Attached files

| file | filename |

|---|---|

| 8-K - UIL FORM 8-K DATED AUGUST 4, 2010 - UIL HOLDINGS CORP | uil_form8kdated08042010.htm |

| EX-99 - UIL EXHIBIT 99 - EARNINGS RELEASE - UIL HOLDINGS CORP | uil_exh99.htm |

1

2Q 2010 Earnings Conference Call

August 5, 2010

EXHIBIT 99.1

2

Safe Harbor Provision

Certain statements contained herein, regarding matters that are not historical facts, are forward-looking statements (as defined in the Private

Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts

for the future including, without limitation, UIL’s expectations with respect to the benefits, costs and other anticipated financial impacts of the

proposed transaction; future financial and operating results of the company; the company’s plans, objectives, expectations and intentions with

respect to future operations and services; approval of the proposed transaction by governmental regulatory authorities; the availability of

financing; the satisfaction of the closing conditions to the proposed transaction; and the timing of the completion of the proposed transaction.

Such forward-looking statements are based on the Corporation’s expectations and involve risks and uncertainties; consequently, actual results

may differ materially from those expressed or implied in the statements. Such risks and uncertainties include, but are not limited to, general

economic conditions, legislative and regulatory changes, changes in demand for electricity and other products and services, changes in

financial markets, unanticipated weather conditions, changes in accounting principles, policies or guidelines, and other economic, competitive,

governmental, and technological factors affecting the operations, timing, markets, products, services and prices of the Corporation’s

subsidiaries. Examples of such risks and uncertainties specific to the transaction include, but are not limited to: the possibility that the

proposed transaction is delayed or does not close, including due to the failure to receive required regulatory approvals, the taking of

governmental action (including the passage of legislation) to block the transaction, or the failure of other closing conditions; the possibility that

the expected benefits will not be realized, or will not be realized within the expected time period; and the ability to issue equity and debt

securities upon terms and conditions UIL believes are appropriate. The foregoing and other factors are discussed and should be reviewed in

the Corporation’s most recent Annual Report on Form 10-K and other subsequent periodic filings with the Securities and Exchange

Commission. Forward-looking statements included herein speak only as of the date hereof and the Corporation undertakes no obligation to

revise or update such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or

circumstances.

Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts

for the future including, without limitation, UIL’s expectations with respect to the benefits, costs and other anticipated financial impacts of the

proposed transaction; future financial and operating results of the company; the company’s plans, objectives, expectations and intentions with

respect to future operations and services; approval of the proposed transaction by governmental regulatory authorities; the availability of

financing; the satisfaction of the closing conditions to the proposed transaction; and the timing of the completion of the proposed transaction.

Such forward-looking statements are based on the Corporation’s expectations and involve risks and uncertainties; consequently, actual results

may differ materially from those expressed or implied in the statements. Such risks and uncertainties include, but are not limited to, general

economic conditions, legislative and regulatory changes, changes in demand for electricity and other products and services, changes in

financial markets, unanticipated weather conditions, changes in accounting principles, policies or guidelines, and other economic, competitive,

governmental, and technological factors affecting the operations, timing, markets, products, services and prices of the Corporation’s

subsidiaries. Examples of such risks and uncertainties specific to the transaction include, but are not limited to: the possibility that the

proposed transaction is delayed or does not close, including due to the failure to receive required regulatory approvals, the taking of

governmental action (including the passage of legislation) to block the transaction, or the failure of other closing conditions; the possibility that

the expected benefits will not be realized, or will not be realized within the expected time period; and the ability to issue equity and debt

securities upon terms and conditions UIL believes are appropriate. The foregoing and other factors are discussed and should be reviewed in

the Corporation’s most recent Annual Report on Form 10-K and other subsequent periodic filings with the Securities and Exchange

Commission. Forward-looking statements included herein speak only as of the date hereof and the Corporation undertakes no obligation to

revise or update such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or

circumstances.

Reconciliation of Non-GAAP Financial Measures

Financial measures highlighted in this presentation may be considered non-GAAP financial measures such as Earnings Before Interest

Expense, Income Tax, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA and Adjusted Net Income. Comparable GAAP financial

measures and a reconciliation of GAAP financial measures to non-GAAP financial measures are available in the Appendix to this presentation.

