Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Energy Future Holdings Corp /TX/ | dex991.htm |

| 8-K - FORM 8-K - Energy Future Holdings Corp /TX/ | d8k.htm |

EFH

Corp. Q2 2010 Investor Call

August 3, 2010

Exhibit 99.2 |

1

Safe Harbor Statement

This presentation contains forward-looking statements, which are subject to

various risks and uncertainties. Discussion of risks and uncertainties

that could cause actual results to differ materially from management's current

projections, forecasts, estimates and expectations is contained in EFH Corp.'s

filings with the Securities and Exchange Commission (SEC).

Regulation G

This presentation includes certain non-GAAP financial measures. A reconciliation

of these measures to the most directly comparable GAAP measures is included in

the appendix to this presentation. In addition to the risks and uncertainties

set forth in EFH Corp.'s SEC filings, the forward-looking statements in

this presentation regarding the company’s long-term hedging program

could be affected by, among other things: any change in the ERCOT electricity

market, including a regulatory or legislative change, that results in

wholesale electricity prices not being largely correlated to natural gas prices;

any decrease in market heat rates as the long-term hedging program generally does

not mitigate exposure to changes in market heat rates; the unwillingness or

failure of any hedge counterparty or the lender under the commodity collateral

posting facility to perform its obligations; or any other unforeseen event

that results in the inability to continue to use a first lien to secure a

substantial portion of the hedges under the long- term hedging

program. |

Today’s Agenda

Q&A

Financial and Operational

Overview

Q2 2010 Review

Paul Keglevic

Executive Vice President & CFO

2 |

3

(248)

-

(299)

206

(155)

Q2 09

(3)

(251)

EFH Corp. adjusted (non-GAAP) operating (loss)

464

165

Unrealized mark-to-market net (gains) losses on interest rate swaps

(83)

93

(426)

Q2 10

(83)

Debt extinguishment

(gain)

–

Q2

10

debt

exchanges

and

repurchases

(113)

Unrealized commodity-related mark-to-market net (gains) losses

Items excluded from adjusted

(non-GAAP)

operating

results

(after

tax)

-

noncash:

(271)

GAAP net (loss) attributable to EFH Corp.

Change

Factor

Consolidated:

reconciliation

of

GAAP

net

income

(loss)

to

adjusted

(non-GAAP)

operating

results

¹

Q2

²

09

vs.

Q2

10;

$

millions,

after

tax

EFH Corp. Adjusted (Non-GAAP) Operating Results -

QTR

1

See Appendix for Regulation G reconciliations and definitions.

2

Three months ended June 30 |

4

8

8

-

Income

tax charge recorded as a result of health care legislation enacted by

Congress in March 2010

(90)

-

90

Goodwill impairment charge

(512)

-

(432)

(457)

287

YTD 09

45

(467)

EFH Corp. adjusted (non-GAAP) operating (loss)

667

235

Unrealized mark-to-market net (gains) losses on interest rate swaps

(93)

(546)

(71)

YTD 10

(93)

Debt extinguishment (gain) –

2010 debt exchanges and repurchases

(89)

Unrealized commodity-related mark-to-market net (gains) losses

Items excluded from adjusted (non-GAAP) operating

results

(after

tax)

-

noncash:

(358)

GAAP net income (loss) attributable to EFH Corp.

Change

Factor

Consolidated:

reconciliation

of

GAAP

net

income

(loss)

to

adjusted

(non-GAAP)

operating

results

¹

YTD

²

09

vs.

YTD

10;

$

millions,

after

tax

1

See Appendix for Regulation G reconciliations and definitions.

2

Six months ended June 30

EFH Corp. Adjusted (Non-GAAP) Operating Results -

YTD |

5

Consolidated key drivers of the change in (non-GAAP) operating results

Q2

¹

10 vs. Q2 09; $ millions, after tax

(9)

Higher depreciation reflecting ongoing investment in generation fleet

Description/Drivers

Better

(Worse)

Than

Q2 09

Competitive business²:

Impact of new lignite-fueled generation units

70

Lower amortization of intangibles arising from purchase accounting

17

Higher margin from asset management and the retail business

14

Higher fuel expense at the legacy coal-fueled generation units primarily due to

increased transportation costs (25)

Lower

production

from

nuclear

fueled

generation

units

due

to

timing

of

refueling

outage

(19)

All other -

net

(12)

Contribution margin

45

Gains on sales of assets (reported in other income)

48

Lower costs related to outsourcing transition and new retail customer care

system 19

Higher

net

interest

expense

driven

by

lower

capitalized

interest

due

to

completion

of

new

generation

units

(42)

Higher depreciation reflecting the three new lignite-fueled generation units and

mining facilities (29)

Higher operating costs related to new generation units

(16)

Higher nuclear plant maintenance due to timing of refueling outage

(11)

All other -

net

(1)

Total improvement -

Competitive business

4

Regulated business:

Higher

distribution

tariffs,

including

the

rates

approved

in

the

September

2009

final

rate

review

order

16

Surcharge to recover AMS deployment costs

10

Higher depreciation reflecting higher depreciation rates approved in the September

final rate review order and infrastructure investment (21)

Higher costs reflecting amortization of regulatory assets approved for recovery, AMS

implementation and higher transmission fees (14)

All

other

–

net

(includes

noncontrolling

interests)

2

Total improvement –

Regulated business (80% owned by EFH Corp.)

