRT Replacement Therapy and MU1140-S, and research and development related to our other products, including our weight loss product and our biomarker discovery platform. See “Use of Proceeds” for more information. |

| Over-allotment option |

We have granted the underwriters an option for a period of 45 days to purchase up to an additional 450,000 shares of common stock to cover over-allotments, if any. |

| OTC Bulletin Board trading symbol |

ORNID.OB |

| Proposed NASDAQ Capital Market trading symbol |

OGEN |

| Risk factors |

The purchase of our common stock involves a high degree of risk. You should carefully review and consider “Risk Factors” beginning on page 9. |

The shares of common stock to be outstanding immediately after this offering as reflected in the table above is based on the actual shares of common stock outstanding as of October 4, 2010, which was 5,663,157 shares, but does not include, as of that date:

| Ø | 306,388 shares of common stock reserved for issuance upon the exercise of outstanding warrants with a weighted average exercise price of $19.20 per share; |

| Ø | 398,112 shares of common stock reserved for issuance upon the exercise of outstanding stock options with a weighted average exercise price of $7.00 per share; and |

| Ø | 223,887 shares of common stock available for future grant under our Amended and Restated 2002 Stock Option and Incentive Plan, or the 2002 Stock Incentive Plan. |

8

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus, including our financial statements and related notes, before deciding to purchase shares of common stock in this offering. The risks described below are not the only ones facing our company. Additional risks not presently known to us or that we currently consider immaterial may also adversely affect our company. If any of the following risks actually occur, our business, financial condition and results of operations could be materially adversely affected. As a result, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Business

Our success will depend on our ability to obtain regulatory approval of our SMaRT Replacement Therapy and MU1140-S product candidates and their successful commercialization.

Our SMaRT Replacement Therapy and MU1140-S product candidates have not received regulatory approval in any jurisdiction and they may never receive approval or, if approvals are obtained, may never be commercialized successfully. We have incurred and will continue to incur significant costs relating to the preclinical and clinical development of our SMaRT Replacement Therapy and MU1140-S product candidates. We are currently in the process of commencing a second Phase 1 clinical trial to examine the safety and genetic stability of an attenuated version of the SMaRT strain in humans. We do not know whether our planned and current clinical trials for our SMaRT Replacement Therapy product candidate will be completed on schedule, if at all. In addition, we do not know whether any of our clinical trials will be successful or can be completed within our current expected budget. For our MU1140-S product candidate, we have performed extensive preclinical testing using native MU1140 and expect to conclude the preclinical testing of MU1140-S, including toxicity testing in rodent and non-rodent animal models, during the first half of 2011. We intend to file an Investigational New Drug, or IND, application with the FDA in mid-2011. Even if we are able to conduct successful clinical trials or the required regulatory approvals are obtained, we may never be able to generate significant revenues from our SMaRT Replacement Therapy and MU1140-S product candidates. If our SMaRT Replacement Therapy or MU1140-S product candidates are unsuccessful, we may be unable to generate sufficient revenues to sustain and grow our business, and our business, financial condition and results of operations will be materially adversely affected.

Our success will also depend on our ability to significantly increase sales of our ProBiora3 products which have only generated modest revenues to date.

Currently our sole source of product revenues is from sales of our ProBiora3 products, which began in late 2008 and have generated only modest revenues to date. Sales of our ProBiora3 products were $521,115 for the six months ended June 30, 2010 and $366,801 and $8,539 for the years ended December 31, 2009 and 2008, respectively. If we are unable to generate significant revenues from our ProBiora3 products our business, financial condition and results of operations will be materially adversely affected.

We have incurred significant losses since our inception and expect to continue to experience losses for the foreseeable future.

