Attached files

| file | filename |

|---|---|

| 8-K - OCT 4, 2010 8-K - PIONEER NATURAL RESOURCES CO | oct48k.htm |

Hart Energy’s

Developing Unconventional Gas

Conference

October 5, 2010

Developing Unconventional Gas

Conference

October 5, 2010

EXHIBIT 99.1

2

Forward-Looking Statements

Except for historical information contained herein, the statements, charts and graphs

in this presentation are forward-looking statements that are made pursuant to the Safe

Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Forward-

looking statements and the business prospects of Pioneer are subject to a number of

risks and uncertainties that may cause Pioneer's actual results in future periods to

differ materially from the forward-looking statements. These risks and uncertainties

include, among other things, volatility of commodity prices, product supply and

demand, competition, the ability to obtain environmental and other permits and the

timing thereof, other government regulation or action, the ability to obtain approvals

from third parties and negotiate agreements with third parties on mutually acceptable

terms, international operations and associated international political and economic

instability, litigation, the costs and results of drilling and operations, availability of

equipment, services and personnel required to complete the Company’s operating

activities, access to and availability of transportation, processing and refining

facilities, Pioneer's ability to replace reserves, implement its business plans or

complete its development activities as scheduled, access to and cost of capital, the

financial strength of counterparties to Pioneer’s credit facility and derivative contracts

and the purchasers of Pioneer’s oil, NGL and gas production, uncertainties about

estimates of reserves and resource potential and the ability to add proved reserves in

the future, the assumptions underlying production forecasts, quality of technical data,

environmental and weather risks, including the possible impacts of climate change, and

acts of war or terrorism. These and other risks are described in Pioneer's 10-K and 10-

Q Reports and other filings with the Securities and Exchange Commission. In addition,

Pioneer may be subject to currently unforeseen risks that may have a materially

adverse impact on it. Pioneer undertakes no duty to publicly update these statements

except as required by law.

in this presentation are forward-looking statements that are made pursuant to the Safe

Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Forward-

looking statements and the business prospects of Pioneer are subject to a number of

risks and uncertainties that may cause Pioneer's actual results in future periods to

differ materially from the forward-looking statements. These risks and uncertainties

include, among other things, volatility of commodity prices, product supply and

demand, competition, the ability to obtain environmental and other permits and the

timing thereof, other government regulation or action, the ability to obtain approvals

from third parties and negotiate agreements with third parties on mutually acceptable

terms, international operations and associated international political and economic

instability, litigation, the costs and results of drilling and operations, availability of

equipment, services and personnel required to complete the Company’s operating

activities, access to and availability of transportation, processing and refining

facilities, Pioneer's ability to replace reserves, implement its business plans or

complete its development activities as scheduled, access to and cost of capital, the

financial strength of counterparties to Pioneer’s credit facility and derivative contracts

and the purchasers of Pioneer’s oil, NGL and gas production, uncertainties about

estimates of reserves and resource potential and the ability to add proved reserves in

the future, the assumptions underlying production forecasts, quality of technical data,

environmental and weather risks, including the possible impacts of climate change, and

acts of war or terrorism. These and other risks are described in Pioneer's 10-K and 10-

Q Reports and other filings with the Securities and Exchange Commission. In addition,

Pioneer may be subject to currently unforeseen risks that may have a materially

adverse impact on it. Pioneer undertakes no duty to publicly update these statements

except as required by law.

3

Returning to Our Texas Roots

Dallas

San Antonio

Houston

Barnett

Combo

Combo

Spraberry

Eagle Ford

Shale

Shale

PXD - Largest Spraberry Acreage Holder and Producer

PXD Acreage

(~900,000 Acres;

~75% HBP)

~75% HBP)

All Others

(~800,000 Acres)

