Attached files

| file | filename |

|---|---|

| EX-10.8 - SRKP 25 INC | v195076_ex10-8.htm |

| EX-23.3 - SRKP 25 INC | v195076_ex23-3.htm |

| EX-10.7 - SRKP 25 INC | v195076_ex10-7.htm |

| EX-10.6 - SRKP 25 INC | v195076_ex10-6.htm |

|

Registration

No. 333-166866

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1/A

China

Century Dragon Media, Inc.

(Name

of Registrant As Specified in its Charter)

|

Delaware

|

7311

|

26-1583852

|

|

(State

or Other Jurisdiction of

|

(Primary

Standard Industrial

|

(I.R.S.

Employer Identification No.)

|

|

Incorporation

|

Classification

Code Number)

|

|

|

or

Organization)

|

Jiangbei,

Huizhou City, Guangdong Province, China

0086-0752-3138789

(Address

and Telephone Number of Principal Executive Offices)

Corporation

Service Company

2711

Centerville Road

Suite

400

Wilmington,

DE 19808

800-222-2122

(Name,

Address and Telephone Number of Agent for Service)

Copies

to

|

Thomas

J. Poletti, Esq.

Melissa

A. Brown, Esq.

K&L

Gates LLP

10100

Santa Monica Blvd., 7th Floor

Los

Angeles, CA 90067

Telephone:

(310) 552-5000

Facsimile:

(310) 552-5001

|

David

Ficksman, Esq.

TroyGould

PC

1801

Century Park East, Suite 1600

Los

Angeles, CA 90067-2367

Telephone:

(310) 789-1290

Facsimile:

(310) 789-1490

|

Approximate Date of Proposed Sale to

the Public: From time to time after the effective date of this

Registration Statement

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement the same

offering. £

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer þ

(Do not check if a smaller reporting

company)

|

Smaller reporting company o

|

|

|

||||||||||||||||

|

Proposed

|

Proposed

|

|||||||||||||||

|

Maximum

|

Maximum

|

Amount of

|

||||||||||||||

|

Title of Each Class of

|

Amount To Be

|

Offering Price

|

Aggregate

|

Registration

|

||||||||||||

|

Securities To Be Registered

|

Registered (1)

|

Per Share

|

Offering Price

|

Fee

|

||||||||||||

|

Common

Stock, $0.0001 par value per share

|

2,875,000 | (2) | 4.00 | (2) | $ | 11,500,000 | (2) | $ | 819.95 | |||||||

|

Common

Stock, $0.0001 par value per share

|

3,566,838 | (3) | 4.00 | (4) | $ | 14,267,352 | (4) | $ | 1,017.26 | |||||||

|

Underwriter’s

Warrants to Purchase Common Stock

|

125,000 | (5) | N/A | N/A | N/A | (6) | ||||||||||

|

Common

Stock Underlying Underwriter’s Warrants, $0.0001 par value per

share

|

125,000 | (7) | N/A | $ | 600,000 | (8) | $ | 42.78 | ||||||||

|

Total

Registration Fee

|

$ | 1,879.99 | (9) | |||||||||||||

|

In

accordance with Rule 416(a), the Registrant is also registering hereunder

an indeterminate number of additional shares of Common Stock that shall be

issuable pursuant to Rule 416 to prevent dilution resulting from stock

splits, stock dividends or similar

transactions.

|

|

The

registration fee for securities to be offered by the Registrant is based

on an estimate of the Proposed Maximum Aggregate Offering Price of the

securities, and such estimate is solely for the purpose of calculating the

registration fee pursuant to Rule 457(o). Includes shares that the

Underwriter has the option to purchase from the selling stockholders and

the Registrant to cover over-allotments, if

any.

|

|

This

Registration Statement also covers the resale under a separate resale

prospectus (the “Resale Prospectus”) by selling stockholders of the

Registrant of up to 3,566,838 shares of Common Stock previously issued to

the selling stockholders as named in the Resale

Prospectus.

|

|

Estimated

solely for the purpose of calculating the registration fee pursuant to

Rule 457.

|

|

Represents

the maximum number of warrants, each of which will be exercisable at a

percentage of the per share offering price, to purchase the Registrant’s

common stock to be issued to the Underwriter in connection with the public

offering.

|

|

In

accordance with Rule 457(g) under the Securities Act, because the shares

of the Registrant’s common stock underlying the Underwriter’s warrants are

registered hereby, no separate registration fee is required with respect

to the warrants registered

hereby.

|

|

Represents

the maximum number of shares of the Registrant’s common stock issuable

upon exercise of the Underwriter’s

warrants.

|

|

Estimated

solely for the purpose of calculating the registration fee pursuant to

Rule 457(g) under the Securities Act, based on an estimated maximum

exercise price of $4.80 per share, or 120% of the maximum offering

price.

|

|

Previously

paid.

|

The

Registrant amends this registration statement on such date or dates as may be

necessary to delay its effective date until the Registrant shall file a further

amendment which specifically states that this registration statement shall

hereafter become effective in accordance with Section 8(a) of the Securities Act

of 1933, or until the registration statement shall become effective on such date

as the Commission, acting pursuant to Section 8(a), may determine.

EXPLANATORY

NOTE

This

Registration Statement contains two prospectuses, as set forth

below.

|

|

Public

Offering Prospectus. A prospectus to be used for the public

offering by the Registrant (the “Public Offering Prospectus”) of up to

2,500,000 shares of the Registrant’s common stock (in addition to 375,000

shares that may be sold upon exercise of the Underwriter’s over-allotment

option, if any) through the Underwriter named on the cover page of the

Public Offering Prospectus. We are also registering the warrants and

shares of common stock underlying the warrants to be received by the

Underwriter in this offering.

|

|

|

Resale

Prospectus. A prospectus to be used for the resale by selling

stockholders of up to 3,566,838 shares of the Registrant’s common stock

(the “Resale Prospectus”).

|

The

Resale Prospectus is substantively identical to the Public Offering Prospectus,

except for the following principal points:

|

|

they

contain different outside front

covers;

|

|

|

they

contain different Offering sections in the Prospectus Summary section

beginning on page 2;

|

|

|

they

contain different Use of Proceeds sections on page 35;

|

|

|

the

Capitalization and Dilution sections on pages 37 and 38, respectively, of the Public

Offering Prospectus are deleted from the Resale

Prospectus;

|

|

|

the

“Selling Stockholders” portion of the Beneficial Ownership of Certain

Beneficial Owners, Management, and Selling Stockholders on page 72 of the Public Offering

Prospectus is deleted from the Resale

Prospectus;

|

|

|

a

Selling Stockholder section is included in the Resale Prospectus beginning

on page 81A;

|

|

|

references

in the Public Offering Prospectus to the Resale Prospectus will be deleted

from the Resale Prospectus;

|

|

|

the

Underwriting section from the Public Offering Prospectus on page 81 is deleted from the

Resale Prospectus and a Plan of Distribution is inserted in its

place;

|

|

|

the

Legal Matters section in the Resale Prospectus on page 84 deletes the reference

to counsel for the Underwriter;

and

|

|

|

the

outside back cover of the Public Offering Prospectus is deleted from the

Resale Prospectus.

|

The

Registrant has included in this Registration Statement, after the financial

statements, a set of alternate pages to reflect the foregoing differences of the

Resale Prospectus as compared to the Public Offering Prospectus.

|

Subject

To Completion

|

August

24, 2010

|

|

2,500,000

Shares

|

China

Century Dragon Media, Inc.

|

Common

Stock

Neither

the U.S. Securities and Exchange Commission nor any state securities commission

has approved or disapproved of anyone’s investment in these securities or

determined if this prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

|

Per Share

|

Total

|

|||||||

|

Public

offering price

|

$ | [___ | ] | $ | [___ | ] | ||

|

Underwriting

discounts and commissions

|

$ | [___ | ] | $ | [___ | ] | ||

|

Proceeds,

before expenses, to China Century Dragon Media, Inc.

|

$ | [___ | ] | $ | [___ | ] | ||

|

Proceeds,

before expenses, to selling stockholders

|

$ | [___ | ] | $ |

[___

|

] | ||

We have

agreed to pay the Underwriter an aggregate non-accountable expense allowance of

3.0% of the gross proceeds of this offering or $[__], based on a public offering

price of $[__] per share.

