Attached files

| file | filename |

|---|---|

| EX-32.1 - INFRAX SYSTEMS, INC. | infrax10k63010x321_92710.htm |

| EX-31.2 - INFRAX SYSTEMS, INC. | infrax10k63010x312_92710.htm |

| EX-32.2 - INFRAX SYSTEMS, INC. | infrax10k63010x322_92710.htm |

| EX-31.1 - INFRAX SYSTEMS, INC. | infrax10k63010ex311_92810.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 10-K

______________

|

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended June 30, 2010

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ______________ to ______________

Commission File No.000-52488

|

Infrax Systems, Inc.

|

|

(Exact name of Registrant as specified in its charter)

|

|

Nevada

|

20-2583185

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

6365 53 rd Street No., Pinellas Park, FL

|

33781

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(Former name, former address, if changed since last report)

|

|

Tel: (727) 498-8514

|

|

(Issuer’s telephone number)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2)has been subject to such filing requirements for the past 90 days. Yes √ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. √

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨ |

Accelerated filer

|

¨ | |

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

¨ |

Smaller reporting company

|

þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No √

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, June 30, 2008: N/A.

Number of the issuer’s Common Stock outstanding as of September 22, 2010: 2,835,417,440

Documents incorporated by reference: None.

Transitional Small Business Disclosure Format (Check One): Yes No

INFRAX SYSTEMS, INC

Annual Report on Form 10-K

For the Fiscal Year Ended June 30, 2010

INDEX

|

Page

Number

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

14

|

|

Item 1B.

|

Unresolved Staff Comments

|

17

|

|

Item 2.

|

Properties

|

17

|

|

Item 3.

|

Legal Proceedings

|

17

|

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

17

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

18

|

|

Item 6.

|

Selected Financial Data

|

19

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

20

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

26

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

54

|

|

Item 9A.

|

Controls and Procedures

|

54

|

|

Item 9A(T)

|

Controls and Procedures

|

54

|

|

Item 9B.

|

Other Information.

|

55

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

55

|

|

Item 11.

|

Executive Compensation

|

57

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

60

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

61

|

|

Item 14.

|

Principal Accountant Fees and Services

|

61

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

62

|

|

Signatures

|

63

|

- 2 -

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including, without limitation, statements regarding our expectations, beliefs, intentions or future strategies that are signified by the words “expects,” “anticipates,” “intends,” “believes,” “estimates” or similar language, and among other things: (i) events that may occur in the future, (ii) implementation of our business model; development and marketing of our products and services and (iii) prospects for revenues and profitability. All forward-looking statements included in this document are based on information available to us on the date hereof. We caution investors that our business and financial performance and the matters described in these forward-looking statements are subject to substantial risks and uncertainties. Because of these risks and uncertainties, some of which may not be currently ascertainable and many of which are beyond our control, actual results could differ materially from those projected in the forward-looking statements. Deviations between actual future events and our estimates and assumptions could lead to results that are materially different from those expressed in or implied by the forward looking statements. We do not intend to update these forward looking statements to reflect actual future events.

Background information

OUR HISTORY

“We”, “us”, “our”, “Opticon” and “Infrax” refer to Infrax Systems, Inc. (formally known as OptiCon Systems, Inc.), a Nevada corporation. We were incorporated in Nevada on October 22, 2004. On January 10, 2010, we officially changed the name of the Company from OptiCon Systems, Inc. to Infrax Systems, Inc. to reflect the change in the Company’s direction and were issued a new trading symbol as “IFXY”.

The address of our executive offices is 6365 53rd St. N, Pinellas Park, FL 33781 and our telephone number at that address is 727-498-8514. The address of our web site is www.infraxinc.com. The information at our web site is for general information and marketing purposes and is not part of this annual report for purposes of liability for disclosures under the federal securities laws.

|

●

|

We were incorporated in Nevada on October 22, 2004.

|

|

●

|

J. Marshall Batton, Jeffrey A. Hoke, Jacques Laurin and Douglass W. Wright were our founders and original stockholders, each then owning twenty-five percent of our common stock.

|

|

●

|

On July 29, 2005, FutureTech Capital LLC, a company entirely owned by Saed Talari, acquired eighty percent of our common stock as a result of our acquisition of the Opticon Network Manager software (see below) from FutureTech and the stock ownership of each of our founders was reduced to five percent.

|

|

●

|

Also on July 29, 2005, following our acquisition of the Opticon Network Manager software, FutureTech and our founders exchanged all of our issued and outstanding common stock for an aggregate of sixty-six percent of FutureWorld Energy, Inc., (formerly Isys Medical) issued and outstanding common and all of its preferred stock; and, as a result of the exchange, we became a wholly owned subsidiary of FutureWorld Energy, Inc.

|

|

●

|

Before the exchange of our shares for FutureWorld Energy Inc.’s shares, Mr. Talari legally and beneficially owned eighty-eight percent of FutureWorld Energy Inc.’s common stock and beneficially owned through FutureTech eighty percent of our common stock.

|

|

●

|

After the exchange, our founders each owned directly four percent of FutureWorld Energy Inc.’s common stock and Mr. Talari, directly and indirectly, owned eighty percent of FutureWorld Energy Inc.’s common stock.

|

|

●

|

On April 4, 2006, we consolidated (reverse split) our issued and outstanding common stock by a factor of 0.30107143.

|

|

●

|

In connection with FutureWorld Energy Inc.’s announcement to spin off OptiCon Systems, our Board of Directors approved a stock dividend of 99,118 of our common stock payable to our sole shareholder, FutureWorld Energy, Inc.

|

|

●

|

On July 31, 2007, Mr. Batton and Mr. Wright, our founders, accepted 35,000 shares of our common stock in lieu of deferred compensation and in cancellation their respective, non-expiring rights under their employment agreements to maintain their individual ownership of our common stock to a level of four percent of our issued and outstanding shares.

|

|

●

|

On August 31, 2007, FutureWorld Energy, Inc. paid a stock dividend to its stockholders consisting of 100% of our outstanding common. As of this date, we ceased being a subsidiary of FutureWorld Energy, Inc.

|

|

●

|

On June 10, 2008, we consolidated (reverse split) our issued and outstanding common stock by a factor of 0.05 (1 for 20). Statement of all share amounts, whether before of after June 10, 2008 in this annual report have been adjusted for the share consolidation.

|

|

●

|

On May 13, 2009, Mr. Talari converted the principal amount and accrued interest of one convertible note, and the accrued interest and a portion of the principal amount of a second note into 50,000,000 shares of our common stock respectively. After these conversions, Mr. Talari legally and beneficially owned eighty-four percent of our common stock.

|

|

●

|

On August 11, 2009, we organized Infrax Systems SA (Pty) Ltd., a South African company, as a wholly owned subsidiary, to penetrate the South Africa fiber optic telecommunication market.

