Attached files

EXHIBIT 10.2

LEASE

IIT 1905 RAYMOND AVENUE LLC, LANDLORD

AIR EXPRESS INTERNATIONAL USA, INC. dba DHL GLOBAL FORWARDING, TENANT

Dated as of June 30, 2010

-1-

LEASE

TABLE OF CONTENTS

| Page | ||||||

| 1. |

BASIC LEASE TERMS |

1 | ||||

| 1A. |

SPECIAL LEASE TERMS |

3 | ||||

| 2. |

PREMISES |

6 | ||||

| 3. |

TERM |

6 | ||||

| 3.1 |

Commence | 6 | ||||

| 3.2 |

Expire | 6 | ||||

| 4. |

TENANT IMPROVEMENTS; EARLY POSSESSION; DELAYED DELIVERY OF POSSESSION |

6 | ||||

| 4.1 |

Tenant Improvements | 6 | ||||

| 4.2 |

Early Occupancy [omitted] | 6 | ||||

| 4.3 |

Landlord Delay | 6 | ||||

| 4.4 |

Tenant Delay | 6 | ||||

| 5. |

RENT |

6 | ||||

| 5.1 |

Rent | 6 | ||||

| 5.2 |

Manner of Payment | 7 | ||||

| 5.3 |

No Abatement of Rent | 7 | ||||

| 6. |

PREPAID RENT AND SECURITY DEPOSIT [omitted] |

7 | ||||

| 7. |

USE OF PREMISES |

7 | ||||

| 7.1 |

Use | 7 | ||||

| 7.2 |

Prohibited Uses | 7 | ||||

| 7.3 |

No Nuisance | 7 | ||||

| 7.4 |

Outside Storage | 7 | ||||

| 8. |

ADDITIONAL RENT FOR OPERATING EXPENSES |

8 | ||||

| 8.1 |

Tenant Payment | 8 | ||||

| 8.2 |

Tenant’s Share | 8 | ||||

| 8.3 |

Definitions | 8 | ||||

| 8.4 |

Determination of Operating Expenses | 11 | ||||

| 8.5 |

Reconciliation | 11 | ||||

| 8.6 |

Upon Lease Termination | 11 | ||||

| 8.7 |

Tenant Review of Operating Expenses | 11 | ||||

| 9. |

Common Areas |

12 | ||||

| 9.1 |

Use of Common Areas | 12 | ||||

| 9.2 |

Definition of Common Areas | 12 | ||||

| 10. |

Maintenance and Repair Responsibility |

12 | ||||

| 10.1 |

Landlord’s Maintenance Obligations | 12 | ||||

| 10.2 |

Janitorial Service | 13 | ||||

| 10.3 |

No Obligation For Alteration | 13 | ||||

| 10.4 |

Landlord or Tenant Caused | 13 | ||||

| 11. |

UTILITIES |

13 | ||||

| 11.1 |

Furnishing of Utilities | 13 | ||||

| 11.2 |

Additional Services [omitted] | 13 | ||||

| 11.3 |

After Hours [omitted] | 14 | ||||

| 11.4 |

Landlord’s Restoration Obligation | 14 | ||||

| 11.5 |

Telecommunications Providers | 14 | ||||

| 12. |

LIMITS ON LANDLORD’S LIABILITY |

14 | ||||

| 12.1 |

Circumstances Beyond Control | 14 | ||||

-i-

| 12.2 |

Unreasonable Period of Failure | 14 | ||||

| 12.3 |

No Consequential Damages | 15 | ||||

| 13. |

ALTERATIONS AND ADDITIONS BY TENANT; LIENS AND INSOLVENCY |

15 | ||||

| 13.1 |

Alterations and Additions by Tenant | 15 | ||||

| 13.2 |

Liens and Insolvency | 15 | ||||

| 14. |

INSURANCE; INDEMNITY |

16 | ||||

| 14.1 |

Landlord’s Responsibility | 16 | ||||

| 14.2 |

Waiver | 16 | ||||

| 14.3 |

Indemnity | 16 | ||||

| 14.4 |

Tenant’s Insurance | 16 | ||||

| 14.5 |

Landlord’s Insurance | 16 | ||||

| 14.6 |

Proceeds | 17 | ||||

| 14.7 |

Waiver of Subrogation | 17 | ||||

| 14.8 |

Notification of Accidents | 17 | ||||

| 15. |

DESTRUCTION |

17 | ||||

| 15.1 |

Election to Restore | 17 | ||||

| 15.2 |

Rent Abatement | 18 | ||||

| 15.3 |

Repairs to Tenant Installations | 18 | ||||

| 15.4 |

No Compensation | 18 | ||||

| 15.5 |

Common Areas | 18 | ||||

| 15.6 |

Damage at the End of Term | 18 | ||||

| 16. |

CONDEMNATION |

18 | ||||

| 16.1 |

Termination of Lease | 18 | ||||

| 16.2 |

Election of Termination | 18 | ||||

| 16.3 |

Reduction of Rent | 19 | ||||

| 16.4 |

Award | 19 | ||||

| 16.5 |

Landlord Authority | 19 | ||||

| 17. |

ASSIGNMENT AND SUBLETTING |

19 | ||||

| 17.1 |

Landlord Consent Required; Exceptions | 19 | ||||

| 17.2 |

Deemed Assignment | 19 | ||||

| 17.3 |

Recapture | 20 | ||||

| 17.4 |

Additional Requirements; Release | 20 | ||||

| 17.5 |

Assignment with Bankruptcy | 20 | ||||

| 17.6 |

Sale | 21 | ||||

| 17.7 |

Binding | 21 | ||||

| 18. |

DEFAULT |

21 | ||||

| 18.1 |

Definition of Default | 21 | ||||

| 18.2 |

Landlord Default | 22 | ||||

| 19. |

REMEDIES IN DEFAULT |

22 | ||||

| 19.1 |

Landlord Remedies | 22 | ||||

| 19.2 |

Tenant Payment of Costs | 22 | ||||

| 19.3 |

Termination | 22 | ||||

| 19.4 |

No Termination | 22 | ||||

| 19.5 |

Landlord Election to Make Tenant Advances | 23 | ||||

| 20. |

ACCESS |

23 | ||||

| 21. |

SURRENDER OF PREMISES; HOLD-OVER TENANCY |

23 | ||||

| 21.1 |

Surrender of Premises | 23 | ||||

| 21.2 |

Removal of Personal Property | 23 | ||||

| 21.3 |

Removal of Alterations and Tenant Improvements | 24 | ||||

| 21.4 |

Delivery of Keys | 24 | ||||

| 21.5 |

Hold-Over Tenancy | 24 | ||||

| 22. |

COMPLIANCE WITH LAW |

24 | ||||

| 23. |

RULES AND REGULATIONS |

25 | ||||

-ii-

| 24. |

PARKING |

25 | ||||

| 25. |

CERTIFICATES |

25 | ||||

| 26. |

SUBORDINATION |

25 | ||||

| 27. |

PERSONAL PROPERTY TAXES |

26 | ||||

| 28. |

NOTICES |

26 | ||||

| 29. |

CONDITION OF PREMISES |

26 | ||||

| 30. |

HAZARDOUS SUBSTANCES |

26 | ||||

| 30.1 |

Tenant Obligations | 26 | ||||

| 30.2 |

Tenant Indemnity | 27 | ||||

| 30.3 |

Landlord Inspection | 27 | ||||

| 30.4 |

Landlord Warranty | 27 | ||||

| 30.5 |

Landlord Obligations | 27 | ||||

| 30.6 |

Environmental Reports | 27 | ||||

| 30.7 |

Survival | 28 | ||||

| 31. |

SIGNS |

28 | ||||

| 32. |

GENERAL PROVISIONS |

28 | ||||

| 32.1 |

Attorneys’ Fees | 28 | ||||

| 32.2 |

Governing Law; Venue | 28 | ||||

| 32.3 |

Cumulative Remedies | 28 | ||||

| 32.4 |

Exhibits; Addenda | 28 | ||||

| 32.5 |

Interpretation | 28 | ||||

| 32.6 |

Joint Obligation | 28 | ||||

| 32.7 |

Late Charges; Interest | 28 | ||||

| 32.8 |

Light, Air, and View | 29 | ||||

| 32.9 |

Measurements | 29 | ||||

| 32.10 |

Abandonment of Premises | 29 | ||||

| 32.11 |

Prior Agreements; Amendments | 29 | ||||

| 32.12 |

Recordation | 29 | ||||

| 32.13 |

Liability | 29 | ||||

| 32.14 |

Severability | 30 | ||||

| 32.15 |

Time | 30 | ||||

| 32.16 |

Waiver | 30 | ||||

| 32.17 |

Force Majeure | 30 | ||||

| 32.18 |

Quiet Enjoyment | 30 | ||||

| 33. |

AUTHORITY OF TENANT |

30 | ||||

| 33.1 |

Tenant as Corporation | 30 | ||||

| 33.2 |

Tenant as Partnership or LLC | 30 | ||||

| 33.3 |

Authority; Binding | 31 | ||||

| 34. |

FINANCIAL STATEMENTS |

31 | ||||

| 35. |

BROKERS |

31 | ||||

| 36. |

COUNTERPARTS |

31 | ||||

| 37. |

FURTHER ASSURANCES |

31 | ||||

| Exhibits to this Lease: |

||||||

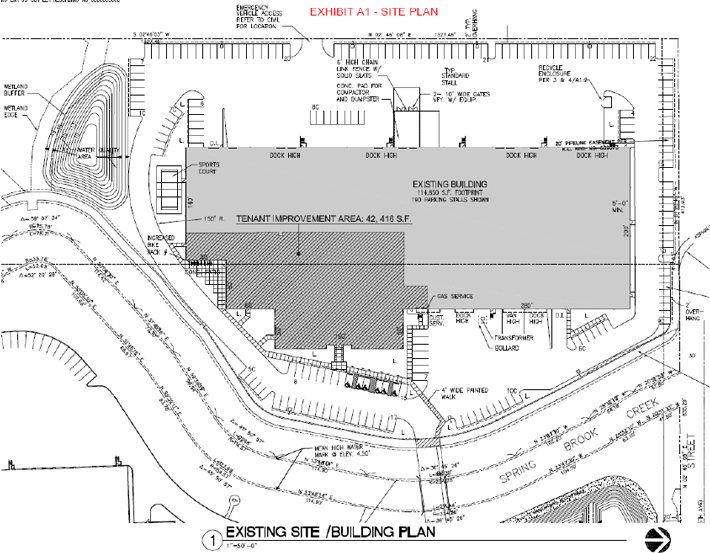

| Exhibit A-1 |

Site Plan Showing Premises | |||||

| Exhibit A-2 |

Legal Description of Property | |||||

| Exhibit B |

Work Letter | |||||

| Exhibit C |

Tenant’s Insurance | |||||

| Exhibit D |

Parent Guaranty | |||||

-iii-

LEASE

THIS LEASE, dated as of , 2010, is made by and between IIT 1905 RAYMOND AVENUE LLC, a Delaware limited liability company (“Landlord”), and AIR EXPRESS INTERNATIONAL USA, INC., an Ohio corporation dba DHL GLOBAL FORWARDING (“Tenant”).

