Attached files

Exhibit 10.40

OFFICE LEASE

BY AND BETWEEN

WOODCREST ROAD ASSOCIATES, L.P.,

A PENNSYLVANIA LIMITED PARTNERSHIP

D/B/A WRAAP, L.P. IN NEW JERSEY

(AS “Landlord”)

AND

PINNACLE FOODS GROUP LLC,

A DELAWARE LIMITED LIABILITY COMPANY

(AS “Tenant”)

SUITE #121

WOODCREST CORPORATE CENTER

101 WOODCREST

CHERRY HILL, NEW JERSEY

| THE DELIVERY OR NEGOTIATION OF THIS DOCUMENT BY LANDLORD OR ITS AGENTS OR ATTORNEYS SHALL NOT BE DEEMED AN OFFER BY LANDLORD TO ENTER INTO ANY TRANSACTION OR RELATIONSHIP WITH ANY PERSON OR PARTY. THIS DOCUMENT SHALL NOT BE BINDING UPON LANDLORD OR ANY AFFILIATE OF LANDLORD OR ITS OR THEIR AGENTS OR ATTORNEYS IN ANY RESPECT, NOR SHALL LANDLORD HAVE ANY OBLIGATIONS OR LIABILITIES TO TENANT UNLESS AND UNTIL BOTH LANDLORD AND TENANT HAVE EXECUTED AND DELIVERED THIS DOCUMENT. UNTIL ANY SUCH FULL EXECUTION AND DELIVERY OF THIS DOCUMENT, EITHER LANDLORD OR TENANT MAY TERMINATE ALL NEGOTIATIONS WITH THE OTHER RELATING TO THE SUBJECT MATTER HEREOF, WITHOUT CAUSE AND FOR ANY REASON, WITHOUT RECOURSE OR LIABILITY. |

TABLE OF CONTENTS

| 1. | BASIC LEASE PROVISIONS | 5 | ||

| 2. | PROJECT | 8 | ||

| 3. | TERM | 9 | ||

| 4. | RENT | 11 | ||

| 5. | USE & OCCUPANCY | 17 | ||

| 6. | SERVICES & UTILITIES | 25 | ||

| 7. | REPAIRS | 28 | ||

| 8. | ALTERATIONS | 28 | ||

| 9. | INSURANCE | 30 | ||

| 10. | DAMAGE OR DESTRUCTION | 32 | ||

| 11. | INDEMNITY | 33 | ||

| 12. | CONDEMNATION | 35 | ||

| 13. | TENANT TRANSFERS | 35 | ||

| 14. | LANDLORD TRANSFERS | 37 | ||

| 15. | DEFAULT AND REMEDIES | 39 | ||

| 16. | INTENTIONALLY OMITTED | 41 | ||

| 17. | MISCELLANEOUS | 41 | ||

i

LIST OF EXHIBITS

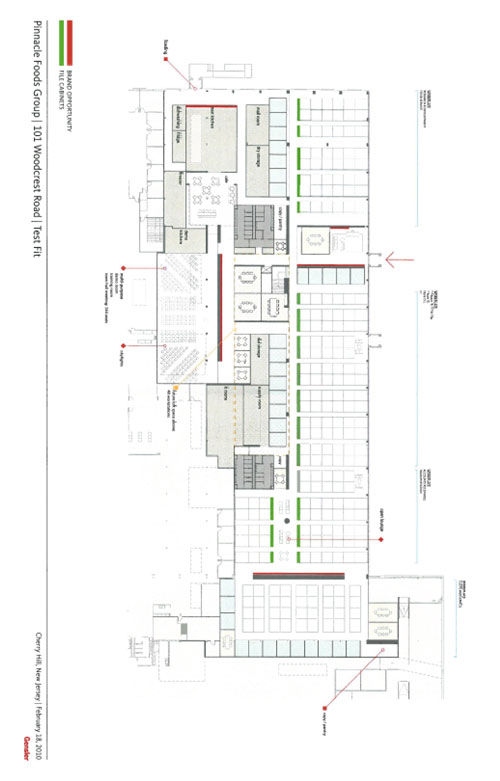

| EXHIBIT A – LOCATION OF PREMISES |

| EXHIBIT B – THE LAND |

| EXHIBIT C – RULES AND REGULATIONS |

| EXHIBIT D – NOTICE OF LEASE TERM |

| EXHIBIT E – WORK LETTER |

| EXHIBIT E-1 – PRELIMINARY PLANS |

| EXHIBIT F – PARKING |

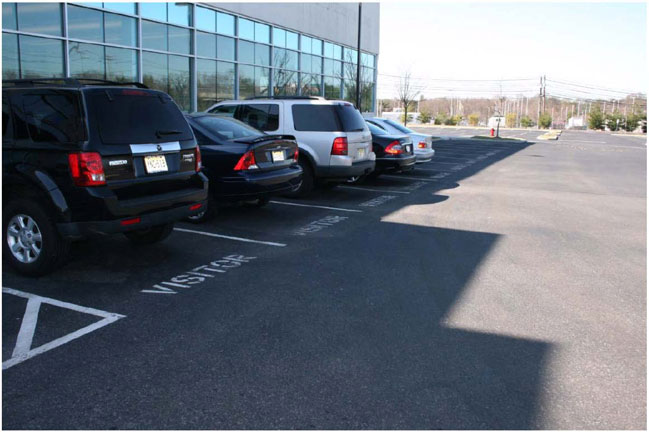

| EXHIBIT F-1 – VISITORS PARKING AREA |

| EXHIBIT G – INTENTIONALLY OMITTED |

| EXHIBIT H – EXTENSION OPTIONS |

| EXHIBIT I – RIGHT OF FIRST OFFER |

| EXHIBIT J – LETTER OF CREDIT |

| EXHIBIT K – SUBORDINATION, NON-DISTURBANCE AND ATTORNMENT AGREEMENT |

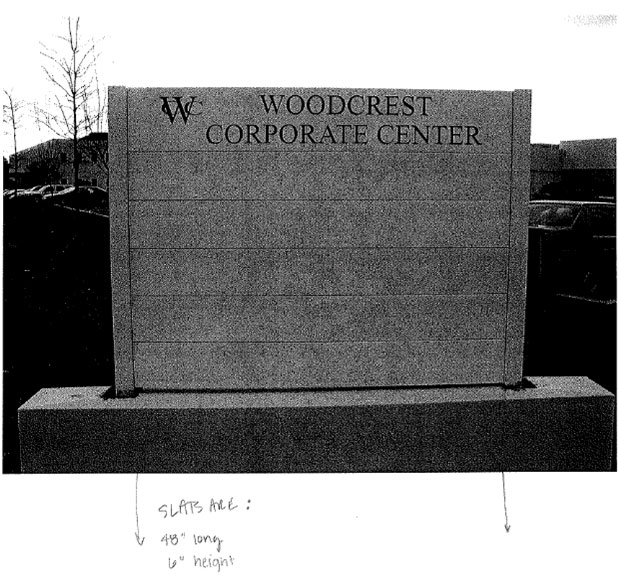

| EXHIBIT L – BUILDING EXTERIOR SIGN |

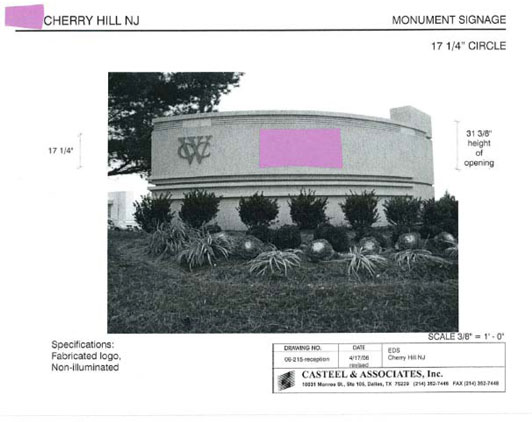

| EXHIBIT M – MONUMENT SIGN |

| EXHIBIT N – JANITORIAL SPECIFICATIONS |

ii

INDEX OF DEFINED TERMS

iii

iv

OFFICE LEASE

Landlord and Tenant enter into this Office Lease (“Lease”) as of the Execution Date on the following terms, covenants, conditions and provisions:

1. BASIC LEASE PROVISIONS

1.1 Basic Lease Definitions. In this Lease, the following defined terms have the meanings indicated.

| (a) | Execution Date: | March ___, 2010. | ||||||

| (b) | Landlord: | WOODCREST ROAD ASSOCIATES, L.P., a Pennsylvania limited partnership d/b/a WRAAP, L.P. in New Jersey. | ||||||

| (c) | Tenant: | PINNACLE FOODS GROUP LLC, a Delaware limited liability company. | ||||||

| (d) | Building: | WOODCREST CORPORATE CENTER, 101 WOODCREST, CHERRY HILL, NEW JERSEY, being Unit B as set forth in the Declaration (defined below), deemed to contain: 333,275 rentable square feet (“RSF”). | ||||||

| (e) | Premises: | Suite 121 (outlined on EXHIBIT A) of the Building, and deemed to contain: 57,166 RSF. | ||||||

| (f) | Use: | General administrative non-governmental office use consistent with that of a first-class office building. | ||||||

| (g) | Scheduled Term: | One hundred thirty-five (135) Months. | ||||||

| (h) | Scheduled Commencement Date: |

June 15, 2010. | ||||||

| (i) | Base Rent: | The following amounts payable in accordance with Article 4: | ||||||

| Months |

Annual Base Rent Rate per RSF |

Annual Base Rent |

Monthly Base Rent |

|||||||

| Lease Commencement Date through the last day of the twenty-fourth Month thereafter |

