Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FULTON FINANCIAL CORP | f8k.htm |

1

Fulton Financial

Corporation

-------------------------------------

July 2010

Investor Presentation

Data as of June 30, 2010

2

Forward-Looking Statement

n This presentation may contain forward-looking statements about Fulton Financial Corporation’s financial

condition, results of operations, business, strategies, products and services. You can identify forward-looking

statements by the use of words such as “may”, “should”, “will”, “could”, “estimates”, “predicts”, “potential”,

“continue”, “anticipates”, “believes”, “plans”, “expects”, “future” and “intends” and similar expressions

which are intended to identify forward-looking statements.

condition, results of operations, business, strategies, products and services. You can identify forward-looking

statements by the use of words such as “may”, “should”, “will”, “could”, “estimates”, “predicts”, “potential”,

“continue”, “anticipates”, “believes”, “plans”, “expects”, “future” and “intends” and similar expressions

which are intended to identify forward-looking statements.

n Such forward-looking statements reflect the current beliefs and expectations of the Corporation’s

management, are based on estimates, assumptions and projections about the Corporation’s business and its

industry, and involve significant risks and uncertainties, some of which are beyond our control and difficult to

predict. These statements are not guarantees of future performance and actual results may differ materially

from those expressed or forecasted in the forward-looking statements. The Corporation undertakes no

obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise. Accordingly, investors and others are cautioned not to place undue reliance on such

forward-looking statements.

management, are based on estimates, assumptions and projections about the Corporation’s business and its

industry, and involve significant risks and uncertainties, some of which are beyond our control and difficult to

predict. These statements are not guarantees of future performance and actual results may differ materially

from those expressed or forecasted in the forward-looking statements. The Corporation undertakes no

obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise. Accordingly, investors and others are cautioned not to place undue reliance on such

forward-looking statements.

n Many factors could affect future financial results including, without limitation, asset quality and the impact of

adverse changes in the economy and in credit or other markets and resulting effects on credit risk and asset

values; acquisition and growth strategies; market risk; changes or adverse developments in economic,

political or regulatory conditions; a continuation or worsening of the current disruption in credit and other

markets, including the lack of or reduced access to, and the abnormal functioning of markets for mortgages

and other asset-backed securities and for commercial paper and other short-term borrowings; changes in the

levels of Federal Deposit Insurance Corporation deposit insurance premiums and assessments; the effect of

competition and interest rates on net interest margin and net interest income; investment strategy and income

growth; investment securities gains and losses; declines in the value of securities which may result in charges

to earnings; changes in rates of deposit and loan growth or a decline in loans originated; balances of risk-

sensitive assets to risk-sensitive liabilities; salaries and employee benefits and other expenses; amortization

of intangible assets; goodwill impairment; capital and liquidity strategies; and other financial and business

matters for future periods.

adverse changes in the economy and in credit or other markets and resulting effects on credit risk and asset

values; acquisition and growth strategies; market risk; changes or adverse developments in economic,

political or regulatory conditions; a continuation or worsening of the current disruption in credit and other

markets, including the lack of or reduced access to, and the abnormal functioning of markets for mortgages

and other asset-backed securities and for commercial paper and other short-term borrowings; changes in the

levels of Federal Deposit Insurance Corporation deposit insurance premiums and assessments; the effect of

competition and interest rates on net interest margin and net interest income; investment strategy and income

growth; investment securities gains and losses; declines in the value of securities which may result in charges

to earnings; changes in rates of deposit and loan growth or a decline in loans originated; balances of risk-

sensitive assets to risk-sensitive liabilities; salaries and employee benefits and other expenses; amortization

of intangible assets; goodwill impairment; capital and liquidity strategies; and other financial and business

matters for future periods.

n For a more complete discussion of certain risks and uncertainties affecting the Corporation, please see the

sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” set forth in the Corporation’s filings with the Securities and Exchange Commission.

sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” set forth in the Corporation’s filings with the Securities and Exchange Commission.

3

Presentation Outline

u Corporate Profile

u Franchise and Markets

u Overview of the 2nd Quarter

u Capital

u Earnings/Peer Group

u Financial Performance

u Supplemental Credit Information

u Investment Portfolio

4

Fulton Financial Profile (as of 6/30/10)

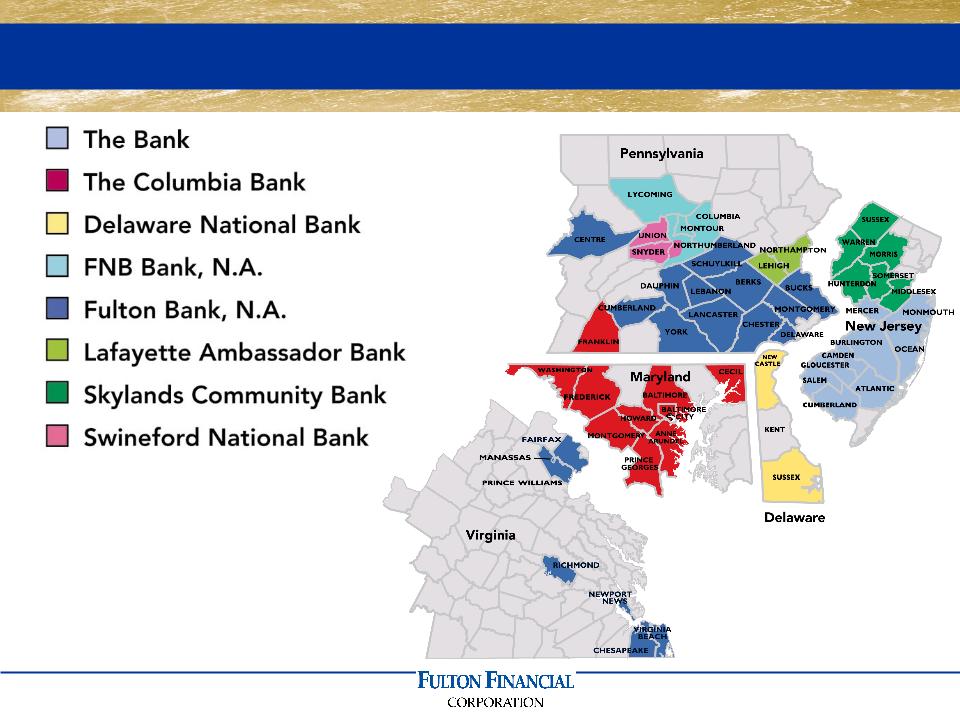

n Mid-Atlantic regional financial holding company

n A family of 8 community banks in 5 states

n Fulton Financial Advisors

n Fulton Mortgage Company

n 270 community banking offices

n Asset size: $ 16.6 billion

n 3,950 Team Members

n Market capitalization: $ 1.8 billion

n Book value per common share: $ 9.37

n Tangible book value per common share: $ 6.60

n Shares outstanding: 198.5 million

5

A Valuable Geographic Franchise

6

Care, Listen, Understand, Deliver

Superior Customer Experience

7

COMMUNITY BANKING

SMALL BUSINESS

HIGH NET WORTH

RETAIL BANKING

LISTENING IS JUST THE BEGINNING.

