Attached files

| file | filename |

|---|---|

| EX-10.8 - Alaska Pacific Energy Corp | exh108formofoptagmt.htm |

| EX-31.1 - Alaska Pacific Energy Corp | askeexh31110qjul312010.htm |

| EX-32.1 - Alaska Pacific Energy Corp | askeexh32110qjul312010.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________

FORM 10-Q

_______________

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the quarterly period ended July 31, 2010

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

ALASKA PACIFIC ENERGY CORP.

(Exact name of registrant as specified in Charter

NEVADA 000-53607 20-4523691

(State or other jurisdiction of (Commission File No. IRS Employee Identification No.)

incorporation or organization)

2005 Costa Del Mar Road, Carlsbad CA, 92009

(Address of Principal Executive Offices) (Zip Code)

Telephone: 604-274-1565

(Registrant's Former Name or Former Address if Changed Since Last Report)

Check whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No__

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of accelerated filer and large accelerated filer in Rule 12b-2 of the Exchange Act (Check one): Large Accelerated Filer ___ Accelerated Filer ___ Non-Accelerated Filer ___ Smaller Reporting Company X

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes ___ No ___ State the number of shares outstanding of each of the issuer s classes of common equity, as of September 14, 2010: 38,583,000 shares of Common Stock.

1

| ALASKA PACIFIC ENERGY CORP. | |

| FORM 10-Q | |

| July 31, 2010 | |

| INDEX | |

| PART I-- FINANCIAL INFORMATION | |

| Item 1. | Financial Statements |

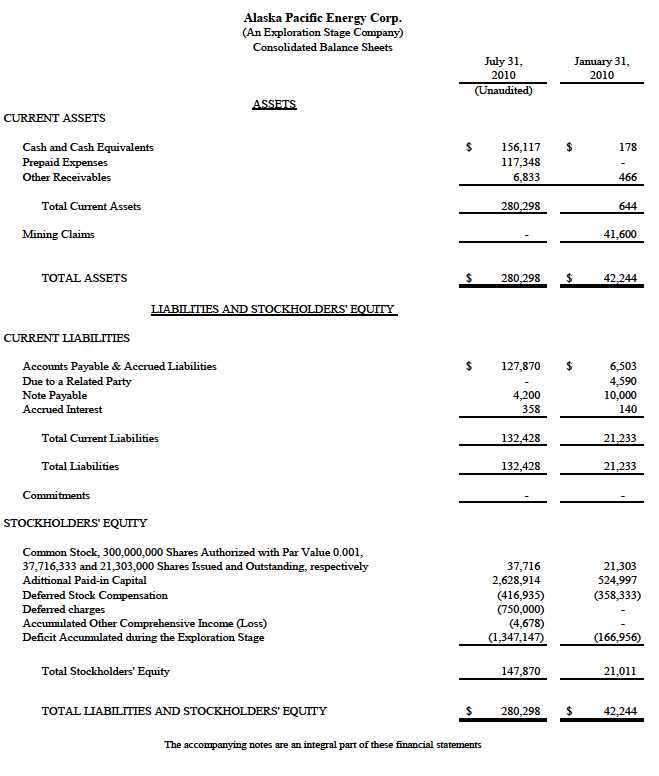

| Consolidated Balance Sheets F-1 | |

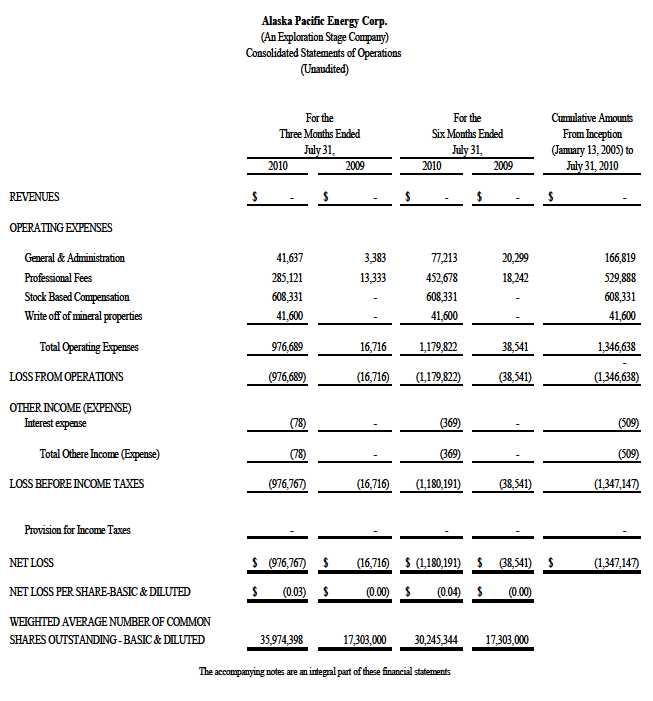

| Consolidated Statements of Operations F-2 | |

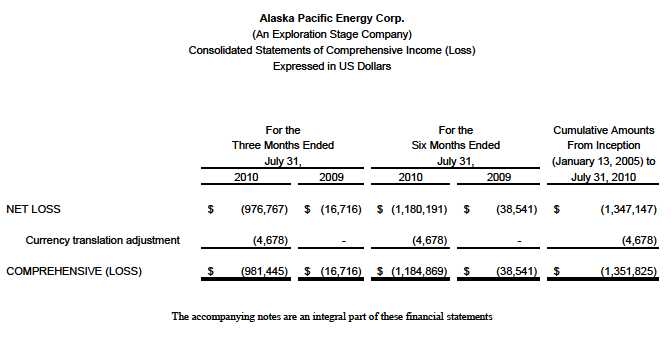

| Consolidated Statements of Other Comprehensive Income (Loss) F-3 | |

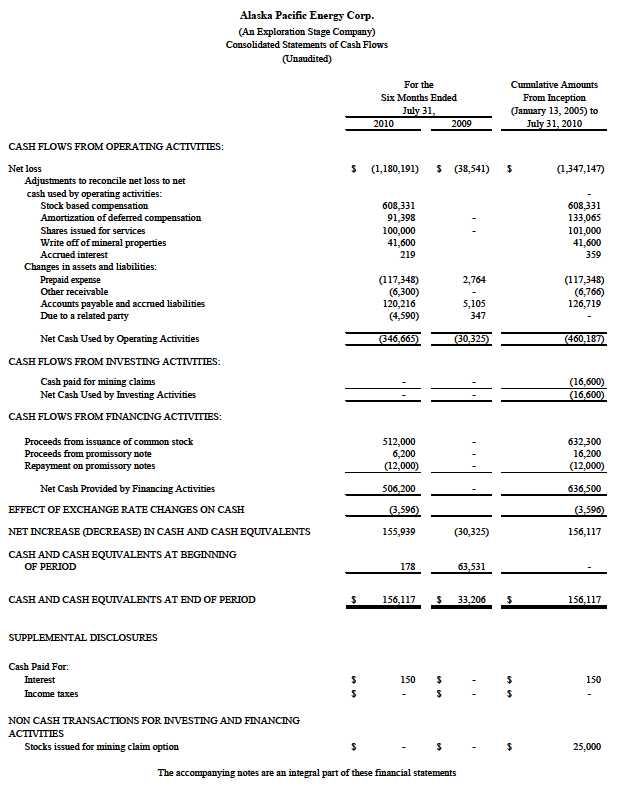

| Consolidated Statements of Cash Flows F-4 | |

| Condensed Notes to the Consolidated Financial Statements F-5 | |

| Item 2. | Management s Discussion and Analysis of Financial Condition |

| Item 3 | Quantitative and Qualitative Disclosures About Market Risk |

| Item 4 | Control and Procedures |

| PART II-- OTHER INFORMATION | |

| Item 1 | Legal Proceedings |

| Item 1A | Risk Factors |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

| Item 3. | Defaults upon Senior Securities |

| Item 4. | Submission of Matters to a Vote of Security Holders |

| Item 5. | Other Information |

| Item 6. | Exhibits and Reports on Form 8-K |

| SIGNATURES | |

2

Alaska Pacific Energy Corp

(An Exploration Stage Company)

Unaudited Consolidated Financial Statements

(Expressed in US dollars)

Three and Six Months Ended July 31, 2010 and 2009

3

4

5

6

7

Alaska Pacific Energy Corp.

(An Exploration Stage Company)

Condensed Notes to Consolidated Financial Statements

Six and Three Months Ended July 31, 2010 and 2009

1. BASIS OF PRESENTATION

