Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - iWallet Corp | ex5_1.htm |

| EX-3.2 - EXHIBIT 3.2 - iWallet Corp | ex3_2.htm |

| EX-3.1 - EXHIBIT 3.1 - iWallet Corp | ex3_1.htm |

| EX-99.1 - EXHIBIT 99.1 - iWallet Corp | ex99_1.htm |

| EX-23.1 - EXHIBIT 23.1 - iWallet Corp | ex23_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

QUEENSRIDGE MINING RESOURCES, INC.

(Exact name of Registrant as specified in its charter)

|

Nevada

|

1000

|

27-1830013

|

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number

|

(I.R.S. Employer Identification Number)

|

|

912 Sir James Bridge Way

Las Vegas, Nevada

|

89145

|

|

|

(Name and address of principal executive offices)

|

(Zip Code)

|

|

|

Registrant's telephone number, including area code: (702) 596-5154

|

||

| Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement. | ||

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box.|__|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer |__| Accelerated filer |__|

Non-accelerated filer |__| Smaller reporting company |X|

CALCULATION OF REGISTRATION FEE

|

TITLE OF EACH

CLASS OF SECURITIES

TO BE REGISTERED

|

AMOUNT TO BE

REGISTERED

|

PROPOSED

MAXIMUM

OFFERING PRICE

PER SHARE

|

PROPOSED

MAXIMUM

AGGREGATE

OFFERING PRICE (1)

|

AMOUNT OF

REGISTRATION FEE

|

|

Common Stock

|

1,702,800

|

$0.25(1)

|

$425,700

|

$30.36(2)

|

|

(1)

|

This price was arbitrarily determined by Queensridge Mining Resources, Inc.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act.

|

COPIES OF COMMUNICATIONS TO:

Puoy K. Premsrirut, Esq.

520. S. Fourth Street, Second Floor

Las Vegas, NV 89101

Ph: (702) 384-5563

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

SUBJECT TO COMPLETION, Dated August 11, 2010

PROSPECTUS

QUEENSRIDGE MINING RESOURCES, INC.

1,702,800

SHARES OF COMMON STOCK

INITIAL PUBLIC OFFERING

___________________

The selling shareholders named in this prospectus are offering up to 1,702,800 shares of common stock offered through this prospectus. We will not receive any proceeds from this offering and have not made any arrangements for the sale of these securities. We have, however, set an offering price for these securities of $0.25 per share. We will use our best efforts to maintain the effectiveness of the resale registration statement from the effective date through and until all securities registered under the registration statement have been sold or are otherwise able to be sold pursuant to Rule 144 promulgated under the Securities Act of 1933.

|

Offering Price

|

Underwriting

Discounts and

Commissions

|

Proceeds to Selling Shareholders

|

|

|

Per Share

|

$0.25

|

None

|

$0.25

|

|

Total

|

$425,700

|

None

|

$425,700

|

Our common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at $0.25 per share until such time as the shares of our common stock are traded on the Over-The-Counter Bulletin Board. Although we intend to apply for quotation of our common stock on the Over-The-Counter Bulletin Board, public trading of our common stock may never materialize. If our common stock becomes traded on the Over-The-Counter Bulletin Board, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling shareholders.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section of this Prospectus entitled "Risk Factors."

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus Is: August 11, 2010

Table of Contents

Queensridge Mining Resources, Inc.

We are in the business of mineral exploration. We have acquired a 100% interest in the Cutwell Harbour block of minerals claim located in northern Newfoundland in Canada. Our ownership in the Cutwell Harbour claims was electronically staked and recorded under the electronic mineral claim staking and recording procedures of the Online Mineral Claims Staking System administered by the Department of Natural Resources, Government of Newfoundland and Labrador, Canada. A party is able to stake and record an interest in a particular mineral claim if no other party has an interest in the said claim that is in good standing and on record. There is no formal agreement between us and the Government of Newfoundland and Labrador.

We have not commenced our planned exploration program. Our plan of operations is to conduct mineral exploration activities on the Cutwell Harbour mineral claims in order to assess whether these claims possess commercially exploitable mineral deposits. Our exploration program is designed to explore for commercially viable deposits of gold and other metallic minerals. We have not, nor to our knowledge has any predecessor, identified any commercially exploitable reserves of these minerals on the Cutwell Harbour mineral claims. We are an exploration stage company and there is no assurance that a commercially viable mineral deposit exists on the Cutwell Harbour mineral claims.

The mineral exploration program, consisting of geological mapping, sampling, and geochemical analyses is oriented toward identifying areas of vein or stockwork mineralization within the Cutwell Harbour mineral claims.

Currently, we are uncertain of the number of mineral exploration phases we will conduct before concluding whether there are commercially viable minerals present on the Cutwell Harbour mineral claims. Further phases beyond the current exploration program will be dependent upon a number of factors such as a consulting geologist’s recommendations based upon ongoing exploration program results, and our available funds.

Since we are in the exploration stage of our business plan, we have not yet earned any revenues from our planned operations. As of June 30, 2010, we had $35,065 cash on hand and current liabilities in the amount of $7,810. Accordingly, our working capital position as of June 30, 2010 was $27,255. Since our inception through June 30, 2010, we have incurred a net loss of $11,545. We attribute our net loss to having no revenues to offset our expenses and the professional fees related to the creation and operation of our business. Our management estimates that, until such time that we are able to identify a commercially viable mineral deposit and to generate revenue from the extraction of precious metals on our mineral claims, we will experience negative cash flow in the approximate average amount of $3,000 to $4,000 per month.

Our fiscal year end is June 30. We were incorporated on January 29, 2010, under the laws of the state of Nevada. Our principal offices are located at 912 Sir James Bridge Way, Las Vegas, Nevada 89145. Our resident agent is Val-U-Corp Services, Inc., 1802 N. Carson St., #212, Carson City, NV 89701. Our phone number is (702) 596-5154.

