Attached files

| file | filename |

|---|---|

| EX-21 - Isoray, Inc. | v197619_ex21.htm |

| EX-32 - Isoray, Inc. | v197619_ex32.htm |

| EX-23.1 - Isoray, Inc. | v197619_ex23-1.htm |

| EX-31.1 - Isoray, Inc. | v197619_ex31-1.htm |

| EX-31.2 - Isoray, Inc. | v197619_ex31-2.htm |

| EX-10.61 - Isoray, Inc. | v197619_ex10-61.htm |

United

States Securities and Exchange Commission

Washington,

D.C. 20549

FORM

10-K

|

|

þ

|

Annual Report Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of

1934

|

For the

fiscal year ended June 30, 2010

or

|

|

¨

|

Transition Report Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of

1934

|

For the

transition period from __________ to ____________

Commission

File No. 001-33407

IsoRay,

Inc

(Exact

name of registrant as specified in its charter)

|

Minnesota

(State

of incorporation)

|

41-1458152

(I.R.S.

Employer Identification No.)

|

|

350 Hills St., Suite 106

Richland, Washington

(Address

of principal executive offices)

|

99354

(Zip

code)

|

Registrant's

telephone number, including area code: (509)

375-1202

Securities

registered pursuant to Section 12(b) of the Exchange Act – Common Stock – $0.001

par value

(NYSE

Amex)

Securities

registered pursuant to Section 12(g) of the Exchange Act – Series C Preferred

Share Purchase Rights

Number of shares outstanding

of each of the issuer's classes of common equity:

|

Class

|

Outstanding as of September 16,

2010

|

|

Common

stock, $0.001 par value

|

23,048,754

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90

days. Yes x No

o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes x No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated

filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

Large

accelerated filer o

Accelerated filer o

Non-accelerated filer o

Smaller

reporting company x

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Act):

Yes o No x

State the

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity was

last sold, or the average bid and asked price of such common equity, as of the

last business day of the registrant’s most recently completed second fiscal

quarter – $22,025,806 as of December 31, 2009.

Documents

incorporated by reference – none.

ISORAY,

INC.

Table

of Contents

|

Page

|

|

|

ITEM

1 – BUSINESS

|

1

|

|

ITEM

1A – RISK FACTORS

|

25

|

|

ITEM

1B – UNRESOLVED STAFF COMMENTS

|

34

|

|

ITEM

2 – PROPERTIES

|

34

|

|

ITEM

3 – LEGAL PROCEEDINGS

|

34

|

|

ITEM

4 – [REMOVED AND RESERVED]

|

34

|

|

ITEM

5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

|

35

|

|

ITEM

6 – SELECTED FINANCIAL DATA

|

37

|

|

ITEM

7 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

|

37

|

|

ITEM

7A – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK

|

48

|

|

ITEM

8 – FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

48

|

|

ITEM

9 – CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

|

49

|

|

ITEM

9A – CONTROLS AND PROCEDURES

|

49

|

|

ITEM

9B – OTHER INFORMATION

|

51

|

|

ITEM

10 – DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE

GOVERNANCE

|

51

|

|

ITEM

11 – EXECUTIVE COMPENSATION

|

55

|

|

ITEM

12 – SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

|

57

|

|

ITEM

13 – CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR

INDEPENDENCE

|

58

|

|

ITEM

14 – PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

59

|

|

ITEM

15 – EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

59

|

|

SIGNATURES

|

63

|

Caution Regarding

Forward-Looking Information

In

addition to historical information, this Form 10-K contains certain

"forward-looking statements" within the meaning of the Private Securities

Litigation Reform Act of 1995 (PSLRA). This statement is included for the

express purpose of availing IsoRay, Inc. of the protections of the safe harbor

provisions of the PSLRA.

All

statements contained in this Form 10-K, other than statements of historical

facts, that address future activities, events or developments are

forward-looking statements, including, but not limited to, statements containing

the words "believe," "expect," "anticipate," "intends," "estimate," "forecast,"

"project," and similar expressions. All statements other than statements

of historical fact are statements that could be deemed forward-looking

statements, including any statements of the plans, strategies and objectives of

management for future operations; any statements concerning proposed new

products, services, developments or industry rankings; any statements regarding

future revenue, economic conditions or performance; any statements of belief;

and any statements of assumptions underlying any of the foregoing. These

statements are based on certain assumptions and analyses made by us in light of

our experience and our assessment of historical trends, current conditions and

expected future developments as well as other factors we believe are appropriate

under the circumstances. However, whether actual results will conform to

the expectations and predictions of management is subject to a number of risks

and uncertainties described under Item 1A – Risk Factors beginning on page 25

below that may cause actual results to differ materially.

Consequently,

all of the forward-looking statements made in this Form 10-K are qualified by

these cautionary statements and there can be no assurance that the actual

results anticipated by management will be realized or, even if substantially

realized, that they will have the expected consequences to or effects on our

business operations. Readers are cautioned not to place undue reliance on

such forward-looking statements as they speak only of the Company's views as of

the date the statement was made. The Company undertakes no obligation to

publicly update or revise any forward-looking statements, whether as a result of

new information, future events or otherwise.

PART

I

As used

in this Form 10-K, unless the context requires otherwise, “we” or “us” or the

“Company” means IsoRay, Inc. and its subsidiaries.

ITEM

1 – BUSINESS

General

Century

Park Pictures Corporation (Century) was organized under Minnesota law in

1983. Century had no operations since its fiscal year ended September 30,

1999 through June 30, 2005.

On July

28, 2005, IsoRay Medical, Inc. (Medical) became a wholly-owned subsidiary of

Century pursuant to a merger. Century changed its name to IsoRay, Inc.

(IsoRay or the Company). In the merger, the Medical stockholders received

approximately 82% of the then outstanding securities of the

Company.

Medical,

a Delaware corporation, was incorporated on June 15, 2004 to develop,

manufacture and sell isotope-based medical products and devices for the

treatment of cancer and other malignant diseases. Medical is headquartered

in Richland, Washington.

IsoRay

International LLC (International), a Washington limited liability company, was

formed on November 27, 2007 and is a wholly-owned subsidiary of the

Company. International has not had any significant transactions since its

inception.

1

Available

Information

The

Company electronically files its annual reports on Form 10-K, quarterly reports

on Form 10-Q, current reports on Form 8-K, and all amendments to these reports

and other information with the Securities and Exchange Commission (SEC).

These reports can be obtained by accessing the SEC’s website at

www.sec.gov. The public can also obtain copies by visiting the SEC’s

Public Reference Room at 100 F Street NE, Washington, DC 20549 or by calling the

SEC at 1-800-SEC-0330. In addition, the Company makes copies of its annual

and quarterly reports available to the public at its website at

www.isoray.com. Information on this website is not a part of this

Report.

Business

Operations

Overview

In 2003,

IsoRay obtained clearance from the FDA for treatment for all solid tumor

applications using Cesium-131 (Cs-131). Such applications include prostate

cancer; ocular melanoma; head, neck and lung tumors; and breast, liver, brain

and pancreatic cancer. The seed may be used in surface, interstitial and

intracavity applications for tumors with known radio sensitivity.

Management believes its Cs-131 technology will allow it to become a leader in

the brachytherapy market. Management believes that the IsoRay Proxcelan

Cesium-131 brachytherapy seed represents the first major advancement in

brachytherapy technology in over 21 years with attributes that could make it the

long-term “seed of choice” for internal radiation therapy

procedures.

IsoRay

began production and sales of Proxcelan Cesium-131 brachytherapy seeds in

October 2004 for the treatment of prostate cancer after clearance of its

premarket notification (510(k)) by the Food and Drug Administration (FDA).

