Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PRUDENTIAL FINANCIAL INC | d8k.htm |

2010

TOKYO INVESTOR DAY 2010 TOKYO INVESTOR DAY

PRUDENTIAL FINANCIAL, INC.

PRUDENTIAL FINANCIAL, INC.

SEPTEMBER 15, 2010

SEPTEMBER 15, 2010

Exhibit 99.0 |

Forward-Looking Statements

Forward-Looking Statements

2

2010 Tokyo Investor Day

Certain of the statements included in this presentation constitute forward-looking statements

within the meaning of the U. S. Private Securities Litigation Reform Act of 1995. It is

possible that actual results may differ materially from any expectations or predictions expressed in this

presentation. Words such as “expects,” “believes,” “anticipates,”

“includes,” “plans,” “assumes,” “estimates,” “projects,” “intends,” “should,” “will,”

“shall,” or variations of such words are generally part of forward-looking

statements. Forward-looking statements are made based on management’s current

expectations and beliefs concerning future developments and their potential effects upon Prudential Financial, Inc. and its

subsidiaries. There can be no assurance that future developments affecting Prudential Financial,

Inc. and its subsidiaries will be those anticipated by management. These forward-looking

statements are not a guarantee of future performance and involve risks and uncertainties, and there are

certain important factors that could cause actual results to differ, possibly materially, from

expectations or estimates reflected in such forward- looking statements, including, among

others: (1) general economic, market and political conditions, including the performance and fluctuations of

fixed income, equity, real estate and other financial markets; (2) the availability and cost of

external financing for our operations, which has been affected by the stress experienced by the

global financial markets; (3) interest rate fluctuations; (4) reestimates of our reserves for future policy

benefits and claims; (5) differences between actual experience regarding mortality, morbidity,

persistency, surrender experience, interest rates or market returns and the assumptions we use

in pricing our products, establishing liabilities and reserves or for other purposes; (6) changes in our

assumptions related to deferred policy acquisition costs, valuation of business acquired or goodwill;

(7) changes in our claims-paying or credit ratings; (8) investment losses, defaults and

counterparty non-performance; (9) competition in our product lines and for personnel; (10) changes in

tax law; (11) economic, political, currency and other risks relating to our international operations;

(12) fluctuations in foreign currency exchange rates and foreign securities markets; (13)

regulatory or legislative changes, including the recently enacted Dodd-Frank Wall Street Reform and

Consumer Protection Act; (14) adverse determinations in litigation or regulatory matters and our

exposure to contingent liabilities, including in connection with our divestiture or winding

down of businesses; (15) domestic or international military actions, natural or man-made disasters

including terrorist activities or pandemic disease, or other events resulting in catastrophic loss of

life; (16) ineffectiveness of risk management policies and procedures in identifying,

monitoring and managing risks; (17) effects of acquisitions, divestitures and restructurings, including

possible difficulties in integrating and realizing the projected results of acquisitions; (18) changes

in statutory or U.S. GAAP accounting principles, practices or policies; (19) changes in

assumptions for retirement expense; (20) Prudential Financial, Inc.’s primary reliance, as a holding company,

on dividends or distributions from its subsidiaries to meet debt payment obligations and the ability

of the subsidiaries to pay such dividends or distributions in light of our ratings objectives

and/or applicable regulatory restrictions; and (21) risks due to the lack of legal separation between our

Financial Services Businesses and our Closed Block Business. The foregoing risks are even more

pronounced in severe adverse market and economic conditions such as those that began in the

second half of 2007 and continued into 2009. Prudential Financial, Inc. does not intend, and

is under no obligation, to update any particular forward-looking statement included in this

presentation.

_______________________________________________________________________________

Prudential Financial, Inc. of the United States is not affiliated with Prudential PLC which is

headquartered in the United Kingdom. |

Non–GAAP Measure

Non–GAAP Measure

3

2010 Tokyo Investor Day

This presentation includes references to “adjusted operating income.” Adjusted operating

income is a non-GAAP measure of performance of our Financial Services Businesses.

Adjusted operating income excludes “Realized investment gains (losses), net,” as adjusted, and related charges

and adjustments. A significant element of realized investment gains and losses are impairments and

credit-related and interest rate-related gains and losses. Impairments and losses

from sales of credit-impaired securities, the timing of which depends largely on market credit cycles, can

vary considerably across periods. The timing of other sales that would result in gains or losses, such

as interest rate-related gains or losses, is largely subject to our discretion and

influenced by market opportunities as well as our tax and capital profile. Realized investment gains (losses)

within certain of our businesses for which such gains (losses) are a principal source of earnings, and

those associated with terminating hedges of foreign currency earnings and current period yield

adjustments are included in adjusted operating income. Realized investment gains and losses

from products that are free standing derivatives or contain embedded derivatives, and from associated derivative portfolios that are part

of an economic hedging program related to the risk of those products, are included in adjusted

operating income. Adjusted operating income excludes gains and losses from changes

in value of certain assets and liabilities related to foreign currency exchange movements that have

been economically hedged, as well as gains and losses on certain investments that are classified as

other trading account assets and debt that is carried at fair value. Adjusted operating income

also excludes investment gains and losses on trading account assets supporting insurance

liabilities and changes in experience-rated contractholder liabilities due to asset value changes,

because these recorded changes in asset and liability values are expected to ultimately accrue

to contractholders. Trends in the underlying profitability of our businesses can be more clearly

identified without the fluctuating effects of these transactions. In addition, adjusted operating

income excludes the results of divested businesses, which are not relevant to our ongoing

operations. Discontinued operations, which is presented as a separate component of net income under

GAAP, is also excluded from adjusted operating income. We believe that the presentation of adjusted

operating income as we measure it for management purposes enhances understanding of the results

of operations of the Financial Services Businesses by highlighting the results from ongoing

operations and the underlying profitability of our businesses. However, adjusted operating income is not a substitute for income

determined in accordance with GAAP, and the adjustments made to derive adjusted operating income are

important to an understanding of our overall results of operations.

For additional information about adjusted operating income and the comparable GAAP measure please

refer to our Annual Report on Form 10-K for the year ended December 31, 2009 and our

Quarterly Report on Form 10-Q for the quarter ended June 30, 2010 located on the Investor

Relations

The information referred to above and on the prior page, as well as the risks of our businesses

described in our Annual Report on Form 10-K for the year ended December 31, 2009 and our

Quarterly Report on Form 10-Q for the quarter ended June 30, 2010 should be considered by

readers when reviewing forward-looking statements contained in this presentation.

website

at

www.investor.prudential.com.

Additional

historical

information

relating

to

the

Company’s

financial

performance,

including

its second quarter 2010 Quarterly Financial Supplement, is also located on the

Investor Relations website. |

2010

TOKYO INVESTOR DAY 2010 TOKYO INVESTOR DAY

EDWARD P. BAIRD

EDWARD P. BAIRD

EXECUTIVE VICE PRESIDENT

EXECUTIVE VICE PRESIDENT

CHIEF OPERATING OFFICER, INTERNATIONAL

CHIEF OPERATING OFFICER, INTERNATIONAL

PRUDENTIAL FINANCIAL, INC.