$ | 18.98 | $ | 1,085,010.72 | $ |

90,417.56 (subject to partial |

| |||

|

25th Month after the Lease Commencement Date through the 36th Month after the Lease Commencement Date |

$ | 19.48 | $ | 1,113,593.64 | $ | 92,799.47 | ||||

|

37th Month after the Lease Commencement Date through the 48th Month after the Lease Commencement Date |

$ | 19.98 | $ | 1,142,176.68 | $ | 95,181.39 | ||||

|

49th Month after the Lease Commencement Date through the 60th Month after the Lease Commencement Date |

$ | 20.48 | $ | 1,170,759.72 | $ | 97,563.31 | ||||

|

61st Month after the Lease Commencement Date through the 72nd Month after the Lease Commencement Date |

$ | 20.98 | $ | 1,199,342.64 | $ | 99,945.22 | ||||

|

73rd Month after the Lease Commencement Date through the 84th Month after the Lease Commencement Date |

$ | 21.48 | $ | 1,227,925.68 | $ | 102,327.14 | ||||

|

85th Month after the Lease Commencement Date through the 96th Month after the Lease Commencement Date |

$ | 21.98 | $ | 1,256,508.72 | $ | 104,709.06 | ||||

|

97th Month after the Lease Commencement Date through the 108th Month after the Lease Commencement Date |

$ | 22.48 | $ | 1,285,091.64 | $ | 107,090.97 | ||||

|

109th Month after the Lease Commencement Date through the 120th Month after the Lease Commencement Date |

$ | 22.98 | $ | 1,313,674.68 | $ | 109,472.89 | ||||

|

121st Month after the Lease Commencement Date through the Expiration Date |

$ | 23.48 | $ | 1,342,257.72 | $ | 111,854.81 | ||||

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 5 |

| (j) |

Tenant’s Share: | 17.153%. | ||||||

| (k) |

Base Year: | The calendar year 2011. | ||||||

| (l) |

Letter of Credit: | One Million Dollars ($1,000,000.00). See EXHIBIT J. | ||||||

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 6 |

| (m) | Notice Address: | For each party, the following address(es): |

| To Landlord |

To Tenant | |||||

| Woodcrest Road Associates, L.P. d/b/a WRAAP, L.P. in New Jersey 15601 Dallas Parkway, Suite 600 Addison, Texas 75001 Attn: Lease Administration

with a copy to:

Woodcrest Road Associates, L.P. d/b/a WRAAP, L.P. in New Jersey c/o Property Manager 30 South 17th Street, Suite 215 Philadelphia, Pennsylvania 19103

with a copy of notices of default to:

Behringer Harvard REIT I, Inc. 15601 Dallas Parkway, Suite 600 Addison, Texas 75001 Attn: Chief Legal Officer |

Before the Lease Commencement Date:

Pinnacle Foods Group LLC 1 Old New Bloomfield Avenue Mountain Lakes, New Jersey 07040-1429 Attn: Office of General Counsel

After the Lease Commencement Date:

Pinnacle Foods Group LLC 1 Old Bloomfield Avenue Mountain Lakes, New Jersey 07046 Attn: Office of General Counsel | |||||

| (n) | Billing Address: | For each party, the following address: |

| For Landlord |

For Tenant | |||||

| Woodcrest Road Associates, L.P. PO Box 974658 Dallas, Texas 75397-4658 |

Pinnacle Foods Group LLC 1 Old Bloomfield Avenue Mountain Lakes, New Jersey 07046 Attn: Office of General Counsel | |||||

| (o) |

Brokers: | Jones Lang LaSalle Americas, Inc. (“Landlord’s Broker”), whose right to a commission to be paid by Landlord is subject to a separate written agreement with Landlord; and Jones Lang LaSalle Brokerage, Inc. (“Tenant’s Broker”), whose right to a commission to be paid by Landlord is subject to a separate written agreement with Landlord. | ||||||

| (p) | Parking Allotment: | 5 parking spaces per 1,000 RSF of the Premises. See EXHIBIT F. | ||||||

| (q) | Tenant’s NAICS Number: | 311911 | ||||||

| (r) | Tenant Allowance: |

Forty-Five Dollars ($45.00) per RSF in the Premises, subject to EXHIBIT E. | ||||||

| (s) | Business Hours: | From 7:00 a.m. to 7:00 p.m. on Monday through Friday and from 8:00 a.m. to 1:00 p.m. on Saturday, excepting: New Year’s Day, Presidents’ Day, Martin Luther King Jr.’s Birthday, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, the day after Thanksgiving Day, and Christmas Day (“Holidays”). | ||||||

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 7 |

| (t) |

Declaration: | That that certain Master Deed for 111 Woodcrest Condominium dated November 14, 2002 and recorded December 6, 2002 in the Camden County recorder’s office at Book 5268, Page 785 et. seq., as amended by that certain First Amendment to Master Deed for 111 Woodcrest Condominium dated April 10, 2003 and recorded May 13, 2003 in the Camden County recorder’s office at Book 7027, Page 628 et. seq. |

2. PROJECT

2.1 Project. The Land and all improvements thereon, including the Building and Premises (as defined in Article 1 and below), and the Common Areas (as defined below) are collectively referred to as the “Project.”

2.2 Land. “Land” means the real property described on EXHIBIT B attached hereto, whether Landlord’s interest in the Land is in fee or is a leasehold. The Land is subject to expansion or reduction after the Execution Date.

2.3 Base Building. “Base Building” means the Building Structure and Mechanical Systems, collectively, defined as follows:

| (a) | Building Structure. “Building Structure” means the foundations, floor/ceiling slabs, roofs, exterior walls, exterior glass and mullions, columns, beams, shafts, Building mechanical, electrical and telephone closets, Common Areas, public areas, and any other structural components in the Building. The Building Structure excludes the Leasehold Improvements (and similar improvements to other premises) and the Mechanical Systems. |

| (b) | Mechanical Systems. “Mechanical Systems” means, without limitation, the mechanical, electronic, physical or informational systems generally serving the Building or Common Areas, including any sprinkler, plumbing, heating, ventilating, air conditioning, lighting, communications, drainage, sewage, waste disposal, fire/life safety and access systems. |

2.4 Common Areas. Tenant will have a non-exclusive right to use the Common Areas subject to the terms of this Lease. “Common Areas” means those common and public areas on the Land and Building (and appurtenant easements) from time-to-time designated by Landlord for the non-exclusive use by Tenant in common with Landlord, other tenants and occupants, and their employees, agents and invitees, including any parking facilities on the Land or otherwise serving the Building that are owned or leased by Landlord.

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 8 |

2.5 Premises. Landlord leases to Tenant the Premises subject to the terms of this Lease. Except as provided elsewhere in this Lease and except for any material latent defects of a structural nature in the roof or the foundation, exterior walls or floor of the Building in which the Premises are located existing as of the Delivery Date and in respect of which the Tenant gives written notice to the Landlord not later than three hundred sixty-five (365) days after the Delivery Date, by taking possession of the Premises Tenant accepts the Premises in its “as is” condition and with all faults, and the Premises is deemed in good order, condition, and repair. Landlord will not be obligated to correct or repair any such defects caused by Tenant or its contractors. Landlord does not make and Tenant does not rely upon any representation or warranty of any kind, express or implied, with respect to the condition of the Premises (including habitability or fitness for any particular purpose of the Premises). TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, LANDLORD HEREBY DISCLAIMS, AND TENANT WAIVES THE BENEFIT OF, ANY AND ALL IMPLIED WARRANTIES, INCLUDING IMPLIED WARRANTIES OF HABITABILITY AND FITNESS OR SUITABILITY FOR A PARTICULAR PURPOSE. The Premises includes the Leasehold Improvements and excludes certain areas, facilities and systems, as follows:

| (a) | Leasehold Improvements. “Leasehold Improvements” means all non-structural improvements in the Premises or exclusively serving the Premises, and any structural improvements to the Building made to accommodate Tenant’s particular use of the Premises. The Leasehold Improvements may exist in the Premises as of the Execution Date, or be installed by Landlord or Tenant under this Lease at the cost of either party. The Leasehold Improvements include: (1) interior walls and partitions (including those surrounding structural columns entirely or partly within the Premises); (2) the interior one-half of walls that separate the Premises from adjacent areas designated for leasing; (3) the interior drywall on exterior structural walls, and walls that separate the Premises from the Common Areas; (4) (intentionally omitted); (5) the frames, casements, doors, windows and openings installed in or on the improvements described in (1-4), or that provide entry/exit to/from the Premises; (6) all hardware, fixtures, cabinetry, railings, paneling, woodwork and finishes in the Premises or that are installed in or on the improvements described in (1-5); (7) the exterior windows (including mullions, frames and glass); (8) integrated ceiling systems (including grid, panels and lighting); (9) carpeting and other floor finishes; (10) kitchen, rest room, lavatory or other similar facilities that exclusively serve the Premises (including plumbing fixtures, toilets, sinks and built-in appliances); (11) (intentionally omitted); and (12) the sprinkler, plumbing, heating, ventilating, air conditioning, lighting, communications, security, drainage, sewage, waste disposal, vertical transportation, fire/life safety, and other mechanical, electronic, physical or informational systems that exclusively serve the Premises. |

| (b) | Exclusions from the Premises. The Premises does not include: (1) the roof of the Building and any areas above the finished ceiling or integrated ceiling systems, or below the finished floor coverings that are not part of the Leasehold Improvements, (2) janitor’s closets, (3) (intentionally omitted, (4) rooms for Mechanical Systems or connection of telecommunications equipment, (5) (intentionally omitted), (6) vertical or horizontal shafts, risers, chases, flues or ducts, or (7) any easements or rights to natural light, air or view. |

2.6 Building Standard. “Building Standard” means the minimum or exclusive type, brand, quality or quantity of materials Landlord designates for use in the Building from time to time, which shall be generally consistent with the type, brand, quality or quantity of materials in use in the Building as of the Execution Date.

2.7 Tenant’s Personal Property. “Tenant’s Personal Property” means those trade fixtures, furnishings, equipment (including all equipment associated with the Test Kitchen, defined below), work product, inventory, stock-in-trade and other personal property of Tenant that are not permanently affixed to the Project in a way that they become a part of the Project and will not, if removed, impair the value of the Leasehold Improvements that Tenant is required to deliver to Landlord at the end of the Term under §3.3.

3. TERM

3.1 Term. “Term” means the period that begins on the Lease Commencement Date and ends on the Expiration Date, subject to renewal, extension or earlier termination as may be further provided in this Lease or otherwise agreed to by Landlord and Tenant in writing. “Month” means a full calendar month of the Term.

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 9 |

| (a) | Lease Commencement Date. “Lease Commencement Date” means the date that is the earlier of: |

| (1) | The day that Tenant first conducts its ordinary and customary business activities in any part of the Premises (which business activities shall not include the constructing of the Tenant Improvements); or |

| (2) | The Scheduled Commencement Date. |

| (b) | Expiration Date. “Expiration Date” means the date that is the last day of the Scheduled Term (plus that many additional days required for the Expiration Date to be the last day of a Month) after the Scheduled Commencement Date. |

| (c) | Delivery Date. Tenant may not enter the Premises for any purpose until the Delivery Date unless Tenant first secures Landlord’s consent, such consent not to be unreasonably withheld, conditioned or delayed. The “Delivery Date” is the date that Landlord tenders the Premises to Tenant, which date will be the first business day following the execution and delivery of this Lease by Landlord and Tenant. Tenant may, from the Delivery Date to the Lease Commencement Date (the “Early Entry Period”), enter the Premises solely for the purpose of constructing and installing the Tenant Improvements as set forth in EXHIBIT E attached hereto, provided that the following conditions are fulfilled: (i) Tenant shall provide evidence reasonably satisfactory to Landlord that Tenant has received permission with respect to such entry by any governmental authority which may have jurisdiction over Tenant’s occupancy of the Premises, (ii) Landlord shall be given prior written notice of any such entry; (iii) such entry shall be coordinated with Landlord and shall not interfere with work, if any, that Landlord is performing in the Premises; (iv) Tenant shall deliver to Landlord evidence that the insurance required under §9.1 of this Lease has been obtained; and (v) Tenant shall agree to pay all utility charges reasonably allocable to Tenant by Landlord in connection with such early entry. Tenant’s entry and activities in the Premises during the Early Entry Period shall be deemed to be subject to all of Tenant’s covenants, agreements, and obligations under this Lease. |

| (d) | Confirmation of Term. Landlord shall notify Tenant of the Lease Commencement Date using a Notice of Lease Term (“NLT”) in the form attached to this Lease as EXHIBIT D. Tenant shall execute and deliver to Landlord the NLT within ten (10) business days after its receipt, but Tenant’s failure to do so will not reduce Tenant’s obligations or Landlord’s rights under this Lease. |

3.2 Holdover. If Tenant keeps possession of the Premises after the end of the Term (a “Holdover”) without Landlord’s prior written consent (which may be withheld in its sole and absolute discretion), then in addition to the remedies available elsewhere under this Lease or by applicable law, Tenant will be a tenant at sufferance and must comply with all of Tenant’s obligations under this Lease, except that (a) during the first two (2) months of Holdover, Tenant will pay one hundred twenty-five percent (125%) of the monthly Base Rent and Additional Rent last payable under this Lease, without prorating for any partial month of Holdover; and (b) after the second month of Holdover, Tenant will pay one hundred fifty percent (150%) of the monthly Base Rent and Additional Rent last payable under this Lease, without prorating for any partial month of Holdover. Tenant shall indemnify and defend Landlord from and against all claims and damages, both consequential and direct, that Landlord suffers due to Tenant’s failure to return possession of the Premises to Landlord at the end of the Term. Except as provided herein, Landlord’s deposit of Tenant’s Holdover payment will not constitute Landlord’s consent to a Holdover, or create or renew any tenancy.

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 10 |

3.3 Condition on Expiration. By the end of the Term, Tenant will return possession of the Premises to Landlord vacant, free of Tenant’s Personal Property, in broom-clean condition, and with all Leasehold Improvements in good working order and repair (excepting ordinary wear and tear), except that Tenant will remove Tenant’s Wiring and those Leasehold Improvements and Alterations (as such terms are defined herein) that, when approved by Landlord, were required to be removed at the end of the Term. If Tenant fails to return possession of the Premises to Landlord in this condition, Tenant shall reimburse Landlord for the reasonable costs, including Landlord’s Standard Admin Fee of ten percent (10%) of costs (“Landlord’s Standard Admin Fee”), incurred to put the Premises in the condition required under this §3.3. Tenant’s Personal Property left behind in the Premises after the end of the Term will be considered abandoned and Landlord may move, store, retain or dispose of these items at Tenant’s cost, including Landlord’s Standard Admin Fee.

4. RENT

4.1 Base Rent. Tenant shall prepay one (1) Month’s installment of Base Rent by the Execution Date, to be applied against Base Rent first due under this Lease. During the Term, Tenant shall pay all other Base Rent in advance, in monthly installments, on the first (1st) business day of each Month. Base Rent for any partial Month will be prorated. Landlord agrees, upon request by Tenant, to accept such payments electronically.

Notwithstanding the foregoing, during the period of time beginning on the Lease Commencement Date and continuing through April 15, 2011 (the “Burnoff Date”), Tenant shall receive a conditional, partial abatement of $83,367.08 per month against Tenant’s Monthly Base Rent payments. On April 16, 2011, Tenant shall make a prorated Base Rent payment of $41,683.54 (representing one-half of the monthly abatement amount), and shall thereafter make Base Rent payments as otherwise provided in this Lease. Notwithstanding such partial abatement of Base Rent, (a) all other sums due under this Lease, including Additional Rent and the unabated portion of each monthly Base Rent installment (which unabated portion is $7,050.48) due and payable from the Lease Commencement Date through April 15, 2011, shall be payable as provided in this Lease, and (b) any increases in Base Rent set forth in this Lease shall occur on the dates scheduled therefor. Abatement of Base Rent is conditioned upon Tenant not being in monetary or other material Default beyond any applicable notice and cure period. If Tenant is in monetary or other material Default beyond any applicable notice and cure period, then in addition to Landlord’s other remedies, any further abatement of Base Rent for the Premises shall immediately cease and become void, and Tenant shall promptly pay to Landlord, in addition to all other amounts due to Landlord under this Lease and any other remedies available to Landlord, the unamortized portion, as of the date of the Default, of the total of all abated Base Rent for the Premises, which portion shall be determined by amortizing said total of abated rent at ten percent (10%) per annum over the period commencing on the Lease Commencement Date and ending on the Expiration Date.

