As filed with the Securities and Exchange

Commission on September 8, 2010

Registration No. 333-167865

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

Amendment No. 2

TO

Form S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF

1933

PORTRAIT INNOVATIONS HOLDING

COMPANY

(Exact name of registrant as

specified in its charter)

| |

|

|

|

|

|

Delaware

(State or other jurisdiction

of

incorporation or organization)

|

|

7200

(Primary Standard

Industrial

Classification Code Number)

|

|

26-4495553

(I.R.S. Employer

Identification Number)

|

2016 Ayrsley Town Boulevard, Suite 200

Charlotte, North Carolina 28273

(704) 499-9300

(Address, including zip code,

and telephone number, including area code, of registrant’s

principal executive offices)

John Grosso

President and Chief Executive Officer

Portrait Innovations Holding Company

2016 Ayrsley Town Boulevard, Suite 200

Charlotte, North Carolina 28273

(704) 499-9300

(704) 499-9301 (facsimile)

(Name, address, including zip

code, and telephone number, including area code, of agent for

service)

Copies to:

| |

|

|

Stephen M. Lynch

Patrick S. Bryant

Robinson, Bradshaw & Hinson, P.A.

101 North Tryon Street, Suite 1900

Charlotte, North Carolina 28246

(704) 377-2536

(704) 378-4000 (facsimile)

|

|

Deanna L. Kirkpatrick, Esq.

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

(212) 450-4000

(212) 450-4800 (facsimile)

|

Approximate date of commencement of proposed sale to the

public: As soon as practicable after the

effective date of this registration statement.

If any of the securities being registered on this Form are to be

offered on a delayed or continuous basis pursuant to

Rule 415 under the Securities Act of 1933, check the

following

box. o

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, check

the following box and list the Securities Act registration

statement number of the earlier effective registration statement

for the same

offering. o

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following

box and list the Securities Act registration statement number of

the earlier effective registration statement for the same

offering. o

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following

box and list the Securities Act registration statement number of

the earlier effective registration statement for the same

offering. o

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated

filer, or a smaller reporting company. See the definitions of

“large accelerated filer,” “accelerated

filer” and “smaller reporting company” in Rule

12b-2 of the

Exchange Act. (Check one):

|

|

|

|

| Large

accelerated

filer o

|

Accelerated

filer o

|

Non-accelerated

filer þ

|

Smaller reporting

company o

|

(Do not check if a smaller

reporting company)

CALCULATION

OF REGISTRATION FEE

| |

|

|

|

|

|

|

|

|

|

|

Proposed Maximum

|

|

|

Amount of

|

Title of Each Class of

|

|

|

Aggregate Offering

|

|

|

Registration

|

|

Securities to be Registered

|

|

|

Price(1)(2)

|

|

|

Fee(3)

|

|

Common Stock, $0.01 par value per share

|

|

|

$75,000,000

|

|

|

$5,348.00

|

|

|

|

|

|

|

|

|

|

|

| (1)

|

Includes shares that the underwriters have the option to

purchase. See “Underwriting.”

|

| |

| (2)

|

Estimated solely for the purpose of calculating the registration

fee pursuant to Rule 457(o) under the Securities Act.

|

| |

| (3)

|

Previously paid.

|

The Registrant hereby amends this Registration Statement on

such date or dates as may be necessary to delay its effective

date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall

thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933 or until the Registration

Statement shall become effective on such date as the Commission,

acting pursuant to said Section 8(a), may determine.

The information

in this preliminary prospectus is not complete and may be

changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is

effective. This prospectus is not an offer to sell these

securities and we are not soliciting an offer to buy these

securities in any state where the offer or sale is not

permitted.

|

SUBJECT TO COMPLETION, DATED

SEPTEMBER 8, 2010

PROSPECTUS

Shares

PORTRAIT INNOVATIONS HOLDING

COMPANY

Common Stock

This is an initial public offering

of shares

of common stock of Portrait Innovations Holding Company.

Portrait Innovations Holding Company is

offering shares

of common stock and the selling stockholders identified in this

prospectus are

offering shares

of common stock. We will not receive any proceeds from the sale

of the shares by the selling stockholders. The estimated initial

public offering price is between $

and $ per share.

Prior to this offering, there has been no public market for our

common stock. We have applied for listing of our common stock on

the NASDAQ Global Market under the symbol PTRT.

| |

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

|

Total

|

|

|

|

|

Initial public offering price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds to Portrait Innovations, before expenses

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds to the selling stockholders, before expenses

|

|

$

|

|

|

|

$

|

|

|

Certain of the selling stockholders have granted the

underwriters an option for a period of 30 days to purchase

up

to

additional shares of common stock on the same terms and

conditions set forth above to cover over-allotments, if any.

Investing in our common stock involves a high

degree of risk. See “Risk Factors” beginning on

page 8.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these

securities or passed on the adequacy or accuracy of this

prospectus. Any representation to the contrary is a criminal

offense.

|

|

| J.P.

Morgan |

Wells Fargo Securities |

The underwriters expect to deliver the shares of common stock to

purchasers

on ,

2010.

,

2010

TABLE OF

CONTENTS

| |

|

|

|

|

|

|

|

|

1

|

|

|

|

|

|

8

|

|

|

|

|

|

25

|

|

|

|

|

|

27

|

|

|

|

|

|

28

|

|

|

|

|

|

29

|

|

|

|

|

|

30

|

|

|

|

|

|

32

|

|

|

|

|

|

35

|

|

|

|

|

|

55

|

|

|

|

|

|

70

|

|

|

|

|

|

76

|

|

|

|

|

|

85

|

|

|

|

|

|

87

|

|

|

|

|

|

89

|

|

|

|

|

|

93

|

|

|

|

|

|

95

|

|

|

|

|

|

97

|

|

|

|

|

|

100

|

|

|

|

|

|

101

|

|

|

|

|

|

101

|

|

|

|

|

|

101

|

|

|

|

|

|

F-1

|

|

| EX-23.1 |

We have not authorized anyone to provide any information

other than that contained in this prospectus or in any free

writing prospectus prepared by or on behalf of us or to which we

have referred you. We take no responsibility for, and can

provide no assurance as to the reliability of, any other

information that others may give you. The company, the selling

stockholders and the underwriters are offering to sell, and

seeking offers to buy, shares of common stock only in

jurisdictions where offers and sales are permitted. You should

assume that the information contained in this prospectus is

accurate only as of the date of this prospectus, regardless of

the time of delivery of this prospectus or of any sale of common

stock. Our business, results of operations, financial condition

and prospects may have changed since that date.

The name “Portrait Innovations” is a registered

trademark of our operating subsidiary, Portrait Innovations,

Inc. This prospectus also includes other registered and

unregistered trademarks and service marks of Portrait

Innovations, Inc. Solely for convenience, our trademarks and

tradenames referred to in this prospectus are without

the®

or

tm

symbol, as applicable, but such references are not intended to

indicate, in any way, that we will not assert, to the fullest

extent under applicable law, our rights to these trademarks and

tradenames. Other brand names or trademarks appearing in this

prospectus are the property of their respective owners.

Certain market and industry data and forecasts used throughout

this prospectus were obtained from market research, consultant

surveys, publicly available information and industry

publications and surveys. These sources generally state that the

information they contain has been obtained from sources believed

to be reliable, but that the accuracy and completeness of such

information is not guaranteed. Although we believe that each

source is reliable as of its respective date, we have not

independently verified any of the data from third-party sources,

nor have we ascertained the assumptions relied upon therein. As

a result, neither we nor the underwriters can assure you of the

accuracy or completeness of the data.