PRUDENTIAL FINANCIAL, INC. |

Life

Insurance Market in Japan Total population of Japan is 127 million

(1)

(#10 in the world)

(2)

Total GDP is $4.9 trillion

(3)

(#2)

(2)

Total life insurance premium is

$367 billion (#2)

(4)

Total life insurance premium is

7.6% of GDP

(4)

90% of households have

life insurance

(5)

5

2010 Tokyo Investor Day

1)

As of July 1, 2010; provisional estimate, Statistics Bureau, Ministry of Internal

Affairs and Communications. (Japanese government) 2)

World Statistics 2010, Statistics Bureau, Ministry of Internal Affairs and

Communications. (Japanese Government) 3)

For the year ended December 31, 2009; nominal gross domestic product, based on

Annual Report on National Accounts, Cabinet Office. (Japanese

government) 4)

Fiscal year, April 1, 2008 –

March 31, 2009; based on Sigma Report No. 3 /2009, World Insurance in 2008, Swiss

Reinsurance Company. 5)

According to the nationwide survey regarding life insurance conducted from April

through May 2009 by Japan Institute of Life Insurance. |

•

Continuing need for insurance protection products

aligned with income replacement requirements

•

$7.7 trillion in low yielding bank deposits and postal

savings

(1)

•

Rapidly aging population

•

Strains on government pension programs lead to

growing individual responsibility for retirement

Japanese Market Offers

Sustainable Growth Potential

6

2010 Tokyo Investor Day

1)

As of March 31, 2010, based on FY2009 Financial Statements of All Banks, Japan

Bankers Association, and Japan Post Bank Annual Report 2010. |

Life

Planners Life Planners

Focus on strategy fundamentals:

Focus on strategy fundamentals:

full-time college educated professionals,

full-time college educated professionals,

highly selective recruiting,

highly selective recruiting,

needs-based selling, emphasis on

needs-based selling, emphasis on

protection products.

protection products.

Life Advisors

Life Advisors

Life Planner concepts adapted to

Life Planner concepts adapted to

broad middle market; key Association

broad middle market; key Association

relationship offers unique access to

relationship offers unique access to

education market.

education market.

Bank Channel

Bank Channel

Growth driven by distribution expertise,

Growth driven by distribution expertise,

emphasis on protection products,

emphasis on protection products,

strong brand and reputation.

strong brand and reputation.

Prudential’s Japanese Insurance Operations

Multiple Distribution Channels in an Attractive Market

7

2010 Tokyo Investor Day |

JAPANESE INSURANCE OPERATIONS

JAPANESE INSURANCE OPERATIONS

KAZUO MAEDA

KAZUO MAEDA

CO-PRESIDENT

CO-PRESIDENT

PRUDENTIAL INTERNATIONAL INSURANCE

PRUDENTIAL INTERNATIONAL INSURANCE |

•

Insurer quality drives market positioning

–

Greater consumer focus on insurer’s financial strength

following market meltdown

–

Retrenchment of weakened competitors

–

Regulators strengthening solvency standards for

insurance companies

•

Growing demand for retirement and savings products

•

Strengthening yen increasing appeal of multi-currency

denominated products

•

Expanding bank distribution of insurance protection products

Japanese Life Insurance

Industry Developments

9

2010 Tokyo Investor Day |

•

Solvency margins exceed “AA”

ratings targets

•

Revised regulatory solvency margin calculations to be implemented

2011-2012 not expected to have significant impact on capital positions relative

to ratings targets

Prudential of Japan

Gibraltar Life

1)

As of June 30, 2010; based on Japanese statutory accounting.

1,339%

1,135%

10

2010 Tokyo Investor Day

Prudential Positioning

Focus on Financial Strength

Focus on Financial Strength

700% solvency

700% solvency

margin

margin

consistent

consistent

with

with

“AA”

ratings

standards

standards

Solvency

Solvency

Margins

Margins

(1)

(1) |

•

Life insurance based retirement income products

combine premature death protection, accumulation and

income features

•

Life Planners’

lifetime relationships with clients support

retirement product sales after death protection needs

are satisfied

•

Gibraltar’s Association relationships provide strong platform

for retirement sales

•

Fixed annuity products attractive to Life Advisor and

Bank Channel clients

Prudential Positioning

11

2010 Tokyo Investor Day

Growing

Growing

Demand

Demand

for

for

Retirement

Retirement

and

and

Savings

Savings

Products

Products |

•

U.S. Dollar denominated whole life and retirement income

products offer enhanced accumulation opportunities

•

U.S. Dollar denominated fixed annuities offer attractive

alternative to consumers wary of market-sensitive products

•

Australian Dollar and Euro denominated products supplement

U.S. Dollar denominated fixed annuities in Gibraltar

Life’s markets

Prudential Positioning

12

2010 Tokyo Investor Day

Strengthening Yen Increasing Appeal of

Strengthening Yen Increasing Appeal of

Multi-Currency Denominated Products

Multi-Currency Denominated Products |

•

Distribution relationships with 27 Japanese banks including

mega-bank, Bank of Tokyo Mitsubishi UFJ; 9 banks selling

insurance protection products

(1)

•

Approximately 170 “seconded”

Life Planners in

Bank Channel

(1)

•

Bank Channel sales of insurance protection products

more than tripled in the first half of 2010, reaching

$105 million in annualized new business premiums

(2)

Prudential Positioning

13

2010 Tokyo Investor Day

1)

As of June 30, 2010.

2)

Foreign denominated activity translated to U.S. dollars at uniform exchange rates for all periods

presented. Japanese yen 99 per U.S. dollar. Expanding Bank Distribution of Insurance Protection Products

Expanding Bank Distribution of Insurance Protection Products

|

Competitive Advantage

Distribution

•

Life Planner profile similar to customer profile

Life Planner profile similar to customer profile

•

•

Life Planner maintains contact with client,

Life Planner maintains contact with client,

as trusted professional

as trusted professional

•

Identify protection needs before

discussing products

•

Protection products purchased as solution to

identified need

•

Variable compensation structure

Variable compensation structure

•

•

Rewards productivity and persistency

Rewards productivity and persistency

Life Planners

Life Planners

•

•

Very selective recruiting

Very selective recruiting

•

•

Highly trained career professional

Highly trained career professional

Needs-Based Selling

Needs-Based Selling

•

•

Financial planning approach

Financial planning approach

•

•

Emphasis on protection

Emphasis on protection

products

products

Compensation structure

Compensation structure

•

•

Aligns customer/agent/

Aligns customer/agent/

company interest

company interest

•

Life Planner system concepts adapted to

Life Planner system concepts adapted to

Life

Advisor

distribution

for

mid-market

and

affinity

affinity

groups

groups

•

•

Distribution expertise driving Bank

Distribution expertise driving Bank

Channel

development

Gibraltar Life

Gibraltar Life

•

•

“Prudentialized”

“Prudentialized”

distribution

distribution

14

2010 Tokyo Investor Day |

Consistent Strategies Drive

Sustainable Financial Performance

•

•

Strong persistency drives revenue growth

Strong persistency drives revenue growth

•

•

Margins

Margins

earned

earned

throughout

throughout

in-force

period

•

•

Business growth increases scale benefits

Business growth increases scale benefits

and expense margins

and expense margins

•

•

Favorable mortality margins drive

Favorable mortality margins drive

strong returns

strong returns

•

•

Retirement products continue protection

Retirement products continue protection

through client life cycles

through client life cycles

•

•

POJ:

POJ:

Full-time

Life

Planners

Planners

serve

serve

mass

mass

affluent and affluent markets

affluent and affluent markets

•

•

Gibraltar

Gibraltar

Life

Life

Advisors

Advisors

serve

serve

mid-market

and affinity groups

and affinity groups

•

•

Gibraltar provides platform for Bank

Gibraltar provides platform for Bank

Channel, emerging distribution opportunities

Channel, emerging distribution opportunities

•

•

Shared management expertise and resources

Shared management expertise and resources

•

•

Cost-effective

common

platform

platform

enhances

enhances

scale benefits

scale benefits

Needs-Based

Needs-Based

Selling

Selling

Pursue Synergies

Pursue Synergies

Across Operations

Across Operations

Emphasis on

Emphasis on

Protection Products

Protection Products

15

2010 Tokyo Investor Day

Maintain Two

Maintain Two

Distinct Brands

Distinct Brands |

Two

Distinct Brands Shared Resources and Synergies

Shared Resources

Shared Resources

Gibraltar Life

Gibraltar Life

Prudential

Prudential

of Japan

of Japan

Systems Integration Initiatives

Systems Integration Initiatives

Developing common platform for:

Developing common platform for:

Insurance administration

Insurance administration

Financial reporting

Financial reporting

Risk management

Risk management

Compliance & Internal controls

Compliance & Internal controls

Human Resources

Human Resources

•

•

Senior management and

Senior management and

marketing officers

marketing officers

•

•

Access to Prudential

Access to Prudential

investment portfolio

investment portfolio

management

management

•

•

Selective transfers of

Selective transfers of

POJ-trained

Life

Planners

to Gibraltar support

to Gibraltar support

expanding distribution

expanding distribution

16

2010 Tokyo Investor Day |

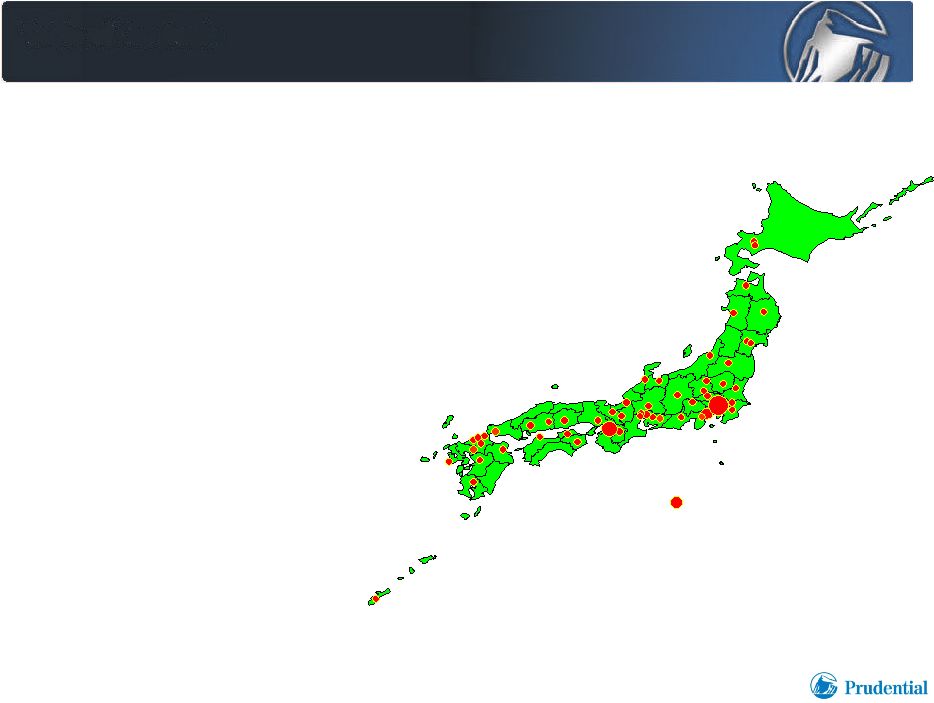

Prudential of Japan

Agency Offices

2010 Tokyo Investor Day

Face

amount

in-force,

$274

billion

(1)

(2)

$31.7

billion

in

assets

(1)

(2)

90

agency

offices

(1)

Ranked #1 in Japan for number of

Million Dollar Round Table

members in each of the

past 13 years

Financial Strength Rating:

Standard

&

Poor’s,

AA-

(3)

1)

As of June 30, 2010.

2)

Translated based on exchange rate of 99 Japanese yen per U.S. dollar.

3)

As of September 1, 2010.

17 |

Business Model

•

Life Planner –

a selective, high quality sales force

–

Hire about 3 out of 100 candidates

–

Well trained and professional

–

Customer focused

–

Disciplined, and demonstrate “missionary zeal”

•

Profile of a typical new POJ Life Planner

–

Age 32

–

College graduate

–

Married with children

–

Good sales experience outside the life insurance industry

–

First job change

–

POJ policyholder

–

Referred by another POJ Life Planner

–

Annual income in the previous job was about $50,000

18

2010 Tokyo Investor Day

Life

Life

Planner

Planner

–

–

Needs-Based

Needs-Based

Selling

Selling |

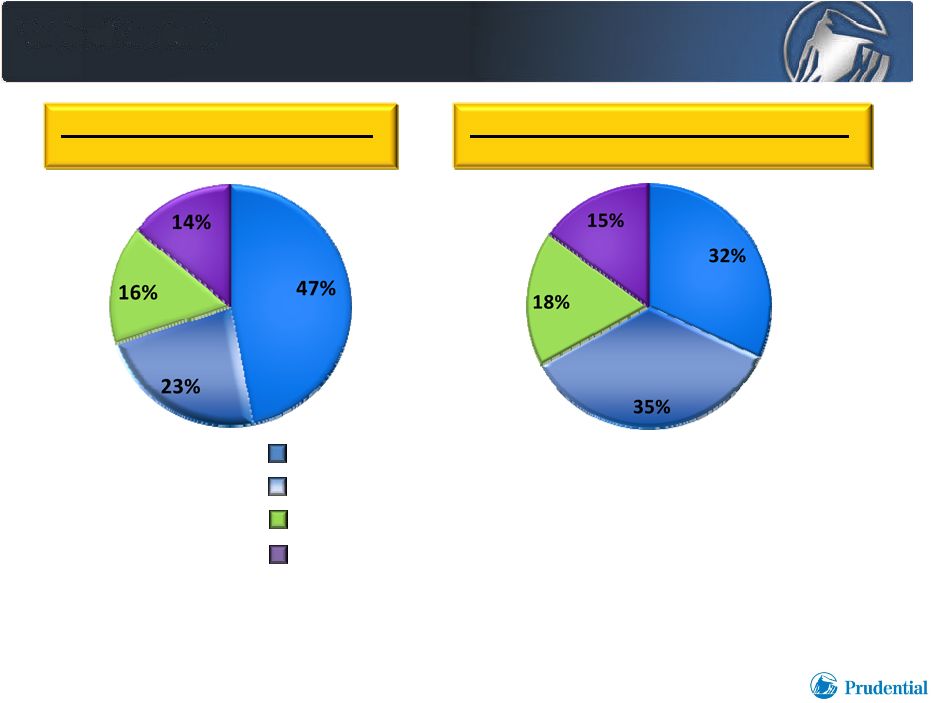

Prudential of Japan

Emphasis on Protection Products

2010 Tokyo Investor Day

1)

Foreign denominated activity translated to U.S. dollars at uniform exchange rates.

Japanese yen 99 per U.S. dollar. 2)

Primarily whole life and term.

3)

Primarily whole life and retirement income.

4)

Includes minor amounts of products based on other currencies.

5)

Cancer, medical, accident and sickness; primarily riders.

19

Yen-based insurance products

(2)

U.S. dollar based insurance products

(3) (4)

Third Sector

(5)

Yen-based savings and retirement income products

In-force Annualized Premiums

(1)

as of June 30, 2010

Annualized New Business Premiums

(1)

Six months ended June 30, 2010 |

Gibraltar Life

Sub-branch

Offices

2010 Tokyo Investor Day

Face

amount

in-force,

$196

billion

(1) (2)

$41.7 billion in assets

(1) (2)

501 sub-branch offices

(1)

Strong affinity group relationships

Growing bancassurance

business

Financial Strength Ratings:

Standard & Poor’s, AA-

(3)

Moody’s,

A2

(3)

1)

As of June 30, 2010.