The Offering

|

Securities Being Offered

|

Up to 1,702,800 shares of our common stock.

|

|

Offering Price and Alternative Plan of Distribution

|

The offering price of the common stock is $0.25 per share. We intend to apply to the over-the-counter bulletin board to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders.

|

|

Minimum Number of Shares To Be Sold in This Offering

|

None

|

| Securities Issued and to be Issued | 6,427,800 shares of our common stock are issued and outstanding as of the date of this prospectus. All of the common stock to be sold under this prospectus will be sold by existing shareholders. There will be no increase in our issued and outstanding shares as a result of this offering. |

| Use of Proceeds | We will not receive any proceeds from the sale of the common stock by the selling shareholders. |

| Summary Financial Information | ||

|

Balance Sheet Data

|

From Inception on

January 29, 2010 through

June 30, 2010 (audited)

|

|

|

Cash

|

$ | 35,065 |

| Total Assets | $ | 35,065 |

| Liabilities | $ | 7,810 |

| Total Stockholder’s Equity | $ | 27,255 |

|

Statement of Operations

|

||

|

Revenue

|

$ | 0 |

| Net Loss for Reporting Period | $ | 11,545 |

Risk Factors

You should consider each of the following risk factors and any other information set forth herein and in our reports filed with the SEC, including our financial statements and related notes, in evaluating our business and prospects. The risks and uncertainties described below are not the only ones that impact on our operations and business. Additional risks and uncertainties not presently known to us, or that we currently consider immaterial, may also impair our business or operations. If any of the following risks actually occur, our business and financial results or prospects could be harmed. In that case, the value of the Common Stock could decline.

Risks Related To Our Financial Condition and Business Model

If we do not obtain additional financing, our business will fail

As of June 30, 2010, we had cash in the amount of $35,065. Our cash on hand will allow us to complete the initial work program recommended by our consulting geologist. The recommended work program will consist of mapping, sampling, and geochemical analyses aimed at identifying and locating potential gold deposits on the Cutwell Harbour property. If significant additional exploration activities are warranted and recommended by our consulting geologist, we will likely require additional financing in order to move forward with our development of the claim. We currently do not have any operations and we have no income. We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. If our exploration programs are successful in discovering reserves of commercial tonnage and grade, we will require significant additional funds in order to place the Cutwell Harbour property into commercial production. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the market prices for gold and other metallic minerals and the costs of exploring for or commercial production of these materials. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

Because we will need additional financing to fund our extensive exploration activities, our accountants believe there is substantial doubt about our ability to continue as a going concern

We have incurred a net loss of $11,545 for the period from our inception, January 29, 2010, to June 30, 2010, and have no sales. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the commercial exploitation of an interest in mineral claims. Our auditors have issued a going concern opinion and have raised substantial doubt about our continuance as a going concern. When an auditor issues a going concern opinion, the auditor has substantial doubt that the company will continue to operate indefinitely and not go out of business and liquidate its assets. This is a significant risk to investors who purchase shares of our common stock because there is an increased risk that we may not be able to generate and/or raise enough resources to remain operational for an indefinite period of time. Potential investors should also be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The auditor’s going concern opinion may inhibit our ability to raise financing because we may not remain operational for an indefinite period of time resulting in potential investors failing to receive any return on their investment.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because we have only recently commenced business operations, we face a high risk of business failure.

We have just planned the initial stages of exploration on our recently –staked mineral claims. As a result, we have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on January 29, 2010, and to date have been involved primarily in organizational activities, the staking of our mineral claim, and obtaining independent consulting geologist’s report on this mineral claim. We have not earned any revenues as of the date of this prospectus, and thus face a high risk of business failure.

Because our executive officers do not have any training specific to the technicalities of mineral exploration, there is a higher risk our business will fail

Mr. Phillip Stromer, our president and director, does not have any training as a geologist or an engineer. As a result, our management may lack certain skills that are advantageous in managing an exploration company. In addition, Mr. Stromer’s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management’s lack of experience in geology and engineering.

Because we conduct our business through verbal agreements with consultants and arms-length third parties, there is a substantial risk that such persons may not be readily available to us and the implementation of our business plan could be impaired.

We have a verbal agreement with our consulting geologist that requires him to review all of the results from the exploration work performed upon the mineral claim that we have purchased and then make recommendations based upon those results. In addition, we have a verbal agreement with our accountants to perform requested financial accounting services and our outside auditors to perform auditing functions. Each of these functions requires the services of persons in high demand and these persons may not always be available. The implementation of our business plan may be impaired if these parties do not perform in accordance with our verbal agreement. In addition, it may be difficult to enforce a verbal agreement in the event that any of these parties fail to perform.

Because of the unique difficulties and uncertainties inherent in the mineral exploration business, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The search for valuable minerals also involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time, we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position. In addition, there is no assurance that the expenditures to be made by us in the exploration of the mineral claims will result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur continuing and significant losses into the foreseeable future. As a result of continuing losses, we may exhaust all of our resources and be unable to complete the exploration of the Cutwell Harbour property. Our accumulated deficit will continue to increase as we continue to incur losses. We may not be able to earn profits or continue operations if we are unable to generate significant revenues from the exploration of the mineral claims if we exercise our option. There is no history upon which to base any assumption as to the likelihood that we will be successful, and we may not be able to generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because we will incur additional costs as the result of becoming a public company, our cash needs will increase and our ability to achieve net profitability may be delayed.