(7)

Total change in EFH Corp. adjusted (non-GAAP) operating results

(3)

1

Three months ended June 30

2

Competitive business consists of Competitive Electric segment and Corp. &

Other. EFH Corp. Adjusted (Non-GAAP) Operating Results -

QTR |

6

Consolidated key drivers of the change in (non-GAAP) operating results

YTD

¹

10 vs. YTD 09; $ millions, after tax

(52)

Higher depreciation reflecting the three new lignite-fueled generation units and

mining facilities (25)

Higher depreciation reflecting ongoing investment in generation fleet

Description/Drivers

Better

(Worse)

Than

YTD 09

Competitive business²:

Impact of new lignite-fueled generation units

122

Lower amortization of intangibles arising from purchase accounting

35

Higher margin from asset management and the retail business

36

Higher

retail

volumes

primarily

driven

by

colder

winter

weather

and

improvement

in

economy

20

Higher fuel expense at the legacy coal-fueled generation units primarily due to

increased transportation costs (45)

Lower production from nuclear fueled generation units due to timing of refueling

outage and main transformer replacement (25)

All Other –

net

(2)

Contribution margin

141

Gains on sales of assets (reported in other income)

52

Lower costs related to outsourcing transition and new retail customer care

system 29

Higher net interest expense primarily driven by lower capitalized interest due to

completion of new generation units (69)

Higher operating costs related to new generation units

(29)

Higher retail bad debt expense

(10)

All other -

net

(2)

Total improvement -

Competitive business

35

Regulated business:

Higher

distribution

tariffs,

including

the

rates

approved

in

the

September

2009

final

rate

review

order

32

Higher average consumption driven by the effect of weather

27

Surcharge to recover AMS deployment costs

19

Higher depreciation reflecting higher depreciation rates approved in the September

final rate review order and infrastructure investment (47)

Higher costs reflecting amortization of regulatory assets approved for recovery, AMS

implementation and higher transmission fees (29)

All

other

–

net

(includes

noncontrolling

interests)

8

Total improvement –

Regulated business (80% owned by EFH Corp.)

10

Total change in EFH Corp. adjusted (non-GAAP) operating results

45

1

Six months ended June 30

2

Competitive business consists of Competitive Electric segment and Corp. &

Other. EFH Corp. Adjusted (Non-GAAP) Operating Results -

YTD |

7

TCEH

EFH Corp. Adjusted EBITDA (Non-GAAP)

YTD 10

YTD 09

2,566

2,307

1

See Appendix for Regulation G reconciliations and definition. Includes $12

million, $6 million, $16 million and $16 million in Q2 09, Q2 10, YTD 09 and YTD 10, respectively, of Corp. &

Other Adjusted EBITDA.

2

Three months ended June 30

3

Six months ended June 30

Q2 10 and YTD 10 performance was largely driven by the same key drivers

impacting (non-GAAP) operating results.

EFH

Corp.

Adjusted

EBITDA

(non-GAAP)

¹

Q2

²

09

vs.

Q2

10

and

YTD

³

09

vs.

YTD

10;

