Attached files

| file | filename |

|---|---|

| EX-23.1 - Sinobiopharma, Inc. | sinob_ex23-1.htm |

| EX-32.1 - Sinobiopharma, Inc. | sinob_ex32-1.htm |

| EX-31.1 - Sinobiopharma, Inc. | sinob_ex31-1.htm |

| EX-32.2 - Sinobiopharma, Inc. | sinob_ex32-2.htm |

| EX-31.2 - Sinobiopharma, Inc. | sinob_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended May 31, 2010

|

or

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from _____________to ______________

|

Commission file number 333-144910

SINOBIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

26-3002371

|

|

State or other jurisdiction of

Incorporation or organization

|

(I.R.S. Employer

Identification No.)

|

8 Zhong Tian Road

Nantong City, Jiangsu Province

People’s Republic of China 226009

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 011 - (86) 51-3853-28336

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [ ] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

|

Non-accelerated filer [ ] (Do not check if a smaller reporting company)

|

Smaller reporting company [X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Ac t). [ ] Yes [X] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Note. – If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

The aggregate market value of the voting and non-voting common stock of the issuer held by non-affiliates as of November 30, 2009 was approximately $13,611,600 (56,715,000 shares of common stock held by non-affiliates) based upon a closing price of the common stock of $0.24 as quoted by the OTC Bulletin Board on November 30, 2009.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. [ ] Yes [ ] No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

As of September 14, 2010, there are presently 117,587,608 shares of common stock, par value $0.0001 issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

2

| TABLE OF CONTENTS | |

|

Page

|

|

3

FORWARD LOOKING STATEMENTS

In this annual report, references to “Sinobiopharma,” “SNBP,” “the Company,” “we,” “our,” “us,” and the Company’s wholly owned subsidiary, “Dongying BVI,” “Big Global Limited,” and our controlled entity “Dong Ying China” refer to Sinobiopharma, Inc.

This Annual Report on Form 10-K contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Annual Report on Form 10-K. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the headings “Risks Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We file reports with the SEC. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us. You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K, except as required by law. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Annual Report, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

PART I

Item 1. Business.

Year of Organization and Corporate History

Sinobiopharma, Inc. was incorporated in the State of Nevada under the name of Buzz Media Ltd. on October 26, 2006. On November 8, 2006 the Company acquired all the issued and outstanding shares of Buzz Media Ltd. (“Buzz Nova Scotia”), a corporation incorporated in the province of Nova Scotia, Canada on October 26, 2006. The transaction was treated as an acquisition for accounting purposes. The consideration for the acquisition of Buzz Nova Scotia was 500 shares (on a post-forward stock split basis) of the Company valued at $0.10, the book value of the net assets of Buzz Nova Scotia, since the acquisition was from a related party.

On July 14, 2008 the Company’s President and majority shareholder sold all of her 62.5% interest in the Company to an unrelated individual. On the same day, she resigned from all of her positions as officer and director of the Company and the purchaser was appointed the sole director and officer of the Company.

Effective July 29, 2008, the Company, under its original name of Buzz Media, Ltd., incorporated a subsidiary, “Sinobiopharma, Inc.” with an investment of $0.001 and merged with it for the sole purpose of changing the name of the Company. As a result, the Company changed its name from “Buzz Media Ltd.” to “Sinobiopharma, Inc.”

Effective July 29, 2008, the Company effected a fifty (50) for one (1) stock split of its authorized, issued and outstanding common stock. As a result, the Company’s authorized capital increased from 50,000,000 shares of common stock with a par value of $0.0001 to 2,500,000,000 shares of common stock with a par value of $0.0001. The Company’s issued and outstanding share capital increased as a result of the split from 2,000,010 shares of common stock to 100,000,500 shares of common stock. Share capital figures are presented in these financial statements giving retroactive effect to the stock split and accordingly all share capital figures are presented on a post-split basis as if the split had been affected upon inception.

4

On August 19, 2008, the Company entered into a share exchange agreement (the “Share Exchange Agreement”) with Dongying Pharmaceutical Co, Limited (“Dongying BVI”), a company organized under the laws of the Territory of the British Virgin Islands, and all the shareholders of Dongying BVI, whereby the Company agreed to acquire 100% of the issued and outstanding shares of Dongying BVI through the issuance of approximately 40,000,000 shares of common stock of the Company in aggregate to the shareholders of Dongying BVI on a pro rata basis in accordance with each Dongying BVI shareholder’s percentage of ownership in Dongying BVI. The Share Exchange Agreement closed on September 22, 2008.

Concurrently with the closing of the Share Exchange Agreement, by a letter agreement entered into on September 8, 2008 between Dongying BVI and the Company’s majority shareholder, that shareholder agreed to cancel 60,100,500 shares of the 62,500,500 shares of common stock of the Company registered in his name within ten (10) days of the closing of the Share Exchange Agreement. The 60,100,500 shares were cancelled on September 26, 2008. The share cancellation completed the reverse merger with Dongying BVI as a recapitalization of the Company, such that voting control of the Company was obtained by the former stockholders of Dongying BVI. The net assets of Dongying BVI and the Company have been brought forward at their historical bases. The costs associated with the reverse merger were expensed as incurred.

Dongying BVI was incorporated under the laws of the British Virgin Islands on January 29, 2008. On May 13, 2008 Dongying BVI acquired a 100% interest in Big Global Limited (“Big Global”) from the sole shareholder of Dongying BVI for consideration of $1.00.

Big Global was incorporated under the laws of Hong Kong on November 26, 2007. On December 10, 2007 Big Global acquired a 100% interest in Dong Ying (Jiangsu) Pharmaceuticals Co., Ltd. (“Dong Ying China”) from the sole shareholder of Big Global for consideration of $1.00. The acquisition was approved by the government of the People’s Republic of China (“PRC” or “China”) in May 2008.

Dong Ying China was incorporated under the laws of the PRC in 2003. Dong Ying China’s business is the development, manufacture and sale of pharmaceutical products in China. There are three product lines currently as of May 31, 2010 and several other potential products in various stages of research and development. The product lines currently commercialized are Cisatracurium Besylate, a skeletal muscle relaxant, Clindamycin Hydrochloride, an antibiotic for penicillin-allergic patients and Perindopril, a cardiovascular drug. Dong Ying China’s offices and manufacturing facility are in owned premises located on land used under license in Nantong, China and its research and development is carried out in Nanjing, China.

On August 20, 2008, the Company entered into a share purchase agreement (the “Share Purchase Agreement”) with the Company’s former majority shareholder, effective concurrently with the closing of the Share Exchange Agreement. Pursuant to the Share Purchase Agreement, the former majority shareholder acquired all of the capital of Buzz Media, Ltd. (“Buzz Nova Scotia”), the wholly-owned subsidiary of the Company incorporated in the Province of Nova Scotia, Canada, in exchange for the payment of $10.00.

