Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

COMMISSION FILE NO.: 0-53905

Date of Report: September 24, 2010

|

SABRE INDUSTRIAL, INC.

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

Delaware

|

65-1714523

|

|

(State of other jurisdiction of

|

(IRS Employer

|

|

incorporation or organization

|

Identification No.)

|

|

Lincan Industrial Park, Linyi County, Shandong Province, P.R. China

|

251500

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

86-534-5054799

|

|

|

(Registrant’s telephone number including area code)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

□ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

□ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

□ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

□ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

|

|

Item 2.01

|

Completion of Acquisition of Assets

|

|

|

Item 3.02

|

Unregistered Sale of Equity Securities

|

|

|

Item 5.02

|

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

|

|

Item 5.06

|

Change in Shell Company Status

|

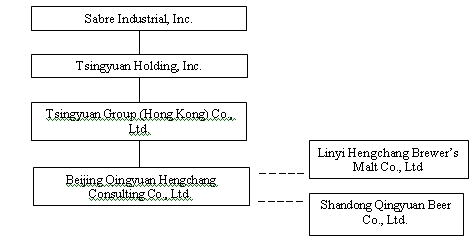

On September 24, 2010, in a transaction hereafter referred to as the “Share Exchange,” Sabre Industrial, Inc. (“Sabre Industrial”) acquired all of the outstanding capital stock of Tsingyuan Holding Inc. (“Tsingyuan Holding”), a Delaware corporation. Tsingyuan Holding is a holding company that owns 100% of the capital stock of Tsingyuan Group (Hong Kong) Co., Ltd. (“Tsingyuan HK”), which in turn owns all of the registered capital of Beijing Qingyuan Hengchang Consulting Co., Ltd. (“Beijing Qingyuan”), a wholly foreign owned enterprise (“WFOE”) organized under the laws of the People’s Republic of China. Beijing Qingyuan has control over the business of Linyi Hengchang Brewer’s Malt Co., Ltd. (“Linyi Hengchang Malt”) and over the business of Shandong Qingyuan Beer Co., Ltd. (“Shandong Qingyuan Beer”), both of which are limited liability companies organized under the laws of The People’s Republic of China. Linyi Hengchang Malt is engaged in the manufacture and distribution of brewer’s malt. Shandong Qingyuan Beer brews and distributes beer throughout northern and eastern China. Linyi Hengchang Malt owns 66.8% of Shandong Qingyuan Beer; the remaining 33.2% is owned by shareholders of Linyi Hengchang Malt.

The control that Beijing Qingyuan has over Linyi Hengchang Malt and Shandong Qingyuan Beer is generally identified as an “entrusted management” business arrangement. Linyi Hengchang Malt and Shandong Qingyuan Beer are commonly referred to as variable interest entities (or VIE’s) with respect to Beijing Qingyuan. The aforementioned entrusted management arrangement is a result of entrusted management agreements, whereby all economic benefits and risks arising from the operations of Linyi Hengchang Malt and Shandong Qingyuan Beer are transferred to Beijing Qingyuan. Details of the VIE Agreements are set out below in the “Entrusted Management Agreements” caption.

Prior to the Share Exchange, Zhang Dingyou owned 60 million shares of Sabre Industrial common stock, representing 99% of the then outstanding shares. He was also the sole member of Sabre Industrial’s Board of Directors, as well as Chairman of Beijing Qingyuan, Linyi Hengchang Malt and Shandong Qingyuan Beer. In exchange for the outstanding shares of Tsingyuan Holding, Sabre Industrial issued 65,107,671 shares of its common stock (the “Exchange Shares”) to the shareholders of Tsingyuan Holding (the “Share Exchange”). The Exchange Shares represent 51.8% of the outstanding shares of Sabre Industrial. The greater portion of the Exchange Shares were issued to Zhang Dingyou, who immediately assigned most of them to 173 other shareholders for whom he served as nominee, thus reducing his own interest in Sabre Industrial (including shares previously owned) to 71,373,301 shares (56.8% of the outstanding).

Immediately after the acquisition of Tsingyuan Holding, Zhang Dingyou, the sole director of Sabre Industrial, elected Zhang Dingfu, his brother, and Yuan Mingxia to serve as members of the Board of Directors. Mr. Zhang then resigned from his position as Chief Financial Officer of Sabre Industrial, and the Board elected a replacement as well as other officers, who are identified below.

New Management

The executive officers and directors of Sabre Industrial, Inc. are:

|

Name

|

Age

|

Positions with the Company

|

|

Zhang Dingyou

|

43

|

Chairman, Chief Executive Officer

|

|

Zhang Dingfu

|

56

|

Director, Chief Operations Officer

|

|

Yuan Mingxia

|

Director, Chief Financial Officer

|

All directors hold office until the next annual meeting of our shareholders and until their successors have been elected and qualify. Officers serve at the pleasure of the Board of Directors.

Zhang Dingyou. In 2004 Mr. Zhang organized Linyi Hengchang Malt, where he has since been employed as Legal Representative and Chief Executive Officer. Mr. Zhang also fills those roles for Shandong Qingyuan Beer, a subsidiary organized by Linyi Hengchang Malt in 2005. In 2000 Mr. Zhang organized the Linyi Hengchang Industrial and Trading Co., Limited, which became the highest earning company in the Linyi Hengchang Industrial District. Previously Mr. Zhang was employed for eight years as General Manager of Shandong Xinwen Mineral Bureau. Mr. Zhang is a member of the Linyi County Standing Committee of the Dezhou Business Committee. Mr. Zhang has a law degree from the Shandong Governmental Law School and attended executive training programs at Tsinghua University School of Business, Beijing. Zhang Dingyou is the brother of Zhang Dingfu, a member of our Board of Directors.

Zhang Dingfu. Mr. Zhang has been employed by Linyi Hengchang Malt as Manager since it was organized in 2004. From 2001 to 2004 Mr. Zhang was employed as Workshop Manager by Linyi Hengchang Industrial and Trading Co., Limited, where he was responsible for employee training and quality control and safety. From 1999 to 2001 Mr. Zhang was employed as Operations Manager by Muping Fenghe Fuel Co. In total, Mr. Zhang has 34 years experience in business management. He is a graduate of Linyi Sales and Supply College. Zhang Dingfu is the brother of Zhang Dingyou, a member of our Board of Directors.

Yuan Mingxia. Ms. Yuan has been employed as Chief Financial Officer of Shandong Qingyuan Beer since 2007. From 2004 to 2007, Ms. Yuan was employed by Linyi Hengchang Malt as senior Accounting Manager. Ms. Yuan is a graduate of Jinan University with a degree in accounting.

Principal Shareholders

Upon completion of the Share Exchange, there were 125,715,573 shares of Sabre Industrial common stock issued and outstanding. The following table sets forth information known to us with respect to the beneficial ownership of our common stock by the following:

2

|

|

·

|

each shareholder who beneficially owns more than 5% of our common stock;

|

|

|

·

|

Zhang Dingyou, our Chief Executive Officer

|

|

|

·

|

each of the members of the Board of Directors; and

|

|

|

·

|

all of our officers and directors as a group.

|

|

Beneficial Owner

|

Amount and Nature

of Beneficial

Ownership(1)

|

Percentage

of Class

|

|

Zhang Dingyou

|

71,373,301

|

56.8%

|

|

Zhang Dingfu

|

5,520,130

|

4.4%

|

|

Yuan Mingxi

|

20,520,128

|

16.3%

|

|

All officers and directors

As a group (3 persons)

|

97,413,568

|

77.5%

|

|

(1) Except as otherwise noted, all shares are owned of record and beneficially.

|

||

INFORMATION REGARDING THE ACQUIRED COMPANIES

This diagram shows our current corporate structure. Solid lines indicate wholly-owned subsidiaries. Dotted lines indicate the entrusted management relationship.