$

millions

Oncor

Q2 10

Q2 09

1,303

1,192

940

851

357

329

1,831

1,674

719

617

9%

11%

9%

10%

17%

9% |

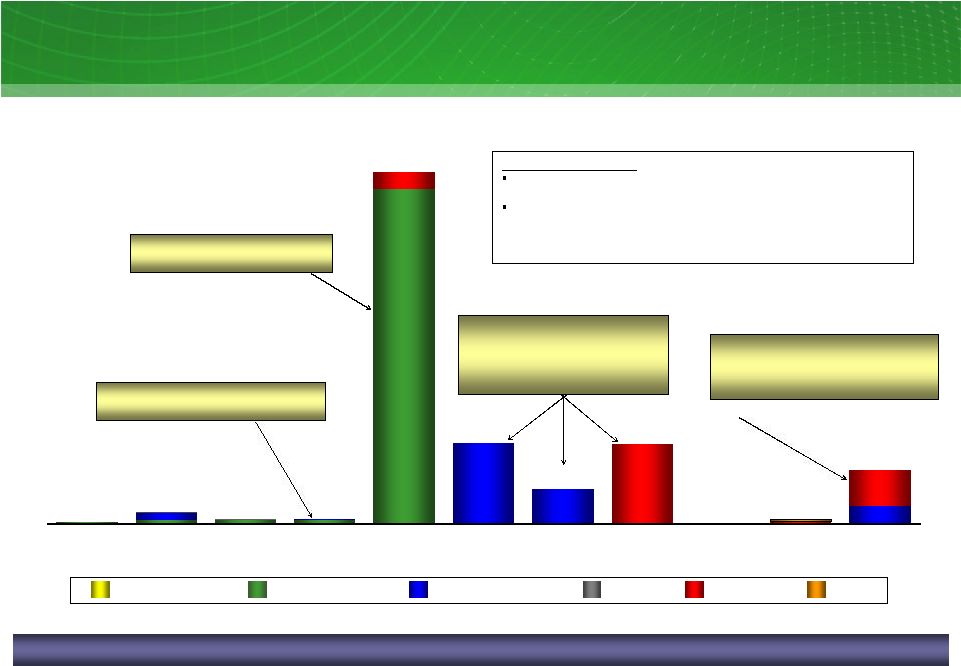

8

8

Luminant Operational Results

Nuclear-fueled generation; GWh

Coal-fueled generation; GWh

2,579

YTD 10

Nuclear production for Q2 impacted by refueling

outage and YTD by main transformer replacement

Q2 09

10,450

12,479

Sandow

5 & Oak Grove

Legacy coal-fueled plants

Q2 10 Results

Continued strong safety focus and

results

New coal-fueled units added 2.6 TWh

of generation in Q2 2010 (4.8 TWh

YTD) to the baseload

fleet

Nuclear production impacted by

refueling outage in April 2010

Generation from legacy coal-fueled

plants was lower due to higher

planned outages and higher

economic backdown

Coal-fueled fleet benefiting from new coal-fueled units

Q2 10

Q2 09

5,103

10,293

7%

YTD

YTD 09

YTD 10

9,539

4,527

4,802

20,705

25,297

Q2 10

YTD 09

11%

QTR

5%

QTR

1%

YTD

Variance does not include generation from Sandow 5 and Oak Grove 1 & 2.

1

¹

¹ |

9

Q2 10 Results

Lower residential sales volumes

driven by lower customer counts

partially offset by slightly warmer

weather in Q2 10 compared to Q2

09

Business load growth attributable

to new customers and slightly

improved economy

Lower residential customer counts

reflect competitive activity in the

marketplace

TXU Energy Operational Results

Continued strong competitive activity

Volume increases due to weather and improved economy

Total residential customers

End of period, thousands

Retail electricity sales volumes by customer class;

GWh

1,849

1,830

1

SMB

–

small

business

2

LCI

-

large

commercial

and

industrial

3

Latest twelve months

YTD 09

SMB

¹

LCI

²

Residential

Q2 09

12,543

23,450

Q2 09

Q1 10

4%

LTM

³

7%

YTD

13,568

7,084

7,444

3,551

1,908

3,974

Q2 10

Q2 10

1,830

1,911

1%

QTR

12,964

6,857

3,629

6,848

3,925

1,993

24,986

12,766

Q2 10

YTD 10

2%

QTR |

15,896

16,245

30,990

31,799

17,181

19,476

8,419

8,048

Oncor Operational Results

Electric energy volumes; GWh

Q2 10

Q2 09

Q2 10

Volume

increases

due

to

weather

and

improved

economy

Growth

below ERCOT estimated CAGR of 2.5% Q2 10 Results

Higher residential energy volumes

due to marginally warmer weather

in Q2 10 compared to Q2 09

Higher SMB and LCI

¹

energy

volumes due to a slightly improved

economy

Execution of AMS plan –

~240,000

advanced meters installed during

Q2 10; over 1.1 million installed

through July 2010

9 of 14 CREZ-related Certificates of

Convenience and Necessity (CCN)

approved by the Public Utility

Commission of Texas

1

SMB

–

small

business;