Our Brand

8

Overview of the 2nd Quarter

n Strong investment community response to our

$230 million capital raise

$230 million capital raise

n Good core deposit growth / strong liquidity

position

position

n Regulation E communication plan implemented

and ongoing

and ongoing

n Expenses well controlled / core competency

n Named 100 Most Trustworthy Companies by

Forbes

Forbes

9

Overview of the 2nd Quarter / Credit

n Non-performing assets increased from prior quarter

n Linked quarter decrease in overall delinquency

n Earning asset growth a challenge / slow economic

recovery

recovery

n $ 40 million provision unchanged from prior quarter

n Asset quality ratios compare favorably to peers

n Diversified loan portfolio with managed reduction in

construction exposure

construction exposure

10

TARP Repayment Completed

n Preferred shares redeemed in full on July 14, 2010

n Eliminates $18.8 million in annual dividends to the

U. S. Treasury

U. S. Treasury

n Additional capital cushion initially obtained as

“insurance” for protracted recession no longer

necessary

“insurance” for protracted recession no longer

necessary

n Positions corporation for future growth

opportunities, both organic and through

acquisition

opportunities, both organic and through

acquisition

11

|

|

Reported(1)

|

Pro-Forma(2)

|

|

GAAP Capital

|

$2.23 billion

|

$1.85 billion

|

|

Total Risk-Based Capital

|

$2.17 billion

|

$1.75 billion

|

|

Total Risk-Based Capital

|

16.60%

|

13.70%

|

|

Tier 1 Risk-Based Capital

|

14.10%

|

11.20%

|

|

Leverage Capital

|

11.30%

|

8.90%

|

|

Tangible Common Equity

|

8.20%

|

8.20%

|

|

Tangible Common Equity

to Risk-Weighted Assets |

10.20%

|

10.20%

|

(1) Risk-based and leverage capital ratios are estimates.

(2) Including estimated effect of TARP repayment.

Capital 6/30/10

12

Forbes.com

n Fulton Financial named one of the nation’s “100

Most Trustworthy Companies”

Most Trustworthy Companies”

n Selected from over 8,000 publicly held companies

n Only bank included in

large-cap or mid-cap

company lists

n One of only 4 banks

on entire list

n Criteria: governance,

accounting practices,

financial transparency

13

n 51 relationships with commitments to lend

of $20 million or more

n Maximum individual commitment: $33 million

n Maximum commitment land development:

$25 million

n Maximum commitment any one development

project: $15 million

project: $15 million

n Average commercial lending relationship size is

$460,957

$460,957

n Loans and corresponding relationships are

within Fulton’s geographic market area

within Fulton’s geographic market area

Summary of Larger Loans

14

Financial Performance

15

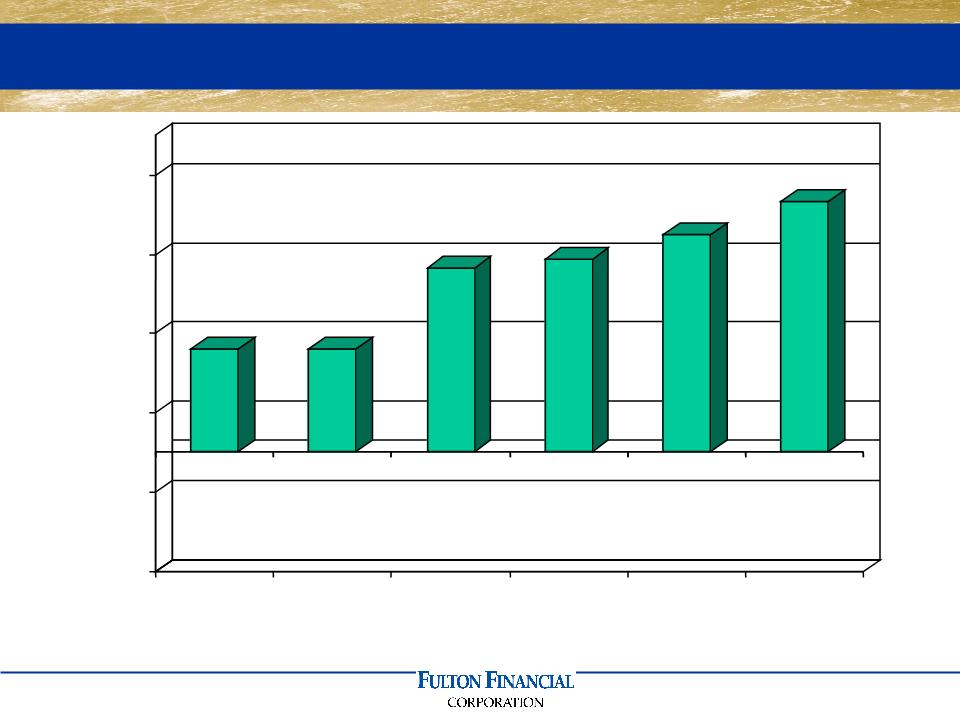

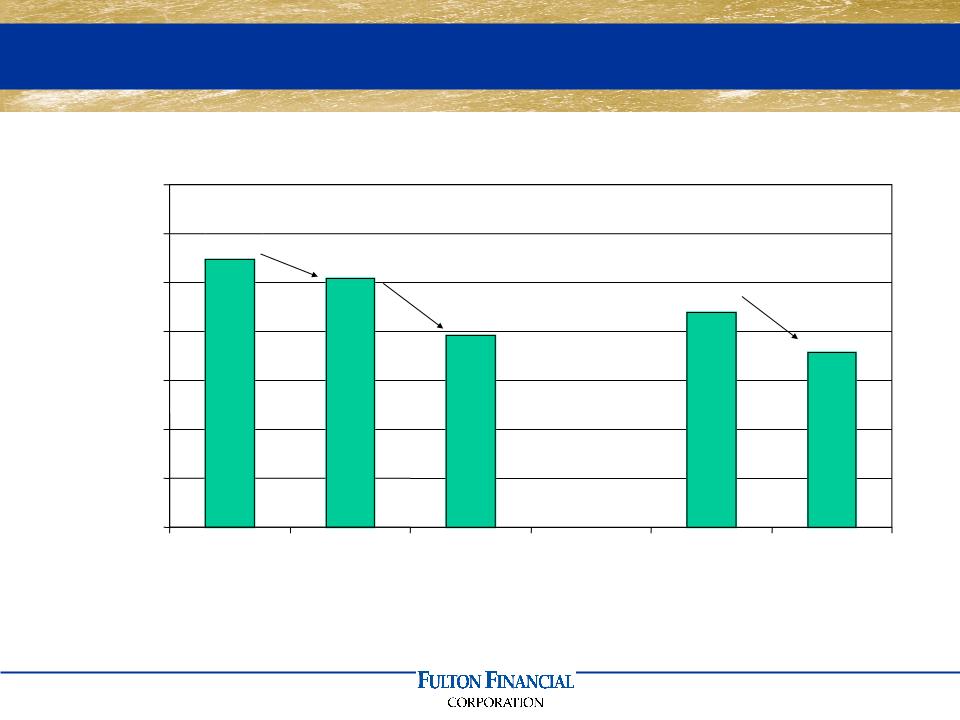

13.1

13.1

23.3

24.4

27.5

31.7

-15.0

-5.0

5.0

15.0

25.0

35.0

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

Quarterly Net Income (in millions)

16

Net Interest Income

139,160

$

138,510

$

650

$

0%

Loan Loss Provision

(40,000)

(40,000)

-

0%

Other Income

43,060

39,690

3,370

8%

Securities Losses

900

(2,220)

3,120

n/m

Other Expenses

(100,160)

(99,230)

(930)