|

|

●

|

On August 12, 2009, we organized PowerCon Energy Systems, Inc., a Nevada corporation, as a wholly owned subsidiary to develop, market and distribute software, based on the R4 architecture, to the power industry.

|

|

●

|

On January 10, 2010, we officially changed the name of the Company from OptiCon Systems, Inc. to Infrax Systems, Inc. and were issued a new trading symbol: “IFXY”.

|

- 3 -

Before our acquisition of the Opticon Network Manager software, both FutureWorld Energy, Inc. (formerly Isys Medical) and FutureTech were under the direct, common control of Mr. Talari. Prior to our acquisition of the Opticon Network Manager software, Mr. Talari did not have a controlling interest in us. With that acquisition, however, we also came under Mr. Talari’s indirect control. Although Mr. Talari may be deemed to have determined or had a controlling influence on the terms of the exchange of stock between our stockholders and FutureWorld Energy, Inc., because he owned (a) all the stock of FutureTech which was our then eighty-percent stockholder and (b) eighty-eight percent of FutureWorld Energy Inc.’s common stock, Mr. Talari did not control the decision of our founders who owned twenty percent of our common stock and who have advised us they made independent, individual decisions to enter into the exchange of their stock in us for FutureWorld Energy Inc. common stock. The Company’s investment in FutureWorld Energy, Inc.’s common stock was distributed to Infrax’s stockholders of record, effective June 2010.

While we continue to enhance the OptiCon Network Management platform, the Company has shifted its focus and energies towards the “Smart Grid” energy sector. The Company believes our secure integrated platform will hasten the deployment of all Smart Grid technology for resource constrained small and mid-sized utilities. Infrax’s advantage comes from our products ability to enable the creation of a secure platform scalable to deliver a broad set of intelligent Smart Grid initiatives across millions of endpoints for Utilities.

According to a report issued to Congress by the Office of Electricity Delivery and Energy Reliability, as required by Section 1309 of Title XIII of the Energy Independence and Security Act of 2007, the security of any future Smart Grid is dependent on successfully addressing the cyber security issues associated with the nation’s current power grid.

The complexity of the grid implies that vulnerabilities exist that have not yet been identified. It is particularly difficult to estimate risk from cyber-attack because of the size, complexity, and dynamic nature of the power grid and the unpredictability of potential attackers.

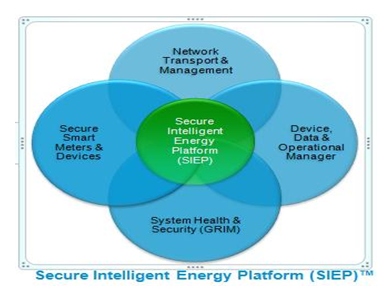

Infrax creates a unified solution path to securely manage Advanced Metering Infrastructure (AMI) and other Smart Grid optimization applications such as substation and distribution automation. Our product portfolio provides Network Transport and Management, Secure Intelligent Devices, and Threat Detection, Grid Optimization and Security, all in an integrated state-of-the-art Smart Grid solution.

Through our wireless broadband business unit, Infrax Networks, we provide outdoor mesh-relay based wireless broadband networks used by customers as the metro-scale IP foundation upon which to run one or many applications that help build greener, safer, smarter communities. Our products have been deployed globally to help connect the unconnected. In addition, our networks are used by electric utilities to build large scale, reliable, and secure networks that deliver the high bandwidth and low latency required for deploying smart grids.

- 4 -

Every utility, telecommunications carrier, wireless service provider, government and businesses with the need to securely transmit data and manage their network is a potential customer for the Infrax product line.

Infrax’s innovative and comprehensive solutions have the power to secure the future.

Industry Background

In today’s environment of increasing threat sophistication and regulatory pressures, managing risk has become a primary concern for Utility IT organizations. Today, a single breach can cost millions, be devastating to industrial, commercial and residential consumers, and create a threat to national security. Infrax’s Sentinel and Grid Intrusion Management (GRIM) products provide a secure solution for complete grid, network and intelligent device management.

Today’s electric system was not designed to handle extensive, well-organized acts of terrorism aimed at strategic elements. The threat of attack is growing and a widespread attack against the infrastructure is more likely today than ever before. It is therefore critical that the Smart Grid address security from the outset, making it a requirement for all the elements of the grid and ensuring an integrated and balanced approach across the system.

Ongoing Mandates

Title XIII of the Energy Independence and Security Act of 2007, mandates that the Department of Energy provides a quantitative assessment and determination of the existing and potential impacts of the deployment of Smart Grid systems on improving the security of the Nation’s electricity infrastructure and operating capability, including recommendations on:

(1) How smart grid systems can help in making the Nation’s electricity system less vulnerable to disruptions due to intentional acts against the system.

(2) How smart grid systems can help in restoring the integrity of the Nation’s electricity system subsequent to disruptions.

(3) How smart grid systems can facilitate nationwide, interoperable emergency communications and control of the Nation’s electricity system during times of localized, regional, or nationwide emergency.

(4) What risks must be taken into account that smart grid systems may, if not carefully created and managed, create vulnerability to security threats of any sort, and how such risks may be mitigated.

- 5 -

The National Institute for Standards and Technology (NIST) stated, “Identifying and implementing security controls is vital in protecting the confidentiality, integrity, and availability of the connected systems and the data that is transferred between the systems. If security controls are not in place or if they are configured improperly, the process of establishing the interconnection could expose the information systems to unauthorized access.”

Our Sentinel and GRid Intrusion Management (GRIM) systems provide an enhanced Cyber Security platform which prevents unwarranted intrusion into any part of the electrical grid. Using advanced encryption algorithms, a secure virtual network can be created over a private or public network. Infrax's GRIM technologies will evolve to include software and hardened hardware solutions for substation deployment.

The energy industry’s assets and systems are not equipped to handle well designed acts of cyber terrorism. With the growing threat of internet attacks, it is critical that robust security is introduced for all the elements of the grid. The deployment of a Smart Grid that reaches from the producer to the consumer, will ultimately add over 150,000,000 communications capable meters in the U.S. alone, creating over 150,000,000 unsecure access points into the grid that previously did not exist. The lack of secure AMI solutions is a major concern of utilities and regulators alike, and Infrax can fill the void.

The market for Infrax’s Sentinel and GRIM solutions includes over 3,400 electric utilities in the United States, several thousand more globally, large consumers of commercial power, as well as power producers and utilities providing water and gas.

According to the research-based business strategy firm Zpryme, Smart Grid IT hardware and software spending in the U.S. was $15.2 billion in 2009 and is forecasted to increase to $39.4 billion by 2014.

INFRAX Solution

- 6 -

Our Secure Intelligent Energy Platform (SIEP) ™ competes in three distinct market segments of the smart grid industry;

Network Transport and Management - the secure network and management platform necessary for utilities to implement smart grid applications including Advanced Metering Infrastructure (AMI),

Secure Smart Sensors and Devices (i.e. Smart Meters) - through SNIC and sensors, for Demand Side Management (DSM), Distribution Monitoring and Automation, and

Threat Detection, Grid Optimization and Security - through Sentinel & GRiM.

