Attached files

EXHIBIT 10.1

OFFICE LEASE

SKYPORT PLAZA

Between

CA-SKYPORT I LIMITED PARTNERSHIP,

a Delaware limited partnership

as Landlord,

and

ATHEROS COMMUNICATIONS, INC.,

a Delaware corporation

as Tenant

TABLE OF CONTENTS

| Page | ||||

| ARTICLE 1 | PREMISES AND COMMON AREAS |

5 | ||

| ARTICLE 2 | LEASE TERM |

8 | ||

| ARTICLE 3 | RENT |

8 | ||

| ARTICLE 4 | EXPENSES AND TAXES |

9 | ||

| ARTICLE 5 | USE OF PREMISES |

17 | ||

| ARTICLE 6 | SERVICES |

17 | ||

| ARTICLE 7 | REPAIRS |

19 | ||

| ARTICLE 8 | ADDITIONS AND ALTERATIONS |

21 | ||

| ARTICLE 9 | COVENANT AGAINST LIENS |

23 | ||

| ARTICLE 10 | INDEMNIFICATION; INSURANCE |

23 | ||

| ARTICLE 11 | DAMAGE AND DESTRUCTION |

26 | ||

| ARTICLE 12 | NONWAIVER |

27 | ||

| ARTICLE 13 | CONDEMNATION |

28 | ||

| ARTICLE 14 | ASSIGNMENT AND SUBLETTING |

28 | ||

| ARTICLE 15 | SURRENDER OF PREMISES; REMOVAL OF PERSONAL PROPERTY AND TRADE FIXTURES |

33 | ||

| ARTICLE 16 | HOLDING OVER |

33 | ||

| ARTICLE 17 | ESTOPPEL CERTIFICATES; FINANCIAL STATEMENTS |

34 | ||

| ARTICLE 18 | SUBORDINATION |

35 | ||

| ARTICLE 19 | DEFAULTS; REMEDIES |

36 | ||

| ARTICLE 20 | RIGHTS RESERVED TO LANDLORD |

38 | ||

| ARTICLE 21 | LANDLORD EXCULPATION |

39 | ||

| ARTICLE 22 | SECURITY DEPOSIT |

39 | ||

| ARTICLE 23 | EMERGENCY GENERATOR |

40 | ||

| ARTICLE 24 | SIGNS |

40 | ||

| ARTICLE 25 | COMPLIANCE WITH LAW; HAZARDOUS SUBSTANCES |

42 | ||

| ARTICLE 26 | LATE CHARGES |

46 | ||

| ARTICLE 27 | LANDLORD’S RIGHT TO CURE DEFAULT |

46 | ||

(i)

