Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - EPOCH HOLDING CORP | a2200111zex-32_1.htm |

| EX-31.2 - EX-31.2 - EPOCH HOLDING CORP | a2200111zex-31_2.htm |

| EX-23.1 - EX-23.1 - EPOCH HOLDING CORP | a2200111zex-23_1.htm |

| EX-31.1 - EX-31.1 - EPOCH HOLDING CORP | a2200111zex-31_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial Statements and Supplementary Data.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Fiscal Year Ended June 30, 2010 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Transition Period from to |

||

Commission File Number 1-9728

EPOCH HOLDING CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

20-1938886 (I.R.S. Employer Identification No.) |

640 Fifth Avenue, New York, NY 10019

(Address of Principal Executive Offices), (Zip Code)

(212) 303-7200

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock, $0.01 per share par value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in rule 12b-2 of the Exchange Act. (Check one).

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not Check if a Smaller Reporting Company) |

Smaller reporting company o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the proceeding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of December 31, 2009, the last trading day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common stock held by nonaffiliates of the registrant was approximately $138.5 million, computed by reference to the closing price of $10.45 on the NASDAQ Global Select Market on that day.

As of September 2, 2010, there were 22,768,522 shares of the registrant's common stock, $.01 par value per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated herein by reference into the Form 10-K as indicated:

| Document | Part of Form 10-K into Which Incorporated | |

|---|---|---|

| Company's Definitive Proxy Statement for the 2010 Annual Meeting of Shareholders |

Part III |

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED JUNE 30, 2010

TABLE OF CONTENTS

2

Forward-Looking Statements

Certain information included, or incorporated by reference in this Annual Report on Form 10-K and other materials filed or to be filed by Epoch Holding Corporation ("Epoch" or the "Company") with the United States Securities and Exchange Commission (the "SEC") contain statements that may be considered forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking words such as "may," "might," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "potential" or "continue," and the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about the Company, may include projections of the Company's future financial performance based on the Company's anticipated growth strategies and trends in the Company's business. These statements are only predictions based on the Company's current expectations and projections about future events. There are important factors that could cause the Company's actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the risks and uncertainties outlined in Item 1A. "Risk Factors."

These risks and uncertainties are not exhaustive. Other sections of this Annual Report on Form 10-K may include additional factors which could adversely impact the Company's business and financial performance. Moreover, the Company operates in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for the Company's management to predict all risks and uncertainties, nor can the Company assess the impact of all factors on the Company's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Although the Company believes the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, level of activity, performance or achievements. Moreover, neither the Company nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The Company is under no duty to update any of these forward-looking statements after the date of this Annual Report on Form 10-K, nor to conform the Company's prior statements to actual results or revised expectations, and the Company does not intend to do so.

Forward-looking statements include, but are not limited to, statements about the Company's:

- •

- business environment,

- •

- expectations with respect to the economy, securities markets, the market for mergers and

acquisitions activity, the market for asset management activity and other industry trends,

- •

- competitive position,

- •

- possible or assumed future results of operations and operating cash

flows,

- •

- business strategies and investment policies,

- •

- potential operating performance, achievements, productivity improvements, efficiency and cost

reduction efforts,

- •

- growth strategy,

- •

- expected tax rates,

- •

- strategic relationships,

3

- •

- product development, and

- •

- the effect of future legislation and regulation on the Company.

The Company uses a fiscal year, which ends on June 30. References to "FY 2010," "FY 2009," and "FY 2008" in this document refer to the fiscal years ended June 30, 2010, June 30, 2009, and June 30, 2008, respectively. This Annual Report on Form 10-K may also include "forward-looking statements" which refer to fiscal years subsequent to the historical financial positions and results of operations contained herein. References to future fiscal years also apply to the June 30 year-end. When we use the terms the "Company," "management," "we," "us," and "our," we mean Epoch Holding Corporation, a Delaware Corporation, and its consolidated subsidiaries.

Overview

Epoch Holding Corporation is a holding company headquartered in New York, NY whose sole line of business is investment advisory and investment management services. The operations of the Company are conducted through its wholly owned subsidiary, Epoch Investment Partners, Inc. ("EIP"). EIP is a registered investment adviser under the Investment Advisers Act of 1940, as amended (the "Investment Advisers Act").

EIP is a global asset management firm. The firm's professional investment staff averages over 20 years of industry experience per person.

History

EIP was established and co-founded by Mr. William W. Priest and three experienced investment industry professionals. Mr. Priest has over 40 years of experience in the investment advisory business. He served as co-managing partner of Steinberg, Priest & Sloane Capital Management, LLC ("SPSCM") for three years and, prior to that, as Chairman and CEO of Credit Suisse Asset Management ("CSAM") Americas, and as CEO of its predecessor firm BEA Associates, which he co-founded in 1972. EIP's other co-founders include Timothy Taussig, former Managing Director, Member of the Global Executive Committee for CSAM and Co-Head of Global Marketing for CSAM worldwide; J. Philip Clark, former Managing Director of Sanford C. Bernstein & Co.'s private client and institutional asset management business; and David Pearl, former Managing Director and Senior Portfolio Manager at SPSCM.

4

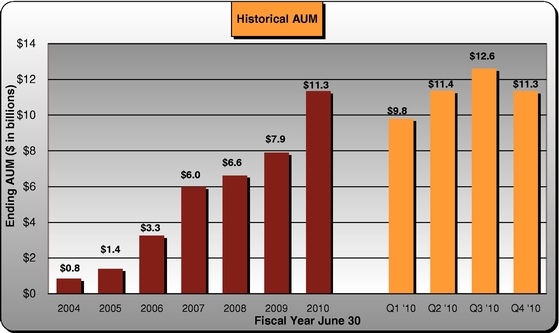

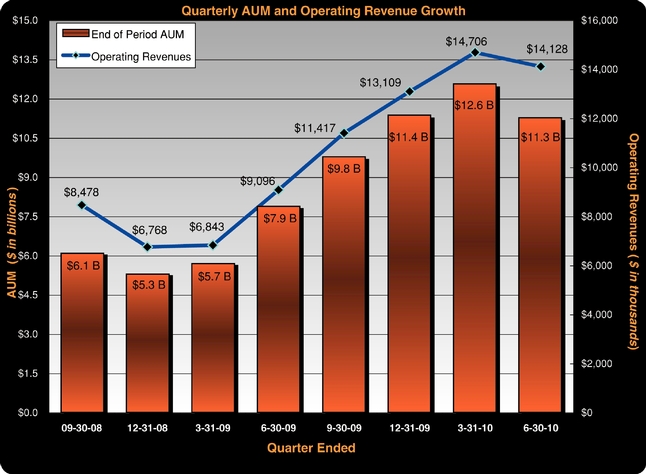

EIP began operations in April 2004 with approximately $0.6 billion in AUM and has grown into a medium-sized asset management firm with $11.3 billion in AUM at June 30, 2010. The chart below depicts the Company's annual AUM growth as well as AUM for the last four fiscal quarters:

The Company's growth reflects long-term investment performance and quality client service, administered across a broad array of financial products, distribution channels, and market exposures. The Company measures relative investment performance by comparing its investment returns to competing products, industry benchmarks and client investment objectives.

Recent Developments and FY 2010 Highlights*

- *

- See Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, for further financial highlights.

The following highlights mark corporate accomplishments and events which transpired during the year ended June 30, 2010:

- (1)

- AUM

at June 30, 2010 was $11.3 billion, a 44% increase from a year ago.

- (2)

- Net

AUM inflows were $2.6 billion. The Company has experienced net AUM inflows every quarter since inception.

- (3)

- The

Company received the following product performance awards:

- •

- The Epoch Global Equity Shareholder Yield Fund ("EPSYX") received the 2009 Lipper Fund Award for the Best Fund over

3 years in the Global Multi-Cap Value Fund category.