WestPark

Capital, Inc.

TABLE

OF CONTENTS

|

2

|

|

|

10

|

|

|

11

|

|

|

32

|

|

|

35

|

|

|

35

|

|

|

37

|

|

|

37

|

|

|

38

|

|

|

40

|

|

|

41

|

|

|

53

|

|

|

63

|

|

|

69

|

|

|

72

|

|

|

74

|

|

|

78

|

|

|

81

|

|

|

84

|

|

|

84

|

|

|

84

|

|

|

F-1

|

|

|

|

|

|

II-1

|

|

|

II-7

|

Please

read this prospectus carefully. It describes our business, our financial

condition and results of operations. We have prepared this prospectus so that

you will have the information necessary to make an informed investment

decision.

You

should rely only on information contained in this prospectus. We and the

selling stockholders have not, and the Underwriter has not, authorized any other

person to provide you with different information. This prospectus is not

an offer to sell, nor is it seeking an offer to buy, these securities in any

state where the offer or sale is not permitted. The information in this

prospectus is complete and accurate as of the date on the front cover, but the

information may have changed since that date.

i

PROSPECTUS

SUMMARY

As

used in this prospectus, unless otherwise indicated, the terms “we,” “our,”

“us,” “Company” and “China Media” refer to China Century Dragon Media, Inc., a

Delaware corporation, formerly known as SRKP 25, Inc. (“SRKP 25”). We conduct

our business through Beijing CD Media Advertisement Co., Ltd., a company

incorporated under the laws of the People’s Republic of China, (“CD Media

Beijing”), an entity controlled by our wholly-owned subsidiary, Huizhou CD Media

Co., Ltd., a company incorporated under the laws of the People’s Republic of

China (“CD Media Huizhou”) through a series of contractual

arrangements.

Company

Overview

Our goal

is to become a leading provider of integrated advertising services in China. We

intend to achieve this goal by implementing the following

strategies:

|

Maximize our

existing resources to increase our profitability.

We

plan to increase our profitability by (1) expanding our sale force; and

(2) strengthening relationships with our existing clients to increase the

rate of contract

renewals.

|

|

|

Expand our purchases of

advertising time on CCTV. We intend to increase our purchases

of advertising time aired on CCTV to help our clients reach a diverse

audience. We also intend to increase our purchase of advertising

directly from CCTV which we believe will provide access to a wider variety

of advertising opportunities.

|

|

|

Develop regional television

advertising opportunities. We intend to build relationships

with providers of advertising time aired on certain highly rated regional

television networks. We believe that our purchase of advertising

time aired on regional networks will allow us to offer our clients new

ways to reach their target audience and allow us to expand our client base

to advertisers who desire a more targeted marketing

strategy.

|

|

|

Enhance our production

consulting services and begin providing production services.

We currently provide a small amount of production consulting services to

our clients, in which we help our clients to integrate market resources,

design their television advertisements, find partners to assist them with

the actual production of their commercials and design and package content

for public service announcements. We plan to actively market our

production consulting capabilities to potential as well as to existing

clients. In the future, we intend to provide full production

services to customers by opening a production studio. A production

studio will allow us to shoot commercial television advertisements and

public service announcements for clients in China, as well as enable us to

produce proprietary television

programming.

|

|

|

Expand into new advertising

platforms. We intend to expand our media resources in new

advertising media platforms, including the Internet, radio, mobile devices

and indoor or outdoor flat panel displays. We believe that our

expansion into new media platforms will enable us to offer added value to

our clients by providing them with an avenue to reach consumers and will

strengthen our competitiveness in the advertising

industry.

|

2

|

|

Pursue acquisitions to broaden

our service offerings and advertising platforms. We will

consider strategic acquisitions that will provide us with a broader range

of service offerings and access to new markets and new advertising media

platforms.

|

Corporate

Information

Our

principal executive offices and corporate offices are located at Room 801, No.

7, Wenchanger Road, Jiangbei, Huizhou City, Guangdong Province, China. Our

telephone number is 0086-0752-3138789.

Recent

Events

Share

Exchange

3

The

transactions contemplated by the Exchange Agreement, as amended, were intended

to be a “tax-free” contribution and/or reorganization pursuant to the provisions

of Sections 351 and/or 368(a) of the Internal Revenue Code of 1986, as

amended.

Private

Placement

We agreed

to file a registration statement covering the common stock sold in the Private

Placement within 30 days of the closing of the Private Placement pursuant to the

subscription agreement entered into with each investor and to cause such

registration statement to be declared effective by the SEC no later than 150

days from the date of filing or 180 days from the date of filing if the

registration statement is subject to a full review by the SEC.

4

Each of

the stockholders and warrantholders of SRKP 25 prior to the

completion of the Share Exchange (the “Existing Securityholders”) and each of

the investors in the Private Placement also entered into a lock-up agreement

pursuant to which they agreed that (i) if the proposed public offering that we

expect to conduct is for $10 million or more, then the investors and the

Existing Securityholders would not be able to sell or transfer their shares

until at least six months after the public offering’s completion, and (ii) if

the offering is for less than $10 million, then one-tenth of their shares would

be released from the lock-up restrictions ninety days after the offering and

there would be a pro rata release of the shares thereafter every 30 days over

the following nine months. WestPark Capital in its discretion, may also

release some or all the shares from the lock-up restrictions earlier, however,

(i) no early release shall be made with respect to Existing Securityholders

prior to the release in full of all such lock-up restrictions on shares of the

common stock acquired in the Private Placement and (ii) any such early release

shall be made pro rata with respect to all investors’ shares acquired in the

Private Placement. We currently intend this offering to be in an amount less

than $10 million. However, there can be no assurance of the actual size of this

offering.