| Page | ||||

| ARTICLE 28 | ENTRY BY LANDLORD |

46 | ||

| ARTICLE 29 | TENANT PARKING |

47 | ||

| ARTICLE 30 | MISCELLANEOUS PROVISIONS |

48 | ||

EXHIBITS

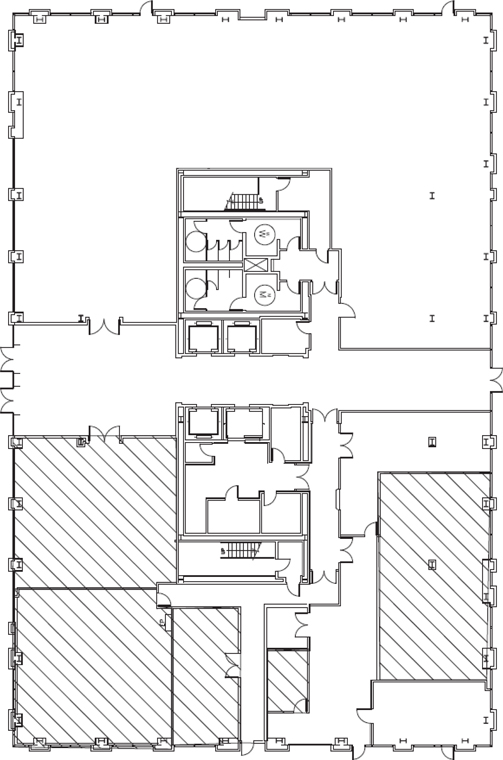

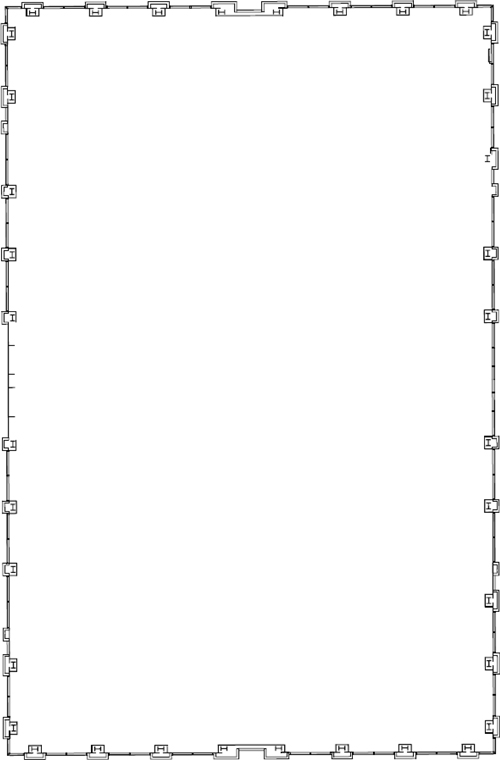

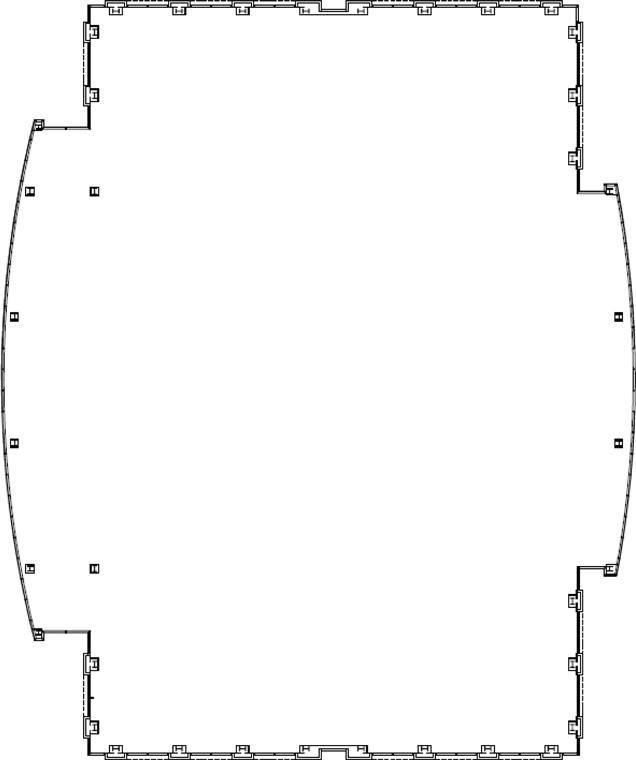

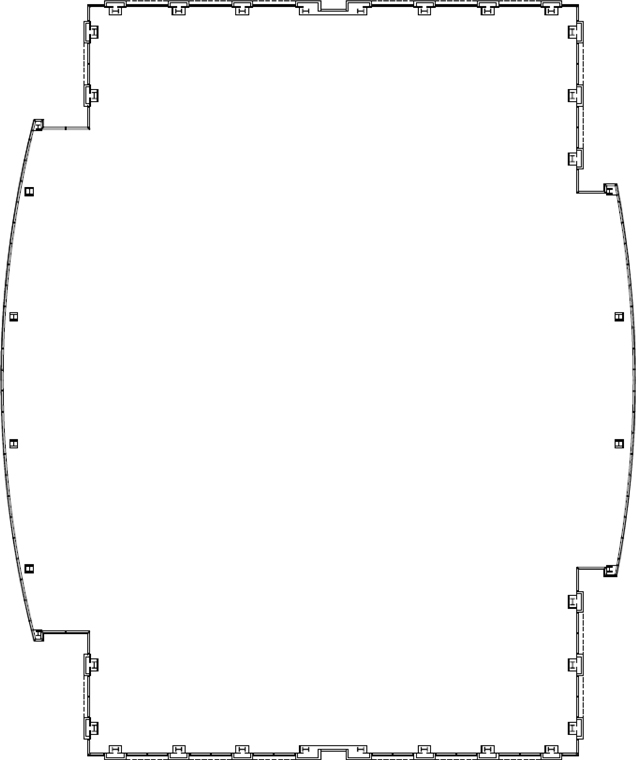

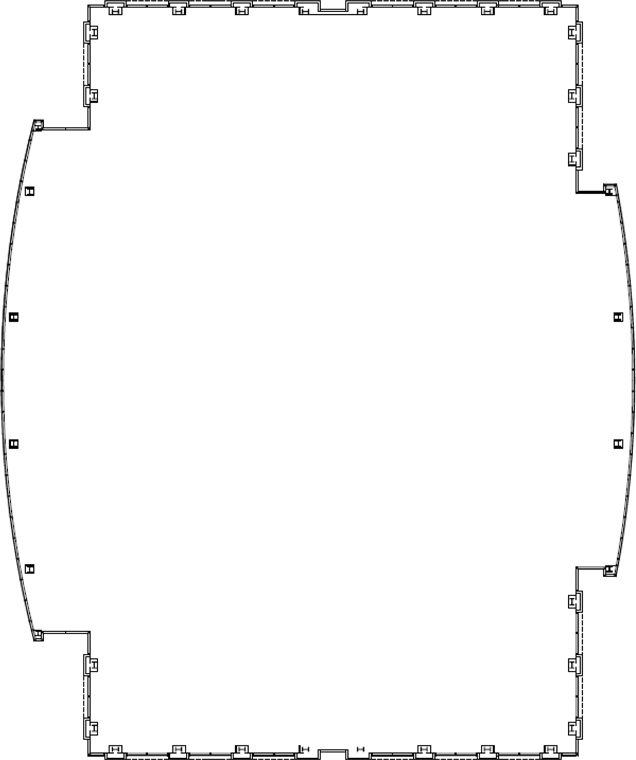

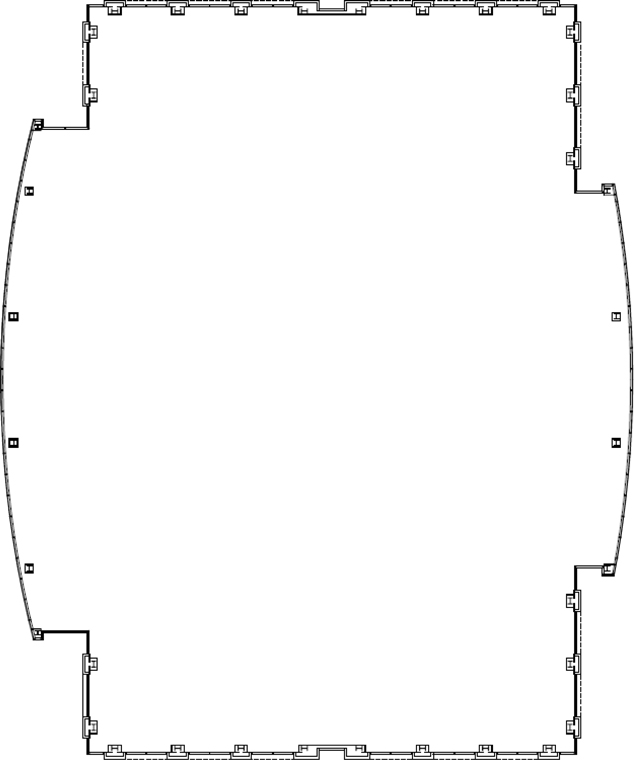

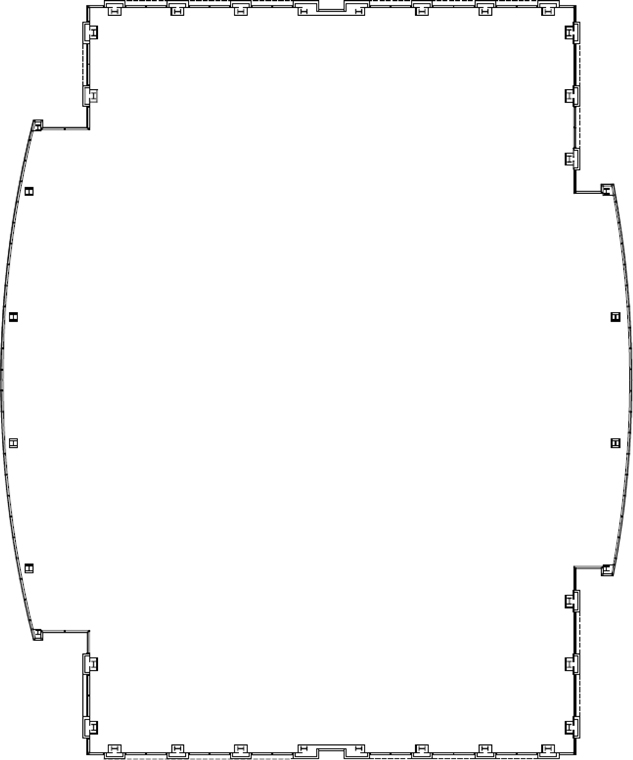

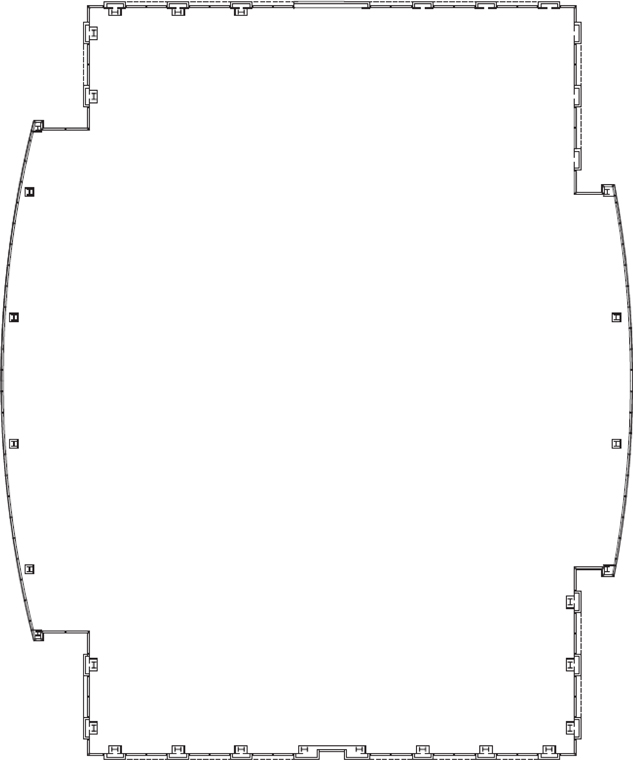

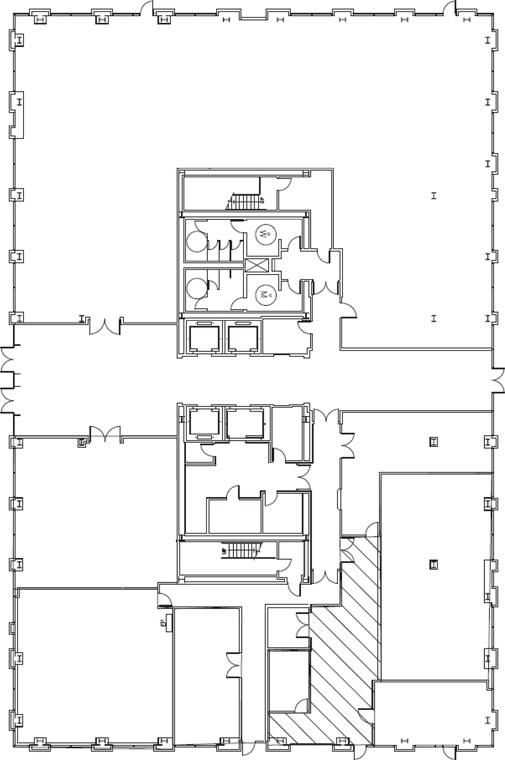

| A | OUTLINE OF PREMISES | |

| B | TENANT WORK LETTER | |

| C | FORM OF NOTICE OF LEASE TERM DATES | |

| D | RULES AND REGULATIONS | |

| E | HAZARDOUS SUBSTANCES DISCLOSURE CERTIFICATE | |

| F | ADDITIONAL PROVISIONS | |

| G | MARKET RENT ANALYSIS | |

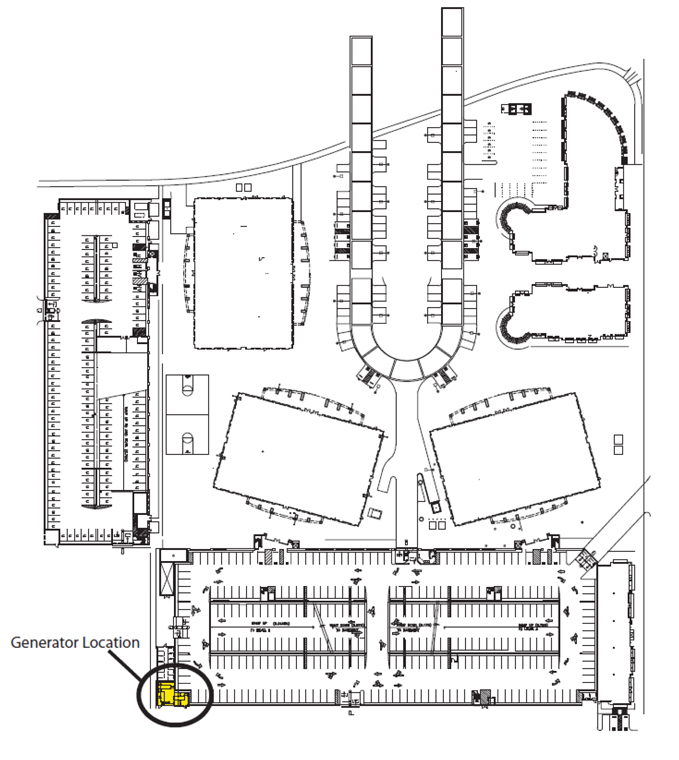

| H | LOCATION OF GENERATOR | |

| I | FIRST OFFER SPACE TERMS FOR MULTI-TENANT BUILDING |

(ii)

OFFICE LEASE

This Office Lease (this “Lease”), dated as of the date set forth in Section 1 of the Summary of Basic Lease Information (the “Summary”), below, is made by and between CA-SKYPORT I LIMITED PARTNERSHIP, a Delaware limited partnership (“Landlord”), and ATHEROS COMMUNICATIONS, INC., a Delaware corporation (“Tenant”).