- •

- The CI American Value Fund, of which Epoch is the sole sub-advisor, received its fifth consecutive annual

Canadian Investment Award TM, presented by Morningstar, Inc., for "best in class" in the U.S. Equity category.

- (4)

- In October 2009, the Company began occupying an additional 10,000 square feet of office space obtained under a new sublease agreement. The additional space provides for firm expansion needs.

5

- (5)

- The

Company paid a special cash dividend of $0.30 per share in December 2009, in addition to the regular quarterly dividends. In January 2010, the Board

approved an increase in the quarterly dividend rate from $0.03 to $0.05 per share.

- (6)

- The

Board of Directors authorized the repurchase of up to an additional 300,000 shares of its outstanding common stock during the second fiscal quarter. The

Company repurchased approximately 210,000 shares during fiscal year ended June 30, 2010. As of June 30, 2010, the Company has repurchased a cumulative total of 482,401 shares and has

317,599 shares remaining for repurchase under the existing repurchase plan.

- (7)

- In

December 2009, the Company moved its stock exchange listing to the NASDAQ Global Select Market from the NASDAQ Capital Market.

- (8)

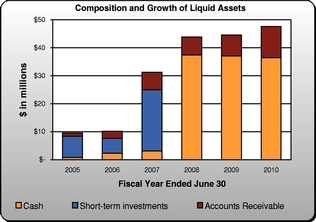

- The Company's balance sheet remains strong. At June 30, 2010, liquid assets—comprising cash, cash equivalents and accounts receivable—were $47.6 million, representing 76% of total assets. The Company continues to operate debt-free.

Investment Philosophy

The Company's investment philosophy is focused on achieving superior risk-adjusted returns by investing in companies that generate free cash flow, have understandable business models, posess transparent financial statements, and are undervalued relative to the investment team's value determinations. Security selection and portfolio construction processes are designed to reduce the likelihood of significant capital losses in declining markets while participating in returns from rising markets.

Investment Process

Our investment process incorporates the following concepts:

- •

- Analyze the Business. Determine the sustainability of the

business, earnings drivers, barriers to entry, and competitive advantages.

- •

- Understand the Cash Flow Structure. Focus on companies

that generate cash earnings and assess the quality and character of those earnings to determine the net cash flow from the business.

- •

- Relate Cash Flow to Enterprise Value. Examine relevant

claims against net cash flow and determine the necessity of these claims to maintain and grow the business. Evaluate how management will use free cash flow. Value the cash flow stream and compare it

to enterprise value to determine the attractiveness of the investment.

- •

- Evaluate Management Quality. Identify management with an

intention and demonstrated ability to create shareholder value.

- •

- Seek Unrecognized Assets. Uncover, where possible, hidden, undervalued or underutilized assets, especially in under-researched small and mid-cap companies.

While the security selection and research methodology is the same for all of the Company's equity strategies, the portfolio construction process is adaptable to the specific parameters of each client's individual mandate.

Products

EIP earns revenues from managing client accounts under investment advisory and sub-advisory agreements. Such agreements provide for fees to EIP as a percentage of AUM. Separate account fees are billed on a quarterly basis, in arrears, generally based on the account's asset value at the end of a quarter. Fees for services performed for mutual funds under advisory and sub-advisory contracts are calculated based upon the daily net asset values of the respective fund, and are generally received in

6

arrears. Advance payments, if received, are deferred and recognized during the periods for which services are provided.

The Company also has certain contracts which allow the Company to earn performance fees in the event that investment returns meet or exceed targeted amounts during a measurement period.

As of June 30, 2010, EIP offered the following investment products to its clients:

- (1)

- U.S. All Cap Value—Comprised of a broad range of U.S. companies with market capitalizations that

resemble stocks in the Russell 3000*, a U.S. Equity index which measures the performance of the 3,000 largest U.S. companies based upon total market capitalization.

- (2)

- U.S. Value—Reflects a selection of equities in U.S. companies with market capitalizations

generally considered comparable to the Russell 1000*, a U.S. Equity index which measures the performance of the 1,000 largest companies in the Russell 3000 Index*.

- (3)

- U.S. Smid (small/mid) Cap Value—Comprises U.S. companies with market capitalizations generally

considered to be comparable to the Russell 2500*, a U.S. Equity index which measures the performance of the 2,500 smallest companies in the Russell 3000 Index*.

- (4)

- U.S. Small Cap Value—Consists of U.S. companies with market capitalizations generally considered

to be comparable to the Russell 2000*, a U.S. Equity index which measures the performance of the 2,000 smallest companies in the Russell 3000 Index*.

- (5)

- U.S. Choice—Uses the same security selection process as our other services but the holdings are

limited to 20 - 30 U.S. equity positions and is fully invested. The benchmark for this product is the Russell 3000 Index*.

- (6)

- International Small Cap—Draws almost all of its holdings from companies outside the U.S., with

"small cap" defined as companies with market capitalization in the bottom 25% of the publicly traded companies in each country where the strategy is applied. MSCI World ex USA Small Cap Index** is the

benchmark for this product.

- (7)

- Global Small Cap—Seeks to capitalize upon the continuing globalization of the world economy by investing in small cap companies in the U.S. and throughout the world. The benchmark for this product is the MSCI World Small Cap Index**.

- *

- Russell

Indices are trademarks of Russell Investments, which are not affiliated with Epoch.

- **

- MSCI

World Indices are trademarks of MSCI Inc., which are not affiliated with Epoch.

- (8)

- Global Choice—Uses the same security selection process as our other services but the holdings

are limited to 20 - 35 global equity positions and is fully invested. The MSCI World Index** is the benchmark for this product.

- (9)

- Global Absolute Return—While this product uses the same security selection process as other

products offered by EIP, its holdings are generally limited to fewer than 30 positions. Individual positions can be as high as 15% and cash is used to control loss exposure. The benchmark for this

product is the MSCI World Index**.

- (10)

- Global Equity Shareholder Yield—Seeks to invest in a diversified portfolio of global equity

securities with a history of attractive dividend yields and positive growth in free cash flow. The primary objective of this product is to seek a high level of income, with capital appreciation as a

secondary investment objective. The MSCI World Index** is the benchmark for this product.

- (11)

- Balanced Portfolios—This product is available primarily to our high net worth investors. The mix of debt and equity securities is tailored to reflect (i) the client's tolerance for risk and (ii) the client's marginal tax rate or other preferences. As a result, the mix can vary among individual clients. The equity components of these portfolios typically reflect EIP's U.S. All Cap equity structure and generally contain 40 - 60 positions, almost all of which are held in

7

other EIP products. The debt component of the portfolio is largely comprised of high quality bonds.

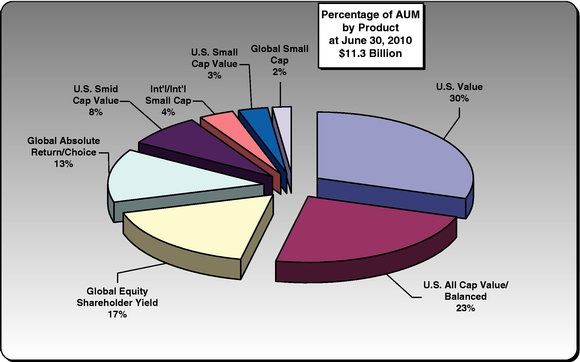

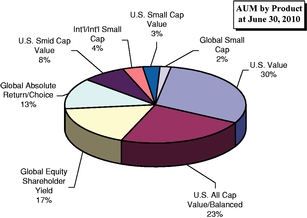

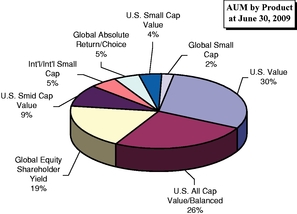

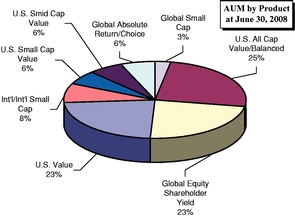

The following chart displays the Company's products as a percentage of AUM as of June 30, 2010:

The table below depicts Epoch's investment products' annual AUM for the past five years, as well as its respective compound annual growth rate for the one, three, and five years ended June 30, 2010:

| |

As of June 30 | Compound Annual Growth Rate(4) |

|||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Product

|

2010 | 2009 | 2008 | 2007 | 2006 | 1 Year | 3 Years | 5 years | |||||||||||||||||

U.S. Value |

$ | 3,403 | $ | 2,340 | $ | 1,499 | $ | 1,155 | $ | 805 | 45.4 | % | 43.4 | % | N/A | ||||||||||

U.S. All Cap Value/Balanced |

2,646 | 2,016 | 1,601 | 1,395 | 787 | 31.3 | % | 23.8 | % | 38.5 | % | ||||||||||||||

Global Equity Shareholder Yield |

1,959 | 1,515 | 1,538 | 1,323 | 219 | 29.3 | % | 14.0 | % | N/A | |||||||||||||||

Global Absolute Return/Choice(1) |

1,462 | 375 | 402 | 259 | 111 | 289.9 | % | 78.1 | % | N/A | |||||||||||||||

U.S. Smid Cap Value |

902 | 749 | 409 | 13 | — | 20.4 | % | 310.9 | % | N/A | |||||||||||||||

U.S. Small Cap Value |

362 | 325 | 423 | (3) | 995 | 661 | 11.4 | % | (28.6 | )% | (8.0 | )% | |||||||||||||

International Small Cap/International |

403 | 396 | 548 | 688 | 373 | 1.8 | % | (16.3 | )% | 8.3 | % | ||||||||||||||

Global Small Cap |

207 | 175 | 214 | 173 | (2) | 297 | 18.3 | % | 6.2 | % | 26.9 | % | |||||||||||||

Total AUM |

$ | 11,344 | $ | 7,891 | $ | 6,634 | $ | 6,001 | $ | 3,253 | 43.8 | % | 23.7 | % | 51.9 | % | |||||||||

- (1)

- Includes

U.S. Choice and Global Choice.

- (2)

- In

the year ended June 30, 2007, approximately $150 million of AUM transferred from the Global Small Cap product to the U.S. Small Cap Value

product.

- (3)

- In

the year ended June 30, 2008, approximately $360 million of AUM transferred from the U.S. Small Cap Value product to the U.S. Smid Cap

Value product.

- (4)

- The compound annual growth rate is calculated by taking the nth root of the total percentage growth rate, where n equals the number of years in the period being considered.

8

Product Development

We have developed several products since our inception. Continued product development has stemmed from our investment team's skill and market knowledge, as well as our responsiveness to client and market demands. We will only launch a new product if we believe that it can add value to a client's investment portfolio, or may be attractive to our clients in the future. In certain instances we may incubate a product using our own capital, in order to test and refine the investment strategy and process before introducing the product to the marketplace.

Performance Highlights

The following table shows each product's composite returns, net of management fees, for the six months, one, three and five years ended June 30, 2010 and from the product's inception date, compared to their applicable benchmarks:

| |

|

Returns*(2) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Product

|

Inception Date(1) |

6 months | 1 Year | 3 Years | 5 Years | Since Inception |

||||||||||||

U.S. All Cap Value |

31-Jul-94 | (7.2 | )% | 12.0 | % | (8.4 | )% | 0.0 | % | 9.5 | % | |||||||

Russell 3000 |

(6.1 | )% | 15.7 | % | (9.5 | )% | (0.5 | )% | 7.3 | % | ||||||||

Russell 3000 Value |

(4.8 | )% | 17.6 | % | (12.1 | )% | (1.6 | )% | 7.9 | % | ||||||||

U.S. Value |

31-Jul-01 |

(7.8 |

)% |

9.8 |

% |

(7.5 |

)% |

1.1 |

% |

3.3 |

% |

|||||||

Russell 1000 |

(6.4 | )% | 15.2 | % | (9.5 | )% | (0.6 | )% | 0.6 | % | ||||||||

Russell 1000 Value |

(5.1 | )% | 16.9 | % | (12.3 | )% | (1.6 | )% | 1.6 | % | ||||||||

U.S. Smid Cap Value |

31-Aug-06 |

(4.2 |

)% |

17.8 |

% |

(8.1 |

)% |

N/A |

(1.9 |

)% |

||||||||

Russell 2500 |

(1.7 | )% | 24.0 | % | (8.0 | )% | N/A | (1.8 | )% | |||||||||

Russell 2500 Value |

(1.6 | )% | 26.5 | % | (9.3 | )% | N/A | (3.5 | )% | |||||||||

U.S. Small Cap Value |

31-Dec-02 |

(4.0 |

)% |

15.1 |

% |

(8.8 |

)% |

(0.4 |

)% |

6.2 |

% |

|||||||

Russell 2000 |

(2.0 | )% | 21.5 | % | (8.6 | )% | 0.4 | % | 7.8 | % | ||||||||

Russell 2000 Value |

(1.6 | )% | 25.1 | % | (9.8 | )% | (0.5 | )% | 7.8 | % | ||||||||

U.S. Choice |

30-Apr-05 |

(6.2 |

)% |

17.5 |

% |

(8.5 |

)% |

0.6 |

% |

1.7 |

% |

|||||||

Russell 3000 |

(6.1 | )% | 15.7 | % | (9.5 | )% | (0.5 | )% | 0.4 | % | ||||||||

International Small Cap |

31-Jan-05 |

(7.2 |

)% |

17.1 |

% |

(11.1 |

)% |

5.5 |

% |

5.8 |

% |

|||||||

MSCI World ex USA Small Cap (Net) |

(6.3 | )% | 15.7 | % | (12.4 | )% | 1.7 | % | 2.0 | % | ||||||||

Global Small Cap |

31-Dec-02 |

(5.6 |

)% |

14.5 |

% |

(8.0 |

)% |

3.4 |

% |

9.6 |

% |

|||||||

MSCI World Small Cap (Net) |

(3.7 | )% | 21.0 | % | (9.7 | )% | 1.7 | % | 10.8 | % | ||||||||

Global Choice |

30-Sep-05 |

(10.1 |

)% |

12.2 |

% |

(7.0 |

)% |

N/A |

4.7 |

% |

||||||||

MSCI World (Net) |

(9.8 | )% | 10.2 | % | (11.5 | )% | N/A | (1.3 | )% | |||||||||

Global Absolute Return |

31-Dec-01 |

(10.2 |

)% |

9.9 |

% |

(6.7 |

)% |

2.5 |

% |

8.1 |

% |

|||||||

MSCI World (Net) |

(9.8 | )% | 10.2 | % | (11.5 | )% | 0.1 | % | 2.4 | % | ||||||||

Global Equity Shareholder Yield |

31-Dec-05 |

(7.2 |

)% |

12.1 |

% |

(7.6 |

)% |

N/A |

1.6 |

% |

||||||||

MSCI World (Net) |

(9.8 | )% | 10.2 | % | (11.5 | )% | N/A | (2.1 | )% | |||||||||

- *

- Index

and product returns assume dividend reinvestment. Product returns are net of management fees.

- (1)

- Epoch Investment Partners became a registered investment adviser under the Investment Advisers Act of 1940 in June 2004. Performance from April 2001 through May 2004 is for Epoch's investment team and accounts while at Steinberg Priest & Sloane Capital Management, LLC. For

9

the period July 1994 through March 2001, Chief Investment Officer William W. Priest managed the accounts while at Credit Suisse Asset Management and was the only individual responsible for selecting the securities to buy and sell.

- (2)

- Past performance is not indicative of future results.

Distribution Channels

EIP provides investment advisory and investment management services to clients including corporations, mutual funds, endowments, foundations and high net worth individuals. Our assets under management are distributed through multiple channels, including intermediaries such as investment consultants and sub-advisory relationships.

Our institutional sales efforts include further developing relationships with institutional consultants, and also establishing direct relationships with institutional clients.

