Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OLIN Corp | form8kkeybancslides091410.htm |

1

KeyBanc Capital Markets

Basic Materials & Packaging

Conference

September 14, 2010

Basic Materials & Packaging

Conference

September 14, 2010

Exhibit 99.1

2

Olin Representatives

Joseph D. Rupp

Chairman, President & Chief Executive Officer

John E. Fischer

Vice President & Chief Financial Officer

Larry P. Kromidas

Assistant Treasurer & Director, Investor Relations

lpkromidas@olin.com

(618) 258 - 3206

3

Company Overview

All financial data are for the six months ending June 30, 2010 and the year ending 2009, and are presented in millions of U.S. dollars

except for earnings per share. Additional information is available on Olin’s website www.olin.com in the Investors section.

except for earnings per share. Additional information is available on Olin’s website www.olin.com in the Investors section.

Winchester

Chlor Alkali

Third Largest North American

Producer of Chlorine and Caustic Soda

Producer of Chlorine and Caustic Soda

6Mo 2010 FY 2009

Revenue: $ 489 $964

Income: $ 37 $125

A Leading North American Producer

of Small Caliber Ammunition

of Small Caliber Ammunition

6Mo 2010 FY 2009

Revenue: $279 $568

Income: $ 41 $ 69

Revenue: $ 768 $ 1,532

EBITDA: $ 96 $ 292

Pretax Operating Inc.: $ 40 $ 210

EPS (Diluted): $ .39 $ 1.73

6MO 2010 FY 2009

Olin

4

Olin Vision

To be a leading Basic Materials company delivering

attractive, sustainable shareholder returns

attractive, sustainable shareholder returns

• Being the low cost, high quality producer, and the

#1 or #2 supplier in the markets we serve

#1 or #2 supplier in the markets we serve

• Providing excellent customer service and

advanced technological solutions

advanced technological solutions

• Generating returns above the cost of capital over

the economic cycle

the economic cycle

5

Olin Corporate Strategy

1. Build on current leadership positions in the

Chlor-Alkali and Ammunition businesses

• Improve operating efficiency and profitability

• Integrate downstream selectively

2. Allocate resources to the businesses that can create the

most value

most value

3. Manage financial resources to satisfy legacy liabilities

Total Return to Shareholders in Top Third of S&P 1000

Return on Capital Employed Over Cost of Capital Through the Cycle

Olin Corporation Goal: Superior Shareholder Returns

6

Investment Rationale

• Leading North American producer of Chlor-Alkali

• Strategically positioned facilities

• Diverse end customer base

• Favorable industry dynamics

• Leading producer of industrial bleach with additional

growth opportunities

growth opportunities

• Pioneer synergies improved chlor-alkali price structure

• Winchester’s leading industry position

7

Chlor Alkali Segment

ECU = Electrochemical Unit; a unit of measure reflecting the chlor alkali process outputs

of 1 ton of chlorine, 1.13 tons of 100% caustic soda and 0.3 tons of hydrogen.

of 1 ton of chlorine, 1.13 tons of 100% caustic soda and 0.3 tons of hydrogen.

N. American

Position

Position

% 2009

Revenue

Revenue

#3

#2

#1

Industrial

Industrial

#1

Merchant

Merchant

#1

Burner

Grade

Burner

Grade

8%

10%

4%

53%

24%

1%

Chlor Alkali Manufacturing Process

SALT + ELECTROLYSIS = OUTPUTS

Caustic Soda

(Sodium Hydroxide)

(Potassium Hydroxide)

Bleach

(Sodium Hypochlorite)

Chlorine

Sodium Salt

or

Potassium Salt

KOH

HCl

(Hydrochloric Acid)

Hydrogen Gas

Caustic Soda

or

KOH

Chlorine

Hydrogen

8

• Be the preferred supplier to chlor alkali customers in

addition to being the low cost producer

addition to being the low cost producer

• Goal is to increase the value of the Chlor Alkali

Division to Olin through:

Division to Olin through:

– Optimizing capacity utilization

– Higher margin downstream products

– Cost reduction and financial discipline

Olin’s Chlor Alkali Strategy

9

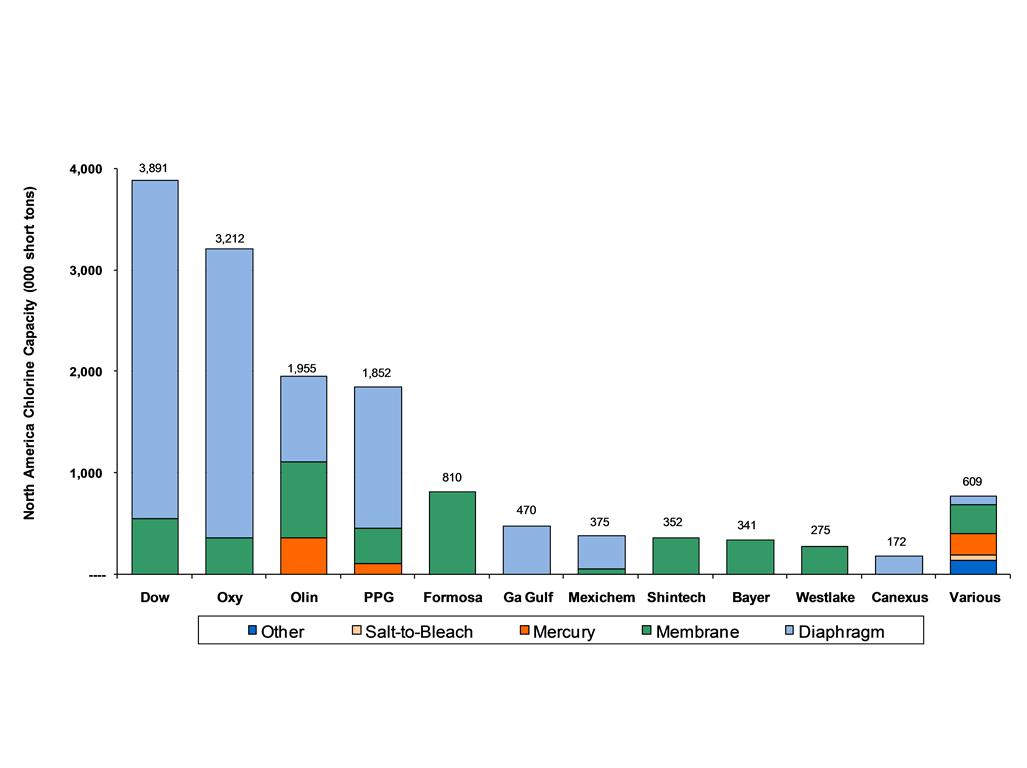

Source: CMAI/Olin - 2009 year-end figures

Oxy includes OxyVinyls and does not reflect the announced reduction of approximately 280,000 tons of capacity at their Taft, LA facility.

Olin includes 50% of Sunbelt joint venture.