Expense, Income Tax, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA and Adjusted Net Income. Comparable GAAP financial

measures and a reconciliation of GAAP financial measures to non-GAAP financial measures are available in the Appendix to this presentation.

Notices

James P. Torgerson

President and Chief Executive Officer, UIL Holdings Corporation

Richard J. Nicholas

Executive Vice President and Chief Financial Officer, UIL Holdings Corporation

3

Agenda

› 2Q 2010 Major Events

» Earnings Summary

» Gas Companies Acquisition Update

» New England East West Solution (NEEWS) Agreement

» GenConn Update

› Capital Expenditure Program

» Refreshed T&D 10-Year Capital Expenditure Program

» Average Rate Base Growth

› State Regulatory Update

› 2Q 2010 Financial Results Detail

› Debt Maturity & Liquidity

› 2010 Earnings Guidance

4

2Q 2010 Financial Results - Summary

2Q 2010

» 2Q ’10 consolidated earnings of $10.1 million, or $0.34 per basic share, compared to

$13.8 million, or $0.51 per basic share, in 2Q ’09

$13.8 million, or $0.51 per basic share, in 2Q ’09

» After-tax acquisition-related costs in the amount of $4.3 million, or $0.14 per share

included in the 2Q and YTD ’10 results

included in the 2Q and YTD ’10 results

» Excluding acquisition-related costs, consolidated net income was $14.4 million, or $0.48

per share for the 2Q ’10

per share for the 2Q ’10

YTD 2010

» YTD ’10 consolidated earnings of $26.2 million, or $0.87 per basic share, compared to

$25.8 million, or $0.99 per basic share

$25.8 million, or $0.99 per basic share

» Excluding acquisition-related costs, consolidated net income was $30.5 million, or $1.01

per share

per share

» Distribution expected to earn above its allowed return of 8.75%

» Transmission expected to earn its allowed weighted average ROE of 12.3%-12.5%

5

Description

› Acquisition of three regulated gas LDCs owned by Iberdrola with approximately

369,000 customers

369,000 customers

» Southern Connecticut Gas (“SCG”) - 176,000 customers

» Connecticut Natural Gas (“CNG”) - 157,000 customers

» Berkshire Gas Company (“BGC”) - 36,000 customers

› Adjusted EBITDA for 12 months ended 3/31/10 of three gas LDCs of approx. $138 million1

Purchase Price

› $1,296 million less net debt of approximately $411 million for an expected cash payment at

closing of approximately $885 million, subject to post closing adjustments

closing of approximately $885 million, subject to post closing adjustments

Tax Treatment

› UIL expects to realize transaction related tax benefits of approximately $135 million on a net

present value basis

present value basis

Timing

› Expected closing in the first quarter of 2011

Approvals

› Connecticut Department of Public Utility Control (DPUC) à filed 7/16; hearings 8/16 & 8/25

› Massachusetts Department of Public Utilities (DPU) à filed 7/23

› HSR (Hart-Scott-Rodino) à filed 7/14

› No shareowner vote required

Financing Plan

› Approximately $400 million UIL Holdings unsecured debt

› Approximately $500 million equity

(1) Source: Adjustments based on notes in audited financial statements and estimates from discussions with Iberdrola USA management.

May 25, 2010 Announcement

Gas Companies Acquisition

Gas Companies Acquisition

6

Pending Acquisition

Strategic Rationale

Strategic Rationale

› Transformative transaction nearly doubling the size of UIL’s regulated investments

› Expected enhanced cash flow and earnings per share accretion provide continued support of UIL’s

dividend

dividend

» Cash flow accretive immediately

» EPS accretive beginning in the first full year following closing (2012)

› Consistent with core business - regulated energy delivery

» UI’s electric utility has a proven ability to earn its allowed return in Connecticut