What Our Technology Does

Our platform creates a modular unified solution path for utilities to securely manage Advanced Metering Infrastructure and other Smart Grid optimization applications such as substation automation. Infrax’s secure smart grid platform, know as Secure Intelligent Energy Platform or SIEP, incorporates communications transport and management system, device and data security management, and ultimately secure intelligent endpoint devices.

Based on our review of the Smart Grid related products against which the Secure Intelligent Energy Platform now competes, we believe that none of them provide the required encryption and threat detection capabilities required to secure the energy grid.

The Utility industry’s aggressive deployment of Advanced Metering Infrastructure (AMI) and data management devices has led to the accelerated reliance on fiber optic communications. The existing utility networks cannot provide the security, reliability and high bandwidth required, nor do they currently extend to the consumer location.

Today’s evolution of Smart Grid design and implementations actually began several years prior to the current initiatives. The same applies to the products designed by most of the major players including Itron, Silver Spring and GridPoint. Although the current security initiatives and elected officials have good intentions, they have missed the window of opportunity to truly integrate security from the beginning by several years. Similar to the credit card industry, banking, health care, and most other industries that conduct business online, the next electrical infrastructure will need to feature security as an add-on that is applied after the Smart Grid is implemented.

- 7 -

The current Smart meters were declared “Too Easy to Hack” by the computer security company IOActive, which performed penetration tests on several Smart Grid products. The company created a worm that can infiltrate a smart meter system using an automatic upgrade feature, because it lacks an authentication process. It unveiled the research at the Black Hat computer security conference in Las Vegas in July 2009, and has also briefed the US Department of Homeland Security.

These recent penetration tests have shown that proper security mechanisms are not currently built into components of the smart grid. Recently discovered vulnerabilities in smart meters have been identified that could allow an attacker to obtain complete control of the meters. Specifically, an attacker could exploit these vulnerabilities to turn off electricity to hundreds of thousands of homes. Thus, an attacker could execute a wide-scale Denial of Service (“DoS”) attack against homes and businesses.

Whether RF or WiFi enabled, the current AMI meters available from Itron, Echelon, GE, Landis+Gyr, and others utilize 128-bit encryption, which is basic encryption, if they employ any encryption at all. There are dozens of software programs available on the internet which can easily break this level of encryption.

The Advantage of Our Technology

By entering the market without the burden of legacy products and technology, Infrax is able to focus on future technologies and will be poised to provide advanced solutions for companies that are yet to deploy AMI and harden previously installed networks and devices.

While the current use of RF and WiFi technology is inherently less secure, Infrax is focused on IP enabled technology preferably utilizing fiber optics as the primary communications medium where possible, otherwise using highly encrypted data over secure tunnels using WiFi, Cellular or other public communication media. Infrax's secure smart grid platform incorporates a communications transport known as GridMesh™, and a device and data security management tool known as GRiM. The secure management of the "last mile" backhaul will be necessary for utilities to implement Smart Grid applications such as AMI, and substation and distribution automation.

We believe that the use of secure IP-based tunnels will become the standard for Smart Grid communications and our expertise in managing fiber optic networks enables us to aid utilities in the design, implementation and management of their networks

Infrax is in the process of designing a Security and Network Interface Card (SNIC), based on higher levels of encryption, which can be imbedded in all intelligent end devices including Smart Meters and sensors. The SNIC will be offered in a variety of configurations and depending on the application, can provide up to 2048-bit encryption.

- 8 -

Data traffic passing through SNIC will be encrypted AES 256 which combines the benefits of high security with fast data processing. Encrypted keys are periodically replaced to ensure the integrity of the network. These keys are protected by a much stronger, 1024-bit RSA encryption to ensure that the key cannot be intercepted. When combined with our security based software and management tools, our SNIC creates an impenetrable barrier against cyber attacks.

In addition to the higher levels of encryption provided, our Secure Intelligent Energy Platform provides data and device security management enabling early threat detection and automated event response.

Our software is based on a hardened Linux OS and we deploy distributed Peer-to-Peer Systems interconnected via a Secure Tunnel. We actively interrogate all devices on the network for security breaches and performance, and cross correlate the data on a real time basis to determine the appropriate response. Our system also provides live situation reporting and alerts and all the management and security information is graphically displayed on our customizable dashboards.

We believe that our Secure Intelligent Energy Platform will give us a competitive advantage in the emerging and evolving Smart Grid environment. By utilizing our solution, Utilities can secure their networks and prolong the lifecycle of previously deployed components by eliminating the security concerns that would necessitate replacement.

INFRAX Strategy

We intend to generate revenues from the design, sales, installation, and support of the hardware, software and technology, associated with our integrated solution, Infrax Secure Intelligent Energy Platform (SIEP) ™. Additionally, revenues may be generated from licensing our Sentinel™ Information Security, GRiM and, Infrax Networks wireless communications and future products.

Our efforts are presently focused on attaining the following:

INCREASED MARKET PENETRATION OF OUR WIRELESS BROADBAND PRODUCTS

Our strategy is to capitalize on the millions of dollars and thousands of man hours invested in one of our core technologies, the T-Max family of wireless broadband products, developed by Trimax Wireless, Inc, which we acquired in June 2010. We own the Intellectual Property of these systems having acquired Trimax Wireless, Inc and are enhancing the T-Max product line for use in Smart Grid applications for utility infrastructure management.

- 9 -

EXPAND OUR STRATEGIC ASSOCIATIONS

Since our inception, we have built relationships with Utilities, Manufacturers, major DC Lobbyist Firms, and International Law firms, and certain Government Officials nationally and locally. These relationships will afford us the visibility needed for Government grants, loan guarantees, and funding, as well as aid in the prioritization of global markets.

DRIVE BUSINESS DEVELOPMENT

We believes the industry will be driven by a few, key early adopters who will set the stage for North American smart grid deployments, especially those companies that have been awarded millions in stimulus grants . Initially we have been focusing our efforts on utilities that have recently obtained grants from the Stimulus Act. Upon funding, we will direct our business development effort towards the 3,448 small to mid-sized utilities in the United States, as the majority of these utilities lack the resources to adequately migrate to the Smart Grid infrastructure.

PURSUE OUR ROLE AS A SECURE SYSTEMS INTEGRATOR

We are committed to our role as a supplier of secure Smart Grid communications platforms. We will continue to expand our professional services including network design, hardware and software development and integration, installation support, operator training and network management. Our understanding of the architecture, hardware, and software requirements of major utilities from our prior experience enables us to design solutions from the ground up and to meet utility requirements. We intend to design, manufacture and market all of the key components of the network.