Tsingyuan Holding, Inc.

Tsingyuan Holding Inc. (“Tsingyuan Holding”) was organized under the laws of Delaware on March 30, 2010. It has initiated no business activity, except that Tsingyuan Holding is the registered owner of the outstanding capital stock of registered capital of Tsingyuan Group (Hong Kong) Co., Ltd. Those shares represent the only asset of Tsingyuan Holding.

3

Tsingyuan Group (Hong Kong) Co., Ltd.

Tsingyuan Group (Hong Kong) Co., Ltd. was organized under the laws of Hong Kong on April 22, 2010. It has initiated no business activity, except that Tsingyuan Holding is the owner of the registered capital of Beijing Qingyuan Hengchang Consulting Co., Ltd. That equity interest represents the only asset of Tsingyuan Group (Hong Kong) Co., Ltd.

Beijing Qingyuan Hengchang Consulting Co., Ltd.

Beijing Qingyuan Hengchang Consulting Co., Ltd. (“Beijing Qingyuan”) is a Wholly Foreign Owned Entity organized under the laws of the People’s Republic of China on June 17, 2010. On June 26, 2010, Beijing Qingyuan entered into four agreements with Linyi Hengchang Malt and with the equity owners in Linyi Hengchang Malt, and four agreements with Shandong Qingyuan Beer and with the equity owners in Shandong Qingyuan Beer. Collectively, the agreements provide Beijing Qingyuan exclusive control over the business of Linyi Hengchang Malt and its majority-owned subsidiary, Shandong Qingyuan Beer. The relationship is one that is generally identified as “entrusted management.”

The Entrusted Management Agreements

On June 26, 2010 Beijing Qingyuan, Linyi Hengchang Malt and the registered equity holders in Linyi Hengchang Malt signed four agreement (the “Entrusted Management Agreements”), the purpose of which is to transfer to Beijing Qingyuan full responsibility for the management of Linyi Hengchang Malt, as well as the financial benefits and responsibility for any losses that arise from the business of Linyi Hengchang Malt. On the same date Beijing Qingyuan, Shandong Qingyuan Beer and the registered equity holders in Shandong Qingyuan Beer signed substantially identical agreements, the purpose of which is to transfer to Beijing Qingyuan full responsibility for the management of Shandong Qingyuan Beer, as well as the financial benefits and responsibility for any losses that arise from the business of Shandong Qingyuan Beer. A summary of the agreements follows:

|

|

§

|

Exclusive Technical Service and Business Consulting Agreements. In these agreements Beijing Qingyuan undertakes to provide Linyi Hengchang Malt and Shandong Qingyuan Beer advice and assistance with respect to all aspects of their business. In exchange for the services, Linyi Hengchang Malt and Shandong Qingyuan Beer will each pay Beijing Qingyuan 10,000 RMB ($1,475) per month plus 100% of their annual gross profit. Beijing Qingyuan will reimburse Linyi Hengchang Malt and Shandong Qingyuan Beer for any net loss that either company incurs.

|

|

|

§

|

Call Option Agreements. In these agreements the shareholders of Linyi Hengchang Malt and Shandong Qingyuan Beer grant to Beijing Qingyuan an option to purchase their equity interests in those companies, if permitted by the laws of the People’s Republic of China. The purchase price will equal the greater of 1 RMB or the minimum price required under applicable law. The equity owners covenant in the Call Option Agreements that they will not permit Linyi Hengchang Malt or Shandong Qingyuan Beer to issue an equity interest to any other party, nor to take any material action without the consent of Beijing Qingyuan.

|

|

|

§

|

Proxy Agreement. In these agreements the shareholders of Linyi Hengchang Malt and Shandong Qingyuan Beer have given to Beijing Qingyuan a proxy to vote their shares at any meeting of the shareholders of either Linyi Hengchang Malt or Shandong Qingyuan Beer.

|

4

|

|

§

|

Share Pledge Agreements. In these agreements, the shareholders of Linyi Hengchang Malt and Shandong Qingyuan Beer have pledged their equity interests in these companies as security for their obligations and the obligations of Linyi Hengchang Malt and Shandong Qingyuan Beer under the Exclusive Technical Service and Business Consulting Agreements, the Call Option Agreements and the Proxy Agreements. During the term of the pledge, the shareholders are barred from transferring any interest in the equity in Linyi Hengchang Malt or Shandong Qingyuan Beer.

|

Linyi Hengchang Brewer’s Malt Co., Ltd.

Linyi Hengchang Malt and its majority-owned subsidiary, Shandong Qingyuan Beer, are located in Linyi County, in Shandong Province, in eastern China. The location places them centrally in the industrial corridor of China from Harbin through Beijing and Guangzhou to Shanghai, while also providing ready access to train lines and roadways connecting to western China. The location of Linyi and Shandong, therefore, facilitates rapid delivery of our products to the greater portion of the Chinese population. At present, approximately half of our revenue is produced by the sale of brewer’s malt and half by the sale of beer.

Our Malt Business

Linyi Hengchang Malt was organized in 2004 with 76.75 million Renminbi (RMB) (approximately $11.3 million) in registered capital. Its business purpose is to engage in the manufacture and sale of brewer’s malt used in the production of beer. With the growth of demand for beer in both urban and rural China, industry data has consistently indicated a shortage of suppliers of quality brewer’s malt. Linyi Hengchang Malt was established to help fill that gap. In 2008 Chinese manufacturers produced 41.23 million tons of beer, which required 4.9 million tons of brewer’s malt for production. Linyi Hengchang Malt currently produces 200,000 tons per year.

Linyi Hengchang Malt imports barley from Australia, Canada and France, depending on customer demand and market conditions. We also malt a variety of domestic barleys, including Jiangsu barley, Gansu barley from northwest China, and a particularly high quality barley from Inner Mongolia. We also import French wheat for malting for use in wheat beers. Raw material generally arrives at the nearly Pingyuan railway station, from which we transport it to our factory in our own vehicles.

The malting process is an ancient process, but modern technology has enabled us to optimize the quality and consistency of our end product. Malting, in general, consist of germinating grain in water, then applying heat to rapidly halt the germination process. Our technology allows us to adjust the timing and ventilation process to provide the optimal malting conditions for each variety of grain that we use.

Our brewer’s malt is currently shipped to brewers in ten provinces of China. The central location of Shandong Province within China’s industrial corridor makes transportation particularly convenient. In general, our customers pay the freight charges from our warehouse loading dock.

5

In 2008 Linyi Hengchang Malt was awarded the Quality Management System Certification by the Beijing United Intelligence Certificate Co., Ltd. The certification verified that the company’s quality management system for the production of brewer’s malt met the standards of ISO9001:2000.