» Berkshire operating under a constructive rate plan in Massachusetts

› Scale benefits

» Acquisition creates a larger, diversified energy delivery company

› Asset diversification and growth opportunities

» Diversifies UIL’s revenue mix

» Diverse peaking seasons help levelize earnings and cash flow

4 Adds gas winter peak to electric summer peak

» Growth opportunities through efficient expansion of customer gas utilization

› Cost savings potential

» 2009 allocated corporate overheads, support costs and shared services totaled approximately $23

million at the gas LDCs

million at the gas LDCs

» Opportunity to realize expected savings of roughly half of the allocated amount, which is expected

to contribute to the gas LDCs’ ability to earn their allowed return beginning in the first full year

following closing

to contribute to the gas LDCs’ ability to earn their allowed return beginning in the first full year

following closing

7

Combined Service Territory

|

2009

|

|

UIL

Holdings Contribution |

Gas

Companies Contribution |

|

Adjusted

EBITDA(1) |

$349 Million

|

63%

|

37%

|

|

Adjusted

Net Income(1) |

$93 Million

|

59%

|

41%

|

|

Avg Rate Base

|

$1,909 Million

|

55%

|

45%

|

|

Electric Customers

|

325,000

|

100%

|

0%

|

|

Gas Customers

|

369,000

|

0%

|

100%

|

|

Regulated States

|

CT, MA

|

CT

|

CT, MA

|

Combined Statistics

Combined dollar amounts may not add due to rounding.

Note: (1) UIL and Berkshire Gas amounts are unadjusted.

Pending Acquisition

Combined Business Snapshot

Combined Business Snapshot

8

Agreement builds off of successful

partnership between UI and CL&P

on the recently completed

Middletown-to-Norwalk Project.

partnership between UI and CL&P

on the recently completed

Middletown-to-Norwalk Project.

July 15, 2010 Announcement

NEEWS Agreement

NEEWS Agreement

› On July 14, 2010 UI entered into an agreement

with CL&P under which UI will have the right

to invest in and own transmission assets

associated with the CT portion of CL&P’s

NEEWS projects

with CL&P under which UI will have the right

to invest in and own transmission assets

associated with the CT portion of CL&P’s

NEEWS projects

› Total expected CT portion project cost - $711

million

million

» UI has the right to invest up to the greater of $60

million or an amount equal to 8.4 percent of

CL&P’s costs for the CT portions

million or an amount equal to 8.4 percent of

CL&P’s costs for the CT portions

› Upon commercial operation, assets will be

transferred to UI in proportion to its

investments

transferred to UI in proportion to its

investments

» UI investments expected to be made over the next

three or more years depending on the project in

service dates

three or more years depending on the project in

service dates

› Regulatory approvals:

» Joint application filed with the DPUC on 7/15

» FERC filing following DPUC approval

9

Financing

GenConn Energy LLC

› 50/50 debt/equity

Status

› On July 30, 2010 filed with the DPUC the 2011

revenue requirement application for both the

Devon and Middletown facilities

revenue requirement application for both the

Devon and Middletown facilities

10

Total

2010-2019P

Distribution

147

$

187

$

129

$

111

$

114

$

577

$

1,265

$

Transmission

74

$

75

$

70

$

56

$

58

$

204

$

537

$

GenConn*

$

63

$

$

-

$

-

$

-

$

117

$

Total Base Capital Exp.**

* Equity investment - Devon plant now operating, Middletown expected operation 6/1/11. ** Amounts may not add due to rounding.

($ in millions)

Base 10-yr CapEx Forecast

› High probability of occurrence (90+%)

» Identified projects with clear need and

regulatory support

regulatory support

› Represents 12.6% or $214 million increase

over prior 10-year CapEx Plan

over prior 10-year CapEx Plan

» Distribution up 7.4% or $87 million

42 new substations

4Capacity expansions at existing substations

» Transmission up 32.6% or $132 million

42 new substations

4Greater Bridgeport area compliance

expenditures

expenditures

» GenConn down 4.4% or ($5 million)

4Lower projected capitalized costs & interest

Growth Opportunities Beyond Base Forecast

› Transmission investment within the

region

region

» Renewable Portfolio Standards driving

new transmission

new transmission

» Policy support from New England

Governors’ Energy Blueprint

Governors’ Energy Blueprint

› Generation Opportunities

» Potential opportunity for ownership of

base-load generation

base-load generation

54

-

UI T&D Base 10-yr Capital Expenditure Program

11

Aging Infrastructure

Cable & Pole Replacement

Distribution Transformer

Replacement

Replacement

Splice Chambers

Substation Rebuilds (5)

Substation Removals

Capacity

Shelton Substation

Bus Additions

Feeder Transfers

Core Support

Central Facility

System Operations

Customer Projects

* Amounts may not add due to rounding.