PROSPECTUS

SUMMARY

This summary highlights selected information contained in

greater detail elsewhere in this prospectus and does not contain

all of the information that you should consider before investing

in our common stock. You should carefully read the following

summary together with the more detailed information appearing

elsewhere in this prospectus regarding us and our common stock

being sold in this offering, including “Risk Factors”

and the financial statements and the related notes, before

making an investment decision.

In this prospectus, except where the context otherwise

requires, “Portrait Innovations,” “our

company,” “we,” “us,” and

“our” refer to Portrait Innovations Holding Company, a

Delaware corporation, and, where appropriate, its subsidiary and

predecessor corporation. Prior to our formation of a holding

company structure in 2008, we conducted our business through

Portrait Innovations, Inc., a Delaware corporation which now

operates as a wholly-owned subsidiary of Portrait Innovations

Holding Company.

Our fiscal year is the 52- or 53-week period ending on the

Sunday nearest January 31. Fiscal 2009 ended on

January 31, 2010, fiscal 2008 ended on February 1,

2009, and fiscal 2007 ended on February 3, 2008. Fiscal

2007 was a 53-week year.

Our

Company

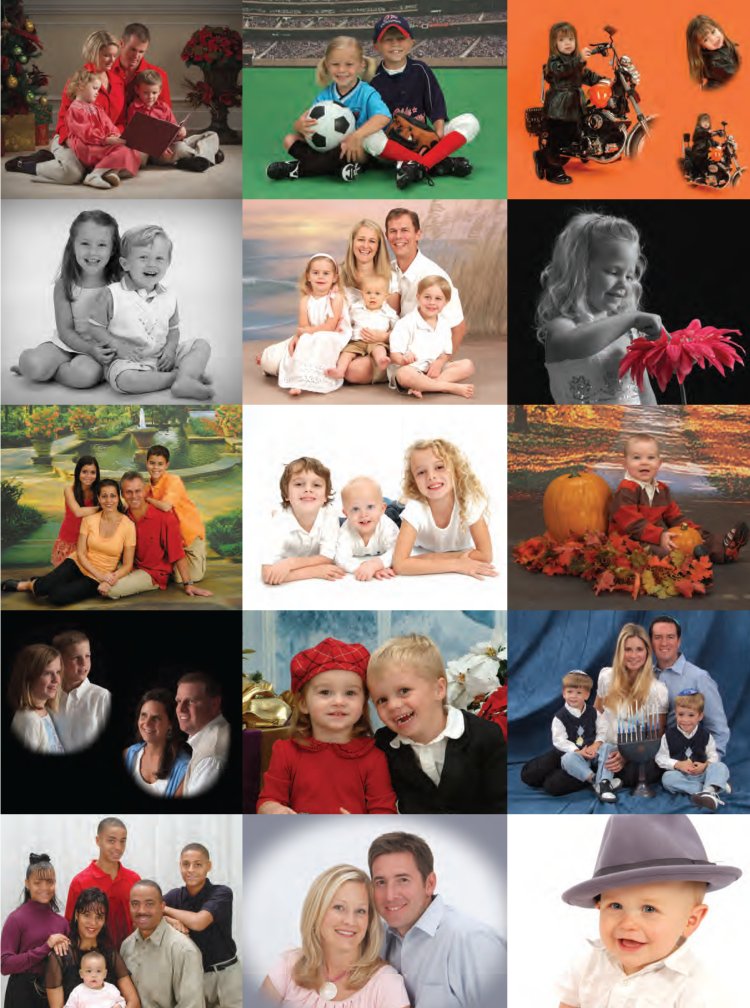

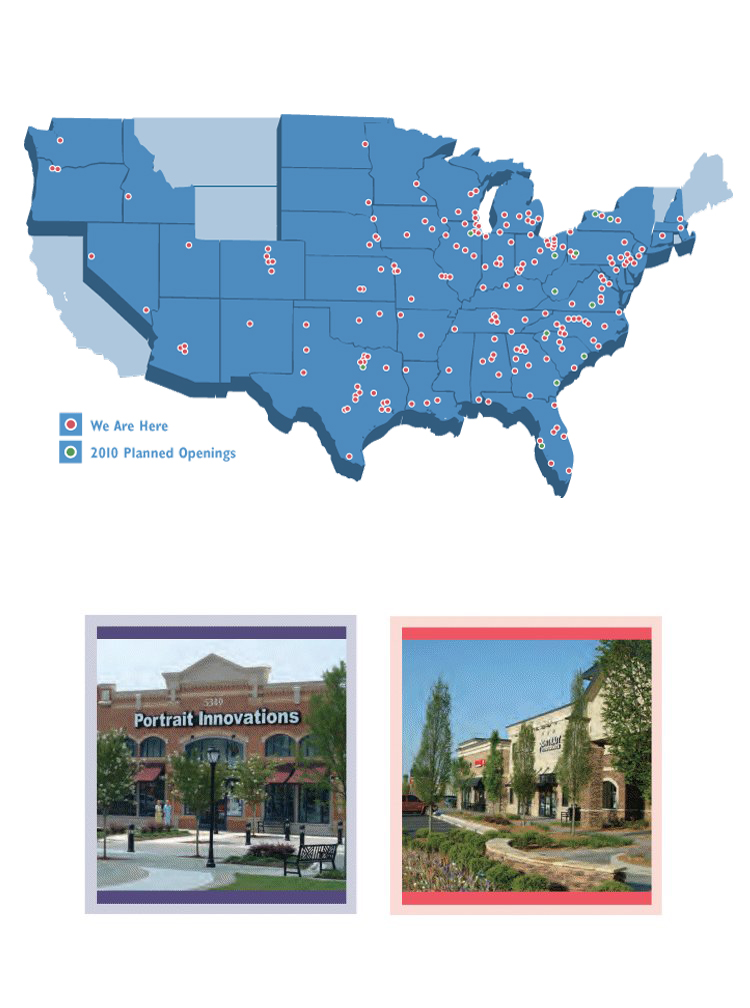

We are a fast-growing retail operator of free-standing portrait

studios under the Portrait Innovations brand name. We provide

our customers with high-quality portraits typically within an

hour and a half of entering our studio by integrating

sophisticated professional photography techniques with

state-of-the-art,

on-site

digital imaging and printing technologies. We have opened an

average of 30 new studios per year for the past five years, and

as of August 1, 2010, we operated 188 studios across

41 states.

We believe that our customers value the importance of capturing

cherished family and personal memories, events and milestones,

but have limited options available to purchase high-quality,

professional portraits at affordable prices in a convenient,

efficient manner. We believe that we offer a differentiated

studio experience that meets these consumer needs. We believe

our customers recognize and appreciate this differentiated

approach, which engenders loyalty and repeat business.

