Attached files

| file | filename |

|---|---|

| EX-5.1 - MAM SOFTWARE GROUP, INC. | v196543_ex5-1.htm |

| EX-23.1 - MAM SOFTWARE GROUP, INC. | v196543_ex23-1.htm |

As filed with the Securities and

Exchange Commission on September 14, 2010

Registration No.

333-167483

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C.

20549

AMENDMENT NO.

3

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

MAM SOFTWARE GROUP,

INC.

(Exact name of Registrant as specified

in its charter)

|

Delaware

|

6770

|

84-1108035

|

||

|

(State or other

jurisdiction

of

incorporation)

|

(Primary Standard

Industrial

Classification Code

Number)

|

(I.R.S.

Employer

Identification

No.)

|

Maple

Park, Maple Court,

Tankersley,

Barnsley, UK S75 3DP

011-44-124-431-1794

(Address, including zip code, and

telephone number, including area code,

of Registrant’s principal executive

offices)

Incorporating Services,

Ltd.

3500 South DuPont

Highway

Dover, Delaware

19901

(302) 531 0855

(Name, address, including zip code, and

telephone number,

including area code, of agent for

service)

Copies of all correspondence

to:

Gersten Savage LLP

David E. Danovitch,

Esq.

Kristin J. Angelino,

Esq.

600 Lexington Avenue

New York, NY

10022-6018

Tel: (212) 752-9700 Fax: (212)

980-5192

Approximate date of commencement of

proposed sale to the public: As soon as practicable after the effective date of

this registration statement.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis

pursuant to Rule 415 under the Securities Act of 1933, please check the

following box: þ

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. o

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. o

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. o

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated

filer or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large accelerated

filer

¨

|

Accelerated filer

¨

|

|

Non-accelerated filer

¨ (Do not check if

smaller reporting company)

|

Smaller reporting

company þ

|

|

CALCULATION OF REGISTRATION FEE

|

||||||||||||||||

|

Title of Each Class of

Securities to be Registered (1)

|

Amount to be

Registered

|

Proposed

Maximum

Offering Price

per

Share

|

Proposed

Maximum

Aggregate

Offering

Price

|

Amount of

Registration

Fee

|

||||||||||||

|

Common Stock, par value

$0.0001 per share

|

51,516,111 | $ | 0.065 | $ | 3,348,547 | (2) | $ | 238.75 | (3) | |||||||

|

(1)

|

This registration statement

relates to shares of our common stock, par value $0.0001 per share, deliverable upon the exercise of

the subscription rights.

|

|

(2)

|

Represents the gross proceeds from

the sale of shares of our common stock assuming the exercise of all

non-transferable subscription rights

to be distributed and additional over-subscriptions up to the maximum

amount contemplated in this registration

statement.

|

|

(3)

|

Note that $236.93 has already been

paid.

|

The Registrant hereby amends this

Registration Statement on such date or dates as may be necessary to delay its

effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, as

amended, or until the Registration Statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may

determine.

|

The information in this prospectus

is not complete and may be amended. These securities may not be sold until

the Registration Statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these

securities and it is not soliciting an offer to buy these securities in

any state where the offer or sale is not

permitted.

|

SUBJECT TO COMPLETION DATED SEPTEMBER

14, 2010

PRELIMINARY

PROSPECTUS

MAM SOFTWARE GROUP,

INC.

Up to

51,516,111 Shares of Common Stock Issuable Upon

Exercise of Rights to Subscribe for Such Shares at $0.065 per

Share

We are distributing, at no charge, to

holders of our common stock non-transferable subscription rights to purchase up

to 51,516,111 shares

of our common stock. We

refer to this offering as the “rights offering.” In this rights offering, you

will receive one subscription right for every one share of common stock owned at

5:00 p.m., New York time, on September 7, 2010, the record date.

Each whole subscription right will

entitle you to purchase 0.6 shares of our common stock at a

subscription price of $0.065 per share, which we refer to as the

“basic subscription privilege.” The per share subscription price was determined

by a committee of our board of directors after a review of recent historical

trading prices of our common stock. We will not issue fractional shares of

common stock in the rights offering, and holders will only be entitled to

purchase a whole number of shares of common stock, rounded down to the nearest

whole number a holder would otherwise be entitled to

purchase.

If you fully exercise your basic

subscription privilege and other stockholders do not fully exercise their basic

subscription privileges, you may also exercise an over-subscription privilege to

purchase a portion of the unsubscribed shares at the same subscription price of

$0.065 per share, subject to certain

limitations. To the extent you properly exercise

your over-subscription privilege for an amount of shares that exceeds the number

of the unsubscribed shares available to you, any excess subscription payment

received by the subscription agent will be returned promptly, without interest

or penalty. If all of the rights are exercised, the total purchase price of the

shares offered in the rights offering would be $3,348,547. The net proceeds

to the Company, after deducting offering expenses of $50,000, would be

$3,298,547.

We are not entering into any standby

purchase agreement or similar agreement with respect to the purchase of any

shares of our common stock not subscribed for through the basic subscription

privilege or the over-subscription privilege. Therefore, there is no certainty

that any shares will be purchased pursuant to the rights offering and there is

no minimum purchase requirement as a condition to accepting

subscriptions.

The subscription rights will expire void

and worthless if they are not exercised by 5:00 p.m., New York time, on

October 15,

2010 unless we extend

the rights offering period. However, our board of

directors reserves the right to cancel the rights offering at any time, for any

reason. If the rights offering is cancelled, all subscription

payments received by the subscription agent will be returned

promptly.

Shares of our common stock are, and we

expect that the shares of common stock to be issued in the rights offering will

be, quoted on the OTC Bulletin Board under the symbol

“MAMS.OB”. On August 31, 2010, the bid and ask prices of our

Common Stock were $0.07 and $0.09 per share, respectively, as reported by

the OTC Bulletin Board. We urge you to obtain a current market price for the

shares of our common stock before making any determination with respect to the

exercise of your rights.

This is not an underwritten offering.

The shares of common stock are being offered directly by us without the services

of an underwriter or selling agent.

Exercising the rights and investing in

our common stock involves a high degree of risk. We urge you to read

carefully this prospectus, and the “Risk Factors” section beginning on page 10

of this prospectus, the section entitled “Risk Factors” in our Annual Report on

Form 10-K for the fiscal year ended June 30, 2009, and all other information

included or incorporated herein by reference in this prospectus in its entirety

before you decide whether to exercise your rights.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of

these securities or passed upon the adequacy or accuracy of this prospectus. Any

representation to the contrary is a criminal offense.