We manage sub-advisory mandates that provide access to market segments that we would not otherwise serve. For example, we currently serve as sub-advisor to mutual funds offered by major financial institutions in retail channels. Such mandates are attractive to us as we have chosen not to build the large team of sales professionals typically required to service those channels. We approach the servicing of those sub-advisory relationships in a manner similar to our approach with other large institutional account clients.

We service the high net worth channel both directly and through third party intermediaries, such as wealth advisers who utilize our investment strategies in investment programs they construct for their clients. During the current fiscal year, the Company raised the minimum separate account size substantially for this channel.

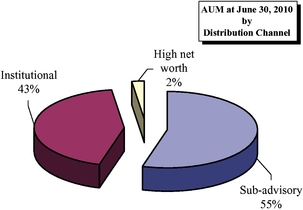

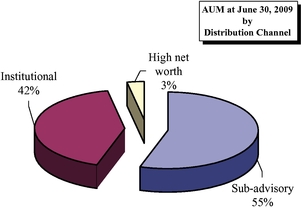

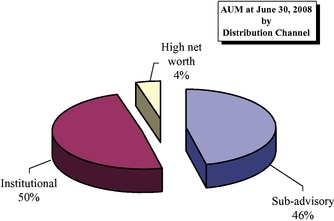

The following table provides information regarding the composition of our AUM and respective compound annual growth rate by distribution channel for the past five years, as well as its respective compound annual growth rate for the one, three, and five years ended June 30, 2010:

| |

As of June 30 | Compound Annual Growth Rate | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Distribution Channel

|

2010 | 2009 | 2008 | 2007 | 2006 | 1 year | 3 years | 5 years | |||||||||||||||||

Sub-advisory |

$ | 6,183 | (1) | $ | 4,332 | $ | 3,080 | $ | 2,876 | $ | 1,715 | 42.7 | % | 29.1 | % | 46.3 | % | ||||||||

Institutional |

4,915 | (1) | 3,309 | 3,263 | (2) | 2,765 | 1,245 | 48.5 | % | 21.1 | % | 84.0 | % | ||||||||||||

High Net Worth |

246 | 250 | 291 | (2) | 360 | 293 | (1.6 | )% | (11.9 | )% | (0.1 | )% | |||||||||||||

Total AUM |

$ | 11,344 | $ | 7,891 | $ | 6,634 | $ | 6,001 | $ | 3,253 | 43.8 | % | 23.7 | % | 51.9 | % | |||||||||

- (1)

- During

the three months ended December 31, 2009, approximately $820 million of AUM previously classified as Institutional was reclassified to

Sub-advisory in conjunction with the adoption of the Epoch Funds by New York Life Investment Management.

- (2)

- During the fiscal year ended June 30, 2008, approximately $28 million of AUM in separate accounts within the high net worth distribution channel transferred to the Epoch Global Absolute Return Fund, LLC, and approximately $8 million transferred to the Epoch U.S. All Cap Equity Fund, both of which are included within the Institutional distribution channel above.

Strategic Relationship

On July 9, 2009, EIP entered into a strategic relationship with New York Life Investments, whereby the MainStay Group of Funds adopted the Company's family of mutual funds (the "Epoch Funds"). The transaction was approved by the Board of Directors of the Epoch Funds and

10

subsequently approved by the shareholders of the Epoch Funds at a special meeting on October 30, 2009. The adoption of the Epoch Funds by New York Life Investments' MainStay Group of Funds was completed in November 2009. EIP continues to be responsible for the day-to-day investment management of the funds through a sub-advisory relationship, while MainStay Investments ("MainStay"), the retail distribution arm of New York Life Investments, is responsible for the distribution and administration of the funds. Each former Epoch Fund is now co-branded as a "MainStay Epoch" Fund.

In addition to an existing sub-advisory relationship between EIP and New York Life Investments for certain funds, and the adoption of the Epoch Funds indicated above, EIP and New York Life Investments have entered into an arrangement wherein, among other things, EIP and an affiliate of New York Life Investments have established a distribution and administration relationship with respect to certain separately managed account and unified managed account products, and for a period of three years New York Life Investments agrees to pay certain additional base fees and meet minimum distribution targets. For the fiscal year ended June 30, 2010, New York Life Investment Management, through the MainStay Epoch Funds and other funds sub-advised by EIP, accounted for approximately 16% of consolidated operating revenues. The Company's services and relationship with New York Life Investment Management is considered important to the Company's ongoing growth strategy.

Competitive Strengths

We are a global asset management firm with accomplished and experienced professionals that combines in-house research and insight in pursuing superior risk-adjusted performance returns for our clients. Our team of senior managers, including our investment professionals, marketing and sales directors, and client service personnel, averages over 20 years of industry experience per person. All of our employees are shareholders; accordingly our employees' interests are aligned with those of our clients and shareholders.

Our overall investment philosophy is focused on achieving superior risk-adjusted returns by investing in companies that generate free cash flow and are undervalued relative to our investment team's value determinations. We have a track record of achieving superior risk-adjusted investment returns over the longer term across our key investment strategies. As of the fiscal year ended June 30, 2010, most of our products have outperformed their respective benchmarks for the past three and five year periods, as well as since product inception.

We foster an open, collaborative culture that encourages the sharing of ideas and insights. We believe that sharing ideas and analyses across investment teams allows us to leverage our knowledge of markets and industries across the globe. Additionally, this collaboration enables us to readily implement ideas across our range of investment products.

We are a global firm in both product set and in distribution. We offer a set of investment strategies that allow our clients to access investment opportunities worldwide. Our assets under management are distributed through multiple channels, including intermediaries such as investment consultants and sub-advisory relationships. Our distribution model allows us to achieve significant leverage from our focused sales force and client service infrastructure.

We are committed to growing and reinvesting in our business. A strong capital base is essential to developing our business. Our balance sheet continues to reflect significant liquidity sufficient to weather adverse market conditions and to enable us to take advantage of growth opportunities.

Competition

The investment advisory and investment management business is highly competitive. The Company continuously encounters competitors in the marketplace who offer similar products and services. We

11

compete with a large number of global and U.S. investment advisors, commercial banks, broker/dealers, insurance companies and other financial institutions. According to Pensions & Investments, a publication covering the money management industry, the Company ranked as the 202nd largest asset management firm worldwide as of December 31, 2009, up from a ranking of 353rd at December 31, 2008.

The Company competes primarily on the basis of investment philosophy, performance, product features, range of products, and client service. We believe that our investment style, investment products, and distribution channels enable us to compete effectively in our industry. We also believe that being an independent asset management firm is a competitive advantage, enabling our business model to avoid conflicts that are inherent within institutions that both distribute and manage investment products. While the Company believes it will continue to be successful in growing its AUM, it may be necessary to expend additional resources to compete effectively.

Growth Strategy

As the Company enters its seventh full year of operations, it remains focused on generating superior risk-adjusted performance returns, providing the highest level of client service, and continuing to generate operating margins consistent with leading firms within our industry. Its growth strategy includes the development of distribution channels through which to offer its broad array of products. These efforts include further developing relationships with investment advisory consultants, establishing direct relationships with institutional clients, initiating managed accounts with third party institutions, and maintaining strong advisory and sub-advisory relationships.

The Company routinely evaluates its strategic position and maintains a disciplined acquisition and alliance effort that seeks complementary products or new products which could benefit clients. While the Company continues to actively seek such opportunities, there can be no assurance that acquisitions will be identified and consummated on terms that are favorable to the Company, its business and its stockholders. Management believes that opportunities are available, but will only act on opportunities that it believes are accretive to the Company's long-term business strategy.

The Company's ability to attract and retain key employees is paramount to the continued success of the business. The Company believes it offers competitive compensation to its employees, including share-based compensation, which the Company believes promotes a common objective with shareholders.