Certain

Relationships and Related Transactions

|

$

|

Other

|

|||

|

Share

Exchange

|

235,750

|

(1) |

Registration

rights for an aggregate of 2,244,616 shares and 1,262,178

shares underlying warrants (2) (3)

|

|

|

Private

Placement

|

789,039

|

(4) | ||

|

Public

Offering

|

[______

|

](5) |

Warrants

to purchase 125,000 shares of common stock at an exercise price of $4.80

per share

|

|

|

Total

|

[______

|

] |

5

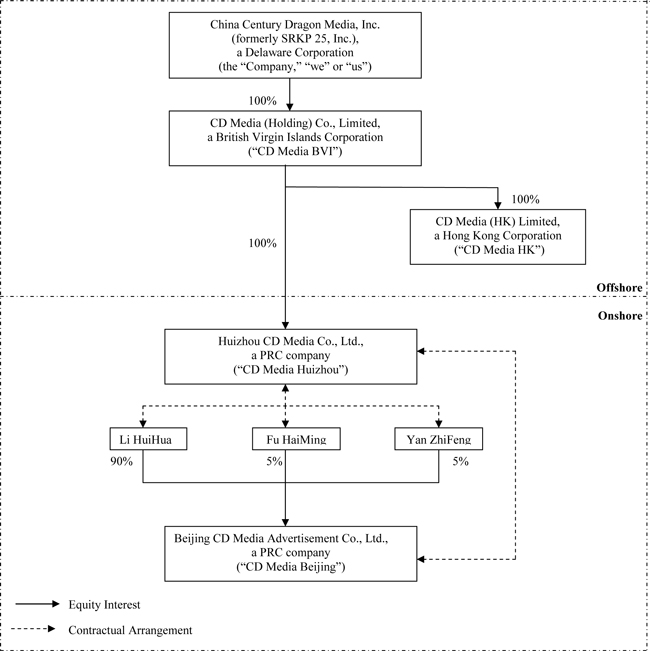

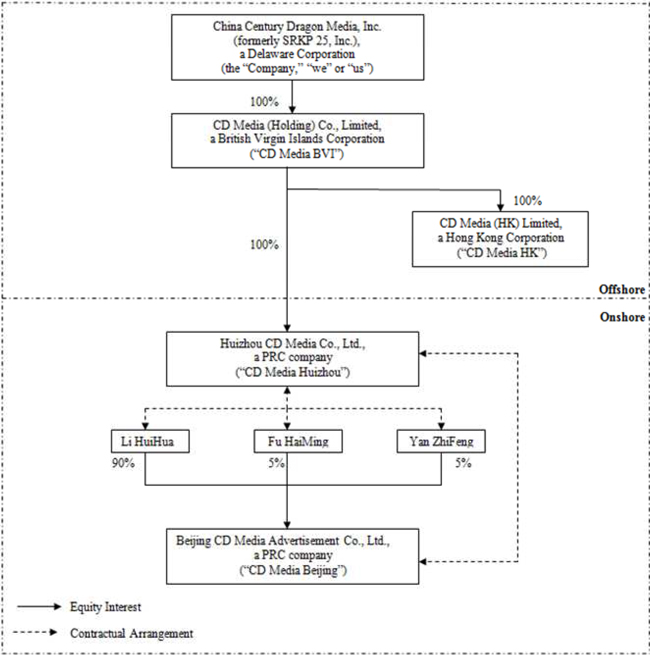

Corporate

Structure

The

corporate structure of the Company is illustrated as follows:

6

7

Power

of Attorney.

Each of the Beijing Shareholders signed a power of attorney dated

July 30, 2010 providing CD Media Huizhou the power to act as his/her exclusive

agent with respect to all matters related to his/her ownership of the ownership

interest in CD Media Beijing, including without limitation to: 1) attend the

shareholders’ meetings of CD Media Beijing; 2) exercise all the

shareholder's rights and shareholder's voting rights, including the sale,

transfer, pledge or disposition of such shareholder’s shareholding in part or in

whole; and 3) designate and appoint on behalf of such shareholders the legal

representative, the executive director and/or director, supervisor, the chief

executive officer and other senior management members of CD Media

Beijing.

|

|

the

ownership structure of CD Media Beijing and CD Media Huizhou complies with

current PRC laws, rules and

regulations;

|

|

|

each

agreement under our contractual arrangements with CD Media Beijing and its

shareholders is valid and binding on all parties to these arrangements,

and do not violate current PRC laws, rules or regulations;

and

|

|

|

the

business operations of CD Media Huizhou and CD Media Beijing comply with

current PRC laws, rules and

regulations.

|

8

|

Common

stock we are offering

|

2,500,000

shares (1)

|

|

|

Common

stock included in Underwriter’s option to purchase shares from the selling

stockholders to cover over-allotments, if any (up to 70% of the

over-allotment option)

|

262,500

shares

|

|

|

Common

stock included in Underwriter’s option to purchase shares from us to cover

over-allotments, if any

|

112,500

shares

|

|

|

Common

stock outstanding after the offering

|

27,812,838

shares (2)

|

|

|

Offering

price

|

$3.00

to $4.00 per share (estimate)

|

|

|

Use

of proceeds

|

We

intend to use approximately one-fifth of the net proceeds from this

offering to invest in our present advertising business to obtain more

advertising time, two-fifths of the net proceeds of this offering to

obtain advertising time and cooperation rights on regional television

stations; and two fifths of the proceeds for general corporate

purposes. See “Use of Proceeds” on page 35 for more information on

the use of proceeds. We will not receive any proceeds from the sale of any

shares in this offering by the selling

stockholders.

|

|

|

Conflicts

of interest

|

Affiliates

of WestPark Capital beneficially own approximately 13.2% of our company

and, therefore, WestPark Capital has a “conflict of interest” under FINRA

Rule 2720. Accordingly, this offering is being conducted in

accordance with FINRA Rule 2720, which requires that a “qualified

independent underwriter” as defined in FINRA Rule 2720 participate in the

preparation of the registration statement and prospectus and exercise its

usual standards of due diligence in respect thereto. [_________] is

assuming the responsibilities of acting as the qualified independent

underwriter in the offering. The public offering price will be no

higher than that recommended by [________]. See

“Underwriting—Conflicts of Interest” on page 83 for more

information.

|

|

|

Risk

factors

|

Investing

in these securities involves a high degree of risk. As an investor you

should be able to bear a complete loss of your investment. You should

carefully consider the information set forth in the “Risk Factors” section

beginning on page 11.

|

|

|

Proposed

symbol

|

We

intend to apply for the listing of our common stock on the NASDAQ Global

Market or the NYSE Amex Equities under the symbol

“[___].”

|

|

|

Concurrent

resale registration

|

|

Upon

the effectiveness of the Registration Statement of which this prospectus

forms a part, 3,566,838 shares of our common stock will be registered for

resale by the holders of such shares. None of these securities are

being offered by us and we will not receive any proceeds from the sale of

these shares. For additional information, see above under “Prospectus

Summary — Recent

Events.”

|

|

|

|

|

Excludes

(i) up to 125,000 shares of common stock underlying warrants to be

received by the Underwriters in this offering, and (ii) 3,566,838 shares

of our common stock held by the selling stockholders that are concurrently

being registered with this offering for resale by such selling stockholder

under a separate prospectus, and (iii) the 112,500 shares of our common

stock that we may issue upon the Underwriters’ over-allotment option

exercise. The exercise of the Underwriters’ over-allotment option to

purchase the 262,500

shares from selling stockholders named in this prospectus to cover

over-allotments, if any, will not affect the number of shares outstanding

after this offering.

|

|

|

|

|

Based

on 25,312,838 shares of common stock issued and outstanding as of the date

of this prospectus and (ii) 2,500,000 shares of common stock issued in the

public offering. Excludes (i) the Underwriters’ warrants to purchase

a number of shares equal to 5% of the shares of common stock sold in this

offering excluding the shares sold in the over-allotment option, and (ii)

1,419,333 shares of common stock underlying warrants that are exercisable

at $0.0001. Excludes the 112,500 shares of our common stock that we

may issue upon the Underwriters’ over-allotment option exercise and is not

affected by the 262,500 shares that the Underwriters may purchase from

selling stockholders named in this

prospectus.