2)

Translated based on exchange rate of 99 Japanese yen per U.S. dollar.

3)

As of September 1, 2010.

20 |

•

Life Advisors focus on mid-market clientele

•

Life Advisor distribution leverages Life Planner system concepts

to improve key drivers

•

Wider geographical coverage than Prudential of Japan

•

Teachers Association market generates consistent mortality

margins; substantial retirement market opportunity

•

Expanding bank channel fueled by distribution expertise,

emphasis on protection products

Business Model

21

2010 Tokyo Investor Day

Life Advisor

Strong Affinity Group Relationships

Platform for Expanding Distribution |

Life

Advisor Distribution •

Selection criteria designed for sales in affinity group market

•

Candidates often introduced by successful Life Advisors

Selective Recruiting Standards

Selective Recruiting Standards

Training: Adapted From Life Planner System

Training: Adapted From Life Planner System

•

Basic training concepts adapted from Prudential of Japan

•

Specialized training for affinity group marketing and service

Assignment to Affinity Groups

Assignment to Affinity Groups

22

2010 Tokyo Investor Day

•

Affinity group provides access; Life Advisor provides

continuing service and consultation to client |

•

Teachers Association

–

Relationship commenced 1952

–

Approximately 600,000 members

–

Access to approximately 950,000

teachers and 37,000 schools

throughout Japan

•

Other Associations include:

–

Shoko (small business owners)

–

Japanese Social Welfare Foundation

–

Self-Defense Force

•

Commenced bank distribution

in 2005

•

Disciplined development

of bancassurance

•

U.S. Dollar denominated fixed

annuity products provided

foundation for bank relationships

•

27 bank relationships

including mega-bank,

Bank of Tokyo Mitsubishi UFJ

(1)

•

POJ Life Planner expertise

driving expansion of protection

product distribution

23

2010 Tokyo Investor Day

Affinity Group Relationships

Affinity Group Relationships

Bank Channel

Bank Channel

Two Distinct Distribution Opportunities

1)

As of June 30, 2010. |

Gibraltar Life

Emphasis on Protection Products

2010 Tokyo Investor Day

1)

Foreign denominated activity translated to U.S. dollars at uniform exchange rates.

Japanese yen 99 per U.S. dollar. 2)

Includes third sector products.

24

Yen-based insurance products

(2)

U.S. dollar based insurance products

Other than Yen-based fixed annuities

Yen-based savings and retirement income products

In-force Annualized Premiums

(1)

as of June 30, 2010

Annualized New Business Premiums

(1)

Six months ended June 30, 2010 |

Japanese Insurance Operations

Annualized New Business Premiums

(1)

25

2010 Tokyo Investor Day

Gibraltar –

Bank Channel

Gibraltar –

Life Advisors

Prudential of Japan –

Life Planners

(millions)

1)

Foreign denominated activity translated to U.S. dollars at uniform exchange rates for all periods

presented. Japanese yen 99 per U.S. dollar. $0

$200

$400

$600

$800

$1,000

$1,200

2007

2008

2009

YTD

2Q09

2Q10 |

Overall

Position – New

Business

(Face

Amount)

(1)

2010 Tokyo Investor Day

FY 2009 New Business Amount

FY 2009 New Business Amount

Billion

Billion

Yen

Yen

Share

Share

5

Years

Ago

-

FY

2004

Share

Share

1. Dai-ichi

7,643

12.6%

1. Nippon

18.4%

2. Nippon

7,603

12.5%

2. Dai-ichi

14.3%

3. T&D Group

6,330

10.4%

3. Meiji-Yasuda

11.1%

4. Sumitomo

5,618

9.2%

4. Sumitomo

10.8%

5. Prudential

4,917

8.1%

5. T&D Group

7.7%

(POJ)

2,802

(Gibraltar)

2,115

6. Sony

4,057

6.7%

6. AIG Group

5.6%

7. AIG Group

3,665

6.0%

7. Prudential

4.9%

8. Meiji-Yasuda

3,290

5.4%

8. Sony

3.8%

9. Tokio

Marine

3,011

5.0%

9. Fukoku

3.4%

10. Sompo

Japan

2,197

3.6%

10. Mitsui

2.9%

26

1)

Industry data from Life Insurance Association of Japan. Data shown are based on companies’

Japanese statutory results for fiscal years ended March 31, 2010 and March 31, 2005,

respectively. New business amounts are individual life and annuity contracts including net increase by conversion. Excludes

Japan Post Insurance. |

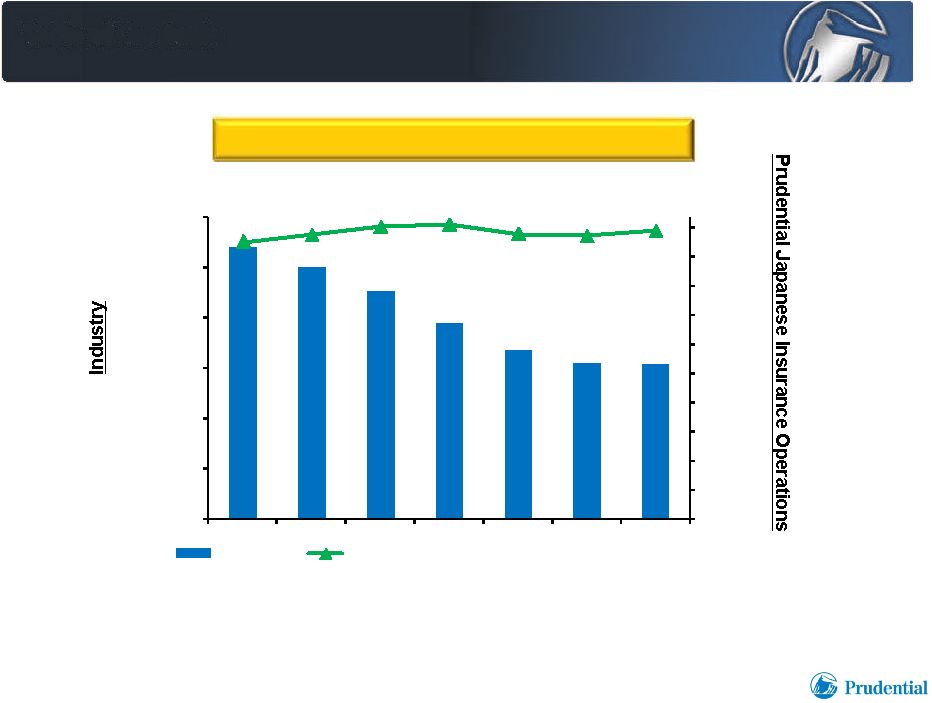

Prudential Japanese Insurance Operations vs.

