As Filed with the Securities and Exchange Commission on August 17, 2010

Registration No. 333-166283

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 3 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

JEFFERIES S&P 500 VIX SHORT-TERM FUTURES ETF

(Registrant)

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware

(State of Organization) |

|

6799

(Primary Standard Industrial

Classification Number) |

|

80-6160257

(I.R.S. Employer

Identification Number) |

|

|

|

| c/o Jefferies Commodity

Investment Services, LLC

One Station Place

Three North

Stamford, CT 06902

(203) 708-6500 |

|

|

|

Andrew R. Kaplan, Esq.

c/o Jefferies Commodity

Investment Services, LLC

One Station Place

Three North

Stamford, CT 06902

(203) 708-6500 |

| (Address, including zip code, and

telephone number, including

area code, of registrant’s principal

executive offices) |

|

|

|

(Name, address, including zip code,

and telephone number,

including area code, of agent for

service) |

Copies to:

Michael J. Schmidtberger, Esq.

James C. Munsell, Esq.

Sidley Austin LLP

787 Seventh Avenue

New York, New York 10019

Approximate

date of commencement of proposed sale to the public:

As promptly as practicable after the effective date of this

Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post–effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post–effective amendment filed pursuant

to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated

filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

(Do not check if a smaller reporting company) ¨ |

|

Smaller reporting company |

|

x |

CALCULATION

OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of Securities to be Registered |

|

Amount

to be

Registered |

|

Proposed

Maximum

Aggregate

Offering Price

Per Share |

|

Proposed

Maximum

Aggregate

Offering Price1 |

|

Amount of

Registration Fee2 |

| Jefferies S&P 500 VIX Short-Term Futures ETF Common Units of Beneficial

Interest |

|

8,000,000 |

|

$50.00 |

|

$400,000,000.00 |

|

$28,520.00 |

| |

| |

| 1

|

The proposed maximum aggregate offering price has been calculated assuming that all Shares are sold at a price of $50.00 per Share.

|

| 2

|

The amount of the registration fee of the Shares is calculated in reliance upon Rule 457(o) under the Securities Act and using the proposed maximum

aggregate offering price as described above. An initial registration fee of $7,130.00 was paid on April 23, 2010. At the time of the initial filing, the proposed maximum aggregate offering price per Share was $100.00 and, therefore, the

registrant listed 1,000,000 Shares as the amount of Shares to be registered. The registrant now anticipates that the proposed maximum aggregate offering price per Share will be $50.00 and therefore, the initial registration fee accounted for the

registration of 2,000,000 Shares with respect to the April 23, 2010 filing. 6,000,000 additional Shares were registered and a registration fee of $21,390.00 was paid with respect thereto with the filing of Pre-Effective Amendment No. 1 on

June 18, 2010. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become

effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this Prospectus is not complete and may be changed. We may not sell these

securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer

or sale is not permitted.

Subject to completion, dated August 17, 2010.

Jefferies S&P 500 VIX Short-Term Futures ETF

8,000,000 Common Units of Beneficial Interest

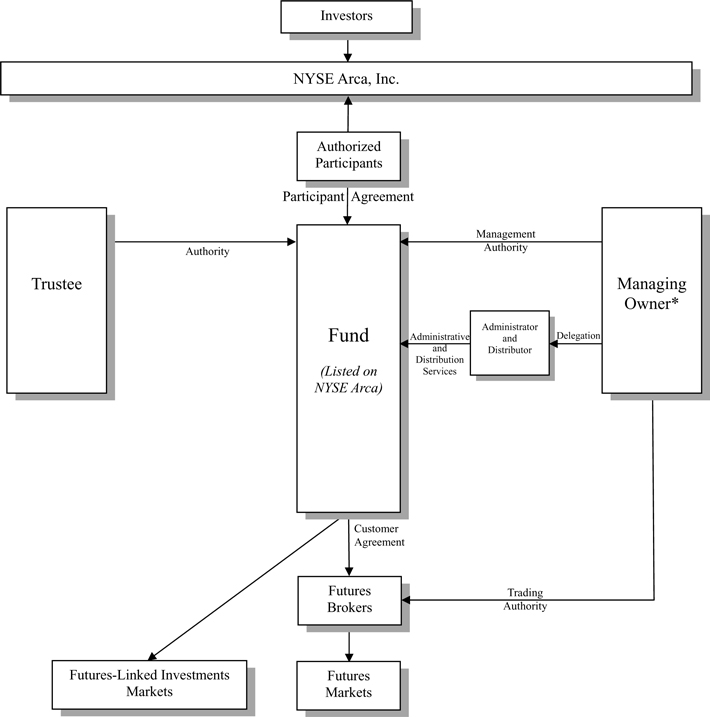

Jefferies S&P 500 VIX Short-Term Futures ETF, the Fund, is organized as a

Delaware statutory trust. The Fund will issue common units of beneficial interest, or Shares, which represent units of fractional undivided beneficial interest in and ownership of the Fund. Shares may be purchased from the Fund only by certain

eligible financial institutions, called Authorized Participants, and only in one or more blocks of 20,000 Shares, called a Basket. The Fund will issue its Shares in Baskets to Authorized Participants continuously at the net asset value of 20,000

Shares. The Fund’s Participant Agreements set forth the terms and conditions on which Authorized Participants may create or redeem Baskets. The offering of Shares will terminate on the third anniversary of the registration statement of which

this Prospectus is a part unless prior thereto a new registration statement is filed.

The Shares will trade on the

NYSE Arca under the symbol VIXX.

Jefferies Commodity Investment Services, LLC, a Delaware limited

liability company will serve as the managing owner, or the Managing Owner, commodity pool operator and commodity trading advisor of the Fund. The Fund establishes long positions in futures contracts underlying the S&P 500 VIX Short-Term Futures

TM Index ER, or the VIX Futures Index, with a view to

tracking the changes, whether positive or negative, in the level of the VIX Futures Index over time.

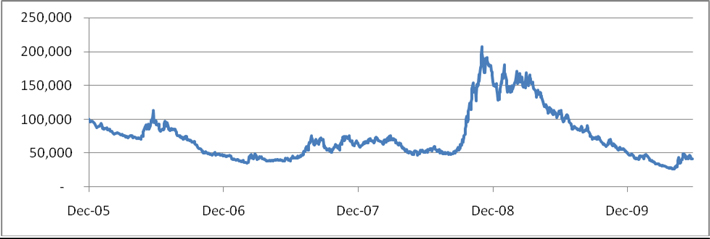

The VIX Futures Index is designed to provide investors with exposure

to one or more maturities of futures contracts on the CBOE Volatility Index®, or the Volatility Index, which

reflects implied volatility in the S&P 500® Index at various points along the volatility forward curve.

The Volatility Index is a benchmark index designed to estimate expected volatility in large cap U.S.

stocks over 30 days in the future by averaging the weighted prices of certain put and call options on the S&P 500®

Index. Because the Volatility Index may increase in times of uncertainty, the Volatility Index is commonly known as the “fear gauge” of the broad U.S. equities market. The VIX Futures Index and the Volatility Index historically

have had negative correlations to the S&P 500® Index.

The Fund does not intend to outperform the VIX Futures Index. The Managing Owner will seek to cause the net asset value of the Fund to

track the level of the VIX Futures Index during periods in which the level of the VIX Futures Index is flat or declining as well as when the VIX Futures Index is rising.

Except when aggregated in Baskets, the Shares are not redeemable securities.