|

9

SUMMARY

FINANCIAL DATA

|

Consolidated Statements of Operations

|

Six Months Ended June 30,

|

Years Ended December 31,

|

||||||||||||||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||||||||

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

|||||||||||||||||||||||||

|

(all

amounts are in US Dollars and in thousands, except share and per share

amounts)

|

||||||||||||||||||||||||||||

|

Revenues

|

$ | 51,774 | $ | 23,760 | $ | 74,480 | $ | 44,684 | $ | 17,103 | $ | 6,231 | $ | 1,926 | ||||||||||||||

|

Gross

profit

|

9,089 | 4,366 | 14,734 | 8,186 | 4,264 | 1,417 | (66 | ) | ||||||||||||||||||||

|

Income

(loss) from operations

|

6,295 | 3,216 | 12,040 | 6,135 | 1,820 | 636 | (131 | ) | ||||||||||||||||||||

|

Net

income (loss)

|

$ | 4,432 | $ | 2,413 | $ | 9,010 | $ | 4,605 | $ | 1,223 | $ | 711 | $ | (130 | ) | |||||||||||||

|

Earnings

per share — basic

|

$ | 0.21 | $ | 0.13 | $ | 0.47 | $ | 0.24 | $ | 0.06 | $ | 0.04 | $ | (0.01 | ) | |||||||||||||

|

Earnings

per share — diluted

|

$ | 0.20 | 0.13 | |||||||||||||||||||||||||

|

Weighted

average shares outstanding – basic

|

21,228,154 | 19,100,000 | 19,100,000 | 19,100,000 | 19,100,000 | 19,100,000 | 19,100,000 | |||||||||||||||||||||

|

Weighted

average shares outstanding – diluted

|

22,647,487 | 19,100,000 | 19,100,000 | 19,100,000 | 19,100,000 | 19,100,000 | 19,100,000 | |||||||||||||||||||||

|

Consolidated Balance Sheets

|

As of June 30,

|

As of December 31,

|

||||||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||||||

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

||||||||||||||||||||||

|

(all

amounts are in US Dollars and in thousands)

|

||||||||||||||||||||||||

|

Total

Current Assets

|

$ | 27,766 | $ | 13,678 | $ | 11,158 | $ | 4,545 | 2,265 | 1,443 | ||||||||||||||

|

Total

Assets

|

27,796 | 20,532 | 11,188 | 4,564 | 2,267 | 1,443 | ||||||||||||||||||

|

Total

Current Liabilities

|

3,079 | 4,844 | 4,579 | 2,767 | 1,777 | 2,229 | ||||||||||||||||||

|

Total

Liabilities

|

3,079 | 4,844 | 4,579 | 2,767 | 1,777 | 2,229 | ||||||||||||||||||

|

Total

Stockholders' Equity (Deficiency)

|

24,716 | 15,687 | 6,609 | 1,797 | 490 | (786 | ) | |||||||||||||||||

The

acquisition of CD Media BVI by us on April 30, 2010 pursuant to the Share

Exchange was accounted for as a recapitalization by us. The recapitalization

was, at the time of the Share Exchange, the merger of a private operating

company (CD Media BVI) into a non-operating public shell corporation (us) with

nominal net assets and as such is treated as a capital recapitalization, rather

than a business combination. As a result, the assets of the operating company

are recorded at historical cost. The transaction is the equivalent to the

issuance of stock by the private company for the net monetary assets of the

shell corporation. The pre-acquisition financial statements of CD Media BVI are

treated as the historical financial statements of the consolidated companies.

The financial statements presented will reflect the change in capitalization for

all periods presented, therefore the capital structure of the consolidated

enterprise, being the capital structure of the legal parent, is different from

that appearing in the financial statements of CD Media BVI in earlier periods

due to this recapitalization.

10

RISK

FACTORS

RISKS

RELATED TO OUR OPERATIONS

Our

CCTV-related business has been, and is expected to continue to be, critical to

our business and financial performance.

|

|

CCTV

may change its sales method at any time as it wishes and without prior

notice. While CCTV currently uses third-party agencies to sell a

significant portion of its advertising time slots to companies such as

ours, CCTV also sells a portion of its advertising time slots

directly by itself or through auctions. If CCTV introduces new methods of

sales that are materially different from the methods it is currently

using, it may take us a significant amount of time to develop expertise,

if at all, in buying advertising time on CCTV under any new sales

method.

|

|

|

CCTV’s

advertising time, particularly prime-time advertising time, is limited and

is highly coveted by advertisers and advertising agencies. As a result,

there is intense competition for such advertising time. In particular, we

face intense competition for CCTV related advertising business from a

number of domestic competitors, such as Walk-On Advertising Co., Ltd. (San

Ren Xing) and Vision CN Communications Group (Tong Lu), Charm

Communications, Inc. and China Mass Media Corp., which may have

competitive advantages, such as significantly greater financial, marketing

or other resources or stronger market

reputation.

|

11

An

unfavorable change in CCTV’s market position could materially and adversely

affect our ability to generate revenues and income.

We

rely on access to advertising time slots during television programs to place our

clients’ advertisements and the desirability of the advertising time slots we

obtain depends on the popularity of the relevant television programs and other

factors that are difficult to predict.

We

may experience difficulties in our planned expansion into regional television

networks, which could result in a decrease in our revenues and

profitability.

12

We

plan to secure media resources in new advertising media platforms. We may not be

successful in that business due to our lack of experience and expertise with

respect to those new media platforms and we may face many other risks and

uncertainties.

|

|

continue

to identify and obtain media resources in those new media platforms that

are attractive to advertisers;

|

|

|

significantly

expand our capital expenditures to pay for media

resources;

|

|

|

obtain

related governmental approvals;

and

|

|

|

expand

the number of operations and sales staff that we

employ.

|

We cannot

assure you that we will be able to successfully secure media resources in new

advertising media platforms or that the related business will generate new

revenues to pay for any increased capital expenditures or operating costs. If we

are unable to successfully implement our strategy relating to new advertising

media platforms, or if such expansion does not otherwise benefit our business,

our prospects and competitive position may be materially harmed and our

business, financial condition and results of operations may be materially and

adversely affected.

China

regulates media content extensively and we may be subject to government actions

based on the advertising content we design for advertising clients or services

we provide to them.

PRC

advertising laws and regulations require advertisers, advertising operators and

advertising distributors, including businesses such as ours, to ensure that the

content of the advertisements they prepare or distribute is fair and accurate

and is in full compliance with applicable laws, rules and regulations. Violation

of these laws, rules or regulations may result in penalties, including fines,

confiscation of advertising fees, orders to cease dissemination of the

advertisements and orders to publish an advertisement correcting the misleading

information. In circumstances involving serious violations, the PRC government

may revoke a violator’s license for advertising business

operations.

