Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - TERRACE VENTURES INC | exhibit32-1.htm |

| EX-31.1 - CERTIFICATION - TERRACE VENTURES INC | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended April 30, 2010

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

COMMISSION FILE NUMBER 000-50569

TERRACE VENTURES INC.

(Exact name of registrant as specified in its charter)

| NEVADA | 91-2147101 |

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

| Suite 202, 810 Peace Portal Drive, | |

| Blaine, WA | 98230 |

| (Address of principal executive offices) | (Zip Code) |

| Registrant's telephone number, including area code | (360) 220-5218 |

| Securities registered under Section 12(b) of the Exchange Act: | NONE. |

| Securities registered under Section 12(g) of the Exchange Act: | Common Stock, $0.001 Par Value Per Share. |

Indicate by check mark if the registrant

is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant

is not required to file reports pursuant to Section 13 or Section 15(d) of the

Act.

Yes [ ] No [X]

Indicate by check mark whether the

registrant (1) has filed all reports required to be filed by Section 13 or 15(d)

of the Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the

registrant has submitted electronically and posted on its corporate Web site, if

any, every Interactive Data File required to be submitted and posted pursuant to

Rule 405 of Regulation S-T (s. 229.405 of this chapter) during the preceding 12

months (or for such shorter period that the registrant was required to submit

and post such files).

Yes [ ] No [

]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (s229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Act).

Yes [X]

No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $250,826 based on a price of $0.0325, being the closing price for the Registrant’s common stock as quoted on the OTC Bulletin Board on October 31, 2009.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of September 10, 2010, the Registrant had 9,470,660 shares of common stock outstanding.

TERRACE VENTURES INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED

APRIL 30, 2010

TABLE OF CONTENTS

Page 2

PART I

The information in this discussion contains forward-looking statements. These forward-looking statements involve risks and uncertainties, including statements regarding the Company's capital needs, business strategy and expectations. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "intend," "anticipate," "believe," "estimate,” "predict," "potential" or "continue", the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks described below, and, from time to time, in other reports the Company files with the United States Securities and Exchange Commission (the “SEC”). These factors may cause the Company's actual results to differ materially from any forward-looking statement. The Company disclaims any obligation to publicly update these statements, or disclose any difference between its actual results and those reflected in these statements.

As used in this Annual Report, the terms “we,” “us,” “our,” “Terrace,” and the “Company” mean Terrace Ventures Inc. and its subsidiaries, unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

ITEM 1. BUSINESS.

Overview

We were incorporated on February 20, 2001 under the laws of the State of Nevada.

We do not have any business operations or significant assets. We had previously entered into a Share Purchase Agreement dated April 29, 2010, as amended, with Marktech Acquisition Corp. (the "Vendor"), Worldbid International Inc. ("Worldbid") and Geobiz Systems Inc., our wholly-owned subsidiary ("Geobiz") whereby Geobiz agreed to acquire all of the issued and outstanding shares of Worldbid in consideration of $250,000. The parties of the agreement were unable to close the transaction by the closing date, being June 30, 2010. Accordingly, we are actively seeking and evaluating alternative business opportunities. Our ability to seek out and acquire an alternative business opportunity is subject to our obtaining financing, of which there is no assurance.

Recent Corporate Developments

The following corporate developments occurred since the filing of our Form 10-Q for the nine months ended January 31, 2010:

| 1. |

On June 8 2010, our Board of Directors approved a private placement offering of up to 5,000,000 Units at a price of $0.01 US per Unit, with each Unit consisting of one share of our common stock and one share purchase warrant (the “Foreign Private Placement”). Each share purchase warrant entitles the holder to purchase an additional share of common stock exercisable for a period of two years at a price of $0.01 US per share. The private placement offering will be made to persons who are not “U.S. Persons” as defined in Regulation S. We have received any proceeds under the Foreign Private Placement. We have not issued any Units under the Foreign Private Placement and there is no assurance that the private placement offering or any part of it will be completed. |

| 2. |

Also, on June 8 2010, our Board of Directors approved a private placement offering of up to 5,000,000 Units at a price of $0.01 US per Unit, with each Unit consisting of one share of our common stock and one share purchase warrant (the “U.S. Private Placement”). Each share purchase warrant entitles the holder to purchase an additional share of common stock exercisable for a period of two years at a price of $0.01 US per share. The private placement offering will be made to persons who are “Accredited Investors” as defined in Regulation D. We have not received any proceeds under the U.S. Private Placement. We have not issued any Units under the U.S. Private Placement and there is no assurance that the private placement offering or any part of it will be completed. |

3

Employees

We have no employees as of the date of this Annual Report on Form 10-K other than our sole executive officer and director. We conduct our business largely through agreements with consultants and arms-length third parties.

Research And Development Expenditures

We have not incurred any research expenditures since our incorporation.

Patents And Trademarks

We do not own, either legally or beneficially, any patent or trademark.

ITEM 1A. RISK FACTORS.

The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in our forward-looking statements. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, financial condition or results of operation.

If we do not obtain additional financing, our business will fail.

As at April 30, 2010, we had cash in the amount of $1,169. We are in the process of seeking out and evaluating alternative business opportunities. In order to acquire an alternative business opportunity, of which there is no assurance, and to meet our ongoing expenditures, we will need to raise substantial financing.

Our Board of Directors has approved the Foreign Private Placement of up to 5,000,000 Units for gross proceeds of $50,000 and the U.S. Private Placement of up to 5,000,000 Units for gross proceeds of $50,000. There is no assurance that we will be able to complete the sale of any securities under the Foreign Private Placement or the U.S. Private Placement. There is no assurance that we will be able to complete the sale of any securities under these offerings. If we are unable to obtain sufficient financing to meet our ongoing expenditures, our business will fail.

We have yet to attain profitable operations and because we will need additional financing to continue our business operations, our accountants believe that there is substantial doubt about our ability to continue as a going concern.

We have incurred a net loss of $1,979,058 for the period from February 20, 2001 (inception) to April 30, 2010 and have no revenues to date. Our future is dependent upon our ability to obtain suitable business opportunity and obtain substantial financing in order to meet our current obligations and to continue our operations. These factors raise substantial doubt that we will be able to continue as a going concern.

We may conduct further offerings in the future in which case investors’ shareholdings will be diluted.

Since our inception, we have relied on equity sales of our common stock to fund our operations. We may conduct additional equity offerings in the future to finance any future business projects that we decide to undertake. If common stock is issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations. If we issue additional stock, investors’ percentage interest in us will be diluted. The result of this could reduce the value of their stock.

4

Because our stock is a penny stock, stockholders will be more limited in their ability to sell their stock.

The shares of our common stock constitute “penny stocks” under the Securities Exchange Act of 1934 (the “Exchange Act”). The shares will remain classified as a penny stock for the foreseeable future. The classification as a penny stock makes it more difficult for a broker/dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker/dealer engaged by the purchaser for the purpose of selling his or her shares will be subject to rules 15g-1 through 15g-10 of the Exchange Act. Rather than having to comply with these rules, some broker-dealers will refuse to attempt to sell a penny stock.