THE SHARES ARE SPECULATIVE

SECURITIES AND THEIR PURCHASE INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CONSIDER ALL RISK FACTORS BEFORE INVESTING IN THE FUND. PLEASE REFER TO “THE RISKS YOU FACE” BEGINNING ON PAGE 15.

| • |

|

Futures trading is volatile and even a small movement in market prices could cause large losses for investors in the Fund.

|

| • |

|

The Managing Owner and its trading principals have not managed any other public commodity pool or any other commodity pool that seeks to track an index

of commodity futures, although certain of the trading principals do have experience managing other types of private commodity pools, and therefore there is no indication of their ability to manage investment vehicles such as the Fund. If the

experience of the Managing Owner and its trading principals is not adequate or suitable to manage investment vehicles such as the Fund, the operations of the Fund may be adversely affected. |

| • |

|

You could lose all or substantially all of your investment. |

| • |

|

The Fund will be subject to actual and potential conflicts of interest involving the Managing Owner, the Clearing Broker, various futures brokers and

the Authorized Participants. |

| • |

|

Investors in the Fund will pay fees in connection with their investment in Shares including asset-based management fees of 0.75% per annum. The Fund

will also pay additional fees and expenses up to an aggregate of 0.14% per annum of the daily net asset value of the Fund, or the Overall Expense Cap. The Managing Owner has agreed to pay any additional fees and expenses incurred by the Fund (other

than management fees) to the extent that they exceed the Overall Expense Cap, subject to reimbursement, as described herein. |

| • |

|

Fees and commissions are charged, and expenses are incurred, regardless of profitability and may result in depletion of assets and, as a result, losses

to your investment. |

On [•], 2010, Jefferies & Company, Inc., as the Initial Purchaser,

subject to certain conditions, agreed to purchase and take delivery of 100,000 Shares, which comprise the initial Baskets, at a purchase price of $50.00 per Share ($1,000,000 per Basket), as described in “Plan of Distribution.” This price

has been arbitrarily determined inasmuch as the Shares will have no inherent value at the Fund’s inception, and it is not indicative of prices that will prevail in the trading market. The Initial Purchaser proposes to offer the Shares to the

public at a per-Share price that will vary depending upon, among other factors, the trading price of the Shares on the NYSE Arca, the net asset value per Share and the supply of and demand for the Shares at the time of offer. Shares offered by the

Initial Purchaser at different times may have different offering prices. The Initial Purchaser will not receive from the Fund, the Managing Owner or any of their affiliates, any fee or other compensation in connection with its sale of Shares to the

public.

Authorized Participants may from time-to-time offer to the public Shares from any Baskets they create. Shares offered

to the public by Authorized Participants will be offered at a per-Share offering price that will vary depending upon, among other factors, the trading price of the Shares on the NYSE Arca, the net asset value per Share and the supply of and demand

for the Shares at the time of offer. Shares initially comprising the same Basket but offered by Authorized Participants to the public at different times may have different offering prices. Authorized Participants will not receive from the Fund, the

Managing Owner or any of their affiliates, any fee or other compensation in connection with their sale of Shares to the public. An Authorized Participant may receive commissions or fees from investors who purchase Shares through their commission or

fee-based brokerage accounts with the Authorized Participant. In addition, the Fund will pay a marketing fee to the Distributor. For more information regarding items of compensation paid to FINRA members, please see the “Plan of

Distribution” section on page 89.

These securities have not been approved or disapproved by the Securities and

Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal

offense.

The Fund is not a mutual fund or any other type of investment company within the meaning of the Investment

Company Act of 1940, as amended, and is not subject to regulation thereunder.

THE COMMODITY FUTURES TRADING COMMISSION

HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT. THE SHARES ARE NEITHER INTERESTS IN NOR OBLIGATIONS OF ANY OF THE MANAGING OWNER, THE INITIAL

PURCHASER, ANY AUTHORIZED PARTICIPANT, THE TRUSTEE OR ANY OF THEIR RESPECTIVE AFFILIATES.

[ ], 2010

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE

AWARE THAT FUTURES AND OPTIONS TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON

REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT

TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE

DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED TO THIS POOL AT PAGE 47 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE 11.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL.

THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 15 THROUGH 30.

THIS POOL HAS NOT COMMENCED TRADING AND DOES NOT HAVE ANY PERFORMANCE HISTORY.

THE BOOKS AND RECORDS OF THE FUND WILL BE MAINTAINED AS FOLLOWS: ALL MARKETING MATERIALS WILL BE MAINTAINED AT THE

OFFICES OF ALPS DISTRIBUTORS, INC., 1290 BROADWAY, SUITE 1100, DENVER, COLORADO 80203; TELEPHONE NUMBER (303) 623-2577; BASKET CREATION AND REDEMPTION BOOKS AND RECORDS, ACCOUNTING AND CERTAIN OTHER FINANCIAL BOOKS AND RECORDS (INCLUDING FUND

ACCOUNTING RECORDS, LEDGERS WITH RESPECT TO ASSETS, LIABILITIES, CAPITAL, INCOME AND EXPENSES, THE REGISTER, TRANSFER JOURNALS AND RELATED DETAILS) AND TRADING AND RELATED DOCUMENTS RECEIVED FROM FUTURES COMMISSION MERCHANTS ARE MAINTAINED BY THE

BANK OF NEW YORK MELLON, 2 HANSON PLACE, 12TH FLOOR,

BROOKLYN, NEW YORK 11217, TELEPHONE NUMBER (718) 315-4412. ALL OTHER BOOKS AND RECORDS OF THE FUND (INCLUDING MINUTE BOOKS AND OTHER GENERAL CORPORATE RECORDS, TRADING RECORDS AND RELATED REPORTS AND OTHER ITEMS RECEIVED FROM THE FUND’S

FUTURES BROKERS) WILL BE MAINTAINED AT THE FUND’S PRINCIPAL OFFICE, C/O JEFFERIES COMMODITY INVESTMENT SERVICES, LLC, ONE STATION PLACE, THREE NORTH, STAMFORD, CT 06902; TELEPHONE NUMBER (203) 708-6500. SHAREHOLDERS WILL HAVE THE RIGHT,

DURING NORMAL BUSINESS HOURS, TO HAVE ACCESS TO AND COPY (UPON PAYMENT OF REASONABLE REPRODUCTION COSTS) SUCH BOOKS AND RECORDS IN PERSON OR BY THEIR AUTHORIZED ATTORNEY OR AGENT. MONTHLY ACCOUNT STATEMENTS FOR THE FUND CONFORMING TO COMMODITY

FUTURES TRADING COMMISSION (THE “CFTC”) AND THE NATIONAL FUTURES ASSOCIATION (THE “NFA”) REQUIREMENTS WILL BE POSTED ON THE MANAGING OWNER’S WEBSITE AT HTTP://WWW.JAMFUNDS.COM/JCIS. ADDITIONAL REPORTS WILL BE POSTED ON THE

MANAGING OWNER’S WEBSITE IN THE DISCRETION OF THE MANAGING OWNER OR AS REQUIRED BY REGULATORY AUTHORITIES. THERE WILL SIMILARLY BE DISTRIBUTED TO SHAREHOLDERS, NOT MORE THAN 90 DAYS AFTER THE CLOSE OF THE FUND’S FISCAL YEAR, CERTIFIED

AUDITED

-i-

FINANCIAL STATEMENTS AND (IN NO EVENT LATER THAN MARCH 15 OF THE IMMEDIATELY FOLLOWING YEAR) THE TAX INFORMATION RELATING TO SHARES OF THE FUND NECESSARY FOR THE PREPARATION OF SHAREHOLDERS’

ANNUAL FEDERAL INCOME TAX RETURNS.

THIS PROSPECTUS DOES NOT INCLUDE ALL OF THE INFORMATION OR EXHIBITS IN THE REGISTRATION STATEMENT OF THE FUND. YOU CAN READ AND COPY THE

ENTIRE REGISTRATION STATEMENT AT THE PUBLIC REFERENCE FACILITIES MAINTAINED BY THE SEC IN WASHINGTON, D.C.

THE FUND WILL

FILE PERIODIC, QUARTERLY AND ANNUAL REPORTS WITH THE SEC. YOU CAN READ AND COPY THESE REPORTS AT THE SEC PUBLIC REFERENCE FACILITIES IN WASHINGTON, D.C. PLEASE CALL THE SEC AT 1–800–SEC–0330 FOR FURTHER INFORMATION.

THE FILINGS OF THE FUND WILL BE POSTED AT THE SEC WEBSITE AT HTTP://WWW.SEC.GOV.

REGULATORY NOTICES

NO DEALER, SALESMAN OR ANY OTHER PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION NOT CONTAINED IN THIS

PROSPECTUS, AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE FUND, THE MANAGING OWNER, THE INITIAL PURCHASER, THE AUTHORIZED PARTICIPANTS OR ANY OTHER PERSON.

THIS PROSPECTUS DOES NOT CONSTITUTE AN OFFER OR SOLICITATION TO SELL OR A SOLICITATION OF AN OFFER TO BUY, NOR SHALL THERE BE ANY OFFER,

SOLICITATION, OR SALE OF THE SHARES IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION, OR SALE IS NOT AUTHORIZED OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE ANY SUCH OFFER, SOLICITATION, OR SALE.

AUTHORIZED PARTICIPANTS MAY BE REQUIRED TO DELIVER A PROSPECTUS WHEN TRANSACTING IN SHARES. SEE “PLAN OF DISTRIBUTION.”

