As Filed with the Securities and Exchange Commission on August 19, 2010

Registration No. 333-164811

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 2 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

JEFFERIES COMMODITY REAL RETURN ETF

(Registrant)

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

6799 |

|

01-6270570 |

| (State of Organization) |

|

(Primary Standard Industrial

Classification Number) |

|

(I.R.S. Employer

Identification Number) |

|

|

|

| c/o Jefferies Commodity

Investment Services, LLC

One Station Place

Three North

Stamford, CT 06902

(203) 708-6500 |

|

|

|

Andrew R. Kaplan, Esq.

c/o Jefferies Commodity

Investment Services, LLC

One Station Place

Three North

Stamford, CT 06902

(203) 708-6500 |

| (Address, including zip code, and

telephone number, including

area code, of registrant’s principal

executive offices) |

|

|

|

(Name, address, including zip code,

and telephone number,

including area code, of agent for

service) |

Copies to:

Michael J. Schmidtberger, Esq.

James C. Munsell, Esq.

Sidley Austin LLP

787 Seventh Avenue

New York, New York 10019

Approximate date of commencement of proposed sale to the public:

As promptly as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. x

If this Form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ¨

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ¨

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ¨

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act. (Check one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

(Do not check if a smaller reporting company) ¨ |

|

Smaller reporting company |

|

x |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of Securities to be Registered |

|

Amount

to be

Registered |

|

Proposed

Maximum

Offering Price

Per Share |

|

Proposed

Maximum

Aggregate

Offering Price1 |

|

Amount of

Registration

Fee2 |

| Jefferies Commodity Real Return ETF Common Units of Beneficial Interest |

|

20,000,000 |

|

$25.001

|

|

$500,000,000 |

|

$35,650 |

| |

| |

| 1

|

The proposed maximum aggregate offering price has been calculated assuming that all Shares are sold at a price of $25.00 per Share.

|

| 2

|

The amount of the registration fee of the Shares is calculated in reliance upon Rule 457(o) under the Securities Act and using the proposed maximum

aggregate offering price as described above. 250,000 Shares were registered and the registration fee of $445.63 in respect thereof was paid on February 9, 2009. 19,750,000 additional Shares were registered and the registration fee of $35,204.38

was paid with respect thereto on June 28, 2010. |

The registrant hereby amends this

Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this Prospectus is not complete and may be changed. We may not sell these

securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer

or sale is not permitted.

Subject to completion, dated August 19, 2010

Jefferies Commodity Real Return ETF

20,000,000 Common Units of Beneficial Interest

Jefferies Commodity Real Return ETF, the Fund, is organized as a Delaware statutory

trust. The Fund will issue common units of beneficial interest, or Shares, which represent units of fractional undivided beneficial interest in and ownership of the Fund. Shares may be purchased from the Fund only by certain eligible financial

institutions, called Authorized Participants, and only in one or more blocks of 50,000 Shares, called a Basket. The Fund will issue its Shares in Baskets to Authorized Participants continuously at the net asset value of 50,000 Shares. The

Fund’s Participant Agreements set forth the terms and conditions on which Authorized Participants may create or redeem Baskets. The offering of Shares will terminate on the third anniversary of the registration statement of which this

Prospectus is a part unless prior thereto a new registration statement is filed.

The Shares will trade on the NYSE

Arca under the symbol RRET.

The Fund establishes long positions in futures contracts underlying the Thomson

Reuters / Jefferies CRB 3 Month Forward Index, or the Index, with a view to tracking the changes, whether positive or negative, in the level of the Index over time. The Index is designed to provide a timely and accurate representation of a

long-only, broadly diversified investment in commodities through a transparent and disciplined calculation methodology.

The Fund does not intend to outperform the Index. The Managing Owner will seek to cause the net asset value of the Fund to track the

Index during periods in which the Index is flat or declining as well as when the Index is rising.

Except when aggregated in

Baskets, the Shares are not redeemable securities.

THE SHARES ARE SPECULATIVE

SECURITIES AND THEIR PURCHASE INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CONSIDER ALL RISK FACTORS BEFORE INVESTING IN THE FUND. PLEASE REFER TO “THE RISKS YOU FACE” BEGINNING ON PAGE 18.

| • |

|

Futures trading is volatile and even a small movement in market prices could cause large losses for investors in the Fund.

|

| • |

|

The Managing Owner and its trading principals have not managed any other public commodity pool or any other commodity pool that seeks to track an index

of commodity futures, although certain of the trading principals do have experience managing other types of private commodity pools, and therefore there is no indication of their ability to manage investment vehicles such as the Fund. If the

experience of the Managing Owner and its trading principals is not adequate or suitable to manage investment vehicles such as the Fund, the operations of the Fund may be adversely affected. |

| • |

|

You could lose all or substantially all of your investment. |

| • |

|

The Fund will be subject to actual and potential conflicts of interest involving the Managing Owner, the Clearing Broker, various commodity brokers and

the Authorized Participants. |

| • |

|

Investors in the Fund will pay fees in connection with their investment in Shares including asset-based management fees of 0.85% per annum. The

Fund will also pay additional fees and expenses up to an aggregate of 0.15% per annum of the daily net asset value of the Fund, or the Overall Expense Cap. The Managing Owner has agreed to pay any additional fees and expenses incurred by the

Fund (other than management fees) to the extent that they exceed the Overall Expense Cap, subject to reimbursement, as described herein. |

| • |

|

Fees and commissions are charged, and expenses are incurred, regardless of profitability and may result in depletion of assets and, as a result, losses

to your investment. |

|

| On [•], 2010, Jefferies & Company, Inc., as the Initial Purchaser, subject to certain conditions, agreed to purchase

and take delivery of 100,000 Shares, which comprise the initial Baskets, at a purchase price of $25.00 per Share ($1,250,000 per Basket), as described in “Plan of Distribution.” This price has been arbitrarily determined inasmuch as the

Shares will have no inherent value at the Fund’s inception, and it is not indicative of prices that will prevail in the trading market. The Initial Purchaser proposes to offer the Shares to the public at a per-Share price that will vary

depending upon, among other factors, the trading price of the Shares on the NYSE Arca, the net asset value per Share and the supply of and demand for the Shares at the time of offer. Shares offered by the Initial Purchaser at different times may

have different offering prices. The Initial Purchaser will not receive from the Fund, the Managing Owner or any of their affiliates, any fee or other compensation in connection with its sale of Shares to the public. |

Authorized Participants may from time-to-time offer to the public Shares from any Baskets they create. Shares offered to the public by

Authorized Participants will be offered at a per-Share offering price that will vary depending upon, among other factors, the trading price of the Shares on the NYSE Arca, the net asset value per Share and the supply of and demand for the Shares at

the time of offer. Shares initially comprising the same Basket but offered by Authorized Participants to the public at different times may have different offering prices. Authorized Participants will not receive from the Fund, the Managing Owner or

any of their affiliates, any fee or other compensation in connection with their sale of Shares to the public. An Authorized Participant may receive commissions or fees from investors who purchase Shares through their commission or fee-based

brokerage accounts with the Authorized Participant. In addition, the Fund will pay a marketing fee to the Distributor. For more information regarding items of compensation paid to FINRA members, please see the “Plan of Distribution”

section on page 94.

These securities have not been approved or disapproved by the Securities and Exchange

Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense. The

Fund is not a mutual fund or any other type of investment company within the meaning of the Investment Company Act of 1940, as amended, and is not subject to regulation thereunder.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON

THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

THE SHARES ARE NEITHER INTERESTS IN NOR OBLIGATIONS OF ANY OF

THE MANAGING OWNER, THE INITIAL PURCHASER, ANY AUTHORIZED PARTICIPANT, THE TRUSTEE OR ANY OF THEIR RESPECTIVE AFFILIATES.

[ ], 2010

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE

AWARE THAT FUTURES AND OPTIONS TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON

REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT

TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE

DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED TO THIS POOL AT PAGE 53 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGES 13-15.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL.

THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 17 THROUGH 32.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE

THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE

UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

THIS POOL HAS NOT COMMENCED TRADING AND DOES NOT HAVE ANY PERFORMANCE HISTORY.