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules and regulations of the United States Securities and Exchange Commission for interim financial information. Accordingly, they do not include all the information and footnotes necessary for a comprehensive presentation of financial position, results of operations, stockholders equity (deficit) or cash flows. It is management's opinion, however, that all material adjustments (consisting of normal recurring adjustments) have been made which are necessary for a fair financial statement presentation. The unaudited interim consolidated financial statements should be read in conjunction with the Company s Annual Report on Form 10-K, which contains the audited financial statements and notes thereto, together with the Management s Discussion and Analysis, for the year ended January 31, 2010. The interim results for the period ended July 31, 2010 are not necessarily indicative of the results that may be expected for the year ending January 31, 2011.

2. NATURE ORGANIZATION OF OPERATIONS

Alaska Pacific Energy Corp. (the Company ), was incorporated under the laws of the State of Nevada on January 13, 2005 and is engaged in the acquisition, exploration and development of resource properties. The Company has not yet determined whether their properties contain enough mineral reserves, such that their recovery would be economically viable. Further, the Company is considered a development stage Company as defined in accordance with accounting guidance, FASB ASC 915, Development Stage Entities, and has not, thus far, commenced planned principal operations. On May 12, 2010, the Company incorporated its wholly owned subsidiary, Alaska Pacific Energy Canada Ltd. under the laws of Alberta, Canada.

The unaudited interim consolidated financial statements included the accounts of the Company and its wholly owned subsidiary and all inter-company transaction and balance have been eliminated.

3. GOING CONCERN

These consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America applicable to a going concern which assumes that the Company realize its asset and discharge its liabilities in the normal course of business. The Company has no revenue source and is dependent on financing to sustain operations and pay for future commitments related to the mineral option, and might not have sufficient working capital for the next twelve months. As shown in the accompanying unaudited consolidated financial statements, the Company incurred a net loss of $1,180,191 and $38,541 during the periods ended July 31, 2010 and 2009. The Company has historically incurred net losses which have resulted in an accumulated deficit of $1,347,147 as at July 31, 2010. These factors create substantial doubt as to the ability of the Company to continue as a going concern. Realization values may be substantially different from the carrying values as shown in these financial statement should the Company be unable to continue as a going concern. Management is in the process of identifying sources for additional financing to fund the ongoing development of the Company s business. As of July 31, 2010, the Company had cash and cash equivalents of $156,117, prepaid of $117,348 and other receivables of $6,833, among the current assets. The accompanying unaudited consolidated financial statements do not include any adjustments

8

related to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might result from the outcome of this uncertainty.