In December 2007, IsoRay began selling its Proxcelan Cs-131 seeds for the

treatment of ocular melanoma. In June 2009, the Company began selling its

Proxcelan Cs-131 seeds for treatment of head and neck tumors, commencing with

treatment of a tumor that could not be accessed by other treatment

modalities. During the fiscal year ended June 30, 2010, the Company

continued to expand the number of areas of the body in which the Proxcelan

Cs-131 seeds were being utilized by adding lung cancer in August 2009,

colorectal cancer in October 2009, and chest wall cancer in December 2009.

The Company is continuing to expand the use of the Proxcelan Cs-131 seed for

other cancer treatment applications using both existing delivery systems and

researching delivery systems other than those historically used by the

Company.

In August

2009, IsoRay Medical received clearance from the FDA for its premarket

notification (510(k)) for Proxcelan™ Cesium-131 brachytherapy seeds that are

preloaded into bioabsorbable braided strands. This clearance permits the product

to be commercially distributed for treatment of lung, head and neck tumors as

well as tumors in other organs. While Cs-131 brachytherapy seeds

themselves have been cleared for treatment in all organs since 2003, this 510(k)

allows Cs-131 seeds to be delivered in a convenient and sterile format that can

be implanted without additional seed loading by the facility. The 510(k)

also clears the application of braided strands onto a bioabsorbable mesh matrix

to further facilitate the implant procedure.

Brachytherapy

seeds are small devices used in an interstitial radiation procedure. The

procedure has become one of the primary treatments for prostate cancer.

The brachytherapy procedure places radioactive seeds as close as possible to (in

or near) the cancerous tumor (the word “brachytherapy” means close

therapy). The seeds deliver therapeutic radiation thereby killing the

cancerous tumor cells while minimizing exposure to adjacent healthy

tissue. This procedure allows doctors to administer a higher dose of

radiation directly to the tumor. Each seed contains a radioisotope sealed

within a welded titanium capsule. When brachytherapy is the only treatment

(monotherapy), approximately 70 to 120 seeds are permanently implanted in the

prostate in an outpatient procedure lasting less than one hour. The number

of seeds used varies based on the size of the prostate and the activity level

specified by the physician. When brachytherapy is combined with external

beam radiation or intensity modulated radiation therapy (dual therapy), then

approximately 40 to 80 seeds are used in the procedure. The isotope decays

over time and eventually the seeds become inert. The seeds may be used as

a primary treatment or in conjunction with other treatment modalities, such as

chemotherapy, or as treatment for residual disease after excision of primary

tumors. The number of seeds for other treatment sites will vary from as

few as 8 to16 to as many at 117 to 123 depending on the type of cancer, the

location of the tumor being treated and the type of therapy being

utilized.

2

Brachytherapy

Isotope Comparison

Increasingly,

prostate cancer patients and their doctors who decide to use seed brachytherapy

as a treatment option choose Cs-131 because of its significant advantages over

Palladium-103 (Pd-103) and Iodine-125 (I-125), two other isotopes currently in

use. These advantages include:

Higher

Energy

Cs-131

has a higher average energy than any other commonly used prostate brachytherapy

isotope on the market. Energy is a key factor in how uniformly the

radiation dose can be delivered throughout the prostate. This quality of a

prostate implant is known as homogeneity. Early studies demonstrate Cs-131

implants are able to deliver the required dose while maintaining homogeneity

across the gland itself and potentially reducing unnecessary dose to critical

structures such as the urethra and rectum. (Prestidge B.R., Bice W.S., Jurkovic

I., et al. Cesium-131 Permanent Prostate Brachytherapy: An Initial

Report. Int. J.

Radiation Oncology Biol. Phys. 2005: 63 (1)

5336-5337.)

Shorter

Half-Life

Cs-131

has the shortest half-life of any commonly used prostate brachytherapy isotope

at 9.7 days. Cs-131 delivers 90% of the prescribed dose in just 33 days

compared to 58 days for Pd-103 and 204 days for I-125. By far the most

commonly reported side effects of prostate brachytherapy are irritative and

obstructive symptoms in the acute phase post-implant (Neill B, et al. The Nature

and Extent of Urinary Morbidity in Relation to Prostate Brachytherapy Urethral

Dosimetry. Brachytherapy

2007:6(3)173-9.). The short half-life of Cs-131 reduces the duration of

time during which the patient experiences the irritating effects of the

radiation.

Improved Coverage of the

Prostate

Permanent

prostate brachytherapy utilizing Cs-131 seeds allows for better dose homogeneity

and sparing of the urethra and rectum while providing comparable prostate

coverage compared to I-125 or Pd-103 seeds with comparable or fewer seeds and

needles. Several studies have demonstrated dosimetric advantages of Cs-131

over the other commonly used prostate brachytherapy isotopes. (Musmacher JS, et

al. Dosimetric Comparison of Cesium-131 and Palladium-103 for Permanent Prostate

Brachytherapy. Int. J.

Radiation Oncology Biol. Phys. 2007:69(3)S730-1.) (Yaparpalvi R, et al.

Is Cs-131 or I-125 or Pd-103 the “Ideal” Isotope for Prostate Boost

Brachytherapy? A Dosimetric View Point. Int. J. Radiation Oncology Biol.

Phys. 2007:69(3)S677-8) (Sutlief S, et al. Cs-131 Prostate

Brachytherapy and Treatment Plan Parameters. Medical Physics

2007:34(6)2431.) (Yang R, et al. Dosimetric Comparison of Permanent

Prostate Brachytherapy Plans Utilizing Cs-131, I-125 and Pd-103 Seeds. Medical Physics

2008:35(6)2734.)

Rapid Resolution of Side

Effects

Studies

demonstrate that objective measures of common side-effects showed an early peak

in symptoms in the 2-week to 1-month time frame. Resolution of morbidity

resolved rapidly within 4-6 months. (Prestidge B, et. al. Clinical Outcomes of a

Phase-II, Multi-institutional Cesium-131 Permanent Prostate Brachytherapy Trial.

Brachytherapy. 2007: 6

(2)78.) (Moran B, et al. Cesium-131 Prostate Brachytherapy: An Early

Experience. Brachytherapy 2007:6(2)80.)

(Jones A, et al. IPSS Trends for Cs-131 Permanent Prostate Brachytherapy. Brachytherapy 2008:7(2)194.)

(DeFoe SG, et al. Is There Decreased Duration of Acute Urinary and Bowel

Symptoms after Prostate Brachytherapy with Cesium 131 Radioisotope? Int. J. Radiation Oncology Biol.

Phys. 2008:72(S1)S317.) More stringent studies are underway to more

fully characterize any advantage in side effect resolution experienced by

patients undergoing Cs-131 prostate brachytherapy versus brachytherapy with

other isotopes.

3

Higher Biologically

Effective Dose

Another

benefit to the short half-life of Cs-131 is what is known as the “biological

effective dose” or BED. BED is a way for health care providers to predict

how an isotope will perform against cancers exhibiting different characteristics

– for instance, slow versus fast growing tumors. Studies have shown Cs-131

is able to deliver a higher BED across a wide range of tumor types than either

I-125 or Pd-103. Although prostate cancer is typically viewed as a slow growing

cancer it can present with aggressive features. Cs-131’s higher BED may be

particularly beneficial in such situations. (Armpilia CI, et al. The

Determination of Radiobiologically Optimized Half-lives for Radionuclides Used

in Permanent Brachytherapy Implants. Int. J. Radiation Oncology Biol.

Phys. 2003; 55 (2): 378-385.)

PSA

Control

Investigators

tracking PSA in both single arm and randomized trials have concluded Cs-131’s

PSA response rates show similar early tumor control to I-125, long considered

the gold standard in permanent seed brachytherapy. Longitudinal PSA

measurements from ongoing Cs-131 clinical series demonstrate trends very similar

to those seen with other isotopes. (Moran B, et. al. Cesium-131 Prostate

Brachytherapy” An Early Experience. Brachytherapy. 2007:6(2)80.)