75 miles

PERMIAN

BASIN

24 MM acres

20,000+ Drilling Locations

Spraberry Field Gross Production by Operator

(MBOED)1

(MBOED)1

1) Based on 2009 data from Railroad Commission of Texas

History of Spraberry Trend Completions

2010+

2008 - 09

2000s

1980 - 90s

1950 - 70s

Drilling deeper and adding fracture stimulation stages have added

production and improved recoveries

production and improved recoveries

Average

Cased Depth

of Wellbore

Cased Depth

of Wellbore

Fracture

Stimulation

Stages

Stimulation

Stages

Dean

Limestone Pay

Sandstone Pay

Non-Organic Shale Non-Pay

Organic Rich Shale Pay

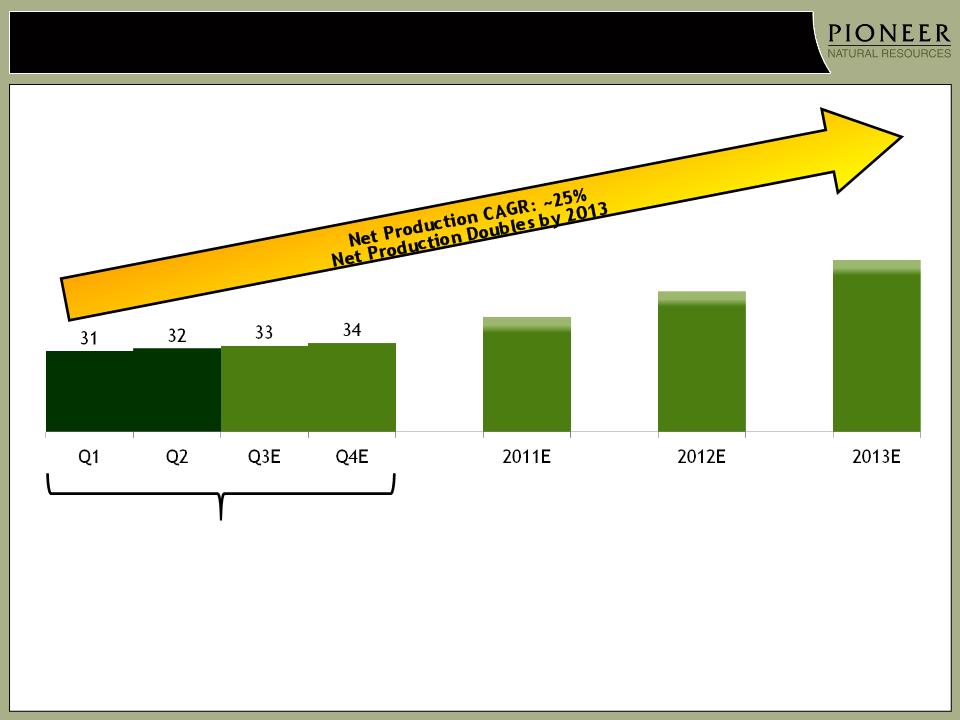

Increasing to 40 Rigs by 2012 - Accelerating Spraberry Development

6

Spraberry Net Production1

(MBOED)

(MBOED)

2010

|

Wells

|

~440

|

|

|

~700

|

~1,000

|

~1,000

|

38 - 44

48 - 54

60 - 66

1) Reflects planned drilling program and expiration of VPP commitments

+2% vs.

Q4 2009

Q4 2009

+4% vs.

Q1 2010

Q1 2010

7

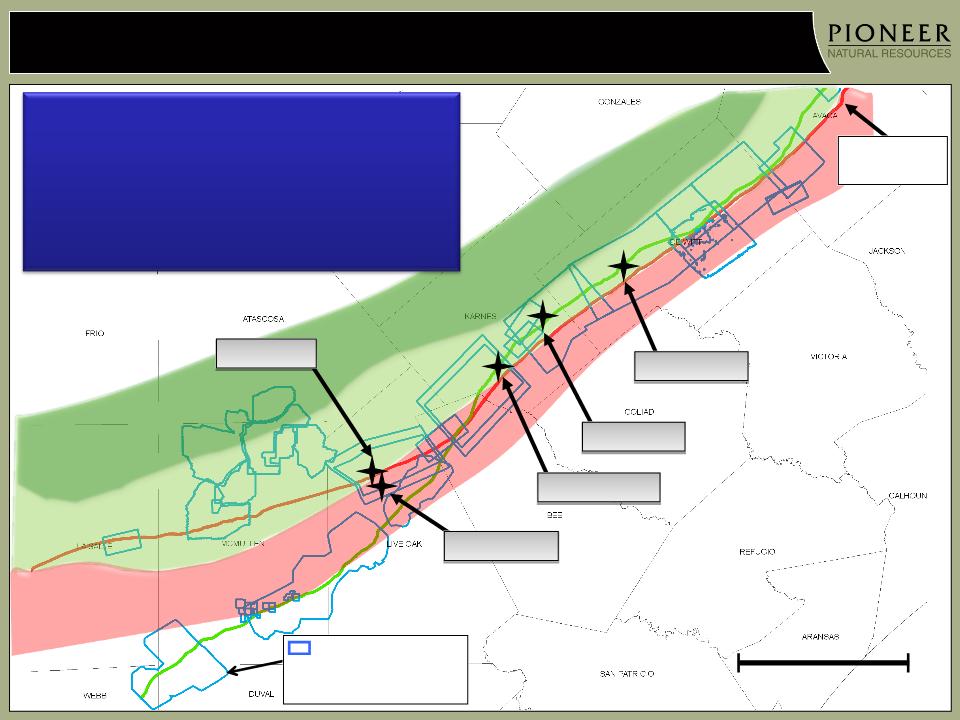

§ Gross resource potential of play: ~150 TCF1

§ >100 rigs currently running in the play

Eagle Ford Shale: Largest U.S. Oil Discovery Since Prudhoe Bay

Oil Window

Map source: PXD

1) Source: Tudor, Pickering, Holt & Co.