The date of this prospectus is

_________, 2010

TABLE OF CONTENTS

The following table of contents has been

designed to help you find information contained in this prospectus. We encourage

you to read the entire prospectus.

|

Page

|

|

|

QUESTIONS AND ANSWERS RELATED TO

THE RIGHTS OFFERING

|

1

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

|

4

|

|

PROSPECTUS SUMMARY

|

4

|

|

RISK

FACTORS

|

10

|

|

USE OF

PROCEEDS

|

17

|

|

DETERMINATION OF OFFERING

PRICE

|

17

|

|

DILUTION

|

17

|

|

CAPITALIZATION

|

18

|

|

THE RIGHTS

OFFERING

|

19

|

|

MATERIAL U.S. FEDERAL INCOME

TAX CONSEQUENCES

|

25

|

|

PLAN OF

DISTRIBUTION

|

27

|

|

DESCRIPTION OF

SECURITIES TO BE

REGISTERED

|

28

|

|

EXPERTS

|

28

|

|

LEGAL

REPRESENTATION

|

28

|

|

DESCRIPTION OF

BUSINESS

|

29

|

|

DESCRIPTION OF

PROPERTY

|

37

|

|

LEGAL

PROCEEDINGS

|

38

|

|

MARKET PRICE OF AND DIVIDENDS ON

COMMON EQUITY AND

RELATED STOCKHOLDER MATTERS

|

39

|

|

MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATION

|

41

|

|

CHANGES AND DISAGREEMENTS WITH

ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES

|

61

|

|

DIRECTORS, EXECUTIVE OFFICERS,

PROMOTERS AND CONTROL PERSONS

|

62

|

|

EXECUTIVE

COMPENSATION

|

64

|

|

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

|

73

|

|

CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS AND DIRECTOR INDEPENDENCE

|

76

|

|

DISCLOSURE OF COMMISSION POSITION

ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

79

|

|

WHERE YOU CAN GET MORE

INFORMATION

|

79

|

|

FINANCIAL

STATEMENTS

|

80

|

i

QUESTIONS AND ANSWERS RELATED TO THE

RIGHTS OFFERING

Q:

What is a rights offering?

A: A

rights offering is a distribution of subscription rights on a pro rata basis to all

stockholders of a company. We are distributing to holders of our common stock as

of 5:00 p.m., New York time, on September 7, 2010 the “record date,”

at no charge, non-transferable subscription rights to purchase shares of our

common stock. You will receive one subscription right for every share of our

common stock you owned as of 5:00 p.m., New York time, on the record date.

The subscription rights will be evidenced by rights certificates.

Q:

Why are we engaging in a rights offering and how will we use the proceeds from

the rights offering?

A: The

purpose of this rights offering is to raise equity capital in a cost-effective

manner that allows all shareholders to participate. The net proceeds will be

used to repay the ComVest loans and for working capital needs.

Q:

Am I required to subscribe in the rights offering?

A:

No.

Q:

What is the basic subscription right?

A: Each

subscription right evidences a right to purchase 0.6 share of our common stock

at a subscription price of $0.065 per share and carries with it a basic

subscription right and an over-subscription right.

Q:

What is the oversubscription right?

A: We do

not expect all of our shareholders to exercise all of their basic subscription

rights. The oversubscription right provides shareholders that exercise all of

their basic subscription rights the opportunity to purchase the shares that are

not purchased by other shareholders. If you fully exercise your basic

subscription right, the oversubscription right of each right entitles you to

subscribe for additional shares of our common stock unclaimed by other holders

of rights in this offering at the same subscription price per share. If an

insufficient number of shares are available to fully satisfy all

oversubscription right requests, the available shares will be distributed

proportionately among rights holders who exercise their oversubscription right

based on the number of shares each rights holder subscribed for under the basic

subscription right. The subscription agent will return any excess payments by

mail without interest or deduction promptly after the expiration of the

subscription period.

Q:

How was the $0.065 per share subscription price established?

A: A

Special Committee of our board of directors determined that the subscription

price should be designed to, among other things, provide an incentive to our

current shareholders to exercise their rights. Other factors considered in

setting the subscription price included the amount of proceeds desired, our need

for equity capital, alternatives available to us for raising equity capital, the

historic and current market price and liquidity of our common stock, the pricing

of similar transactions, the historic volatility of the market price of our

common stock, the historic trading volume of our common stock, our business

prospects, our recent and anticipated operating results and general conditions

in the securities market. The subscription price does not necessarily bear any

relationship to the book value of our assets, net worth, past operations, cash

flows, losses, financial condition, or any other established criteria for

valuing the Company. You should not consider the subscription price as an

indication of the value of the Company or our common stock.

Q:

Who will receive subscription rights?

A:

Holders of our common stock will receive one non-transferable subscription right

for each share of common stock owned as of September 7, 2010, the record

date.

Q:

How many shares may I purchase if I exercise my subscription

rights?

A: You

will receive one non-transferable subscription right for each share of our

common stock that you owned on September 7, 2010, the record date. Each

subscription right evidences a right to purchase 0.6 share of our common stock

at a subscription price of $0.065 per share. You may exercise any number of your

subscription rights.

Q:

What happens if I choose not to exercise my subscription rights?

A: If you

choose not to exercise your subscription rights you will retain your current

number of shares of common stock of the Company. However, the percentage of the

common stock of the Company that you own will decrease and your voting rights

and other rights will be diluted if and to the extent that other shareholders

exercise their subscription rights. Your subscription rights will expire and

have no value if they are not exercised prior to 5:00 p.m., New York City time,

on October 15, 2010, subject to extension, the expiration date.

Q:

Does the Company need to achieve a certain participation level in order to

complete the rights offering?

A: No. We

may choose to consummate the rights offering regardless of the number of shares

actually purchased.

1

Q:

Can the board of directors cancel,

terminate, amend, or extend the rights offering?

A: Yes. We have the option to extend the

rights offering and the period for exercising your subscription rights, although

we do not presently intend to do so. Our board of directors may cancel the

rights offering at any time for any reason. If the rights offering is cancelled,

all subscription payments received by the subscription agent will be returned

promptly, without interest or penalty. Our board of directors reserves the right

to amend or modify the terms of the rights offering at any time, for any

reason. See

“The Rights Offering—Expiration of the Rights Offering and Extensions,

Amendments and Termination.”

Q:

May I transfer my subscription rights if I do not want to purchase any

shares?

A: No.

Should you choose not to exercise your rights, you may not sell, give away or

otherwise transfer your rights. However, rights will be transferable to

affiliates of the recipient and by operation of law, for example, upon the death

of the recipient.

Q:

When will the rights offering expire?

A: The

subscription rights will expire and will have no value, if not exercised prior

thereto, at 5:00 p.m., New York City time, on October 15, 2010, unless we decide

to extend the rights offering expiration date until some later time. See “The

Rights Offering—Expiration of the Rights Offering and Extensions, Amendments and

Termination.” The subscription agent must actually receive all required

documents and payments before the expiration date.

Q:

How do I exercise my subscription rights?

A: You

may exercise your subscription rights by properly completing and executing your

rights certificate and delivering it, together in full with the subscription

price for each share of common stock you subscribe for, to the subscription

agent on or prior to the expiration date. If you use the mail, we recommend that

you use insured, registered mail, return receipt requested. If you cannot

deliver your rights certificate to the subscription agent on time, you may

follow the guaranteed delivery procedures described under “The Rights

Offering—Guaranteed Delivery Procedures” beginning on page 22. If you hold

shares of our common stock through a broker, custodian bank or other nominee,

see “The Rights Offering—Beneficial Owners” beginning on page 23.

Q:

What should I do if I want to participate in the rights offering but my shares

are held in the name of my broker, custodian bank or other nominee?