Alaska Pacific Energy Corp.

(An Exploration Stage Company)

Condensed Notes to Consolidated Financial Statements

Six and Three Months Ended July 31, 2010 and 2009

4. SIGNIFICANT ACCOUNTING POLICIES Foreign Currency Translation

The Company s subsidiary functional currency is Canadian dollars. Transactions in other currencies are recorded in Canadian dollars at the rates of exchange prevailing when the transactions occur. Monetary assets and liabilities denominated in other currencies are translated into Canadian dollars at rates of exchange in effect at the balance sheet dates. Exchange gains and losses are recorded in the statements of operations.

At the period end, the subsidiary s assets and liabilities are translated into the U.S. dollars at exchange rates at the balance sheet date, equity accounts are translated at historical exchange rate and revenues and expenses are translated by using the average exchange rates. Accumulated translation adjustments are reported as a separate component of other comprehensive income (loss) in the consolidated statements of stockholders equity (deficiency).

Fair Value Measurements and Financial Instruments

Financial instruments measured at fair value are classified into one of three levels in the fair value hierarchy according to the relative reliability of the inputs used to estimate the fair values. The three levels of the fair value hierarchy are:

· Level 1 unadjusted quoted prices in active markets for identical assets or liabilities

· Level 2 inputs other than quoted prices that are observable for the asset or liability either directly or indirectly; and· Level 3 inputs that are not based on observable market data.

The Company s financial instruments include cash and cash equivalents, other receivables, accounts payable and accrued liabilities, due to related party, promissory note payable and accrued interest. Fair values were assumed to approximate carrying values for these financial instruments due to their short-term nature. Management is of the opinion that the Company is not exposed to significant interest, credit or currency risks arising from these financial instruments.

5. NEW ACCOUNTING PRONOUNCEMENTS

In January 2010, the FASB issued ASU No. 2010-06 regarding fair value measurements and disclosures and improvement in the disclosure about fair value measurements. This ASU requires additional disclosures regarding significant transfers in and out of Levels 1 and 2 of fair value measurements, including a description of the reasons for the transfers. Further, this ASU requires additional disclosures for the activity in Level 3 fair value measurements, requiring presentation of information about purchases, sales, issuances, and settlements in the reconciliation for fair value measurements. This ASU is effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. The Company is currently evaluating the impact of this ASU; however, the Company does not expect the adoption of this ASU to have a material impact on our financial statements.

9

Alaska Pacific Energy Corp.

(An Exploration Stage Company)

Condensed Notes to Consolidated Financial Statements

Six and Three Months Ended July 31, 2010 and 2009

In February 2010, the FASB issued ASC No. 2010-09, Amendments to Certain Recognition and Disclosure Requirements , which eliminates the requirement for SEC filers to disclose the date through which an entity has evaluated subsequent events. ASC No. 2010-09 is effective for its fiscal quarter beginning after 15 December 2010. The adoption of ASC No. 2010-09 is not expected to have a material impact on the Company s financial statements

5. NEW ACCOUNTING PRONOUNCEMENTS (Cont d&)

ASU No. 2010-13 was issued in April 2010, and clarified the classification of an employee share based payment award with an exercise price denominated in the currency of a market in which the underlying security trades. This ASU will be effective for the first fiscal quarter beginning after December 15, 2010, with early adoption permitted. The adoption of ASU No. 2010-13 is not expected to have a material impact on the Company s financial statements.

Other accounting pronouncements that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company s financial statements upon adoption.

6. MINING CLAIMS

Whitton Township and Gayhurst Township in Province of Quebec Mining Claims Canada

The Company entered into an option agreement dated June 26, 2008 to acquire a 100% interest in three groups of mineral claims with 21, 28 and 12 claims, respectively, in Whitton Township and Gayhurst Township, Province of Quebec, Canada. Pursuant to the agreement, the Company paid $16,600 and issued 250,000 common shares at $0.10 per share on July 15th 2008 for the first payment. The second cash payment in amount of $16,600 and 250,000 common shares issuance was to be executed on or before July 15, 2009. The Company signed an extension for the second payment to July 15, 2010 pursuant to the agreement to purchase the claims.

During the period ended July 31, 2010, the Company did not make the second option payment and the related mining claims had also lapsed and expired. The Company wrote off the related capitalized cost of $41,660.

7. TRANSACTIONS WITH ENGINEERING TECHNOLOGY, INC. ( ENTEC )

On March 18, 2010, the Company and ENTEC entered into a Technology License Agreement ( License Agreement ) whereas ENTEC granted the Company and its affiliates a non-exclusive, non-transferrable, non-sub-licensable, royalty-free, fully paid-up license to use the technology, documentation and associated intellectual property within the territory for any oil sands recovery activities in which the Company or its affiliates are now or hereafter engaged with a term of 25 years for a consideration of 15 million common shares of the Company. Upon the signing of the above noted License Agreement, the Company approved and issued 15 million common shares.

10

Prior to the closing of the above License Agreement, on June 1, 2010, the Company and the shareholders of ENTEC entered into a Share Purchase and Sales Agreement ( Purchase Agreement )

Alaska Pacific Energy Corp.

(An Exploration Stage Company)

Condensed Notes to Consolidated Financial Statements

Six and Three Months Ended July 31, 2010 and 2009

to acquired 100% ownership of ENTEC for a consideration of $10 million with $3 million payable as by the equity of the Company (a total of 12 million common shares) and $7 million cash.

