Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CEDAR FAIR L P | d8k.htm |

1

Exhibit 99 |

2

Forward Looking Statements

Some

slides

and

comments

included

here,

particularly

related

to

estimates,

comments

on

expectations

about

future

performance

or

business

conditions,

may

contain

forward

looking

statements.

These

statements

may

involve

risks

and

uncertainties

that

are

difficult

to

predict,

may

be

beyond

our

control

and

could

cause

actual

results

to

differ

materially

from

those

described

in

such

statements.

Although

we

believe

that

the

expectations

reflected

in

such

forward-looking

statements

are

reasonable,

we

can

give

no

assurance

that

such

expectations

will

prove

to

be

correct.

Important

factors,

including

those

listed

under

Item

1A

in

the

Partnership’s

Form

10-K,

could

adversely

affect

our

future

financial

performance

and

cause

actual

results

to

differ

materially

from

our

expectations. |

3

Richard Kinzel

Chairman, President and Chief Executive Officer

Cedar Fair Entertainment Company

Peter Crage

Corporate VP of Finance and Chief Financial Officer

Cedar Fair Entertainment Company

Speakers |

4

AGENDA

Investment Highlights

YTD Financial Results

2010 Outlook

Long-Term Strategy

Growth Goals & Catalysts

Key Metrics

Capital Structure

Cash Flows

Distribution Strategy

Q&A |

5

Investment Highlights

Recognized innovative leader in regional amusement parks, water

parks, resorts and active entertainment

Attractive park locations and diverse geographical footprint

High-margin industry niche with significant barriers to entry

Strong and distinctive brands known for high-quality, pristine parks

with cutting-edge attractions

Consistently voted “Best in Class”

Proven and stable business model that consistently generates a

healthy revenue stream and strong cash flows in all economic

climates

A “Total Return”

investment

Growth strategy designed to increase revenues, adjusted EBITDA and

cash flows while further reducing debt

Experienced and proven management team focused on sustainable

long-term value creation for unitholders |

6

Overview of Financial Results

Year-to-Date Performance (unaudited)

Cedar Fair reports strong summer season operating results

In millions, except per capita amounts

9/5/2010

9/6/2009

Change

% Change

Total revenues

$ 824

$ 792

$ 32

4.0%

Attendance

18.8

17.9

0.9

5.0%

Average in-park guest per

capita spending

$ 39.28

$ 39.75

$ (0.47)

-1.2%

Out-of-park revenues

$ 87

$ 82

$ 5

6.1% |

7

Financial Highlights (through Sept. 5, 2010)

