Attached files

| file | filename |

|---|---|

| EX-5.0 - MANTHEY REDMOND Corp | v193050_ex5-0.htm |

| EX-23.1 - MANTHEY REDMOND Corp | v193050_ex23-1.htm |

|

As filed with the Securities and Exchange

Commission on August 11, 2010

|

Registration No.

333-161600

|

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment

No. 3 to

FORM

S-1

REGISTRATION

STATEMENT UNDER

THE

SECURITIES ACT OF 1933

MANTHEY

REDMOND CORPORATION

(Exact

name of registrant as specified in its charter)

|

Delaware

|

3510

|

26-4722406

|

||

|

State

or other jurisdiction of

|

Primary

Standard Industrial

|

(I.R.S.

Employer

|

||

|

incorporation

or organization

|

|

Classification

Code Number)

|

|

Identification

Number)

|

10940

Wilshire Boulevard, Suite 1600

Los

Angeles, California 90024

(310)

443-4116

(Address,

including zip code, and telephone number, including area code

of

registrant’s principal executive offices)

Steven

Charles Manthey

10940

Wilshire Boulevard, Suite 1600

Los

Angeles, California 90024

(310)

443-4116

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service)

with copy

to

Lee W.

Cassidy, Esq.

Cassidy

& Associates

215

Apolena Avenue

Newport

Beach, California

202/387-5400 949/673-4525

(fax)

|

Approximate

Date of Commencement

of proposed sale to the public: |

As

soon as practicable after the effective date of this Registration

Statement.

|

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier

registration statement for the same offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, check the following

box and list the Securities Act registration number of the earlier effective

registration statement for the same offering. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definitions “large accelerated filer,”“accelerated

file,” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act. (Check one):

|

Large

accelerated filer

|

¨

|

Accelerated

filed

|

¨

|

|

Non-accelerated

filed

|

¨

|

Smaller

reporting company

|

x

|

CALCULATION OF REGISTRATION

FEE

|

Proposed

|

Proposed

|

|||||||||||||

|

Amount

|

Maximum

|

Maximum

|

Amount

of

|

|||||||||||

|

Title

of Each Class of

|

to

be

|

Offering

Price

|

Aggregate

|

Registration

|

||||||||||

|

Securities to be Registered

|

Registered

|

Per Unit(1)

|

Offering Price

|

Fee (2)

|

||||||||||

|

Common

Stock held by Selling Shareholders

|

3,729,200

shares

|

$ | 0.10 | $ | 372,920 | $ | 14.66 | |||||||

|

Total

|

3,729,200

shares

|

$ | 0.10 | $ | 372,920 | $ | 14.66 | |||||||

|

(1)

|

There

is no current market for the securities and the price at which the Shares

are being offered has been arbitrarily set d by the Company at par value

and used for the purpose of computing the amount of the registration fee

in accordance with Rule 457 under the Securities Act of 1933, as

amended.

|

|

(2)

|

Paid

by electronic transfer.

|

|

The

registrant hereby amends this registration statement on such date or dates

as may be necessary to delay its effective date until the registrant shall

file a further amendment which specifically states that this registration

statement shall thereafter become effective in accordance with section

8(a) of the Securities Act of 1933 or until the registration statement

shall become effective on such date as the Commission acting pursuant to

said section 8(a), may

determine.

|

The

information contained in this prospectus is not complete and may be

changed. A registration statement relating to these securities has

been filed with the Securities and Exchange Commission and these securities may

not be sold until that registration statement becomes effective. This

prospectus is not an offer to sell these securities and it is not soliciting an

offer to buy these securities in any state where the offer or sale is not

permitted.

|

PROSPECTUS

|

Subject

to Completion, Dated ______ ,

2010

|

MANTHEY

REDMOND CORPORATION

3,729,200 shares of

Common Stock

to

be sold by the holders of such stock

This

prospectus relates to 3,729,200 shares of common stock of Manthey Redmond

Corporation ("Manthey Redmond (US)" or the “Company”), a Delaware

company (the “Company”), $.0001 par value per share, to be sold by

the holders of such stock (the "selling shareholders"). The selling

shareholders' shares offered by this Prospectus may be sold from time to time by

the selling shareholders at a price of $0.10 per share until such time as the

Company’s shares are listed on the OTC Bulletin Board or a national exchange and

thereafter at prevailing market prices or at privately negotiated prices, in one

or more transactions that may take place on the over-the-counter market

including ordinary broker's transactions, privately-negotiated transactions or

through sales to one or more dealers for resale of such. Usual and

customary or specifically negotiated brokerage fees or commissions may be paid

by the selling shareholders in connection with such sales.

No

underwriting arrangements have been entered into by any of the selling

shareholders. The selling shareholders and any intermediaries through

whom such securities are sold may be deemed "underwriters" within the meaning of

the Securities Act of 1933, as amended (the "Securities Act") with respect to

the securities offered and any profits realized or commissions received may be

deemed underwriting compensation.

|

Proceeds

to selling

|

|||||||||

|

Assumed

Price

|

shareholders

before

|

||||||||

|

To Public

|

Commissions

|

expenses and commissions

|

|||||||

|

Per

Share

|

$ | 0.10 |

Not

applicable

|

$ | 0.10 | ||||

|

Total

|

$ | 372,920 |

Not

applicable

|

$ | 372,920 | ||||

The

Company will not receive any of the proceeds from the sale of shares by the

selling shareholders. All costs incurred in the registration of the

selling shareholders shares being offered by the selling shareholders are being

borne by the Company.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS

APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR

ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENSE.

These

securities involve a high degree of risk. See “RISK FACTORS”

contained in this prospectus beginning on page __.

10940

Wilshire Boulevard, Suite 1600

Los

Angeles, California 90024

(310)

443-4116

Prospectus

dated __________________, 2010

TABLE

OF CONTENTS

|

Prospectus

Summary

|

4

|

|||

|

Risk

Factors

|

6

|

|||

|

Forward

Looking Statement

|

10

|

|||

|

Use

of Proceeds

|

10

|

|||

|

Determination

of Offering Price

|

11

|

|||

|

Dilution

|

11

|

|||

|

Selling

Shareholders

|

11

|

|||

|

Plan

of Distribution

|

16

|

|||

|

Description

of Securities

|

17 | |||

|

The

Business

|

18 | |||

|

The

Company

|

21 | |||

|

Plan

of Operation

|

26 | |||

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operations

|

27 | |||

|

Management

|

30 | |||

|

Executive

Compensation

|

31 | |||

|

Security

Ownership of Certain Beneficial Owners and Management

|

31 | |||

|

Certain

Relationships and Related Transactions

|

32 | |||

|

Shares

Eligible for Future Sales

|

33 | |||

|

Interest

of Named Experts and Counsel

|

33 | |||

|

Experts

|

33 | |||

|

Disclosure

of Commission Position of Indemnification for Securities Act

Liabilities

|

34 | |||

|

Financial

Statements

|

F-1 | |||

|

Part

II

|

35 | |||

|

Other

Expenses of Issuance and Distribution

|

35 | |||

|

Indemnification

of directors and Officers

|

35 | |||

|

Recent

Sales of Unregistered Securities

|

35 | |||

|

Exhibits

|

37 | |||

|

Signatures

|

40 | |||

Until

_______________, all dealers that effect transactions in these

securities, whether or not participating in this offering, may be required to

deliver a prospectus. This is in addition to the dealers' obligation to deliver

a prospectus when acting as underwriters and with respect to their unsold

allotments or subscriptions.