The "penny stock" rules adopted by the SEC under the Exchange Act subjects the sale of the shares of our common stock to certain regulations which impose sales practice requirements on broker/dealers. For example, the penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that:

| 1. |

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| 2. |

contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws; |

| 3. |

contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| 4. |

contains a toll-free telephone number for inquiries on disciplinary actions; |

| 5. |

defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| 6. |

contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation. |

Legal remedies, which may be available to an investor in "penny stocks,” are as follows:

| (a) |

if "penny stock" is sold to an investor in violation of his or her rights listed above, or other federal or states securities laws, the investor may be able to cancel his or her purchase and get his or her money back. |

| (b) |

if the stocks are sold in a fraudulent manner, the investor may be able to sue the persons and firms that caused the fraud for damages. |

| (c) |

if the investor has signed an arbitration agreement, however, he or she may have to pursue his or her claim through arbitration. |

If the person purchasing the securities is someone other than an accredited investor or an established customer of the broker/dealer, the broker/dealer must also approve the potential customer's account by obtaining information concerning the customer's financial situation, investment experience and investment objectives. The broker/dealer must also make a determination whether the transaction is suitable for the customer and whether the customer has sufficient knowledge and experience in financial matters to be reasonably expected to be capable of evaluating the risk of transactions in such securities. Accordingly, the SEC's rules may limit the number of potential purchasers of the shares of our common stock.

5

ITEM 2. PROPERTIES.

We rent office space at Suite 202, 810 Peace Portal Drive, Blaine, WA 98230, consisting of approximately 1,124 square feet, at a cost of $250 per month. This rental is on a month-to-month basis without a formal contract. We pay a fee of $500 per month for office related services provided in connection with our office rental.

ITEM 3. LEGAL PROCEEDINGS.

We are not a party to any other legal proceedings and, to our knowledge, no other legal proceedings are pending, threatened or contemplated.

6

PART II

|

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

MARKET INFORMATION

Our shares are quoted on the OTC Bulletin Board under the symbol “TVER”. The high and the low prices for our shares for each quarter of our last two fiscal years of actual trading were:

| Quarter Ended | High | Low |

| Fiscal Year 2010 | ||

| April 30, 2010 | $0.04 | $0.03 |

| January 31, 2010 | $0.11 | $0.03 |

| October 31, 2009 | $0.15 | $0.04 |

| July 31, 2009 | $0.10 | $0.05 |

| Fiscal Year 2009 | ||

| April 30, 2009 | $0.275 | $0.05 |

| January 31, 2009 | $0.15 | $0.075 |

| October 31, 2008 | $0.30 | $0.075 |

| July 31, 2008 | $0.325 | $0.075 |

The above quotations have been adjusted to reflect the 1-for-5 reverse stock split effected October 1, 2009. Quotations provided by the OTCBB reflect inter-dealer prices, without retail mark-up, markdown or commission and may not represent actual transactions. The high and low bid price information provided above was obtained from the OTC Bulletin Board. The market quotations provided reflect inter-dealer prices, without retail mark-up, markdown or commission and may not represent actual transactions.

REGISTERED HOLDERS OF OUR COMMON STOCK

As of September 10, 2010, there were one hundred and five (105) registered holders of our common stock. We believe that a large number of stockholders hold stock on deposit with their brokers or investment bankers registered in the name of stock depositories.

DIVIDENDS

We have not declared any dividends on our common stock since our inception. There are no dividend restrictions that limit our ability to pay dividends on our common stock in our Articles of Incorporation or bylaws. Chapter 78 of the Nevada Revised Statutes (the “NRS”), does provide certain limitations on our ability to declare dividends. Section 78.288 of Chapter 78 of the NRS prohibits us from declaring dividends where, after giving effect to the distribution of the dividend:

| (a) |

we would not be able to pay our debts as they become due in the usual course of business; or |

| (b) |

except as may be allowed by our Articles of Incorporation, our total assets would be less than the sum of our total liabilities plus the amount that would be needed, if we were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of stockholders who may have preferential rights and whose preferential rights are superior to those receiving the distribution. |

We have neither declared nor paid any cash dividends on our capital stock and do not anticipate paying cash dividends in the foreseeable future. Our current policy is to retain any earnings in order to finance the expansion of our operations. Our board of directors will determine future declaration and payment of dividends, if any, in light of the then-current conditions they deem relevant and in accordance with the Nevada Revised Statutes.

7

RECENT SALES OF UNREGISTERED SECURITIES

Other than as disclosed in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, we did not complete any sales of unregistered securities during the year ended April 30, 2010.

| ITEM 7. |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

PLAN OF OPERATION

We are currently in the process of reorganizing our business and are seeking and evaluating alternative business opportunities. As a result, we are unable to provide an accurate estimate of our financial requirements for the next twelve months. However, as at April 30, 2010, we currently have a working capital deficit of $158,163 and will need substantial financing in the near term in order to meet our current obligations as they become due and to meet our ongoing reporting obligations under the Exchange Act. In addition, if our management is successful in identifying a suitable business opportunity for us to pursue, we will likely need significantly more financing in order to pursue the new business opportunity.

RESULTS OF OPERATIONS

| Summary of Year End Results | |||||||||

| Year Ended April 30, | Percentage | ||||||||

| 2010 | 2009 | Increase / (Decrease) | |||||||

| Revenue | $ | -- | $ | -- | n/a | ||||

| Expenses | (99,514 | ) | (355,923 | ) | (72.0)% | ||||

| Net Loss | $ | (99,514 | ) | $ | (355,923 | ) | (72.0)% | ||

Revenues

We have not earned any revenues since our inception and we do not anticipate earning revenues in the near future. We are an exploration stage company and are presently seeking and evaluating alternative business opportunities.

Operating Expenses

The major components of our expenses for the year ended April 30, 2009 and 2008 are outlined in the table below:

| Year Ended April 30 | Percentage | ||||||||

| 2010 | 2009 | Increase / (Decrease) | |||||||

| Accounting | $ | 25,320 | $ | 24,120 | 5.0% | ||||

| Bad Debt Expense | -- | 214,892 | (100)% | ||||||

| Bank Charges | 290 | 111 | 161.3% | ||||||

| Cancelled Merger Costs | 8,300 | -- | n/a | ||||||

| Legal | 29,115 | 76,916 | (62.1)% | ||||||

| Office Administration | 30,000 | 30,000 | n/a | ||||||

| Office Expenses | -- | 340 | (100)% | ||||||

8

| Regulatory Expenses/Fees | 3,714 | 4,386 | (15.3)% | ||||||

| Rent | 1,875 | 3,000 | (37.5)% | ||||||

| Telephone | 900 | 1,470 | (38.8)% | ||||||

| Travel & Entertainment | -- | 688 | (100)% | ||||||

| Total Operating Expenses | $ | 99,514 | $ | 355,923 | (72.0)% |

Our operating expenses decreased from $355,923, during the year ended April 30, 2009, to $99,514, during the year ended April 30, 2010. The decease in our operating expenses is due to the fact that we recorded bad debts of $214,892 during the year ended April 30, 2009.

Accounting and legal expenses primarily related to expenses incurred in connection with meeting our ongoing reporting obligations under the Exchange Act.

Office administration expenses consist of amounts incurred to our sole executive officer and director for his management consulting services.

LIQUIDITY AND CAPITAL RESOURCES

| Cash Flows | ||||||

| Year Ended April 30 | ||||||

| 2010 | 2009 | |||||

| Net Cash used in Operating Activities | $ | 1,037 | $ | (130,643 | ) | |

| Net Cash used in Investing Activities | -- | -- | ||||

| Net Cash from Financing Activities | -- | 116,900 | ||||

| Net Increase (Decrease) in Cash During Period | $ | 1,037 | $ | (13,743 | ) | |

| Working Capital | |||||||||

| Percentage | |||||||||

| At April 30, 2010 | At April 30, 2009 | Increase / (Decrease) | |||||||

| Current Assets | $ | 1,169 | $ | 4,632 | (74.8)% | ||||

| Current Liabilities | (159,332 | ) | (63,281 | ) | 151.8% | ||||

| Working Capital Deficit | $ | (158,163 | ) | $ | (58,649 | ) | 169.7% |

We had cash on hand of $1,169 and a working capital deficit of $158,163 as of April 30, 2010 compared to a working capital deficit of $58,649 as of April 30, 2009. The increase in our working capital deficit is due to: (i) an increase in accounts payable and accrued expenses as a result of our lack of capital to meet ongoing costs, and (ii) the fact that our sole source of financing came in the form of short term loans.

