Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

|

|

|

þ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

For the fiscal year ended June 30, 2010 |

|

|

or |

|

|

|

|

|

o |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

For the transition period from __________________ to ____________________ |

|

Commission file number: 000-30311

GOLD HORSE INTERNATIONAL, INC.

________________________________________________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Florida |

|

22-3719165 |

|

|

||

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

No. 31 Tongdao South Road, Hohhot, Inner Mongolia, China |

|

010030 |

|

|

||

|

(Address of principal executive offices) |

|

(Zip Code) |

|

|

|

|

|

Registrant’s telephone number, including area code: |

|

86 (471) 339 7999 |

|

|

|

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act:

Common stock, par value $0.0001 per share

(Title of class)

Indicate by

check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o No x

Indicate by

check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by

check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company:

|

|

|

|

|

|

Large accelerated filer |

o |

Accelerated filer |

o |

|

Non-accelerated filer |

o |

Smaller reporting company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $4,608,576 on December 31, 2009.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 1,934,878 shares of common stock are issued and outstanding as of September 24, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

ii

GOLD HORSE INTERNATIONAL, INC.

FORM 10-K

TABLE OF CONTENTS

|

|

|

|

|

|

|

Page No. |

|

|

|

|

|

|

Part I |

|

|

Item 1. |

Business. |

1 |

|

Item 1A. |

Risk Factors. |

18 |

|

Item 1B. |

Unresolved Staff Comments. |

29 |

|

Item 2. |

Properties. |

29 |

|

Item 3. |

Legal Proceedings. |

29 |

|

Item 4. |

(Removed and Reserved) |

29 |

|

|

Part II |

|

|

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

30 |

|

Item 6. |

Selected Financial Data. |

30 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

30 |

|

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk. |

45 |

|

Item 8. |

Financial Statements and Supplementary Data. |

45 |

|

Item 9. |

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure. |

45 |

|

Item 9A. |

Controls and Procedures. |

45 |

|

Item 9B. |

Other Information. |

46 |

|

|

Part III |

|

|

Item 10. |

Directors, Executive Officers and Corporate Governance. |

46 |

|

Item 11. |

Executive Compensation. |

51 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

54 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence. |

55 |

|

Item 14. |

Principal Accounting Fees and Services. |

56 |

|

|

Part IV |

|

|

Item 15. |

Exhibits, Financial Statement Schedules. |

56 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to:

|

|

|

|

• |

risks associated with our lack of operations and dependence upon the Contractual Arrangements which may not be renewed, |

|

• |

the possibility that the Contractual Arrangements may not provide us with effective control over the Jin Ma Companies, |

|

• |

possible adverse effects of PRC regulations on the businesses of the Jin Ma Companies, |

|

• |

our ability to satisfy or refinance $3.1 million of debt which becomes due in May 2011, |

|

• |

conflicts of interest involving our management and Board, |

|

• |

our dependence on the Jin Ma Companies’ to pay their fees to us which presently owe us total of $21.6 million, |

|

• |

the Jin Ma Companies’ dependence on a limited number of customers and the recent change in business model of Jin Ma Construction, |

|

• |

risks associated with the construction industry which could impact Jin Ma Construction, |

|

• |

risks associated with the real estate industry which could impact Jin Ma Real Estate, |

|

• |

risks associated with the hotel industry which could impact Jin Ma Hotel, |

|

• |

risks associated with doing business in the PRC, |

|

• |

control of our company by our management, and |

|

• |

quotation of our common stock on the OTC Bulletin Board which can limit trading and liquidity. |

iii

Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this report in its entirety, including the risks described in “Item 1A. - Risk Factors”. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

OTHER PERTINENT INFORMATION

Our web site is www.goldhorseinternational.com. The information which appears on our web site is not part of this report.

All share and per share information in this report gives effect to the 40:1 reverse stock split of our common stock which was effective on September 8, 2010.

Our business is conducted in China, using the renminbi (the “RMB”), the currency of China, and our financial statements are presented in United States dollars. In this annual report, we refer to assets, obligations, commitments and liabilities in our financial statements in United States dollars. These dollar references are based on the exchange rate of RMB to United States dollars, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets, including accounts receivable (expressed in dollars).

INDEX OF CERTAIN DEFINED TERMS USED IN THIS REPORT

Unless specifically set forth to the contrary, when used in this annual report the terms:

|

|

|

|

|

|

• |

“Gold Horse International,” the “Company, “we,” “us,” “ours,” and similar terms refers to Gold Horse International, Inc., a Florida corporation, |

|

|

|

|

|

|

• |

“Gold Horse Nevada” refers to Gold Horse International, Inc., a Nevada corporation and wholly-owned subsidiary of Gold Horse International, |

|

|

|

|

|

|

• |

“Global Rise” refers to Global Rise International Limited, a Cayman Islands corporation and wholly-owned subsidiary of Gold Horse Nevada, |

|

|

|

|

|

|

• |

“IMTD” refers to Inner Mongolia (Cayman) Technology & Development Ltd., a Chinese company and wholly-owned subsidiary of Global Rise, |

|

|

|

|

|

|

• |

“Jin Ma Real Estate” refers to Inner Mongolia Jin Ma Real Estate Development Co., Ltd., a Chinese company, |

|

|

|

|

|

|

• |

“Jin Ma Construction” refers to Inner Mongolia Jin Ma Construction Co., Ltd., a Chinese company, |

|

|

|

|

|

|

• |

“Jin Ma Hotel” refers to Inner Mongolia Jin Ma Hotel Co., Ltd., a Chinese company, |

|

|

|

|

|

|

• |

“Jin Ma Companies” collectively refers to Jin Ma Real Estate, Jin Ma Construction, and Jin Ma Hotel, which are variable interest entities under contractual arrangements with us and whose financial statements are consolidated with ours, unless the context specifically states or implies otherwise; |

|

|

|

|

|

|

• |

“PRC” or “China” refers to the People’s Republic of China, and |

|

|

|

|

|

|

• |

“fiscal 2009” refers to the fiscal year ended June 30, 2009, “fiscal 2010” refers to the fiscal year ended June 30, 2010 and “fiscal 2011” refers to the fiscal year ending June 30, 2011, unless the context otherwise defines. |

iv

PART I

ITEM 1. DESCRIPTION OF BUSINESS.

OVERVIEW

We operate, control and beneficially own the construction, hotel and real estate development businesses in China of the Jin Ma Companies under a series of Contractual Arrangements. Both our company and the Jin Ma Companies are principally controlled by the same individuals. Other than the Contractual Arrangements with the Jin Ma Companies, we do not have any business or operations except for the performance of administrative services on a contract basis to Jin Ma Real Estate. Pursuant to the Contractual Arrangements we provide business consulting and other general business operation services to the Jin Ma Companies. Through these Contractual Arrangements, we have the ability to control the daily operations and financial affairs of the Jin Ma Companies, appoint each of their senior executives and approve all matters requiring shareholder approval. As a result of these Contractual Arrangements, which enable us to control the Jin Ma Companies, we are considered the primary beneficiary of the Jin Ma Companies. Accordingly, we consolidate the Jin Ma Companies’ results, assets and liabilities in our financial statements. The creditors of the Jin Ma Companies do not have recourse to any assets we may have.