SUMMARY OF BASIC LEASE INFORMATION

| TERMS OF LEASE |

DESCRIPTION | |||||

| 1. | Date: |

April 30, 2010 | ||||

| 2. |

Premises (Article 1). |

|||||

| 2.1 | “Building”: | 1700 Technology Drive San Jose, California 95110 | ||||

| 2.2 | “Premises”: | Subject to Section 1.1.1, 160,224 rentable square feet of space comprised of:

(i) all of the second (2nd) floor (containing approximately 21,918 rentable square feet of space),

(ii) all of the third (3rd) floor (containing approximately 25,114 rentable square feet of space),

(iii) all of the fifth (5th) floor (containing approximately 25,114 rentable square feet of space),

(iv) all of the sixth (6th) floor (containing approximately 25,114 rentable square feet of space),

(v) all of the seventh (7th) floor (containing approximately 25,114 rentable square feet of space),

(vi) all of the eighth (8th) floor (containing approximately 25,114 rentable square feet of space),and

(vii) a portion of the first (1 st) floor of the Building consisting of 12,736 rentable square feet of space.

The outline and location of which is set forth in Exhibit A to this Lease. If the Premises includes any floor in its entirety, all corridors and restroom facilities located on such floor shall be considered part of the Premises. | ||||

| 2.3 | “Property”: | The Building, the parcel(s) of land upon which it is located, and, at Landlord’s discretion, any parking facilities and other improvements serving the Building and the parcel(s) of land upon which such parking facilities and other improvements are located. | ||||

| 2.4 | “Project”: | The office/R&D project, consisting of two (2) buildings (i.e., the Building and that certain other building located at 1650 Technology Drive (the “1650 TD Building”), including (i) the land (which is improved with landscaping, parking facilities and other improvements) upon which such buildings and the Common Areas are located, and (ii) at Landlord’s reasonable discretion, any additional real property, areas, land, buildings or other improvements added thereto outside of the Project. | ||||

| 3. |

Lease Term (Article 2). |

|||||

| 3.1 | Lease Term: | The term of this Lease (the “Lease Term”) shall be the period commencing on the Lease Commencement Date and ending on the Lease Expiration Date (or any earlier date on which this Lease is terminated as provided herein); subject to extension of the Lease Expiration Date by Tenant’s exercise of one or both of the extension options granted under Section 1 of Exhibit F to this Lease. | ||||

| 3.2 | “Lease Commencement Date”: | August 1, 2010. | ||||

| 3.3 | “Lease Expiration Date”: | July 31, 2017. | ||||

| 4. |

“Base Rent” (Article 3): | |||||

| Period During Lease Term |

Monthly Base Rent Per Rentable Square Foot |

Monthly Installment of Base Rent |

Annual Base Rent | |||||

| Months 1 –12* |

$1.60 | $ | 256,358.40 | $ | 3,076,300.80 | |||

| Months 13 – 24 |

$1.65 | $ | 264,369.60 | $ | 3,172,435.20 | |||

| Months 25 – 36 |

$1.70 | $ | 272,380.80 | $ | 3,268,569.60 | |||

| Months 37 – 48** |

$1.75 | $ | 324,341.50 | $ | 3,892,098.00 | |||

| Months 49 – 60 |

$1.80 | $ | 333,608.40 | $ | 4,003,300.80 | |||

| Months 61 – 72 |

$1.85 | $ | 342,875.30 | $ | 4,114,503.60 | |||

| Months 73 – 84 |

$1.91 | $ | 353,995.58 | $ | 4,247,946.96 | |||

-2-

| * | Notwithstanding the foregoing, so long as no Default (defined in Section 19.1 below) exists, Tenant shall be entitled to an abatement of Base Rent, in the amount of $256,358.40 per month, for the first ten (10) consecutive full calendar months of the Lease Term, subject to the terms of Section 3.2, below. |

| ** | The Base Rent schedule for the period commencing on the Lease Commencement Date and ending on the thirty-sixth (36th) calendar month of the Lease Term is calculated based on the square footage of the Premises only (i.e., 160,224 rentable square feet). The Base Rent schedule for the period commencing on the first day of the thirty-seventh (37th) calendar month of the Lease Term and ending on the Lease Expiration Date, is based on the combined square footage of the Premises and the “Must-Take Space”, as that term is defined in Section 1.3, below (i.e., a total of 185,338 rentable square feet). |

| 5. |

“Tenant’s Share” (Article 4): |

From the Lease Commencement Date through the end of the 36th Month – 82.36%;

From and after the Must-Take Commencement Date – 95.27%.

The determination of Tenant’s Share is based upon a total of 194,530 rentable square feet in the Building), subject to Article 1 below. | ||

| 6. |

“Permitted Use” (Article 5): |

General office, laboratory, research and development, warehousing, sales and marketing and related purposes consistent with a “Class A” office/R&D building and in conformity with municipal zoning requirements of the City of San Jose and other applicable Laws (as defined in Section 25.1 below); provided, however, that except as otherwise expressly provided in Article 5 below, the area of the Premises used for laboratory purposes shall not exceed 110% of the area of the Premises (including the Must-Take Space) dedicated to laboratory use as of the date of this Lease. The Permitted Use may be expanded to include other lawful uses not expressly prohibited by this Lease, subject to Landlord’s prior written consent (not to be unreasonably withheld), to the extent the same comply with applicable laws and zoning and are consistent with the character of the Project as a first-class office/R&D project. | ||

| 7. |

“Security Deposit” (Article 22): |

None. | ||

| Prepaid Base Rent (Article 3): |

$256,358.40, as more particularly described in Article 3 below. | |||

| Prepaid Additional Rent (Article 3): |

$155,096.83, as more particularly described in Article 3 of this Lease. | |||

| 8. |

Parking (Article 29): |

Three and one-half (3.5) unreserved parking spaces for every one thousand rentable square feet contained within the Premises (which has been calculated to equal 561 unreserved parking spaces based on the Premises containing 160,224 rentable square feet, and, following the “Must-Take Delivery Date,” as | ||

-3-

| that term is defined in Section 1.3.2 of this Lease, 649 unreserved parking spaces based on the Premises containing 185,338 rentable square feet, and if Tenant leases the First Refusal Space (as defined in Section 2 of Exhibit F), 681 unreserved parking spaces based on the Premises containing 194,530 rentable square feet (which square footage also includes the Must-Take Space). | ||||

| 9. |

Address of Tenant (Section 30.16): |

Before the Lease Commencement Date:

Atheros Communications, Inc. 5480 Great America Parkway Santa Clara, CA 95054 Attention: David Torre

With a copy to:

Atheros Communications, Inc. 5480 Great America Parkway Santa Clara, CA 95054 Attention: General Counsel | ||

| From and after the Lease Commencement Date:

Atheros Communications, Inc. 1700 Technology Drive San Jose, California 95110 Attention: David Torre

With a copy to:

Atheros Communications, Inc. 1700 Technology Drive San Jose, California 95110 Attention: General Counsel | ||||

| 10. |

Address of Landlord (Section 30.16): |

CA-Skyport I Limited Partnership 2655 Campus Drive, Suite 100 San Mateo, CA 94403 Attn: Market Officer

and

Equity Office 2655 Campus Drive, Suite 100 San Mateo, CA 94403 Attn: Managing Counsel | ||

-4-

| and

Equity Office Two North Riverside Plaza Suite 2100 Chicago, IL 60606 Attn: Lease Administration | ||||

| 11. |

Broker (Section 30.22): |

Jones Lang LaSalle Americas, Inc. (“Tenant’s Broker”), representing Tenant. | ||

| 12. |

“Transfer Radius” (Section 14.2.7): |

None. | ||

| 13. | “Tenant Improvements”: | Defined in the Tenant Work Letter attached hereto as Exhibit B. | ||

| 14. | “Guarantor”: | As of the date of this Lease, there is no Guarantor. | ||

ARTICLE 1

PREMISES AND COMMON AREAS

1.1 The Premises.

1.1.1 Subject to the terms hereof, Landlord hereby leases the Premises to Tenant and Tenant hereby leases the Premises from Landlord. Landlord and Tenant acknowledge and agree that the rentable square footage of the Premises is as set forth in Section 2.2 of the Summary and the rentable square footage of the Building is as set forth in Section 5 of the Summary. Tenant acknowledges and agrees that this Lease is made upon the condition that Tenant will perform each of its obligations hereunder and that Tenant’s agreement to perform each such obligation is a material part of the consideration for this Lease. The parties acknowledge that Exhibit A is intended only to show the approximate location of the Premises in the Building, and not to constitute an agreement, representation or warranty as to the construction or precise area of the Premises, or as to the specific location or elements of the Common Areas (defined in Section 1.2 below) or of the access ways to the Premises or the Project.

1.1.2 Landlord shall deliver possession of the Premises to Tenant (the “Premises Delivery Date”) as soon as practicable following the mutual execution and delivery of this Lease by Landlord and Tenant, and, except as specifically set forth in this Lease (including in any Tenant Work Letter attached hereto as Exhibit B (“Tenant Work Letter”), and the “Landlord’s Six Month Warranty,” as that term is defined in Section 1.1.3, below), the Premises is accepted by Tenant in its condition and configuration existing on the date hereof, without any obligation of Landlord to perform or pay for any alterations to the Premises, and without any representation or warranty regarding the condition of the Premises, the Building or the Project or their suitability for Tenant’s business.