Financing Requirements

Currently, we do not have sufficient financial resources to meet our ongoing operating expenditures. As such, our ability to complete our plan of operation is dependent upon our ability to obtain additional financing in the near term.

Our Board of Directors has approved two private placement offerings for up to an aggregate of 10,000,000 Units for proceeds of up to $100,000 as follows:

Foreign Private Placement

On June 8 2010, our Board of Directors approved a private placement offering of up to 5,000,000 Units at a price of $0.01 US per Unit, with each Unit consisting of one share of our common stock and one share purchase warrant (the “Foreign Private Placement”). Each share purchase warrant entitles the holder to purchase an additional share of common stock exercisable for a period of two years at a price of $0.01 US per share. The private placement offering will be made to persons who are not “U.S. Persons” as defined in Regulation S. We have received any proceeds under the Foreign Private Placement. There is no assurance that the private placement offering or any part of it will be completed.

9

U.S. Private Placement

Also, on June 8 2010, our Board of Directors approved a private placement offering of up to 5,000,000 Units at a price of $0.01 US per Unit, with each Unit consisting of one share of our common stock and one share purchase warrant (the “U.S. Private Placement”). Each share purchase warrant entitles the holder to purchase an additional share of common stock exercisable for a period of two years at a price of $0.01 US per share. The private placement offering will be made to persons who are “accredited investors” as defined in Regulation D. We have not received any proceeds under the U.S. Private Placement. There is no assurance that the private placement offering or any part of it will be completed.

We anticipate continuing to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing shareholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our business operations.

OFF-BALANCE SHEET ARRANGEMENTS

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with United States generally accepted accounting principles requires our management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Our management routinely makes judgments and estimates about the effects of matters that are inherently uncertain.

Our significant accounting policies are disclosed in Note 1 to the audited financial statements included in this Annual Report.

10

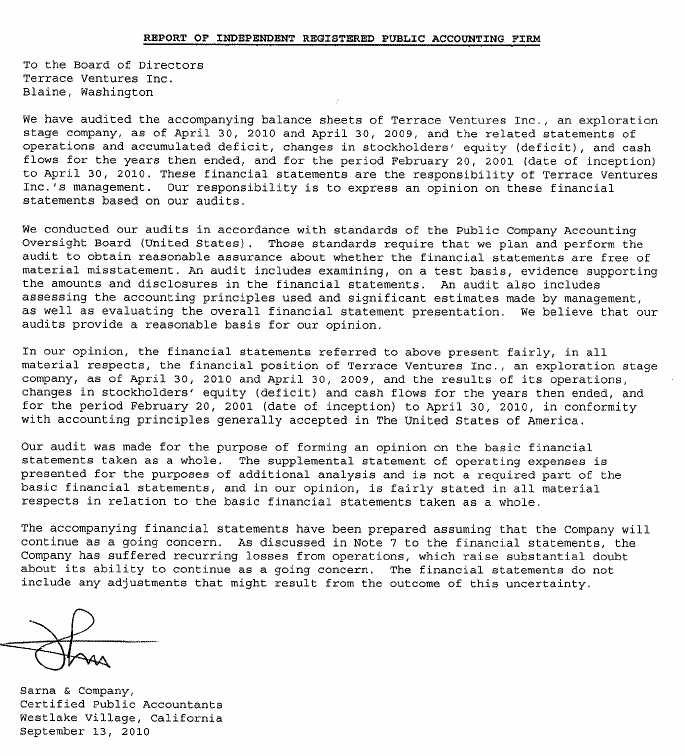

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

Audited Financial Statements for the Years Ended April 30, 2010 and 2009, including:

11

TERRACE VENTURES INC.

(AN EXPLORATION STAGE

COMPANY)

BALANCE SHEET

| ASSETS | ||||||

| APRIL 30, | APRIL 30, | |||||

| 2010 | 2009 | |||||

| Current Assets: | ||||||

| Cash | $ | 1,169 | $ | 132 | ||

| Loan Receivable | -0- | 4,500 | ||||

| Total Current Assets | 1,169 | 4,632 | ||||

| Other Asset – Investment | -0- | -0- | ||||

| TOTAL ASSETS | $ | 1,169 | $ | 4,632 | ||

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | ||||||

| Current Liabilities: | ||||||

| Accounts Payable and | ||||||

| Accrued Expenses | $ | 118,132 | $ | 63,281 | ||

| Loans Payable | 27,000 | -0- | ||||

| Loans Payable – Related Parties | 14,200 | -0- | ||||

| Total Current Liabilities | 159,332 | 63,281 | ||||

| Stockholders' Equity: | ||||||

| Common Stock,

$0.001 par value 400,000,000 shares authorized, 9,470,660 and 47,353,200 shares issued |

9,471 | 47,353 | ||||

| Additional Paid in Capital | 1,811,424 | 1,773,542 | ||||

| Deficit Accumulated During the Exploration Stage | (1,979,058 | ) | (1,879,544 | ) | ||

| Total Stockholders' Equity (Deficit) | (158,163 | ) | (58,649 | ) | ||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | $ | 1,169 | $ | 4,632 | ||

See Notes to Financial Statements.

2

TERRACE VENTURES INC.

(AN EXPLORATION STAGE

COMPANY)

STATEMENTS OF OPERATIONS AND ACCUMULATED DEFICIT

| YEAR ENDED | YEAR ENDED | INCEPTION to | |||||||

| APRIL 30, 2010 | APRIL 30, 2009 | APRIL 30, 2010 | |||||||

| Revenues | $ | -0- | $ | -0- | $ | -0- | |||

| Operating Expenses | (99,514 | ) | (355,923 | ) | (964,569 | ) | |||

| Loss Before Other Income And Expenses | (99,514 | ) | (355,923 | ) | (964,569 | ) | |||

| Other Income | |||||||||

| Interest Income | -0- | -0- | 14,491 | ||||||

| Other Expense | |||||||||

| Unrealized Loss on Investment | -0- | -0- | (1,028,980 | ) | |||||

| Loss Before Provision for Income Taxes | (99,514 | ) | (355,923 | ) | (1,979,058 | ) | |||

| Provision for Income Taxes | -0- | -0- | -0- | ||||||

| Net Loss | (99,514 | ) | (355,923 | ) | (1,979,058 | ) | |||

| Accumulated Deficit, Beginning of Period | (1,879,544 | ) | (1,523,621 | ) | -0- | ||||

| Accumulated Deficit, End of Period | $ | (1,979,058 | ) | $ | (1,879,544 | ) | $ | (1,979,058 | ) |

| Net Loss per Share | $ | (0.01 | ) | $ | (0.05 | ) | $ | (0.31 | ) |

| Weighted Average Shares Outstanding | 9,470,660 | 8,615,640 | 6,378,749 |

See Notes to Financial Statements.

3

TERRACE VENTURES INC.