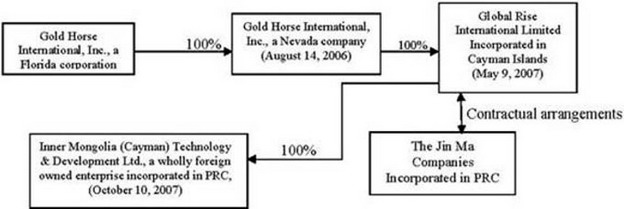

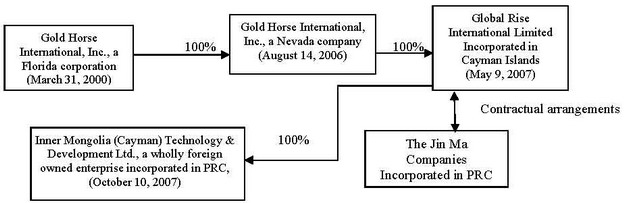

The relationship among the above companies as follows:

Notwithstanding that Gold Horse International and the Jin Ma Companies are separate legal entities and the legal obligations of the parties are governed by the Contractual Arrangements, there is commonality of control between Gold Horse International and the Jin Ma Companies as set forth in the following table:

|

|

|

|

|

|

|

Name |

Executive |

Director |

Principal |

Stockholder of |

|

Liankuan Yang |

√ |

√ |

√ |

√ |

|

Yang Yang |

√ |

√ |

√ |

√ |

|

Runlan Ma |

|

|

√ |

√ |

(1) Each of Jin Ma Construction, Jin Ma Hotel, and Jin Ma Real Estate are owed 70% by Liankuan Yang, our Chairman and CEO, 15% by Runlan Ma, the spouse of Liankuan Yang and our corporate secretary, and 15% by Yang Yang, the daughter of Liankuan Yang and a Vice President and member of our Board of Directors.

PRC law currently places certain limitations on foreign ownership of Chinese companies. To comply with these foreign ownership restrictions, we operate our business in China through the Contractual Arrangements with the Jin Ma Companies, each of which is a limited liability company headquartered in Hohhot, the capital city of the Autonomous Region of Inner Mongolia in China, and organized under PRC laws. Each of the Jin Ma Companies has the relevant licenses and approvals necessary to operate our businesses in China.

1

The Contractual Arrangements are comprised of a series of agreements, including a Consulting Services Agreement and an Operating Agreement, through which we have the right to advise, consult, manage and operate each of the Jin Ma Companies, and collect and own all of their respective net profits. Additionally, under a Shareholders’ Voting Rights Proxy Agreement, the Jin Ma Companies’ shareholders have vested their voting control over the Jin Ma Companies to us. In order to further reinforce our rights to control and operate the Jin Ma Companies, these companies and their shareholders have granted us, under an Option Agreement, the exclusive right and option to acquire all of their equity interests in the Jin Ma Companies or, alternatively, all of the assets of the Jin Ma Companies. Further the Jin Ma Companies’ shareholders have pledged all of their rights, titles and interests in the Jin Ma Companies to us under an Equity Pledge Agreement.

Under PRC laws, each of Gold Horse International, Gold Horse Nevada, Global Rise, Jin Ma Real Estate, Jin Ma Construction and Jin Ma Hotel is an independent legal person and none of them is exposed to liabilities incurred by the other party. Other than pursuant to the Contractual Arrangements, the Jin Ma Companies do not transfer any other funds generated from their respective operations to us.

We have entered into the following Contractual Arrangements with each of the Jin Ma Companies:

Consulting Services Agreements. Pursuant to the exclusive Consulting Services Agreements with each of the Jin Ma Companies, we exclusively provide to the Jin Ma Companies general business operations services and consulting services as well as general business operation advice and strategic planning. Each of the Jin Ma Companies agreed to a quarterly consulting service fees in Renminbi (“RMB”) to us that is equal to all of its net profit for such quarter. However, as described elsewhere in this report, the Jin Ma Companies have never remitted these fees to us and are retaining the funds for operating capital. At June 30, 2010 we are owed $21.6 million by the Jin Ma Companies.

Operating Agreements. Pursuant to the Operating Agreements with the Jin Ma Companies and their respective shareholders, we provide guidance and instructions on the Jin Ma Companies’ daily operations, financial management and employment issues. The Jin Ma Companies’ shareholders must designate the candidates recommended by us as their representatives on each of the Jin Ma Companies’ board of directors. We have the right to appoint senior executives of the Jin Ma Companies. In addition, we agreed to guarantee the Jin Ma Companies’ performance under any agreements or arrangements relating to the Jin Ma Companies’ business arrangements with any third party, although we have issued no such guarantees as of the date hereof. Each of the Jin Ma Companies, in return, pledged its accounts receivable and all of its assets to us. Moreover, each of the Jin Ma Companies agreed that without our prior consent, it will not engage in any transactions that could materially affect its assets, liabilities, rights or operations, including, without limitation, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of its assets or intellectual property rights in favor of a third party or transfer of any agreements relating to its business operation to any third party. The term of this agreement is 10 years and may be extended only upon our written confirmation prior to the expiration of this agreement, with the extended term to be mutually agreed upon by the parties.

Equity Pledge Agreements.Under the Equity Pledge Agreements, the shareholders of the Jin Ma Companies pledged all of their equity interests in the Jin Ma Companies to us to guarantee the Jin Ma Companies’ performance of their obligations under the exclusive Consulting Services Agreements. If the Jin Ma Companies or any of their shareholders breach their respective contractual obligations, we, as pledgee, are entitled to certain rights, including the right to sell the pledged equity interests. The shareholders of the Jin Ma Companies also agreed that upon occurrence of any event of default, we will be granted an exclusive, irrevocable power of attorney to take actions in the place and stead of the shareholders of the Jin Ma Companies to carry out the security provisions of the Equity Pledge Agreement and take any action and execute any instrument that we may deem necessary or advisable to accomplish the purposes of the Equity Pledge Agreement. The shareholders of the Jin Ma Companies agreed not to dispose of the pledged equity interests or take any actions that would prejudice our interest. The Equity Pledge Agreement will expire two years after the Jin Ma Companies’ obligations under the Consulting Services Agreements have been fulfilled.

Option Agreements.Under the Option Agreements, the shareholders of the Jin Ma Companies irrevocably granted us or our designee an exclusive option to purchase, to the extent permitted under PRC law, all or part of the equity interests in the Jin Ma Companies for the cost of the initial contributions to the registered capital or the minimum amount of consideration permitted by applicable PRC law. We, or our designee, have sole discretion to decide when to exercise the option, whether in part or in full. The term of this agreement is 10 years and may be extended prior to its expiration by written agreement of the parties.

2

Proxy Agreements.Pursuant to the Proxy Agreements, the shareholders of the Jin Ma Companies agreed to irrevocably grant a person to be designated by us with the right to exercise their voting rights and their other rights, in accordance with applicable laws and their respective Articles of Association, including but not limited to the rights to sell or transfer all or any of their equity interests of the Jin Ma Companies, and appoint and vote for the directors and chairman as the authorized representative of the shareholders of the Jin Ma Companies.

THE JIN MA COMPANIES

Through the three Jin Ma Companies, we operate in three reportable segments:

|

|

|

|

|

|

• |

Construction, |

|

|

• |

Real estate development, and |

|

|

• |

Hotel and banquet facility management. |

Jin Ma Construction, Jin Ma Real Estate, and Jin Ma Hotel, all are limited liability companies in China and organized under the laws of PRC.

