Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HEXION INC. | d8k.htm |

| EX-99.1 - COMBINATION AGREEMENT - HEXION INC. | dex991.htm |

September

13,

2010

Creating a Global Leader in

Specialty Chemicals and Materials

Exhibit 99.2 |

2

Forward-Looking Statements

Certain statements in this presentation, including but not limited to those made under the caption

“Outlook” are forward-looking statements within the meaning of and made pursuant

to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. In addition, our management may from

time to time make oral forward-looking statements. All statements, other than statements of

historical fact, could be forward- looking statements. Forward-looking statements

may be identified by the words “believe,” “expect,” “anticipate,” “project,” “plan,”

“estimate,” “will” or “intend” or similar expressions.

Forward-looking statements reflect our current expectations and assumptions regarding our

businesses, the economy and other future events and conditions, and are based on currently available financial

economic and competitive data and current business plans. Actual results could vary materially

depending on risks and uncertainties that may affect operations, markets, services, prices and

other factors as discussed in the most recent Annual Report on Form 10-K and the other

filings made by Hexion Specialty Chemicals, Inc. (“Hexion”) and Momentive Performance

Materials Inc. (“Momentive”) with the Securities and Exchange Commission (SEC). We

caution you against relying on any forward-looking statements as they are neither

statements of historical fact nor guarantees of future performance. •

Important factors that could cause actual results to differ materially from those in the

forward-looking statements include regional or global economic, competitive and regulatory

factors including, but not limited to, the current credit crises and global economic

downturn, interruptions in the supply of or increased pricing of raw materials due to natural

disasters, pricing actions by our competitors that could affect our operating margins, changes

in governmental regulations involving our products, and the following:

•

risks and uncertainties from the possibility that the closing of the transaction may be delayed or not

occur, •

difficulties with the integration process or realization of benefits from the transaction

•

our inability to achieve expected cost savings,

•

the outcome of litigation described in the footnote to financial statements on Commitments and

Contingencies in the most recent Hexion and Momentive Annual Reports on Form 10-K,

•

our failure to comply with financial covenants under our credit facilities or other debt, and

•

the other factors described in the Risk Factors sections of the Annual Reports on Form 10-K and in

the other Hexion and Momentive SEC filings.

•

Any forward-looking statement made by us in this document speaks only as of the date on which it

is made. Factors or events that could cause our actual results to differ may emerge from

time to time. |

3

Creating One of the Largest Specialty Chemical

and Material Companies in the World

1H 2010 Annualized PF Revenue

(1)

: $7.47 bn

1H 2010 Annualized PF Adj. EBITDA

(2)

:

$1.24 bn

(1)

Reflects 1H’10 revenue of Hexion and Momentive on a pro forma annualized basis.

(2)

This presentation contains non-GAAP financial information. Adjusted

EBITDA is a non-GAAP financial measure as defined by SEC rules. Adjusted EBITDA is not

intended to represent any measure of earnings or cash flow in accordance with US GAAP and the

calculation and use of this measure may differ from other companies. Adjusted EBITDA should not

be used in isolation or as a substitute for measures of performance or liquidity. Adjusted EBITDA should not be considered an alternative to

operating income or net income (loss) under US GAAP to evaluate results of operations or as an

alternative to cash flows as a measure of liquidity. Pro Forma Adjusted EBITDA for the combined

entities reflects Hexion Specialty Chemical, Inc.'s previously reported Segment EBITDA for the six-month period ended June 30, 2010 and

Momentive Performance Materials Inc.'s previously reported Adjusted EBITDA for the six-month

period ended June 27,2010, in each case on a pro forma annualized basis, as well as $100

million in estimated synergies from the transaction and Hexion's $70 million of in-process productivity savings at June 30, 2010. For additional

information on Hexion's Segment EBITDA and Momentive's Adjusted EBITDA, including a reconciliation of

such previously reported amounts to such company's net income (loss), please see such company's

most recent Quarterly Report on Form 10-Q for the period then ended. |

4

Transformational Merger: Building a Global Leader

in Specialty Chemicals & Materials

•

Momentive Performance Materials Holdings Inc., the parent company of

Momentive Performance Materials, Inc., and Hexion LLC, the parent

company of Hexion Specialty Chemicals, Inc., today jointly announced that

their newly formed holding companies plan to merge, creating a new global

leader in specialty chemicals and materials

•

The Boards of Directors of Momentive Performance Materials Holdings Inc.