4.2 Additional Rent. Tenant’s obligation to pay Taxes and Expenses under this §4.2 is referred to in this Lease as “Additional Rent.”

| (a) | Taxes. For each calendar year after the Base Year (each, a “Comparison Year”), Tenant shall pay, in the manner described below, Tenant’s Share of the amount that Taxes for the Comparison Year exceed Taxes for the Base Year. “Taxes” means the total costs incurred by Landlord for: (1) real and personal property taxes and assessments (including ad valorem and general or special assessments) levied on the Project and Landlord’s personal property used in connection with the Project, as well as all fees or assessments payable on account of the Project being located in any special services district, and including any payments payable by Landlord to Cherry Hill Township in connection with the Building in lieu of real estate taxes; (2) taxes on rents or other income derived from the Project; (3) capital and place-of-business taxes; (4) taxes, assessments or fees in lieu of the taxes described in (1-3); and (5) the reasonable costs incurred to reduce the taxes described in (1-4). Taxes excludes federal income taxes and taxes paid under §4.3, as well as any taxes assessed specifically to any specific tenant of the Project or against any specific leasehold improvements above Building Standard within another tenant’s space in the Project. |

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 11 |

| (b) | Expenses. For each Comparison Year, Tenant shall pay in the manner described below the Tenant’s Share of the amount that Expenses for the Comparison Year exceed Expenses for the Base Year. “Expenses” means the total costs incurred by Landlord to operate, manage, administer, equip, secure, protect, repair, replace, refurbish, clean, maintain, decorate and inspect the Project, including a market fee to manage the Project of not less than three percent (3%) of the gross revenue of the Project (but in any event not more than three percent (3%) of Tenant’s Base Rent). If the Building is less than ninety-five percent (95%) occupied during any Comparison Year (including without limitation, the Base Year), or if less than ninety-five percent (95%) of the RSF of the Building is provided with Building Standard services during any Comparison Year (including without limitation, the Base Year), an adjustment shall be made in computing each component of Expenses for such year [which varies with the rate of occupancy of the Building] so that the Expenses shall be computed for such year as though the Building had been ninety-five percent (95%) occupied during such year and as though ninety-five percent (95%) of the Building had been provided with Building Standard services during such year. |

For purposes of calculating Tenant’s Share of Expenses following the Base Year, the maximum increase in the amount of Controllable Expenses (defined below) that may be included in calculating Expenses for each Comparison Year shall be limited to an amount equal to five percent (5%) of the amount of Controllable Expenses for the immediately preceding year (the “Expense Cap”). “Controllable Expenses” shall mean all Expenses (after the 100% gross-up adjustment provided above) which are within the reasonable control of Landlord; thus, excluding insurance, utilities, snow/ice removal and other costs beyond the reasonable control of Landlord.

| (1) | Expenses include, without limitation: |

| (A) | Standard Services provided under §6.1, except for Electrical Costs (as defined in §4.2(f) below); |

| (B) | Repairs and maintenance performed under §7.2; |

| (C) | Insurance maintained under §9.2 (including deductibles paid); |

| (D) | Wages, salaries and benefits of personnel at or below the level of the Building’s manager, to the extent they render services to the Project; |

| (E) | Costs of operating the Project management office (including reasonable rent); |

| (F) | Costs of operating the parking facilities, if any; |

| (G) | Amortization installments of costs required to be capitalized and incurred to: |

| (i) | Comply with laws, but only to the extent such compliance relates to laws which are amended, become effective, or are interpreted or enforced differently after the date of this Lease (“Government Mandated Expenses”); |

| (ii) | Reduce other Expenses or the rate of increase in other Expenses (“Cost-Saving Expenses”); or |

| (iii) | Improve or maintain the safety, health or access of Project occupants, and otherwise maintain the quality, appearance, or integrity of the Project (“Well-Being Expenses”); and |

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 12 |

| (H) | Expenses allocated to the Project pursuant to the Declaration, if and to the extent they would be Expenses hereunder if incurred by Landlord. |

| (2) | Expenses exclude: |

| (A) | Taxes; |

| (B) | Mortgage payments (principal and interest), ground lease rent, and costs of financing or refinancing the Building; |

| (C) | Commissions, advertising costs, attorney’s fees and costs of improvements in connection with leasing space in the Building; |

| (D) | Costs reimbursed by insurance proceeds, warranties or guarantees, or by tenants of the Building (other than as Additional Rent) or any other third party; |

| (E) | Depreciation; |

| (F) | Except for the costs identified in §4.2(b)(1)(G), costs required to be capitalized according to sound real estate accounting and management principles, consistently applied; |

| (G) | Collection costs and legal fees paid in disputes with tenants; |

| (H) | Costs to maintain and operate the entity that is Landlord (as opposed to operation and maintenance of the Project); |

| (I) | In the Base Year only, installments of costs amortized under subsection (c) of this §4.2; |

| (J) | Costs of performing additional services to or for tenants to any extent that such services exceed those provided by Landlord to Tenant without charge hereunder; |

| (K) | Amounts payable by Landlord for damages or which constitute a fine, interest, or penalty, including interest or penalties for any late payments of operating costs; |

| (L) | Costs representing an amount paid for services or materials to an affiliate of Landlord to any extent such amount exceeds the amount that would be paid for such services or materials at the then existing market rates to a person or entity that is not an affiliate of Landlord; |

| (M) | Bad debt loss, rent loss, or reserves for bad debts or rent loss; |

| (N) | Governmental charges, impositions, penalties or any other costs incurred by Landlord in order to clean-up, remediate, remove or abate any Hazardous Materials if such Hazardous Materials were installed or deposited in or on the Property in violation of then applicable law by Landlord, any tenant of the Building, any party expressly permitted by Landlord, or any such tenant to install or deposit such Hazardous Materials in the Building; |

| (O) | Electrical Costs (see §4.2(f) below); |

| (P) | Wages, salaries, fees, fringe benefits, and any other form of compensation paid to any executive employee of Landlord and/or Landlord’s managing agent above the grade of the day to day manager directly allocable to the Building/Project, provided, however, all wages, salaries and other compensation otherwise allowed to be included in Expenses shall also exclude any portion of such costs related to any employee’s time devoted to other efforts unrelated to the maintenance and operation of the Building/Project; |

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 13 |

| (Q) | Any reserves of any kind; |

| (R) | Costs, other than those incurred in ordinary maintenance and repair, for sculptures, paintings, fountains or other objects of art or the display of such items; |

| (S) | Costs arising from Landlord’s charitable or political contributions; |

| (T) | Any income, franchise, corporate, personal property, capital levy, capital stock, gross receipts, excess profits, transfer, revenue, estate, inheritance, gift, devolution or succession tax payable by Landlord other than Taxes; |

| (U) | Federal, state or local income taxes imposed on or measured by the income of Landlord from the operation of the Building or the Project, Landlord’s income and franchise taxes, special assessments and other business taxes except for Taxes and other business taxes which relate solely to the operation of the Building or the Project; and |

| (V) | Costs, fines, late payment charges, interest, penalties, legal fees or costs of litigation incurred due to the late payments of any taxes, unless such late payment was caused, in whole or in part, by a tenant’s failure to timely pay its rental obligations hereunder. |

| (c) | Amortization and Accounting Principles. |

| (1) | Each item of Government Mandated Expenses and Well-Being Expenses will be fully amortized in equal annual installments, with interest on the principal balance at the Amortization Rate, over the number of years, not to exceed ten (10), that Landlord projects the item of Expenses will be productive for its intended use, without replacement, but properly repaired and maintained. |

| (2) | Each item of Cost-Saving Expenses will be fully amortized in equal annual installments, with interest on the principal balance at the Amortization Rate, over the number of years that Landlord reasonably estimates for the present value of the projected savings in Expenses (discounted at the Amortization Rate) to equal the cost. |

| (3) | Any item of Expenses of significant cost that is not required to be capitalized but is unexpected or does not typically recur may, in Landlord’s discretion, be amortized in equal annual installments, with interest on the principal balance at the Amortization Rate, over a number of years determined by Landlord. |

| (4) | “Amortization Rate” means the prime rate of Citibank, N.A. (or a comparable financial institution selected by Landlord), plus two percent (2%). |

| (5) | Landlord will otherwise use sound real estate accounting and management principles, consistently applied and in substantial conformity with generally accepted accounting principles, to determine Additional Rent. |