Our Business

The business of the Company is conducted through its subsidiary, Dongying BVI, which, in turn, conducts its business through its subsidiary, Big Global Limited, which, in turn, conducts its business through Dong Ying China.

The diagram below illustrates the corporate structure of the Company as a result of the completion of the Share Exchange Agreement and the Share Purchase Agreement:

5

Dongying BVI, Big Global Limited and Dong Ying China

Dongying BVI

Dongying BVI was incorporated pursuant to the laws of the British Virgin Islands on January 29, 2008. As a result of the closing of the Share Exchange Agreement, the Company is the sole shareholder of Dongying BVI. Dongying BVI’s sole director is Dr. Lequn Lee Huang. On May 13, 2008, Dongying BVI purchased the sole common share of Big Global Limited from Dr. Lequn Lee Huang in exchange for payment of $1.00HK.

Big Global Limited

Big Global Limited was incorporated pursuant to the laws of Hong Kong on November 26, 2007. Dongying BVI is the sole shareholder of Big Global Limited and Dr. Lequn Lee Huang is the sole director of the Company. Pursuant to an equity transfer contract between Big Global Limited and Cyton International, Inc., a company incorporated pursuant to the laws of the state of Connecticut, USA, dated December 10, 2007, Big Global Limited acquired 100% of the registered capital of Dong Ying China in exchange for the payment of US$1.00 as Cyton International, Inc. was merely a nominee shareholder for Dr. Lequn Huang and there was no change in the beneficial ownership of Dong Ying China.

Dong Ying China

Dong Ying China was incorporated under the name Nantong Dongying Pharmaceutical Co., Ltd. pursuant to the laws of the People’s Republic of China. Effective September 29, 2008, upon the purchase by Cyton International, Inc., of 100% of the issue and outstanding shares of Nantong Dongying Pharmaceutical Co., Ltd., Dong Ying China was reincorporated and approved by the relevant PRC authorities as a wholly-foreign owned enterprise. Effective 11, 2004, Dong Ying China changed its name to Dongying (Jiangsu) Pharmaceutical Co., Ltd. and received the relevant governmental approval for such change. During the last six fiscal years, Dong Ying China has been engaged in the research, development, manufacture and marketing of biopharmaceutical products in China.

Business of Dong Ying China

Dong Ying China is engaged in the research, development, manufacture and marketing of biopharmaceutical products in China. Dong Ying China has developed new methods for synthesis of active pharmaceutical ingredient (“API”) and innovative drug delivery (new formulation) that dramatically reduces the time and cost of drug development. Dong Ying China’s current therapeutic focus is on anesthesia-assisted agents and cardiovascular drugs. Dong Ying China’s R&D focus is new, innovative methods of synthesizing compounds more rapidly at lower cost, and/or improved drug formulation with enhanced usability.

Dong Ying China’s headquarters and 30,000 sq. meter (approximately 322,917.31 sq. foot) Good Manufacturing Practice (“GMP”) certified production facilities are located in the Nantong Economic and Technology Development Zone, is located in Nantong City, Jiangsu, and qualifies Dong Ying China for tax benefits. Dong Ying China’s research and development (“R&D”) labs are located in Nanjing, China. The Nantong Economic and Technology Development Zone is a major R&D center within China with several universities and research institutes. Dong Ying China’s distribution network enables Dong Ying China to market its products in every major city in China.

Dong Ying China’s Strengths

|

*

|

Leadership of CEO, Dr. Lequn Lee Huang (Ph.D., Chemistry, Iowa State University), a former manager, Head of MS lab for drug discovery, at Bayer Co.;

|

|

*

|

Patents applied and granted for technology for fast, low-cost synthesis of API and new drug formulations;

|

|

*

|

Integrated, large capacity GMP-certified manufacturing facilities for freeze-dried powder, injection formula, tablets, hard capsules, granules and pharmaceutical raw materials;

|

|

*

|

10 research specialists and more than 40 of the Company’s 110 employees have college or higher educations.

|

6

Dong Ying China’s Products

Currently the product line of Dong Ying China includes Cisatracurium Besylate (marketed as “Kutai” in China), a skeletal muscle relaxant, Perindopril (Marketed as “Yitai” in China”), a cardiovascular for blood hypertention and Clindamycin Hydrochloride (marketed as “kesu” in China), an antibiotic for penicillin-allergic patients. Dong Ying China has the ability to expand its market through its research cooperation with Nanjing University and Nanjing Suji Pharmaceutical Research Center.

Dong Ying China launched its patented product for new freeze-dried formulation of the pre-surgical skeletal muscle relaxant Cisatracurium Besylate on May 30, 2006. By May 31, 2010, the Company estimated Kutai had captured approximately 65% of the Chinese market and was in use in more than 700 hospitals. Developed using Dong Ying China’s patent granted for method for drug synthesis that can dramatically reduce the time and cost of drug development, Dong Ying China’s Cisatracurium Besylate is the only one can be stored at room temperature whereas competitors’ versions must be kept at between 35.6 to 46.4 degrees Fahrenheit.

Sinobiopharma launched the Perindopril product in early 2010. Perindopril, used alone or in combination with other medications to treat high blood pressure, is the latest generation of a class of medications called ACE inhibitors. It supports circulation by preventing the production of chemicals that occur naturally in the body but constrict blood vessels.

The Company has received the Drug Certificate for Perindopril raw material (Certificate H20073699) from the Chinese State Food and Drug Administration (the “Chinese SFDA”) and obtained GMP Certification as of February 21, 2010. The Company has submitted its application to China's State Intellectual Property Office (SIPO) for a Chinese patent for Perindopril and its new drug compounds and obtained a receiving number (200810242989.1; "New Drug Compounds Containing Perindopril"). Sinobiopharma completed clinical trials for the capsule formulation in September 2007. Sinobiopharma has received approval from the Chinese SFDA to manufacture and market the Perindopril tablet in April 2010 (Certificate H20093504).

As the first-to-market (FTM) Chinese producer of Perindopril, Sinobiopharma will come to market with certain competitive advantages, including higher price approvability by the Chinese Government, exclusivity for penetrating to hospitals, and the ability to export of lower cost active pharmaceutical ingredients (API) to the globe market. Prior to Chinese SFDA approval of Sinobiopharma's version of Perindopril, Servier (France) was the only firm to market imported Perindopril in China.