Olin is #3 Chlor-alkali Producer

10

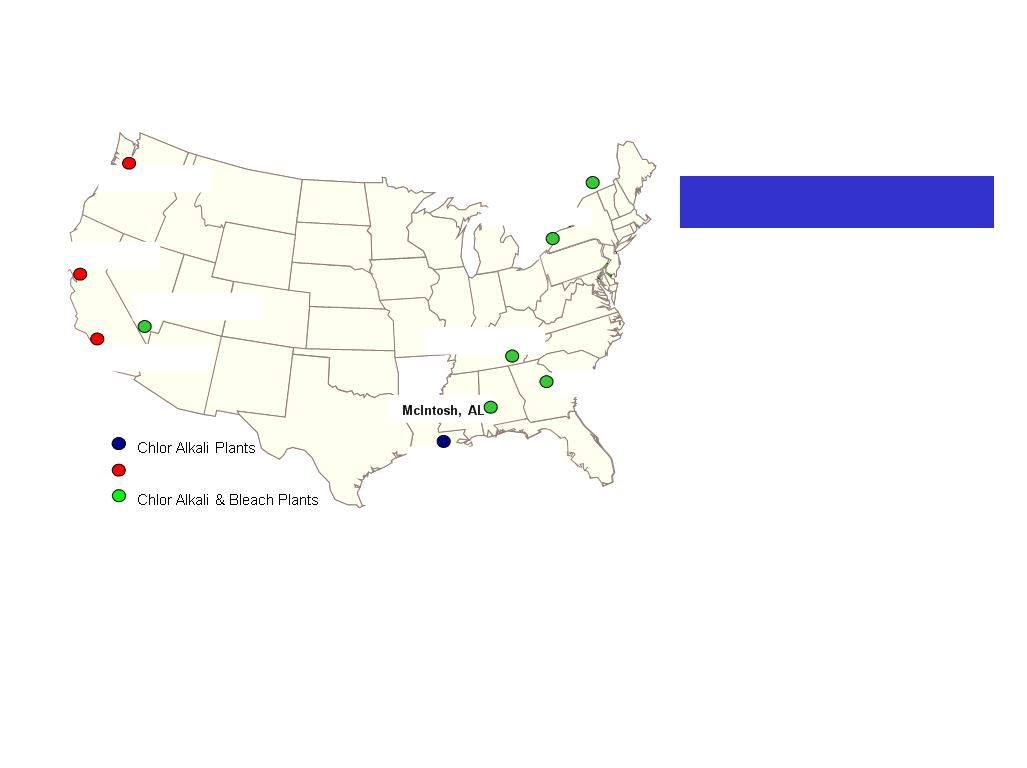

Bleach Plants

39

Tacoma, WA

Tracy, CA

Santa Fe Springs, CA

Henderson, NV

St. Gabriel, LA

Augusta, GA

Charleston, TN

Niagara Falls, NY

Becancour,

Quebec

Olin’s Geographic Advantage

Source: Olin.

(1) The Becancour Plant has 275,000 short tons diaphragm and 65,000 short tons membrane capacity.

|

Location

|

Chlorine Capacity

(000s Short Tons)

|

|

McIntosh, AL

|

415

|

|

Becancour, Quebec

(1) |

340

|

|

Niagara Falls, NY

|

286

|

|

Charleston, TN

|

248

|

|

St. Gabriel, LA

|

246

|

|

McIntosh, AL

(50% of Sunbelt JV)

|

160

|

|

Henderson, NV

|

152

|

|

Augusta, GA

|

108

|

|

Total

|

1,955

|

• Access to regional customers including bleach and water treatment

• Access to alternative energy sources

– Coal, hydroelectric, nuclear, natural gas

11

Diverse Customer Base

Chlorine: “Organics” includes: Propylene oxide, epichlorohydrin, MDI, TDI, polycarbonates. “Inorganics” includes: Titanium dioxide and bromine.

Caustic Soda: “Organics” includes: MDI, TDI, polycarbonates, synthetic glycerin, sodium formate, monosodium glutamate. “Inorganics” includes: titanium dioxide, sodium silicates, sodium cyanide.