“STANDARD &

POOR’S®”,

“S&P®”, “S&P

500®”, “STANDARD & POOR’S 500™” AND “S&P 500 VIX SHORT-TERM

FUTURES™” ARE TRADEMARKS OF S&P AND HAVE BEEN LICENSED FOR USE BY THE MANAGING OWNER. “VIX” IS A REGISTERED TRADEMARK OF THE CBOE AND HAS BEEN LICENSED FOR USE BY S&P.

-ii-

JEFFERIES S&P 500 VIX

SHORT-TERM FUTURES ETF

Table of Contents

|

|

|

|

|

| Prospectus Section |

|

Page |

|

|

|

| (2) |

|

Numerous Factors May Affect the Value of the Price of the VIX Futures, and in turn, the value of the Fund’s Shares |

|

15 |

| (3) |

|

The Fund’s Investments Are Indirectly Concentrated in Large-Cap U.S. Equities |

|

15 |

| (4) |

|

The Fund Is Subject To Issuer Risk |

|

15 |

| (5) |

|

The Fund is Subject To Market Risk |

|

16 |

| (6) |

|

Net Asset Value May Not Always Correspond to Market Price and, as a Result, Baskets May Be Created or Redeemed at a Value that Differs From the Market Price of the

Shares |

|

16 |

| (7) |

|

Non-concurrent Trading Hours Between the NYSE Arca and the Futures Exchange on Which the VIX Futures are Traded May Impact the Value of Your Investment |

|

16 |

| (8) |

|

The Lack of Active Trading Markets For the Shares May Result in Losses on Your Investment in The Fund at the Time of Disposition of Your Shares |

|

16 |

| (9) |

|

A Liquid Trading Market For Shares Of The Issuers Underlying The S&P

500® Index May Not Develop Or Exist, Which In Turn, May Adversely Affect The Value Of The Shares Of The Fund

|

|

17 |

| (10) |

|

Price Volatility May Possibly Cause the Total Loss of Your Investment |

|

17 |

| (11) |

|

Potentially Illiquid Markets, Disruption of Market Trading and Daily Price Fluctuation Limits, Among Other Events, May Exacerbate Losses Of the Fund And, In Turn, The Value Of Your

Shares |

|

17 |

| (12) |

|

Because Futures Contracts and other Derivatives Have No Intrinsic Value, the Positive Performance of Your Investment Is Wholly Dependent Upon an Equal and Offsetting Loss.

Therefore, the Value of Your Investment Could Decrease Significantly while Overall Stock Prices are Rising and the Economy as a Whole Prospering |

|

17 |

| (13) |

|

An Investment in Shares May Be Adversely Affected by Competition From Other Methods of Investing in Volatility in Securities |

|

18 |

| (14) |

|

You May Not Rely on Past Index Results in Deciding Whether to Buy Shares, Therefore, You Will Have to Make Your Decision to Invest in the Fund on the Basis of Limited Information

|

|

18 |

| (15) |

|

The Fund’s Performance May Not Always Replicate Exactly the Changes in the Level of the VIX Futures Index. As a Result, There Will be Times When the Fund’s Performance

Will Not Meet the Investment Expectations of the Shareholders |

|

18 |

-iii-

|

|

|

|

|

| Prospectus Section |

|

Page |

|

|

|

| (16) |

|

The Fund is Not Actively Managed and Will Track the VIX Futures Index During Periods in Which the VIX Futures Index Is Flat or Declining as Well as When the VIX Futures Index Is

Rising. Therefore, Investors Will Not be Protected Against Declines in the VIX Futures Index That Can Have a Significantly Adverse Impact on the Shares |

|

18 |

| (17) |

|

Shareholders Have No Rights Against the VIX Futures Index Committee For Decisions That May Negatively Affect the Existence of the VIX Futures Index or the VIX Futures Index Level

|

|

18 |

| (18) |

|

The Index Committee and Index Sponsor Have No Obligation to Consider Your Interests in Calculating or Revising the VIX Futures Index. Some of Their Actions Could Adversely Affect

the Value of the Shares |

|

19 |

| (19) |

|

The Index Committee and Index Sponsor Have No Obligation to Consider Your Interests and May Adjust the VIX Futures Index in ways that May Negatively Affect its Level, and, in Turn,

the Value of Your Shares |

|

19 |

| (20) |

|

Jefferies Group, Inc. and Its Affiliates May Publish Research That Conflicts With Each Other and Which May Negatively Impact the Value of the Fund and Your Shares |

|

19 |

| (21) |

|

Calculation of the VIX Futures Index May Not be Possible or Feasible Under Certain Events or Circumstances. Such Interruption in the Index Calculation May Have an Adverse Effect on

the Value of Your Shares |

|

19 |

| (22) |

|

The Volatility Index Is a Theoretical Calculation. In Turn, the VIX Futures Are Financially and Not Physically Settled. Therefore, the Value of the VIX Futures May Not be as

Accurate as the Value of Physically Settled Futures Contracts |

|

19 |

| (23) |

|

Your Shares Are Not Directly Linked to the Volatility Index and the Value of Your Shares May Be Less Than It Would Have Been Had Your Shares Been Directly Linked to the Volatility

Index |

|

20 |

| (24) |

|

The Volatility Index Is A Measure of Forward Volatility of the S&P

500® Index and Your Shares Are Not Linked to the Options Used to Calculate the Volatility Index, to the Actual

Volatility of the S&P 500® Index or the Equity Securities Included in the S&P

500® Index, Nor Will the Return on Your Shares Be a Participation in the Actual Volatility of the S&P

500® Index |

|

20 |

|

|

|

|

|

| Prospectus Section |

|

Page |

|

|

|

| (25) |

|

The Level of the Volatility Index Has Historically Reverted to a Long-Term Mean Level and Any Increase in the Spot Level of the Volatility Index Will Likely Continue To Be

Constrained |

|

20 |

| (26) |

|

The Policies of the Index Sponsor and the CBOE and Changes That Affect the Composition and Valuation of the S&P

500® Index, the Volatility Index or the VIX Futures Index Could Adversely Affect the Net Asset Value and Market

Value of Your Shares |

|

20 |

| (27) |

|

The VIX Futures Index and VIX Index Futures Have Limited Historical Information |

|

21 |

| (28) |

|

A Change In The Ownership Of The VIX Futures Index May Change The Determination, Valuation Methodology Or Any Other Aspect Of The VIX Futures Index In A Manner That May Be Adverse

To The VIX Futures Index, And Ultimately, The Value Of Your Shares |

|

21 |

| (29) |

|

Cessation Of Publication Of The VIX Futures Index May Materially And Adversely Affect The Activities Of The VIX Futures Index Futures Contracts, And In Turn, The Managing Owner May

Terminate The Fund |

|

21 |

| (30) |

|

The Shares Are a New Securities Product and Their Value Could Decrease If Unanticipated Operational or Trading Problems Arise |

|

22 |

| (31) |

|

The Liquidity Of The Shares Of The Fund May Also Be Affected By The Withdrawal From Participation Of One Or More Authorized Participants With Respect To The Fund, Which Could

Adversely Affect The Value Of Your Shares |

|

22 |

| (32) |

|

As the Managing Owner and Its Trading Principals Have No History of Operating Investment Vehicles Like the Fund, Their Experience May Be Inadequate or Unsuitable to Manage the Fund

|

|

22 |

| (33) |

|

The Fund Has No Past Performance on Which to Rely on in Deciding Whether to Buy Shares |

|

22 |

| (34) |

|

Fees and Commissions are Charged Regardless of Profitability and May Result in Depletion of Assets and, as a Result, Losses to Your Investment |

|

22 |

-iv-

|

|

|

|

|

| Prospectus Section |

|

Page |

|

|

|

| (35) |

|

Changing Prices of the VIX Futures May Result in a Reduced Amount Payable Upon Redemption |

|

22 |

| (36) |

|

The Fund Will Experience A Loss If It Is Required To Sell Treasuries At A Price Lower Than The Price At Which They Were Acquired |

|

23 |

| (37) |

|

The Fund May Terminate Because The Managing Owner May Be Unwilling Or Unable To Continue To Service The Fund Or Owners May Vote To Terminate The Fund, Each Of Which May Adversely