We have developed a business strategy and operating model that

we believe creates a superior studio experience and is difficult

to replicate. Key elements of our strategy include:

|

|

|

| |

•

|

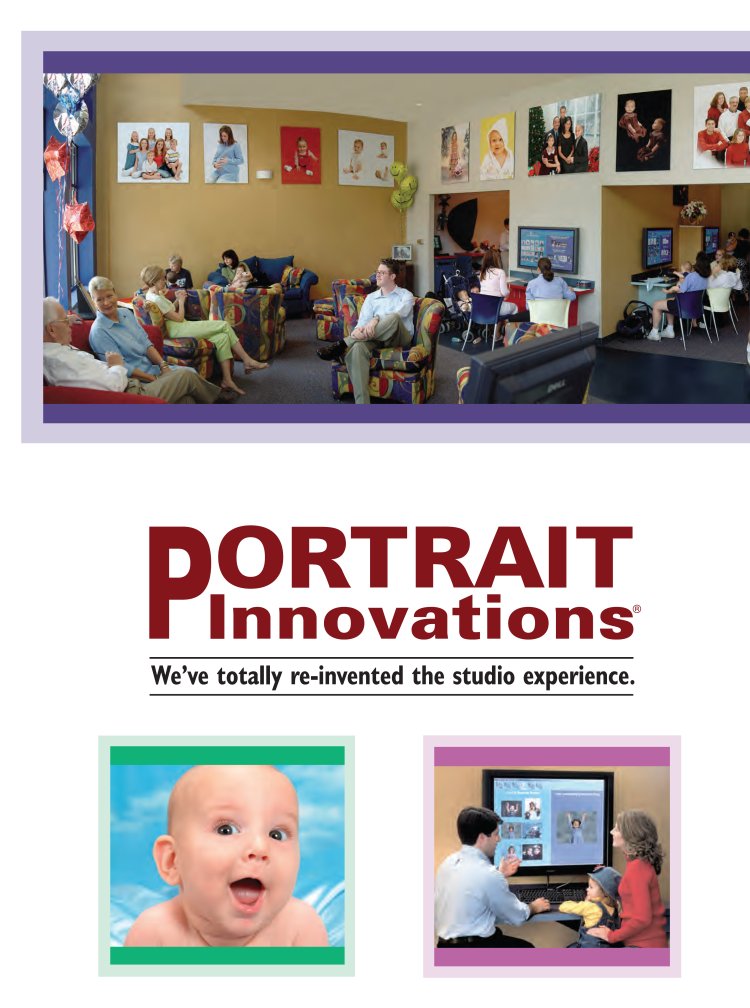

Convenient, attractive locations. We locate

our free-standing studios in high-visibility, high-traffic,

open-air lifestyle and power centers with easy parking and

access. Our studios are designed to be warm and inviting, and

feature large camera rooms, portrait viewing stations and

dressing rooms, as well as spacious reception areas with

comfortable couches and children’s play areas.

|

| |

| |

•

|

Interactive, professional photography

session. Our highly trained studio managers and

associates use professional handheld digital cameras and

interact with our customers to capture candid expressions and

emotions, creating high-quality and artistically appealing

portraits. Our sophisticated camera rooms feature

auto-adjusting, computerized lighting and background systems,

which enhance the variety, quality and consistency of our images

and enable us to complete photography sessions quickly and

efficiently.

|

| |

| |

•

|

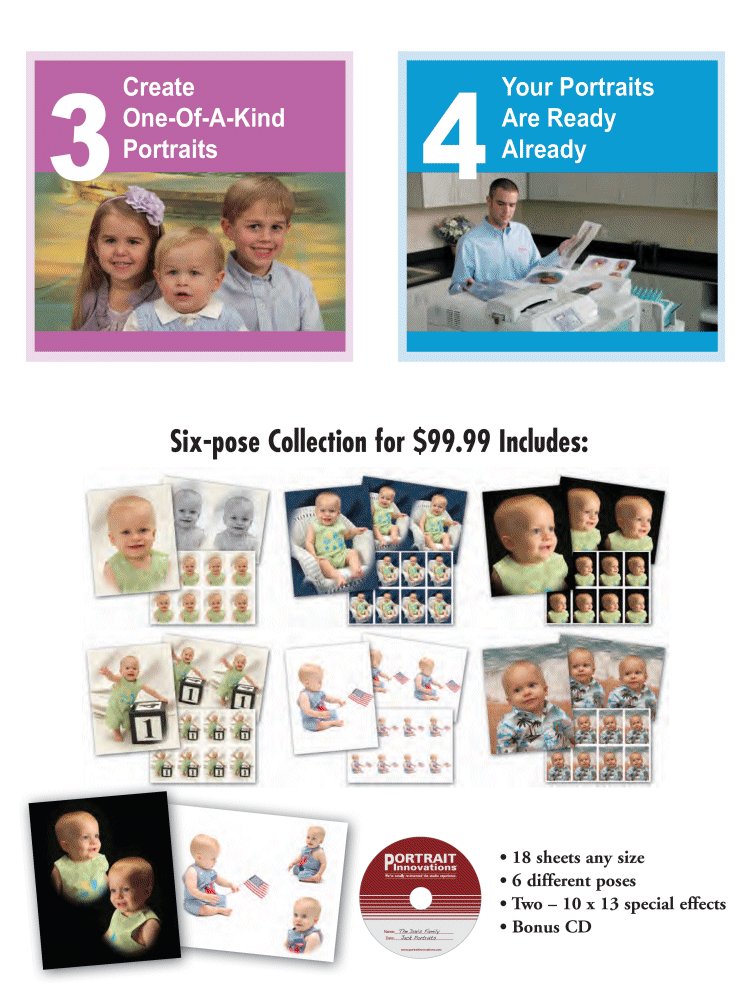

Efficient, proprietary portrait selection

process. Immediately following the photography

session, we utilize our proprietary software and processes to

allow our customers to quickly and easily review their image

choices, select their favorite poses and create personal,

one-of-a-kind

portraits using a variety of special effects. With guidance from

our well-trained studio associates, our customers can customize

a portrait collection tailored to their tastes and budgets. Our

average customer purchase has been more than $100 in each fiscal

year since our inception.

|

| |

| |

•

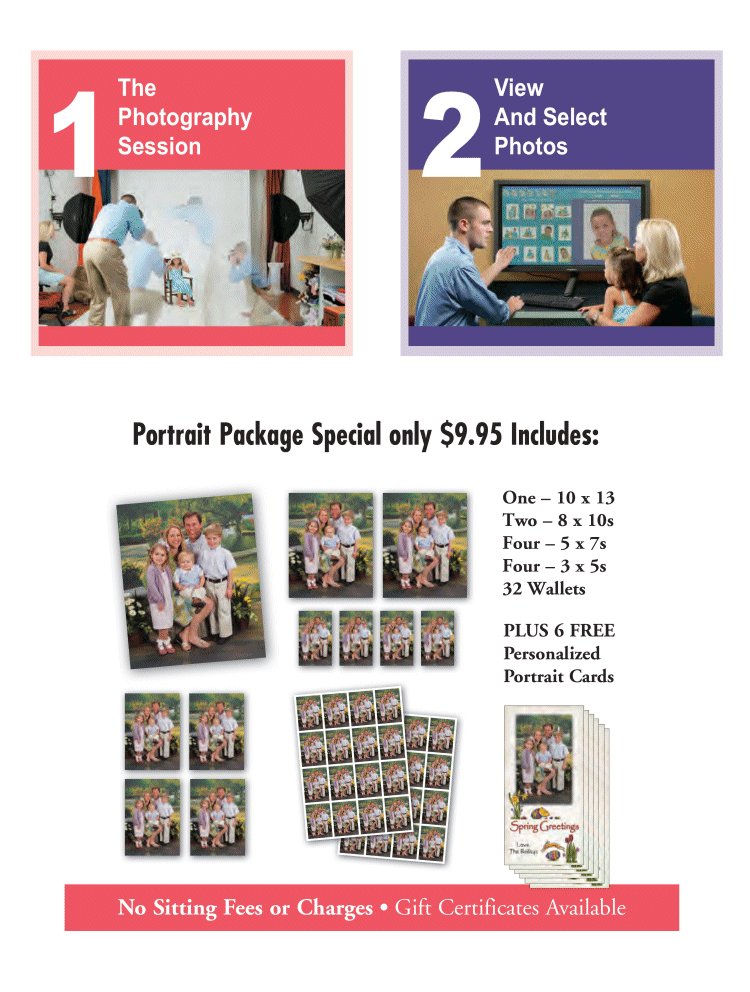

|

High-quality, in-studio portrait

production. Each of our studios features a

Fujifilm

Frontiertm

printer system and uses professional-quality, silver halide

Crystal

Archivetm

portrait paper, which together

|

1

|

|

|

| |

|

produce vivid colors and image stability. Ordered portraits are

printed

on-site and

typically are ready within 15 minutes after a customer selects a

portrait collection.

|

Under the leadership of our President and Chief Executive

Officer, John Grosso, we have grown net sales from

$43.0 million in fiscal 2006 to $111.0 million in

fiscal 2009, representing a compound annual growth rate (CAGR)

of 37.2%. Over the same period we have grown net income from

$1.3 million to $2.5 million and EBITDA from

$7.0 million to $16.5 million, representing a CAGR of

24.4% and 33.1%, respectively. We have achieved positive

comparable studio sales growth in every year since opening our

first studio in 2002. We believe our business performs well

through economic cycles, including the recent economic downturn,

as demonstrated by our comparable studio sales increases of

11.3% in fiscal 2008 and 6.9% in fiscal 2009. Comparable studio

sales increased 4.7% for the first twenty-six weeks of fiscal

2010.

