Attached files

| file | filename |

|---|---|

| EX-32 - CannAwake Corp | v190746_ex32.htm |

| EX-31 - CannAwake Corp | v190746_ex31.htm |

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment

No. 2

to

FORM

10-K

x ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

fiscal year ended: December 31, 2009

OR

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the

transition period from __________ to __________

Commission

File No. 000-30563

DELTA

MUTUAL, INC.

(Exact

name of Registrant as Specified in Its Charter)

|

Delaware

|

14-1818394

|

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

|

Incorporation

or organization)

|

Identification

No.)

|

|

14362

N. Frank Lloyd Wright Blvd., Suite 1103, Scottsdale, AZ

|

85260

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

Telephone Number, Including Area Code: (480)

477-5808

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, $.0001

par value per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities

Act.

Yes ¨ No

x

Indicate

by checkmark if the registrant is not required to file reports to Section 13 or

15(d)Of the

Act. ¨

Yes x

No

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past 90

days. x Yes ¨ No

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant's knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such

files). Yes

¨ No ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a smaller reporting company. (Check

One):

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

|

|

Non-accelerated

filer ¨

|

Smaller

reporting company x

|

|

|

(Do

not check if a smaller reporting company)

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange

Act).

¨ Yes x No

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates as of the last business day of the registrant’s most

recently completed second fiscal quarter was $3,393,966.

Number of

shares of Common Stock outstanding as of March 31, 2010:

27,073,996.

Documents

incorporated by reference: None

TABLE

OF CONTENTS

|

PART

I

|

3

|

|

Item

1. Business.

|

3

|

|

Item

1A. Risk Factors.

|

11

|

|

Item

1B. Unresolved Staff Comments.

|

14

|

|

Item

2. Properties.

|

14

|

|

Item

3. Legal Proceedings.

|

15

|

|

Item

4. Reserved.

|

15

|

|

PART

II

|

16

|

|

Item

5. Market for Registrant's Common Equity, Related Shareholder Matters and

Issuer Purchases of Equity Securities.

|

16

|

|

Item

6. Selected Financial Data.

|

17

|

|

Item

7. Management's Discussion and Analysis of Financial Condition and Results

of Operations.

|

17

|

|

Item

7A. Quantitative and Qualitative Disclosures About Market

Risk.

|

21

|

|

Item

8. Financial Statements and Supplementary Data.

|

22

|

|

Item

9. Changes In and Disagreements With Accountants on Accounting and

Financial Disclosure.

|

49

|

|

Item

9A (T). Controls and Procedures.

|

49

|

|

Item

9B. Other Information.

|

49

|

|

PART

III

|

50

|

|

Item

10. Directors, Executive Officers, and Corporate

Governance.

|

50

|

|

Item

11. Executive Compensation.

|

51

|

|

Item

12. Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters.

|

53

|

|

Item

13. Certain Relationships and Related Transactions, and Director

Independence.

|

53

|

|

Item

14. Principal Accountant Fees and Services

|

55

|

|

Item

15. Exhibits and Financial Statement Schedules.

|

55

|

ii

EXPLANATORY

NOTE

WE

ARE FILING THIS AMENDMENT NO. 2 TO OUR FORM 10-K FOR THE YEAR ENDED

DECEMBER 31, 2009 (THE “2009 FORM 10-K”) TO FURTHER AMEND THE NOTES

TO

THE CONSOLIDATED FINANCIAL STATEMENTS, THE REPORT OF THE INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM, AND ITEMS 5, 9 AND 12. IN THIS

AMENDMENT NO. 2, OUR FINANCIAL STATEMENTS HAVE BEEN RESTATED DUE TO AN

UNDERSTATEMENT OF THE NUMBER OF SHARES OF COMMON STOCK OUTSTANDING AS OF

DECEMBER 31, 2009. IN ORDER TO PRESERVE THE NATURE AND CHARACTER OF THE

DISCLOSURES SET FORTH IN THE 2009 FORM 10-K AS OF APRIL 15, 2010, THE DATE ON

WHICH THE 2009 10-K WAS FILED, NO ATTEMPT EXCEPT AS DESCRIBED ABOVE HAS

BEEN MADE IN THIS AMENDMENT NO. 2 TO MODIFY OR UPDATE

DISCLOSURES.

PART

I

NOTE

REGARDING FORWARD LOOKING STATEMENTS

CAUTIONARY

STATEMENT FOR PURPOSES OF THE "SAFE HARBOR" PROVISIONS

OF THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This

Annual Report contains historical information as well as forward- looking

statements. Statements looking forward in time are included in this Annual

Report pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Such statements involve known and unknown risks

and uncertainties that may cause our actual results in future periods to be

materially different from any future performance suggested herein. We wish to

caution readers that in addition to the important factors described elsewhere in

this Form 10-K, the following forward-looking statements, among others,

sometimes have affected, and in the future could affect, our actual results and

could cause our actual consolidated results during 2009, and beyond, to differ

materially from those expressed in any forward-looking statements made by or on

our behalf.

Forward-looking

statements include, but are not limited to, statements under the following

headings; (i) "Business Plan," about the development of certain projects and

business opportunities and the Company's attempts to convert these plans and

opportunities into operating businesses that generate revenues and profits; (ii)

"Business Plan," about the intentions of the Company to fund its businesses and

operations by borrowings and the successful placement of debt and equity

financings; (iii) "Results of Operations"; (iv) "Liquidity and Capital

Resources," about the Company's plan to raise additional capital; and (v)

"Liquidity and Capital Resources," about the contingent nature of the

consummation of any agreements with its contracting and joint venture

parties.

Item

1. Business.

Unless

the context otherwise requires, the terms "the Company," "we," "our" and "us"

refers to Delta Mutual, Inc., and, as the context requires, its consolidated

subsidiaries.

Background

We were

incorporated under the name Delta Mutual, Inc. on November 17, 1999, in the

State of Delaware with the purpose of providing mortgage services through the

Internet. In 2003, we established business operations focused on providing

environmental and construction technologies and services to specific geographic

reporting segments in the Far East, the Middle East, and the United States.

During the year ended December 31, 2008, the Company discontinued all of its

operations in the Far East (Indonesia) and its construction technology

activities that were conducted through its wholly owned U.S. subsidiary, Delta

Technologies, Inc. The Company’s construction operations in Puerto Rico were

discontinued in 2008, which included.

Effective

March 4, 2008, we entered into a Membership Interest Purchase Agreement,

pursuant to which we acquired from Egani, Inc. shares of Altony SA,

an Uruguayan Sociedad Anonima (“Altony”), which owns 100% of the issued and

outstanding membership interests in South American Hedge Fund LLC, a Delaware

limited liability company (sometimes herein referred to as

“SAHF”). At the closing of the Agreement, we issued 13,000,000 shares

of our common stock to Egani, Inc. which constituted, following such issuance, a

majority of the outstanding shares of our common stock. Immediately following

the closing of the Agreement, Altony became a wholly-owned subsidiary of the

Company. For accounting purposes, the transaction was treated as a

recapitalization of the Company, as of March 4, 2008, with Altony as the

acquirer.