Since our inception, we have incurred operating losses and negative cash flow from operating activities. To achieve and maintain profitability, we must successfully develop, obtain regulatory approval for, manufacture, market and sell, or license, partner or sell the rights to, one or more of the product candidates we either license or own. Furthermore, our cash burn rate and expenses have increased significantly due to our recent commercialization initiatives with our ProBiora3 products. We expect to continue to incur losses for the foreseeable future as we expand our sales and marketing capabilities for our ProBiora3 products and continue our preclinical testing, clinical trials and research and development activities.

9

Table of Contents

Risk factors

Net losses have totaled $3,757,421 for the six months ended June 30, 2010 and $5,519,348 and $6,021,742 for the years ended December 31, 2009 and 2008, respectively. We have experienced losses from operations during the last two years and have an accumulated deficit of $29,269,304 as of June 30, 2010. We have used cash in our operating activities of $3,281,330 for the six months ended June 30, 2010 and $5,799,481 and $3,835,190 for the years ended December 31, 2009 and 2008, respectively. Our accounts payable and accrued expenses have also increased due to operational changes instituted in connection with the launch of our consumer products. We have working capital (deficit) of ($140,223) as of June 30, 2010 ($882,905 deficit when the current cash reserved for DPOLT research is excluded), and $2,564,147 and ($500,672) as of December 31, 2009 and 2008, respectively.

Our auditor has expressed substantial doubt about our ability to continue as a going concern.

In light of our recurring losses, accumulated deficit and negative cash flow, the report of our independent registered public accounting firm on our financial statements for the year ended December 31, 2009 contains an explanatory paragraph raising substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that may be necessary in the event we are unable to continue as a going concern. If we are unable to establish to the satisfaction of our independent registered public accounting firm that the net proceeds from this offering will be sufficient to allow for the removal of this going concern qualification, we may need to significantly modify our operational plans for us to continue as a going concern.

Our financial results could vary significantly from quarter to quarter and are difficult to predict.

Our revenues and operating results could vary significantly from quarter to quarter due to a variety of factors, many of which are outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful. In addition, we may not be able to predict our future revenues or results of operations. We base our current and future expense levels on our internal operating plans and sales forecasts, and our operating costs are to a large extent fixed. As a result, we may not be able to reduce our costs sufficiently to compensate for an unexpected shortfall in revenues, and even a modest shortfall in revenues could disproportionately and adversely affect financial results for that quarter. Individual products represent meaningful portions of our revenues in any quarter. We may incur significant or unanticipated expenses associated with our research and development efforts of our product candidates under development. In addition to other risk factors discussed in this section, factors that may contribute to the variability of our quarterly results include:

| Ø | the timing of release of new products and services by us and our competitors, particularly those that may represent a significant portion of revenues in any given period; |

| Ø | the popularity of new products, and products released in prior periods; |

| Ø | changes in pricing policies by us or our competitors; |

| Ø | fluctuations in the size and rate of growth of overall consumer and retailer demand for our ProBiora3 products; |

| Ø | our success in entering new geographic markets; |

| Ø | decisions by us to incur additional expenses, such as increases in marketing or research and development; |

| Ø | the level of expenses associated with our clinical trials; |

| Ø | accounting rules governing recognition of revenues; |

| Ø | the amount we reserve against returns and allowances; and |

| Ø | the timing of compensation expense associated with equity compensation grants. |

10

Table of Contents

Risk factors

As a result of these and other factors, our quarterly and annual operating results could be materially adversely affected. Moreover, our operating results may not meet announced guidance or the expectations of research analysts or investors, in which case the price of our common stock could decrease significantly.

Current and future economic and market conditions could materially adversely affect our revenues, expense levels and profitability.

The U.S. economy and the global economy are recovering from a severe recession. Factors such as uncertainties in consumer spending, a sustained regional and/or global economic downturn or slow recovery may reduce the demand for our ProBiora3 products. Furthermore, challenging economic conditions also may impair the ability of our customers to pay for our commercial products. Because consumer spending for our ProBiora3 products can generally be considered a discretionary purchase, we may experience a more negative impact on our business due to these conditions than other companies that do not depend on discretionary spending. If demand for our ProBiora3 products declines or our customers are otherwise unable to pay for our products, we may be required to offer extensive discounts or spend more on marketing than budgeted and our revenues, expense levels, and profitability will be materially adversely affected.