Upon effectiveness of the Registration Statement for the Offering, we will become a publicly reporting company and will be required to stay current in our filings with the SEC, including, but not limited to, quarterly and annual reports, current reports on materials events, and other filings that may be required from time to time. We believe that, as a public company, our ongoing filings with the SEC will benefit shareholders in the form of greater transparency regarding our business activities and results of operations. In becoming a public company, however, we will incur additional costs in the form of audit and accounting fees and legal fees for the professional services necessary to assist us in remaining current in our reporting obligations. We expect that, during our first year of operations following the effectiveness of our Registration Statement, we will occur additional costs for professional fees in the approximate amount of $20,000. These additional costs will increase our cash needs and may hinder or delay our ability to achieve net profitability even after we have begun to generate revenues from the extraction of minerals on our mining claims.

Because our president has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Mr. Stromer, our president and chief financial officer, devotes 5 to 10 hours per week to our business affairs. We do not have an employment agreement with Mr. Stromer nor do we maintain a key man life insurance policy for him. Currently, we do not have any full or part-time employees. If the demands of our business require the full business time of Mr. Stromer, it is possible that Mr. Stromer may not be able to devote sufficient time to the management of our business, as and when needed. If our management is unable to devote a sufficient amount of time to manage our operations, our business will fail.

Because our president, Mr. Phillip Stromer owns 48.23% of our outstanding common stock, investors may find that corporate decisions influenced by Mr. Stromer are inconsistent with the best interests of other stockholders.

Mr. Stromer is our president, chief financial officer and sole director. He owns 48.23% of the outstanding shares of our common stock. Accordingly, he will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. While we have no current plans with regard to any merger, consolidation or sale of substantially all of its assets, the interests of Mr. Stromer may still differ from the interests of the other stockholders.

Because our president, Mr. Phillip Stromer, owns 48.23% of our outstanding common stock, the market price of our shares would most likely decline if he were to sell a substantial number of shares all at once or in large blocks.

Our president, Mr. Phillip Stromer, owns 3,100,000 shares of our common stock which equates to 48.23% of our outstanding common stock. There is presently no public market for our common stock and we plan to apply for quotation of our common stock on the over-the-counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. If our shares are publicly traded on the over-the-counter bulletin board, Mr. Stromer will eventually be eligible to sell his shares publicly subject to the volume limitations in Rule 144. The offer or sale of a large number of shares at any price may cause the market price to fall. Sales of substantial amounts of common stock or the perception that such transactions could occur, may materially and adversely affect prevailing markets prices for our common stock.

If we are unable to successfully compete within the mineral exploration business, we will not be able to achieve profitable operations.

The mineral exploration business is highly competitive. This industry has a multitude of competitors and no small number of competitors dominates this industry with respect to any of the large volume metallic minerals. Our exploration activities will be focused on attempting to locate commercially viable gold deposits on the Cutwell Harbour property. Many of our competitors have greater financial resources than us. As a result, we may experience difficulty competing with other businesses when conducting mineral exploration activities on the Cutwell Harbour property. If we are unable to retain qualified personnel to assist us in conducting mineral exploration activities on the Cutwell Harbour property if a commercially viable deposit is found to exist, we may be unable to enter into production and achieve profitable operations.

Because of factors beyond our control which could affect the marketability of any substances found, we may be difficulty selling any substances we discover.

Even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. These factors could inhibit our ability to sell minerals in the event that commercial amounts of minerals are found.

Risks Related To Legal Uncertainty

Because we will be subject to compliance with government regulation which may change, the anticipated costs of our exploration program may increase

There are several governmental regulations that materially restrict mineral exploration or exploitation. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. Currently, we have not experienced any difficulty with compliance of any laws or regulations which affect our business. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business, prevent us from carrying out our exploration program, and make compliance with new regulations unduly burdensome.

If Native land claims affect the title to our mineral claims, our ability to prospect the mineral claims may be lost.

We are unaware of any outstanding native land claims on the Cutwell Harbour property. Notwithstanding, it is possible that a native land claim could be made in the future. The federal and provincial government policy is at this time is to consult with all potentially affected native bands and other stakeholders in the area of any potential commercial production. In the event that we encounter a situation where a native person or group claims an interest in the Cutwell Harbour property, we may be unable to provide compensation to the affected party in order to continue with our exploration work, or if such an option is not available, we may have to relinquish any interest that we may have in this claim. The Supreme Court of Canada has ruled that both the federal and provincial governments in Canada are obliged to negotiate these matters in good faith with native groups and at no cost to us. Notwithstanding, the costs and/or losses could be greater than our financial capacity and our business would fail.

Because the Province of Newfoundland owns the land covered by the Cutwell Harbour property, our availability to conduct an exploratory program on the Cutwell Harbour property is subject to the consent of the Government of Newfoundland and Labrador and we can be ejected from the land and our interest in the land could be forfeit.

The land covered by the Cutwell Harbour property is owned by the Government of Newfoundland and Labrador. The availability to conduct an exploratory program on the Cutwell Harbour property is subject to the consent of the Government of Newfoundland and Labrador.

In order to keep the Cutwell Harbour claims in good standing with the Government of Newfoundland and Labrador, the Government of Newfoundland and Labrador requires that before the expiry dates of the mineral claims that exploration work on the mineral claim valued at an amount stipulated by the government be completed together with the payment of a filing fee or payment to the Government of Newfoundland and Labrador in lieu of completing exploration work. In the event that these conditions are not satisfied prior to the expiry dates of the mineral claims, we will lose our interest in the mineral claim and the mineral claim then become available again to any party that wishes to stake an interest in these claims. In the event that either we are ejected from the land or our mineral claims expire, we will lose all interest that we have in the Cutwell Harbour mineral claims.

Because new legislation, including the Sarbanes-Oxley Act of 2002, increases the cost of compliance with federal securities regulations as well as the risks of liability to officers and directors, we may find it more difficult for us to retain or attract officers and directors.