Chlorine

North American Industry

Olin

12

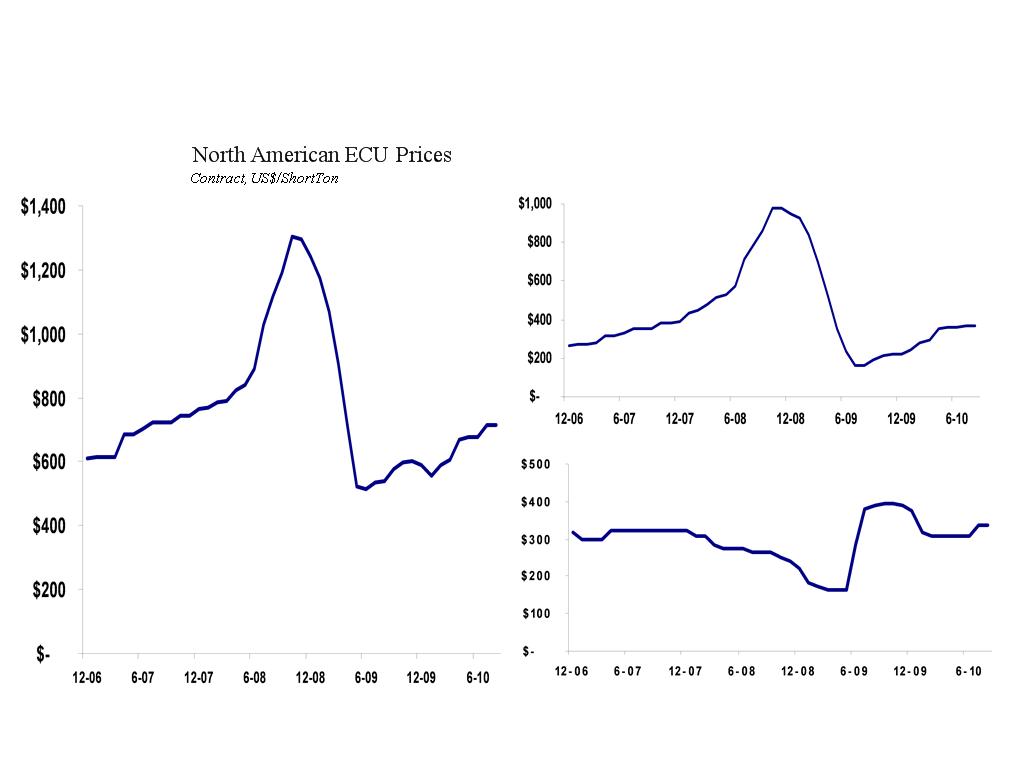

Product Pricing Has Been Dynamic

(1) ECU Price = the price of 1 ton of chlorine + 1.1 times the price of 1 ton of caustic Source: CMAI.

North American Caustic Soda

Avg. Acquisition, US$/Short Ton

Avg. Acquisition, US$/Short Ton

North American Chlorine

Contract, US$/Short Ton

Contract, US$/Short Ton

(1)

13

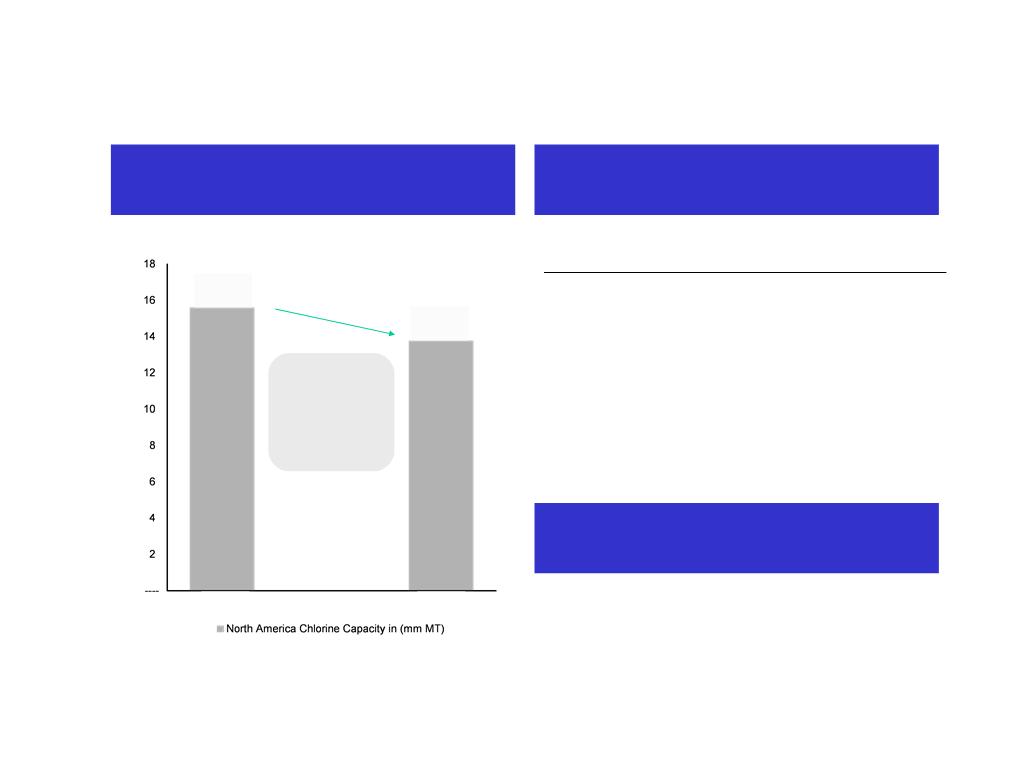

Capacity Rationalization

Favorable Industry Dynamics

Target

Acquisition

Date

Date

Position

2007

2004

• Acquired by Olin

• 725,000 Short Tons ECU Capacity

• Then the #7 ranked producer in

North America

North America

• 4.7% of North American capacity

• Acquired by OxyChem

• 859,000 Short Tons ECU Capacity

• Then the #7 ranked producer in

North America

North America

• 5.5% of North American capacity

• 250,000 Short Ton ECU capacity

plant expansion 2H 2013

plant expansion 2H 2013

• Plant located at Geismar, LA

Source: CMAI.