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 14 |

| (d) | Estimates and Payments. Each calendar year, Landlord will reasonably estimate and advise Tenant in writing of Additional Rent that may be payable with respect to such calendar year. Tenant will pay the estimated Additional Rent in advance, in monthly installments, on the first day of each month, until the estimate is revised by Landlord. Landlord may reasonably revise its estimate twice during any calendar year, and the monthly installments after the revision will be paid based on the revised estimate. The aggregate estimates of Additional Rent paid by Tenant in a calendar year is the “Estimated Additional Rent.” Without limiting Landlord’s other rights hereunder and at law, Additional Rent not paid when due shall be subject to the Late Charge set forth in §4.5 below. |

| (e) | Settlement. As soon as practical after the end of each calendar year that Additional Rent is payable, Landlord will give Tenant a reasonably detailed statement of the actual (subject to the Expense Cap) Additional Rent for the calendar year. The statement of the actual Additional Rent is conclusive, binds Tenant, and Tenant waives all rights to contest the statement, except for items of Additional Rent to which Tenant objects by notice (the “Objection Notice”) to Landlord given within one hundred twenty (120) days after receipt of Landlord’s statement; however, Tenant’s objection will not relieve Tenant from its obligation to pay Additional Rent pending resolution of any objection. Subject to the Expense Cap, if the actual Additional Rent exceeds the Estimated Additional Rent for the calendar year, then Tenant shall pay the underpayment to Landlord in a lump sum as Rent within thirty (30) days after receipt of Landlord’s statement of Additional Rent. If the Estimated Additional Rent exceeds the actual Additional Rent for the calendar year, then Landlord shall credit the overpayment against Rent next due. However, if the Term ends during a calendar year, then Landlord may, in Landlord’s sole and absolute discretion, elect either of the following: (1) to forego the settlement of Additional Rent for the final calendar year that is otherwise required and accept the Estimated Additional Rent payable in the final calendar year in satisfaction of Tenant’s obligations to pay Additional Rent for the final calendar year, or (2) to have Landlord’s and Tenant’s obligations under this §4.2(e) survive the end of the Term. |

If Tenant has delivered an Objection Notice in connection with a statement of actual Additional Rent, and Tenant is not then in Default under this Lease, Tenant shall have the right, at Tenant’s sole expense, to conduct an audit of Landlord’s Expenses set forth on such statement. Such audit shall be at Landlord’s offices using the services of an independent, national public accounting firm designated by Tenant with not less than ten (10) years’ experience in conducting audits of the operating expense records of Class A office buildings in major metropolitan areas, within one hundred eighty (180) days of delivery of Landlord’s statement of actual Additional Rent. Under no circumstances will Tenant be permitted to review or audit income tax records of Landlord and similar financial records pertaining to Landlord as a business entity. Landlord shall have the right to dispute the results of the audit. Any refund due Tenant will be credited to the next installment of Base Rent due, or paid to Tenant within thirty (30) days if such Base Rent is not due. Any payment due from Tenant will be paid to Landlord within thirty (30) days of the audit. If the audit determines an over-billing of Expenses exceeding five percent (5%) of the corrected/reconciled total Expenses, then Landlord will reimburse Tenant for the actual costs of conducting the audit, but in no event will the amount of such reimbursement exceed the amount of the over-billing determined by such audit.

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 15 |

Any such audit by Tenant shall be upon at least thirty (30) days’ prior written notice to Landlord. Any such audit shall be conducted at a reasonable time, in a reasonable manner and otherwise so as to cause the least interference reasonably practicable to Landlord’s business and operations. Tenant will treat as confidential all information disclosed to Tenant as a result of any such audits; provided, however, that Tenant may disclose such information to Tenant’s employees, agents, attorneys and accountants and in connection with any lawsuit or other legal proceeding in connection with any dispute over Tenant’s obligations to pay Additional Rent. Landlord shall not be required to preserve its records relating to Expenses payable by Tenant for more than twenty-four (24) months after the end of the calendar year to which they relate.

| (f) | Electrical Costs. In addition to Expenses, and as a separate obligation, Tenant shall pay to Landlord, as Rent, the following electrical costs (the “Premises Electrical Costs”) incurred by Landlord which are directly attributable or reasonably allocable to the Premises: (1) actual grossed up costs of electrical services for HVAC, convenience outlets, and lighting in the Premises or otherwise used in the operation, maintenance and use of the Premises; (2) sales, use, excise and other taxes assessed by governmental authorities on electrical services described in subsection (1), above; and (3) other costs of providing electrical services to the Premises. Landlord will separately meter Tenant’s total consumption of electricity in and for the Premises pursuant to a submeter. Tenant shall, on the first day of each month during the Term, pay Landlord’s estimate of the Premises Electrical Costs. As soon as practical after the end of each calendar year, Landlord will give Tenant a reasonably detailed statement of the actual Premises Electrical Costs for the calendar year. The statement of the actual Premises Electrical Costs is conclusive, binds Tenant, and Tenant waives all rights to contest the statement, except for those objections to the actual Premises Electrical Costs specified in the Objection Notice. If the actual Premises Electrical Costs exceeds the estimated Premises Electrical Costs for the calendar year, then Tenant shall pay the underpayment to Landlord in a lump sum as Rent within thirty (30) days after receipt of Landlord’s statement of actual Premises Electrical Costs. If the estimated Premises Electrical Costs exceeds the actual Premises Electrical Costs for the calendar year, then Landlord shall credit the overpayment against Rent next due. However, if the Term ends during a calendar year, then Landlord may, in Landlord’s sole and absolute discretion, elect either of the following: (1) to forego the settlement of Premises Electrical Costs for the final calendar year that is otherwise required and accept the estimated Premises Electrical Costs payable in the final calendar year in satisfaction of Tenant’s obligations to pay Premises Electrical Costs for the final calendar year, or (2) to have Landlord’s and Tenant’s obligations under this §4.2(f) survive the end of the Term. Tenant’s payment of Premises Electrical Costs shall be in lieu of including in Expenses the cost of consumption of electricity of tenanted premises. Without limiting Landlord’s other rights hereunder and at law, Premises Electrical Costs not paid when due shall be subject to the Late Charge set forth in §4.5 below. |

In addition to Expenses, and as a separate obligation, Tenant shall pay to Landlord, as Rent, Tenant’s Share of the following electrical costs (the “Common Area Electrical Costs”) incurred by Landlord which are directly attributable or reasonably allocable to the Common Areas of the Project: (1) actual grossed up costs of electrical services used in the operation, maintenance and use of the Common Areas; (2) sales, use, excise and other taxes assessed by governmental authorities on electrical services supplied to the Common Areas; and (3) other costs of providing electrical services to the Common Areas. Tenant shall, on the first day of each month during the Term, pay Landlord’s estimate of Tenant’s Share of Common Area Electrical Costs. Tenant’s payment of Tenant’s Share of Common Area Electrical Costs shall be in lieu of including in Expenses the cost of consumption of electricity for the Common Areas. Payment of Common Area Electrical Costs by Tenant shall be subject to the provisions of §4.2 (d) and (e), above.

Notwithstanding the foregoing, Tenant shall not be obligated to pay either the Premises Electrical Costs or Tenant’s Share of the Common Area Electrical Costs until January 1, 2012.

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 16 |

4.3 Other Taxes. Upon demand, Tenant will reimburse Landlord for taxes paid by Landlord on (a) Tenant’s Personal Property, (b) Rent, (c) Tenant’s occupancy of the Premises, or (d) this Lease. If Tenant cannot lawfully reimburse Landlord for these taxes, then to the extent not prohibited by applicable law, the Base Rent will be increased to yield to Landlord the same amount after these taxes were imposed as Landlord would have received before these taxes were imposed.

4.4 Terms of Payment. “Rent” means all amounts payable by Tenant under this Lease and the Exhibits, including, without limitation, Base Rent, Additional Rent, and charges for any Additional Services (as defined in §6.2). If a time for payment of an item of Rent is not specified in this Lease, then Tenant will pay such item of Rent within thirty (30) days after receipt of Landlord’s statement or invoice. Unless otherwise provided in this Lease, Tenant shall pay Rent without notice, demand, deduction, abatement or setoff, in lawful U.S. currency, at Landlord’s Billing Address. Neither Landlord’s failure to send an invoice nor Tenant’s failure to receive an invoice for Base Rent (and installments of Estimated Additional Rent) will relieve Tenant of its obligation to timely pay Base Rent (and installments of Estimated Additional Rent). Each partial payment by Tenant shall be deemed a payment on account; and, no endorsement or statement on any check or any accompanying letter shall constitute an accord and satisfaction, or affect Landlord’s right to collect the full amount due. No payment by Tenant to Landlord will be deemed to extend the Term or render any notice, pending suit or judgment ineffective. By notice to the other, each party may change its Billing Address.

4.5 Late Payment. If Landlord does not receive any item of Rent when due, including, without limitation, Base Rent, Additional Rent, Premises Electrical Costs, Tenant’s Share of Common Area Electrical Costs and charges for any Additional Services, then Tenant shall pay Landlord a “Late Charge” of five percent (5%) of the overdue amount. Notwithstanding anything to the contrary set forth above, any such Late Charge shall not be payable with respect to the first such delinquent item of Rent during each calendar year during the Term (provided that such delinquent item of Rent is actually received by Landlord no later than ten (10) days after its due date), it being understood that said Late Charge shall apply to the second and any subsequent delinquent payment of Rent during each calendar year during the Term. Tenant agrees that the Late Charge is not a penalty, and will compensate Landlord for costs not contemplated under this Lease that are impracticable or extremely difficult to fix. Landlord’s acceptance of a Late Charge does not waive any Tenant default arising from such late payment.

5. USE & OCCUPANCY

5.1 Use. Tenant shall use and occupy the Premises only for the Use. Landlord does not represent or warrant that the Project is suitable for the conduct of Tenant’s particular business.