1.1.3 Notwithstanding the foregoing, upon the Premises Delivery Date, the “Building Systems,” as that term is defined in Section 7.1.1 of this Lease (excluding any furniture, trade fixtures and/or equipment located in the Premises and any specialty equipment or systems installed by a prior occupant of the Building) serving the Premises or the Must-Take Space, and the structural portions of the Building (collectively, the “Existing Base Building”), shall be in good working condition and repair, and Landlord hereby covenants that the Existing Base Building shall remain in good working condition for a period of six (6) months following the Lease Commencement Date pursuant to the terms of this

-5-

Section 1.1.3. Landlord shall, at Landlord’s sole cost and expense (which shall not be deemed an “Expense,” as that term is defined in Section 4.2.2), repair or replace any failed or inoperable portion of the Existing Base Building during such six (6) month period (“Landlord’s Six Month Warranty”), provided that the need to repair or replace was not caused by the misuse, misconduct, damage, destruction, omissions, and/or negligence (collectively, “Tenant Damage”) of Tenant, its subtenants and/or assignees, if any, or any company which it acquired, sold or merged with Tenant or any “Tenant Party”, as that term is defined in Section 10.1.2, below, or by any modifications, Alterations or improvements (including the Tenant Improvements) constructed by or on behalf of Tenant. In determining the scope of Landlord’s Six Month Warranty, the phrase “specialty equipment or systems installed by a prior occupant of the Building” refers only to equipment or systems existing in the Premises that customarily would be installed by or at the behest of a tenant to support information technology installations as well as activities not associated with general office use, including supplemental HVAC equipment, uninterruptable power systems, auxiliary generators, and laboratory-related equipment or systems. Landlord’s Six Month Warranty shall not be deemed to require Landlord to replace any portion of the Existing Base Building, as opposed to repair such portion of the Existing Base Building, unless prudent commercial property management practices dictate replacement rather than repair of the item in question. To the extent repairs which Landlord is required to make pursuant to this Section 1.1.3 are necessitated in part by Tenant Damage, then Tenant shall reimburse Landlord for an equitable proportion of the cost of such repair. If it is determined that any of the Existing Base Building was not in good working condition and repair as of the Lease Commencement Date, Landlord shall not be liable to Tenant for any damages, but as Tenant’s sole remedy, Landlord, at no cost to Tenant, shall promptly commence such work or take such other action as may be necessary to place the same in good working condition and repair, and shall thereafter diligently pursue the same to completion.

1.2 Common Areas. Tenant shall have the non-exclusive right to use, in common with Landlord, other Project occupants and other parties reasonably related to the Project, and subject to the Rules and Regulations (defined in Exhibit D attached hereto), any portions of the Property that are designated from time to time by Landlord for such common use (the “Common Areas”). The manner in which the Common Areas are maintained and operated shall be at the reasonable discretion of Landlord (but shall at least be consistent with the manner in which the common areas of the “Comparable Buildings,” as that term is defined on Exhibit G, attached hereto, are maintained and operated). Landlord reserves the right to close temporarily, make alterations or additions to, or change the location of elements of the Project and the Common Areas, and any inconvenience suffered by Tenant in connection therewith shall not subject Landlord to any liability for any loss or damage resulting therefrom, constitute a constructive eviction, or entitle Tenant to any abatement of Rent, provided that, in connection therewith, (i) Landlord shall perform such closures, alterations, additions or changes in a commercially reasonable manner and, in connection therewith, shall use commercially reasonable efforts to minimize any material interference with Tenant’s use of and access to the Premises and those Common Areas (including parking facilities) necessary for the full use and enjoyment of the Premises, (ii) Landlord shall not, without Tenant’s prior written consent, which consent shall not be unreasonably withheld, permanently change the location or configuration of the parking facilities serving the Project, and (iii) Landlord shall not, without Tenant’s prior written consent, which consent shall not be unreasonably withheld, eliminate Project amenities located in the Project Common Areas and existing as of the date of this Lease to the extent the same are consistent with the amenities typically provided in similar office/R&D projects located near the Project.

1.3 Must-Take Space. Effective on the Must-Take Commencement Date, the Premises shall be expanded to include the rentable square footage of the “Must-Take Space,” as that term is defined in Section 1.3.1, below, as set forth in this Section 1.3 and this Lease. The “Must-Take Commencement Date” means the earlier to occur of (i) the date upon which Tenant first commences to conduct business in the Must-Take Space, and (ii) the third (3rd) anniversary of the Lease Commencement Date. Between

-6-

the Lease Commencement Date and the Must-Take Commencement Date, Tenant shall be entitled to early and unrestricted access to the Must-Take Space for the purposes authorized under Exhibit B to this Lease and to monitor compliance with Landlord’s Six Month Warranty. All terms, covenants and conditions of this Lease shall apply to the Must-Take Space between the Lease Commencement Date and the Must-Take Commencement Date, except that Tenant shall not be required to pay any Base Rent or Expenses with respect to the Must-Take Space prior to the Must-Take Commencement Date.

1.3.1 Description of the Must-Take Space. The “Must-Take Space,” as used in this Lease, shall mean the fourth (4th) floor of the Building consisting of 25,114 rentable square feet of space.

1.3.2 Delivery of the Must-Take Space. Tenant shall accept delivery of the Must Take Space from Landlord, and Landlord shall deliver the Must Take Space to Tenant, on the Premises Delivery Date (as such date is used with respect to the Must-Take Space, the “Must-Take Delivery Date”). Landlord and Tenant hereby acknowledge that the Must-Take Space is currently vacant, and Tenant hereby covenants that it shall not conduct business, or otherwise use, all or any portion of the Must-Take Space prior to the Must-Take Delivery Date. In the event that Landlord determines that (A) Tenant has commenced conducting business in any portion of the Must-Take Space, or (B) Tenant has otherwise commenced using any portion of the Must-Take Space in any capacity whatsoever (including, without limitation, for storage, but excluding as reasonably necessary to perform any maintenance or repair for which Tenant is responsible), then the Must-Take Commencement Date shall be deemed to have immediately occurred pursuant to Section 1.3(i), above, and the Base Rent schedule and Tenant’s Share, as set forth in Sections 4 and 5 of the Summary, respectively, shall be revised to reflect such early lease of the Must-Take Space by Tenant.

1.3.3 Rent and Term. The Must-Take Space shall become part of the Premises for all purposes hereunder on the Must-Take Commencement Date, and, except as otherwise provided in this Section 1.3, shall be subject to every term and condition of this Lease. The base rent and additional rent for the Must-Take Space has been included in the Base Rent schedule and Tenant’s Share in Sections 4 and 5 of the Summary, respectively. The lease term for the Must-Take Space shall commence, and Tenant shall commence payment of the Base Rent and the Additional Rent for the Must-Take Space, upon the Must-Take Delivery Date, and the lease term for the Must-Take Space shall expire upon the Lease Expiration Date.

1.3.4 Improvement of Must-Take Space. The Must-Take Space shall be improved by Tenant pursuant to the terms of the Tenant Work Letter, attached hereto as Exhibit B. Subject to the terms of this Lease (including the Tenant Work Letter), Tenant shall accept the Must-Take Space in its then existing “as is” condition. However, Landlord shall deliver the Must-Take Space to Tenant in a broom clean condition, free of personal property.

1.3.5 Other Terms. Except as specifically set forth in this Lease, all other terms of this Lease shall apply to the Must-Take Space as though the Must-Take Space was originally part of the Premises. Upon Landlord’s request anytime after the Must-Take Delivery Date, Tenant shall execute an amendment adding such Must-Take Space to this Lease upon such terms and conditions within five (5) days of delivery of such amendment to Tenant by Landlord.

1.4 Conversion to Multi-Tenant Building. Landlord and Tenant acknowledge that the Building is currently unoccupied and that, as of the Lease Commencement Date, Tenant shall be the sole occupant in the Building. Because Tenant is expected to be the sole occupant in the Building, Landlord and Tenant have agreed to certain provisions in this Lease that would not have been agreed upon if Tenant were not the sole occupant in the Building (i.e, if the Building were a multi-tenant office building). Notwithstanding the foregoing, in the event that Landlord leases or otherwise enters into any

-7-

occupancy agreement with an unaffiliated third-party for any space in the Building, then this Lease shall automatically be deemed to incorporate the terms and conditions set forth on Exhibit I, attached hereto, and, upon Landlord’s or Tenant’s request therefor, the other shall execute an amendment acknowledging the addition of such terms and conditions to this Lease within five (5) days of delivery of such amendment to Tenant by Landlord or by Tenant to Landlord.

ARTICLE 2

LEASE TERM

The Lease Term shall commence and, unless ended sooner as herein provided, shall expire, unless extended pursuant to Section 1 of Exhibit F, on the Lease Commencement Date and Lease Expiration Date, respectively, specified in Section 3 of the Summary of Basic Lease Information, provided, however, that upon Tenant’s exercise of one or both of the extension options granted under Section 1 of Exhibit F, the Lease Expiration Date shall be extended to the last day of the applicable Option Term. At any time during the Lease Term, Landlord may deliver to Tenant a notice substantially in the form of Exhibit C attached hereto, as a confirmation of the information set forth therein, which Tenant shall execute and return to Landlord within ten (10) business days of receipt thereof, provided that if such notice is not factually correct, then Tenant shall make such changes as are necessary to make such notice factually correct and shall thereafter return such notice to Landlord within said ten (10) business day period. If Tenant fails to execute and return (or reasonably object in writing to) such notice within ten (10) business days after receiving it, Tenant shall be deemed to have executed and returned it without exception. This Lease shall be a binding contractual obligation effective upon execution and delivery hereof by Landlord and Tenant, notwithstanding the later commencement of the Lease Term.

ARTICLE 3

RENT

3.1 In General. Tenant shall pay to Landlord or Landlord’s agent, without prior notice or demand or any setoff or deduction, except as expressly provided in this Lease, at the place Landlord may from time to time designate in writing, by a check for currency which, at the time of payment, is legal tender for private or public debts in the United States of America, all Base Rent and Additional Rent (defined below) (collectively, “Rent”). As used herein, “Additional Rent” means all amounts, other than Base Rent, that Tenant is required to pay Landlord hereunder. Monthly payments of Base Rent and monthly payments of “Direct Expenses” (defined in Section 4.1 below) shall be paid in advance on or before the first day of each calendar month during the Lease Term; provided, however, that the installment of Base Rent for the first full calendar month for which Base Rent is payable hereunder and the installment of Direct Expenses for the first full calendar month for which such Additional Rent is payable hereunder shall be paid upon Tenant’s execution and delivery hereof. Except as otherwise provided herein, all other items of Additional Rent shall be paid within 30 days after Landlord’s written request for payment. Rent for any partial calendar month shall be prorated based on the actual number of days in the month.