The Sarbanes-Oxley Act of 2002 was enacted in response to public concerns regarding corporate accountability in connection with recent accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies, and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. The Sarbanes-Oxley Act generally applies to all companies that file or are required to file periodic reports with the SEC, under the Securities Exchange Act of 1934. Upon becoming a public company, we will be required to comply with the Sarbanes-Oxley Act and it is costly to remain in compliance with the federal securities regulations. Additionally, we may be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles. Significant costs incurred as a result of becoming a public company could divert the use of finances from our operations resulting in our inability to achieve profitability.

Risks Related To This Offering

If a market for our common stock does not develop, shareholders may be unable to sell their shares

A market for our common stock may never develop. We currently plan to apply for quotation of our common stock on the over-the-counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. However, our shares may never be traded on the bulletin board, or, if traded, a public market may not materialize. If our common stock is not traded on the bulletin board or if a public market for our common stock does not develop, investors may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline.

The selling shareholders are offering 1,702,800 shares of our common stock through this prospectus. Our common stock is presently not traded on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is trading will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent 26.49% of the common shares outstanding as of the date of this prospectus.

Because we will be subject to the “Penny Stock” rules once our shares are quoted on the over-the-counter bulletin board, the level of trading activity in our stock may be reduced.

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on Nasdaq). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, broker-dealers who sell these securities to persons other than established customers and "accredited investors" must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

If our shares are quoted on the over-the-counter bulletin board, we will be required to remain current in our filings with the SEC and our securities will not be eligible for quotation if we are not current in our filings with the SEC.

In the event that our shares are quoted on the over-the-counter bulletin board, we will be required order to remain current in our filings with the SEC in order for shares of our common stock to be eligible for quotation on the over-the-counter bulletin board. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 or 60 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on the over-the-counter bulletin board, investors in our common stock may find it difficult to sell their shares.

If we undertake future offerings of our common stock, purchasers in this offering will experience dilution of their ownership percentage.

Generally, existing shareholders will experience dilution of their ownership percentage in the company if and when additional shares of common stock are offered and sold. In the future, we may be required to seek additional equity funding in the form of private or public offerings of our common stock. In the event that we undertake subsequent offerings of common stock, your ownership percentage, voting power as a common shareholder, and earnings per share, if any, will be proportionately diluted. This may, in turn, result in a substantial decrease in the per-share value of your common stock.

Forward-Looking Statements

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. The actual results could differ materially from our forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section and elsewhere in this prospectus.

Use of Proceeds

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

Determination of Offering Price

All shares being offered will be sold by existing shareholders without our involvement, consequently the actual price of the stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price will thus be determined by market factors and the independent decisions of the selling shareholders.

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

Selling Shareholders

The selling shareholders named in this prospectus are offering all of the 1,702,800 shares of common stock offered through this prospectus. All of the shares were acquired from us by the selling shareholders in offerings that were exempt from registration pursuant to Rule 504 of Regulation D of the Securities Act of 1933. The selling shareholders purchased their shares in two offerings completed on March 29, 2010 and May 29, 2010, respectively.

The following table provides information regarding the beneficial ownership of our common stock held by each of the selling shareholders as of June 30, 2010 including:

1. the number of shares owned by each prior to this offering;

2. the total number of shares that are to be offered by each;

3. the total number of shares that will be owned by each upon completion of the offering;

4. the percentage owned by each upon completion of the offering; and

5. the identity of the beneficial holder of any entity that owns the shares.

The named party beneficially owns and has sole voting and investment power over all shares or rights to the shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. The

percentages are based on 6,427,800 shares of common stock outstanding on June 30, 2010.

|

Name of Selling Shareholder

|

Shares Owned

Prior to this Offering

|

Total Number of

Shares to be Offered for Selling Shareholder Account

|

Total Shares to be Owned Upon Completion of this Offering

|

Percent Owned Upon Completion of this Offering

|

|

Star M. Blehm

1704 Cuno Ct.

Las Vegas, NV 89117

|

300,000

|

150,000

|

150,000

|

2.33%

|

|

Josephine C. Koerber

3678 Spring Shower Dr.

Las Vegas, NV 89147

|

225,000

|

112,500

|

112,500

|

1.75%

|

|

Alan Cutter

2735 Cool Lilac Ave.

Henderson, NV 89052

|

225,000

|

112,500

|

112,500

|

1.75%

|

|

David M. Ferguson

7568 Coral River Dr

Las Vegas, NV 89131

|

225,000

|

112,500

|

112,500

|

1.75%

|

|

Ladonna F. Mason

8001 Festivity Circle

Las Vegas, NV 89145

|

225,000

|

112,500

|

112,500

|

1.75%

|

|

Richette Mathis

1540 Linda Vista Dr.

Ukiah, CA 95482

|

200,000

|

100,000

|

100,000

|

1.56%

|

|

Cynthia M. Baker

2811 Beacon Point Circle

Elgin, IL 60124

|

200,000

|

100,000

|

100,000

|

1.56%

|

|

Elyse Baker

2811 Beacon Pt

Elgin, IL 60124

|

200,000

|

100,000

|

100,000

|

1.56%

|

|

Stephen M. Koch

234 Tioga Ave.

Bensenville IL 60106

|

200,000

|

100,000

|

100,000

|

1.56%

|

|

Carolyn Koerber

234 Tioga Ave.

Bensenville, IL 60106

|

200,000

|

100,000

|

100,000

|

1.56%

|

|

John E. Gibbons

1084 Old Stone House Way

Park City, UT 84098

|

200,000

|

100,000

|

100,000

|

1.56%

|

|

Patrick Baker

2811 Beacon Point Circle

Elgin, IL 60124

|

200,000

|

100,000

|

100,000

|

1.56%

|

|

Robert A. Baker

2811 Beacon Point Circle

Elgin, IL 60124

|

175,000

|

87,500

|

87,500

|

1.36%

|

|

Greg Cantrell

P.O. Box 11673

Las Vegas, NV 89111

|

175,000

|

87,500

|

87,500

|

1.36%

|

|

James E. Gillespie

9900 Wilbur May Pkwy. #3201

Reno, NV 89521

|

150,000

|

75,000

|

75,000

|

1.17%

|

|

Laura Fergeson

10 Ranch View Tr.

Wimbeiley, TX 78676

|

150,000

|

75,000

|

75,000

|

1.17%

|

|

Steve Blehm

1704 Cuno Ct.

Las Vegas, NV 89117

|

2,200

|

2,200

|

zero

|

zero

|

|

Ronald Greene

328 Redondo St.

Henderson, NV 89014

|

4,500

|

4,500

|

zero

|

zero

|

|

James Hale, Jr.