Jin Ma Construction.Jin Ma Construction is an engineering and construction company that offers general contracting, construction management and building design services primarily in Hohhot city, in the Autonomous Region of Inner Mongolia in China. In operation since 1980, Jin Ma Construction was formally registered as a limited liability company in Hohhot in March 2002. Jin Ma Construction is a Level Two national construction company. To qualify as a Level Two national construction company, Jin Ma Construction must have:

|

|

|

|

|

|

• |

at least 40 million RMB in registered capital, |

|

|

• |

at least 150 engineering, technical, accounting staff in the aggregate, |

|

|

• |

achieved, within a three year period, annual revenue in excess of 80 million RMB, |

|

|

• |

achieved satisfactory rating in construction quality, and |

|

|

• |

within a five year period, obtained a construction contract worth at least 30 million RMB and/or completed a construction project that is: |

|

|

• |

at least 12 stories, and/or |

|

|

• |

at least 50 meters in height, and/or |

|

|

• |

at least 21 meters in width, and/or |

|

|

• |

at least 10,000 square meters in gross floor area (“GFA”) for a single-building project or at least 50,000 square meters in GFA for a multiple-building project (“Level Two Project”). |

For fiscal 2010 and fiscal 2009, net revenues from Jin Ma Construction represented 74% and 95%, respectively, of our net revenues. For a description of Jin Ma Construction’s recent and future construction projects, including its Level Two Projects, please refer to the section titled “Construction Operation” in the discussion below.

Jin Ma Real Estate.Jin Ma Real Estate, established in 1999, was formally registered as a limited liability company in Hohhot in February 2004. Jin Ma Real Estate is a Level Four real estate development company. To meet the qualifications of Level Four real estate development company, the company must

|

|

|

|

|

|

• |

have registered capital of at least one million RMB, |

|

|

• |

be engaged in real estate development and be in operation for at least one year, |

|

|

• |

have finished GFA 20,000 square meter construction area in the most recent 3 years or 10,000 square meter construction area in the last year, |

|

|

• |

have finished the construction investment over 20 million RMB within three years or 10 million RMB in the last year, |

|

|

• |

have passed and satisfied the quality standard examination for all of its finished projects, |

|

|

• |

employ at least five management personnel and two accounting staff; and |

|

|

• |

have implemented a standardized system of “Residential Quality Guarantee” and “Residential Instruction Manual” to be issued in connection with the sale of residential units. |

3

For fiscal 2010 and fiscal 2009, net revenues from Jin Ma Real Estate represented 20% and less than 1%, respectively, of our net revenues. For a description of the development activities of Jin Ma Real Estate, please refer to the section titled “Real Estate Development” in the discussion of our business operations below.

Jin Ma Hotel.Founded in 1999 and formally registered in April 2004 as a limited liability company in Hohhot, Jin Ma Hotel owns, operates and manages the Inner Mongolia Jin Ma Hotel. The hotel contains 22 rooms with extensive catering and entertaining facilities and offers guests the option to participate in traditional Chinese ceremonies in its restaurant and banquet facilities. The hotel had a 96% occupancy rate in 2009 and an 80% occupancy rate in 2010. Hohhot is a popular tourist destination, especially during the summer. In 2001, the Hohhot Tourism Bureau certified the hotel as a two-star hotel, pursuant to the PRC Standard and Star Rating for Tourism and Foreign Use Hotels. The two-star hotel is conveniently located 15 kilometers from the Hohhot Baita Airport, three kilometers from the Hohhot main train station, and is targeted toward price-sensitive travelers. For fiscal 2010 and fiscal 2009, net revenues from the Jin Ma Hotel represented 6% and 4%, respectively, of our net revenues. For a description of the hotel’s premises and facilities, including recent renovations, please refer to the section titled “Hotel Management” in the discussion of our business operations below.

ABOUT INNER MONGOLIA AND HOHHOT

Inner Mongolia is a Mongol-autonomous region in western China that is about the size of Texas and California combined. Inner Mongolia borders, from east to west, the provinces of Heilongjiang, Jilin, Liaoning, Hebei, Shanxi, Ningxia Hui Autonomous Region, and Gansu, while to the north it borders Mongolia and Russia. The regional capital of Inner Mongolia is Hohhot.

Due to its abundance of natural resources, Inner Mongolia is a national production base in iron, steel and coal, as well as animal husbandry. The Baiyunebo Mine in Baotou, Inner Mongolia is the largest rare earth mine in the world, including gold deposits, iron ore, granite, and graphite, and is also the biggest open-air mine in the world. Inner Mongolia also ranks first in China for wind power storage. According to an article on www.chinaknowledge.com dated April 12, 2010, statistics released by the Inner Mongolia Electric Power Corp. the installed capacity of wind power in Inner Mongolia Autonomous Region had surged more than 40-fold to 7.3 gigawatts at the end of March 2010 from 170,000 kW in 2005. The Hulunbuir Grassland in Inner Mongolia is the largest area of natural grass in the world, and the region is a leading producer of animal feeds. The “white goat” cashmere of Inner Mongolia is regarded as the best cashmere in the world for its fineness, brightness and whiteness and is commonly referred to as “Soft Gold”.

Inner Mongolia also has the most inland ports - 18 - of all provinces in China. The Manzhouli Railway Port and the Highway Port, which run across Russia to Eastern Europe and Western Europe, are the bridgeheads of the Euro-Asia Land Bridge. By railway, Hohhot lies on the Jingbao Railway from Beijing to Baotou. Hohhot Baita International Airport is about an hour from city center and only half an hour drive from the Second Ring Road. It serves Hohhot and surrounding areas, and has direct flights to Beijing, Shanghai, Shenzhen, Chengdu, Wuhan, Hong Kong, and Ulan Bator in Mongolia. The Hubao Expressway connects Hohhot to the more remote areas in Inner Mongolia.

Inner Mongolia is also a popular tourism destination, renowned especially for its natural springs. Hohhot, located in the south-central part of Inner Mongolia, is especially popular during the summer months as a place to escape the heat.

Hohhot itself has an educated workforce, with many scientific research and design institutions and over ten universities and colleges all located in the city, which collectively account for about 80% of higher education schools in the entire Inner Mongolia.

Since 2000, the Chinese central government has been actively encouraging economic developments in Inner Mongolia. Under the auspices of the Western China Development Policy, the Chinese central government has enacted and implemented specific regulations and policies to boost investments in the region, including the Regulations on Encouragement of Foreign Investment of Inner Mongolia Autonomous Region (I) and the Regulations on Encouragement of Foreign Investment of Inner Mongolia Autonomous Region (II), both issued in 1996, and the Preferential Policies on Encouragement of Foreign Investment of the People’s Government of Inner Mongolia Autonomous Region, issued in 1999. Additionally, in July 2000, the Hohhot Economic and Technological Development Zone (the “HETDZ”) was approved as state-level development zone. Located on the western outskirt of Hohhot city proper, the HETDZ now encompasses 9.1 square kilometers, with established companies in such industries as high technology manufacturing, biopharmaceutical, electronic information, chemical manufacturing, textile, and dairy product processing.

4

The nominal gross domestic product (GDP) of Inner Mongolia in 2009 was 972.578 billion RMB (approximately $142.8 billion), a growth of 16.9% from 2008. The annual per capita GDP in 2009 was 40,225 RMB (approximately $5,908), a growth of 16.5% from 2008 according to the Inner Mongolia Government website (www.nmgtj.gov.cn). For Hohhot, in 2009, the regional GDP was 164.4 billion RMB (approximately $24.1 billion), an increase of 15.9% from 2008 and per capita GDP was approximately 61,108 RMB (approximately $8,975), a growth of 14.3% from 2008, according to the Hohhot Government website (www.huhhot.gov.cn).