PXD Acreage Area

8

Pioneer’s History in the Eagle Ford Shale

§ Re-completed several vertical wells in late

2006 in the Eagle Ford zone of interest

2006 in the Eagle Ford zone of interest

§ Play “exploded” with several key horizontal

wells tested at high rates in 2008/2009

wells tested at high rates in 2008/2009

§ Drilled 20 wells (15 with pilots & full suite of

logs)

logs)

§ Cut over 1,000 feet of core

§ Shot >2,000 sq miles of 3-D seismic

§ Joint venture with Reliance

§ Drilling with 5 rigs; planning to be at 14 rigs by

2012

2012

§ Constructing midstream facilities

Exploration

Appraisal

Development

9

Early Vertical Recompletions Encouraging

Perfs

§ 2006 Re-Completion Program

– Rolf 2-6: 2,500 lbs proppant à 50 MCFPD (dry gas)

– Wernli 1-4: 45,000 lbs proppant à 200 MCFPD (dry gas)

– Menn 1: 190,000 lbs proppant à 550 MCFPD (wet gas)

§ Results

– Larger frac was more productive

– Liquids are present

– Fracture gradient >0.9 psi/ft (higher than expected)

– Pore pressure >0.7 psi/ft (abnormally high)

Menn 1

Menn 1

Charles Riedesel

4,500 ft lateral

4 MM lbs proppant in 14 stages

IP: 15.7 MMCFEPD

w/ 680 BBL condensate

Horizontal Wells Deliver True Potential

Riedesel

Base Eagle Ford From 3D Seismic

Top Eagle Ford

Menn 1

Riedesel

Menn 1

Eagle

Ford

Shale

Ford

Shale

§ IP of 15.7 MMCFEPD was ~30x

more productive than vertical

completion in Menn 1 using

~20x more proppant

more productive than vertical

completion in Menn 1 using

~20x more proppant

10

Drilling Results Leader in Eagle Ford Shale

PXD 3-D Seismic

Coverage :

>2,000 sq. miles

Coverage :

>2,000 sq. miles

Dry Gas

Window

Window

Condensate

Window

Window

Oil

Window

Sinor #5

Crawley #1

11

Edwards

shelf margin

shelf margin

Riedesel #1

Play Leading IP’s:

Handy #1 19.9 MMCFEPD (75% Liquids)

Crawley #1 17.0 MMCFPD (Dry Gas)

Riedesel #1 15.7 MMCFEPD (55% Liquids)

Chestnutt #1 15.6 MMCFEPD (45% Liquids)

Sinor #5 11.3 MMCFEPD (55% Liquids)