(Bice W, et. al. Recommendations for permanent prostate brachytherapy with

131Cs: a consensus report from the Cesium Advisory Group. Brachytherapy

2008:7(4)290-296.) (Platta CS, et al. Early Outcomes of Prostate Seed Implants

with 131Cs: Toxicity and Initial PSA Dynamics from a Single Institution. Int. J. Radiation Oncology Biol.

Phys. 2008:72(S1)S323-4.)

Industry

Information

Incidence

of Prostate Cancer

The

prostate is a walnut-sized gland located in front of the rectum and underneath

the urinary bladder. Prostate cancer is a malignant tumor that begins most

often in the periphery of the gland and, like other forms of cancer, may spread

beyond the prostate to other parts of the body. According to the American

Cancer Society, approximately one man in six will be diagnosed with prostate

cancer during his lifetime and one man in thirty-six will die of prostate

cancer. It is the most common form of cancer in men after skin cancer, and

the second leading cause of cancer deaths in men following lung and bronchus

cancers that account for 30% of deaths from cancer in men in the United

States. The American Cancer Society estimates there will be about 217,730

new cases of prostate cancer diagnosed and an estimated 32,050 deaths associated

with the disease in the United States in 2010. Because of early detection

techniques (e.g., screening for prostate specific antigen, or PSA),

approximately nine out of ten prostate cancers are found in the local and

regional stages (local means it is still confined to the prostate; regional

means it has spread from the prostate to nearby areas, but not to distant sites,

such as bone).

Prostate

cancer accounts for about 11% of cancer related deaths in men. Prostate

cancer incidence and mortality increase with age. The American Cancer

Society has reported that the incidence of prostate cancer rises rapidly after

age 50. Almost 2 of 3 prostate cancers are found in men over the age of

65.

The

American Cancer Society recommends that men be given an opportunity to make an

informed decision with their health care provider about whether to be screened

for prostate cancer. The decision should be made after getting information

about the uncertainties, risks, and potential benefits of prostate cancer

screening. Men should not be screened unless they receive this

information. In March 2010, the American Cancer Society warned that

regular testing for prostate cancer is of questionable value and can do more

harm than good.

This

discussion about screening should take place at age 50 for men who are at

average risk of prostate cancer and are expected to live at least 10 more

years.

4

This

discussion should take place starting at age 45 for men at high risk of

developing prostate cancer. This includes African American men and men who

have a first-degree relative (father, brother or son) diagnosed with prostate

cancer at an early age (younger than age 65).

This

discussion should take place at age 40 for men at even higher risk (those with

several first-degree relatives who had prostate cancer at an early

age).

After

this discussion, those men who want to be screened should be tested with the

prostate specific antigen (PSA) blood test. The digital rectal exam (DRE)

may also be done as a part of screening but is no longer

recommended.

Incidence

of Lung Cancer

An

estimated 222,520 new cases of lung cancer are expected in 2010, accounting for

15% of all cancer diagnoses in the United States. Lung cancer accounts for

the most cancer related deaths in both men and women in the United States.

An estimated 157,300 deaths, accounting for about 28% of all cancer deaths, are

expected to occur in 2010. This exceeds the combined number of deaths from

the three leading causes of cancer (breast, prostate, and colon cancers).

It also accounts for 6% of all deaths from any source in the United

States. (Cancer

Management: A Multidisciplinary Approach, 11th ed. (2008). Richard

Pazdur, Lawrence R. Coia, William J. Hoskins, Lawrence D. Wagman; American

Cancer Society, 2009.)

Cigarette

smoking is by far the most important risk factor for lung cancer. Risk

increases with quantity and duration of cigarette consumption. Cigar and

pipe smoking also increase risk. Other risk factors include occupational

or environmental exposure to secondhand smoke, radon, asbestos (particularly

among smokers), certain metals (chromium, cadmium, arsenic), some organic

chemicals, radiation, air pollution, and a history of tuberculosis.

Genetic susceptibility plays a contributing role in the development of lung

cancer, especially in those who develop the disease at a younger age.

(American Cancer Society, 2010)

The

1-year relative survival for lung cancer increased from 35% in 1975-1979 to 42%

in 2002-2005, largely due to improvements in surgical techniques and combined

therapies. However, the 5-year survival rate for all stages combined is

only 16%. The 5-year survival rate is 53% for cases detected when the

disease is still localized, but only 15% of lung cancers are diagnosed at this

early stage. (American Cancer Society, 2010)

Incidence

of Head and Neck Cancers

An estimated 49,260 new cases of head

and neck cancer are expected in 2010, including 23,880 cases of oral cavity

cancer, 12,720 cases of laryngeal cancer, and 12,660 cases of pharyngeal cancer

diagnosed in the United States. (American Cancer Society,

2010.)

Symptoms

may include a sore in the throat or mouth that bleeds easily and does not heal,

a lump or thickening, ear pain, a neck mass, coughing up blood, and a red or

white patch that persists. Difficulties in chewing, swallowing, or moving

the tongue or jaw are often late symptoms. (American Cancer Society,

2010)

Known

risk factors include all forms of smoked and smokeless tobacco products and

excessive consumption of alcohol. Many studies have reported a synergism

between smoking and alcohol use, resulting in more than a 30-fold increased risk

in individuals who both smoke and drink heavily. Human Papilloma Virus

(HPV) infection is associated with certain types of oropharyngeal cancer.

(American Cancer Society, 2010)

5

Incidence

of Ocular Melanoma

The

American Cancer Society estimates that 2,480 new cases of cancers of the eye and

orbit (primarily melanoma) will be diagnosed in 2010 and about 230 deaths from

cancer of the eye will occur in 2010 in the United States. Primary eye

cancer can occur at any age but most occur in people over 50 years of age.

(American Cancer Society, 2010)

Many

patients with eye melanoma (cancer) have no symptoms unless the cancer grows in

certain parts of the eye or becomes more advanced. Signs and symptoms of

eye melanomas can include problems with vision including blurry vision or sudden

loss of vision, floaters or flashes of light, visual field loss, a growing dark

spot on the iris, change in the size or shape of the pupil, change in position

of the eyeball within its socket, bulging of the eye, and/or change in the way

the eye moves within the socket. Known risk factors for ocular melanoma

include sun exposure, certain occupations (e.g. welders, farmers, fishermen,

chemical workers and laundry workers), race/ethnicity/eye and skin color, and

certain inherited conditions such as dysplastic nevus syndrome. (American

Cancer Society, 2010)

Incidence

of Colorectal Cancer

An

estimated 142,570 new cases of colorectal cancer are expected in the United

States in 2010, including 102,900 new cases of colon cancer and 39,670 new cases

of rectal cancer. (American Cancer Society, 2010.)

Symptoms

may include a change in bowel habits including diarrhea, constipation, or

narrowing of the stool that lasts for more than a few days, a feeling of the

need to have a bowel movement which is not relieved by doing so, rectal

bleeding, dark stools or blood in the stool, cramping or abdominal pain,

weakness and fatigue, and unintended weight loss.

Known

risk factors include age, personal history of colorectal polyps or colorectal

cancer, personal history of inflammatory bowel disease, family history of

colorectal cancer, inherited syndromes and racial and ethnic

background.

The

5-year relative survival rates for colon cancer are 74% in stage I, a range of

37% to 67% in stage II, a range of 28% to 73% in stage III and 6% in stage

IV. The 5-year relative survival rates for rectal cancer are 74% in stage

I, a range of 32% to 65% in stage II, a range of 33% to 74% in stage III and 6%

in stage IV.

Prostate

Brachytherapy

The

industry has experienced an overall decrease in the number of cases of prostate

cancer treated with brachytherapy as physicians have elected to utilize other

treatment modalities, or to defer definitive treatment to a higher degree than

historically.

