Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONTINENTAL RESOURCES, INC | d8k.htm |

Denver

August 23-25, 2010

ENERCOM Energy Conference 2010

Exhibit 99.1 |

2

This presentation includes forward-looking information that is subject to a number of risks

and uncertainties, many of which are beyond the Company’s control. All information,

other than historical facts included in this presentation, regarding strategy, future

operations, drilling plans, estimated reserves, future production, estimated capital

expenditures, projected costs, the potential of drilling prospects and other plans and

objectives of management is forward-looking information. All forward-looking

statements speak only as of the date of this presentation. Although the Company believes

that the plans, intentions and expectations reflected in or suggested by the forward-looking

statements are reasonable, there is no assurance that these plans, intentions or expectations

will be achieved. Actual results may differ materially from those anticipated due to

many factors, including oil and natural gas prices, industry conditions, drilling

results, uncertainties in estimating reserves, uncertainties in estimating future production from

enhanced recovery operations, availability of drilling rigs, pipe and other services and

equipment, availability of oil and natural gas transportation capacity, availability of

capital resources and other factors listed in reports we have filed or may file with the

Securities and Exchange Commission. This presentation also includes information on

reserves potentially recoverable through additional drilling or enhanced recovery

operations. Non-proven estimates are generally not permitted to be disclosed in SEC filings and are subject to a

substantial risk of not being realized.

|

3

#3 oil producer in the Rocky Mountains

Accelerating growth with oil-rich drilling inventory

Excellent 1H10 results

•

$392MM EBITDAX

•

20%> in EUR model to 518,000 Boe per well (ND Bakken)