Linyi Hengchang Malt is required to qualify with several government agencies in order to carry out its business. Primary among its government approvals are:

|

|

·

|

Grain Purchases Permit issued by Linyi County Grain Administration in 2008 (renewable biennially);

|

|

|

·

|

Sanitation License issued by Linyi County Health Bureau in 2010 (renewable every three years);

|

|

|

·

|

Drawing of Water Permit issued by the Ministry of Water Resources in 2007, which authorizes the company to draw up to 10,000 cubic meters of deep underground water into its plant;

|

|

|

·

|

Certification to act as consignee or consignor for import-export of malt products, awarded in 2005.

|

The establishment of Shandong Qingyuan Beer in 2005 provides us a captive customer for our brewer’s malt. Currently, only a small percentage of our malt production is delivered to Shandong Qingyuan Beer. If its growth continues, Shandong Qingyuan Beer will become a larger portion of our customer base, which will increase the profitability of our overall enterprise.

Our Beer Business

Shandong Qingyuan Beer was organized in December 2005 with registered capital of 30 million RMB (approximately $4.4 million) to take advantage of the synergies that arise from integrating a manufacturer of high quality brewer’s malt with a brewery. Linyi Hengchang Malt owns 66.8% of the registered capital of Shandong Qingyuan Beer. The remainder is owned by our officers, Zhang Dingyou and Yuan Mingxia. In September 2007, after government inspection of our newly-developed production facilities, we were awarded the National Industrial Product Manufacture Licensing Certification, which enables us to distribute our beers throughout China. Currently our beers are distributed by retailers in six provinces in eastern and northern China: Shandong, Hebei, Tianjin, Henan Anhui, Jiangsu and Shanxi.

In the past decade the beer industry in China, like most consumer goods industries, has experienced rapid growth. For example, industry analysts reported that from 2007 to 2008 beer production increased by nearly 13%. The growth has been primarily driven by the remarkable expansion of the purchasing power of the Chinese population over the past two decades. In addition, the Chinese government has provided favorable tax advantages to the industry, with a goal of rapid expansion. As beer consumption has increased, consumers had become more aware of brand differentiation and differences in product quality. This process of market stratification opens the door for new entrants to successfully target specific strata of the market.

Shandong Qingyuan Beer’s business plan targets the mid-market, which management believes has been underexploited in China. This is the market for the well-crafted, but moderately priced beers that our relationship with Linyi Hengchang Malt allows us to produce. With the rapid growth of the middle class in China, we believe that the demand for well-crafted beer is likewise expanding and will continue to do so. Nevertheless, 90% of the beer produced in China today remains the low quality, low price beer developed to meet the demands of a less developed economy. Significant improvements in beer technology in the past twenty years have enabled low cost production of generic beer, which has prompted most established brewers to compete on the basis of price. This phenomenon has resulted in reducing margins across the industry, preventing most brewers from capturing a significant portion of the market outside their own province. All but a few of the beer manufacturers in China sell their products only locally, where they hold market position on the basis of familiarity. So it is neither easy nor profitable to attempt to gain a nationwide foothold in the low-end market.

6

The majority of the new beers entering the market, therefore, are directed to the mid- and upper price level, where it remains possible to garner a significant profit. However, because China’s economic growth has focused on its larger cities, and because prestige is a dominant factor in the development of brand consciousness in the larger cities, the majority of new brands entering the market have been high priced, finely crafted beers. While these are attractive to urbanites seeking to develop a cosmopolitan image, most Chinese residents cannot afford to drink these beers on a daily basis.

Our plan for growth targets the most underserved portion of the growing Chinese middle class. While the newer high-end entrants to the market and the importers focus on the largest cities in China, we are focused on the second and third tier cities, as well as small towns that are within the Chinese industrial and technology zone and so are sharing in the growing prosperity of China. In many of these areas our beers are among the few available that are crafted from top quality raw materials using advanced brewing technology, while remaining priced at a level affordable for everyday consumption. Our wholesalers and distributors are generally pleased by our “alternative market” focus, since their marketing efforts can be more effective in areas where they don’t face the intense marketing pressure common in Beijing, Guangzhou and other major metropolitan areas. Moreover, the receptivity of the middle class population of the smaller cities to a quality brand tends to be in inverse proportion to the number of quality brands available.

Our factory currently has an annual manufacturing capacity of 100,000 metric tons. Our facilities include two bottling lines, one fermentation line, and one cooling line, plus a laboratory to monitor the content and qualify of the beer. In order to sustain our reputation for quality, we manufacture all of our beer in-house, and apply strict controls over the manufacturing process, to assure consistent quality. Our brewing professionals were previously employed in senior positions by Tsingtao, the largest and most well-known brand of Chinese beer, both in China and internationally. All of the water used in our beer is drawn from our own sources and carefully monitored for purity, which is crucial to the quality of a brewed product.

To assure quality, we use high grade raw materials, including malt imported from Australia, high quality Dongbei rice that is locally grown, and hops from Ganshu Province. Ownership by Linyi Hengchang Malt provides us a dedicated supplier of the key beer component, the malt. The predictability of price and supply that our integration offers is what enables us to pursue our target market, the developing market for a high quality but moderately priced beer.

7

We market our beer under the trademarks “Qinglin,” “Qingyi” and “Qingyuan.” Our application to the provincial government for designation of each of these three trademarks as a “Famous Shandong Brand” is pending. Currently, our products include:

|

Qinglin Original Draft

|

Qingyuan Light Beer

|

Qingyuan Woniucheng Beer

|

|

Qingyi Original Draft

|

Qingyuan Aumaiwang

|

Qingyuan Qingdao Qingyi Beer

|

|

Qingyi Pure

|

Qingyuan Qingyi Beer

|

Qingyuan Golden Wheat Dry

|

We sell directly to distributors, who in turn sell to wholesalers. The wholesalers are responsible for securing and stocking our retailers. This multi-tier network is particularly effective in achieving the widespread distribution necessary for us to achieve market position in small cities and villages. Our advertising program supports our distribution network by emphasizing the association between our brand and quality beer.

Competition in the Chinese beer industry is developing rapidly, due to the growth in demand and the encouragement of China’s government. Within Linyi County alone, there are two brewers with annual production of 200,000 tons, and five brewers with annual production of 100,000 tons, including Shandong Qingyuan Beer. There are few national brands, however, Tsingtao being the exception with 26% of the national market. That situation may change, however, as foreign beer begins to make inroads into China. Currently 85% of the beer consumed in China is brewed by Chinese brewers, and only one foreign-owned beer company has established control of a significant portion of the Chinese market: Huangren Xuhua Beer (China) Co., Ltd, a subsidiary of SABMiller, has a 13% market share. Our expectation, however, is that the major international brewers will make further inroads into the China market in the coming years.

Our plan for growth is primarily based on utilization of our existing marketing network to introduce our brands into new cities and towns. In addition, however, we expect to acquire compatible breweries in new areas of China, where we can introduce our production technology and marketing practices, and achieve exponential expansion. We intend to make such acquisitions slowly and carefully, however, in order to avoid any risk to the association we have developed between our brand and idea of quality in beer.

Employees

Presently, Linyi Hengchang Malt has 67 employees, all of whom are employed full-time. Ten of the employees of Linyi Hengchang Malt have college diplomas and are employed as technicians. Shandong Qingyuan Beer has approximately 350 employees, all of whom are employed full-time.

Physical Facilities

The executive offices and manufacturing facilities of Shandong Qingyuan Beer are located on a parcel of land in the Lingyi Lingpan Industrial Park, Shandong Province, P.R. China. The facilities, which contain 13,582 square meters of usable space, are located on a parcel of land covering 103,477 square meters. The facilities are owned by Shandong Qingyuan Beer and the land is leased from the government by Shandong Qingyuan Beer, all free of liens.