(AN EXPLORATION STAGE

COMPANY)

STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT)

| Deficit | |||||||||||||||

| Accumulated | Total | ||||||||||||||

| Common Stock | Additional | During the | Stockholders' | ||||||||||||

| Dollar | Paid in | Exploration | Equity | ||||||||||||

| Shares | Amount | Capital | Stage | (Deficit) | |||||||||||

| Inception, February 20, 2001 | ---- | $ | ---- | $ | ---- | $ | ---- | $ | ---- | ||||||

| Common Stock Issued $0.001 per share April 9, 2001 | 4,000,000 | 400 | 3,600 | ---- | 4,000 | ||||||||||

| Net Loss, Period Ended April 30, 2001 | ---- | ---- | ---- | (1,410 | ) | (1,410 | ) | ||||||||

| Balances, April 30, 2001 | 4,000,000 | 400 | 3,600 | (1,410 | ) | 2,590 | |||||||||

| Common Stock Issued $0.01 per share August 15, 2001 | 2,500,000 | 250 | 24,750 | ---- | 25,000 | ||||||||||

| Net Loss, Period Ended April 30, 2002 | ---- | ---- | ---- | (19,196 | ) | (19,196 | ) | ||||||||

| Balances, April 30, 2002 | 6,500,000 | 650 | 28,350 | (20,606 | ) | 8,394 | |||||||||

| Common Stock Issued $0.10 per share September 30, 2002 | 142,500 | 14 | 14,236 | ---- | 14,250 | ||||||||||

| Net Loss, Period Ended April 30, 2003 | ---- | ---- | ---- | (17,632 | ) | (17,632 | ) | ||||||||

| Balances, April 30, 2003 | 6,642,500 | 664 | 42,586 | (38,238 | ) | 5,012 | |||||||||

| Common Stock Issued $0.10 per share November 6, 2003 | 400,000 | 40 | 39,960 | ---- | 40,000 | ||||||||||

| Net Loss, Period Ended April 30, 2004 | ---- | ---- | ---- | (58,708 | ) | (58,708 | ) | ||||||||

| Balances, April 30, 2004 | 7,042,500 | 704 | 82,546 | (96,946 | ) | (13,696 | ) | ||||||||

| Net Loss, Period Ended April 30, 2005 | ---- | ---- | ---- | (37,532 | ) | (37,532 | ) | ||||||||

| Balances, April 30, 2005 | 7,042,500 | 704 | 82,546 | (134,478 | ) | (51,228 | ) | ||||||||

See Notes to Financial Statements.

4

TERRACE VENTURES INC.

(AN EXPLORATION STAGE

COMPANY)

STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT) - CONTINUED

| Deficit | |||||||||||||||

| Accumulated | Total | ||||||||||||||

| Common Stock | Additional | During the | Stockholders' | ||||||||||||

| Dollar | Paid in | Exploration | Equity | ||||||||||||

| Shares | Amount | Capital | Stage | (Deficit) | |||||||||||

| Balances, April 30, 2005 | 7,042,500 | 704 | 82,546 | (134,478 | ) | (51,228 | ) | ||||||||

| Common Stock Issued $1.00 per share November 23,2005 | 500,000 | 50 | 499,950 | ---- | 500,000 | ||||||||||

| 4-for-1 Stock Split, December 19, 2005 | 22,627,500 | 29,416 | (29,416 | ) | ---- | ---- | |||||||||

| Common Stock Issued $0.25 per share February 3, 2006 | 400,000 | 400 | 99,600 | ---- | 100,000 | ||||||||||

| Common Stock Issued $0.25 per share March 13, 2006 | 380,000 | 380 | 94,620 | ---- | 95,000 | ||||||||||

| Common Stock Issued $0.25 per share March 31, 2006 | 999,920 | 1,000 | 248,980 | ---- | 249,980 | ||||||||||

| Net Loss, Period Ended April 30, 2006 | ---- | ---- | ---- | (987,633 | ) | (987,633 | ) | ||||||||

| Balances April 30, 2006 | 31,949,920 | 31,950 | 996,280 | (1,122,111 | ) | (93,881 | ) | ||||||||

| Common Stock Issued $0.25 per share May 24, 2006 | 220,080 | 220 | 54,800 | ---- | 55,020 | ||||||||||

| Common Stock Issued $0.30 per share June 5, 2006 | 335,000 | 335 | 100,165 | ---- | 100,500 | ||||||||||

| Common Stock Issued $0.10 per share January 23, 2007 | 1,678,200 | 1,678 | 166,142 | ---- | 167,820 | ||||||||||

| Net Loss, Period Ended April 30, 2007 | ---- | ---- | ---- | (301,060 | ) | (301,060 | ) | ||||||||

| Balances April 30, 2007 | 34,183,200 | $ | 34,183 | $ | 1,317,387 | $ | (1,423,171 | ) | $ | (71,601 | ) | ||||

See Notes to Financial Statements.

5

TERRACE VENTURES INC.

(AN EXPLORATION STAGE

COMPANY)

STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT) - CONTINUED

| Deficit | |||||||||||||||

| Accumulated | Total | ||||||||||||||

| Common Stock | Additional | During the | Stockholders' | ||||||||||||

| Dollar | Paid in | Exploration | Equity | ||||||||||||

| Shares | Amount | Capital | Stage | (Deficit) | |||||||||||

| Balances April 30, 2007 | 34,183,200 | $ | 34,183 | $ | 1,317,387 | $ | (1,423,171 | ) | $ | (71,601 | ) | ||||

| Common Stock Issued $0.10 per share July 12, 2007 | 2,570,000 | 2,570 | 254,755 | ---- | 257,325 | ||||||||||

| Net Loss, Period Ended April 30, 2008 | ---- | ---- | ---- | (100,450 | ) | (100,450 | ) | ||||||||

| Balances April 30, 2008 | 36,753,200 | $ | 36,753 | $ | 1,572,142 | $ | (1,523,621 | ) | $ | 85,274 | |||||

| Common Stock Issued $0.10 per share October 10, 2008 | 10,000,000 | 10,000 | 190,000 | ---- | 200,000 | ||||||||||

| Common Stock Issued $0.20 per share April 8, 2009 | 600,000 | 600 | 11,400 | ---- | 12,000 | ||||||||||

| Net Loss, Period Ended April 30, 2009 | ---- | ---- | ---- | (355,923 | ) | (355,923 | ) | ||||||||

| Balances April 30, 2009 | 47,353,200 | 47,353 | 1,773,542 | (1,879,544 | ) | (58,649 | ) | ||||||||

| 1-for-5 Reverse Stock Split, October 1, 2009 | (37,882,540 | ) | (37,882 | ) | 37,882 | ---- | ---- | ||||||||

| Net Loss, Period Ended April 30, 2010 | ---- | ---- | ---- | (99,514 | ) | (99,514 | ) | ||||||||

| Balances April 30, 2010 | 9,470,660 | 9,471 | 1,811,424 | (1,979,058 | ) | (158,163 | ) | ||||||||

See Notes to Financial Statements.

6

TERRACE VENTURES INC.

(AN EXPLORATION STAGE

COMPANY)

STATEMENTS OF CASH FLOWS

| YEAR ENDED | YEAR ENDED | INCEPTION to | |||||||

| APRIL 30, 2010 | APRIL 30, 2009 | APRIL 30, 2010 | |||||||

| Cash Flows from | |||||||||

| Operating Activities: | |||||||||

| Net Loss | $ | (99,514 | ) | $ | (355,923 | ) | $ | (1,979,058 | ) |

| Adjustments to Reconcile Net Loss | |||||||||

| To Net Cash Provided/(Used) by | |||||||||

| Operating Activities: | |||||||||

| Unrealized Loss on Investment | -0- | -0- | 1,028,980 | ||||||

| (Increase)/Decrease in: | |||||||||

| Loans Receivable | 4,500 | (4,500 | ) | ||||||

| Notes Receivable | -0- | 214,892 | -0- | ||||||

| Increase/(Decrease) in: | |||||||||

| Accounts Payable | 54,851 | 14,888 | 118,132 | ||||||

| Loans Payable | 27,000 | -0- | 27,000 | ||||||

| Loans Payable – Related Parties | 14,200 | -0- | 14,200 | ||||||

| Net Cash Used by | |||||||||

| Operating Activities | 1,037 | (130,643 | ) | (790,746 | ) | ||||

| Cash Flows from | |||||||||

| Investing Activities: | |||||||||

| Investment in Stock | -0- | -0- | (1,028,980 | ) | |||||

| Net Cash Used by | |||||||||

| Investing Activities | -0- | -0- | (1,028,980 | ) | |||||

| Cash Flows from | |||||||||

| Financing Activities: | |||||||||

| Loans from Shareholders | -0- | 41,000 | -0- | ||||||

| Payments on Loans | -0- | (136,100 | ) | -0- | |||||

| Proceeds from Issuance of | |||||||||

| Common Stock | -0- | 212,000 | 1,820,895 | ||||||

| Net Cash Provided by | |||||||||

| Financing Activities | -0- | 116,900 | 1,820,895 | ||||||

| Net Increase (Decrease) in Cash | 1,037 | (13,743 | ) | 1,169 | |||||

| Cash at Beginning of Period | 132 | 13,875 | -0- | ||||||

| Cash at End of Period | $ | 1,169 | $ | 132 | $ | 1,169 |

See Notes to Financial Statements.