•

#1 Land position in Bakken Shale play with 816,852 net acres

•

9% production growth in 2Q10 vs. 1Q10

•

2Q10: 41,913 Boepd

•

1Q10: 38,428 Boepd

•

2Q09: 37,347 Boepd

Continental Resources, Inc. |

Organic growth

•

Inventory to 3X

production and reserves over the next five years

Crude-oil focused

•

75% of 2Q10 production

Advanced technology applied to unconventional

resource plays

Conservative fiscal discipline

4

Growth Strategy |

5

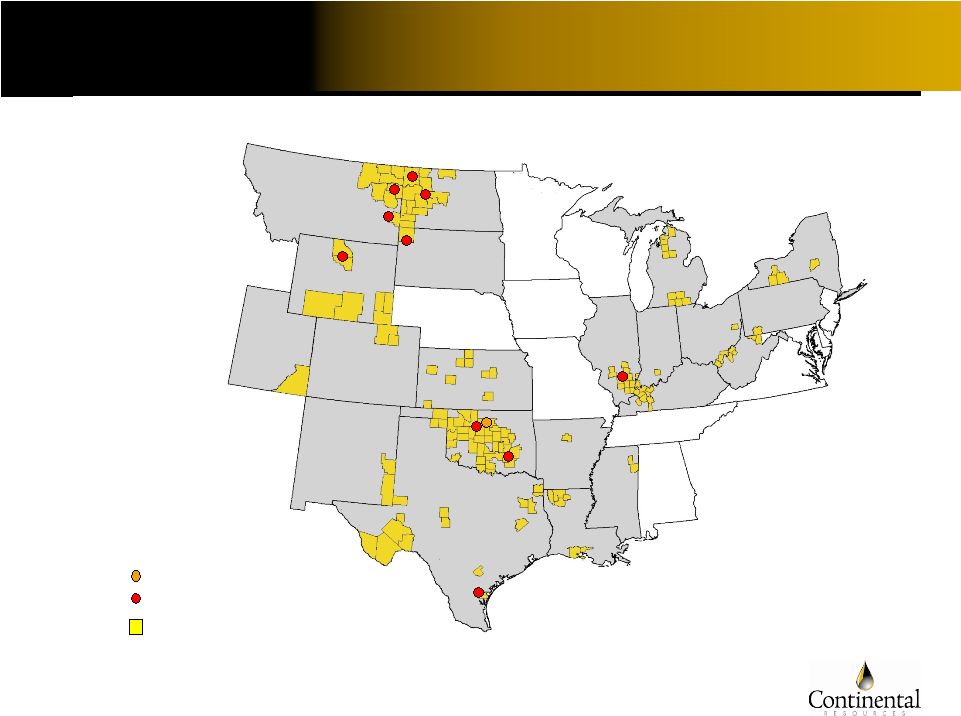

Operating Areas

Headquarters: Enid, Oklahoma

Field offices

Counties with acreage

holdings are highlighted |

6

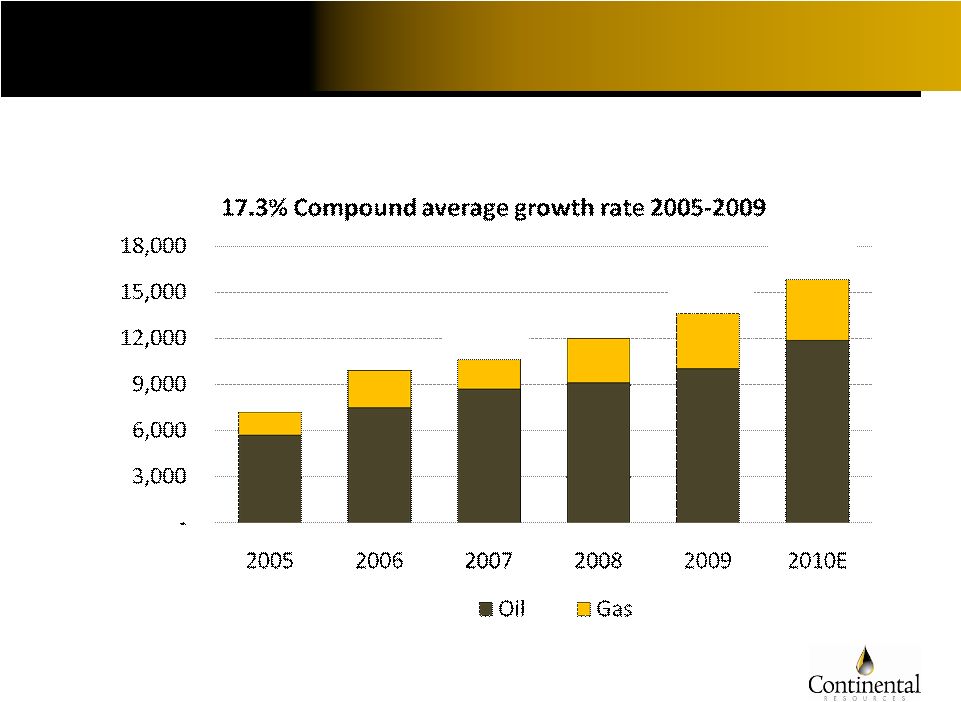

Strong Production Growth 2005-2009

7,209

9,018

10,621

12,006

13,623

79%

oil

83%

82%

76%

75%

MBoe

Est.

15,800

74%

*

CLR

2Q10

production

75%

crude

oil.