A: If you

hold our common stock through a broker, custodian bank or other nominee, we will

ask your broker, custodian bank or other nominee to notify you of the rights

offering. If you wish to exercise your rights, you will need to have your

broker, custodian bank or other nominee act for you. To indicate your decision,

you should complete and return to your broker, custodian bank or other nominee

the form entitled “Beneficial Owner Election Form.” You should receive this form

from your broker, custodian bank or other nominee with the other rights offering

materials. You should contact your broker, custodian bank or other nominee if

you believe you are entitled to participate in the rights offering but you have

not received this form.

Q:

What should I do if I want to participate in the rights offering, but I am a

shareholder with a foreign address or a shareholder with an APO or FPO

address?

A: The

subscription agent will not mail rights certificates to you if you are a

shareholder whose address is outside the United States or if you have an Army

Post Office or a Fleet Post Office address. To exercise your rights, you must

notify the subscription agent prior to 11:00 a.m., New York City time, at least

three business days prior to the expiration date, and establish to the

satisfaction of the subscription agent that it is permitted to exercise your

subscription rights under applicable law. If you do not follow these procedures

by such time, your rights will expire and will have no value.

Q:

Will I be charged a sales commission or a fee if I exercise my subscription

rights?

A: We

will not charge a brokerage commission or a fee to rights holders for exercising

their subscription rights. However, if you exercise your subscription rights

through a broker, dealer or nominee, you will be responsible for any fees

charged by your broker, dealer or nominee.

Q:

Are there any conditions to my right to exercise my subscription

rights?

A: Yes.

The rights offering is subject to certain limited conditions. Please see “The

Rights Offering—Conditions to the Rights Offering.”

Q:

Has the board of directors made a recommendation regarding the rights

offering?

A:

Neither we, nor our board of directors is making any recommendation as to

whether or not you should exercise your subscription rights. You are urged to

make your decision based on your own assessment of our business and the rights

offering, after considering all of the information herein, including the “Risk

Factors” section of this document.

Q:

May shareholders in all states participate in the rights offering?

A:

Although we intend to distribute the rights to all shareholders, we reserve the

right in some states to require shareholders, if they wish to participate, to

state and agree upon exercise of their respective rights that they are acquiring

the shares for investment purposes only, and that they have no present intention

to resell or transfer any shares acquired. Our securities are not being offered

in any jurisdiction where the offer is not permitted under applicable local

laws.

2

Q:

Have any shareholders indicated they will exercise their rights?

A: Yes.

Wynnefield Persons (as defined below) has indicated to the Company that it

intends to exercise all of its basic subscription rights, but has not made any

formal commitment to do so. Wynnefield Persons also has indicated its intention

to over-subscribe for the maximum amount of shares it can over-subscribe

for. Depending on the level of participation in the rights offering,

the exercise by the Wynnefield Persons of its basic subscription rights and

oversubscription rights may result in the Wynnefield Persons being able to

exercise substantial control over matters requiring shareholder approval upon

completion of the offering. You should not view the intentions of the Wynnefield

Persons as a recommendation or other indication by them that the exercise of the

subscription rights is in your best interests. Please see the “Risk

Factors” section of this prospectus for more information.

Q:

Is exercising my subscription rights risky?

A: The

exercise of your subscription rights involves significant risks. Exercising your

rights means buying additional shares of our common stock and should be

considered as carefully as you would consider any other equity investment. Among

other things, you should carefully consider the risks described under the “Risk

Factors” section of this prospectus for more information.

Q:

How many shares will be outstanding after the rights offering?

A: The

number of shares of common stock that will be outstanding after the rights

offering will depend on the number of shares that are purchased in the rights

offering. If we sell all of the shares being offered, then we will issue

approximately 51,516,111 shares of common stock. In that case, we will have

approximately 137,376,296 shares of common stock outstanding after the

rights offering. This would represent an increase of approximately 60% in the

number of outstanding shares of common stock. However, we do not expect that all

of the subscription rights will be exercised.

Q:

What will be the proceeds of the rights offering?

A: If we

sell all the shares being offered, we will receive gross proceeds of

approximately $3.348 million. We are offering shares in the rights offering with

no minimum purchase requirement. As a result, there is no assurance we will be

able to sell all or any of the shares being offered, and it is not likely that

all of our shareholders will participate in the rights offering. We reserve the

right to limit the exercise of rights by certain shareholders in order to

protect against an unexpected “ownership change” for federal income tax

purposes. This may affect our ability to receive gross proceeds of up to $3.348

million in the rights offering.

Q:

After I exercise my rights, can I change my mind and cancel my

purchase?

A: No.

Once you exercise and send in your subscription rights certificate and payment

you cannot revoke the exercise of your subscription rights, even if you later

learn information about the Company that you consider to be unfavorable and even

if the market price of our common stock falls below the $0.065 per share

subscription price. You should not exercise your subscription rights unless you

are certain that you wish to purchase additional shares of our common stock at a

price of $0.065 per share. See “The Rights Offering—No Revocation or

Change.”

Q:

What are the material United States Federal income tax consequences of

exercising my subscription rights?

A: A

holder should not recognize income or loss for United States Federal income tax

purposes in connection with the receipt or exercise of subscription rights in

the rights offering. For a detailed discussion, see the “Material United States

Federal Income Tax Consequences” section of the prospectus. You should consult

your tax advisor as to the particular consequences to you of the rights

offering.

Q:

If I exercise my subscription rights, when will I receive shares of common stock

I purchased in the rights offering?

A: We

will deliver certificates representing the shares of our common stock purchased

in the rights offering as soon as practicable after the expiration of the rights

offering and after all pro rata allocations and adjustments have been completed.

We will not be able to calculate the number of shares to be issued to each

exercising holder until 5:00 p.m., New York City time, on the third business day

after the expiration date of the rights offering, which is the latest time by

which subscription rights certificates may be delivered to the subscription

agent under the guaranteed delivery procedures described under “The Rights

Offering—Guaranteed Delivery Procedures” section of the prospectus.

Q:

To whom should I send my forms and payment?

A: If

your shares are held in the name of a broker, dealer or other nominee, then you

should send your subscription documents, rights certificate and payment to that

record holder. If you are the record holder, then you should send your

subscription documents, rights certificate and payment by hand delivery, first

class mail or courier service to Corporate Stock Transfer, the subscription

agent. The address for delivery to the subscription agent is as

follows:

If delivering by

Hand/Mail/Overnight Courier:

Corporate

Stock Transfer

3200

Cherry Creek Dr. South Suite 430

Denver,

Colorado 80209

(303) 282-4800

3

Your

delivery other than in the manner or to the address listed above will not

constitute valid delivery.

Q:

What if I have other questions?

A: If you

have other questions about the rights offering, please contact our information

agent, Corporate Stock Transfer, by telephone at

(303) 282-4800.