7

TERRACE VENTURES INC.

(AN EXPLORATION STAGE

COMPANY)

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

General

Terrace Ventures Inc. was incorporated on February 20, 2001 in the state of Nevada. The Company acquires and develops certain mineral rights in Canada.

Basis of Presentation

The Company reports revenue and expenses using the accrual method of accounting for financial and tax reporting purposes.

Use of Estimates

Management uses estimates and assumptions in preparing these financial statements in accordance with generally accepted accounting principles. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses.

Exploration Stage Company

The Company has been in the exploration stage since its formation and has not yet realized any revenues from its planned operations. The Company is primarily engaged in the acquisition and exploration of mining properties. Upon the location of commercially minable reserves, the Company plans to prepare for mineral extraction and enter the development stage.

Pro Forma Compensation Expense

The Company accounts for options and restricted stock granted to employees and directors in accordance with the fair value method of SFAS No. 123, Accounting for Stock-Based Compensation (“SFAS No. 123”), as amended by SFAS No. 148, Accounting for Stock-Based Compensation Transition and Disclosure an amendment of FASB Statement No. 123 and related interpretations. As such, compensation expense is recorded on stock option and restricted stock grants based on the fair value of the options or restricted stock granted, which is estimated on the date of grant using the Black-Scholes option-pricing model for stock options granted, and is recognized on a straight-line basis over the vesting period.

8

TERRACE VENTURES INC.

(AN EXPLORATION STAGE

COMPANY)

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED

Mineral Property Acquisition and Exploration Costs

The Company expenses all costs related to the acquisition and exploration of mineral properties in which it has secured exploration rights prior to establishment of proven and probable reserves. To date, the Company has not established the commercial feasibility of any exploration prospects, therefore, all costs are being expensed.

Depreciation, Amortization and Capitalization

The Company records depreciation and amortization when appropriate using both straight-line and declining balance methods over the estimated useful life of the assets (five to seven years). Expenditures for maintenance and repairs are charged to expense as incurred. Additions, major renewals and replacements that increase the property's useful life are capitalized. Property sold or retired, together with the related accumulated depreciation, is removed from the appropriate accounts and the resultant gain or loss is included in net income.

Income Taxes

The Company accounts for its income taxes in accordance with Statement of Financial Accounting Standards No. 109, "Accounting for Income Taxes". Under Statement 109, a liability method is used whereby deferred tax assets and liabilities are determined based on temporary differences between basis used for financial reporting and income tax reporting purposes. Income taxes are provided based on tax rates in effect at the time such temporary differences are expected to reverse. A valuation allowance is provided for certain deferred tax assets if it is more likely than not, that the Company will not realize the tax assets through future operations.

Fair Value of Financial Instruments

Financial accounting Standards Statement No. 107, "Disclosures About Fair Value of Financial Instruments", requires the Company to disclose, when reasonably attainable, the fair market values of its assets and liabilities which are deemed to be financial instruments. The Company's financial instruments consist primarily of cash and certain investments.

9

TERRACE VENTURES INC.

(AN EXPLORATION STAGE

COMPANY)

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED

Investments

Investments that are purchased in other companies are valued at cost less any impairment in the value that is other than temporary in nature.

Per Share Information

The Company computes per share information by dividing the net loss for the period presented by the weighted average number of shares outstanding during such period.

NOTE 2 – LOANS PAYABLE

Loans payable consist of short term monies advanced. These loans are unsecured, bear no interest rate and no specified maturity date.

NOTE 3 – LOANS PAYABLE – RELATED PARTIES

Loans payable related parties consist of various short term monies advanced by shareholders. These loans are unsecured, bear no interest rate and no specified maturity date.

NOTE 4 - PROVISION FOR INCOME TAXES

The provision for income taxes for the periods ended April 30, 2010 and April 30, 2009 represents the minimum state income tax expense of the Company, which is not considered significant.

NOTE 5 - COMMITMENTS AND CONTINGENCIES

Operating Leases

The Company currently rents administrative office space under a monthly renewable contract.

Litigation

The Company is not presently involved in any litigation.

10

TERRACE VENTURES INC.

(AN EXPLORATION STAGE

COMPANY)

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

NOTE 6 - RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

Recently issued accounting pronouncements will have no significant impact on the Company and its reporting methods.

NOTE 7 – GOING CONCERN

Future issuances of the Company’s equity or debt securities will be required in order for the Company to continue to finance its operations and continue as a going concern. The Company’s present revenues are insufficient to meet operating expenses.

The consolidated financial statements of the Company have been prepared assuming that the Company will continue as a going concern, which contemplates, among other things, the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred cumulative net losses of $1,979,058 since its inception and requires capital for its contemplated operational and marketing activities to take place. The Company's ability to raise additional capital through the future issuances of common stock is unknown. The obtainment of additional financing, the successful development of the Company's contemplated plan of operations, and its transition, ultimately, to the attainment of profitable operations are necessary for the Company to continue operations. The ability to successfully resolve these factors raise substantial doubt about the Company's ability to continue as a going concern. The consolidated financial statements of the Company do not include any adjustments that may result from the outcome of these aforementioned uncertainties.

NOTE 8 – REVERSE STOCK SPLIT

On September 2, 2009, the Board of Directors approved a one-for-five reverse split of the Company’s common stock. Upon the completion of the reverse stock split, which was effective on October 1, 2009, the Company’s authorized shares of common stock was decreased from 400,000,000 shares, par value $0.001 per share, to 80,000,000 shares, par value $0.001 per share. Issued and outstanding common stock was reduced from 47,353,200 shares to approximately 9,470,660 shares. Weighted Average Shares Outstanding and Net Loss per Share have been restated on the Statements of Operations and Accumulated Deficit for the effect of the reverse stock split.

11

TERRACE VENTURES INC.

(AN EXPLORATION STAGE

COMPANY)

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

NOTE 9 – SUBSEQUENT EVENTS

On June 8, 2010 our Board of Directors approved two private placement offerings for up to an aggregate of 10,000,000 Units for proceeds of up to $100,000 as follows:

Foreign Private Placement

On June 8, 2010, our Board of Directors approved a private placement offering of up to 5,000,000 Units at a price of $0.01 US per unit, with each Unit consisting of one share of our common stock and one share purchase warrant (the “Foreign Private Placement”). Each share purchase warrant entitles the holder to purchase an additional share of common stock exercisable for a period of two years at a price of $0.01 US per share. The private placement offering will be made to persons who are not “U.S. Persons” as defined in Regulation S. We have received any proceeds under the Foreign Private Placement. There is no assurance that the private placement offering or any part of it will be completed.