Japan Life Insurance Industry

27

2010 Tokyo Investor Day

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

$0

$200

$400

$600

$800

$1,000

$1,200

Industry

Prudential Japanese Insurance Operations

2003

2004

2005

2006

2007

2008

2009

(billions)

New Business Face Amount

New Business Face Amount

(1)

(1)

1)

On fiscal year basis; Industry data from Life Insurance Association of Japan. Data shown are based on

companies’ Japanese statutory results translated to U.S. dollars at uniform exchange

rates for all periods presented (Japanese yen 99 per U.S. dollar). |

Japanese Insurance Operations

Driver of Prudential’s International Insurance Financial Performance

1)

Results include corporate management and development expenses incurred in the U.S.

related to Japanese Insurance operations excluding Gibraltar Life. 2)

Based on after-tax adjusted operating income for the year ended December 31,

2009. 28

2010 Tokyo Investor Day

Six months ended

June 30,

(millions)

2008

2009

2009

2010

Pre-tax adjusted operating income

Prudential of Japan

Prudential of Japan

$ 943

$ 943

$ 974

$ 974

$ 494

$ 494

$ 510

$ 510

Gibraltar Life

Gibraltar Life

622

622

622

622

281

281

325

325

Total Japanese Insurance Operations

Total Japanese Insurance Operations

1,565

1,565

1,596

1,596

775

775

835

835

All Other Countries

(1)

182

182

247

247

115

115

108

108

Total Prudential International Insurance

$ 1,747

$ 1,747

$ 1,843

$ 1,843

$ 890

$ 890

$ 943

$ 943

22.8%

ROE

(2) |

PROTECTING FINANCIAL SECURITY OVER A

PROTECTING FINANCIAL SECURITY OVER A

LIFETIME

LIFETIME

JOHN HANRAHAN

JOHN HANRAHAN

PRESIDENT AND CHIEF EXECUTIVE OFFICER

PRESIDENT AND CHIEF EXECUTIVE OFFICER

PRUDENTIAL OF JAPAN

PRUDENTIAL OF JAPAN |

23%

19%

27%

21%

27%

29%

23%

31%

0%

50%

100%

2010

2030

Age 0-24

Age 25-44

Age 45-64

Age 65+

Evolving Protection Needs in

Prudential’s Largest International Market

(1)

Japan

Japan

Population 127 million

Population 127 million

•

Substantial mass affluent/affluent premature death protection market

•

Rapidly growing pre-retirement/retirement market

30

2010 Tokyo Investor Day

1)

Source: United Nations Secretariat estimates, World Population Prospects, the 2008

Revision. |

Needs-Based Selling Over a Lifetime

Client Age

20

30 40 50

60+

Client Focus

Death

Retirement

Protection

Income

Needs

Needs

Prudential

Solutions

Term Insurance

Term Insurance

Whole Life

Whole Life

U.S.

Dollar

Retirement

Income

Fixed

Annuity

Products

•

Lifetime client relationships

•

Needs-based selling through client life cycles

•

Innovative products serve evolving needs

31

2010 Tokyo Investor Day |

Prudential Life Planners

Selected and Trained for Lifetime Protection Focus

32

2010 Tokyo Investor Day

Selection

Selection

•

•

College education

College education

•

•

Successful track record,

Successful track record,

but no prior life insurance

but no prior life insurance

sales experience

sales experience

•

•

Values and beliefs of a

Values and beliefs of a

“trusted advisor”

“trusted advisor”

•

•

Only 3 out of 100 candidates

Only 3 out of 100 candidates

are hired

are hired

Training

Training

•

•

Structured training program

Structured training program

•

•

First month:

First month:

Dedicated to intensive training

Dedicated to intensive training

•

•

Weeks 5-50:

Weeks 5-50:

Basic training program

Basic training program

complemented by

complemented by

on-the-job activity

on-the-job activity

•

•

Weeks 51 and thereafter:

Weeks 51 and thereafter:

Continuing on-the-job training

Continuing on-the-job training |

Primary Market

Primary Market

Typical Client

Typical Client

Profile

Profile

Typical Life Planner

Typical Life Planner

Profile

Profile

Primary Death Protection Market

•

Young professional,

Age 35-45

•

Annual income,

approximately

$60 thousand

•

College graduate,

age similar to clients

•

5 years experience as

Life Planner

•

Established clients serve

as potential referral

sources

Primary Pre-Retirement Market

•

Rising and

seasoned

professionals

•

Building retirement

funds include low-

yielding savings

deposits

•

Achieved professional

designations, recognition

(e.g. MDRT); age similar

to clients

•

Building on relationship

with clients

Life Planner Perspective

Aligned with the Client

33

2010 Tokyo Investor Day |

Financial Security Value Proposition

34

2010 Tokyo Investor Day

Family Financial Security Over a Lifetime

Family Financial Security Over a Lifetime

Prudential

Life

Planner:

Trusted

Advisor

Products

Selected

Based

on

Professional

Evaluation

of

Needs

Promises

Backed

by

a

Strong

Company |

Client

Need Client Need

Product Class

Product Class

Key Features

Key Features

Low cost premature

death protection

Term Insurance

•

Death protection for stated period

with level premiums

•

May add third-sector protection riders

Death protection with

savings feature

Whole Life

•

Death protection

•

Savings fund

•

Guaranteed crediting rate

•

May add third sector protection riders

Retirement

accumulation

and income

Retirement

•

Death protection in working years

•

Retirement accumulation fund

•

Policy paid-up at retirement age

•

Annuitization options

•

May add third-sector protection riders

Product Portfolio Meets Client Needs

Over a Lifetime

35

2010 Tokyo Investor Day |

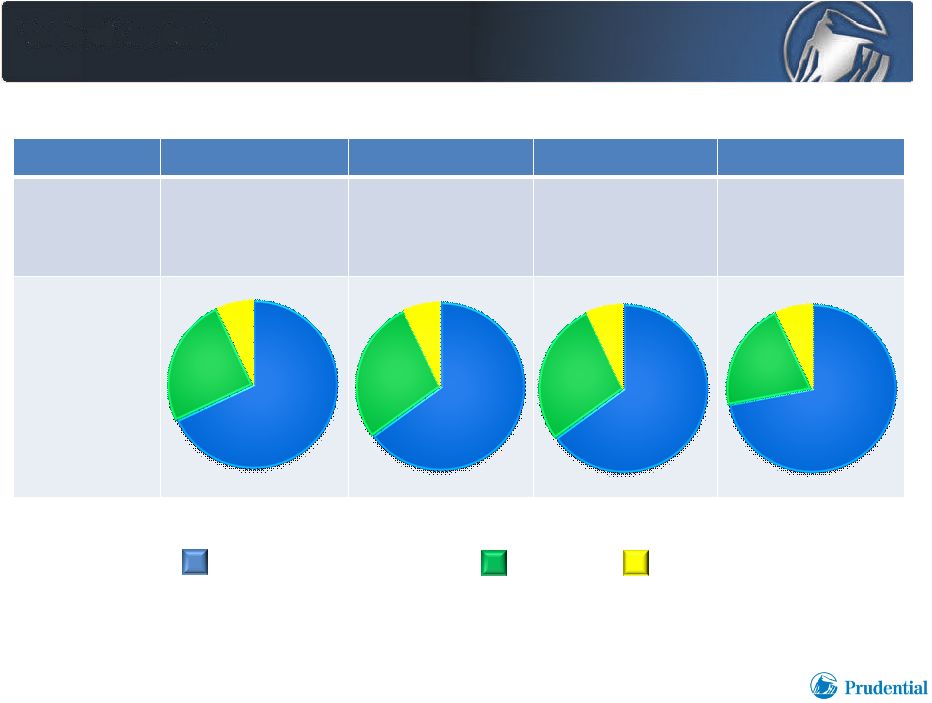

Protecting Financial Security

For a Lifetime

36

2010 Tokyo Investor Day

Client Age

Client Age

25-34

25-34

35-44

35-44

45-54

45-54

55-64

55-64

Annual

Premium

per client

(1)

$3,000

$3,800

$4,900

$5,500

Product

Mix

(1)

1)

Based on annual premium for new Prudential of Japan insureds in 2009 (male, married

insured, individual policies); foreign-denominated activity translated

to U.S. dollars at uniform exchange rate, Japanese yen 99 per U.S. dollar. 68%

25%

7%

65%

28%

7%

65%

28%

7%

72%

21%

7%

Whole Life and Retirement

Term

Medical |

Protection-Focused Product Portfolio

Drives Sustainable Returns

37

2010 Tokyo Investor Day

PRODUCT

PRODUCT

DRIVERS OF RETURNS

DRIVERS OF RETURNS

Term Insurance

•

Serves basic death

protection needs

•

Robust mortality margins on

high average face amounts

•

Potential for add-on and

replacement sales through

client life cycle

Whole Life

Insurance

•

Death protection with

savings elements

•

Robust mortality margins on

protection element

•

Potential for investment spread

earnings over policy term

Retirement Products

•

Savings and

protection for

financial security in

mature phase of

life cycle

•

Robust mortality margins on

protection element during

working years

•

Potential for investment spread

earnings over policy term

•

Potential for extended margins

over annuitization period

•

Expense margins

driven by scale,

back-office

efficiencies

•

Margins earned

over in-force period

extended by

superior

persistency

•

Third-sector

riders enhance

overall margins |

U.S.