BECOME A LEADING SOLUTIONS PROVIDER WITH A DIVERSIFIED PLATFORM AND A GLOBAL PRESENCE

Our customers’ requirements create the need for our products and our goal is to drive application development to meet these needs. While Infrax’s Secure Intelligent Energy Platform incorporates our secure wireless technology, we believe that growth in the Smart Grid communications industry will come primarily as utilities deploy Smart Grid applications including AMR/AMI, distribution and substation automation. These future points of entry for Smart Grid applications may include home energy management systems, demand response tools and other applications which will require the secure access provided by our Secured Network Interface Card (SNIC) ™ technology currently under development.

- 10 -

EXPAND OUR STRATEGIC COLLABORATIVE RELATIONSHIPS

Continued collaboration with our development partners, utility customers and synergistic smart grid application providers will further enhance the development and functionality of our Secure Intelligent Energy Platform. We have established joint development arrangements with a host of technology providers to keep us on the cutting edge of new technologies, and we will continue to create working relationships with leading suppliers of critical network and IEDs (Intelligent Endpoint Devices) components such as sensors, integrated communication hub and aggregators, consumer centric energy management devices as well as metering solution providers. We are working with electric utilities to conduct application trials. We intend to strengthen these relationships and to seek out new strategic and commercial relationships with utilities and other technology companies.

ACTIVELY PURSUE TARGETED STRATEGIC ACQUISITIONS

We intend to actively pursue selective acquisitions to enhance our product/service offerings and to further expand our solutions into the alternative energy and intelligent energy solutions sector. Utilizing our core platform as the foundation for additional products and services, we can increase the potential of other technology products by integrating them with our solution. We have identified several potential technology companies which have technologically advanced products to compliment our solution. We intend to look for opportunities to acquire technologies that would support and enhance our current technology platform with a particular focus on growing managed services offerings through our energy management solutions.

Contracts and Agreements

In July 2010, we signed an agreement with Tampa Electric Company (TECO) to provide a wireless network interconnecting multiple substation facilities.

In August 2010, we received an order from USKS to deliver and install the next phase of the wireless network in Abuja, Nigeria. This phase will include WiMax/LTE capability.

Our Intellectual Property and Its Protection

Infrax Systems: Opticon Network Manager software and Smart Grid products

Our intellectual property consists of all of Corning Cable, Inc,’s intellectual property related to the Opticon Network Manager software. Our rights by purchase in our intellectual property are equivalent to that of any developer or creator of intellectual property. We have exclusive ownership of the Opticon Network Manager software and all its revisions and new versions, including R4, with the exclusive right to license it to others.

- 11 -

Additionally, our intellectual property relating to our Smart Grid products includes the design of the Secure Network Interface Card (SNIC) and its associated proprietary mesh routing scheme, customized modifications to our security software platform, and the wireless equipment hardware and software designs as well as the associated patents included in the Trimax Wireless, Inc. acquisition.

We regard all of our hardware, software and its documentation as proprietary and the source code for the software as a trade secret. We intend to complete the implementation of confidentiality procedures, contractual arrangements, physical security systems and other measures to protect our proprietary and trade secret information when we begin to hire employees. As part of our confidentiality procedures, we will generally enter into non-disclosure agreements with our key employees, and our license agreements will include provisions for protection of our proprietary information. We also plan to educate our employees on trade secret protection and employ measures to protect our facilities and equipment. We plan to license our software products under signed license agreements that impose restrictions on the licensee’s ability to utilize the software and do not permit the re-sale, sublicense or other transfer of the software.

We have not yet filed patent applications for our Smart Grid products, but intend to do so as development progresses. We do hold patents associated with the Trimax acquisition and continue to patent our wireless mesh technology as we complete each development phase.

Our software is protected under U.S. and international copyright laws and laws related to the protection of intellectual property and proprietary information. We do not need to do any further steps to protect our IP than stated. Neither we, nor to our knowledge Corning Cable, has filed a U.S. copyright registration. We will file a registration for the Secure Intelligent Energy Platform products as they are completed. We take measures to label our product with the appropriate proprietary rights notices, and we plan to actively enforce such rights in the U.S. and abroad. We believe that our ability to maintain and protect our intellectual property rights is important to the success of our business. Our intellectual property is at this time our only asset that will enable us to engage in our planned business. The measures for its protection described in this section may not provide sufficient protection and our intellectual property rights may be challenged. Efforts to enforce our intellectual property rights in litigation, or defend suits brought against us for copyright infringement, which we do not have reason to expect, would be expensive and consume substantial amounts of our management’s time. Our ability to pursue remedies against person who we believe may infringe our intellectual property rights will depend on our financial condition from time to time.

Trimax Wireless Systems (acquired intellectual property June 29, 2010)

Trimax' solutions enable multiple applications to run concurrently over the same standards-based infrastructure, leveraging capital investment and operating costs. Trimax has a growing list of Solution Partners that provide best-of-breed complementary products to help customers implement whole product solutions.

- 12 -

The Trimax Wireless TMAX™ Cross Platform product line is the first to combine Wi-Fi, WiMAX and DECT into a single unified system. TMAX includes base stations, broadband wireless routers, edge nodes and CPE devices. The entire TMAX product line is based on modular, rugged outdoor platforms that support a common set of radio modules.

Around the world, Trimax leads the way in helping to increase public safety, improve mobile worker efficiency, boost the local economy, and deliver wireless broadband connectivity to people wherever they are...and wherever they're going.

Our proprietary software provides:

|

·

|

Mobile Public Safety - Providing public safety workers in the field with timely access to the information they need is reducing crime and saving lives

|

|

·

|

Video Surveillance - A cost-effective alternative to adding additional people to increase security coverage, cameras are extending the visual reach of police, fire, lifeguards and park rangers

|

|

·

|

Utility Meter Reading- Centrally connected utility meters are improving customer satisfaction and encouraging conservation while lowering operational costs

|

|

·

|

Intelligent Transportation Systems (ITS) - Real-time traffic analytics and control is minimizing congestion and improving safety on crowded roadways as well as reducing emissions

|

|

·

|

Municipal Modernization and Mobility - Extending office IT resources to the field is improving worker efficiency, lowering costs, and raising citizen satisfaction

|

|

·

|

Automated Parking Meters - Variable parking rates, and flexible payment options, are improving main street business.

|

|

·

|

Industrial - Often operating in hostile conditions, industrial site networks are used for a range of activities that improve business operational efficiencies, reduce operating cost, and increase worker and site safety

|

|

·

|

Public Access - Citywide, campus-wide, and hot zone Wi-Fi networks increase quality of life, educational opportunities, and economic development

|

Security and Network Interface Card (SNIC)(Intellectual Property Rights to be filed)

We will file for global patent for our Security and Network Interface Card after the successful completion of the prototype in the first quarter of 2011.

GridMesh (Intellectual Property Rights to be filed)

We will file for global patent for our GridMesh technology after the successful completion of the development in the first quarter of 2011.