5.2 Compliance with Laws and Directives.

| (a) | Tenant’s Compliance. Subject to the remaining terms of this Lease, Tenant shall comply at Tenant’s expense with all directives of Landlord’s insurers or laws concerning: |

| (1) | The Leasehold Improvements and Alterations, |

| (2) | Tenant’s use or occupancy of the Premises, |

| (3) | Tenant’s employer/employee obligations, |

| (4) | A condition created by Tenant, |

| (5) | Tenant’s or its invitees’ failure to comply with this Lease, |

| (6) | The negligence of Tenant, its agents, contractors, employees, servants, invitees, vendors, licensees or Tenant’s Affiliates, or |

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 17 |

| (7) | Any chemical wastes, contaminants, pollutants or substances that are hazardous, toxic, infectious, flammable or dangerous, or regulated by any local, state or federal statute, rule, regulation or ordinance for the protection of health or the environment (“Hazardous Materials”) that are introduced to the Project, handled or disposed by Tenant or its Affiliates, or any of their contractors. |

| (b) | Landlord’s Compliance. Subject to the remaining terms of this Lease, Landlord shall comply at Landlord’s cost with all directives of Landlord’s insurers or laws concerning the Project other than those that are Tenant’s obligation under §5.2(a). The costs of compliance under this subsection (b) will be included in Expenses to the extent allowed under §4.2. |

5.3 Occupancy. Tenant shall not interfere with Building services or other tenants’ rights to quietly enjoy their respective premises or the Common Areas. Tenant shall not make or continue any nuisance, including any objectionable odor, noise, fire hazard, vibration, or wireless or electromagnetic transmission. Tenant will not maintain any Leasehold Improvements or use the Premises in a way that increases the cost of insurance required under §9.2, or requires insurance in addition to the coverage required under §9.2.

5.4 Prohibited Persons and Transactions. Tenant represents and warrants to Landlord that (a) Tenant and, to the best of Tenant’s knowledge, each of its officers, directors, shareholders, partners, members, and associates, are currently in compliance with and shall at all times during the Scheduled Term (including any extension thereof) remain in compliance with the regulations of the Office of Foreign Asset Control (“OFAC”) of the Department of the Treasury (including those named on the OFAC’s Specially Designated and Blocked Persons List) and any statute, executive order (including the September 24, 2001, Executive Order No. 13224 Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit or Support Terrorism (the “Executive Order”)), or other governmental action relating thereto; and (b) Tenant and, to Tenant’s knowledge, each of its officers, directors, shareholders, partners, members, and associates, are not, and will not be, a person with whom Landlord is restricted from doing business under the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA Patriot Act), H.R. 3152, Public Law 107-56 and the Executive Order and regulations promulgated thereunder and including persons and entities named on the OFAC Specially Designated Nations and Blocked Persons List.

5.5 Environmental Matters.

| (a) | Hazardous Substances. |

| (1) | Tenant shall not, except as provided in subparagraph (2) below, bring or otherwise cause to be brought or permit any of its agents, employees, contractors or invitees to bring in, on or about any part of the Premises, Building or Project, any hazardous substance or hazardous waste in violation of law, as such terms are or may be defined in (x) the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. 9601 et seq., as the same may from time to time be amended, and the regulations promulgated pursuant thereto (“CERCLA”); the United States Department of Transportation Hazardous Materials Table (49 CFR 172.102); by the Environmental Protection Agency as hazardous substances (40 CFR Part 302); the Clean Air Act; and the Clean Water Act, and all amendments, modifications or supplements thereto; (y) the Industrial Site Recovery Act, formerly known as the Environmental Cleanup Responsibility Act, N.J.S.A. 13:1K-6 et seq., as the same may from time to time be amended, and the regulations promulgated pursuant thereto (“ISRA”); and/or (z) any other rule, regulation, ordinance, statute or requirements of any governmental or administrative agency regarding the environment (collectively, (x), (y) and (z) shall be referred to as an “Applicable Environmental Law”). |

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 18 |

| (2) | Tenant may bring to and use at the Premises, hazardous substances incidental to its normal business operations under the NAICS Number referenced in §1(p) above solely in de minimis quantities and strictly in accordance with all Applicable Environmental Law. Tenant shall store and handle such substances in strict accordance with all Applicable Environmental Law. |

| (3) | Landlord represents to Tenant that as of the Delivery Date, to the actual knowledge of Landlord, (i) the Premises and the Common Areas will comply with all Applicable Environmental Laws binding on Landlord or the Building, and (ii) there are no Hazardous Materials in the Premises or the Common Areas, other than those in non-reportable quantities that are customarily used in connection with the operation and maintenance of an office building. If Landlord shall breach any of the above representations set forth in this §5.5(a)(3), Landlord shall not be deemed to be in default under this Lease unless Landlord shall fail to commence a Cure (defined below) within sixty (60) days after written notice from Tenant or, having commenced, shall thereafter fail to prosecute such Cure to completion with reasonable diligence. The term “Cure” shall mean, as applicable, causing compliance with the applicable law, rule or regulation, provided, however, that Landlord shall be required to cause such compliance only as, if and to the extent such compliance is actually required under such applicable law, rule or regulation. When the phrase “to the actual knowledge of Landlord” or similar phrase is used herein, it shall mean the current, actual knowledge, without duty of investigation or inquiry, of Deidre Hardister, who Landlord represents is the asset manager for the Project and is the representative of Landlord with the most knowledge concerning the Project. |

| (b) | NAICS Numbers/ISRA. |

| (1) | Tenant represents and warrants that Tenant’s NAICS Number as designated by the Executive Office of the President, Office of Management and Budget, and as set forth in §1(p) hereof, is correct. Tenant represents that the specific activities intended to be carried on in the Premises are in accordance with Article 1(i) and Tenant covenants and agrees that it will not do or suffer anything which will cause its NAICS Number (or that of any assignee or subtenant) to fall within any of the ISRA Subject NAICS Codes listed in Appendix C to the Regulations adopted pursuant to ISRA (subject to the specified exceptions and limitations) as same may be revised, modified, supplemented and/or amended from time to time during the Term (and any exercised renewal term) hereof (collectively, the “Covered Numbers”). Tenant further covenants and agrees to notify Landlord at least thirty (30) days prior to any change of facts which would result in the change of Tenant’s NAICS number from its present number to any of the Covered Numbers. Upon such notice, Landlord shall have the right, at its option, to terminate this Lease within thirty (30) days of receipt of such notice by notifying Tenant in writing. |

| (2) | Tenant shall not engage in operations at the Premises which involve the generation, manufacture, refining, transportation, treatment, storage, handling or disposal of “hazardous substance” or “hazardous waste” as such terms are defined under any Applicable Environmental Law. Tenant further covenants that it will not cause or permit to exist any “discharge” (as such term is defined under Applicable Environmental Law) on or about the Premises. |

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 19 |

| (c) | Additional Terms. In the event of Tenant’s failure to comply in full with this Article, Landlord may, after written notice to Tenant and Tenant’s failure to cure within thirty (30) days of its receipt of such notice, at Landlord’s option, perform any and all of Tenant’s obligations as aforesaid and all costs and expenses incurred by Landlord in the exercise of this right shall be deemed to be Additional Rent payable on demand and with interest at the Default Rate (as hereinafter defined). The parties acknowledge and agree that Tenant shall not be held responsible for any environmental issue at the Premises unless such issue was caused by an action or omission of Tenant or its agents, employees, consultants or invitees. This §5.5 shall survive the expiration or sooner termination of this Lease. |

5.6 Premises Security System. Tenant, at its sole cost and expense, may install a cardkey access and security system (and related equipment) in the Premises to limit and/or monitor access to the Premises, provided that such system is first approved by Landlord, such approval to not be unreasonably withheld, conditioned or delayed, and further provided that such system is compatible with the Building’s fire and life safety systems and complies with all applicable laws. Any changes to or replacement of such system must be approved in advance by Landlord, which approval shall not be unreasonably withheld, conditioned or delayed. Landlord will in no event have any responsibility for monitoring access to, or the security of, the Premises, and shall have no liability to Tenant or its employees or any other person for Claims due to theft or burglary or otherwise arising from any entry by any unauthorized persons into the Premises except for those acting under Landlord’s direct supervision and control. Further, Landlord shall not be required to insure against any such Claims. Tenant shall continuously throughout the Term provide Landlord with a “master” access card or access codes to permit Landlord entry into the Premises as permitted under this Lease. Further, upon termination of this Lease or Tenant’s right to possession of the Premises, Tenant shall provide Landlord with any codes or sequences necessary for Landlord to change or alter the cardkey access system. Subject to the forgoing, Tenant shall not affix additional locks on doors and will provide to Landlord the means of opening all areas of the Premises (excluding Tenant’s own safes, cabinets, or vaults, so long as Tenant provides means of opening same to Landlord after expiration of the Term to the extent same are part of the Leasehold Improvements to be left on the Premises after expiration or termination). In the event of the loss of any keys or Building access cards furnished by Landlord, Tenant shall pay to Landlord the cost of any replacement thereof. Each tenant shall, upon the termination of its tenancy, return to Landlord all keys to offices, storage and toilet rooms either furnished to, or otherwise procured by, Tenant.