FOR

A MORE COMPLETE DESCRIPTION OF THE RIGHTS OFFERING, SEE “THE RIGHTS OFFERING”

BEGINNING ON PAGE 19.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking

statements and information relating to our business that are based on our

beliefs as well as assumptions made by us or based upon information currently

available to us. These statements reflect our current views and assumptions with

respect to future events and are subject to risks and

uncertainties. No forward-looking statement can be guaranteed, and

actual results may vary materially from those anticipated in any forward-looking

statement. Forward-looking statements are often identified by words like:

“believe,” “expect,” “estimate,” “anticipate,” “intend,” “project” and similar

expressions or words which, by their nature, refer to future events. In some

cases, you can also identify forward-looking statements by terminology such as

“may,” “will,” “should,” “plans,” “predicts,” “potential” or “continue” or the

negative of these terms or other comparable terminology. These statements are

only predictions and involve known and unknown risks, uncertainties and other

factors, including the risks in the section entitled Risk Factors beginning on

page [10], that may cause our or our industry’s actual results, levels of

activity, performance or achievements to be materially different from any future

results, levels of activity, performance or achievements expressed or implied by

these forward-looking statements. In addition, you are directed to factors

discussed in the Management’s Discussion and Analysis of Financial Condition and

Results of Operation section beginning on page 41, and the section entitled

Description of Business beginning on page 29, and as well as those discussed

elsewhere in this prospectus.

The aforementioned factors do not

represent an all-inclusive list. Actual results, performance or achievements

could differ materially from those contemplated, expressed or implied by the

forward-looking statements contained in this prospectus. In particular, this

prospectus sets forth important factors that could cause actual results to

differ materially from our forward-looking statements. These and other factors,

including general economic factors, business strategies, the state of capital

markets, regulatory conditions, and other factors not currently known to us, may

be significant, now or in the future, and the factors set forth in this

prospectus may affect us to a greater extent than indicated. All forward-looking

statements attributable to us or persons acting on our behalf are expressly

qualified in their entirety by the cautionary statements set forth in this

prospectus and in other documents that we may file from time to time with the

Securities and Exchange Commission including Quarterly Reports on Form 10-Q,

Annual Reports on Form 10-K and Current Reports on Form 8-K.

These forward-looking statements speak

only as of the date of this prospectus. Although we believe that the

expectations reflected in the forward-looking statements are reasonable, we

cannot guarantee future results, levels of activity, or achievements. Except as

required by applicable law, including the securities laws of the United States,

we expressly disclaim any obligation or undertaking to disseminate any update or

revisions of any of the forward-looking statements to reflect any change in our

expectations with regard thereto or to conform these statements to actual

results.

PROSPECTUS SUMMARY

You should read the following summary

together with the more detailed information elsewhere in this Prospectus,

including our consolidated financial statements and the notes to those

consolidated financial statements and the section titled Risks Factors,

regarding us and the Common Stock being offered for sale by means of this

Prospectus.

Unless the context indicates or requires

otherwise, (i) the term “MAM” refers to MAM Software Group, Inc. and its

principal operating subsidiaries; (ii) the term “MAM Software” refers to MAM

Software Limited and its operating subsidiaries; (iii) the term “ASNA” refers to

Aftersoft Network N.A., Inc. and its operating subsidiaries;(iv) the term “EXP

Dealer Software” refers to EXP Dealer Software Limited and its operating

subsidiaries; and (v) the terms “we,” “our,” “ours,” “us” and the “Company”

refer collectively to MAM Software Group, Inc.

4

CORPORATE BACKGROUND

The Company’s principal executive office

is located at Maple Park, Maple Court, Tankersley, Barnsley, UK S75

3DP and its phone number is

011-44-124-431-1794.

In December 2005, W3 Group, Inc. (“W3”)

consummated a reverse acquisition and changed its corporate name to Aftersoft

Group, Inc. W3, which was initially incorporated in February 1988 in Colorado,

changed its state of incorporation to Delaware in May 2003. On December 21,

2005, an Acquisition Agreement (the “Agreement”) was consummated among W3, a

separate Delaware corporation named Aftersoft Group, Inc. (“Oldco”) and Auto

Data Network, Inc. (“ADNW”) in which W3 acquired all of the issued and

outstanding shares of Oldco in exchange for issuing 32,500,000 shares of Common

Stock of W3, par value $0.0001 per share, to ADNW, which was then the sole

shareholder of the Company. At the time of the acquisition, W3 had no business

operations. Concurrent with the acquisition, W3 changed its name to Aftersoft

Group, Inc. and its corporate officers were replaced. The Board of Directors of

the Company appointed three additional directors designated by ADNW to serve

until the next annual election of directors. As a result of the acquisition,

former W3 shareholders owned 1,601,167, or 4.7% of the 34,101,167 total issued

and outstanding shares of Common Stock and ADNW owned 32,500,000 or 95.3% of the

Company’s Common Stock. On December 22, 2005, Oldco changed its name to

Aftersoft Software, Inc. and is currently inactive.

On August 26, 2006, the Company acquired

100% of the issued and outstanding shares of EXP from ADNW in exchange for

issuing 28,000,000 shares of Common Stock to ADNW with a market value of

$30,800,000. On February 1, 2007, the Company consummated an agreement to

acquire Dealer Software and Services Limited (“DSS”), a subsidiary of ADNW, in

exchange for issuing 16,750,000 shares of Common Stock to ADNW with a market

value of $15,075,000.

During 2007, the Company conducted a

strategic assessment of its businesses and determined that neither EXP nor DSS

fit within its long-term business model. The Company identified a buyer for the

two businesses in First London PLC (formerly, First London Securities PLC)

(“First London”). First London is a UK-based holding company for a group of

businesses engaged in asset management, investment banking, and merchant

banking. First London’s shares are traded on the London Plus market. First

London’s areas of specialization include technology, healthcare, and resources,

and its merchant banking operations take strategic, principal positions in

businesses that fall within its areas of specialization.

On June 17, 2007, DSS sold all of the

shares of Consolidated Software Capital Limited (“CSC”), its wholly owned

subsidiary, to RLI Limited, a company affiliated with First London (“RLI”). The

consideration for this sale consisted of a note from RLI with a face value of

$865,000. On November 12, 2007, as part of the sale of EXP (see below), the

$865,000 note was exchanged for 578,672 shares of First London common stock

having a fair value of $682,000. The transaction resulted in a loss of $183,000

to the Company.

The Company sold its interest in EXP and

DSS, EXP’s wholly owned subsidiary, on November 12, 2007. Pursuant to the terms

of a Share Sale Agreement (the “EXP Agreement”), EU Web Services Limited (“EU

Web Services”) a subsidiary of First London, agreed to acquire, and the Company

agreed to sell, the entire issued share capital of EXP it then owned, which

amounted to 100% of EXP’s outstanding stock.

As consideration for the sale of EXP,

including DSS, EU Web Services agreed to issue to the Company, within 28 days of

the closing, 1,980,198 Ordinary shares (the UK equivalent of common stock),

£0.01 par value, in its parent company, First London. The Ordinary shares

received by the Company had an agreed upon fair market value of $3,000,000 at

the date of issuance of such shares. The Company recorded the shares received at

$2,334,000, which represents the bid price of the restricted securities

received, and discounted the carrying value by 11% (or $280,000) as, pursuant to

the EXP Agreement, the shares could not be sold by the Company for at least 12

months. Further, the EXP Agreement provided that the Company receive on May 12,

2008 additional consideration in the form of: (i) Ordinary shares in EU Web

Services having a fair market value of $2,000,000 as of the date of issuance,

provided that EU Web Services is listed and becomes quoted on a recognized

trading market within six (6) months from the date of the Agreement; or (ii) if

EU Web Services does not become listed within the time period specified,

Ordinary shares in First London having a fair market value of $2,000,000 as of

May 12, 2008. As EU Web Services did not become listed within the six-month

timeframe, the Company received on August 14, 2008 1,874,414 shares in First

London, which had a fair market value of $2,000,000 on May 12,

2008.