Our

business includes assisting advertising clients in designing and producing

advertisements, as well as executing their advertising campaign. Under our

agreements with third parties providing advertising time on CCTV we are

typically responsible for the compliance with applicable laws, rules and

regulations with respect to advertising content that we provide to the media. In

addition, some of our advertising clients provide completed advertisements for

us to display on CCTV. Although these advertisements are subject to internal

review and verification of CCTV, their content may not fully comply with

applicable laws, rules and regulations. Further, for advertising content related

to special types of products and services, such as alcohol, cosmetics,

pharmaceuticals and medical procedures, we are required to confirm that our

clients have obtained requisite government approvals, including operating

qualifications, proof of quality inspection of the advertised products and

services, government pre-approval of the content of the advertisement and

filings with the local authorities. We endeavor to comply with such

requirements, including by requesting relevant documents from the advertising

clients and employing qualified advertising inspectors who are trained to review

advertising content for compliance with applicable PRC laws, rules and

regulations. However, we cannot assure you that violations or alleged violations

of the content requirements will not occur with respect to our operations. If

the relevant PRC governmental agencies determine the content of the

advertisements that we represent violated any applicable laws, rules or

regulations, we could be subject to penalties. Although our agreements with our

clients normally require them to warrant the fairness, accuracy and compliance

with relevant laws and regulations of their advertising content and agree to

indemnify us for violations of these warranties, these contractual remedies may

not cover all of our losses resulting from governmental penalties. Violations or

alleged violations of the content requirements could also harm our reputation

and impair our ability to conduct and expand our business.

13

We

may be exposed to liabilities from allegations that certain of our clients’

advertisements may be false or misleading or that our clients’ products may be

defective.

We

receive a significant portion of our revenues from a few large clients, and the

loss of one or more of these clients could materially and adversely impact our

business, results of operations and financial condition.

If

we are unable to adapt to changing advertising trends and preferences of

advertisers, television channels and viewers, we will not be able to compete

effectively.

The

market for television advertising requires us to continuously identify new

advertising trends and the preferences of advertisers, television channels and

viewers, which may require us to develop new features and enhancements for our

services. We may incur development and acquisition costs or to hire new managers

or other personnel in order to keep pace with new market trends, but we may not

have the financial and other resources necessary to fund and implement these

development or acquisition projects or to hire suitable personnel. Further, we

may fail to respond to changing market preferences in a timely fashion. If we

cannot succeed in developing and introducing new services on a timely and

cost-effective basis, the demand for our advertising services may decrease and

we may not be able to compete effectively or attract advertising clients, which

would have a material adverse effect on our business and prospects.

The

nature of the advertising business in China is such that sudden changes in

advertising proposals and actual advertisements are frequent. In China,

television stations remain responsible for the content of advertisements, and as

a result, television stations may reject or recommend changes to the content of

advertisements. We strive to minimize problems related to work for clients by

encouraging the conclusion of basic written agreements, but we are exposed to

the risk of unforeseen incidents or disputes with advertising clients. In

addition, similar to other companies in our industry in the PRC where

relationships between advertising clients within a particular industry and

advertising companies are not typically exclusive, we are currently acting for

multiple clients within a single industry in a number of industries. If this

practice in China were to change in favor of exclusive relationships and if our

efforts to respond to this change were ineffective, our business, results of

operations and financial condition could be materially and adversely

affected.

14

We

rely on computer software and hardware systems in our operations, the failure of

which could adversely affect our business, results of operations and financial

condition.

We are

dependent upon our computer software and hardware systems in designing our

advertisements and keeping important operational and market information. In

addition, we rely on our computer hardware for the storage, delivery and

transmission of data. Any system failure that causes interruptions to the input,

retrieval and transmission of data or increase in the service time could disrupt

our normal operations. Although we have a disaster recovery plan that is

designed to address the failures of our computer software and hardware systems,

we may not be able to effectively carry out this disaster recovery plan or

restore our operations within a sufficiently short time frame to avoid business

disruptions. Any failure in our computer software or hardware systems could

decrease our revenues and harm our relationships with advertisers, television

channels and other media companies, which in turn could have a material adverse

effect on our business, results of operations and financial

condition.

Our

failure to maintain a skilled a dedicated sales and marketing team, our sales

and revenues could decrease and cause an adverse effect on our results of

operations.

15

Our

labor costs are likely to increase as a result of changes in Chinese labor

laws.

Our

business may be adversely affected by the global economic downturn, in addition

to the continuing uncertainties in the financial markets.

We

may pursue future growth through strategic acquisitions and alliances which may

not yield anticipated benefits and may adversely affect our operating results,

financial condition and existing business.

|

|

the

availability of suitable

candidates;

|

|

|

competition

from other companies for the purchase of available

candidates;

|

|

|

our

ability to value those candidates accurately and negotiate favorable terms

for those acquisitions;

|

|

|

the

availability of funds to finance

acquisitions;

|

|

|

the

ability to establish new informational, operational and financial systems

to meet the needs of our

business;

|

|

|

the

ability to achieve anticipated synergies, including with respect to

complementary products or services;

and

|

|

|

the

availability of management resources to oversee the integration and

operation of the acquired

businesses.

|

16

We

may need additional capital to implement our current business strategy, which

may not be available to us, and if we raise additional capital, it may dilute

your ownership in us.

Our

failure to effectively manage growth could harm our business.

We

may be subject to intellectual property infringement claims, which could result

in litigation and substantial costs to defend.

We

face risks related to natural disasters, terrorist attacks or other

unpredictable events in China which could have a material adverse effect on our

business and results of operations.

We

may adopt an equity incentive plan under which we may grant securities to

compensate employees and other services providers, which would result in

increased share-based compensation expenses and, therefore, reduce net

income.

17

RISKS

RELATED TO OUR CORPORATE STRUCTURE

If

the PRC government determines that the agreements establishing the structure for

operating our China business do not comply with applicable PRC laws, rules and

regulations, we could be subject to severe penalties including being prohibited

from continuing our advertising operations in the PRC.

|

|

revoking

the business and operating licenses of CD Media Huizhou and/or CD Media

Beijing;

|

|

|

ending

or restricting any transactions among CD Media Huizhou and CD Media

Beijing;

|

|

|

imposing

fines;

|

|

|

confiscating

our, CD Media Huizhou’s or CD Media Beijing’s

income;

|

|

|

imposing

restrictions on our operations with which we may be unable to

comply;

|

|

|

requiring

us to restructure our corporate structure or operations;

or

|

|

|

restricting

or prohibiting the use of any proceeds of an offering of our securities to

finance our operations in the

PRC.

|

The

imposition of any such penalties would have a material adverse effect on our

business and results of operations.

We

rely on contractual arrangements with CD Media Beijing, our consolidated

affiliated entity in China, and its shareholders, which may not be as effective

in providing us with operational control or enabling us to derive economic

benefits as through ownership of controlling equity interest.

18

19

RISKS

RELATED TO US DOING BUSINESS IN CHINA

As

substantially all of our assets are located in the PRC and all of our revenues

are derived from our operations in China, changes in the political and economic

policies of the PRC government could have a significant impact upon the business

we may be able to conduct in the PRC and accordingly on the results of our

operations and financial condition.

Our

operations are subject to PRC laws and regulations that are sometimes vague and

uncertain. Any changes in such PRC laws and regulations, or the interpretations

thereof, may have a material and adverse effect on our business.

20

|

|

levying

fines;

|

|

|

revoking

our business license, other licenses or

authorities;

|

|

|

requiring

that we restructure our ownership or operations;

and

|

|

|

requiring

that we discontinue any portion or all of our

business.

|

Investors

may experience difficulties in effecting service of legal process, enforcing

foreign judgments or bringing original actions in China based upon U.S. laws,

including the federal securities laws or other foreign laws against us or our

management.

The

scope of the business license for CD Media Beijing in China is limited, and we

may not expand or continue our business without government approval and renewal,

respectively.

Contract

drafting, interpretation and enforcement in China involves significant

uncertainty.