1%

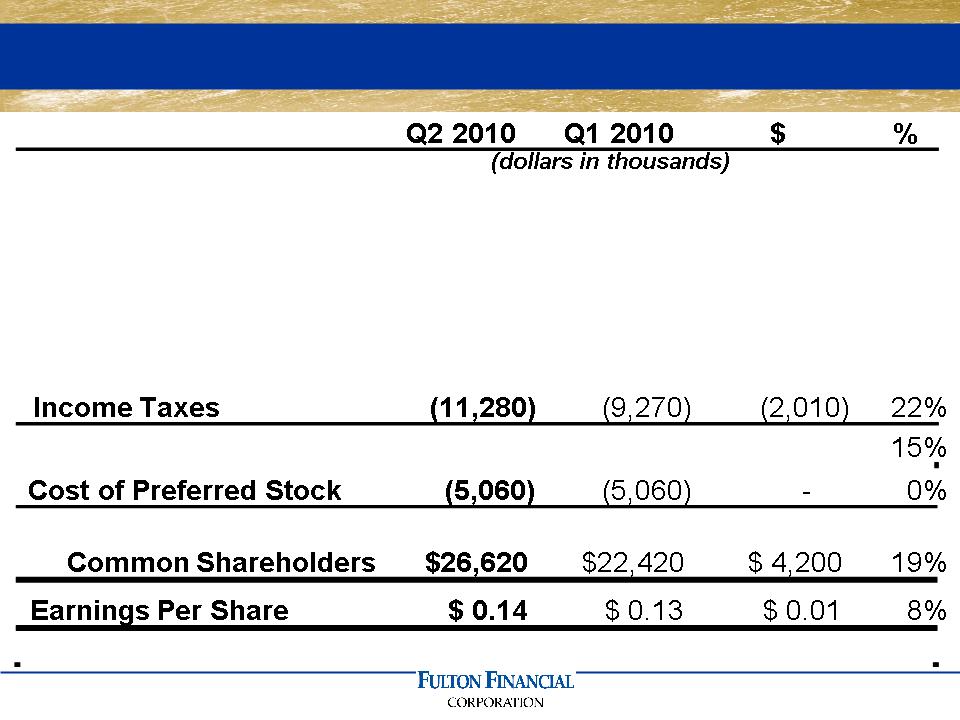

Net Income

31,680

27,480

4,200

Net Income Available to

Income Statement Summary (Q2 2010 vs. Q1 2010)

17

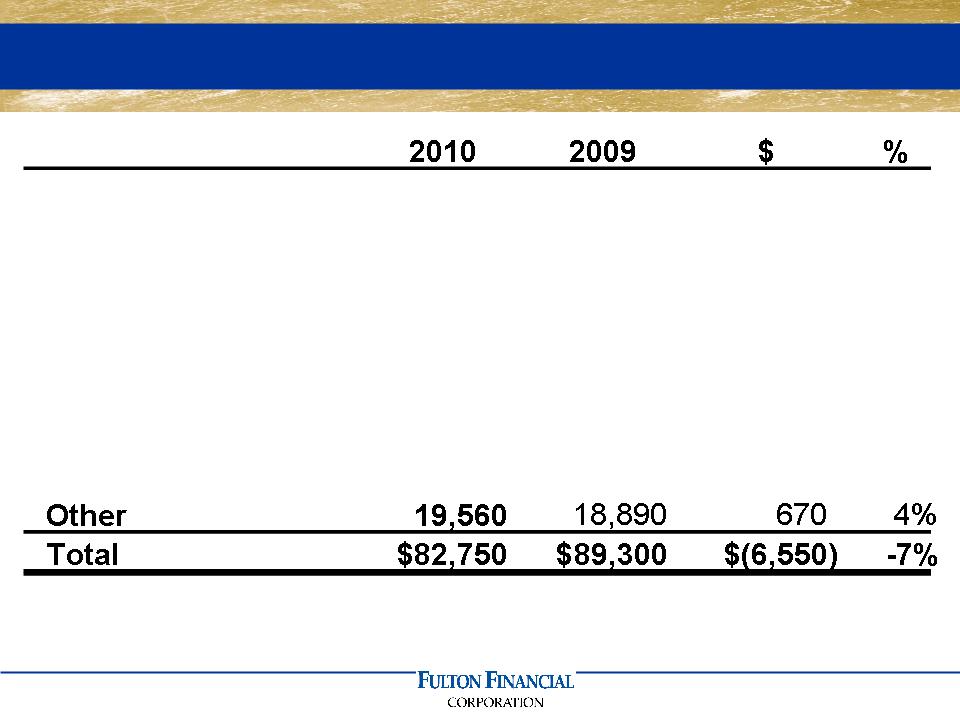

Net Interest Income

277,670

$

252,060

$

25,610

$

10%

Loan Loss Provision

(80,000)

(100,000)

20,000

-20%

Other Income

82,750

89,300

(6,550)

-7%

Securities (Losses) Gains

(1,320)

3,000

(4,320)

n/m

Other Expenses

(199,390)

(214,180)

14,790

-7%

Net Income

59,160

26,200

32,960

Cost of Preferred Stock

(10,130)

(10,080)

(50)

0%

Net Income Available to

Income Statement Summary (YTD June)

18

International Bancshares Corporation

Old National Bancorp

South Financial Group, Inc.

Susquehanna Bancshares, Inc.

TCF Financial Corporation

Trustmark Corporation

UMB Financial Corporation

United Bankshares, Inc.

Valley National Bancorp

Whitney Holding Corporation

Wilmington Trust Corporation

*Fulton’s peer group as of June 30, 2010

Associated Banc-Corp

BancorpSouth, Inc.

Bank of Hawaii Corporation

BOK Financial Corporation

Citizens Republic Bancorp

City National Corporation

Commerce Bancshares, Inc.

Cullen/Frost Bankers, Inc.

First Citizens BancShares, Inc.

First Midwest Bancorp, Inc.