OVERVIEW OF THE JIN MA COMPANIES’ INDUSTRY SEGMENTS

China’s Real Estate Market

China’s growing real estate market is primarily the confluence of two factors: the passage of laws protecting property ownership rights by the Chinese central government to encourage homeownership, and rapid urbanization caused by steady internal migrations from rural regions to cities.

Prior to the 1990s, all land and housing was owned by the state. Then in 1998, the Chinese central government created the basic building block of a market economy in real estate - a transferable ownership interest. This interest, known as a “land use right”, is not 100% ownership interest as we know it in the West. Rather, the state grants a right for a fixed period - varying from 40 years to 70 years - to use a land for the purpose specified in the land use right’s granting charter. Land use rights are transferable, mortgageable, leasable and renewable, and can usually be subdivided, and, although the long term implications of land use right are still uncertain as the concept is still relatively new, any such uncertainties have not discouraged real estate investments and developments. A large and active market in the private sector has developed for sales and transfers of land use rights which were initially granted by the Chinese government. All property units built on such land belong to private developers for the term of period indicated. The recent transition in the real estate industry’s structure in China has fostered the development of real estate-related businesses, such as property development, property management and real estate agencies.

The significant growth of the Chinese economy during the past decade has led to a significant expansion of the real estate industry. This expansion has been supported by other factors, including increasing urbanization, growing personal affluence, as well as the emergence of the mortgage lending market. The following table sets forth selected statistics for the overall real estate industry in mainland China, which includes the autonomous region of Inner Mongolia, for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the years ended December 31, |

|

|||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||

|

|

|

2001 |

|

2002 |

|

2003 |

|

2004 |

|

2005 |

|

2006 |

|

2007 |

|

2008 |

|

2001-2008 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Invest in real estate development ($in billion) |

|

|

76.6 |

|

|

94.2 |

|

|

122.5 |

|

|

158.9 |

|

|

192.2 |

|

|

290.4 |

|

|

345.4 |

|

|

417.7 |

|

|

25.20 |

% |

|

Total housing area (square feet in billion) |

|

|

24.5 |

|

|

29.6 |

|

|

96.4 |

|

|

41.2 |

|

|

59.7 |

|

|

64.5 |

|

|

72.2 |

|

|

93.1 |

|

|

21.90 |

% |

|

Average price of properties sold ($/square feet) |

|

|

24.9 |

|

|

25.2 |

|

|

25.2 |

|

|

26.4 |

|

|

91.2 |

|

|

95.6 |

|

|

95.6 |

|

|

109.3 |

|

|

11.60 |

% |

Source: China Statistic Year Book

Growth of the Chinese Real Estate Industry

The growth in China’s real estate industry is reflected in the growth of investment in real estate development, total GFA sold, and average home prices. According to the National Bureau of Statistics of China, total investment on real estate development in 2009 was RMB 3.623 trillion (approximately $530 billion), up 16.1% from 2008.

According to the National Bureau of Statistics of China, the total GFA of residential and commercial properties sold increased from 224.1 million square meters in 2001 to 937.1 million square meters in 2009, a compound annual growth rate of 19.6%.

5

Based upon information published by the Hohhot Real Estate Bureau, in the first half calendar year of 2010, Hohhot’s real estate investment amounted to 4.002 billion RMB (approximately $587.8 million), an increase of 83.29% compare to the same period of 2009 and consisted of the following:

|

|

|

|

• |

Investment in commercial and residential buildings amounted to 2.47 billion RMB (approximately $363 million), an increase of 48.06% compared to the same period of last year; |

|

• |

Investment in office buildings amounted to 218.85 million RMB (approximately $32 million), an increase of 115.76% compared to the same period of last year; |

|

• |

Investment in buildings for commercial operation amount to 886.03 million RMB (approximately $130 million), an increase of 197.2% compared to the same period of last year; and |

|

• |

Other real estate investment amounted to 424.87 million RMB (approximately $62 million), an increase of 272.43% compared to the same period of last year. |

In the first half of 2010,

|

|

|

|

|

|

• |

Hohhot city land purchases amounted to 271,562 square meters, a decrease of 27.62% compared to the comparable period of 2009, |

|

|

• |

the area of developed land in Hohhot was 403,348 square meters, an increase of 48.45% compared to the corresponding period of 2009, and |

|

|

• |

the area of land which will be developed in Hohhot was 898,061 square meters, a decrease of 68.6% compared to the same period of 2009. |

Jin Ma Real Estate’s goal is to become one of the most prominent real estate development companies in Western China. Jin Ma Real Estate’s management believes that real estate development in Hohhot, Inner Mongolia, as a third-tier city, and its surrounding areas will remain strong and may not feel the effects of the slower real estate markets occurring in tier-one cities such as Beijing and Shanghai.

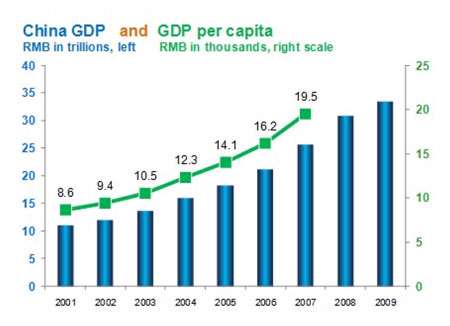

China’s real estate sector is in the early stage of a long-term growth cycle, supported by growth in its gross domestic product, or GDP, rising demand for housing, and substantial structural changes. China has experienced rapid economic growth in the last 20 years. According to the Ministry of Commerce of China, China’s GDP achieved an annualized growth rate of 17.1% from 2004 to 2008. According to the National Bureau of Statistics of China, China’s GDP in 2009 was RMB 33.5 trillion, up 8.7% from 2008. The official per capita data for 2008 and 2009 is not yet available as of the date of this report. The following information and charts illustrates to the continued growth in the China economy, the increase in urbanization and need for housing, as well as factors that continue to encourage growth and investment.

6

Source: National Bureau of Statistics of China

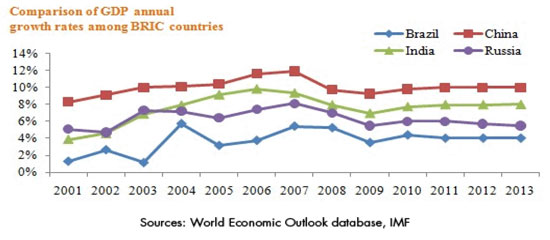

Despite the recent global economic recession, China is expected to achieve relatively good economic growth in the next several years, compared to many other major economies in the world as reflected in the following chart:

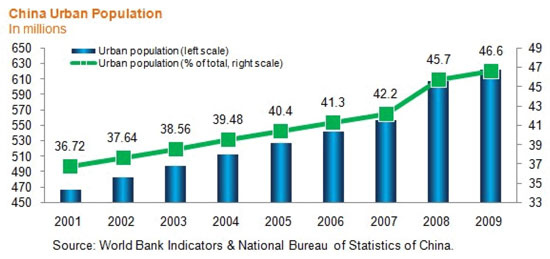

China’s real estate bull market began more than six years ago. Despite the moderations in growth caused by the global economic weakness in 2008 and 2009, we believe the structural forces in China support continuing good demand for real estate in China during the next 10 years. The two primary drivers for this long-term real estate demand in China are urbanization, which includes both the expansion and development of cities and the dramatic migration of people from rural to urban areas, and the rising disposable income per capita in the cities.