Pioneer

Vulcan

Westlake Chemical

Industry Consolidation

Delayed Capacity Expansion

2.0 mm MT

or 13% of

2000 net

capacity

reduction

or 13% of

2000 net

capacity

reduction

mmMT

13.6

15.6

2009

2000

14

Chlor-Alkali Outlook

• Q3 2010 segment earnings are expected to improve over Q2

2010 results on higher caustic soda prices

2010 results on higher caustic soda prices

• ECU Netbacks are expected to improve as caustic soda prices

reflect the bulk of the $80 February price announcement

reflect the bulk of the $80 February price announcement

• May price announcements of $50 on chlorine and $35/$50 on

caustic soda are currently being negotiated, if successful, will

increase Q4 2010 ECU netbacks

caustic soda are currently being negotiated, if successful, will

increase Q4 2010 ECU netbacks

• In early August, North American chlor-alkali producers

announced a $40/ton caustic price increase, and in late

August followed it with an additional $45/ton caustic hike

announced a $40/ton caustic price increase, and in late

August followed it with an additional $45/ton caustic hike

• Q2 2010 operating rates improved to 83%, Q3 2010

operating rates are expected to be in the mid 80% range

operating rates are expected to be in the mid 80% range

15

Why Industrial Bleach?

• Olin is the leading North American bleach producer with a capacity of

250 million gallons (or 160,000 ECUs) in a 1 billion gallon industry

250 million gallons (or 160,000 ECUs) in a 1 billion gallon industry

• Olin has 18% market share and current installed capacity to service

25% of the market with low-cost expansion opportunities

25% of the market with low-cost expansion opportunities

• Utilizes both chlorine and caustic soda in an ECU ratio

• Commands a $100 to $200/ton premium over ECU prices

• Demand is not materially impacted by economic cycles

• Regional nature of bleach business benefits Olin’s geographic diversity,

further enhanced by Olin’s proprietary railcar technology to reach more

distant customers

further enhanced by Olin’s proprietary railcar technology to reach more

distant customers

• 2009 bleach volumes increased almost 18% over 2008 levels, and Olin

expects 2010 volumes to be 20 to 25% higher than 2009

expects 2010 volumes to be 20 to 25% higher than 2009

16

Mercury Legislation

• On October 21, 2009, the U.S. House of Representatives

Committee on Energy and Commerce passed a bill that

would require chlor-alkali producers using mercury cell

technology to decide by 6/30/12 whether they would shut

down or convert those plants. The plants would need to be

shut down by 6/30/13 or converted by 6/30/15.

Committee on Energy and Commerce passed a bill that

would require chlor-alkali producers using mercury cell

technology to decide by 6/30/12 whether they would shut

down or convert those plants. The plants would need to be

shut down by 6/30/13 or converted by 6/30/15.