In substance, the above noted License Agreement and Purchase Agreement together are considered as business acquisition as the Company is acquiring ENTEC for a total consideration of 27 million common shares of APEC and $7 million cash. The issuance of 15 million common shares that have been distributed to the shareholders of ENTEC has been considered as a part of the purchase price. The Company accounted the issuance of 15 million common shares as deferred charges which will be applied as part of purchase price upon the closing of the Purchase Agreement.

Subsequent to July 31, 2010, the Company re-negotiated with the shareholders of ENTEC and amended and restated the above noted Purchase Agreement for the following purchase prices:

7. TRANSACTIONS WITH ENGINEERING TECHNOLOGY, INC. ( ENTEC ) (Cont d&)

· $7,000,000 cash; and

· An aggregate of $8,100,000 (the Convertible Debenture Amount ) under convertible debenture issued by the Company to and in favour of the shareholders of ENTEC which is convertible into the common shares of the Company for not less than 27 million common shares of the Company; and· The termination of the above noted License Agreement and return and cancel the above issued 15 million common shares of the Company.

The amended and restated Purchase Agreement will be terminated and expired if not closed on October 31, 2010.

As at July 31, 2010, the deferred charges related to the issuance of 15 million common shares have been included in the shareholders equity to reflect the substance of the above noted transactions.

8. NOTE PAYABLE

On January 9, 2010, the Company received $10,000 from Ms. Sally Alston ( the lender ) pursuant to a promissory note payable. The note bears interest at 6% per annum, and is due on demand. On January 31, 2010, the Company entered into an additional promissory note with Ms. Sally Alston in an amount of $2,000 bearing interest of 6% per annum and is due on demand. On February 1, 2010, the Company received $2,000 from Ms. Sally Alston pursuant to this promissory. On June 11, 2010, the Company paid back $2,000 of principal plus $150 accrual interests on demand to this lender. On February 25, 2010, the Company entered into another additional convertible promissory note with Ms. Sally Alston and received in the amount of $5,000 bearing interest of 10% per annum. The promissory note and interest are due and will be paid on demand. Under the agreement when demand for payment is presented to the Company, providing 10 clear days notice in written are give to the Company, the lender has the option to convert this loan outstanding at a deemed price of $0.15 into Company s common stock. On April 27, 2010, the Company paid back $15,000 of principal on demand to this lender. As of July 31, 2010, the Company repaid back the principal in full and accrued total interest of $254 and outstanding.

11

On February 22, 2010, the Company entered into a convertible promissory note with Mike Moustakis in amount of $4,200 bearing interest of 6% per annum. The promissory note and interest are due and

Alaska Pacific Energy Corp.

(An Exploration Stage Company)

Condensed Notes to Consolidated Financial Statements

Six and Three Months Ended July 31, 2010 and 2009

will be paid on demand. Under the agreement when demand for payment is presented to the Company, providing 15 clear days notice in written are given to the Company, the lender has the option to convert this loan outstanding at a deemed price of $0.15 into Company s common stock. The Company has received $4,200 (CAD$4,340) from the lender pursuant to the promissory note. As of July 31, 2010, the Company had $4,200 principal and accrued interest of $104.

The Company did not incur beneficial conversion charges for the above noted convertible promissory notes because the conversion price is great than the fair value of the Company s equity at the date of the convertible promissory note was issued.

9. CAPITAL STOCK

Issued and Outstanding

On February 6, 2010, the Company issued 1,000,000 shares of common stock of the Company valued at $0.10 per share or $100,000, pursuant to a business advisory consulting agreement dated November 1, 2009.

On February 26, 2010, Nanita Holding Ltd., George Skrivanos, and Anastasios Koutsoumbos authorized to affect the share cancellation of 2,000,000, 1,000,000 and 1,000,000 common stocks of the Company, respectively which were originally issued in 2007.

On March 11, 2010, the board of directors of the Company approved the issuance of 1,000,000 shares of common stock of the Company to a director and officer of the Company for services provided to the Company. The shares were issued in accordance with Regulation S of the Securities Act of 1933 and valued at $0.10 per share or $100,000.

On March 18, 2010, pursuant to the License Agreement, the Company issued 15,000,000 restricted common shares of the Company to ENTEC at a deemed price of $0.05 per share or $750,000.

On April 1, 2010, the Company issued 25,000 shares of common stock of the Company for cash valued at $0.15 per share or $3,750.

On April 16, 2010, the Company issued 1,333,333 shares of common stock of the Company for cash valued at $0.15 per share or $200,000.

On May 14, 2010, the Company issued 35,000 shares of common stock of the Company for cash valued at $0.15 per share or $5,250.

On May 17, 2010, the Company issued 20,000 shares of common stock of the Company for cash valued at $0.15 per share or $3,000.

On June 30, 2010, the Company issued 2,000,000 shares of common stock of the Company for cash valued at $0.15 per share or $300,000.

12

Alaska Pacific Energy Corp.

An Exploration Stage Company)

Condensed Notes to Consolidated Financial Statements

Six and Three Months Ended July 31, 2010 and 2009

9. CAPITAL STOCK (Cont d&)

Deferred Stock Compensation

On November 1, 2009, the Company entered into a business advisory consulting agreement with James Andrews. The Company agreed to issue the consultant a total of 5,000,000 restricted common shares of the Company vesting as follows: 2,000,000 restricted Common Shares upon the signing of this agreement, 1,000,000 restricted Common Shares on December 1, 2009, 1,000,000 restricted Common Shares on January 1, 2010, and rest of 1,000,000 restricted Common Shares on February 6, 2010 for his services over 3 years, commencing on November 1, 2009. The Company used the straight-line amortization method to amortize the entire 5 million shares over the three-year service period. As of July 31, 2010, the Company issued the 5,000,000 common stock and recorded deferred stock compensation of $500,000. The amount of $125,000 is amortized as of July 31, 2010.