The following table sets forth information relating to key products that Dong Ying China has launched in the Chinese market:

|

Key Products

|

Dose

|

Approval Number

|

||

|

Cisatracurium Besylate

|

Raw Material (API)

|

H20060926

|

||

|

for injection

|

5 mg

|

H20060927

|

||

|

Clindamycin Hydrochloride

|

||||

|

for injection

|

0.75g/0.9g

|

H20040927

|

||

|

Perindopril

|

Raw Material (API)

|

H20073699

|

||

|

Tablet

|

2 mg

|

H20093504

|

The following table sets forth information relating to a key product that Dong Ying China expects to launch in the Chinese Market in the very near future:

|

Key Products

|

Dose

|

Approval Number

|

||

|

N(2)-L-alanyl-L- glutamine for injection (1)

|

10 g

|

2006B01379

|

7

Dong Ying China has also obtained approved certificates of approval to produce a number of generic drugs in China, which Dong Ying China can produce and market when the market price for such generic products increases and allows production to become profitable, which is currently not the situation.

|

Generic Products

|

Dose

|

Approval Number

|

||

|

Naproxen Tablets

|

0.1g

|

H32021028

|

||

|

Aminophylline tablets

|

0.1g

|

H32021024

|

||

|

Nitrendipine Tablets

|

10mg

|

H32021023

|

||

|

Propafenone tablets

|

50 mg

|

H32021025

|

||

|

Verapamil Tablets

|

40 mg

|

H32021026

|

||

|

Ketotifen Fumarate Tablets

|

1mg

|

H32024391

|

||

|

Oleanolic acid tablets

|

10mg

|

H32024392

|

||

|

Oleanolic acid tablets

|

20mg

|

H32024393

|

||

|

Vitamin C tablets

|

0.1g

|

H32024997

|

||

|

Difenidol tablets

|

25mg

|

H32024914

|

||

|

Pentoxyverine Citrate Tablets

|

25mg

|

H32024999

|

||

|

Atenolol tablets

|

25mg

|

H32024160

|

||

|

Atenolol tablets

|

50mg

|

H32024159

|

||

|

Perphenazine Tablets

|

2mg

|

H32024162

|

||

|

Perphenazine Tablets

|

4mg

|

H32024163

|

||

|

Captopril Tablets

|

25mg

|

H32024167

|

||

|

Clozapine Tablets

|

25mg

|

H32024169

|

||

|

Chlorprothixene Tablets

|

25mg

|

H32024170

|

||

|

Fenfluramine Tablets

|

20mg

|

H32024172

|

||

|

Doxepin Hydrochloride Tablets

|

25mg

|

H32024395

|

||

|

Chlorpromazine Tablets

|

25mg

|

H32024397

|

||

|

Chlorpromazine Tablets

|

50mg

|

H32024396

|

||

|

Breviscapine Tablets

|

20mg

|

Z32021122

|

||

|

Troxerutin Tablets

|

60mg

|

H32025915

|

||

|

Trepibutone Tables

|

40mg

|

H32025533

|

||

|

Tiapride Hydrochloride Tablets

|

0.1g

|

H32025535

|

||

|

Ranitidine Capsules

|

150 mg

|

H32024998

|

||

|

Ciprofloxacin Capsules

|

0.25g

|

H32025000

|

||

|

Ganoderma Capsules

|

0.27g

|

Z32021190

|

Dong Ying China’s Development Pipeline

In addition to those products currently on the market in China, Dong Ying China has product candidates in the development pipeline using its patent applied for method for quickly synthesizing low-cost API and improved delivery formulations. Product candidates currently in the development pipeline include:

|

*

|

Rocuronium bromide (skeletal muscle relaxant): Like its formulation of Cisatracurium Besylate, we expect that Dong Ying China’s next generation Rocuronium Bromide formulation will be the world’s first that can be stored at room temperature, making it more convenient to use; and Rocuronium Bromide is a fast acting muscle relaxant, can be used in cocktail with Cisatracurium Besylate

|

|

*

|

Memantine (treatment of Alzheimer’s): received the Chinese SFDA’s approval for Phase II Clinical Trial. Dong Ying China’s formulation is the latest generation of the drug and Dong Ying China expects to be one of the first companies to launch the drug in the Chinese market.

|

8

The following table sets forth information relating to different product candidates that Dong Ying China has developed or co-developed with Meisu Jining Bio-medicine Research and Development Co., Ltd., which product candidates are in different stages, many of which require additional funds to support clinical trials, pending for launch in the Chinese market:

|

Development Pipeline

|

Dose

|

Approval Number

(only for Pre-clinic)

|

||

|

Rocuronium Bromide injection

|

25mg/50mg

|

|||

|

Memantine Hydrochloride

|

2005L01497

|

|||

|

Memantine Hydrochloride Tablets

|

5mg

|

2005L01498

|

||

|

Azithromycin Granules

(just passed human trials, pending for approval)

|

0.1g

|

2005L03871

|

In 2006, Dong Ying China wrote-off the intangible asset related to the product rights to Azithromycin as it was deemed not realizable through impairment analysis, however, in 2008, Dong Ying China performed clinical trials on Azithromycin, which just passed human trials in August 2008, and which is pending governmental approval.

Dong Ying China’s Marketing Plan

The Industry

With approximately one-fifth of the world’s population and a fast-growing gross domestic product, China represents a significant potential market for the pharmaceutical industry. The Company expects significant growth in the pharmaceutical market in China due to the following factors: robust economic growth; increased pharmaceutical expenditures; an aging population; increased lifestyle-related diseases; government support of the pharmaceutical industry; relatively low research and development and clinical trial costs in China as compared to developed countries; and the increased availability of funding for medical insurance and industry consolidation in China.

Dong Ying China has an established sales and marketing network that distributes its products in 30 provinces and key major cities throughout China over 700 hospitals. The Company intends to expand Dong Ying China’s sales and marketing infrastructure to meet China’s rapidly growing demand for safer, lower-cost, higher-efficacy drugs.

Strategy

Dong Ying China has a clearly defined strategy to drive short, middle and long term growth. All drug development is expected to leverage Dong Ying China’s patent applied for technology for fast, low-cost drug synthesis and new technology for formulation.

In the short term, the Company’s focus is in launching new drugs in the Chinese market. The patented synthesis method allows Dong Ying China to develop new API at lower cost and new formulations that generally offer greater convenience in application and efficacy with fewer side effects.

In the middle term, Dong Ying China intends to focus on exporting API and drug reformulations developed with Dong Ying China’s patent applied for freeze-dried formulation technology for the global market.

In the long term, Dong Ying China intends to focus on applying its technology platform to identifying candidate compounds from traditional Chinese medicines. Dong Ying China intends to accelerate its discovery, synthesis and formulation of pharmaceutical applications.