and Hexion LLC have unanimously approved the transaction, which is

subject to customary conditions

•

Anticipated closing on October 1, 2010

•

The legal structure will not require a refinancing of either company’s

debt A NEW GLOBAL LEADER IN SPECIALTY CHEMICALS AND MATERIALS

|

5

Strategic Rationale for the Combination

•

The combination will create one of world’s largest specialty chemical

companies:

–

1H’10 annualized pro forma sales of $7.47 billion

–

1H’10 annualized pro forma Adj. EBITDA of $1.24 billion

–

More than 10,000 associates

–

117 facilities globally

•

Industry leadership positions in more than 80 percent

of its portfolio with a

range of attractive technologies including: Silicones, Quartz, Specialty Epoxy

resins, Specialty Phenolic resins, Acrylic and Versatic™

Acids

and Derivatives

•

Balanced geographic portfolio with an ability to serve global customers in all

major regions of the world

•

Accelerates portfolio optimization opportunities

(1)

(1)

As of 12/31/09 |

6

Strategic Rationale for the Combination

•

The newly-formed company will leverage the best demonstrated business

processes delivering optimal cost, cash, margin and growth opportunities

•

The combination delivers a conservative estimate of $100 million

in synergies

–

Best-of-sourcing contractual terms

–

Regional site rationalization

–

Shared services optimization

•

The new Momentive provides an opportunity to leverage geographic

growth positions across the high growth regions --

Latin America, Asia Pacific,

India and the Middle East

•

New Product Development synergy opportunities also exist across a range of

technologies in shared end use markets, such as energy, automotive,

construction and electronics |

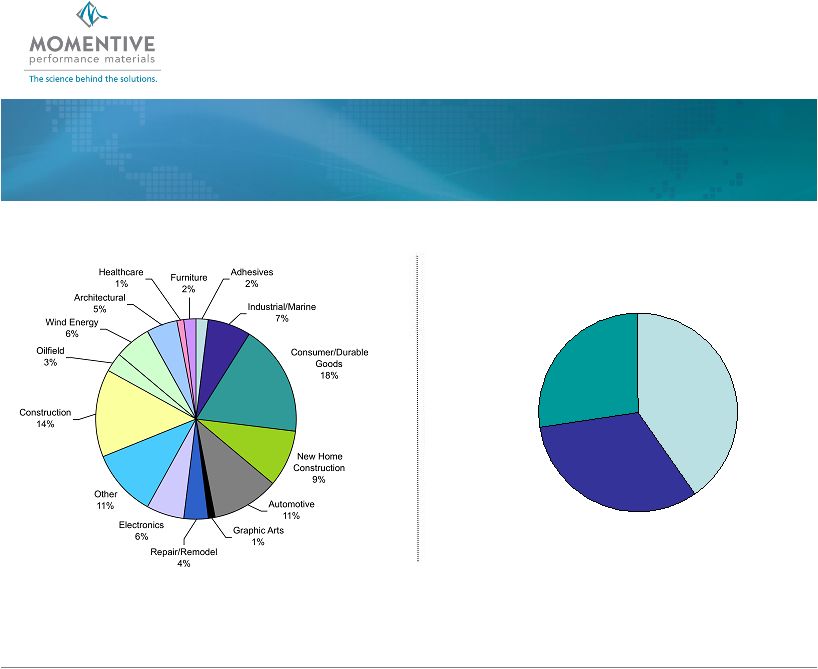

7

7

BRIC/ROW

28%

Europe

33%

N. America

41%

PF Geographical Revenue

Hexion & Momentive Will Form a $7.5 billion

Specialty Chemical & Materials Company

PF Revenue by Industry

DIVERSE INDUSTRIES AND GEOGRAPHICAL PRESENCE

SUPPORT GROWTH OBJECTIVES |

8

Global Leadership Positions Across a Broad Range of

Technologies and Industries

THE COMBINED COMPANY WOULD HAVE LEADING MARKET POSITIONS

IN MORE THAN 80% OF ITS REVENUE BASE

Forest Product Resins

Global

Oilfield Proppant Resins

Global

Phenolic Specialty

Resins

Global

Versatic™

Acids &

Derivatives

Global

Specialty Epoxy

Global

Silicones

Global

Quartz

Global

Base Epoxy Resins

Global |

9

Conservative Synergy Targets

•

Targeting $100 million in

synergies from the transaction

•

Both companies have strong

track records of achieving

planned cost savings

•

The Company is expected to

realize $70 million of Hexion’s

in-process productivity actions

•

Projected savings to be

allocated

between the two

companies

$49

$37

$14

Corporate /

SG&A

Raw Material &

Indirect Procurement

Logistics

Optimization

Targeted Synergies

($ in millions)

(1)

(1)