| 1. | Basic Lease Terms. This Section sets forth certain basic terms of this Lease for reference purposes. This Section is to be read in conjunction with the other provisions of this Lease; provided, however, to the extent of any inconsistency between this Section and the other provisions of this Lease, this Section shall control. |

Leased Premises (See § 2)

| Building: | Raymond Avenue Building | |

| Address: | 1905 Raymond Avenue SW Renton, WA 98057-9005 | |

Premises: Approximately 126,660 square feet of rentable area, on 2 floors

Term (See §§ 1A.6, 1A.9, 3 and 4)

Commencement Date: The Closing Date under the Purchase and Sale Agreement (as that term is defined in Section 38, below)

Expiration Date: October 31, 2020

Base Monthly Rent (See § 5)

Commencing on the Commencement Date, Tenant shall pay Base Monthly Rent as follows:

| Months |

Monthly Rent: | ||

| The Commencement Date - July 31, 2010 | $ | 25,000 | |

| August 1, 2010 - August 31, 2010 | $ | 50,000 | |

| September 1, 2010 - September 30, 2010 | $ | 50,000 | |

| October 1, 2010 - October 31, 2010 | $ | 50,000 | |

| November 1, 2010 - November 30, 2010 | $ | 50,000 | |

| December 1, 2010 - December 31, 2010 | $ | 71,305.81 | |

| January 1, 2011 - October 31, 2011 | $ | 84,440.00 | |

| November 1, 2011- October 31, 2012 | $ | 86,128.80 | |

| November 1, 2012- October 31, 2013 | $ | 87,851.38 | |

| November 1, 2013- October 31, 2014 | $ | 89,608.40 | |

| November 1, 2014- October 31, 2015 | $ | 91,400.57 | |

| November 1, 2015 October 31, 2016 | $ | 93,228.58 | |

| November 1, 2016- October 31, 2017 | $ | 95,093.15 | |

| November 1, 2017- October 31, 2018 | $ | 96,995.02 | |

| November 1, 2018- October 31, 2019 | $ | 98,934.92 | |

| November 1, 2019 - October 31, 2020 | $ | 100,913.62 | |

-1-

Security Deposit (See § 6) $0

Operating Expenses (See § 8)

Tenant’s Share 100.00%

Initial Additional Rent $13,147.00/Mo. (estimate)

Parking (See § 24) 189 spaces

Permitted Use (See § 7) Office and warehouse for airfreight operations and sales, including truck staging, light maintenance and washing of vehicles used in airfreight operations. Uses permitted 24/7.

Addresses for Notices (See § 28; see also § 10.1 of Work Letter)

Landlord:

IIT 1905 RAYMOND AVENUE LLC

c/o IIT Acquisitions LLC

518 17th Street, Suite 1700

Denver, CO 80202

Attn: Tom McGonagle, Chief Financial Officer

With a copy to:

Brownstein Hyatt Farber Schreck, LLP

410 Seventeenth Street, Suite 2200

Denver, CO 80202

Attn: Noelle Riccardella, Esq.

Tenant:

DHL Global Forwarding

1210 South Pine Island Road

Plantation, Florida 33324

Attn: Suite 200 Real Estate

With a copy to:

DHL Global Forwarding

1210 South Pine Island Road

Plantation, Florida 33324

Attn: Suite 100 Legal

Brokers (See § 35)

None

-2-

| 1A. | Special Lease Terms. The following additional Lease terms shall apply. To the extent of any inconsistency between this Section 1A and the other provisions of this Lease, this Section 1A shall control. |

| 1A.1 | Tenant Improvements. Tenant will construct Tenant Improvements in accordance with the Work Letter attached to this Lease as Exhibit B and the Tenant Improvements Plans developed and approved as described in the Work Letter. The cost of the Tenant Improvements will be covered by Tenant, subject to Section 7.6 of the Work Letter. As provided in detail in the Work Letter, the actual Tenant Improvements Costs in excess of $1,330,000, up to $150,000, shall be Amortized TI Costs. The total amount of Amortized TI Costs will be amortized over the initial Term at the rate of 9% per annum and paid monthly by Tenant as Additional Rent. Actual Tenant Improvement Costs in excess of $1,480,000 will be Tenant’s responsibility. |

Tenant will use commercially reasonable efforts to achieve Substantial Completion of the Tenant Improvements by December 15, 2010.

| 1A.2 | Early Access. Tenant acknowledges that Hunter Douglas Real Property, Inc. (“Hunter Douglas”) has the right to occupy the Premises after the Commencement Date of this Lease pursuant to a lease agreement between Landlord and Hunter Douglas (the “Hunter Douglas Lease”). Tenant acknowledges that its right to possession of the Premises shall be subject to the rights of Hunter Douglas under the Hunter Douglas Lease, and that in no event shall the Hunter Douglas Lease be considered a breach of this Lease. Tenant further acknowledges that it shall commence paying Rent in accordance with the terms of this Lease, notwithstanding Hunter Douglas’ possession of the Premises, and that Tenant shall have no right to terminate this Lease or to receive an abatement of Rent due to Hunter Douglas’ possession of the Premises. Upon Hunter Douglas’ vacation of the Premises, or upon an express agreement between Tenant and Hunter Douglas, Tenant shall have the right to enter the Property and the Premises to begin construction of the Tenant Improvements, in accordance with the Work Letter. If Hunter Douglas has not vacated and surrendered the Premises by September 1, 2010, Landlord will promptly initiate the commercially reasonable legal proceedings to cause the eviction of Hunter Douglas from the Premises, subject to Tenant’s reimbursement of Landlord’s actual and reasonable costs incurred in connection therewith. Any such amounts owed by Tenant shall be Additional Rent. Tenant shall pay such amounts within thirty (30) days of receipt of an invoice from Landlord for the same. |

| 1A.3 | Condition of Premises. Notwithstanding Section 29, Landlord will at its sole expense cause the lighting, mechanical and other building operating systems in the Premises to be in good working order by the Commencement Date. |

| 1A.4 | Acknowledgment of Hazardous Substances. Landlord hereby acknowledges that Tenant’s use of the Premises involves trucks and other vehicles, using gasoline and other petroleum products, and approves the use of Hazardous Substances in connection with that use, as provided in, and subject to the other requirements of, Section 30. |

| 1A.5 | Tenant Exterior Sign. Landlord approves the installation by Tenant of an exterior sign on the Building, provided that the sign and installation thereof meet all applicable local sign ordnances and other legal requirements, as provided in Section 31. Tenant shall install any such sign after the Commencement Date, at Tenant’s sole expense and risk. |

| 1A.6 | Early Termination by Tenant. Provided there is no uncured Default by Tenant under this Lease at such time, Tenant shall have a one-time right to terminate this Lease effective |