On July 27, 2010, the Company signed an Investor Relations/Media Consulting Agreement with Longview Communications Corp ( Consultant ) for the services effective from July 27, 2010 through August 27, 2010. The Company agreed to pay $50,000 for consultants work in the form of cash, and 142,857 restricted shares (rule 144) of its common stock, as total and complete consideration for the services to be provided by the consultant to the Company. Payment in full shall be due no later than July 27, 2010. The Company paid $50,000 in cash and committed to issue 142,857 common shares of the Company. As at July 31, 2010, the Company credited additional paid-in capital and debited deferred stock based compensation of $50,000 and $50,000, respectively, for the above noted 142,857 common shares committed to issue. The amount of $$8,065 is amortized as of July 31, 2010

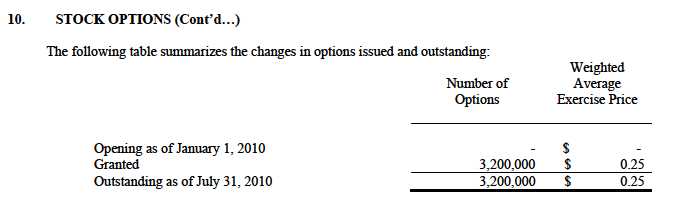

10. STOCK OPTIONS

On May 1, 2010, the Company granted a total of 3,200,000 stock options to the consultants of the Company at the exercise price of $0.25 per share. The options will be vested immediately and will expire on April 30, 2012.

The Company estimates the fair value of each stock option at a grant date by using the Black-Scholes option pricing model pursuant to FASB ASC718, Share Based Payment and the following assumptions: expected term of 2 years, a risk free interest rate of 0.97%, a dividend yield of 0% and volatility of 117%.

Under the provisions of SFAS ASC718 stock based compensation expenses of $608,331 and $0 was recorded for the period ended July 31, 2010 and 2009, respectively.

13

Alaska Pacific Energy Corp.

An Exploration Stage Company)

Condensed Notes to Consolidated Financial Statements

Six and Three Months Ended July 31, 2010 and 2009

11. RELATED PARTY TRANSACTIONS

Related party transactions are in the normal course of operations, occurring on terms and conditions that are similar to those of transactions with unrelated parties and, therefore, are measure at the exchange amount.

During the period ended July 31, 2010 and 2009, the Company was charged $60,000 and $0 consulting fees by the President and CEO of the Company and $95,938 and $0 consulting fees by companies controlled senior officers of the Company, respectively.

Included in prepaid expenses and deposits is amounts of $55,582 (January 31, 2010 - $0) advanced to the President and CEO of the Company for operating expenses.

Included in accounts payable and accrued liabilities, $114,926 (January 31, 2010 - $0) was payable to a senior officer and companies controlled by senior officers of the Company.

Also see Note 12.

12. COMMITMENTS

On May 12, 2010, the Company entered into a consulting agreement with Emerald Isle Services Ltd.

( Consultant ), an Alberta Company owned by a senior officer of the Company (director of the Company s subsidiary) for service providing for a period of three years. The Company agreed to pay CAD$25,000 per month. However, The Consultant agreed to receive CAD$10,000 per month from March 2010 through August 31, 2010. As of July 31, 2010, the Company paid / accrued CAD$50,000.

On May 12, 2010, the Company entered in a consultant agreement with JCL Henery Inc. ( Consultant ), an Alberta Company owned by a senior officer (director of the Company s subsidiary) for services providing for a period of three years. The Company agreed to pay CAD$10,000 per month from March 2010. As of July 31, 2010, the Company paid / accrued CAD$50,000 outstanding.

14

On May 12, 2010, the Company entered into a consulting agreement with James Andrews for his service for a period of three years. The Company agreed to pay CAD$5,000 per month commencing from March 1. As of July 31, the Company paid CAD$20,000.

Alaska Pacific Energy Corp.

An Exploration Stage Company)

Condensed Notes to Consolidated Financial Statements

Six and Three Months Ended July 31, 2010 and 2009

12. COMMITMENTS (Cont d&)

On July 27, 2010, the Company signed an Investor Relations/Media Consulting Agreement with Longview Communications Corp ( Consultant ) for the services effective from July 27, 2010 through August 27, 2010. The Company agreed to pay $50,000 for consultants work in the form of cash, and 142,857 restricted shares (rule 144) of its common stock, as total and complete consideration for the services to be provided by the consultant to the Company. Payment in full shall be due no later than July 27, 2010. As of July 31, 2010, the Company paid $50,000 in cash and committed to issue 142,857 of common shares.

13. SUBSEQUENT EVENTS

Subsequent to July 31, 2010, the Company received $67,500 for 450,000 shares subscription at $0.15 per share.

Subsequent to July 31, 2010, the Company issued 866,667 shares of common stock of the Company for cash valued at $0.15 per share or $130,000.

On August 2, 2010, the Company entered into a convertible promissory note with Asher Enterprises, Inc. in amount of $53,000 bearing interest of 8% per annum due 9 months after issuance. The promissory note is convertible into the shares of common stock of the Company during the term of the promissory note at the variable conversion price, which equals to 58% multiplied by the market price. Market price means the average of the lowest three trading price for the common stock during the ten trading day period ending one trading day prior to the date of conversion notice.