1601 Hidden Falls Ct.

Prosper, TX 75078-8780

|

3,400

|

3,400

|

zero

|

zero

|

|

Robert B. Stromer

1540 Linda Vista Way

Ukah, CA 95482

|

3,800

|

3,800

|

zero

|

zero

|

|

Virginia M. Stromer

1540 Linda Vista Way

Ukah, CA 95482

|

3,800

|

3,800

|

zero

|

zero

|

|

Kenneth R. Koerber

1974 Birch St.

Des Plaines, IL 60018

|

2,600

|

2,600

|

zero

|

zero

|

|

Cosimo Boechini

2153 Running River Road

Henderson, NV 89074

|

6,500

|

6,500

|

zero

|

zero

|

|

Nativity Kolpin

2153 Running River Road

Henderson, NV 89074

|

10,500

|

10,500

|

zero

|

zero

|

|

Lou Buzzato

7376 W. Tonopah Dr.

Glendale, AZ 85308

|

10,000

|

10,000

|

zero

|

zero

|

|

Deanne Martin

7409 W. Tonopah Dr.

Glendale, AZ 85308

|

9,000

|

9,000

|

zero

|

zero

|

|

Paige Howarth

5782 Field Breeze St.

Las Vegas, NV 89148

|

8,000

|

8,000

|

zero

|

zero

|

|

Katie Clark

1219 Simfire Ave.

Henderson, NV 89014

|

7,500

|

7,500

|

zero

|

zero

|

|

Amy Geldhof

9332 Straw Hays #101

Las Vegas, NV 89178

|

6,000

|

6,000

|

zero

|

zero

|

None of the selling shareholders: (1) has had a material relationship with us other than as a shareholder at any time within the past three years; or (2) has ever been one of our officers or directors.

Plan of Distribution

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

1. on such public markets or exchanges as the common stock may from time to time be trading;

2. in privately negotiated transactions;

3. through the writing of options on the common stock;

4. in short sales, or;

5. in any combination of these methods of distribution.

The sales price to the public is fixed at $0.25 per share until such time as the shares of our common stock become traded on the Over-The-Counter Bulletin Board or another exchange. Although we intend to apply for quotation of our common stock on the Over-The-Counter Bulletin Board, public trading of our common stock may never materialize. If our common stock becomes traded on the Over-The-Counter Bulletin Board, or another exchange, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

1. the market price of our common stock prevailing at the time of sale;

2. a price related to such prevailing market price of our common stock, or;

3. such other price as the selling shareholders determine from time to time.

The shares may also be sold in compliance with the Securities and Exchange Commission's Rule 144.

The selling shareholders may also sell their shares directly to market makers acting as agents in unsolicited brokerage transactions. Any broker or dealer participating in such transactions as an agent may receive a commission from the selling shareholders or from such purchaser if they act as agent for the purchaser. If applicable, the selling shareholders may distribute shares to one or more of their partners who are unaffiliated with us. Such partners may, in turn, distribute such shares as described above.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders must comply with the requirements of the Securities Act of 1933 and the Securities Exchange Act in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

1. not engage in any stabilization activities in connection with our common stock;

2. furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and;

3. not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Securities Exchange Act.

Description of Securities

Common Stock

We have 75,000,000 common shares with a par value of $0.001 per share of common stock authorized, of which 6,427,800 shares were outstanding as of June 30, 2010.

Voting Rights

Holders of common stock have the right to cast one vote for each share of stock in his or her own name on the books of the corporation, whether represented in person or by proxy, on all matters submitted to a vote of holders of common stock, including the election of directors. There is no right to cumulative voting in the election of directors. Except where a greater requirement is provided by statute or by the Articles of Incorporation, or by the Bylaws, the presence, in person or by proxy duly authorized, of the holder or holders of a majority of the outstanding shares of the our common voting stock shall constitute a quorum for the transaction of business. The vote by the holders of a majority of such outstanding shares is also required to effect certain fundamental corporate changes such as liquidation, merger or amendment of the Company's Articles of Incorporation.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

1. we would not be able to pay our debts as they become due in the usual course of business, or;

2. our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Pre-emptive Rights

Holders of common stock are not entitled to pre-emptive or subscription or conversion rights, and there are no redemption or sinking fund provisions applicable to the Common Stock. All outstanding shares of common stock are, and the shares of common stock offered hereby will be when issued, fully paid and non-assessable.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Nevada Anti-Takeover Laws

Nevada Revised Statutes sections 78.378 to 78.379 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation. Because of these conditions, the statute currently does not apply to our company.

Interests of Named Experts and Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Puoy K. Premsrirut, Esq., our independent legal counsel, has provided an opinion on the validity of our common stock.

Silberstein Ungar, PLLC, Certified Public Accountants, has audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Silberstein Ungar , PLLC has presented their report with respect to our audited financial statements. The report of Silberstein Ungar , PLLC is included in reliance upon their authority as experts in accounting and auditing.

Richard A. Jeanne, Consulting Geologist has provided a geological evaluation report on the Cutwell Harbour mineral property. He was employed on a flat rate consulting fee and he has no interest, nor does he expect any interest in the property or securities of Queensridge Mining Resources, Inc.