Distribution Methods

Dong Ying China sells its prescription-based and pharmaceutical products via regional distributors in China. Dong Ying China intends to expand its sales force as well as its coverage with the regional distributors across China. Currently, Dong Ying China has a marketing department and a sales department. The marketing department is responsible for the promotion of new products to the national market and intended global market by attending industry trade shows, conducting educational seminars to physicians, advertising in newspapers and in industry publications, as well as using internet marketing and collaborating with the government.

The sales department has four regional managers with each manager responsible for his or her assigned region in China, with each region having about 7 to 10 provinces. The four regional managers report directly to the VP of Sales. We staff between 1 to 3 agents per province to be in charge of all the cities in such province, which is how Dong Ying China obtains distribution in all major cities in China.

9

During fiscal year 2008, the majority of Dong Ying China’s sales were conducted through a limited number of regional distributors who subsequently sold Dong Ying China’s products to hospitals, clinics, and pharmacies. Since the fiscal year 2008, Dong Ying China has been expanding its distributor base and believes that the number of its regional distributors will increase substantially in the next few years.

In January 2009, we signed distribution agreements for Cisatracurium Besylate with our 32 distribution agents who distribute our products in 30 provinces and key major cities throughout China.

In the first calendar quarter of 2010, we have renewed distribution contracts with 30 distribution agents totaling US$8.4 million for 2010 for distribution of our flagship product Cisatracurium Besylate. These distributors have coverage in more than 30 provinces throughout China and in most major cities.

Our expansion strategy also includes possible targeted acquisitions intended to expand our first-to-market drug pipeline and advancing new development of innovative drugs that is expected to consolidate leadership position in our chosen therapeutic areas.

Dong Ying China’s Competition

The following table sets forth information with respect to competition in China for Dong Ying China’s flagship product of Cisatracurium Besylate:

|

Competitor

|

Percentage of Market

|

||

|

Jiangsu Hengrui Pharmeutical Co., Ltd.

|

30%

|

||

|

GlaxoSmithKline

|

5%

|

Our competitive advantages are discussed in the subsection entitled “Dong Ying China’s Products” above. Although the above-listed competitors occupy a much smaller percentage of market share than Dong Ying China, which is estimated to account for approximately 35% of the market share for Cisatracurium Besylate in China, the main competition for Cisatracurium Besylate comes from these two companies because they are the only companies that currently produce and sell Cisatracurium Besylate in China.

Intellectual Property

Patents

As of August 31, 2010, the Company acquired the following patent, “Composition for Lyophilized Powder of Atracurium,” previously jointly owned by Lei Wang and Lequn Huang, the Company’s chief executive officer and director, pursuant to a patent transfer agreement by and among the Company, Dong Ying China, Mr. Wang, and Dr. Huang:

|

Title

|

Application No.

|

Application Date

|

Status

|

Patent No.

|

||||

|

Atracurium combination of freeze-dried formulation

|

200710020588.7

|

2007.3.13

|

Granted

|

ZL200710127756.2

|

New Patents under Application:

Dong Ying China has applied for the following patents:

|

Title

|

Application No.

|

Application Date

|

Status

|

Patent No.

|

||||

|

Method for separating and purifying cisatracurium besylate by column chromatography

|

200910028198.3

|

2009.1.16

|

Pending

|

Waiting for approval

|

||||

|

Pharmaceutical composition comprising perindopril

|

200810242989.1

|

2008.12.31

|

Pending

|

Waiting for approval

|

10

Material Contracts

On March, 29, 2004, Cyton International, Inc., the sole shareholder of Dong Ying China at that time, entered into an agreement (the “Development Agreement”) with the Jiangsu Province Nantong Economic and Technology Development Zone Administration (the “Administration”), for the construction of factories in the Jiangsu Nantong Economic and Technology Development Zone (the “Zone”), a state-level economic and technological development zone qualified for state preferential policies. Pursuant to the Development Agreement, Dong Ying China was provided with 60 acres within the Zone for the construction of factories and is required to pay a land-use fee of 40,000RMB per acre. Dong Ying China ended up paying RMB2,248,000 as there only ended up being 56.2 acres provided to Dong Ying China. All land in China is owned by the State. Individuals and companies are permitted to acquire rights to use land or land use rights for specific purposes. In the case of land used for industrial purposes, the land use rights are granted for a period of 50 years. This period may be renewed at the expiration of the initial and any subsequent terms. Granted land use rights are transferable and may be used as security for borrowings and other obligations. Dong Ying China holds the State-owned Land Use Rights Certificate No.: TONGKAIGUOYONG [2007] No. D0310158, and the RMB40,000 per acre is a one-time payment. In addition, the Administration agreed to provide Dong Ying China with a RMB20,000,000 fund (the “Fund”) to support the construction of factories and the building and purchasing of affiliated equipment. Dong Ying China has three years from the date of each portion of the Fund used to repay such portion. The Administration has the right to convert or exchange the Fund into shares of Dong Ying China, but recently the Administration decided to waive the right to convert or exchange the outstanding Fund into shares of Dong Ying China and agreed to the repayment of the Fund by December 31, 2010. Dong Ying China has repaid RMB12,000,000 as of May 31, 2010, and plans to complete the repayment of the outstanding Fund by the end of 2010. Also in accordance with the Development Agreement, Dong Ying China is required to have a registered capital of USD$5,000,000, which has already been satisfied.

At present, Dong Ying China has used all of the RMB20,000,000 in the Fund and has repaid RMB12,000,000 to date. In addition, Dong Ying China is required to repay the following amounts on the following dates:

|

Amount

|

Due Date

|

|

|

RMB8,000,000

|

December 31, 2010

|

On July 26, 2010, Dong Ying China, entered into a Cooperation Agreement with Jiangsu LianHuan Pharmaceuticals Co., Ltd. (“LianHuan”) for the co-development, manufacture, and marketing of the drug Eplerenone, a therapeutic agent formulated to treat high blood pressure and vascular diseases, and its tablet and capsule forms (the “Eplerenone”). Clinical trial certificates for Eplerenone are currently owned by DongYing. According to the Agreement, LianHuan shall be responsible for all fees and expenses incurred in the clinical trials. Following the completion of clinical trials, LianHuan and DongYing shall jointly complete and submit the drug production application. Once production approval for Eplerenone is obtained, LianHuan and DongYing shall jointly own the new drug production certificate for Eplerenone. LianHuan shall be responsible for the manufacture of Eplerenone and its tablet form, though Dong Ying China retains the option to produce Eplerenone capsules. The net profit from the sales of Eplerenone shall be apportioned as 60 percent to Dong Ying China and 40 percent to LianHuan.