The

principal business of Altony SA is the ownership and management of South

American Hedge Fund, which maintains its business office in Uruguay and has

investments in oil and gas concessions in Argentina and intends to focus its

investment activities in the energy sector. We have also signed a purchase

option agreement related to the acquisition of approximate 150,000 hectares in

forty mines located in the Northwest part of Argentina, south of the border with

Bolivia, with high lithium and borates brines concentration. As of December 30,

2009, Altony SA closed its business operations and is currently under a process

of dissolution.

3

Our

principal offices are located at 14362 N. Frank Lloyd Wright Blvd. #2105,

Scottsdale, AZ 85260. Our telephone number is

(480) 480-477-5807. Our common stock is quoted on the

Over-the-Counter Electronic Bulletin Board under the symbol

"DLTZ.OB".

General

The

primary focus of the Company’s business at this time is the SAHF subsidiary,

South American Hedge Fund, which has investments in oil and gas concessions in

Argentina and will continue its focus on the energy sector, including the

development and supply of energy and alternative energy sources in Latin America

and North America. As of December 31, 2008, we terminated all of the

construction technology activities that were carried out by Delta Technologies,

Inc. (a wholly owned subsidiary). Also as of December 31, 2008 the securities

trading activities of South American Hedge Fund were accounted for as a

discontinued operation. As of December 31, 2009, we terminated the operation of

oil sludge processing facilities in Bahrain and Kuwait and the manufacture

of insulating concrete from ICF products in Saudi Arabia, which are accounted

for as discontinued operations.

As of

December 31, 2009, the Company holds 45% ownership interest in Delta

–Envirotech, Inc. which is engaged in select business opportunities

in the Middle East related to environmental remediation and other projects.

These activities are managed and carried out by majority

stockholders of Delta-Envirotech, Inc., (“Envirotech”) a joint

venture company incorporated in the state of Delaware with headquarters in

Virginia and formed in January 2004. The Company’s majority stockholders

are Hi-Tech Consulting and Construction, Inc. and an unrelated

individual. We hold a 45% interest in Envirotech, which has entered

into strategic alliance agreements with several United States-based entities

with technologies and products in the environmental field to support its

activities. As of December 2009, management has determined that Envirotech, Inc.

is not considered the variable interest entity for the year ending December 31,

2009 and accordingly has been deconsolidated from the consolidated financial

statements effective December 31, 2009 (see “Management Discussion and Analysis

of Financial Condition and Results of Operations”, as well as our Consolidated

Financial Statements included in this Annual Report for further

information).

Our goal

is to generate meaningful growth in our net asset value per share for proved

reserves by acquisition, exploitation and exploration of oil and gas projects

with attractive rates of return on capital

employed. Specifically, we have focused, and plan to continue

to focus, on the following investments in South America.

Our

Oil and Gas Investments

Our main

source of revenue will derive from the sale of the crude oil and natural gas

produced from the oil and gas concessions in which we have made investments. In

August 2007, SAHF signed agreements to purchase partial ownership interests in

four in oil and gas concessions in Northern Argentina. The joint venture owning

these concessions then started the process to obtain the necessary government

and environmental operating permits for the commercial exploitation of these

concessions. While we are not the operators of these concessions, we expect to

have representation on the operating committees that are responsible for

managing the business affairs of these concessions.

On

September 25, 2009 SAHF was approved to be registered in Salta, Argentina as a

branch of SAHF LLC. In March 19, 2010 a tax ID number was granted to SAHF as the

last requisite needed to be included in the nine exploration/exploitation joint

ventures for oil-gas blocks. Formal approval of the Secretary of Energy

authorities is expected in second quarter 2010 .Until the approval, SAHF

interest are protected with the Escrow Agreement with the joint venture

members.

As per

December 2009 the SAHF participation in the Argentina concessions are as

follows:

Blocks with current Delta

Mutual participation (through SAHF):

|

Block

|

#Wells

|

Status

|

Delta

%

|

Partners

|

JV

Investment

|

||||||||

|

Jollin

|

3 |

Testing

|

10

|

% CO* |

JHP(China)Maxi

|

2.7

MM

|

|||||||

|

Tonono

|

10 |

Product

|

10

|

% CO* |

JHP(China)Maxi

|

1.7

MM

|

|||||||

|

Tartagal

|

21 |

Seismic

|

9

|

% CO* |

New

Energy (HK)M

|

30

MM

|

|||||||

|

Morillo

|

1 |

Seismic

|

9

|

% CO * |

New

Energy(HK) M

|

5

MM

|

|||||||

|

Guemes**

|

2 |

Drilling

|

20 | % |

Ketsal

|

1

MM

|

|||||||

|

La

Union**

|

2 |

Geodesic

|

20 | % |

Ketsal

|

.5

MM

|

|||||||

|

Cobres**

|

0 |

Geodesic

|

20 | % |

Ketsal

|

.5

MM

|

|||||||

|

Valles**

|

0 |

Geodesic

|

20 | % |

Ketsal

|

.5

MM

|

|||||||

|

Rosario**

|

4 |

Geodesic

|

20 | % |

Ketsal

|

.5 MM

|

|||||||

4

*CO means

a carried interest in the project.

** Of

these five properties, the Company and its joint venture partner have made

initial investments in Guemes. As of March 31, 2010, our joint venture partner

has made the initial payments to the government, for our share of which we will

be responsible when SAHF is accepted as a qualified company in

Argintina. This is expected to occur in the second quarter of

2010.

Jollin

and Tonono Concessions

The

Company has a 10% ownership interest in the Jollin and Tonono oil and gas

concessions located in Salta Province, Argentina. During 2007, SAHF purchased

47% of these concessions and paid the purchase price by issuing a non-interest

bearing note in the principal amount of $1,820,000 to Oxipetrol-Petroleros

de Occidente S.A. (“Oxipetrol”), one of the other owners, with a maturity date

of July 2008. The purchase price was subsequently reduced to

$1,270,000 by mutual agreement among the parties, prior to the maturity

date. During 2008, the Company exchanged 50% of its ownership in this investment

with a third party for no cash consideration, however, the acquirer

contractually agreed to assume 50% of the Company’s obligations with respect to

future development expenses.

In

December 2008, a reentry workover was made in the Jollin 2 well for 23 days

until gas presence was detected in January 3, 2009 with a 170psi associated with

the burning test. After several hours of test a strong presence of sand stopped

the test. After 10 weeks of workover with two different rigs without a

satisfactory performance of the well, a technical decision was taken to perform

a 3D seismic job around the Jollin Block including the Jollin 2. After the

conclusion of the 3D, estimated for second quarter 2010 a side track will be

performed in the J2 or a bypass in the trouble stage in the

vicinity of 2270 mt of the tubing.

5

We also

expect to complete a 3D total research in the Tonono Block to identify the

potential reserves in the second quarter 2010.In 2008, the well Tonono 6 was

declared commercially viable by the authorities with a daily production around

90/obd. The produce was sold to the Grasta refinery. In the second semester 2009

the daily average was reduced and technical decision was taken to work over the

well after the seismic conclusion is received.