12

Key Performance Indicators

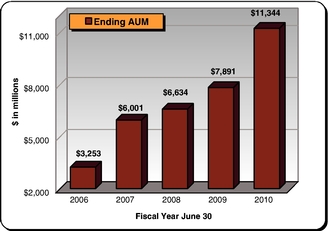

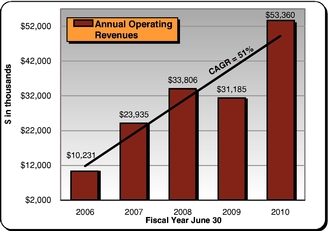

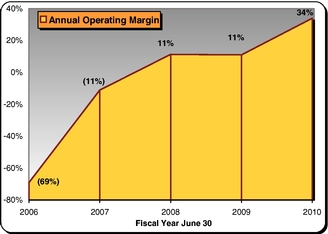

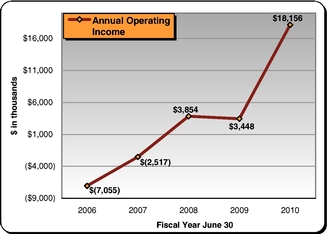

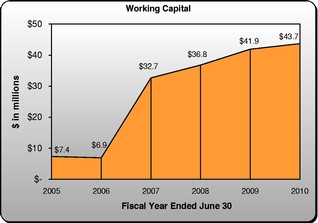

The charts that follow depict the Company's 5-year performance in certain key financial measures:

- 1.

- AUM

- 2.

- Operating

revenues

- 3.

- Operating

margin*

- 4.

- Operating income

- *

- defined as operating income divided by operating revenue.

|

|

|

|

|

Regulation

The Company's business, as well as the financial services industry, is subject to extensive regulation throughout the world. As a matter of public policy, regulatory bodies are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of customers participating in those markets.

In the U.S., the Securities and Exchange Commission (the "SEC") is the federal agency responsible for the administration of the federal securities laws. The Financial Industry Regulatory Authority ("FINRA") and the National Futures Association are voluntary, self-regulatory bodies composed of members that have agreed to abide by the respective bodies' rules and regulations. To the extent that an investment adviser is a "fiduciary" under the Employment Retirement Act of 1974 ("ERISA") with respect to benefit plan clients, it is subject to ERISA, and to regulations promulgated

13

thereunder. ERISA and applicable provisions of the Internal Revenue Code impose certain duties on persons who are fiduciaries under ERISA and prohibit certain transactions involving ERISA plan clients.

In addition to the extensive regulation of our asset management business in the U.S. we are also subject to regulation internationally in a number of jurisdictions.

Each of these regulatory organizations may examine the activities of, and may expel, fine and otherwise discipline, member firms and their employees. The laws, rules and regulations comprising this framework of regulation and the interpretation and enforcement of existing laws, rules and regulations are constantly changing. The effect of any such change cannot be predicted and may impact the manner of operation and profitability of the Company.

EIP, the Company's sole operating subsidiary, is registered as an investment adviser with the SEC. As a registered investment adviser, EIP is subject to the requirements of the Investment Advisers Act and the SEC's regulations thereunder. Requirements relate to, among other things, principal transactions between an adviser and advisory clients, and include disclosure obligations, record keeping and reporting obligations, and general anti-fraud prohibitions. The Company is also subject to the filing and reporting obligations of the Securities Act of 1933, as amended (the "Securities Act") and the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Regulators are empowered to conduct administrative proceedings that can result in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion of an investment adviser or its directors, officers or employees.

The preceding descriptions of the regulatory and statutory provisions applicable to the Company and EIP are not complete and are qualified in their entirety by reference to their respective statutory or regulatory provisions. Any change in applicable laws or regulations may have a material effect on the Company's business, prospects and operations.

Geographic Information

We have clients in several countries outside the United States, including Canada, United Kingdom, Japan, and Australia. The Company has expanded its international distribution network through both direct sales to clients and sales through intermediaries, such as investment consultants, private banks, asset managers, and third party distributors. One of our key priorities is to continue to expand our global distribution network and partnerships.

The following table displays the Company's operating revenues by geographic region for the fiscal years ended June 30, 2010, 2009, and 2008, respectively. These amounts are aggregated based upon the domicile of the customer's corporate headquarters.

Revenues ($ in thousands)

|

June 30 2010 |

% of Total |

June 30 2009 |

% of Total |

June 30 2008 |

% of Total |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

United States |

$ | 37,771 | 71 | % | $ | 24,349 | 78 | % | $ | 27,203 | 80 | % | ||||||||

Canada |

7,020 | 13 | % | 5,115 | 17 | % | 6,030 | 18 | % | |||||||||||

Europe |

4,709 | 9 | % | 1,304 | 4 | % | 571 | 2 | % | |||||||||||

Asia/Australia |

3,860 | 7 | % | 417 | 1 | % | 2 | NM | ||||||||||||

Total revenues |

$ | 53,360 | 100 | % | $ | 31,185 | 100 | % | $ | 33,806 | 100 | % | ||||||||

NM—not meaningful

Employees

As of June 30, 2010, the Company employed 52 full-time employees, including 20 investment management, research and trading professionals, 11 marketing and client service professionals and 21 operations and business management professionals. None of our employees are subject to any collective bargaining agreements.

14

Available Information

Reports the Company files electronically with the SEC via the SEC's Electronic Data Gathering, Analysis and Retrieval system ("EDGAR") may be accessed through the internet. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, at www.sec.gov.

The Company maintains a website which contains current information on operations and other matters. The website address is www.eipny.com. Through the Investor Relations section of our website, and the "Financial Information" tab therein, we make available, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statement, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Also available free of charge on our website within the Investors Relations section, and the "Corporate Governance" tab therein, is our Code of Ethics and Business Conduct and charters for the Audit, Nominating/Corporate Governance, and the Compensation Committees of our Board of Directors.

As an investment management firm, risk is an inherent part of our business. Capital markets, by their nature, are prone to uncertainty and expose participants to a variety of risks. While we devote significant resources across all of our operations to identify, measure, monitor, manage and analyze market and operating risk, our business, financial condition, operating results, or share price could be materially adversely affected by any of the following risks. Additionally, other risks and uncertainties that we do not presently consider to be material or of which we are not presently aware may become important factors that affect us in the future. You should carefully consider the risks described below before making an investment decision.

Our results of operations and financial condition could be adversely affected by negative performance of the securities markets.

Our investment advisory and investment management business would be expected to generate lower revenues in a market or general economic downturn. Under our asset management business arrangements, investment advisory fees we receive typically are based on the market value of AUM. Accordingly, a decline in the prices of securities would be expected to cause our revenue and net income to decline by:

- •

- causing the value of our AUM to decrease, which would result in lower investment advisory fees, and/or

- •

- causing some of our clients to withdraw funds from our asset management business in favor of investments they perceive as offering greater opportunity or lower risk, which also would result in lower investment advisory fees.

Because of market fluctuations, there may not be a consistent pattern in our financial results from period to period. This may make it difficult for us to achieve steady earnings growth on a quarterly basis and may cause the price of our common stock to decline.

We may experience significant fluctuations in revenue and profits. Because our revenues are based on the value of AUM, a decline in the value of AUM would adversely affect our revenues. Because of

15

market fluctuations, it may be difficult for us to achieve steady earnings growth on a quarterly basis, which could lead to large adverse movements in the price of our common stock or increased volatility in our stock price.

Investment performance affects our AUM related to existing clients and is one of the most important factors in retaining clients and competing for new asset management business. Poor investment performance could impair our revenue and growth because:

- •

- existing clients might withdraw funds from our asset management business in favor of better performing products, which

would result in lower investment advisory fees;

- •

- third-party financial intermediaries, advisers or consultants may rate our products poorly, which may result in client

withdrawals and reduced asset flows from these third parties or their clients; or

- •

- firms with which we have strategic alliances may terminate such relationships with us, and future strategic alliances may be unavailable.