Minimally

invasive brachytherapy has significant advantages over competing treatments

including lower cost, equal or better survival data, fewer side effects, faster

recovery time and the convenience of a single outpatient implant procedure that

generally lasts less than one hour (Merrick, et al., Techniques in Urology, Vol.

7, 2001; Potters, et al., Journal of Urology, May 2005; Sharkey, et al., Current

Urology Reports, 2002).

Treatment

Options and Protocol

In

addition to brachytherapy, localized prostate cancer can be treated with

prostatectomy surgery (RP for radical prostatectomy), external beam radiation

therapy (EBRT), intensity modulated radiation therapy (IMRT), dual or

combination therapy, high dose rate brachytherapy (HDR), cryosurgery, hormone

therapy, and watchful waiting. The success of any treatment is measured by

the feasibility of the procedure for the patient, morbidities associated with

the treatment, overall survival, and cost. When the cancerous tissue is

not completely eliminated, the cancer typically returns to the primary site,

often with metastases to other areas of the body.

6

Prostatectomy Surgery Options.

Historically the most common treatment option for prostate cancer,

radical prostatectomy is the removal of the prostate gland and some surrounding

tissue through an invasive surgical procedure. RP is performed under

general anesthesia and involves a hospital stay of three days on average for

patient observation and recovery. Possible side affects of RP include

impotence and incontinence. According to a study published in the Journal of the American Medical Association

in January 2000, approximately 60% of men who had a RP reported erectile

dysfunction as a result of surgery. This same study stated that

approximately 40% of the patients observed reported at least occasional

incontinence. New methods such as laparoscopic and robotic prostatectomy

surgeries are currently being used more frequently in order to minimize the

nerve damage that leads to impotence and incontinence, but these techniques

require a high degree of surgical skill. RP and laparoscopic prostatectomy

are projected to decrease approximately 31% in the U.S. from the 2004 high of

66,567 to 20,838 procedures in 2014. However, robotic surgeries are

projected to more than replace the decrease in the RP and laparoscopic

procedures (Source: iData Research Inc., 2008).

Primary External Beam Radiation

Therapy. EBRT involves directing a beam of radiation from outside

the body at the prostate gland to destroy cancerous tissue. EBRT

treatments are received on an outpatient basis five days per week usually over a

period of eight or nine weeks. Some studies have shown, however, that the

ten-year disease free survival rates with treatment through EBRT are less than

the disease free survival rates after RP or brachytherapy treatment. Side

effects of EBRT can include diarrhea, rectal leakage, irritated intestines,

frequent urination, burning while urinating, and blood in the urine. Also

the incidence of incontinence and impotence five to six years after EBRT is

comparable to that for surgery. EBRT procedures are projected to increase

slightly from 22,000 procedures in 2006 to 24,900 in 2012 (Source: Millennium

Research Group, 2008).

Intensity Modulated Radiation

Therapy. IMRT is considered a more advanced form of EBRT in which

sophisticated computer control is used to aim the beam at the prostate from

multiple different angles and to vary the intensity of the beam. Thus,

damage to normal tissue and critical structures is minimized by distributing the

unwanted radiation over a larger geometric area. This course of treatment

is similar to EBRT and requires daily doses over a period of seven to eight

weeks to deliver the total dose of radiation prescribed to kill the tumor.

Because IMRT is a new treatment, less clinical data regarding treatment

effectiveness and the incidence of side effects is available. One

advantage of IMRT, and to some extent EBRT, is the ability to treat cancers that

have begun to spread from the tumor site. An increasingly popular therapy

for patients with more advanced prostate cancer is a combination of IMRT with

seed brachytherapy, known as combination or dual therapy. IMRT in the U.S.

(including dual therapy) is projected to grow 9% per year from 31,500 procedures

in 2007 to 48,500 procedures in 2012 (Source: Millennium Research Group,

2008). IMRT is generally more expensive than other common treatment

modalities.

Dual or Combination Therapy.

Dual therapy is the combination of IMRT or 3-dimensional conformal

external beam radiation and seed brachytherapy to treat extra-prostatic

extensions or high risk prostate cancers that have grown outside the

prostate. Combination therapy treats high risk patients with a full course

of IMRT or EBRT over a period of several weeks. When this initial

treatment is completed, the patient must then wait for several more weeks to

months to have the prostate seed implant. Management estimates that at

least 30% of all prostate implants are now dual therapy cases.

High Dose Rate Temporary

Brachytherapy. HDR temporary brachytherapy involves placing very

tiny plastic catheters into the prostate gland, and then giving a series of

radiation treatments through these catheters. The catheters are then

removed, and no radioactive material is left in the prostate gland. A

computer-controlled machine inserts a single highly radioactive iridium seed

into the catheters one by one. This procedure is typically repeated at

least three times while the patient is hospitalized for at least 24 hours.

HDR is projected to grow approximately 1.3% per year from 26,200 procedures in

2007 through 2012 (Source: Millennium Research Group, 2008).

7

Cryosurgery.

Cryosurgery involves placing cold metal probes into the prostate and

freezing the tissue in order to destroy the tumor. Cryosurgery patients

typically stay in the hospital for a day or two and have had higher rates of

impotence and other side effects than those who have used seed implant

brachytherapy.

Additional Treatments.

Additional treatments include hormone therapy and chemotherapy.

Hormone therapy is generally used to shrink the tumor or make it grow more

slowly but will not eradicate the cancer. Likewise, chemotherapy will not

eradicate the cancer but can slow the tumor growth. Generally, these

treatment alternatives are used by doctors to extend patients’ lives once the

cancer has reached an advanced stage or in conjunction with other treatment

methods. Hormone therapy can cause impotence, decreased libido, and breast

enlargement. Most recently, hormone therapy has been linked to an

increased risk of cardiovascular disease in men with certain pre-existing

conditions such as heart disease or diabetes. Chemotherapy can cause

anemia, nausea, hair loss, and fatigue.

Watchful Waiting.

Watchful waiting is not a treatment but might be suggested by some

healthcare providers depending on the age and life expectancy of the

patient. Watchful waiting may be recommended if the cancer is diagnosed as

localized and slow growing, and the patient is asymptomatic. Generally,

this approach is chosen when patients are trying to avoid the side affects

associated with other treatments or when they are not candidates for current

therapies due to other health issues. Healthcare providers will carefully

monitor the patient’s PSA levels and other symptoms of prostate cancer and may

decide on active treatments at a later date.

Comparing

Cs-131 to I-125 and Pd-103 Clinical Results

Long-term

survival data is now available for brachytherapy with I-125 and Pd-103, which

support the efficacy of brachytherapy. Clinical data indicate that

brachytherapy offers success rates for early-stage prostate cancer treatment

that are equal to or better than those of RP or EBRT. While clinical

studies of brachytherapy to date have focused primarily on results from

brachytherapy with I-125 and Pd-103, management believes that these data are

also relevant for brachytherapy with Cs-131. In fact, it appears that

Cs-131 offers improved clinical outcomes over I-125 and Pd-103, given its

shorter half-life and higher energy.

Improved patient

outcomes. A number of published studies describing the use of I-125

and Pd-103 brachytherapy in the treatment of early-stage prostate cancer have

been very positive when compared to other treatment options. A recent

study of 2,963 prostate cancer patients who underwent brachytherapy as their

sole therapeutic modality at 11 institutions across the U.S. concluded that

low-risk patients (who make up the preponderance of localized cases) who

underwent adequate implants experienced rates of PSA relapse survival of greater

than 90% between eight and ten years (Zelefsky MJ, et al, “Multi-institutional

analysis of long-term outcome for stages T1-T2 prostate cancer treated with

permanent seed implantation” International Journal of Radiation

Oncology Biology Physics, Volume 67, Issue 2, 2007,

327-333).