At the end of 2008, 607 million people were living in urban areas, accounting for 45.7% of total population of 1.33 billion, according to the National Bureau of Statistics of China. The Ministry of Housing and Urban-Rural Development of China estimated in 2007 that China’s urban population in 2015 would exceed 800 million people, or approximately 55% of the total projected population of 1.45 billion.

7

Another source, the United Nations’ State of World Population 2007, reported that approximately 18 million people in China are expected to migrate from rural to urban areas each year, and that the urban population would reach about 877 million people in the next 10 years.

The rural to urban migration is likely to continue, both because of the potential for higher income and greater wealth accumulation, and because of the evolution of China’s farming toward larger-scale and more efficient methods that require fewer people to do the agricultural work. With the substantial housing demand created by the structural shift of the migration, the urban real estate market has been thriving. That long-term trend is expected to continue.

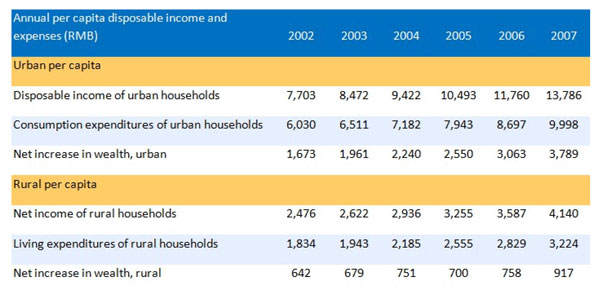

In addition, according to the 2009 annual report of the National Bureau of Statistics of China, disposable income per capita in urban areas between 2000 and 2008 has grown at a compound average annual growth rate of 12.2%, from RMB 6,280 (approximately $919) in 2000 to RMB 15,781 (approximately $2,311) in 2008. As disposable income per capital increases, urban residents have strong motivation to improve their living conditions by purchasing new or larger properties, demonstrated by urban living expenses per capita in the same years that have steadily increased at a compound annual growth rate of 10.7%, from RMB 4,998 (approximately $732) in 2000 to RMB 11,243 (approximately $1,646) in 2008, which is the most recent year available for this measurement.

Rural dwellers are also drawn to cities primarily by the potential of higher incomes and greater wealth, because urban jobs generally pay higher wages and salaries. The latest data from the National Bureau of Statistics of China shows that both disposable income and wealth accumulation are higher for urban dwellers and confirms the economic attractiveness of the migration from rural to urban areas.

8

Source: The National Bureau of Statistics of China

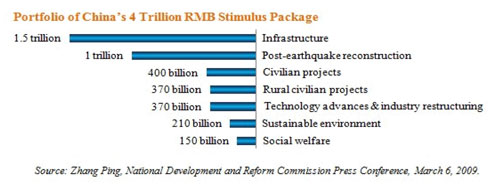

In response to the global financial and economic crisis, the Chinese government announced a RMB 4 trillion stimulus program on November 27, 2008. Subsequently, on March 6, 2009, the National Development and Reform Commission Director announced a reshaping of that economic stimulus package that retained the investment total of RMB 4 trillion but adjusted its focus. Within the RMB 4 trillion package, about RMB 400 billion will go toward civil works, including low-income housing and renovation, which we believe will benefit Inner Mongolia,

China’s Hotel Industry

The hotel industry is a growing segment within the hospitality industry, which is itself a major component of the travel industry. Companies in the lodging industry generally operate in one or more of the various lodging segments, including luxury, upscale, middle and economy. Growth in demand in the lodging industry is driven by two main factors: (i) the general health of the travel and tourism industry and (ii) the propensity for corporate spending on business travel.

According to the World Tourism rankings compiled by the United Nations World Tourism Organization as part of their World Tourism Barometer publication, in 2009, China ranked fourth in the world in terms of overseas tourist arrivals, and the World Travel Organization predicts China will become the number one global tourism destination by 2020. China received 50.9 million international tourist arrivals in 2009, down 4.0% from 2008, according to the World Tourism Barometer publication. Business tourists account for 23.87% of all foreign visitor arrivals in 2009. The country is now competing head on with other global tourism destinations.

9

Although the national tourism is slowing down due to the global financial uncertainties in fiscal 2010, the regional tourism in Inner Mongolia is prosperous. The growing popularity of Inner Mongolia as a tourism destination, and the importance of Hohhot as the gateway to the region, is demonstrated by the number of foreign hotel operators that are expanding their operations in the city. To further elevate the level of China’s tourist service, as well as promote the protection, development, management and construction of tourist spots and destinations, the central government has actively promoted the use of rating systems throughout the hotel industry. The Jin Ma Hotel was certified as a two-star facility in 2001 by the Hohhot Tourism Bureau.

THE JIN MA COMPANIES BUSINESS OPERATIONS

The Construction Business

Jin Ma Construction offers its customers a comprehensive range of services. Jin Ma Construction acts as the general contractor in a real estate development project. Its employees monitor the construction of each project, participate in all material design and building decisions, coordinate the activities of subcontractors and suppliers and subject their work to quality and cost controls and monitor compliance with applicable zoning and building codes. The selection of its subcontractors is conducted through a competitive process, and several subcontractors are invited to participate. The main criteria for selecting subcontractors are cost, qualifications, the quality of completed projects and of work done, if any, on our existing or prior projects. Once the selection process is completed, Jin Ma Construction will normally negotiate a fixed price contract with the sub-contractors which include terms relating to time for completion of construction, quality of materials used and warranty periods.

Jin Ma Construction’s project management is undertaken by a team of architects, engineers, project managers and other support staff. The project management team is responsible for the overall management of all of the development projects. For each project, there is a team responsible for the day-to-day management. Project management covers all major stages of a development project, as follows:

|

|

|

|

|

• |

|

Feasibility Studies. Conducting a detailed geological study and market study, formulating a master timetable, and preparing preliminary proposals for the type and class of property to be constructed; |

|

• |

|

Design. Completing a preliminary design layout and obtaining approvals from relevant authorities, commencing site preparation, selecting construction materials, modifying the design layout, producing a construction blue-print and establishing a construction management team; |

|

• |

|

Construction. Obtaining, evaluating and selecting sub-contractor bids, finalizing the design layout and construction blue-print, monitoring construction progress compared to our timetable and introducing and implementing quality and cost control procedures; and |

|

• |

|

Completion. Establishing a property management team, submitting a completion and inspection report to the governmental authorities, obtaining required government approvals and settling payments. |

Jin Ma Construction places emphasis on the quality of its development projects and implements quality control procedures at different construction stages to ensure that the work done by its sub-contractors meets its standards and requirements and those of the relevant governmental authorities. Jin Ma Construction also imposes quality control on its building materials. Its on-site management team conducts regular quality inspections of the construction work. When a particular section of construction work is completed, Jin Ma Construction’s on-site management team will inspect the work to ensure that the work is in compliance with its quality standards and the relevant governmental regulations. Jin Ma Construction requires its sub-contractors to promptly remedy all defects, and it then makes a further inspection of their work.

Jin Ma Construction derives revenue primarily from services in general contracting, pre-construction planning and comprehensive construction management services in Hohhot. Its duties as general contractor typically include planning, preparing and organizing each phase of the construction, applying and securing all governmental certificates required for the specific project, coordinating and supervising construction crews and work progress, inspecting and ensuring the quality of the construction, and accounting and distributing construction funds.

Jin Ma Construction is presently dependent upon revenues from a limited number of customers. For fiscal 2010, four construction projects accounted for 73.9% of total consolidated net revenues (6.7%, 11.3%, 28.1% and 27.8%) and 64% of its total accounts receivable are due from these customers. For fiscal 2009, four construction projects accounted for 89.5% of total consolidated net revenues (13.0%, 20.6%, 33.1% and 22.8%) and $11,076,151 of accounts receivable due from these customers.