First Merit Corporation

Peer Group*

19

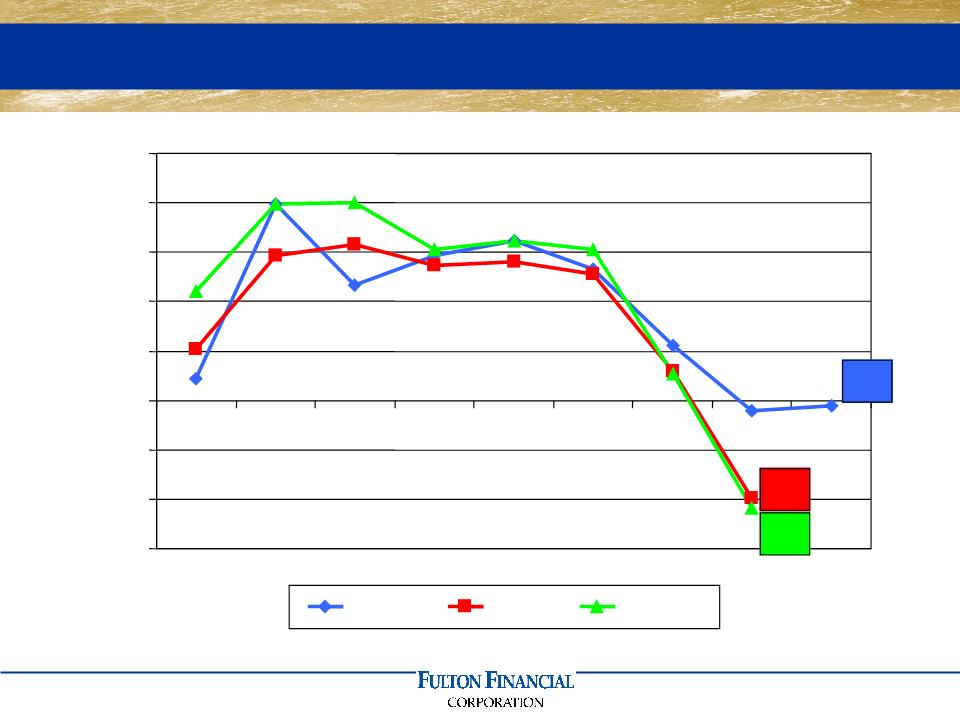

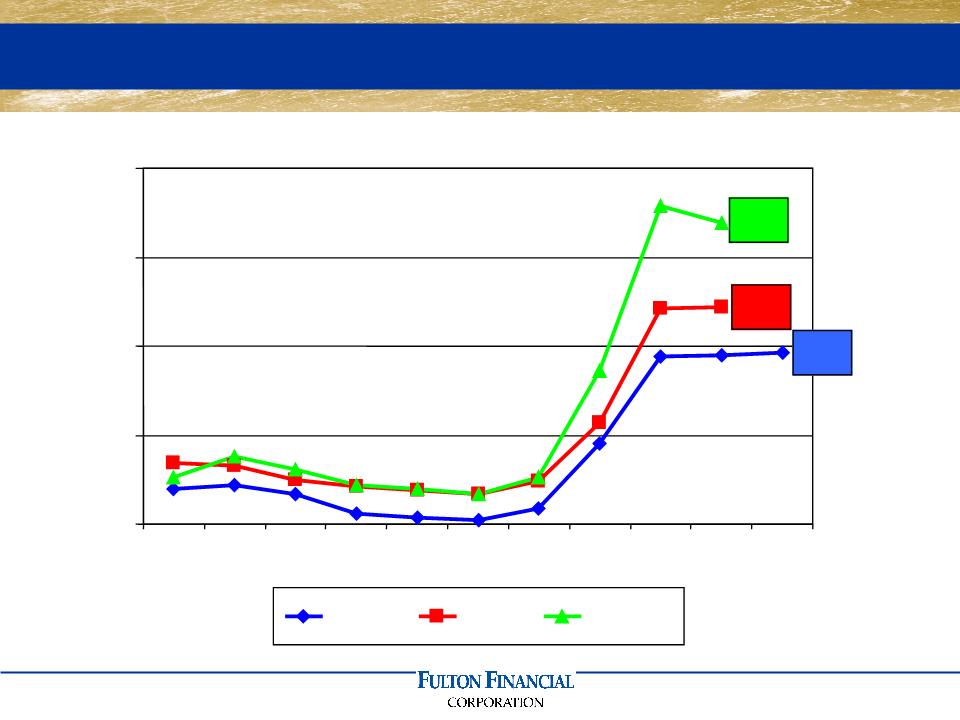

3.77

3.66

3.39

3.00

3.25

3.50

3.75

4.00

Q1

06

Q2

06

Q3

06

Q4

06

Q1

07

Q2

07

Q3

07

Q4

07

Q1

08

Q2

08

Q3

08

Q4

08

Q1

09

Q2

09

Q3

09

Q4

09

Q1

10

YTD

6/10

FULT

Peer

Top 50

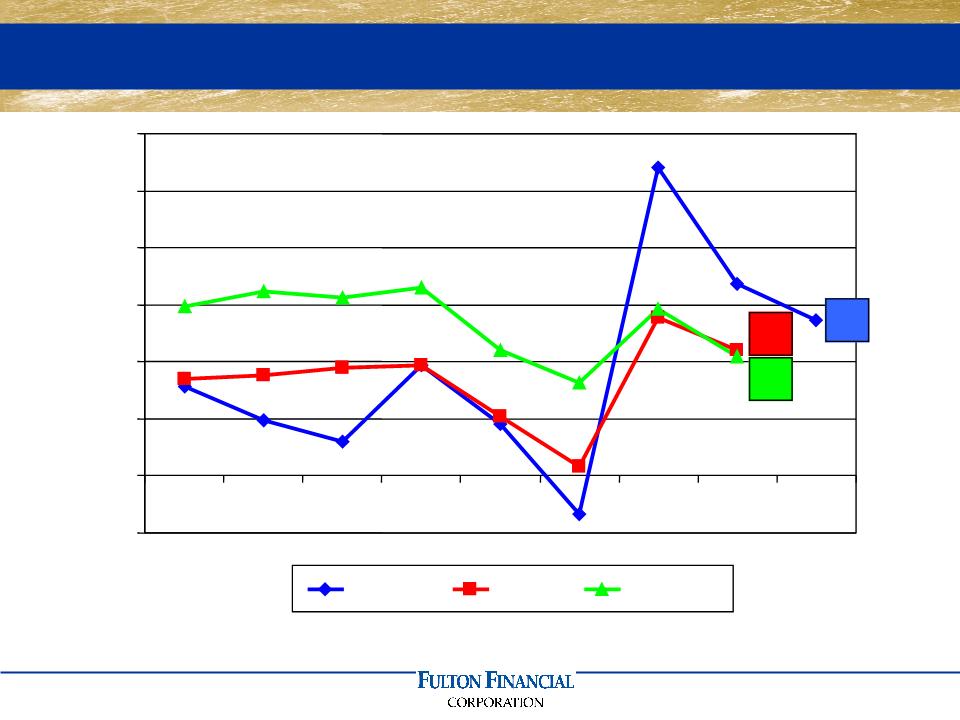

Net Interest Margin

20

Q2 2010

Q1 2010

$

%

(dollars in millions)

Comm'l Mort

4,320

$

4,310

$

10

$

0%

Commercial

3,690

3,690

-

0%

Home Equity

1,640

1,640

-

0%

Resid Mort

970

940

30

3%

Construction

910

960

(50)

-5%

Cons./Other

430

430

-

0%

Total Loans

11,960

$

11,970

$

(10)

$

0%

Average Loans (Q2 2010 vs. Q1 2010)

21

2010

2009

$

%

(dollars in millions)

Comm'l Mort

4,310

$

4,070

$

240

$

6%

Commercial

3,690

3,660

30

1%

Home Equity

1,640

1,680

(40)

-2%

Resid Mort

960

950

10

1%

Construction

940

1,190

(250)

-21%

Cons./Other

430

450

(20)

-4%

Total Loans

11,970

$

12,000

$

(30)

$

0%

Average Loans (June 30th - Year to Date)