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 20 |

5.7 Signage. Subject to the approval by all applicable governmental authorities, and Tenant’s compliance with all applicable governmental laws and ordinances, all recorded covenants, conditions and restrictions affecting the Building, and the terms of this §5.7, Tenant shall have the non-exclusive right (the “Signage Right”) to install, at Tenant’s cost, (a) up to two (2) signs (the “Building Exterior Sign”) displaying Tenant’s name, “Pinnacle Foods Group, LLC,” and/or its logo on the exterior of the Building as depicted on EXHIBIT L attached hereto; and (b) one (1) sign (the “Monument Sign”) on a ground mounted monument in front of the Building as depicted on EXHIBIT M attached hereto. The graphics, materials, color, design, lettering, lighting, size, specifications and manner of affixing the Building Exterior Sign and Monument Sign shall be subject to Landlord’s reasonable approval, which shall not be unreasonably withheld, conditioned or delayed. Tenant shall pay for all costs and expenses related to the Building Exterior Sign and Monument Sign, including, without limitation, costs of the design, construction, installation, maintenance, insurance, utilities, repair and replacement thereof. Tenant shall install and maintain the Building Exterior Sign and Monument Sign in good condition and repair, in compliance with all laws and ordinances affecting same, and will be subject to any reasonable rules and regulations of Landlord. Landlord shall reasonably cooperate with Tenant, at no cost to Landlord, in obtaining the necessary governmental approvals and permits for the Building Exterior Sign and Monument Sign. Notwithstanding any of the foregoing, the Signage Right shall terminate and Landlord may require that Tenant remove the Building Exterior Sign and/or Monument Sign at any time if a Default by Tenant exists under this Lease. Upon the expiration or earlier termination of this Lease, Tenant shall promptly remove the Building Exterior Sign and Monument Sign, at Tenant’s sole cost and expense, and restore the portion of the Building and monument where the Building Exterior Sign and Monument Sign, respectively, were installed to the condition existing immediately prior to the installation of the Building Exterior Sign and Monument Sign, which obligations shall survive the Expiration Date. Tenant may assign its Signage Right to any third party to whom Tenant assigns all of its right, title and interest under this Lease pursuant to a Permitted Transfer or other assignment consented to by Landlord. Tenant may transfer all (but not less than all) of its Signage Rights under this §5.7 to a subtenant only upon Landlord’s prior written approval, which approval will not be unreasonably withheld, delayed or conditioned so long as the proposed subtenant is of a quality, character and business reputation reasonably comparable to the quality and character of other companies with exterior signage on other multi-tenant office buildings of comparable size, age and quality in the Cherry Hill, New Jersey area (“Comparable Buildings”). Any transfer of the Signage Right to a subtenant shall be subject to the corresponding limitations and obligations set forth in this Lease. Other than as set forth above, Tenant’s signage rights described in this §5.7 shall not be assignable, and any attempted assignment in violation of this requirement shall be null and void.

5.8 Roof-Mounted Equipment. Landlord grants to Tenant the non-exclusive right to install up to two (2) wireless communication antennae and/or satellite dishes on the roof of the Building, and connect said antennae/dishes to the Premises without any obligation for any monthly rental therefore, provided that (i) Landlord or Landlord’s designated agent has first approved of the proposed location and manner of installation thereof and all plans and specifications therefore, and (ii) all installation work shall be performed in a good and workmanlike manner, free and clear of liens and in compliance with all applicable laws and otherwise in compliance with this Lease as it applies to Tenant’s Alterations. Tenant shall be solely responsible for the cost of installation, operation and maintenance of the antennae/dishes, including, without limitation, the cost of any electricity usage associated therewith, and the cost of any necessary licenses and permits (including any required FCC licenses and permits). Tenant shall clearly and conspicuously use and maintain tags to mark the antennae/dishes with the Tenant’s name, frequency numbers, date of installation, and Tenant’s contact information. Tenant shall provide evidence to Landlord reasonably satisfactory to Landlord that all such permits and licenses have been obtained prior to any installation of the antennae/dishes. Tenant shall operate the antennae/dishes strictly in accordance with applicable laws. Tenant may not penetrate the roof or roof membrane in installing the antennae/dishes without Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed. Notwithstanding such consent and any other provision of this Lease, Tenant shall use only Landlord’s contractors to install, maintain, repair, and/or remove any antennae/dish, and Tenant shall be solely responsible for, and hereby releases Landlord from, damage to the roof and any liability or expense suffered by Tenant caused by the installation or existence of the antennae/dishes, including, without limitation, any damages suffered by Tenant due to roof leakage caused by the antennae/dishes. Tenant may access the roof only with an escort by Landlord or Landlord’s property manager; if such an escort is required after normal business hours, Tenant shall pay the actual cost to Landlord for such escort. In the event of an emergency, Tenant may access the roof without an escort. The antennae/dishes shall remain the property of Tenant and, upon termination or expiration of this Lease, Tenant shall promptly remove the antennae/dishes and shall repair (or reimburse Landlord for such repair) any damage caused by the removal of the antennae/dishes. This section shall survive any expiration or termination of this Lease.

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 21 |

Tenant warrants and covenants that on the installation of the antennae/dishes and for the entire Term of this Lease, the antennae/dishes and the installation, maintenance and operation thereof is and will be in full compliance with all applicable Federal Communications Commission (“FCC”) and Federal Aviation Administration (“FAA”) rules, regulations or guidelines and will not cause interference with any existing communications equipment installed on the Property or the ability of occupants of the Property to receive radio, television, telephone, microwave, short-wave, long-wave or other signals of any sort or with any antennas, satellite dishes or other electronic or electric equipment or facilities currently or hereafter located on the roof or any floor of the Building or on the Property or with any equipment, installation, wires, cabling or machinery on the Building or the Property. Tenant acknowledges that carriers other than Tenant may license space on the Building or Property, including the roof of the Building. Upon request, Tenant shall provide Landlord or Landlord’s agent with a comparison of the emissions of the antennae/dishes with that of the FCC standards. If Tenant causes such interference, Landlord shall provide Tenant with notice of such interference and Tenant shall promptly make all necessary repairs and adjustments, at Tenant’s own expense, to eliminate such interference and to insure maximum interference protection, to Landlord’s and Landlord’s agent’s reasonable satisfaction and in accordance with all applicable FCC and FAA rules, regulations and guidelines, including but not limited to modifying the antennae/dishes or relocating the antennae/dishes to another location on the Building or other area of the Property reasonably designated by Landlord, so long as such location has substantially the same “line of sight” transmission and/or receiving capacity as the prior location; and all costs incurred by Landlord in connection therewith shall be paid by Tenant to Landlord, without setoff or deduction, within thirty (30) days after Tenant’s receipt of Landlord’s invoice. If such interference cannot be eliminated within seventy-two (72) hours after notice from Landlord to Tenant, Tenant shall temporarily power down the equipment causing the interference, except for intermittent operation for the purpose of testing after performing maintenance, repair, modification, replacement or other action taken for the purpose of correcting such interference. If Tenant does not power down the equipment causing the interference, Landlord may disconnect power to the antenna, except for intermittent operation for the purpose of testing after performing maintenance, repair, modification, replacement or other action taken for the purpose of correcting such interference. The parties acknowledge that there will not be an adequate remedy at law for non-compliance with the provisions of this paragraph and, therefore, either party shall have the right to specifically enforce the provisions of this paragraph at law or in equity in a court of competent jurisdiction.