LCI

–

large

commercial

and

industrial

2

Latest twelve months

Residential

SMB & LCI

23,944

3,137

3,159

1%

LTM

²

Electricity

distribution points of delivery

End of period, thousands of meters

Q2 10

Q1 10

3,154

3,159

24,664

48,171

51,275

3%

QTR

6%

YTD

Q2 09

YTD 09

YTD 10

10

¹ |

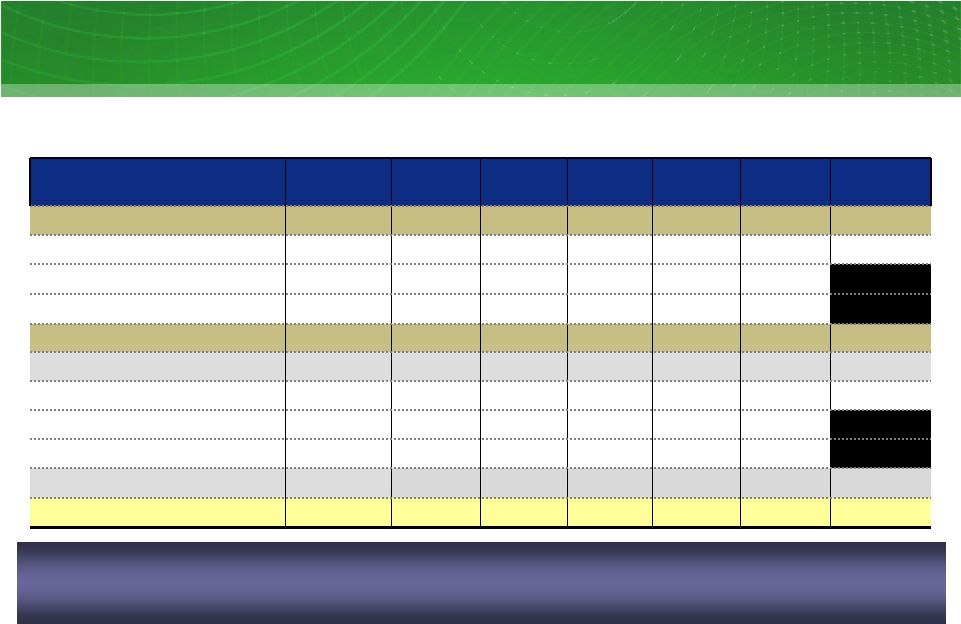

11

1

2

Cash and Equivalents

TCEH Letter of Credit Facility

TCEH Revolving Credit Facility

EFH Corp. Liquidity Management

2,700

735

1,880

1,250

821

429

1,211

Facility Limit

LOCs/Cash Borrowings

Availability

3,520

1,556

3,950

EFH Corp. and TCEH have sufficient liquidity to meet their anticipated short-term

needs, but will continue to monitor market conditions to ensure financial

flexibility. 1

Facility

to

be

used

for

issuing

letters

of

credit

for

general

corporate

purposes.

Cash

borrowings

of

$1.250

billion

were

drawn

on

this

facility

in

October

2007,

and

except for $115 million related to a letter of credit drawn in June 2009, have been

retained as restricted cash. Outstanding letters of credit are supported by the

restricted cash.

2

Facility availability includes $144 million of undrawn commitments from a

subsidiary of Lehman Brothers that has filed for bankruptcy. These funds are only available

from the fronting banks and the swingline lender, and exclude $85 million of

requested draws not funded by the Lehman subsidiary. EFH Corp. (excluding

Oncor) available liquidity As of 6/30/10; $ millions

•

Liquidity reflected in the table

does not include the unlimited

capacity available under the

Commodity Collateral Posting

Facility for ~490 million MMBtu

of natural gas hedges. |

12

Current Maturity Profile

EFH Corp. debt maturities

(excluding Oncor), 2010-2020 and thereafter

As of 6/30/10; $ millions

1

Includes amortization of the $4.1 billion Delayed Draw Term Loan.

2

Excludes

borrowings

under

the

TCEH

Revolving

Credit

Facility

maturing

in

2013,

the

Deposit

Letter

of

Credit

maturing

in

2014

and

unamortized

discounts

and

premiums.

3

Does not include the public exchange offer launched on July 16, 2010, which expires

on August 12, 2010. 19,317

2,007

1,029

4,689

4,575

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020+

122

669

20,348

4,713

2,028

4,614

11

TCEH-Secured

EFH Corp

EFCH

TCEH-Revolver

TCEH-Unsecured

2,106

3,149

2

266

EFH Corp. continues to explore opportunities to improve the

enterprise’s maturity profile.

440

EFIH

July 2010 transactions :

EFH Corp. repurchased $28 million of EFH PIK Toggle Notes and $8

million of TCEH 10.25% Notes for $24 million

EFH Corp. exchanged $455 million of EFH 10% Senior Secured

Notes for $549 million of EFH 5.55% Series P Notes, $25 million of

EFH PIK Toggle Notes, $25 million of EFH 10.875% Notes and $13

million of TCEH 10.25% Notes

Q2

10

exchanges

-

$72

million

of

EFH 10% Senior Secured Notes

were exchanged for $102 million of

EFH and TCEH PIK Toggle Notes

$1.25 billion LOC Facility

expires in 2014

$2.70 billion Revolving Credit

Facility expires in 2013

Q2 10 exchanges and

repurchases

-

reduced

2015,

2016 and 2017 maturities by $168

million, $25 million and $200

million, respectively

251

305

¹

³

2 |

Today’s Agenda

Q&A

Financial and Operational

Overview

Q2 2010 Review

John Young

President & CEO

13 |

Today’s Agenda

Q&A

Financial and Operational

Overview

Q2 2010 Review

EFH Corp. Senior Executive Team

14 |

15

Questions & Answers |

16

Appendix –

Additional Slides and

Regulation G Reconciliations

Appendix |

17

17

Luminant Solid-Fuel Development Program

Sandow Power Plant Unit 5

Rockdale, Texas

Oak Grove

Power Plant

Robertson County, Texas

Unit 1

Unit 2

Estimated net capacity

~800 MW

~800 MW

Primary fuel

Texas lignite

Texas lignite

Initial synchronization

August 2009

January 2010

Substantial completion date

December 2009

June 2010

Estimated net capacity

~580 MW

Primary fuel

Texas lignite

Initial synchronization

July 2009

Substantial

completion

date

September 2009

•

Both Sandow 5 and Oak Grove 1 lignite-fueled generating units achieved 70%

average capacity factors during the first quarter of 2010.

