Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NAVISTAR INTERNATIONAL CORP | d8k.htm |

Jefferies 6

th

Annual Global Industrials

and A&D Conference

August 10th, 2010

Exhibit 99.1

1

NYSE:

NAV |

2

NYSE:

NAV

Safe Harbor

Statement &

Other Cautionary Notes

Information provided and statements contained in this presentation that are not

purely historical are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, Section

21E of the Securities Exchange Act of

1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such

forward-looking statements only speak as of the date of this

presentation and the Company assumes no obligation to update the information included in this presentation.

Such forward-looking statements include information concerning our possible or

assumed future results of operations, including descriptions

of

our

business

strategy.

These

statements

often

include

words

such

as

“believe,”

“expect,”

“anticipate,”

“intend,”

“plan,”

“estimate,”

or similar expressions. These statements are not guarantees of performance or

results and they involve risks, uncertainties,

and

assumptions.

For

a

further

description

of

these

factors,

see

Item

1A,

Risk

Factors,

included

within

our

Form

10-K

for

the

year

ended

October

31,

2009,

which

was

filed

on

December

21,

2009.

Although

we

believe

that

these

forward-

looking statements are based on reasonable assumptions, there are many factors that

could affect our actual financial results or results of operations and could

cause actual results to differ materially from those in the forward-looking statements. All future

written and oral forward-looking statements by us or persons acting on our

behalf are expressly qualified in their entirety by the cautionary

statements

contained

or

referred

to

above.

Except

for

our

ongoing

obligations

to

disclose

material

information

as

required by the federal securities laws, we do not have any obligations or

intention to release publicly any revisions to any forward-looking

statements to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events.

The financial information herein contains audited and unaudited information and has

been prepared by management in good faith and based on data currently

available to the Company. Certain

Non-GAAP

measures

are

used

in

this

presentation

to

assist

the

reader

in

understanding

our

core

manufacturing

business.

We

believe

this

information

is

useful

and

relevant

to

assess

and

measure

the

performance

of

our

core

manufacturing

business as it illustrates manufacturing performance without regard to selected

historical legacy costs (i.e. pension and other postretirement costs). It

also excludes financial services and other expenses that may not be related to the core manufacturing

business.

Management

often

uses

this

information

to

assess

and

measure

the

performance

of

our

operating

segments.

A

reconciliation to the most appropriate GAAP number is included in the appendix of

this presentation. |

Actions Taken in 2010 That Impact

Our Strategy

Strategy: Leveraging What We Have and What Others Have Built

•

Focus is on reducing impact of cyclicality

•

Improve cost structure while developing

synergistic niche businesses

•

Controlling our Destiny

•

Goal of:

-

$15 billion in

revenue

-

$1.6 billion in

segment profit at

peak of cycle

•

•

Revised goal of:

Revised goal of:

$20 billion in

$20 billion in

revenue

revenue

$1.8 billion in

$1.8 billion in

segment profit at

segment profit at

average of cycle

average of cycle

3

NYSE:

NAV

Note: This slide contains both GAAP and non-GAAP information, please see the Reg G in