3

PROSPECTUS

SUMMARY

This

summary highlights some information from this prospectus, and it may not contain

all the information important to making an investment decision. A

potential investor should read the following summary together with the more

detailed information regarding the Company and the common stock being sold in

this offering, including “Risk Factors” and the financial statements and related

notes, included elsewhere in this prospectus.

The

Company

The

Business

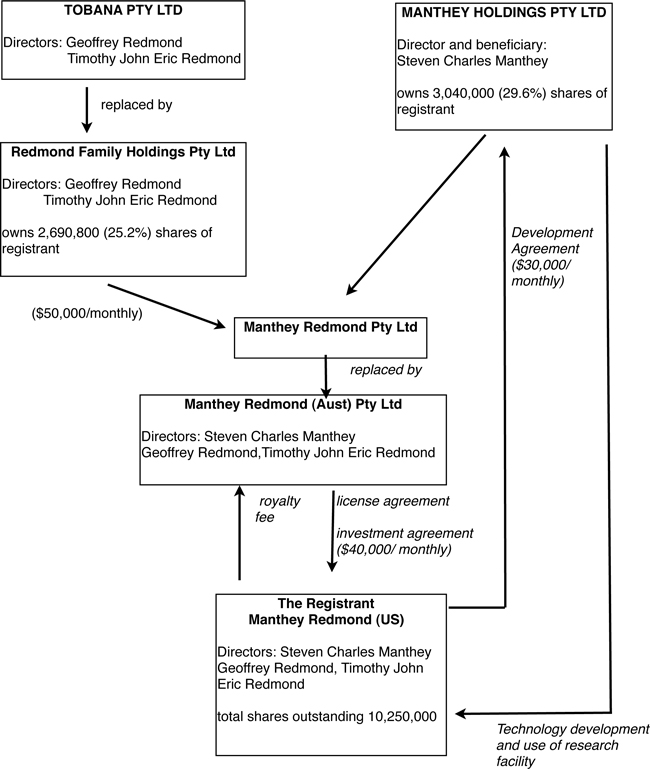

Manthey

Redmond (US) is a development stage company incorporated in Delaware in April,

2009, to exploit and market certain internal combustion engine technology now

leased by it from its Australian affiliate, Manthey Redmond

(Aust). Manthey Redmond (Aust) Pty Ltd., an Australian corporation

("Manthey Redmond (Aust)"), is the patent owner and developer of the technology

and the Manthey Redmond Eco-Engine, a fuel-efficient, lightweight, low-emission,

multi-fuel engine smaller and less expensive than conventional internal

combustion engines initially targeted for marine applications. The

Company has entered into two agreements with Manthey Redmond

(Aust): (i) the licensing agreement for the development, manufacture,

use, sale, and sublicense of the Manthey Redmond Eco-Engine and all developed

technology and products related to the technology (the "Technology") for a

royalty payment to Manthey Redmond (Aust) of 5% of annual gross profits and (ii)

a investment agreement by which Manthey Redmond (Aust) will fund the Company

with monthly payments of $40,000, up to a maximum of $4,200,000 to assist the

Company in its commercialization and development of the

Technology. These two agreements and the development agreement

discussed below are with Australian affiliates that are owned and controlled by

the officer and directors of the Company.

Manthey

Redmond (US) has also entered into a development agreement with Manthey Holdings

Pty Limited for the non-exclusive use of Manthey Holdings'

engineering facility and employees for research and development of and related

to the Technology for a monthly fee of $30,000. Manthey Holdings is a

29.6% shareholder in the Company. The Company anticipates that it

will endeavor to form co-development agreements and/or license agreements to

succeed the development agreement. However, in the event that such

relationships are not developed or not developed sufficiently to manufacture and

develop the engines, the Company maintains a direct relationship with the

Manthey Holding's facility which contemplates the possible extension of the

development agreement.

Although

the Technology is leased from an Australian company and the research and

development facility is outsourced to Australia, Manthey Redmond (US) intends to

market the Technology principally in the United States and will seek to form

alliances with U.S. based manufacturers for such market

development. The Company will, at least initially, utilize the

facilities of its Australian affiliate for the research, design and development

of the Technology but the focus of such research, design and development will be

for use and success of the Technology and Eco-Engine in the American

market. Although outsourcing the research and manufacturing., the

Company anticipates building its sales and marketing network in the United

States with a business plan and focus directed to the U.S. market.

In

addition to the revenue provided by Manthey Redmond (Aust), Manthey Redmond (US)

will seek to raise revenue through co-development and co-licensing agreements

with manufacturers principally located in the United States. Manthey

Redmond (US) intends to market and sell the Manthey Redmond Eco-Engines in the

United States and to develop the sale of such engines for use in the stationary

generator market in the United States. To develop such market,

Manthey Redmond (US) intends to commence private demonstrations of its prototype

engines targeted to manufacturers of internal combustion engines, government

agencies engaged in internal combustion engine research and development, and

other consumers, including governmental, of internal combustion

engines. The Company has not entered into any co-development or

co-licensing agreements with manufacturers in the United States as of the date

of this prospectus.

The

Company anticipates that Steven Manthey, President of the Company, will conduct

most of such demonstrations. Steven Manthey resides outside the

United States and when he is not in the U.S., the business operations of the

Company are conducted outside the U.S. as well. Likewise, prototypes

built pursuant to the Development Agreement will be built in Australia until

transported to the United States for the demonstrations or pursuant to a sale or

other commercial agreement. Accordingly, the Company has no assets in

the United States as of the date of this prospectus but maintains an executive

office suite in Los Angeles, California, to develop as its American company

headquarters.

4

By

securing the use of the research and development facility, Manthey Redmond (US)

will be able to develop prototypes tailored to specific applications, such as

the stationary generator market, outboard and inboard marine market, heavy

freight vehicle market, construction vehicle market and agricultural vehicle

market. The research and development facility has the capability to

manufacture these tailored products on a commercial scale thereby allowing

Manthey Redmond (US) to market and sell the engines directly without utilizing

other manufacturers. Management realizes possible inherent

limitations associated with having a facility situated in Australia, but it

believes that it can initially meet production requirements from this facility

and as demand increases, it can establish manufacturing facilities within the

United States.

The

Agreements

The two

agreements with Manthey Redmond (Aust) contain no restrictions on the Company on

how to develop and commercialize the Technology but pursuant to the patent

licensing agreement the Company is obligated to cover all costs associated with

the protection of the Technology including patent application and maintenance

fees. The Company is not obligated to use funds received under the

investment agreement to pay obligations owed under the patent license agreement

or development agreement if it were able to raise funds

elsewhere. However, until such time as the Company can develop

another source of revenue to meet its patent license and development agreement

obligations, it will be necessary for it to use the funds from the investment

agreement to pay those obligations. Pursuant to the development

agreement with Manthey Holdings, the Company is obligated to fund the ongoing

development of the Technology by its inventor, Steven Charles Manthey, the

president and a director of the Company. The development agreement

with Manthey Holdings not only secures the non-exclusive use of a development

facility, but also ensures the ongoing involvement of Steven Charles Manthey,

its sole director and shareholder. Payments under the development

agreement to Manthey Holdings were scheduled to commence in November, 2009 to

coincide with the delivery of the newest prototype. The agreement is subject

to and governed by the law of Queensland, Australia. For the period

from April 20, 2009 (inception) through March 31, 2010, the Company incurred

$131,000 of service fees pursuant to the amended Development Agreement, $37,773

of which was paid during the period, while the remaining $93,227 was recorded as

accrued expense as of March 31, 2010.