Our

Competitive Strengths

We believe the following strengths differentiate us from our

competitors and are important to our success:

|

|

|

| |

•

|

Compelling customer experience and value

proposition. We provide our customers

high-quality portraits, typically within an hour and a half of

entering our studio, in a pleasant and convenient studio

environment. We believe that our proprietary systems and

software and

on-site,

state-of-the-art

digital imaging and printing technology allow us to offer a wide

variety of portrait collections at compelling price points to a

high volume of customers.

|

| |

| |

•

|

Customer-focused real estate strategy. We

locate our free-standing portrait studios in high-visibility,

high-traffic, open-air lifestyle and power centers that we

believe have become the preferred shopping destinations for

U.S. consumers due to their accessibility and convenience.

In contrast, our primary competitors typically locate their

studios within enclosed malls or other host retailers.

|

| |

| |

•

|

Disciplined operating philosophy with scalable

processes. We have developed and documented

detailed and standardized systems, procedures and processes that

we believe have allowed us to rapidly grow our studio base while

maintaining consistently high-quality customer service and

in-studio execution.

|

| |

| |

•

|

Performance-based culture with emphasis on

training. We believe our customer-focused and

performance-based culture allows us to attract and retain

motivated, high-achieving employees who share our vision for

success. The majority of our associates are college-educated and

start their employment at our central training facility, where

they attend a comprehensive two-week training program that

focuses on developing professional portrait techniques and

personalizing the customer experience while maximizing sales

productivity. Our associates also receive ongoing evaluation and

training to enhance their skills.

|

| |

| |

•

|

Attractive and consistent studio

economics. Our studio model has consistently

delivered strong unit economics across a variety of geographic

locations. Our studios require minimal inventory investment and

typically generate positive cash flow within one year of

opening. For new studios, we target a pre-tax, cumulative cash

payback on our net investment within three years.

|

| |

| |

•

|

Experienced management team with a proven track

record. We have assembled a management team that

has over 100 combined years of experience in the retail

photography industry. Our co-founders, John Grosso, President

and Chief Executive Officer, and John Davis, Executive Vice

President and Chief Development Officer, have each spent more

than 30 years in the photography industry.

|

Our

Growth Strategies

We plan to execute several strategies to drive revenue and

operating income growth, including:

|

|

|

| |

•

|

Accelerating the expansion of our studio

base. We intend to accelerate the expansion of

our studio base in new and existing markets. Based on our

operating experience, we believe the U.S. market can

|

2

|

|

|

| |

|

support over 850 Portrait Innovations studios. We intend to open

approximately 30 new studios in fiscal 2010 and increase our

studio base by approximately 20% annually thereafter.

|

|

|

|

| |

•

|

Increasing sales productivity. We seek to

maximize our comparable studio sales by maintaining consistent

studio-level execution and generating increased customer

traffic. We plan to continue to implement a variety of

initiatives to enhance sales productivity in our studios, which

we believe already generate the highest average studio sales

volume of any major chain in the portrait industry.

|

| |

| |

•

|

Growing our national brand awareness. We

believe our Portrait Innovations brand will continue to gain

awareness as we accelerate our studio openings and expand our

geographic footprint. We plan to continue to support the brand

through a broad mix of media, and we also believe we will

continue to benefit from

word-of-mouth

and grass roots marketing.

|

| |

| |

•

|

Investing in and developing technology. We

intend to remain at the forefront of digital image capture and

printing technology, which we believe will further differentiate

us from our competitors. We also plan to continue to develop

business systems and methodologies intended to improve business

processes, create and deliver innovative product offerings, and

capture and analyze information to better manage our business.

|

| |

| |

•

|

Improving our operating margins. We believe

that our initiatives to improve sales productivity will result

in increased studio-level contribution margins. In addition, we

believe we will achieve higher levels of profitability by

leveraging corporate and other overhead costs against a growing

revenue base as our studio location footprint expands.

|

Our

Market

We operate within the large and highly fragmented

U.S. professional portrait market which serves a broad

range of consumers who purchase professional portraits to

capture cherished memories and commemorate life milestones. The

professional market is distinguished by photographers trained in

advanced techniques who utilize sophisticated camera, lighting

and printing systems to produce high-quality and artistically

appealing portraits. According to Photofinishing News, Inc., the

U.S. professional portrait market totaled $8.6 billion

in sales in 2009 and has grown modestly over the past several

years. Competition within this market includes large studio

chains operating in national retail hosts, other free-standing

portrait studio chains, national school and church photographers

and a large number of small, independent companies and

individual photographers.

As a result of their many years of experience in the

professional portrait industry, our co-founders,

Messrs. Grosso and Davis, and other senior officers and key

employees, designed our business model and strategy to respond

to and take advantage of certain trends that have been

transforming the U.S. professional portrait market and

significantly altering its competitive landscape. These trends

include the proliferation of digital technology in personal

photography, changes in consumer shopping preferences and the

increasing importance of key demographic groups.

We believe that, based on net sales, Portrait Innovations is the

fastest growing of the major studio chains in the professional

portrait market.

Corporate

Information

Portrait Innovations, Inc., our subsidiary, was incorporated in

North Carolina in 2000 and re-incorporated in Delaware in 2002.

In 2008, we completed a holding company formation transaction

and Portrait Innovations, Inc. became the wholly-owned

subsidiary of Portrait Innovations Holding Company, a Delaware

corporation incorporated in 2008.

Our principal executive offices are located at 2016 Ayrsley Town

Boulevard, Suite 200, Charlotte, North Carolina 28273.

Our telephone number is

(704) 499-9300

and our website address is www.portraitinnovations.com. The

information contained on our website is not incorporated into

and does not form a part of this prospectus.