21

Recent

PRC regulations relating to acquisitions of PRC companies by foreign entities

may create regulatory uncertainties that could restrict or limit our ability to

operate. Our failure to obtain the prior approval of the China Securities

Regulatory Commission, or the CSRC, for our planned public offering and the

listing and trading of our common stock could have a material adverse effect on

our business, operating results, reputation and trading price of our common

stock.

22

If

the land use rights of our landlord are revoked, we would be forced to relocate

operations.

We

will not be able to complete an acquisition of prospective acquisition targets

in the PRC unless their financial statements can be reconciled to U.S. generally

accepted accounting principles in a timely manner.

23

We

face uncertainty from China’s Circular on Strengthening the Administration of

Enterprise Income Tax on Non-Resident Enterprises' Share Transfer Income

(“Circular 698”) that was released in December 2009 with retroactive effect from

January 1, 2008.

The

foreign currency exchange rate between U.S. Dollars and Renminbi could adversely

affect our financial condition.

24

Governmental

control of currency conversion may limit our ability to utilize our

revenues.

Inflation

in the PRC could negatively affect our profitability and growth.

Because

our funds are held in banks which do not provide insurance, the failure of any

bank in which we deposit our funds could affect our ability to continue in

business.

Failure

to comply with the United States Foreign Corrupt Practices Act could subject us

to penalties and other adverse consequences.

25

If

we make equity compensation grants to persons who are PRC citizens, they may be

required to register with the State Administration of Foreign Exchange of the

PRC, or SAFE. We may also face regulatory uncertainties that could restrict our

ability to adopt an equity compensation plan for our directors and employees and

other parties under PRC law.

Under

the New EIT Law, we and CD Media BVI may be classified as “resident enterprises”

of China for tax purpose, which may subject us and CD Media BVI to PRC income

tax on taxable global income.

26

Dividends

payable by us to our foreign investors and any gain on the sale of our shares

may be subject to taxes under PRC tax laws.

SAFE

rules and regulations may limit our ability to transfer the net proceeds from

this offering to CD Media Beijing, which may adversely affect the business

expansion of CD Media Beijing, and we may not be able to convert the net

proceeds from this offering into Renminbi to invest in or acquire any other PRC

companies.

27

Any

recurrence of Severe Acute Respiratory Syndrome (SARS), Avian Flu, or another

widespread public health problem, such as the spread of H1N1 (“Swine”) Flu, in

the PRC could adversely affect our operations.

|

|

quarantines

or closures of some of our facilities, which would severely disrupt our

operations,

|

|

|

the

sickness or death of our key officers and employees,

and

|

|

|

a

general slowdown in the Chinese

economy.

|

Further

downturn in the economy of the PRC may slow our growth and

profitability.

Because

our business is located in the PRC, we may have difficulty establishing adequate

management, legal and financial controls, which we are required to do in order

to comply with U.S. GAAP and securities laws, and which could cause a materially

adverse impact on our financial statements, the trading of our common stock and

our business

28

RISKS

RELATED TO OUR OWNERSHIP OF OUR COMMON STOCK AND THIS OFFERING

There

is no current trading market for our common stock, and there is no assurance of

an established public trading market, which would adversely affect the ability

of our investors to sell their securities in the public market.

The

market price and trading volume of shares of our common stock may be

volatile.

When and

if a market develops for our securities, the market price of our common stock

could fluctuate significantly for many reasons, including for reasons unrelated

to our specific performance, such as reports by industry analysts, investor

perceptions, or negative announcements by customers, competitors or suppliers

regarding their own performance, as well as general economic and industry

conditions. For example, to the extent that other large companies within

our industry experience declines in their share price, our share price may

decline as well. In addition, when the market price of a company’s shares drops

significantly, shareholders could institute securities class action lawsuits

against the company. A lawsuit against us could cause us to incur substantial

costs and could divert the time and attention of our management and other

resources.

Shares

eligible for future sale may adversely affect the market price of our common

stock, as the future sale of a substantial amount of outstanding stock in the

public marketplace could reduce the price of our common stock.

We have

also agreed to register shares of common stock held by our stockholders

immediately prior to the Share Exchange and all of the shares of common stock

underlying the warrants held by our stockholders immediately prior to the Share

Exchange, both of which total 4,065,333 shares of common stock. All of the

shares included in an effective registration statement may be freely sold and

transferred, subject to any applicable lock-up agreement.

29

The

shareholders of CD Media BVI and their designee have significant influence over

us.

As a

result, the former shareholders of CD Media BVI and their designee have

significant influence over our company and they, with their combined share

ownership, have a controlling influence in determining the outcome of any

corporate transaction or other matters submitted to our stockholders for

approval, including mergers, consolidations and the sale of all or substantially

all of our assets, election of directors, and other significant corporate

actions. The designee is an unaffiliated third party who was not a

shareholder of CD Media BVI prior to the Share Exchange, and none of the former

shareholders of CD Media BVI has control over the shares held by such

designee. While there is no agreement among the former shareholders of CD

Media BVI and the designee to vote their shares in any particular manner, should

these stockholders vote together they would have the power to prevent

or cause a change in control. In addition, without the consent of these

stockholders, we could be prevented from entering into transactions that could

be beneficial to us. The interests of these stockholders may differ from

the interests of our other stockholders.

Our

management will have broad discretion in the application of the net proceeds

from this offering and could spend the proceeds in ways that do not improve our

results of operations or enhance the value of our securities. We intend to use

the net proceeds for working capital and general corporate purposes. The

failure by our management to apply these funds effectively could result in

financial losses that could have a material adverse effect on our business and

cause the price of our securities to decline. Pending the application of these

funds, we may invest the net proceeds from this offering in a manner that does

not produce income or that loses value.

If

we fail to maintain effective internal controls over financial reporting, the

price of our common stock may be adversely affected.

We are

required to establish and maintain appropriate internal controls over financial

reporting. Failure to establish those controls, or any failure of those controls

once established, could adversely impact our public disclosures regarding our

business, financial condition or results of operations. Any failure of these

controls could also prevent us from maintaining accurate accounting records and

discovering accounting errors and financial frauds. Rules adopted by the SEC

pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual

assessment of our internal control over financial reporting, and attestation of

this assessment by our independent registered public accountants. We believe

that the annual assessment of our internal controls requirement and the

attestation requirement of management’s assessment by our independent registered

public accountants will first apply to our annual report for the 2010 fiscal

year. The standards that must be met for management to assess the internal

control over financial reporting as effective are new and complex, and require

significant documentation, testing and possible remediation to meet the detailed

standards. We may encounter problems or delays in completing activities

necessary to make an assessment of our internal control over financial

reporting. In addition, the attestation process by our independent registered

public accountants is new and we may encounter problems or delays in completing

the implementation of any requested improvements and receiving an attestation of

our assessment by our independent registered public accountants. If we cannot

assess our internal control over financial reporting as effective, or our

independent registered public accountants are unable to provide an unqualified

attestation report on such assessment, investor confidence and share value may

be negatively impacted.

30

We

may not be able to achieve the benefits we expect to result from the Share

Exchange.