22

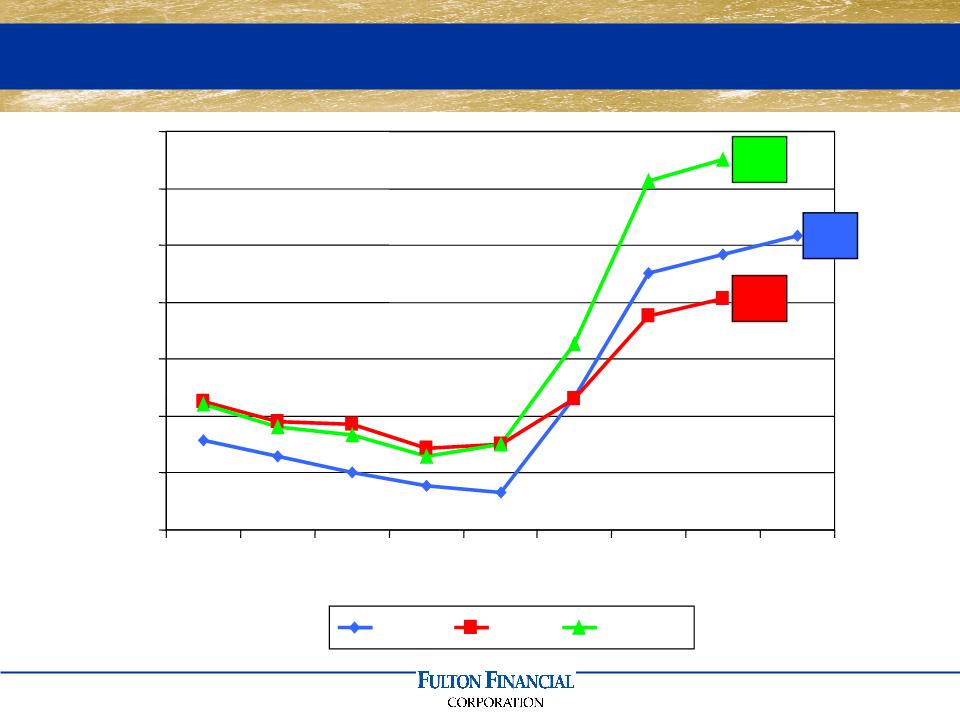

-0.3

-5.9

-6.5

-9.0

-6.0

-3.0

0.0

3.0

6.0

9.0

12.0

15.0

03

04

05

06

07

08

09

Q1 10

YTD

6/10

FULT

Peer

Top 50

Average Loan Growth

23

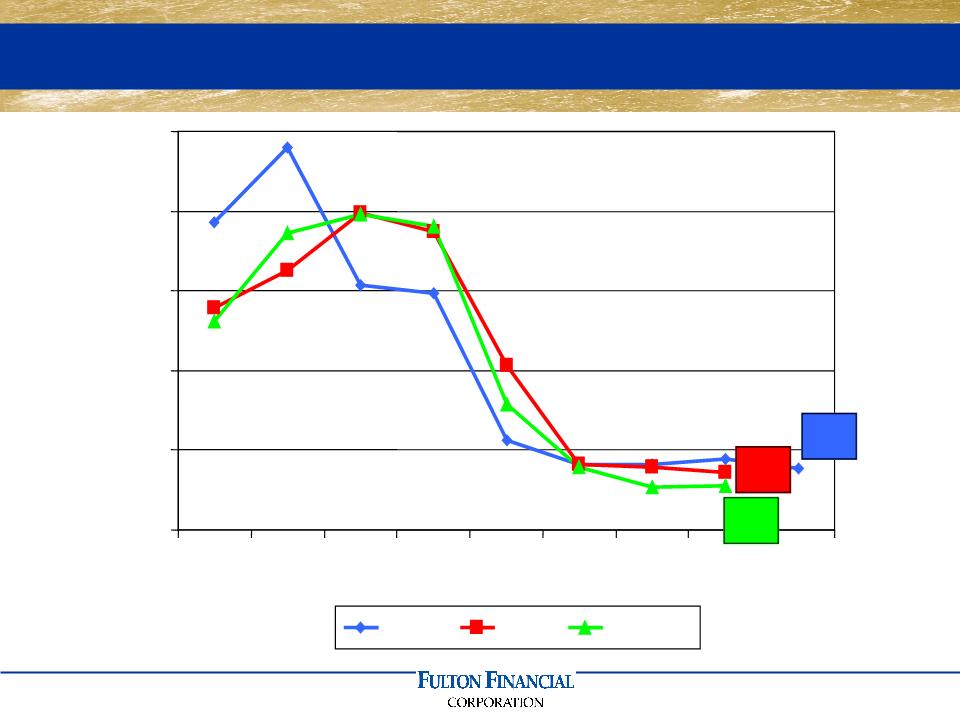

0.96

1.22

1.69

0.00

0.50

1.00

1.50

2.00

01

02

03

04

05

06

07

08

09

Q1 10

YTD

6/10

FULT

Peer

Top 50

Net Charge-Offs To Average Loans

24

2.65

2.46

3.21

0.00

1.00

2.00

3.00

4.00

04

05

06

07

08

09

Q1 10

Q2 10

FULT

Peer

Top 50

Non-performing Loans to Loans

25

2.35

2.02

2.75

0.80

1.10

1.40

1.70

2.00

2.30

2.60

2.90

03

04

05

06

07

08

09

Q1 10

Q2 10

FULT

Peer

Top 50

Allowance to Loans

26

88.5

85.8

77.9

50.0

100.0

150.0

200.0

250.0

300.0

03

04

05

06

07

08

09

Q1 10

Q2 10

FULT

Peer

Top 50

Allowance to Non-performing Loans

27

Q2 2010

Q1 2010

$

%

(dollars in millions)

Nonint DDA

2,080

$

1,970

$

110

$

6%

Int DDA

2,020

1,980

40

2%

Savings/MMDA

3,090

2,850

240

8%

CD's

5,120

5,210

(90)

-2%

Cash Management

470

470

-

0%

Total Deposits

12,780

$

12,480

$

300

$

2%

Average Deposits (Q2 2010 vs. Q1

2010)

2010)

28

2010

2009

$

%

(dollars in millions)

Nonint DDA

2,030

$

1,740

$

290

$

17%

Int DDA

2,000

1,790

210

12%

Savings/MMDA

2,970

2,180

790

36%

CD's

5,160

5,520

(360)

-7%

Cash Management

470

570

(100)

-18%

Total Deposits

12,630

$

11,800

$

830

$

7%

Average Deposits (June 30th - Year to Date)

29

8.2

6.6

6.3

(3.0)