U.S. Private Placement

Also, on June 8, 2010, our Board of Directors approved a private placement offering of up to 5,000,000 Units at a price of $0.01 US per Unit, with each Unit consisting of one share of our common stock and one share purchase warrant (the “U.S. Private Placement”). Each share purchase warrant entitles the holder to purchase an additional share of common stock exercisable for a period of two years at a price of $.01 US per share. The pivate placement offering will be made to persons who are “Accredited Investors” as defined in Regulation D. We have not received any proceeds under the U.S. Private Placement. There is no assurance that the private placement offering or any part of it will be completed.

12

SUPPLEMENTAL STATEMENT

TERRACE VENTURES INC.

(AN EXPLORATION STAGE

COMPANY)

STATEMENT OF OPERATING EXPENSES

| YEAR ENDED | YEAR ENDED | INCEPTION to | |||||||

| APRIL 30, 2010 | APRIL 30, 2009 | APRIL 30, 2009 | |||||||

| Operating Expenses: | |||||||||

| Accounting | $ | 25,320 | $ | 24,120 | $ | 132,100 | |||

| Bad Debt Expense | -0- | 214,892 | 214,892 | ||||||

| Bank Charges | 290 | 111 | 744 | ||||||

| Cancelled Merger Costs | 8,300 | -0- | 8,300 | ||||||

| Consulting | -0- | -0- | 114,150 | ||||||

| Exploration Expense | -0- | -0- | 24,266 | ||||||

| Legal | 29,115 | 76,916 | 255,717 | ||||||

| Office Administration | 30,000 | 30,000 | 144,600 | ||||||

| Office Expenses | -0- | 340 | 4,271 | ||||||

| Regulatory Expenses/Fees | 3,714 | 4,386 | 30,165 | ||||||

| Rent | 1,875 | 3,000 | 24,825 | ||||||

| Telephone | 900 | 1,470 | 5,831 | ||||||

| Travel & Entertainment | -0- | 688 | 4,708 | ||||||

| Total Operating Expenses | $ | 99,514 | $ | 355,923 | $ | 964,569 |

See Notes to Financial Statements.

14

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. |

None.

ITEM 9AT. CONTROLS AND PROCEDURES.

Disclosure Controls and Procedures

We carried out an evaluation of the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of April 30, 2010 (the “Evaluation Date”). This evaluation was carried out under the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were not effective as of the Evaluation Date as a result of the material weaknesses in internal control over financial reporting discussed below.

Disclosure controls and procedures are those controls and procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Exchange Act are recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our reports filed under the Exchange Act is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

Notwithstanding the assessment that our internal control over financial reporting was not effective and that there were material weaknesses as identified in this report, we believe that our financial statements contained in our Annual Report on Form 10-K for the year ended April 30, 2010 fairly present our financial condition, results of operations and cash flows in all material respects.

Management's Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act, for the Company.

Internal control over financial reporting includes those policies and procedures that: (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of its management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements.

Management recognizes that there are inherent limitations in the effectiveness of any system of internal control, and accordingly, even effective internal control can provide only reasonable assurance with respect to financial statement preparation and may not prevent or detect material misstatements. In addition, effective internal control at a point in time may become ineffective in future periods because of changes in conditions or due to deterioration in the degree of compliance with our established policies and procedures.

A material weakness is a significant deficiency, or combination of significant deficiencies, that results in there being a more than remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected.

Under the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer, management conducted an evaluation of the effectiveness of our internal control over financial reporting, as of the Evaluation Date, based on the framework set forth in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on its evaluation under this framework, management concluded that our internal control over financial reporting was not effective as of the Evaluation Date.

12

Management assessed the effectiveness of the Company’s internal control over financial reporting as of Evaluation Date and identified the following material weaknesses:

Insufficient Resources: We have an inadequate number of personnel with requisite expertise in the key functional areas of finance and accounting.

Inadequate Segregation of Duties: We have an inadequate number of personnel to properly implement control procedures.

Insufficient Written Policies & Procedures: We have insufficient written policies and procedures for accounting and financial reporting.

Inadequate Financial Statement Closing Process: We have an inadequate financial statement closing process.

Lack of Audit Committee & Outside Directors on the Company’s Board of Directors: We do not have a functioning audit committee and outside directors on the Company’s Board of Directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures.

Management is committed to improving its internal controls and will (1) continue to use third party specialists to address shortfalls in staffing and to assist the Company with accounting and finance responsibilities, (2) increase the frequency of independent reconciliations of significant accounts which will mitigate the lack of segregation of duties until there are sufficient personnel and (3) prepare and implement sufficient written policies and checklists for financial reporting and closing processes and (4) may consider appointing outside directors and audit committee members in the future.

Management, including our Chief Executive Officer and the Chief Financial Officer, has discussed the material weakness noted above with our independent registered public accounting firm. Due to the nature of this material weakness, there is a more than remote likelihood that misstatements which could be material to the annual or interim financial statements could occur that would not be prevented or detected.

This Annual Report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the our registered public accounting firm pursuant to temporary rules of the SEC that permit us to provide only management's report in this Annual Report.

Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during the fiscal year ended April 30, 2010 that have materially affected, or that are reasonably likely to materially affect, our internal control over financial reporting.

Limitations on the Effectiveness of Controls and Procedures

Our management, including our Chief Executive Officer and the Chief Financial Officer, do not expect that the our controls and procedures will prevent all potential errors or fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met.

13

ITEM 9B. OTHER INFORMATION.

On June 8, 2010, our Board of Directors terminated the convertible notes offering approved on March 16, 2010 and approved two private placement offerings for up to an aggregate of 10,000,000 Units for proceeds of up to $100,000 as follows:

Foreign Private Placement

On June 8, 2010, our Board of Directors approved a private placement offering of up to 5,000,000 Units at a price of $0.01 US per Unit, with each Unit consisting of one share of our common stock and one share purchase warrant (the “Foreign Private Placement”). Each share purchase warrant entitles the holder to purchase an additional share of common stock exercisable for a period of two years at a price of $0.01 US per share. The private placement offering will be made to persons who are not “U.S. Persons” as defined in Regulation S. We have received any proceeds under the Foreign Private Placement. We have not issued any Units under the Foreign Private Placement and there is no assurance that the private placement offering or any part of it will be completed.

U.S. Private Placement

Also, on June 8, 2010, our Board of Directors approved a private placement offering of up to 5,000,000 Units at a price of $0.01 US per Unit, with each Unit consisting of one share of our common stock and one share purchase warrant (the “U.S. Private Placement”). Each share purchase warrant entitles the holder to purchase an additional share of common stock exercisable for a period of two years at a price of $0.01 US per share. The private placement offering will be made to persons who are “Accredited Investors” as defined in Regulation D. We have not received any proceeds under the U.S. Private Placement. We have not issued any Units under the U.S. Private Placement and there is no assurance that the private placement offering or any part of it will be completed.

14

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

The following table sets forth the name and positions of our sole executive officer and director.

| Name | Age | Positions |

| Howard Thomson | 64 | President, Secretary, Treasurer, Chief Executive Officer, Chief Financial Officer and Sole Director |

Set forth below is a brief description of the background and business experience of our sole executive officer and director:

Howard Thomson is our President, Secretary, Treasurer, Chief Executive Officer, Chief Financial Officer, and the sole member of our Board of Directors. Mr. Thomson was appointed a director on January 16, 2006 and has served as our President, Secretary, Treasurer, Chief Executive Officer and Chief Financial Officer since January 16, 2006. Mr. Thomson was employed from 1981 to 1998 in senior management positions with the Bank of Montreal, including five years as Branch Manager, four years as Regional Marketing Manager and five years as Senior Private Banker. Mr. Thomson retired from the Bank of Montreal in 1998. From February 1999 to August 2006, Mr. Thomson served as a director and officer of Royalite Petroleum Company Inc. (formerly Worldbid Corporation), a public company quoted on the OTC Bulletin Board, engaged in the acquisition and exploration of oil and gas properties. Since February 16, 2008, Mr. Thomson has served as the sole executive officer and sole director of Greenlite Ventures Inc., a public company quoted on the OTC Bulletin Board, engaged in the exploration of mineral properties.