2010

production

guidance

is

for

15%

to

17%

growth. |

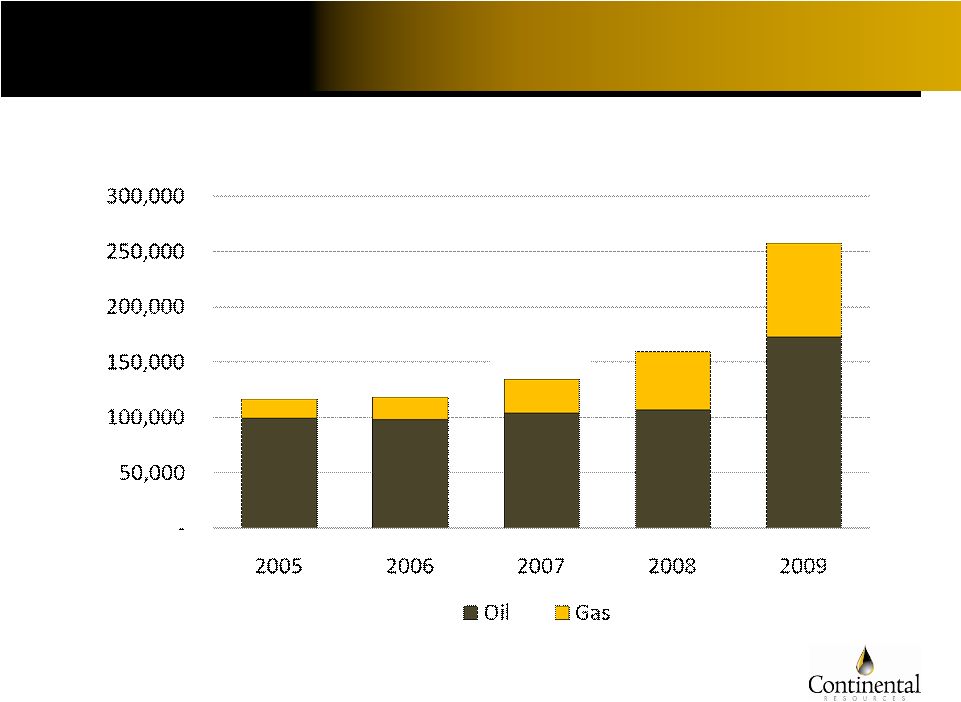

7

116,665

118,349

134,615

159,262

257,293

85%

oil

83%

77%

67%

67%

Growth in Reserves 2005-2009