Sales of our ProBiora3 products may be adversely affected by fluctuations in buying decisions of our retailers and consolidation among retailers.

Our ProBiora3 products are sold to national and regional retailers in the United States. Our revenues could be affected by fluctuations in the buying patterns of these customers, which may result from wholesale buying decisions, economic conditions and other factors. In addition, with the growing trend towards retail consolidation, we are increasingly dependent upon a limited number of leading retailers with greater bargaining strength. Such retailers have demanded, and may continue to demand, increased service and order accommodations as well as price and incremental promotional investment concessions. As a result, we may face pressure on our prices and experience increased expenses from promotions to meet these demands, which would reduce our profitability. We also may be negatively affected by changes in the policies of our customers such as inventory destocking, limitations on access to shelf space and other conditions.

Our agreements with large national mass retailers with respect to our ProBiora3 products may be delayed, terminated or reduced in scope with little or no notice, which could adversely impact our profitability.

Our agreements with large national mass retailers with respect to our ProBiora3 products may be terminated or reduced in scope with little or no notice. Cancellations may occur for a variety of reasons, including the failure of our products to satisfy safety requirements, and unexpected health consequences of our products. Agreements with national mass retailers may provide for rights of return that are unfavorable to us and may require us to adjust our future estimates of returns and allowances. We have vendor agreements whereby the vendors reserve the right to cancel a purchase order without penalty by providing notice to us on or before the given cancellation date and at any time if the completion or delivery date is not met.

We are subject to government regulation of the processing, formulation, packaging, labeling and advertising of our consumer products.

Under the Federal Food, Drug, and Cosmetic Act, or FDCA, companies that manufacture and distribute foods, such as our ProBiora3 products, are limited in the claims that they are permitted to make about nutritional support on the product label without FDA approval. Any failure by us to adhere to the labeling requirements could lead to the FDA’s requiring that our products be repackaged and relabeled, which would have a material adverse effect on our business. In addition, companies are responsible for the accuracy and truthfulness of, and must have substantiation for, any such statements. These claims must be truthful and not misleading. Statements must not claim to diagnose, mitigate, treat, cure or prevent a specific disease

11

Table of Contents

Risk factors

or class of disease. We are able to market our ProBiora3 products in reliance on the self-affirmed Generally Recognized As Safe, or GRAS, status of our active ingredient, ProBiora3. No governmental agency or other third party has made a determination as to whether or not ProBiora3 has achieved GRAS status. We make this determination based on independent scientific opinions that ProBiora3 is not harmful under its intended conditions of use. If the FDA, another regulatory authority or other third party denied our self-affirmed GRAS status for ProBiora3, we could face significant penalties or be required to undergo the regulatory approval process in order to market our probiotic products, and our business, financial condition and results of operations will be adversely affected. We cannot guarantee that in such a situation ProBiora3 would be approved.

The FDA’s Good Manufacturing Practices, or GMPs, describe the methods, equipment, facilities, and controls for producing processed food and set the minimum sanitary and processing requirements for producing safe and wholesome food. Those who manufacture, package, or hold human food must comply with the GMPs. If we or our suppliers fail to comply with the GMPs, the FDA may take enforcement action against us or our suppliers.