THE BOOKS AND RECORDS OF THE FUND WILL BE MAINTAINED AS FOLLOWS: ALL MARKETING MATERIALS WILL BE MAINTAINED AT THE OFFICES OF ALPS

DISTRIBUTORS, INC., 1290 BROADWAY, SUITE 1100, DENVER, COLORADO 80203; TELEPHONE NUMBER (303) 623-2577; BASKET CREATION AND REDEMPTION BOOKS AND RECORDS, ACCOUNTING AND CERTAIN OTHER FINANCIAL BOOKS AND RECORDS (INCLUDING FUND ACCOUNTING

RECORDS, LEDGERS WITH RESPECT TO ASSETS, LIABILITIES, CAPITAL, INCOME AND EXPENSES, THE REGISTER, TRANSFER JOURNALS AND RELATED DETAILS) AND TRADING AND RELATED DOCUMENTS RECEIVED FROM FUTURES COMMISSION MERCHANTS ARE MAINTAINED BY THE BANK OF NEW

YORK MELLON, 2 HANSON PLACE, 12TH FLOOR, BROOKLYN, NEW YORK 11217, TELEPHONE NUMBER (718) 315-4412. ALL OTHER BOOKS AND RECORDS OF THE FUND (INCLUDING MINUTE BOOKS AND OTHER GENERAL CORPORATE RECORDS, TRADING RECORDS AND RELATED REPORTS AND

OTHER ITEMS RECEIVED FROM THE FUND’S COMMODITY BROKERS) WILL BE MAINTAINED AT THE FUND’S PRINCIPAL OFFICE, C/O JEFFERIES COMMODITY INVESTMENT SERVICES, LLC, ONE STATION PLACE, THREE NORTH, STAMFORD, CT 06902; TELEPHONE NUMBER

(203) 708-6500. SHAREHOLDERS WILL HAVE THE RIGHT, DURING NORMAL BUSINESS HOURS, TO HAVE ACCESS TO AND COPY (UPON PAYMENT OF REASONABLE REPRODUCTION COSTS) SUCH BOOKS AND RECORDS IN PERSON OR BY THEIR AUTHORIZED ATTORNEY OR AGENT. MONTHLY

ACCOUNT STATEMENTS FOR THE FUND CONFORMING TO COMMODITY FUTURES TRADING COMMISSION (THE “CFTC”) AND THE NATIONAL FUTURES ASSOCIATION (THE “NFA”) REQUIREMENTS WILL BE POSTED ON THE MANAGING OWNER’S WEBSITE AT

HTTP://WWW.JAMFUNDS.COM/JCIS. ADDITIONAL REPORTS WILL BE POSTED ON THE MANAGING

OWNER’S WEBSITE IN THE DISCRETION OF THE MANAGING OWNER OR AS REQUIRED BY REGULATORY AUTHORITIES. THERE WILL SIMILARLY BE DISTRIBUTED TO SHAREHOLDERS, NOT MORE THAN 90 DAYS AFTER THE CLOSE

OF THE FUND’S FISCAL YEAR, CERTIFIED AUDITED FINANCIAL STATEMENTS AND (IN NO EVENT LATER THAN MARCH 15 OF THE IMMEDIATELY FOLLOWING YEAR) THE TAX INFORMATION RELATING TO SHARES OF THE FUND NECESSARY FOR THE PREPARATION OF SHAREHOLDERS’

ANNUAL FEDERAL INCOME TAX RETURNS.

THIS PROSPECTUS DOES NOT INCLUDE ALL OF THE INFORMATION OR EXHIBITS IN THE REGISTRATION STATEMENT OF THE FUND. YOU CAN READ AND COPY THE

ENTIRE REGISTRATION STATEMENT AT THE PUBLIC REFERENCE FACILITIES MAINTAINED BY THE SEC IN WASHINGTON, D.C.

THE FUND WILL

FILE PERIODIC, QUARTERLY AND ANNUAL REPORTS WITH THE SEC. YOU CAN READ AND COPY THESE REPORTS AT THE SEC PUBLIC REFERENCE FACILITIES IN WASHINGTON, D.C. PLEASE CALL THE SEC AT 1–800–SEC–0330 FOR FURTHER INFORMATION.

THE FILINGS OF THE FUND WILL BE POSTED AT THE SEC WEBSITE AT HTTP://WWW.SEC.GOV.

REGULATORY NOTICES

NO DEALER, SALESMAN OR ANY OTHER PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION NOT CONTAINED IN THIS

PROSPECTUS, AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE FUND, THE MANAGING OWNER, THE INITIAL PURCHASER, THE AUTHORIZED PARTICIPANTS OR ANY OTHER PERSON.

THIS PROSPECTUS DOES NOT CONSTITUTE AN OFFER OR SOLICITATION TO SELL OR A SOLICITATION OF AN OFFER TO BUY, NOR SHALL THERE BE ANY OFFER,

SOLICITATION, OR SALE OF THE SHARES IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION, OR SALE IS NOT AUTHORIZED OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE ANY SUCH OFFER, SOLICITATION, OR SALE.

AUTHORIZED PARTICIPANTS MAY BE REQUIRED TO DELIVER A PROSPECTUS WHEN TRANSACTING IN SHARES. SEE “PLAN OF DISTRIBUTION.”

“THOMSON,” “THOMSON REUTERS,” “REUTERS” AND “CRB” ARE SERVICE MARKS OR TRADEMARKS OF THOMSON

REUTERS (MARKETS) LLC, A THOMSON REUTERS COMPANY, OR ITS AFFILIATES (“THOMSON REUTERS”). “JEFFERIES” IS A SERVICE MARK OR TRADEMARK OF THE MANAGING OWNER OR ITS AFFILIATES.

JEFFERIES COMMODITY REAL

RETURN ETF

Table of Contents

|

|

|

|

|

| Prospectus Section |

|

Page |

|

|

|

| (2) |

|

Numerous Factors May Affect the Value of the Price of the Index Commodities, and in turn, the value of the Fund’s Shares |

|

18 |

| (3) |

|

Net Asset Value May Not Always Correspond to Market Price and, as a Result, Baskets May Be Created or Redeemed at a Value that Differs From the Market Price of the Shares

|

|

18 |

| (4) |

|

Non-concurrent Trading Hours Between the NYSE Arca and the Various Futures Exchanges on Which the Index Commodities are Traded May Impact the Value of Your

Investment |

|

18 |

| (5) |

|

The Lack of Active Trading Markets For the Shares May Result in Losses on Your Investment in The Fund at the Time of Disposition of Your Shares |

|

19 |

| (6) |

|

Price Volatility May Possibly Cause the Total Loss of Your Investment |

|

19 |

| (7) |

|

Potentially Illiquid Markets, Disruption of Market Trading and Daily Price Fluctuation Limits, Among Other Events, May Exacerbate Losses Of the Fund And, In Turn, The Value Of

Your Shares |

|

19 |

| (8) |

|

Because Futures Contracts and other Derivatives Have No Intrinsic Value, the Positive Performance of Your Investment Is Wholly Dependent Upon an Equal and Offsetting Loss.

Therefore, Overall Stocks and Bond Prices Could Rise Significantly, and the Economy as a Whole Prosper, While Shares Trade Unprofitably |

|

19 |

| (9) |

|

Failure of Commodity Futures Trading to Exhibit Low to Negative Correlation to General Financial Markets Will Reduce Benefits of Diversification and May Increase Losses to

Your Portfolio |

|

19 |

| (10) |

|

An Investment in Shares May Be Adversely Affected by Competition From Other Methods of Investing in Commodities |

|

20 |

| (11) |

|

“Backwardation” or “Contango” in the Market Prices of the Commodities Will Affect the Value of Your Shares |

|

20 |

| (12) |

|

The Shares Are a New Securities Product and Their Value Could Decrease If Unanticipated Operational or Trading Problems Arise |

|

20 |

| (13) |

|

The Liquidity Of The Shares Of The Fund May Also Be Affected By The Withdrawal From Participation Of One Or More Authorized Participants With Respect To The Fund, Which Could

Adversely Affect The Value Of Your Shares |

|

20 |

|

|

|

|

|

| Prospectus Section |

|

Page |

|

|

|

| (14) |

|

As the Managing Owner and Its Trading Principals Have No History of Operating Investment Vehicles Like the Fund, Their Experience May Be Inadequate or Unsuitable to Manage the