Southern Region Parks

In-park revenues up 9%

Attendance up 444k visits

World-class roller coasters introduced at

Kings Dominion and Carowinds

Northern Region Parks

In-park revenues up 3%

Attendance up 83k visits

Out-of-park revenues up more than 10%

Western Region Parks

In-park revenues up 3%

Attendance up 378k visits

Successful change to season pass

strategy –

volume approach

Positive response to the Planet Snoopy

children’s areas introduced at various

parks across all regions |

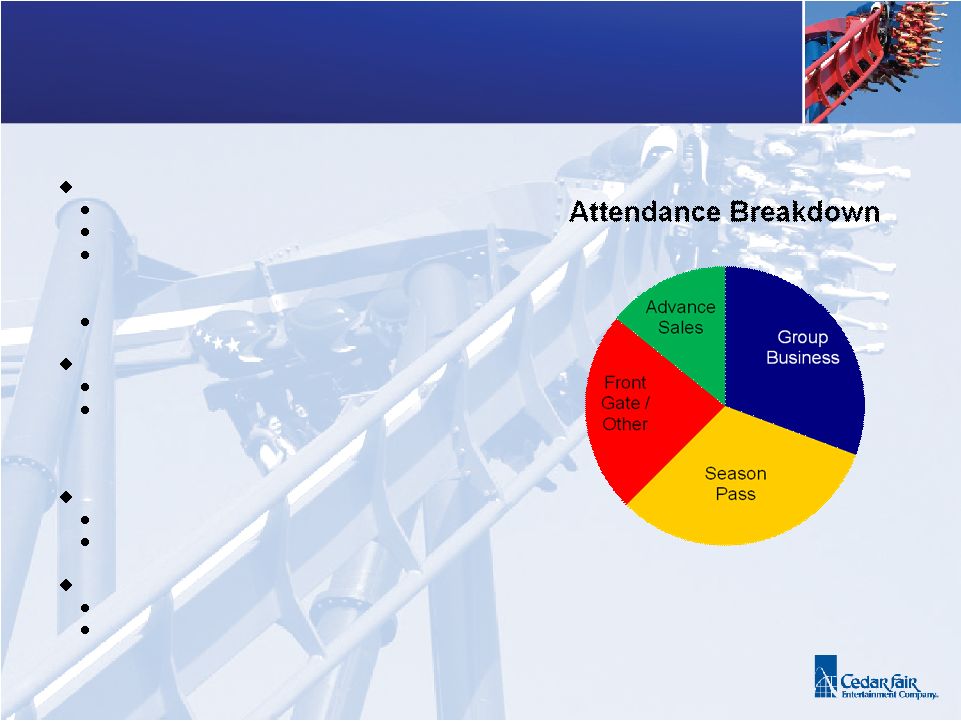

8

Financial Highlights (through Sept. 5, 2010)

Season Pass Sales/Visits

Revenues from pass sales up ~$16 million

Season pass visits up 870k

Results driven by “value price”

marketing

campaign geared towards families and

targeted capital expenditures

High perceived value

Group Business

365k visit increase

Return of group business due to stabilizing

economy and favorable, albeit modest,

employment trends

Advanced Sales

Up slightly year-over-year

Online promotions to create urgency

Front Gate/Other

Down 395k visits

Successfully converted portion of visitors to

season pass business and some to

advanced sales |

9

2010 Outlook

Reaffirm 2010 Company

Guidance

Revenues between $940 million

and $965 million

Adjusted EBITDA, excluding one-

time costs, between $320 million

and $340 million

Cash interest costs ~$130

million

Cash taxes of $20 million to

$23 million

2010 Capital Expenditures ~$85

million |

10

2010 Outlook

Other Fall Special Events Include:

Rev3 Triathlon Event at Cedar Point

Christian Music Concerts at Cedar Point and

Carowinds

Cheerleading Events at Kings Dominion,

Carowinds and California’s Great America

Approx. 15% of Operating Season Still Remaining (as of September 5,

2010) Award Winning Halloween Events

Several parks charge separate gate

admission |

11

Long-Term Financial Goals

Grow revenues by 10% to 14% by 2015

(~2.3% CAGR)

Grow adjusted EBITDA by 10% to 14%

by 2015 (~2.3% CAGR)

Achieve free cash flows of $120 million to

$140 million on an annual basis during

2012 to 2015

Reduce Consolidated Leverage Ratio to

4.0x in 2013

Provide for a responsible, sustainable

and growing distribution to unitholders

Goal of $1.25 to $1.75 per limited partner

unit (“LP unit”) by 2015

Represents a10%-14% annual yield based

on today’s market price

Our proven and stable business model should allow us to:

|

12

Long-Term Growth Strategy

Steadily grow attendance and revenues

through continued investment in trend-

setting new rides and attractions along

with new targeted marketing programs

Maintain strict controls over operating

costs while maintaining “best-in-class”

visitor experience

Further reduction of debt through the

prudent use of excess cash flows

Provides balance sheet flexibility to take

advantage of growth opportunities in the

future |

13

Achieving Long-Term Growth

Create Value

Trademark new rides and attractions

Unique experience customer cannot

recreate at home

Increased focus on special events

Create Urgency

“Limited Time”

offers

Text message offers when inside park

Goal: Grow revenues by 10% to 14% by 2015 (~2.3% CAGR)

Create Buzz

Media placement

Online social networks (Facebook,

Twitter)

Digital marketing (blogs, text messaging)

Extend Customers’