- 13 -

Competitive Landscape

We face strong competition from traditional grid optimization providers, both larger and smaller than us. We compete in four distinct market sectors:

|

|

·

|

advanced metering,

|

|

|

·

|

networking and communications,

|

|

|

·

|

grid optimization/distribution automation, and

|

|

|

·

|

software.

|

We may compete directly with certain companies in certain sectors and indirectly in others. It is important to note that some market segments are more defined than others.

The market for our products is in its infancy and there is no clear market leader, which provides Infrax entry with a unique product line. We also believe that none of our competitors offer a unique blend of network, device, data and security management as Infrax. In order to maintain and improve our competitive position in the market, we must continue to invest in research and development, and continue to anticipate changes in the market and our customers’ requirements

At the date of this annual report, we have ten (10) full-time and four part-time employees. The majority of employees work out of our offices in Pinellas Park and Naples, Florida. We have several remote employees dedicated to sales and deployments.

We wish to caution you that there are risks and uncertainties that could cause our actual results to be materially different from those indicated by forward looking statements that we make from time to time in filings with the U.S. Securities and Exchange Commission, news releases, reports, proxy statements, registration statements and other written communications as well as oral forward looking statements made from time to time by our representatives. These risks and uncertainties include, but are not limited to, those risks described below that we are presently aware of. Additional risks and uncertainties that we currently deem immaterial may also impair our business operations, and historical results are not necessarily an indication of the future results. The cautionary statements below discuss important factors that could cause our business, financial condition, operating results and cash flows to be materially adversely affected.

An investment in our common stock involves a high degree of risk. Therefore, if you are considering buying our common stock, you should consider all of the risk factors discussed below, as well as the other information contained in this annual report. You should not invest in our common stock unless you can afford to lose your entire investment and you are not dependent on the funds you are investing in order to pay your monthly expenses.

Without minimum funding of $5 million and additional funding of up to $20 million, we may not be able to establish, maintain and grow our business.

- 14 -

At the date of this annual report, we do not have the funding we require to maintain our business and we have had no success in raising capital in the past 2 years. We have concentrated mainly on developing our hardware and software solutions. Furthermore, we do not have any existing or ongoing arrangement, understandings, commitments or agreements for additional funding. Failure to raise additional debt or equity funding would prevent us from completing development of the Secure Intelligent Energy Platform and associated products and possibly cease operations. There is no assurance that we will be able to obtain sufficient debt or equity funding, or that the terms of available funding will be acceptable to us. Failure to raise additional debt or equity funding would most probably result in a complete loss of their investment by purchasers of our common stock.

Trading in our securities is expected to be subject, at least initially, to the “penny stock” rules. The SEC has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions, none of which apply to our common stock. These rules require that a broker-dealer, who recommends our common stock to persons other than its existing customers and accredited investors, must, prior to the sale:

|

●

|

Make a suitability determination prior to selling a penny stock to the purchaser;

|

|

●

|

Receive the purchaser’s written consent to the transaction;

|

|

●

|

Provide certain written disclosures to the purchaser;

|

|

●

|

Deliver a disclosure schedule explaining the penny stock market and the risks associated with trading in the penny stock market;

|

|

●

|

Disclose commissions payable to both the broker-dealer and the registered representative; and

|

|

●

|

Disclose current quotations for the common stock.

|

The additional burdens imposed upon broker-dealers by these requirements may discourage broker-dealers from effecting transactions in our common stock, which could severely limit the market price and liquidity of our common stock. These requirements may restrict the ability of broker-dealers to sell our common stock and may affect your ability to resell our common stock.

The price of our common stock may fluctuate significantly and you may find it difficult to sell your shares at or above the price you paid for them.

We do not know the extent to which the market for our shares of common stock may be volatile. Therefore, your ability to resell your shares may be limited. Actions or announcements by our competitors and economic conditions, as well as period-to-period fluctuations in our financial results and other factors, may have significant effects on the price of our common stock and prevent you from selling your shares at or above the price you paid for them.

- 15 -

We have a limited operating history that can be used to evaluate us, and the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays that we may encounter because we are a small business. As a result, we may not be profitable and we may not be able to generate sufficient revenue to develop as we have planned.

Our ability to achieve and maintain profitability and positive cash flow will be dependent upon:

|

Ø

|

Management’s ability to maintain the technology skills for our services; |

|

Ø

|

The Company’s ability to keep abreast of the changes by the government agencies and law;

|

|

Ø

|

Our ability to attract customers who require the services we offer; and

|

|

Ø

|

Our ability to generate revenues through the sale of our services to potential clients who need our services.

|

Based upon current plans, we expect to incur operating losses in future periods because we will be incurring expenses and not generating sufficient revenues to cover our expenses. We cannot be sure that we will be successful in generating revenues in the future. Failure to generate sufficient revenues will cause us to go out of business and any investment in our Company would be lost.

Managing a small public company involves a high degree of risk. Few small public companies ever reach market stability and we will be subject to oversight from governing bodies and regulations that will be costly to meet. Our present officers and directors do not have any experience in managing a fully reporting public company so we may be forced to obtain outside consultants to assist with our meeting these requirements. These outside consultants are expensive and can have a direct impact on our ability to be profitable. This will make an investment in our Company a highly speculative and risky investment.

While the Company is attempting to disclose all of the potential risks associated with an investment in the Company, there can be no assurance that all of the risks are visible to management. Events occurring in the future may caus additional risks to an investment in the Company which are currently unforeseen.

We have a limited operating history that you can use to evaluate us, and the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays that we may encounter because we are a small company. As a result, we may not be profitable and we may not be able to generate sufficient revenue to develop as we have planned.

The success of our business depends, in part, upon proprietary technologies and information which may be difficult to protect and may be perceived to infringe on the intellectual property rights of third parties.

- 16 -

We believe that the identification, acquisition and development of proprietary technologies are key drivers of our business. Our success depends, in part, on our ability to obtain patents, maintain the secrecy of our proprietary technology and information, and operate without infringing on the proprietary rights of third parties. We cannot assure you that the patents of others will not have an adverse effect on our ability to conduct our business, that the patents that provide us with competitive advantages or will not be challenged by third parties, that we will develop additional proprietary technology that is patentable or that any patents issued to us will provide us with competitive advantages or will not be challenged by third parties. Further, we cannot assure you that others will not independently develop similar or superior technologies, duplicate elements of our technology or design around it.

None.

Item 2. Properties

Our executive office is now located in an office complex under annual three year lease, beginning May 1, 2010 at a rent of $2,756 per month. We entered into this 3-year commercial lease agreement in Pinellas Park, Florida with Accu Centre. Our lease provides us with approximately 4,100 square feet of: reception area, nine offices, eight cubicles, a lab/production area, kitchenette and two conference rooms. We believe the facilities are adequate for our operational needs. We may require additional offices in the event we obtain funding and acquire additional customers.