Other

recent studies have demonstrated similar, durably high rates of control

following brachytherapy for localized prostate cancer out to 15 years

post-treatment (Sylvester J, et al. “15-year biochemical relapse free survival

in clinical stage T1-T3 prostate cancer following combined external beam

radiotherapy and brachytherapy; Seattle experience”, International Journal of Radiation

Oncology Biology Physics, Vol. 67, Issue 1, 2007, 57-64). The

cumulative effect of these series has been the conclusion by leaders in the

field that brachytherapy offers a disease control rate as high as surgery,

though with a lesser side-effect profile than surgery (Ciezki JP.

“Prostate brachytherapy for localized prostate cancer” Current Treatment Options in

Oncology, Volume 6, 2005, 389-393).

8

Reduced Incidence of Side

Effects. Sexual impotence and urinary incontinence are two major

concerns men face when choosing among various forms of treatment for prostate

cancer. Studies have shown that brachytherapy with existing sources

results in lower rates of impotence and incontinence than surgery (Buron C, et al.

“Brachytherapy versus prostatectomy in localized prostate cancer: results of a

French multicenter prospective medico-economic study”. International

Journal of Radiation Oncology, Biology, Physics, Volume 67, 2007,

812-822). Combined with the high disease control rates described in many

studies, these findings have driven the adoption of brachytherapy as a

front-line therapy for localized prostate cancer.

It has

been noted, however, that a significant proportion of patients who undergo I-125

or Pd-103 brachytherapy experience acute urinary irritative symptoms following

treatment – in fact more so than with surgery or external beam radiation therapy

(Frank SJ, et al, “An assessment of quality of life following radical

prostatectomy, high dose external beam radiation therapy, and brachytherapy

iodine implantation as monotherapies for localized prostate cancer” Journal of Urology, Volume

177, 2007, 2151-2156). It has been postulated that Cs-131, with the

shortest available half-life for a low-dose rate therapy isotope, will result in

a quicker resolution of these irritative symptoms based on the shorter time

interval over which normal tissue receives radiation from the implanted

sources.

Preliminary

data drawn from several clinical studies suggest that patients treated with

Cs-131 do in fact experience a faster resolution of these side effects in

comparison to similar studies published for other isotopes (Defoe SG, et al, “Is

there a decreased duration of acute urinary and bowel symptoms after prostate

brachytherapy with Cesium 131 isotope?", International Journal of Radiation

Oncology Biology Physics, Volume 72 (Supplement 1), S317; Jones A, et al,

"IPSS Trends for Cs-131 Permanent Prostate Brachytherapy" Brachytherapy, Volume 7,

Issue 2, 194; Platta CS, et al, “Early Outcomes of Prostate Seed Implants with

131Cs: Toxicity and Initial PSA Dynamics from a Single Institution" International Journal of Radiation

Oncology Biology Physics, Volume 72 (Supplement 1), 2008,

S323-4).

A Cs-131

monotherapy trial for the treatment of prostate cancer was fully enrolled in

February 2007. The trial was a 100 patient multi-institutional study that

sought to (1) document the dosimetric characteristics of Cs-131, (2) to

summarize the side effect profile of Cs-131 treatment, and (3) to track

biochemical (PSA) results in patients following Cs-131

therapy.

The

investigators responsible for conducting the study have concluded based on the

results of the monotherapy trial that Cs-131 is a viable alternative as an

isotope for permanent seed prostate brachytherapy (Prestidge BR, Bice WS,

“Clinical outcomes of a Phase II, multi-institutional Cesium-131 permanent

prostate brachytherapy trial”. Brachytherapy, Volume 6,

Issue 2, April-June 2007, Page 78).

Some of

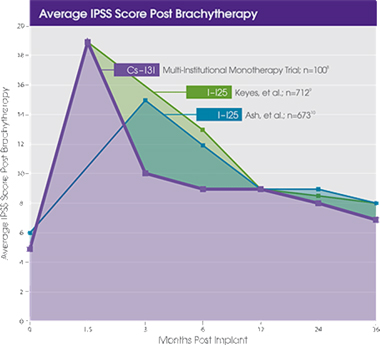

the significant and specific findings were as follows:

|

|

§

|

Patient

reported irritative urinary symptoms (IPSS Scores) were mild to moderate

with relatively rapid resolution within 4-6 months. The figure below

depicts the symptom scores in the Cs-131 study as compared to published

reports of patients who underwent I-125 brachytherapy. Especially

notable is the steep drop in the Cs-131 group scores (purple line) as

opposed to the more gradual drop in the I-125 group scores (green and blue

lines).

|

9

|

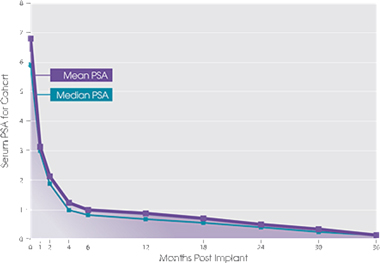

|

§

|

Prostate

Specific Antigen, or PSA, response over 36 months has been very

encouraging to date with similar tumor control rates to that of

I-125. (Prestidge BR, Bice WS, “Clinical outcomes of a Phase II,

multi-institutional Cesium-131 permanent prostate brachytherapy trial”.

Brachytherapy, Volume 6, Issue

2, April-June 2007, Page 78). The graph below depicts the

median PSAs to date from the 100 patient Cs-131 brachytherapy series as

compared to previously published I-125 series. There have been no

PSA failures in the Cs-131 monotherapy study to date. (A PSA failure

is a rise in the blood level of PSA in prostate cancer patients after

treatment with radiation or

surgery.)

|

|

|

§

|

Gland

coverage was excellent and the dose delivered to critical structures

outside the prostate was well within acceptable limits. (Bice WS,

Prestidge BR, “Cesium-131 permanent prostate brachytherapy: The dosimetric

analysis of a multi-institutional Phase II trial”. Brachytherapy 2007(6);

88-89.).

|

10

Several

other series have been reported that have compared dosimetric parameters

(indicators of dose) among Cs-131, Pd-103, and I-125. These comparative

studies have shown a clear advantage to Cesium-131 from a dosimetric

point-of-view, in terms of successful gland coverage obtained (typically

measured by D90) while keeping unnecessary gland over-dosing (typically measured

by V150 or V200) to a minimum (Musmacher JS, et al, "Dosimetric Comparison of

Cesium-131 and Palladium-103 for Permanent Prostate Brachytherapy" International Journal of Radiation

Oncology Biology Physics, Volume 69, (Supplement 3), 2007, S730-1;

Yaparpalvi R, et al, "Is Cs-131 or I-125 or Pd-103 the Ideal Isotope for

Prostate Boost Brachytherapy? A Dosimetric View Point." International Journal of Radiation

Oncology Biology Physics, Volume 69 (Supplement 3), 2007, S677-8; Sutlief

S and Wallner K, "Cs-131 Prostate Brachytherapy and Treatment Plan

Parameters." Medical

Physics, Volume 34, 2007, 2431; Kurtzman S, "Dosimetric Evaluation of

Permanent Prostate Brachytherapy Using Cs-131 Sources" International Journal of Radiation

Oncology Biology Physics, Volume 66 (Supplement 3),

S395).

The

monotherapy Cs-131 trial will continue to follow patients with annual updates on

symptoms and patient long-term survival data. The Company anticipates

maintaining this ongoing monitoring over several years to prove the long-term

effectiveness of Cs-131.

The

prospective randomized monotherapy trial headed by Dr. Brian Moran of The

Chicago Prostate Cancer Center directly compared Cs-131 to I-125 PSA response

and treatment related morbidities following brachytherapy for localized

carcinoma of the prostate in low to intermediate risk patients. Dr. Moran

concluded that prostate brachytherapy with Cs-131 is effective and

well-tolerated; both PSA response and the acute morbidity profile were very

encouraging. Dr. Moran will continue to track these patients in order to

collect long-term outcomes.