Dollar U.S. Dollar

Denominated

Denominated

Whole Life

Whole Life

U.S. Dollar

U.S. Dollar

Denominated

Denominated

Retirement Income

Retirement Income

U.S. Dollar

U.S. Dollar

Denominated

Denominated

Fixed Annuities

Fixed Annuities

Death Protection

Death Protection

Benefits

Benefits

Retirement

Retirement

Accumulation

Accumulation

Retirement

Retirement

Income

Income

Attractive Yields

Attractive Yields

for Japanese

for Japanese

Market

Market

Rates offered reflect yields on U.S. Dollar denominated

investments; compare favorably to Japanese

yen-based products

U.S. Dollar Denominated Products

Attractive Value Proposition for Japanese Clients

38

2010 Tokyo Investor Day |

Lifetime Relationships and Innovative Products

Drive Second-Sale Opportunities

39

2010 Tokyo Investor Day

Annualized New Business Premiums

(millions)

Prudential of Japan

Prudential of Japan

Second Sales to Existing Customers

Second Sales to Existing Customers

(1)(2)

(1)(2)

1)

Foreign denominated activity translated to U.S. dollars at uniform exchange rates for all periods

presented. Japanese yen 99 per U.S. dollar. 2)

Individual market only.

$86

$94

$98

$109

$0

$20

$40

$60

$80

$100

$120

2006

2007

2008

2009 |

Prudential of Japan

Prudential of Japan

Gibraltar Life

Gibraltar Life

Productivity

(2)

6.9

3.8

Policy Persistency

(face amount)

13-month

25-month

94.5%

88.6%

92.2%

83.8%

Distribution

Representative Retention

12-month

24-month

81.8%

64.4%

64.1%

30.6%

Average size policy

(3)

$274

$196

Superior Performance Measures

Driven by Needs-Based Protection Focus

(1)

40

2010 Tokyo Investor Day

1)

Measured as of or for the twelve months ended June 30, 2010.

2)

Policies sold by sales representative per month; includes medical and cancer

policies. 3)

Face amount, in thousands. |

Protecting Financial Security Over a Lifetime

Drives Our Beneficial Cycle

41

2010 Tokyo Investor Day

Satisfy

Satisfy

Customers

Customers

Needs

Needs

High

High

Customer

Customer

Satisfaction

Satisfaction

Proven Execution Track Record

Proven Execution Track Record

Life-Long Customer Relationships

Life-Long Customer Relationships |

THE

POWER OF ASSOCIATIONS THE POWER OF ASSOCIATIONS

DISTRIBUTION ADVANTAGE BASED ON

DISTRIBUTION ADVANTAGE BASED ON

RELATIONSHIPS

RELATIONSHIPS

MITSUO KURASHIGE

MITSUO KURASHIGE

PRESIDENT AND CHIEF EXECUTIVE OFFICER

PRESIDENT AND CHIEF EXECUTIVE OFFICER

GIBRALTAR LIFE

GIBRALTAR LIFE |

Association Relationships

Key Contributor to Gibraltar Business

Associations

Other Life Advisor Business

Banks

1)

Foreign denominated activity translated to U.S. dollars at uniform exchange rates.

Japanese yen 99 per U.S. dollar. 43

2010 Tokyo Investor Day

In-Force Annualized Premiums

as of June 30, 2010

(1)

Annualized New Business Premiums

Six months ended June 30, 2010

(1) |

Teachers Association

Core Relationship for More Than Half a Century

•

Relationship since 1952

•

Approximately 600,000 members

(1)

•

Access to approximately 950,000

teachers and school personnel

through 47 prefectural (local)

associations and 37,000 schools

(1)

Member eligibility:

School teachers and personnel

Supervised by:

Ministry of Education, Culture,

Sports, Science and Technology

Japanese Educational Mutual Aid

Japanese Educational Mutual Aid

Association of Welfare Foundation

Association of Welfare Foundation

(Teachers Association)

(Teachers Association)

44

2010 Tokyo Investor Day

1)

As of June 30, 2010. |

Working

Together to Support The Educational Community

Teachers Association

Teachers Association

Mainly support for Teachers

Mainly support for Teachers

•

•

Scholarships

Scholarships

Interest-free college tuition loans

for teachers’

children

•

•

Research Grants

Research Grants

Support research achievements

Support research achievements

of teachers and schools

of teachers and schools

•

•

Educational & Cultural

Educational & Cultural

Promote lectures and other

Promote lectures and other

educational activities including

educational activities including

international exchanges

international exchanges

•

•

Welfare

Welfare

Support general welfare of teaching

Support general welfare of teaching

community through financial

community through financial

assistance and subsidies

assistance and subsidies

Mainly support for Students

Mainly support for Students

•

•

Overseas Education

Overseas Education

•

•

Cultivation of skills

Cultivation of skills

and interests

and interests

•

•

Volunteer programs

Volunteer programs

•

•

Athletic programs

Athletic programs

45

2010 Tokyo Investor Day |

Prudential’s

Spirit of Community •AFS

Program -

American Field Service

International Exchange program

•

Volunteer Award for teenagers

•International Math Olympiad

•

Coaching

by

professional

basketball

players

of

“bj

league”

to elementary school students

(bj

league: Japan professional basketball league)

•

Dodge-ball tournament for

elementary and junior high school students

Gibraltar Life

Enriching the Japanese Student Experience

46

2010 Tokyo Investor Day

“Let’s Play Basketball”

“Dome Dodge in Nagoya” |

Teachers Market

Size

Size

(1)

(1)

# of public school teachers

# of public school teachers

950,000

950,000

# of annual retirees/new hires

# of annual retirees/new hires

20,000

20,000

30,000/yr

30,000/yr

Average annual salary

Average annual salary

7.5 million yen

7.5 million yen

($85 thousand)

($85 thousand)

Typical retirement allowance

Typical retirement allowance

25-30 million yen

25-30 million yen

($285 –

($285 –

$340 thousand)

$340 thousand)

Characteristics

Characteristics

High social status

High social status

(Local dignitaries)

(Local dignitaries)

Comfortable, steady income

Comfortable, steady income

Well-managed healthcare

Well-managed healthcare

Limited expertise for

Limited expertise for

financial security

financial security

Teachers desire Life Advisor

Teachers desire Life Advisor

product explanation

product explanation

and advice

and advice

47

2010 Tokyo Investor Day

1)

All numbers approximated; U.S. dollar equivalents based on exchange rate as of June