-3-

| at the expiration of the first 60 Months of the Term. This right may be exercised only by written notice by Tenant to Landlord and the payment by Tenant to Landlord of a cancellation fee. The notice must be given and the fee must be paid on or before the expiration of the first 54 Months of the Term. Timely delivery of the written notice together with the fee to Landlord is a condition to Tenant’s right to terminate this Lease. The amount of the cancellation fee shall be $1,210,000. Between the exercise of the termination right and the effective date of termination, Tenant shall continue to pay Rent as before, and all the other provisions of this Lease shall continue to apply. Tenant’s exercise of the right to terminate shall not affect any obligation for Rent, or other obligation of Tenant under this Lease, that accrued before the exercise of the termination right. |

| 1A.7 | Option and Right of First Offer. [intentionally omitted] |

| 1A.8 | Abatement of Base Monthly Rent. [intentionally omitted] |

| 1A.9 | Extension Options. |

| 1A.9.1 | Grant of Extension Options. Tenant shall have 2 successive options to extend the Term of this Lease for an additional 3 years each (each, an “Extension Term”). Each such option may be exercised by Tenant only by written notice of exercise to Landlord no earlier than 210 days and no later than 180 days before the expiration of the then-effective Term. |

| 1A.9.2 | Effect of Exercise. Upon Tenant’s exercise, all the terms and conditions of this Lease shall apply through the Extension Term, except that (a) Base Monthly Rent at the commencement of the Extension Term shall be equal to 95% of the Fair Market Monthly Rent for the Premises in accordance with Section 1A.9.3, and (b) the Base Monthly Rent shall increase by 2.75% on the expiration of each 12 months of the Extension Term. In no event will the Fair Market Monthly Rent be less than the Base Rent during the last month of the then expiring term. As used in this Section 1A.9, the “Fair Market Monthly Rent” shall mean the prevailing fair market monthly rent during the Extension Term for comparable space located in Kent Valley (“Rent Comparison Area”), and shall take into account the Base Monthly Rent increase as specified above. Upon determination of the Fair Market Monthly Rent, the parties shall execute an amendment to the Lease memorializing the Base Monthly Rent for the Extension Term. |

| 1A.9.3 | Determination of Rent for Extension Term. |

| (a) | Within 20 days of Tenant’s notice of exercise, Landlord shall propose a Base Monthly Rent for the Extension Term. The parties shall negotiate in good faith, but if they do not agree upon the Base Monthly Rent by 30 days after the delivery of Landlord’s proposal, then either party may elect to cause the Base Monthly Rent to be determined by reference to the appraised Fair Market Rent. That election shall be made by notice to the other party, including in the notice the designation of an appraiser. The other party may accept the designated appraiser or designate another appraiser within 10 days of the notice. If it does not designate another appraiser in that period, it shall be deemed to have accepted the first appraiser. If a second appraiser is designated, the two appraisers shall promptly appoint a third appraiser. |

-4-

| (b) | Each appraiser shall determine the Fair Market Rent by reference to all factors deemed appropriate in his or her professional opinion, and notify the parties, within 30 days of the date of appointment of the last appraiser, of Fair Market Rent. The Base Monthly Rent for the Extension Term shall be calculated as provided in Section 1A.9.2 with the Fair Market Monthly Rent determined by the single appraiser or, if there are three appraisers, the mean average of the two closest Fair Market Monthly Rents. |

| (c) | All appraisers under this appraisal provision shall be independent certified professional MAI appraisers with at least five years’ experience appraising office/warehouse properties within the Rent Comparison Area. If there are three appraisers, each party shall pay for the cost of its designated appraiser and 50% of the cost of the third appraiser. If there is only one appraiser, each party shall pay 50% of the cost of the appraiser. |

| 1A.9.4 | No Default. Tenant may not exercise its option to renew the Term at any time in which it is in Default under this Lease and such Default remains uncured. If Tenant becomes in Default under this Lease after exercise of its option to extend the Term but before the commencement of the Extension Term and such Default remains uncured, Landlord may, in addition to its other remedies under this Lease, elect to terminate the extension by notice in writing to Tenant, whereupon the Term shall expire without any extension. |

| 1A.10 | Expansion of Office Uses. [intentionally omitted]. |

| 1A.11 | Flood Insurance Without limiting Section 14.5, Landlord shall continue to carry flood loss insurance for the Building and Property, with the following coverage, or higher coverage: flood damage policy in the amount of $2,000,000 per occurrence and $2,000,000 in the aggregate. |

| 1A.12 | Parking. In addition to the right to exclusive parking spaces described in Section 24, Tenant may park trucks and other vehicles used in its airfreight operations at the loading dock areas of the Premises 24/7. |

| 1A.13 | Flood Risk. Landlord shall use diligent efforts from and after the date of this Lease to stay informed concerning flood risks related to the Property. Landlord shall have no obligation to implement any mitigation measures that Landlord determines in good faith are financially or physically unfeasible or impracticable. To the extent any loss by flooding during construction of the Tenant Improvements is beyond the reasonable control of Landlord, it shall be a Force Majeure event within the meaning of Section 32.17 of this Lease. |

| 1A.14 | Financial Statements. The requirement to deliver financial statements under Section 34 shall not apply to the original Tenant or to any permitted assignee who is an affiliate of the original Tenant. |

| 1A.15 | Guaranty. Within 20 days after the execution of this Lease, Tenant’s parent, Deutsche Post, shall execute and deliver to Landlord an absolute and unconditional guaranty of payment (in amount not to exceed $11,095,133.00), of any and all amounts due under this Lease, including to pay or reimburse Landlord for leasing commissions, previously abated Base Rent, and Tenant Improvement Costs, as defined in the Work Letter (“Guaranteed Costs”), whether (i) for excess Tenant Improvement Costs under Section |

-5-

| 7.1 of the Work Letter or for Tenant Changes under Section 7.3 of the Work Letter, (ii) through the amortization of such Tenant Improvement Costs into Additional Rent as described in Section 1A.1, (iii) in connection with an early termination by Tenant, as described in Section 1A.6, (iv) in the event Tenant becomes liable for any Guaranteed Costs upon the exercise by Landlord of remedies for any Default by Tenant, or for any other requirement to pay or reimburse Landlord for Guaranteed Costs under this Lease or the Work Letter (“Parent Guaranty”). The guaranty shall be in the form Attached as Exhibit D hereto. No assignment of this Lease, or sublease of all or any portion of the Premises, to an affiliate of Tenant that is permitted under Section 17 shall affect the continuing effectiveness of the Parent Guaranty. If the Parent Guaranty is not delivered as required by the expiration of 40 days after the mutual execution of this Lease, Landlord shall have the option to terminate this Lease at any time thereafter until the Parent Guaranty is provided. |

| 2. | Premises. Landlord agrees to lease to Tenant and Tenant agrees to lease from Landlord the Premises shown on the site plan attached as Exhibit A-1 and consisting of approximately the square feet designated in Section 1, which is 100% of the rentable area of the Building The Building is located on the real property described on Exhibit A-2 (“Property”). Tenant shall also have the exclusive right to use the parking areas described in Section 24 and as provided in Section 24. Tenant shall also have the exclusive right to use the loading dock areas of the Building. Notwithstanding the foregoing, Landlord’s obligation to lease the Premises to Tenant and Tenant’s obligation to lease the Premises from Landlord shall be contingent upon Landlord acquiring title to the property on or prior to the Commencement Date. |

| 3. | Term. |

| 3.1 | Commence. The term of this Lease (“Term”) shall commence on the Commencement Date set forth in Section 1. |

| 3.2 | Expire. The Term shall expire on the Expiration Date set forth in Section 1, subject to Section 4, unless sooner terminated or extended as provided in this Lease. |

| 4. | Tenant Improvements; Early Possession; Delayed Delivery of Possession. |

| 4.1 | Tenant Improvements. Any initial improvements to or construction on the Premises to prepare the Premises for Tenant shall be carried out in accordance with the Work Letter attached as Exhibit B and the Tenant Improvements Plans developed and approved as described in the Work Letter. As used herein, “Tenant Improvements” shall be as defined in the Work Letter. |

| 4.2 | Early Occupancy. [omitted—see Section 1A.2] |

| 4.3 | Landlord Delay. [intentionally omitted] |

| 4.4 | Tenant Delay. [intentionally omitted] |

| 5. | Rent. |

| 5.1 | Rent. Beginning on the Commencement Date and throughout the Term, Tenant shall pay to Landlord the Base Monthly Rent specified in Section 1 and the Additional Rent as set forth in Section 8 and elsewhere in this Lease (the Base Monthly Rent and the Additional Rent are collectively referred to as “Rent”). Rent shall be paid in advance, first on or before the Commencement Date and thereafter on the first day of each calendar |