Fund |

|

21 |

| (15) |

|

The Fund Has No Past Performance on Which to Rely on in Deciding Whether to Buy Shares |

|

21 |

| (16) |

|

Fees and Commissions are Charged Regardless of Profitability and May Result in Depletion of Assets and, as a Result, Losses to Your Investment |

|

21 |

| (17) |

|

The Fund May Terminate Because The Managing Owner May Be Unwilling Or Unable To Continue To Service The Fund Or Owners May Vote To Terminate The Fund, Each Of Which May

Adversely Affect The Value Of Your Portfolio |

|

21 |

| (18) |

|

The Value of Your Shares May Be Adversely Affected by Redemption Orders That Are Subject to Suspension Postponement or Rejection Under Certain Circumstances |

|

22 |

| (19) |

|

Various Actual and Potential Conflicts of Interest May Be Detrimental to Shareholders |

|

22 |

| (20) |

|

Shareholders Do Not Have Certain Rights and Protections Enjoyed by Investors in Certain Other Vehicles, Such As Corporations |

|

22 |

| (21) |

|

The Value of the Shares Will Be Adversely Affected If the Fund is Required to Indemnify the Trustee or the Managing Owner |

|

22 |

| (22) |

|

The Net Asset Value Calculation of the Fund, And In Turn, The Value Of Your Shares, May Be Overstated or Understated Due to the Valuation Method Employed When a Settlement

Price Is Not Available on the Date of Net Asset Value Calculation |

|

22 |

| (23) |

|

Although the Shares are Limited Liability Investments, Certain Circumstances such as Bankruptcy of the Fund or Indemnification of the Fund by the Shareholders Will Increase a

Shareholder’s Liability |

|

23 |

| (24) |

|

You May Not Rely on Past Index Results in Deciding Whether to Buy Shares, Therefore, You Will Have to Make Your Decision to Invest in the Fund on the Basis of Limited

Information |

|

23 |

| (25) |

|

The Fund’s Performance May Not Always Replicate Exactly the Changes in the Level of the Index. As a Result, There Will be Times When the Fund’s Performance Will Not

Meet the Investment Expectations of the Shareholders |

|

23 |

|

|

|

|

|

| Prospectus Section |

|

Page |

|

|

|

| (26) |

|

The Fund is Not Actively Managed and Will Track the Index During Periods in Which the Index Is Flat or Declining as Well as When the Index Is Rising. Therefore, Investors Will

Not be Protected Against Declines in the Index That Can Have a Significantly Adverse Impact on the Shares |

|

24 |

| (27) |

|

Fewer Representative Commodities Sectors May Result in Greater Index Volatility |

|

24 |

| (28) |

|

The Index May Be Potentially Over-Concentrated in a Particular Index Commodity Sector, and in Turn, Your Shares May Become More Volatile |

|

24 |

| (29) |

|

Changes in the Value of the Index Commodities May Offset Each Other |

|

24 |

| (30) |

|

Shareholders Have No Rights Against the Index Oversight Committee For Decisions That May Negatively Affect the Existence of the Index or the Index Level |

|

24 |

| (31) |

|

The Index Oversight Committee and Index Calculation Agent Have No Obligation to Consider Your Interests in Calculating or Revising the Index. Some of Their Actions Could

Adversely Affect the Value of the Shares |

|

25 |

| (32) |

|

The Index Calculation Agent Has No Obligation to Consider Your Interests and May Adjust the Index in ways that May Negatively Affect its Level, and, In Turn, the Value of Your

Shares |

|

25 |

| (33) |

|

Jefferies Group, Inc. and Its Affiliates May Publish Research That Conflicts With Each Other and Which May Negatively Impact the Value of the Fund and Your

Shares |

|

25 |

| (34) |

|

The Investment Strategy Used to Construct the Index Involves Rebalancing and Weighting Limitations that are Applied to the Index Commodities, Which May Limit the Potential

Results of the Index, and in Turn, the Potential Value of Your Shares |

|

25 |

| (35) |

|

Because the Index Commodities May Not Be Equally Weighted, the Index Commodities With Greater Weight Will Have a Larger Impact on the Aggregate Results of the Index, and May

Increase the Potential Losses to Your Shares |

|

25 |

| (36) |

|

Correlation of Changes in the Closing Levels Among the Index Commodities May Reduce the Performance of the Shares |

|

25 |

| (37) |

|

The Level of the Index May Be Lower Than the Level of an Index Based Upon Different Combinations of the Index Commodities |

|

26 |

|

|

|

|

|

| Prospectus Section |

|

Page |

|

|

|

| (38) |

|

Certain of the Futures Contracts Underlying the Index Commodities and the Related Futures-Linked Investments Will Be Subject to Pronounced Risks of Pricing

Volatility |

|

26 |

| (39) |

|

Certain Interest Rate Environments May Cause TIPS to Experience Greater Losses Than Other Fixed Income Securities With Similar Duration |

|

26 |

| (40) |

|

There Can Be No Assurance That the Inflation Adjustment Made to TIPS Will Be Accurate |

|

26 |

| (41) |

|

Deflation Causes the Principal Value of TIPS to Fall, Reducing the Potential Interest Earned by the Fund’s Holdings of TIPS |

|

27 |

| (42) |

|

Shareholders Will Not Have the Protections Associated With Ownership of Shares in an Investment Company Registered Under the Investment Company Act of 1940. Such Protections

Are Intended To Decrease Certain Conflicts And Also Impose A Number Of Investment Restrictions And Diversification Requirements |

|

27 |

| (43) |

|

Trading on Commodity Exchanges Outside the United States, such as The London Metal Exchange, Is Not Subject to U.S. Regulation. Shareholders Could Incur Substantial Losses

From Trading on Commodity Exchanges Which Such Shareholders Would Not Have Otherwise Been Subject Had the Fund’s Trading Been Limited to U.S. Markets |

|

27 |

| (44) |

|

The Effect Of Market Disruptions, Governmental Intervention And The Dodd-Frank Wall Street Reform And Consumer Protection Act Are Unpredictable And May Have An Adverse Effect

On The Value Of Your Shares |

|

27 |

| (45) |

|

The Effects of New Regulation of the Over-the-Counter Derivatives Markets is Unknown and May Have a Detrimental Effect on the Value of Your Shares |

|

28 |

| (46) |

|

Certain Operations of the Fund, Including the Creation of Baskets, May Be Restricted by Regulatory and Exchange Position Limits, Position Accountability Levels and Other Rules

and Could Result in Tracking Error Between Changes in the Net Asset Value per Share and Changes in the Level of the Index, or Could Result in the Shares Trading at a Premium or Discount to Net Asset Value per Share |

|

29 |

|

|

|

|

|

| Prospectus Section |

|

Page |

| (47) |

|

The NYSE Arca May Halt Trading in the Shares Which Would Adversely Impact Your Ability to Sell Shares |

|

30 |

| (48) |

|

Shareholders Will Be Subject to Taxation on Their Allocable Share of the Fund’s Taxable Income, Whether or Not They Receive Cash Distributions |

|

30 |

| (49) |

|

Items of Income, Gain, Deduction, Loss and Credit with Respect to Shares Could Be Reallocated if the IRS Does Not Accept the Assumptions or Conventions Used by the Fund in

Allocating Fund Tax Items |

|

30 |

| (50) |

|

The Current Treatment of Long-Term Capital Gains Under Current U.S. Federal Income Tax Law May Be Adversely Affected, Changed or Repealed in the Future, And In Turn, May

Adversely Affect The Value Of Your Shares |

|

30 |

| (51) |

|

Futures-Linked Investments, such as Forward Agreements, Swaps, or other OTC Derivatives Are Not Regulated and Are Subject to the Risk of Counterparty Non-Performance Resulting

in the Fund Not Realizing a Trading Gain |

|

31 |

| (52) |

|

Failure of Futures Commission Merchants or Commodity Brokers to Segregate Assets May Increase Losses; Despite Segregation of Assets, the Fund Remains at Risk of Significant

Losses Because the Fund May Only Receive a Pro-Rata Share of the Assets, or No Assets at All |

|

31 |

| (53) |

|

You Should Consult Your Own Legal, Tax And Financial Advisers Regarding The Desirability Of An Investment In The Shares Because No Independent Advisers Were Appointed To