Description of Business

In General

We are an exploration stage company that intends to engage in the exploration of mineral properties. We have acquired a block of mineral claims that we refer to as the Cutwell Harbour property. Exploration of these mineral claims is required before a final determination as to its viability can be made.

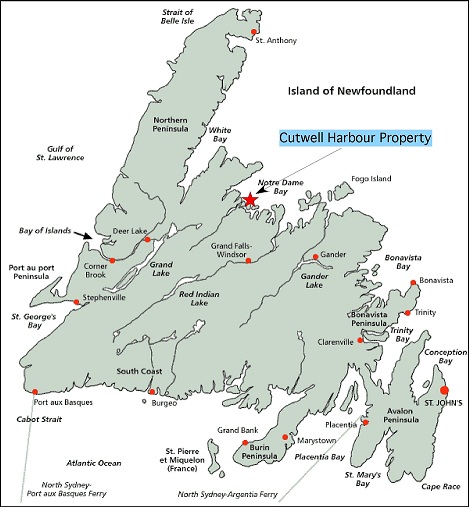

The property is on Long Island in Notre Dame Bay, Northern Newfoundland. The property comprises 6 claim blocks totaling 150 hectares or approximately 371 acres in area and is located on NTS map sheet 02E/12.

Our plan of operations is to carry out exploration work on this claim in order to ascertain whether it possesses commercially exploitable quantities of gold and other metals. We will not be able to determine whether or not the Cutwell Harbour mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work indicates economic viability.

Phase I of our exploration program will begin in the Spring of 2011 and will cost approximately $10,614. This phase will consist of on-site surface reconnaissance, mapping, sampling, and geochemical analyses. Phase II of our program will consist of on-site mapping, sampling, and followed by geochemical analyses of the various samples gathered. Phase II of our exploration program will cost approximately $16,767, and is expected commence in the late Summer or early Fall of 2011. The existence of commercially exploitable mineral deposits in the Cutwell Harbour property is unknown at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our exploration program.

Acquisition of the Cutwell Harbour mineral claims.

We have acquired a 100% interest in the Cutwell Harbour mineral claims located in northern Newfoundland, Canada. Our ownership in the Cutwell Harbor claims was electronically staked and recorded under the electronic mineral claim staking and recording procedures of the Online Mineral Claims Staking System administered by the Department of Natural Resources, Government of Newfoundland and Labrador, Canada. A party is able to stake and record an interest in a particular mineral claim if no other party has an interest in the said claim that is in good standing and on record. There is no formal agreement between us and/or our subsidiary and the Government of Newfoundland and Labrador.

The Cutwell Harbor claims are administered under the Mineral Act of Newfoundland and Labrador. Our interest in the Cutwell Harbor claims will continue for up to twenty years provided that the minimum required expenditures toward exploration work on the claim are made in compliance with the Act. The required amount of expenditures toward exploration work is set by the Province of Newfoundland and Labrador and can be altered in its sole discretion. Currently, the amount required to be expended annually for exploration work within the first year that the mineral claim is acquired is $200 per claim. The required expenditures per claim increase gradually each year up to a maximum of $1,200 per claim for the sixteenth year and beyond. Within 60 days following the anniversary date of the claim, an assessment report on the work performed must be submitted to the Mineral Claims Recorder. Every five years, renewal fee of between $25 and $100 per claim is also required.

We selected the Cutwell Harbour mineral property based upon an independent geological report which was commissioned from Richard A. Jeanne, a Consulting Geologist. Mr. Jeanne recommended an exploration program on this claim which will cost us approximately $27,381.

Description and Location of the Appleton #2 mineral claim

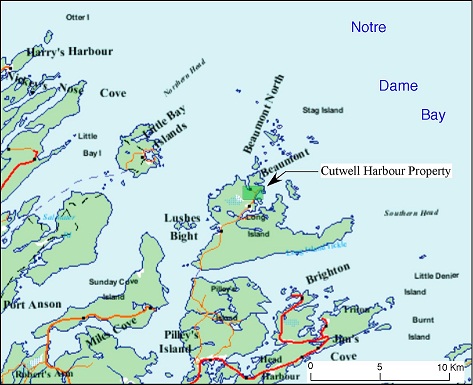

The Cutwell Harbour property is located on Long Island in Notre Dame Bay, on the north coast of Newfoundland, Canada (fig. 1). It comprises 150 hectares (≈ 371 acres), approximately centered at latitude 49° 36’ 55.8" North, longitude 55° 40’ 54.1" West (UTM Zone 21, 595230E – 5496497N). It lies within the area covered by NTS map sheet 02E/12.

The description of the property is as follows:

Beginning at the Northeast corner of the herein described parcel of land, and said corner having UTM coordinates of 5 497 000 N, 596 000 E; of Zone 21; thence South 1,000 metres, thence West 1,500 metres, thence North 1,000 metres, thence East 1,500 metres to the point of beginning. All bearings are referred to the UTM grid, Zone 21. NAD27.

The Government of Newfoundland and Labrador owns the land covered by the Cutwell Harbour mineral claims. Currently, we are not aware of any native land claims that might affect the title to the mineral claim or to Newfoundland and Labrador’s title of the property. Although we are unaware of any situation that would threaten this claim, it is possible that a native land claim could be made in the future. The federal and provincial government policy at this time is to consult with all potentially affected native bands and other stakeholders in the area of any potential commercial production. If we should encounter a situation where a native person or group claims and interest in this claim, we may choose to provide compensation to the affected party in order to continue with our exploration work, or if such an option is not available, we may have to relinquish any interest that we hold in this claim.

Geological Exploration Program in General

We have obtained an independent Geological Report and have acquired a 100% ownership interest in the Cutwell Harbour mineral claims. Richard A. Jeanne, Consulting Geologist, has prepared this Geological Report and reviewed all available exploration data completed on this mineral claim.