Mr. Thomson provides his services on a part-time basis as required for our business. Mr. Thomson presently commits approximately 6 to 8 hours a week of his business time to our business. On March 21, 2006, we entered into a management agreement with Howard Thomson. See “Employment Contracts” below.

Terms of Office

Our directors are appointed for one year terms to hold office until the next annual general meeting of the holders of the our common stock, as provided by Article 330 of Chapter 78 “Private Corporations” of the Nevada Revised Statutes, or until removed from office in accordance with our by-laws. Our officers are appointed by our board of directors and hold office until removed by our board.

We do not pay to our directors any compensation for each director serving as a director on our board of directors. We anticipate that compensation may be paid to officers in the event that we determine to proceed with additional exploration programs beyond the fourth phase of our exploration program.

Significant Employees

We have no significant employees other than our sole officer and director. We conduct our business through agreements with consultants and arms-length third parties.

Committees of the Board Of Directors

Our audit committee presently consists of our sole director. We do not have a compensation committee, nominating committee, an executive committee of our board of directors, stock plan committee or any other committees. Our sole director performs the functions of a nominating committee and oversees the process by which individuals may be nominated to our board of directors. The current size of our board of directors does not facilitate the establishment of a separate committee. We hope to establish a separate nominating committee consisting of independent directors, if the number of our directors is expanded.

15

Audit Committee Financial Expert

We have no audit committee financial expert serving on our audit committee. We believe the cost related to retaining a financial expert at this time is prohibitive. Further, because of our stage of development, we believe the services of a financial expert are not warranted.

Code Of Ethics

We adopted a Code of Ethics applicable to our Chief Executive Officer, Chief Financial Officer, Corporate Controller and certain other finance executives, which is a "code of ethics" as defined by applicable rules of the SEC. Our Code of Ethics was attached as an exhibit to our Annual Report on Form 10-KSB for the year ended April 30, 2004. If we make any amendments to our Code of Ethics other than technical, administrative, or other non-substantive amendments, or grant any waivers, including implicit waivers, from a provision of our Code of Ethics to our Chief Executive Officer, Chief Financial Officer, or certain other finance executives, we will disclose the nature of the amendment or waiver, its effective date and to whom it applies in a Current Report on Form 8-K filed with the SEC.

Compliance with Section 16(a) of the Securities Exchange Act

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who beneficially own more than 10% of our equity securities (collectively, the “Reporting Persons”), to file reports of ownership and changes in ownership with the SEC. Reporting Persons are required by SEC regulations to furnish us with copies of all forms they file pursuant to Section 16(a). Based solely on our review of such reports received by the Company, no other reports were required for those persons.

ITEM 11. EXECUTIVE COMPENSATION.

Summary Compensation Table

The following table sets forth total compensation paid to or earned by our named executive officers, as that term is defined in Item 402(m)(2) of Regulation S-K, during the fiscal years ended April 30, 2010 and 2009.

| SUMMARY COMPENSATION TABLE | |||||||||

Name & Principal Position |

Year End April 30, |

Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compen- sation ($) |

Nonqualified Deferred Compen- sation Earnings ($) |

All Other Compen- sation ($) |

Total ($) |

| Howard Thomson President, Secretary, Treasurer, CEO & CFO |

2010 2009 |

$30,000 $30,000 |

$0 $0 |

$0 $0 |

$0 $0 |

$0 $0 |

$0 $0 |

$0 $0 |

$30,000 $30,000 |

Outstanding Equity Awards at Fiscal Year End

As at April 30, 2010, we had no outstanding equity awards.

Employment Contracts

Other than as described below, we are not party to any employment contracts.

On March 21, 2006, we entered into a management consulting agreement with Mr. Thomson, pursuant to which he agreed to act as our President, Secretary, Treasurer, Chief Executive Officer and Chief Financial Officer and provide certain management consulting services in consideration of which we agreed to pay a fee of $2,500 per month and make a payment of $2,500 for prior services provided in the month of February, 2006. Pursuant to the terms of the agreement, Mr. Thomson may also be granted incentive stock options from time to time as the board of Terrace may determine in their discretion. The agreement may be terminated by Terrace at any time on three months notice to Mr. Thomson and Mr. Thomson may terminate on 30 days notice. The management consulting agreement with Mr. Thomson expired effective March 21, 2008. Although this agreement has expired, we have agreed to continue to pay Mr. Thomson $2,500 for his management services.

16

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. |

EQUITY COMPENSATION PLANS

On March 21, 2006, our Board of Directors approved the 2006 Stock Incentive Plan (the "2006 Option Plan"). The 2006 Option Plan provides that the option price be the fair market value of the stock at the date of grant as determined by our Board of Directors. Options granted become exercisable and expire as determined by our Board of Directors.

The following table sets forth certain information concerning all equity compensation plans previously approved by stockholders and all previous equity compensation plans not previously approved by stockholders, as of the most recently completed fiscal year.

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in column (a)) | |

| Plan Category | (a) | (b) | (c) |

| Equity Compensation Plans Approved By Security Holders | Nil |

N/A |

N/A |

| Equity Compensation Plans Not Approved By Security Holders | Nil |

N/A |

1,503,499 |

2006 Stock Incentive Plan

On March 21, 2006, we established our 2006 Stock Incentive Plan. The purpose of the 2006 Option Plan is to enhance the long-term stockholder value of Terrace by offering opportunities to our directors, officers, employees and eligible consultants and any entity that directly or indirectly is in control of or is controlled by Terrace (a “Related Company”) to acquire and maintain stock ownership in Terrace in order to give these persons the opportunity to participate in our growth and success, and to encourage them to remain in our service or a Related Company.

The 2006 Option Plan is administered by our Board of Directors or by a committee of two or more non-employee directors appointed by our Board of Directors (the "Plan Administrator"). Subject to the provisions of the 2006 Option Plan, the Plan Administrator has full and final authority to grant the awards of stock options and to determine the terms and conditions of the awards and the number of shares to be issued pursuant thereto. Options granted under the 2006 Option Plan may be either "incentive stock options," which qualify for special tax treatment under the Internal Revenue Code of 1986, as amended, (the "Code"), non-qualified stock options or restricted shares.

All of our employees and members of our Board of Directors are eligible to be granted options. Individuals who have rendered or are expected to render advisory or consulting services to us are also eligible to receive options. The maximum number of shares of our Common Stock with respect to which options or rights may be granted under the 2006 Option Plan to any participant is 1,000,000 shares with the number of authorized shares under the 2006 Option Plan increasing on the first day of each quarter beginning with the fiscal quarter commencing May 1, 2006 by the lesser of the following amounts: (1) 15% of the total increase in the number of shares of Common Stock outstanding during the previous fiscal quarter; or (2) a lesser number of shares of Common Stock as may be determined by the Board, subject to certain adjustments to prevent dilution.

17

The exact terms of the option granted are contained in an option agreement between us and the person to whom such option is granted. Eligible employees are not required to pay anything to receive options. The exercise price for incentive stock options must be no less than 75% of the fair market value of the Common Stock on the date of grant. The exercise price for non-qualified stock options is determined by the Plan Administrator in its sole and complete discretion. An option holder may exercise options from time to time, subject to vesting. Options will vest immediately upon death or disability of a participant and upon certain change of control events.