The executive offices of and manufacturing facilities of Linyi Hengchang Malt are located on a parcel of land in the Lingyi Hengyuan Economic Zone at Area #1 and YuanZhen Road, in Shandong Province, P.R. China. The facilities, which contain 17,791 square meters of usable space, are located on a parcel of land covering 51,554 square meters. The facilities are owned by Linyi Hengchang Malt and the land is leased from the government by Linyi Hengchang Malt, all free of liens.

8

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The accounting effect of the Entrusted Management Agreements is to cause the balance sheets and financial results of Linyi Hengchang Malt and Shandong Qingyuan Beer to be consolidated with those of our subsidiary, Beijing Qingyuan, with respect to which Linyi Hengchang Malt and Shandong Qingyuan Beer are now variable interest entities. The financial statements of Sabre Industrial filed after the Share Exchange will also consolidate the balance sheets and financial results of Linyi Hengchang Malt and Shandong Qingyuan Beer, since Beijing Qingyuan is now a wholly-owned subsidiary of Sabre Industrial. Since the parties to the Entrusted Management Agreements as well as the parties to the Share Exchange were all controlled by Zhang Dingyou, the financial statements included in future reports will reflect the consolidation of the results of operations and cash flows of Linyi Hengchang Malt and its subsidiary, Shandong Qingyuan Beer, since their inception.

The financial statements included with this Current Report are the combined financial statements of Linyi Hengchang Malt and Shandong Qingyuan Beer. Accordingly the following discussion refers to the combined results of those two entities. We are, however, also filing with this Current Report a pro forma combined balance sheet indicating the effect that the Share Exchange would have on the balance sheet of Sabre Industrial as of June 30, 2010 if it had occurred on that date.

Results of Operations

Our brewer’s malt operations were supplemented by sales of beer in the fall of 2007, when we received government authority to distribute our beers. Since that time, revenue from both malt sales and beer sales has grown steadily, although the growth of beer sales has been more rapid. From the year ended December 31, 2008 (“2008”) to the year ended December 31, 2009 (“2009”) our overall sales increased by 50%, from $7,961,587 to $11,919,013, with malt sales increasing by 42% ($6,321,933 to $8,981,030) and beer sales increasing by 79% ($1,639,654 to $2,937,983), In the first six months of 2010 overall sales revenue of $14,343,053 represented an increase of 137% over the $6,063,123 in revenue achieved in the first six months of 2009, with beer revenue now representing 33% of our overall sales revenue. The revenue level in the first six months of 2010, which exceeded revenue for all of 2009 by 20%, occurred despite the cyclical nature of beer sales - our brewery all but closes during January and February due to cold weather and the extended Chinese New Year holiday. The increase is a credit to the strength of our distribution network. So we expect that sales for the entirety of 2010 will more than double our revenues for 2009.

Our gross profit margin stabilized in 2009 at 22.2%, more closely reflecting the norm in the beer industry than the 2.5% gross margin we realized in 2008, when we were still developing the production systems in our brewery. Both of the half-year periods reported gross margin similar to 2009 - 22.7% in the first six months of 2009 and 18.4% in the first six months of 2010. The fall-off in 2010, while not statistically significant, was primarily the result of the growing importance of beer sales to our overall revenues. In general, the margins on beer will be somewhat lower than the margins on brewer’s malt - provided the market price for barley does not increase significantly.

9

Our general and administrative expenses have increased roughly in proportion to the increase in our sales revenue, reflecting the expansion of management in proportion to sales growth. General and administrative expenses increased by 46% from 2008 to 2009 and by 85% from the first half of 2009 to the first half of 2010. In none of the periods reported did general and administrative expenses exceed 2.7% of revenue, reflecting the relative efficiency of our operations. Likewise, in all periods selling expenses have been nearly immaterial, a result of our distribution network that passes to our distributors both the cost of transporting products and most of the responsibility for marketing.

We anticipate, however, that general and administrative expenses will increase in the future both absolutely and in their ratio to revenue. Among the factors that we expect to contribute to the increase in general and administrative expenses will be:

|

|

·

|

The fact that we are now a U.S. reporting company will impose on us the expenses necessary to comply with reporting requirements and to service our shareholders’ requirements, including legal and accounting fees, transfer agent fees, investor relations services, and other costs.

|

|

|

·

|

Our plan for growth entails acquisition of compatible brewers to increase our production capacity and geographic market. Such acquisitions generally entail considerable expense, including expenses for investigation of acquisition opportunities (both realized and abandoned), expenses for due diligence, legal and accounting expenses, as well as the considerable costs that attend the integration of the acquired management systems with our own.

|

|

|

·

|

Our plan for expansion of our existing marketing network contemplates a significant increase in advertising, which will make our selling expenses less minimal.

|

Since direct expenses have grown in approximate proportion to revenue, our income from operations likewise grew in approximately the same proportions. Due to the low gross profit realized in 2008, the 2009 income from operations was markedly higher. However, from the first half of 2009 to the first half of 2010, income from operations grew by 111%, compared to the 137% increase in revenue. On the other hand, our “other income (expense)” changed dramatically from period to period, as changes in our debt structure significantly reduced our interest expense. In 2009 our interest expense was $893,090 and in the first six months of 2009 was $588,520. Those expenses arose from the several short-term bank loans that we carried into 2010, the balance of which totalled $13,422,427 at December 31, 2008 and $6,581,642 at December 31, 2009. In the first six months of 2010, however, we borrowed almost $6 million from related parties on a non-interest-bearing basis. and used the funds to eliminate most of our bank loans. The result was a reduction in our interest expense for the six months ending June 30, 2010 to $186,460.

10

As a result of increased sales and the recent restructuring of our debt, pre-tax income for the first six months of 2010 exceeded pre-tax income for all of 2009, the first year in which we had realized such income. In 2009 we achieved $2,237,739 in pre-tax income, with $1,000,474 of that achieved in the first six months of 2009. In the first six months of 2010, our pre-tax income was $2,304,108. After application of China’s 25% tax on corporate income, our net income for the first half of 2010 was $1,731,562, compared to $795,329 in the first six months of 2009 (a period-to-period increase of 118%) and $1,675,972 in all of 2009.

Our business operates entirely in Chinese Renminbi, but we report our results in our SEC filings in U.S. Dollars. The conversion of our accounts from RMB to Dollars results in translation adjustments, which are reported as a middle step between net income and comprehensive income. The net income is added to the retained earnings on our balance sheet; while the translation adjustment is added to a line item on our balance sheet labeled “accumulated other comprehensive income,” since it is more reflective of changes in the relative values of U.S. and Chinese currencies than of the success of our business. In the six months ended June 30, 2010, the effect of converting our financial results to Dollars was to add $58,121 to our accumulated other comprehensive income. In 2009, when the exchange rates were more stable, the increase in our accumulated other comprehensive income was only $27,134.

Liquidity and Capital Resources

The development of Linyi Hengchang Malt was initially funded by the contribution of 76.75 RMB (approximately $11.3 million) in registered capital made by Linyi Hengchang Malt’s founders: Zhang Dingyou, Zhang Dingfu and Wang Mingxia. In 2006, when we commenced construction of the facilities for Shandong Qingyuan Beer, we again relied extensively on loans from our founders, but the greater portion of the funds were obtained through borrowing on a short-term basis, at relatively high interest rates (7.31% to 12.1%) from a consortium of the major banks in China. As a result, at the end of 2008, we had $13.4 million in short-term loans outstanding, reduced to $6.6 million at the end of 2009. As a result, our profitability was burdened by a significant interest charge.