3

The

Offering

|

|

|

|

Common stock offered by us |

|

shares |

| |

|

Common stock offered by the selling stockholders |

|

shares |

| |

|

Total common stock offered |

|

shares |

| |

|

Common stock to be outstanding after the offering |

|

shares |

| |

|

Over-allotment shares |

|

shares

from certain selling stockholders. |

|

|

|

|

Use of proceeds |

|

We intend to use the net proceeds from this offering to repay

debt under our revolving credit facility and to pay accrued and

unpaid dividends on our outstanding preferred stock, which were

approximately $10.0 million and $3.6 million,

respectively, as of August 1, 2010, and the remainder to

fund studio expansion and for other general corporate purposes. |

|

|

|

|

|

|

We will not receive any proceeds from the sale of shares by the

selling stockholders, including upon exercise, if any, of the

underwriters’ over-allotment option. We estimate that our

net proceeds from this offering will be approximately

$ million, based on an assumed

initial public offering price of

$ per share (the mid-point of the

price range set forth on the cover page of this prospectus) and

after deducting the underwriting discounts and commissions and

our estimated offering costs of

$ million. See “Use of

Proceeds.” |

| |

|

Dividend policy |

|

We do not anticipate declaring or paying cash dividends on our

common stock for the foreseeable future. See “Dividend

Policy.” |

| |

|

Proposed NASDAQ Global Market symbol |

|

PTRT |

| |

|

Risk factors |

|

See “Risk Factors” and other information included in

this prospectus for a discussion of factors you should carefully

consider before deciding to invest in shares of our common stock. |

| |

|

Conflicts of interest |

|

An affiliate of Wells Fargo Securities, LLC, one of the

underwriters, is the lender under our revolving credit facility

and may receive more than five percent of the net proceeds of

this offering. Thus, Wells Fargo Securities, LLC has a

“conflict of interest” as defined in Rule 2720 of

the Conduct Rules of the Financial Industry Regulatory

Authority, Inc. and, accordingly, J.P. Morgan Securities

Inc. is acting as the “qualified independent

underwriter.” See “Conflicts of Interest.” |

The number of shares of our common stock to be outstanding after

this offering is based

on shares

outstanding as

of ,

2010, after giving effect to the conversion of all of our

convertible preferred stock into common stock upon the

completion of this offering, and excludes:

|

|

|

| |

•

|

shares

of common stock issuable upon the exercise of outstanding stock

options with a weighted average exercise price of

$ per share; and

|

| |

| |

•

|

an aggregate

of

additional shares of common stock reserved for future issuance

under our stock option plans as

of ,

2010.

|

4

Unless the context otherwise requires or we specifically state

otherwise, all information in this prospectus:

|

|

|

| |

•

|

assumes an initial public offering price of

$ per share of common stock, the

mid-point of the range set forth on the cover page of this

prospectus; and

|

| |

| |

•

|

gives effect to the conversion of all outstanding shares of our

convertible preferred stock into shares of our common stock

subject to and upon the completion of this offering.

|

Share numbers presented in this prospectus do not give effect to

the

for stock

split that will be effected prior to the completion of this

offering.

5

Summary

Consolidated Financial Information and Operating Data

The following table presents summary historical consolidated

financial information and operating data for the periods

indicated. You should read the following summary consolidated

financial information and operating data in conjunction with our

audited and unaudited financial statements, including the notes

thereto, and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” included

elsewhere in this prospectus. We have derived the consolidated

statement of income data for the years ended February 3,

2008, February 1, 2009 and January 31, 2010, and the

consolidated balance sheet data as of February 1, 2009 and

January 31, 2010 from our audited consolidated financial

statements included elsewhere in this prospectus. We have

derived the consolidated statement of income data for the

twenty-six weeks ended August 2, 2009 and August 1,

2010 and the consolidated balance sheet data as of

August 1, 2010 from our unaudited condensed consolidated

financial statements included elsewhere in this prospectus. We

have derived the consolidated balance sheet data as of

February 3, 2008 and August 2, 2009 from our audited

and unaudited financial statements, respectively, not included

in this prospectus. Our historical results for any prior period

are not necessarily indicative of results to be expected in any

future period.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended(1)

|

|

|

Twenty-six Weeks Ended

|

|

|

|

|

February 3,

|

|

|

February 1,

|

|

|

January 31,

|

|

|

August 2,

|

|

|

August 1,

|

|

|

|

|

2008

|

|

|

2009

|

|

|

2010

|

|

|

2009

|

|

|

2010

|

|

|

|

|

(Dollars in thousands, except per share, per studio and per

square foot data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

Statement of income data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$

|

73,203

|

|

|

$

|

97,402

|

|

|

$

|

111,009

|

|

|

$

|

48,568

|

|

|

$

|

54,428

|

|

|

Cost of goods sold (exclusive of depreciation and amortization

shown below)

|

|

|

18,433

|

|

|

|

24,422

|

|

|

|

28,663

|

|

|

|

13,030

|

|

|

|

14,573

|

|

|

Selling, general and administrative expenses

|

|

|

44,409

|

|

|

|

58,559

|

|

|

|

65,863

|

|

|

|

29,192

|

|

|

|

33,025

|

|

|

Depreciation and amortization expense

|

|

|

7,247

|

|

|

|

10,643

|

|

|

|

12,208

|

|

|

|

5,895

|

|

|

|

6,215

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

3,114

|

|

|

|

3,778

|

|

|

|

4,275

|

|

|

|

451

|

|

|

|

615

|

|

|

Interest expense, net

|

|

|

1,459

|

|

|

|

1,257

|

|

|

|

497

|

|

|

|

270

|

|

|

|

139

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

1,655

|

|

|

|

2,521

|

|

|

|

3,778

|

|

|

|

181

|

|

|

|

476

|

|

|

Provision (benefit) for income taxes

|

|

|

(1,454

|

)

|

|

|

1,234

|

|

|

|

1,244

|

|

|

|

88

|

|

|

|

183

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

3,109

|

|

|

$

|

1,287

|

|

|

$

|

2,534

|

|

|

$

|

93

|

|

|

$

|

293

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

2,944,759

|

|

|

|

3,879,927

|

|

|

|

4,164,487

|

|

|

|

4,161,527

|

|

|

|

4,296,215

|

|

|

Diluted

|

|

|

7,092,963

|

|

|

|

3,879,927

|

|

|

|

8,544,890

|

|

|

|

4,161,527

|

|

|

|

4,296,215

|

|

|

Net income (loss) per common share(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.12

|

|

|

$

|

(0.29

|

)

|

|

$

|

0.02

|

|

|

$

|

(0.27

|

)

|

|

$

|

(0.21

|

)

|

|

Diluted

|

|

$

|

0.12

|

|

|

$

|

(0.29

|

)

|

|

$

|

0.02

|

|

|

$

|

(0.27

|

)

|

|

$

|

(0.21

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other operating data (unaudited):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comparable studio sales increase(3)

|

|

|

21.6%

|

|

|

|

11.3%

|

|

|

|

6.9%

|

|

|

|

7.3%

|

|

|

|

4.7%

|

|

|

Number of studios (at period end)

|

|

|

120

|

|

|

|

150

|

|

|

|

170

|

|

|

|

160

|

|

|

|

188

|

|

|

Total square footage (at period end)

|

|

|

261,568

|

|

|

|

334,547

|

|

|

|

387,172

|

|

|

|

361,417

|

|

|

|

432,293

|

|

|

Average square footage per studio (at period end)(4)

|

|

|

2,180

|

|

|

|

2,230

|

|

|

|

2,277

|

|

|

|

2,259

|

|

|

|

2,299

|

|

|

Net sales per average number of studios(5)

|

|

$

|

732,000

|

|

|

$

|

695,000

|

|

|

$

|

692,000

|

|

|

$

|

314,153

|

|

|

$

|

301,540

|

|

|

Net sales per average square foot(6)

|

|

$

|

339

|

|

|

$

|

315

|

|

|

$

|

307

|

|

|

$

|

140.24

|

|

|

$

|

131.69

|

|

|

Capital expenditures

|

|

$

|

26,514

|

|

|

$

|

15,292

|

|

|

$

|

11,709

|

|

|

$

|

4,448

|

|

|

$

|

7,129

|

|

|

EBITDA(7)

|

|

$

|

10,361

|

|

|

$

|

14,421

|

|

|

$

|

16,483

|

|

|

$

|

6,346

|

|

|

$

|

6,830

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance sheet data (at period end):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