5.9 Test Kitchen. As used in this Lease, the term “Use” shall include the operation of a Test Kitchen (herein so called), whereby Tenant shall directly or with third party consultants develop new food products and packaging for sale and taste-test various food samples prepared or developed by Tenant. Notwithstanding the foregoing:

| (a) | Tenant shall not cause or maintain any nuisance in or about the Premises, and shall keep the Premises free of debris, rodents, vermin and anything of a dangerous, noxious or offensive nature or which could create a fire hazard (through undue load on electrical circuits or otherwise) or undue vibration, heat or noise. Tenant shall not permit any objectionable or offensive noise or odors to be emitted from the Premises; or do anything, or permit anything to be done, which would, in Landlord’s opinion, disturb or tend to disturb other tenants occupying leased space in the Building. If, within fifteen (15) days of receipt of written notice, Tenant does not act upon a request from Landlord that Tenant control any such odors, then Landlord shall have the right to take reasonable steps to cure the problem, and Tenant shall reimburse Landlord within thirty (30) days thereafter for the costs thereof. |

| (b) | Tenant shall procure at its sole expense any permits and licenses required for the transaction of business in the Premises for the Use. At Landlord’s request, Tenant shall deliver to Landlord copies of all such permits and licenses and proof of Tenant’s compliance with all such laws. |

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 22 |

| (c) | Tenant shall accept delivery of and ship goods and merchandise from the Premises only in the manner and at such times and in such areas as may be reasonably designated by Landlord and conform to all rules and regulations adopted by Landlord with respect thereto, including, but not limited to, security arrangements with respect to shipping and receiving areas and the transport of goods and merchandise to and from the Premises. Because of the unique nature of Tenant’s business, Tenant further agrees that: |

| (i) | it will not permit any deliveries of goods or merchandise at any time when Tenant’s employees are not available to receive same; |

| (ii) | it will not permit any goods or merchandise to remain in, on or near any doorways, loading docks, receiving areas or other portions of the Project; |

| (iii) | it will require that all purveyors with whom Tenant does business adequately and securely package all goods and merchandise so as to prevent any leaking, spilling, spoilage, odors or infestation; and |

| (iv) | it will immediately transfer all goods and merchandise received to the Premises and properly store the same in the Premises so as to retard any spoilage thereof, to prevent any odors emanating therefrom and to prevent the infestation thereof. |

| (d) | Tenant shall, at its sole cost and expense, and as needed engage professional exterminators to service the Premises, including but not limited to the Test Kitchen, at such frequency and to the extent necessary to keep the Premises free of insects, rodents, vermin and other pests and to prevent insects, rodents, vermin and other pests from the Premises infesting spaces leased to other tenants of the Project. Tenant shall provide to Landlord, upon demand, reasonable proof that Tenant is causing such exterminating to be performed. |

| (e) | Tenant shall be responsible for maintenance of the grease traps pursuant to Section 7.1 of this Lease, and further: |

| (i) | Tenant shall, at its sole cost and expense, provide the necessary piping, connections, grease traps, catch basins and other facilities for the removal of all waste liquids from the Premises in compliance with all applicable codes and ordinances of Cherry Hill, New Jersey and Burlington County, New Jersey and other governmental authorities having jurisdiction. |

| (ii) | No pipes, connections, grease traps, catch basins or other facilities shall be installed through the walls, floor or ceiling of the Premises or through any portion of the Building (including but not limited to the exterior walls or the foundation of the Building) without the written consent of Landlord as to the location and construction thereof, such consent not to be unreasonably delayed, conditioned or withheld. Landlord may require that Tenant’s facilities be connected to pipes, risers, catch basins or other facilities located outside the Premises and intended for use by Tenant and other food preparation facilities in the Project. In such event, Tenant shall provide the necessary pipes, connections and other facilities to connect Tenant’s facilities thereto. |

| (iii) | Tenant shall not dispose of waste grease, oil or other materials which tend to cause clogging or blockage of pipes and drains (hereinafter collectively referred to as “grease”) by pouring or permitting the same to flow into any drains or pipes. In the event that Tenant shall do so, Tenant shall reimburse Landlord for the entire cost of cleaning of all drains, pipes, sewers or other waste liquid disposal facilities damaged thereby plus Landlord’s standard administrative charge. |

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 23 |

| (iv) | Tenant shall, on a reasonably regular basis (but not less frequently than semi-annually), adequately clean or provide for the cleaning of all grease traps and similar facilities serving the Premises. Tenant shall not use any chemicals or other cleaning methods which could damage the drain pipes or other portions of the drainage and/or sewer system in the Premises or in or serving the Project. Tenant shall provide to Landlord, upon demand, reasonable proof that Tenant is regularly doing such cleaning or causing it to be done. |

| (f) | Tenant shall be responsible for maintenance of the exhaust systems pursuant to Section 7.1 of this Lease, and: |

| (i) | Tenant shall, at its sole cost and expense provide the necessary exhaust fans and systems, ductwork and venting to ensure that all smoke, odors, vapors and steam are exhausted from the Premises. Such systems shall be installed, using Landlord’s contractors, so as to prevent the discharge of smoke, odors, vapors and steam into the Common Areas of the Building or into spaces leased to others and to avoid the likelihood that such smoke, odors, vapors and steam will be directed to or carried to the Common Areas of the Project or into spaces leased by others. |

| (ii) | No exhaust vents, flues, pipes or other outlets shall be installed through the walls, floor or ceiling of the Premises or through any portion of the Building (including but not limited to the exterior walls or the roof of the Building) without the written consent of Landlord as to the location, such consent not to be unreasonably delayed, conditioned or withheld, construction and appearance thereof. Landlord may require that Tenant’s exhaust system(s) be connected to pipes, stacks, flues, vents or other facilities located outside the Premises and intended for use by Tenant and other food preparation facilities in the Building. In such event, Tenant shall provide the necessary pipes, vents, ductwork and other facilities to connect Tenant’s exhaust system thereto. |

| (iii) | Tenant shall, at its sole cost and expense and on a reasonably regular basis (but not less frequently than semi-annually), adequately clean or provide for the cleaning of all exhaust and venting systems serving the Premises. This cleaning shall include degreasing of all hoods, fans, vents, pipes, flues, grease traps and other areas of such systems subject to grease buildup. Tenant shall provide to Landlord, upon demand, reasonable proof that Tenant is doing such cleaning and degreasing or causing it to be done. |

| (g) | If Tenant desires to have gas service in the Premises for cooking (no other use of gas being permitted in the Project), Tenant shall be responsible for the installation of necessary pipes and other facilities to connect the Premises to the gas supply lines in the Project or, if not such connections are existing, to the gas supply lines of the public utility providing gas service. All such installations shall be in accordance with and subject to the other provisions of the Lease. If gas connections are provided within the Project, Landlord reserves the right to submeter gas to the Premises in which event Tenant shall pay to Landlord the cost of such service (without mark-up by Landlord) within fifteen (15) days after invoice as Additional Rent. Otherwise, Tenant shall contract directly with the public utility providing gas service and shall pay the entire cost of such gas service and the cost of metering (including meter installation) directly to such provider. |

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 24 |

| (h) | Landlord’s Standard Services do not include janitorial services to the Test Kitchen. Tenant, at its sole cost and expense, shall be solely responsible for all cleaning and sanitation of and janitorial services to the Test Kitchen and shall keep the Test Kitchen and service-ways and loading areas adjacent to the Test Kitchen neat, clean and free from waste, dirt, garbage, rubbish, insects and pests at all times, and shall store all trash and garbage within the Premises and/or within the areas designated by Landlord for trash pickup and removal and only in the receptacles prescribed by Landlord, all at Tenant’s sole cost and expense. Notwithstanding the above, without Landlord’s prior written consent, which consent will not be unreasonably withheld, conditioned or delayed, Tenant shall not employ any third parties (other than employees of Tenant) to provide any cleaning, sanitation or janitorial service to the Test Kitchen. |

5.10 Generator/Equipment License. Landlord grants to Tenant a license to use and maintain Landlord’s emergency back-up generator in its existing location on the pad behind the Premises or any other location mutually agreed-upon by Landlord and Tenant. This grant of license does not create an easement, leasehold or any other interest in the Project, Land or Building. Tenant shall, at Tenant’s sole cost and expense, be responsible for the maintenance of this equipment, and shall be in compliance with all laws in connection with its use and operation.

6. SERVICES & UTILITIES

6.1 Standard Services.

| (a) | Standard Services Defined. “Standard Services” means: |

| (1) | Heating, ventilation and air-conditioning (“HVAC”) during Business Hours as reasonably required to for an ordinary person to comfortably use and occupy the Premises for ordinary office purposes in a commercially reasonable manner; |

| (2) | Tempered water from the public utility for use in the Premises; |

| (3) | Janitorial Services to the Premises (except the Test Kitchen) five (5) days a week, except Holidays, as set forth in EXHIBIT N; |

| (4) | Access to the Premises at all times (24 hours a day/seven days a week); |

| (5) | Building Standard bulbs are provided to Tenant (specialty bulbs will be billed to Tenant as set forth in §6.2 below); |

| (6) | Labor to replace fluorescent tubes and ballasts in Building Standard light fixtures in the Premises; |

| (7) | Electricity from Landlord’s selected provider(s) for lighting in the Common Areas and as follows in the Premises: electricity for Building Standard lighting (one 3 amp fixture per each 80 RSF of the Premises), electricity for Building Standard HVAC and the operation of customary quantities and types of office equipment (excluding data processing), and kitchen equipment for a similarly situated usage, so long as the connected load does not exceed eight (8) watts per RSF of the premises demand load with respect to lighting and receptacles, exclusive of base building electrical loads, which include, but are not limited to, electricity for HVAC that serves or will serve the Premises. For the kitchen equipment, Tenant shall limit demand load of kitchen related equipment to no more than the rating of conductors and electrical distribution equipment, new or existing, that serve the Premises; and |

| (8) | Washing of the interior (at least once a year) and the exterior (at least twice a year) of all exterior window glass in the Premises. |

| 10604.006/101 Woodcrest Corporate Center-Pinnacle Foods Group Lease v4sdp |

Page 25 |