3.2 Abated Base Rent. Provided that Tenant is not then in Default (defined in Section 19.1 below) under the Lease, then during the first ten (10) consecutive full calendar months of the Lease Term (the “Rent Abatement Period”), Tenant shall not be obligated to pay any Base Rent otherwise attributable to the Premises during such Rent Abatement Period (the “Rent Abatement”). Landlord and Tenant acknowledge that the aggregate amount of the Rent Abatement equals Two Million Five Hundred Sixty-Three Thousand Five Hundred Eighty-Four and 00/100 Dollars ($2,563,584.00). Tenant acknowledges and agrees that the foregoing Rent Abatement has been granted to Tenant as additional

-8-

consideration for entering into this Lease, and for agreeing to pay the rent and performing the terms and conditions otherwise required under this Lease. If Tenant shall be in default under this Lease, and shall fail to cure such default within the notice and cure period, if any, permitted for cure pursuant to this Lease, then Landlord may at its option, by notice to Tenant, elect, in addition to any other remedies Landlord may have under this Lease, that the dollar amount of the unapplied portion of the Rent Abatement as of such default shall be converted to a credit to be applied to the Base Rent applicable at the end of the Lease Term and Tenant shall immediately be obligated to begin paying Base Rent for the Premises in full. If the unapplied portion of the Rent Abatement is converted to a credit to be applied to the Base Rent applicable at the end of the Lease Term, then, without limiting the binding nature of any other provision of this Lease, the terms of this Section 3.2 shall be binding on any successor-in-interest to Landlord in this Lease.

ARTICLE 4

EXPENSES AND TAXES

4.1 General Terms. In addition to paying the Base Rent, Tenant shall pay, in accordance with Section 4.4 below, for each Expense Year (defined in Section 4.2.1 below), an amount equal to the sum of the following (collectively, the “Direct Expenses”): (a) Tenant’s Share of Expenses for such Expense Year, plus (b) Tenant’s Share of Taxes for such Expense Year, plus (c) a management fee (the “Management Fee”) equal to three percent (3%) of the Base Rent payable by Tenant for the applicable Expense Year (without regard to any free rent, rent abatement, or the like). The obligations of Tenant to pay the Additional Rent provided for in this Article 4 shall survive the expiration or earlier termination of this Lease. If this Lease commences on a day other than the first day of an Expense Year or expires or terminates on a day other than the last day of an Expense Year, Tenant’s payment of Direct Expenses for the Expense Year in which such commencement, expiration or termination occurs shall be prorated based on the ratio between (x) the number of days in such Expense Year that fall within the Lease Term, and (y) the number of days in such Expense Year. Accordingly, no Direct Expenses shall be payable prior to the Lease Commencement Date.

4.2 Definitions of Key Terms Relating to Additional Rent. As used in this Lease, the following terms shall have the meanings hereinafter set forth:

4.2.1 “Expense Year” shall mean each calendar year in which any portion of the Lease Term falls, the parties acknowledging that Tenant’s payment of Direct Expenses shall begin on the Lease Commencement Date, notwithstanding the later commencement of the payment of Base Rent hereunder.

4.2.2 “Expenses” shall mean all expenses, costs and amounts that Landlord pays or accrues during any Expense Year because of or in connection with the ownership, management, maintenance, security, repair, replacement, restoration or operation of the Property. Landlord shall act in a reasonable manner in incurring Expenses. Without limiting the foregoing, Expenses shall include: (i) the cost of supplying all utilities, the cost of operating, repairing, maintaining and renovating the utility, telephone, mechanical, sanitary, storm-drainage, and elevator systems, and the cost of maintenance and service contracts in connection therewith; (ii) the cost of licenses, certificates, permits and inspections, the cost of contesting any Laws that may affect Expenses, and the costs of complying with any governmentally-mandated transportation-management or similar program; (iii) the cost of all insurance premiums and deductibles (provided, however, that the premiums for earthquake insurance shall not materially exceed those paid by institutional owners of the Comparable Buildings and the earthquake insurance deductibles shall not exceed 5.0% of the total insurable value of the Project per occurrence and shall not exceed $1.50 per rentable square foot of the Building in any Expense Year (the “Annual EQ Deductible Cap”), with any excess amount amortized, with interest at a reasonable rate,

-9-

over a period of time necessary to fully amortize such amount without exceeding the Annual EQ Deductible Cap, and any other insurance deductibles shall not exceed $100,000.00 per occurrence or $200,000.00 in the aggregate per Expense Year); (iv) the cost of landscaping and re-lamping; (v) the cost of parking-area operation, repair, restoration, and maintenance; (vi) fees and other costs, including management and/or incentive fees, consulting fees, legal fees and accounting fees, of all contractors and consultants in connection with the management, operation, maintenance and repair of the Property; (vii) payments under any equipment-rental agreements; (viii) wages, salaries and other compensation, expenses and benefits, including taxes levied thereon, of all persons engaged in the operation, maintenance and security of the Property, and costs of training, uniforms, and employee enrichment for such persons; (ix) the costs of operation, repair, maintenance and replacement of all systems and equipment (and components thereof) of the Property; (x) the cost of janitorial, alarm, security and other services, replacement of wall and floor coverings, ceiling tiles and fixtures in common areas, maintenance and replacement of curbs and walkways, repair to roofs and re-roofing; (xi) rental or acquisition costs of supplies, tools, equipment, materials and personal property used in the maintenance, operation and repair of the Property; (xii) the cost of capital improvements or any other items that are (A) intended to effect economies in the operation or maintenance of the Property, reduce current or future Expenses, enhance the safety or security of the Property or its occupants, or enhance the environmental sustainability of the Property’s operations (it being understood, however, that the amortized amount of such capital improvements to effect economies of operation or enhanced sustainability shall not exceed the reasonably estimated cost savings to be achieved thereby), (B) repairs, replacements or modifications of the nonstructural portions of the Base Building (as defined in Section 7.2 below) or the Common Areas, or (C) required under any Law, except for capital improvements to remedy a condition existing prior to the Lease Commencement Date which an applicable governmental authority, if it had knowledge of such condition prior to the Lease Commencement Date, would have then required to be remedied pursuant to then-current governmental laws or regulations in their form existing as of the Lease Commencement Date and pursuant to the then-current interpretation of such governmental laws or regulations by the applicable governmental authority as of the Lease Commencement Date; (xiii) except for costs and expenses which are the sole responsibility of Tenant pursuant to Section 7.2 below, all costs paid or incurred by Landlord to perform Landlord’s Repair Obligations (as defined in pursuant to Section 7.2.1 below); and (xiv) payments under any reciprocal easement agreement, transportation management agreement, cost-sharing agreement or other covenant, condition, restriction or similar instrument affecting the Property, whether now or hereafter in effect (collectively, the “Underlying Documents”); provided, however, Landlord shall not, after the date of this Lease, without Tenant’s prior written approval, which approval shall not be unreasonably withheld, enter into any new Underlying Documents, or consent to any revisions of any existing Underlying Documents, that would impose any new payments to be included in Expenses or otherwise conflict with or impair Tenant’s express rights under this Lease.

Notwithstanding the foregoing, Expenses shall not include the following:

(a) costs incurred in connection with the original construction of the Project or in connection with any major change in the Project, such as adding or deleting floors, and costs for the repair or replacement of any structural portion of the Building made necessary as a result of defects in the original design, workmanship or materials (but Expenses may include reasonable recurring costs for enhanced maintenance necessary due to such defect(s) where prudent property management practices call for such maintenance rather than repair or replacement of the affected elements of the Project);

(b) costs of the design and construction of tenant improvements to the Premises or the premises of other tenants or other occupants and the amount of any allowances or credits paid to or granted to tenants or other occupants for any such design or construction or any costs to supervise such tenant improvements or any costs of correcting any defects or deficiencies in such tenant improvements;

-10-

(c) except as set forth in items (xii), above, depreciation, interest and principal payments on mortgages and other debt costs, if any;

(d) marketing costs, legal fees, space planners’ and architects’ fees, advertising and promotional expenses, and brokerage fees incurred in connection with the original development, subsequent improvement, or original or future leasing of the Project;

(e) costs for which the Landlord is reimbursed, or would have been reimbursed if Landlord had carried the insurance Landlord is required to carry pursuant to this Lease or would have been reimbursed if Landlord had used commercially reasonable efforts to collect such amounts, from any tenant or occupant of the Project or by insurance from its carrier or any tenant’s carrier;

(f) any bad debt loss, rent loss, or reserves for bad debts or rent loss or any reserves of any kind;

(g) costs associated with the operation of the business of the partnership or entity which constitutes the Landlord, as the same are distinguished from the costs of operation of the Project, including partnership accounting and legal matters, costs of defending any lawsuits with any mortgagee (except as the actions of the Tenant may be in issue), costs of selling, syndicating, financing, mortgaging or hypothecating any of the Landlord’s interest in the Project, and costs incurred in connection with any disputes between Landlord and its employees, between Landlord and Project management, or between Landlord and other tenants or occupants;

(h) the wages and benefits of any employee who does not devote substantially all of his or her employed time to the Project unless such wages and benefits are prorated to reflect time spent on operating and managing the Project vis-à-vis time spent on matters unrelated to operating and managing the Project;

(i) except as set forth in item (l), below, items (xii) and (xiii), above, late charges, penalties, liquidated damages, interest and other finance charges;

(j) amount paid as ground rental or as rental for the Project by the Landlord;