Represent You In Connection With The Formation And Operation Of The Fund |

|

31 |

| (54) |

|

Competing Claims Over Ownership of Intellectual Property Rights Related to the Fund Could Adversely Affect the Fund and an Investment in the Shares |

|

32 |

|

|

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

|

33 |

|

|

| INVESTMENT OBJECTIVE OF THE FUND |

|

34 |

|

|

|

|

|

Investment Objective |

|

34 |

|

|

Role of Managing Owner |

|

37 |

|

|

| DESCRIPTION OF THE THOMSON REUTERS /JEFFERIES CRB 3 MONTH FORWARD INDEX |

|

38 |

|

|

|

|

|

General |

|

38 |

|

|

Weighting Factors: A Tiered Approach |

|

38 |

|

|

Group I - Petroleum Sector |

|

39 |

|

|

|

|

|

| Prospectus Section |

|

Page |

| Statement of Changes in Net Assets for the Period from January

1, 2010 through May 31, 2010 and the Period from December 28, 2009 (Formation) through December 31, 2009 |

|

101 |

| Statement of Cash Flows for the Period from January 1, 2010 through May

31, 2010 and the Period from December 28, 2009 (Formation) through December 31, 2009 |

|

102 |

| Notes to Financial Statements |

|

103 |

| Jefferies Commodity Investment Services, LLC

Report of Independent Registered Public Accounting Firm dated August 17, 2010.

|

|

107 |

| Consolidated Statement of Financial Condition dated May 31, 2010 and December

31, 2009 |

|

108 |

| Consolidated Statement of Operations for the Period from January

1, 2010 through May 31, 2010 and the Period from December 2, 2009 (Commencement of Operations) through December 31, 2009 |

|

109 |

| Consolidated Statement of Changes in Member’s Deficit for the Period from January 1,

2010 through May 31, 2010 and the Period from December 2, 2009 (Commencement of Operations) through December 31, 2009 |

|

110 |

| Consolidated Statement of Cash Flows for the Period from January

1, 2010 through May 31, 2010 and the Period from December 2, 2009 (Commencement of Operations) through December 31, 2009 |

|

111 |

| Notes to Consolidated Financial Statements |

|

112 |

PART TWO

STATEMENT OF ADDITIONAL

INFORMATION

SUMMARY

This summary of all material information provided in this Prospectus is intended for quick reference only. The remainder of this

Prospectus contains more detailed information. You should read the entire Prospectus, including all exhibits to the registration statement of which this Prospectus is a part, before deciding to invest in Shares. This Prospectus is intended to be

used beginning [ ], 2010.

The Fund

The Fund was formed as a Delaware statutory trust on December 28, 2009. The Fund will issue common units of beneficial interest, or

Shares, which represent units of fractional undivided beneficial interest in and ownership of the Fund. The term of the Fund is perpetual (unless terminated earlier in certain circumstances). The principal office of the Fund is located at c/o

Jefferies Commodity Investment Services, LLC, One Station Place, Three North, Stamford, CT 06902, and the telephone number is (203) 708-6500.

Shares Listed on the NYSE Arca

The Shares will be listed on the NYSE Arca under the symbol RRET.

Secondary market purchases and sales of Shares will be subject to ordinary brokerage commissions and charges.

Purchases and Sales in the Secondary Market on the NYSE Arca

The Shares will trade on the NYSE Arca like any other equity security.

Baskets of Shares may be created or redeemed only by Authorized Participants, except that the initial Baskets will be created by the

Initial Purchaser. It is expected that Baskets will be created when there is sufficient demand for Shares that the market price per Share is at a premium to the net asset value per Share. Authorized Participants are expected to sell such Shares,

which will be listed on the NYSE Arca, to the public at prices that are

expected to reflect, among other factors, the trading price of the Shares on the NYSE Arca and the supply

of and demand for the Shares at the time of sale. This price is expected to fall between the net asset value per Share and the trading price of the Shares on the NYSE Arca at the time of sale. Similarly, it is expected that Baskets will be redeemed

when the market price per Share is at a discount to the net asset value per Share. Investors seeking to purchase or sell Shares on any day generally are expected to effect such transactions in the secondary market, on the NYSE Arca, at the market

price per Share, rather than in connection with the creation or redemption of Baskets.

The market price of the Shares

may not be identical to the net asset value per Share, but these valuations generally are expected to be very close. Investors will be able to use the indicative intra-day value per Share to determine if they want to purchase in the secondary market

via the NYSE Arca. The intra-day indicative value per Share is based on the prior day’s final net asset value, adjusted once every fifteen seconds throughout the trading day to reflect the percentage price changes of the Fund’s futures

contracts and holdings of TIPS (as described under the bullet point “Potential Inflation Protection for Investors” under the section “Summary—Investment Objective of the Fund; The Index”), United States Treasuries and

other high credit quality short-term fixed income securities to provide a continuously updated estimated net asset value per Share.

Investors may purchase and sell Shares through traditional brokerage accounts. Purchases and sales of Shares may be subject to

customary brokerage commissions. Investors are encouraged to review the terms of their brokerage accounts for applicable charges.

Pricing Information Available on the NYSE Arca and Other Sources

The following table lists additional NYSE Arca symbols and their meanings with respect to the Fund and the Index:

|

|

|

| RRETIV |

|

Intra-day indicative value per Share |

|

RRETSO |

|

Number of outstanding Shares |

|

RRETNV |

|

End of day net asset value of the Fund |

|

RJCTB.ER |

|

Intra-day and Index closing level as of

close of NYSE Arca from the prior day |

The intra-day data in the above table will be published once every fifteen seconds throughout each trading day.

-1-

Thomson Reuters (Markets) LLC, a Thomson Reuters company, which will be referred to

herein as either Thomson Reuters or the Index Calculation Agent, will publish the daily closing level of the Index as of the close of the NYSE Arca. The Managing Owner will publish the net asset value of the Fund, the net asset value per Share and

the number of outstanding Shares daily. Additionally, the Index Calculation Agent will publish the intra-day Index level, and the Managing Owner will publish the indicative value per Share (quoted in U.S. dollars) and the number of outstanding

Shares once every fifteen seconds throughout each trading day. All of the foregoing information will be published as follows:

The intra-day level of the Index (symbol: RJCTB.ER) and the intra-day indicative value per Share (symbol: RRETIV) (each quoted in U.S.

dollars) will be published once every fifteen seconds throughout each trading day on the consolidated tape, Thomson Reuters and/or Bloomberg and on the Managing Owner’s website at http://www.jamfunds.com/jcis, or any successor thereto.

The current trading price per Share (symbol: RRET) (quoted in U.S. dollars) will be published continuously as trades occur

throughout each trading day on the consolidated tape, Thomson Reuters and/or Bloomberg and on the Managing Owner’s website at http://www.jamfunds.com/jcis, or any successor thereto.

The number of outstanding Shares (symbol: RRETSO) will be published once every fifteen seconds throughout the trading day and as of the

close of business on the consolidated tape, Thomson Reuters and/or Bloomberg and on the Managing Owner’s website at http://www.jamfunds.com/jcis, or any successor.

The most recent end-of-day Index closing level (symbol: RJCTB.ER) will be published as of the close of the NYSE Arca each trading day

on the consolidated tape, Thomson Reuters and/or Bloomberg and on the Managing Owner’s website at http://www.jamfunds.com/jcis, or any successor thereto.

The most recent end-of-day net asset value of the Fund (symbol: RRETNV) will be published as of the close of business on Thomson

Reuters and/or Bloomberg and on the Managing Owner’s website at http://www.jamfunds.com/jcis, or any successor thereto. In addition, the most recent end-of-day net

asset value of the Fund will be published the following morning on the consolidated tape.

The Index Calculation Agent obtains information for inclusion in, or for use in the calculation of, the Index from sources the

Index Calculation Agent considers reliable. None of the Index Calculation Agent, the Managing Owner, the Fund or any of their respective affiliates accepts responsibility for or guarantees the accuracy and/or completeness of the Index or any data

included in the Index.

CUSIP Number

The Fund’s CUSIP number is 47233F106.