Affect The Value Of Your Portfolio |

|

23 |

| (38) |

|

The Value of Your Shares May Be Adversely Affected by Redemption Orders That Are Subject to Suspension, Postponement, or Rejection Under Certain Circumstances |

|

23 |

| (39) |

|

Various Actual and Potential Conflicts of Interest May Be Detrimental to Shareholders |

|

24 |

| (40) |

|

Shareholders Do Not Have Certain Rights and Protections Enjoyed by Investors in Certain Other Vehicles, Such As Corporations |

|

24 |

| (41) |

|

The Value of the Shares Will Be Adversely Affected If the Fund is Required to Indemnify the Trustee or the Managing Owner |

|

24 |

| (42) |

|

The Net Asset Value Calculation of the Fund, And In Turn, The Value Of Your Shares, May Be Overstated or Understated Due to the Valuation Method Employed When a Settlement Price Is

Not Available on the Date of Net Asset Value Calculation |

|

24 |

| (43) |

|

Although the Shares are Limited Liability Investments, Certain Circumstances such as Bankruptcy of the Fund or Indemnification of the Fund by the Shareholders Will Increase a

Shareholder’s Liability |

|

25 |

| (44) |

|

Shareholders Will Not Have the Protections Associated With Ownership of Shares in an Investment Company Registered Under the Investment Company Act of 1940. Such Protections Are

Intended To Decrease Certain Conflicts And Also Impose A Number Of Investment Restrictions And Diversification Requirements |

|

25 |

| (45) |

|

The Effect Of Market Disruptions, Governmental Intervention And The Dodd-Frank Wall Street Reform And Consumer Protection Act Are Unpredictable And May Have An Adverse Effect On The

Value Of Your Shares |

|

25 |

|

|

|

|

|

| Prospectus Section |

|

Page |

|

|

|

| (46) |

|

The Effects of New Regulation of the Over-the-Counter Derivatives Markets is Unknown and May Have a Detrimental Effect on the Value of Your Shares |

|

26 |

| (47) |

|

Certain Operations of the Fund, Including the Creation of Baskets, May Be Restricted by Regulatory and Exchange Position Limits, Position Accountability Levels and Other Rules and

Could Result in Tracking Error Between Changes in the Net Asset Value per Share and Changes in the Level of the VIX Futures Index, or Could Result in the Shares Trading at a Premium or Discount to Net Asset Value per Share |

|

27 |

| (48) |

|

The NYSE Arca May Halt Trading in the Shares Which Would Adversely Impact Your Ability to Sell Shares |

|

27 |

| (49) |

|

Futures-Linked Investments, such as Forward Agreements, Swaps, or other OTC Derivatives Are Not Regulated and Are Subject to the Risk of Counterparty Non-Performance Resulting in

the Fund Not Realizing a Trading Gain |

|

28 |

| (50) |

|

Shareholders Will Be Subject to Taxation on Their Allocable Share of the Fund’s Taxable Income, Whether or Not They Receive Cash Distributions |

|

28 |

| (51) |

|

Items of Income, Gain, Deduction, Loss and Credit with Respect to Shares Could Be Reallocated if the IRS Does Not Accept the Assumptions or Conventions Used by the Fund in

Allocating Fund Tax Items |

|

28 |

| (52) |

|

The Current Treatment of Long-Term Capital Gains Under Current U.S. Federal Income Tax Law May Be Adversely Affected, Changed or Repealed in the Future, And In Turn, May Adversely

Affect The Value Of Your Shares |

|

29 |

| (53) |

|

Failure of Futures Commission Merchants or Futures Brokers to Segregate Assets May Increase Losses; Despite Segregation of Assets, the Fund Remains at Risk of Significant Losses

Because the Fund May Only Receive a Pro-Rata Share of the Assets, or No Assets at All |

|

29 |

| (54) |

|

You Should Consult Your Own Legal, Tax And Financial Advisers Regarding The Desirability Of An Investment In The Shares Because No Independent Advisers Were Appointed To Represent

You In Connection With The Formation And Operation Of The Fund |

|

29 |

| (55) |

|

Competing Claims Over Ownership of Intellectual Property Rights Related to the Fund Could Adversely Affect the Fund and an Investment in the Shares |

|

29 |

-v-

-vi-

|

|

|

| Prospectus Section |

|

Page |

|

|

| Statement of Financial Condition dated June 11, 2010 |

|

95 |

| Statement of Changes in Net Assets for the Period from April 21, 2010 (Formation) through June

11, 2010 |

|

96 |

| Statement of Cash Flows for the Period from April 21, 2010 (Formation) through June 11,

2010 |

|

97 |

| Notes to Financial Statements |

|

98 |

| Jefferies Commodity Investment Services, LLC |

|

|

| Report of Independent Registered Public Accounting Firm dated August 17,

2010 |

|

102 |

| Consolidated Statement of Financial Condition dated May 31, 2010 and December 31, 2009

|

|

103 |

| Consolidated Statement of Operations for the Period from January

1, 2010 through May 31, 2010 and the Period from December 2, 2009 (Commencement of Operations) through December 31, 2009 |

|

104 |

| Consolidated Statement of Changes in Member’s Deficit for the Period from January

1, 2010 through May 31, 2010 and the Period from December 2, 2009 (Commencement of Operations) through December 31, 2009 |

|

105 |

| Consolidated Statement of Cash Flows for the Period from January

1, 2010 through May 31, 2010 and the Period from December 2, 2009 (Commencement of Operations) through December 31, 2009 |

|

106 |

| Notes to Consolidated Financial Statements |

|

107 |

| |

| PART TWO |

STATEMENT OF ADDITIONAL

INFORMATION |

|

|

| General Information Relating to Jefferies Group, Inc. |

|

112 |

|

|

| The Futures Markets |

|

112 |

| Futures Contracts |

|

112 |

| Hedgers and Speculators |

|

112 |

| Futures Exchanges |

|

112 |

| Daily Limits |

|

113 |

| Position Accountability Limits |

|

113 |

| Regulations |

|

113 |

| Margin |

|

114 |

|

|

| Exhibit A—Privacy Notice |

|

P-1 |

-vii-

SUMMARY

This summary of all material information provided in this Prospectus is intended for quick reference only. The remainder of this

Prospectus contains more detailed information. You should read the entire Prospectus, including all exhibits to the registration statement of which this Prospectus is a part, before deciding to invest in Shares. This Prospectus is intended to be

used beginning [ ], 2010.

The Fund

The Fund was formed as a Delaware statutory trust on April 21, 2010. The Fund will issue common units of beneficial interest, or

Shares, which represent units of fractional undivided beneficial interest in and ownership of the Fund. The term of the Fund is perpetual (unless terminated earlier in certain circumstances). The principal office of the Fund is located at c/o

Jefferies Commodity Investment Services, LLC, One Station Place, Three North, Stamford, CT 06902, and the telephone number is (203) 708-6500.

Shares Listed on the NYSE Arca

The Shares will be listed on the NYSE Arca under the symbol VIXX.

Secondary market purchases and sales of Shares will be subject to ordinary brokerage commissions and charges.

Purchases and Sales in the Secondary Market on the NYSE Arca

The Shares will trade on the NYSE Arca like any other equity security.

Baskets of Shares may be created or redeemed only by Authorized Participants, except that the initial Baskets will be created by the

Initial Purchaser. It is expected that Baskets will be created when there is sufficient demand for Shares that the market price per Share is at a premium to the net asset value per Share. Authorized Participants are expected to sell such Shares,

which will be listed on the NYSE Arca, to the public at prices that are expected to reflect, among other factors, the trading

price of the Shares on the NYSE Arca and the supply of and demand for the Shares at the time of sale. This price is expected to fall between the net asset value per Share and the trading price of

the Shares on the NYSE Arca at the time of sale. Similarly, it is expected that Baskets will be redeemed when the market price per Share is at a discount to the net asset value per Share. Investors seeking to purchase or sell Shares on any day

generally are expected to effect such transactions in the secondary market, on the NYSE Arca, at the market price per Share, rather than in connection with the creation or redemption of Baskets.

The market price of the Shares may not be identical to the net asset value per Share, but these valuations generally are expected to be

very close. Investors will be able to use the indicative intra-day value per Share to determine if they want to purchase in the secondary market via the NYSE Arca. The intra-day indicative value per Share is based on the prior day’s final net

asset value, adjusted once every fifteen seconds throughout the trading day to reflect the percentage price changes of the Fund’s futures contracts and holdings of United States Treasuries and other high credit quality short-term fixed income

securities to provide a continuously updated estimated net asset value per Share.

Investors may purchase and sell Shares

through traditional brokerage accounts. Purchases and sales of Shares may be subject to customary brokerage commissions. Investors are encouraged to review the terms of their brokerage accounts for applicable charges.