On April 21, 2010, the Company’s

stockholders approved the proposal to amend the Company’s Certificate of

Incorporation to change the Company’s name from Aftersoft Group, Inc. to MAM

Software Group, Inc. (“MAM”)

5

MAM is a former subsidiary of ADNW, a

publicly traded company, the stock of which is currently traded on the Pink

Sheets under the symbol ADNW.PK. ADNW transferred its software aftermarket

services operating businesses to MAM and retained its database technology,

Orbit. Orbit is a system for supply and collection of data throughout the

automotive industry. To date, Orbit is still in its development phase, and ADNW

will require substantial external funding to bring the technology to its first

phase of testing and deployment. On November 24, 2008, ADNW distributed a

dividend of the 71,250,000 shares of MAM common stock that ADNW owned at such

time in order to complete the previously announced spin-off of MAM’s businesses.

The dividend shares were distributed in the form of a pro rata dividend to the

holders of record as of November 17, 2008 (the “Record Date”) of ADNW’s common

and convertible preferred stock. Each holder of record of shares of ADNW common

and preferred stock as of the close of business on the Record Date was entitled

to receive 0.6864782 shares of MAM’s common stock for each share of common stock

of ADNW held at such time, and/or for each share of ADNW common stock that such

holder would own, assuming the convertible preferred stock owned on the Record

Date was converted in full. Prior to the spin-off, ADNW owned

approximately 77% of MAM’s issued and outstanding common stock. Subsequent to

and as a result of the spin-off, MAM is no longer a subsidiary of

ADNW.

DESCRIPTION OF THE COMPANY AND

BUSINESS

MAM Software Group, Inc. provides

software, information and related services to businesses engaged in the

automotive aftermarket in the US, UK and Canada and to the automotive dealership

market in the UK. The automotive aftermarket consists of businesses associated

with the life cycle of a motor vehicle from when the original manufacturer’s

warranty expires to when the vehicle is scrapped. Products sold by businesses

engaged in this market include the parts, tires and auto services required to

maintain and improve the performance or appeal of a vehicle throughout its

useful life. The Company aims to meet the business needs of customers who are

involved in the maintenance and repair of automobiles and light trucks in three

key segments of the automotive aftermarket, namely parts, tires and auto

service.

The Company’s business management

systems, information products and online services permit our customers to manage

their critical day-to-day business operations through automated point-of-sale,

inventory management, purchasing, general accounting and customer relationship

management.

The Company’s customer base consists of

wholesale parts and tire distributors, retailers, franchisees, cooperatives,

auto service chains and single location auto service businesses with high

customer service expectations and complex commercial

relationships.

The Company’s revenues are derived from

the following:

|

|

·

|

The sale of business management

systems comprised of proprietary software applications, implementation and

training; and

|

|

|

·

|

Providing subscription-based

services, including software support and maintenance, information

(content) products and online services for a

fee.

|

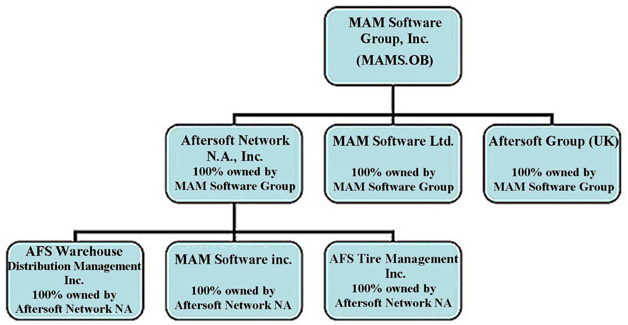

The Company currently has the following

wholly owned direct operating subsidiaries: MAM Software in the UK, and ASNA in

the US.

MAM Software Ltd.

MAM Software is a provider of software

to the automotive aftermarket in the UK. MAM Software specializes in providing

reliable and competitive business management solutions to the motor factoring

(also known as jobber), retailing, and wholesale distribution sectors. It also

develops applications for vehicle repair management and provides solutions to

the retail and wholesale tire industry. All MAM Software programs are based on

the Microsoft Windows family of operating systems. Each program is fully

compatible with the other applications in their range, enabling them to be

combined to create a fully integrated package. MAM Software is based in

Barnsley, UK.

Aftersoft Network N.A., Inc.

(ASNA)

ASNA develops open business automation

and distribution channel e-commerce systems for the automotive aftermarket

supply chain. These systems are used by leading aftermarket outlets, including

tier one manufacturers, program groups, warehouse distributors, tire and service

chains and independent installers. ASNA products and services enable companies

to generate new sales, operate more cost efficiently, accelerate inventory turns

and maintain stronger relationships with suppliers and customers. ASNA has three

wholly owned subsidiaries operating separate businesses: (i) AFS Warehouse

Distribution Management, Inc. and (ii) AFS Tire Management, Inc. which are both

based in Dana Point, California, and (iii) MAM Software, Inc., which is based in

Allentown, Pennsylvania.

6

Summary of the

Offering

The following summary describes the

principal terms of the rights offering, but is not intended to be complete. See

the information in the section entitled “The Rights Offering” in this prospectus

for a more detailed description of the terms and conditions of the rights

offering.

|

Rights

Granted

|

|

We

will distribute to each stockholder of record on September 7, 2010, at no

charge, one non-transferable subscription right for each share of our

common stock then owned. The rights will be evidenced by rights

certificates. If and to the extent that our stockholders exercise their

right to purchase our common stock we will issue up to 51,516,111

shares and receive gross proceeds of up to $3.348 million in cash in the

rights offering.

|

|

Subscription

Rights

|

|

Each

subscription right will entitle the holder to purchase 0.6 shares of our

common stock for $0.065 per share, the subscription price, which shall be

paid in cash. We will not issue fractional shares, but rather will round

down the aggregate number of shares you are entitled to receive to the

nearest whole number.

|

|

Subscription

Price

|

|

$0.065

per share, which shall be paid in cash.

|

|

Record

Date

|

|

September

7, 2010

|

|

Expiration

Date

|

|

5:00

p.m., New York City time, on October 15, 2010, subject to extension or

earlier termination

|

|

Oversubscription

Rights

|

|

We

do not expect that all of our stockholders will exercise all of their

basic subscription rights. If you fully exercise your basic subscription

right, the oversubscription right entitles you to subscribe for additional

shares of our common stock unclaimed by other holders of rights in this

offering at the same subscription price per share. If an insufficient

number of shares is available to fully satisfy all oversubscription right

requests, the available shares will be distributed proportionately among

rights holders who exercise their oversubscription right based on the

number of shares each rights holder subscribed for under the basic

subscription right. The subscription agent will return any excess payments

by mail without interest or deduction promptly after the expiration of the

subscription period.

|

|

Non-Transferability of Rights

|

|

The

subscription rights are not transferable, other than to affiliates of the

recipient or by operation of law.

|

|

Amendment,

Extension and Termination

|

|

We

may extend the expiration date at any time after the record date. We may

amend or modify the terms of the rights offering. We also reserve the

right to terminate the rights offering at any time prior to the expiration

date for any reason, in which event all funds received in connection with

the rights offering will be returned without interest or deduction to

those persons who exercised their subscription rights.