Mr. Jeanne is a geologist with offices at 3055 Natalie Street, Reno Nevada, 89509. He has a B.S. in Geology from Northern Arizona University and an M.A. in Geology from Boston University with over 27 years experience since graduation. Mr. Jeanne is a Certified Professional Geologist with the American Institute of Professional Geologists (Certificate Number 8397).

The property that is the subject of the Cutwell Harbour mineral claims is undeveloped and does not contain any open-pit or underground mines which can be rehabilitated. There is no commercial production plant or equipment located on the property that is the subject of the mineral claim. Currently, there is no power supply to the mineral claims. We have not yet commenced the field work phase of our initial exploration program. Exploration is currently in the planning stages. Our exploration program is exploratory in nature and there is no assurance that mineral reserves will be found. The details of the Geological Report are provided below.

Cutwell Harbour Mineral Claims Geological Report, Dated March 27, 2010

A primary purpose of the geological report is to review information, if any, from the previous exploration of the mineral claims and to recommend exploration procedures to establish the feasibility of commercial production project on the mineral claims. The summary report lists results of the history of the exploration of the mineral claims, the regional and local geology of the mineral claims and the mineralization and the geological formations identified as a result of the prior exploration. The summary report also gave conclusions regarding potential mineralization of the mineral claims and recommended a further geological exploration program.

Exploration Potential of the Cutwell Harbor Mineral Claims

The property is located near the community of Beaumont on Long Island, in Notre Dame Bay, just off the north coast of Newfoundland on NTS map sheet 02E/12. Access to the property can be gained from the Trans-Canada Highway at South Brook via route 380 to Pilley’s island then north via secondary roads and ferry to Long Island and the community of Beaumont. The region receives abundant snowfall during the winter months, making geological exploration and other related activities impractical during this time. The climate during the remainder of the year is moderate. The topography is moderately rugged with elevations ranging from sea level to about 140 meters. Although some portions of the property are wooded, in general, vegetative and soil cover is sparse, providing good bedrock exposure.

In 1980, Brinco Mining, Ltd. and Getty Mines Limited formed a joint venture and conducted reconnaissance exploration that included geological, geochemical and geophysical surveys in the vicinity of the Cutwell Harbour Property. In response to the discovery of several base metal occurrences in felsic volcanic rocks during this program, Getty Canadian Minerals engaged Tillicum Resources Ltd in 1983 to conduct geologic mapping, sampling and geophysical surveys over other areas of Long Island that are underlain by these rock types. A number of additional base metal anomalies were identified during this program, and in 1990, northern Long Island was staked under license 3948, issued to Eastern Goldfields. Continued exploration on this claim by Tillicum Resources for Eastern Goldfields led to the discovery of anomalous gold (1072 ppb) at Cutwell Harbour. These claims were relinquished by Eastern Goldfields in 1993.

Most rock chip sampling conducted by Tillicum Resources was concentrated within an area less that 20 by 60 meters in dimension with the exception of one sample collected about 100 meters along strike on the mineralized unit. An anomalous gold value of 1072 ppb was returned for one of the clustered samples and a value of 225 ppb for the sample collected 100 meters distant. The 1072 ppb sample is notable as it was not collected from a single site, but over a 10 meter interval. The elevated values indicate potential for economic grades of gold mineralization over significant portions of this unit. Widespread silicification and pyritization coupled with the proximity of a possible source of mineralization in the form of the nearby felsic stock lend further support to this potential.

The clustering of samples taken to date has not delineated the aerial extent nor defined the nature of mineralization. It is known that the region has been subjected to extensive structural deformation so the possibility of vein or stockwork mineralization exists.

Armed with our present understanding of this gold occurrence, the potential for economic mineralization could be evaluated relatively easily through a mapping and sampling program.

No visit to the property has yet been made by us or our consulting geologist.

Recommendations From Our Consulting Geologist

In order to evaluate the exploration potential of the Cutwell Harbour claims, our consulting geologist has recommended on site surface reconnaissance, mapping and sampling to be followed by geochemical analyses of the samples to be taken. The primary goal of the exploration program is to identify sites for additional gold exploration.

|

Exploration Budget

Phase I

|

Exploration Expenditure

|

|

|

Preparation for field, travel & lodging arrangements, base map preparation

|

$ | 700 |

| On site surface reconnaissance, mapping, sampling | $ | 4,900 |

| Geochemical analyses (≈30 samples) | $ | 900 |

| Other expenses and contingency | $ | 4,114 |

|

Total

|

$ | 10,614 |

|

Phase II

|

||

|

On site mapping and sampling

|

$ | 7,000 |

| Geochemical Analyses (≈50 samples) | $ | 1,500 |

| Data compilation and report preparation | $ | 2,800 |

| Other expenses and contingency | $ | 5,467 |

|

Total

|

$ | 16,767 |

|

Total, Phases I and II

|

$ | 27,381 |

While we have not commenced the field work phase of our initial exploration program, we intend to proceed with the initial exploratory work as recommended. We expect that Phase I will begin in the Spring of 2011, with Phase II to begin in the late Summer or Fall of 2011. Upon our review of the results, we will assess whether the results are sufficiently positive to warrant additional phases of the exploration program. We will make the decision to proceed with any further programs based upon our consulting geologist’s review of the results and recommendations. In order to complete significant additional exploration beyond the currently planned Phase I and Phase II, we will need to raise additional capital.

Competition

The mineral exploration industry, in general, is intensely competitive and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves.

Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims. We were incorporated on January 29, 2010 and our operations are not well-established. Our resources at the present time are limited. We may exhaust all of our resources and be unable to complete full exploration of the Cutwell Harbour mineral claims. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and entered into production of the mineral claim if a commercial viable deposit is found to exist.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result our not receiving an adequate return on invested capital.