Reflects Hexion in-process productivity actions as of June 30, 2010

|

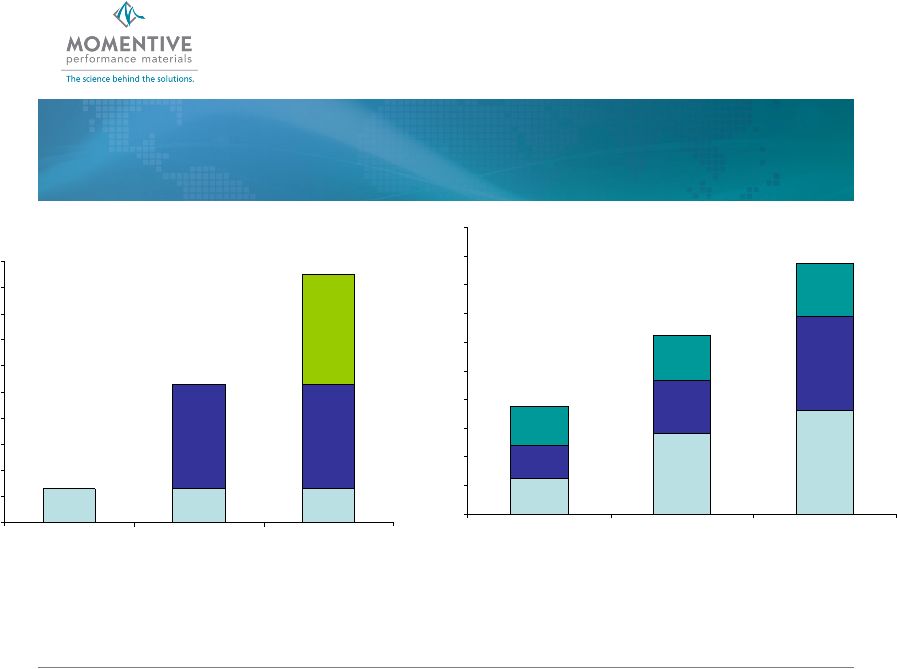

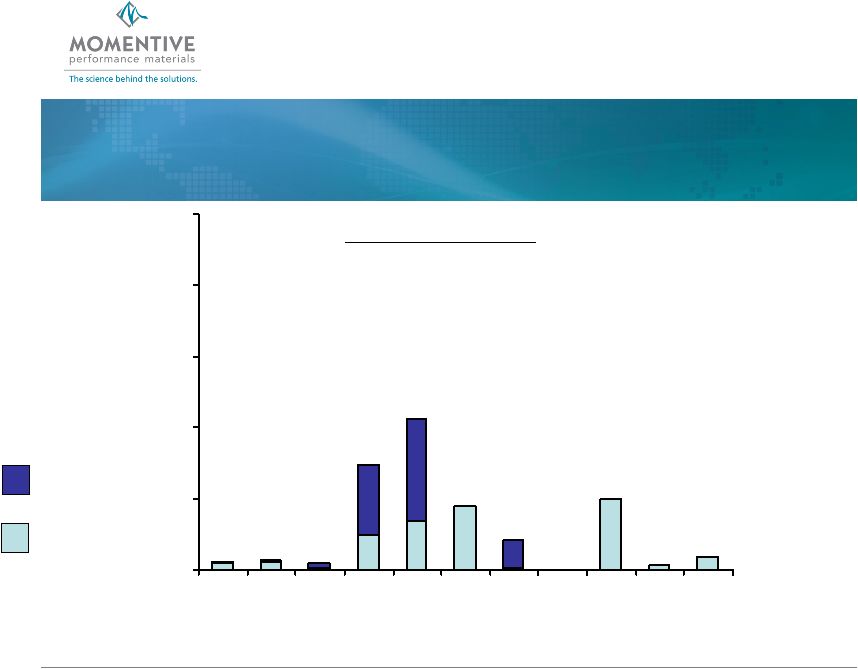

10

Proven Ability to Dramatically Exceed Cost Reduction

Targets

25

56

72

23

37

66

27

32

37

0

20

40

60

80

100

120

140

160

180

200

Original Target

Revision #1

Final Achievement

Hexion Formation Synergies

Sourcing

Mfg.

SG&A

Sourcing

Mfg.

SG&A

Sourcing

Mfg.

SG&A

•

Prior to current productivity program, Hexion aggressively

achieved synergies from the formation of the Company

•

Hexion’s recession driven productivity program has added

an incremental $250mm in cost savings

0

20

40

60

80

100

120

140

160

180

200

2007

2008

2009

$75

$125

$175

Momentive Cumulative Annual Savings

$190

$106

$26

($ in millions)

($ in millions)

•

Since its separation from General Electric Company,

Momentive consistently has taken significant actions to

improve the operating leverage of its business

•

Structural actions include SG&A and indirect expense

reduction, material productivity and facility rationalizations

(1)

(1)

Includes temporary pay and benefit reductions for salaried workforce, which yielded