Tartagal

and Morillo Concessions

The

Company has 9% ownership of the Tartagal and Morillo oil and gas concessions

located in Salta Province, Argentina. During 2007, SAHF purchased 18% ownership

of these concessions and paid the purchase price by issuing a non-interest

bearing note in the principal amount of $480,000 to Oxipetrol-Petroleros de

Occidente S.A. (“Oxipetrol”), one of the other owners, with a maturity date of

July 2008. The purchase price was subsequently reduced to $450,000, by mutual

agreement among the parties, prior to the maturity date. During 2008, the

Company exchanged 50% of its ownership in this investment with a third party for

no cash consideration, however, the acquirer contractually agreed to assume 50%

of the Company’s obligations with respect to future development

expenses.

In December 15, 2009 a

services contract was signed between the Joint Venture of Tartagal & Morillo

and Wiccap, a local company using the equipment, technical assistance and data

processing of Westerngeco Clean and Cut(Completion, opening, leveling and

topographic calculations for source and reception of seismic lines) of the work

areas and the performance of 3-D seismic work in the Tartagal Oriental Area and

2-D seismic work in Morillo Area. Wiccap has the option to accept the data

interpretation of Schlumberger. Conclusion of this services are expected to be

delivered to the Tartagal and Morillo JV in second quarter 2010.The total amount

of seismic investment is over $25 MM.

Exploration

Rights (Guemes Block)

On

February 6, 2008, SAHF purchased 40% of the oil and gas exploration rights to

five geographically defined areas in the Salta Province of Northern Argentina

for $697,000. Provided certain development activities are undertaken by owners,

these exploration rights will remain in effect until the year 2010. The initial

development costs and fees were paid by the majority owner and the Company

incurred no additional expenses related to this investment in 2008.

As of

March 12, 2010, we had completed analysis of 25 microbial and 8 sorbed gas

samples along a single traverse over the seismic line 33115 and across the

Cuchuma prospect of the Guemes area in the Northwest Basin, Salta Province,

Argentina. The study area is located approximately 75 kilometers from the

capital city of Salta by Province Route Nº 9/34. Samples were collected at

100-150 meter intervals.

With this

confirmation, the drilling plan on the K-K Salta CuN x-2001 was approved to

start on April 1, 2010. The main objective is the Yacoraite formation ceiling

and the Maiz Gordo formation bottom. The drilling rig to be utilized is an Oil

Well 66 Britain with Perterser operators. Well completion is expected in May

2010.

Development Schedule for Our Oil and

Gas Investments

In

December 2008, a well located in the Tonono Concession received government

approval to begin commercial production of oil. When the test re-entry well at

this location was completed in the fourth quarter of 2008, it initially produced

between 10-15 cubic meters of oil per day, the equivalent of 90-101 barrels of

oil.

The same

well also contains natural gas. A natural gas pipeline connecting the Jollin

Concession to a nearby refinery is in the pre-construction phase. It is expected

to become operational in during the third quarter of 20 10. Upon completion, it

will permit the joint venture to commence deriving additional revenue from

natural gas sales. The gas pipeline construction is delayed until the 3-D

seismic conclusion will be delivered to substantiate critical design factors as

the total expected delivery volume.

Deliveries

of crude oil are expected to commence from the Tartagal and Morillo concessions

during the third quarter of 2010. Deliveries of crude oil are

expected in the second quarter of 2010 from the Guemes Block.

6

The main

costs associated with our oil and gas investments are related to oil and gas

property acquisition, drilling costs, initial well revitalization, gas pipeline

construction and ongoing operating expenses. The revitalization of wells allows

short-term cash increases while holding the lease for additional future

development.

Commitment to

Technology

In each

of our core operating areas, we have accumulated detailed geologic and

geophysical knowledge and have developed significant technical and operational

expertise. This data is analyzed with advanced geophysical and

geological computer resources dedicated to the accurate and efficient

characterization of the subsurface oil and gas reservoirs that comprise our

asset base. This commitment to technology has increased

the productivity and efficiency of our field operations and development

activities.

Lithium

Project

On March

1, 2010, we signed a purchase option agreement with Minera Jujuy from the Jujuy

Province, Argentina related to the acquisition of approximate 143,000 hectares

with 29 mines located in the Northwest part of Argentina, south of the border

with Bolivia, with high lithium and borates brines concentration. Currently, we

are performing sampling and geological conclusions with a local geological

company in order to determine value to the property.

The

Central Andes has the main concentrations of lithium brines in South America.

World Class deposits are: “Uyuni” in Bolivia, “Atacama” in Chile and “Hombre

Muerto” and “Rincon” in Argentina. The Argentina Puna is very rich in salt pan

deposits, locally called "salares". The biggest one is Salar Arizaro, located in

the western side of the Salta Puna region.

The salt

pan of the Puna has different compositions, one to the east and another to the

west. The eastern salars are rich in borate deposits (ulexite, 30%

boric oxide), meanwhile the western salars contain sulphates (sodium sulphate,

mirabilite-thenardite) as their main economic minerals. Likewise, all the salars

has sodium chloride (halite) followed by calcium sulphate (gypsum) and scarce

carbonate (mainly travertines from thermal springs). Currently, the main mining

activity related to salars are borates, represented by ulexite (calcium-sodium

borate) and borax (sodium borate) which are exploited for use in the

boric acid industry. Common salt is mined from the upper crust and sold for use

in paper, leather, table salt and other minor uses.

Moreover,

salars contain rich brines

mineralized by different chemical elements. The most important among them

is lithium, followed

by boron, magnesium, potash,

cesium and strontium. A 150 million dollar to obtain lithium

from brines (600 ppm) was carried out by Minera del Altiplano, a subsidiary

of FMC (an American company), in the salar del Hombre Muerto

(Salta-Catamarca boundary). A $30 million project is carried out in Salar del

Rincón by Ady Resources Ltd., from Australia.(Excerpts from a Geological Report

by Geol G.Horacio)

A

confidentiality agreement was signed by Delta with a European joint

venture on March 12th, 2010

for thirty days to perform samples procedures regarding the 150,000 hectares in

the Jujuy prospect.

7

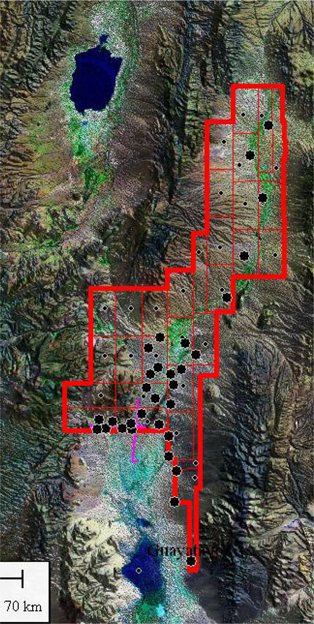

Each of

the black dots represents a mine location.

Development

Activities

Development

projects on the concessions in which we have investments include accessing

additional productive formations in existing well bores, formation stimulation,

infill drilling on closer well spacing, and retrofitting or reworking existing

wells.