5,060

|

|

|

$

|

5,951

|

|

|

$

|

1,987

|

|

|

$

|

2,662

|

|

|

$

|

752

|

|

|

Working capital

|

|

|

(3,797

|

)

|

|

|

(4,130

|

)

|

|

|

(12,333

|

)

|

|

|

(5,570

|

)

|

|

|

(8,544

|

)

|

|

Total assets

|

|

|

56,845

|

|

|

|

61,062

|

|

|

|

57,761

|

|

|

|

59,091

|

|

|

|

61,111

|

|

|

Total debt

|

|

|

13,950

|

|

|

|

13,950

|

|

|

|

4,950

|

|

|

|

13,950

|

|

|

|

9,950

|

|

|

Redeemable preferred stock(8)

|

|

|

28,414

|

|

|

|

26,393

|

|

|

|

26,433

|

|

|

|

25,237

|

|

|

|

27,630

|

|

|

Total stockholders’ equity (deficit)

|

|

|

(3,978

|

)

|

|

|

(401

|

)

|

|

|

198

|

|

|

|

(1,280

|

)

|

|

|

(155

|

)

|

6

|

|

|

|

(1) |

|

Our fiscal year is the 52- or 53-week period ending on the

Sunday nearest January 31. Fiscal years ended

February 1, 2009 and January 31, 2010 were 52-week

years. The fiscal year ended February 3, 2008 was a 53-week

year, and the 53rd week accounted for approximately $1,045,000

in net sales. |

| |

|

(2) |

|

Net income (loss) per common share reflects dividends accrued

on, and net income allocated to, our preferred stock. See

Note 15 of notes to our consolidated financial statements

and Note 12 of notes to our unaudited condensed

consolidated financial statements included elsewhere in this

prospectus. |

| |

|

(3) |

|

Comparable studio sales increase reflects sales for studios

beginning on the first day of the 53rd week after opening.

Comparable studio sales increase for the fiscal year ended

February 3, 2008 was adjusted by excluding the 53rd week. |

| |

|

(4) |

|

Average square footage per studio is calculated by dividing

total square footage at period end by the number of studios at

period end. |

| |

|

(5) |

|

Net sales per average number of studios was calculated by

dividing net sales for the trailing

12-month

period by the average number of studios open during such

trailing

12-month

period. Net sales per average number of studios for the fiscal

year ended February 3, 2008 was adjusted to exclude the net

sales effects of the 53rd week. |

| |

|

(6) |

|

Net sales per average square foot was calculated by dividing net

sales for the trailing

12-month

period by the average square footage for those studios open

during such trailing

12-month

period. Net sales per average total square foot for the fiscal

year ended February 3, 2008 was adjusted to exclude the net

sales effects of the 53rd week. |

| |

|

(7) |

|

“EBITDA” is defined as net income (loss) before

interest expense (net of interest income), provision for income

taxes and depreciation and amortization expense. EBITDA does not

represent, and should not be considered as, an alternative to

net income or cash flows from operating activities, each as

determined in accordance with generally accepted accounting

principles in the United States (“GAAP”). We have

presented EBITDA because we consider it an important

supplemental measure of our performance and believe it is

frequently used by analysts, investors and other interested

parties in the evaluation of retail companies. Management uses

EBITDA as a measurement tool for evaluating our actual operating

performance compared to budget and prior periods and in

evaluating performance for incentive compensation purposes.

Other companies may calculate EBITDA differently than we do.

EBITDA is not a measure of performance under GAAP and should not

be considered as a substitute for net income prepared in

accordance with GAAP. EBITDA has limitations as an analytical

tool, and you should not consider it in isolation or as a

substitute for analysis of our results as reported under GAAP. |

The following table sets forth the reconciliation of net income

to EBITDA:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended

|

|

|

Twenty-six Weeks Ended

|

|

|

|

|

February 3,

|

|

|

February 1,

|

|

|

January 31,

|

|

|

August 2,

|

|

|

August 1,

|

|

|

|

|

2008

|

|

|

2009

|

|

|

2010

|

|

|

2009

|

|

|

2010

|

|

|

|

|

(In thousands)

|

|

|

|

|

(Unaudited)

|

|

|

|

|

Net income

|

|

$

|

3,109

|

|

|

$

|

1,287

|

|

|

$

|

2,534

|

|

|

$

|

93

|

|

|

$

|

293

|

|

|

Provision (benefit) for income taxes

|

|

|

(1,454

|

)

|

|

|

1,234

|

|

|

|

1,244

|

|

|

|

88

|

|

|

|

183

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

1,655

|

|

|

|

2,521

|

|

|

|

3,778

|

|

|

|

181

|

|

|

|

476

|

|

|

Depreciation and amortization expense

|

|

|

7,247

|

|

|

|

10,643

|

|

|

|

12,208

|

|

|

|

5,895

|

|

|

|

6,215

|

|

|

Interest expense, net

|

|

|

1,459

|

|

|

|

1,257

|

|

|

|

497

|

|

|

|

270

|

|

|

|

139

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

$

|

10,361

|

|

|

$

|

14,421

|

|

|

$

|

16,483

|

|

|

$

|

6,346

|

|

|

$

|

6,830

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(8) |

|

The holders of all of the outstanding shares of preferred stock

have agreed to convert such preferred stock into common stock

subject to, and upon the completion of, this offering. |

7

RISK

FACTORS

An investment in our common stock involves a number of risks.

You should carefully consider the following risk factors in

addition to the other information contained in this prospectus

before investing in our common stock. If any of the following

risks or uncertainties occurs, our business, results of

operations and financial condition could be materially and

adversely affected. As a result, the trading price of our common

stock could decline and you may lose all or a part of your

investment in our common stock.

Risks

related to our business and industry

Our

business is highly dependent on our ability to anticipate and

appropriately respond to the trends and preferences that drive

our customers’ behavior and purchasing

habits.

Our business is subject to changing consumer trends and

preferences. The professional portrait market has been and

continues to be affected by shifts in consumer preferences and

expectations regarding convenience, speed, quality, value and

preferred shopping venue, and our failure to accurately predict

or respond to evolving consumer trends could negatively affect

consumers’ opinions of us as a choice for portraits. The

success of our business model depends upon a number of factors,

including our ability to continue to refine and innovate our

portrait experience and product offerings, price our products

competitively and differentiate our product offerings and

portrait experience from those of our competitors. If we are

unsuccessful on any of these fronts, our business, results of

operations, financial condition and prospects could be adversely

affected.

In addition, changing customer preferences in favor of

preserving and sharing photographic images in electronic, rather

than printed, form could erode our market share and overall

demand for our products. If such changes reduce consumer demand

for our product offerings, we could be forced to significantly

adapt or abandon our business model. We also believe the

proliferation of amateur digital photography is making customers

more discerning, demanding and self-reliant, particularly given

the abundance of high-quality and easy-to-use technology now

available at accessible price points, which may adversely affect

overall activity in the professional portrait market.

Our

business, sales and growth prospects depend upon our ability to

continue to provide our customers a high-quality, differentiated

portrait experience.

A critical component of our strategy is providing a

high-quality, differentiated portrait experience to our

customers. Accordingly, our ability to consistently and

effectively deliver this experience for new and repeat customers

across our existing and expanding studio base is important to

our reputation and our ability to attract and retain customers.

As a result, we need to continue to invest substantial capital

resources in technology, studio development and employee

recruiting and training. If we do not make such investments or

fail to provide a high-quality, differentiated portrait

experience to our customers, we may lose studio traffic,

revenues, market share and suffer harm to our reputation and

brand, which could have a material adverse effect on our

business, results of operations and financial condition.

Since our business is highly dependent on customer satisfaction

and providing a differentiated portrait experience, any

significant increase in average waiting time will directly

impact customer satisfaction. Average waiting times may increase

for a variety of reasons, including the failure to adhere to

scheduled appointment times, overbooking, the

longer-than-expected

duration of any particular portrait session and the higher

customer volume we experience during busy holiday periods.