appendix for detailed reconciliation. |

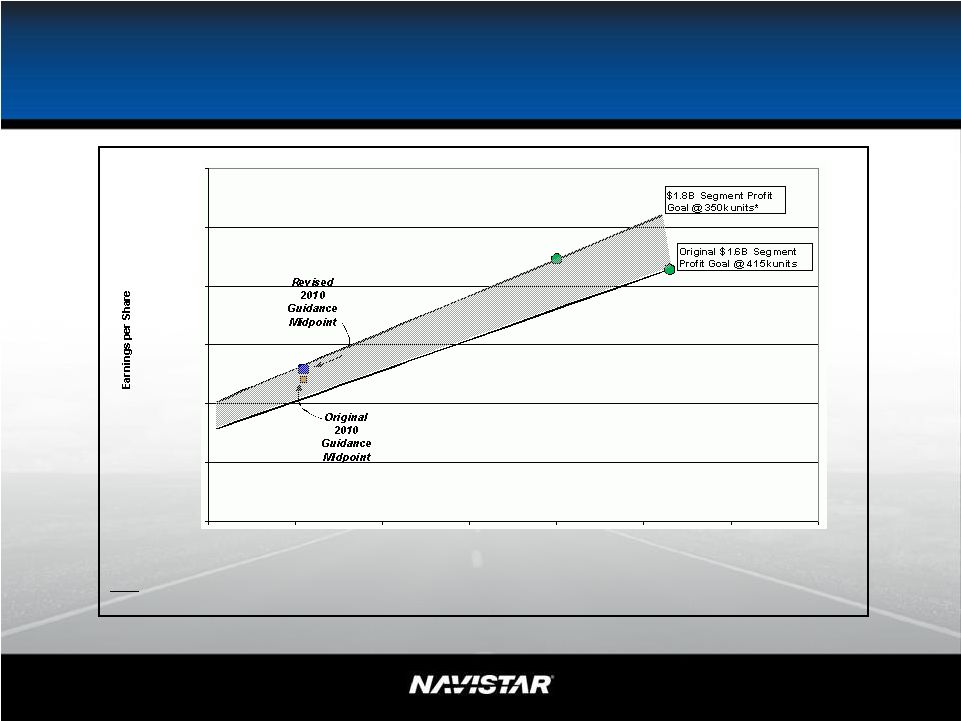

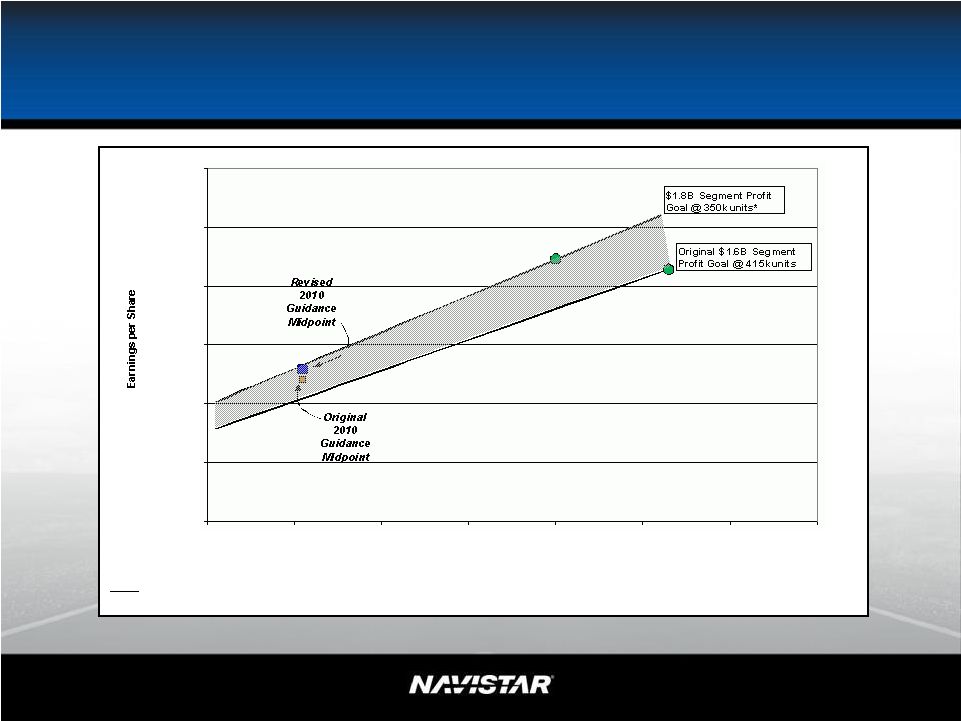

4

NYSE:

NAV

4

Profitable Growth

Earnings Per Share vs. Industry Volume

Note:

This

is

not

to

illustrate

updated

guidance.

Any

updated

guidance

will

be

provided

during

our

3

Quarter

Earnings

Call.