Total

Aging Infrastructure

59.0

$

47.1

$

53.4

$

49.1

$

50.6

$

231.1

$

490.1

$

Capacity

25.8

$

26.0

$

25.6

$

26.3

$

35.8

$

184.3

$

323.9

$

System Operations

17.4

$

18.3

$

12.3

$

12.0

$

10.9

$

60.6

$

131.5

$

Core Support

44.9

$

95.8

$

37.8

$

23.6

$

17.0

$

100.7

$

319.8

$

Total Base Distribution*

($ in millions)

UI Base Plan - Distribution Investments

12

Grand Ave Switching Station Rebuild

Other Substation Rebuilds (5)

Line/Cable Replacement

Capacity

Standards Compliance /

Other

Other

*Amounts may not add due to rounding.

Total

Aging Infrastructure

42.1

$

35.3

$

15.3

$

14.9

$

12.8

$

107.1

$

227.5

$

Capacity

13.4

$

13.6

$

4.4

$

2.1

$

11.5

$

49.3

$

94.2

$

Standards Compliance/Other

18.4

$

25.7

$

50.4

$

39.3

$

33.8

$

47.8

$

215.3

$

Total Base Transmission*

($ in millions)

Aging Infrastructure

Greater Bridgeport Area

Compliance Expenditures

Compliance Expenditures

NERC/Cyber Security/IT related

NEEWS

UI Base Plan - Transmission Investments

13

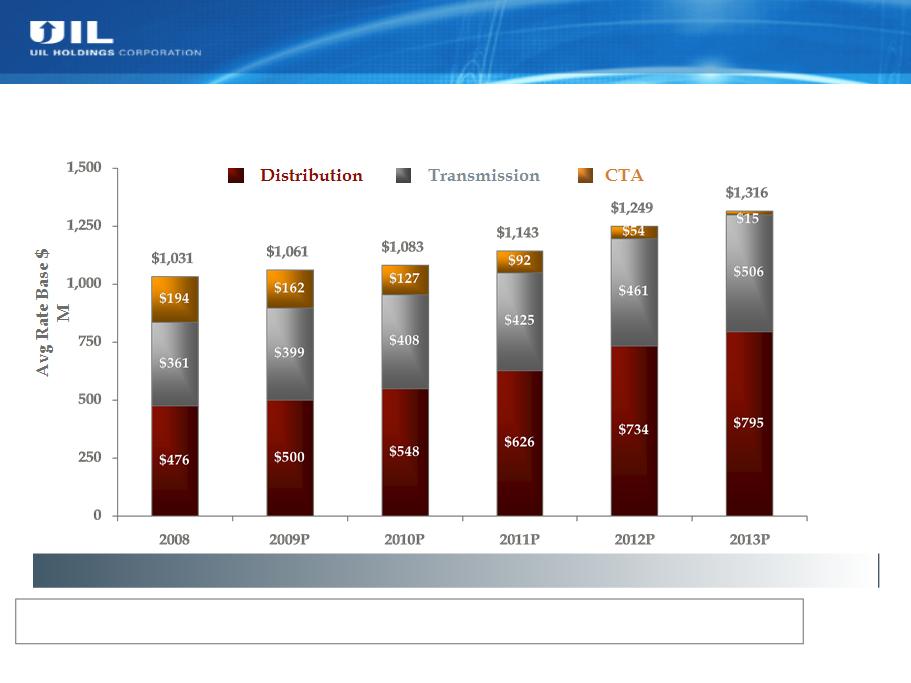

47%

38%

15%

49%

39%

12%

Rate base growth even with a declining CTA balance

54%

38%

8%

58%

38%

4%

60%

39%

1%

61%

39%

Avg. GenConn RB Equivalent

UI CAGR 7.4%

$153m

$199m

$188m

$177m

Avg. GenConn Equity “Rate Base”

$77m

$94m

$89m

$99m

UI’s 50% Share:

$52m

$26m

UI + GenConn CAGR 9.8%

UI 2010 - 2014 Average Rate Base Forecast

(Excluding GenConn Equity Investments)

(Excluding GenConn Equity Investments)

14

State Regulatory Update

› Decoupling Draft Decision (DN 08-07-04RE02)