The processing, formulation, packaging, labeling and advertising of our probiotic products are subject to regulation by one or more federal agencies including the FDA, the Federal Trade Commission and the Environmental Protection Agency. Our activities are also subject to regulation by various agencies of the states and localities in which our probiotic products are sold. Any changes in the current regulatory environment could impose requirements that would limit our ability to market our probiotic products and make bringing new products to market more expensive. In addition, the adoption of new regulations or changes in the interpretation of existing regulations may result in significant compliance costs or discontinuation of product sales and may adversely affect our business, financial condition and results of operations. While our ProBiora3 products are categorized as foods, it is possible that the FDA or a state regulatory agency could classify these products as a cosmetic or a drug. If the products are classified as cosmetics rather than a food, we would be limited to making claims that the products cleanse and beautify, but we could not make structure or function claims. If our probiotic products are classified as drugs, we would not be able to market the ProBoira3 products without going through the drug approval process. Either of these events would limit our ability to effectively market our products and would adversely affect our financial condition and results of operations. If the FDA or a state regulatory agency viewed the products as cosmetics or drugs, they could claim that the products are misbranded and require that we repackage and relabel the products and impose civil and/or criminal penalties. Either or both of these situations could adversely affect our business and operations.

If we undertake product recalls or incur liability claims with respect to our ProBiora3 products, such recalls or claims could increase our costs and adversely affect our reputation, revenues and operating income.

Our ProBiora3 products are designed for human and animal consumption and we may face product recalls or liability claims if the use of our products is alleged to have resulted in injury or death. ProBiora3 is classified as a food ingredient and is not subject to pre-market regulatory approval in the United States. Our ProBiora3 products contain ingredients that do not have long histories of human or animal consumption. Previously unknown adverse reactions resulting from consumption of these ingredients could occur. We may have to undertake various product recalls or be subject to liability claims, including, among others, that our ProBiora3 products include inadequate instructions for use or inadequate warnings concerning possible side effects and interactions with other substances. A product recall or liability claim against us could result in increased costs and could adversely affect our reputation with our customers, which, in turn, could have a material adverse effect on our business, financial condition and results of operations.

Product liability insurance is expensive, is subject to deductibles and coverage limitations, and may not be available in the future. While we currently maintain product liability insurance coverage, we cannot be sure that such coverage will be adequate to cover any incident or all incidents. In addition, we cannot be sure that we will be able to obtain or maintain insurance coverage at acceptable costs or in a sufficient amount, that our insurer will not disclaim coverage as to a future claim or that a product liability claim would not otherwise adversely affect our business, financial condition and results of operations. The cost of any product liability litigation or other proceeding, even if resolved in our favor, could be substantial. Uncertainties resulting from the initiation and continuation of product liability litigation or other proceedings could have a

12

Table of Contents

Risk factors

material adverse effect on our ability to compete in the marketplace. Product liability litigation and other related proceedings may also require significant management attention.

If we fail to comply with our obligations in the agreements with the University of Florida Research Foundation, Inc., under which we license our rights to SMaRT Replacement Therapy and MU1140, our licenses to these product candidates may be terminated and we will be unable to commercialize these products candidates.

We hold our SMaRT Replacement Therapy and MU1140 product candidates under licenses from the University of Florida Research Foundation, Inc., or UFRF. Under the terms of the licenses, we must spend at least $1,000,000 per year on development of those product candidates until the first commercial sale of products derived from those product candidates has occurred. In addition, we must pay $25,000 per quarter as minimum royalties to the UFRF under our license agreements. The UFRF may terminate our licenses to SMaRT Replacement Therapy and MU1140 if we breach our obligations to timely pay these amounts, to submit development reports as required under the license agreements or commit any other breach of any other covenants contained in the license agreements. There is no assurance that we will be able to comply with these conditions in a timely manner or at all. If our license agreements are terminated, we will be unable to commercialize these product candidates.

Until commercial sale of any products developed from these licensed product candidates takes place, we will not earn any revenues from these product candidates and will, therefore, need additional financing to fund our required royalty payments and development expenses, such as through the commercialization and sale of our ProBiora3 products, the sale of our debt or equity securities, or otherwise. There can be no assurance that we will achieve sufficient sales of our ProBiora3 products or be able to raise the capital necessary to meet our obligations under our licenses. If we are unable to meet our obligations under these licenses, we may lose the licenses to these product candidates and our business, financial condition and results of operations will be materially adversely affected.