30 Miles

Handy #1

Chestnutt #1

80% of Pioneer’s Acreage in Condensate Window

80% of Pioneer’s Acreage in Condensate Window

6 miles

NW

Handy

Riedesel

Chesnutt

SE

13,400 ft

13,200 ft

13,000 ft

Top

Eagle Ford

Base

Sligo

Margin

14,000 ft

13,800 ft

13,600 ft

Yield

285

285

BBL/MM

Eagle Ford

Yield

55

55

BBL/MM

Yield

115

BBL/MM

Yield

211

211

BBL/MM

Pioneer Well

Pioneer Well

Austin Chalk

Yield

16

16

BBL/MM

Pioneer Well

Condensate window contains high-value liquids with

stronger EURs from gas depletion drive

stronger EURs from gas depletion drive

Dry

Gas

Gas

Condensate Window

12

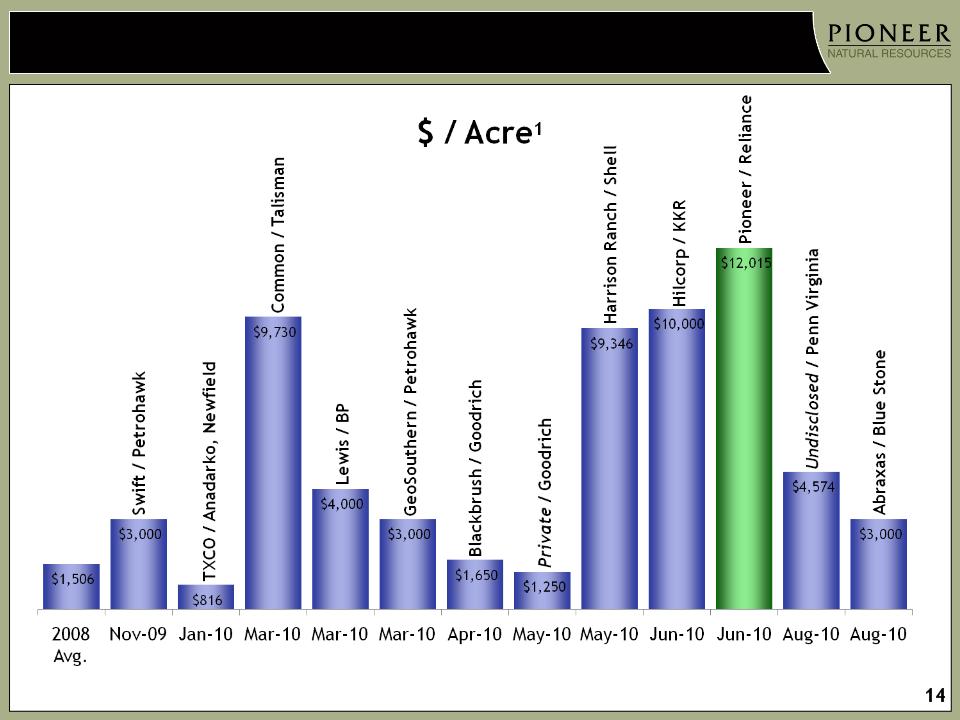

Eagle Ford Shale Joint Venture Highlights

§ Sold 45% of PXD’s interest in ~212 M net acres in the Eagle Ford Shale to

Reliance Industries Ltd. (RIL) for ~$1.15 B

Reliance Industries Ltd. (RIL) for ~$1.15 B

– Effective June 1, 2010

– $266 MM in cash received upfront

– $879 MM in drilling carry; RIL funding 75% of PXD’s share of well costs until

drilling carry has been fully utilized (~4 years)

drilling carry has been fully utilized (~4 years)

– RIL participating in midstream development as a 49.9% partner

§ Created area of mutual interest (AMI) for expected future acreage acquisitions

– AMI includes acreage in 6 South Texas counties

– PXD is sole leasing agent

– RIL has option to acquire 45% of PXD’s interest in new acreage at terms

similar to those agreed to by PXD and the leaseholder

similar to those agreed to by PXD and the leaseholder

§ PXD continues as operator

– PXD 42% WI, RIL 41% WI and other working interest owners 17% WI (average

within AMI)

within AMI)