» Would defer ruling on extension of decoupling pilot to the early part of 2011

» Would approve decoupling charge of approx. $1.6 million, which includes approx. $3.8

million already recovered in rates from the previously approved rate increase

acceleration to 1/1/10

million already recovered in rates from the previously approved rate increase

acceleration to 1/1/10

4 Offset by approx. $3.9 million credit for pension tracker and earnings sharing surcredit

4 Net credit of approx. $2.3 million to be returned over the 12 month period starting in September

› Generic ROE proceeding (DN 09-10-06)

» Hearings set for mid-September

» Final decision expected late December

15

* Competitive Transition Assessment

Quarter Ended June 30,

6 Months Ended June 30,

2010

2009

Difference

2010

2009

Difference

UI

Distribution, CTA* and Other

8.0

$

8.1

$

(0.1)

$

17.9

$

14.9

$

3.0

$

Transmission

7.1

6.2

0.9

13.8

12.3

1.5

Total UI Net Income

15.1

$

14.3

$

0.8

$

31.7

$

27.2

$

4.5

$

UIL Corporate, excl. acquisition-related costs

(0.7)

(0.5)

(0.2)

(1.2)

(1.4)

0.2

Subtotal

14.4

$

13.8

$

0.6

$

30.5

$

25.8

$

4.7

$

UIL Corporate acquisition-related costs

(4.3)

-

(4.3)

(4.3)

-

(4.3)

Total Net Income

10.1

$

13.8

$

(3.7)

$

26.2

$

25.8

$

0.4

$

Average Shares Outstanding - Basic

30.1

27.0

3.1

30.0

26.1

3.9

EPS - basic, excl. acquisition-related costs

0.48

$

0.51

$

(0.03)

$

1.01

$

0.99

$

0.02

$

EPS - basic, incl. acquisition-related costs (GAAP)

0.34

$

0.51

$

(0.17)

$

0.87

$

0.99

$

(0.12)

$

The dilutive effect of the May 2009 issuance of 4,600,000 shares of common stock was $0.03 per share and

$0.12 per share for the second quarter and the first six months of 2010, respectively.

2Q 2010 Financial Results - Details

16

2Q 2010 Financial Results - Details (cont.)

2Q 2010

Distribution, CTA and Other

» 2Q ’10 earnings of $8.0 million compared to $8.1 million in 2Q ’09

» Favorable variance in revenues due to the approved rate increase effective January 1,

2010 was more than offset by the unfavorable variance from the equity investment in

GenConn

2010 was more than offset by the unfavorable variance from the equity investment in

GenConn

4 GenConn equity investment generated an after-tax loss of $0.5 million due to the delay (from

June 1, 2010) in commencing operations. All four units at GenConn’s Devon site are now

operating.

June 1, 2010) in commencing operations. All four units at GenConn’s Devon site are now

operating.

Transmission

» 2Q ’10 earnings of $7.1 million compared to $6.2 million in 2Q ’09

» Increase in AFUDC coupled with higher rate base and equity capitalization

YTD 2010

Distribution, CTA and Other

» YTD ’10 earnings of $17.9 million compared to $14.9 million in first six months of ‘09

» Favorable variance in rates and pricing offset slightly by unfavorable variance from the

equity investment in GenConn

equity investment in GenConn

Transmission

» YTD ’10 earnings of $13.8 million compared to $12.3 million in first six months of ’09

» Increase in AFUDC coupled with higher rate base and equity capitalization

17

Liquidity outlook

› Short-term borrowings outstanding of $30M as of

6/30/10 under UIL & UI $175M joint credit facility

due 12/22/11 ($50M of limit available for UIL)

6/30/10 under UIL & UI $175M joint credit facility

due 12/22/11 ($50M of limit available for UIL)

› No outstanding balance as of 6/30/10 under UIL

uncommitted money market loan facility

uncommitted money market loan facility

› $115.9M borrowed under $121.5M equity bridge

loan at UI acquired to fund its portion of the

contribution to GenConn. UI must pay off the

outstanding balance on the commercial operation

date for each facility, Devon Q3 ’10, Middletown

Q2 ‘11

loan at UI acquired to fund its portion of the

contribution to GenConn. UI must pay off the

outstanding balance on the commercial operation

date for each facility, Devon Q3 ’10, Middletown

Q2 ‘11

› UIL had $49.3M of long-term debt at the holding

company as of 6/30/10, maturing in 2/11

company as of 6/30/10, maturing in 2/11

› UI closed on $100M 30-year 6.09% Private

Placement Debt on 7/27/10

Placement Debt on 7/27/10

› In parallel with the pending gas companies

acquisition, UIL revolver to be negotiated

acquisition, UIL revolver to be negotiated

Debt maturity schedule as of 6/30/10 ($M)