10

Generally, in fiscal 2010 and fiscal 2009, construction projects were primarily performed for third party customers and we recognized net revenues pursuant to our revenue recognition policy. Additionally, Jin Ma Construction acts as the general contractor for Jin Ma Real Estate’s residential real estate development projects. During fiscal 2010 and fiscal 2009, Jin Ma Construction performed general contracting, construction management and building design services on the following third-party residential apartment and commercial properties in Hohhot:

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Location |

|

Property Type |

|

Number of |

|

Date of Commencement/ |

|

Riverbank Garden Community-He Ban Garden (Buildings 5 to 8 and Phase II) |

|

In Sai Han district of Hohhot |

|

Residential |

|

Nine buildings |

|

April 2008/November 2008 |

|

|

|

|

|

|

|

|

|

|

|

AiBo Garden (Phase I) |

|

Hui Min District, Hohhot |

|

Residential Buildings |

|

Multiple |

|

April 2008/ November 2008 |

|

|

|

|

|

|

|

|

|

|

|

Tian Fu

Garden |

|

Xin Cheng District, Hohhot |

|

Residential |

|

Multiple |

|

April 2008/November 2008 |

|

|

|

|

|

|

|

|

|

|

|

AiBo Garden |

|

Hui Min District, Hohhot |

|

Residential |

|

Multiple |

|

April 2008/June 2009 |

|

|

|

|

|

|

|

|

|

|

|

Lanyu Garden (No. 3 Residential Building) |

|

Hohhot |

|

Residential Buildings |

|

One building |

|

October 2008/December 2009 |

|

|

|

|

|

|

|

|

|

|

|

Fu Xing Committee Bath Center Project |

|

Xin Cheng District, Hohhot |

|

Commercial Building |

|

One building |

|

November 2008/June2010 |

|

|

|

|

|

|

|

|

|

|

|

Tuzuoqi

(Chasuqi) Low- Rent Housing |

|

Tuzuoqi, Hohhot |

|

Residential |

|

Three buildings |

|

November 2009/June2010 |

|

|

|

|

|

|

|

|

|

|

|

Jianhe Garden No. 1 to No. 10 |

|

Nanerhuan District, Hohhot |

|

Residential |

|

10 buildings |

|

November 2009/ December 2010 (estimated date) |

Competitive Strengths

Jin Ma Construction is in competition with other construction companies in Hohhot and other areas of Inner Mongolia, some of which are larger and have greater financial resources than it. These include Inner Mongolia Third Construction Company and Hohhot City Construction Company. Nevertheless, Jin Ma Construction believes that it can effectively compete with these companies based upon its operating history, reputation, and expertise. Jin Ma Construction is one of the first construction companies in the region, and it believes it has gained a solid reputation based on the quality of its work and an established track record spanning a diverse array of projects. Through numerous government projects that it has been complemented, Jin Ma Construction believes that it has established an excellent working relationship with the local and regional governments, and it will seek to continue to act as general contractor in many ongoing government projects. All of its engineering and technical staffs are certified in their respective fields, and many, such as its construction manager and its technical director, have been involved in the industry and with Jin Ma Construction for over 20 years. Since 2004, Jin Ma Construction had been independently audited and certified as being in conformance with the ISO 9001:2000 standards for quality management system, the ISO 140001:1996 standards for environmental management system, and the GB/T28001:200 standards for occupational safety management system. Jin Ma Construction believes that these certifications, while not mandated by law, provide it with a competitive edge over many of its competitors that are not similarly certified, in that they lend further assurance to its customers in the quality of its work.

11

Real Estate Development Business

Jin Ma Real Estate designs, develops, markets and sells high-quality, affordable homes in apartment high-rises, which are targeted at Chinese middle income families. It also designs, develops, markets and sells these homes in mixed-use development projects. All of its development projects are all in Hohhot. As Jin Ma Real Estate does not have a construction license, Jin Ma Construction performed all of the construction services on behalf of Jin Ma Real Estate.

Jin Ma Real Estate’s focus is on the development of residential communities in Hohhot and the surrounding areas that are within reasonable commuting distance. Jin Ma Real Estate believes that the size and growth potential of Hohhot-area market coupled with the ongoing liberalization of the real estate markets in general offer it considerable growth opportunities. Jin Ma Real Estate believes that the following features of Hohhot represent continuing growth opportunities for it in the city:

|

|

|

|

|

|

• |

a population of more than 2.6 million with established economic development and infrastructure; |

|

|

• |

a demand for high quality, yet affordable homes; |

|

|

• |

a regulatory environment that encourages the development of residential communities, in terms of enabling Jin Ma Real Estate to obtain necessary permits and approvals to engage in its business without undue difficulty or expense, and encourages individual home ownership through the use of subsidies or otherwise; and |

|

|

• |

available real estate development rights at attractive prices. |

Its apartments are targeted for different segments within the mass residential property market, including young, white-collar employees, middle to senior managers in enterprises, entrepreneurs and families with young children. These upwardly mobile people represent the emerging middle class and are a growing source of demand in the mass residential property market. Its target market for residential customers is Chinese middle income families in key urban markets who want to become home owners in a planned community. It classifies a typical family income of approximately RMB 75,000, or approximately $11,000, per year as middle income earners. Jin Ma Real Estate believes that families earning this income will be able to purchase its residential units which cost approximately RMB 350,000, or approximately $51,000.

China’s home builders have traditionally targeted the upper and lower income market, and largely ignored the middle-income class. Because of banking reforms permitting wider availability of home mortgage loans and the positive effects of China’s economic reforms, Jin Ma Real Estate believes that the home building market for the middle-income class represents substantial growth opportunities for it. Jin Ma real Estate believes the emerging middle class will offer an attractive opportunity for growth, since its purchasing power is growing and it has a strong desire for ownership driven by the influence of Chinese culture and values. JinMa Real Estate plans to leverage its brand name, experience and design capabilities to meet the demand from the middle class.

Jin Ma Real Estate seeks to enter markets early where it can acquire land use rights at reasonable prices and develop residential communities in potential growth centers in and around Hohhot. It believes that early entry into markets will continue to enable it to establish ourselves in these markets before the onset of widespread competition. Jin Ma Real Estate has successfully implemented this strategy, where it is one of the first home builders to develop a residential community targeted at middle income families.

It believes that securing a good location is a major factor in the success of a property development project. It considers the following factors when it evaluates it property development sites:

|

|

|

|

|

|

• |

size of land; |

|

|

• |

geographic location; |

|

|

• |

potential financial return; |

|

|

• |

potential market demand for the development; |

|

|

• |

its existing property portfolio and available resources; |

|

|

• |

land cost, affordability and potential financial return; |

|

|

• |

overall market situation and opportunities; |

|

|

• |

access to city centers; |

|

|

• |

geological conditions; |

|

|

• |

demolition and resettlement costs; and |

|

|

• |

infrastructure support. |

12

During the site selection process, it will evaluate and research the economic and social situation of the area, the market demand for and potential returns from a proposed project and the funding and manpower requirements. Once Jin Ma Real Estate has selected a site, it formulates a comprehensive development plan.