On August 4, 2010, the Company entered into an E-Trax Subscription Agreement with AlphaTrade.com ( APTD ) a Nevada corporation. APTD agrees to provide the Company, in specified order form with access to the APTD Services. The data, text, graphics and images contained in the APTD Services, and any portion thereof, shall be referred to, individually and collectively, as the APTD Content . The agreement will take effect on the contract start date of August 4, 2010 until the contract termination set in the agreement. As of this filing report, the Company paid $12,000.

In August 2010, the Company entered into a consulting agreement with Information Solutions Group ( ISG ) for the management consulting services, business advisory services, shareholder information services and public relations services. The Company agreed to pay $30,000 before August 13, 2010 for a start date of August 16, 2010 and coverage through October 29, 2010. As of this filing report, the Company paid $30,000 in full.

On August 13, 2010, the Company made a consulting agreement with Tritos Inc. ( Consultant ) for management consulting services, business advisory services, shareholder information services and public relations services. The Company agreed to pay $15,000 in exchange for the first round of services ranging from August 18, 2010 through September 30, 2010. Either party may terminate this

15

agreement at the end of any month during the term of this agreement. As of this filing report, the Company paid $15,000.

Alaska Pacific Energy Corp.

An Exploration Stage Company)

Condensed Notes to Consolidated Financial Statements

Six and Three Months Ended July 31, 2010 and 2009

13. SUBSEQUENT EVENTS (Cont d&)

On August 12, 2010, the Company entered into an office lease agreement with 120 Eglinton East Business Centre Inc. ( 120 ) for a period of six months beginning from August 19, 2010 at a monthly basic rental charge of $1,750 plus telecom package of $420 monthly charge. Total of $2,170 payable in advance will be due on the 19th day of each month during the term. At the end of this agreement, the Company may renew this tenancy on a month-to-month basis. This renewal can be terminated by giving a minimum of 60 days prior written notice to terminate, and such termination to be effective on the 19th day of the next month after such 60-day period.

On August 25, 2010, the Company entered into an agreement with G.M. Astor & Associates. The Company agreed to pay $1 million in cash and issue 500,000 restricted common shares of the Company upon successful completion of the raising of $18,000,000 for the Company.

Also see note 7.

Alaska Pacific Energy Corp. has evaluated subsequent events for the period July 31, 2010 through the date the financial statements were issued, and concluded there were no other events or transactions occurring during this period that required recognition or disclosure in its financial statements.

16

In this report references to APEC , Alaska Pacific, the Company we, us, and our refer to Alaska Pacific Energy Corp. and Alaska Pacific Canada Ltd.

FORWARD LOOKING STATEMENTS

The Securities and Exchange Commission ( SEC ) encourages companies to disclose forward-looking information so that investors can better understand future prospects and make informed investment decisions. This report contains these types of statements. Words such as may, expect, believe, anticipate, intend, estimate, project, or continue or comparable terminology used in connection with any discussion of future operating results or financial performance identify forward-looking statements. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this report. All forward-looking statements reflect our present expectation of future events and are subject to a number of important factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements.

ITEM 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Our business activities to date have not provided any cash flow. During the next twelve months we anticipate incurring costs and expenses related to our planned business. We are currently in need of additional equity financing to fund our planned business. Based on our history as a developmental stage company, it is difficult to predict our future results of operations. Our planned business may not be materialized or our operations may never generate significant revenues or any revenues whatsoever, and we may never achieve profitable operations.

We incurred total operating expenses in the amount of $1,347,147 for the period from our inception on January 13, 2005 to July 31, 2010.

Plan of Operations

The Company will continue to manage its operations and cash resources in a manner consistent with its expectation that it will be able to satisfy cash requirements through fiscal 2011.

On May 12, 2010, the Company incorporated its subsidiary company, Alaska Pacific Energy Canada Ltd. under the laws of Alberta, Canada to engage in developing oil and gas energy business in Canada.

During the period ended July 31, 2010, the Company s mining option was forfeited as the Company failed to fulfill the second option payment and the underlying mining claims have been lapsed and expired. The capitalized cost of mining claims $41,600 has been written off during the period ended July 31, 2010.

The Company is currently in the process of obtaining equity financing to complete the related amended Share Purchase and Sales Agreement to acquire 100% ownership of Engineering Technology, Inc. which will be expired on October 31, 2010.

Results of Operations

We have not earned and recorded any revenues from the time of our incorporation on January 13, 2005 to July 31, 2010. We do not anticipate earning revenues unless we succeed with our planned business operations. In terms of our mineral properties, during the period ended July 31, 2010, our mining option was forfeited and currently we have no mineral claims. We are in the process of completing the amended

17

Share Purchase and Sales Agreement to acquire 100% ownership of Engineering Technology, Inc. and can provide no assurance that we will successfully raise the financing and complete the acquisition.

The Company recognized a net loss of $1,180,191 and $38,541 for the periods ended July 31, 2010 and 2009, respectively. From inception through July 31, 2010, the Company recognized a net loss of $1,347,147.

Our operating expenses increased $1,141,281 from $38,541 for the first six-month period in 2009 to $1,180,191 for the first six-month period in 2010. Such represented an increase of G & A expenses in the amount of $56,914, an increase of professional fees in the amount of $434,436 primarily related to the management fees and consulting fees, an increase of stock based compensation in the amount of $608,331 related to 3.2 million stock options granted to consultants of the Company and the write off of the mining claims of $41,600.