MBoe |

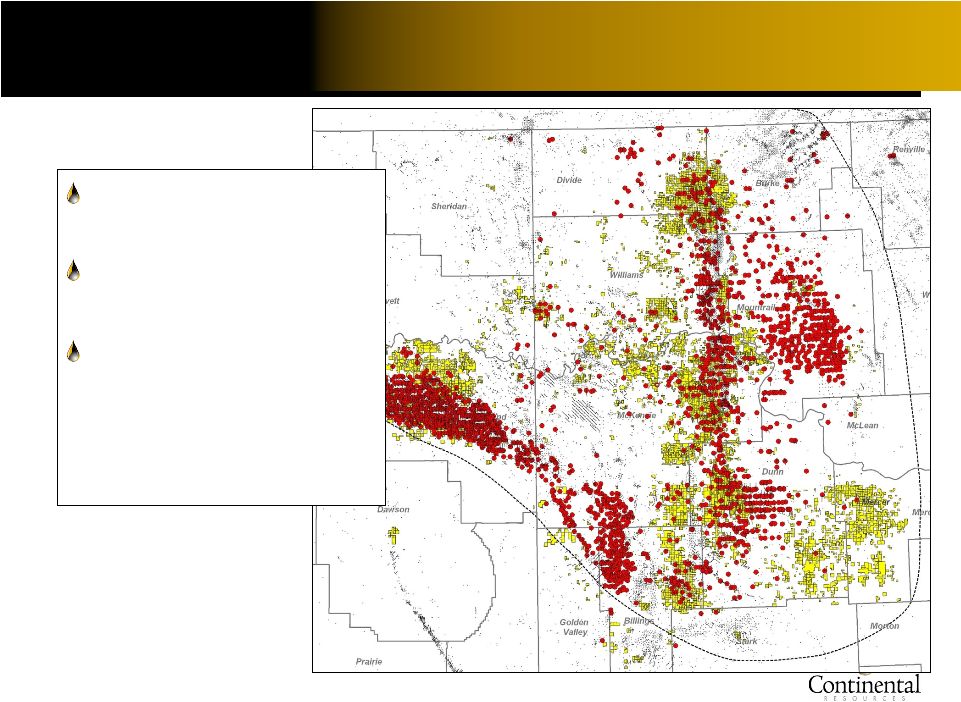

8

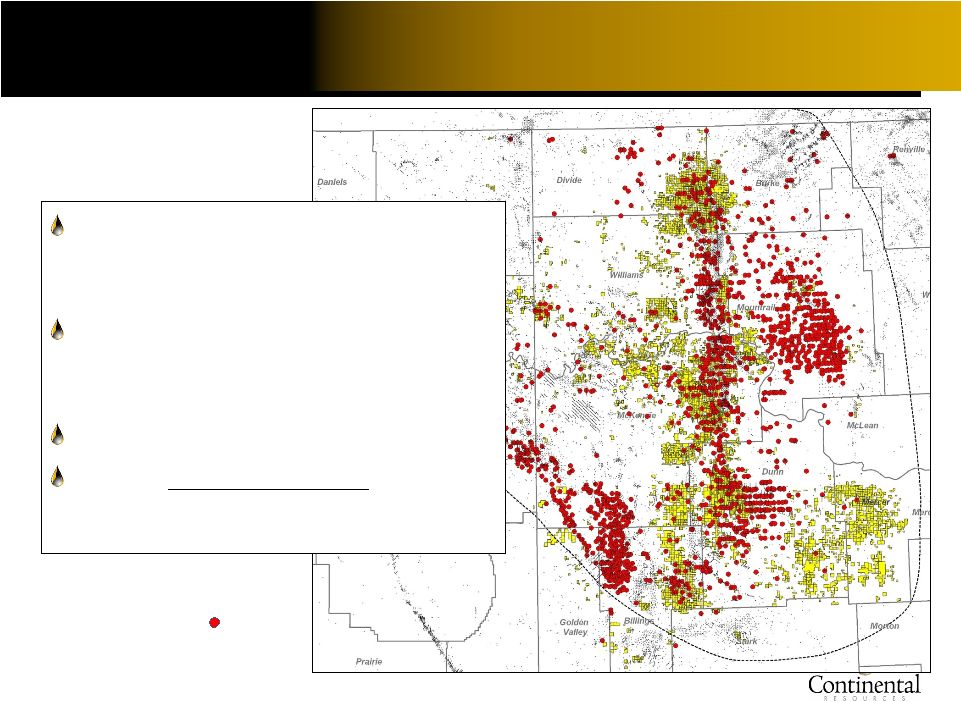

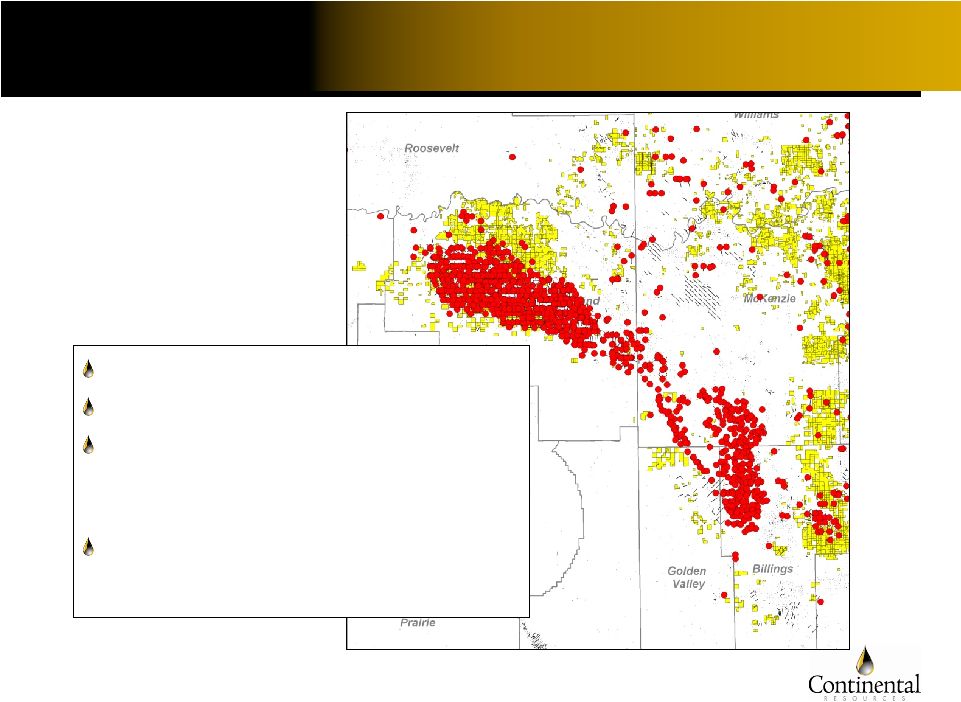

The Bakken

#1 crude oil play in

lower 48 (USGS)