Solid liquidity position enabling future CapEx plans

$27.5M refunded 2/1/10

$4.3M sinking fund payment 2/16/10

* To be remarketed

*

NONE

Debt Maturity and Liquidity Profile

18

|

|

Approximate 2010 Net

Income * |

2010 EPS - Basic

|

|

The United Illuminating Company

|

|

|

|

Distribution, CTA & Other

|

$32 - $34

|

$1.06 - $1.13

|

|

Transmission

|

26 - 28

|

0.87 - 0.93

|

|

GenConn

|

1 - 2

|

0.05 - 0.07

|

|

Total UI

|

$59 - $63

|

$1.98 - $2.10

|

|

Corporate, excl. acquisition-related costs

and events |

(3) - (2)

|

(0.09) - (0.05)

|

|

Total UIL, excl. acquisition-related costs

and events |

$57 - $62

|

$1.92 - $2.07

|

|

2009 Actual

|

$54.3

|

$1.94

|

Expectations are not intended to be additive

* Rounded to the nearest million

2010 Earnings Guidance as of 8/5/10 - Consolidated Affirmed

Excluding Acquisition-Related Costs and Events

Excluding Acquisition-Related Costs and Events

Guidance Assumptions

› 2010 EPS estimates include $0.15 per share dilution from May 2009 equity issuance, when compared to 2009

› Earnings from CTA are expected to decline $0.06-$0.08 per share in 2010

› Sustainable O&M cost savings in the Distribution business

› Combination of Distribution & CTA is expected to earn above its allowed ROE of 8.75% in 2010

› Transmission is expected to earn a weighted average return on equity of 12.3% to 12.5%

› GenConn Devon is now operating

19

Q&A

20

Appendix

21

Total

2009-2018P

Distribution

95

$

141

$

147

$

141

$

122

$

534

$

1,178

$

Transmission

29

$

47

$

63

$

80

$

96

$

91

$

405

$

GenConn*

-

$

57

$

65

$

-

$

-

$

-

$

122

$

Total Base Capital Exp.**

* Equity investment - Devon plant in-service 6/1/10, Middletown plant in-service 6/1/11.

** Amounts may not add due to rounding.

($ in millions)

Base 10-yr CapEx Forecast

› High probability of occurrence (90+%)

»Identified projects with clear need and

regulatory support

regulatory support

› Reflects decline in future peak load

forecasts

forecasts

»Pushing out some capacity projects and

dollars beyond prior 10-yr plan

dollars beyond prior 10-yr plan

Growth Opportunities Beyond Base Forecast

› Transmission investment within the

region

region

»Renewable Portfolio Standards driving

new transmission

new transmission

»Policy support from New England

Governors’ Energy Blueprint

Governors’ Energy Blueprint

› Generation Opportunities

»Potential opportunity for ownership of

base-load generation

base-load generation

Previous UI T&D Base 10-yr Capital Expenditure Program

as of November 2009

as of November 2009

22

46%

35%

19%

47%

38%

15%

Rate base growth even with a declining CTA balance

51%

38%

11%

55%

37%

8%

59%

37%

4%

60%

39%

Avg. GenConn Rate Base Equivalent (UI’s share)

CAGR 5%

1%

$56m

$174m

$232m

$224m

Avg. GenConn Equity Investment (UI’s share)