Steven

Charles Manthey is the president and a director of the Company and beneficial

owner of 29.6% of the Company's outstanding shares. He is also the

sole officer, director and shareholder of Manthey Holdings, the company with

which the Company has the development agreement.

In regard

to Manthey Redmond (Aust), the source of the Company's current funding, and

Manthey Redmond (US) the board of directors of each company is identical, namely

consisting of Steven Charles Manthey, Geoffrey Redmond and Timothy John Eric

Redmond. In addition, 82.8% of the outstanding shares of the Company

are beneficially owned by Steven Charles Manthey (29.6%) and Timothy and

Geoffrey Redmond (53.2%) whom are also the sole beneficial owners of Manthey

Redmond (Aust).

Until

such time as Manthey Redmond (US) is able to enter into co-development or

co-licensing agreements or to develop a sales market for its engines, it is

financially reliant on the funding provided by the agreements entered into with

Manthey Redmond (Aust).

Given

that the composition of the boards of directors of Manthey Redmond (Aust) and

Manthey Redmond (US) is identical, there is a risk that the directors could vary

or cancel the terms of the Investment Agreement by which Manthey Redmond

receives its current funding and thereby compromise the capacity of Manthey

Redmond (US) to continue its development and operations if it has not by such

time secured other sources of revenue.

The

principal offices of the Company are located at 10940 Wilshire Boulevard, Suite

1600, Los Angeles, California 90024 and its telephone number is

310/443-4116.

5

The

Technology

The

Manthey Redmond Eco-Engine is a newly-developed, patented, fuel-efficient,

lightweight, low-emission, multi-fuel engine smaller and less expensive than

conventional internal combustion engines. The Technology will be

initially targeted for use in marine engines, by both inboard and outboard

engines but is also applicable to, and will be marketed to, the stationary

generator market, heavy freight vehicle market, construction vehicle market and

agricultural vehicle market. During the two years in development,

three prototypes of the Technology have been produced with the fourth prototype

to be available for demonstration in the U.S. market in November,

2009. The two year development period has been supervised by the

inventor of the Technology (Steven Charles Manthey) and the three prototypes

have operated without any critical component failure. Like other

newly-developed technology, the Technology runs the risk that the ultimate level

of advancement from development will not be sufficiently superior to existing

technology to warrant market place advantage. Management believes,

from the results of its prototype testing and comparison of the Technology to

current internal combustion engines, that internal combustion engines developed

from the Technology are capable of halving the size of internal combustion

engines currently available in the market and dramatically reducing the

weight. Management believes that the Technology's sustainable

advantage arises from the reduction in uses of natural resources to build and

fuel internal combustion engines and the related reduction in

emissions.

Trading

Market

Currently,

there is no trading market for the securities of the Company. The

Company intends to initially apply for admission to quotation of its securities

on the OTC Bulletin Board. There can be no assurance that the Company

will qualify for quotation of its securities on the OTC Bulletin

Board. See

“RISK FACTORS” and “DESCRIPTION OF SECURITIES”.

The

Offering

Sixty-two

shareholders of the Company are offering up to 3,729,200 shares of common stock

held by them ("the Shares"). These Shares are offered at a sales

price of $0.10 until such time as the Company's common stock is quoted on the

OTC Bulletin Board after which time such selling shareholders may sell their

shares at prevailing market or privately negotiated prices, in one or more

transaction that may take place on the over-the-counter market including

ordinary broker's transactions, privately-negotiated transactions or through

sales to one or more dealers for resale. Usual and customary or

specifically negotiated brokerage fees or commissions may be paid by the selling

shareholders in connection with such sales.

|

Common

stock outstanding before the offering

|

10,250,000

|

|

|

Common

Stock offered by selling shareholders

|

3,729,200

|

|

|

Proceeds

to Manthey Redmond (US)

|

Manthey

Redmond (US) will not receive any proceeds from the sale of the shares by

selling shareholders.

|

Summary

Financial Information

The

following summary financial data should be read in conjunction with additional

discussions of the financial status of the Company and the Financial Statements

and Notes thereto, included elsewhere in this prospectus. The Company

was formed on April 20, 2009 and is a development stage company with no

operating revenues or profits. At March 31, 2010 and December 31, 2009, the

Company had $41 and $4,455cash in bank accounts,

respectively. Company has entered into an investment agreement with

Manthey Redmond (Aust) by which the Company receives a monthly investment amount

of $40,000. The Company has also entered into an agreement with

Manthey Holdings Pty Limited for the use of its research facilities and staff at

a monthly fee of $30,000.

RISK

FACTORS

A

purchase of any Shares is an investment in the Company’s common stock and

involves a high degree of risk. Investors should consider carefully the

following information about these risks, together with the other information

contained in this prospectus, before the purchase of the Shares. If

any of the following risks actually occur, the business, financial condition or

results of operations of the Company would likely suffer. In this case, the

market price of the common stock could decline, and investors may lose all or

part of the money they paid to buy the Shares.

6

The

Company is a development-stage company with no operating history of its own and

as such an investor cannot assess the Company’s profitability or

performance.

Because

the Company is a development-stage company with no operating history, it is

impossible for an investor to assess the performance of the Company or to

determine whether the Company will meet its projected business

plan. The Company has limited financial results upon which an

investor may judge its potential. The likelihood of its success must be

considered in light of the problems, expenses, difficulties, complications and

delays frequently encountered by a small developing company starting a new

business enterprise and the highly competitive environment in which it will

operate. Since Manthey Redmond does not have an operating history, it cannot

assure an investor that its business will be profitable or that it will ever

generate sufficient revenues to meet our expenses and support its anticipated

activities.

The

Investment Agreement between the Company and Manthey Redmond (Aust) Pty Ltd is

governed by and enforceable under the laws of Queensland, Australia and the

Company's officer and directors control Manthey Redmond (Aust), therefore if

Manthey Redmond (Aust) were to breach its agreement to fund the Company there

may be little or no likelihood that the officer and director would seek its

enforcement and even if they chose to so enforce such enforcement of the $40,000

monthly investment payment may be difficult or impossible.

Pursuant

to the investment contract between the Company and Manthey Redmond (Aust) Pty

Ltd, Manthey Redmond (Aust) makes a monthly payment to the Company of $40,000

for assistance in the development and commercialization of the

Technology. Should Manthey Redmond (Aust) Pty Ltd stop making or

reducing such investment payments, the Company would be required to enforce the

contract in Queensland, Australia and such enforcement may be too costly for the

Company to undertake. Also, because the directors and controlling

shareholders of Manthey Redmond (Aust) are also the directors of the Company, a

conflict may exist and the directors of the Company may determine, in breach of

their duty to the Company, not to attempt to enforce the Investment

Agreement. In addition, if the Company determined to enforce the

contract in Queensland, Australia, it may be at a significant disadvantage as

such long distance legal matter may be difficult to pursue and difficult to

obtain a favorable judgment. The loss of funding source for the

Company would impact its ability to proceed with its business plan in developing

and marketing the commercial applications of the Eco-Engine and developing

additional technology.

Previous

payments made by the Redmond Family Holdings provide no assurance that such

payments will continue.

Redmond

Family Holdings has provided at least $50,000 per month to Manthey Redmond

(Aust). This payment is the source of funds by which Manthey Redmond

(Aust) intends to meet its contractual obligation pursuant to the Investment

Agreement to fund the Company $40,000 per month. History of the

payments by the Redmond Family Holdings is not a guarantee such payments will

continue. Unforeseen circumstances or other changes may, for whatever

reason, make the Redmond Family Holdings unable or unwilling to continue such

monthly payments. As noted above, the Company has a contractual right

to the continuation of these payments, but enforcement of such contract may be

difficult if not impossible if such contract were breached.