$15 million and $4 million of savings, respectively, in 2009. 84

80

26

26

26

80 |

11

Broad Geographic Footprint Provides an

Excellent Platform for Growth

Asia Pacific: 28 Facilities

Americas: 55 Facilities

Europe: 34 Facilities

THE NEW MOMENTIVE WILL SERVE MORE THAN 20,000 CUSTOMERS FROM 117

GLOBAL SITES |

12

A Diversified Customer Base with Global

Leadership Positions

SERVING CUSTOMERS THROUGH LEADING TECHNICAL SERVICES, A DIVERSE

TECHNOLOGY PORTFOLIO AND A GLOBAL FOOTPRINT |

13

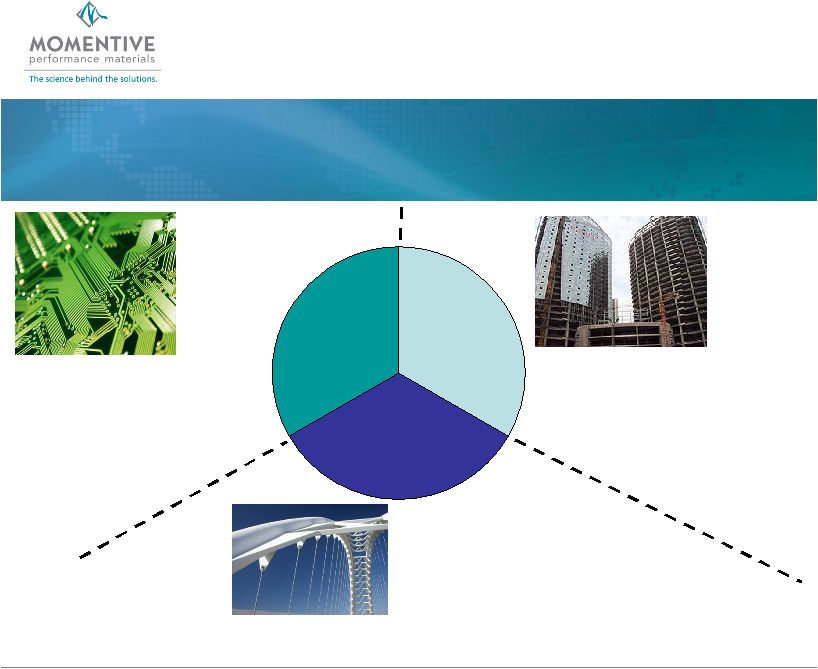

Significant Growth Opportunities Exist From Common

Industry Segments |

14

Technology

Cross

Fertilization

Global

Expansion

Market

Penetration

Product Portfolio and Global Expansion Plans Provide

a Strong Base for Growth

Waterborne Coatings Resins

–

Silane

modifiers (Momentive) in

combination with latex and epoxy

coatings (Hexion) for expanded

waterborne and solvent borne portfolio

Building & Construction

–

Glazing materials for

glass and walls

(Momentive) and

adhesive mortars for

insulation and exterior

finishing systems

(Hexion)

Electronics

–

Momentive and Hexion

participate throughout the

value chain –

from wafer

processing through

assembled electronic

components |

15

Building and Construction / Civil Engineering

Epoxy, RDP, wax emulsions

Silanes, Sealants

Electronic Applications

Epoxy, Phenolics

Elastomers

Silanes, Sealants

Silicones, Engineered Materials

Coating Applications

Medium and High Voltage Electrical Applications

Epoxy, Acrylic, Versatics

Silicone Fluids

Phenolic and Epoxy based

Proppants

Oilfield Technologies

Epoxy, Phenolics

Multiple Opportunities for Top line Growth |

16

New Structure Upon Closing

Momentive

Performance

Materials Holdings Inc.

(Delaware)

Momentive

Performance

Materials Inc.

(Delaware)

Various U.S. and

foreign subsidiaries

Various U.S. and

foreign subsidiaries

Hexion LLC