Business Strategy

The key

elements of our business strategy are to:

|

|

·

|

Make

accretive acquisitions of producing properties generally characterized by

long-lived reserves with stable production and reserve development

potential;

|

|

|

·

|

Add

proved reserves and maximize cash flow and production through development

projects and operational efficiencies;

and

|

8

|

|

·

|

Engage

in adjacent exploration drilling where evaluation of the property is

positive.

|

Our investments have focused on

concessions where there are shut-in, plugged and abandoned wells that have, in

our assessment, a high probability of additional recovery of reserves through

our revitalization process. The revitalization process is directed toward

bringing wells back into production, or to enhance production through ordinary

practices used in the oil and gas industry.

In

addition, we will continue to evaluate newly developed alternative energy

technologies for possible investment and development.

Customers

Crude oil

production from the Guemes and Tonono Concessions would be sold to nearby

refineries, and is transported by truck. The natural gas production of the

Jollin concession will be transported by a pipeline to be constructed to the

Refinor oil company refinery also located in the Salta Province in Northern

Argentina. Sales are made based on spot market price postings, and vary month to

month. These prices typically are tied to domestic market crude and natural gas

prices.

Title to

Properties

We

believe that we have satisfactory title to or rights in all of our producing

properties. As is customary in the oil and gas industry, minimal

investigation of title is made at the time of acquisition of undeveloped

properties. In most cases, we investigate title and obtain title

opinions from counsel only when we acquire producing properties or before

commencement of drilling operations.

Competition

We

operate in a highly competitive environment for acquiring properties, marketing

oil and natural gas and securing trained personnel. Many of our

competitors possess and employ financial, technical and personnel resources

substantially greater than ours, which can be particularly important in the

areas in which we operate. Those companies may be able to pay more

for productive oil and gas properties and exploratory prospects and to evaluate,

bid for and purchase a greater number of properties and prospects than our

financial or personnel resources permit. Our ability to acquire

additional prospects and to find and develop reserves in the future will depend

on our ability to evaluate and select suitable properties and to consummate

transactions in a highly competitive environment. Also, there is

substantial competition for capital available for investment in the oil and gas

industry.

Middle

East

Envirotech

holds the exclusive Middle East distribution rights to a gas-imaging product,

which detects and visualizes harmful gasses produced by oilfield and refinery

operations. This product was field tested by ARAMCO, the Saudi government oil

company, during the third quarter of 2009. ARAMCO is currently evaluating

whether or not to purchase this technology and may elect to purchase it from a

competitor.

During

the second half of 2007, Envirotech, as a distributor, introduced an organic

supplement, designed to increase crop yield, to one of the major farming

operators in Saudi Arabia. During the third and fourth quarters of 2008, the

farm operator purchased sample quantities of the organic supplement for crop

testing. Envirotech received commission revenue of $43,000 associated with these

purchases. Subsequent purchases in commercial quantities will depend upon the

evaluation of the crop yield during the second quarter of 2010.

Governmental

Regulation

The key

points of the statutory and regulatory regime in respect of oil and gas

operations in Argentina are as follows:

9

Statutory

royalties on hydrocarbon production are payable to the Province of Salta. These

royalties are monthly levies collected by the provincial government, based on

hydrocarbon production lifted within their territories under an exploration

permit or exploitation concession. The applicable royalty rate is 12% for

exploitation concessions. The royalty is calculated from the well head value of

the hydrocarbon production, less certain allowable deductions. Royalties are, in

principle, paid in cash, although in certain cases royalties may be paid, or may

be required to be paid, in kind. Concession holders responsible for the payment

of royalties are required to report to the Secretary of Energy in a royalty

return, the volumes of natural gas and oil actually produced for the purpose of

determining the computable production and the statutory royalty payments due of

12%.

A surface

canon is a statutory, yearly fee payable in advance to the federal government on

each anniversary of the grant of the relevant concession and is calculated using

the acreage of the relevant concession. Surface canon payments are required in

order to maintain a concession in good-standing. The actual surface canon

payable under a particular block depends on the nature of the title over the

relevant block. The concession joint ventures in which the Company is a member

pay to the Secretary of Energy the highest retention option canon for the

current period.

The

holder of an exploration permit or exploitation concession must compensate

surface owners for any damage caused by hydrocarbon activities to their

properties. Such compensation may be established by: (i) a court in a lawsuit

for damages filed by the surface owner; (ii) mutual agreement of the parties; or

(iii) the surface owner’s acceptance of the tariffed compensation amounts

established by the government from time to time. Tariffed compensation charts

for each of the main oil and gas basins are issued from time to time, taking

into account the agricultural activities generally carried out in each such

zone.

The

concession joint ventures in which the Company is a member have executed written

agreements with the owners of the surface corresponding to its four exploitation

concessions in Argentina under which the joint ventures have agreed to

compensate them following the applicable tariffed compensation

charts.

There are

minimum work commitments and minimum investment commitments under statute in the

concession documents. However, the Federal Hydrocarbons Law 17,319 provides that

the “holder of an exploitation concession shall make such investments as may be

necessary, within reasonable periods of time, for the execution of the works

required for the development of the entire acreage comprised in the area of his

concession ... in such a manner as to ensure the maximum production of

hydrocarbons”. To such end, the holders of exploration permits and exploitation

concessions must file each year with the Secretary of Energy a “Form of

Investments”, reporting the investments made during the preceding year and the

projected investments for the then current year.

All

imports and exports of foreign currency into the domestic exchange market must

be registered with the Central Bank of Argentina; imports of foreign currency

(except foreign direct investment, foreign trade financing and initial public

offerings) may not be repaid or remitted abroad earlier than 365 days, from the

date the Central Bank recorded their entrance; importers of foreign currency

(except for foreign direct investment, foreign trade financing and initial

public offerings) must deposit 30 per cent. of their foreign currency imports

into Argentina with a local financial institution for a minimum 365 day term.

Said deposit shall be non transferable and “non remunerative” (without

interest). The remittance abroad of interests on financial obligations payable

by local residents to foreign creditors is allowed, subject to the minimum 365

day stay described above. Furthermore, the relevant financial obligations must

be registered with the Central Bank. Remittance of dividends approved in closed

and audited financial statements is allowed, and therefore dividends can be

remitted abroad.

Research

and Development

We do not

anticipate performing any significant product research and development under our

plan of operation.

Employees

Currently, we have

two employees: Dr. Daniel R. Peralta, President and CEO, and Malcolm W. Sherman,

Executive Vice President.

10

Available

Information

We

maintain a website at the address www.deltamutual.com. We

are not including the information contained on our website as part of, or

incorporating it by reference into, this report. We make available

free of charge (other than an investor’s own Internet access charges) through

our website our Annual Report on Form 10-K, quarterly reports on Form 10-Q and

current reports on Form 8-K, and amendments to these reports, as soon as

reasonably practicable after we electronically file such material with, or

furnish such material to, the Securities and Exchange Commission.

Item

1A. Risk Factors.

Our

oil and gas investments made by our subsidiary South American Hedge Fund may not

be profitable.

The

success of our investments in Argentina will depend to a great extent on the

operations, financial condition and management of the oil and gas concession and

exploration rights in which we have investments. Their success may depend upon

management of the operations in which the investments were made and numerous

other factors beyond our control.