Furthermore, if our studio associates and managers fail to

provide a satisfactory experience to our customers, those

customers may not return and our reputation and brand may be

harmed. If we are unable to address customer service issues

adequately, our business and results of operations could be

materially adversely affected.

We may

not be able to sustain comparable studio sales

growth.

We may not be able to sustain or improve upon the levels of

comparable studio sales that we have experienced in the recent

past. A variety of factors, many of which are beyond our

control, affect our comparable studio sales and could cause our

quarterly and annual operating results to fluctuate

significantly.

8

For example, our comparable studio sales increase for the

fiscal quarter ending August 1, 2010 was 0.4%, compared to

8.7% for the prior fiscal quarter. We define comparable studio

sales to include sales for each of our studios beginning in its

53rd week of operations. Comparable studio sales may be

affected by a number of factors, including but not limited to:

|

|

|

| |

•

|

the rate at which sales in our new studios increase during their

first years of operation;

|

| |

| |

•

|

customer trends and preferences, and our ability to anticipate

and effectively respond to changes in such trends and

preferences;

|

| |

| |

•

|

pricing of our products;

|

| |

| |

•

|

cannibalization of existing studio sales by new studio openings;

|

| |

| |

•

|

the number and timing of studios we may open, close, renovate,

relocate or expand;

|

| |

| |

•

|

the timing of the release of new product offerings and

promotional events;

|

| |

| |

•

|

changes in our product mix;

|

| |

| |

•

|

changes in the overall economy; and

|

| |

| |

•

|

weather conditions.

|

Accordingly, our comparable studio sales results for any one

fiscal period are not necessarily indicative of the comparable

studio sales results to be expected for any other period, and

our comparable studio sales for any particular future period may

decrease. In addition, many retail operators have been unable to

sustain high levels of comparable store sales growth during and

after periods of substantial expansion. These factors may cause

our comparable studio sales results to be materially lower than

in recent periods and materially lower than our expectations,

which could reduce our sales and profitability and limit our

ability to finance our growth strategy. If our future comparable

studio sales decline or fail to meet market expectations, the

price of our common stock could also decline.

Our

growth strategy depends upon our ability to successfully manage

our business on a substantially larger scale by opening and

operating a significant number of new studios each year in a

timely and cost-effective manner without diminishing the sales

and negatively affecting the performance of our existing studio

base. We may not be able to open new studios as planned and any

new studios we do open may not achieve our targeted

profitability.

We intend to pursue an aggressive growth strategy of opening new

studios for the foreseeable future. As a result, our future

operating results will depend largely upon our ability to

successfully open and operate a significant number of new

studios each year in a timely and cost-effective manner and to

profitably and effectively manage a significantly larger

business.

Our ability to successfully execute our growth strategy depends

on many factors including, among others, our ability to:

|

|

|

| |

•

|

identify and satisfy the preferences of our customers in new

geographic areas and markets;

|

| |

| |

•

|

address competitive, marketing, distribution and other

challenges encountered in connection with expansion into new

geographic areas and markets;

|

| |

| |

•

|

identify desirable studio locations, the availability of which

is largely outside of our control;

|

| |

| |

•

|

negotiate acceptable lease terms and desired tenant allowances;

|

| |

| |

•

|

ensure completion of a new studio build-out, which depends in

part on the financial resources of the contractors we retain,

timely compliance with local building codes and our ability to

timely obtain any required governmental approvals, licenses and

permits;

|

| |

| |

•

|

generate sufficient cash flows from operations or obtain the

necessary capital to fund expansion on acceptable terms;

|

9

|

|

|

| |

•

|

hire, train and retain an expanded workforce of studio

associates, managers and support personnel;

|

| |

| |

•

|

successfully integrate new studios into our existing control

structure and operations, including information systems

integration; and

|

| |

| |

•

|

achieve targeted profitability for new studios.

|

In addition, as the number of our studios increases, we may face

risks associated with market saturation of our product

offerings. To the extent our new studio openings are in markets

where we have existing studios, we may experience reduced net

sales in existing studios in those markets. There is no

assurance that any newly opened studios will be received as well

as, or achieve net sales or profitability levels comparable to

those of, our existing studios in the time periods estimated by

us, or at all. If our studios fail to achieve, or are unable to

sustain, acceptable net sales and profitability levels, or incur

significant losses, our business and results of operations may

be materially harmed and we may incur significant costs

associated with closing those studios.

Our current expansion plans are only estimates. The actual

number of new studios we open each year and our cash payback on

investment period could differ significantly from our targets.

For example, we significantly decreased the number of studio

openings in 2009 as a result of the economic downturn. In

addition, while we believe the U.S. market can support over

850 Portrait Innovations studios, this estimate is not based on

an identification of specific, future locations and other

factors that we consider in opening a new studio. Any failure to

successfully open and operate new studios in the numbers, within

the time frames and at the costs estimated by us could have a

material adverse effect on our business, results of operations,

financial condition and prospects and result in a decline in the

price of our common stock. Furthermore, our failure to

effectively address challenges such as these could also

significantly divert the time and resources of our senior

management.

If we

fail to keep pace with or adapt to changes that continue to take

place in digital imaging, printing and software application

technologies, or if such changes reduce consumer demand for our

product offerings, our business, results of operations and

financial condition could be adversely affected.

We believe that a key to our success to date has been our

ability to invest in

state-of-the-art

digital imaging and printing technologies and customized

software applications and systems that we believe enable us to

deliver a differentiated customer experience at compelling price

points. If we are unable to keep pace with changes in these

technologies or invest in software applications and systems that

further our business objectives, our business, results of

operations, financial condition and competitive position could

be adversely affected. Advances in these areas have required and

could continue to require us to make significant capital

expenditures, which could adversely affect our profitability. In

addition, evolving technology could enable customers or small

operators to capture images and produce portraits that are

comparable to the quality of our portraiture at a significantly

lower cost, which could force us to significantly adapt or

abandon our business model.

The

loss of our key senior management, particularly Mr. John

Grosso or Mr. John Davis, or the failure to attract

additional senior management, could have a material adverse

effect on our business.

Our success depends to a significant extent on the continued

services of our senior management team, particularly

Mr. John Grosso and Mr. John Davis, who co-founded our

business and developed our overall business and operating

strategy and whose experience and knowledge of our business and

industry would be difficult to replace. We do not have

employment agreements or non-compete agreements with

Mr. Grosso or Mr. Davis, and do not have agreements

that provide for employment other than on an “at will”

basis with any of our other senior executive officers. We do not

maintain key person life insurance for any of our senior

executives other than Mr. John Grosso.

In addition, the performance of our stock price may also affect

our ability to attract and retain our key employees. Our senior

executive officers hold a significant amount of our common

stock, are vested in a substantial amount of stock options and

will continue to become vested in additional stock options.

These

10

senior executive officers may be more likely to monetize their

holdings and leave us if the trading price of our common stock

significantly exceeds their investment in any shares they own or

the exercise price of any options they hold. They also may be

more likely to leave us if the trading price of our common stock

drops significantly below the exercise price of the options they

hold.

Our inability to retain our key management and attract new

senior management could adversely affect our ability to operate

our business and execute our growth strategy, which could have a

material adverse effect on our business, results of operations

and financial condition.

Increased

competition in the U.S. professional portrait market could

adversely impact our business, results of operations and

financial condition, as well as our future growth

strategy.

The U.S. professional portrait market in which we operate

is highly competitive. We believe the most important competitive

factors in our market include service, innovation, technology,

quality, convenience, value, price and package variety. Our

failure to deliver on any of these measures would adversely

affect our competitive position.