Pricing Information Available on the NYSE Arca and Other Sources

The following table lists additional NYSE Arca symbols and their meanings with respect to the Fund, the Shares and

the S&P 500 VIX Short-Term FuturesTM Index ER, or the

VIX Futures Index:

|

|

|

| VIXXIV |

|

Intra-day indicative value per Share |

|

VIXXSO |

|

Number of outstanding Shares |

|

VIXXNV |

|

End of day net asset value of the Fund |

|

SPVXSP |

|

Intra-day and VIX Futures Index closing level as of close of NYSE Arca from the prior day |

The intra-day data in the above table will be published once every fifteen seconds throughout each trading day.

-1-

Standard and Poor’s Financial Services, LLC, S&P or the Index Sponsor, will

publish the daily closing level of the VIX Futures Index as of the close of the NYSE Arca. The Managing Owner will publish the net asset value of the Fund, the net asset value per Share and the number of outstanding Shares daily. Additionally, the

Index Sponsor will publish the intra-day Index level, and the Managing Owner will publish the indicative value per Share (quoted in U.S. dollars) and the number of outstanding Shares once every fifteen seconds throughout each trading day.

All of the foregoing information will be published as follows:

The intra-day level of the VIX Futures Index (symbol: SPVXSP) and the intra-day indicative value per Share (symbol: VIXXIV) (each

quoted in U.S. dollars) will be published once every fifteen seconds throughout each trading day on the consolidated tape, Reuters and/or Bloomberg and on the Managing Owner’s website at http://www.jamfunds.com/jcis, or any successor

thereto.

The current trading price per Share (symbol: VIXX) (quoted in U.S. dollars) will be published continuously as

trades occur throughout each trading day on the consolidated tape, Reuters and/or Bloomberg and on the Managing Owner’s website at http://www.jamfunds.com/jcis, or any successor thereto.

The number of outstanding Shares (symbol: VIXXSO) will be published once every fifteen seconds throughout the trading day and as of the

close of business on the consolidated tape, Reuters and/or Bloomberg and on the Managing Owner’s website at http://www.jamfunds.com/jcis, or any successor.

The most recent end-of-day VIX Futures Index closing level (symbol: SPVXSP) will be published as of the close of the NYSE Arca each

trading day on the consolidated tape, Reuters and/or Bloomberg and on the Managing Owner’s website at http://www.jamfunds.com/jcis, or any successor thereto.

The most recent end-of-day net asset value of the Fund (symbol: VIXXNV) will be published as of the close of business on Reuters and/or

Bloomberg and on the Managing Owner’s website at http://www.jamfunds.com/jcis, or any successor thereto. In addition, the most recent end-of-day net asset value of the Fund will be published the following morning on the consolidated

tape.

All of the foregoing information with respect to the VIX Futures Index will also be

published at http://www.standardandpoors.com.

The Index Sponsor obtains information for inclusion in, or for use

in the calculation of, the VIX Futures Index from sources the Index Sponsor considers reliable. None of the Index Sponsor, the Managing Owner, the Fund or any of their respective affiliates accepts responsibility for, or guarantees the accuracy

and/or completeness of, the VIX Futures Index or any data included in the VIX Futures Index.

CUSIP Number

The Fund’s CUSIP number is 47233K105.

Risk Factors

An investment in Shares is speculative and involves a high degree of risk. The summary risk factors set forth below are intended

merely to highlight certain risks of the Fund. The Fund has particular risks that are set forth elsewhere in this Prospectus.

| |

• |

|

The Fund has no operating history. Therefore, a potential investor has no performance history to serve as a factor for evaluating an investment in the

Fund. |

| |

• |

|

Past performance, when available, is not necessarily indicative of future results; all or substantially all of an investment in the Fund could be lost.

|

| |

• |

|

The trading of the Fund takes place in very volatile markets that may be subject to sudden and rapid changes. Consequently, all or substantially all of

your investment in the Fund could be lost quickly. |

| |

• |

|

The Managing Owner was formed to be the managing owner of investment vehicles such as the Fund and has no history of past performance. The Managing

Owner and its trading principals have not managed any other public commodity pool or any other commodity pool that seeks to track an index of commodity futures, although certain of the trading principals do have experience

|

-2-

| |

|

managing other types of private commodity pools, and therefore there is no indication of their ability to manage investment vehicles such as the Fund. If the experience of the Managing Owner and

its trading principals is not adequate or suitable to manage investment vehicles such as the Fund, the operations of the Fund may be adversely affected. |

| |

• |

|

The Fund will be subject to fees and expenses in the aggregate amount of approximately 0.89% per annum as described herein. The Fund will be

successful only if its annual returns from futures trading, plus its annual interest income from its holdings of U.S. Treasury bills, generally with a maturity of less than one year, and other high credit quality short-term fixed income securities,

exceed these fees and expenses of approximately 0.89% per annum. The Fund is expected to earn interest income equal to 0.16% per annum, based upon the yield of 3-month U.S. Treasury bills as of July 14, 2010. Therefore, based upon the

difference between the current yield of 3-month U.S. Treasury bills and the annual fees and expenses, the Fund will be required to earn from its futures trading approximately 0.73% per annum, or $0.37 per annum per Share at $50.00 as the net

asset value per Share, in order for an investor to break even on an investment during the first twelve months of an investment. Actual interest may be higher or lower. |

| |

• |

|

If the Managing Owner determines in its commercially reasonable judgment that it has become impracticable or inefficient for any reason for the Fund to

gain full or partial exposure to the VIX Futures Index or any VIX Future by investing in a specific futures contract that is a part of the VIX Futures Index, the Fund may invest in one or more forward agreements, swaps, or other over-the-counter, or

OTC, derivatives, which we refer to collectively as Futures-Linked Investments, referencing the VIX Futures. Investing in Futures-Linked Investments exposes the Fund to counterparty risk, or the risk that a Futures-Linked Investment counterparty

will default on its obligations under the Futures-Linked Investment. |

| |

• |

|

The VIX Futures have historically traded in “contango” markets. Contango markets are those in which the prices of contracts are higher in the

distant settlement months than in the nearer settlement months. VIX Futures have frequently exhibited very high contango in the past, resulting in a significant cost to “roll” the futures. The existence of contango in the futures markets

could result in negative “roll yields”, which could adversely affect the value of the VIX Futures underlying your Shares. |

| |

• |

|

Fees and commissions are charged regardless of profitability and may result in depletion of assets and, as a result, losses to your investment.

|

| |

• |

|

There can be no assurance that the Fund will achieve profits or avoid losses, significant or otherwise. |

| |

• |

|

Performance of the Fund may not track the VIX Futures Index during particular periods or over the long term. |

| |

• |

|

Certain potential conflicts of interest exist. The futures brokers may have a conflict of interest between their execution of trades for the Fund and

for their other customers. More specifically, the futures brokers will benefit from executing orders for other clients, whereas the Fund may be harmed to the extent that the futures brokers have fewer resources to allocate to the Fund’s account

due to the existence of such other clients. Proprietary trading by the Managing Owner, its affiliates, and its and their trading principals may create conflicts of interest from time-to-time because such proprietary trades may take a position that

is opposite of that of the Fund or may compete with the Fund for certain positions within the marketplace. See “Conflicts of Interest” for a more complete disclosure of various conflicts. Although the Managing Owner has established

procedures designed to resolve certain of these conflicts equitably, the Managing Owner has not established formal procedures to resolve all potential conflicts of interest. Consequently, investors may be dependent on the good faith of the

respective parties subject to such conflicts to resolve them equitably. Although the Managing Owner attempts to

|

-3-

| |

|

monitor these conflicts, it is extremely difficult, if not impossible, for the Managing Owner to ensure that these conflicts will not, in fact, result in adverse consequences to the Fund.

|

The Trustee

Wilmington Trust Company, or the Trustee, a Delaware banking corporation, is the sole trustee of the Fund. The Trustee has only nominal

duties and liabilities to the Fund.

Under the Amended and Restated Declaration of Trust of the Fund, or the Declaration

of Trust, the Managing Owner is vested with the exclusive management, authority and control of all aspects of the business of the Fund. The Trustee has no duty or liability to supervise or monitor the performance of the Managing Owner, nor will the

Trustee have any liability for the acts or omissions of the Managing Owner.