During the first six months of 2010, we virtually eliminated that burden. With $5,968,337 borrowed from our founders, we satisfied all by one of our short-term loans. So at June 30, 2010 our entire bank debt consisted of a note for $587,492 payable to the Agricultural Bank of China with interest at 6.903%. That note was due on July 15, 2010, at which time it was fully paid. We are, therefore, now debt-free, except for debts to our founders, which are interest-free.

During 2009 we used $9,210,161 - primarily drawn from our founders’ commitment of registered capital - to expand our production facilities. The result was that at December 31, 2009 our balance sheet showed a working capital deficit of $6,073,086. By June 30, 2010, as a result of our profits during the six month period, we had reduced our working capital deficit to $3,819,412. Included in the deficit, however, was $6,363,916 owed to members of our board of directors and shareholders, which is due on demand. Since our directors do not intend to demand payment until the company can afford to satisfy that debt, for practical purposes we had a working capital surplus of $2.5 million at June 30, 2010.

11

During the 18 months ended June 30, 2010, our operations provided us $8,413,898 in cash. This outpaced net income in this period due to our use in 2009 of $2.5 million in credits that we had purchased from suppliers in 2008 and our 2009 increase in payables and accrued expenses by almost $3.6 million. Generally, however, the cash provided by our operations will increase and decrease in proportion to net income. The primary reason for this is that we sell our beer on a c.o.d. basis, and sell our malt on a net-30 basis that is strictly enforced. At June 30, 2010 we had no account receivable that was older than 30 days. Cash flow from operations, therefore, is not significantly burdened by unpaid receivables.

Our business plan contemplates that we will obtain $2 million in additional capital during 2010 and $8 million during 2011. The funds are needed in order to:

|

|

·

|

Make a strategic acquisition of a smaller beer company;

|

|

|

·

|

Establish new executive offices;

|

|

|

·

|

Enlarge our talent base and competitive abilities by adding experienced executives; and

|

|

|

·

|

Provide the working capital needed to fund rapid growth in sales.

|

Our plan is to sell a portion of our equity in order to obtain the necessary funds, which will reduce the equity share of our existing shareholders. To date, however, we have received no commitment from any source for funds.

Off-Balance Sheet Arrangements

Neither Tsingyuan Holding nor Tsingyuan Group (Hong Kong) Co., Ltd. nor Beijing Qingyuan nor Linyi Hengchang Malt has any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on their financial condition or results of operations.

Risk Factors That May Affect Future Results

You should carefully consider the risks described below before buying our common stock. If any of the risks described below were realized, that event could cause the trading price of our common stock to decline, and you could lose all or part of your investment.

Our beer business and operations are newly established. Unless we manage our growth effectively, our business will fail.

Shandong Qingyuan Beer was organized in December 2005 and was licensed to commence marketing beer in the fall of 2007. We have completed only two full fiscal years of operations as a brewery. The extrapolation of that experience into a marketing business on the magnitude contemplated by Shandong Qingyuan Beer will place significant demands on our management, and on our operational and financial infrastructure. If we do not effectively manage our operations, the quality of our marketing program will suffer, which would negatively affect our operating results. If the necessary funding can be obtained, we will be able to improve our operational, financial and management controls and our reporting systems and procedures. The complexity of this undertaking means that we are likely to face many challenges, some of which are not yet foreseeable. Problems may occur with sourcing of our raw materials, large scale production, or with our ability to successfully market our beer. If we are not able to obtain the necessary funding and operate efficiently, our business plan may fall short of its goals, and our ability to manage our growth could be hurt.

12

The capital investments that we plan may result in dilution of the equity of our present shareholders.

Our business plan contemplates that we will raise $10 million in capital during the next two years. We intend to raise all or a large portion of the necessary funds by selling equity in our company. At present we have no commitment from any source for those funds. We cannot determine, therefore, the terms on which we will be able to raise the necessary funds. It is possible that we will be required to dilute the value of our current shareholders’ equity in order to obtain the funds. If, on the other hand, we are unable to raise the necessary funds, our growth will be limited, as will our ability to compete effectively.

We rely on contractual arrangements with Linyi Hengchang Malt and Shandong Qingyuan Beer for control over their operations, which may not be as effective in providing control over those entities as direct ownership.

Because Chinese regulations restrict our ability to conduct our business operations in China through directly-owned subsidiaries, our relationship with the two operating companies that carry on our business is defined by contractual relationships - the “entrusted management agreements.” We have no equity ownership interest in either Linyi Hengchang Malt or Shandong Qingyuan Beer. These contractual arrangements may not be as effective in providing control over those operating entities as direct ownership. For example, if Linyi Hengchang Malt failed to perform under its agreements with us, we would have to rely on legal remedies under Chinese law, which we cannot be sure would be available. In addition, we cannot be certain that the individual equity owners of Linyi Hengchang Malt and Shandong Qingyuan Beer will always act in the best interests of Sabre Industrial.

If we lost control of our distribution network, our business would fail.

We will depend on our distribution network for the success of our beer business. Currently we are actively enlarging our distribution network to provide us access to ever wider territories in China. To the extent that our distribution network is successful, competitors will be likely to attempt to pull our distribution network away from us. In addition, if dominant members of our distribution network become dissatisfied with their relationship with Shandong Qingyuan Beer, a concerted effort by the distribution network could force us to accept less favorable financial terms from the distribution network. Either of these possibilities, if realized, would have an adverse effect on our business.

Our results of operations are cyclical and could be adversely affected by fluctuations in the market prices for grain.

Our profitability depends on access to barley, rice and hops at affordable prices. We are largely dependent on the market price of these grains, which are determined by constantly changing and volatile market forces of supply and demand as well as other factors over which we have little or no control. These other factors include:

13

|

•

|

demand for grain for use in the manufacture of alternative fuels,

|

|

•

|

energy prices, which directly affect the cost of growing and transporting grain,

|

|

•

|

weather, including weather impacts on our water supply and the impact on the availability and pricing of grains,

|

|

•

|

crop diseases.

|

Because the marketability of our beer depends, in significant part, on its retail price, we often cannot pass along to our customers increases in the cost of our raw materials, but must accept lower profit margins until the grain market turns more favorable.

China has not yet developed a formal market on which we could purchase and sell futures contracts in order to hedge against volatility in the prices of grains. Therefore, our operating results will reflect, almost unmediated, the impact of market conditions.

We operate in a highly competitive marketplace, which could adversely affect our sales and financial condition.

The international beer market is dominated by a small number of very large organizations. To date, beer manufacturers owned by international conglomerates control only 15% of the market in China. It is likely, however, that the international brewers will make further inroads into the Chinese market in the coming years. These competitors may introduce new products based on more competitive alternative technologies that may be causing us to lose customers which would result in a decline in our sales volume and earnings. Our customers demand high quality and low cost beer. The cost of research and development and marketing expansion will likely continue to increase and thus adversely affect the competitiveness of our products. Competition could cause us to lose market share, or to increase expenditures or reduce pricing, each of which would have an adverse effect on our results of operations, cash flows and financial condition.

Our trademarks may be subject to counterfeiting and/or imitation, which could have an adverse impact upon our reputation and brand image, as well as lead to higher administrative costs.