The

success of the development and manufacturing of the Technology and related

internal combustion engines by the Company is unknown and contains many inherent

risks.

The

company is dependent upon the performance and ultimate marketability of the

Technology which is untested in the market place. The continuing

development stage of the Technology and related internal combustion engines may

reveal failures in the Technology presently unknown and unanticipated by the

Company and that can not be resolved with adequate research and development.

Such failures may not be immediately readily apparent and may occur only after

engines are placed in different applications or different climates throughout

the world. Likewise, at the manufacturing stage, development and/or

cost issues may arise presently unknown or unanticipated by the Company that

render the production of engines based on the Technology on a commercial scale

impractical.

7

The

Company may not be able to market the Technology as easily and readily as it

currently anticipates.

The

internal combustion engine market is a highly competitive market and new

technology related to the internal combustion engine attempting to make engines

more fuel efficient and more economical appears on the market

frequently. The successful marketing of the Technology will depend on

the ability of the Company to demonstrate sustainable advantages over existing

proven and other newly developed technology and the ability of the Company to

fund the marketing of these advantages. The Company believes that its

Technology is highly competitive and provides provable and sufficient advantages

but the Company cannot predict what new technology is being developed that may

impact on the Company's Technology and make it less attractive.

The

controlling directors and beneficial shareholders of Manthey Redmond (Aust) Pty

Ltd are the directors and officers of the Company which creates a conflict of

interest.

The

directors and beneficial and controlling shareholders of Manthey Redmond (Aust)

are Steven Charles

Manthey, Timothy John Eric Redmond and Geoffrey Redmond who are also the

directors of the Company. As such they control the actions of Manthey

Redmond (Aust). If for any reason, they should determine not to

continue the research, development and commercialization of the Manthey Redmond

Eco-Engine, they could effect Manthey Redmond (Aust) board action to terminate

or breach the agreements with the Company providing the monthly investment of

$40,000 and the licensing rights to the patent Eco-Engine and Technology; and as

directors of the Company, they would also be in a position to determine whether

to pursue legal enforcement of either or both of the agreements. In effect, they

could breach the development agreement and/or the patent licensing agreement

with the Company with no likely enforcement actions. As directors of

the Company, Messrs. Redmond and Mr. Manthey have an obligation and duty to act

in the best interests of the Company and make the best business judgment for it;

however, they each have this same duty and obligation to Manthey Redmond (Aust)

as directors of it as well and a breach of the agreements with the Company may

be in the best interests and be the best business judgment for that company

despite its ramifications to the Company. This would result in a

conflict between the two companies and the directors would be in a position to

have to assist one at the expense of the other.

The

sole officer and two directors of the Company beneficially own and will continue

to own a majority of the Company's common stock and, as a result, can exercise

control over shareholder and corporate actions.

The three

directors (one of whom is the sole officer) of the Company own 57.7% of the

Company's outstanding common stock. As such, they are able to control

matters requiring approval by shareholders, including the election of directors

and approval of significant corporate transactions. A director is

required to act in the best interest of the company and to make his best

business judgments based on such best interests of the company in approving

corporate actions. As a director, and when voting on matters under

consideration by the board of directors, the directors have a duty to act in the

best interests of the Company; there is no such required duty when acting as

shareholders or voting on matters under consideration by

shareholders.

The

directors and executive officers all reside outside the United States which may

inhibit the ability of investors to bring any legal action or to enforce or

collect on any favorable judgement that in such case may be

received.

All the

directors and the executive officer of the Company reside outside of the United

States which may compromise the ability of investors to enforce their legal

rights or effect service of process upon directors or executive officer or

enforce civil or criminal judgments of United States courts against the Company,

its directors or executive officer. Likewise, other than the cash on hand, as

of the date of the registration statement, the Company has no assets

in the United States. In addition, the Company's licensed research

facility is located outside the United States and the jurisdiction of the United

States legal system. This may render any monetary penalty (whether

civil or criminal in nature) obtained by any investor for any reason against the

Company or any of its directors or executives difficult if not impossible to

enforce.

8

As

the Technology licensed by the Company is not protected by patent, the Company

may find it difficult to protect it or additional developments based on the

Technology and competitors or others may develop or copy similar

technology.

The

Technology licensed by the Company is not protected by a

patent. There is no such thing as a world patent and the issuance of

a patent in Australian does not necessarily prohibit others from using or

developing the same technology. To protect its intellectual property, the

Company will need to secure patent protection for the Technology under the

Patent Cooperation Treaty (PCT) and also lodge separate patent applications in

countries that are not members of the PCT. Under the PCT, member states, which

include the United States and Australia, may initially lodge one application and

all member states will recognize this application as recording a "priority date"

for the invention. The Company has leased Technology that is the subject of a

provisional patent lodged in Australia and as Australia is a member of the PCT,

the Company's leased intellectual property can be secured by the prosecution of

a full patent application under the PCT process. Should the PCT process not be

correctly prosecuted, the Company may fail to secure a patent for the Technology

in all jurisdictions covered under the PCT and this could give rise to

commercial harm. Likewise, if the Company becomes unable to fund the prosecution

of the PCT process, or fund patent application process in non-member countries,

the Company would fail to secure ongoing patent protection for the Technology

and this could give rise to commercial harm. Moreover, to mitigate against the

risk of circumvention of its intellectual property, the Company will need to

ensure that all initial demonstrations of the technology are conducted on a

private and confidential basis and that confidentiality agreements are entered

into with

organizations

seeking to view and evaluate the Technology.

The

Company is a development stage company and has a correspondingly small financial

and accounting organization. Being a public company may strain the Company's

resources, divert management’s attention and affect its ability to attract and

retain qualified directors.

The

Company is a development stage company with a newly formed and developing

finance and accounting organization; the rigorous demands of being a public

reporting company will require a large and experienced finance and accounting

group. As a public company, the Company will be subject to the reporting

requirements of the Securities Exchange Act of 1934. The requirements of these

laws and the rules and regulations promulgated thereunder entail significant

accounting, legal and financial compliance costs, and have made, and will

continue to make, some activities more difficult, time consuming or costly and

may place significant strain on the Company's personnel, systems and

resources.

The

Securities Exchange Act requires, among other things, that the Company maintain

effective disclosure controls and procedures and internal control over financial

reporting. In order to establish the requisite disclosure controls and

procedures and internal control over financial reporting, significant resources

and management oversight are required. As a result, management’s attention may

be diverted from other business concerns, which could have a material adverse

effect on the Company's business, financial condition and results of

operations.

These

rules and regulations may also make it difficult and expensive for the Company

to obtain director and officer liability insurance. If the Company is unable to

obtain adequate director and officer insurance, its ability to recruit and

retain qualified officers and directors, especially those directors who may be

deemed independent, will be significantly curtailed.

Government

regulation could negatively impact the technology.

The

Manthey Redmond Eco-Engine has been developed to comply and surpass

environmental standards and regulations for air, water and noise as

well as meet and surpass regulations and guidelines for fuel efficiency and

consumption. However, unforeseen changes in these regulations and

standards could have an impact on the business if any such changes were not able

to be met by the Eco-Engine.

9

There has been no prior public market

for the Company’s Shares and the lack of such a market may make resale of the

stock difficult.