-6-

| month of the Term. Rent for any period during the Term that is for less than one month shall be prorated for the actual number of days in such period. For purposes of determining when any adjustments in Base Monthly Rent set forth in Section 1 occur, the first full calendar month of the Term shall be Month 1. |

| 5.2 | Manner of Payment. Rent shall be paid without prior notice, demand, set off, counterclaim, deduction or defense and, except as otherwise expressly provided in this Lease, without abatement or suspension. All Rent shall be paid to Landlord at the address for notices set forth in Section 1, in lawful money of the United States of America, or to such other person or at such other place as Landlord may from time to time designate in writing. |

| 6. | Prepaid Rent and Security Deposit. |

[omitted]

| 7. | Use of Premises. |

| 7.1 | Use. Tenant shall use the Premises only for the purpose set forth in Section 1. The Premises may not be used for any other purpose without Landlord’s written consent. Tenant is responsible for determining that the purpose set forth in Section 1 is permitted as of the date hereof under the applicable laws, regulations and codes governing zoning, land use and similar matters affecting the Building and the Property. Landlord represents and warrants that to Landlord’s actual knowledge without inquiry or investigation, Tenant’s use of the Premises as set forth in this Section 7.1 is permitted under all applicable laws (including without limitation any zoning or general or specific plan restrictions). |

| 7.2 | Prohibited Uses. Tenant shall not do or permit anything to be done in or about the Premises, Building or Property or bring or keep anything therein which will in any way increase the cost of or affect any fire or other insurance upon the Building or Property or any part thereof or any of its contents, or cause cancellation of any insurance policy covering the Building or Property or any part thereof or any of its contents. |

| 7.3 | No Nuisance. Tenant shall not commit or suffer to be committed any waste, damage or nuisance in or upon the Premises, Building or Property. Tenant shall not do or permit anything to be done in or about the Premises, Building or Property that will obstruct or interfere with the rights of adjacent owners and occupants or injure them or their property, or use or allow the Premises, or exclusive parking areas to be used for any unlawful purpose. Tenant shall not, without the prior written consent of Landlord, which consent Landlord may withhold in its sole, reasonable discretion, use any apparatus, machinery or device in or about the Premises, Building or Property which will cause any substantial noise or vibration. Tenant shall not place any boxes, cartons or other rubbish in the Building, or Property. Tenant shall use due care in the use of the Premises and of the Building, and Property, and shall not neglect or misuse water fixtures, electric lights and heating and air-conditioning apparatus. |

| 7.4 | Outside Storage. Provided such use does not violate any applicable laws or the requirements of any insurer, Tenant shall be permitted to store materials, equipment and vehicles outside the Premises and Building at the space shown on Exhibit A-1 at all times. Such storage shall be at Tenant’s sole risk and expense. Tenant shall keep all such storage areas in a neat, clean and safe condition at all times. |

-7-

| 8. | Additional Rent for Operating Expenses. |

| 8.1 | Tenant Payment. Commencing on the Commencement Date, Tenant shall pay, as Additional Rent, Tenant’s Share, as set forth in Section 1 and Section 8.2, of all Operating Expenses. Tenant’s payment of Additional Rent shall be made in the same manner as Base Monthly Rent. Notwithstanding the foregoing, for the period beginning on the Commencement Date and ending on December 15, 2010, Tenant shall receive a credit against Tenant’s Share of Operating Expenses equal to the amount of rent received by Landlord from Hunter Douglas pursuant to the lease governing Hunter Douglas’ rights to occupy the Premises following the Commencement Date. |

| 8.2 | Tenant’s Share. Tenant’s Share shall be 100%. |

| 8.3 | Definitions. |

| 8.3.1 | Definition of Operating Expenses. “Operating Expenses” means all expenses and charges incurred by Landlord in the operation and maintenance of the Building and Property including without limitation the following costs by way of illustration: (i) all real property taxes, assessments and other general or special charges assessed or imposed during the Term by any public, governmental or quasi-governmental authority against the real or personal property included in the Building or the Property, including without limitation Landlord’s personal property used in the maintenance, repair or operation of the Building or the Property, or any other tax on the leasing of the Building or on the rents from the Building; provided (a) such taxes and/or assessments shall be prorated on a per diem basis for any portion of the Term that occurs during a partial tax year, and (b) Tenant shall not be responsible for any (A) estate, inheritance, income or transfer taxes on Landlord, (B) the cost of any challenge to taxes unless such challenge results in a verifiable tax savings to Tenant, or (C) any tax penalties assessed due to any action or inaction by Landlord or its employees, agents or contractors (collectively “Tax Costs”); (ii) any and all assessments Landlord must pay for the Building or Property pursuant to the CC&Rs, any transportation or any other improvement monitoring or management plan, or any other covenant, condition or reciprocal easement agreements; (iii) electricity, gas and similar energy sources, refuse collection, water, sewer and other utilities services for the Building and the Property to the extent not paid by directly Tenant (collectively, “Common Utilities Costs”) (iv) annual inspection fees, property management fees paid to independent or affiliated contractors or to Landlord; provided such fees are not more than 2% of the Base Rent payable hereunder, and out of pocket legal, accounting and other professional expenses; (v) janitorial, cleaning, window washing, painting and refuse removal; (vi) all costs of improvements or alterations to the Building and Property required by Laws coming into effect after the Commencement Date (collectively, “Required Improvement Costs”) (vii) all premiums and deductibles for liability, property damage, casualty (including earthquake, flood, terrorism and other special coverages), automobile, garage keeper’s, rental loss compensation or other insurance that may be maintained by Landlord for the Building or Property in accordance with the requirements, and subject to the limitations set forth in Section 14 of this Lease (“Insurance Costs”); (viii) the cost of replacement of any Building equipment or elements needed to operate the Building at the same quality levels as prior to the replacement; (ix) air conditioning, heating, ventilating, plumbing, electrical system, elevator maintenance supplies, materials, equipment and tools; (x) the repair of the air conditioning, heating, ventilating, plumbing, electrical systems |

-8-

| and elevators of the Building; (xi) maintenance costs, including payroll expenses, rental of personal property used in maintenance and all other upkeep of parking, including cleaning, snow and ice removal, landscaping and lighting; (xii) costs and expenses of repairs, resurfacing, reroofing, repainting, and similar items, (xiii) costs and expenses associated with security and monitoring; (xiv) costs incurred in the management of the Building and Property (including supplies, wages and salaries of employees used in the management, operation and maintenance thereof below the grade of Property Manager, and payroll taxes and similar governmental charges with respect thereto); (xv) all license and permit fees; and (xvi) any other expense or charge whether or not described above that in accordance with commercially reasonable accounting and management practices is properly an expense of maintaining, operating or repairing the Building or the Property, subject to the exclusions and limitations set forth in this Lease. Operating Expenses shall not include depreciation on the Building or equipment therein, real estate brokers’ commissions, and costs or expenses for which Landlord is reimbursed or indemnified by an insurer, condemnor, tenant or otherwise. Landlord shall not collect more than 100% of Operating Expenses and shall not recover any item of cost more than once. |

Notwithstanding the foregoing in Section 8.3.1, or anything else in this Lease to the contrary, “Operating Expenses” shall expressly exclude the following: (1) any costs associated with Landlord’s maintenance and repair responsibilities that Landlord and Tenant have expressly agreed are Landlord’s sole responsibility to pay for under the Lease; (2) the cost of tenant improvements made for new tenant(s) of the Building; (3) financing or refinancing costs, including interest, principal, points and fees on debts or amortization on any mortgage or mortgages or any other debt instrument encumbering the Building; (4) salaries and fringe benefits for officers, employees (above the position of Building manager) and executives; (5) any management or administrative fee in excess of the amount set forth above; (6) any ground lease rental or charges; (7) any (i) estate, inheritance, income or transfer taxes on Landlord, (ii) the cost of any challenge to taxes unless such challenge results in a verifiable tax savings to Tenant, or (iii) any tax penalties assessed due to any action or inaction by Landlord or its employees, agents or contractors; (8) rentals for items (except when needed in connection with normal repairs and maintenance of permanent systems) which if purchased, rather than rented, would constitute a capital repair, replacement, improvement or equipment under commercially reasonable accounting principles consistently applied or otherwise; (9) costs incurred by Landlord that Landlord is or has the right to be reimbursed for by insurance proceeds or third parties, unless Landlord reasonably concludes in any such case that collection efforts would not be cost-effective; (10) marketing costs, including without limitation, leasing commissions, attorneys’ fees and other costs and expenses incurred in connection with lease, sublease and/or assignment negotiations and transactions with Tenant or present or prospective tenants or other occupants of the Building; (11) costs incurred by Landlord due to the violation by Landlord of the terms and conditions of any lease of space in the Building; (12) costs incurred by Landlord due to a violation of laws or recorded covenants by Landlord or its employees, agents or contractors, or by any other tenant of the Building; (13) overhead and profit increment paid to Landlord or to subsidiaries or affiliates of Landlord for goods and/or services in or to the Building or Project to the extent the same exceeds the costs of such goods and/or services rendered by unaffiliated third parties on a competitive basis; (14) any costs incurred in connection with upgrading the Building or Property to