We regard brand positioning as one of our core competitive advantages, and intend to position our “Qinglin,” “Qingyi” and “Qingyuan” brands to create the perception and image of freshness and quality in the minds of consumers. There have been frequent occurrences of counterfeiting and imitation of products in the PRC in the past. We cannot guarantee that counterfeiting or imitation of our beer will not occur in the future or that we will be able to detect it and deal with it effectively. Any occurrence of counterfeiting or imitation could impact negatively upon our corporate and brand image, particularly as the counterfeit or imitation product is likely to lack the quality of our products. In addition, counterfeit or imitation products could result in a reduction in our market share, a loss of revenues or an increase in our administrative expenses in respect of detection or prosecution.

If litigation becomes necessary to enforce our intellectual property rights, protect our trade secrets or determine the validity and scope of the proprietary rights of others, such litigation may be costly and may divert management attention away from our business. An adverse determination in any such litigation would impair our intellectual property rights and could harm our business, prospects and reputation. Enforcement of judgments in China is uncertain and even if we are successful in litigation it may not provide us with an effective remedy. In addition, we have no insurance coverage against litigation costs and would have to bear all costs arising from such litigation to the extent we are unable to recover them from other parties. The occurrence of any of the foregoing could have a material adverse effect on our business, financial condition and results of operations.

14

We do not carry any business interruption insurance or products liability insurance. As a result, we may incur uninsured losses that would adversely affect our operating results.

We could be exposed to liabilities or other claims for which we would have no insurance protection. Unlike consumer product manufacturers in the U.S., but as is common in China, we do not currently maintain any business interruption insurance, products liability insurance, or any other comprehensive insurance policy. As a result, we may incur uninsured liabilities and losses as a result of the conduct of our business. There can be no guarantee that we will be able to obtain insurance coverage in the future, and even if we are able to obtain coverage, we may not carry sufficient insurance coverage to satisfy potential claims.

Contamination of our beer products could result in widespread injury to the ultimate consumers. In such a situation, our company could be faced with legal claims, even if the contamination were caused by problems in the storage of grain before we acquired it. Because we do not have product liability insurance, we cannot assure that we will have enough funds to defend our company in such litigation or to pay for liabilities arising out of a products liability claim. To the extent we incur any product liability or other litigation losses, our expenses could materially increase substantially.

We require various licenses and permits to operate our business, and the loss of or failure to renew any or all of these licenses and permits could require us to suspend some or all of our production or distribution operations.

In accordance with PRC laws and regulations, we are required to maintain various licenses and permits in order to operate our business. We are required to comply with applicable hygiene and food safety standards in relation to our production processes. Our premises and transportation vehicles are subject to regular inspections by the regulatory authorities for compliance with applicable regulations. Failure to pass these inspections, or the loss of or failure to renew our licenses and permits, could require us to temporarily or permanently suspend some or all of our production or distribution operations, which could disrupt our operations and adversely affect our revenues and profitability.

The loss of senior management or key technicians or our inability to recruit additional personnel may harm our business.

We are highly dependent on our senior management to manage our business and operations. We are also highly dependent on the experienced brew masters who guide our production activities. We do not maintain key man life insurance on any of our senior management or key technicians. The loss of any one of them could have a material adverse effect on our business and operations. Competition for senior management and experienced brew masters is intense and the pool of suitable candidates is limited. We may be unable to locate a suitable replacement for any senior management or key technician that we lose. In addition, if any member of our senior management or key technician joins a competitor or forms a competing company, they may compete with us for customers, business partners and other key professionals and staff members of our company.

15

We compete for qualified personnel with other brewers and malt producers. Intense competition for these personnel could cause our compensation costs to increase significantly, which could have a material adverse effect on our results of operations. Our future success and ability to grow our business will depend in part on the continued service of these individuals and our ability to identify, hire and retain additional qualified personnel. If we are unable to attract and retain qualified employees, we may be unable to meet our business and financial goals.

We may have difficulty establishing adequate management and financial controls in China.

The People’s Republic of China has only recently begun to adopt the management and financial reporting concepts and practices that investors in the United States are familiar with. We may have difficulty in hiring and retaining employees in China who have the experience necessary to implement the kind of management and financial controls that are expected of a United States public company. If we cannot establish such controls, we may experience difficulty in collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet U.S. standards.

We may incur significant costs to ensure compliance with U.S. corporate governance and accounting requirements.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002, and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors, on committees of our board of directors or as executive officers.

As a public company, we are required to comply with rules and regulations of the SEC, including expanded disclosure, accelerated reporting requirements and more complex accounting rules. This will require additional cost management resources. We will need to implement additional finance and accounting systems, procedures and controls as we grow to satisfy these reporting requirements. In addition, we may need to hire additional legal and accounting staff with appropriate experience and technical knowledge, and we cannot assure you that if additional staffing is necessary that we will be able to do so in a timely fashion.

16

Our operations are subject to PRC laws and regulations that are sometimes vague and uncertain. Any changes in such PRC laws and regulations, or the interpretations thereof, may have a material and adverse effect on our business.

The PRC’s legal system is a civil law system based on written statutes. Unlike the common law system prevalent in the United States, decided legal cases have little value as precedent in China. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to, the laws and regulations governing our business, or the enforcement and performance of our arrangements with third party contractors, distributors or customers in the event of the imposition of statutory liens, death, bankruptcy or criminal proceedings. The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. Accordingly, we cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses.

The ability of our Chinese subsidiary to pay dividends may be restricted due to foreign exchange control and other regulations of China.

Under applicable PRC regulations, foreign-invested enterprises in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a foreign-invested enterprise in China is required to set aside at least 10% of its after-tax profit based on PRC accounting standards each year to its general reserves until the accumulative amount of such reserves reach 50% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a foreign-invested enterprise has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

Furthermore, the ability of our Chinese subsidiary to pay dividends may be restricted due to the foreign exchange control policies and availability of cash balance of the Chinese operating subsidiaries. Because substantially all of our operations are conducted in China, all of our revenue being earned and currency received are denominated in Renminbi (RMB). The RMB is subject to the exchange control regulation in China, and, as a result, we may unable to distribute any dividends outside of China due to PRC exchange control regulations that restrict our ability to convert RMB into U.S. Dollars.

Our inability to receive dividends or other payments from our Chinese operating subsidiary could adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business. Beijing Qingyuan’s funds may not be readily available to us to satisfy obligations which have been incurred outside the PRC, which could adversely affect our business and prospects or our ability to meet our cash obligations. Accordingly, if we do not receive dividends from our Chinese operating subsidiary, we may not have sufficient cash flow to fund our corporate overhead and regulatory obligations in the United States and may be unable to pay dividends on our shares of capital stock.

17

The foreign currency exchange rate between U.S. Dollars and Renminbi could adversely affect our financial condition.

To the extent that we need to convert U.S. Dollars into Renminbi for our operational needs, our financial position and the price of our common stock may be adversely affected should the Renminbi appreciate against the U.S. Dollar at that time. Conversely, if we decide to convert our Renminbi into U.S. Dollars for the operational needs or paying dividends on our common stock, the dollar equivalent of our earnings from our subsidiaries in China would be reduced should the U.S. Dollar appreciate against the Renminbi.