The

Cs-131 Advisory Group’s (CAG) article entitled “Recommendations for permanent

prostate brachytherapy with 131Cs: a

consensus report from the Cesium Advisory Group” was published in Brachytherapy in the fourth

quarter of calendar year 2008. The CAG is sponsored by the Company.

The objective of the article was to provide consensus

recommendations for Cs-131 prostate brachytherapy based on experience to date

for physicians still unfamiliar with Cs-131. These recommendations are

based on three clinical trials in which one of the trials has completed the

patient accrual, published in the peer reviewed literature, and the combined CAG

experience of more than 1,200 Cs-131 implants. The recommendations from

the group are designed to aid practitioners in the safe and effective delivery

of Cs-131 prostate brachytherapy.

The

Company has also commissioned a dual therapy protocol. This

multi-institutional trial observes the dosimetric characteristics of Cs-131 and

health related quality of life (HRQOL) results following combined Cs-131

transperineal permanent prostate brachytherapy and external beam radiotherapy in

patients with intermediate to high risk prostate cancer. This protocol is

being conducted to confirm clinically what radiobiological data suggests

regarding this treatment modality. The quantified dosimetric variables

collected will be correlated to the reported HRQOL data and ultimately compared

to existing data in the literature for similar investigations using I-125 and

Pd-103. Patient enrollment for this study began in April 2007 and during

the year ended June 30, 2010 enrollment to the study was closed.

In

addition to establishing the dosimetric and quality of life impact of Proxcelan

Cesium-131 brachytherapy seeds in different treatment modalities, all trials

have been designed to collect ongoing PSA results for the purposes of

establishing long-term survival rates using Cs-131 seed implant

brachytherapy.

Lung

Cancer Treatment Options

Lung

cancer has historically been treated utilizing surgery, radiation therapy, other

local treatments, chemotherapy and targeted therapy. Surgery generally

involves removing a portion of the lung (lobectomy, segmentectomy, wedge

resection) or the entire lung (pneumonectomy). Chemotherapy may be used

either as a primary treatment or a secondary treatment depending on the type and

stage of the lung cancer. Standard external beam radiation therapy is

sometimes used as the primary treatment if the tumor cannot be removed by

surgery due to the tumor’s location or the patient’s health however this is now

used less often as it is being replaced with newer EBRT techniques such as

3D-CRT, IMRT and stereotactic radiation therapy. (American Cancer Society,

2010)

11

Brachytherapy

is now being used in conjunction with surgery to kill small areas of cancer that

might be missed during surgery. The Company believes that Cs-131, with its

shorter half-life and high energy, is better suited for treating lung cancer

than either I-125 or Pd-103. The bioabsorbable mesh used in this procedure

to apply the Proxcelan Cs-131 brachytherapy seeds generally dissolves after

about 45 days. Cs-131 delivers 90% of its dose in 33 days and is therefore

well-suited to use with bioabsorbable mesh.

Head

and Neck Cancer Treatment Options

Most head

and neck cancers have historically been treated with some combination of surgery

including tumor resection, Mohs micrographic surgery, full or partial mandible

(jaw bone) resection, maxillectomy, laryngectomy, neck dissection, pedicle or

free flap reconstruction, tracheostomy, gastrostomy tube or dental extraction

and implants; chemotherapy and radiation therapy including external beam

radiation therapy (EBRT), accelerated and hyperfractionated radiation therapy,

three-dimensional conformal radiation therapy (3D-CRT) and intensity modulated

radiation therapy (IMRT), and brachytherapy (both high-dose rate (HDR) and

low-dose rate (LDR)).

Surgery

is the most common option. Chemotherapy is often used in conjunction with

surgery or radiation therapy depending on the type and stage of the

cancer. External beam radiation therapy and brachytherapy have been used

together or in combination with surgery or chemotherapy

Management

believes Proxcelan Cs-131 represents an improved approach to brachytherapy

treatment of head and neck cancers.

Ocular

Melanoma Treatment Options

In

addition to brachytherapy to treat ocular melanoma, other treatment options

include surgery, external beam radiation, and laser therapy. Surgery could

include removal of part of the iris, a portion of the outer eyeball, or the

removal of the entire eyeball, and is used less often than in the past as the

use of radiation therapy has grown. External beam radiation (including

conformal proton beam radiation therapy and stereotactic radiosurgery) involves

sending radiation from a source outside the body that is focused on the cancer

but has not been as widely used to date for ocular melanoma. Laser

therapy, rarely used now to treat ocular melanoma, burns the cancerous tissue by

using a highly focused, high-energy light beam. Laser therapy can be

effective for very small melanomas but it is more often used to treat side

effects from radiation. (American Cancer Society, 2010)

Brachytherapy

has become the most commonly used radiation treatment for most eye

melanomas. Brachytherapy using Cs-131, I-125, or Pd-103 is done by placing

the seeds in a plaque (shaped like a small cap) that is attached to the eyeball

with minute stitches for 4 to 5 days. The patient generally stays in the

hospital until the plaque is removed from the eye. Brachytherapy cures

approximately 9 out of 10 small tumors and can preserve the vision of some

patients. (American Cancer Society, 2010)

Colorectal

Treatment Options

Colorectal

cancer has historically been treated using surgery, radiation therapy,

chemotherapy and other targeted therapies. Depending on the stage of the

cancer, two or more of these types of treatment may be combined at the same time

or used after one another. (American Cancer Society, 2010)

For the

treatment of early stage colon and rectal cancers, surgery is often the main

treatment. Colorectal surgeries include open colectomy,

laparoscopic-assisted colectomy, and polypectomy and local excision.

Rectal surgeries include polypectomy and local excision, local transanal

resection, transanal endoscopic microsurgery (TEM), lower anterior resection,

proctectomy with coloanal anastomosis, abdominoperineal resection and

pelvic exenteration. (American Cancer Society, 2010)

12

For the

treatment of colorectal cancers beyond early stage, other surgery treatments

(radiofrequency ablation, ethanol ablation, cryosurgery and hepatic artery

embolization), radiation therapy (external beam radiation, endocavitary

radiation, brachytherapy, yttrium-90 microsphere radioembolization),

chemotherapy, and targeted therapies (Avastin, Erbitux, Vectibix) can be used.

(American Cancer Society, 2010)

Low-dose

rate (LDR) brachytherapy including Proxcelan Cesium-131 is typically utilized in

treating individuals with rectal cancer who are not healthy enough to tolerate

curative surgery. This is generally a one-time only procedure and does not

require ongoing visits for several weeks as is common with other types of

radiation therapy such as external-beam radiation therapy and endocavitary

radiation therapy. Management believes that the advantages provided by

Cesium-131 shown through the treatment of other cancers will benefit patients

utilizing Proxcelan Cesium -131 brachytherapy seeds in the treatment of their

colorectal cancers with low-dose rate brachytherapy.

Our

Strategy

The key

elements of IsoRay’s strategy for fiscal year 2011 include:

|

|

§

|

Support clinical research and

sustained product development. The Company plans to structure

and support clinical studies on the therapeutic benefits of Cs-131 for the

treatment of solid tumors and other patient benefits. We are and

will continue to support clinical studies with several leading radiation

oncologists to clinically document patient outcomes, provide support for

our product claims, and compare the performance of our seeds to competing

seeds. IsoRay plans to sustain long-term growth by implementing

research and development programs with leading medical institutions in the

U.S. and other countries to identify and develop other applications for

IsoRay’s core radioisotope

technology.

|

Management

plans to continue to build on an increasing number of studies related to Cs-131

therapy in the management of cancer that were published in the medical

literature and presented at relevant oncology society meetings in 2010.