The lease for our facilities in Naples, Florida was extended in August 2010 for a one year (12 month) period. Monthly costs are approximately $2,500 for the administrative, testing and production areas.

(a) We are not engaged in any legal proceedings at the date of this report, nor are we aware of any demands or claims against us that may result in litigation. We may be involved in legal proceedings from time to time in the normal course of our business.

Item 4. Submission of matters to a vote of security holders

We did not submit any matter to a vote of our security holders, through the solicitation of proxies or otherwise during the fourth quarter of our 2010 fiscal year.

- 17 -

Item 5. Market for registrant’s common equity, related stockholder matters and issuer purchases of equity securities

Our common stock is quoted on OTC Bulletin Board under the symbol “IFXY”. The Company began trading on January 11, 2008.

Price History of our common stock.

The following table sets forth high and low bid quotations for the quarters indicated and trading volume data for our common stock for the period indicated. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not necessarily represent actual transactions.

|

High Bid

|

Low Bid

|

||||

|

Fiscal Year 2010

|

|||||

|

Fourth Quarter Ended June 30, 2010

|

$ .032

|

$ .004

|

|||

|

Third Quarter Ended March 31, 2010

|

$ .045

|

$ .011

|

|||

|

Second Quarter Ended December 31, 2009

|

$ .085

|

$ .020

|

|||

|

First Quarter Ended September 30, 2009

|

$ .125

|

$ .050

|

|||

|

|

|||||

|

Fiscal Year 2009

|

|||||

|

Fourth Quarter Ended June 30, 2009

|

$ .59

|

$ .20

|

|||

|

Third Quarter Ended March 31, 2009

|

$ .20

|

$ .10

|

|||

|

Second Quarter Ended December 31, 2008

|

$ .15

|

$ .01

|

|||

|

First Quarter Ended September 30, 2008

|

$ .20

|

$ .10

|

As of September 22, 2010 we had 56 shareholders of record and approximately 4, 352 beneficial shareholders, and we had 2,835,417,440 shares of $0.001 par value common stock outstanding.

Dividend Policy

We have never declared or paid any cash dividends on our capital stock, except for distribution of shares previously held in FutureWorld (FWDG), that were acquired in the exchange for intellectual property. We do not have earnings out of which to pay cash dividends. Our board of directors has the authority to declare cash dividends when and if we have earning sufficient for that purpose.

Equity Compensation Plan

See description our Stock Option Plan in Item 12.

- 18 -

Transfer Agent

We have engaged ClearTrust, Inc. to serve as our stock register and transfer agent. ClearTrust’s address is 17961 Hunting Bow Circle, Unit 102, Lutz, FL 33558.

Sales of Unregistered Securities

The following table sets forth information about our unregistered sales of securities during the three months ended June 30, 2010.

|

Date

|

Title of Security

|

Amount

|

Purchaser

|

Price

|

Exemption

|

|

|

2010

|

Common

|

126,560,000

|

Paul Aiello

|

(1)

|

Services

|

Section 4(2)

|

|

2010

|

Common

|

3,500,375

|

Saed (Sam) Talari

|

(2)

|

Conversion

|

Section 4(2)

|

|

2010

|

Common

|

27,962,500

|

John Verghese

|

(1)

|

Services

|

Section 4(2)

|

|

2010

|

Common

|

94,044,000

|

Monika Altvater

|

(2)

|

Conversion

|

Section 4(2)

|

|

2010

|

Common

|

94,044,000

|

Ulrich Altvater

|

(2)

|

Conversion

|

Section 4(2)

|

|

2010

|

Common

|

156,740,100

|

Gloria Lynch

|

(3)

|

Conversion

|

Section 4(2)

|

|

2010

|

Common

|

98,211,000

|

Michael Lynch

|

(3)

|

Conversion

|

Section 4(2)

|

We did not pay and no one acting on our behalf or to our knowledge paid any commissions or other compensation with respect to the sale of any of the shares listed in the tables above.

|

|

(1)

|

Mr. Talari, Mr. Aiello, and Mr. Verghese are thoroughly familiar with our proposed business in their respective positions as Director, Chief Executive Officer and Director of Product Devlopment.

|

|

|

(2)

|

Mr. Talari converted notes payable, in exchange for common stock. Mr. Talari is the majority holder and Director of the Company.

|

|

|

(3)

|

Ulrich Altvater, Monika Altvater, Gloria Lynch, Michael Lynch converted preferred shares received, acquired in Trimax Wireless, Inc. acquisition.

|

The following financial data is derived from, and should be read in conjunction with, the “Financial Statements” and notes thereto. Information concerning significant trends in the financial condition and results of operations is contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

- 19 -

|

2010

|

2009

|

||||||

|

Cash

|

$ | 115,015 | $ | 1,996 | |||

|

Current assets

|

230,361 | 79,907 | |||||

|

Total Assets

|

7,112,507 | 295,319 | |||||

|

Total current liabilities

|

1,668,635 | 514,541 | |||||

|

Total liabilities

|

1,854,339 | 514,541 | |||||

|

Total stockholders' equity (deficit)

|

5,258,168 | (219,222 | ) | ||||

|

Working Capital

|

(1,438,274 | ) | (434,634 | ) | |||

|

Net Cash (Used) Provided by Operating Activities

|

26,362 | (71,743 | ) | ||||

|

For the Year Ended June 30,

|

2010

|

2009

|

||||||

|

Revenues

|

$ | 9,895 | $ | - | ||||

|

Direct costs

|

- | - | ||||||

|

Gross Profit

|

9,895 | - | ||||||

|

Operating expenses:

|

975,324 | 450,920 | ||||||

|

Net loss

|

$ | (986,710 | ) | $ | (450,920 | ) | ||

Our significant accounting policies are more fully described in Note 1 to the financial statements. However, certain accounting policies are particularly important to the portrayal of our financial position and results of operations and require the application of significant judgment by our management; as a result they are subject to an inherent degree of uncertainty. In applying these policies, our management uses their judgment to determine the appropriate assumptions to be used in the determination of certain estimates. Those estimates are based on knowledge of our industry, historical operations, terms of existing contracts, and our observance of trends in the industry, information provided by our customers and information available from other outside sources, as appropriate.

As more fully described in “LIQUIDITY AND CAPITAL RESOURCES”, we had approximately $115,000 in cash at June 30, 2010, and approximately $164,000 remaining on the line of credit from Mr. Talari with which to satisfy our future cash requirements. Our management believes our cash and credit line will support only limited activities for the next twelve months. We are attempting to secure other sources of financing to develop our business plan, and to implement our sales and marketing plan. We believe full implementation of our plan of operations, completion of development of the smart grid related hardware and software, and the integration of the Trimax Suite of Products will cost approximately $5 million. We have no assurance we will be able to obtain additional funding to sustain even limited operations beyond twelve months based on the available cash and balance of our line of credit with Mr. Talari. If we do not obtain additional funding, we may need to cease operations until we do so and, in that event, may consider a sale of our technology. Our plan of operations set forth below depends entirely upon obtaining additional funding.