-9-

comply with recorded covenants, the recommendations of any insurance company, or life, fire and safety codes, ordinances, statutes or other laws, including, without limitation, the ADA, all as in existence as of the Commencement Date, including penalties or damages incurred due to such non-compliance, except to the extent Tenant has expressly agreed to incur all or a portion of such costs pursuant to the terms of this Lease; (15) costs arising from the sole or gross negligence or willful misconduct of Landlord or its employees, or agents; (16) any and all costs arising from the presence of hazardous materials or substances (as defined by applicable laws in effect on the date this Lease is executed) in or about the Premises, Building, or Property, not placed in such by Tenant or its employees, agents or contractors, including without limitation costs incurred in connection with any environmental investigation, clean-up, response action, or remediation, and costs and expenses associated with the defense, administration, settlement, monitoring or management thereof; (17) costs associated with the operation of the business of the partnership or entity which constitutes Landlord, including general corporate overhead, accounting and legal matters, the costs of selling, syndicating, financing, mortgaging or hypothecating any of Landlord’s interest in the Building or Project, any “in-house” legal and/or accounting fees, costs of any disputes between Landlord and its employees or agents; (18) reserves of any kind; and (19) any other expenses which, in accordance with commercially reasonable accounting principles, consistently applied, would not normally and customarily charged as common area maintenance expenses or “triple-net” expenses by landlords of comparable buildings in the Renton, Washington warehouse and industrial market area.

| 8.3.2 | Definition and Treatment of Capital Improvements. The cost of any Capital Improvement included in Operating Expenses pursuant to this Lease shall be amortized over the useful life of the Capital Improvement with interest accruing on the unamortized balance at the prime rate then in effect at the Seattle Head Office of Bank of America or its successors, or such higher rate as may have been paid by Landlord on funds borrowed for the purpose of paying for such Capital Improvement. As used herein, the term “Capital Improvement” shall mean the addition or replacement of any component or element of the Building, including replacement of the roof membrane, generators, parking and driving areas relating to the Building, electrical, lighting, plumbing, life-safety/sprinkler, or HVAC systems in the Premises, all to the extent treated as a capitalized cost rather than an operating expense under accounting practices (including without limitation commercially reasonable accounting principles, consistently applied) that are customary in the Renton, Washington warehouse and industrial market area. Notwithstanding the foregoing or anything else contained in this Lease, if Landlord elects to replace the roof membrane prior to the fifth anniversary of the Commencement Date, any amortized cost of such replacement attributable to the portion of the Term prior to the fifth anniversary of the Commencement Date shall be the sole responsibility of Landlord. |

| 8.3.3 | Landlord’s Responsibility for Structural Repairs. Subject to Section 10.5, Landlord shall be responsible at its sole cost and expense for any (a) repairs and maintenance of the roof membrane and roof drainage systems and (b) repairs or replacement of the structural portions of the Building, including the roof structure, the roofing system (excluding replacement of the roof membrane), underground plumbing and other underground utility systems, foundation, bearing and exterior walls, and subflooring, and the cost of such repairs or replacements shall not be included in Operating Expenses. |

-10-

| 8.3.4 | Tenant Responsibility for Defects in Tenant Improvement Work. Notwithstanding Sections 8.3.2 and 8.3.1 or anything else contained in this Lease, Landlord shall not be responsible for any failure for the construction of the Tenant Improvements to comply with the terms of the Work Letter attached hereto as Exhibit B or for any defects in construction materials or workmanship in connection with the Tenant Improvements. |

| 8.3.5 | Cap on Increases. In each calendar year after the first full calendar year of the initial Term of the Lease, Controllable Operating Expenses (defined below) shall not increase by more than 3% over those same Operating Expenses in the immediately preceding calendar year. As used herein, “Controllable Operating Expenses” shall mean all Operating Expenses except for (i) Common Utilities Costs, (ii) Tax Costs, (iii) Required Improvement Costs, (iv) Landlord’s Insurance Costs and (v) any other costs beyond the reasonable control of Landlord (e.g. excessive snow removal); to the extent (i) - (iv) are included in the definition of Operating Expenses. |

| 8.4 | Determination of Operating Expenses. Prior to each January 1 of the Term, Landlord shall furnish Tenant a written statement of the estimated monthly Tenant’s Share of Operating Expenses for the coming calendar year. The estimated monthly Tenant’s Share of Operating Expenses for the period before the first January 1 after the Commencement Date is set forth in Section 1. Landlord may, by written notice to Tenant, revise its estimate of Tenant’s Share of Operating Expenses from time to time. |

| 8.5 | Reconciliation. Within 90 days after each January 1 during the Term, or as soon thereafter as practicable, Landlord shall deliver to Tenant a written statement setting forth the actual Operating Expenses and Tenant’s Share thereof during the preceding calendar year (or portion of such calendar year after the Commencement Date). To the extent Tenant’s Share of such actual Operating Expenses exceeded the estimated Tenant’s Share thereof paid by Tenant, Tenant shall pay such excess as Additional Rent to Landlord within 30 days after receipt of such statement by Tenant. To the extent Tenant’s Share of such actual Operating Expenses was less than the estimated Tenant’s Share thereof paid by Tenant, Tenant shall receive a refund. |

| 8.6 | Upon Lease Termination. If this Lease shall expire or otherwise terminate other than on a December 31, Landlord may in its discretion make a special determination of Tenant’s Share of actual Operating Expenses for the partial calendar year ending on the date of such expiration or other termination, or may defer such determination until its usual reconciliation of Operating Expenses for the Building for the entire calendar year. The excess actual Tenant’s Share for such partial calendar year shall be paid by Tenant to Landlord, or the excess estimated Tenant’s Share already paid by Tenant shall be paid by Landlord to Tenant, as the case may be, within 15 days of such determination, which shall be reasonable. |

| 8.7 | Tenant Review of Operating Expenses. Tenant shall have the right to review and audit Landlord’s calculation of Operating Expenses, as provided in this Section 8.7. Tenant may exercise this right as to the Operating Expenses covered by reconciliation under Section 8.5 by giving notice to Landlord within 120 days after receipt of the reconciliation. The review shall be conducted at Tenant’s expense. Landlord shall cooperate with Tenant and its representatives in the review, which shall include making |

-11-

| available, at Landlord’s office where its bills and records are kept, such information used in the Operating Expense calculation as Tenant reasonably requests. Tenant may make copies of any such information, at Tenant’s sole expense. Tenant’s representatives may include an independent accountant or other operating expense professional, provided that such accountant’s or other professional’s compensation is not contingent on the results of the review. Landlord shall be entitled to a complete copy of any report prepared by or for Tenant in the review, within 10 business days after Tenant receives the report. To the extent that the review demonstrates that Tenant has overpaid Operating Expenses in the covered period, Tenant will be entitled to a credit against future Operating Expenses, except if the Lease has terminated or expired, then Landlord shall pay such amount to Tenant within 30 days, or to a cash payment within 30 days, if future Operating Expenses will be insufficient to cover the overpayment. To the extent the review demonstrates that Tenant has underpaid Operating Expenses, Tenant shall pay Landlord the amount of the underpayment within 30 days. If such audit discloses a overcharge in excess of 5% of the annual total, Landlord shall reimburse Tenant for the reasonable costs of the audit. Any disagreement among the parties about the results of the review that they are unable to resolve themselves shall be submitted to an independent certified public accountant selected by mutual agreement of the parties, whose decision shall be binding. The fees of the accountant shall be borne 50% by each party, or in such other percentages as the accountant determines is fair under the circumstances. The obligations of the parties under Section 8.7 shall survive the termination of this Lease. |

| 9. | Intentionally Deleted. |

| 10. | Maintenance and Repair Responsibility. |

| 10.1 | Landlord’s Maintenance Obligations. Subject to Sections 8.3, 10.3, 10.5 and 15, Landlord shall maintain and keep in good condition, repair and replace throughout the Term the following elements of the Premises and the Building, in a manner and at a level of quality that is consistent with comparable buildings in the area, and except for the elements for which maintenance or repair is expressly allocated to Tenant (“Maintenance Obligations”): (a) the exterior walls and foundation and other structural elements of the Building, (b) exterior doors and windows; (c) the slab and floor, (d) the roof structure and roof membrane and other elements of the roof system, including gutters, downspouts and other drainage elements; (e) all utility lines and equipment serving the Property, up to the point of connection with the Premises; (f) life safety, lighting, electrical, plumbing, security and HVAC and generator systems in the Property and Premises, except to the extent regular maintenance of the same inside the Premises is the responsibility of Tenant; (g) all parking areas and drives and landscaping. Except as otherwise expressly provided in this Lease, all costs and expenses incurred by Landlord in performing the Maintenance Obligations shall be considered Operating Expenses. |