The publication and presentation of speculative and real-world data contribute

to the acceptability of Cs-131 in the oncologic marketplace, and discussion in

the medico-scientific community of established and novel Cs-131 applications is

considered a prerequisite to expansion into untapped markets.

In

calendar year 2010, eight presentations were made at the American Brachytherapy

Society describing Cs-131 treatment of prostate, lung, and breast cancer.

Five publications were abstracted to the MEDLINE database of citations of the

medical literature that reported patients treated with Cs-131 for prostate

cancer. Five additional publications mentioned Cs-131 as an accepted

treatment for prostate cancer, and two publications specifically discussed the

physics and dosimetric profile of Cs-131 for the treatment of prostate and eye

cancers.

|

|

§

|

Continue to introduce the

Proxcelan Cs-131 brachytherapy seed into the U.S. market for prostate

cancer. Utilizing our direct sales organization, IsoRay

intends to continue to seek to increase the number of centers making the

use of Proxcelan Cs-131 seeds available to their patients in brachytherapy

procedures for prostate cancer and by increasing the number of patients

being treated at current centers using the Proxcelan Cs-131 seeds.

IsoRay hopes to capture much of the incremental market growth if and when

seed implant brachytherapy recovers market share from other treatments and

to take market share from existing

competitors.

|

|

|

§

|

Increase utilization of Cs-131

in treatment of other solid tumor applications such as head and neck,

lung, chest wall, and colorectal cancers. IsoRay Medical has

clearance from the FDA for its premarket notification, (510(k)) for

Proxcelan™ brachytherapy seeds that are preloaded into bioabsorbable

braided strands. This order cleared the product for commercial

distribution for treatment of lung and head and neck tumors as well as

tumors in other organs. IsoRay will continue to explore licenses or

joint ventures with other companies to develop the appropriate

technologies and therapeutic delivery systems for treatment of other solid

tumors such as breast, liver, pancreas, and brain

cancers.

|

13

|

|

§

|

Return GliaSite® radiation

therapy system to market in the United States and European Union (EU).

In June of 2010, the Company acquired exclusive worldwide

distribution rights to the GliaSite® radiation therapy system, the only

FDA-cleared balloon catheter device used in the treatment of brain cancer

from Hologic, Inc. The product possesses an established

reimbursement rate for both in-patient and out-patient settings. The

Company intends to return the product to market in a configuration

equivalent to the original FDA-cleared device. The Company is

working to obtain the rights to license or acquire the Iotrex solution

(Iodine -125) manufactured for use in the GliaSite® radiation therapy

system. The Company has developed a liquid Cesium-131

solution for use in the GliaSite® radiation therapy system as either a

substitute for the Iotrex or as an alternative treatment option for

physicians to utilize in the

system.

|

|

|

§

|

Continue to develop data on

Cs-131 for treatment of ocular melanoma. The Company’s

first sale for ocular melanoma occurred in late 2007 and periodic sales

have occurred since then. IsoRay is sponsoring a prospective review

of the patients treated with Cs-131 to date. This clinical data will

be presented at the November 2010 annual meeting of the American Society

for Therapeutic Radiology and Oncology (ASTRO). Although the ocular

melanoma market is not a large one, this application of Cs-131 continues

to demonstrate the potential viability for other solid

tumors.

|

|

|

·

|

Introduce Proxcelan Cesium-131

brachytherapy seeds to the Canadian and European Union (EU)

markets. Health Canada’s Therapeutic Products Directorate has

approved IsoRay’s Class 3 Medical Device License Applications for Model

CS-1 Proxcelan ™ (Cesium-131) brachytherapy seeds and the Proxcelan™

Sterile Implant Devices containing Model CS-1 Seeds. This allows

IsoRay to market its brachytherapy seeds and related preloaded

brachytherapy seeds throughout Canada. In November 2009, the Company

entered into a distribution agreement with Inter V Medical of Montreal,

Quebec, Canada for exclusive rights to sell the Proxcelan Cs-131

brachytherapy seed in Canada. Approval to market Cesium-131 seeds in

Russia was also obtained in 2009; and the Company has an exclusive

distribution agreement in place with a Russian distributor, UralDial LLC,

to distribute Proxcelan Cs-131 brachytherapy seeds in Russia, however, the

economic downturn in Russia has slowed the Company’s market penetration

efforts. The Company is focusing on the Canadian and European Union

(EU) markets until the Russian market

recovers.

|

|

|

§

|

Maintain ISO 13485

certification. In August 2008, the Company obtained its ISO

13485 certification. This was an important step to allow the Company

to register and eventually sell its Proxcelan Cs-131 brachytherapy seeds

in Canada, the European Union (EU) and Russia. The Company completed

its registrations of Proxcelan Cs-131 brachytherapy seeds in Canada and

Russia during fiscal year 2009.

|

Products

IsoRay

markets the Proxcelan Cs-131 brachytherapy

seed for the treatment of prostate cancer, lung cancer, ocular melanomas, head

and neck cancers, and colorectal cancer. The Company intends to market

Cs-131 for the treatment of other malignant disease, such as brain and

gynecological cancers, in the near future through the use of existing proven

technologies that have received FDA-clearance. The strategy of utilizing

existing FDA-cleared technologies intends to reduce the time and cost required

to develop new applications of Cs-131 and deliver them to market.

Competitive

Advantages of Proxcelan Cs-131

Management

believes that the Proxcelan Cesium-131 brachytherapy seed has specific clinical

advantages for treating cancer over I-125 and Pd-103, the other isotopes

currently used in brachytherapy seeds. The table below highlights the key

differences of the three seeds. The Company believes that the short

half-life, high-energy characteristics of Cs-131 will increase industry growth

and facilitate meaningful penetration into the treatment of other forms of

cancer such as lung cancer.

14

|

Isotope

Delivery Over Time

|

||||

|

Isotope

|

Half-Life

|

Energy

|

90%

Dose

|

Total

Dose

|

|

Cs-131

|

9.7

days

|

30.4

KeV

|

33

days

|

115

Gy

|

|

Pd-103

|

17

days

|

20.8

KeV

|

58

days

|

125

Gy

|

|

I-125

|

60

days

|

28.5

KeV

|

204

days

|

145

Gy

|

Cs-131

Manufacturing Process and Suppliers

Product Overview. Cs-131 is a

radioactive isotope that can be produced by the neutron bombardment of

Barium-130 (Ba-130). When placed into a nuclear reactor and exposed to a

flux of neutrons, Ba-130 becomes Ba-131, the radioactive material that is the

parent isotope of Cs-131. The radioactive isotope Cs-131 is normally

produced by placing a quantity of stable non-radioactive barium (ideally barium

enriched in isotope Ba-130) into the neutron flux of a nuclear reactor.

The irradiation process converts a small fraction of this material into a

radioactive form of barium (Ba-131). The Ba-131 decays by electron capture

to the radioactive isotope of interest (Cs-131).

To

produce the Proxcelan seed, the purified Cs-131 isotope is adsorbed onto a

ceramic core containing a gold X-ray marker. This internal core assembly is

subsequently inserted into a titanium capsule that is then welded shut and

becomes a sealed radioactive source and a biocompatible medical device. The

dimensional tolerances for the ceramic core, gold X-ray marker, and the titanium

capsule are extremely important. To date the Company has used sole-source

providers for certain components such as the gold X-ray marker and the titanium

capsule as these suppliers have been validated by our quality department and

they have been cost effective.

Isotope Suppliers. Due

to the short half-life of both the Ba-131 and Cs-131 isotopes, potential

suppliers must be capable of removing irradiated materials from the reactor core

on a routine basis for subsequent processing to produce ultra-pure Cs-131.