- 20 -

We do not have any ongoing discussions, arrangements, understandings, commitments or agreements for additional funding. We will consider equity funding, either or both of a private sale or a registered public offering of our common stock; however, it seems unlikely that we can obtain an underwriter. We will consider a joint venture in which the joint venture partner provides funding to the enterprise. We will consider debt financing, both unsecured and secured by a pledge of our technology. As noted above, we may be forced to cease operations without additional funding, after our limited cash and line of credit with Mr. Talari are exhausted.

Our Marketing Plan

The first phase in our plan of operations, subject to adequate funding, will be implementation of our sales and marketing plan. We plan to initially select several resource constrained small to mid-sized utilities to function as beta test sites for our Secure Intelligent Energy Platform. We are currently working with one mid-sized utility during the design phase of product development. We will also be targeting utilities for the immediate deployment of our “Smart Grid Ready” wireless products in preparation of the completion and launch of our SIEP.

Additionally, during this stage we will continue to design and implement wireless networks in developing countries in continuation of the former Trimax Wireless strategy. In parallel with this activity we plan to continue to target wireless ISP’s and carriers, offering our current wireless voice and data communications products.

We may explore the opportunities to locate local and regionally based companies in emerging markets with existing relationships with the key decision makers in Africa, and Middle East, that would be willing establish strategic relationships in those markets and establishing their own Network Operating Centers to increase our visibility and support our customers in those markets. We are considering the establishment of this concept as our business model for countries in these emerging markets.

Product Research and Development

Our Smart Grid products are in the late stages of development and we anticipate delivering prototype solutions to our targeted beta customers by the end of the 1st quarter of 2011. We have budgeted $1.8M for the completion of our hardware and software products. We do not have financial or other resources to undertake this development. Without additional funding sufficient to cover this budgeted amount, we will not have the resources to conduct this development.

We anticipate that as funding is received, of which there is no assurance, and we will begin hiring the appropriate technical staff that will be able to handle support requirements for this market segment. We anticipate a need for up to forty-four employees by the end of the first year of full operation after funding. The number of employees we hire during the next twelve months will depend upon the level of funding and sales achieved.

- 21 -

Funding

To support our activities and provide the initial sales and support for entry into the Utility marketplace, as noted above, we will require an initial investment of approximately $5 million. We expect this level of funding to carry us into the Smart Grid and Utility marketplaces and provide the capital necessary to complete the development of our SIEP and SNIC products.

Our previous efforts to secure funding have been unsuccessful.

RESULTS OF OPERATIONS

Comparison year ended June 30, 2010 to June 30, 2009

For the year ended June 30, 2010, we incurred a net loss of $986,710. The loss consisted of $510,267 of stock based compensation. Loss also includes depreciation and amortization, non-cash expenses, in the amount of $2,398.

For the year ended June 30, 2009, we incurred a net loss of $450,920. Of this loss, $209,994 consisting of depreciation and amortization of ($3,054) and deferred compensation to our officers ($84,000), as well as issuance of common stock in exchange for services ($108,790) did not require the use of cash.

For the year ended June 30, 2010 compared to June 30, 2009, salaries and benefits increased from $90,462 to $644,512 reflecting increase in employment agreement, both in number of individuals under contract and annual amounts, of which, represents the majority of the $510,267 of stock-based compensation payments. Additional amounts remain as accrued expense. the increase in salaries is also the result of several consulting contracts being reported under employment contracts, resulting in a decrease in consulting expense from $217,200 for the year ended June 30, 2009 to $128,111 for the year ended June 30, 2010. For the same period, legal expenses remained consistent. General and administrative expenses increased from $65,077 to $127,556 for the comparative years, due to the increasing activity of marketing, public expense and expense that incurred during the due diligence phase of the Trimax acquisition.

As of June 30, 2010, we had $115,015 in cash, along with $164,296 remaining on the line of credit from Mr. Talari to pay normal operating expenses, while we attempt to secure other sources of financing to develop our business plan, and increase efforts of our marketing plan. Cash provided from operations was $26,362; however this was primarily due to an overall increase in working capital components.

- 22 -

On September 6, 2005, we obtained a loan commitment from Mr. Talari, one of our director and controlling person in the aggregate amount of $350,000 under a revolving master promissory note, due on demand, with interest at the rate of five percent per annum. We have been receiving advances on this note on an as needed basis and through June 30, 2010, we have received a total of $89,456 for the year ended June 30, 2010 and $521,004 since the inception of the commitment. During the course of this agreement Mr. Talari has made a number of conversions, reducing the note and accrued interest in exchange for our common stock.

On June 29, 2010 the Company entered into an agreement with the shareholders of Trimax Wireless, Inc. (“Trimax”) for the purchase of their business assets and technology. As part of the agreement a promissory note, in the amount of $712,500 was entered. The note is interest bearing at 6% per annum until fully paid with a start period of 90 (September 29, 2010) days for the first payment. The Company shall make interest-only payments on the first day of each month from the date of this Note until the earlier of (a) receipt of Investment Funding as defined; or (b) 180 days from the date hereof ("Maturity Date") (December 29, 2010). Principal plus all accrued and unpaid interest on such principal shall be due and payable on the Maturity Date. The terms of the agreement require the Company to accelerate the growth, of which, substantial earnings from the Trimax assets are considered. The Company is searching for alternative financial debt sourcing.

On June 17, 2010 the Company entered into a Bridge Loan Agreement with Blue Diamond Consulting, LLC (“Lender”). The Company may be advanced up to $500,000, secured by the Company’s common stock. Advances may be requested in increments of $25,000 and bear interest of 8% per annum. Advances have repayment terms of six months from the date of the requested advance. The Lender has the right, at their option, to convert any amounts due, plus interest, into the Company’s common stock at a conversion rate, as defined, at 50% of the closing bid price at the date of conversion request. As of June 30, 2010, there have been no requested advances and no amount is due to Lender.

We anticipate that, depending on market conditions and our plan of operations, we may incur operating losses in the future. We base this expectation, in part, on the fact that we may not be able to generate enough gross profit from our sales and services to cover our operating expenses and increased sales and marketing efforts. Consequently, there remains doubt about the Company’s future and sustained profitability.

Recent Accounting Pronouncements

We have reviewed accounting pronouncements and interpretations thereof that have effectiveness dates during the periods reported and in future periods. The Company has carefully considered the new pronouncements that alter previous generally accepted accounting principles and does not believe that any new or modified principles will have a material impact on the corporation’s reported financial position or operations in the near term. The applicability of any standard is subject to the formal review of our financial management and certain standards are under consideration. Those standards have been addressed in the notes to the audited financial statement and in our Annual Report, filed on this Form 10-K.