(Delaware)

Momentive

Performance

Materials Holdings LLC

(Delaware)

Summary

•

Existing capital structures will remain

separate and in place upon closing

•

No financing required for the

transaction

•

No breakage costs for either

company

•

Upon closing, new structure would

not impact collateral or covenant

compliance requirements for existing

Hexion or Momentive debt

Hexion Specialty

Chemicals, Inc.

(New Jersey) |

17

0

1,000

2,000

3,000

4,000

5,000

2010

2011

2012

2013

2014

2015

2016

2017

2018

2021

2023

Momentive

($ in millions)

Hexion

Maturity Schedule

Combined OpCo

Debt Maturities

STABLE, LONG-TERM CAPITAL STRUCTURE

WITH NO MATERIAL NEAR-TERM MATURITIES |

18

Summary: Combination Creates Value for

Both Companies

•

Top-line growth:

Transaction will provide entry to end markets and geographic

regions of the world that neither company could fully access independently

•

Expanded

Technology

Portfolio:

Unmatched

depth

and

breadth

of

specialty

products leveraging our proprietary technology base

•

Unique Customer Solutions:

Further penetration of customer base via

cross-selling and new product development opportunities

•

Streamlined Operations:

Synergy savings will further improve combined

company operations and operating leverage

•

Best Practices:

Combined company will leverage best practices of each

company, such as technology/R&D and supply chain expertise

•

World-Class Management Team:

Combined company leadership will be

formed from both companies |

19

Next Steps

•

Teams composed of Momentive & Hexion associates are working

to finalize plans to optimize operations

•

Anticipated closing on October 1, 2010

•

Information will be shared as we move through the planning

process

A TRANSFORMATIONAL MERGER THAT CREATES A NEW MARKET LEADER

IN SPECIALTY CHEMICALS AND MATERIALS |

Creating a Global Leader in Specialty Chemicals and Materials

|