Risk Factors

An investment in Shares is speculative and involves a high degree of risk. The summary risk factors set forth below are intended

merely to highlight certain risks of the Fund. The Fund has particular risks that are set forth elsewhere in this Prospectus.

| |

• |

|

The Fund has no operating history. Therefore, a potential investor has no performance history to serve as a factor for evaluating an investment in the

Fund. |

| |

• |

|

Past performance, when available, is not necessarily indicative of future results; all or substantially all of an investment in the Fund could be lost.

|

| |

• |

|

The trading of the Fund takes place in very volatile markets that may be subject to sudden and rapid changes. Consequently, all or substantially all of

your investment in the Fund could be lost quickly. |

| |

• |

|

The Managing Owner was formed to be the managing owner of investment vehicles such as the Fund and has no history of past performance. The Managing

Owner and its trading principals have not managed any other public commodity pool or any other commodity pool that seeks to track an index of commodity futures, although certain of the trading principals do have

|

-2-

| |

|

experience managing other types of private commodity pools, and therefore there is no indication of their ability to manage investment vehicles such as the Fund. If the experience of the Managing

Owner and its trading principals is not adequate or suitable to manage investment vehicles such as the Fund, the operations of the Fund may be adversely affected. |

| |

• |

|

The Fund will be subject to fees and expenses in the aggregate amount of approximately 1.00% per annum as described herein.

|

| |

• |

|

The Fund will be successful only if its annual returns from futures trading, plus its annual interest income from its holdings of 3-month U.S. Treasury

bills, TIPS and other high credit quality short-term fixed income securities, exceed these fees and expenses of approximately 1.00% per annum. |

| |

• |

|

The Fund is expected to earn interest income equal to 0.60% per annum based upon the blended yield of 3-month U.S. Treasury bills and TIPS ranging

in maturity from 1 to 5 years with an average duration of three years, based on prevailing rates on August 18, 2010, or $0.15 per annum per Share at $25.00 as the net asset value per Share. Therefore, based upon the difference between

the annual fees and expenses and the blended yield of both 3-month U.S. Treasury bills and TIPS (as provided in the immediately preceding sentence), the Fund will be required to earn from its futures trading approximately 0.40% per annum,

or $0.10 per annum per Share at $25.00 as the net asset value per Share, in order for an investor to break even on an investment during the first twelve months of an investment. Actual interest income could be higher or lower.

|

| |

• |

|

As of the date of this Prospectus, CFTC and commodity exchange rules impose speculative position limits on market participants trading in the following

17 commodities that may be included in the Index from time-to-time: WTI Crude Oil, Heating Oil, RBOB Gasoline, Natural Gas, Corn, Soybeans, Live Cattle, Gold, Copper, Sugar, Cotton, Cocoa, Coffee, Wheat, Lean Hogs, Orange Juice, and Silver, or the

Affected Index Commodities (as defined below). The Fund is subject to these position limits and, consequently, the Fund’s ability to issue new Baskets or to reinvest income in additional futures contracts corresponding to the Affected Index

Commodities may be limited to the extent that these activities would cause the Fund to exceed the applicable position limits, unless the Fund establishes long positions in alternative futures contracts or over-the-counter derivatives in addition to

and as a proxy for futures on the Affected Index Commodities. Speculative position limits and the use of alternative futures contracts or over-the-counter derivatives in addition to or as a proxy for futures on the Affected Index Commodities may

affect the correlation between changes in the net asset value per Share and changes in the level of the Index, and the correlation between the price of the Shares on the NYSE Arca and the net asset value per Share. |

| |

• |

|

Fees and commissions are charged regardless of profitability and may result in depletion of assets and, as a result, losses to your investment.

|

| |

• |

|

There can be no assurance that the Fund will achieve profits or avoid losses, significant or otherwise. |

| |

• |

|

Performance of the Fund may not track the Index during particular periods or over the long term. |

| |

• |

|

Certain potential conflicts of interest exist. The commodity brokers may have a conflict of interest between their execution of trades for the Fund and

for their other |

-3-

customers. More specifically, the commodity brokers will benefit from executing orders

for other clients, whereas the Fund may be harmed to the extent that the commodity brokers have fewer resources to allocate to the Fund’s account due to the existence of such other clients. Proprietary trading by the Managing Owner, its

affiliates, and its and their trading principals may create conflicts of interest from time-to-time because such proprietary trades may take a position that is opposite of that of the Fund or may compete with the Fund for certain positions within

the marketplace. Among other things, the Managing Owner’s trading principals may trade in the commodity or foreign exchange markets on behalf of affiliates of the Managing Owner and for the accounts of other clients. See “Conflicts of

Interest” for a more complete disclosure of various conflicts. Although the Managing Owner has established procedures designed to resolve certain of these conflicts equitably, the Managing Owner has not established formal procedures to resolve

all potential conflicts of interest. Consequently, investors may be dependent on the good faith of the respective parties subject to such conflicts to resolve them equitably. Although the Managing Owner attempts to monitor these conflicts, it is

extremely difficult, if not impossible, for the Managing Owner to ensure that these conflicts will not, in fact, result in adverse consequences to the Fund.

The Trustee

Wilmington Trust Company, or the Trustee, a Delaware banking corporation, is the sole trustee of the Fund. The Trustee has only nominal

duties and liabilities to the Fund.

Under the Amended and Restated Declaration of Trust of the Fund, or the Declaration

of Trust, the Managing Owner is vested with the exclusive management, authority and control of all aspects of the business of the Fund. The Trustee has no duty or liability to supervise or monitor the performance of the Managing Owner, nor will the

Trustee have any liability for the acts or omissions of the Managing Owner.

The Managing Owner

Jefferies Commodity Investment Services, LLC, a Delaware limited liability company, will serve as Managing Owner of the Fund. The

Managing Owner was formed on December 2, 2009. The Managing Owner will serve as the commodity pool operator and commodity trading advisor of the Fund. The Managing Owner has no experience in operating commodity pools and managing futures

trading accounts of this type. The Managing Owner has been registered as a commodity pool operator and commodity trading advisor with the Commodity Futures Trading Commission, or the CFTC, and has been a member of the National Futures Association,

or the NFA, since December 22, 2009. As a registered commodity pool operator and commodity trading advisor, with respect to the Fund, the Managing Owner must comply with various regulatory requirements under the Commodity Exchange Act and the

rules and regulations of the CFTC and the NFA, including investor protection requirements, antifraud prohibitions, disclosure requirements, and reporting and recordkeeping requirements. The Managing Owner also will be subject to periodic inspections

and audits by the CFTC and NFA. The principal office of the Managing Owner is located at One Station Place, Three North, Stamford, CT 06902. The telephone number of the Managing Owner is (203) 708-6500.

The Managing Owner was formed to be the managing owner of investment vehicles such as the Fund and has no history of past performance.

The Managing Owner and its trading principals have not managed any other public commodity pool or any other commodity pool that seeks to track an index of commodity futures, although certain of the trading principals do have experience managing

other types of private commodity pools, and therefore there is no indication of their ability to manage investment vehicles such as the Fund. If the experience of the Managing Owner and its trading principals is not adequate or suitable to manage

investment vehicles such as the Fund, the operations of the Fund may be adversely affected.

The Fund will pay the Managing

Owner a management fee, monthly in arrears, in an amount equal to 0.85% per annum of the daily net asset value of the Fund, which we refer to as the Management Fee. The Management Fee will not be subject to the Overall Expense Cap as described

in this Prospectus. The Management Fee will be paid in consideration of the Managing Owner’s futures trading advisory services.

-4-

Investment Objective of the Fund; The Index

The Fund seeks to track changes, whether positive or negative, in the level of the Index over time. The Fund will pursue its

investment objective primarily by maintaining long futures positions corresponding to the futures contracts that comprise the Index with an aggregate notional amount equal to the Fund’s total capital. The Fund may use alternative futures

contracts or Futures-Linked Investments (as defined below) under certain circumstances. The Fund’s performance also will reflect the difference, positive or negative, between its interest income from its holdings of 3-month U.S. Treasury bills,

TIPS and other high credit quality short-term fixed income securities, and the expenses of the Fund. The Shares are designed for investors who want a cost effective and convenient way to invest in a diversified index of commodity futures on U.S. and

non-U.S. markets.