$28m

$116m

$112m

$87m

Previous UI Average Rate Base Forecast

(Excl. GenConn Equity Investments) as of November 2009

(Excl. GenConn Equity Investments) as of November 2009

23

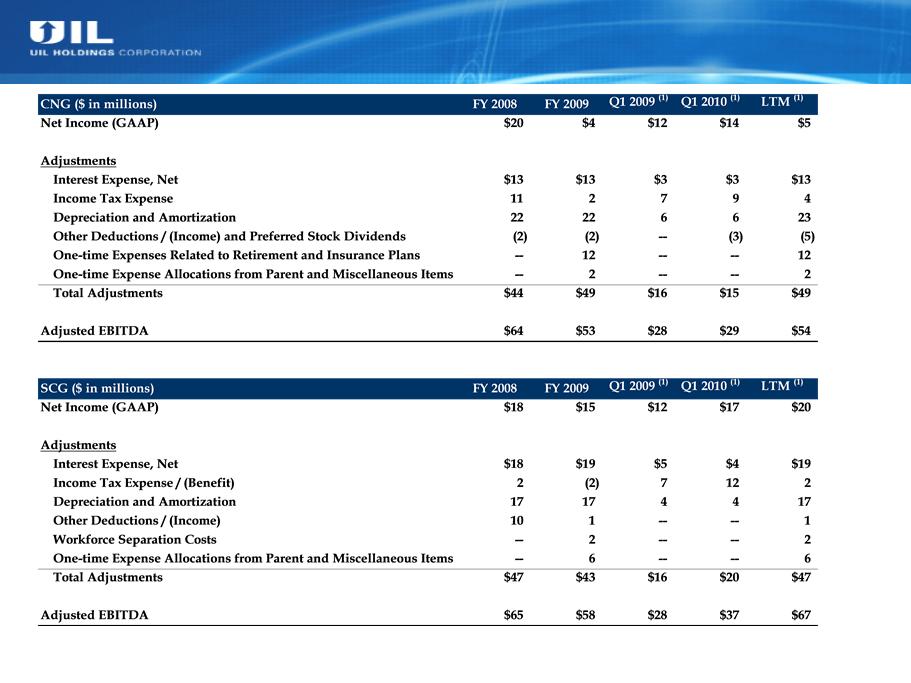

Amounts may not add due to rounding.

Source: SEC filings and audited financial statements.

(1) Last twelve months ended 03/31/2010. Quarterly data is unaudited.

Acquisition Net Income to EBITDA Reconciliation

24

Amounts may not add due to rounding.

Source: Adjustments based on notes in audited financial statements and estimates from discussions with Iberdrola USA management.

(1) Last twelve months ended 03/31/2010. Quarterly data is unaudited.

Acquisition Net Income to Adjusted EBITDA Reconciliation

25

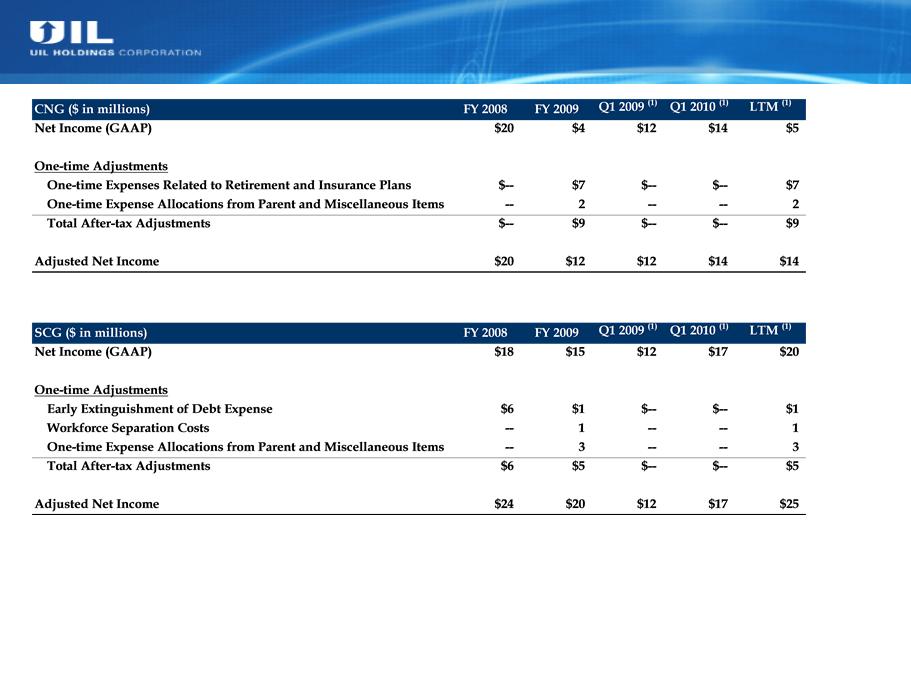

Amounts may not add due to rounding.

Source: Adjustments based on notes in audited financial statements and estimates from discussions with Iberdrola USA management.

(1) Last twelve months ended 03/31/2010. Quarterly data is unaudited.

Acquisition Adjusted Net Income Reconciliation