Landlord shall proceed diligently to perform its Maintenance Obligations. Tenant shall provide written notice to Landlord specifying any Maintenance Obligation which Landlord has failed to perform. Landlord shall thereafter have thirty (30) days to perform such Maintenance Obligation, or 48 hours in the event of an emergency, (provided if such work reasonably takes longer than thirty (30) days or 48 hours to complete, as the case may be, Landlord shall not be in default hereunder if Landlord has commenced performance within the thirty (30) day period or such 48-hour period and at all times thereafter proceeds diligently to complete its obligations). If Landlord fails to perform the Maintenance Obligations within the time period set forth in this Section 10.1, then Tenant shall have the right (but shall not have the obligation), to undertake to perform

-12-

the Maintenance Obligation, at Landlord’s cost. For the purposes of this Section 10.1, an “emergency,” is defined as an event which threatens the safety and/or well-being of the occupants of the Premises or is likely to materially damage Tenant’s property located within the Premises. Tenant shall keep detailed records of the costs it incurs in performing any such Maintenance Obligation, and Landlord shall reimburse Tenant for the same within 30 days of Tenant’s request for reimbursement, which request shows the costs incurred and evidence of payment thereof in reasonable detail. To the extent Landlord fails to reimburse Tenant when and as required by this Section 10.1, Tenant shall have the right to offset the amount of the reimbursement to which it is entitled against Base Monthly Rent, provided (a) the amount offset against Base Monthly Rent in any month shall not exceed 20% of the Base Monthly Rent payable for such month, and (b) any offset amounts in excess of the 20% cap described in clause (a) above shall bear interest from the date such amounts would have been reimbursable to Tenant until fully paid at the per annum rate of eight and one half percent (8.5%), which amounts, including such interest, Tenant shall have the right to offset against subsequent Base Monthly Rent payments until all such amounts, including all interest accrued thereon, have been fully reimbursed to Tenant.

| 10.2 | Janitorial Service. Janitorial service is not part of the Maintenance Obligations under this Lease. |

| 10.3 | Tenant’s Maintenance Obligations. In addition to its maintenance and repair obligations elsewhere in this Lease, Tenant shall keep the Premises neat and clean and in good condition and repair, ordinary wear and tear excepted. This includes specifically without limitation (a) maintenance, repair and replacement of the loading dock doors and equipment, (b) regular maintenance of and minor repair of utility lines within the Premises, and all related plumbing, lighting HVAC and other fixtures and other equipment within the Premises, (c) maintenance, repair and replacement of all interior windows and doors, and cleaning of parking stalls and truck parking areas. |

| 10.4 | No Obligation For Alteration. Except as specifically provided elsewhere in this Lease, Landlord shall have no obligation to alter, remodel, improve, repair, decorate, or paint the Premises or any part thereof. Tenant affirms that Landlord has made no representations to Tenant about the condition of the Premises or the Building, except as specifically herein set forth. |

| 10.5 | Landlord or Tenant Caused. To the extent that the need for maintenance and repairs to the Premises or Building or the Property is caused by the act, neglect, fault, or omission of any duty by either party, its agents, servants, employees, or invitees, and is not ordinary wear and tear, such party shall pay for the costs of such maintenance and repairs. |

| 11. | Utilities. |

| 11.1 | Furnishing of Utilities. Provided that Tenant is not in Default under this Lease, Landlord shall arrange to be furnished to the Premises lines for water, electricity, telephone, gas, and sanitary sewer. Tenant shall pay before delinquency all charges for water, gas, heat, electricity, power, telephone service, sewer service charges, and other utilities or services charged or attributable to the Premises. If any of the foregoing are billed to Landlord and are not separately billed to the Premises, the amount thereof shall be included in Operating Expenses. |

| 11.2 | Additional Services. [omitted]. |

-13-

| 11.3 | After Hours. [omitted] |

| 11.4 | Landlord’s Restoration Obligation. In the event of any failure or interruption of utilities due to damage to the utility lines and equipment serving the Property, up to the point of connection with the Premises, that is caused by the negligent acts or omissions of Landlord or its employees or agents (“Utility Interruption”), upon receiving notice of the Utility Interruption from Tenant, Landlord shall use commercially reasonable efforts to cause, at Landlord’s sole cost and expense, such utility service to be restored promptly (“Restoration Obligation”). In the event any such failure or interruption of utilities is caused by the negligent acts or omissions of Tenant or its employees or agents, Tenant shall be responsible, at its sole cost and expense, for restoring such utility service. |

| 11.5 | Telecommunications Providers. Tenant acknowledges that any provision of telecommunications, data transmission and office automation services, equipment and systems by a third party provider, its agents, affiliates and successors, that has a right, whether exclusive or not, to provide such services to the Premises or Building or Property (each, a “Telecommunications Provider”) is separate and distinct from this Lease and that Landlord has no duty of performance concerning the provision of services by a Telecommunications Provider. Tenant hereby agrees to look solely to the Telecommunications Provider for any failure in the provision of services provided by such Telecommunications Provider. Landlord will cooperate in good faith with any such effort by Tenant. |

| 12. | Limits on Landlord’s Liability. Landlord’s liability with respect to its Maintenance Obligations and Restoration Obligations and with respect to Utility Interruptions is subject to the following limitations: |

| 12.1 | Circumstances Beyond Control. Landlord shall not be liable for any failure of its Maintenance Obligations or Restoration Obligations or for any Utility Interruption when caused by (i) strikes, lockouts or other labor disturbance or labor dispute of any character, (ii) governmental regulation, moratorium or other governmental action, (iii) inability despite the exercise of reasonable diligence to obtain electricity, water or fuel from the providers thereof, (iv) acts of God or (v) any other cause beyond Landlord’s reasonable control. Notwithstanding the foregoing or Section 11.4, Landlord shall use commercially reasonable efforts to fully restore or cause the utility provider to fully restore any Utility Interruption to the Premises; provided, however, that any costs incurred by Landlord in connection therewith shall be Operating Expenses payable by Tenant in accordance with Section 8.1 and provided further than Landlord’s failure to perform this obligation shall not be considered a Landlord default under the Lease, and instead Tenant’s sole and exclusive remedy in such event shall be to exercise the rights afforded to Tenant in Section 12.2, below. |

| 12.2 | Unreasonable Period of Failure. If Landlord fails to perform any Restoration Obligation, and such failure lasts for greater than forty-eight (48) hours after Landlord receives written notice from Tenant identifying the specific Restoration Obligation that Landlord needs to perform, and Landlord is not responding as required under Sections 11.4 and 12.1, then Tenant shall have the right, 5 days after notice to Landlord (but only 48 hours in the event of an emergency that threatens the safety of occupants of the Premises or prevents or substantially impairs Tenant’s ability to operate in the Premises) to undertake to perform the Restoration Obligation, at Landlord’s cost. Tenant shall keep detailed records of the costs it incurs in so doing, and Landlord shall reimburse Tenant for the same within 30 days of Tenant’s request for reimbursement, which request shows the costs incurred and evidence of payment thereof in reasonable detail. To the extent |

-14-

| Landlord fails to reimburse Tenant when and as required by this Section 12.2, Tenant shall have the right to offset the amount of the reimbursement to which it is entitled against Base Monthly Rent, provided (a) the amount offset against Base Monthly Rent in any month shall not exceed 20% of the Base Monthly Rent payable for such month, and (b) any offset amounts in excess of the 20% cap described in clause (a) above shall bear interest from the date such amounts would have been reimbursable to Tenant until fully paid at the per annum rate of eight and one half percent (8.5%), which amounts, including such interest, Tenant shall have the right to offset against subsequent Base Monthly Rent payments until all such amounts, including all interest accrued thereon, have been fully reimbursed to Tenant. |

| 12.3 | No Consequential Damages. Landlord shall not be liable for any injury to or interference with Tenant’s business arising from the making of any repairs, alterations, or improvements in or to any portion of the Building, the Premises, or the Property, or to fixtures, appurtenances, and equipment therein, or from a Utility Interruption. Without limiting the generality of this Section 12.3, in no event shall Landlord have any liability for consequential damages resulting from any Utility Interruption or any act or omission of Landlord related to its Maintenance Obligations or Restoration Obligations, even if Landlord has been advised of the possibility of such consequential damages. |