Advantages of investing in the Shares include:

| |

• |

|

Ease and Flexibility of Investment. The Shares will trade on the NYSE Arca and provide investors with indirect access to the commodity futures

markets. The Shares may be bought and sold throughout the business day at real-time prices on the NYSE Arca like other exchange-listed securities. Investors may purchase and sell Shares through traditional brokerage accounts.

|

| |

• |

|

Shares May Provide A More Cost Effective Alternative. Investing in the Shares can be easier and less expensive for an investor than constructing

and trading a comparable commodity futures portfolio. For example, investors seeking to construct a similar portfolio of commodities would have to trade on their own in commodity futures contracts, or retain a commodity trading advisor to manage

their commodity futures trading, or become a participant with limited liability in a private or public commodity pool. Through an investment in the Shares, investors buy into a fund that already trades futures contracts on 19 Index Commodities that

comprise the Index. |

| |

• |

|

Margin. Shares are eligible for margin accounts. |

| |

• |

|

Diversification. The Shares may help to diversify a portfolio because the Index historically has tended to exhibit low to negative correlation

with both equities and conventional bonds. |

| |

• |

|

Transparency. Because the Fund is designed to track the Index, the components of which are disclosed daily on the Managing Owner’s website,

the Shares provide a more transparent investment in commodities than mutual funds that invest in commodity-linked notes. |

| |

• |

|

Potential Inflation Protection for Investors. The Fund expects to invest a significant amount of its holding of cash in the form of 3-month U.S.

Treasury bills and TIPS, which are backed by the full faith and credit of the U.S. government. Because repayment of the original principal upon maturity (as adjusted for inflation) is guaranteed by the U.S. government, TIPS provide a degree of

protection against inflation. |

Investing in the Shares does not insulate Shareholders from certain risks,

including price volatility.

If the Managing Owner determines in its commercially reasonable judgment that it has become

impracticable or inefficient for any reason for the Fund to gain a full or a partial exposure to any Index Commodity by investing in a specific futures contract that is a part of the Index, the Fund may:

| |

• |

|

invest in a futures contract referencing the particular Index Commodity other than the specific futures contract that is a part of the Index,

|

| |

• |

|

invest in a forward agreement, swap or other OTC derivative referencing the particular Index Commodity, collectively referred to as Futures-Linked

Investments, or |

| |

• |

|

invest in other futures contracts or other Futures-Linked Investments not based on the particular Index Commodity |

if, in the commercially reasonable judgment of the Managing Owner, such above instruments tend to exhibit trading prices or returns that correlate with a

futures contract that is a part of the Index.

-5-

General

The Index is designed to provide timely and accurate representation of a long-only, broadly diversified investment in commodities

through a transparent and disciplined calculation methodology. The Index is currently composed of futures contracts on the following 19 physical commodities, each of which is referred to as an Index Commodity: aluminum, cocoa, coffee, copper, corn,

cotton, crude oil, gold, heating oil, lean hogs, live cattle, natural gas, nickel, orange juice, silver, soybeans, sugar, RBOB gasoline, and wheat. The Index Commodities currently trade on United States futures exchanges, with the exception of

aluminum and nickel, which trade on The London Metal Exchange, or the LME.

The Index tracks the changes in the closing

levels of the futures positions that would in three months comprise the Thomson Reuters/Jefferies CRB Index, or the TR/J CRB Index. A commodity futures contract is a bilateral agreement that provides for the purchase and sale of a specified type and

quantity of a commodity during a stated delivery month for a fixed price.

The Index was first published in April 2007.

The Index is calculated daily by the Index Calculation Agent.

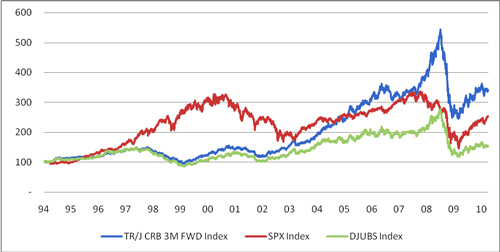

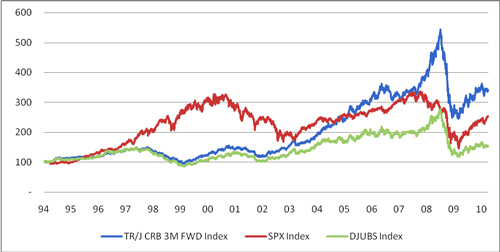

The Index historically has tended to

exhibit low to negative correlation with both equities and conventional bonds, respectively. The correlation table below illustrates the low and negative correlation of the Index to the S&P

500® Index (Total Return) and the Barclays Capital US Aggregate Bond Index (Total Return), respectively, for the

period January 1, 1995 through December 31, 2009. In this table, statistically, investments with a

correlation of 100% increase or decrease at the same time, while investments with a correlation of

-100% always move in the opposite direction.

|

|

|

|

| Index |

|

Correlation to the

Index |

|

| S&P

500® Index (Total Return) |

|

17.14 |

% |

| Barclays

Capital US Aggregate Bond Index (Total Return) |

|

-8.52 |

% |

The methodology for determining the composition and weighting of the Index is subject to modification by Thomson Reuters and Jefferies

at any time. The changes in the closing levels the Index are reported on a number of financial information sites, including Thomson Reuters under the ticker symbol RJCTB.ER. For a more complete description of the Index, please see the Index

Calculation Supplement, which is available at

http://www.jamfunds.com/jcis.

Weighting Factors: A Tiered Approach

The Index uses a four-tiered approach to allocate among the Index Commodities. Group I includes only petroleum products; Group II

includes seven Index Commodities which are highly liquid; Group III is comprised of four liquid Index Commodities; Group IV includes Index Commodities that may provide diversification.

All Index Commodities are equally weighted within Groups II, III and IV, as provided below.

-6-

THOMSON REUTERS/JEFFERIES CRB 3 MONTH FORWARD INDEX

|

|

|

|

|

|

|

|

|

|

| Group |

|

Index Commodity |

|

Index Weight* |

|

|

Contract Months |

|

Exchange |

|

|

WTI Crude Oil |

|

23 |

% |

|

Jan-Dec |

|

NYMEX |

| Group I |

|

Heating Oil |

|

5 |

% |

|

Jan-Dec |

|

NYMEX |

|

|

RBOB Gasoline |

|

5 |

% |

|

Jan-Dec |

|

NYMEX |

| |

|

|

Total |

|

33 |

% |

|

|

|

|

| |

|

|

Natural Gas |

|

6 |

% |

|

Jan-Dec |

|

NYMEX |

|

|

Corn |

|

6 |

% |

|

Mar, May, Jul, Sep, Dec |

|

CBOT |

|

|

Soybeans |

|

6 |

% |

|

Jan, Mar, May, Jul, Nov |

|

CBOT |

| Group II |

|

Live Cattle |

|

6 |

% |

|

Feb, Apr, Jun, Aug, Oct, Dec |

|

CME |

|

|

Gold |

|

6 |

% |

|

Feb, Apr, Jun, Aug, Dec |

|

COMEX |

|

|

Aluminum |

|

6 |

% |

|

Mar, Jun, Sep, Dec |

|

LME |

|

|

Copper |

|

6 |

% |

|

Mar, May, Jul, Sep, Dec |

|

COMEX |

| |

|

|

Total |

|

42 |

% |

|

|

|

|

| |

|

|

Sugar |

|

5 |

% |

|

Mar, May, Jul, Oct |

|

ICE-US |

|

|

Cotton |

|

5 |

% |

|

Mar, May, Jul, Dec |

|

ICE-US |

| Group III |

|

Cocoa |

|

5 |

% |

|

Mar, May, Jul, Sep, Dec |

|

ICE-US |

|

|

Coffee |

|

5 |

% |

|

Mar, May, Jul, Sep, Dec |

|

ICE-US |

| |

|

|

Total |

|

20 |

% |

|

|

|

|

| |

|

|

Nickel |

|

1 |

% |

|

Mar, Jun, Sep, Dec |

|

LME |

|

|

Wheat |

|

1 |

% |

|

Mar, May, Jul, Sep, Dec |

|

CBOT |

| Group IV |

|

Lean Hogs |

|

1 |

% |

|

Feb, Apr, Jun, Jul, Aug, Oct, Dec |

|

CME |

|

|

Orange Juice |

|

1 |

% |

|

Jan, Mar, May, Jul, Sep, Nov |

|

ICE-US |

|

|

Silver |

|

1 |

% |

|

Mar, May, Jul, Sep, Dec |

|

COMEX |

| |

|

|

Total |

|

5 |

% |

|

|

|

|

| |

Legend:

“NYMEX” means the New York Mercantile Exchange, or its successor.

“CBOT” means the Board of Trade of the City of Chicago Inc., or its successor.

“CME” means the Chicago Mercantile Exchange, Inc., or its successor.

“COMEX” means the Commodity Exchange Inc., New York, or its successor.

“LME” means The London Metal Exchange Limited or its successor.

“ICE-US” means ICE Futures U.S., Inc., or its successor.