|

|

Fractional

Shares

|

|

We

will not issue fractional shares, but rather will round down the aggregate

number of shares you are entitled to receive to the nearest whole

number.

|

|

Procedure

for Exercising Rights

|

|

You

may exercise your subscription rights by properly completing and executing

your rights certificate and delivering it, together with the subscription

price for each share of common stock for which you subscribe, to the

subscription agent on or prior to the expiration date. If you use the

mail, we recommend that you use insured, registered mail, return receipt

requested. If you cannot deliver your rights certificate to the

subscription agent on time, you may follow the guaranteed delivery

procedures described under “The Rights Offering — Guaranteed Delivery

Procedures” beginning on page 22.

|

|

No

Revocation

|

|

Once

you submit the form of rights certificate to exercise any subscription

rights, you may not revoke or change your exercise or request a refund of

monies paid. All exercises of rights are irrevocable, even if you

subsequently learn information about us that you consider to be

unfavorable.

|

|

Payment

Adjustments

|

|

If

you send a payment that is insufficient to purchase the number of shares

requested, or if the number of shares requested is not specified in the

rights certificate, the payment received will be applied to exercise your

subscription rights to the extent of the payment. If the payment exceeds

the amount necessary for the full exercise of your subscription rights,

including any oversubscription rights exercised and permitted, the excess

will be returned to you as soon as practicable in cash. You will not

receive interest or a deduction on any payments refunded to you under the

rights offering.

|

7

|

How

Rights Holders Can Exercise Rights Through Others

|

|

If

you hold our common stock through a broker, custodian bank or other

nominee, we will ask your broker, custodian bank or other nominee to

notify you of the rights offering. If you wish to exercise your rights,

you will need to have your broker, custodian bank or other nominee act for

you. To indicate your decision, you should complete and return to your

broker, custodian bank or other nominee the form entitled “Beneficial

Owners Election Form.” You should receive this form from your broker,

custodian bank or other nominee with the other rights offering materials.

You should contact your broker, custodian bank or other nominee if you

believe you are entitled to participate in the rights offering but you

have not received this form.

|

|

How

Foreign Stockholders and Other Stockholders Can Exercise

Rights

|

|

The

subscription agent will not mail rights certificates to you if you are a

stockholder whose address is outside the United States or if you have an

Army Post Office or a Fleet Post Office address. Instead, we will have the

subscription agent hold the subscription rights certificates for your

account. To exercise your rights, you must notify the subscription agent

prior to 11:00 a.m., New York City time, at least three business days

prior to the expiration date, and establish to the satisfaction of the

subscription agent that it is permitted to exercise your subscription

rights under applicable law. If you do not follow these procedures by such

time, your rights will expire and will have no value.

|

|

Material

United States Federal Income Tax Consequences

|

|

A

holder will not recognize income or loss for United States Federal income

tax purposes in connection with the receipt or exercise of subscription

rights in the rights offering. For a detailed discussion, see “Material

United States Federal Income Tax Consequences” beginning on page 25. You

should consult your tax advisor as to the particular consequences to you

of the rights offering.

|

|

Issuance

of Our Common Stock

|

|

We

will issue certificates representing shares purchased in the rights

offering as soon as practicable after the expiration of the rights

offering.

|

|

Conditions

|

|

See

“The Rights Offering—Conditions to the Rights

Offering.”

|

|

No

Recommendation to Rights Holders

|

|

An

investment in shares of our common stock must be made according to your

evaluation of our business and the rights offering and after considering

all of the information herein, including the “Risk Factors” section of

this prospectus. Neither we nor our Board of Directors are making any

recommendation regarding whether you should exercise your subscription

rights.

|

|

Use

of Proceeds

|

|

The

proceeds from the rights offering will be used for (i) repayment of the term loan

with the Company’s senior secured lender, ComVest Capital LLC (“ComVest’);

and (ii) working capital needs. In the event that we do not

obtain all or a portion of the maximum proceeds from this rights offering,

we will need to obtain additional financing.

|

|

Subscription

Agent

|

|

Corporate

Stock Transfer

|

|

Information

Agent

|

|

Corporate

Stock Transfer

|

Summary Financial

Data

The summary consolidated financial data

set forth below should be read in conjunction with the information presented in

this prospectus under “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” and with our audited consolidated

financial statements and the related notes included elsewhere in this

prospectus.

8

The summary

consolidated financial data set forth below is derived from our consolidated

financial statements. The consolidated statement of operations data for the

fiscal years ended June 30, 2010 and 2009 and the consolidated balance sheet

data as of June 30, 2010 and 2009 is derived from our audited consolidated

financial statements included elsewhere in this

prospectus.

Statement of Operations

Data

|

(In thousands, except per share

data)

|

Fiscal Years Ended

(audited)

|

|||||||

|

June 30, 2010

|

June 30, 2009

|

|||||||

|

Total

revenue

|

$

|

24,156

|

$

|

21,119

|

||||

|

Costs and operating

expenses

|

$

|

24,783

|

$

|

28,742

|

||||

|

Net loss

|

$

|

(627

|

)

|

$

|

(7,623

|

)

|

||

|

Loss per share attributed to common

stockholders basic and diluted:

|

||||||||

|

Net loss per

share

|

$

|

(0.01

|

)

|

$

|

(0.09

|

)

|

||

|

Weighted average number of shares

- basic and diluted

|

83,970,278

|

86,272,712

|

||||||

Balance Sheet Data

|

(In

thousands)

|

June 30, 2010

|

June 30, 2009

|

||||||

|

Total

assets

|

$

|

18,559

|

$

|

20,654

|

||||

|

Cash and cash

equivalents

|

$

|

1,196

|

$

|

1,663

|

||||

|

Total

liabilities

|

$

|

13,227

|

$

|

14,154

|

||||

|

Working capital

(deficiency)

|

$

|

(6,735

|

)

|

$

|

(2,972

|

)

|

||

|

Shareholders’

equity

|

$

|

5,332

|

$

|

6,500

|

||||

9

RISK FACTORS

Investing in our securities involves a

high degree of risk. You should carefully consider the specific risks described

below, the risks described in our Annual Report on Form 10-K for the fiscal

year ended June 30, 2009 and any risks described in our other filings with the

Securities and Exchange Commission, pursuant to Sections 13(a), 13(c), 14,

or 15(d) of the Securities

Exchange Act of 1934 (the “Exchange Act”) before making an investment decision.

See the section of this prospectus entitled “Where You Can Find More

Information.” Any of the risks we describe below or in the information

incorporated herein by reference could cause our business, financial condition,

results of operations or future prospects to be materially adversely affected.

Our business strategy involves significant risks and could result in operating

losses. The market price of our common stock could decline if one or more of

these risks and uncertainties develop into actual events and you could lose all

or part of your investment. Additional risks and uncertainties not currently

known to us or that we currently deem to be immaterial also may materially

adversely affect our business, financial condition, results of operations or

future prospects. Some of the statements in this section of the prospectus are

forward-looking statements. For more information about forward-looking

statements, please see the section of this prospectus entitled “Cautionary Note Regarding Forward-Looking

Statements.”