Sources and Availability of Materials

Dong Ying China uses over 120 different medical raw materials and procures its raw materials from various vendors and suppliers in China with no limitation. Dong Ying China always requires an analysis report for quality control purposes to document each and every medicinal raw material received from third parties as its standard operating procedure.

In the fiscal year ended May 31, 2010, 2 suppliers accounted for more than 10% of the Company’s purchases. Purchases of raw material from Lianyungang Youlite Biochemical Science and Technology Co., Ltd. accounted for approximately 55% of total purchases during this period. Purchases of raw material from Nanjing Weier Chemical Co.Ltd. accounted for approximately 15 % of total purchases during this period.

In the fiscal year ended May 31, 2009, 3 suppliers accounted for more than 10% of the Company’s purchases. Purchases of raw material from Lianyungang Youlite Biochemical Science and Technology Co., Ltd. accounted for approximately 47% of total purchases during this period. Purchases of raw material from Suzhou Forth Pharmaceutical Co., Ltd. accounted for approximately 13% of total purchases during this period. Purchases of raw material from Nanjing Weier Chemical Co., Ltd accounted for approximately 12% of total purchases during this period.

Customers

In the fiscal year ended May 31, 2010, Dong Ying China’s five largest customers accounted, in the aggregate, for approximately 61% of sales revenues, as follows:

11

|

*

|

Hebei Dezelong Medicine Co., Ltd. - accounted for approximately 21% of sales

|

|

*

|

Hainan Zhongyu Medicine Co., Ltd. - accounted for approximately 20% of sales

|

|

*

|

Sichuang Ruihai Medicine Co., Ltd. - accounted for approximately 7% of sales

|

|

*

|

Hebei Yongzhengrunsheng Medicine Co., Ltd. - accounted for approximately 7% of sales

|

|

*

|

Zhengzhou Changjin Medicine Co., Ltd - accounted for approximately 6% of sales

|

Research and Development

Research and development expenses were $ 816,262 in the year ended May 31, 2010, compared to $197,286 in the year ended May 31, 2009, which increased as a result of expenses spent on Perindopril, the new product that the Company launched in 2010.

Employees

Dong Ying China has over 110 full time employees, 40 of whom have college or higher education, and 10 research specialists.

Governmental Regulation

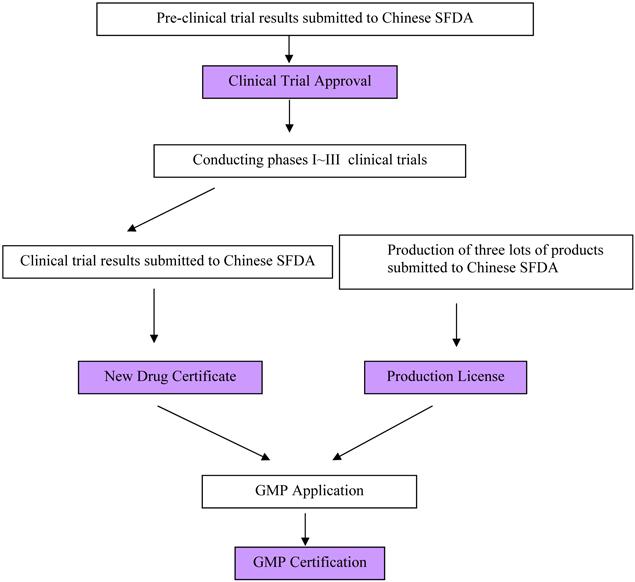

The Chinese SFDA regulates pharmaceutical products in China. Dong Ying China takes the following steps to gain approval from the Chinese SFDA to sell its products in China:

12

Pre-Clinical Study: The pre-clinical studies are divided into two parts: the pharmacy study and the pharmaco-toxicological studies. The pharmacy study includes the construction of the expression strain, the potency & Antigenicity studies, the Batch Production Reports, the data from Quality Control and the preliminary stability test. The pharmaco-toxicological studies include the acute toxic study, long-term toxicity, efficacy study, the pharmacokinetics and the other studies. All these study reports need to be submitted to the Chinese SFDA for review and evaluation. Meanwhile, Dong Ying China is required to produce three continuous lots of bulk and final products and send the samples to the National Institute for the Control of Pharmaceutical and Biological Products (the “NICPBP”) for quality inspection. The NICPBP is directly affiliated with the Chinese SFDA and its responsibility is for inspecting the quality of new products and vaccines.

Clinical Trial Approval and Conduct: During the period of evaluation, the Chinese SFDA may ask Dong Ying China to submit supplementary documents for further evaluation. If the Chinese SFDA is satisfied with everything, then the Chinese SFDA may approve the Phase I trial. After the end of the Phase I trial, Dong Ying China needs to submit the final clinical reports of Phase I trial to the Chinese SFDA for their review and evaluation. If no safety issues are visible or detected in the reports, the approvals for the Phase II trial may be issued. The same process occurs in order to receive the approvals for Phase III.

New Drug Certificate & Production License: Once all three phases of the clinical trial are complete, Dong Ying China must submit all clinical dossiers, including Phase I to Phase III, to the Chinese SFDA. Meanwhile the samples of three lots of bulk and final products manufactured in the Company’s GMP facilities also need to be submitted to the Chinese SFDA for quality inspection. If no serious adverse events are reported, the product shows a good efficacy in the trial, and the bulk and the final products pass quality inspection, the Chinese SFDA may issue the New Drug Certificate & Production License for a new product.

The New Drug Certificate & Production License grants the filing company intellectual property rights to the drug. Chinese administrative protection for the new proprietary drug starts from the date of the issuance of the new drug certificate.

Good Manufacturing Practice Certificate: The GMP certificate is for the monitoring of drug manufacturers and quality management. After receiving a new drug certificate and production license, the company submits an application for GMP certification. The Chinese SFDA will organize a group of specialists to validate the GMP facilities if the facilities satisfy the current GMP requirements. After GMP validation, if qualified, the GMP certificate may be issued. This provides approval for the equipment and control of the manufacturing workshop of the particular drug.

A new drug is only officially approved for sale in the Chinese market once these steps have been completed. The Company believes that the most significant milestone is the new drug certificate.

Environmental Compliance Costs

Our manufacturing operations are subject to numerous laws, regulations, rules and specifications relating to human health and safety and the environment. These laws and regulations address and regulate, among other matters, wastewater discharge, air quality and the generation, handling, storage, treatment, disposal and transportation of solid and hazardous wastes and releases of hazardous substances into the environment. In addition, third parties and governmental agencies in some cases have the power under such laws and regulations to require remediation of environmental conditions and, in the case of governmental agencies, to impose fines and penalties. We make capital expenditures from time to time to stay in compliance with applicable laws and regulations.