No prior

public market has existed for the Company’s securities and the Company cannot

assure any investor that a market will develop subsequent to this

offering. An investor must be fully aware of the long-term nature of

an investment in the Company. The Company intends to apply for

quotation of its common stock on the OTC Bulletin Board. However, the

Company does not know if it will be successful in such application, how long

such application will take, or, that if successful, that a market for the common

stock will ever develop or continue on the OTC Bulletin Board. If for any reason

the common stock is not listed on the OTC Bulletin Board or a public trading

market does not otherwise develop, investors in the offering may have difficulty

selling their common stock should they desire to do so. If the

Company is not successful in its application for quotation on the OTC Bulletin

Board, it will apply to have its securities quoted by the Pink OTC

Markets, Inc., real-time quotation service for over-the-counter

equities.

The

Company does not intend to pay dividends to its stockholders, so investors will

not receive any return on investment in the Company prior to selling their

interest in it.

The

Company does not project paying dividends but anticipates that it will retain

future earnings for funding the Company’s growth and

development. Therefore, investors should not expect the Company to

pay dividends in the foreseeable future. As a result, investors will

not receive any return on their investment prior to selling their Shares in the

Company, if and when a market for such Shares develops. Furthermore,

even if a market for the Company’s securities does develop, there is no

guarantee that the market price for the shares would be equal to or more than

the initial per share investment price paid by any investor. There is

a possibility that the shares could lose all or a significant portion of their

value from the initial price paid in this offering.

The

Company’s stock may be considered a penny stock and any investment in the

Company’s stock will be considered a high-risk investment and subject to

restrictions on marketability.

If the

Shares commence trading, the trading price of the Company's common stock may be

below $5.00 per share. If the price of the common stock is below such

level, trading in its common stock would be subject to the requirements of

certain rules promulgated under the Securities Exchange Act of 1934, as

amended. These rules require additional disclosure by broker-dealers

in connection with any trades generally involving any non-NASDAQ equity security

that has a market price of less than $5.00 per share, subject to certain

exceptions. Such rules require the delivery, before any penny stock

transaction, of a disclosure schedule explaining the penny stock market and the

risks associated therewith, and impose various sales practice requirements on

broker-dealers who sell penny stocks to persons other than established customers

and accredited investors (generally institutions). For these types of

transactions, the broker-dealer must determine the suitability of the penny

stock for the purchaser and receive the purchaser’s written consent to the

transactions before sale. The additional burdens imposed upon

broker-dealers by such requirements may discourage broker-dealers from effecting

transactions in the Company’s common stock which could impact the liquidity of

the Company’s common stock.

Forward-Looking

Statements

This

prospectus contains, in addition to historical information, certain information,

assumptions and discussions that may constitute forward-looking statements. Such

statements are subject to certain risks and uncertainties which could cause

actual results to differ materially than those projected or

anticipated. Actual results could differ materially from those

projected in the forward-looking statements. Although the Company believes its

assumptions underlying the forward-looking statements are reasonable, the

Company cannot assure an investor that the forward-looking statements set out in

this prospectus will prove to be accurate. The Company’s businesses

can be affected by, without limitation, such things as natural disasters,

economic trends, international strife or upheavals, consumer demand patterns,

labor relations, existing and new competition, consolidation, and growth

patterns within the industries in which the Company competes and any

deterioration in the economy may individually or in combination impact future

results.

USE

OF PROCEEDS

The

Company will not receive any proceeds from the sale of the Shares by the selling

shareholders.

10

DETERMINATION

OF OFFERING PRICE

There is

no public market for the Company’s common stock and the price at which the

Shares are being offered has been arbitrarily determined by the Company based on

the Company’s belief in its internal projections, anticipated growth and market

potential. This price does not necessarily bear any direct

relationship to any assets, operations, book or other established

criteria of value of the Company but represents solely the opinion of management

that the Company will be able to develop and market the Eco-Engine and other

technology and that such engine will be successful in its

application. Other than cash on hand and value that one may ascribe

to Lease Agreement, the Company has no assets and no current

operations. The Company issued 10,250,000shares of common stock at

par ($.0001) for an aggregate of $1,025.

DIVIDEND

POLICY

The

Company does not anticipate that it will declare dividends in the foreseeable

future but rather intends to use any future earnings for the development of the

business.

DILUTION

The

common stock to be sold by the selling shareholders is common stock that is

already issued and outstanding. The Company will not be issuing any

additional shares of common stock as part of this offering nor will the Company

be receiving any funds from the sale of any shares. The sale of the

shares will not result in any diminution or increase in net tangible book value

to the Company and consequently there will be no dilution to investors or

shareholders.

SELLING

SHAREHOLDERS

The

Company is registering for offer and sale by 62 holders thereof 3,729,200 shares

of common stock held by such shareholders.

The

Company will not receive any proceeds from the sale of the

Shares. The selling shareholders have no agreement with any

underwriters with respect to the sale of the Shares. The selling

shareholders may from time to time offer their Shares through underwriters,

dealers or agents, which may receive compensation in the form of underwriting

discounts, concessions or commissions from them and/or the purchasers of the

Shares for whom they may act as agents. The selling shareholders and

any agents, dealers or underwriters that participate in the distribution of the

Shares may be deemed to be "underwriters" under the Securities Act and any

profit on the sale of the Shares by them and any discounts, commissions or

concessions received by any such underwriters, dealers or agents might be deemed

to be underwriting discounts and commissions under the Securities

Act.

All the

Shares registered hereby will become tradeable on the effective date of the

registration statement of which this prospectus is a part.

11

The

following table sets forth ownership of the shares held by each person who is a

selling shareholder.

|

Owned Before the Offering

|

Offered Herein

|

After the Offering (2)

|

||||||||||||||||||

|

Number

|

Percentage

|

Number

|

Shares

|

Percentage

|

||||||||||||||||

|

Name and Address

|

of Shares

|

Of Class (1)

|

of Shares

|

Owned

|

Of Class (3)

|

|||||||||||||||

|

A

& J Stone Trust

A

& J Stone Holdings, Trustee(1)

|

290,000 | 2 | % | 290,000 | 0 | 0 | % | |||||||||||||

|

Nau

Toutai Ahovelo

|

650 | * | 650 | 0 | 0 | % | ||||||||||||||

|

4

Antrim Street

|

||||||||||||||||||||

|

Hebersham,

NSW Australia 2770

|

||||||||||||||||||||

|

Allied

Securities Inc (2)

|

200,000 | 1.9 | % | 200,000 | 0 | 0 | % | |||||||||||||

|

Vicky

Narelle Baker and

|

||||||||||||||||||||

|

Stephen

James Baker

|

10,000 | * | 10,000 | 0 | 0 | % | ||||||||||||||

|

11

Mace Drive

|

||||||||||||||||||||

|

Buderim,

QLD Australia 4556

|

||||||||||||||||||||

|

Paul

Battisti and

|

||||||||||||||||||||

|

Samantha

Battisti

|

13,000 | * | 13,000 | 0 | 0 | % | ||||||||||||||

|

11a

Helen Court

|

||||||||||||||||||||

|

Castle

Hills, NSW, Australia 2154

|

||||||||||||||||||||

|

Peter

Bottele Superannuation Fund,

|

||||||||||||||||||||

|

Peter

and Tess Bottele, Trustee

|

16,250 | * | 16,250 | 0 | 0 | % | ||||||||||||||

|

Level

1, 65 Kembla Street

|

||||||||||||||||||||

|

Wollongong,

NSW, Australia 2500

|

||||||||||||||||||||

|

Drago

Bozic

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

83

Eastern Avenue

|

||||||||||||||||||||

|

Kingsford,

NSW, Australia 2032

|

||||||||||||||||||||

|

Tobias

Essington Breen

|

100,000 | * | 100,000 | 0 | 0 | % | ||||||||||||||

|

60-62

Alexander Avenue

|

||||||||||||||||||||

|

Taren

Point, NSW, Australia 2229

|

||||||||||||||||||||

|

The

Byron Real Estate

|

||||||||||||||||||||

|

Consulting

Group Pty(3)