In addition, the supplier’s nuclear reactor facility must have sufficient

irradiation capacity to accommodate barium targets and the nuclear reactors must

have sufficient neutron flux to economically produce commercially viable

quantities of Cs-131. Ideally, the irradiation facility will also have a

radiochemical separation infrastructure to carry out the initial separation

steps. The Company has identified key reactor facilities in the U.S. and

Russia that are capable of meeting these requirements. In order to manage

the Russian supply more effectively IsoRay entered into a second agreement with

UralDial, LLC (a Russian LLC) on November 30, 2009 to provide Cs-131 isotope

from Russia to the Company’s facility in Richland, WA through December 31,

2010. UralDial obtains Cs-131 from two suppliers. The Company also

continues to receive irradiated barium from the MURR reactor located in the

United States. For the fiscal year ended June 30, 2010, approximately

sixty-eight percent (68%) of our Cs-131 was supplied by one of two Russian

supply sources and thirty-two percent (32%) from domestic sources.

The

Company plans to expand Cs-131 manufacturing capability at the MURR reactor but

will continue to obtain Cs-131 from multiple suppliers. Failure to obtain

deliveries of Cs-131 from at least one of its Russian suppliers could have a

material adverse effect on seed production. Management believes it will

continue to rely solely on its existing suppliers in the near future, however,

shutdowns from these suppliers could cause delays in deliveries and

production.

Quality Controls. We

have established procedures and controls to comply with the FDA’s Quality System

Regulation. The Company constantly monitors these procedures and controls

to ensure that they are operating properly, thereby working to maintain a

high-quality product. Also, the quality, production, and customer service

departments maintain open communications to ensure that all regulatory

requirements for the FDA, DOT, and applicable nuclear radiation and health

authorities are fulfilled.

15

In July

2008, IsoRay had its baseline inspection by the FDA at its manufacturing and

administrative offices in Richland, WA. This inspection was carried out

over a five day period of time during which the investigator performed a

complete inspection following Quality Systems Inspection Techniques

(QSIT). At the end of the inspection, no report of deviations from Good

Manufacturing Practices or list of observations (form FDA 483) was issued to

IsoRay.

Order Processing. The

Company has implemented a just-in-time production process that is responsive to

customer input and orders to ensure that individual customers receive a higher

level of customer service than received from our competitors who have the luxury

of longer lead times due to longer half-life products. Time from order

confirmation to completion of product manufacture is reduced to several working

days, including receipt of irradiated barium (from the domestic supplier’s

reactor) or unpurified Cs-131 (from the international supplier’s reactor),

separation and purification of Cs-131, isotope labeling of the core, loading of

cores into pre-welded titanium “cans” for final welding, testing, quality

assurance and shipping.

It is up

to each physician to determine the dosage necessary for implants and acceptable

dosages vary among physicians. Many of the physicians who order our seeds

order more seeds than necessary to assure themselves that they have a sufficient

quantity. Upon receipt of an order, the Company either delivers the seeds

from its facility directly to the physician in either loose or preloaded form or

sends the order to an independent preloading service that delivers the seeds

preloaded into needles or cartridges just prior to implant. If the implant

is postponed or rescheduled, the short half-life of the seeds makes them

unsuitable for use and therefore they must be re-ordered.

Due to

the lead time for obtaining and processing the Cs-131 isotope and the short

half-life, the Company relies on sales forecasts and historical knowledge to

estimate the proper inventory levels of isotope needed to fulfill all customer

orders. Consequently, some portion of the isotope is lost through decay

and is not used in an end product. Management continues to reduce the

variances between ordered isotope and isotope deliveries and is continually

improving its ordering process efficiencies.

Automated

Manufacturing Process

In fiscal

2010, IsoRay pursued further automation identified by management to reduce cost

and increase radiation safety while allowing an expansion of product loading

configurations. The Company will continue to evaluate and implement

automation in the future that supports process improvement, employee safety and

resource management. The Company continues to contract with a third party

to outsource certain sub-processes where cost effective.

Manufacturing

Facility

The

Company maintains a production facility located at Applied Process Engineering

Laboratory (APEL). The APEL facility became operational in September

2007. The production facility has over 15,000 square feet and includes

space for isotope separation, seed production, order dispensing, a clean room

for radiopharmacy work, and a dedicated shipping area. A description of

the lease terms for the APEL facility is located in the Other Commitments and

Contingencies section of Item 7 below. Management believes that the APEL

facility will be utilized for manufacturing space through fiscal year 2016 which

is the original lease term plus the two three-year renewal options.

Management has exercised the first of two three-year renewal options to extend

the APEL facility lease through April 2013 and it believes that the Company will

exercise the second three-year renewal option through April 2016.

Management

no longer believes that the shuttle system at Idaho's Advanced Test Reactor

(ATR) will provide the conditions necessary for Cs-131 production. The

facility's capacity is fully allocated to the Navy and management believes it

would be difficult to have IsoRay's commercial operations at the same facility

as these military operations, even if the shuttle was certified for use in

IsoRay operations, which has not occurred.

16

Repackaging

Services

Most

brachytherapy manufacturers offer their seed product to the end user packaged in

five principal configurations provided in a sterile or non-sterile package

depending on the customer’s preference. These include:

|

|

§

|

Loose

seeds

|

|

|

§

|

Pre-loaded needles

(loaded typically with three to five seeds and

spacers)

|

|

|

§

|

Pre-loaded Mick

cartridges (fits the Mick

applicator)

|

|

|

§

|

Strands of seeds

(consists of seeds and spacers in a biocompatible “shrink

wrap”)

|

|

|

§

|

Preloaded Strands

(strands loaded into the

needle)

|

In fiscal

year 2010, the Company delivered approximately 67% of its Proxcelan seeds to

customers configured in Mick cartridges, approximately 31% of the Proxcelan seed

configured in stranded forms and the remaining 2% in a loose form.

The role

of the preloading service is to package, assay and certify the contents of the

final product configuration shipped to the customer. A commonly used

method of providing this service is through independent radiopharmacies.

Manufacturers send loose seeds along with the physician's instructions to

the radiopharmacy which, in turn, loads needles and/or strands the seeds

according to the doctor's instructions. These radiopharmacies then

sterilize the product and certify the final packaging prior to shipping directly

to the end user.

IsoRay

currently has agreements with several independent radiopharmacies to assay,

preload, and sterilize loose seeds. Shipping to independent pharmacies

creates additional loss of our isotope through decay. While the Company

pre-loads many of its current orders, we have continued to utilize loading

services to supplement our own custom preloading operation and to meet the

requests of the ordering physicians.

We

currently load approximately 96% of Mick cartridges in our own facility which in

fiscal year 2010 accounted for approximately 67% of seeds sold. The

remaining approximately 33% of seeds sold are strand configurations including

preloaded strands. Although the Company performs in-house analytical

services to eliminate loss in isotope activity due to radioactive decay, the

Company utilizes independent radiopharmacies to back up its own preloading

operation, handle periodic increases in demand and cater to certain doctors’

preferences.

Independent

radiopharmacies traditionally provide the final packaging of the product

delivered to the end user thereby eliminating the opportunity for

reinforcing the "branding" of our seed product. By providing our own

repackaging service, we are able to preserve the product branding

opportunity and eliminate any concerns related to the handling of our product by

a third party prior to receipt by the end user.

Providing

custom packaging configurations enhances our product while providing an

additional revenue stream and incremental margins to the Company through

pricing premiums charged to our customers. The end users of these

packaging options are willing to pay a premium because of the savings they

realize by eliminating the need for loose seed handling and

loading requirements on-site, eliminating the need for additional staffing

to sterilize seeds and needles, and eliminating the expense of additional

assaying of the seeds.

With

clearance from the FDA for preloading flexible braided strands and bioabsorbable

mesh, IsoRay became the second company in the industry that has 510(k) clearance

to preload both the strands and the mesh. This allows IsoRay to reduce

loading costs by providing them directly to our customers.

17

Marketing

and Sales

Marketing

Strategy

The