30, 2010 (88 Japanese yen per U.S. dollar). |

Distribution Advantage

Drives High Quality Business

Favorable mortality

Favorable mortality

experience driven by superior

experience driven by superior

underwriting characteristics

underwriting characteristics

•

•

Educational employees a naturally

Educational employees a naturally

“select”

group

•

•

Annual health examinations,

Annual health examinations,

medical screenings required for

medical screenings required for

school personnel

school personnel

Strong persistency driven

Strong persistency driven

by link to employment

by link to employment

•

•

School personnel are government

School personnel are government

employees with reliable

employees with reliable

steady income

steady income

•

•

Monthly premiums through payroll

Monthly premiums through payroll

deduction or similar arrangements

deduction or similar arrangements

Customer loyalty reinforced

Customer loyalty reinforced

by co-branding

by co-branding

•

•

Teachers Association branding

Teachers Association branding

respected among

respected among

education community

education community

•

•

Gibraltar Life products include

Gibraltar Life products include

Association in product name

Association in product name

48

2010 Tokyo Investor Day |

Association Sales

Proven Approach in an Attractive Market

•

Association relationship provides Gibraltar Life Advisors with access

to school sites and teachers’

offices

•

One-on-one sales on site by Gibraltar Life Advisors

•

Specialized training program for Life Advisors working in

education market

•

Co-promotion by Association employees and Life Advisors

•

Marketing approaches adapted to characteristics of 47 local

prefecture Association membership bases

•

Specialized products tailored to Association membership status;

favorable underwriting and persistency support competitive pricing

49

2010 Tokyo Investor Day |

Approximately

Public schools nationwide

Specially Trained Life Advisors

Cover Nationwide Public School Network

(1)

50

2010 Tokyo Investor Day

Approximately

Life Advisors

1)

Data as of June 30, 2010. |

Participation

(1)

Association members

Association members

480,000

480,000

(50%)

(50%)

Active Teachers

Active Teachers

950,000

950,000

Policyholders

Policyholders

(Active)

(Active)

450,000

450,000

(47%)

(47%)

1)

Numbers represent headcount and are approximate as of June 30, 2010.

51

2010 Tokyo Investor Day

Retired Teachers

Retired Teachers

Retired Teachers

Policyholders

Policyholders

100,000

100,000 |

Perennial Sales Opportunities

1)

Numbers approximate as of June 30, 2010.

52

2010 Tokyo Investor Day

120,000

120,000

Retired

Retired

Teachers

Teachers

Association

Association

members

members

(1)

(1)

950,000

950,000

Active

Active

Teachers

Teachers

(1)

(1)

Active

Market

Retirement

Market

20,000

20,000

–

–

30,000 new

30,000 new

teachers

teachers

hired

hired

each year

each year

20,000

20,000

–

–

30,000

30,000

teachers

teachers

retire

retire

each year

each year |

Specialized Products

Tailored to Education Market

Active Market

Active Market

•

•

Primary Products:

Primary Products:

–

–

Teachers Term

Teachers Term

–

–

Teachers Medical

Teachers Medical

–

–

Teachers Whole Life

Teachers Whole Life

–

–

Teachers Nursing Care

Teachers Nursing Care

•

•

Supplemented by other

Supplemented by other

individual products

individual products

Retirement Market

Retirement Market

•

•

Single premium whole life

Single premium whole life

•

•

Endowment

Endowment

•

•

U.S. dollar and alternative currency

U.S. dollar and alternative currency

denominated annuities

denominated annuities

•

Competitive pricing enhances attractiveness of education

market products

•

Annual survey identifies market needs for product development

53

2010 Tokyo Investor Day |

Teachers Term Product

Affordable Basic Protection with Broad Appeal

•

Favorable actuarial experience of group enables

attractive premium rates

•

Access to Teachers Term product perceived as key

benefit of Association membership; many teachers

join Association and purchase product simultaneously

•

Second sale opportunity: 50%-60% of Association

clients purchase multiple Gibraltar Life products

54

2010 Tokyo Investor Day |

Japanese Teachers Association

Retirement Market Opportunity

•

Teachers receive lump sum payment at retirement,

average about $300,000

•

Trusted brand and attractive single premium retirement

oriented products form solid value proposition

at retirement

•

Products compare favorably to low-rate bank deposits

55

2010 Tokyo Investor Day |

2009

(Single

pay)

Foreign

Foreign

currency

currency

fixed

fixed

annuity

annuity

/

/

Whole

Whole

life

life

/

/

Endowment

Endowment

(Recurring

Pay)

Whole

Whole

life

life

/

/

Term

Term

/

/

US$

US$

Retirement

Retirement

income

income

/

/

Endowment

Endowment

/

/

Medical/Nursing

Medical/Nursing

care

care

Specially trained Life Advisors / Seminars / Exclusive Website

Specially trained Life Advisors / Seminars / Exclusive Website

Teachers Association Market Key Driver of

Teachers Association Market Key Driver of

Gibraltar’s Retirement Sales

Gibraltar’s Retirement Sales

2007

2008

(millions)

(millions)

$145

$145

$172

$172

$175

$175

88

88

87

87

87

87

87

87

85

85

58

58

Single Pay

Single Pay

Recurring

Pay

Recurring

Pay

Special Approach

Special Approach

Products

Products

Communication

Communication

56

2010 Tokyo Investor Day

Total Gibraltar Life

Annualized

New

Business

Premiums

(1)

10,000

20,000

30,000

40,000

Age

30

40

50

60

65

Number of Public School Teachers

Active

Active

Retired

1)

Represents total Gibraltar Life sales to “Retirement Red Zone” clients (age 50-65);

foreign-denominated activity translated to U.S. dollars at uniform exchange rate for all

periods presented, Japanese yen 99 per U.S. dollar. |

Annualized New Business Premiums

Year ended December 31, 2009

(1)

In-Force Annualized Premiums

as of June 30, 2010

(1)

Retirement Products Complement

Protection-Focused Business

1)

Teachers Association business; foreign denominated activity translated to U.S.

dollars at uniform exchange rates, Japanese yen 99 per U.S. dollar. 2)

Primarily Teachers Term; includes third sector products (e.g., medical, nursing

care). 3)

Includes products based on other currencies.

4)

Primarily fixed annuities and endowment contracts.

57

2010 Tokyo Investor Day

Yen-based

insurance

products

(2)

U.S.

dollar

based

insurance

products

(3)

Savings

products

(4)

$1.5 billion

$145 million |

Gibraltar

Life

–

Japanese

Teachers

Association

A Sustainable Partnership

•

Exclusive partnership in serving educators, for more than

55 years

•

Attractive products encourage Association membership

•

Joint ownership of Association’s membership management

system, which processes recurring premium data

•

Favorable pricing reflects “collective term”

business in force;

insurance contract terms preclude transfer of existing policies

to other carriers without Gibraltar’s approval

58

2010 Tokyo Investor Day |

BANK

CHANNEL DISTRIBUTION BANK CHANNEL DISTRIBUTION

A PLATFORM FOR GROWTH

A PLATFORM FOR GROWTH

TAKESHI TANIGAWA

TAKESHI TANIGAWA

EVP, GIBRALTAR LIFE / CEO, PRUDENTIAL GIBRALTAR FINANCIAL LIFE

EVP, GIBRALTAR LIFE / CEO, PRUDENTIAL GIBRALTAR FINANCIAL LIFE

|

Competitive Advantages Support

a Strong Bancassurance Model

•

Fixed annuity products attractive to bank clientele, form basis

for initial distribution relationships

•

Competitive protection product portfolio meets life insurance

needs of bank customer base

•

Prudential/Gibraltar brands appeal to security-focused

customers; especially attractive to “large ticket”

clients

•

Prudential-trained former Life Planners bring expertise in

protection product sales and support

60

2010 Tokyo Investor Day |

Expanding Bank Channel Distribution

Introduced U.S. dollar denominated fixed annuity product for Bank Channel

distribution Commenced distribution relationship with Japanese mega-bank,

Bank of Tokyo Mitsubishi UFJ

Assigned

Assigned

experienced

experienced

Life

Life

Planners

Planners

to

to

Gibraltar

Gibraltar

Life

Life

for

for

Bank

Bank

Channel

Channel

development

development

Introduced life insurance

Introduced life insurance

protection products

protection products

In 2010,

In 2010,

distribution

distribution

agreements grow to

agreements grow to

include 27 banks and

include 27 banks and

6 affiliated agencies

6 affiliated agencies

(1)

(1)

2005

2006

2007

2008

2009

1)

As of June 30, 2010.