Until 1994, the Renminbi experienced a gradual but significant devaluation against most major currencies, including U.S. Dollars, and there was a significant devaluation of the Renminbi on January 1, 1994 in connection with the replacement of the dual exchange rate system with a unified managed floating rate foreign exchange system. Since 1994, the value of the Renminbi relative to the U.S. Dollar has remained stable and has appreciated slightly against the U.S. Dollar. Countries, including the United States, have argued that the Renminbi is artificially undervalued due to China’s current monetary policies and have pressured China to allow the Renminbi to float freely in world markets. In July 2005, the PRC government changed its policy of pegging the value of the Renminbi to the U.S. Dollar. Under the new policy the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of designated foreign currencies. While the international reaction to the Renminbi revaluation has generally been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in further and more significant appreciation of the Renminbi against the U.S. Dollar.

We may be classified as a “resident enterprise” for PRC enterprise income tax purposes, which could result in unfavorable tax consequences to us and our non-PRC shareholders.

The Enterprise Income Tax Law provides that enterprises established outside of China whose “de facto management bodies” are located in China are considered “resident enterprises” and are generally subject to the uniform 25% enterprise income tax rate on their worldwide income. In addition, a recent circular issued by the State Administration of Taxation regarding the standards used to classify certain Chinese-invested enterprises controlled by Chinese enterprises or Chinese group enterprises and established outside of China as “resident enterprises” clarified that dividends and other income paid by such “resident enterprises” will be considered to be PRC source income, subject to PRC withholding tax, currently at a rate of 10%, when recognized by non-PRC shareholders. This recent circular also subjects such “resident enterprises” to various reporting requirements with the PRC tax authorities. Under the implementation regulations to the enterprise income tax, a “de facto management body” is defined as a body that has material and overall management and control over the manufacturing and business operations, personnel and human resources, finances and treasury, and acquisition and disposition of properties and other assets of an enterprise. In addition, the recent circular mentioned above details that certain Chinese-invested enterprises controlled by Chinese enterprises or Chinese group enterprises will be classified as “resident enterprises” if the following are located or resident in China: senior management personnel and departments that are responsible for daily production, operation and management; financial and personnel decision making bodies; key properties, accounting books, company seal, and minutes of board meetings and shareholders’ meetings; and half or more of the directors with voting rights or senior management. If the PRC tax authorities determine that we are a “resident enterprise,” we may be subject to enterprise income tax at a rate of 25% on our worldwide income and dividends paid by us to our non-PRC shareholders. In addition, capital gains recognized by them with respect to the sale of our stock may be subject to a PRC withholding tax. This will have an impact on our effective tax rate, a material adverse effect on our net income and results of operations, and may require us to withhold tax on our non-PRC shareholders.

18

PRC Regulations Relating To Offshore Investment Activities By PRC Residents May Increase The Administrative Burden We Face And May Subject Our PRC Resident Beneficial Owners To Personal Liabilities, Limit Our PRC Subsidiary’s Ability To Distribute Profits To Us, Limit Our Ability To Inject Capital Into Our PRC Subsidiary, Or May Otherwise Expose Us To Liability Under The PRC Law.

In October 2005, the PRC State Administration of Foreign Exchange, or SAFE, issued the “Notice on Relevant Issues Concerning Foreign Exchange Administration on Financing and Round-Trip Investment through Offshore Special Purpose Vehicles by Domestic Residents,” generally referred to as Circular 75. The policy announced in this notice required PRC residents to register with the relevant SAFE branch before establishing or controlling offshore special purpose vehicles, or SPVs, for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. In addition, any PRC resident that is a shareholder of an SPV is required to amend its SAFE registration within 30 days after any major change in the share capital of the offshore special purpose company without any roundtrip investment being made, such as any increase or decrease of capital, stock right assignment or exchange, merger or division, investment with long term stock rights or credits, provision of guaranty to a foreign party etc. In May 2007, SAFE issued relevant guidance to its local branches with respect to the operational process for SAFE registration, which standardised more specific and stringent supervision on the registration relating to SAFE Circular No. 75. Failure to comply with the requirements of Circular 75 may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the SPV’s PRC affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV.

We are committed to complying with and to ensuring that our shareholders who are subject to the regulations will comply with the relevant rules. However, we cannot assure you that all of our current or future shareholders who are PRC residents will comply with our request to make or obtain any applicable registrations or comply with other requirements required by Circular 75 or other related rules. Any future failure by any of our current or future shareholders who is a PRC resident, or controlled by a PRC resident, to comply with relevant requirements under this regulation could subject us to fines or sanctions imposed by the PRC government, including restrictions on our PRC subsidiary’s ability to pay dividends or make distributions to us and our ability to increase our investment in our PRC subsidy.

19

We face uncertainty from the Circular on Strengthening the Administration of Enterprise Income Tax on Non-resident Enterprises' Share Transfer (“Circular 698”) released in December 2009 by China's State Administration of Taxation (SAT), effective as of January 1, 2008.

Recently issued Circular 698 provides that when a foreign investor indirectly transfers equity interests in a Chinese resident enterprise by selling the shares in an offshore holding company, and the latter is located in a country where the effective tax burden is less than 12.5% or where the offshore income of its residents is not taxable, the foreign investor shall provide the tax authority with jurisdiction over that Chinese resident enterprise with the relevant information within 30 days of the transfers.

In addition, if a foreign investor indirectly transfers equity interests in a Chinese resident enterprise through the abuse of form of organization and there are no reasonable commercial purposes other than the avoidance of corporate income tax liability, the Chinese tax authority shall have the power to re-assess the nature of the equity transfer in accordance with the “substance-over-form” principle and deny the existence of the offshore holding company that is used for tax planning purposes.

While the term "indirectly transfer" is not defined, the PRC tax authorities appear to be asserting jurisdiction to request information regarding a wide range of foreign entities having no direct contact with China, which would appear to include Sabre Industrial after its acquisition of Tsingyuan Holding. The authority has not yet promulgated any formal provisions or formally declared or stated how to calculate the effective tax in the offshore country or the process of the disclosure to the tax authority with jurisdiction over the Chinese resident enterprise. Meanwhile, there are not any formal declarations with regard to how to decide “abuse of form of organization” and “reasonable commercial purpose,” which can be utilized by us to determine whether our company complies with the Circular 698.

Because our funds are held in banks which do not provide insurance, the failure of any bank in which we deposit our funds could affect our ability to continue in business.

Banks and other financial institutions in the People’s Republic of China do not provide insurance for funds held on deposit. As a result, in the event of a bank failure, we may not have access to funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to have access to our cash could impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue in business.

Sabre Industrial is not likely to hold annual shareholder meetings in the next few years.

Management does not expect to hold annual meetings of shareholders in the next few years, due to the expense involved. The current members of the Board of Directors were appointed to that position by the previous director. If other directors are added to the Board in the future, it is likely that the current directors will appoint them. As a result, the shareholders of Sabre Industrial will have no effective means of exercising control over the operations of the company.

20

Executive Compensation

Information regarding the compensation paid to the executive officers of Sabre Industrial during the past three fiscal years is set forth in Part III, Item 11 of Sabre Industrial‘s Annual Report on Form 10-K which was filed with the Securities and Exchange Commission on April 23, 2010. None of the individuals who served as officers of Sabre Industrial during the past three fiscal years will remain an officer or director of Sabre Industrial after the Share Exchange.