(k) costs, including permit, license and inspection costs, incurred with respect to the installation of tenant improvements made for new tenants or other occupants in the Project or incurred in renovating or otherwise improving, decorating, painting or redecorating vacant space for tenants or other occupants of the Project (excluding, however, such costs relating to any Common Areas of the Project or parking facilities);

(l) costs of capital repairs and alterations, capital improvements and capital equipment, except as set forth in items (xii), above and provided that any permitted capital expenditure shall be amortized, with reasonable interest, over the reasonable useful life of the relevant improvement or equipment;

(m) costs of repair or replacement of any items covered by Landlord’s Six Month Warranty set forth in Section 1.1.3 above;

(n) any amount paid by Landlord or to the parent organization or a subsidiary or affiliate of the Landlord for supplies and/or services in the Project to the extent the same exceeds the costs of such supplies and/or services rendered by qualified, first-class unaffiliated third parties on a competitive basis;

-11-

(o) rentals and other related expenses incurred in leasing air conditioning systems, elevators or other equipment which if purchased the cost of which would be excluded from Expenses as a capital cost, except equipment not affixed to the Project which is used in providing janitorial or similar services and, further excepting from this exclusion such equipment rented or leased to remedy or ameliorate an emergency condition in the Project;

(p) all items and services for which Tenant or any other tenant in the Project reimburses Landlord, provided that Landlord shall use commercially reasonable efforts to collect such reimbursable amounts, or which Landlord provides selectively to one or more tenants (other than Tenant) without reimbursement;

(q) electric power costs and janitorial costs for tenant spaces in the Project (but the foregoing shall not limit the electric power and janitorial component of Expenses applicable to the Common Areas), but only if Tenant is contracting and directly for such utilities with respect to the Premises;

(r) costs, other than those incurred in ordinary maintenance and repair, for sculpture, paintings, fountains or other objects of art;

(s) tax penalties as a result of Landlord’s refusal or inability to pay taxes;

(t) any costs expressly excluded from Expenses elsewhere in this Lease;

(u) rent for any office space occupied by Project management personnel to the extent the size or rental rate of such office space exceeds the size or fair market rental value of office space occupied by management personnel of the buildings comparable to and in the vicinity of the Building, with adjustment where appropriate for the size of the applicable project;

(v) Landlord’s general corporate overhead and general and administrative expenses;

(w) fines and penalties arising from the gross negligence or willful misconduct of Landlord, its agents, employees or contractors;

(x) costs incurred to comply with Applicable Law with respect to hazardous materials, as defined by applicable law (“Hazardous Material”), which was in existence in the Building or on the Project prior to the date of this Lease, and was of such a nature that a federal, state or municipal governmental or quasi-governmental authority, if it had then had knowledge of the presence of such Hazardous Material, in the state, and under the conditions that it then existed in the Building or on the Project, would have then required the removal, remediation or other action with respect to such Hazardous Material; and costs incurred with respect to Hazardous Material, which Hazardous Material is brought into the Building or onto the Project after the date hereof by Landlord or any other tenant of the Project or by anyone other than Tenant or Tenant Parties and is of such a nature, at that time, that a federal, state or municipal governmental or quasi-governmental authority, if it had then had knowledge of the presence of such Hazardous Material, in the state, and under the conditions, that it then exists in the Building or on the Project, would have then required the removal, remediation or other action with respect to such Hazardous Material;

-12-

(y) legal fees and costs, settlements, judgments or awards paid or incurred because of disputes between Landlord and Tenant, Landlord and other tenants or prospective occupants or prospective tenants/occupants or providers of goods and services to the Project;

(z) legal fees and costs concerning the negotiation and preparation of this Lease or any other Project lease or any litigation between Landlord and Tenant or between Landlord and any other tenant of the Project;

(aa) any finders fees, brokerage commissions, job placement costs or job advertising cost;

(bb) costs for extra or after-hours HVAC, utilities or services which are provided to Tenant and or any occupant of the Building and as to which either (x) Tenant is separately charged, or (y) the same is not offered or made available to Tenant at no charge; and

(cc) any amounts Landlord would be entitled to recover directly from other tenants or occupants of the Project if their leases or occupancy agreements contained provisions comparable to those in this Lease which allow Landlord to recover directly from Tenant (and not as an item of Expenses) costs of providing excess or after hours utilities, taxes on personal property, trade fixtures and improvements in excess of “building standard”, increased insurance premiums caused by usage and other similar expenditures.

Notwithstanding any contrary provision hereof, during the initial Term, “Controllable Expenses” (defined below) shall not increase after the first year of the Term by more than five percent (5%) per calendar year, as determined on a compounding and cumulative basis. By way of example and not of limitation, if Controllable Expenses for calendar year 2010 are $10.00 per rentable square foot, then Controllable Expenses for calendar year 2011 shall not exceed $10.50 per rentable square foot; Controllable Expenses for calendar year 2012 shall not exceed $11.03 per rentable square foot; and so on. As used herein, “Controllable Expenses” means all Expenses other than (i) costs of utilities, (ii) insurance premiums and deductibles, (iii) capital expenditures, (iv) any market-wide cost increases resulting from extraordinary circumstances, including Force Majeure, boycotts, strikes, conservation surcharges, embargoes or shortages, and (v) the cost of any repair or replacement that Landlord reasonably expects will not recur on an annual or more frequent basis. For purposes of determining Controllable Expenses, any management fee shall be calculated without regard to any free rent, abated rent, or the like. In the event that Landlord commences to provide maintenance services to the Building following a period in which Tenant was providing such services pursuant to the terms of this Lease, the cap on Controllable Expenses shall only apply to the costs incurred by Landlord in connection with such services after the first twelve (12) months of Landlord’s provision of such services.

4.2.3 “Taxes” shall mean all federal, state, county or local governmental or municipal taxes, fees, charges, assessments, levies, licenses or other impositions, whether general, special, ordinary or extraordinary, that are paid or accrued during any Expense Year (without regard to any different fiscal year used by such governmental or municipal authority) because of or in connection with the ownership, leasing or operation of the Property. Taxes shall include (a) real estate taxes; (b) general and special assessments; (c) transit taxes; (d) leasehold taxes; (e) personal property taxes imposed upon the fixtures, machinery, equipment, apparatus, systems, appurtenances, furniture and other personal property used in connection with the Property; (f) any tax on the rent, right to rent or other income from any portion of the Property or as against the business of leasing any portion of the Property; (g) any assessment, tax, fee, levy or charge imposed by any governmental agency, or by any non-governmental entity pursuant to any private cost-sharing agreement, in order to fund the provision or enhancement of any fire-protection, street-, sidewalk- or road-maintenance, refuse-removal or other service that is (or, before the enactment of

-13-

Proposition 13, was) normally provided by governmental agencies to property owners or occupants without charge (other than through real property taxes); and (h) any assessment, tax, fee, levy or charge allocable or measured by the area of the Premises or by the Rent payable hereunder, including any business, gross income, gross receipts, sales or excise tax with respect to the receipt of such Rent. Any costs and expenses (including reasonable attorneys’ and consultants’ fees) reasonably incurred in attempting to protest, reduce or minimize Taxes (a “Tax Appeal”) shall be included in Taxes for the year in which they are incurred. Notwithstanding anything herein to the contrary, Taxes shall be determined without regard to any “green building” credit (unless the cost to obtain such credit was included in Expenses, either directly or on an amortized basis) and shall exclude (i) all excess profits taxes, franchise taxes, gift taxes, capital stock taxes, inheritance and succession taxes, estate taxes, federal and state income taxes, and other taxes to the extent applicable to Landlord’s general or net income (as opposed to rents, receipts or income attributable to operations at the Property), (ii) any Expenses, and (iii) any items required to be paid by Tenant under Section 4.5 below. If Landlord does not initiate within thirty (30) days after written request by Tenant and thereafter diligently pursue a Tax Appeal, Tenant shall have the right to do so and if Tenant’s Tax Appeal results in a refund or reduction of such Taxes, then within thirty (30) days after Landlord’s receipt of the refund, Landlord shall refund to Tenant all costs and expenses incurred by Tenant (to the extent the refund exceeds such costs and expenses) and Tenant’s proportionate share of the remaining amount of such abatement or refund as a credit to be applied by Landlord against Rent next becoming due.

4.3 Allocation. The parties acknowledge that the Project now includes only the Building and the 1650 TD Building and related Common Areas. However, these Common Areas also serve the building commonly known and addressed as 1600 Technology Drive, San Jose, California (the “1600 TD Building”) which, as of the date of this Lease, is owned by an affiliate of Landlord. For purposes of allocating Common Area Expenses during the Lease Term, those Common Area Expenses not reasonably attributable exclusively to the Project, the 1600 TD Building or any future building in the Project shall be allocated between or among these buildings on a rentable area basis, except where otherwise dictated by prudent commercial property management practices or to achieve an equitable and customary allocation of Common Area Expenses. Accordingly, as set forth in Section 4.2 above, Direct Expenses (which consists of Expenses and Taxes) are determined annually for the Project as a whole(including, as appropriate, the 1600 TD Building), and a portion of the Direct Expenses, which portion shall be determined by Landlord on a reasonable and equitable basis and allocated to the tenants of the Building (as opposed to the tenants of any other buildings in the Project and, as appropriate, the 1600 TD Building) and such portion shall be the Direct Expenses for purposes of this Lease. Such portion of Direct Expenses allocated to the tenants of the Building shall include all Expenses attributable solely to the Building and a reasonable and equitable portion of the Direct Expenses attributable to the Project (including, as appropriate, the 1600 TD Building) as a whole (and not to a particular building of the Project other than the Building). In addition, Landlord, in its reasonable discretion, may equitably allocate Expenses among office, retail or other portions or occupants of the Property. If Landlord incurs Expenses or Taxes for the Property together with another property, Landlord, in its reasonable discretion, shall equitably allocate such shared amounts between the Property and such other property. In allocating Expenses and Taxes among the Building, the 1600 TD Building and the 1650 TD Building, Landlord must in any event conform to prudent commercial property management practices as observed by owners of Comparable Buildings.