$(10.00)

$(5.00)

$-

$5.00

$10.00

$15.00

$20.00

150

200

250

300

350

400

450

500

Traditional Industry Volume (Thousands of Units)

Notes:

*

Assumes

attainment

of

mature

global

growth

by

end

of

calendar

year

2013

rd

Note: This slide contains both GAAP and non-GAAP information, please see the Reg G in

appendix for detailed reconciliation. |

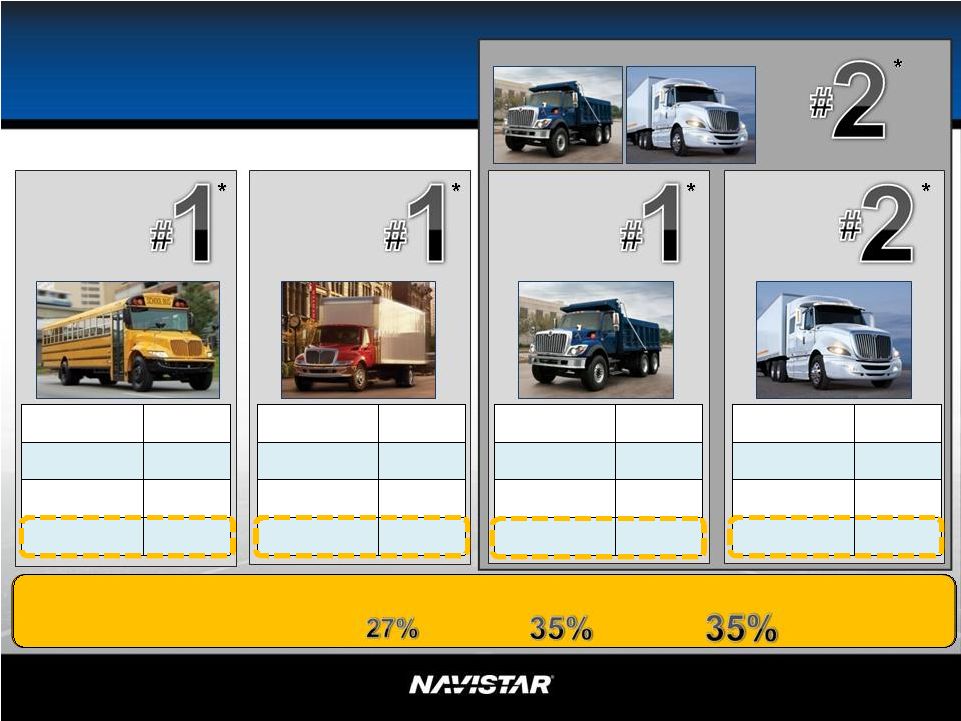

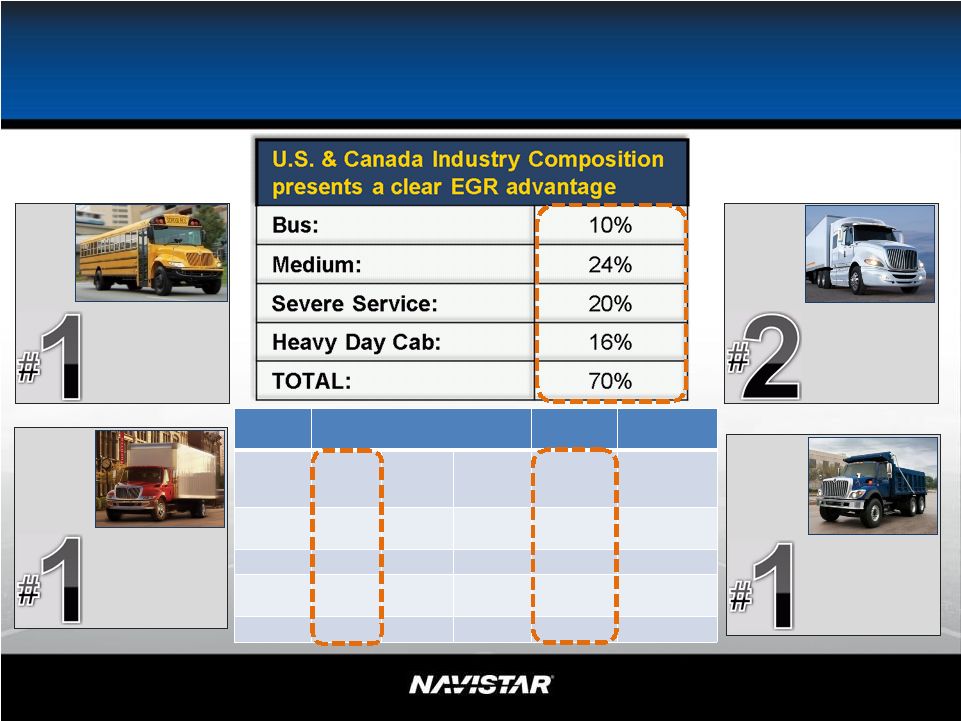

NYSE: NAV

5

5

Medium

Truck

Great Products –

Market Share

Severe

Service

Truck**

Heavy

Truck

FY07

60%

FY08

55%

FY09

61%

June YTD10

60%

**Excludes U.S. Military shipments

FY07

36%

FY08

36%

FY09

35%

June YTD10

40%

FY07

25%

FY08

27%

FY09

34%

June YTD10

35%

FY07

15%

FY08

19%

FY09

25%

June YTD10

25%

Class 8**

School

Bus

(U.S. & Canada)

School Bus & Combined Class 6-8 Market Share –

2Q

FY08:

;

2Q

FY09:

;

2Q

FY10:

*Market Share based on brand |

6

NYSE:

NAV

Launches of New Product

•

2010 emission lineup

•

ProStar+

®

•

15L engine

•

EStar

®

•

Mahindra

•

TerraStar

®

Class 4-5

•

Military

-

MaxxPro

DXM™

•

Continental Mixer

•

NC

2

® |

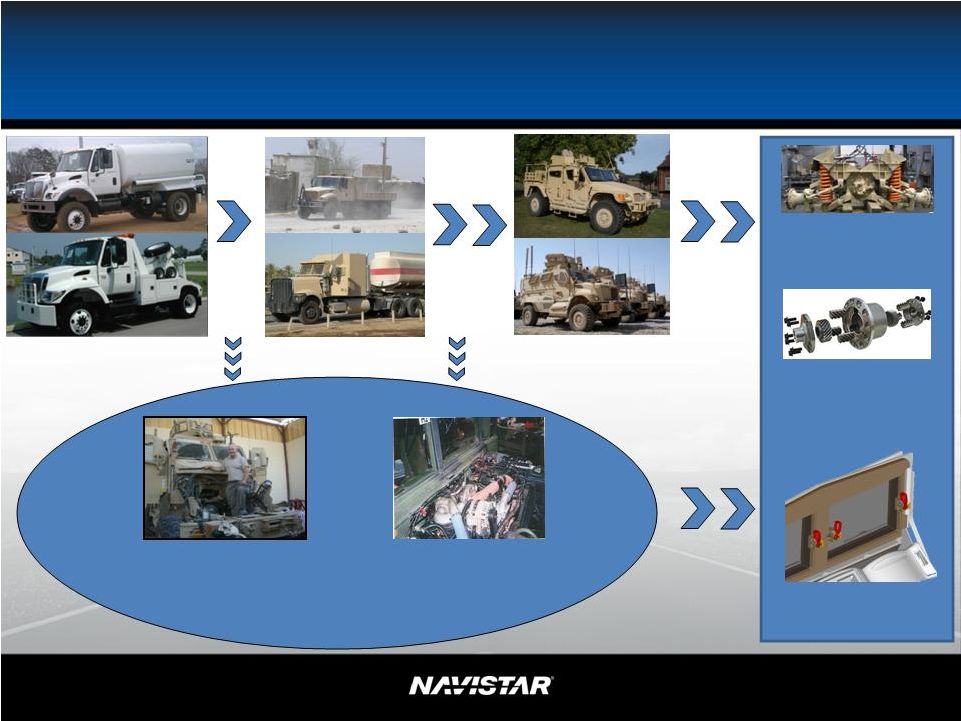

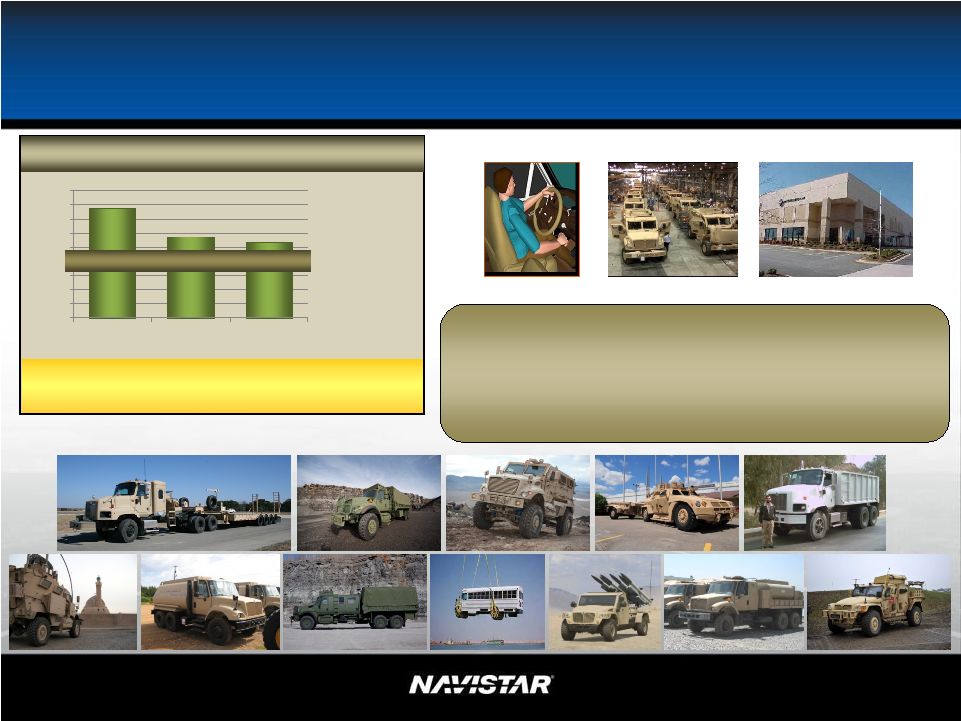

Navistar Defense Business

Model “Leveraging what we have and what others have built.”

COTS

True Tactical Vehicles

Field Service Reps

Integrated Logistics

Services

Parts Support Reset,

Refurbish, Repower

Independent

Suspension

Emergency

Egress Windows

MXT Limited Slip

Differential

Upgrade

7

7

MilCOTS

NYSE:

NAV |

8

NYSE:

NAV

$2 Billion Sustainable

Navistar Defense

•

Leverages

base

business

•

Continued

strength

Augment

Sustainable

base

with

Selective

Opportunities

Engineering

Manufacturing

Sustainment

Enablers

What’s happened since we talked to you last:

•

May 4 -

$89 million for TACOM vehicles for the Afghan

National Army

•

May

4

-

$102

million

for

MaxxPro

Dash

MRAP

capability

insertion

•

May 26 -

$61 million to support Foreign Military Sales (FMS)

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

FY 2008

FY 2009

FY 2010

Guidance

$2 billion sustainable

Note: This is not to illustrate updated guidance. Any updated guidance

will be provided

during

our

3

Quarter

Earnings

Call.

rd

® |

Customer friendly

solutions

Manage timing

transition

Improved fuel

economy

Improved

performance

Torque and weight

Improved margins

2010 Engines Hit the Mark!

Evolution of

technology

Improved durability

Lead conversion

from 15L to 13L

Earn credits early

Leading used truck

values

9

NYSE:

NAV |

10

NYSE:

NAV

North America Vehicle Strategy

•

Profitable growth

•

Product

differentiation

–

leadership

•

Continuous growth

–

North America

–

Global

•

Engineering and product development/keep

investing

•

Position us for when market returns |

11

NYSE:

NAV

11

Profitable Growth

Earnings Per Share vs. Industry Volume

Note:

This

is

not

to

illustrate

updated

guidance.

Any

updated

guidance

will

be

provided

during

our

3

rd

Quarter

Earnings

Call.