•

Luminant’s

construction of the Oak Grove 2 lignite-fueled generating unit reached

substantial completion on June 1, 2010

1

Substantial completion date is the contractual milestone when Luminant takes over

operations of the unit from the EPC contractor. ¹

¹ |

18

18

TCEH Natural Gas Exposure

TCEH Natural Gas Position

10-14 ; million MMBtu

Hedges Backed by Asset First Lien

Open Position

1

As of 6/30/10. Balance of 2010 is from August 1, 2010 to December 31,

2010. Assumes conversion of electricity positions based on a ~8.0 heat rate with natural gas being on the

margin

~75-90%

of

the

time

(i.e.

when

other

technologies

are

forecast

to

be

on

the

margin,

no

natural

gas

position

is

assumed

to

be

generated).

2

Includes

estimated

retail/wholesale

effects.

2010

position

includes

~4

million

MMBtu

of

short

gas

positions

associated

with

proprietary

trading

positions;

excluding

these

positions,

2010 position is ~102% hedged.

157

35

26

102

360

298

270

115

55

83

497

584

593

125

11

3

105

88

294

230

603

605

BAL 10

2011

2012

2013

2014

100% Hedge Level

Factor

Measure

BAL 10

2011

2012

2013

2014

Total or

Average

Natural gas hedging program

million

MMBtu

~114

~372

~475

~298

~105

~1,364

TXUE and Luminant

net positions

million

MMBtu

~125

~157

~35

~11

~3

~331

Overall estimated percent of total

NG position hedged

percent

~104%

~91%

~86%

~51%

~18%

~65%

TXUE and Luminant

Net Positions

Hedges Backed by CCP

1

²

TCEH has hedged approximately 65% of its estimated Henry Hub-based natural gas price exposure

from August 1, 2010 through December 31, 2014. More than 95% of the NG Hedges are supported

directly by a first lien or by the TCEH Commodity Collateral Posting Facility.

|

19

1

3

1

19

Unrealized Mark-To-Market Impact Of Hedging

Unrealized mark-to-market impact of hedging program

6/30/10 vs. 3/31/10; mixed measures, pre-tax

Factor

Measure

2010

2011

2012

2013

2014

Total or

Avg.

3/31/10

Natural gas hedges

mm MMBtu

~181

~424

~487

~300

~99

~1,491

Wtd. avg. hedge price

$/MMBtu

~$7.71

~$7.56

~$7.36

~$7.19

~$7.80

Natural gas prices

$/MMBtu

~$4.27

~$5.34

~$5.79

~$6.07

~$6.36

Cum. MtM

gain at 3/31/10

$ billions

~$0.8

~$0.9

~$0.8

~$0.3

~$0.3

~$3.1

6/30/10

Natural gas hedges

mm MMBtu

~126

~372

~475

~298

~105

~1,376

Wtd. avg. hedge price

$/MMBtu

~$7.75

~$7.53

~$7.34

~$7.18

~$7.80

Natural gas prices

$/MMBtu

~$4.82

~$5.34

~$5.68

~$5.89

~$6.10

Cum. MtM

gain at 6/30/10

$ billions

~$0.5

~$0.9

~$0.8

~$0.4

~$0.3

~$2.9

Q2 10 MtM

gain

$ billions

~($0.3)

~$0

~$0

~$0.1

~$0

~($0.2)

Weighted average prices are based on NYMEX Henry Hub prices of forward natural gas sales positions in

the long-term hedging program (excluding the impact of offsetting purchases for

rebalancing and pricing point basis transactions). Where collars are reflected, sales price represents the collar floor price. 6/30/10 prices for 2010 represent July 1, 2010 through

December 31, 2010 values.

MtM values include the effects of all transactions in the long-term hedging program including

offsetting purchases (for re-balancing) and natural gas basis deals. As of 6/30/10. 2010

represents July 1, 2010 through December 31, 2010 volumes. Where collars are reflected, the volumes are estimated based on the natural gas price sensitivity

(i.e., delta position) of the derivatives. The notional volumes for collars are approximately

150 million MMBtu, which corresponds to a delta position of approximately 105 million MMBtu in

2014. 1

2

2

2

Reversals of prior unrealized gains for positions settled during the second quarter of 2010 more

than offset gains in the forward years of the hedge program, resulting in a ~$170 million

(~$110 million after tax) unrealized mark-to-market net loss in GAAP income for Q2 10.

|

20

20

Unrealized Mark-To-Market Impact Of Hedging

Unrealized mark-to-market impact of hedging program

6/30/10 vs. 12/31/09; mixed measures, pre-tax

Factor

Measure

2010

2011

2012

2013

2014

Total or

Avg.