Advances in technology and changing consumer preferences may

enable current or new competitors to innovate and more cheaply

develop similar or new products or software platforms to compete

with our business or develop a similar business model. If

competitors with significantly greater resources than ours

decide to replicate or develop a similar business model, they

may be able to quickly gain recognition and acceptance of their

products through marketing and promotion.

Because of the competitive pressures in our industry, it may be

difficult for us to increase profitability on a sustained basis

by raising our prices. Our ability to increase profitability

over the longer term will largely depend on our ability to open

new studios, increase customer traffic in existing studios and

manage operating costs effectively. Furthermore, there can be no

assurance that we will not be forced to engage in price-cutting

initiatives to respond to competitive and consumer pressures.

Our

failure to build and maintain a strong brand image and generate

studio traffic through our marketing activities could harm our

business, results of operations, financial condition and growth

prospects.

We believe our success in our existing markets, as well as our

prospects for growing our business in new markets, is dependent

on our ability to build and maintain strong brand image and

awareness. We believe a number of channels support our brand

awareness, from

word-of-mouth

and grass roots marketing, such as our participation in local

charity and public service events in markets where we operate

studios, to more focused marketing efforts, such as

participation in target-specific online social networking sites,

an interactive website, seasonal

e-mail

communications, targeted customer-specific direct mail, as well

as advertising through newspapers and magazines, and selective

television advertising. Our success depends in part on our

ability to generate positive customer feedback for dissemination

through

word-of-mouth

and primary online channels where consumers seek and share

information regarding products and services, as well as our

ability to connect with customers through our marketing

campaigns. If our marketing efforts and selected methods of

advertising fail to keep pace with continuing changes in

consumer preferences or if customers provide negative feedback

on our products and services through

word-of-mouth

and online channels, we may be unsuccessful in our efforts to

attract and retain customers, which could have a material

adverse effect on our business, results of operations and

financial condition.

Economic

or other conditions that would reduce the availability or

attractiveness of the locations where we operate studios or seek

to open new studios, increase our leasing or construction costs

or otherwise impair our real estate expansion strategy could

adversely affect our business, results of operations and growth

prospects.

We intend to grow our studio base by continuing to seek

attractive locations in our target markets that are located in

open-air lifestyle or power centers in high traffic areas with

easy access and

drive-up

parking. The recent economic downturn, coupled with tightened

credit markets, has slowed the pace of commercial real

11

estate development generally, including the types of retail

centers in which we seek to locate new studios. These conditions

have also led to the closure of substantial amounts of retail

space nationwide. The continuation or worsening of conditions

that would limit the availability of attractive retail space

could adversely affect our growth plans. Conversely, as a tenant

of substantial amounts of retail space, we are subject to

economic risks that would increase our occupancy costs, such as

rent increases due to a reduced supply of retail space,

increased demand for such space, or other factors. The success

of our studio locations also partly depends on our ability to

establish and maintain good relationships with developers and

operators of the centers where we have studios and seek to lease

our studios. If our relationships with these parties become

strained, it could affect our ability to renew existing leases,

secure new leases or obtain lease terms or tenant allowances we

deem favorable or necessary. Any reputational damage resulting

from conflicts with a particular developer or operator could

also impair our ability to negotiate future leases with other

developers or operators.

Our studio sales are derived in part from the volume of traffic

generated by anchor stores and other destination retailers in

the centers where our studios are located. General or regional

economic downturns, increases in fuel prices, increased

competition or changes in demographics or consumer shopping

preferences could all adversely affect actual or projected

customer traffic to these centers, which in turn could affect

the ability or willingness of other desirable tenants to secure

leases or maintain stores in these centers. To the extent any

anchor stores or other destination retailers close stores,

default on pre-opening commitments or otherwise change plans in

a manner that reduces customer traffic to the centers in which

we have located or have committed to locate our studios, the

business and revenues of our studios could be materially and

adversely affected.

In addition, the raw materials we use to build and remodel our

studios are subject to availability constraints and price

volatility caused by weather, supply conditions, government

regulations, general economic conditions and other unpredictable

factors. Increases in the demand for, or the price of, these raw

materials could increase the startup costs of building new

studios and hurt our profitability. Any such changes could have

a material adverse effect on our business, results of operations

and financial condition.

Changing

economic conditions, declines in consumer confidence and

spending and other drivers of customer demand for our products

could materially and adversely affect our business, results of

operations, financial condition and future growth

plans.

Demand for our products is driven by trends that affect consumer

confidence, discretionary spending and disposable income, which

have been materially and adversely affected by the recent

economic downturn, including greater levels of unemployment,

declining wages, volatile energy and food costs, higher levels

of consumer debt, declines in home values and in the value of

consumers’ investments and savings, restrictions on the

availability of credit and other adverse economic conditions. To

the extent any of these negative trends continue, re-emerge or

worsen, demand for our products could decrease, which in turn

could reduce our net sales, income from operations, operating

cash flows and net income and adversely affect our future studio

expansion plans. Additionally, adverse changes in economic

factors that affect our operating expenses, such as increases in

interest rates, prices of the commodities we purchase to operate

our studios and build and equip new studios, rent and utility

expenses and labor and employment costs may increase operating

expenses and thereby adversely affect our operating results and

growth plans.

In addition, our sales are highly dependent on economic

conditions and discretionary spending in the local markets in

which we operate. Local economic conditions that affect

discretionary spending include, among other things, unemployment

trends, the housing market, consumer credit availability and

debt levels. A deterioration in economic conditions in any of

our local markets could result in a decline in our sales and

profitability.

12

Our

business is highly seasonal and we typically generate a

significant portion of our net sales and net income for the

fiscal year during our fourth fiscal quarter, which includes the

November/December holiday period. Accordingly, results for our

fourth fiscal quarter are not indicative of results to be

expected for the full fiscal year. Historical results for our

other fiscal quarters have and are likely to continue to reflect

significantly lower sales and either net losses or nominal net

income. In addition, because of our significant dependence on

fourth quarter performance, we are particularly vulnerable to

conditions that would adversely affect customer traffic,

shopping patterns and holiday spending during this

period.

Our business is highly seasonal. Our fourth quarter, which

includes the holiday season from early November through the end

of December, typically accounts for and is expected to continue

to account for a high percentage of our annual net sales and

income from operations. Our fourth fiscal quarters in fiscal

2008 and 2009 accounted for approximately 36.5% and 37.1%,

respectively, of our net sales in those fiscal years and more

than 100% of our total income from operations and net income in

each of those fiscal years because of offsetting losses incurred

in certain other quarters, particularly the third fiscal

quarter. See “Management’s Discussion and Analysis of

Financial Condition and Results of Operations —

Quarterly results and seasonality,” for information

regarding our seasonality and financial results for our previous

nine fiscal quarters.

Our operations in general, and particularly during our important

fourth quarter period, can be adversely affected by any factors

that reduce consumer and holiday spending, including those

listed above under “— Changing economic

conditions, declines in consumer confidence and spending and

other drivers of customer demand for our products could

materially and adversely affect our business, results of

operations, financial condition and future growth plans,”

and other factors such as inclement weather conditions, which

are unpredictable but to which our studios are generally more

susceptible during the winter months. A decrease in net sales

and income from operations during our fourth quarter would

materially adversely affect our results of operations for the

fiscal year.

The

ultimate resolution of an outstanding tax matter regarding a

benefit we previously provided our employees could differ

materially from our expectations, which could cause us to incur

and recognize cash costs that materially differ from our

estimates and related accruals reflected in our consolidated

financial statements. In addition, our efforts to remediate this

matter could continue to increase our labor and other

administrative costs and adversely affect our employee