We depend on third-party manufacturers for our ProBiora3 products. The loss of any manufacturer or any interruptions in the supply of our ProBiora3 products, would have a negative impact on our revenues and profitability.

We currently have no manufacturing facilities and are dependent upon establishing relationships with independent manufacturers to supply our product needs. We have contracted with multiple GMP-certified manufacturers to produce our active ingredient, ProBiora3, under GMPs. We believe our arrangements with our contract manufacturers have the capacity to meet our current and expected future manufacturing needs. Although we have qualified and used at least two contract manufacturers for each step in our manufacturing process, we do not have a long-term supply agreement or commitment with any of our manufacturers. If our manufacturers are unable or unwilling to produce our ProBiora products in sufficient quantities, or at all, at acceptable pricing in accordance with specifications we establish from time to time we would need to find alternative manufacturers that are qualified. If, in such instances, we are unsuccessful in obtaining alternative manufacturers, it could impair our ability to sell our ProBiora3 products and would have a negative impact on our revenues and profitability. In addition, competitors who own their manufacturing facilities may have an advantage over us with respect to pricing, availability of product and in other areas through their control of the manufacturing process.

The risks associated with the numerous factors that could cause interruptions in the supply of our products, including manufacturing capacity limitations, regulatory inspections, changes in our sources for manufacturing, disputes with a manufacturer, our failure to timely locate and obtain replacement manufacturers as needed and conditions affecting the cost and availability of raw materials, are magnified when the suppliers are limited in number. Any interruption in the supply of finished products could hinder our ability to timely distribute our products and satisfy customer demand. If we are unable to obtain adequate product supplies to satisfy our customers’ orders, we may lose those orders, our customers may cancel other orders, and they may choose instead to stock and purchase competing products. This could result in a loss of our market share and negatively affect our revenues and profitability.

13

Table of Contents

Risk factors

If our manufacturers in general fail to meet our requirements and the requirements of regulatory authorities, our revenues and profitability may be materially adversely affected.

We do not have the internal capability to manufacture our ProBiora3 products or our SMaRT Replacement Therapy and MU1140-S product candidates under GMPs, as required by the FDA and other regulatory agencies. In order to continue to develop our product candidates, apply for regulatory approvals for our SMaRT Replacement Therapy and MU1140-S product candidates, and commercialize our ProBiora3 products and other product candidates, we will need to contract with third parties that have, or otherwise develop, the necessary manufacturing capabilities.

There are a limited number of manufacturers that operate under GMPs that are capable of manufacturing our ProBiora3 products and SMaRT Replacement Therapy product candidate. Furthermore, manufacturing MU1140-S on a commercial scale has not yet been achieved, so there are additional technical skills needed for the manufacture of MU1140-S that will further limit the number of potential manufacturers. As such, if we are unable to enter into supply and processing contracts with any of these manufacturers or processors for our ProBiora3 products or our development stage product candidates, we may incur additional costs and delays in development and commercialization.

Problems with these manufacturing processes such as equipment malfunctions, facility contamination, labor problems, raw material shortages or contamination, natural disasters, power outages, terrorist activities, or disruptions in the operations of our suppliers and even minor deviations from normal procedures, could result in product defects or manufacturing failures that result in lot failures, product recalls, product liability claims and insufficient inventory.

If we are required to find an additional or alternative source of supply, there may be additional costs and delays in the development or commercialization of our product candidates. Additionally, the FDA and other regulatory agencies routinely inspect manufacturing facilities before approving a New Drug Application, or NDA, or Biologic License Application, or BLA, for a drug or biologic manufactured at those sites. If any of our manufacturers or processors fails to satisfy regulatory requirements, the approval and eventual commercialization of our commercial products and product candidates may be delayed.