Drilling

for and producing oil and natural gas are high risk activities with many

uncertainties.

Our

future success will depend on the success of our development, exploitation,

production and exploration activities. Our oil and natural gas

exploration and production activities are subject to numerous risks beyond our

control, including the risk that drilling will not result in commercially viable

oil or natural gas production. Our decisions to purchase, explore,

develop or otherwise exploit prospects or properties will depend in part on the

evaluation of data obtained through geophysical and geological analyses,

production data and engineering studies, the results of which are often

inconclusive or subject to varying interpretations. Our cost of

drilling, completing and operating wells is often uncertain before drilling

commences. Overruns in budgeted expenditures are common risks that

can make a particular project uneconomical. Further, many factors may

curtail, delay or cancel drilling, including the following:

|

|

·

|

delays

imposed by or resulting from compliance with regulatory

requirements;

|

|

|

·

|

pressure

or irregularities in geological

formations;

|

|

|

·

|

shortages

of or delays in obtaining qualified personnel or equipment, including

drilling rigs and CO2;

|

|

|

·

|

equipment

failures or accidents; and

|

|

|

·

|

adverse

weather conditions, such as freezing temperatures, hurricanes and

storms.

|

The

presence of one or a combination of these factors at our properties could

adversely affect our business, financial condition or results of

operations.

Prospects

that we decide to drill may not yield oil or gas in commercially viable

quantities.

A

prospect is a property on which we have identified what our geoscientists

believe, based on available seismic and geological information, to be

indications of oil or gas. Our prospects are in various stages of

evaluation, ranging from a prospect which is ready to drill to a prospect that

will require substantial additional seismic data processing and

interpretation. There is no way to predict in advance of drilling and

testing whether any particular prospect will yield oil or gas in sufficient

quantities to recover drilling or completion costs or to be economically

viable. The use of seismic data and other technologies and the study

of producing fields in the same area will not enable us to know conclusively

prior to drilling whether oil or gas will be present or, if present, whether oil

or gas will be present in commercial quantities. In addition, because

of the wide variance that results from different equipment used to test the

wells, initial flowrates may not be indicative of sufficient oil or gas

quantities in a particular field. The analogies we draw from

available data from other wells, from more fully explored prospects, or from

producing fields may not be applicable to our drilling prospects. We

may terminate our drilling program for a prospect if results do not merit

further investment.

11

The

global recession and tight financial markets may have impacts on our business

and financial condition that we currently cannot predict.

The

current global recession and tight credit financial markets may have an impact

on our business and our financial condition, and we may face challenges if

conditions in the financial markets do not improve. Our ability to

access the capital markets may be restricted at a time when we would like, or

need, to raise financing, which could have an impact on our flexibility to react

to changing economic and business conditions. The economic situation

could have an impact on our lenders or customers, causing them to fail to meet

their obligations to us. Additionally, market conditions could have

an impact on our commodity hedging arrangements if our counterparties are unable

to perform their obligations or seek bankruptcy protection.

We

are subject to complex laws that can affect the cost, manner or feasibility of

doing business.

Exploration,

development, production and sale of oil and natural gas are subject to extensive

federal, state, local and international regulation. We may be

required to make large expenditures to comply with governmental

regulations. Matters subject to regulation include:

|

|

·

|

discharge

permits for drilling operations;

|

|

|

·

|

drilling

bonds;

|

|

|

·

|

reports

concerning operations;

|

|

|

·

|

the

spacing of wells;

|

|

|

·

|

unitization

and pooling of properties; and

|

|

|

·

|

taxation.

|

Under

these laws, we could be liable for personal injuries, property damage and other

damages. Failure to comply with these laws also may result in the

suspension or termination of our operations and subject us to administrative,

civil and criminal penalties. Moreover, these laws could change in

ways that could substantially increase our costs. Any such

liabilities, penalties, suspensions, terminations or regulatory changes could

materially adversely affect our financial condition and results of

operations.

Our

operations may incur substantial liabilities to comply with environmental laws

and regulations.

Our oil

and gas operations are subject to stringent federal and state laws and

regulations relating to the release or disposal of materials into the

environment or otherwise relating to environmental protection. These

laws and regulations may require the acquisition of a permit before drilling

commences; restrict the types, quantities, and concentration of materials that

can be released into the environment in connection with drilling and production

activities; limit or prohibit drilling activities on certain lands lying within

wilderness, wetlands, and other protected areas; and impose substantial

liabilities for pollution resulting from our operations. Failure to

comply with these laws and regulations may result in the assessment of

administrative, civil, and criminal penalties, incurrence of investigatory or

remedial obligations, or the imposition of injunctive relief.

Market

conditions or operational impediments may hinder our access to oil and gas

markets or delay our production.

In

connection with our continued development of oil and gas properties, we may be

disproportionately exposed to the impact of delays or interruptions of

production from wells in these properties, caused by transportation capacity

constraints, curtailment of production or the interruption of transporting oil

and gas volumes produced. In addition, market conditions or a lack of

satisfactory oil and gas transportation arrangements may hinder our access to

oil and gas markets or delay our production. The availability of a

ready market for our oil and natural gas production depends on a number of

factors, including the demand for and supply of oil and natural gas and the

proximity of reserves to pipelines and terminal facilities. Our

ability to market our production depends substantially on the availability and

capacity of gathering systems, pipelines and processing facilities owned and

operated by third-parties. Additionally, entering into arrangements

for these services exposes us to the risk that third parties will default on

their obligations under such arrangements. Our failure to obtain such

services on acceptable terms or the default by a third party on their obligation

to provide such services could materially harm our business. We may

be required to shut in wells for a lack of a market or because access to gas

pipelines, gathering systems or processing facilities may be limited or

unavailable. If that were to occur, then we would be unable to

realize revenue from those wells until production arrangements were made to

deliver the production to market.

12

Crude

oil and natural gas prices are volatile and a substantial reduction in these

prices could adversely affect our results and the price of our common

stock.

Our

revenues, operating results and future rate of growth depend highly upon the

prices we receive from crude oil and natural gas produced by the concession in

which we have investments. Historically, the markets for crude oil and natural

gas have been volatile and are likely to continue to be volatile in the future.