• During the third quarter of 2009, a companion bill was

introduced in the U.S. Senate

introduced in the U.S. Senate

• To date, no votes have been taken on the House floor and the

Senate has not acted; outcome of legislation is uncertain

Senate has not acted; outcome of legislation is uncertain

• Olin currently operates 2 mercury cell plants representing

356,000 ECUs or 18% of our total capacity *

356,000 ECUs or 18% of our total capacity *

* Olin’s total capacity includes 50% ownership of the SunBelt JV

17

Winchester Segment

Winchester Strategy

• Leverage existing strengths

– Seek new opportunities

to leverage the

legendary Winchester®

brand name

to leverage the

legendary Winchester®

brand name

– Investments that

maintain Winchester as

the retail brand of

choice, and lower costs

maintain Winchester as

the retail brand of

choice, and lower costs

• Focus on product line

growth

growth

– Continue to develop

new product offerings

new product offerings

• Provide returns in excess of

cost of capital

cost of capital

|

|

Hunters & Recreational Shooters

|

|

|

|

||

|

Products

|

Retail

|

Distributors

|

Mass

Merchants |

Law

Enforcement |

Military

|

Industrial

|

|

Rifle

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

|

Handgun

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

|

Rimfire

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

Shotshell

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

Components

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

Brands

18

Winchester’s Leading

Industry Position

Industry Position

• One of the three leading ammunition manufacturers

in the United States *

in the United States *

• Strong brand awareness

– Top 15 of all sporting goods brands

• Legendary brand image

– Positively associated with American heritage,

John Wayne, Teddy Roosevelt and

cowboy/western connotations

John Wayne, Teddy Roosevelt and

cowboy/western connotations

• Category leadership and expertise demonstrated by

selection to manage ammunition category for key,

national retailers

selection to manage ammunition category for key,

national retailers

• Leading consumer goods marketer with an increased

presence on television and the Internet

presence on television and the Internet

• Innovator of market-driven new products

* Source: National Shooting Sports Foundation.