12/31/09

Natural gas hedges

mm MMBtu

~240

~447

~490

~300

~97

~1,574

Wtd. avg. hedge price

¹

$/MMBtu

~$7.79

~$7.56

~$7.36

~$7.19

~$7.80

Natural gas prices

$/MMBtu

~$5.79

~$6.34

~$6.53

~$6.67

~$6.84

Cum. MtM

gain at 12/31/09

²

$ billions

~$0.8

~$0.4

~$0.4

~$0.2

~$0.2

~$2.0

6/30/10

Natural gas hedges

³

mm MMBtu

~126

~372

~475

~298

~105

~1,376

Wtd. avg. hedge price

¹

$/MMBtu

~$7.75

~$7.53

~$7.34

~$7.18

~$7.80

Natural gas prices

$/MMBtu

~$4.82

~$5.34

~$5.68

~$5.89

~$6.10

Cum. MtM

gain at 6/30/10

²

$ billions

~$0.5

~$0.9

~$0.8

~$0.4

~$0.3

~$2.9

YTD MtM

gain

$ billions

~(0.3)

~$0.5

~$0.4

~$0.2

~$0.1

~$0.9

Decreases in natural gas prices during the first six months of 2010 resulted in a

~$890 million (~$570 million after tax) unrealized mark-to-market net

gain in GAAP income for YTD 10. 1

2

3

Weighted average prices are based on NYMEX Henry Hub prices of forward natural gas sales positions in

the long-term hedging program (excluding the impact of offsetting purchases for

rebalancing and pricing point basis transactions). Where collars are reflected, sales price represents the collar floor price. 6/30/10 prices for 2010 represent July 1, 2010 through

December 31, 2010 values.

MtM values include the effects of all transactions in the long-term hedging program including

offsetting purchases (for re-balancing) and natural gas basis deals. As of 6/30/10. 2010

represents July 1, 2010 through December 31, 2010 volumes. Where collars are reflected, the volumes are estimated based on the natural gas price sensitivity

(i.e., delta position) of the derivatives. The notional volumes for collars are approximately

150 million MMBtu, which corresponds to a delta position of approximately 105 million MMBtu in

2014. |

21

21

21

EFH Corp. Adjusted EBITDA Sensitivities

Commodity

Percent Hedged at

June 30, 2010

Change

BOY 10E

Impact

$ millions

7X24 market heat rate (MMBtu/MWh)

~85

0.1 MMBtu/MWh

~3

NYMEX gas price ($/MMBtu)

~100

$1/MMBtu

~9

Texas gas vs. NYMEX Henry Hub price ($/MMBtu)

3,4

>95

$0.10/MMBtu

~0

Diesel ($/gallon)

5

~100

$1/gallon

~1

Base coal ($/ton)

6

~100

$5/ton

~2

Generation operations

Baseload

generation (TWh)

n.a.

1 TWh

~25

Retail operations

Balance of 2010

Residential contribution margin ($/MWh)

14 TWh

$1/MWh

~14

Residential consumption

14 TWh

1%

~5

Business markets consumption

13 TWh

1%

~2

Impact on EFH Corp. Adjusted EBITDA

10E; mixed measures

The majority of 2010 commodity-related risks are significantly mitigated.

2010 estimate based on commodity positions as of 6/30/10, net of long-term hedges and

wholesale/retail effects, excludes gains and losses incurred prior to June 30, 2010. See

Appendix for definition. Simplified representation of heat rate position in a single TWh position. In reality, heat rate

impacts are differentiated across plants and respective pricing periods: baseload (linked

primarily to changes in North Zone 7x24), natural gas plants (primarily North Zone 5x16) and wind (primarily West Zone 7x8).

Assumes conversion of electricity positions based on a ~8.0 market heat rate with natural gas being on

the margin ~75-90% of the time (i.e., when coal is forecast to be on the margin, no natural

gas position is assumed to be generated). The percentage hedged represents the amount of estimated natural gas exposure based on Houston Ship

Channel (HSC) gas price sensitivity as a proxy for Texas gas price.

Includes positions related to fuel surcharge on rail transportation.

Excludes fuel surcharge on rail

transportation.

1

2

3

4

5

6

3

2

1 |

22

22

22

Commodity Prices

$7.75

$7.78

$7.51

$8.11

$/MMBtu

TCEH weighted avg. hedge price

4

Commodity

Units

Q2 09 Actual

Q2 10 Actual

YTD 10 Actual

BOY 10E

NYMEX gas price

$/MMBtu

$3.69

$4.30

$4.72

$4.82

HSC gas price

$/MMBtu

$3.57

$4.25

$4.67

$4.66

7x24 market heat rate (HSC)

MMBtu/MWh

8.08

8.17

7.93

8.16

North Zone 7x24 power price

$/MWh

$28.82

$34.85

$37.02

$37.99

Gulf Coast ultra-low sulfur diesel

$/gallon

$1.57

$2.14

$2.10

$2.09

PRB 8400 coal

$/ton

$7.61

$9.59

$8.84

$9.69

LIBOR interest rate

5

percent

1.39%

0.63%

0.51%

0.75%

Commodity prices

Q2 09, Q2 10, YTD 10 and BOY 10E; mixed measures

1

BOY

10

estimate

based

on

commodity

prices

as

of

6/30/10

for

July

1,

2010

through

December

31,

2010

2

Based on NYMEX forward curve

3

Based on market clearing price for power

4

Weighted average prices in the TCEH long-term natural gas hedging

program. Based on NYMEX Henry Hub prices of forward natural gas sales positions in the long-term hedging

program

(excluding the impact of offsetting purchases for rebalancing and pricing point

basis transactions). 5

The index for the settled value is a 6 month LIBOR rate.