The Managing

Owner

Jefferies Commodity Investment Services, LLC, a Delaware limited liability company, will serve as Managing Owner

of the Fund. The Managing Owner was formed on December 2, 2009. The Managing Owner will serve as the commodity pool operator and commodity trading advisor of the Fund. The Managing Owner has no experience in operating commodity pools and

managing futures trading accounts of this type. The Managing Owner has been registered as a commodity pool operator and commodity trading advisor with the Commodity Futures Trading Commission, or the CFTC, and has been a member of the National

Futures Association, or the NFA, since December 22, 2009. As a registered commodity pool operator and commodity trading advisor, with respect to the Fund, the Managing Owner must comply with various regulatory requirements under the Commodity

Exchange Act and the rules and regulations of the CFTC and the NFA, including investor protection requirements, antifraud prohibitions, disclosure requirements, and reporting and recordkeeping requirements. The Managing Owner also will be subject to

periodic inspections and audits by the CFTC and NFA. The principal office of the Managing Owner is located at One Station Place, Three North, Stamford, CT 06902. The telephone number of the Managing Owner is (203) 708-6500.

The Managing Owner was formed to be the managing owner of investment vehicles such as the

Fund and has no history of past performance. The Managing Owner and its trading principals have not managed any other public commodity pool or any other commodity pool that seeks to track an index of commodity futures, although certain of the

trading principals do have experience managing other types of private commodity pools, and therefore there is no indication of their ability to manage investment vehicles such as the Fund. If the experience of the Managing Owner and its trading

principals is not adequate or suitable to manage investment vehicles such as the Fund, the operations of the Fund may be adversely affected.

The Fund will pay the Managing Owner a management fee, monthly in arrears, in an amount equal to 0.75% per annum of the daily net

asset value of the Fund, which we refer to as the Management Fee. The Management Fee will not be subject to the Overall Expense Cap described in this Prospectus. The Management Fee will be paid in consideration of the Managing Owner’s futures

trading advisory services.

Investment Objective of the Fund; The VIX Futures Index

The Fund seeks to track changes, whether positive or negative, in the level of the VIX Futures Index, over time. The

Fund will pursue its investment objective primarily by maintaining long futures positions corresponding to the futures contracts underlying the VIX Futures Index, with an aggregate notional amount equal to the Fund’s total capital. The Fund may

use alternative futures contracts or Futures-Linked Investments under certain circumstances. The Fund’s performance also will reflect the difference, positive or negative, between its interest income from its holdings of U.S. Treasury bills,

generally with a maturity of less than one year, and other high credit quality short-term fixed income securities, over the expenses of the Fund.

The VIX Futures Index is designed to provide an exposure to one or more maturities of futures contracts on the CBOE

Volatility Index®, or the Volatility Index, which reflect implied volatility in the S&P

500® Index at various points along the volatility forward curve, or VIX Futures. VIX Futures trade on the CBOE

Futures Exchange, or the CFE. The Volatility Index is a benchmark index designed to estimate expected volatility in large cap

-4-

U.S. stocks over 30 days in the future by averaging the weighted prices of certain put and call options on the S&P

500® Index. During periods of market instability, the implied level of volatility of the S&P

500® Index typically increases and, consequently, the prices of options linked to the S&P

500® Index typically increase (assuming all other relevant factors remain constant or have negligible changes).

This, in turn, causes the level of the Volatility Index to increase. Because the Volatility Index may increase in times of uncertainty, the Volatility Index is commonly known as the “fear gauge” of the broad U.S. equities market. The

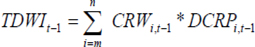

Volatility Index and the VIX Futures Index historically have had negative correlations to the S&P 500®

Index. The correlation table below illustrates the negative correlations of the Volatility Index and the VIX Futures Index to the S&P

500® Index for the three year period ended December 31, 2009. In this table, statistically, investments

with a correlation of 1.0000 increase or decrease at the same time, while investments with a correlation of -1.0000 always move in the opposite direction. This table illustrates the correlation of the Volatility Index and the VIX Futures Index to

the S&P 500® Index (the S&P

500® Index has a correlation of 1.000, meaning it is perfectly correlated with itself).

|

|

|

| Index |

|

Correlation to the

S&P

500® Index |

| S&P

500® Index |

|

1.0000 |

| Volatility Index |

|

-0.6625 |

| VIX Futures Index |

|

-0.7422 |

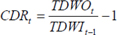

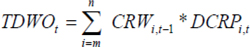

The VIX Futures

Index measures the return from a daily rolling long position in the first and second month VIX Futures, targeting a constant weighted average futures maturity of one month. The Fund will acquire and roll long positions in the first and second month

VIX Futures with a view to tracking the level of the VIX Futures Index over time. Unlike equities, which typically entitle the holder to a continuing stake in a corporation, futures contracts normally specify a certain date for delivery of the

underlying asset or for settlement in cash based on the level of the underlying asset. As the futures contracts underlying the VIX Futures Index approach expiration, they are replaced by similar contracts that have a later expiration. Thus, for

example, a futures contract purchased and held in August may specify

an October expiration. As time passes, the contract expiring in October may be replaced by a contract for delivery in November. This process is referred to as “rolling”.

The Fund will both roll and rebalance its holdings of VIX Futures in a manner that is consistent with the method described under

“Description of the VIX Futures Index.” The Fund will rebalance its holding of VIX Futures in order to ensure that its portfolio of VIX Futures will accurately reflect the composition of the VIX Futures Index.

The VIX Futures Index was created by the Index Sponsor.

The Fund does not intend to outperform the VIX Futures Index. The Managing Owner will seek to cause the net asset value of the Fund to

track the VIX Futures Index during periods in which the VIX Futures Index is flat or declining as well as when the VIX Futures Index is rising. For the avoidance of doubt, the Fund does not seek to track the Volatility Index.

Advantages of investing in the Shares include:

| |

• |

|

Ease and Flexibility of Investment. The Shares will trade on the NYSE Arca and provide investors with indirect access to the futures markets.

The Shares may be bought and sold throughout the business day at real-time prices on the NYSE Arca like other exchange-listed securities. Investors may purchase and sell Shares through traditional brokerage accounts. |

| |

• |

|

Margin. Shares are eligible for margin accounts. |

| |

• |

|

Shares May Provide A More Cost Effective Alternative. Investing in the Shares can be easier and less expensive for an investor than constructing

and trading a comparable portfolio of VIX Futures due to the relatively low minimum amount for an investment in the Fund by comparison to the amount of initial margin deposit required to establish and maintain a portfolio of futures designed to

track the VIX Futures Index, the limited liability nature of an investment in Shares (a futures trading account does not offer limited liability), and the administrative convenience of buying a security rather than establishing and continuously

rolling a portfolio of futures. |

-5-

The level of the VIX Futures Index is calculated in accordance with the method described

in “— Composition of the VIX Futures Index” below. The value of the VIX Futures Index in real time and at the close of trading on each Index business day will be published by Standard & Poor’s or a successor under the

ticker symbol SPVXSP.

The Index Sponsor obtains information for inclusion in, or for use in the calculation of, the VIX

Futures Index from sources the Index Sponsor considers reliable. None of the Index Sponsor, the Managing Owner, the Fund or any of their respective affiliates accepts responsibility for or guarantees the accuracy and/or completeness of the VIX

Futures Index or any data included in the VIX Futures Index.

The intra-day indicative value per Share is based on the prior

day’s final net asset value, adjusted once every fifteen seconds throughout the trading day to reflect the percentage price changes of the Fund’s futures contracts and holdings of United States Treasuries and other high credit quality

short-term fixed income securities to provide a continuously updated estimated net asset value per Share. The final net asset value of the Fund and the final net asset value per Share will be calculated as of the closing time of the NYSE Arca or the

CFE, the exchange on which the Fund’s futures contracts are traded, whichever is latest, and posted in the same manner. Although a time gap may exist between the close of the NYSE Arca and the CFE, the exchange on which the VIX Futures are

traded, there is no effect on the net asset value calculations as a result.

The value of the Shares is expected to

fluctuate in relation to changes in the net asset value of the Fund. The market price of the Shares may not be identical to the net asset value per Share, but these two valuations are generally expected to be very close. See “The Risks You Face

– (6) Net Asset Value May Not Always Correspond to Market Price and, as a Result, Baskets May Be Created or Redeemed at a Value that Differs From the Market Price of the Shares.”

There can be no assurance that the Fund will achieve its investment objective or avoid substantial losses. The Fund has no

performance history. The value of the Shares on the secondary market is expected to fluctuate generally in relation to changes in the net asset value of the Fund.