Capital Resources and Liquidity

Working capital, which was current assets less current liabilities, was $147,870 at July 31, 2010 compared to a working capital deficit of $20,589 at January 31, 2010. Current assets at July 31, 2010 included cash and cash equivalents of $156,117, prepaid of $117,348 and other receivables of $6,833.

As at July 31, 2010, we had total assets of $280,298, comprising of cash and cash equivalents of $156,117, prepaid expense of $117,348 and other receivables of $6,833. This is an increase from $42,244 in total assets as at January 31, 2010. The increase was attributable to cash and cash equivalents and prepaid expenses.

As at July 31, 2010, our total liabilities increased to $132,428 from $21,233 as at January 31, 2010. This increase primarily resulted from the increase of accounts payable and accrued liabilities and offset by the repayment of promissory note payable and reduction of related party advances.

The Company s cash flows used by operating activities are $346,665 and 30,325 for the six months periods in 2010 and 2009, respectively. The increase in the Company s cash flow provided by financing activities from $0 for the period ended July 2009 to $506,200 to the period ended July 31, 2010 was due to share issue for cash, proceeds from promissory note payable and offset by the repayment of promissory note payable for the period ended July 31, 2010.

As of July 31, 2010 and January 31, 2010, we had $156,117 and $178, respectively in cash. We received funds of $512,000 and $0 for the second quarter ended July 31, 2010 and 2009, respectively through proceeds from share issue for cash. Our operating expenses increased for the 2010 second quarter compared to the same quarter ended July 31, 2009. The increase was primarily due to professional fees related to legal, audit and consulting service fees and general administration expenses related to rental, office expenses and stock based compensation in the 2010 second quarter. As a result of the increase, we recorded a larger net loss for the 2010 second quarter compared to the 2009 second quarter. Therefore we have limited capital resources and will have to rely upon the issuance of common stock to fund our planned operations. Cash and cash equivalents from inception to date have been sufficient to cover expenses involved in starting our business. We will require additional funds to continue to implement our business plan during the next twelve months.

The increase in the Company s cash flow provided by financing activities from $0 to $506,200 was due to the increase in proceeds from share issue for cash, proceeds from promissory note payable and offset by the repayment of promissory note payable for the period ended July 31, 2010 compared with the same period ended July 31, 2009.

We currently do not have enough cash to satisfy our minimum cash requirements and planned business operations for the next twelve months. The Company's financial statements have been presented on the basis that it is a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred losses from inception to July 31,

18

2010. The Company has no mining claims as of July 31, 2010. These factors raise substantial doubt about the Company's ability to continue as a going concern.

Management continues to actively seek additional sources of capital to fund current and future operations. There is no assurance that the Company will be successful in continuing to raise additional capital and realizing its planned operation. These financial statements do not include any adjustments that might result from the outcome of these uncertainties.

Subsequent to the quarter ended July 31, 2010, the Company received a deposit of $197,500 for share subscription pursuant to sale of common stock to issue 1,316,667 shares of the common stock of the Company for cash at $0.15 per share.

Recent Accounting Pronouncements Critical Accounting Policies

Our financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States ( GAAP ). GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expense amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

Off Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

The Company is subject to certain market risks, including changes in interest rates and currency exchange rates. The Company does not undertake any specific actions to limit those exposures.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our principal executive officer and our principal financial officer have concluded that our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) were not effective as of the end of the period covered by this report, based on their evaluation of these controls and procedures required by paragraph (b) of Rules 13a-15 and 15d-15, due to certain material weaknesses in our internal control over financial reporting as discussed below.

Internal Control over Financial Reporting

Management of Alaska Pacific Energy Corp. is responsible for establishing and maintaining adequate internal control over financial reporting. Alaska Pacific Energy Corp.'s internal control over financial reporting is a process, under the supervision of the Chief Executive Officer and the Chief Financial Officer, designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company's financial statements for external purposes in accordance with United States generally accepted accounting principles (GAAP). Internal control over financial reporting includes those policies and procedures that:

19

Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the Company's assets;

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of the financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures are being made only in accordance with authorizations of management and the Board of Directors; and

Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company's assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions or that the degree of compliance with the policies or procedures may deteriorate.

Alaska Pacific Energy Corp.'s management conducted an assessment of the effectiveness of the Company's internal control over financial reporting as of July 31, 2010, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO"). As a result of this assessment, management identified material weaknesses in internal control over financial reporting.

A material weakness is a control deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the Company's annual or interim financial statements will not be prevented or detected on a timely basis.

Alaska Pacific Energy Corp.'s is currently attempting to remedy the Lack of Adequate Independent Oversight (as described above) by searching for and recruiting qualified individuals to sit as independent board members whose mandate is to oversee management. The Company is not in a financial position to effectively remediate the Lack of Segregation of Duties at this time, however, improvements to Independent Oversight will challenge management to justify the information produced for the period-end financial reporting process. This report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management's report in this annual report.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal control over financial reporting during our second fiscal quarter of our fiscal year ended January 31, 2011 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Management s Report on Internal Controls over Financial Reporting

Internal control over financial reporting is a process to provide reasonable assurance regarding the reliability of consolidated financial reporting and the preparation of financial statements for external purposes in accordance with U.S. generally accepted accounting principles. There has been no change in the Company s internal control over financial reporting during the second quarter ended July 31, 2010 that has materially affected, or is reasonably likely to materially affect, the Company s internal control over financial reporting.