0.0

3.0

6.0

9.0

12.0

15.0

18.0

03

04

05

06

07

08

09

Q1 10

YTD

6/10

FULT

Peer

Top 50

Average Deposit Growth

30

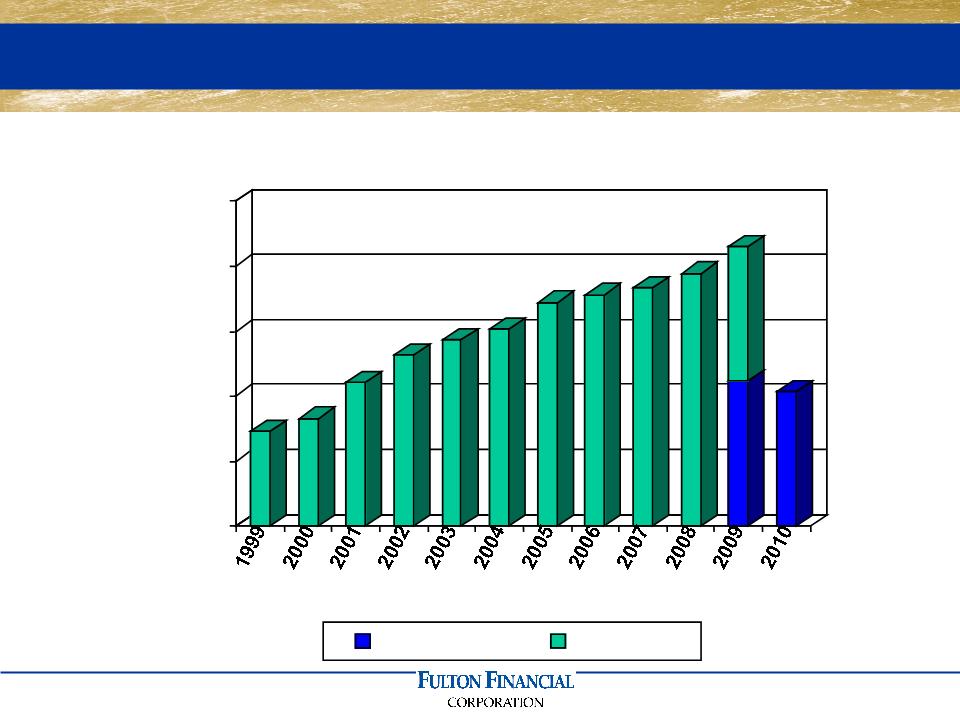

0.0

40.0

80.0

120.0

160.0

200.0

Millions

YTD June

YTD Dec

Other Income

31

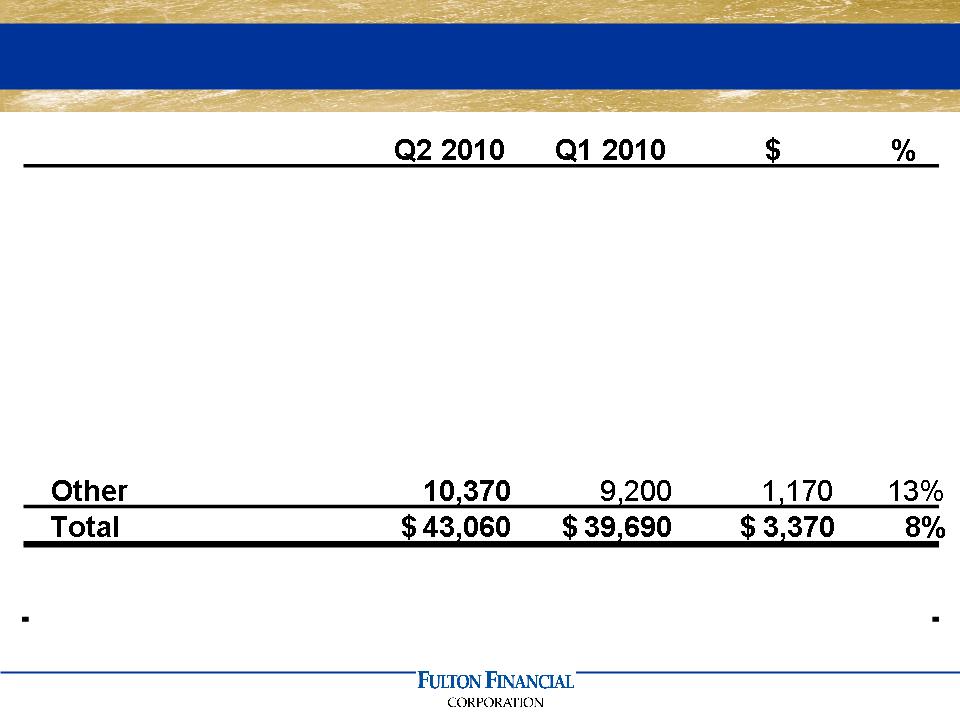

(dollars in thousands)

Overdraft & NSF Fees

9,620

$

8,880

$

740

$

8%

Invt Mgt & Trust

8,660

8,090

570

7%

Debit Card Fees

3,370

2,950

420

14%

Service Charges

3,350

3,110

240

8%

Mort. Sales Gains

3,060

3,360

(300)

-9%

Cash Mgt Fees

2,510

2,280

230

10%

Merchant Fees

2,120

1,820

300

16%

Other Income (Q2 2010 vs. Q1 2010)

32

(dollars in thousands)

Overdraft & NSF Fees

18,500

$

17,230

$

1,270

$

7%

Invt Mgt & Trust

16,740

15,780

960

6%

Service Charges

6,460

6,430

30

0%

Mort. Sales Gains

6,430

15,990

(9,560)

-60%

Debit Card Fees

6,320

5,190

1,130

22%

Cash Mgt Fees

4,790

6,290

(1,500)

-24%

Merchant Fees

3,950

3,500

450

13%

Other Income (June 30th - Year to Date)

33

53.4

61.4

62.4

50.0

52.0

54.0

56.0

58.0

60.0

62.0

64.0

03

04

05

06

07

08

09

1Q 10

YTD

6/10

FULT

Peer

Top 50

Efficiency Ratio Lower Than Peers

34

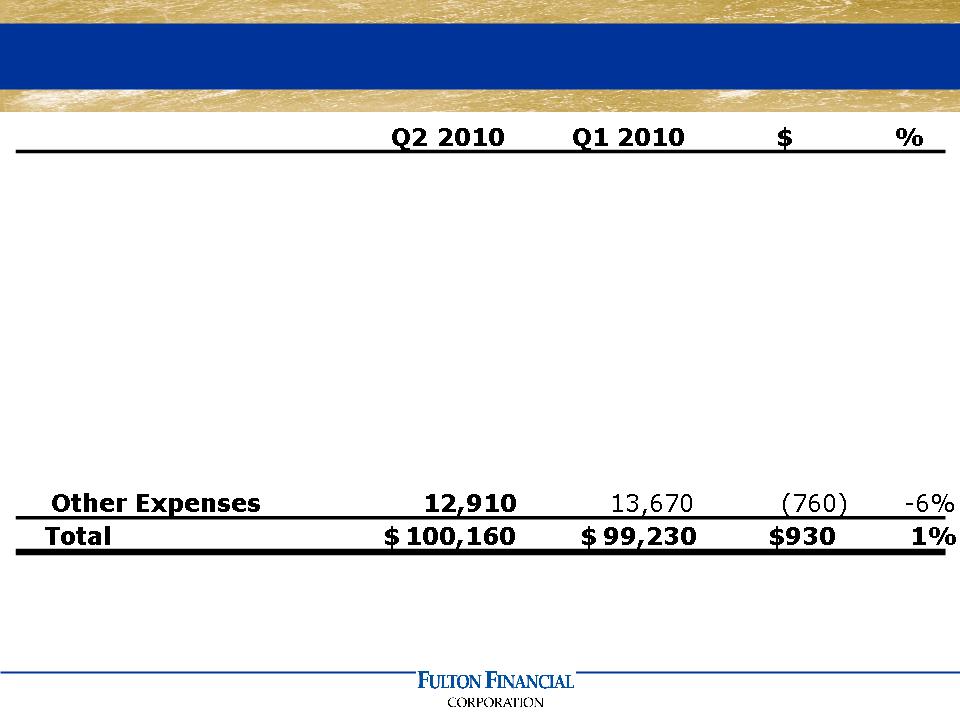

(dollars in thousands)

Salaries & Benefits

54,650

$

52,350

$

2,300

$

4%

Occupancy & Equip.

13,180

14,740

(1,560)

-11%

FDIC Insurance

5,140

4,950

190

4%

Data Proc. & Software

4,070

4,240

(170)

-4%

Legal & Audit

3,030

2,550

480

19%

Supplies & Postage

2,820

2,630

190

7%

Marketing

2,270

1,830

440

24%

Telecommunications

2,090

2,270

(180)

-8%

Other Expense (Q2 2010 vs. Q1 2010)

35

(dollars in thousands)

Salaries & Benefits

107,000

$

111,100

$

(4,100)

$

-4%

Occupancy & Equip.