|

290,000 | 2 | % | 290,000 | 0 | 0 | % | |||||||||||||

|

310

Olsen Avenue

|

||||||||||||||||||||

|

Parkwood,

QLD Australia 4212

|

||||||||||||||||||||

|

Alexsandar

Citroski

|

26,000 | * | 26,000 | 0 | 0 | % | ||||||||||||||

|

48

Dalpra Crescent

|

||||||||||||||||||||

|

Bossley

Park, NSW Australia 2176

|

||||||||||||||||||||

|

Peter

Geoffrey Craig

|

100,000 | * | 100,000 | 0 | 0 | % | ||||||||||||||

|

John

Daniels

|

160,000 | 1.5 | % | 160,000 | 0 | 0 | % | |||||||||||||

|

Peter

Darcy

|

10,000 | * | 10,000 | 0 | 0 | % | ||||||||||||||

|

Gaiu

Dinu

|

650 | * | 650 | 0 | 0 | % | ||||||||||||||

|

Martin

Dunning

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

PO

Box 129

|

||||||||||||||||||||

|

Caringbah,

NSW, Australia 2229

|

||||||||||||||||||||

|

Maureen

Egan

|

4,550 | * | 4,550 | 0 | 0 | % | ||||||||||||||

|

7

Phoenix Crescent

|

||||||||||||||||||||

|

Erskine

Park, NSW Australia 2759

|

||||||||||||||||||||

|

Con

and Vick Elfes

|

40,000 | * | 40,000 | 0 | 0 | % | ||||||||||||||

|

307a

Port Hacking Road

|

||||||||||||||||||||

|

Miranda,

NSW, Australia 2228

|

||||||||||||||||||||

12

|

Kevin

Ellem and Beryl Ellem

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

5

Golf Street

|

||||||||||||||||||||

|

Tamworth,

NSW, Australia 2340

|

||||||||||||||||||||

|

Ferriter

Super Fund

|

||||||||||||||||||||

|

Paul

Ferriter Pty Ltd, Trustee(4)

|

133,000 | 1.3 | % | 133,000 | 0 | 0 | % | |||||||||||||

|

Fock

Family Superannuation Fund,

|

||||||||||||||||||||

|

Zugspitze

Holdings Pty, Trustee(5)

|

16,250 | * | 16,250 | 0 | 0 | % | ||||||||||||||

|

Level

1, 65 Kembla Street

|

||||||||||||||||||||

|

Wollongong,

NSW, Australia 2500

|

||||||||||||||||||||

|

Anna

Gamulin

|

3,250 | * | 3.250 | 0 | 0 | % | ||||||||||||||

|

11/39-241

Doncaster Avenue

|

||||||||||||||||||||

|

Kensington,

NSW, Australia 2033

|

||||||||||||||||||||

|

GJA

Developments Pty Ltd(6)

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

PO

Box 1289

|

||||||||||||||||||||

|

Castle

Hill, NSW, Australia 1765

|

||||||||||||||||||||

|

Nathan

Ghosn

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

6

Nymboida Crescent

|

||||||||||||||||||||

|

Sylvania

Waters, NSW, Australia 2224

|

||||||||||||||||||||

|

Global

IP Traders Corporation(7)

|

380,000 | 4 | % | 380,000 | 0 | 0 | % | |||||||||||||

|

PO

Box 2588

|

||||||||||||||||||||

|

Burleigh

Heads, QLD, Australia 4220

|

||||||||||||||||||||

|

Elly

Marie Hohai

|

100,000 | * | 100,000 | 0 | 0 | % | ||||||||||||||

|

PO

Box 2588 Burleigh Heads

|

||||||||||||||||||||

|

Burleigh

Heads, QLD Australia 4213

|

||||||||||||||||||||

|

Brandon

Howard

|

650 | * | 650 | 0 | 0 | % | ||||||||||||||

|

Donald

Jessup

|

1,500 | * | 1,500 | 0 | 0 | % | ||||||||||||||

|

Geoffrey

Alan Johnston

|

||||||||||||||||||||

|

and

Ada Ida Stella Johnston

|

10,000 | * | 10,000 | 0 | 0 | % | ||||||||||||||

|

31

Belrose Boulevard

|

||||||||||||||||||||

|

Varsity

Lakes, QLD Australia 4220

|

||||||||||||||||||||

|

Sharyn

Alayne Johnston

|

84,000 | * | 84,000 | 0 | 0 | % | ||||||||||||||

|

34

Tribulation Circuit

|

||||||||||||||||||||

|

Buderim,

QLD Australia 4556

|

||||||||||||||||||||

|

Jodie

Manthey

|

1,500 | * | 1,500 | 0 | 0 | % | ||||||||||||||

|

Sally

Manthey

|

1,500 | * | 1,500 | 0 | 0 | % | ||||||||||||||

|

533

Bonogin Road

|

||||||||||||||||||||

|

Bonogin,

QLD Australia 4213

|

||||||||||||||||||||

|

Sylvania

Marina

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

25

Harrow Street

|

||||||||||||||||||||

|

Sylvania,

NSW, Australia 2224

|

13

|

Marko

Matach

|

3,250 | * | 3,250 | 0 | 0 | % | ||||||||||||||

|

48a

Olola Avenue

|

||||||||||||||||||||

|

Vaucluse,

NSW, Australia 2030

|

||||||||||||||||||||

|

Losh

Hazen Matthews

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

58

Flora Street

|

||||||||||||||||||||

|

Kirrawee,

NSW Australia 2232

|

||||||||||||||||||||

|

Peter

McDonald

|

100,000 | * | 100,000 | 0 | 0 | % | ||||||||||||||

|

Neilson

Family Trust

|

||||||||||||||||||||

|

Filmduke

Pty Limited, Trustee(8)

|

32,500 | * | 32,500 | 0 | 0 | % | ||||||||||||||

|

Level

1, 65 Kembla Street

|

||||||||||||||||||||

|

Wollongong,

NSW, Australia 2500

|

||||||||||||||||||||

|

Newstew

Family Trust,

|

||||||||||||||||||||

|

Newstew

Pty Ltd , Trustee(9)