The Company s management, including the Company s CEO and CFO, does not expect that the Company s disclosure controls and procedures or the Company s internal controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable,

20

not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of the controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected.

This quarterly report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management's report in this quarterly report.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

Currently we are not aware of any litigation pending or threatened by or against the Company.

Item 1A. Risk Factors.

Not required because we are a smaller reporting Company.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

Sales of Equity Securities have been conducted and shares of the Company s stock have been issued during the period ended July 31, 2010.

On February 6, 2010, the Company issued 1,000,000 shares of common stock of the Company valued at $0.10 per share or $100,000, pursuant to a business advisory consulting agreement dated November 1, 2009.

On February 26, 2010, Nanita Holding Ltd., George Skrivanos, and Anastasios Koutsoumbos authorized to affect the share cancellation of 2,000,000, 1,000,000 and 1,000,000 common stocks of the Company, respectively which were originally issued in 2007.

On March 11, 2010, the board of directors of the Company approved the issuance of 1,000,000 shares of common stock of the Company to a director and officer of the Company for services provided to the Company. The shares were issued in accordance with Regulation S of the Securities Act of 1933 and valued at $0.10 per share or $100,000.

On March 18, 2010, pursuant to the License Agreement, the Company issued 15,000,000 restricted common shares of the Company to ENTEC at a deemed price of $0.05 per share or $750,000.

On April 1, 2010, the Company issued 25,000 shares of common stock of the Company for cash valued at $0.15 per share or $3,750.

On April 16, 2010, the Company issued 1,333,333 shares of common stock of the Company for cash valued at $0.15 per share or $200,000.

On May 14, 2010, the Company issued 35,000 shares of common stock of the Company for cash valued at $0.15 per share or $5,250.

On May 17, 2010, the Company issued 20,000 shares of common stock of the Company for cash valued at $0.15 per share or $3,000.

On June 30, 2010, the Company issued 2,000,000 shares of common stock of the Company for cash valued at $0.15 per share or $300,000.

21

In August 2010, the Company received $67,500 for 450,000 share subscription at $0.15 per share.

In August 2010, the Company issued 866,667 shares of common stock of the Company for cash valued at $0.15 per share or $130,000.

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Submission of Matters to a Vote of Security Holders.

None.

Item 5. Other Information. None

Item 6. Exhibits and Reports of Form 8-K.

(a) Exhibits

10.8 Form of Option Agreement

31.1 Certifications pursuant to Section 302 of Sarbanes Oxley Act of 2002 32.1 Certifications pursuant to Section 906 of Sarbanes Oxley Act of 2002

(b) Reports of Form 8-K

On June 9, 2010 the Company filed a Current Report on Form 8-K (Entry into a Material Definitive Agreement) reporting that it had entered into a purchase agreement to acquire all the outstanding shares and assets of Engineering Technology Inc ( Entec ) a Calgary Alberta based, private company. Pursuant to the terms of the Agreement the Company will pay $7,000,000 and issue a total of 12,000,000 restricted common shares to the Entec shareholders at a deemed price of $0.25 per share. Additionally, APEC will have to raise $5,000,000 dollars for working capital. The agreement is subject to a full due diligence review of Entec. Completion of the due diligence and the closing is expected by August 31, 2010 has been deferred by mutual agreement until October 31, 2010 with amended and restated agreement.

On September 1, 2010 filed a Current Report on Form 8-K (Changes in registrant s certifying accountant) reporting the resignation of Chisholm Bierwolf Nilson & Morrill, LLC as the Company independent registered public accounting firm. The reports of Chisholm Bierwolf Nilson & Morrill, LLC regarding the financial statements of the Company as of and for the years ended January 31, 2010 and January 31, 2009 do not contain an adverse opinion or disclaimer of opinion, nor are they qualified or modified as to uncertainty, audit scope, or accounting principles. During the years ended January 31, 2009 and January 31, 2010 and continuing through August 29, 2010, there were no disagreements with Chisholm Bierwolf Nilson & Morrill, LLC regarding any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Chisholm Bierwolf Nilson & Morrill, LLC would have caused Chisholm Bierwolf Nilson & Morrill, LLC to make reference to the subject matter of any such disagreement in its reports regarding the Company s financial statements for such periods. During the fiscal years ended January 31, 2009 and January 31, 2010, there were no reportable events as defined in Item 304 (a)(1)(v) of Regulation S-K The Company filed a letter from Chisholm Bierwolf Nilson & Morrill, LLC with the Securities and Exchange Commission as Exhibit 16.1

Additionally, in the same Form 8-K, the Company reported that On August 29, 2010, upon the authorization and approval of its Board of Directors, the Company engaged Chang Lee LLP ( Chang ) as its independent registered public accounting firm.

No consultations occurred among the Company and Chang during the years ended January 31, 2010 and January 31, 2009 and continuing through August 29, 2010, regarding either (i) the application of accounting principles to a specific completed or contemplated transaction, the type of audit opinion that

22

might be rendered regarding the Company s financial statements, or other information provided that was an important factor considered by the Company in reaching a decision as to an accounting, auditing, or financial reporting issue, or (ii) any matter that was either subject of disagreement as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions or a reportable event requiring disclosure pursuant to Item 304(a)(1)(iv) of Regulation S-K.

Chang Lee LLP accepted the engagement as the Company s independent registered public accounting firm as of the date of filing the above noted Form 8-K

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Alaska Pacific Energy Corp.

| /s/ James R. King | |

| James R. King | Dated: September 20, 2010 |

| President, Chief Executive Officer, | |

| Chief Financial Officer |

23