| 13. | Alterations and Additions by Tenant; Liens and Insolvency. |

| 13.1 | Alterations and Additions by Tenant. Tenant shall not make any improvements or alterations to the Premises (“Alterations”) without first obtaining the prior written consent of Landlord which consent shall not be unreasonably withheld, conditioned or delayed. Notwithstanding the foregoing, Alterations to the interior of the Premises costing less than $25,000 per instance which do not affect the Building systems or structure and do not penetrate the roof structure or membrane shall not require Landlord’s consent; provided Tenant gives Landlord written notice of such Alterations before commencing any work. Any Alterations by Tenant shall be done, at Tenant’s expense, in conformity with plans and specifications approved by Landlord, by contractors approved by Landlord, (provided, that Landlord may require that such Alterations be performed by Landlord’s employees or contractor(s) employed by Landlord) and subject to Landlord’s reasonable rules and regulations regarding such construction. All Alterations performed shall be done lien-free in a workmanlike manner and shall become the property of Landlord. Landlord shall have the right to post and record a notice of non-responsibility of work being performed by Tenant within the Premises as permitted by law. Tenant shall give Landlord prompt written notice of the commencement of any Alterations. Notwithstanding anything contained in the Lease to the contrary, any work performed by Tenant shall be at the election of Tenant and shall not be a requirement of Landlord hereunder. Any liens for unpaid work or materials supplied to the premises shall be a lien on Tenant’s leasehold estate and shall not be a lien against Landlord’s fee interest in the Property. |

| 13.2 | Liens and Insolvency. Tenant shall keep the Premises, Building and Property free from any liens arising out of any work performed, materials ordered or obligations incurred by Tenant. Landlord shall have the right at all reasonable times to post on the Premises any notices which it deems necessary for its protection from such liens. If such liens are filed unless such liens are removed or bonded around to Landlord’s satisfaction within 14 days of Landlord’s notice to Tenant, Landlord may, without waiving its rights and remedies based on such breach by Tenant and without releasing Tenant from any of its obligations hereunder, cause such liens to be released by any means it shall deem proper, including payment in satisfaction of the claim giving rise to such lien. Tenant shall pay to Landlord on demand, any reasonable sum paid by Landlord to remove such liens, together with interest at the rate specified in Section 32.7. |

-15-

| 14. | Insurance; Indemnity. |

| 14.1 | Landlord’s Responsibility. The exculpation, release and indemnity provisions of Sections 14.2 and 14.3 shall not apply to the extent the subject claims thereunder were caused by Landlord’s or its employees’, agents’, or contractors’ gross negligence or willful misconduct. In no event shall Landlord be liable to Tenant for consequential damages. |

| 14.2 | Waiver. The waiver by either party of any agreement, condition, or provision contained in this Lease will not be deemed to be a waiver of any subsequent breach of the same or any other agreement, condition or provision contained in this Lease, nor will any custom or practice which may grow up between the parties in the administration of the terms of this Lease be construed to waive or to lessen the right of both parties to insist upon the performance by the other party of all such agreements, conditions or obligations in strict accordance with the terms of this Lease. |

| 14.3 | Indemnity. Except to the extent due to the gross negligence or willful misconduct of Landlord or its employees, agents or contractors, or Landlord’s failure to perform its obligations hereunder, Tenant shall indemnify and defend (using legal counsel acceptable to Landlord) Landlord and hold Landlord harmless, from and against any and all loss, cost, damage, claim, judgment, liability and expense (including reasonable attorneys’ fees) whatsoever that may arise out of or in connection with the occupation, use or improvement of the Premises, the Building or the Property by Tenant or Tenant’s employees, agents or contractors, or Tenant’s breach of its obligations under this Lease. Except to the extent due to the gross negligence or willful misconduct of Tenant or its employees, agents or contractors, or Tenant’s failure to perform its obligations hereunder, Landlord agrees to protect, defend, indemnify, and hold Tenant harmless from and against any and all liabilities, claims, expenses, losses and damages (including reasonable attorney fees and costs), that may at any time be asserted against Tenant by any person as a result of the negligent acts or omissions of Landlord or its employees, agents or contractors in on or about the Premises, or Landlord’s failure to perform its Lease obligations. The provisions of this Section 14.3 shall survive the expiration or termination of the Term. Solely for the purpose of giving effect to the foregoing indemnification obligation, Tenant hereby waives its immunity as an employer under the Washington Industrial Insurance Act, Title RCW 51. Tenant acknowledges that this waiver was specifically negotiated. This waiver is not for the benefit of any of Tenant’s employees or third parties unrelated to Landlord. |

| 14.4 | Tenant’s Insurance. Tenant shall procure and maintain throughout the Term at Tenant’s expense insurance meeting the requirements of Exhibit C, and shall otherwise comply with its obligations under Exhibit C. |

| 14.5 | Landlord’s Insurance. During the Term, Landlord shall maintain Property Insurance written on a Special Form (formerly known as “all risk”) basis covering the Building, including the initial Tenant Improvements (excluding, however, Tenant’s furniture, equipment and other personal property and Alterations), against damage by fire and standard extended coverage perils and with vandalism and malicious mischief endorsements, and, at Landlord’s option, rental loss coverage and earthquake damage coverage, and such additional coverage as may be required by Landlord’s mortgagee or |

-16-

| that may be carried by a prudent owner of a similar building in King county. Landlord shall also carry commercial general liability and commercial automobile liability insurance in such reasonable amounts and with such reasonable deductibles as would be carried by a prudent owner of a similar building in King County. At Landlord’s option, all such insurance may be carried under any blanket or umbrella policies which Landlord has in force for other buildings and projects. Landlord may, but shall not be obligated to, carry any other form or forms of insurance as Landlord or Landlord’s mortgagee or may reasonably determine is advisable. The premiums for the insurance obtained by Landlord pursuant to this Section 14.5 (including reasonable deductibles for any claims not arising due to the acts or omissions of Landlord or its employees, agents, or contractors) shall be included in Operating Expenses. |

| 14.6 | Proceeds. The proceeds of any insurance policies maintained by or for the benefit of Landlord shall belong to and be paid over to Landlord. Any interest or right of Tenant in any such proceeds shall be subject to Landlord’s interest and right in such proceeds. |

| 14.7 | Waiver of Subrogation. Anything in this Lease to the contrary notwithstanding, Tenant waives its right of recovery, claims, actions, or causes of action against Landlord for loss or damage to the Premises, Building, or Property or any personal property of Tenant, for maintenance and repair obligations of Tenant pursuant to Section 10.5, and for loss of income to the extent the same is actually covered by the insurance policies maintained by Tenant or would have been covered if Tenant had maintained the insurance policies required of Tenant under this Lease. Anything in this Lease to the contrary notwithstanding, Landlord waives its right of recovery, claims, actions, or causes of action against Tenant for loss or damage to the Premises, Building, or Property or any personal property of Landlord, for maintenance and repair obligations of Landlord pursuant to Section 10.5, and for loss of income to the extent the same are actually covered by insurance policies maintained by Landlord. The effect of these waivers is not limited by the amount of insurance carried or required, or by any deductibles applicable to that insurance. Each party shall arrange for its property damage insurance carrier to waive any right of subrogation that the carrier may have against the other party, so long as the insurance is not invalidated thereby. |

| 14.8 | Notification of Accidents. Tenant shall promptly notify Landlord of any casualty or accident occurring in or about the Premises. |

| 15. | Destruction. |

| 15.1 | Election to Restore. If the Premises or the Building is destroyed by fire, flood, earthquake, windstorm, the elements, casualty, accident, war, riot, public disorder, acts authorized or unauthorized by the government or any other cause or happening or other casualty to the extent that they are untenantable in whole or in part, then Landlord shall have the right but not the obligation to proceed with reasonable diligence to rebuild and restore the Premises or the Building or such part thereof. Landlord shall within 60 days after receipt of written notice of such destruction or injury notify Tenant whether Landlord intends to rebuild, including Landlord’s estimate of the required length of time to rebuild. If in Landlord’s reasonable estimate more than 120 days will be required to rebuild from the date of destruction, Tenant shall have the right to terminate this Lease by written notice to Landlord given within 30 days after Landlord’s notice. If Landlord elects to rebuild and Tenant does not exercise its right to terminate the Lease under the preceding sentence, this Lease shall continue. During the restoration period, Landlord shall use commercially reasonable efforts to provide Tenant with any temporary accommodations or services that Tenant may require to continue operating at the |