Risks Related to the Rights

Offering

IF YOU DO NOT EXERCISE YOUR SUBSCRIPTION

RIGHTS, YOUR OWNERSHIP INTEREST WILL BE DILUTED UPON THE COMPLETION OF THE

RIGHTS OFFERING.

The rights offering will result in the Company

having more shares of its common stock issued and outstanding. To the

extent that you do not exercise your rights under the rights offering and the Company’s shares being offered

pursuant thereto are purchased by other shareholders, your proportionate

ownership and voting interest in the Company will be reduced. As

such, the percentage that your original shares represent of our outstanding

common stock after the rights offering will be diluted.

THE PRICE OF OUR COMMON STOCK IS

VOLATILE AND MAY DECLINE EITHER BEFORE OR AFTER THE RIGHTS OFFERING

EXPIRES.

The market price of our common stock is

subject to fluctuations in response to numerous factors, including factors that

have little or nothing to do with us or our performance as a

company. These fluctuations could materially reduce our stock price

and include, among other things:

|

|

•

|

|

actual or anticipated variations

in our operating results and cash

flow;

|

|

|

•

|

|

the nature and content of our

earnings releases, and our competitors’ and customers’ earnings

releases;

|

|

|

•

|

|

changes in financial estimates by

securities analysts;

|

|

|

•

|

|

business conditions in our

markets, the general state of the securities markets and the market for

common stock in companies similar to

ours;

|

|

|

•

|

|

the number of shares of our common

stock outstanding;

|

|

|

•

|

|

changes in capital markets that

affect the perceived availability of capital to companies in our

industries;

|

|

|

•

|

|

governmental legislation or

regulation;

|

|

|

•

|

|

currency and exchange rate

fluctuations; and

|

|

|

•

|

|

general economic and market

conditions.

|

In addition, the stock market

historically has experienced significant price and volume fluctuations

which, at times, are unrelated to the

operating performance of any particular company. We do not have

control over these fluctuations, which may occur irrespective of our operating

results or performance and may cause a decline in the market price of our common

stock.

10

THE SUBSCRIPTION PRICE DETERMINED FOR

THE RIGHTS OFFERING IS NOT NECESSARILY AN INDICATION OF THE FAIR VALUE OF OUR

COMMON STOCK.

The

subscription price for the shares of our common stock pursuant to the rights

offering is $0.065 per share of our common stock. The subscription price was

determined by members of a special committee of our board of directors and

represents a discount to the market price of a share of common stock on the date

that the subscription price was determined. Factors considered by the special

committee included the market price of the common stock before the announcement

of the rights offering, the business prospects of our company and the general

condition of the securities market. No assurance can be given that

the market price for our common stock during the rights offering will continue

to be above or even equal to the subscription price or that a subscribing owner

of rights will be able to sell the shares of common stock purchased in the

rights offering at a price equal to or greater than the subscription

price.

ONCE YOU AGREE TO SUBSCRIBE TO OUR

SHARES PURSUANT TO THE RIGHTS OFFERING, YOU ARE COMMITTED TO BUYING SHARES OF

OUR COMMON STOCK AT A PRICE WHICH MAY BE ABOVE THE PREVAILING MARKET

PRICE.

Once you exercise your subscription rights, you may not revoke the exercise of

such rights. The trading price of our common stock may decline before the

rights offering is concluded or before the subscription rights expire. If you exercise your

subscription

rights and, thereafter, the

trading price of our common stock decreases below the subscription price, you

will have committed to buying shares of our common stock at a price above the

prevailing market price, in which case you will have an immediate, unrealized

loss. No assurance can be given that following the exercise of your

subscription

rights, you will be able to

sell your shares of common stock at a price equal to or greater than the

subscription price paid for such shares. As such, you may lose all or

part of your investment in our common stock. Further, until the certificate

representing the shares purchased under the rights offering is delivered to you, you will not be

able to sell such shares of our common stock.

IF YOU DO NOT ACT PROMPTLY AND FOLLOW

THE SUBSCRIPTION INSTRUCTIONS, YOUR EXERCISE OF SUBSCRIPTION RIGHTS MAY BE

REJECTED.

Shareholders

who desire to purchase shares in the rights offering must act promptly to ensure

that all required forms and payments are actually received by the subscription

agent before 5:00 p.m., New York time, on October 15, 2010, the expiration date

of the rights offering, unless extended by us, in our sole discretion. If you

are a beneficial owner of shares, but not a record holder, you must act promptly

to ensure that your broker, bank, or other nominee acts for you and that all

required forms and payments are actually received by the subscription agent

before the expiration date of the rights offering. We will not be responsible if

your broker, custodian, or nominee fails to ensure that all required forms and

payments are actually received by the subscription agent before the expiration

date of the rights offering. If you fail to complete and sign the required

subscription forms, send an incorrect payment amount or otherwise fail to follow

the subscription procedures of the rights offering, the subscription agent may

reject your subscription or accept it only to the extent of the payment

received. Neither we nor the subscription agent undertakes to contact you

concerning an incomplete or incorrect subscription form or payment, nor are we

under any obligation to correct such forms or payment. We have the sole

discretion to determine whether a subscription exercise properly follows the

subscription procedures.

SIGNIFICANT SALES OF OUR COMMON STOCK,

OR THE PERCEPTION THAT SIGNIFICANT SALES THEREOF MAY OCCUR IN THE FUTURE COULD

ADVERSELY AFFECT THE MARKET PRICE FOR OUR COMMON STOCK.

The sale of substantial amounts of our

common stock could adversely affect the price of these securities. Sales of

substantial amounts of our common stock in the public market, and the

availability of shares for future sale could adversely affect the prevailing

market price of our common stock and could cause the market price of our common

stock to remain low for a substantial amount of time.

WE MAY CANCEL THE RIGHTS OFFERING AT ANY

TIME IN WHICH EVENT OUR ONLY OBLIGATION WOULD BE TO RETURN YOUR EXERCISE

PAYMENTS.

We may, in our sole discretion, decide

not to continue with the rights offering or to cancel the same, in which case

our only obligation would be to return to you, without interest or penalty, all subscription payments received by

the subscription

agent.

DEPENDING ON THE LEVEL OF PARTICIPATION

IN THE RIGHTS OFFERING, WYNNEFIELD PERSONS MAY BE ABLE TO EXERCISE SUBSTANTIAL

CONTROL OVER MATTERS REQUIRING SHAREHOLDER APPROVAL UPON COMPLETION OF THE

OFFERING.

On the

record date of the rights offering, Wynnefield Persons collectively beneficially

owned 12.61% of the outstanding shares of the Company’s common stock. As a

shareholder as of the record date, Wynnefield Persons will have the right to

subscribe for and purchase shares of our common stock under both the basic

subscription and oversubscription rights provided by the rights offering.

Wynnefield Persons has indicated to us that it intends to exercise all of its

basic subscription rights, but has not made any formal commitment to do so.

Wynnefield Persons has also indicated that it intends to oversubscribe for the

maximum amount of shares for which it can oversubscribe without endangering the

availability of the Company’s net operating loss carryforwards under Section 382

of the Internal Revenue Code. However, there is no guarantee or commitment that

Wynnefield Persons will ultimately decide to exercise any of its rights,

including its basic subscription or oversubscription rights. If Wynnefield

Persons exercises its rights in the rights offering and a significant number of

other shareholders do not exercise their rights, the ownership percentage of

Wynnefield Persons following completion of the offering may increase to greater

than 50% of the outstanding shares of the Company’s common stock. If this were

to occur, Wynnefield Persons would be able to exercise substantial control over

matters requiring shareholder approval. Your interests as a holder of common

stock may differ from the interests of Wynnefield

Persons.