On April

23, 2010, we entered into an Amended and Restated Share Exchange Agreement with

CB Media BVI, the shareholders of CD Media BVI, CD Media Beijing and CD Media

Huizhou, pursuant to which we agreed to acquire 100% of the issued and

outstanding securities of CD Media BVI in exchange for shares of our common

stock. On April 30, 2010, the Share Exchange closed, CD Media BVI became

our 100%-owned subsidiary, and our sole business operations became that of CD

Media BVI and its subsidiaries and CD Media Beijing. We also have a new

Board of Directors and management consisting of persons from CD Media BVI and

changed our corporate name from SRKP 25, Inc. to China Century Dragon Media,

Inc.

|

the

increased market liquidity expected to result from exchanging stock in a

private company for securities of a public company that may eventually be

traded;

|

Compliance

with changing regulation of corporate governance and public disclosure will

result in additional expenses.

Changing

laws, regulations and standards relating to corporate governance and public

disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC

regulations, have created uncertainty for public companies and significantly

increased the costs and risks associated with accessing the public markets and

public reporting. For example, on January 30, 2009, the SEC adopted rules

requiring companies to provide their financial statements in interactive data

format using the eXtensible Business Reporting Language, or XBRL. We will have

to comply with these rules by June 15, 2011. Our management team will need to

invest significant management time and financial resources to comply with both

existing and evolving standards for public companies, which will lead to

increased general and administrative expenses and a diversion of management time

and attention from revenue generating activities to compliance

activities.

Our

common stock may be considered a “penny stock,” and thereby be subject to

additional sale and trading regulations that may make it more difficult to

sell.

31

We

do not foresee paying cash dividends in the foreseeable future and, as a result,

our investors’ sole source of gain, if any, will depend on capital appreciation,

if any.

We do not

plan to declare or pay any cash dividends on our shares of common stock in the

foreseeable future and currently intend to retain any future earnings for

funding growth. As a result, investors should not rely on an investment in

our securities if they require the investment to produce dividend income.

Capital appreciation, if any, of our shares may be investors’ sole source of

gain for the foreseeable future. Moreover, investors may not be able to

resell their shares of our common stock at or above the price they paid for

them.

The

forward-looking statements contained in this prospectus are based on current

expectations and beliefs concerning future developments and the potential

effects on the parties and the transaction. There can be no assurance that

future developments actually affecting us will be those anticipated. These

forward-looking statements involve a number of risks, uncertainties (some of

which are beyond the parties’ control) or other assumptions that may cause

actual results or performance to be materially different from those expressed or

implied by these forward-looking statements, including the

following:

|

|

Our

dependence on CCTV;

|

32

|

|

Our

ability to continue obtaining advertising time slots aired on

CCTV;

|

|

|

The

continued strong market position and national coverage of CCTV

channels;

|

|

|

CCTV’s

continuing to use third party agencies to sell advertising

time;

|

|

|

Our

dependence on a limited number of suppliers for our advertising

time;

|

|

|

Our

lack of long-term contracts with our

customers;

|

|

|

Our

ability to adapt to changing advertising trends and preferences of

advertisers, television channels and

viewers;

|

|

|

Our

limited ability to adjust the fees we charge for our

services;

|

|

|

Our

ability to purchase advertising time from satellite and regional

television networks;

|

|

|

Our

ability enter into new advertising media

platforms;

|

|

|

Exposure

to PRC governmental actions regarding the advertising content of our

clients;

|

|

|

Exposure

to intellectual property claims from third

parties;

|

|

|

Our

ability to raise additional capital to fund our

operations;

|

|

|

Expected

growth in consumer spending, average income levels and advertising

spending levels;

|

|

|

Changes

in the laws of the PRC that affect our operations and our corporate

structure;

|

|

|

Inflation

and fluctuations in foreign currency exchange

rates;

|

|

|

Our

ability to obtain all necessary government certifications, approvals,

and/or licenses to conduct our

business;

|

|

|

Development

of a public trading market for our

securities;

|

|

|

The

cost of complying with current and future governmental regulations and the

impact of any changes in the regulations on our operations;

and

|

|

|

The

other factors referenced in this Current Report, including, without

limitation, under the sections entitled “Risk Factors,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,”

and “Business.”

|

33

You

should read this prospectus, and the documents that we reference in this

prospectus and have filed as exhibits to this prospectus with the Securities and

Exchange Commission, completely and with the understanding that our actual

future results, levels of activity, performance and achievements may materially

differ from what we expect. We qualify all of our forward-looking statements by

these cautionary statements.

34

The

Underwriters have a 45-day option to purchase up to 375,000 additional shares of

common stock at the public offering price solely to cover over-allotments, if

any, if the Underwriters sell more than 2,500,000 shares of common stock in this

offering. The Underwriters agreed to purchase up to 70% of the

over-allotment shares from the selling stockholders identified in this

prospectus and the remaining shares from us. We will not receive any

proceeds from the sale of the shares by the selling stockholders, if

any.

DIVIDEND

POLICY

Under

applicable PRC regulations, foreign-invested enterprises in China may pay

dividends only out of their accumulated profits, if any, determined in

accordance with PRC accounting standards and regulations. In addition, a

foreign-invested enterprise in China is required to set aside at least 10.0% of

its after-tax profit based on PRC accounting standards each year to its general

reserves until the accumulative amount of such reserves reaches 50.0% of its

registered capital. These reserves are not distributable as cash dividends. The

board of directors of a foreign-invested enterprise has the discretion to

allocate a portion of its after-tax profits to staff welfare and bonus funds,

which may not be distributed to equity owners except in the event of

liquidation.

35

Because

all of our operations are conducted in the PRC, substantially all of our

revenues and expenses are denominated in Renminbi (RMB). Under PRC law, RMB is

currently convertible into U.S. Dollars under a company’s “current account,”

which includes dividends, trade and service-related foreign exchange

transactions, without prior approval of SAFE, but is not from a company’s

“capital account,” which includes foreign direct investment and loans, without

the prior approval of SAFE. Currently, CD Media Huizhou may convert RMB into

U.S. Dollars to declare and pay dividends outside of the PRC without the

approval of SAFE.

Our

inability to receive dividends or other payments from our Chinese subsidiary, CD

Media Huizhou, could adversely limit our ability to grow, make investments or

acquisitions that could be beneficial to our business, pay dividends, or

otherwise fund and conduct our business. Our funds may not be readily available

to us to satisfy obligations which have been incurred outside the PRC, which

could adversely affect our business and prospects or our ability to meet our

cash obligations. Accordingly, if we do not receive dividends from CD Media

Huizhou, our liquidity, financial condition and ability to make dividend

distributions to our stockholders will be materially and adversely

affected.