4.3B barrels of

recoverable oil

CLR: +171,505 net

acres since

January 1, 2010

~ |

9

Growth Driver: North Dakota Bakken

Hz producer

2Q10: 13,046 Boepd

•

+93% over 2Q09

•

+30% over 1Q10

41% of ‘09 proved reserves

•

616 gross (261.9 net) PUD

locations at YE09

589,937 net acres

2010: $588MM capex

(67% of

total drilling capex) |

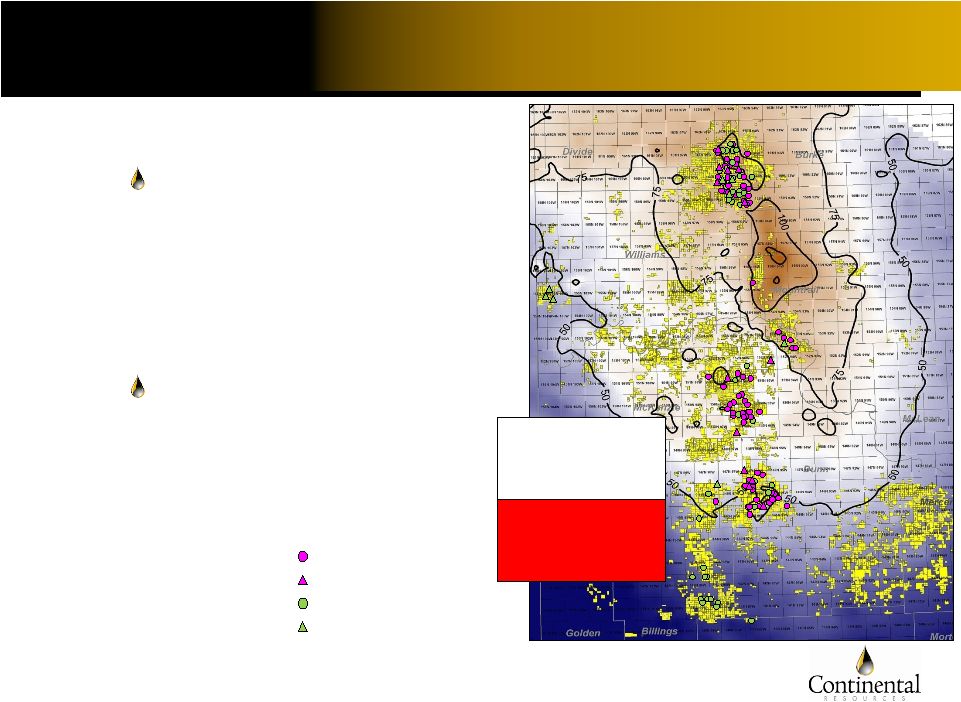

CLR firsts

•

Drilled the Three Forks in

May 2008

•

Dual zone development with

Mathistad 2-35H in 2009

•

ECO-Pad drilling in 2010

75% of acreage could

be prospective for dual

zone development

10

MB/TF Dual Reservoir Development

®

CLR TF producer

CLR Q2 MB completion

CLR Q2 TF completion

CLR MB producer

2Q10 TF Completions

Meldahl 1-23H –

2,489 Boe

Ole 1-29H –

1,864 Boe

Bang 2-33H –

1,860 Boe

Roger 1-18H –

1,486 Boe

2Q10 MB Completions

Franklin 1-20H –

1,288 Boe

Bohmbach 2-35H –

1,271 Boe

Brockmeier 1-1H –

1,217 Boe

Anseth 1-29H –

1,088 Boe |

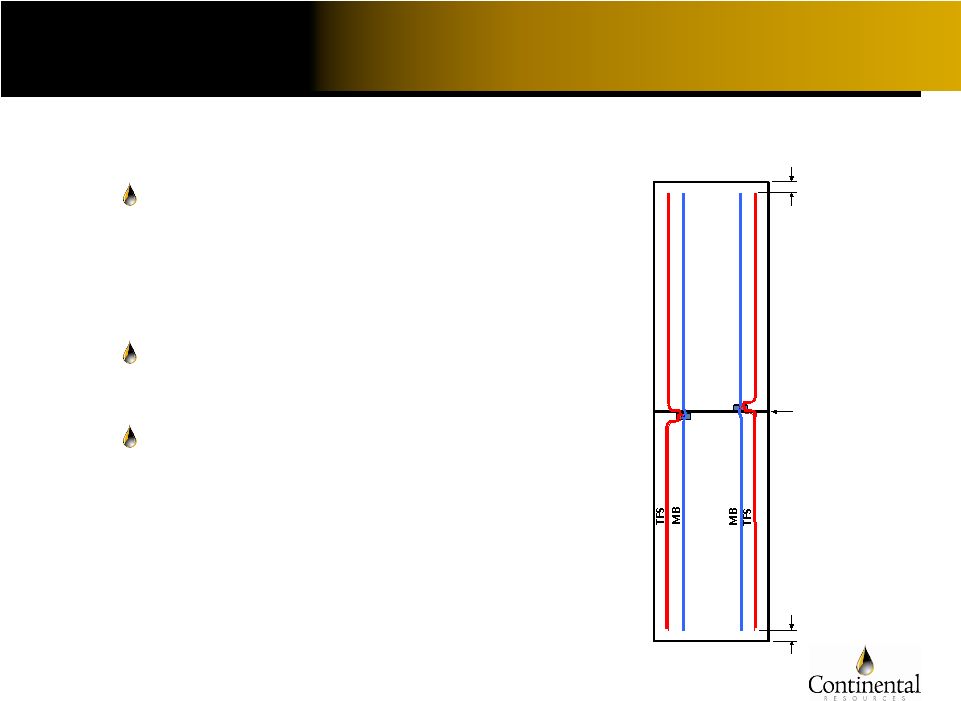

North Dakota

Industrial Commission reduced property

line set-back requirement

•

At least 5% longer lateral

Expect results from first ECO-

Pad projects in near future

10% less D&C cost

•

4 wells per ECO-Pad, versus 4

separate drilling pads

11

ECO-Pad Development

Spacing unit #2

1,280-acre spacing

unit #1

50’

set-back

500’

set-back

500’

set-back

® |

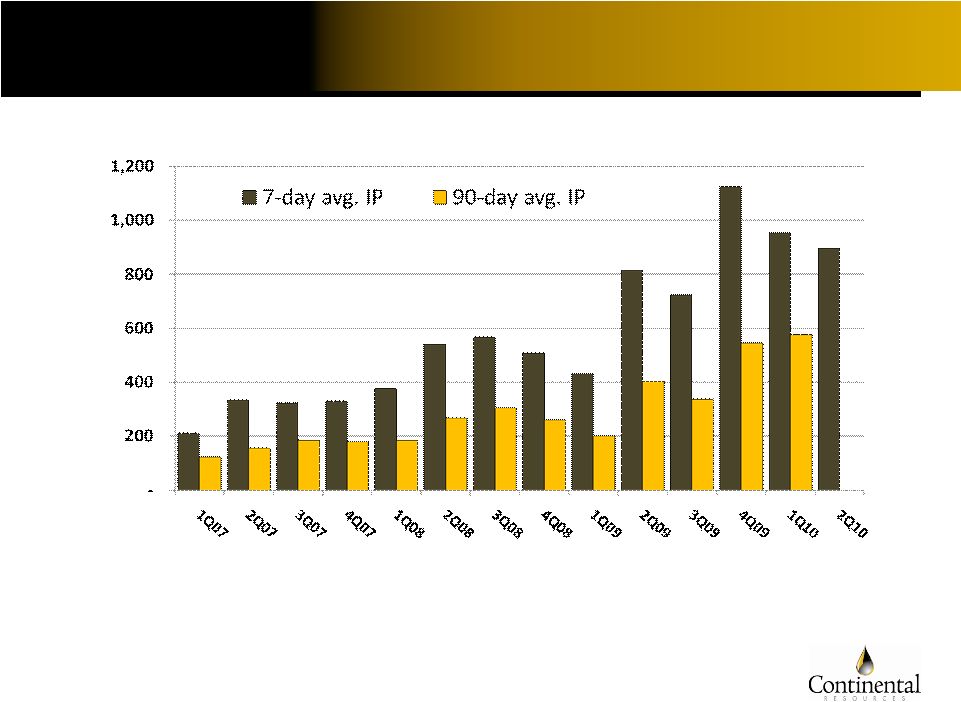

12

Improving ND Bakken Well Results

Boepd

Current standard is 24 stages; testing 30

210

333

323

329

376

539

567

507

432

815

722

1,123

954

122

155

184

179

185

267

306

260

201

402

335

546

576

895

Completions:

7

7

7

5

5

10

6

15

11

9

9

9

14

Avg. CLR stages:

1

1

4

9

8

10

11

13

11

12

15

18

20

23

24

NA |

13

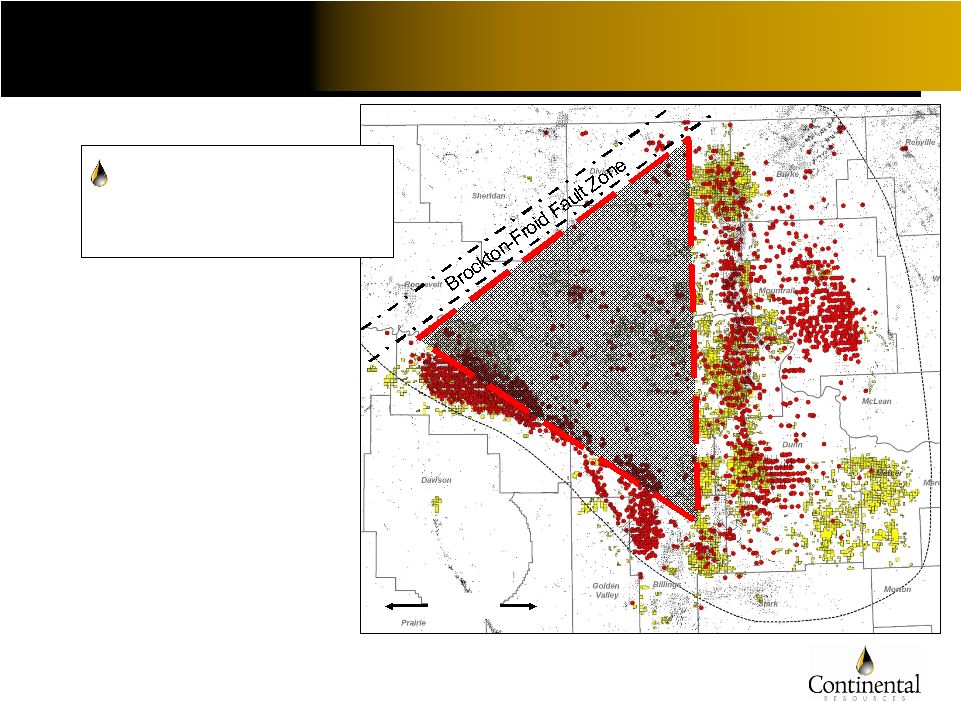

Expanding Montana Bakken

+63,416 net acres added in 2010

2Q10: 5,196 Boepd

11% of 2009 proved reserves

•

65 gross (44.7 net) PUD

locations

$55MM in 2010 capex

•

Added second rig to play |

14

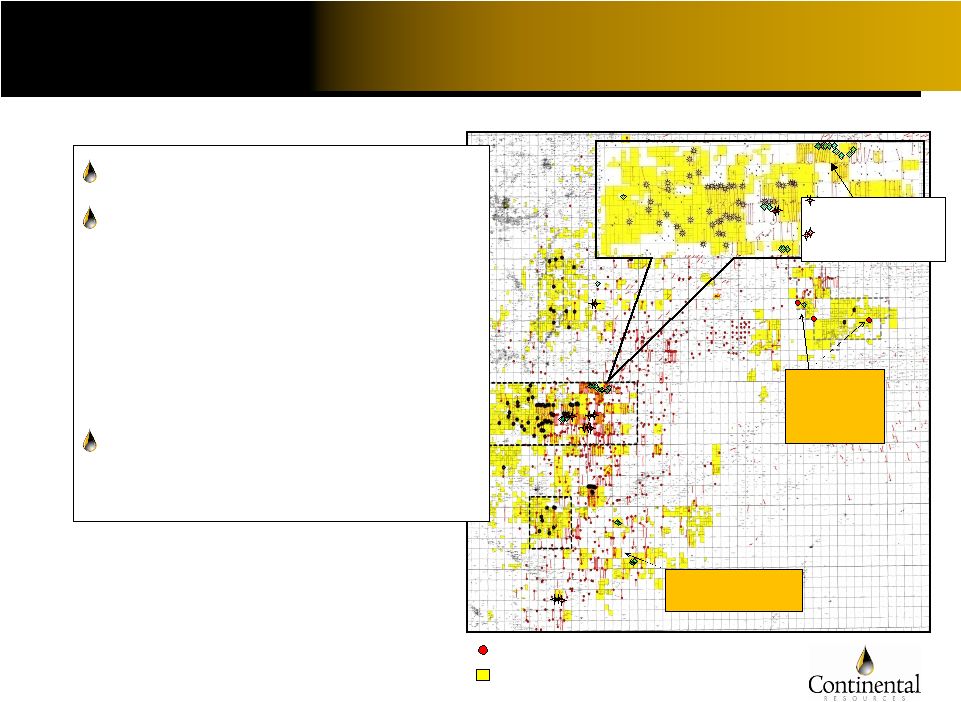

Good Plays Keep Getting Better

50 Miles

The Bakken

keeps growing |

15

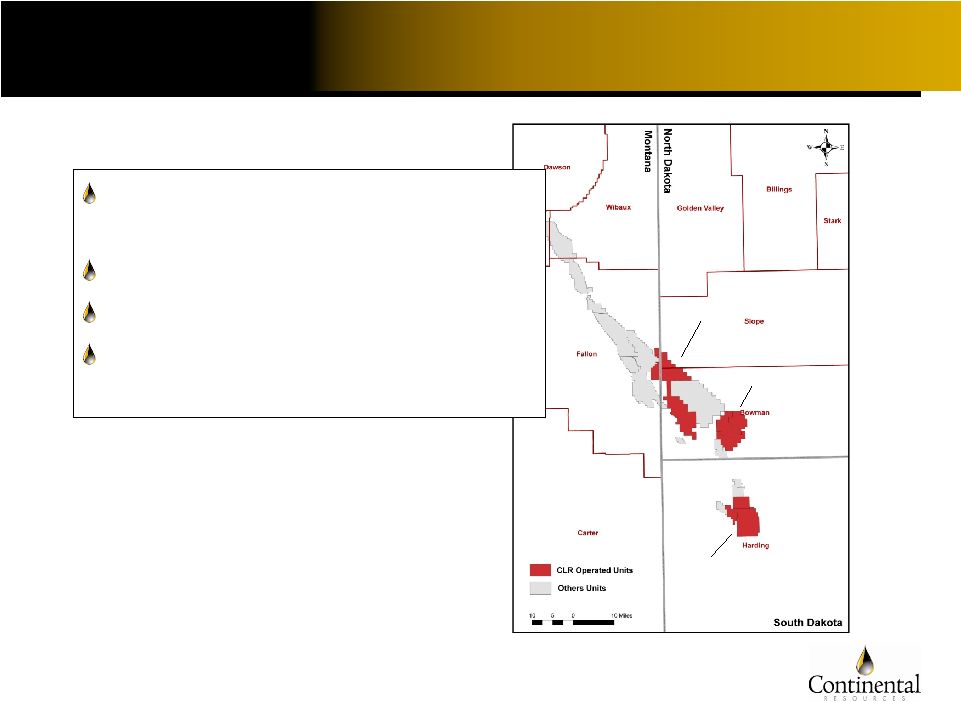

Production Base: Red River Units