Our investment style in the asset management business may underperform other investment approaches, which may result in significant client or asset departures or a reduction in AUM.

Even when securities prices are rising, performance can be affected by investment style. Many of the equity investment strategies in our asset management business share a common investment orientation towards fundamental security selection. Our overall investment philosophy is focused on achieving a superior risk-adjusted return by investing in companies that generate free cash flow. We believe this style tends to outperform the market in some market environments and underperform it in others. In particular, a prolonged "growth" environment (i.e., a prolonged period whereby growth stocks outperform value stocks) may cause our investment strategy to go out of favor with some clients, consultants or third-party intermediaries. In combination with poor performance relative to peers, any changes in personnel, extensive periods in particular market environments, or other difficulties, may result in significant client or asset departures or a reduction in AUM.

The significant growth we have experienced since inception may not be indicative of future growth.

Our assets under management have increased from approximately $0.8 billion at June 30, 2004 to approximately $11.3 billion at June 30, 2010, and represents a significant rate of growth that may be difficult to sustain. The growth of our business will depend on, among other things, our success in producing attractive returns in our investment strategies, our ability to expand our distribution capabilities, overall performance of the equity markets, our ability to deal with changing market conditions, our ability to maintain adequate financial and business controls, and our ability to comply with new legal and regulatory requirements.

Because our clients can remove the assets we manage on short notice, we may experience unexpected declines in revenue and profitability.

Our investment advisory and sub-advisory contracts are generally cancellable upon very short notice. Institutional and individual clients, and firms with which we have strategic alliances, can terminate their relationship with use, reduce the aggregate amount of AUM or shift their funds to other types of accounts with different rate structures for a number of reasons—including investment performance, changes in prevailing interest rates and financial market performance. Poor performance relative to other investment management firms may result in decreased inflows into our investment products, increased withdrawals from our investment products, and the loss of institutional or individual accounts or strategic alliances. In addition, the ability to terminate relationships may allow clients to renegotiate for lower fees paid for asset management services.

16

In addition, in the U.S., as required by the Investment Advisers Act, each of our investment advisory contracts with the mutual funds we advise or sub-advise automatically terminates upon its "assignment," or transfer of our responsibility for fund management. Each of our other investment advisory contracts subject to the provisions of the Investment Advisers Act, as required by this act, provides that the contract may not be "assigned" without the consent of the customer. A sale of a sufficiently large block of shares of our voting securities or other transactions could be deemed an "assignment" in certain circumstances. An assignment, actual or constructive, will trigger these termination provisions and could adversely affect our ability to continue managing these client accounts.

To the extent that a technical "assignment" of investment advisory contracts arises, we will take the necessary steps to provide clients an opportunity to consent to the continuation of their advisory agreements. Such new agreements may need approval by the stockholders of the respective funds. In the event that any of these clients do not consent to a renewal of their agreement, we could lose AUM, which would result in a loss of revenue.

Fluctuations in foreign currency exchange rates could lower our net income or negatively impact the portfolios of our clients and may affect the levels of our AUM.

Although most portfolios are in U.S. dollar base currency, certain client portfolios are invested in securities denominated in foreign currencies. Foreign currency fluctuations can adversely impact investment performance for a client's portfolio. Accordingly, foreign currency fluctuations may affect the levels of our AUM. As our AUM includes assets that are denominated in currencies other than U.S. dollars, an increase in the value of the U.S. dollar relative to those non-U.S. currencies may result in a decrease in the dollar value of our AUM, which, in turn, would result in lower U.S. dollar denominated revenue in our business. Additionally, while this risk could be limited by foreign currency hedging, some risks cannot be hedged and there is no guarantee that our hedging activity would be successful.

Access to clients through intermediaries is important to our asset management business, and reductions in referrals from such intermediaries or poor reviews of our products or our organization by such intermediaries could materially reduce our revenue and impair our ability to attract new clients.

Our ability to market its services relies, in part, on receiving mandates from the client base of international and regional securities firms, banks, insurance companies, defined contribution plan administrators, investment consultants and other intermediaries. To an increasing extent, our business uses referrals from accountants, lawyers, financial planners and other professional advisers. The inability to have this access could materially adversely affect our business. In addition, these intermediaries review and evaluate our products and our organization. Poor reviews or evaluations of either the particular products or of our Company may result in client withdrawals or an inability to attract new assets through such intermediaries.

Some members of management are critical to our success, and the inability to attract and retain key employees could compromise our future success.

If key employees were to leave the firm, whether to join a competitor or otherwise, we may experience a decline in revenue or earnings, which may have an adverse effect on our financial position. Loss of key employees may occur due to perceived opportunity for promotion, increased compensation, work environment or other individual reasons, some of which may be beyond our control.

Except for our CEO, there are no employment agreements with any other key employees. The loss of services of one or more key employees, or failure to attract, retain and motivate qualified personnel

17

could negatively impact the business, financial condition, results of operations and future prospects. As with other asset management businesses, future performance depends to a significant degree upon the continued contributions of certain officers, portfolio managers and other key marketing, client service and management personnel. There is substantial competition for these types of skilled personnel. In order to attract or retain key personnel, we may be required to increase compensation. Compensation levels in the investment management industry are highly competitive and can fluctuate significantly from year to year.

Our reputation is critical to our success.

As a financial services firm, we depend, to a large extent, on our relationships with our clients and our reputation for integrity and high-caliber professional services. Any damage to our reputation could impede our ability to attract and retain clients and key personnel, and lead to a reduction in the amount of our assets under management.

Additionally, there have been a number of highly publicized cases involving fraud or other misconduct by employees in the financial services industry, and we run the risk that employee misconduct could occur in our business, as well. For example, misconduct by employees could involve the improper use or disclosure of confidential information, which could result in regulatory sanctions and serious reputational or financial harm. In our business, we have discretion to trade client assets on the client's behalf and must do so acting in the best interest of the client. As a result, we are subject to a number of obligations and standards, and the violation of those obligations or standards may adversely affect the Company's clients and the Company. We have adopted and implemented a number of insider trading, code of ethics, and other related policies and procedures to address such obligations and standards. It is not always possible to deter employee misconduct, and the precautions we take to detect and prevent this activity may not be effective in all cases.

We derive more than 10% of its operating revenue from one client.

Pursuant to a strategic relationship with New York Life Investment Management, EIP is the sub-advisor of several mutual funds within New York Life Investment Management's MainStay group of funds. As such, New York Life Investment Management accounted for approximately 16% of revenues for FY 2010. A loss of this client could negatively impact our operating revenues.

Changes in fee levels or asset mix could reduce revenues and margins.

Our profit margins and net income are dependent, in significant part, on our ability to maintain current fee levels for the products that we offer. There has been a trend towards lower fees in some segments of the asset management industry and no assurances can be given that we will be able to maintain our current fee structure. Although our investment management fees vary from product to product, we compete primarily on the basis of our performance and not on the level of our investment management fees relative to those of our competitors. In order to maintain our fee structure in a competitive environment, we must be able to continue to provide clients with investment returns and client service that incentivize our clients to pay our fees. Additionally, a shift in the mix in our assets under management from higher revenue-generating assets to lower revenue-generating assets may result in a decrease in revenues even if our aggregate level of assets under management remains unchanged or increases.

Other operational risks may disrupt our business, result in regulatory action against us, or limit our growth.

Our business is dependent on communications and information systems, including those of our vendors. Any failure or interruption of these systems, whether caused by fire, other natural disaster, power or telecommunications failure, act of terrorism or war or otherwise, could materially adversely

18

affect our operating results. Although we have back-up systems in place, our back-up procedures and capabilities in the event of a failure or interruption may not be adequate.

We rely heavily on our financial, accounting, trading, compliance and other data processing systems. If any of these systems do not operate properly or are disabled, we could suffer financial loss, a disruption of our business, liability to its clients, regulatory intervention or reputational damage. The inability of our systems to accommodate an increasing volume of transactions could also constrain our ability to expand our businesses. We expect that we will need to continue to upgrade and expand these capabilities in the future to avoid disruption of, or constraints on, our operations.