13

Pioneer Has Received Highest Acreage Value

1) Source: Raymond James

2) Source: Madison Williams

2

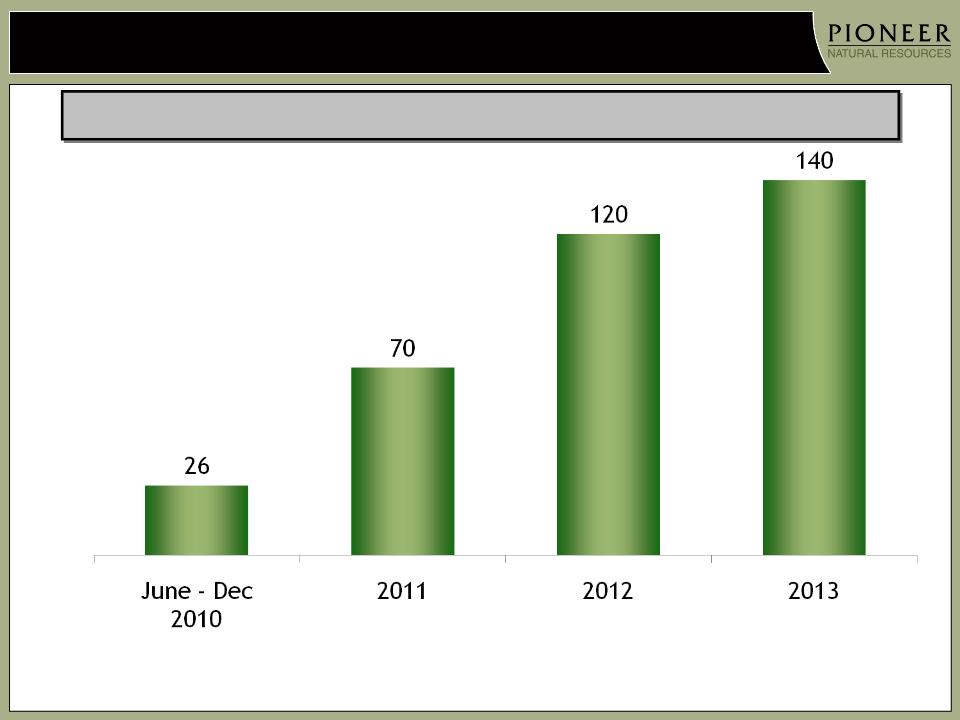

Eagle Ford Shale Joint Venture Development Plan

|

Year-end

Rig Count |

7

|

|

10

|

14

|

14

|

Gross Wells

15

Over 700 MMBOE Net Resource Potential from ~2,000 drilling locations

Significant Eagle Ford Shale Production Ramp-up

16

Eagle Ford Net Production1

(MBOEPD)

(MBOEPD)

2010

10 - 13

19 - 24

32 - 41

1) Reflects planned drilling program and working interest of 42%

Midstream

connections

begin

connections

begin

|

Gross Wells

|

|||

|

26

(June - Dec)

|

70

|

120

|

140

|

RIL JV

effective June

1st

effective June

1st

YE exit rate

~5 MBOEPD

~5 MBOEPD

17

Eagle Ford Shale Production Breakdown

30%

NGL*

NGL*

50%

Gas

Gas

20%

Condensate

20%

NGL*

NGL*

30%

Gas

Gas

100%

Gas

Gas

50%

Condensate

*NGLs are 50% ethane, 25% propane, 15% butanes and 10% heavier liquids

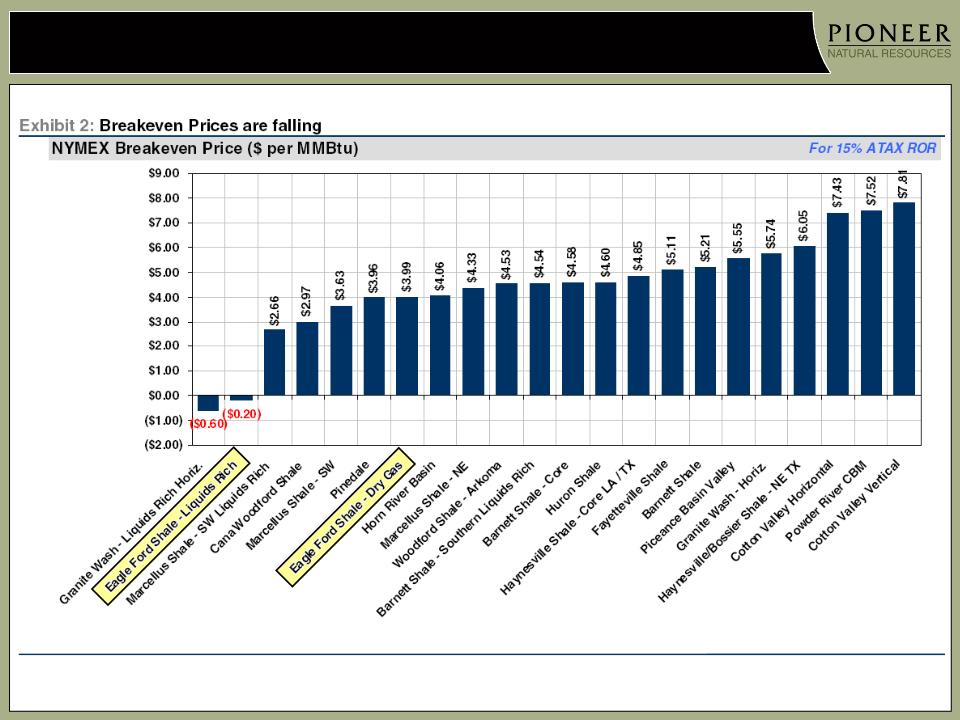

Higher Condensate / NGL Yields Result in Low Breakeven Gas Price for Eagle Ford Shale

18

Assumes condensate yield of 25%, NGL yield of ~85 BBL/MM, $80/BBL oil price and NGL price 45% of oil

Source: Credit Suisse

|

Strip Case (August)

|

Oil

|

Gas

|

|

2010 (August-Dec)

|

|

|

|

2011

|

$ 86.24

|

$ 5.17

|

|

2012

|

|

.