Compliance with Government Regulation

The main agency that governs the exploration of minerals in the Province of Newfoundland and Labrador is the Department of Natural Resources.

The Department of Natural Resources manages the development of Newfoundland and Labrador’s mineral resources, and implements policies and programs respecting their development while protecting the environment. In addition, the Department regulates and inspects the exploration and mineral production industries in Newfoundland and Labrador to protect workers, the public and the environment.

The material legislation applicable to Queensridge Mining Resources, Inc. is the Mineral Act of Newfoundland and Labrador. Any person who intends to conduct an exploration program on a staked or licensed area must submit prior notice with a detailed description of the activity to the Department of Natural Resources. An exploration program that may result in major ground disturbance or disruption to wildlife or wildlife habitat must have an Exploration Approval from the department before the activity can commence.

We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy any environmental damage caused such as refilling trenches after sampling or cleaning up fuel spills. Our initial exploration program does not require any reclamation or remediation because of minimal disturbance to the ground. The amount of these costs is not known at this time because we do not know the extent of the exploration program we will undertake, beyond completion of the recommended exploration phase described above, or if we will enter into production on the property. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially-economic deposit is discovered.

Employees

We have no employees as of the date of this prospectus other than our president and CEO, Mr. Stromer. We conduct our business largely through agreements with consultants and other independent third party vendors.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

Subsidiaries

We do not currently have any subsidiaries.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

Description of Property

The Cutwell Harbour property is located on Long Island in Notre Dame Bay, on the north coast of Newfoundland, Canada (fig. 1). It comprises 150 hectares (≈ 371 acres), approximately centered at latitude 49° 36’ 55.8" North, longitude 55° 40’ 54.1" West (UTM Zone 21, 595230E – 5496497N). It lies within the area covered by NTS map sheet 02E/12. The boundaries of the property are described as follows: Beginning at the Northeast corner of the herein described parcel of land, and said corner having UTM coordinates of 5 497 000 N, 596 000 E; of Zone 21; thence South 1,000 metres, thence West 1,500 metres, thence North 1,000 metres, thence East 1,500 metres to the point of beginning. All bearings are referred to the UTM grid, Zone 21. NAD27.

Figure 1. Location map of the Cutwell Harbour property

Figure 2. Claim Layout. Cutwell Harbour property shown in green.

Legal Proceedings

We are not currently a party to any legal proceedings. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Our agent for service of process in Nevada is Val-U-Corp Services, Inc., 1802 N. Carson St., #212, Carson City, NV 89701.

Market for Common Equity and Related Stockholder Matters

No Public Market for Common Stock.

There is presently no public market for our common stock. We anticipate making an application for trading of our common stock on the over the counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. We can provide no assurance that our shares will be traded on the bulletin board, or if traded, that a public market will materialize.

The Securities Exchange Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;(b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities' laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price;(d) contains a toll-free telephone number for inquiries on disciplinary actions;(e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and;(f) contains such other information and is in such form, including language, type, size and format, as the Commission shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with; (a) bid and offer quotations for the penny stock;(b) the compensation of the broker-dealer and its salesperson in the transaction;(c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock if it becomes subject to these penny stock rules. Therefore, because our common stock is subject to the penny stock rules, stockholders may have difficulty selling those securities.

Holders of Our Common Stock

Currently, we have thirty (30) holders of record of our common stock.

Rule 144 Shares

None of our common stock is currently available for resale to the public under Rule 144. In general, under Rule 144 as currently in effect, a person who has beneficially owned shares of a company's common stock for at least 180 days is entitled to sell his or her shares. However, Rule 144 is not available to shareholders for at least one year subsequent to an issuer that previously met the definition of Rule 144(i)(1)(i) having publicly filed, on Form 8K, the information required by Form 10.

As of the date of this prospectus, no selling shareholder has held their shares for more than 180 days and it has not been at least one year since the company filed the Form 10 Information on Form 8K as contemplated by Rule 144(i)(2) and (3). Sales under Rule 144 are also subject to manner of sale provisions and notice requirements and to the availability of current public information about the company.

Stock Option Grants

To date, we have not granted any stock options.

Registration Rights

We have not granted registration rights to the selling shareholders or to any other persons.

We are paying the expenses of the offering because we seek to: (i) become a reporting company with the Commission under the Securities Exchange Act of 1934; and (ii) enable our common stock to be traded on the over-the-counter bulletin board. We plan to file a Form 8-A registration statement with the Commission to cause us to become a reporting company with the Commission under the 1934 Act. We must be a reporting company under the 1934 Act in order that our common stock is eligible for trading on the over-the-counter bulletin board. We believe that the registration of the resale of shares on behalf of existing shareholders may facilitate the development of a public market in our common stock if our common stock is approved for trading on a recognized market for the trading of securities in the United States.

We consider that the development of a public market for our common stock will make an investment in our common stock more attractive to future investors. In the near future, in order for us to continue with our mineral exploration program, we will need to raise additional capital. We believe that obtaining reporting company status under the 1934 Act and trading on the OTCBB should increase our ability to raise these additional funds from investors.

Financial Statements

Index to Financial Statements

Audited consolidated financial statements for the fiscal year ended June 30, 2010 including:

Silberstein Ungar, PLLC CPAs and Business Advisors

Phone (248) 203-0080

Fax (248) 281-0940

30600 Telegraph Road, Suite 2175

Bingham Farms, MI 48025-4586

www.sucpas.com

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Queensridge Mining Resources, Inc.

Las Vegas, NV

We have audited the accompanying balance sheet of Queensridge Mining Resources, Inc. as of June 30, 2010, and the related statements of operations, stockholders’ equity, and cash flows for the period from January 29, 2010 (date of inception) to June 30, 2010. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.