The markets and prices for crude oil and natural gas depend on factors beyond

our control. These factors include demand for crude oil and natural gas, which

fluctuates with changes in market and economic conditions, and other factors,

including:

|

|

·

|

worldwide

and domestic supplies of crude oil and natural

gas;

|

|

|

·

|

actions

taken by foreign oil and gas producing

nations;

|

|

|

·

|

political

conditions and events (including instability or armed conflict) in crude

oil or natural gas producing

regions;

|

|

|

·

|

the

level of global crude oil and natural gas

inventories;

|

|

|

·

|

the

price and level of foreign imports;

|

|

|

·

|

the

price and availability of alternative

fuels;

|

|

|

·

|

the

availability of pipeline capacity and

infrastructure;

|

|

|

·

|

the

availability of crude oil transportation and refining

capacity;

|

|

|

·

|

weather

conditions;

|

|

|

·

|

domestic

and foreign governmental regulations and taxes;

and

|

|

|

·

|

the

overall economic environment.

|

Significant

declines in crude oil and natural gas prices for an extended period may have the

following effects on our business:

|

|

·

|

limiting

our financial condition, liquidity, and ability to finance planned capital

expenditures and results of

operations;

|

|

|

·

|

reducing

the amount of crude oil and natural gas that can be produced

economically;

|

|

|

·

|

causing

us to delay or postpone some of our capital

projects;

|

|

|

·

|

reducing

our revenues, operating income and cash

flows;

|

|

|

·

|

reducing

the carrying value of our investments in crude oil and natural gas

properties; or

|

|

|

·

|

limiting

our access to sources of capital, such as equity and long-term

debt.

|

The

current recession could have a material adverse impact on our financial

position, results of operations and cash flows.

The oil

and gas industry is cyclical in nature and tends to reflect general economic

conditions. The U.S. and other world economies are in a recession, which could

last well into 2010 and beyond. The recession may lead to significant

fluctuations in demand and pricing for crude oil and natural gas production,

such as the decline in commodity prices which occurred during 2008 and into

2009. If commodity prices decline, there could be additional impairments of our

investment assets or an impairment of goodwill.

Our

business involves many operating risks that may result in substantial losses for

which insurance may be unavailable or inadequate.

Our oil

and gas investments are subject to hazards and risks inherent in operating and

restoring oil and gas wells, such as fires, natural disasters, explosions,

casing collapses, surface cratering, pipeline ruptures or cement failures, and

environmental hazards such as natural gas leaks, oil spills and discharges of

toxic gases. Any of these risks can cause substantial losses resulting from

injury or loss of life, damage to or destruction of property, natural resources

and equipment, pollution and other environmental damages, regulatory

investigations and penalties, suspension of our operations and repair and

remediation costs. In addition, our liability for environmental hazards may

include conditions created by the previous owners of properties in which we have

investments or purchase or lease.

We do not

believe that insurance coverage for all environmental damages that could occur

is available at a reasonable cost. Losses could occur for uninsurable or

uninsured risks. The occurrence of an event that is not fully covered by

insurance could harm our financial condition and results of

operations.

13

Competition

in our industry is intense and many of our competitors have greater financial

and technological resources.

We have

investments in the competitive area of oil and gas exploration and production.

Many competitors are large, well-established companies that have larger

operating staffs and significantly greater capital resources.

Competition

for experienced personnel may negatively impact our operations.

Our

future profitability will depend on our ability to attract and retain qualified

personnel. The loss of any key executives or other key personnel could have a

material adverse effect on investments results and revenues. In particular, the

loss of the services of our President, Dr. Daniel Peralta, could adversely

affect our South American oil and gas investment results.

International operations expose us

to political, economic and currency risks.

With

regard to our investments in oil and gas concessions located outside of the

United States, we are subject to the risks of doing business abroad,

including,

|

|

·

|

Currency

fluctuations;

|

|

|

·

|

Changes

in tariffs and taxes; and

|

|

|

·

|

Political

and economic instability.

|

Changes

in currency exchange rates may affect the relative costs of operations in

Argentina, and may affect the cost of certain items required in oil and gas

processing, thus possibly adversely affecting our profitability.

There are

inherent risks for the foreseeable future of conducting business

internationally. Language barriers, foreign laws and tariff and taxation issues

all have a potential negative effect on our ability to transact business.

Changes in tariffs or taxes applicable to our investments in foreign operations

may adversely affect our profitability. Political instability may increase the

difficulties and costs of doing business. We may be subject to the jurisdiction

of the government and/or private litigants in foreign countries where we

transact business, and may be forced to expend funds to contest legal matters in

those countries in disputes with those governments or with customers or

suppliers.

We do not expect to pay

dividends.

We have never paid dividends on our

common stock. Management anticipates that any earnings generated will be used to

finance our current and planned business operations. For the foreseeable future,

we do not expect to pay cash dividends to holders of our common

stock.

Item

1B. Unresolved Staff Comments.

Not

applicable.

Item

2. Properties.

As of

December 31, 2009, our principal assets included Partial Rights Ownership in

nine oil and gas properties.

Developed

and Undeveloped Acreage

The

following table summarizes our estimated gross and net developed and undeveloped

acreage by concession at December 31, 2009. Net acreage

represents our percentage ownership of gross acreage. The following

table does not include acreage in which our interest is limited to royalty and

overriding royalty interests.

14

|

Block Name

|

Developed Acreage

|

Undeveloped Acreage

|

||||||||||||||

|

Gross

|

Net

|

Gross

|

Net

|

|||||||||||||

|

Tartagal

Oriental

|

0 | 7065 | Km2 | 635.85 | Km2 | |||||||||||

|

Morillo

|

0 | 3518 | Km2 | 316.62 | Km2 | |||||||||||

|

Tonono

|

66 | Km2 | 6.6 | Km2 | ||||||||||||

|

Jollin

|

32 | Km2 | 3.2 | Km2 | ||||||||||||

|

Guemes

|

0 | 8971 | Km2 | 1794 | Km2 | |||||||||||

|

Rosario

|

0 | 4510 | Km2 | 902 | Km2 | |||||||||||

|

Union

|

0 | 2467 | Km2 | 493 | Km2 | |||||||||||

|

Valles

|

0 | 5756 | Km2 | 1115 | Km2 | |||||||||||

|

Cobres

|

0 | 2558 | Km2 | 511 | Km2 | |||||||||||

Reserves

We expect

to have completed our reservoir engineering analysis as of July 31,

2010.

Executive

Offices

In

November 2009, we entered into a one-year lease for our principal office in

Scottsdale, Arizona, at a monthly rental of $1,276. We anticipate that our

current office space will accommodate our operations for the foreseeable

future.

Item

3. Legal Proceedings.

Former

Employee Wage Claims

On

September 16, 2008, the Company was notified of a complaint filed with the

Pennsylvania Department of Labor & Industry by its former President and CEO

alleging non-payment of wages in the amount of $53,271. The Company also

received notice of a similar complaint filed by a former employee alleging

non-payment of wages in the amount of $17,782. In October 2008, the Company

entered into repayment agreements with both of the former employees. As of the

date of this report, the Company has not made any payments to these two former

employees pursuant to these agreements. In addition, the employee that alleged

non-payment of wages in the amount of $17,782 has obtained a default judgment

against the Company, entered on January 8, 2010 in the Court of Common Pleas of

Bucks County, Pennsylvania, Civil Division, in the amount of $29,625.94 as to

this wage claim. As of December 31, 2009, the Company has recorded an accrued

liability of $17,782 in the accompanying consolidated financial statements. We

believe that a portion of the claim is without merit and are vigorously

contesting the claim as of the date of this filing.

The

Company has been notified by letter dated October 9, 2009 of a complaint filed

with the Pennsylvania Department of Labor & Industry by its former Chief

Financial Officer alleging non-payment of wages in the amount of $131,250. The

Company has responded to the Department of Labor & Industry that the wages

owed this former officer are substantially less than alleged in this

claim and are vigorously contesting the claim as of the date of this

filing. As of the date of filing, the Company is awaiting a response from the

Department of Labor and Industry and this matter is disclosed in the contingent

liabilities footnote to the consolidated financial statements.