We may be exposed to data security risks.

A failure to safeguard the integrity and confidentiality of client data from the infiltration by an unauthorized user that is either stored on or transmitted between our information systems or to other third party service provider systems may lead to modifications or theft of critical and sensitive data pertaining to our clients. The costs incurred to correct client data and prevent further unauthorized access could be extensive.

Sales of a substantial number of shares of our common stock may adversely affect the market price of our common stock.

Sales of a substantial number of shares of our common stock in the public market, or the perception that such sales could occur, could adversely affect the market price of our common stock.

Various factors may prevent the declaration and payment of common stock dividends.

We began to pay a quarterly cash dividend, commencing in the quarter ended December 31, 2007. However, the payment of dividends in the future is subject to the discretion of our Board of Directors, and various other factors may prevent us from paying dividends. Our Board of Directors will take into account such matters as general business conditions, our financial results, and legal or regulatory restrictions.

We may pursue acquisitions or joint ventures that could present unforeseen integration obstacles or costs and could dilute the stock ownership of our stockholders.

We routinely assess our strategic position and may seek acquisitions or other transactions to further enhance our competitive position. As part of our long-term business strategy, we may pursue joint ventures and other transactions aimed at expanding the geography and scope of our operations. We expect to explore partnership opportunities that we believe to be attractive. If we are not correct when we assess the value, strengths and weaknesses, liabilities and potential profitability of acquisition candidates or are not successful in integrating the operations of the acquired business, the success of the combined business could be compromised.

Acquisitions and joint ventures involve a number of risks and present financial, managerial and operational challenges, including potential disruption of our ongoing business and distraction of management, difficulty with integrating personnel and financial and other systems, hiring additional management and other critical personnel and increasing the scope, geographic diversity and complexity of our operations. Our clients may react unfavorably to our acquisition and joint venture strategy, we may not realize any anticipated benefits from acquisitions, and may be exposed to additional liabilities of any acquired business or joint venture, any of which could materially adversely affect our revenue and results of operations. In addition, future acquisitions or joint ventures may involve the issuance of additional shares of our common stock, which would dilute our existing ownership.

19

Certain changes in accounting and/or financial reporting standards issued by the Financial Accounting Standards Board ("FASB"), the SEC or other standard-setting bodies could have a material impact on our financial position or results of operations.

We are subject to the application of U.S. generally accepted accounting principles ("GAAP"), which periodically are revised and/or expanded. As such, we periodically are required to adopt new or revised accounting and/or financial reporting standards issued by recognized accounting standard setters or regulators, including the FASB and the SEC. It is possible that future requirements, including the recently proposed implementation of International Financial Reporting Standards ("IFRS"), could change our current application of GAAP, resulting in a material impact on our financial position or results of operations.

We face strong competition from financial services firms, many of whom have the ability to offer clients a wider range of products and services than we can offer, which could lead to pricing pressures that could materially adversely affect our revenue and profitability.

The financial services industry is intensely competitive and we expect it to remain so. In addition to performance, we compete on the basis of a number of factors including the quality of our employees, transaction execution, our products and services, innovation, reputation and price. We believe that we may experience pricing pressures in the future as some of our competitors seek to obtain increased market share by reducing fees.

Any event that negatively affects the asset management industry could have a material adverse impact on us.

Any event affecting the asset management industry that results in a general decrease in AUM or a significant general decline in the number of advisory clients or accounts could negatively impact revenues. Future growth and success depends, in part, upon favorable market conditions and the growth of the asset management industry.

Extensive regulation of our business limits our activities and results in ongoing exposure to the potential for significant penalties, including fines or limitations on our ability to conduct its business.

The financial services industry is subject to extensive regulation. We are subject to regulation by governmental and self-regulatory organizations in the jurisdictions in which we operate around the world. Many of these regulators, including U.S. and non-U.S. government agencies and self-regulatory organizations, as well as state securities commissions in the U.S., are empowered to conduct administrative proceedings that can result in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion of an investment adviser. The requirements imposed by our regulators are designed to ensure the integrity of the financial markets and to protect customers and other third parties who deal with us and are not designed to protect our stockholders. Consequently, these regulations often serve to limit our activities, including customer protection and market conduct requirements.

We face the risk of significant intervention by regulatory authorities, including extended investigation and surveillance activity, adoption of costly or restrictive new regulations and judicial or administrative proceedings that may result in substantial penalties. In addition, the regulatory environment in which we operate is subject to modifications and further regulation. New laws, regulations, or changes in the enforcement of existing laws or regulations applicable to our Company and our clients may also adversely affect our business, and our ability to function in this environment will depend on our ability to constantly monitor and react to these changes. In addition, the regulatory environment in which our clients operate may impact our business. For example, changes in antitrust

20

laws or the enforcement of antitrust laws could affect the level of mergers and acquisitions activity and changes in state laws may limit investment activities of state pension plans.

Instances of criminal activity and fraud by participants in the asset management industry, disclosures of trading and other abuses by participants in the financial services industry, and the recent massive governmental intervention and investment in the financial markets and financial firms have lead the U.S. government and regulators to increase the rules and regulations governing, and oversight of, the U.S. financial system. The cumulative effect of these actions may result in increased expenses, or lower management fees, and therefore, adversely affect the revenues or profitability of our business.

In addition, financial services firms are subject to numerous conflicts of interests or perceived conflicts, have adopted various policies, controls and procedures to address or limit actual or perceived conflicts and regularly seeks to review and update our policies, controls and procedures. These policies and procedures may result in increased costs, additional operational personnel, and increased regulatory risk. Failure to adhere to our policies and procedures could result in regulatory sanctions or client litigation.

Specific regulatory changes may also have a direct impact on the revenue of our asset management business. In addition to regulatory scrutiny and potential fines and sanctions, regulators continue to examine different aspects of the asset management industry. These regulatory changes and other proposed or potential changes may result in a reduction of revenue associated with asset management.

The financial services industry faces substantial litigation and regulatory risks.

In recent years, the volume of claims and amount of damages claimed in litigation and regulatory proceedings against financial advisers has been increasing. In our business, we make investment decisions on behalf of our clients which could result in substantial losses. This may subject us to the risk of legal liabilities or actions alleging negligent misconduct, breach of fiduciary duty or breach of contract. These risks often may be difficult to assess or quantify and their existence and magnitude often remain unknown for substantial periods of time. Our engagements typically include broad indemnities from our clients and provisions designed to limit our exposure to legal claims relating to our services, but these provisions may not protect us or may not be adhered to in all cases. We may also be subject to claims arising from disputes with employees for alleged discrimination or harassment, among other things. These risks often may be difficult to assess or quantify, and their existence and magnitude often remain unknown for substantial periods of time. As a result, we may incur significant legal expenses in defending against litigation. Substantial legal liability or significant regulatory action against us could materially adversely affect our business, financial condition or results of operations or cause significant reputational harm to us, which could seriously harm our business.

Due to the extensive laws and regulations to which we are subject, management is required to devote substantial time and effort to legal and regulatory compliance issues. In addition, the regulatory environment in which we operate is subject to change. We may be adversely affected as a result of new or revised legislation or regulations or by changes in the interpretation or enforcement of existing laws and regulations.

Item 1B. Unresolved Staff Comments.

None.

The Company's headquarters and operations are located at 640 Fifth Avenue, New York, New York. Business is conducted at a location with approximately 20,000 square feet under long-term leases that expire in September 2015.

21

The Company is also the primary party to another lease in New York City with approximately 8,500 square feet, which expires in November 2010. This property is subleased to an unrelated third party, under a sublease which expired in August 2010.

Management believes the office space utilized by the Company is adequate for its existing operating needs.

From time to time, the Company or its subsidiaries may become parties to claims, legal actions and complaints arising in the ordinary course of business. Management is not aware of any claims which would have a material adverse effect on its consolidated financial position, results of operations, or cash flows.