-17-

| Premises, including without limitation, temporary truck access and utility services, if needed. If Landlord fails to notify Tenant within such 60-day period that Landlord will rebuild, then this Lease shall terminate as of the end of such period. |

| 15.2 | Rent Abatement. Rent shall be abated in its entirety during the restoration period unless Tenant is able to conduct limited operations on a portion of the Premises, in which case Rent shall be abated proportionally in the same proportion as the rentable floor area of the Premises which Tenant is unable to use to conduct its business bears to the total rentable area of the Premises from the date of the casualty until the restoration has been substantially completed. Notwithstanding the foregoing, if in Tenant’s reasonable opinion (taking into account its ability to process the volume of cargo needed to meet its published customer standards) Tenant is unable to use the Premises to conduct its business during the restoration period, and Tenant does in fact cease operating at the Premises during the restoration period, then Rent shall be abated in its entirety until the restoration of the Premises has been completed or Tenant resumes operating at the Premises, whichever occurs first. |

| 15.3 | Repairs to Tenant Installations. Landlord shall not be required under this Section 15 to repair, rebuild or replace any Alterations installed by Tenant under Section 13, or any panels, decoration, office fixtures, paintings, wall coverings, floor coverings, or any other improvements to the Premises installed by Tenant. If Landlord repairs or rebuild the Premises under Section 15.1, Tenant shall repair or rebuild such installations. The initial Tenant Improvements to be constructed by Landlord for Tenant in accordance with the Work Letter shall be included in Landlord’s repair, rebuilding or replacement work when required under this Section 15. |

| 15.4 | No Compensation. Except for the abatement of Rent under Section 15.2, Tenant shall not be entitled to any compensation or damages from Landlord for loss of use of the whole or any part of the Premises, the property of Tenant, or any inconvenience, annoyance or business interruption occasioned by any damage, casualty, repair, reconstruction or restoration covered by this Section 15. |

| 15.5. | Intentionally Deleted. |

| 15.6 | Damage at the End of the Term. If the casualty occurs during the last 180 days of the Lease Term (as it may have been extended by Tenant’s notice as provided in this Lease) and such damage will require more than thirty (30) days to repair, either Landlord or Tenant may elect to terminate this Lease as of the date the damage occurred. Landlord shall give such election in the restoration notice, and Tenant must give such election within thirty (30) days after receipt of the restoration notice. |

| 16. | Condemnation. |

| 16.1 | Termination of Lease. If all or part of the Premises are taken under power of eminent domain, or sold under the threat of the exercise of said power, this Lease shall terminate as to the part so taken as of the date the condemning authority takes possession. |

| 16.2 | Election of Termination. If more than 25% of the floor area of Premises is taken by condemnation, or the condemnation impacts any portion of the Property, including without limitation the Premises, parking areas, and driveways, and will have a material adverse impact on Tenant’s access to or ability to operate in the Premises, Landlord or Tenant may, by written notice to the other within ten (10) business days after receipt of written notice of such taking, terminate this Lease as to the remainder of the Premises as of the date the condemning authority takes possession. |

-18-

| 16.3 | Reduction of Rent. If Landlord or Tenant does not so terminate, this Lease shall remain in effect as to such remainder, except that the Rent shall be reduced in the proportion that the rentable floor area taken bears to the original rentable total floor area. However, if circumstances make abatement based on floor area unreasonable, the Rent shall abate by a reasonable amount to be determined by Landlord. In the event that neither Landlord nor Tenant elects to terminate this Lease, Landlord’s responsibility to restore the remainder of the Premises shall be limited to the amount of any condemnation award allocable to the Premises, as determined by Landlord. |

| 16.4 | Award. Any award for the taking of all or part of the Premises under the power of eminent domain, including payment made under threat of the exercise of such power, shall be the property of Landlord, whether made as compensation for diminution in value of the leasehold or for the taking of the fee or as severance damages. Tenant shall only be entitled to such compensation as may be separately awarded or recoverable by Tenant in Tenant’s own right for the loss of or damage to improvements to the Premises installed by Tenant, for Tenant’s trade fixtures and removable personal property and for Tenant’s relocation or moving expenses. Landlord shall not be liable to Tenant for the loss of the use of all or any part of the Premises taken by condemnation. |

| 16.5 | Landlord Authority. Landlord shall have the exclusive authority to grant possession and use to the condemning authority and to negotiate and settle all issues of just compensation or, in the alternative, to conduct litigation concerning such issues; provided, however, that Landlord shall not enter into any settlement of any separate award that may be made to Tenant as described in Section 16.4 without Tenant’s prior approval of such settlement, which approval shall not be unreasonably withheld. |

| 17. | Assignment and Subletting. |

| 17.1 | Landlord Consent Required; Exception. Tenant shall not assign this Lease, or sublet the Premises or any part thereof, either by operation of law or otherwise, or permit any other party to occupy all or any part of the Premises, without first obtaining the written consent of Landlord. Landlord’s consent shall not be unreasonably withheld, conditioned or delayed. Tenant shall propose such assignment or sublease by written notice to Landlord, and such notice shall specify an effective date which shall be the first day of a calendar month and shall be not less than 60 days after the date of such notice. This Lease shall not be assignable by operation of law. Tenant shall further provide to Landlord other information concerning any proposed assignee or sublessee as is reasonably requested by Landlord. |

Notwithstanding the foregoing paragraph, Tenant shall have the right, without Landlord’s consent (but with contemporaneous or prior notice), to assign this Lease or sublet all or any part of the Premises to an affiliated entity or a successor by merger or consolidation, provided only that the transferee or sublessee in writing adopts and agrees to be bound by all the provisions of this Lease. For this purpose, “affiliated” means controlled by, controlling or under common control with Tenant.

| 17.2 | Deemed Assignment. If Tenant is a corporation, any transfer of this Lease from Tenant by merger, consolidation, or liquidation, or any change in the ownership of or power to vote 50% or more of the outstanding voting stock of Tenant shall constitute an assignment under this Lease. If Tenant is a partnership or limited liability company, any |

-19-

| change in the identity or majority ownership of partners or members in Tenant serving as general partner or manager or owning 50% or more of the outstanding economic interests in such entity shall constitute an assignment under this Lease. |

| 17.3 | Recapture. In the alternative to consenting, where Landlord’s consent is required, to a proposed assignment or sublease, Landlord shall have the right to recapture the Premises, or applicable portion thereof (the “Recapture Right”). The option shall be exercised by Landlord giving Tenant written notice within sixty (60) days following Landlord’s receipt of Tenant’s written notice as required above; provided that Landlord shall deliver written notice to Tenant at least 10 days prior to its exercise of its Recapture Right of its intent thereof, and Tenant shall have the opportunity to rescind its proposed subletting or assignment with written notice to Landlord within 10 days after Landlord’s notice, after which Landlord shall have no Recapture Right or termination right with respect to such proposed subletting or assignment. If this lease shall be terminated with respect to the entire Premises, the Lease Term shall end on the date stated in Tenant’s notice as the effective date of the sublease or assignment as if that date had been originally fixed in this lease for the expiration of the Lease Term. If Landlord recaptures only a portion of the Premises, the Base Rent during the unexpired Lease Term shall abate, proportionately, based on the Base Rent due as of the date immediately prior to such recapture. Notwithstanding anything to the contrary contained in this Section 17.3, Landlord shall have no right to terminate this lease by virtue of any proposed subletting or assignment to an entity controlling, controlled by, or under common control with Tenant. |

| 17.4 | Additional Requirement; Release. Landlord may charge Tenant a reasonable sum (not to exceed $750.00 if Tenant complies with the requirements of this Section 17) to reimburse Landlord for legal and administrative costs incurred in connection with evaluating, approving and/or disapproving any proposed assignment or sublease that requires Landlord’s consent. If Landlord elects to gives its consent to the proposed assignment or sublease, the assigning or subletting Tenant, and any previous assigning or subletting Tenants, shall remain liable to Landlord for the full and faithful performance of all of Tenant’s obligations under this Lease. Notwithstanding the foregoing, in the case of an assignment, Tenant shall be entitled to be released from all liability and obligations under this Lease accruing after the effective date of the assignment, if (i) the assignee in writing adopts and agrees to be bound by all the provisions of this Lease as Tenant, and (ii) Landlord has been furnished with evidence of the assignee’s creditworthiness and, has approved the same, acting in a commercially reasonable manner. For purposes of this Section 17.4, Landlord will not be acting in a commercially unreasonable manner if Landlord disapproves a proposed assignee that is less creditworthy than Tenant and Deutsche Post; provided, however, that if Landlord determines that such assignee is less creditworthy than Tenant and Deutsche Post, Landlord shall, prior to disapproving such assignee, provide such assignee with a period of 30 days to provide alternative credit support sufficient to address the credit concerns of Landlord. If such alternative credit support is provided, Landlord shall not disapprove such assignee, provided such assignee complies with the requirements of clause (i) above. |

| 17.5 | Assignment with Bankruptcy. If this Lease is assigned pursuant to the provisions of the Revised Bankruptcy Act, 11 U.S.C. Section 101 et seq., any and all consideration paid or payable in connection with such assignment shall be Landlord’s exclusive property and paid or delivered to Landlord, and shall not constitute the property of Tenant or Tenant’s estate in bankruptcy. Any person or entity to whom the Lease is assigned pursuant to the Revised Bankruptcy Act shall be deemed automatically to have assumed all of Tenant’s obligations under this Lease. |

-20-