A “Contract Month” means the month in which the futures contract matures and becomes deliverable.

| * |

The Index Weights included in this table show the allocation among the Index Commodities as measured from the Base Date (as defined herein) of the Index and as

rebalanced after each monthly rebalancing of the Index Commodities. |

-7-

Rollover Methodology

A rolling futures position is a position where, on a periodic basis, futures contracts on physical commodities specifying delivery in a

particular month are sold and futures contracts specifying delivery in a later month are purchased. An investor with a rolling futures position is able to avoid taking delivery of the underlying physical commodity while maintaining exposure to those

commodities. To maximize liquidity and transparency, this “rolling” process for the Index Commodities occurs over the first four Business Days of each month according to a fixed schedule as set forth on page 41. (In the context of the

Index, “Business Day” is any day on which the New York Mercantile Exchange is open for business.)

Rebalancing Methodology

The Index employs arithmetic averaging with monthly rebalancing, while maintaining a uniform

exposure to the various Index Commodities over time.

The Index Commodities are rebalanced monthly, generally following

the close of business on the sixth Business Day of each month, to return to the specified dollar weights, referenced as “Index Weight” in the table on page 39. This rebalancing is achieved by selling Index Commodities that have gained in

value relative to other Index Commodities and buying Index Commodities that have lost in value relative to other Index Commodities. This monthly rebalancing helps to maintain both the stability and consistency of the Index and the consistent

exposure to the Index Weights of the underlying Index Commodities over time.

The physical commodities underlying the

exchange-traded futures contracts included as Index Commodities may from time-to-time be heavily concentrated in a limited number of sectors, particularly energy and agriculture. An investment in the Fund may therefore carry risks similar to a

concentrated securities investment in a limited number of industries or sectors.

The composition of the Index may be

adjusted in the event that the Index Calculation Agent is not able to calculate the closing prices of the Index Commodities.

There can be no assurance that the Fund will achieve its investment objective or avoid

substantial losses. The Fund has no performance history. The value of the Shares on the secondary market is expected to fluctuate generally in relation to changes in the net asset value of the Fund.

The Value of the Shares Should Track Closely the Changes in the Level of the Index

The value of the Shares is expected to fluctuate in relation to changes in the value of the Fund’s portfolio. The market

price of the Shares may not be identical to the net asset value per Share, but these two valuations generally are expected to be very close.

The Fund will hold a portfolio of futures contracts on the Index Commodities as well as cash, 3-month U.S. Treasury bills, TIPS and

other high credit quality short-term fixed income securities for deposit with the Fund’s Clearing Broker as margin. The Fund’s portfolio will be traded with a view to tracking the Index over time, whether the Index is rising, falling or

flat over any particular period. The Fund is not “managed” by traditional methods, which typically involve effecting changes in the composition of the Fund’s portfolio on the basis of judgments relating to economic, financial and

market considerations with a view to obtaining positive results under all market conditions. To maintain the correspondence between the composition and weightings of the Index Commodities comprising the Index, the Managing Owner will adjust the

Fund’s portfolio from time-to-time to conform to periodic changes in the identity and/or relative weighting of the Index Commodities. The Managing Owner will aggregate certain of the adjustments and make changes to the Fund’s portfolio at

least monthly or more frequently in the case of significant changes to the Index.

The

Commodity Broker

A variety of executing brokers will execute futures transactions on behalf of the Fund. The executing

brokers will give-up all transactions to Credit Suisse Securities (USA) LLC, which will serve as the Fund’s clearing broker, or Clearing Broker. In its capacity as clearing broker, the Clearing Broker will execute and clear the Fund’s

futures transactions and will perform certain administrative services for the Fund. Credit Suisse

-8-

Securities (USA) LLC is registered with the CFTC as a futures commission merchant and is a member of the

NFA in such capacity.

The Fund will pay to the Clearing Broker all brokerage commissions, including applicable exchange

fees, NFA fees, give-up fees, pit brokerage fees and other transaction related fees and expenses charged in connection with its trading activities, which are referred to collectively as Brokerage Expenses, subject to the Overall Expense Cap as

described in this Prospectus. For a more detailed explanation of the Brokerage Expenses, see pages 53–54. On average, total charges paid to the Clearing Broker are expected to be less than $8.00 per round-turn trade, although the Clearing

Broker’s brokerage commissions and fees will be determined on a contract-by-contract, or round-turn basis.

A

round-turn trade is a completed transaction involving both a purchase and a liquidating sale, or a sale followed by a covering purchase.

The Administrator

The Managing Owner, on behalf of the Fund, has appointed The Bank of New York Mellon as the administrator, or Administrator, of the Fund

and has entered into an Administration and Accounting Agreement, or the Administration Agreement, in connection therewith. The Bank of New York Mellon will serve as custodian, or Custodian, of the Fund and has entered into a Global Custody

Agreement, or Custody Agreement, in connection therewith. The Bank of New York Mellon will also serve as the transfer agent, or Transfer Agent, of the Fund and has entered into a Transfer Agency and Service Agreement in connection therewith.

The Bank of New York Mellon, a banking corporation organized under the laws of the State of New

York with trust powers, has an office at 2 Hanson Place,

12th Floor, Brooklyn, New York 11217. The Bank of New York

Mellon is subject to supervision by the New York State Banking Department and the Board of Governors of the Federal Reserve System. Information regarding the net asset value of the Fund, creation and redemption transaction fees and the current list

of names of the parties that have executed a Participant Agreement may be obtained from The Bank of New York Mellon by calling the following number: (718) 315-4412. A list of the names of the parties that have executed a Participant Agreement

as of the date of this Prospectus may be found in the “Plan of

Distribution” Section. A copy of the Administration Agreement is available for inspection at The Bank

of New York Mellon’s trust office identified above.

Pursuant to the Administration Agreement, the

Administrator will perform or supervise the performance of services necessary for the operation and administration of the Fund (other than making investment decisions), including receiving and processing orders from Authorized Participants to create

and redeem Baskets, net asset value calculations, accounting and other fund administrative services. The Administrator will retain certain financial books and records, including: Basket creation and redemption books and records, fund accounting

records, ledgers with respect to assets, liabilities, capital, income and expenses, the register, transfer journals and related details and trading and related documents received from futures commission merchants, c/o The Bank of New York Mellon, 2

Hanson Place, 12th Floor, Brooklyn, New York 11217,

telephone number (718) 315-4412.

Key terms of the Administration Agreement are summarized under the heading

“Material Contracts.”

The Fund will be responsible for paying, or for reimbursing the Managing Owner or its

affiliates for paying, the Administrator up to 0.04% of the daily net asset value per annum of the Fund for administration fees, monthly in arrears, subject to the Overall Expense Cap.

The Administrator and any of its affiliates may from time-to-time purchase or sell Shares for their own account, as agent for their

customers and for accounts over which they exercise investment discretion.

The Transfer Agent also will receive a

transaction processing fee in connection with orders from Authorized Participants to create or redeem Baskets in the amount of $500 per order. These transaction processing fees are paid by the Authorized Participants and not by the Fund.

The Fund is expected to retain the services of one or more additional service providers to assist with certain tax reporting

requirements of the Fund and its Shareholders.

The Distributor

The Managing Owner, on behalf of the Fund, has appointed ALPS Distributors, Inc., or ALPS

-9-

Distributors, to assist the Managing Owner and the Administrator with certain functions and duties relating

to distribution and marketing, including reviewing and approving marketing materials. ALPS Distributors will retain all marketing materials at c/o ALPS Distributors, Inc., 1290 Broadway, Suite 1100, Denver, Colorado 80203; telephone number

(303) 623-2577. Investors may contact ALPS Distributors toll-free in the U.S. at (877) 369-4617. The Fund has entered into a Marketing Agreement with ALPS Distributors. ALPS Distributors is affiliated with ALPS Fund Services, Inc., a

Denver-based outsourcing solution for administration, compliance, fund accounting, legal, marketing, tax administration, transfer agency and shareholder services for open-end, closed-end, hedge and exchange-traded funds. ALPS Fund Services, Inc. and

its affiliates provide fund administration services to funds with assets in excess of $40 billion. ALPS Distributors, Inc. provides distribution services to funds with assets of more than $220 billion.