Cedar Hills Units

Buffalo Units

Medicine Pole Hills

Units

Cedar Hills Units: 7 largest

onshore oil field in Lower 48

2Q10: 15,080 Boepd

21% of 2009 proved reserves

$82MM in 2010 capex

•

5 new producers drilled 2Q10

th |

16

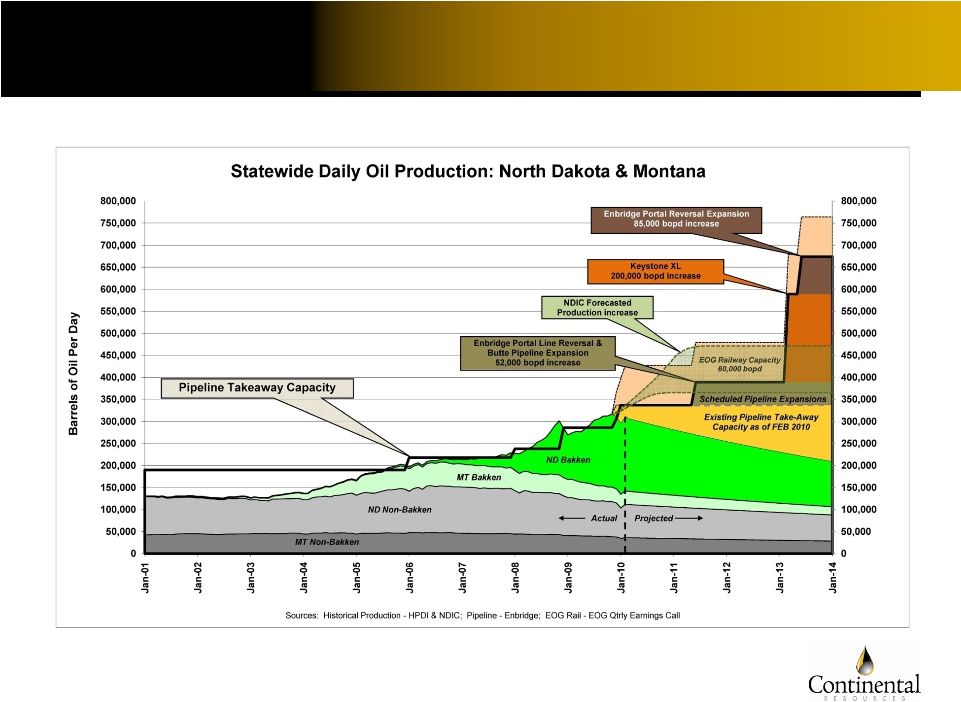

Williston Takeaway Capacity |

17

Arkoma Woodford: Working East

CLR Acreage

Woodford Producer

SALT CREEK

RUSHING

ASHLAND AMI

Foster Development

6 wells: avg. 2.4

MMcfpd

EAST KREBS

Ennis 7H-12 (non-op)