All of our contract manufacturers must comply with the applicable GMPs, which include quality control and quality assurance requirements as well as the corresponding maintenance of records and documentation. If our contract manufacturers do not comply with the applicable GMPs and other FDA regulatory requirements, we may be subject to product liability claims, the availability of marketed products for sale could be reduced, our product commercialization could be delayed or subject to restrictions, we may be unable to meet demand for our products and may lose potential revenues and we could suffer delays in the progress of preclinical testing and clinical trials for products under development. We do not have control over our third-party manufacturers’ compliance with these regulations and standards. Moreover, while we may choose to manufacture ProBiora3 products ourselves in the future, we have no experience in the manufacture of pharmaceutical products for clinical trials or commercial purposes. If we decide to manufacture products, we would be subject to the regulatory requirements described above. In addition, we would require substantial additional capital and would be subject to delays or difficulties encountered in manufacturing pharmaceutical products. Regardless of the manufacturer of our products, we will be subject to continuing obligations regarding the submission of safety reports and other post-market information.

We may be unable to find a method to produce MU1140-S in large-scale commercial quantities. If we cannot, we will be unable to generate revenues from sales of our MU1140-S product candidate.

Our antibiotic product candidate, MU1140-S, is a synthetic form of MU1140 produced by our strain of S. mutans. To date, it has been produced only in laboratory cultures. In March 2005 we successfully developed a methodology for producing MU1140 in quantities sufficient to undertake its preclinical testing. In addition, we developed the DPOLT synthetic chemistry methodology to allow large-scale commercial production of the MU1140-S antibiotic. However, this methodology may not be feasible for cost effective, large scale manufacture. If we are not able to utilize this methodology for large-scale manufacture, we will be unable to generate revenues from this product candidate and our business, financial condition and results of

14

Table of Contents

Risk factors

operations will be materially adversely affected. We have retained Almac Sciences to refine and scale-up GMP production of MU1140-S. The manufacturing of MU1140-S is a highly exacting and complex process. Manufacturing MU1140-S on a commercial scale has not yet been achieved so there are additional risks. Third-party manufacturers must have additional technical skills and must take multiple steps to attempt to control the manufacturing processes.

Our ProBiora3 products and our SMaRT Replacement Therapy and MU1140-S product candidates face various forms of competition from other products in the marketplace.

The pharmaceutical and biotechnology industries are characterized by intense competition, rapid product development and technological change. Most of the competition that our ProBiora3 products and our SMaRT Replacement Therapy and MU1140-S product candidates face comes from companies that are large, well established and have greater financial, marketing, sales and technological resources than we have. Our ProBiora3 products compete with a range of consumer and nutraceutical products. Our commercial success with SMaRT Replacement Therapy and MU1140-S will depend on our ability and the ability of any sub-licensees to compete effectively in marketing and product development areas including, but not limited to, sales and branding, drug safety, efficacy, ease of use, patient or customer compliance, price, marketing and distribution. There can be no assurance that competitors will not succeed in developing and marketing products that are more desirable or effective than our ProBiora3 products or the products developed from our product candidates or that would render our products obsolete and non-competitive.

We anticipate that our SMaRT Replacement Therapy, if approved for the treatment of tooth decay, would compete with other companies attempting to develop technologies in the oral health care market, including vaccines.

We rely on the significant experience and specialized expertise of our senior management and scientific team.

Our performance is substantially dependent on the continued services and on the performance of our senior management and scientific team, who have extensive experience and specialized expertise in our business. Our performance also depends on our ability to retain and motivate our other key employees. The loss of the services of our Chief Executive Officer and President, David Hirsch, our Chief Scientific Officer, Dr. Jeffrey Hillman, and our Chief Financial Officer, Brian Bohunicky, and any members of our scientific team, could harm our ability to develop and commercialize our product candidates. We have no key man life insurance policies. We have employment agreements with Mr. Hirsch, Dr. Hillman and Mr. Bohunicky. The term of each of these employment agreements is for an indefinite period and each employment agreement shall end when the employment relationship is terminated by either party.