The Value of the Shares Should Track Closely the Changes in

the Level of the VIX Futures Index

The Shares are intended to provide investment results that generally correspond

to the changes, whether positive or negative, in the levels of the VIX Futures Index, over time.

The Fund

will hold a portfolio of VIX Futures as well as cash and U.S. Treasury bills, generally with a maturity of less than one year, and other high credit quality short-term fixed income securities for deposit with the Fund’s Clearing Broker as

margin. The Fund’s portfolio will be traded with a view to tracking the VIX Futures Index, over time, whether the VIX Futures Index is rising, falling or flat over any particular period. The Fund is not “managed” by traditional

methods, which typically involve effecting changes in the composition of the Fund’s portfolio on the basis of judgments relating to economic, financial and market considerations with a view to obtaining positive results under all market

conditions.

The Futures Broker

A variety of executing brokers will execute futures transactions on behalf of the Fund. The executing brokers will give-up all

transactions to Credit Suisse Securities (USA) LLC, which will serve as the Fund’s clearing broker, or Clearing Broker. In its capacity as clearing broker, the Clearing Broker will execute and clear the Fund’s futures transactions and will

perform certain administrative services for the Fund. Credit Suisse Securities (USA) LLC is registered with the CFTC as a futures commission merchant and is a member of the NFA in such capacity.

The Fund will pay to the Clearing Broker all brokerage commissions, including applicable exchange fees, NFA fees, give-up fees, pit

brokerage fees and other transaction related fees and expenses charged in connection with its trading activities, which we refer to collectively as Brokerage Expenses, subject to the Overall Expense Cap as described in this Prospectus. For a more

detailed explanation of the Brokerage Expenses, see pages 47-48. On average, total charges paid to the Clearing Broker are expected to be less than $3.50 per round-turn trade, although the Clearing Broker’s brokerage commissions and fees

will be determined on a contract-by-contract, or round-turn basis.

-6-

A round-turn trade is a completed transaction involving both a purchase and a liquidating

sale, or a sale followed by a covering purchase.

The Administrator

The Managing Owner, on behalf of the Fund, has appointed The Bank of New York Mellon as the administrator, or Administrator, of the Fund

and has entered into an Administration and Accounting Agreement, or the Administration Agreement, in connection therewith. The Bank of New York Mellon will serve as custodian, or Custodian, of the Fund and has entered into a Global Custody

Agreement, or Custody Agreement, in connection therewith. The Bank of New York Mellon will also serve as the transfer agent, or Transfer Agent, of the Fund and has entered into a Transfer Agency and Service Agreement in connection therewith.

The Bank of New York Mellon, a banking corporation organized under the laws of the State of New

York with trust powers, has an office at 2 Hanson Place,

12th Floor, Brooklyn, New York 11217. The Bank of New York

Mellon is subject to supervision by the New York State Banking Department and the Board of Governors of the Federal Reserve System. Information regarding the net asset value of the Fund, creation and redemption transaction fees and the current list

of names of the parties that have executed a Participant Agreement may be obtained from The Bank of New York Mellon by calling the following number: (718) 315-4412. A list of the names of the parties that have executed a Participant Agreement

as of the date of this Prospectus may be found in the “Plan of Distribution” Section. A copy of the Administration Agreement is available for inspection at The Bank of New York Mellon’s trust office identified above.

Pursuant to the Administration Agreement, the Administrator will perform or supervise the performance of services necessary for the

operation and administration of the Fund (other than making investment decisions), including receiving and processing orders from Authorized Participants to create and redeem Baskets, net asset value calculations, accounting and other fund

administrative services. The Administrator will retain certain financial books and records, including: Basket creation and redemption books and records, fund accounting records, ledgers with respect to assets, liabilities, capital, income and

expenses, the register, transfer journals and related details and trading and related documents received from futures

commission merchants, c/o The Bank of New York Mellon, 2 Hanson Place,

12th Floor, Brooklyn, New York 11217, telephone number

(718) 315-4412.

Key terms of the Administration Agreement are summarized under the heading “Material

Contracts.”

The Fund will be responsible for paying, or for reimbursing the Managing Owner or its affiliates for

paying, the Administrator up to 0.05% of the daily net asset value per annum of the Fund for administration fees, monthly in arrears, subject to the Overall Expense Cap.

The Administrator and any of its affiliates may from time-to-time purchase or sell Shares for their own account, as agent for their

customers and for accounts over which they exercise investment discretion.

The Administrator also will receive a

transaction processing fee in connection with orders from Authorized Participants to create or redeem Baskets in the amount of $500 per order. These transaction processing fees are paid by the Authorized Participants and not by the Fund.

The Fund is expected to retain the services of one or more additional service providers to assist with certain tax reporting

requirements of the Fund and its Shareholders.

The Distributor

The Managing Owner, on behalf of the Fund, has appointed ALPS Distributors, Inc., or ALPS Distributors, to assist the Managing Owner and

the Administrator with certain functions and duties relating to distribution and marketing, including reviewing and approving marketing materials. ALPS Distributors will retain all marketing materials at c/o ALPS Distributors, Inc., 1290 Broadway,

Suite 1100, Denver, Colorado 80203; telephone number (303) 623-2577. Investors may contact ALPS Distributors toll-free in the U.S. at (877) 369-4617. The Fund has entered into a Marketing Agreement with ALPS Distributors. ALPS Distributors

is affiliated with ALPS Fund Services, Inc., a Denver-based outsourcing solution for administration, compliance, fund accounting, legal, marketing, tax administration, transfer agency and shareholder services for open-end, closed-end, hedge and

exchange-traded funds. ALPS Fund Services, Inc. and its affiliates provide fund administration services to funds with assets in excess of $40 billion. ALPS Distributors, Inc. provides distribution services to funds with assets of more than $220

billion.

-7-

The Fund will pay ALPS Distributors for performing its duties on behalf of the Fund and

may pay ALPS Distributors additional compensation in consideration of the performance by ALPS Distributors of additional marketing, distribution and ongoing support services. Such additional services may include, among other services, the

development and implementation of a marketing plan and the utilization of ALPS Distributors’ resources, which include an extensive broker database and a network of internal and external wholesalers.

Limitation of Liabilities

You cannot lose more than your investment in the Shares. Shareholders will be entitled to limitation on liability equivalent to the

limitation on liability enjoyed by stockholders of a Delaware business corporation for profit.

Creation and Redemption of Baskets

The Fund will create and redeem Shares from time-to-time, but only in one or more Baskets. A Basket is a block of 20,000 Shares. Baskets

may be created or redeemed only by Authorized Participants, except that the initial Baskets in the Fund will be created by the Initial Purchaser. Baskets are created and redeemed continuously as of noon, Eastern time, on the business day immediately

following the date on which a valid order to create or redeem a Basket is accepted by the Fund. Baskets are created and redeemed at the net asset value of 20,000 Shares as of the closing time of the NYSE Arca or the CFE, the exchange on which the

Fund’s futures contracts are traded, whichever is latest, on the date that a valid order to create or redeem a Basket is accepted by the Fund. For purposes of processing both purchase and redemption orders, a “business day” means any

day other than a day when banks in New York City are required or permitted to be closed. Except when aggregated in Baskets, the Shares are not redeemable securities. Authorized Participants pay a transaction fee of $500 in connection with each order

to create or redeem a Basket. Authorized Participants may sell the Shares included in the Baskets they purchase from the Fund to other investors.

See “Creation and Redemption of Baskets” for more details.

The Offering

On [ ], 2010, Jefferies & Company, Inc., as the Initial Purchaser, subject to certain conditions, agreed

to purchase and take delivery of 100,000 Shares, which comprise the initial Baskets of the Fund, at a purchase price of $50.00 per Share ($1,000,000 per Basket), as described in “Plan of Distribution.”

The Fund will issue Shares in Baskets to Authorized Participants continuously as of noon, Eastern time, on the business day immediately

following the date on which a valid order to create a Basket is accepted by the Fund. Baskets will be created at the net asset value of 20,000 Shares as of the closing time of the NYSE Arca or the CFE, the exchange on which the Fund’s futures

contracts are traded, whichever is latest, on the date that a valid order to create a Basket is accepted by the Fund.

Authorized Participants

Baskets may be created or redeemed only by Authorized Participants, except that the initial Baskets in the Fund will be created by the

Initial Purchaser. Each Authorized Participant must (1) be a registered broker dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker dealer to engage in

securities transactions, (2) be a direct participant in DTC, and (3) have entered into an agreement with the Fund and the Managing Owner, or a Participant Agreement. The Participant Agreement sets forth the procedures for the creation and

redemption of Baskets and for the delivery of cash required for such creations or redemptions. The list of current Authorized Participants can be obtained from the Administrator.