8.4 MMcfpd

Marilyn 1-29H

4.2 MMcfpd

Delphia

1-34H

2.1 MMcfpd

2Q10: 3,721 Boepd

17% of 2009 proved

reserves

•

401 gross (100 net) PUD

locations

•

46,074 net acre position; 47%

HBP

$41MM in 2010 capex |

18

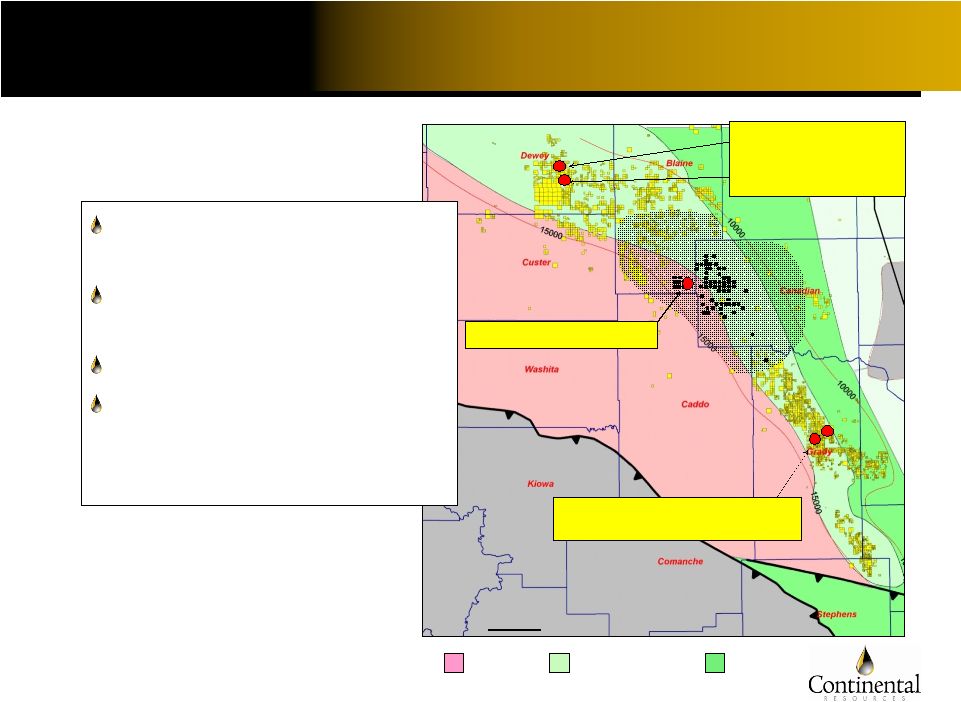

Anadarko Woodford: Coming on Strong

12 miles

Wichita

Uplift

Nemaha

Uplift

Cana

Gas/Condensate

Oil

Gas

Brown 1-2H

4.2 MMcfpd, 102 Bopd

Doris 1-25H

4.5 MMcfpd, 72 Bopd

McCalla

1-11H

Ballard 1-17H 750 Mcfpd, 200 Bopd

NW Cana

SE Cana

Young 2-22H 7.5 MMcfpd

Very encouraged by early

well results

Liquids content enhances

economics

251,626 net acres

$75MM in 2010 capex

•

3 operated rigs

•

Adding 4 by year end |

19

Operating and Fiscal Discipline

1

See Non-GAAP Financial Measures in Form 10-K, Form 10-Q and earnings

release for a reconciliation of net income to EBITDAX. 2

Average costs per Boe

have been computed using sales volumes.

Realized oil price ($/bbl)

Realized natural gas price ($/Mcf)

Oil production (bopd)

Natural gas production (Mcfd)

Total production (boepd)

EBITDAX ($000’s)

Key Operational Statistics

Average oil equivalent price

Production expense

Production tax

G&A

Interest

Total cash costs

Cash margin

Cash margin %

Years ended December 31,

2009

$54.44

$3.22

27,459

59,194

37,324

$450,648

$45.10

6.89

3.37

3.03

1.72

$15.01

$30.09

66.7%

2008

$88.87

$6.90

24,993

46,861

32,803

$757,708

$77.66

8.40

4.84

2.95

1.01

$17.20

$60.46

77.9%

1H10

$69.87

$4.84

30,373

58,844

40,180

$391,578

$59.92

6.17

4.70

3.20

2.78

$16.85

$43.07

71.9%

1

2 |

20

Plenty of Running Room

* CLR internal economic model, based on EUR of 518K Boe

and 640-acre spacing for the ND Bakken; 430K Boe

and 320-acre

spacing for the MT Bakken; 300K and 320-acre spacing for the Niobrara; 3

Bcf 80-acre spacing for the Arkoma Woodford; and

6 Bcf

and 160-acre spacing for the Anadarko Woodford.

ND Bakken

MB zone

600

253

1,932

MMBoe

additional reserves potential in the Bakken, Niobrara and Woodford;

7.5X 2009 reserves of 257.3 MMBoe.

In addition to our 62% increase in 2009 proved reserves...

Potential unbooked

locations (net)

Additional MMBoe

reserve potential

ND Bakken

TF zone

400

168

Arkoma

Woodford

425

174

(1.0 Tcf)

Anadarko

Woodford

1,500

1,218

(7.3 Tcf)

MT

Bakken

200

70

Niobrara

200

49 |

21

Positioned for Value Creation

Low-cost, high-margin

operator

•

Operate 93% of our PV-10

Strong balance sheet

Hedged for operational

stability

Huge drilling inventory

Goal: 3X in 5 years

–

production and

reserves |

Continental Resources, Inc. |

23

Appendix |

Year ended December

31, 2010 Production growth

Price differentials (1)

Oil (Bbl)

Gas (Mcf)

Operating expenses per Boe:

Production expense

Production tax (percent of sales)

Depreciation, depletion, amortization

and accretion

General and administrative expense (2)

Non-cash stock-based compensation

Income tax rate, percent of pre-tax income

Percent of income tax deferred

24

2010 Guidance

15% to 17%

$8 to $10

+/-

$0.25

$6.50 to $7.00

7.0% to 7.5%

$15 to $18

$2.00 to $2.40

$0.75 to $1.00

38%

95%

(1)

Differential to calendar month average NYMEX futures price for oil and to average

of last three trading days of prompt NYMEX futures contract for gas.

(2)

Excludes non-cash stock-based compensation.

|

25

Crude Oil Hedge Positions

2010

Jul. to Sep.

Swaps

Collars

Oct. to Dec.

Swaps

Collars

2011

Jan. to Mar.

Swaps

Collars

Apr. to Dec.

Collars

2012

Jan. to Dec.

Collars

Volume in

Barrels

687,000

1,380,000

1,089,000

1,380,000

225,000

2,565,000

7,837,500

2,745,000

Weighted Avg.

of Swaps

$84.58

$83.99

$84.55

Range

$75-78

$75-78

$75-80

$75-80

$80

Weighted

Average

$76.00

$76.00

$78.95

$79.39

$80

Range

$88.75-96.75

$88.75-96.75

$88.65-97.25

$89.00-97.25

$93.25-93.65

Weighted

Average

$93.43

$93.43

$91.70

$91.27

$93.54

Collars: Floors

Collars: Ceilings |

26

Natgas Swaps

2010

Jul. to Sep.

Oct. to Dec.

2011

Jan. to Dec.

Natgas Basis Swaps, Centerpoint East

2010

Jul. to Dec.

Natural Gas Swaps

MMBtus

3,778,000

3,778,000

11,862,500

3,600,000

Swaps

Weighted Avg.

$6.09

$6.09

$6.36

($0.62) |