|

|

2013

|

|

|

|

2014+

|

$ 88.77

|

$ 5.82

|

NGL % of WTI

~60% IRR

at NGL Prices

50% of WTI

at NGL Prices

50% of WTI

High Condensate Yield

200 BBL / MMCF

200 BBL / MMCF

Low Condensate Yield

60 BBL / MMCF

60 BBL / MMCF

~85% IRR

at NGL Prices

50% of WTI

at NGL Prices

50% of WTI

Eagle Ford Shale Operational Update

§ 5 wells currently producing

§ 5 wells completed and awaiting central gathering

facility construction; expect to be online during Q4

facility construction; expect to be online during Q4

§ 5 wells awaiting completion; expect to be online

during Q4 following completion of gathering facilities

during Q4 following completion of gathering facilities

§ Running 5 rigs; will increase to 7 rigs by YE 2010

§ Contracted dedicated third-party frac fleet (Q1 2011);

purchasing Company-owned frac fleet (Q2 2011)

purchasing Company-owned frac fleet (Q2 2011)

§ Midstream construction underway

§ Negotiating third-party processing agreements

Awaiting Completion

Eagle Ford

Shale

Upstream

Shale

Upstream

•Production

from Drilling

from Drilling

– Rich or Dry

Gas

Gas

–Condensate

PXD/RIL Joint Venture

21

Fractionation

•NGLs separated

into ethane,

propane, butanes

and pentanes+

into ethane,

propane, butanes

and pentanes+

Eagle Ford Shale Joint Venture Midstream Plan

Midstream

Central

Gathering

Facilities

Central

Gathering

Facilities

•Gather gas and

condensate

condensate

•Separate gas and

condensate

condensate

•Treat gas

•Stabilize

condensate

condensate

•Cost ~$300 MM

through 2013

(PXD’s share)

through 2013

(PXD’s share)

Processing

•Separate NGLs

from rich gas

from rich gas

•Negotiating

agreements

with 3rd parties

to process gas

agreements

with 3rd parties

to process gas

Condensate sold

Dry Gas sold

Production

Rich Gas

NGLs

3rd Party

NGL components sold

Eagle Ford Shale Midstream Development Plan

§ 14 Central Gathering Facilities

§ 250 miles of pipeline

§ Cost: ~$300 MM through 2013 (PXD’s share)

§ Provides enhanced control and efficiencies

for marketing of upstream production

for marketing of upstream production

§ Potential for 3rd party business

Gathering Pipeline

Significant Surplus Capacity to Process PXD’s Eagle Ford Shale Production

23

Pioneer Acreage

Midstream - To Transport and

Process Wet Gas1

Process Wet Gas1

Existing Processing Capacity:

~3 BCF/D

~3 BCF/D

Surplus Processing Capacity:

0.75 - 1.0 BCF/D

0.75 - 1.0 BCF/D

Fractionation - To Process NGLs2

Mont Belvieu

Existing Capacity: ~700 MBPD

Proposed Expansion: ~150 MBPD

Refinery Capacity - To Process

Condensate3

Condensate3

Corpus Christi: ~725 MBPD

Port Arthur: ~950 MBPD

Houston Area: >2 MMBPD

South Texas Pipelines - Wet & Dry Gas

1) Copano, DCP, Enterprise, Kinder-Morgan

2) ConocoPhillips, Enterprise, Oneok/DCP, Targa/BP

3) BP, Citgo, ExxonMobil, Shell, Valero

Operating Cash Flow Expected to Double by 2013

Billions1

24

1) Based on August strip pricing and includes derivative positions as of July 20, 2010

Additional Cash Flow

From Deepwater

GOM Refund

From Deepwater

GOM Refund

PXD Stock Price Performance vs. Peers Since 12/31/07

25

The Shale Gas Revolution

Haynesville

Fayetteville

New Albany

Floyd-Neal

Marcellus/

Devonian/Utica

Woodford

Barnett-

Woodford

Eagle Ford

Barnett

Lewis

Cody

Niobrara

Mulky

Bakken

Antrim

Baxter-Mancos

Mowry

Gammon

Mancos

Pierre

Total Potential

Natural Gas

Resources:

Natural Gas

Resources:

Source: Potential Gas Committee Report, June 2009

26

Promote Using More Natural Gas

ABUNDANT

DOMESTIC

CLEAN

JOBS

And Natural Gas is Available Now!

27

How We Use Natural Gas

Source: EIA, Natural Gas Year In Review, 2009

How Natural Gas is Used Today

3% Transportation

28

Today’s Electricity Mix

Source: EIA, 2009 Annual Energy Review

1% other non-renewable

EIA expects demand for electricity to grow ~1% per year and that

250 gigawatts of new generating capacity will be needed by 2035.