19

Favorable Industry Dynamics

Commercial

• Economic environment leading to personal security concerns

• Fears of increased gun/ammunition control due to change in administration

• New gun and ammunition products

• Strong hunting activity in weak economy, driven by cost/benefit of hunting

for food and increased discretionary time

for food and increased discretionary time

Law

Enforcement

Enforcement

• Significant new federal agency contracts and solid federal law enforcement

funding

funding

• Higher numbers of law enforcement officers and increase in federal agency

hiring

hiring

• Increased firearms training requirements among state and local law

enforcement agencies

enforcement agencies

Military

• Sustained high demand for small caliber ammunition due to wars in Iraq and

Afghanistan

Afghanistan

• Commitment to maintaining the “Second-Source Program” to mitigate the

risk of a sole-source small caliber ammunition contract

risk of a sole-source small caliber ammunition contract

20

Winchester

• Record Q2 2010 segment earnings of $21 million follows record

Q1 2010 and full year 2009 earnings of $69 million

Q1 2010 and full year 2009 earnings of $69 million

• Long-term military and law enforcement agency contract sales

accounted for more than 30% of segment revenue in 2010

accounted for more than 30% of segment revenue in 2010

• Winchester has been awarded approximately $110 million of new

military and law enforcement business thus far this year

military and law enforcement business thus far this year

• New gun ownership is expected to translate into higher long-term

ammunition consumption

ammunition consumption

• Commercial backlog declined in Q2 2010 to $117 million

• Military and Law Enforcement backlog remains strong and stable

at $118 million at June 30, 2010

at $118 million at June 30, 2010

21

Financial Highlights

• Strong Balance Sheet

– Q2 2010 cash balance approximately $388 million and is

expected to be at least $425 million by year end

expected to be at least $425 million by year end

– Pension plan remains fully funded with no contributions

required until at least 2012

required until at least 2012

– 2010 capital spending forecast to be 85% of depreciation

• Profit Outlook

– ECU pricing trends are positive

– Higher margin bleach business is growing

– Converted and expanded St. Gabriel facility is on-line and

reducing both operating and freight costs

reducing both operating and freight costs

– Winchester performance continues to be strong

22

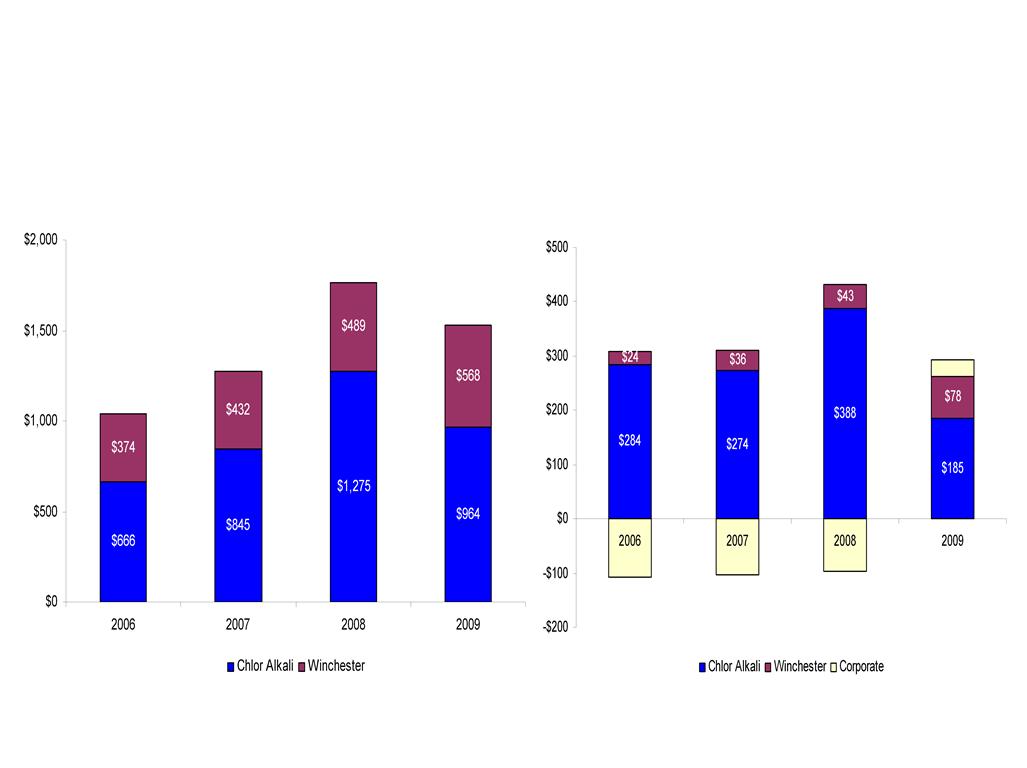

Historical Financial Performance

Revenues

($ millions)

($ millions)

EBITDA

($ millions)

($ millions)

$1,040

$1,277

$1,765

$1,532

$201

$207

$335

$292

Note: EBITDA is Income from Continuing Operations Before Taxes, excluding Interest Expense, Interest Income, and Depreciation and Amortization expense.

-$107

-$103

-$96

$29

23

Potential Uses of Cash

• Olin’s financial policies have prioritized conservatism,

caution and prudence

caution and prudence

• Current cash levels support:

• Annual working capital swings of $50 to $100 million

• Investments to expand bleach business including low salt,

high strength bleach plants

high strength bleach plants

• Restructuring/downsizing of Chlor Alkali system necessitated

by low industry operating rates and mercury legislation

by low industry operating rates and mercury legislation

• Potential acquisitions

• $75 million notes due 2011

• Liquidity cushion for uncertain economic and credit

environments

environments

24

Investment Rationale

• Leading North American producer of Chlor-Alkali

• Strategically positioned facilities

• Diverse end customer base

• Favorable industry dynamics

• Leading producer of industrial bleach with additional

growth opportunities

growth opportunities

• Pioneer synergies improved chlor-alkali price structure

• Winchester’s leading industry position

25

Forward-Looking Statements

This presentation contains estimates of future

performance, which are forward-looking

statements and actual results could differ

materially from those anticipated in the forward-

looking statements. Some of the factors that could

cause actual results to differ are described in the

business and outlook sections of Olin’s Form 10-K

for the year ended December 31, 2009 and Form

10-Q for the quarter ended June 30, 2010. These

reports are filed with the U.S. Securities and

Exchange Commission.

performance, which are forward-looking

statements and actual results could differ

materially from those anticipated in the forward-

looking statements. Some of the factors that could

cause actual results to differ are described in the

business and outlook sections of Olin’s Form 10-K

for the year ended December 31, 2009 and Form

10-Q for the quarter ended June 30, 2010. These

reports are filed with the U.S. Securities and

Exchange Commission.

26

Appendix

1892 founded in East Alton, IL providing

blasting powder to Midwestern coal mines

blasting powder to Midwestern coal mines

1898 formed Western Cartridge Company

to manufacture small arms ammunition

to manufacture small arms ammunition

1931 acquires Winchester Repeating Arms

1940s & 1950s acquires cellophane, paper,

lumber & powder-actuated tools businesses

lumber & powder-actuated tools businesses

1892 founded in Saltville, VA to produce

soda ash.

soda ash.