The Fund will pay ALPS Distributors for performing its duties on behalf of the Fund and may pay ALPS Distributors additional

compensation in consideration of the performance by ALPS Distributors of additional marketing, distribution and ongoing support services. Such additional services may include, among other services, the development and implementation of a marketing

plan and the utilization of ALPS Distributors’ resources, which include an extensive broker database and a network of internal and external wholesalers.

Limitation of Liabilities

You cannot lose more than your investment in the Shares. Shareholders will be entitled to limitation on liability equivalent to the

limitation on liability enjoyed by stockholders of a Delaware business corporation for profit.

The Offering; Creation and Redemption of Baskets

On [ ], 2010, Jefferies &

Company, Inc., as the Initial Purchaser, subject to certain conditions, agreed to purchase and take delivery of 100,000 Shares, which comprise the initial Baskets of the Fund, at a purchase price of $25.00 per Share ($1,250,000 per Basket), as

described in “Plan of Distribution.”

The Fund will create and redeem Shares from time-to-time, but only in

one or more Baskets. A

Basket is a block of 50,000 Shares. Baskets may be created or redeemed only by Authorized Participants,

except that the initial Baskets in the Fund will be created by the Initial Purchaser. Baskets are created and redeemed continuously as of noon, Eastern time, on the business day immediately following the date on which a valid order to create or

redeem a Basket is accepted by the Fund. Baskets are created and redeemed at the net asset value of 50,000 Shares as of the closing time of the NYSE Arca or the last to close of the exchanges on which the Fund’s futures contracts are traded,

whichever is latest, on the date that a valid order to create or redeem a Basket is accepted by the Fund. For purposes of processing both purchase and redemption orders, a “business day” means any day other than a day when banks in New

York City are required or permitted to be closed. Except when aggregated in Baskets, the Shares are not redeemable securities. Authorized Participants pay a transaction fee of $500 in connection with each order to create or redeem a Basket.

Authorized Participants may sell the Shares included in the Baskets they purchase from the Fund to other investors.

See “Creation and Redemption of Baskets” for more details.

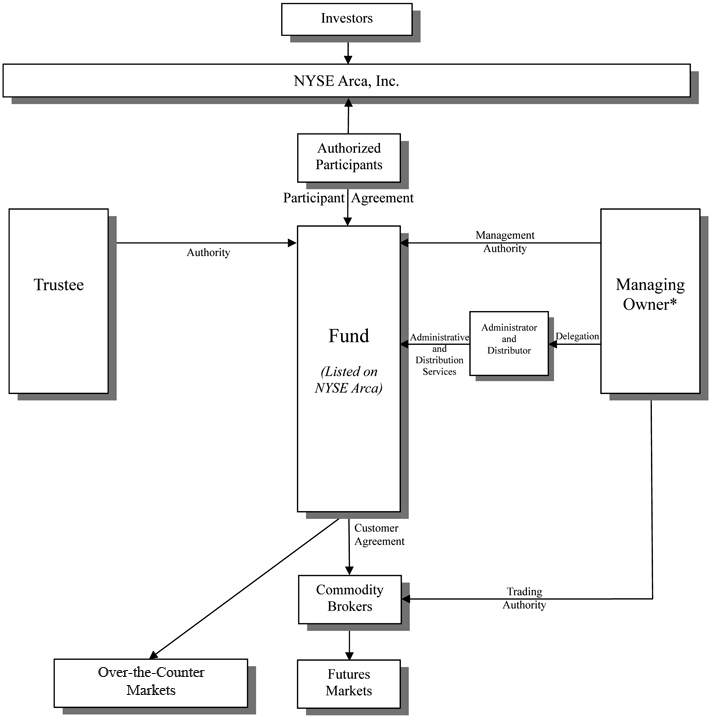

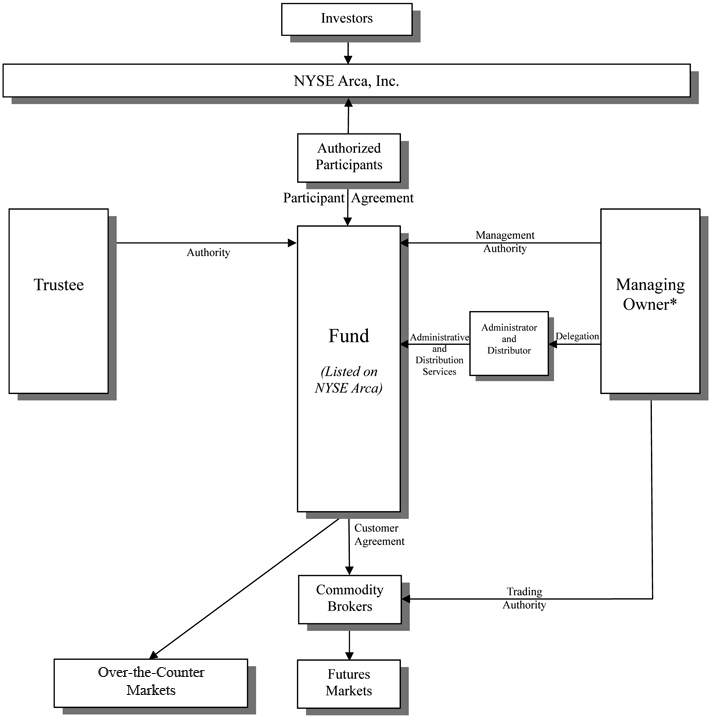

Authorized Participants

Baskets may be created or redeemed only by Authorized Participants, except that the initial Baskets in the Fund will be created by the

Initial Purchaser. Each Authorized Participant must (1) be a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in

securities transactions, (2) be a direct participant in DTC, and (3) have entered into an agreement with the Fund and the Managing Owner, or a Participant Agreement. The Participant Agreements set forth the procedures for the creation and

redemption of Baskets and for the delivery of cash required for such creations or redemptions. The list of current Authorized Participants can be obtained from the Administrator.

Net Asset Value

Net asset value means the total assets of the Fund including, but not limited to, all cash and cash equivalents or other debt securities

less total liabilities of the Fund, each determined on the basis of generally accepted accounting principles.

-10-

See “Description of the Shares; The Fund; Certain Material Terms of the Declaration

of Trust – Net Asset Value” for more details.

Clearance and Settlement

The Shares are evidenced by a global certificate that the Fund issues to DTC. The Shares are available only in

book-entry form. Shareholders may hold Shares through DTC, if they are direct participants in DTC, or indirectly through entities that are direct or indirect participants in DTC.

Segregated Accounts/Interest Income

The proceeds of the offering will be deposited in cash in a segregated account in the name of the Fund at the Clearing Broker in

accordance with CFTC investor protection and segregation requirements or with the Custodian. The Fund will be credited with 100% of the interest earned on its average net assets on deposit with the Clearing Broker or the Custodian each month. In an

attempt to increase interest income earned, the Managing Owner expects to invest the assets of the Fund that are not on deposit as margin in support of futures positions in 3-month U.S. Treasury bills, TIPS, certain cash items such as money market

funds, certificates of deposit (under nine months) and time deposits or other instruments permitted by applicable rules and regulations and other high credit quality short-term fixed income securities. As of August 18, 2010, the interest rate

expected to be earned by the Fund is estimated to be 0.60% per annum based upon the blended yield of 3-month U.S. Treasury bills and TIPS ranging in maturity from 1 to 5 years with an average duration of three years. Actual interest income

could be higher or lower.

This interest income will be used by the Fund to pay its expenses. See “Fees and

Expenses” for more details.

[Remainder of page left blank intentionally]

-11-

Fees and Expenses

|

|

|

| Management Fee |

|

The Fund will pay the Managing Owner a Management Fee, monthly in arrears, in an amount equal to 0.85% per annum of the daily net asset value of the Fund and will not be subject

to the Overall Expense Cap (as defined below). The Management Fee will be paid in consideration of the Managing Owner’s futures trading advisory services. |

|

|

| Organization and Offering Expenses |

|

The Fund will be responsible for paying, or for reimbursing the Managing Owner or its affiliates for paying, all of the expenses incurred in connection with organizing the Fund

as well as the expenses incurred in connection with the offering of the Fund’s Shares (whether incurred prior to or after the commencement of the Fund’s trading operations), subject to the Overall Expense Cap described

below. |

|

|

| Brokerage Commissions and Fees |

|

The Fund will pay to the Clearing Broker all brokerage commissions, including applicable exchange fees, NFA fees, give-up fees, pit brokerage fees and other transaction related