We have obtained all permits and approvals and filed all registrations required for the conduct of our business, except where the failure to obtain any permit or approval or file any registration would not have a material adverse effect on our business, financial condition and results of operations. We are in compliance in all material respects with the numerous laws, regulations, rules, specifications and permits, approvals and registrations relating to human health and safety and the environment except where noncompliance would not have a material adverse effect on our business, financial condition and results of operations.

The PRC governmental authorities have not revealed any material environmental liability that would have a material adverse effect on us. We have not been notified by any governmental authority of any continuing noncompliance, liability or other claim in connection with any of our properties or business operations, nor are we aware of any other material environmental condition with respect to any of our properties or arising out of our business operations at any other location.

It is possible that compliance with a new regulatory requirement could impose significant compliance costs on us. Such costs could have a material adverse effect on our business, financial condition and results of operations.

13

Executive Offices

Our executive offices in the PRC are located at 8 Zhong Tian Road, Nantong City, Jiangsu Province, People’s Republic of China. Our telephone is 011 - (86) 51-3853-28336.

Available Information

The Company’s website is www.sinobp.com, where information about the Company may be reviewed and obtained. In addition, the Company’s filings with the Securities and Exchange Commission (“SEC”) may be accessed at the internet address of the SEC, which is http://www.sec.gov. Also, the public may read and copy any materials that the Company files with at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580 Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Item 1A. Risk Factors.

Risks Relating to our Business

Our operating history may not serve as an adequate basis to judge our future prospects and results of operations.

Dong Ying China commenced its current line of business operations on September 29, 2003 and has received Good Manufacturing Practices (“GMP”) certifications for its production lines that are valid through January 27, 2006 and January 26, 2011, respectively. This certification must be renewed every five years for Dong Ying China to stay in business. Dong Ying China’s operating history may not provide a meaningful basis on which to evaluate its business. We cannot assure you that Dong Ying China will maintain its profitability or that we will not incur net losses in the future. We expect that Dong Ying China’s operating expenses will increase as it expands. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

* raise adequate capital for expansion and operations;

* implement our business model and strategy and adapt and modify them as needed;

* increase awareness of our brand name, protect our reputation and develop customer loyalty;

* manage our expanding operations and service offerings, including the integration of any future acquisitions;

* maintain adequate control of our expenses; and

* anticipate and adapt to changing conditions in the medical over the counter, pharmaceutical and nutritional supplement markets in which we operate as well as the impact of any changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics.

If we are not successful in addressing any or all of these risks, our business may be materially and adversely affected.

Dong Ying China’s failure to compete effectively may adversely affect our ability to generate revenue.

Dong Ying China competes with other companies, many of whom are developing or can be expected to develop products similar to Dong Ying China. Dong Ying China’s market is a large market with many competitors. Many of its competitors are more established than Dong Ying China is, and have significantly greater financial, technical, marketing and other resources than it presently possess. Some of Dong Ying China’s competitors have greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We cannot assure you that Dong Ying China will be able to compete effectively with current or future competitors or that the competitive pressures it faces will not harm it business.

We may not be able to effectively control and manage the growth of Dong Ying China.

If Dong Ying China’s business and markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. An expansion would increase demands on existing management, workforce and facilities. Failure to satisfy such increased demands could interrupt or adversely affect its operations and cause delay in production and delivery of its pharmaceutical prescription, over the counter and medical nutrient products as well as administrative inefficiencies.

14

We may require additional financing in the future and a failure to obtain such required financing will inhibit Dong Ying China’s ability to grow.

The continued growth of Dong Ying China’s business may require additional funding from time to time, which we expect to raise in private placements of our equity or debt securities with accredited investors or by offering our securities for sale pursuant to an effective registration statement on a market where our common stock is traded. The proceeds of these funding will be forwarded to Dong Ying China and accounted for as a loan to Dong Ying China and eliminated during consolidation. The proceeds would be used for general corporate purposes of Dong Ying China, which could include acquisitions, investments, repayment of debt and capital expenditures among other things. We may also use the proceeds to repurchase our capital stock or for our corporate overhead expenses. If we borrow funds we expect to be the primary obligor on any debt. Obtaining additional funding would be subject to a number of factors including market conditions, operating performance and investor sentiment, many of which are outside of our control. These factors could make the timing, amount, terms and conditions of additional funding unattractive or unavailable to us. Our management believes that we currently have sufficient funds from working capital to meet our current operating costs over the next 12 months.

The terms of any future financing may adversely affect your interest as shareholders.

If we require additional financing in the future, we may be required to incur indebtedness or issue equity securities, the terms of which may adversely affect your interests in us. For example, the issuance of additional indebtedness may be senior in right of payment to your shares upon our liquidation. In addition, indebtedness may be under terms that make the operation of Dong Ying China’s business more difficult because the lender's consent could be required before we take certain actions. Similarly the terms of any equity securities we issue may be senior in right of payment of dividends to your common stock and may contain superior rights and other rights as compared to your common stock. Further, any such issuance of equity securities may dilute your interest in us.

We, through our subsidiaries/affiliated companies Dongying BVI, Big Global Limited or Dong Ying China, may engage in future acquisitions that could dilute the ownership interests of our shareholders, cause us to incur debt and assume contingent liabilities.

We, through our subsidiaries/affiliated companies Dongying BVI, Big Global Limited, or Dong Ying China, may review acquisition and strategic investment prospects that we believe would complement the current product offerings of Dong Ying China, augment its market coverage or enhance its technical capabilities, or otherwise offer growth opportunities. From time to time Dong Ying China reviews investments in new businesses and we, through our subsidiaries/affiliated companies Dongying BVI, Big Global Limited, or Dong Ying China, expect to make investments in, and to acquire, businesses, products, or technologies in the future. We expect that when we raise funds from investors for any of these purposes we will be either the issuer or the primary obligor while the proceeds will be forwarded to Dong Ying China and accounted for as a loan to Dong Ying China and eliminated during consolidation. In the event of any future acquisitions, we could:

|

*

|

issue equity securities which would dilute current shareholders’ percentage ownership;

|

|

*

|

incur substantial debt;

|

|

*

|

assume contingent liabilities; or

|

|

*

|

expend significant cash.

|

These actions could have a material adverse effect on our operating results or the price of our common stock. Moreover, even if through our subsidiary, Big Global Limited or Dong Ying China, we do obtain benefits in the form of increased sales and earnings, there may be a lag between the time when the expenses associated with an acquisition are incurred and the time when we recognize such benefits. Acquisitions and investment activities also entail numerous risks, including:

|

*

|

difficulties in the assimilation of acquired operations, technologies and/or products;

|

|

*

|

unanticipated costs associated with the acquisition or investment transaction;

|

We may not have adequate internal accounting controls. While we have certain internal procedures in our budgeting, forecasting and in the management and allocation of funds, our internal controls may not be adequate.