$(10.00)

$(5.00)

$-

$5.00

$10.00

$15.00

$20.00

150

200

250

300

350

400

450

500

Traditional Industry Volume (Thousands of Units)

Notes:

*

Assumes

attainment

of

mature

global

growth

by

end

of

calendar

year

2013

Note: This slide contains both GAAP and non-GAAP information, please see the Reg G in

appendix for detailed reconciliation. |

Product Differentiation –

Leadership

“Highest in

Customer

Satisfaction

among Vocational

Segment Class 8

Trucks”

“Highest in

Customer

Satisfaction with

Heavy-Duty Truck

Dealer Service” |

DuraStar

DuraStar

Cab

Cab

Day, Extended & Crew

CF Chassis

CF Chassis

Drop Rails

Drop Rails

MaxxForce

MaxxForce

7

7

®

Engine

Engine

Continuous Growth:

North American Niche Market Launches

Type A School

Launch: May 2011

Cutaway Commercial

Launch: January 2011

Class 2c-3 All-Electric Truck

Announced: August 2009

Launch: May 2011

Class 4/5

13

NYSE:

NAV |

14

NYSE:

NAV

Continuous Growth:

2011 Monaco Vesta |

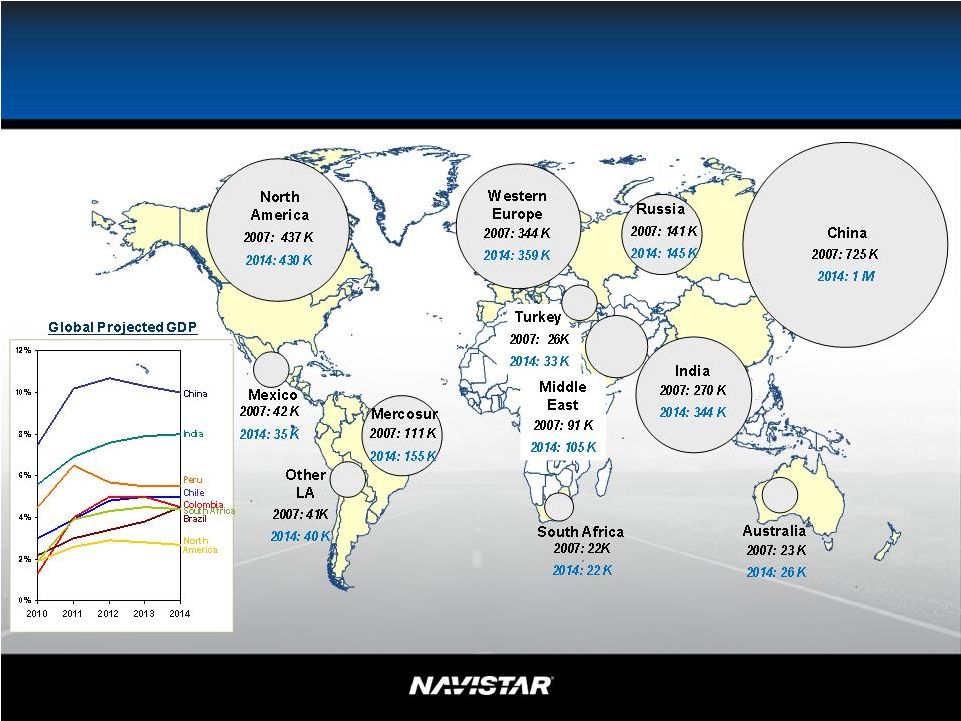

15

Continuous Growth:

2014 Global Truck Market Overview

Note: Includes Medium and Heavy Trucks >6T only Source: JD Power; Monitor

Analysis, Regional Analysis, Econometrix, ERG, and World Truck manufacturer’s Report

NYSE:

NAV

15 |

Continuous Growth:

Global Truck Market

31 T

Launch: July 2010

25 T Tipper

Launch: June 2010

40 T

Launch: July 2010

49T

Launch: Sept 2010

25 T

Launch: May 2010

25 T Cowl

Launch: June 2010

•

2010 invest in the future

•

Launch

–

Leverage our strengths

–

Select countries that have

largest opportunities: South

America, China, Australia

•

Goal –

10% segment margins

Mahindra

NC

16

2

NYSE:

NAV |

Engineering and Product

Development

Finished

NYSE:

NAV

17 |

18

NYSE:

NAV

100,000

200,000

300,000

400,000

500,000

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Fcst

2011

Fcst

U.S.

and

Canada

Class

6

-

8

Retail

Industry

Position Us For When Market Returns:

Industry Landscape –

Investing in Our Future

R&D ($ millions)

$375

$384

$433

$0

$100

$200

$300

$400

$500

FY2007

FY2008

FY2009

Note: This

is

not

to

illustrate

updated

guidance.