For each development project, Jin Ma Real Estate designates specific employees as a team to handle the related sales and marketing activities. Subject to market conditions and government approval by the relevant land administration bureau, it seeks to pre-sell its development projects at an early stage. It will also arrange with one or more banks to provide mortgage loan facilities to home purchasers for up to 70% of the home purchase price, substantially all of which is guaranteed by Jin Ma Real Estate until the homes are delivered to the buyers. Its sales and marketing strategy involves the following key elements:

|

|

|

|

|

|

• |

offering a financing package for home buyers which pre-qualifies home buyers for a 60% mortgage with only a down payment, or booking fee, which is typically no more than RMB 140,000, or approximately $20,600, and the balance of the purchase price paid over a staggered period between one to two months; |

|

|

• |

advertising through various media, including regional newspapers, magazines, posters, billboards and advertising pamphlets to reach potential purchasers; |

|

|

• |

using sales literature and brochures which describe its projects and its company; and |

|

|

• |

operating a sales center in a high-traffic downtown area where its office is located and on-site. |

Jin Ma Real Estate has established a high level of visibility in Hohhot. It also believes that local awareness of its projects has been facilitated through word of mouth. Sales of its homes are normally made at its sales centers situated either in the city center or at its development site.

Jin Ma Real Estate seeks to pre-sell homes in the several phases in its development as early as possible, subject to market conditions and regulatory constraints. Pre-sales occur when units of a project are sold while the project is still under construction. Under Chinese law, pre-sale is only permitted if a pre-sale permit has been granted by the relevant land administration bureau to the project which is still under construction. Pre-selling allows Jin Ma Real Estate to begin marketing its development before it would otherwise be able to do so, and shortens the time during which it has market exposure for the construction and other expenses of its developments. Pre-sales also allow Jin Ma Real Estate to improve its working capital management by accelerating its cash inflow and to minimize market risks associated with its development projects.

In a pre-sale, the first step is that the home buyer pays an initial booking fee. The home buyer then pays 40% of the purchase price less the booking fee upon the execution of a sales and purchase agreement. The remaining 60% must be paid over a staggered period between one to two months although, in most instances, it is paid by the bank providing the mortgage financing upon execution of the sales and purchase agreement. It plans on using its best efforts to increase the amount of presold units in the future.

As part of its pre-sale activities, Jin Ma Real Estate may arrange for commercial banks to provide purchaser financing in the sale of its developments. Unlike mortgage financing in the United States, Chinese banks will typically look to the developer and the planned development to determine whether to make a commitment to provide purchaser mortgages. However, the banks retain the right to approve or reject mortgages on an individual basis based upon the perceived credit-worthiness of the home purchaser and other factors that it considers appropriate. Jin Ma Real Estate guarantees a customer’s mortgage until the home is handed over to the customer. Jin Ma Real Estate’s customers typically arrange for mortgages through China Construction Bank, The People’s Bank of China, or Agricultural Bank of China.

Jin Ma Real Estate finances the development of its projects through bank borrowings, proceeds from the pre-sale of portions of its development projects, credit provided by its contractors and through its internally generated funds. Because each development project will require a substantial amount of capital to finance its construction cost, it is Jin Ma Real Estate’s policy to control the timing of the launch of each of its development projects and the phases of these projects.

13

Completed Projects and Projects under Development with Jin Ma Construction

|

|

|

|

|

|

|

|

|

|

|

Building

1 to 4 of |

Building

5 of |

Beiyuan |

Building

6 of |

Jinwu |

| Area (sq. meters) |

|

46,054m |

5,825m |

70,000m |

38,000m |

53,000m |

|

Project type |

|

Multi Family Residential & Commercial |

Multi Family Residential & Commercial |

Multi Family Residential & Commercial |

Multi Family Residential & Commercial |

Multi Family Residential & Commercial |

| Completion/estimated completion date |

|

3/2010 |

6/2010 |

6/2011 |

10/2011 |

12/2012 |

|

# of Units available for sale upon completion (Residential) |

|

150 |

69 |

* |

587 |

* |

| # of Units Sold (as of June 30, 2010) |

|

137 |

69 |

0 |

0 |

0 |

|

Estimated aggregate revenue ($ millions) |

|

$8.5 |

$2.2 |

$37.0 |

$22.0 |

$37.0 |

| Fiscal 2010 Revenue ($ millions) |

|

$7.7 |

$2.2 |

$0 |

$0 |

$0 |

* Not yet determined

In July 2010, Jin Ma Construction began construction of building number 6 of Procuratorate Housing Estates, which consists of a construction area of 38,000 square meters and is expected to be completed in October 2011. As of the date of this report, Jin Ma Real Estates has not yet begun to pre-sell this project.

Other Real Estate Development Projects Completed

In November 2007, Jin Ma Real Estate entered into an agreement to construct new dormitories for the Inner Mongolia Electrical Vocational Technical School (the “Vocational School”) which is located in Hohhot. Pursuant to the terms of the agreement, Jin Ma Real Estate constructed the buildings and, upon completion, pursuant to a sale-type capital lease, leased the buildings to the vocational school. The total cost of the project, which was completed in November 2008, was approximately $9 million. It receives payments over a period of 26 years at an amount of 4,800,000 RMB or approximately $700,000 per annum.

In 2008, Jin Ma Real Estate and Inner Mongolia Chemistry College entered an oral agreement and on September 29, 2009, formalized a written agreement for the construction of student apartments for the Inner Mongolia Chemistry College (the “Chemistry School”) situated in Inner Mongolia University City, a compound where many higher education institutions are located. Jin Ma Construction began developing the 51,037 square-meter project in July 2008 and completed the construction in October 2009. The total cost of the project was approximately $8.5 million. Jin Ma Real Estate leased the buildings to the Inner Mongolia Chemistry College for a period of 20 years under an agreement which provides for annual lease payments are RMB 10.62 million (approximately $1.55 million) for five years (from fiscal 2010 to fiscal 2014), and the annual lease payment is RMB 5.42 million (approximately $0.79 million) for 15 years (from fiscal 2015 to fiscal 2029).

14

In accordance with terms of the agreements, at the end of the lease terms, ownership of the buildings will be transferred to the respective university. During the term of lease, Jin Ma Real Estate will not have additional commitments to the universities, other than the customary construction warranties.

Competitive Strengths

The development and sale of residential and commercial real estate markets in China are subject to intense competition. Jin Ma Real Estate competes with numerous small and large developers for sales on the basis of a number of interrelated factors, including location, reputation, amenities, design, quality and price. It also competes for sales with individual resale of existing homes and condominiums and available rental housing. Jin Ma Real Estate believes that it compares favorably to other developers in the Hohhot City area in which it operates, due primarily to its experience within this geographic market, and its responsiveness to market conditions enables it to capitalize on the opportunities for advantageous land acquisitions in desirable locations. Its competitors include the Inner Mongolia Da Hua Real Estate Development Co., Ltd., Inner Mongolia Feng Hua Real Estate Development Co., many of whom have greater financial, managerial, marketing and other resources than these of Jin Ma Real Estate. Residential and commercial property developers compete not only for property buyers, but also for desirable properties, raw materials and skilled subcontractors. Jin Ma Real Estate also expects that continued economic development of China in general and in Hohhot in particular will be accompanied by further property development and expansion. It believes that its principal competitive strengths are as follows:

|

|

|

|

|

|

• |

Jin Ma Real Estate’s management has extensive experience and in-depth knowledge of the Hohhot and Inner Mongolia real estate markets; |

|

|

• |

its strategy which emphasizes development of high-quality residential properties for middle income families; |

|

|

• |

its access to construction capabilities through Jin Ma Construction; |

|

|

• |

its focus on Hohhot and surrounding areas in which Jin Ma Real Estate believes it enjoys competitive advantages; |

|

|

• |

its experienced project management team, which effectively and actively controls every stage of the development of its projects; and |

|

|

• |

its close working relationships with both the local and regional governments. |

The Hotel and Banquet Management Business

Jin Ma Hotel derives revenue primarily from the sale of food and beverages at its banquet facilities located in the Jin Ma Hotel. Additionally, Jin Ma Hotel received revenues from the rental of its guest rooms. The 22-room hotel is a full-service two-star facility, offering amenities such as restaurant and banquet center. Its guests can also partake in traditional Chinese ceremonies that are offered regularly in its restaurant and banquet facilities. The hotel is located on an approximately 2.16 acre lot, owned by Jin Ma Hotel, and housed in a single building with approximately 5,048 square meters that has been configured for use as the hotel as well as offices on the upper floor of the building for the Jin Ma Companies. The property includes a parking area for 24 cars. Jin Ma Hotel also owns all of the fixtures, improvements, furniture, and the other contents currently used in the business of the hotel.