We are constantly striving to improve our internal accounting controls. We expect to continue to improve our internal accounting control for budgeting, forecasting, managing and allocating our funds and to better account for them as we grow. There is no guarantee that such improvements will be adequate or successful or that such improvements will be carried out on a timely basis. If we do not have adequate internal accounting controls, we may not be able to appropriately budget, forecast and manage our funds, we may also be unable to prepare accurate accounts on a timely basis to meet our continuing financial reporting obligations and we may not be able to satisfy our obligations under US securities laws.

15

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal control over financial reporting, and attestation of this assessment by our company's independent registered public accountants. The SEC has extended the compliance dates for "non-accelerated filers," as defined by the SEC, for the 2010 fiscal year, and, given the recent passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act, we expect the SEC to permanently exempt smaller reporting companies from the attestation requirement. Notwithstanding the above, this exemption does not affect the requirement that we include a report of management on our internal controls over financial reporting and will not affect the requirement to include the auditor’s attestation if our public float exceeds $75 million and we cease to be a smaller reporting company. Additionally, the standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, testing and possible remediation to meet the detailed standards. Though we have evaluated our internal controls over financial reporting in order to allow management to report on our internal controls over financial reporting, as will be required by Section 404 of the Sarbanes-Oxley Act of 2002 and the rules and regulations of the SEC, our lack of familiarity with Section 404 may unduly divert management's time and resources in executing the business plan. If, in the future, management identifies one or more material weaknesses, or our external auditors are unable to express an opinion on the effectiveness of our internal controls, this could result in a loss of investor confidence in our financial reports, have an adverse effect on our stock price and/or subject us to sanctions or investigation by regulatory authorities. So far, our external auditors have not reported to our board of directors any significant weakness on our internal control and provided recommendations accordingly.

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Our success is, to a certain extent, attributable to the management, sales and marketing, and pharmaceutical factory operational expertise of key personnel. Dr. Lequn Lee Huang, our President and Chief Executive Officer, and Xinjie Mu, our Chief Financial Officer, perform key functions in the operation of our and Dong Ying China’s business. There can be no assurance that Dong Ying China will be able to retain these officers. The loss of these officers could have a material adverse effect upon our business, financial condition, and results of operations. Dong Ying China must attract, recruit and retain a sizeable workforce of technically competent employees. We do not carry key man life insurance for any of our key personnel or personnel nor do we foresee purchasing such insurance to protect against a loss of key personnel and the key personnel.

We are dependent upon the services of Dr. Huang and Mr. Mu, for the continued growth and operation of our company because of their experience in the industry and their personal and business contacts in the PRC. We have no reason to believe that they will discontinue their services with the Company or Dong Ying China, the interruption or loss of their services would adversely affect our ability to effectively run our business and pursue our business strategy as well as our results of operations.

We may not be able to hire and retain qualified personnel to support its growth and if it is unable to retain or hire these personnel in the future, its ability to improve its products and implement its business objectives could be adversely affected.

Competition for senior management and senior personnel in the PRC is intense, the pool of qualified candidates in the PRC is very limited, and we may not be able to retain the services of our senior executives or senior personnel, or attract and retain high-quality senior executives or senior personnel in the future. This failure could materially and adversely affect our future growth and financial condition. We expect to hire additional sales and plant personnel throughout fiscal year 2010 in order to accommodate our growth.

If we fail to increase our brand recognition, we may face difficulty in obtaining new customers and business partners.

We believe that establishing, maintaining and enhancing our brand in a cost-effective manner is critical to achieving widespread acceptance of our current and future products and services and is an important element in our effort to increase our customer base and obtain new business partners. We believe that the importance of brand recognition will increase as competition in our market develops. Some of our potential competitors already have well-established brands in the pharmaceutical promotion and distribution industry. Successful promotion of our brand will depend largely on our ability to maintain a sizeable and active customer base, our marketing efforts and ability to provide reliable and useful products and services at competitive prices. Brand promotion activities may not yield increased revenue, and even if they do, any increased revenue may not offset the expenses we will incur in building our brand. If we fail to successfully promote and maintain our brand, or if we incur substantial expenses in an unsuccessful attempt to promote and maintain our brand, we may fail to attract enough new customers or retain our existing customers to the extent necessary to realize a sufficient return on our brand-building efforts, in which case our business, operating results and financial condition, would be materially adversely affected.

16

Our operating results may fluctuate as a result of factors beyond our control.

Our operating results may fluctuate significantly in the future as a result of a variety of factors, many of which are beyond our control. These factors include:

|

*

|

the costs of pharmaceutical products and development;

|

|

*

|

the relative speed and success with which we can obtain and maintain customers, merchants and vendors for our products;

|

|

*

|

capital expenditure for equipment;

|

|

*

|

marketing and promotional activities and other costs;

|

|

*

|

changes in our pricing policies, suppliers and competitors;

|

|

*

|

the ability of our suppliers to provide products in a timely manner to their customers;

|

|

*

|

changes in operating expenses;

|

|

*

|

increased competition in the pharmaceutical markets; and

|

|

*

|

other general economic and seasonal factors.

|

We face risks related to product liability claims.

We presently do not maintain product liability insurance. We face the risk of loss because of adverse publicity associated with product liability lawsuits, whether or not such claims are valid. We may not be able to avoid such claims. Although product liability lawsuits in the PRC are rare, and we have not, to date, experienced significant failure of our products, there is no guarantee that we will not face such liability in the future. This liability could be substantial and the occurrence of such loss or liability may have a material adverse effect on our business, financial condition and prospects.

We face marketing risks.

Newly developed drugs and technology may not be compatible with market needs. Because markets for drugs differentiate geographically inside the PRC, we must develop and manufacture our products to accurately target specific markets to ensure product sales. If we fail to invest in extensive market research to understand the health needs of consumers in different geographic areas, we may face limited market acceptance of our products, which could have material adverse effect on our sales and earnings.

We face risks relating to difficulty in defending intellectual property rights from infringement.