The table below itemizes the compensation that we expect to pay to our officers for services during 2010.

|

Zhang Dingyou

|

$73,746

|

|

Zhang Dingfu

|

$44,248

|

|

Yuan Mingxi

|

$44,248

|

Employment Agreements

All of our officers and directors serve on an at-will basis.

Director Compensation

Sabre Industrial has not adopted any policy regarding compensation of the members of its Board of Directors, as it has no members who are not also employees of its subsidiaries.

Related Party Transactions

During 2010 Linyi Hengchang Malt borrowed $5,968,337 from the members of its board of directors. The debt bears no interest and is due on demand.

Director Independence

None of the member of our Board of Directors are independent, as “independent” is defined in the rules of the NASDAQ Stock Market.

Description of Securities

The Board of Directors of Sabre Industrial is authorized to issue the following classes of common stock:

|

|

·

|

300,000,000 shares of Common Stock, $.001 par value per share, of which 125,715,573 shares are outstanding;

|

|

|

·

|

1,000 shares of Series B Preferred Stock, all 1,000 of which are issued and outstanding; and

|

|

|

·

|

9,989,000 shares of Preferred Stock, $.001 par value, none of which are outstanding.

|

Common Stock. Holders of our Common Stock are entitled to one vote for each share in the election of directors and in all other matters to be voted on by the stockholders. There is no cumulative voting in the election of directors. Holders of Common Stock are entitled to receive such dividends as may be declared from time to time by the Board of Directors with respect to the Common Stock out of funds legally available therefore and, in the event of liquidation, dissolution or winding up of Sabre Industrial, to share rateably in all assets remaining after payment of liabilities. The holders of Common Stock have no pre-emptive or conversion rights and are not subject to further calls or assessments. There are no redemption or sinking fund provisions applicable to the Common Stock.

21

Series B Preferred Stock. The Series B Preferred Stock are owned by Corporate Services International, Inc. (“CSI”), which was the majority holder of our common stock until September 16, 2010, and which is owned by Michael Anthony, who was our sole director and Chief Executive Officer until that date. The Series B Preferred Stock affords CSI the right to convert the preferred shares into 1,141,716 shares of our common stock at any time prior to the close of business on October 24, 2010. Shares of the Series B Preferred Stock have no voting rights and have a liquidation preference of $.01 per share.

Preferred Stock. The Board of Directors of Sabre Industrial is authorized to designate the preferred stock in classes, and to determine the rights, privileges and limitations of the shares in each class.

Recent Sales of Unregistered Securities

In exchange for an aggregate capital investment of $8,700 by Century Capital Partners on or near October 1, 2007, Sabre Industrial issued to Century Capital Partners 133,334 shares of its common stock representing approximately 20.53% of its common stock outstanding on that date. The funds were used to pay ongoing administrative expenses, including but not limited to, outstanding transfer agent fees, state reinstatement and filing fees and all costs associated with conducting the shareholders meeting. On February 23, 2010 Century Capital Partners transferred these shares to Corporate Services International, Inc.

In exchange for an aggregate capital investment of $8,700 by Corporate Services International on or near January 21, 2008, Sabre Industrial issued to Corporate Services International 17,307 shares of its common stock representing approximately 2.6% of its common stock outstanding on that date. The funds were used to pay ongoing administrative expenses.

On or near May 15, 2008, Corporate Services International, Inc. agreed to contribute $25,000 as paid in capital to Sabre Industrial, the entire amount of which was paid to Sabre Industrial on February 19, 2009. Sabre Industrial used these funds to pay the costs and expenses necessary to revive the company's business. Such expenses include, without limitation, fees to re-domicile Sabre Industrial to the state of Delaware; payment of state filing fees; transfer agent fees; calling and holding a shareholder’s meeting; accounting and legal fees; and costs associated with registering with the Securities and Exchange Commission. In exchange for that contribution, Sabre International issued 10,000 shares of Series A Preferred Stock to Corporate Services International. Corporate Services International subsequently converted the Series A Preferred Stock into 100,000,000 shares of common stock.

All of the above offerings and sales were exempt from registration pursuant to Rule 506 of Regulation D and Section 4(2) of the Securities Act of 1933, as amended. No advertising or general solicitation was employed in offering the securities. The offerings and sales were made to a limited number of persons, all of whom were accredited investors, and transfer was restricted by Sabre Industrial in accordance with the requirements of the Securities Act of 1933. The principal officer of the investor was an officer of Sabre Industrial, and had access to all available information regarding Sabre Industrial.

22

Market Price and Dividends on Common Equity and Other Shareholder Matters

Information regarding the market price of Sabre Industrial’s common equity, payment of dividends, and other shareholder matters is set forth in is set forth in Part II, Item 5 of Sabre Industrial‘s Annual Report on Form 10-K which was filed with the Securities and Exchange Commission on April 23, 2010.

Legal Proceedings

Neither Sabre Industrial nor Tsingyuan Holding, Beijing Qingyuan, or Linyi Hengchang Malt is party to any material legal proceedings.

Changes in and Disagreements with Accountants

Not applicable.

Indemnification of Directors and Officers

Section 145 of the General Corporation Law of the State of Delaware authorizes a corporation to provide indemnification to a director, officer, employee or agent of the corporation, including attorneys’ fees, judgments, fines and amounts paid in settlement, actually and reasonably incurred by him in connection with such action, suit or proceeding, if such party acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful as determined in accordance with the statute, and except that with respect to any action which results in a judgment against the person and in favor of the corporation the corporation may not indemnify unless a court determines that the person is fairly and reasonably entitled to the indemnification. Section 145 further provides that indemnification shall be provided if the party in question is successful on the merits.

Our Certificate of Incorporation provides that Sabre Industrial will indemnify its directors and officers, and shall provide for advancement of the expenses of such persons, to the extent permitted by §145 of the General Corporation Law.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 (the “Act”) may be permitted to directors, officers, employees or agents of Sabre Industrial pursuant to the foregoing provisions, or otherwise, Sabre Industrial has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than payment by Sabre Industrial of expenses incurred or paid by a director, officer, employee or agent of Sabre Industrial in the successful defence of any proceeding) is asserted by such director, officer, employee or agent, Sabre Industrial will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

23

Item 9.01 Financial Statements and Exhibits

|

Financial Statements of Linyi Hengchang Malt Co., Ltd. and

|

|||

|

Shandong Qingyuan Beer Co., Ltd.

|

Page

|

|

Audit Report of Independent Registered Pubic Accounting Firm

|

F-1

|

||

|

Combined Balance Sheets as of June 30, 2010 (unaudited) and

|

|||

|

December 31, 2009 and 2008 (audited)

|

F-2

|

||

|

Combined Statements of Operations and Comprehensive Income for

|

|||

|

the Six Months ended June 30, 2010 and 2009 (unaudited) and

|

|||

|

the years ended December31, 2009 and 2008 (audited)

|

F-3

|

||

|

Combined Statements of Owners’ Equity as of December 31, 2009

|

|||

|

and 2008 (audited) and as of June 30, 2010 (unaudited)

|

F-4

|

||

|

Combined Statements of Cash Flows for the Six Months ended

|

|||

|

June 30, 2010 and 2009 (unaudited) and the years ended

|

|||

|

December 31, 2009 and 2008 (audited)

|

F-5

|

||

|

Notes to Combined Financial Statements

|

F-6 – F-32

|

| Pro Forma Combined Financial Statements of Sabre Industrial, Inc. | |||

| and Subsidiaries | F-33 – F-38 |

Exhibits

|

10-a

|