29

Natural Gas is Cleaner for Power Generation

Compared to coal, natural gas…

Reduces CO2 emissions

Reduces NOx emissions

Virtually Eliminates SO2 Emissions

Virtually Eliminates Particulate Emissions

50%

80%

99.96%

99.74%

Completely Eliminates Mercury Emissions

100%

30

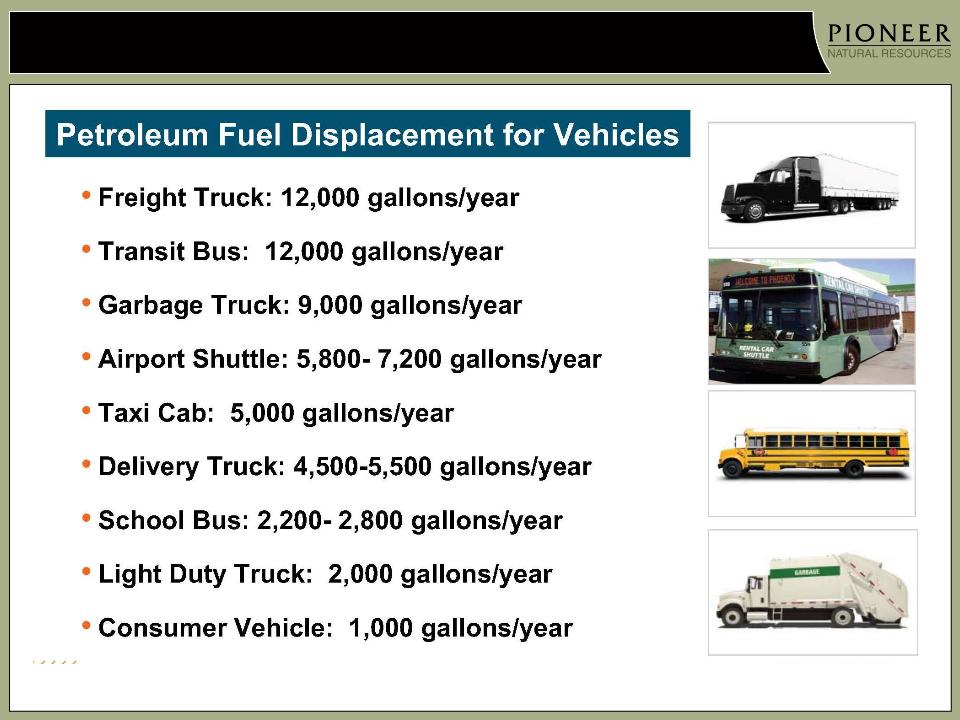

Natural Gas for Transportation

Source: NGVAmerica

31

Our Dependence on Foreign Oil

§ We imported 3,540,500,000 barrels in 2009

• That’s 9,700,000 barrels per day

§ We paid out

$208,894,495,000

for imported oil in 2009

• That’s $572,000,000 per day

• Or $680 for each person

in America

in America

§ Among the top countries we import from:

Venezuela, Saudi Arabia, Nigeria, Russia, Algeria, Angola

and Iraq

and Iraq

$208,894,495,000

32

Natural Gas is Cleaner for Vehicles

§ Compared to gasoline or diesel, NGVs:

Reduce CO2 emissions

Reduce CO emissions

Reduce NOx emissions

Reduce Particulate Matter emissions

Reduce VOC emissions

20-30%

70-90%

75-95%

90%

89%

33

Infrastructure: Refueling Stations

• ~ 10,000 natural gas vehicles in U.S. today

• ~ 1,600 natural gas fueling stations

• NGV fueling infrastructure is growing:

‒ cleaner, more affordable fleets

‒ governments concerned about air quality

‒ more commitment to reduce reliance on

foreign oil

foreign oil

• Public access to refueling is expanding:

‒ South Coast Air Quality Management District and UPS completing 700-mile

natural gas corridor from Las Vegas to Ontario, California

natural gas corridor from Las Vegas to Ontario, California

‒ Utah Governor Jon Huntsman has designated I-15 from Idaho to Arizona as a

natural gas vehicle corridor

natural gas vehicle corridor

‒ Seattle is among a growing number of cities making fueling stations for

municipal fleets available to the public

municipal fleets available to the public

Texas should take the lead as Top Natural Gas Producing State

Texas Clean Transportation Triangle

34

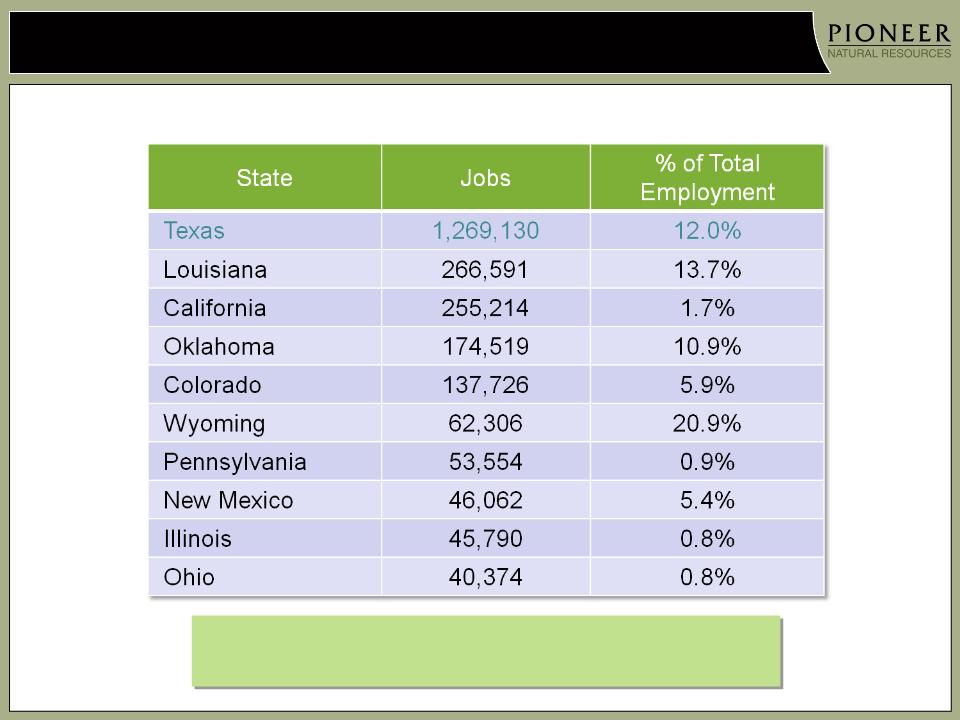

Jobs Across the Country

Top 10 States for Natural Gas Jobs

Source: IHS Global

Insight, 2009

Insight, 2009

31 states have more than 10,000 jobs tied to natural gas

More jobs being added every year

35

Protecting Natural Gas Operations

36

ANGA Members

37

Natural Gas

The Natural Choice Now.

www.anga.us

twitter @ANGAus

twitter @ANGAus

38

39

Certain Reserve Information

Cautionary Note to U.S. Investors --The U.S. Securities and Exchange Commission (the

"SEC") prohibits oil and gas companies, in their filings with the SEC, from disclosing

estimates of oil or gas resources other than “reserves,” as that term is defined by the

SEC. In this presentation, Pioneer includes estimates of quantities of oil and gas using

certain terms, such as “resource potential,” “EUR” or other descriptions of volumes of

reserves, which terms include quantities of oil and gas that may not meet the SEC’s

definitions of proved, probable and possible reserves, and which the SEC's guidelines

strictly prohibit Pioneer from including in filings with the SEC. These estimates are by

their nature more speculative than estimates of proved reserves and accordingly are

subject to substantially greater risk of being recovered by Pioneer. U.S. investors are

urged to consider closely the disclosures in the Company’s periodic filings with the SEC,

available from the Company at 5205 N. O'Connor Blvd., Suite 200, Irving, Texas 75039,

Attention Investor Relations, and the Company’s website at www.pxd.com. These filings

also can be obtained from the SEC by calling 1-800-SEC-0330.

"SEC") prohibits oil and gas companies, in their filings with the SEC, from disclosing

estimates of oil or gas resources other than “reserves,” as that term is defined by the

SEC. In this presentation, Pioneer includes estimates of quantities of oil and gas using

certain terms, such as “resource potential,” “EUR” or other descriptions of volumes of

reserves, which terms include quantities of oil and gas that may not meet the SEC’s

definitions of proved, probable and possible reserves, and which the SEC's guidelines

strictly prohibit Pioneer from including in filings with the SEC. These estimates are by

their nature more speculative than estimates of proved reserves and accordingly are

subject to substantially greater risk of being recovered by Pioneer. U.S. investors are

urged to consider closely the disclosures in the Company’s periodic filings with the SEC,

available from the Company at 5205 N. O'Connor Blvd., Suite 200, Irving, Texas 75039,

Attention Investor Relations, and the Company’s website at www.pxd.com. These filings

also can be obtained from the SEC by calling 1-800-SEC-0330.