36

CAPITALIZATION

The

following table sets forth our capitalization as of June 30, 2010 (unaudited)

on:

|

|

·

|

an

actual basis,

which consists of

|

|

|

(i)

|

the

19,100,000 shares of common stock that were issued to the shareholders of

CD Media BVI and their designee pursuant to the Share Exchange as

outstanding as of June 30, 2010, as the Share Exchange was accounted for

as a reverse merger and a recapitalization CD Media BVI and its

subsidiaries (see Note 1 to the financial

statements);

|

|

|

(ii)

|

the

2,646,000 shares of common stock outstanding immediately prior to the

Share Exchange after giving effect to the cancellation of 4,450,390 shares

in connection with the Share Exchange that closed on April 30, 2010;

and

|

|

|

(iii)

|

the

3,566,838 shares of common stock at $1.50 per share in the Private

Placement that closed concurrently with the Share Exchange pursuant to

which we received approximately $3.7 million (unaudited) in net proceeds;

and

|

|

|

·

|

an

as adjusted to

give effect to reflect our receipt of estimated net proceeds of

approximately $7.0 million from the sale of 2,500,000 shares of common

stock in this offering at an assumed public offering price of $3.50, which

is the mid-point of the estimated range of the per share offering price,

and after deducting estimated underwriting discounts of 9% and commissions

and estimated offering expenses of approximately $1.0

million.

|

You

should read this table in conjunction with “Use of Proceeds,” “Summary Financial

Information,” “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and our consolidated financial statements and related

notes included elsewhere in this prospectus.

|

June 30,

2010

|

||||||||

|

Actual

|

As Adjusted

|

|||||||

|

(amounts

in thousands)

|

||||||||

|

Due

to Related Parties

|

1 | 1 | ||||||

|

Stockholders’

equity:

|

||||||||

|

Preferred

stock, $0.0001 par value, 10,000,000 shares authorized, none issued and

outstanding

|

$ | - | $ | - | ||||

|

Common

stock, $0.0001 par value, 100,000,000 shares authorized, 25,312,838 shares

issued and outstanding on an actual basis and 27,812,838 issued and

outstanding on an as-adjusted basis (1)

|

3 | 3 | ||||||

|

Additional

paid-in capital

|

5,165 |

11,858

|

||||||

|

Accumulated

other comprehensive income

|

445 | 406 | ||||||

|

Statutory

surplus reserve fund

|

790 | 790 | ||||||

|

Retained

earnings (unrestricted)

|

18,314 |

18,314

|

||||||

|

Total

stockholders’ equity

|

$ | 24,717 | $ |

31,371

|

||||

|

Total

capitalization

|

$ | 27,798 | $ |

31,372

|

||||

|

(1)

|

The

number of our shares of common stock shown above to be outstanding after

this offering is based on (i) 25,312,838 shares of common stock issued and

outstanding as of June 30, 2010. The number (i) excludes the 112,500

shares of our common stock that we may issue upon the Underwriters’

over-allotment option exercise, (ii) excludes the 1,419,333 shares of

common stock that will be issued upon the exercise of outstanding warrants

exercisable at $0.0001 per share; (iii) excludes the 125,000 shares of

common stock underlying warrants that will be issued to the Underwriters

upon completion of this offering, and (iv) is not affected by the 262,500

shares that the Underwriters may purchase from selling stockholders named

in this prospectus.

|

MARKET

FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

There

has never been a public trading market for our common stock and our shares of

common stock are not currently listed or quoted for trading on any national

securities exchange or national quotation system. We intend to apply for the

listing of our common stock on the NASDAQ Global Market or the NYSE Amex

Equities. As of the date of this prospectus, we had 140 stockholders of

record.

37

DILUTION

If you invest in our shares of common

stock, you will incur immediate, substantial dilution based on the difference

between the public offering price per share you will pay in this offering and

the net tangible book value per share of common stock immediately after this

offering.

As of

June 30, 2010, we had 25,312,838 shares of common

stock outstanding, which consists of (i) the 19,100,000shares of common stock

that were issued to the former shareholders of CD Media BVI and their designee

pursuant to the Share Exchange, which was accounted for as a reverse merger and

a recapitalization CD Media BVI and its subsidiaries (see Note 1 to the

financial statements); (ii) the 2,646,000 shares of common stock outstanding

immediately prior to the Share Exchange after the cancellation of 4,450,390

shares in connection with the Share Exchange, and (iii) the sale and issuance of

3,566,838 shares of common stock at $1.50 per share in the Private Placement

that closed concurrently with the Share Exchange pursuant to which we received

approximately $3.7 million (unaudited) in net proceeds.

Our

net tangible book value as of June 30, 2010 was approximately $24.7 million, or

$0.98 per share (unaudited) based on 25,312,838 shares of common stock

outstanding. Based on the mid-range point of the per share offering price of

$3.50, investors will incur further dilution from the sale by us of 2,500,000

shares of common stock offered in this offering, and after deducting the

estimated underwriting discount and commissions of 9%, a non-accountable

allowance of 3% and estimated offering expenses of $1.0 million, our as adjusted

net tangible book value as of June 30, 2010 would have been $31.4 million, or

$1.13 per share, based on 27,812,838 after this offering. This represents an

immediate increase in net tangible book value of $0.15 per share to our existing

stockholders and an immediate dilution of $2.37 per share to the new investors

purchasing shares of common stock in this offering.

The

following table illustrates this per share dilution, excluding 1,419,333 shares

issuable upon the exercise of outstanding warrants at $0.0001 per

share:

|

Assumed

public offering price per share (mid-range price)

|

$ | 3.50 | ||||||

|

Net

tangible book value per share as of June 30, 2010

|

$ | 0.98 | ||||||

|

Increase

per share attributable to new public investors

|

$ | 0.15 | ||||||

|

Net

tangible book value per share after this offering

|

$ | 1.13 | ||||||

|

Dilution

per share to new public investors

|

$ | 2.37 | ||||||

Furthermore,

our stockholders hold warrants to purchase 1,419,333 shares of common stock at a

per share exercise price of $0.0001. If all of the warrants were

exercised, the as-adjusted net tangible book value per share as of June 30, 2010

would decrease to $1.07 per share after this offering, which would represent an

immediate increase in net tangible book value of $.09 per share to our existing

stockholders and an immediate dilution of $2.43 per share to the new investors

purchasing shares of common stock in this offering.

The

following table sets forth, on an as-adjusted basis as of June 30, 2010, the

difference between the number of shares of common stock purchased from us, the

total cash consideration paid, and the average price per share paid by our

existing stockholders and the average price to be paid by new investors in this

public offering before deducting estimated underwriting discounts and

commissions and estimated offering expenses payable by us, using an assumed

public offering price of $3.50 per share of common stock.

The

shares outstanding as of June 30, 2010 on an actual basis

includes:

|

|

·

|

19,100,000

shares of common stock that was issued to the shareholders of CD Media BVI

and their designee pursuant to the Share Exchange that closed on April 30,

2010;

|

|

|

·

|

2,646,000

shares of common stock and 1,419,333 shares of common stock underlying

currently outstanding warrants, each held by the original SRKP 25, Inc.

stockholders, with the warrants being exercisable at $0.0001 per share;

and

|

|

|

·

|

3,566,838 shares of common

stock sold at $1.50 per share in our Private Placement that closed

concurrently with the Share

Exchange.

|

38

|

Shares Purchased

|

Total Cash Consideration

|

|||||||||||||||||||

|

Number

|

Percent

|

Amount

(in thousands)

|

Percent

|

Average Price

Per Share

|

||||||||||||||||

|

Shares

issued to shareholders of CD Media BVI in the Share

Exchange

|

19,100,000 | 65.3 | % | $ | 632 | 4.3 | % | $ | 0.03 | |||||||||||

|

Shares

held by original SRKP 25, Inc. stockholders after Share Exchange,

including assumed exercise of warrants to purchase 1,419,333 shares of

common stock at $0.0001 per share

|

4,065,333 | 13.9 | % | $ | 2 | 0 | % | $ | 0.00 | |||||||||||

|

Investors

in the Private Placement

|

3,566,838 | 12.2 | % | $ | 5,350 | 36.3 | % | $ | 1.50 | |||||||||||

|

New

investors in this offering

|

2,500,000 | 8.6 | % | $ | 8,750 | 59.4 | % | $ | 3.50 | |||||||||||

|

Total

|

29,232,171 | 100.0 | % | $ | 14,734 | 100.0 | % | |||||||||||||

The