We need to hire and retain additional qualified scientists and other highly skilled personnel to maintain and grow our business.

Our future success depends on our ability to identify, attract, hire, train, retain and motivate highly skilled technical, managerial and research personnel in all areas within our organization. We plan to continue to grow our business and will need to hire additional personnel to support this growth. We believe that there are only a limited number of individuals with the requisite skills to serve in many of our key positions, and we compete for key personnel with other biotechnology companies, as well as universities and research institutions. It is often difficult to hire and retain these persons, and we may be unable to replace key persons if they leave or be unable to fill new positions requiring key persons with appropriate experience. If we fail to attract, integrate and retain the necessary personnel, our ability to maintain and grow our business could suffer significantly.

If our SMaRT Replacement Therapy and MU1140-S product candidates are shown to be ineffective or harmful in humans, we will be unable to generate revenues from these product candidates.

Before obtaining regulatory approvals for the commercial sale of our SMaRT Replacement Therapy or MU1140-S product candidates, we must demonstrate through preclinical testing and clinical trials that our products are safe and effective for use

15

Table of Contents

Risk factors

in humans. To date, the testing of our SMaRT Replacement Therapy product candidate has been undertaken solely in animals and a limited number of humans. Studies have proven our genetically altered strain of S. mutans to be effective in preventing tooth decay in animals. It is possible that our strain of S. mutans will be shown to be less effective in preventing tooth decay in humans in clinical trials. If our SMaRT Replacement Therapy product candidate is shown to be ineffective in preventing tooth decay in humans, we will be unable to commercialize and generate revenues from this product candidate. To date the testing of the antibiotic substance, MU1140, has been undertaken solely in the laboratory and in animals. We have not yet conducted human studies of MU1140-S. It is possible that when these studies are conducted, they will show that MU1140-S is ineffective or harmful in humans. If MU1140-S is shown to be ineffective or harmful in humans, we will be unable to commercialize and generate revenues from sales of this compound. If we are unable to generate revenues from our SMaRT Replacement Therapy and MU1140-S product candidates, our business, financial condition and results of operations will be materially adversely affected.

We intend to rely on third parties to pay the majority of the costs associated with obtaining regulatory approval for, and manufacturing and marketing of, our MU1140-S and SMaRT Replacement Therapy product candidates. If we are unable to obtain agreements with third parties to fund these costs, we will have to fund such costs ourselves or we may be unable to continue our operations.

Assuming the successful completion of Phase 1 trials for our MU1140-S and SMaRT Replacement Therapy product candidates, we intend to either license these product candidates to, or partner with, one or more major pharmaceutical companies prior to commercialization. If we do so, we intend for these licensees or partners to pay the costs associated with our remaining clinical trials and the manufacturing and marketing of our product candidates. If we are unable to license our product candidates or otherwise partner with third parties, we will have to fund the costs of our Phase 2 and Phase 3 trials ourselves. We will also have to establish our own manufacturing facilities and find our own distribution channels. This would greatly increase our future capital requirements and we cannot assure you that we would be able to obtain the necessary financing to pay these costs or that we will be generating significant revenues from any of our products, such as ProBiora3, sufficient to cover the associated costs. If we do not generate sufficient revenues to cover the associated costs or we cannot obtain financing on acceptable terms or at all, our business, financial condition and results of operations will be materially adversely affected.