- 23 -

Critical Accounting Policies

The Company’s significant accounting policies are presented in the Company’s notes to financial statements for the period ended June 30, 2010 and 2009, which are contained in this filing, the Company’s 2010 Annual Report on Form 10-K. The significant accounting policies that are most critical and aid in fully understanding and evaluating the reported financial results include the following:

The Company prepares its financial statements in conformity with generally accepted accounting principles in the United States of America. These principals require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Management believes that these estimates are reasonable and have been discussed with the Board of Directors; however, actual results could differ from those estimates.

The Company issues restricted stock to employees and consultants for various services. Cost for these transactions are measured at the fair value of the consideration received or the fair value of the equity instruments issued, whichever is measurable more reliably measurable. The value of the common stock is measured at the earlier of (i) the date at which a firm commitment for performance by the counterparty to earn the equity instruments is reached or (ii) the date at which the counterparty's performance is complete.

Long-lived assets such as property, equipment and identifiable intangibles are reviewed for impairment whenever facts and circumstances indicate that the carrying value may not be recoverable. When required impairment losses on assets to be held and used are recognized based on the fair value of the asset. The fair value is determined based on estimates of future cash flows, market value of similar assets, if available, or independent appraisals, if required. If the carrying amount of the long-lived asset is not recoverable from its undiscounted cash flows, an impairment loss is recognized for the difference between the carrying amount and fair value of the asset. When fair values are not available, the Company estimates fair value using the expected future cash flows discounted at a rate commensurate with the risk associated with the recovery of the assets. We did not recognize any impairment losses for any periods presented.

We do not participate in transactions that generate relationships with unconsolidated entities or financial partnerships, such as special purpose entities or variable interest entities, which have been established for the purpose of facilitating off-balance sheet arrangements or other limited purposes.

- 24 -

Management Consideration of Alternative Business Strategies

In order to continue to protect and increase shareholder value management believes that it may, from time to time, consider alternative management strategies to create value for the company or additional revenues. Strategies to be reviewed may include acquisitions; roll-ups; strategic alliances; joint ventures on large projects; and/or mergers.

Management will only consider these options where it believes the result would be to increase shareholder value while continuing the viability of the company.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Not Required.

- 25 -

Item 8. Financial statements and supplementary data

Infrax Systems, Inc.

2010 Annual Report

Index to Financial Statements and Financial Statement Schedules

|

Page

|

|

|

Report of Independent Registered Public Accounting Firm

|

27

|

|

Consolidated Balance Sheets

|

29

|

|

Consolidated Statements of Operations

|

30

|

|

Consolidated Statements of Changes in Stockholders’ Deficit

|

31

|

|

Consolidated Statements of Cash Flows

|

32

|

|

Notes to Consolidated Financial Statements

|

33

|

- 26 -

To the Board of Directors and Stockholders of

Infrax Systems, Inc.

Pinellas Park, Florida

We have audited the accompanying consolidated balance sheet of Infrax Systems, Inc as of June 30, 2010 and the related consolidated statements of operations, stockholders’ deficit, and consolidated cash flows for the year then ended and for the period from October 22, 2004 (date of inception) to June 30, 2010. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Infrax Systems, Inc. as of June 30, 2010, and the results of their operations, changes in their stockholders' deficit and their cash flows for the year then ended and for the period from October 22, 2004 (date of inception) to June 30, 2010, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As shown in the financial statements and discussed in Note 3 of the accompanying consolidated financial statements, the Company has incurred significant recurring losses from operations since inception and is dependent on outside sources of financing for continuation of its operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

/s/ Randall N. Drake, CPA, PA

Clearwater Florida

September 28, 2010

- 27 -

To the Board of Directors and Stockholders of

OptiCon Systems, Inc.

St. Petersburg, Florida

We have audited the accompanying balance sheet of OptiCon Systems, Inc as of June 30, 2009 and 2008 and the related statement of operations, stockholders’ deficit, and cash flows for the years ended June 30, 2009 and 2008 and for the period from October 22, 2004 (date of inception) to June 30, 2009. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Opticon Systems, Inc. as of June 30, 2009 and 2008, and the results of their operations, changes in their stockholders' deficit and their cash flows for the years ended June 30, 2009 and 2008 and period from October 22, 2004 (date of inception) to June 30, 2009, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As shown in the financial statements and discussed in Note 3 of the accompanying financial statements, the Company has incurred significant recurring losses from operations since inception and is dependent on outside sources of financing for continuation of its operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

/s/ Meeks International, LLC

Tampa, Florida

September 30, 2009

- 28 -

|

Infrax Systems, Inc.

|

||||||||

|

(A Development Stage Enterprise)

|

||||||||

|

Consoldiated Balance Sheets

|

||||||||

|

June 30,

|

June 30,

|

|||||||

|

2010

|

2009

|

|||||||

|

(audited)

|

(audited)

|

|||||||

|

Assets

|

||||||||

|

Current assets

|

||||||||

|

Cash

|

$ | 115,015 | $ | 1,996 | ||||

|

Accounts receivable

|

1,091 | 49,215 | ||||||

|

Inventory

|

110,726 | - | ||||||

|

Loan receivable from affiliate

|

580 | - | ||||||

|

Deferred contract costs

|

- | 26,696 | ||||||

|

Prepaid expenses

|

2,949 | 2,000 | ||||||

|

Total current assets

|

230,361 | 79,907 | ||||||

|

Property & equipment, net of accumulated

|

||||||||

|

depreciation of $11,229 and $9,254, respectively

|

183,251 | 3,206 | ||||||

|

Intangible property, net of accumulated

|

||||||||

|

amortization of $1,329 and $906, respectively

|

6,698,895 | 212,206 | ||||||

|

Total Assets

|

$ | 7,112,507 | $ | 295,319 | ||||

|

Liabilities and Stockholders' Equity

|

||||||||

|

Current liabilities

|

||||||||

|

Accounts payable, includes $180,505 and $0 due to related parties, respectively

|

$ | 196,153 | $ | 27,835 | ||||

|

Accrued expenses

|

478,967 | 372,441 | ||||||

|

Customer deposits and deferred revenue

|

267,213 | 49,215 | ||||||

|

Notes payable

|

718,500 | 6,000 | ||||||

|

Loans and notes payable, related parties

|

7,802 | 59,050 | ||||||

|

Total current liabilities

|

1,668,635 | 514,541 | ||||||

|

Notes payable, net of current portion

|

- | - | ||||||

|

Notes payable to shareholder

|

185,704 | - | ||||||

|

Total liabilities

|

1,854,339 | 514,541 | ||||||

|

Stockholders' Equity

|

||||||||

|

Preferred Stock, 50,000,000 authorized, $.001 par value:

|

||||||||

|

Series A Convertible: 5,000,000 shares designated;

|