Stay

Market competitive renovations to

existing hotels

Consideration of accommodations /

resort development at other parks where

appropriate |

14

Achieving Long-Term Growth

Revenue Growth

Expanding market share and

visitor spend

Strict cost controls

Proven history of controlling

operating costs

Low corporate overhead

Remain focused on our four

cornerstones: Safety,

Cleanliness, Courtesy and

Service –

wrapped in Integrity

Maintain operating margins

between 34% and 36%

Goal: Grow adjusted EBITDA by 10% to 14% by 2015 (~2.3% CAGR)

|

15

Achieving Long-Term Growth

Adjusted EBITDA

CAGR of ~2.3% to 2015 required to meet cash flow goals

Cash FOR:

Cash Interest Expense

2011

~$160

million

(due

to

“old”

swaps

which

mature

in

2011

and

2012)

2012

and

beyond

$110

million

to

$120

million

Capital Expenditures

2011 expected to be approximately $75 million to $80 million

Future average annual spend approximately $80 million to $90 million

Cash Taxes

Approximately $15 million to $20 million on an annual basis starting with

2011 Goal: Achieve free cash flows of $120 million to $140 million on an

annual basis during 2012 to 2015 |

16

Achieving Long-Term Growth

We have stabilized our capital structure:

Long-term debt includes:

$1,175 million senior secured term loan (matures Dec 2016)

$405 million senior unsecured notes (matures Dec 2018)

$260

million

available

through

a

senior

secured

revolving

credit

facility

(matures Jul 2015)

Reduce Leverage Ratios

Reduced through growth in adjusted EBITDA and reduction of debt through the use

of excess cash flow

Senior secured leverage ratio reduced to sub-3.0x in 2013 (currently at

3.6x) Consolidated Leverage Ratio reduced to 4.0x in 2013 (currently at

4.9x) Interest Rates

Guideline: ~60/40 fixed/variable

Current swaps expire in Oct. 2011 ($1.0 billion) and Feb. 2012 ($268

million) Recently entered into $600 million of forward starting swaps

Begins October 2011, matures in December 2015

Fixes LIBOR at an average rate of 2.6%

Goal: Reduce Consolidated Leverage Ratio to 4.0x in 2013

|

17

Achieving Long-Term Growth

Excess Cash Flow Treatment per Credit Agreement

50% available

senior secured leverage ratio is >3.25x

75% available

senior secured leverage ratio is 2.75x to 3.25x

100%

available

senior

secured

leverage

ratio

is

<2.75x

Cedar Fair remains committed to issuing a distribution on an annual basis

Provide

for

a

responsible,

sustainable

and

growing

distribution

to

unitholders

beginning

today

Represents a 10%-14% annual yield beginning 2015 based on current unit

price Stabilizing the capital structure has put us in a position to reward unit

holders as we execute on our plan: |

18

Achieving Long-Term Growth

Stabilizing the capital structure has put us in a position to reward unit holders

as we execute on our plan:

Declaring 2010 distribution of $0.25 per unit

Payable on December 15, 2010 to unitholders

of record on December 3, 2010

24

th

consecutive year Cedar Fair has paid a distribution

2011 Distribution

$20 million available for distributions under current senior secured credit

agreement Additional $20 million available for distributions if senior

secured leverage ratio below 3.0x 2012 Distribution and Beyond

Plan to steadily increase distribution on an annual basis

Goal: $1.25 -

$1.75 annual distribution per LP unit by 2015 |

19

Investment Highlights

Recognized innovative leader in regional amusement parks, water

parks, resorts and active entertainment

Attractive park locations and diverse geographical footprint

High-margin industry niche with significant barriers to entry

Strong and distinctive brands known for high-quality, pristine parks

with cutting-edge attractions

Consistently voted “Best in Class”

Proven and stable business model that consistently generates a

healthy revenue stream and strong cash flows in all economic

climates

A “Total Return”

investment

Growth strategy designed to increase revenues, adjusted EBITDA and

cash flows while further reducing debt

Experienced and proven management team focused on sustainable

long-term value creation for unitholders |

20

Q&A |