Any

updated

guidance

will

be

provided

during

our

3

rd

Quarter Earnings Call.

Industry

FY99

FY00

FY01

FY02

FY03

FY04

FY 05

FY06

FY 07

FY08

FY09

School Bus

33,800

33,900

27,900

27,400

29,200

26,200

26,800

28,200

24,500

24,400

22,600

20,000

22,000

Class 6-7

-

Medium

126,000

129,600

96,000

72,700

74,900

99,200

104,600

110,400

88,500

59,600

39,800

45,000

50,000

Combined Class 8 (Heavy & Severe Service)

286,000

258,300

163,700

163,300

159,300

219,300

282,900

316,100

206,000

160,100

119,400

130,000

143,000

Total Industry Demand

445,800

421,800

287,600

263,400

263,400

344,700

414,300

454,700

319,000

244,100

181,800

195,000

215,000

FY 10

Forecast

Current 2010

Actual

United

States

and

Canadian

Class

6-8

Truck

Industry

-

Retail

Sales Volume

Historical Information |

19

NYSE:

NAV

Our Emission Strategy Gives Us a

Competitive Advantage

60% Market Share

June YTD2010

School

Bus

40% Market Share

June YTD2010

35% Market Share

June YTD2010

Severe

Service

Truck**

Heavy

Truck

25% Market share

June YTD2010

Medium

Truck

*Market share based on brand

**Excludes U.S. Military deliveries

Heavy

Sleeper

–

30%

Market Share

YTD Order

Receipts

Market

Share

Full

Year

2009

2Q 2010

YTD

June

2010

YTD

June

Full Year

2010 Goal

School

Bus

61%

63%

60%

51%

60% +

Medium

35%

44%

40%

49%

40% +

Severe

Service

34%

35%

35%

40%

35% +

Heavy

25%

22%

25%

28%

25% _

*

*

*

*

*

*

*

* |

20

NYSE:

NAV

Status -

Next Steps

•

Build and hold strategy

–

Delivering 2010 compliant products

•

15L to 13L transition

–

JB Hunt

–

Boyd Bros.

–

Heartland Express

•

Post-retirement

–

OPEB

–

Pension

•

MaxxForce

®

15L currently in

several customers’

hands

accumulating real world miles

•

Distribution channel

Status

What’s next?

•

Increase customer penetration

of 13L with Jake brake

•

15L to 13L transition

•

Post-retirement

•

Financing -

customer financing

still in progress

•

MaxxForce

®

15L –

seed

additional customers

•

Improving our already robust

distribution channel |

21

NYSE:

NAV

SEC Regulation G –

Fiscal Year Comparison

Future

2009

*Includes net income attributable to non-controlling interests

U.S. and Canada Industry

414,500

350,000

($billions)

Sales and revenues, net

$ 15 +

$ 20 +

($millions)

Manufacturing segment profit*

$ 1,600

Below the line items

Income excluding income tax

Income tax expense

(298)

Net Income attributable to Navistar International Corporation (NIC)

Diluted earnings per share ($'s) attributable to NIC

$12.31

Weighted average shares outstanding: diluted (millions)

Original Target

@ 414.5k Industry

Revised Target

@ 350k Industry

$ 1,780

(590)

~ 72.5

$892

~ 72.5

(500)

1,100

(275)

$825

$11.46

1,190

This presentation is not in accordance with, or an alternative for, U.S. generally accepted

accounting principles (GAAP). The non-GAAP financial information presented herein should be considered

supplemental to, and not as a substitute for, or superior to, financial measures calculated in

accordance with GAAP. However, we believe that non-GAAP reporting, giving effect to the adjustments shown in

the reconciliation above, provides meaningful information and therefore we use it to supplement our

GAAP reporting by identifying items that may not be related to the core manufacturing business.

Management often uses this information to assess and measure the performance of our operating segments.

We have chosen to provide this supplemental information to investors, analysts and other

interested parties to enable them to perform additional analyses of operating results, to illustrate

the results of operations giving effect to the non-GAAP adjustments shown in the above reconciliations and to

provide an additional measure of performance. |