4.4 Calculation and Payment of Expenses and Taxes.

4.4.1 Statement of Actual Expenses and Taxes and Payment by Tenant. Landlord shall endeavor to give to Tenant after the end of each Expense Year a statement (the “Statement”) setting forth the actual amount of Direct Expenses for such Expense Year, including Tenant’s Share of Expenses and Taxes for such Expense Year. If the amount paid by Tenant for such Expense Year pursuant to

-14-

Section 4.4.2 below is less or more than the actual sum of Tenant’s Direct Expenses for such Expense Year (as such amounts are set forth in such Statement), Tenant shall pay Landlord the amount of such underpayment, or receive a credit in the amount of such overpayment, with or against the Rent next due hereunder; provided, however, that if this Lease has expired or terminated and Tenant has vacated the Premises, Tenant shall pay Landlord the amount of such underpayment, or Landlord shall pay Tenant the amount of such overpayment (less any Rent due), within 30 days after delivery of such Statement. Any failure of Landlord to timely furnish the Statement for any Expense Year shall not preclude Landlord or Tenant from enforcing its rights under this Article 4. Tenant shall not be responsible for Tenant’s Share of any Expenses which are first billed to Tenant more than two (2) calendar years after the end of the Expense Year to which such Expenses relate, except and only to the extent such Expenses are not reasonably discoverable or quantifiable (including, without limitation, if Landlord did not receive a bill for such Expense) by Landlord on or before the date that occurs six (6) months before such 2-year deadline.

4.4.2 Statement of Estimated Expenses and Taxes. Landlord shall endeavor to give to Tenant, for each Expense Year, a statement (the “Estimate Statement”) setting forth Landlord’s reasonable estimates of the Direct Expenses (the “Estimated Direct Expenses”) for such Expense Year, including Tenant’s Share of Expenses and Taxes for such Expense Year. Upon receiving an Estimate Statement, Tenant shall pay, within thirty (30) days, an amount equal to the excess of (a) the amount obtained by multiplying (i) the sum of the Estimated Direct Expenses (as such amount is set forth in such Estimate Statement), by (ii) a fraction, the numerator of which is the number of months that have elapsed in the applicable Expense Year (including the month of such payment) and the denominator of which is 12, over (b) any amount previously paid by Tenant for such Expense Year pursuant to this Section 4.4.2. Until a new Estimate Statement is furnished (which Landlord shall have the right to deliver to Tenant at any time), Tenant shall pay monthly, with the monthly Base Rent installments, an amount equal to one-twelfth (1/12) of the sum of the Estimated Direct Expenses, as such amount is set forth in the previous Estimate Statement delivered by Landlord to Tenant. Any failure of Landlord to timely furnish any Estimate Statement shall not preclude Landlord from enforcing its rights to receive payments and revise any previous Estimate Statement under this Article 4.

4.4.3 Retroactive Adjustment of Taxes. Subject to the time limitation under Section 4.4.1 above, if, after Landlord’s delivery of any Statement, an increase or decrease in Taxes occurs for the applicable Expense Year (whether by reason of reassessment, error, or otherwise), Taxes for such Expense Year shall be retroactively adjusted. If, as a result of such adjustment, it is determined that Tenant has under- or overpaid Tenant’s Share of such Taxes, Tenant shall pay Landlord the amount of such underpayment, or receive a credit in the amount of such overpayment, with or against the Rent then or next due hereunder; provided, however, that if this Lease has expired or terminated and Tenant has vacated the Premises, Tenant shall pay Landlord the amount of such underpayment, or Landlord shall pay Tenant the amount of such overpayment (less any Rent due), within 30 days after such adjustment is made.

4.5 Taxes and Other Charges for Which Tenant Is Directly Responsible.

4.5.1 Tenant shall pay, 10 days before delinquency, any taxes levied against Tenant’s equipment, furniture, fixtures and other personal property located in or about the Premises. If any such taxes are levied against Landlord or its property (or if the assessed value of Landlord’s property is increased by the inclusion therein of a value placed upon such equipment, furniture, fixtures or other personal property of Tenant), and if Landlord pays such taxes (or such increased assessment), which Landlord shall have the right to do regardless of the validity thereof, Tenant shall, upon demand, repay to Landlord the amount so paid.

-15-

4.5.2 If the leasehold improvements in the Premises, whether installed and/or paid for by Landlord, Tenant or any prior tenant, are assessed for real property tax purposes at a valuation higher than the valuation at which tenant improvements conforming to Landlord’s “building standard” in other space in the Building are assessed, then the Taxes levied against Landlord or the Property by reason of such excess assessed valuation shall be deemed to be taxes levied against personal property of Tenant for purposes of Section 4.5.1 above; provided, however, Landlord hereby acknowledges that the office improvements existing in the Premises as of the date of this Lease, other than those existing in any laboratory space, are “building standard.”

4.5.3 Notwithstanding any contrary provision herein, Tenant shall pay, before delinquency, (i) any rent tax, sales tax, service tax, transfer tax applicable to only this Lease (as opposed to a transfer tax due to a sale of the Building) or value added tax, or any other tax respecting the rent or services described herein or otherwise respecting this Lease; (ii) taxes assessed upon the possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of any portion of the Property; and (iii) taxes assessed upon this transaction or any document to which Tenant is a party creating or transferring an interest in the Premises.

4.6 Landlord’s Books and Records. Within one hundred eighty (180) days after receipt of a Statement by Tenant, if Tenant disputes the amount of Expenses and Taxes set forth in the Statement, an independent certified public accountant (which accountant is a member of a nationally or regionally recognized accounting firm and is not working on a contingency fee basis), or a qualified employee of Tenant, may, after reasonable notice to Landlord and at reasonable times, inspect Landlord’s records with respect to the Statement at Landlord’s offices, provided that Tenant is not then in default under this Lease after expiration of any applicable notice and cure periods, and Tenant has paid all amounts required to be paid under the applicable Estimate Statement and Statement, as the case may be (but Tenant shall be deemed to have paid the same “under protest”). In connection with such inspection, Tenant and Tenant’s agents must agree in advance to follow Landlord’s reasonable rules and procedures regarding inspections of Landlord’s records, and shall execute a commercially reasonable confidentiality agreement regarding such inspection. Tenant’s failure to dispute the amount of Expenses and Taxes set forth in any Statement within one hundred eighty (180) days of Tenant’s receipt of such Statement shall be deemed to be Tenant’s approval of such Statement and Tenant, thereafter, waives the right or ability to dispute the amounts set forth in such Statement; provided, however, if Landlord revises a Statement after delivering the same to Tenant, then Tenant shall continue to have the right to dispute such revisions for a period of one hundred eighty (180) days after Landlord delivers such revised Statement to Tenant. If after such inspection, Tenant still disputes such Expenses and Taxes, Landlord and Tenant shall meet in order to resolve the dispute. If Landlord and Tenant are unable to resolve the dispute, a determination as to the proper amount shall be made, at Tenant’s expense, by an independant certified public accountant experienced in lease audits who has not represented Landlord or Tenant in the past five (5) years (a “Qualified Accountant”) selected by mutual agreement of Landlord and Tenant and if the parties are unable to agree upon a Qualified Accountant, then such Qualified Accountant shall be selected by an arbitrator appointed upon application by either party to the JAMS or the American Arbitration Association (or any recognized successor to JAMS or AAA), in the City of San Jose, California, made with not less than ten (10) days prior written notice to the other. The arbitrator shall retain and instruct the Qualified Accountant to prepare a written audit report of the Expenses and Taxes covered by the Statement within ninety (90) days after the Qualified Accountant’s appointment. Upon completion of such audit report, the arbitrator shall schedule a hearing on the audit report, during which hearing the time limits set forth in Sections 1.4.3.11 through 1.4.3.13 of Exhibit F shall apply unless the arbitrator finds good cause to modify such time limits. The arbitrator shall have authority to accept the Qualified Accountant’s report in whole or in part and the decision of the arbitrator shall be final and binding on Landlord and Tenant. Notwithstanding anything contained herein to the contrary, if the determination by the Qualified Accountant, as affirmed by the arbitrator (if applicable), reveals that Expenses and Taxes

-16-

were overstated by more than five percent (5%), then the cost of the Qualified Accountant and the cost of such determination shall be paid for by Landlord. If such determination by the Qualified Accountant, as affirmed by the arbitrator (if applicable), reveals that Landlord has overcharged or undercharged Tenant, then within thirty (30) days after the results of such audit, Landlord shall reimburse Tenant the amount of the overcharge or Tenant shall pay the amount of the undercharge, as applicable. Tenant hereby acknowledges that Tenant’s sole right to inspect Landlord’s books and records and to contest the amount of Expenses and Taxes payable by Tenant shall be as set forth in this Section 4.6, and Tenant hereby waives any and all other rights pursuant to applicable Law to inspect such books and records and/or to contest the amount of Expenses and Taxes payable by Tenant.