Our success depends on protection of our current and future technology and products and our ability to defend our intellectual property rights. Dong Ying China has filed for patent protection for various products that it sells, or plans to sell, in the PRC. However, it is possible for its competitors to develop similar competitive products even though it has taken steps to protect its intellectual property. If we fail to protect Dong Ying China’s intellectual property adequately, competitors may manufacture and market products similar to Dong Ying China. We expect to file patent applications seeking to protect newly developed technology and products in various countries, including the PRC. Some patent applications in the PRC are maintained in secrecy until the patent is issued. Because the publication of discoveries tends to follow their actual discovery by many months, we may not be the first to invent, or file patent applications on any of our discoveries. Patents may not be issued with respect to any of our patent applications and existing or future patents issued to or licensed by us may not provide competitive advantages for our products. Patents that are issued may be challenged, invalidated or circumvented by our competitors. Furthermore, our patent rights may not prevent our competitors from developing, using or commercializing products that are similar or functionally equivalent to our products.

We also rely on trade secrets, non-patented proprietary expertise and continuing technological innovation that we shall seek to protect, in part, by entering into confidentiality agreements with licensees, suppliers, employees and consultants. These agreements may be breached and there may not be adequate remedies in the event of a breach. Disputes may arise concerning the ownership of intellectual property or the applicability of confidentiality agreements. Moreover, our trade secrets and proprietary technology may otherwise become known or be independently developed by our competitors. If patents are not issued with respect to products arising from research, we may not be able to maintain the confidentiality of information relating to these products.

17

We face risks relating to third parties that may claim that we infringe on their proprietary rights and may prevent us from manufacturing and selling certain of our products.

There has been substantial litigation in the pharmaceutical industry with respect to the manufacturing, use and sale of new products. These lawsuits relate to the validity and infringement of patents or proprietary rights of third parties. We may be required to commence or defend against charges relating to the infringement of patents or proprietary rights. Any such litigation could:

|

*

|

require us to incur substantial expense, even if covered by insurance or are successful in the litigation;

|

|

*

|

require us to divert significant time and effort of our technical and management personnel;

|

|

*

|

result in the loss of our rights to develop or make certain products; and

|

|

*

|

require us to pay substantial monetary damages or royalties in order to license proprietary rights from third parties.

|

Although intellectual property disputes within the pharmaceutical industry have often been settled through licensing or similar arrangements, costs associated with these arrangements may be substantial and could include the long-term payment of royalties. These arrangements may be investigated by regulatory agencies and, if improper, may be invalidated. Furthermore, the required licenses may not be made available to us on acceptable terms. Accordingly, an adverse determination in a judicial or administrative proceeding or a failure to obtain necessary licenses could prevent us from manufacturing and selling some of our products or increase our costs to market these products.

In addition, when seeking regulatory approval for some of our products, we may be required to certify to regulatory authorities, including the SFDA, that such products do not infringe upon third party patent rights. Filing a certification against a patent gives the patent holder the right to bring a patent infringement lawsuit against us. Any lawsuit would delay the receipt of regulatory approvals. A claim of infringement and the resulting delay could result in substantial expenses and even prevent us from manufacturing and selling certain of our products.

Our launch of a product prior to a final court decision or the expiration of a patent held by a third party may result in substantial damages to us. If we are found to infringe a patent held by a third party and become subject to such damages, these damages could have a material adverse effect on the results of our operations and financial condition.

We face risks related to research and the ability to develop new drugs.

Our growth and survival depends on our ability to consistently discover, develop and commercialize new products and find new and improve on existing technology and platforms. As such, if we fail to make sufficient investments in research, be attentive to consumer needs or does not focus on the most advanced technology, our current and future products could be surpassed by more effective or advanced products of other companies.

|

|

Risks Related To Doing Business in the PRC

|

Changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business.

Our business operations may be adversely affected by the current and future political environment in the PRC. The PRC has operated as a socialist state since the mid-1900s and is controlled by the Communist Party of China. The PRC government exerts substantial influence and control over the manner in which we and it must conduct our business activities. The PRC has only permitted provincial and local economic autonomy and private economic activities since 1978. The PRC government has exercised and continues to exercise substantial control over virtually every sector of the PRC economy, including the paper industry, through regulation and state ownership. Our ability to operate in the PRC may be adversely affected by changes in the PRC laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under current leadership, the PRC government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the PRC government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

The PRC’s economy is in a transition from a planned economy to a market oriented economy subject to five-year and annual plans adopted by the government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While we believe that this trend will continue, there can be no assurance that this will be the case.

18

A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC’s political, economic and social life.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may harm our business.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. The PRC’s legal system is a civil law system based on written statutes, in which system decided legal cases have little value as precedents unlike the common law system prevalent in the United States. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. The PRC government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. Our operating entity, Dong Ying China, conduct operations in China, and as a result, we are required to comply with PRC laws and regulations. We cannot assure you that our current ownership and operating structure would not be found in violation of any current or future PRC laws or regulations. Any of these or similar actions could significantly disrupt our business operations or restrict us from conducting a substantial portion of our business operations, which could materially and adversely affect our business, financial condition and results of operations. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our business. If the relevant authorities find that we are in violation of PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation:

|

*

|

levying fines;

|

|

*

|

revoking Dong Ying China’s business and other licenses;

|

|

*

|

requiring that we restructure our ownership or operations; and

|

|

*

|

requiring that we discontinue any portion or all of our business.

|

Among the material laws that we are subject to are the Price Law of The People’s Republic of China, Measurement Law of The People’s Republic of China, Tax Law, Environmental Protection Law, Contract Law, Patent Law, Accounting Laws, Corporation Laws and Labor Law.

A slowdown, inflation or other adverse developments in the PRC economy may harm our customers and the demand for our services and products.

All of our operations are conducted in the PRC and all of our revenue is generated from sales in the PRC. Although the PRC economy has grown significantly in recent years, we cannot assure you that this growth will continue. A slowdown in overall economic growth, an economic downturn, a recession or other adverse economic developments in the PRC could significantly reduce the demand for our products and harm our business.

While the PRC economy has experienced rapid growth, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth could lead to growth in the money supply and rising inflation. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies, it may harm our profitability. In order to control inflation in the past, the PRC government has imposed controls on bank credit, limits on loans for fixed assets and restrictions on state bank lending. Such an austere policy can lead to a slowing of economic growth. In January 2010, the People’s Bank of China, the PRC’s central bank, raised interest rates for the first time in nearly five months. Repeated rises in interest rates by the central bank would likely slow economic activity in the PRC which could, in turn, materially increase our costs and also reduce demand for our products.

Any recurrence of severe acute respiratory syndrome, or SARS, or another widespread public health problem, could harm our operations.

A renewed outbreak of SARS or another widespread public health problem (such as bird flu) in the PRC, where all of our revenue is derived, could significantly harm our operations. Our operations may be impacted by a number of health-related factors, including quarantines or closures of some of our offices that would adversely disrupt our operations. Any of the foregoing events or other unforeseen consequences of public health problems could significantly harm our operations.

19

Governmental control of currency conversion may affect the value of your investment.