3

2

1 |

23

Financial Definitions

Refers to the results of Oncor and the Oncor ring-fenced entities.

Regulated Business

Results

Refers to the combined results of the Competitive Electric segment and Corporate

& Other. Competitive Business

Results

Operating revenues less fuel, purchased power costs, and delivery fees, plus or

minus net gain (loss) from commodity hedging and trading activities, which on

an adjusted (non-GAAP) basis, exclude unrealized gains and losses.

Contribution Margin (non-

GAAP)

Net income (loss) from continuing operations before interest expense and related

charges, and income tax expense (benefit) plus depreciation and

amortization. EBITDA

(non-GAAP)

Generally accepted accounting principles.

GAAP

The purchase method of accounting for a business combination as prescribed by GAAP,

whereby the purchase price of a business combination is allocated to

identifiable assets and liabilities (including intangible assets) based upon their fair values.

The excess of the purchase price over the fair values of assets and liabilities is

recorded as goodwill. Depreciation and amortization due to purchase

accounting represents the net increase in such noncash expenses due to recording the fair

market values of property, plant and equipment, debt and other assets and

liabilities, including intangible assets such as emission allowances,

customer relationships and sales and purchase contracts with pricing favorable to market prices at the

date of the Merger. Amortization is reflected in revenues, fuel, purchased

power costs and delivery fees, depreciation and amortization and interest

expense in the income statement. Purchase Accounting

Net income (loss) adjusted for items representing income or losses that are not

reflective of underlying operating results. These items include

unrealized mark-to-market gains and losses, noncash impairment charges and other charges, credits or

gains that are unusual or nonrecurring. EFH Corp. uses adjusted

(non-GAAP) operating earnings as a measure of performance

and believes that analysis of its business by external users is enhanced by

visibility to both net income (loss) prepared in accordance with GAAP and

adjusted (non-GAAP) operating earnings (losses). Adjusted (non-GAAP)

Operating Results

EBITDA adjusted to exclude interest income, noncash items, unusual items, interest

income, income from discontinued operations and other adjustments allowable

under the EFH Corp. senior and senior secured notes indentures. Adjusted

EBITDA plays an important role in respect of certain covenants contained in these

indentures. Adjusted EBITDA is not intended to be an alternative to

GAAP results as a measure of operating performance or an alternative to cash flows from

operating

activities

as

a

measure

of

liquidity

or

an

alternative

to

any

other

measure

of

financial

performance

presented

in

accordance with GAAP, nor is it intended to be used as a measure

of free cash flow available for EFH Corp.’s discretionary use,

as the measure excludes certain cash requirements such as interest payments, tax

payments and other debt service requirements. Because not all companies

use identical calculations, Adjusted EBITDA may not be comparable to similarly titled

measures of other companies.

Adjusted EBITDA

(non-GAAP)

Definition

Measure |

24

Table 1: EFH Corp. Adjusted EBITDA Reconciliation

Three and Six Months Ended June 30, 2009 and 2010

$ millions

-

(5)

145

-

(59)

-

(129)

2

-

58

27

-

57

-

809

350

1,122

(237)

(426)

Q2 10

3

-

320

1

-

16

-

1

-

83

24

(11)

51

(338)

651

423

431

(48)

(155)

Q2 09

(122)

-

Equity in earnings of unconsolidated subsidiary

(11)

-

Amortization of ”day one”

net loss on Sandow 5 power purchase agreement

(143)

-

Net gain on debt exchange offers

-

28

Net income attributable to noncontrolling interests

-

2

EBITDA amount attributable to consolidated unrestricted subsidiaries

(848)

(710)

Unrealized net (gain) loss resulting from hedging transactions

7

2

90

180

48

(12)

75

(636)

2,498

830

1,096

285

287

YTD 09

-

Losses on sale of receivables

-

Impairment of goodwill

²

2

Impairment of assets and inventory write-down

114

Purchase accounting adjustments

¹

(9)

Interest income

64

Amortization of nuclear fuel

Adjustments to EBITDA (pre-tax):

-

Oncor EBITDA

87

Oncor distributions/dividends

2,074

Interest expense and related charges

2,660

692

(35)

(71)

YTD 10

Net income (loss) attributable to EFH Corp.

Income tax expense (benefit)

Depreciation and amortization

EBITDA

Factor

Note: Table and footnotes to this table continue on following page

|

25

1

Includes amortization of the intangible net asset value of retail and wholesale

power sales agreements, environmental credits, coal purchase contracts, nuclear fuel

contracts and power purchase agreements and the stepped-up value of nuclear

fuel. Also includes certain credits not recognized in net income due to purchase

accounting.

2

Reflects the completion in the first quarter of 2009 of the fair

value calculation supporting the goodwill impairment charge that was recorded in

the fourth quarter of 2008.