27,920

27,640

280

1%

FDIC Insurance

10,090

16,490

(6,400)

-39%

Data Proc. & Software

8,310

9,240

(930)

-10%

Legal & Audit

5,580

4,320

1,260

29%

Supplies & Postage

5,460

5,370

90

2%

Telecommunications

4,360

4,340

20

0%

Marketing

4,100

4,290

(190)

-4%

Operating Risk Loss

1,150

6,340

(5,190)

-82%

Other Expense (June 30th - Year to Date)

36

Future Growth Initiatives

n Leverage local community banking

market presence and brand

market presence and brand

n Core deposit growth / segmentation

n Organic growth / increase market share

n Grow quality earning assets

n Superior customer experience /

relationship strategy

relationship strategy

n Grow non-interest income

n Branch expansion / select markets

37

Fulton Financial Corporation

One Penn Square

Lancaster, PA 17602

www.fult.com

38

Supplemental Credit

Information

Information

39

Manufacturing

13.6

RE - Rental and Leasing

13.0

Construction

11.6

Agriculture

8.6

Retail

8.4

Wholesale

7.0

Health Care

6.6

Other

5.5

Financial Services

3.1

Arts and Entertainment

2.4

Transportation

Commercial Loans by Industry (June 30, 2010)

40

Average

% of

10 v. 09

%

Balance

Total

Growth

Growth

Pennsylvania

6,670,000

$

55.8%

225,000

$

2%

New Jersey

2,474,000

20.7%

(24,000)

-1%

Maryland

1,427,000

11.9%

(136,000)

-8%

Virginia

1,056,000

8.8%

(54,000)

-6%

Delaware

333,000

2.8%

(12,000)

-4%

11,960,000

$

Loan Distribution by State (Q2 2010)

41

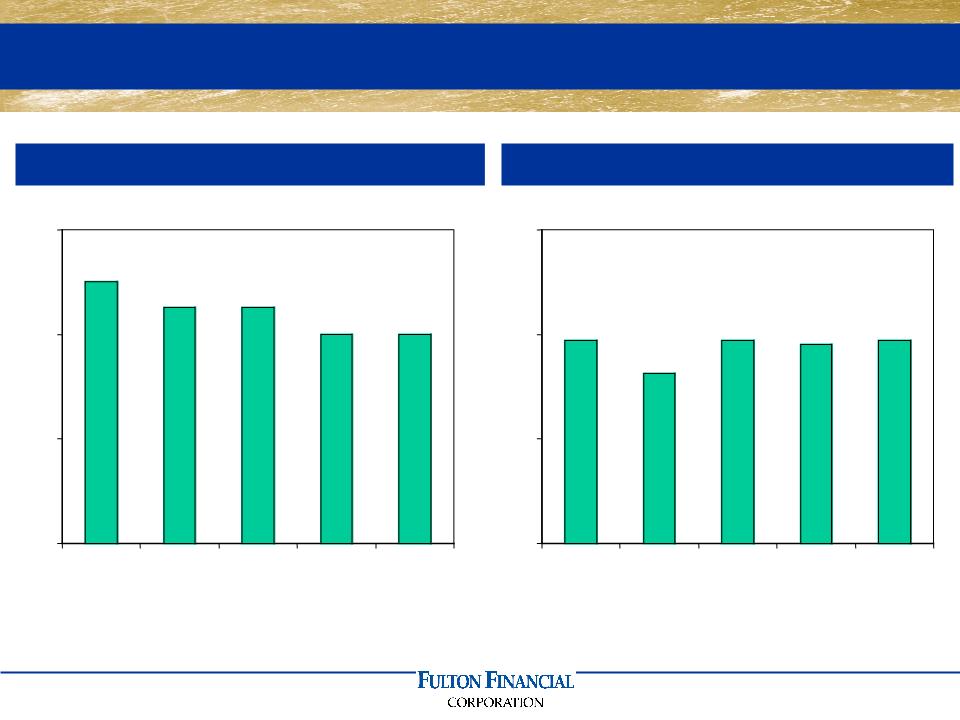

Provision

Net Charge-Offs / Average Loans

$50

$45

$45

$40

$40

$0

$20

$40

$60

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

($ in millions)

0.97%

0.81%

0.97%

0.95%

0.97%

0.00%

0.50%

1.00%

1.50%

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

Provision and Net Charge-Offs Stable

42

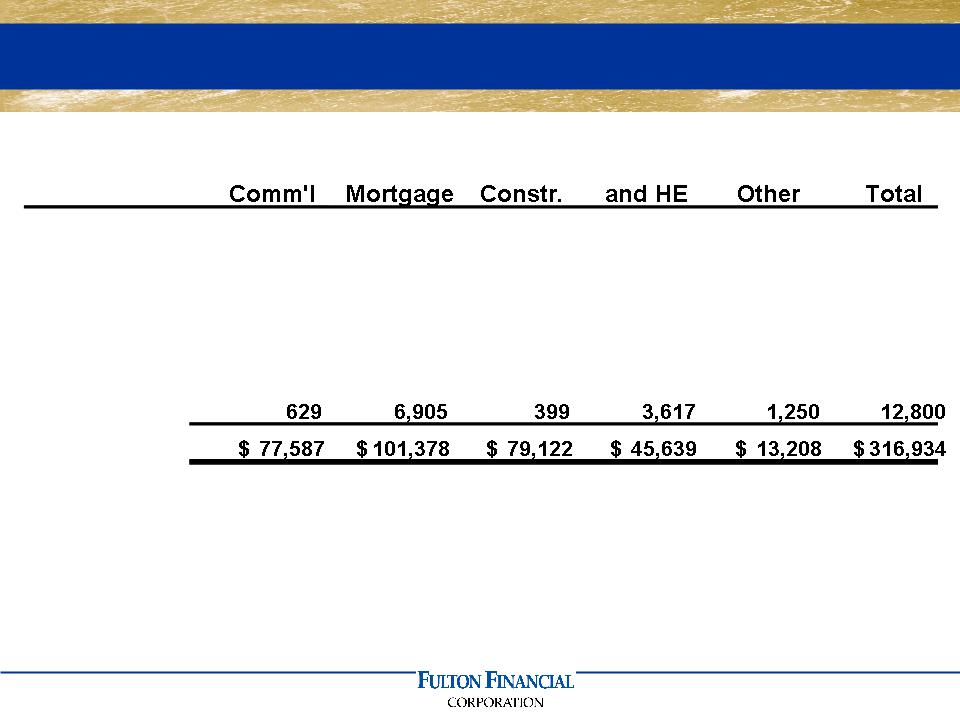

Comm'l

Res. Mtg.

(in thousands)

Pennsylvania

5,373

$

417

$

1,674

$

432

$

1,102

$

8,998

$

Maryland

(476)

-

(483)

138

443

(378)

New Jersey

7,477

3,308

4,939

232

358

16,314

Virginia

(189)

33

2,588

948

261

3,641

Delaware

Avg Loans

3,686,000

4,320,000

910,000

2,610,000

434,000

11,960,000

NCO %

1.33%

0.35%

3.83%

0.29%

2.11%

0.97%

Net Charge-offs (Q2 2010)

43

|

Category

|

Total (%)

6/30/09

|

90-Days

6/30/09

|

Total (%)

6/30/10

|

90-Days

6/30/10

|

|

Commercial

Loans |

2.24

|

1.77

|

2.58

|

2.12

|

|

Consumer

Direct |

1.36

|

0.52

|

1.61

|

0.71

|

|

Commercial

Mortgage |

1.95

|

1.22

|

3.13

|

2.33

|

|

Residential

Mortgage |

9.31

|

4.25

|

8.36

|

4.69

|

|

Construction

|

10.36

|

9.31

|

9.93

|

8.86

|

|

Total

Portfolio |

3.28

|

2.24

|

3.63

|

2.65

|

Loan Delinquency (Key Sectors)

44

Comm'l

Res. Mtg.

(in thousands)

Pennsylvania

39,278

$

42,900

$

12,264

$

11,005

$

4,829

$

110,276

$

Maryland

7,444

5,105

34,012

5,084

1,839

53,484

New Jersey

16,895

41,977

14,153

9,973

4,213

87,211

Virginia

13,341

4,491

18,294

15,960

1,077

53,163

Delaware

End Loans

3,665,000

4,331,000

893,000

2,622,000

429,000

11,940,000

NPL%

2.12%

2.34%

8.86%

1.74%

3.08%

2.65%

* Includes accruing loans > 90 days past due.