Legal Fee Collection

Claim

Delta

Technologies, Inc., a wholly-owned subsidiary of the Company and a discontinued

operation (“Delta Technologies”), has been notified by a collection agency on

behalf of Wolf Block LLP (“Wolf Block”), a law firm that had provided

intellectually property legal services to Delta Technologies, that it had been

retained in an attempt to collect a past due amount of approximately $41,000.

The Company is in discussions with the collection agency and believes that the

resolution of this matter will have no material effect on the Company or its

operations.

Item 4. Reserved.

15

PART

II

Item

5. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer

Purchases of Equity Securities.

Our

common stock has been quoted on the Over-the-Counter Bulletin Board operated by

the National Association of Securities Dealers, since approximately February 1,

2001.

Our

shares are listed under the symbol "DLTZ”. The quotations in the table below

reflect inter-dealer prices, without retail mark-up, mark-down, or commission

and may not represent actual transactions. Prices commencing January 1, 2009

reflect the 1-for-10 reverse stock split effective July 6, 2009.

|

High

|

Low

|

||||||||

|

2008:

|

1st

Quarter

|

0.07 | 0.01 | ||||||

|

2nd

Quarter

|

0.07 | 0.04 | |||||||

|

3rd

Quarter

|

0.08 | 0.04 | |||||||

| 4th Quarter | 0.08 | 0.03 | |||||||

|

2009:

|

1st

Quarter

|

0.60 | 0.30 | ||||||

|

2nd

Quarter

|

0.90 | 0.21 | |||||||

|

3rd

Quarter

|

0.39 | 0.05 | |||||||

|

4th

Quarter

|

0.52 | 0.06 | |||||||

|

|

|||||||||

|

2010:

|

1st

Quarter

|

0.50 | 0.15 | ||||||

During

the last two fiscal years, no cash dividends have been declared on Delta's

common stock and Company management does not anticipate that dividends will be

paid in the foreseeable future. The payment of dividends is within the

discretion of the board of directors and will depend on the Company's earnings,

capital requirements, financial condition, and other relevant factors. There are

no restrictions that currently limit the Company's ability to pay dividends on

its common stock other than those generally imposed by applicable state

law.

As of

April 13, 2010, there were approximately 100 record holders of our common

stock.

Unregistered

Sales of Equity Securities

The

following table sets forth the sales of unregistered securities by the Company

in the year ended December 31, 2009.

|

Principal

|

Total Offering Price/

|

|||||||

|

Date

|

Title and Amount(1)

|

Purchaser

|

Underwriter

|

Underwriting Discounts

|

||||

|

April

21, 2009

|

28,572

shares of common stock

|

Consultant

|

NA

|

$0.35

per share/NA

|

||||

|

April

27, 2009

|

200,000

shares of common stock

|

Consultant

|

NA

|

$0.60

per share/NA

|

||||

|

August

24, 2009

|

64,584

shares of common stock

|

Private

Investor

|

NA

|

$0.08

per share/NA

|

||||

|

October

27, 2009

|

130,000

shares of common stock

|

Consultant

|

NA

|

$0.15

per share/NA

|

||||

|

October

27, 2009

|

166,662

shares of common stock

|

Private

Investor

|

NA

|

$0.06

per share/NA

|

||||

|

October

28, 2009

|

62,500

shares of common stock

|

Private

Investor

|

NA

|

$0.08

per share/NA

|

||||

|

November

10, 2009

|

130,000

shares of common stock

|

Private

Investor

|

NA

|

$0.08

per share/NA

|

||||

|

December

1, 2009

|

50,000

shares of common stock

|

Private

Investor

|

NA

|

$0.13

per share/NA

|

||||

|

December

4, 2009

|

60,000

shares of common stock issued in conversion of $35,000

principal amount of note

|

Private

Investor

|

NA

|

$0.58

per share/NA

|

||||

|

December

22, 2009

|

25,000

shares of common stock

|

Private

Investor

|

NA

|

$0.13

per share/NA

|

||||

|

December

23, 2009

|

133,334

shares of common stock

|

Private

Investor

|

NA

|

$0.15

per share/NA

|

||||

|

December

24, 2009

|

333,334

shares of common stock

|

Private

Investor

|

NA

|

$0.15

per share/NA

|

||||

|

December

30, 2009

|

|

333,334

shares of common stock

|

|

Private

Investor

|

|

NA

|

|

$0.15

per

share/NA

|

(1) The

issuances to lenders, consultants and investors are viewed by the Company as

exempt from registration under the Securities Act of 1933, as amended

(“Securities Act”), alternatively, as transactions either not involving any

public offering, or as exempt under the provisions of Regulation D, Regulation S

or Rule 701 promulgated by the SEC under the Securities

Act.

16

The

Company has no equity compensation plans in effect, or any securities

outstanding under equity compensation plans, as of the date of this

report.

Item

6. Selected Financial Data.

Not

applicable.

Item

7. Management's Discussion and Analysis of Financial Condition and Results of

Operations.

The

following discussion of our consolidated financial condition and results of

operations should be read in conjunction with the consolidated financial

statements and notes thereto and the other financial information included

elsewhere in this report.

Certain

statements contained in this report, including, without limitation, statements

containing the words "believes," "anticipates," "expects" and words of similar

import, constitute "forward looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. Such forward-looking

statements involve known and unknown risks and uncertainties. Our actual results

may differ materially from those anticipated in these forward-looking statements

as a result of certain factors, including our ability to create, sustain, manage

or forecast our growth; our ability to attract and retain key personnel; changes

in our business strategy or development plans; competition; business

disruptions; adverse publicity; and international, national and local general

economic and market conditions.

GENERAL

On March

4, 2008, we entered into a Membership Interest Purchase Agreement (the

“Agreement”) with Egani, Inc., an Arizona corporation (“Egani”). Pursuant to the

Agreement, we acquired from Egani 100% of the shares of stock held by Egani in

Altony S.A., an Uruguay Sociedad Anonima, (“Altony”) which owns 100% of the

issued and outstanding membership interests in South American Hedge Fund LLC, a

Delaware limited liability company (sometimes herein referred to as “SAHF”). At

the closing of the Agreement, we issued 13,000,000 shares of our Common stock to

Egani for the purchase of Altony which constituted, following such issuance, a

majority of the outstanding shares of our common stock. Immediately following

the closing of the Agreement, Altony became a wholly owned subsidiary of the

Company. For accounting purposes, the transaction was treated as a

recapitalization of the Company with Altony as the acquirer.

The

Company’s principal business at this time is conducted by our subsidiary, South

American Hedge Fund, which has investments in oil and gas concessions in

Argentina and intends to focus its investments in the energy sector, including

development of energy producing investments and alternative energy production in

Latin America and North America. Following the acquisition of SAHF, management

has continued to pursue selected business opportunities in the Middle East and

has also signed a purchase option agreement related to the acquisition of

approximate 143,000 hectares with 29 mines located in the Northwest part of

Argentina, south of the border with Bolivia, with high lithium and borates

brines concentration.