|

32,500 | * | 32.500 | 0 | 0 | % | ||||||||||||||

|

Level

1, 65 Kembla Street

|

||||||||||||||||||||

|

Wollongong,

NSW, Australia 2500

|

||||||||||||||||||||

|

Arthur

and Con Nicolis

|

39,000 | * | 39,000 | 0 | 0 | % | ||||||||||||||

|

11

Brisbane Street

|

||||||||||||||||||||

|

Chifley,

NSW Australia 2036

|

||||||||||||||||||||

|

Chad

Parrish

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

10

Vista Place

|

||||||||||||||||||||

|

Little

Hartley, NSW, Australia 2790

|

||||||||||||||||||||

|

Elizabeth

Paskoski

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

48

Dalpra Crescent

|

||||||||||||||||||||

|

Bossley

park, NSW Australia 2176

|

||||||||||||||||||||

|

Branko

Jose Paunovic

|

362,500 | 3.5 | % | 362,500 | 0 | 0 | % | |||||||||||||

|

Vasil

Perovski

|

3,600 | * | 3,600 | 0 | 0 | % | ||||||||||||||

|

4

Fiddick Place

|

||||||||||||||||||||

|

Menai,

NSW, Australia 2234

|

||||||||||||||||||||

|

Mladenko

Radas

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

18

Allwood Crescent

|

||||||||||||||||||||

|

Lugano,

NSW, Australia 2210

|

||||||||||||||||||||

|

Kim

Redmond-Fewtrell

|

71,500 | * | 71,500 | 0 | 0 | % | ||||||||||||||

|

261

Woolooware Road

|

||||||||||||||||||||

|

Cronulla,

NSW Australia 2230

|

||||||||||||||||||||

|

Joshua

Redmond

|

9,500 | * | 9,500 | 0 | 0 | % | ||||||||||||||

|

4

Fitzroy Place

|

||||||||||||||||||||

|

Sylvania

Waters, NSW, Australia 2224

|

||||||||||||||||||||

|

Anne

Rice

|

3,250 | * | 3,250 | 0 | 0 | % | ||||||||||||||

|

2

Great Western Highway

|

||||||||||||||||||||

|

Emu

Plains, NSW Australia 2750

|

14

|

Marsha

Roberts

|

1,950 | * | 1,950 | 0 | 0 | % | ||||||||||||||

|

39b

Gilba Road

|

||||||||||||||||||||

|

Girraween,

NSW, Australia 2145

|

||||||||||||||||||||

|

Amanda

Scuglia

|

650 | * | 650 | 0 | 0 | % | ||||||||||||||

|

33

Roper Road

|

||||||||||||||||||||

|

Colyton,

NSW Australia 2760

|

||||||||||||||||||||

|

Anthony

Stefanac

|

400,000 | 3.9 | % | 400,000 | 0 | 0 | % | |||||||||||||

|

Julieanne

Stone

|

5,200 | * | 5,200 | 0 | 0 | % | ||||||||||||||

|

4

Brown Place

|

||||||||||||||||||||

|

Baulkham

Hills, NSW Australia 2153

|

||||||||||||||||||||

|

Janja

Studenovic

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

9/113

Doncaster Avenue

|

||||||||||||||||||||

|

Kensington,

NSW, Australia 2154

|

||||||||||||||||||||

|

Nada

Studenovic

|

3,250 | * | 3,250 | 0 | 0 | % | ||||||||||||||

|

12

Helen Court

|

||||||||||||||||||||

|

Castle

Hill, NSW, Australia 2154

|

||||||||||||||||||||

|

Ruza

Studenovich

|

290,000 | 2 | % | 290,000 | 0 | 0 | % | |||||||||||||

|

Tiber

Creek Corporation(10)

|

250,000 | 2.4 | % | 250,000 | 0 | 0 | % | |||||||||||||

|

215

Apolena Avenue

|

||||||||||||||||||||

|

Newport

Beach, CA 92662

|

||||||||||||||||||||

|

Brendan

Tresoglavic

|

3,250 | * | 3,250 | 0 | 0 | % | ||||||||||||||

|

12

Helen Court

|

||||||||||||||||||||

|

Castle

Hill, NSW Australia 2154

|

||||||||||||||||||||

|

Simon

Tresoglavic and

|

||||||||||||||||||||

|

Anna

Tresoglavic

|

9,750 | * | 9,750 | 0 | 0 | % | ||||||||||||||

|

12

Helen Court

|

||||||||||||||||||||

|

Castle

Hill, NWS Australia 2154

|

||||||||||||||||||||

|

Sili

Venusi Veamatahau

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

680

Bents Basin Road

|

||||||||||||||||||||

|

Wallacia,

NSW Australia 2745

|

||||||||||||||||||||

|

Telesia

Veamatahau and

|

||||||||||||||||||||

|

Sione

Ahovelo

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

134

Junction Road

|

||||||||||||||||||||

|

Ruse,

NSW Australia 2560

|

15

|

Tevita

Veamatahau

|

1,300 | * | 1,300 | 0 | 0 | % | ||||||||||||||

|

680

Bents Basin Road

|

||||||||||||||||||||

|

Wallacia,

NSW Australia 2745

|

||||||||||||||||||||

|

Julian

Walters

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

54/102

Miller Street

|

||||||||||||||||||||

|

Pyrmont,

NSW Australia 2009

|

||||||||||||||||||||

|

Darryl

Andrew Wandrey

|

16,000 | * | 16,000 | 0 | 0 | % | ||||||||||||||

|

15

Boronia Crescent

|

||||||||||||||||||||

|

Marcoola,

QLD, Australia 4564

|

||||||||||||||||||||

|

Jack

Warfield

|

6,500 | * | 6,500 | 0 | 0 | % | ||||||||||||||

|

4

Cristina Street

|

||||||||||||||||||||

|

Longueville,

NSW, Australia 2066

|

||||||||||||||||||||

|

Total

|

3,729,200 | 36.38 | % | 3,729,200 | 0 | 0 | % |

|

(1)

|

Mr.

Chris Roulstone has the voting and dispositive power for A & J Stone

Holdings.

|

|

(2)

|

Paul

Ferriter has the voting and dispositive power for Allied

Securities.

|

|

(3)

|

Ms.

Sally Fisher has the voting and dispositive power for The Byron Real

Estate Consulting Group Pty Ltd.

|

|

(4)

|

Mr.

Paul Ferriter has the voting and dispositive power for Ferriter Super

Fund

|

|

(5)

|

Ben

Fock has the voting and dispositive power for the Fock Family

Superannuation Fund.

|

|

(6)

|

George

Augerinas has the voting and dispositive power for GJA Developments Pty

Ltd.

|

|

(7)

|

Michael

Geoffrey Johnston has the voting and dispositive power for Global IP

Traders Corporation.

|

|

(8)

|

Brad

Nielson has the voting and dispositive power for the Neilson Family

Trust.

|

|

(9)

|

Andrew

Newhouse has the voting and dispositive power for the Newstew Family

Trust.

|

|

(10)

|

James

Cassidy, a principal in the law firm of Cassidy & Associates, the firm

which opined on the validity of the shares issued by the Company, is the

sole shareholder of Tiber Creek Corporation and may be deemed the

beneficial owner of the shares owned by

it.

|

PLAN

OF DISTRIBUTION

The

Company intends to maintain the currency and accuracy of this prospectus for a

period of up to two years.

Selling

Shareholders

The

Shares offered by the selling shareholders will be offered at $.10 until such

time as the Company's stock is quoted on the OTC Bulletin Board.

The

selling shareholders may from time to time offer the Shares through

underwriters, brokers, dealers, agents or other intermediaries. The distribution

of the Shares by the selling shareholders may be effected in one or more

transactions that may take place through customary brokerage channels, in

privately-negotiated sales, by a combination of these methods or by other

means. Transactions occurring after the stock is quoted on the OTC

Bulletin Board, if at all, will be effected at market prices prevailing at the

time of sale. Usual and customary or specifically negotiated brokerage fees or

commissions may be paid by the selling shareholders in connection with sales of

the Shares.

16

The

Company will not receive any portion or percentage of the proceeds from the sale

of the selling shareholders' Shares. Of the 3,729,200

Shares included in the registration statement of which this prospectus is a

part, none are held by officers, directors or affiliates of the

Company.

DESCRIPTION

OF SECURITIES

Capitalization

The

Company is authorized to issue 100,000,000 shares of common stock of which

10,250,000 shares were outstanding as of the date of the registration statement

of which this prospectus is a part. The Company is authorized

to issue 20,000,000 shares of undesignated preferred stock, none of which has

been designated nor issued.