Competitive Strengths

Locally, Jin Ma Hotel’s competitor includes the Inner Mongolia Hotel and the Inner Mongolia Zhao Jun Hotel. Additionally, many well-known hotel operators have established their presence in the area, including the Shangri-La Hotel and Resort in late 2007 and the Sheraton Hohhot Hotel in July 2009. Because many of these hotels are aimed towards the luxury segment of the industry, Jin Ma Hotel believes that it has a competitive advantage in attracting those travelers to the city who are more price-sensitive. Jin Ma Hotel offers many of the same amenities available at its higher-price competitors, but without increasing the costs to its guests.

15

SUPPLIERS

Construction

Jin Ma Construction does not maintain significant inventories of construction materials except for work in process and a limited amount of other construction materials. Generally, the construction materials used in its operations are readily available from numerous sources. Jin Ma Construction owns, maintains and operates approximately 160 vehicles and construction related equipment that can, and are often deployed, on projects that it is serving as general contractor. Jin Ma Construction uses five to seven subcontractors to perform substantially all of its construction services and to develop its real estate projects. Management is aware of similar subcontractors that are available to perform construction services if required and management has plans to engage their services if necessary.

Real Estate Development

To date, Jin Ma Real Estate has been successful in acquiring land from many sources including open market actions and co-development with local government. It has achieved this through long term working relations with the central and local governments. The supply of land is controlled by the Chinese government. All such purchases of land are required to be reported to and authorized by the regional government of Inner Mongolia and/or the municipal government of Hohhot. Jin Ma Real Estate used Jin Ma Construction to develop its projects and Jin Ma Construction may use subcontractors to perform substantially all of its construction services and for the development of its projects.

Hotel Management

Jin Ma Hotel acquires the supplies for the hotel operation from various local sources. It has no long term agreements with its suppliers, and purchase supplies on a purchase order basis. Management recognizes that this strategy also carries with it the potential disadvantages and risks of shortages and supply interruptions. Jin Ma Hotel’s suppliers generally are meeting its supply requirements, and it believes its relationships with its suppliers are stable.

GOVERNMENT APPROVAL AND REGULATION

The Jin Ma Companies believe that each of the its companies has been compliant to date with all registrations and requirements for the issuance and maintenance of all licenses required by the applicable governing authorities in China and that such laws, rules and regulations do not currently have a material impact on its operations:

Construction. China’s construction industry is heavily regulated by the national government. On November 1, 1997, the Central Government of the PRC published the Construction Law of the PRC, Presidential Order No. 91, which is the basic construction law of China. This law outlines the basic requirements and rules for all construction activity in China. Underneath the National Government, the Ministry of Construction also writes laws. On March 14, 2001, the Ministry of Construction published Rule No. 87, which puts forth licensing requirements for all construction companies operating in China. The Ministry of Construction also writes specific standards for all different types of construction. These standards stipulate the basic requirements for construction companies in China in such areas as registered capital, tangible assets, liability insurance, employee regulations and engineering certifications. The standards also have graded levels of qualification. Jin Ma Construction has second class certification of its constructions operation. In addition, provincial and municipal governments may also enact regulations through their own construction bureaus.

Hotel Management. The hotel industry in China is subject to a number of laws and regulations, including laws and regulations relating specifically to hotel operation and management, as well as those relating to environmental and consumer protection. There are no regulatory ceilings on room rates in China. The market-based pricing is permissible for the hotel industry and room rates may be determined at the sole discretion of hotel management. Relative to other industries in China, regulation of the hotel industry in China is still developing and evolving. As a result, most legislative action has consisted of general measures such as industry standards, rules or circulars issued by different ministries rather than detailed legislation. Many of these standards, rules and circulars date from the late 1990’s, and it is expected that they may be amended, revised or expanded in the coming years as the hotel industry in China matures.

16

Real Estate Development. Jin Ma Real Estate’s real estate development projects are subject to various laws and governmental regulations, such as zoning regulations, relating to its business operations and project developments. Real estate developers may secure land from the city government by obtaining exploitation and utilization rights over land through public tendering. The maximum term for such land use right interest ranges from 40 years to 70 years depending on the purpose of use. Land use rights obtained legally may be transferred, leased, and mortgaged during the leasehold period. Jin Ma Real Estate must obtain and keep current various licenses, permits and regulatory approvals for its development projects. Due to the increasing levels of development in the areas of China where Jin Ma Real Estate operates, it is possible that new laws, rules and/or regulations may be adopted that could affect both its current and proposed development projects. The enactment of such laws, rules or regulations in the future could have a negative impact on its projected growth or profitability, which could decrease its projected revenues or increase its costs of doing business.

WIND POWER PROJECT

On May 8, 2008 Jin Ma Construction signed an agreement to form a joint venture with two development stage companies, Erlianhaote Hengyuan Wind Power Company, Ltd. and Inner Mongolia Inner Mongolia Tianwei Wind Power Equipment Company, Ltd. Under the agreement, Jin Ma Construction was proposing to invest approximately $100 million (RMB 700 million) which would be used to construct a wind power plant and as capital to fund the construction of a manufacturing facility to build wind power generator modules to be used at the wind power plant. Jin Ma Construction’s ability to proceed with the proposed joint venture was subject to its raising the capital necessary to fund the projects and the receipt of certain regulatory approvals. Jin Ma Construction has determined not to proceed with this proposed project at this time.

GEP CAPITAL GROUP, LTD.

In January 2010, we engaged GEP Capital Group, Ltd. as a financial consultant to assist us in our goal of obtaining a listing of our common stock on a U.S. stock exchange as well as to raise additional capital. Under the terms of the 12 month agreement, GEP Capital will provide various services, including assisting us in the revamping of a new corporate website with updated features and information as well as the maintenance of the site, in our efforts to obtain a listing of our common stock on a senior U.S. stock exchange, and once this listing is complete, design and organize a road show for the purpose of securing additional capital for our company. GEP will bear all costs associated with these services, other than the commissions payable to a broker-dealer related to the capital raise. As compensation for its services, we issued GEP 75,000 shares of our common stock valued at $360,000. If GEP assists us in finding funding, we have agreed to issue the placement agent chosen by GEP at the closing of the private placement warrants equal to 10% of the shares sold by us in the offering.

In September 2010, we effected a 40:1 reverse stock split of our common stock in an effort to begin compliance with the listing qualification of a U.S. stock exchange. We have not yet made any application to an exchange and there are no assurances we will satisfy the initial listing qualifications of either The Nasdaq Stock Market or the NYSE Amex.

EMPLOYEES