Our dependence on collaborative arrangements with third parties subjects us to a number of risks. These collaborative arrangements may not be on terms favorable to us. Agreements with collaborative partners typically allow partners significant discretion in electing whether or not to pursue any of the planned activities. We cannot control the amount and timing of resources our collaborative partners may devote to products based on the collaboration, and our partners may choose to pursue alternative products. Our partners may not perform their obligations as expected. Business combinations or significant changes in a collaborative partner’s business strategy may adversely affect a partner’s willingness or ability to complete its obligations under the arrangement. Moreover, we could become involved in disputes with our partners, which could lead to delays or termination of the collaborations and time-consuming and expensive litigation or arbitration. Even if we fulfill our obligations under a collaborative agreement, our partner may be able to terminate the agreement under certain circumstances. If any collaborative partner were to terminate or breach our agreement with it, or otherwise fail to complete its obligations in a timely manner, our chances of successfully commercializing our product candidates would be materially and adversely affected.

We may require additional financing to complete the development of and to commercialize our SMaRT Replacement Therapy and MU1140-S product candidates and we do not know if additional financing will be available to us when and if needed, or, if available, on terms that we find acceptable, particularly given the current and potential future strain in the financial and credit markets.

Our operations have required substantial capital funding since inception and we expect to continue to spend substantial amounts to develop and commercialize our SMaRT Replacement Therapy and MU1140-S product candidates. We may need

16

Table of Contents

Risk factors

substantial additional funding and may be unable to raise capital when needed or on attractive terms, which would force us to significantly delay, scale back or discontinue the development or commercialization of our product candidates. Changing circumstances may cause us to use capital significantly faster than we currently anticipate, and we may incur higher expenses than currently expected because of circumstances beyond our control. If we are not able to raise additional capital and we are not generating positive cash flow from our ProBiora3 products and are unable to commercialize our product candidates, we may be unable to pursue further development of our product candidates, be forced to divest our product candidates prior to maximizing their potential value, be unable to maintain the licenses for our SMaRT Replacement Therapy and MU1140-S product candidates, or be forced to significantly scale back or cease our operations.

Other than our $2,000,000 Credit Facility with the KFLP, we have no other committed sources of capital and do not know whether additional financing will be available to us when and if needed, or, if available, that the terms will be acceptable to us, particularly if the financial and credit markets continue to be constrained.

We may seek additional financing through public or private equity offerings or through arrangements with strategic third parties. If we raise additional financing by issuing equity securities, further dilution to existing stockholders may result. In addition, as a condition to providing additional financing to us, future investors may demand, and may be granted, rights superior to those of existing stockholders. If we raise additional financing through arrangements with strategic third parties, we may be required to relinquish rights to or sell certain of our product candidates or products that we would not otherwise relinquish or sell.

We may seek additional financing through long-term debt and lines of credit or through the issuance of debt securities. If we raise additional financing through borrowing or the issuance of debt securities, our debt service obligations may be significant. If we are unable to generate sufficient cash to meet these debt service obligations, we will need to use existing cash or liquidate investments in order to fund these obligations and to repay our debt, which could force us to delay or terminate our research, development and commercialization efforts.

We are subject to risks of doing business internationally as we attempt to expand our sales through international distributor relationships.

We recently entered into a number of international distributor agreements for our ProBiora3 products. As a result, we expect to increase our revenues from international sales. A number of factors can slow or prevent international sales, or substantially increase the cost of international sales, and we may encounter certain risks of doing business internationally including the following:

| Ø | reduced protection and enforcement for our intellectual property rights; |

| Ø | unexpected changes in, or impositions of, legislative or regulatory requirements that may limit our ability to sell our products and repatriate funds to the United States; |

| Ø | political and economic instability; |

| Ø | fluctuations in foreign currency exchange rates; |

| Ø | difficulties in developing and maintaining distributor relationships in foreign countries; |

| Ø | difficulties in negotiating acceptable contractual terms and enforcing contractual obligations; |

| Ø | exposure to liabilities under the U.S. Foreign Corrupt Practices Act; |

| Ø | potential trade restrictions and exchange controls; |

17

Table of Contents

Risk factors

| Ø | creditworthiness of foreign distributors, customer uncertainty and difficulty in foreign accounts receivable collection; and |

| Ø | the burden of complying with foreign laws. |