11

Risks Related to Our Common

Stock

ADDITIONAL ISSUANCES OF OUR SECURITIES

WILL DILUTE YOUR STOCK OWNERSHIP AND COULD AFFECT OUR STOCK

PRICE.

As of August 31, 2010, there were 85,860,185 shares of

our common stock and 1,792,662 shares of Series A Preferred Stock issued and

outstanding. Our Articles

of Incorporation authorize the issuance of an aggregate of 150,000,000 shares of

Common Stock and 10,000,000 shares of Preferred Stock, on such terms and at such

prices as our board of directors may determine. These shares are intended to

provide us with the necessary flexibility to undertake and complete plans to

raise funds if and when needed. Although we have not entered into any agreements

relating to any future acquisitions, we may do so in the future. Any such

acquisition may entail the issuances of securities that would have a dilutive

effect on current ownership of our common stock. The market price of our common

stock could fall in response to the sale or issuance of a large number of

shares, or the perception that sales of a large number of shares could

occur.

CONCENTRATED OWNERSHIP OF OUR COMMON

STOCK CREATES A RISK OF SUDDEN CHANGE IN OUR SHARE PRICE.

Investors who purchase our common stock

may be subject to certain risks due to the concentrated ownership of our common

stock. The sale by any of our large shareholders of a significant portion of

that shareholder’s holdings could have a material adverse effect on the market

price of our common stock.

As of August 31, 2010, certain shareholders owned common

stock and warrants to

purchase approximately 29.2% of our outstanding common stock. As

such, any sale by these large shareholders of a significant number of our shares

could create a decrease in the price of our common stock.

In addition, the registration of any

significant amount of additional shares of our common stock will have the

immediate effect of increasing the public float of our common stock and any such

increase may cause the market price of our common stock to decline or fluctuate

significantly.

THE MARKET FOR OUR COMMON STOCK IS

LIMITED AND YOU MAY NOT BE ABLE TO SELL YOUR COMMON STOCK.

Our common stock is currently quoted on

the Over the Counter Bulletin Board, and is not traded on a national securities

exchange. The market for purchases and sales of our common stock is limited and

therefore the sale of a relatively small number of shares could cause the price

to fall sharply. Accordingly, it may be difficult to sell shares quickly without

depressing the value of our common stock significantly. Unless we are successful

in developing continued investor interest in our stock, sales of our common

stock could continue to result in major fluctuations in the price

thereof.

WE DO NOT INTEND TO DECLARE DIVIDENDS ON

OUR COMMON STOCK.

We will not distribute dividends to our

shareholders until and unless we can develop sufficient funds from operations to

meet our ongoing needs and implement our business plan. The time frame for that

is inherently unpredictable, and no shareholder should expect to receive

dividends in the near future, or at all.

THE PRICE OF OUR COMMON STOCK IS LIKELY

TO BE VOLATILE AND SUBJECT TO WIDE FLUCTUATIONS.

The market price of the securities of

software companies has been especially volatile. Thus, the market price of our

common stock is likely to be subject to wide fluctuations. If our revenues do

not grow, or if such revenues grow at a slower pace than anticipated, or, if

operating or capital expenditures exceed our expectations and cannot be adjusted

accordingly, the market price of our common stock could decline. If the stock

market in general experiences a loss in investor confidence or otherwise fails,

the market price of our common stock could fall for reasons unrelated to our

business, results of operations and financial condition. The market price of our

stock also might decline in reaction to events that affect other companies in

our industry even if these events do not directly affect

us.

12

SINCE OUR STOCK IS CLASSIFIED AS A

“PENNY STOCK,” THE RESTRICTIONS OF THE SECURITIES AND EXCHANGE COMMISSION’S

PENNY STOCK REGULATIONS MAY RESULT IN LESS LIQUIDITY FOR OUR

STOCK.

The US Securities and Exchange Commission

(the “SEC”) has adopted

regulations which define a “penny stock” to be any equity security that has a

market price (as therein defined) of less than $5.00 per share or an exercise

price of less than $5.00 per share, subject to certain exceptions. For any

transactions involving a penny stock, unless exempt, the rules require the

delivery, prior to any transaction involving a penny stock by a retail customer,

of a disclosure schedule prepared by the SEC relating to the penny stock market.

Disclosure is also required to be made about commissions payable to both the

broker/dealer and the registered representative and current quotations for the

securities. Finally, monthly statements are required to be sent disclosing

recent price information for the penny stock held in the account and information

on the limited market in penny stocks. Because the market price for our shares

of common stock is less than $5.00, our securities are classified as penny

stock. As a result of the penny stock restrictions, brokers or potential

investors may be reluctant to trade in our securities, which may result in less

liquidity for our stock.

Risks Related to Our

Business

WE HAVE A LIMITED OPERATING HISTORY THAT

MAKES IT DIFFICULT TO EVALUATE OUR BUSINESS AND TO PREDICT OUR FUTURE OPERATING

RESULTS.

We were known as W3 Group, Inc. and we

had no operations in December 2005, at which time we engaged in a reverse

acquisition; therefore, we have limited historical operations. Two of our

subsidiaries, MAM Software, Ltd. and AFS Tire Management, Inc. (f/k/a CarParts

Technologies, Inc.) have operated since 1984 and 1997, respectively, as

independent companies under different management until our former parent, ADNW,

acquired MAM Software in April 2003 and CarParts Technologies, Inc. in August

2004. Since the reverse merger in December 2005, we have been primarily engaged

in organizational activities, including developing a strategic operating plan

and developing, marketing and selling our products. In particular, we had

integrated a third subsidiary as a result of the acquisition of EXP from ADNW in

August 2006, its MMI Automotive subsidiary. In February 2007, we acquired DSS

from ADNW, which owned a minority interest of DCS Automotive Limited. On

November 12, 2007, we sold EXP and DSS, which was EXP’s wholly owned subsidiary.

As a result of our limited operating history, it will be difficult to evaluate

our business and predict our future operating results.

WE MAY FAIL TO ADDRESS RISKS WE FACE AS

A DEVELOPING BUSINESS WHICH COULD ADVERSELY AFFECT THE IMPLEMENTATION OF OUR

BUSINESS PLAN.

We are prone to all of the risks

inherent in the establishment of any new business venture. You should consider

the likelihood of our future success to be highly speculative in light of our

limited operating history, as well as the limited resources, problems, expenses,

risks and complications frequently encountered by entities at our current stage

of development. To address these risks, we must, among other

things,

|

|

•

|

implement and successfully execute

our business and marketing

strategy;

|

|

|

•

|

continue to develop new products

and upgrade our existing

products;

|

|

|

•

|

respond to industry and

competitive developments;

|

|

|

•

|

attract, retain, and motivate

qualified personnel; and

|

|

|

•

|

obtain equity and debt financing

on satisfactory terms and in timely fashion in amounts adequate to

implement our business plan and meet our

obligations.

|