3

Accounted for under accounting standards related to stock compensation and excludes

capitalized amounts. 4

Includes amounts incurred related to outsourcing, restructuring and other amounts

deemed to be in excess of normal recurring amounts. 5

Includes professional fees primarily for retail billing and customer care systems

enhancements and certain incentive compensation. 6

Includes costs related to the Merger and abandoned strategic transactions,

outsourcing transition costs, administrative costs related to the cancelled program to

develop coal-fueled facilities, the Sponsor Group management fee, costs related

to certain growth initiatives and costs related to the Oncor sale of noncontrolling

interests.

7

Reflects noncapital outage costs.

1,303

300

1,003

77

6

11

-

-

4

Q2 10

1,192

279

913

66

6

25

8

1

6

Q2 09

2,566

632

1,934

100

-

24

-

3

13

YTD 10

2,307

542

1,765

100

12

42

19

8

12

YTD 09

Severance expense

4

Noncash compensation expense³

EFH Corp. Adjusted EBITDA per Incurrence Covenant

EFH Corp. Adjusted EBITDA per Restricted Payments Covenant

Expenses incurred to upgrade or expand a generation station

7

Add back Oncor adjustments

Transaction and merger expenses

6

Transition and business optimization costs

5

Restructuring and other

Factor

Table 1: EFH Adjusted EBITDA Reconciliation (continued from previous page)

Three and Six Months Ended June 30, 2009 and 2010

$ millions |

26

Table 2: TCEH Adjusted EBITDA Reconciliation

Three and Six Months Ended June 30, 2009 and 2010

$ millions

1

-

1

-

Impairment of assets and inventory writedown

10

1

-

3

-

3

(5)

145

-

-

47

27

(21)

641

344

915

(212)

(406)

Q2 10

1

8

1

2

3

-

-

320

-

-

71

24

(12)

362

283

164

(26)

(59)

Q2 09

2

19

Transition and business optimization costs

3

8

Severance expense

2

4

7

-

-

(710)

2

70

157

48

(19)

1,979

559

562

341

517

YTD 09

5

Corp. depreciation, interest and income tax expense included in SG&A

-

Losses on sale of receivables

(11)

Amortization of ”day one”

net loss on Sandow 5 power purchase agreement

21

Transaction and merger expenses

10

Noncash compensation expense

-

Impairment

of

goodwill

-

EBITDA amount attributable to consolidated unrestricted subsidiaries

91

Purchase

accounting

adjustments

(42)

Interest income

64

Amortization of nuclear fuel

(848)

Unrealized net (gain) loss resulting from hedging transactions

Adjustments to EBITDA (pre-tax):

1,664

Interest expense and related charges

2,434

681

46

43

YTD 10

Net income (loss)

Income tax expense (benefit)

Depreciation and amortization

EBITDA

Factor

Note: Table and footnotes to this table continue on following page

1

2

3

4

5

6 |

27

Table 2: TCEH Adjusted EBITDA Reconciliation (continued from previous page)

Three and Six Months Ended June 30, 2009 and 2010

$ millions

976

4

32

940

77

11

Q2 10

873

7

15

851

66

5

Q2 09

1

7

Restructuring and other

1,734

12

48

1,674

100

YTD 09

9

Other adjustments allowed to determine Adjusted EBITDA per Maintenance

Covenant

8

1,831

TCEH Adjusted EBITDA per Incurrence Covenant

1,931

TCEH Adjusted EBITDA per Maintenance Covenant

100

Expenses incurred to upgrade or expand a generation station

7

91

Expenses related to unplanned generation station outages

7

YTD 10

Factor

1

Includes amortization of the intangible net asset value of retail and wholesale

power sales agreements, environmental credits, coal purchase contracts, nuclear fuel

contracts

and

power

purchase

agreements

and

the

stepped

up

value

of

nuclear

fuel. Also includes certain credits not recognized in net income due to

purchase accounting.

2

Reflects the completion in the first quarter of 2009 of the fair

value calculation supporting the goodwill impairment charge that was recorded in

the fourth quarter of 2008.

3

Excludes capitalized amounts.

4

Includes amounts incurred related to outsourcing, restructuring and other amounts

deemed to be in excess of normal recurring amounts. 5

Includes professional fees primarily for retail billing and customer care systems

enhancements and certain incentive compensation. 6

Includes costs related to the Merger, outsourcing transition costs and costs

related to certain growth initiatives. 7

Reflects noncapital outage costs.

8

Primarily pre-operating expenses related to Oak Grove and Sandow 5 generation

facilities. |

28

1

1

Purchase accounting adjustments consist of amounts related to the accretion of an

adjustment (discount) to regulatory assets resulting from purchase accounting.

Table 3: Oncor Adjusted EBITDA Reconciliation

Three and Six Months Ended June 30, 2009 and 2010

$ millions

357

2

(9)

(9)

373

164

86

47

76

Q2 10

329

-

(10)

(10)

349

132

87

48

82

Q2 09

(19)

(19)

Interest income

617

2

(20)

654

258

171

85

140

YTD 09

(18)

Purchase accounting adjustments

752

EBITDA

719

Oncor Adjusted EBITDA

4

Restructuring and other

170

Interest expense and related charges

331

96

155

YTD 10

Net income

Income tax expense

Depreciation and amortization

Factor |