Net Asset Value

Net asset value means the total assets of the Fund including, but not limited to, all cash and cash equivalents or other debt securities

less total liabilities of the Fund, each determined on the basis of generally accepted accounting principles.

See

“Description of the Shares; The Fund; Certain Material Terms of the Declaration of Trust – Net Asset Value” for more details.

-8-

Clearance and Settlement

The Shares are evidenced by a global certificate that the Fund issues to DTC. The Shares are available only in book-entry form.

Shareholders may hold Shares through DTC, if they are direct participants in DTC, or indirectly through entities that are direct or indirect participants in DTC.

Segregated Accounts/Interest Income

The proceeds of the offering will be deposited in cash in a segregated account in the name of the Fund at the Clearing Broker in

accordance with CFTC investor protection and segregation requirements or with the Custodian. The Fund will be credited with 100% of the interest earned on its average net assets on deposit with the Clearing Broker or the Custodian each month. In an

attempt to increase interest income earned, the Managing Owner expects to invest the assets of the Fund that are not on deposit as margin in support of futures positions in U.S. Treasury bills, generally with a maturity of less than one year,

certain cash items such as money market funds, certificates of deposit (under nine months) and time deposits or other instruments permitted by applicable rules and regulations and other high credit quality short-term fixed income securities. As of

July 14, 2010, the interest rate expected to be earned by the Fund is estimated to be 0.16% per annum, based upon the yield of 3-month U.S. Treasury bills. Actual interest income could be higher or lower.

This interest income will be used by the Fund to pay its expenses. See “Fees and Expenses” for more details.

[Remainder of page left blank intentionally]

-9-

Fees and Expenses

|

|

|

| Management Fee |

|

The Fund will pay the Managing Owner a Management Fee, monthly in arrears, in an amount equal to 0.75% per annum of the daily net asset value of the Fund and will not be subject to

the Overall Expense Cap (as defined below). The Management Fee will be paid in consideration of the Managing Owner’s futures trading advisory services. |

|

|

| Organization and Offering Expenses |

|

The Fund will be responsible for paying, or for reimbursing the Managing Owner or its affiliates for paying, all of the expenses incurred in connection with organizing the Fund as

well as the expenses incurred in connection with the offering of the Fund’s Shares (whether incurred prior to or after the commencement of the Fund’s trading operations), subject to the Overall Expense Cap described below. |

|

|

| Brokerage Commissions and Fees |

|

The Fund will pay to the Clearing Broker all brokerage commissions, including applicable exchange fees, NFA fees, give-up fees, pit brokerage fees and other transaction related fees

and expenses charged in connection with its trading activities, which we refer to collectively as Brokerage Expenses, subject to the Overall Expense Cap described below. On average, total charges paid to the Clearing Broker are expected to be less

than $3.50 per round-turn trade, although the Clearing Broker’s brokerage commissions and fees will be determined on a contract-by-contract basis. |

|

|

| Routine Operational, Administrative and Other Ordinary Expenses |

|

The Fund will be responsible for paying, or for reimbursing the Managing Owner or its affiliates for paying, all of the routine operational, administrative and other ordinary

expenses of the Fund, including, but not limited to, computer services, the fees and expenses of the Trustee, distribution and marketing fees, legal and accounting fees and expenses, audit fees and expenses, tax preparation fees and expenses, filing

fees, and printing, mailing and duplication costs, subject to the Overall Expense Cap described below. |

|

|

| Overall Expense Cap |

|

The Managing Owner has agreed to pay the expenses incurred in connection with organizing the Fund as well as the expenses incurred in connection with the offering of the Fund’s

Shares (whether incurred prior to or after the commencement of the Fund’s trading operations), the Brokerage Expenses, and the routine operational, administrative and other ordinary expenses of the Fund, which we refer to as Covered Expenses,

to the extent that, in the aggregate, they exceed 0.14% per annum of the daily net asset value of the Fund in any month, or the Overall Expense Cap. Any such amounts paid by the Managing Owner will be subject to reimbursement by the Fund, without

interest. Any expense reimbursement payment during any month will be counted toward the 0.14% per annum overall expense cap in respect of such month. The 0.75% per annum Management Fee described above and the extraordinary fees and expenses

described below are not subject to the Overall Expense Cap. If in any month the Fund’s Covered Expenses are lower than the cap, the entire difference between the Covered Expenses for such month and the cap for such month will be available to

reimburse the Managing Owner for unreimbursed expenses paid by the Managing Owner. If the Fund terminates before the Managing Owner has been fully reimbursed for any of the foregoing expenses, the Managing Owner will forfeit the unreimbursed portion

of such expenses outstanding as of such time. |

|

|

| Extraordinary Fees and Expenses |

|

The Fund will be responsible for paying, or for reimbursing the Managing Owner or its affiliates for paying, all the extraordinary fees and expenses, if any, of the Fund.

Extraordinary fees and expenses are fees and expenses which are non-recurring and unusual in nature, such as legal claims and liabilities, litigation costs or indemnification or other unanticipated expenses. Extraordinary fees and expenses will not

be subject to the Overall Expense Cap. Such extraordinary fees and expenses, by their nature, are unpredictable in terms of timing and amount. |

|

|

| Management Fee and Expenses to be Paid First Out of Interest Income |

|

The Management Fee, all expenses incurred in connection with organizing the Fund as well as the expenses incurred in connection with the offering of Shares, Brokerage Expenses, and

the routine operational, administrative and other ordinary expenses of the Fund (including reimbursement payments to the Managing Owner) will be paid first out of interest income from the Fund’s holdings of U.S. Treasury bills, generally with a

maturity of less than one year, and other high credit quality short-term fixed income securities. To the extent interest income is not sufficient to cover the fees and expenses of the Fund during any period, the excess of such fees and expenses over

such interest income will be paid out of income from futures trading, if any, or from sales of the Fund’s fixed income securities. |

|

|

| Selling Commission |

|

Investors may purchase and sell Shares through traditional brokerage accounts. Investors are expected to be charged a customary commission by their brokers in connection with

purchases of Shares that will vary from investor to investor. Investors are encouraged to review the terms of their brokerage accounts for applicable charges. |

-10-

Breakeven Amounts

The estimated amount of all fees and expenses which are anticipated to be incurred by a new investor during the first twelve months of

investment is 0.89% per annum of the net asset value of the Fund, plus the amount of any commissions charged by the investor’s broker in connection with an investor’s purchase of Shares.

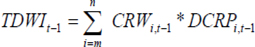

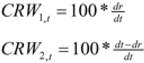

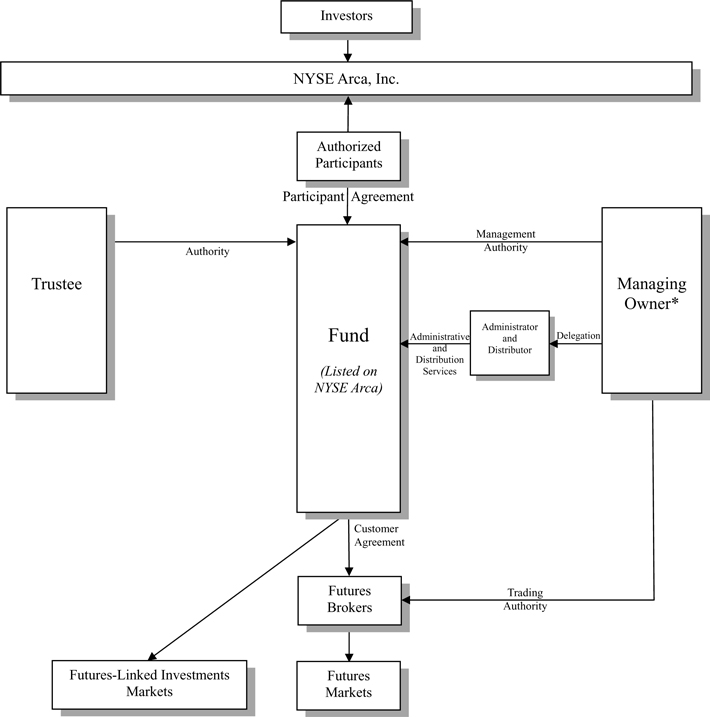

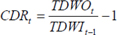

The Fund will be subject to fees and expenses in the aggregate amount of approximately 0.89% per annum as described herein. The