The Plan Administrator may amend the 2006 Option Plan at any time and in any manner, subject to the following: (1) no recipient of any award may, without his or her consent, be deprived thereof or of any of his or her rights thereunder or with respect thereto as a result of such amendment or termination; and (2) any outstanding incentive stock option that is modified, extended, renewed, or otherwise altered must be treated in accordance with Section 424(h) of the Code.

The 2006 Option Plan terminates on March 21, 2016 unless sooner terminated by action of our Board of Directors. All awards granted under the 2006 Option Plan expire ten years from the date of grant, or such shorter period as is determined by the Plan Administrator. No option is exercisable by any person after such expiration. If an award expires, terminates or is canceled, the shares of our Common Stock not purchased thereunder may again be available for issuance under the 2006 Option Plan.

We have not yet filed a registration statement under the Securities Act to register the shares of our Common Stock reserved for issuance under the 2006 Option Plan.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of September 10, 2010 by: (i) each person (including any group) known to us to own more than five percent (5%) of any class of our voting securities, (ii) each of our directors and each of our named executive officers (as defined under Item 402(m)(2) of Regulation S-K), and (iii) officers and directors as a group. Unless otherwise indicated, the shareholders listed possess sole voting and investment power with respect to the shares shown.

Title of Class |

Name and Address of Beneficial Owner |

Number of Shares of Common Stock(1) |

Percentage of Common Stock(1) |

DIRECTORS AND OFFICERS |

|||

| Common Stock |

Howard Thomson CEO, CFO, President, Secretary, Treasurer & Director |

3,200,001 Shares (direct) |

33.8% |

| Common Stock | All Officers and Directors as a Group (1 person) | 3,200,001 Shares | 33.8% |

5% SHAREHOLDERS |

|||

| Common Stock |

Howard Thomson CEO, CFO, President, Secretary, Treasurer & Director Brookside, Ballymabin Dunmore East, County Waterford Ireland |

3,200,001 Shares (direct) |

33.8% |

18

| (1) |

Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding on September 10, 2010. As of September 10, 2010, there were 9,470,660 shares of our common stock issued and outstanding. |

CHANGES IN CONTROL

We are not aware of any arrangement that might result in a change in control in the future.

| ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. |

RELATED TRANSACTIONS

None of the following parties has, during our last two fiscal years, had any material interest, direct or indirect, in any transaction with us or in any presently proposed transaction that has or will materially affect us, in which the Company is a participant:

| (i) |

Any of our directors or officers; | |

| (ii) |

Any person proposed as a nominee for election as a director; | |

| (iii) |

Any person who beneficially owns, directly or indirectly, shares carrying more than 10% of the voting rights attached to our outstanding shares of common stock; | |

| (iv) |

Any of our promoters; and | |

| (v) |

Any relative or spouse of any of the foregoing persons who has the same house as such person. |

DIRECTOR INDEPENDENCE

Our common stock is quoted on the OTC Bulletin Board inter-dealer quotation system, which does not have director independence requirements. Under NASDAQ Rule 5605(a)(2), a director is not considered to be independent if he or she is also an executive officer or employee of the corporation. Our sole director, Howard Thomson, is also our sole executive officer. As a result, we do not have any independent directors.

As a result of our limited operating history and minimal resources, our management believes that it will have difficulty in attracting independent directors. In addition, we would likely be required to obtain directors and officers insurance coverage in order to attract and retain independent directors. Our management believes that the costs associated with maintaining such insurance is prohibitive at this time.

19

| ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES. |

During the fiscal years ended April 30, 2010 and 2009, we retained our independent auditor, Sarna & Company, Certified Public Accountants, to provide services in the following categories and amounts:

| Year Ended April 30, 2010 | Year Ended April 30, 2009 | |

| Audit Fees | $12,800 | $12,800 |

| Audit-Related Fees | $NIL | $NIL |

| Tax Fees | $NIL | $NIL |

| All Other Fees | $NIL | $NIL |

| Total | $12,800 | $12,800 |

Our Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the independence of Sarna & Company, and has concluded that it is.

Policy on Pre-Approval by Audit Committee of Services Performed by Independent Auditors

The policy of our Audit Committee is to pre-approve all audit and permissible non-audit services to be performed by our independent auditors during the fiscal year.

No services related to Audit-Related Fees, Tax Fees or All Other Fees described above that were approved by the Audit Committee pursuant to the waiver of pre-approval provisions set forth in the applicable rules of the SEC.

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

| Exhibit | |

| Number | Description of Exhibit |

| 3.1 | Articles of Incorporation.(1) |

| 3.2 | Certificate of Change to Authorized Capital effective December 19, 2005.(2) |

| 3.3 | Certificate of Change Pursuant to NRS 78.209 decreasing the authorized capital of common stock to 80,000,000 shares, par value $0.001 per share.(9) |

| 3.4 | Bylaws.(1) |

| 10.1 | 2006 Stock Incentive Plan.(4) |

| 10.2 | Stock Option Agreement between the Company and Howard Thomson dated March 31, 2006.(4) |

| 10.3 | Management Consulting Agreement dated March 21, 2006 between the Company and Howard Thomson.(4) |

| 10.4 | Interim Agreement dated July 9, 2008 between the Company and Pyro Pharmaceuticals, Inc.(5) |

| 10.5 | Amendment Agreement dated September 26, 2008 to the Interim Agreement dated July 9, 2008 between the Company and Pyro Pharmaceuticals, Inc.(6) |

| 10.6 | Share Purchase Agreement dated April 29, 2009 among Terrace Ventures Inc., Marktech Acquisition Corp., Worldbid International Inc. and Geobiz Systems Inc.(7) |

| 10.7 | Amendment Agreement to Share Purchase Agreement dated August 12, 2009 among Terrace Ventures Inc., Marktech Acquisition Corp., Worldbid International Inc. and Geobiz Systems Inc.(8) |

| 10.8 | Amendment Agreement to Share Purchase Agreement dated for reference December 31, 2009 among Terrace Ventures Inc., Marktech Acquisition Corp., Worldbid International Inc. and Geobiz Systems Inc.(10) |

| 14.1 | Code of Ethics.(3) |

| 21.1 | List of Subsidiaries. |

20

| Exhibit | |

| Number | Description of Exhibit |

| 31.1 | |

|

|

|

| 32.1 |

Notes:

| (1) |

Filed with the SEC as an exhibit to our Registration Statement on Form 10-SB originally filed on February 2, 2004. |

| (2) |

Filed with the SEC as an exhibit to our Current Report on Form 8-K filed on December 27, 2005. |

| (3) |

Filed with the SEC as an exhibit to our Annual Report on Form 10-KSB filed on September 8, 2004. |

| (4) |

Filed with the SEC as an exhibit to our Quarterly Report on Form 10-QSB filed on March 22, 2006. |

| (5) |

Filed with the SEC as an exhibit to our Current Report on Form 8-K filed on July 15, 2008. |

| (6) |

Filed with the SEC as an exhibit to our Current Report on Form 8-K filed on October 2, 2008. |

| (7) |

Filed with the SEC as an exhibit to our Current Report on Form 8-K filed on April 29, 2009. |

| (8) |

Filed with the SEC as an exhibit to our Annual Report on Form 10-K filed on August 13, 2009. |

| (9) |

Filed with the SEC as an exhibit to our Current Report on Form 8-K filed on October 2, 2009. |

| (10) |

Filed with the SEC as an exhibit to our Quarterly Report on Form 10-Q filed on March 22, 2010. |

21

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TERRACE VENTURES INC. | ||||

| Date: | September 14, 2010 | By: | /s/ Howard Thomson | |

| HOWARD THOMSON | ||||

| Chief Executive Officer, Chief Financial Officer , | ||||

| President, Secretary and Treasurer | ||||

| (Principal Executive Officer & Principal Accounting Officer) |