1896 builds first chlor-alkali plant in US

1909 introduces first commercial

production of liquefied chlorine

production of liquefied chlorine

1940s & 1950s builds plants in Lake

Charles, LA & McIntosh, AL, buys Squibb

Charles, LA & McIntosh, AL, buys Squibb

1954 Merger creates the Olin Mathieson Chemical Corporation

1950s & 1960 entered into phosphates, aluminum, urethanes, TDI, skis, camping

equipment, homebuilding and expanded paper and forestry businesses

equipment, homebuilding and expanded paper and forestry businesses

1970s to 2000 consolidation back to core businesses, spin-offs included forest

products (Olinkraft), military ordnance (Primex) and specialty chemicals (Arch)

and sold aluminum, TDI, urethanes and Squibb businesses

products (Olinkraft), military ordnance (Primex) and specialty chemicals (Arch)

and sold aluminum, TDI, urethanes and Squibb businesses

2007 acquired Pioneer and sold the Metals business, resulting in a company

similar in businesses to that which existed in the late 1890s

similar in businesses to that which existed in the late 1890s

Olin Industries Mathieson Chemical Corp.

27

Capacity Rationalization: 2000-2012

Source: Olin Data

Technology Key: DIA=Diaphragm, HG=Mercury, MB=Membrane, STB=Salt-to-Bleach.

Chlor Alkali Capacity Reductions

Chlor Alkali Capacity Expansions

Company

Location

Tech

ECU

COMPLETED 3,827,000

Dow

Ft. Saskatchewan

DIA

526,000

Dow

Plaquemine, LA

DIA

375,000

Formosa Plastics

Baton Rouge, LA

DIA

201,000

La Roche

Gramercy, LA

DIA

198,000

Oxy Vinyls LP

Deer Park, TX

DIA/HG

395,000

Georgia Pacific

(3 locations)

DIA/HG

24,000

Pioneer

Tacoma, WA

DIA/MB

214,000

Atofina

Portland, OR

DIA/MB

187,000

St. Anne Chem

Nackawic, NB

MB

10,000

PPG

Lake Charles, LA

HG

280,000

Oxy (KOH)

Taft, LA

HG

210,000

Oxy

Delaware City, DE

HG

145,000

Olin (KOH)

Charleston, TN

HG

110,000

Holtra Chem

Orrington, ME

HG

80,000

Holtra Chem

Acme, NC

HG

66,000

Mexichem

Santa Clara, Mex

HG

40,000

Cedar Chem

Vicksburg, MS

HG

40,000

Olin

Dalhousie, NB

HG

36,000

Dow

Oyster Creek, TX

DIA

396,000

ERCO

Port Edwards, WI

HG

97,000

Olin

St. Gabriel, LA

HG

197,000

ANNOUNCED 2,424,000

Dow1

Freeport, TX

DIA

2,279,000

Canexus

North Vancouver,BC

DIA

145,000

Reductions

6,251,000

Completed Announced Total

Reductions (3,827,000) (2,424,000) (6,251,000)

Expansions 2,096,000 3,049,000 5,145,000

Net Reduction (1,731,000) 625,000 (1,106,000)

Company

Location

Tech

ECU

COMPLETED 2,096,000

Dow

Freeport, TX

MB

500,000

PPG

Lake Charles, LA

MB

280,000

Oxy

Geismer, LA

MB

210,000

Equachlor

Longview, WA

MB

88,000

Westlake

Calvert City, KY

MB

80,000

SunBelt

McIntosh, AL

MB

70,000

Mexichem

Santa Clara, Mex

MB

45,000

Oxy

Various Sites

MB

22,000

AV Nackawic

Nackawic, NB

MB

10,000

Kuehne

Delaware City, DE

STB

40,000

Trinity

Hamlet, NC

STB

40,000

Odyssey

Tampa, FL

STB

30,000

Shintech

Plaquemine, LA

MB

330,000

ERCO

Port Edwards, WI

MB

105,000

Olin

St. Gabriel

MB

246,000

ANNOUNCED 3,049,000

Shintech

Plaquemine, LA

MB

252,000

Westlake2

Geismar, LA

MB

352,000

Allied Universal

Fort Pierce, FL

STB

40,000

Dow1

Freeport, TX

MB

2,225,000

Canexus

North Vancouver, BC

MB

180,000

Expansions

5,145,000

Annual caustic demand growth: 0.8% or 110,000 Tons/Year

1 Dow’s announced Freeport, TX membrane conversion is on hold and under review; their supply agreement renewal with Shintech remains pending.

2 Westlake’s announced 352,000 ton green-field project has been postponed and is being reconsidered.