Common

Stock

Holders

of shares of common stock are entitled to one vote for each share on all matters

to be voted on by the shareholders. Holders of common stock do not have

cumulative voting rights. Holders of common stock are entitled to share ratably

in dividends, if any, as may be declared from time to time by the board of

directors in its discretion from funds legally available therefor. In the event

of a liquidation, dissolution or winding up, the holders of common stock are

entitled to share pro rata all assets remaining after payment in full of all

liabilities.

Holders

of common stock have no preemptive rights to purchase the Company’s common

stock. There are no conversion or redemption rights or sinking fund provisions

with respect to the common stock. The Company may issue additional

shares of common stock which could dilute its current shareholder's share

value.

Additional

Information Describing Securities

Reference

is made to applicable statutes of the state of Delaware for a description

concerning statutory rights and liabilities of shareholders.

No

Trading Market

There is

currently no established public trading market for the Company’s securities. A

trading market in the securities may never develop.

17

Admission

to Quotation on the OTC Bulletin Board

If the

Company meets the qualifications, it intends to apply for quotation of its

securities on the OTC Bulletin Board. The OTC Bulletin Board differs from

national and regional stock exchanges in that it (1) is not situated in a single

location but operates through communication of bids, offers and confirmations

between broker-dealers and (2) securities admitted to quotation are offered by

one or more broker-dealers rather than the "specialist" common to stock

exchanges. To qualify for quotation on the OTC Bulletin Board, an equity

security must have one registered broker-dealer, known as the market maker,

willing to list bid or sale quotations and to sponsor the company

listing.

Penny

Stock Regulation

Penny

stocks generally are equity securities with a price of less than $5.00 per share

other than securities registered on national securities exchanges or listed on

the Nasdaq Stock Market, provided that current price and volume information with

respect to transactions in such securities are provided by the exchange or

system. The penny stock rules impose additional sales practice requirements on

broker-dealers who sell such securities to persons other than established

customers and accredited investors (generally those with assets in excess of

$1,000,000 or annual income exceeding $200,000, or $300,000 together with their

spouse). For transactions covered by these rules, the broker-dealer must make a

special suitability determination for the purchase of such securities and have

received the purchaser's written consent to the transaction prior to the

purchase. Additionally, for any transaction involving a penny stock, unless

exempt, the rules require the delivery, prior to the transaction, of a

disclosure schedule prescribed by the SEC relating to the penny stock market.

The broker-dealer also must disclose the commissions payable to both the

broker-dealer and the registered representative and current quotations for the

securities. Finally, monthly statements must be sent disclosing recent price

information on the limited market in penny stocks. Because of these penny stock

rules, broker-dealers may be restricted in their ability to sell the Company’s

common stock. The foregoing required penny stock restrictions will not apply to

the Company’s common stock if such stock reaches and maintains a market price of

$5.00 per share or greater.

THE

BUSINESS

Current

Operations

The

Company is a development stage company and has not commenced operations and has

not received any revenue from operations. The Company has entered

into a licensing agreement with Manthey Redmond (Aust) for the development and

commercialization of the Manthey Redmond Eco-Engine and related technology. The

Company has also entered into an investment agreement with Manthey Redmond

(Aust) by which the Company receives a monthly investment amount of

$40,000. The Company entered into an agreement with Manthey

Holdings Pty Limited for the use of its research facilities and staff at a

monthly fee of $30,000.

18

Manthey

Redmond Eco-Engine

The

Manthey Redmond Eco-Engine was developed by Steven Charles Manthey in

Australia. On June 26, 2009, Manthey Redmond (Aust) applied for an

Australian provisional patent on the Eco-engine and related technology. On July

6, 2009, the corporation was issued with provisional patent number

2009903136. The Manthey Redmond Eco-Engine is a fuel-efficient,

lightweight, low-emission, multi-fueled, small and inexpensive engine primarily

for use in marine applications competitive with conventional internal combustion

engines. The Manthey Redmond Eco-Engine is based on the

opposed-piston engine configuration providing much greater torque (power)

production relative to its cylinder displacement than traditionally configured

engines. In effect, the Manthey Redmond Eco-Engine converts thermal

energy to kinetic energy more efficiently than internal combustion engines

currently on the market. Unlike most commercially available internal

combustion engines, the Manthey Redmond Eco-Engine can run on any fuel although

it is particularly suited to diesel and natural gas.

The

Technology that underpins the configuration of the Manthey Redmond Eco-Engine

incorporates a number of new components that are not contained in a

traditional internal combustion engine. These new components, which are the

subject of patent applications, have resulted in prototypes producing

torque-per-liter performance data that can be compared with published

performance data on internal combustion engines already in the market place. It

is from these comparisons, that the Company has been able to predict that the

Technology appears to convert thermal energy to kinetic energy more efficiently

than internal combustion engines currently in the market place.

At

present, three prototypes of the Manthey Redmond Eco-Engine have been

manufactured. All prototypes are currently being tested at Manthey

Holding's research facility. The Company believes that

development of the prototypes has reached a stage that their performance can be

independently tested by government agencies and academic

institutions. The Company believes that such tests will validate the

Company's testing of superior performance on many levels from the conventional

internal combustion engine including brake thermal efficiency.

Patent Licensing Agreement with

Manthey Redmond (Aust) Pty Limited

On May 1,

2009, the Company entered into a Patent Licensing Agreement with Manthey Redmond

(Aust). Manthey Redmond is the owner, developer and patent applicant

of the Eco-Engine and all related technology (the "Technology") developed and to

be developed. Pursuant to the agreement, Manthey Redmond (Aust) has

granted to the Company, a license to develop, manufacture, have manufactured,

use and sell or supply the Technology in return for a royalty fee equal to 5% of

the Company's gross profits earned as a result of the license

agreement. The Company has the right to sublicense its rights under

the agreement and is entitled to information and use of any inventions or

improvements on the Technology made by Manthey Redmond (Aust) without additional

charge. Manthey Redmond (Aust) Pty Limited will apply for valid

patents pursuant to each invention or improvements on the

Technology. The agreement may be terminated at the option of Manthey

Redmond (Aust) in the event that the Company becomes insolvent, or seeks

protection from its creditors under any United States federal or state

bankruptcy act or if an outside administrator or controller is voluntary or

involuntarily appointed to control the Company. The agreement is

subject to and governed by the law of Queensland, Australia.

19

Investment

Agreement with Manthey Redmond (Aust) Pty Limited

On May 1, 2009, the Company entered

into an Investment Agreement with Manthey Redmond (Aust) by which Manthey

Redmond (Aust) has agreed to invest a non-refundable amount of $40,000 per month

beginning July 1, 2009, aggregating $4,200,000 (USD) to assist the Company in

commercializing products based on the Technology. Manthey Redmond

(Aust) may terminate this agreement in the event that the Patent Licensing

Agreement is terminated. The agreement is subject to and governed by

the law of Queensland, Australia. In November, 2009, and March 2010, the

Company received $39,925 and $955 of capital injection from Manthey Redmond

(AUST) pursuant to the Investment Agreement which was recorded as additional

paid-in capital.

Development

Agreement with Manthey Holdings Pty Limited

On

November 6, 2009, the Company entered into an amended Development Agreement with

Manthey Holdings Pty Limited ("Manthey Holdings") by which, commencing May 1,

2009, Manthey Holdings will provide the unlimited use of its engineering

facility and employees for the purpose of research and development related to