2010

61

2010 Tokyo Investor Day |

Nearly

3,000 Potential Points of Sale 62

2010 Tokyo Investor Day

Bank of Tokyo Mitsubishi

UFJ (Mega-bank)

Over $1 trillion deposits

(1)(2)

772 branches

(1)

Mitsubishi UFJ Trust and

Banking (Trust-bank)

Over $143 billion deposits

(1)(2)

66 branches

(1)

Fukuoka Bank

(Regional

bank) Over

$79 billion deposits (1)(2)

167 branches

(1)

Shinsei

Bank

(Other-bank)

Over $70 billion deposits

(1)(2)

42 branches

(1)

Hiroshima Bank

(Regional bank)

Over $61 billion deposits

(1)(2)

167 branches

(1)

Total

of

27

Bank Relationships

(3)

Over

$2.4 trillion

deposits

(1)(2)

Gibraltar products

sold at 1,773

(3)

of nearly 3,000

branches in total

(1)

1)

As of March 31, 2010 based on bank fiscal year end disclosures.

2)

U.S. dollar equivalents based on exchange rate as of June 30, 2010 (88 Japanese yen

per U.S. dollar). 3)

As of or through June 30, 2010. |

Bancassurance

Powered by Prudential

63

2010 Tokyo Investor Day

Prudential

Prudential

Support

Support

•

•

Insurance education and training

Insurance education and training

backed by proven distribution model

backed by proven distribution model

•

•

Competitive products focused

Competitive products focused

on protection

on protection

•

•

Highly regarded brand, promises

Highly regarded brand, promises

backed by a strong company

backed by a strong company

•

•

Access to expertise of “seconded”

Access to expertise of “seconded”

former Prudential of Japan

former Prudential of Japan

Life Planners

Life Planners

(1)

(1)

1)

At certain banks.

Bank Employee

Bank Employee

Life Insurance Sales

Life Insurance Sales |

On-Site Access to

Attractive Bank Customer Base

64

2010 Tokyo Investor Day

Prudential

Prudential

Support

Support

•

•

Bank customers traditionally not

Bank customers traditionally not

served by trained life insurance

served by trained life insurance

professional at bank branch

professional at bank branch

•

•

Growing market for protection

Growing market for protection

products at banks following

products at banks following

regulation changes

regulation changes

•

•

Prudential-trained bank employees

Prudential-trained bank employees

refer clients to “seconded”

refer clients to “seconded”

former Prudential

former Prudential

of Japan

of Japan

Life Planners

Life Planners

Prudential-Trained On-Site

Prudential-Trained On-Site

Representative Sales

Representative Sales |

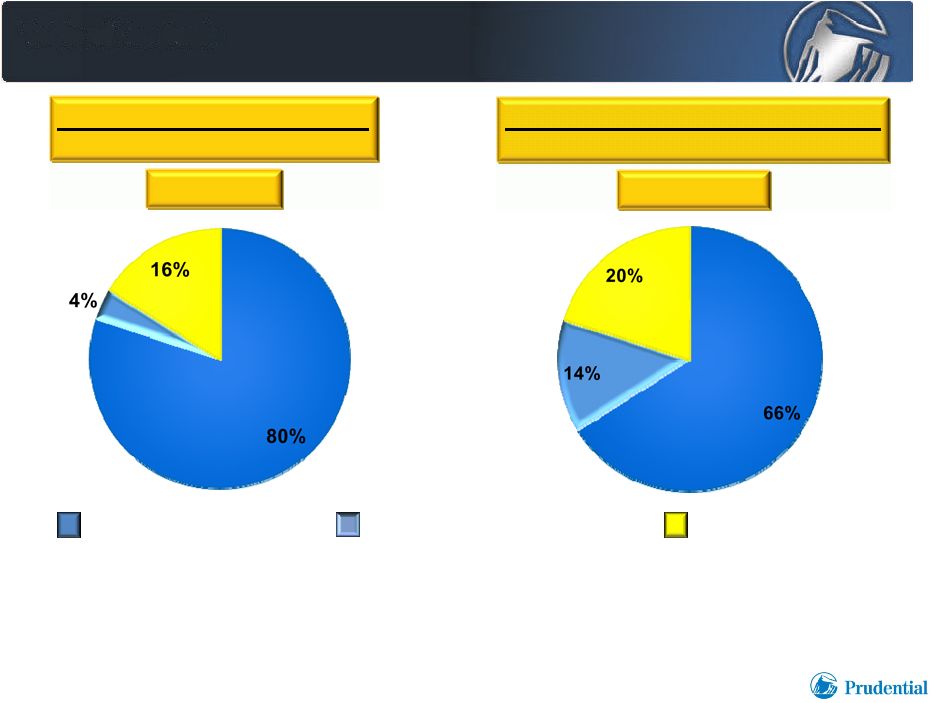

84%

16%

A Successful Partnership

65

2010 Tokyo Investor Day

Bank Channel

Bank Channel

Annualized New Business Premiums

Annualized New Business Premiums

$131 million

$131 million

(1)

(1)

1)

For the six months ended June 30, 2010; foreign denominated activity translated to

U.S. dollars at uniform exchange rates, Japanese yen 99 per U.S. dollar.

Sales by other

bank employees

Sales by former

Prudential of

Japan Life

Planners

“seconded”

to

bank channel |

Bank

Channel Emphasis on Protection Products

66

2010 Tokyo Investor Day

Bank Channel

Bank Channel

Annualized New Business Premiums

Annualized New Business Premiums

$131 million

$131 million

(1)

(1)

1)

For the six months ended June 30, 2010; foreign denominated activity translated to

U.S. dollars at uniform exchange rates, Japanese yen 99 per U.S. dollar. 80%

20%

Life Insurance

protection

products

Other products

(primarily U.S.

dollar fixed

annuities) |

$0

$20

$40

$60

$80

$100

$120

$140

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

2Q09

2Q10

Life Insurance protection products

Other products (primarily fixed annuities)

Bank Channel Growth

67

2010 Tokyo Investor Day

1)

Foreign denominated activity translated to U.S. dollar at uniform exchange rates

for all periods presented. Japanese yen 99 per U.S. dollar. Annualized New

Business Premiums Annualized New Business Premiums

(1)

(1)

$21

$25

$39

$47

$55

$76

$46

$131

YTD

(millions)

(millions) |

Bank

Channel Prospects for Continued Growth

•

Growing bank focus on protection life insurance sales following

recent regulation changes

•

Continued Prudential training of bank employees promotes

product awareness and sales skills; expanding count of employees

qualified to sell life insurance

•

Expanding coverage of bank branches within existing

relationship networks; potential to develop new relationships

•

Large expected volume of maturing bank-sold fixed and variable

annuities provides opportunities to review client’s product portfolio

•

Opportunity to expand life insurance protection market coverage

through regional banks

68

2010 Tokyo Investor Day |