22

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Company's common stock trades on the NASDAQ Global Select Market under the trading symbol "EPHC."

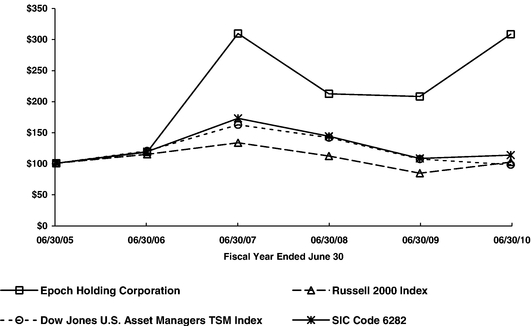

The graph and table that follow compare the performance of an investment in our Common Stock from June 30, 2005 through June 30, 2010 with the Russell 2000 Index, the Dow Jones U.S. Asset Managers Total Stock Market Index*, a composite of publicly traded asset management companies, and an index comprised of public companies with the Standard Industrial Classification ("SIC") Code 6282, Investment Advice. The graph assumes a $100 investment in our Common Stock on June 30, 2005, and an equal investment in each of the selected indices, including reinvestment of dividends, if any. The performance shown in the graph represents past performance and should not be considered an indication of future performance.

- *

- Formerly known as the Dow Jones Asset Manager's Wilshire Index.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN(1)

Among Epoch Holding Corporation, the Russell 2000 Index,

the Dow Jones U.S. Asset Managers TSM Index and SIC Code 6282

- (1)

- $100 invested on 6/30/05 in stock or index, including reinvestment of dividends.

| |

06/30/05 | 06/30/06 | 06/30/07 | 06/30/08 | 06/30/09 | 06/30/10 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Epoch Holding Corporation |

$ | 100.00 | $ | 118.14 | $ | 311.40 | $ | 213.17 | $ | 208.80 | $ | 310.31 | |||||||

Russell 2000 Index |

100.00 | 114.58 | 133.41 | 111.80 | 83.84 | 101.85 | |||||||||||||

Dow Jones U.S. Asset Managers TSM Index |

100.00 | 120.12 | 162.75 | 141.85 | 106.93 | 97.69 | |||||||||||||

SIC Code 6282 |

100.00 | 118.93 | 173.22 | 144.00 | 107.85 | 113.28 | |||||||||||||

23

The foregoing graph shall not be deemed to be "soliciting material" or "filed" or incorporated by reference in any previous or future documents filed by the Company with the SEC under the Securities Act or the Exchange Act, except to the extent that the Company specifically incorporates the information by reference in any such document.

The following table sets forth for the periods indicated the high, low, and quarter-end closing reported sale prices, as well as dividends declared per share for our Common Stock:

| |

Common Stock Prices | |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

High ($) | Low ($) | Closing Price ($) |

Dividends Declared ($) |

||||||||||

FY 2010—Quarter Ended |

||||||||||||||

June 30 |

13.28 | 10.71 | 12.27 | 0.05 | ||||||||||

March 31 |

11.50 | 8.96 | 11.29 | 0.05 | ||||||||||

December 31 |

10.86 | 8.87 | 10.45 | 0.33 | (1) | |||||||||

September 30 |

9.85 | 7.82 | 8.75 | 0.03 | ||||||||||

Year ended June 30, 2010 |

13.28 | 7.82 | 12.27 | 0.46 | ||||||||||

FY 2009—Quarter Ended |

||||||||||||||

June 30 |

8.64 | 6.10 | 8.64 | 0.03 | ||||||||||

March 31 |

7.50 | 4.08 | 6.87 | 0.03 | ||||||||||

December 31 |

10.46 | 6.42 | 7.59 | 0.15 | (2) | |||||||||

September 30 |

11.95 | 8.52 | 10.55 | 0.03 | ||||||||||

Year ended June 30, 2009 |

11.95 | 4.08 | 8.64 | 0.24 | ||||||||||

- (1)

- includes

special dividend of $0.30 per share

- (2)

- includes special dividend of $0.12 per share

The closing price for our common stock as reported on the NASDAQ Global Select Market on September 2, 2010 was $10.33.

As of September 2, 2010 there were approximately 1,046 holders of record of the Company's common stock. Since many of the shares are held in street nominee name, management believes the number of beneficial owners of our common stock is substantially higher.

Dividend Policy:

Regular Dividends on Common Stock

Regular quarterly dividends of $0.03 per share were paid in the first and second quarters of fiscal year 2010. Effective with the third quarter of fiscal year 2010, the Company increased its quarterly dividend rate from $0.03 to $0.05 per share. Approximately $3.6 million of regular dividends were declared and paid during the fiscal year ended June 30, 2010.

Effective with the first quarter of fiscal year 2009, the Company increased its quarterly dividend rate from $0.025 to $0.03 per share. A total of $2.7 million of regular dividends were declared and paid during the fiscal year ended June 30, 2009.

The Company expects regular quarterly cash dividends going forward to be paid in February, May, August and November of each fiscal year. However, the actual declaration of future cash dividends, and the establishment of record and payment dates, is subject to determination by the Board of Directors each quarter after its review of the Company's financial performance, as well as general business conditions, capital requirements, and any legal or regulatory restrictions. The Company may change its dividend policy at any time.

24

Special Cash Dividends

As a result of the Company's strong cash position and debt-free balance sheet, the Board of Directors declared a special cash dividend on November 16, 2009 of $0.30 per share. The dividend was paid on December 15, 2009 to all shareholders of record at the close of business on November 30, 2009. The aggregate dividend payment totaled approximately $6.7 million.

On December 19, 2008, the Board of Directors declared a special cash dividend of $0.12 per share. The dividend was paid on January 15, 2009 to all shareholders of record at the close of business on December 31, 2008. The aggregate dividend payment totaled approximately $2.6 million.

Rule 10b5-1 Plans

Our executive officers may purchase or sell shares of our common stock in the open market from time to time. The Company's management encourages these officers to make these transactions through plans that comply with Exchange Act Rule 10b5-1(c). The Company does not receive any proceeds related to these transactions.

Equity Compensation Plan Information

As of June 30, 2010, there were 3,618,188 shares issued under the Company's Amended and Restated 2004 Omnibus Long-Term Incentive Compensation Plan (the "2004 Plan"). There were 1,881,812 shares available for issuance comprising the following:

Plan Category

|

Number of securities to be issued upon exercise of outstanding options (A) |

Weighted-average exercise price of outstanding options (B) |

Number of securities remaining available for future issuance under equity compensation plan (excluding securities reflected in column (A)) (C) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Equity compensation plans approved by security holders |

572,448 | (1) | $ | 6.17 | 1,309,364 | (2) | ||||

- (1)

- Represents

stock options granted in January 2009 under Epoch's Amended and Restated 2004 Omnibus Long-Term Incentive Compensation Plan. See

Note 13 to the consolidated financial statements for further information regarding the plan.

- (2)

- The 1,309,364 shares may be issued under our Amended and Restated 2004 Omnibus Long-Term Incentive Compensation Plan as options, restricted stock awards or any other form of equity compensation.

Recent Sales of Unregistered Securities

None.

Issuer Purchases of Equity Securities

During the three months ended June 30, 2010, the Company did not repurchase any of its equity securities that are registered pursuant to Section 12 of the Exchange Act.

Item 6. Selected Financial Data.

The table on the following page presents selected financial data of the Company. This data was derived from the Company's consolidated financial statements and reflects the operations and financial position of the Company at the dates and periods indicated.

25

The following selected historical consolidated financial data should be read in conjunction with Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," and Item 8, "Financial Statements and Supplementary Data," on this form 10-K.

Selected Financial Data

(in thousands, except per share, AUM, and employee data)

| |

For the Years Ended June 30, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||

Consolidated Statements of Operations Data(7): |

|||||||||||||||||

Operating revenues: |

|||||||||||||||||