DECONSOLIDATION OF VARIABLE

INTEREST ENTITY

As

described in Part I of this report, as of December 31, 2009, the Company holds

45% ownership interest in Delta –Envirotech, Inc. which is engaged in

activities related to environmental remediation and other projects. These

activities are managed and carried out by majority stockholders of

Delta-Envirotech, Inc., (“Envirotech”), a joint venture company incorporated in

the state of Delaware with headquarters in Virginia and formed in January 2004.

The Company’s majority stockholders are Hi-Tech Consulting and Construction,

Inc. and an unrelated individual. The Company holds 45% interest in

Envirotech, which has entered into strategic alliance agreements with several

United States-based entities with technologies and products in the environmental

field to support its activities.

17

FASB ASC

810 “Consolidation” required the consolidation of a variable interest entity

(VIE) if the Company is deemed to be the primary beneficiary of the VIE. FASB

ASC 810 requires an entity to assess its equity investments and certain other

contractual interests to determine whether they are VIEs. As defined in FASB ASC

810, variable interests are contractual, ownership or other interests in an

entity that change with changes in entity’s net asset value. Variable interests

in an entity may arise from financial instruments, service contracts,

guarantees, leases or other arrangements with the VIE. An entity that will

absorb a majority of the VIE’s expected losses orexpected residual returns, as

defined in FASB ASC 810, is considered the primary beneficiary of the VIE. The

primary beneficiary should include the VIE’s assets, liabilities and results of

operations in its consolidated financial statements until a reconsideration

event, as defined in FASB ASC 810, occurs to require deconsolidation of the VIE.

At the deconsolidation date, the assets and liabilities of the VIE are removed

from the consolidated financial statements and any assets and liabilities of the

Company that were eliminated in consolidation are restored. The gain recognized

from deconsolidating VIE is recorded in the consolidated statements of

operations as gain on deconsolidation of the VIE.

As of

December 2009, management has determined that Envirotech is not considered a VIE

for the year ending December 31, 2009, and accordingly Envirotech has been

deconsolidated from the accompanying consolidated financial statements effective

December 31, 2009. As of December 31, 2009, the Company is not exercising

significant influence over operating and financing policies of Envirotech and

therefore Envirotech is not considered a VIE. As a result of this

deconsolidation, the Company has removed the assets and liabilities of the VIE

from the consolidated financial statements and any assets and liabilities of

Envirotech that were eliminated in consolidation are restored at fair

value.

Prior to

December 31, 2009, the Company was deemed to be the primary beneficiary of the

Envirotech due to relatively significant financial support provided to this

entity in terms of investment of $375,000 (which represents 45% ownership of the

Company) and notes receivable of $810,867. However, due to significant losses of

Envirotech and its deconsolidation as of December 31, 2009, the Company’s entire

investment and notes receivable in the aggregate of approximately $1,186,000 as

of December 31, 2009 has been reduced to zero in order to account for restored

assets at fair value. On the other hand, as of December 31, 2009, the Company

was not liable for Envirotech’s liabilities and losses totaling

approximately $882,000, net of the aforesaid losses on investment and notes

receivable in the aggregate of approximately $1,186,000 per agreed terms

with Envirotech and which resulted in a net gain on deconsolidation of

approximately $882,000 recorded as a separate line item in the accompanying

consolidated financial statements.

As of

December 30, 2009, the Company closed business operations of Altony SA and this

company is currently under a process of dissolution.

Reverse

Stock Split

Effective

July 6, 2009, we effected a 1:10 reverse split (the “Reverse Split”) of our

outstanding common stock, pursuant to a definitive information statement filed

with the Securities and Exchange Commission. Following effectiveness of the

Reverse Split, each ten (10) shares of our common stock outstanding immediately

prior to the effective date was automatically converted into one (1) share of

our common stock. By reason of the Reverse Split, the number of outstanding

shares of our common stock was reduced from 227,225,270 shares to 22,722,527

shares.

RESULTS

OF OPERATIONS

During

the fiscal year ended December 31, 2009, we had a gain from continuing

operations of approximately $835,000. The Company has an accumulated deficit of

approximately $3,596,337 and working capital deficiency of approximately

$967,042 as of December 31, 2009. Additionally, the Company may

require additional funding to execute its strategic business plan for 2010.

These factors raise substantial doubt about the Company’s ability to continue as

a going concern. Successful business operations and its transition to attaining

profitability is dependent upon obtaining additional financing and achieving a

level of revenue adequate to support its cost structure. There can be no

assurances that there will be adequate financing available to the Company, if

the Company requires financing. The accompanying consolidated financial

statements have been prepared assuming that the Company will continue as a going

concern. This basis of accounting contemplates the recovery of the Company’s

assets and the satisfaction of liabilities in the normal course of business. The

consolidated financial statements do not include any adjustments to reflect the

possible future effects on the recoverability and classification of assets or

the amounts and classification of liabilities that may result from the outcome

of this uncertainty.

18

The

Independent Auditors' Report and Note 1 of the Notes to Consolidated Financial

Statements accompanying

this report state that substantial doubt has been raised about our ability to

continue as a going concern.

2009

COMPARED TO 2008

For

accounting and financial reporting purposes only, our acquisition of Altony on

March 4, 2008 was treated as a reverse merger, with Altony as the acquirer. Our

consolidated financial statements for the twelve months ended December 31, 2007

are those of Altony (including its SAHF subsidiary on a consolidated basis). In

2009, we had a gain from continuing operations of approximately $835,000,

primarily as a result of an approximate $882,268 gain on the deconsolidation of

Envirotech, compared to a net loss from continuing operations of approximately

$2,270,000 in the twelve months ended December 31, 2008. Our general and

administrative expenses decreased in the twelve months ended December 31, 2009,

to approximately $636,000, from general and administrative expenses of

approximately $1,490,000 in 2008. In 2008, we also had a loss on the

sale of investments of $860,000, as compared with approximately $158,000 in

2009. In the twelve months ended December 31, 2009, we also had other

income of approximately $582,000, consisting of write-down of payroll and

consulting accruals and settled accounts payable originating more than two years

ago and considered no longer payable..

PLAN OF

OPERATION

The

primary focus of the Company’s business is its South American Hedge Fund

subsidiary that has investments in oil and gas exploration and production in

Argentina and will continue to focus on the energy sector, including the

development of a property for the production of lithium in Argentina, and

development and supply of energy and alternative energy sources in Latin America

and North America. As of December 31, 2008, the securities trading activities of

South American Hedge Fund were accounted for as discontinued

operations.

Oil and

Gas Investments

Our main

source of revenue will derive from the sale of crude oil and natural gas

produced from the oil and gas concessions and exploration properties in which we

have made investments. While we are not the operators of these properties, we

expect to have representation on the operating committees that are responsible

for managing the business affairs of these concessions. Our ownership interests

in these concessions range from 9% to 10%, and we have a 20% interest in the

blocks in which we have exploration rights.

Jollin

and Tonono Concessions

In 2008,