Non-performing Loans* (June 30, 2010)

45

Ending

% of

NPL

Allowance

Pennsylvania

1,364,000

$

52.0%

11,010

$

5,240

$

New Jersey

451,000

17.2%

9,970

2,490

Maryland

433,000

16.5%

5,080

1,570

Virginia

227,000

8.7%

15,960

6,600

Delaware

Res Mtg and HE by State (June 30, 2010)

46

Ending

% of

NPL

Allowance

Pennsylvania

2,442,000

$

66.6%

39,280

$

65,020

$

New Jersey

569,000

15.5%

16,900

19,830

Maryland

357,000

9.7%

7,440

6,520

Virginia

265,000

7.2%

13,340

10,550

Delaware

C&I Loans by State (June 30, 2010)

47

Ending

% of

NPL

Allowance

Pennsylvania

314,000

$

35.2%

12,270

$

10,210

$

Virginia

215,000

24.1%

18,290

28,350

Maryland

194,000

21.7%

34,010

25,730

New Jersey

155,000

17.4%

14,150

10,080

Delaware

Construction Loans (June 30, 2010)

48

$893

$1,096

$1,367

$1,269

$978

$0

$250

$500

$750

$1,000

$1,250

$1,500

$1,750

12/31/2007

12/31/2008

12/31/2009

06/30/2009

06/30/2010

(7%)

(23%)

(19%)

($ in millions)

Construction Loans /

Total Loans

Total Loans

12.2%

10.5%

8.2%

9.2%

7.5%

Declining Construction Exposure

49

Ending

% of

Balance

Total

Commercial Residential

586,000

$

65.6%

Commercial

249,000

27.9%

Real Estate

46,000

5.2%

Other Commercial

12,000

1.3%

893,000

$

Construction Loans by Type

50

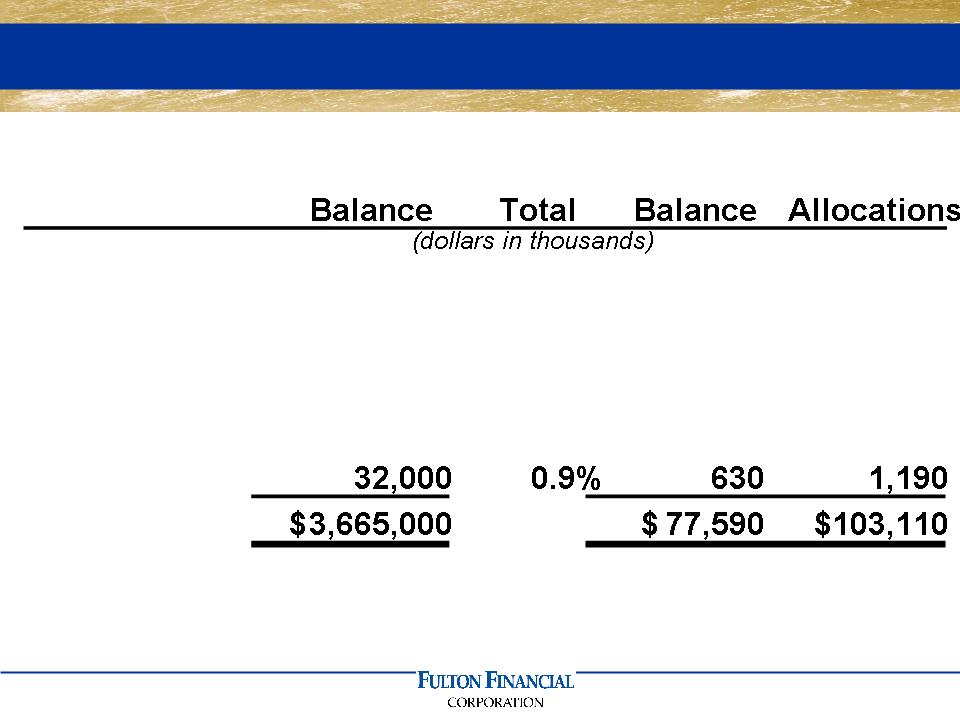

Ending

% of

NPL

Allowance

Balance

Total

Balance

Allocations

Pennsylvania

2,252,000

$

52.0%

42,900

$

17,050

$

New Jersey

1,211,000

28.0%

41,980

12,270

Maryland

389,000

9.0%

5,100

2,940

Virginia

349,000

8.0%

4,490

4,400

Delaware

130,000

3.0%

6,910

3,760

4,331,000

$

101,380

$

40,420

$

CRE Loans by State (June 30, 2010)

51

Ending

Commercial / Industrial

116,440

$

Commercial Real Estate

Total Outstanding

Delinquency: 2.9%

Shared National Credits (June 30, 2010)

52

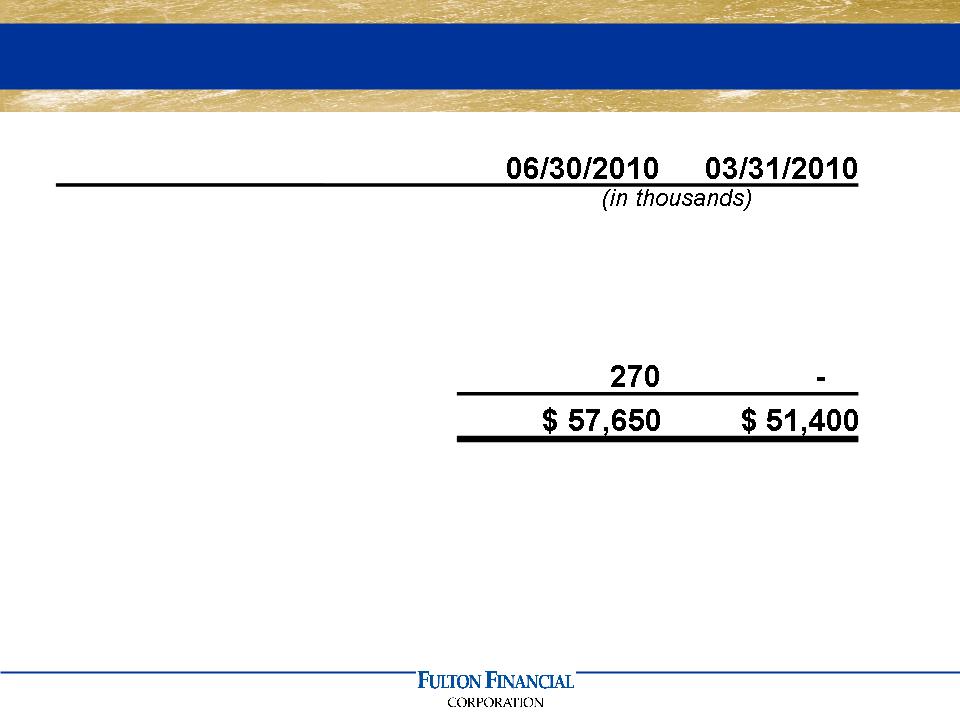

Residential Mtg

32,010

$

27,290

$

C&I/Comm'l Mtg

19,210

19,290

Construction

6,160

4,820

Consumer/other

Note: Excludes non-accrual TDR's

Troubled Debt Restructurings

53

Investment Portfolio Detail

54

ENDING

MODIFIED

BALANCE

DURATION

(in millions)

Agency mortgage-backed securities

883.4

$

3.11

Agency collateralized mortgage obligations

1,003.2

2.48

Municipal bonds

345.1

4.68

Auction rate securities

282.8

3.66

Corporate & trust preferred securities

144.0

10.64

U.S. Treasuries and agencies

11.5

3.13

FHLB & FRB stock

100.3

NA

Bank stocks

31.2

NA

Other investments

24.3

NA

Net unrealized gain / (loss)

67.1

Investment Portfolio (June 30, 2010)

55

Fulton Financial Corporation

One Penn Square

Lancaster, PA 17602

www.fult.com