ARTICLE 5

USE OF PREMISES

Tenant shall not (a) use the Premises for any improper or objectionable purpose, for any purpose not permitted under Article 25 below, or for any purpose other than the Permitted Use; or (b) do anything in or about the Premises that (i) violates any of the Rules and Regulations or any provision of the Underlying Documents, (ii) damages the reputation of the Project or interferes with, injures or annoys other occupants of the Project, or (iii) constitutes a nuisance; provided, however, Landlord hereby agrees not to modify the Rules and Regulation or the Underlying Documents after the date of this Lease in such a manner as to materially and unreasonably impair Tenant’s express rights set forth in this Lease. Without limiting the foregoing, no portion of the Premises shall be used for any of the following uses: any pornographic or obscene purposes, any commercial sex establishment, any pornographic, obscene, nude or semi-nude performances, modeling, materials, activities, or sexual conduct or any other use that, as of the time of the execution hereof, has or could reasonably be expected to have a material adverse effect on the Property or its use, operation or value; provided, however, Landlord hereby agrees to hereafter include reasonably comparable restrictions in the leases of any other new tenant in the Project. Tenant and Tenant Parties shall have the non-exclusive right to use and enjoy the Common Areas of the Project throughout the Lease Term. Subject to the foregoing limitation on future modifications to the Underlying Documents, Tenant’s rights and obligations under this Lease and Tenant’s use of the Premises and the Common Areas shall be subject and subordinate to the Underlying Documents. The limitation on the total area of the Premises devoted to laboratory use pursuant to Section 6 of the Summary shall not apply if Tenant undertakes to remove all laboratory-related Tenant Improvements or Alterations in excess of such limitation upon the Lease Expiration Date or the earlier termination of this Lease; provided, however notwithstanding the foregoing, any such laboratory-related Tenant Improvements or Alterations shall continue to be subject to the terms of Article 8 of this Lease and/or the Tenant Work Letter, as the case may be.

ARTICLE 6

SERVICES

6.1 Landlord Provided Services. Landlord shall provide the following services on all days (unless otherwise stated below): (a) subject to limitations imposed by Law, customary heating, ventilation and air conditioning (“HVAC”); (b) electricity supplied by the applicable public utility, stubbed to the Premises; (c) water supplied by the applicable public utility (i) for use in lavatories and any drinking facilities located in Common Areas within the Building, and (ii) stubbed to the Building core for use in any plumbing fixtures located in the Premises; (d) janitorial services to the Premises, except on weekends and Holidays; and (e) elevator service (subject to scheduling by Landlord, and payment of Landlord’s standard usage fee, for any freight service). “Holidays” the day of observation of New Year’s Day, Presidents Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, Christmas Day,

-17-

and, at Landlord’s discretion, any other locally or nationally recognized holiday that is observed by the Comparable Buildings. Tenant and Tenant Parties shall have the non-exclusive right to use and enjoy the Common Areas of the Project throughout the Lease Term. Except where the provisions of Exhibit I are applicable, Tenant shall pay 100% of all utilities and services applicable to the Building.

6.2 Tenant Provided Services. Notwithstanding anything set forth in Section 6.1 to the contrary, for so long as Tenant is the sole occupant of the Building, Tenant shall have the right, upon not less than thirty (30) days’ prior written notice to Landlord, to contract for and directly pay, as the same become due, all charges for water, gas, electricity, telephone, sewer service, waste pick-up and any other utilities, materials and services furnished directly to or used by Tenant on or about the Premises during the Term (collectively, “Utilities”), including, without limitation, (a) meter, use and/or connection fees, hook-up fees, or standby fees, and (b) penalties for discontinued or interrupted service. If Tenant elects to provide janitorial services to the Premises, then Tenant shall provide such janitorial service in a manner consistent with the janitorial services provided by the landlords of the “Comparable Buildings,” as that term is defined in Section 4 of Exhibit G, attached hereto, and any persons employed by Tenant to do janitorial work shall be subject to Landlord’s prior written approval (not to be unreasonably withheld), and Tenant shall be responsible for all acts of such persons. The cost of any Tenant -provided Utility or janitorial service shall not be included in Expenses.

6.3 Above-Standard Use. If Tenant utilizes the Base Building HVAC system for more than two hundred forty (240) hours in any month, all use within such month in excess of two hundred forty (240) hours shall be “Excess HVAC Use”. Tenant will pay the cost of such Excess HVAC Use as Additional Rent, not more than thirty (30) days after receipt of an invoice therefor, at such hourly cost as Landlord has reasonably established for the Building (or, as applicable, the various HVAC zones of the Building); provided, however, if Tenant is contracting for and directly paying the applicable Utility provided for electrical service to the Building, then Landlord’s cost for such Excess HVAC Use shall only include the reasonable depreciation of the applicable “Building Systems,” as that term is defined in Section 7.1.1, below (attributable to such Excess HVAC Use), and actual administrative charges (to the extent not duplicative of Operating Expenses), incurred by Landlord, as reasonably determined by Landlord but without charge for profit, provided that, notwithstanding the foregoing, any amount actually charged by any third party to Landlord (i.e., unaffiliated with Landlord) for the supply of HVAC to Tenant shall be deemed part of the cost to provide such Excess HVAC Use. In addition, Tenant shall abide by any process, including any notice requirements, reasonably established by Landlord in connection with providing such Excess HVAC Use to Tenant. At no time shall use of electricity in the Premises exceed the capacity of existing feeders and risers to or wiring in the Premises.

6.4 Service Interruptions. Any interruption or cessation of Utilities resulting from any causes, including any entry for repairs pursuant to this Lease, and any renovation, redecoration or rehabilitation of any area of the Project (each, a “Service Interruption”), shall not render Landlord liable for damages to either person or property or for interruption or loss to Tenant’s business, nor be construed as an eviction of Tenant, nor work an abatement of any portion of Rent, nor relieve Tenant from fulfillment of any covenant or agreement hereof; provided, however, that if the Premises, or a material portion thereof, is made untenantable or inaccessible for more than five (5) consecutive business days after written notice from Tenant to Landlord as a result of any Service Interruption that Landlord can correct through reasonable efforts, then Tenant, as its sole remedy, shall be entitled to receive an abatement of Monthly Rent (defined below) payable hereunder for the period beginning on the sixth (6th) consecutive business day of such Service Interruption and ending on the day the service is restored. If a Service Interruption renders less than the entire Premises untenantable or inaccessible, the amount of Monthly Rent abated shall be prorated in proportion to the percentage of the rentable square footage of the Premises that is rendered untenantable or inaccessible. As used herein, “Monthly Rent” means Base Rent and Tenant’s monthly installment of Direct Expenses.

-18-

ARTICLE 7

REPAIRS

7.1 Tenant’s Obligations.

7.1.1 Tenant shall, at its expense, but under the supervision and subject to the prior written approval of Landlord (or without such approval in case of an Emergency, as defined in Section 7.3 below), and within any reasonable period of time specified by Landlord, perform all maintenance and repairs (including replacement) to the Premises that are not Landlord’s express responsibility hereunder (and which are not covered by Landlord’s Six Month Warranty), and keep the Premises in good condition and repair, reasonable wear and tear and damage due to casualty or condemnation excepted (collectively, “Tenant’s Repair Obligations”). As a condition to approving any repair by Tenant, Landlord may, without limitation, require that Tenant comply with the requirements of Sections 8.2, 8.3 and 8.4 below as if such repair were an Alteration (defined in Section 8.1 below). Tenant’s Repair Obligations shall include: (a) floor coverings; (b) interior partitions; (c) interior doors; (d) the interior side of demising walls; (e) Alterations; and (f) the heating, ventilating and air conditioning systems and equipment, the plumbing, sewer, drainage, electrical, fire protection, life safety and security systems and equipment and other mechanical, electrical and communications systems and equipment, that exclusively serve the Premises (the foregoing items set forth in (f) shall be known collectively as the “Building Systems”), including, without limitation, any specialty or supplemental Building Systems installed by or for Tenant.

7.1.2 Tenant shall also be responsible for all pest control within the Premises, and for all trash removal and disposal from the Premises. With respect to any HVAC systems and equipment exclusively serving the Premises, Tenant shall obtain HVAC systems preventive maintenance contracts with bimonthly or monthly service in accordance with manufacturer recommendations, which shall be subject to the reasonable prior written approval of Landlord and paid for by Tenant, and which shall provide for and include replacement of filters, oiling and lubricating of machinery, parts replacement, adjustment of drive belts, oil changes and other preventive maintenance, including annual maintenance of duct work, interior unit drains and caulking of sheet metal, and recaulking of jacks and vents on an annual basis. Tenant shall have the benefit of all warranties available to Landlord regarding the HVAC systems and equipment.

7.1.3 If Tenant fails to perform any of Tenant’s Repair Obligations, then Landlord may, but need not, upon not less than ten (10) days prior written notice to Tenant (except in the case of an Emergency), make such repairs and replacements, in which event Tenant shall pay Landlord the reasonable cost of such work, plus a reasonable percentage of the cost thereof (not to exceed 5%) sufficient to reimburse Landlord for all overhead, general conditions, fees and other costs or expenses arising from Landlord’s involvement with such repairs and replacements, within ten (10) days after receipt of an invoice therefor.

7.2 Landlord’s Obligations.

7.2.1 Landlord shall maintain, repair and replace the following items (“Landlord’s Repair Obligations”) in a manner concistent with the landlords of the Comparable Buildings: (a) the non-structural portions of the roof of the Building, including the roof coverings (provided that Tenant installs no additional air conditioning, wireless or other equipment on the roof that damages the roof coverings, in which event Tenant shall pay all costs resulting from such damage); (b) any Building Systems serving the Premises and/or the Project, or portions thereof, for which Tenant is not responsible pursuant to Section 7.1 above (i.e., those Building Systems, if any, that do not exclusively serve the Premises) (collectively, “Base Building Systems”); and (c) the Parking Facilities, pavement, landscaping,

-19-

sprinkler systems, sidewalks, driveways, curbs, and lighting systems in the Common Areas of the Project. Landlord’s Repair Obligations also includes the routine repair and maintenance of the load bearing and exterior walls of the Building, including, without limitation, any painting, sealing, patching and waterproofing of such walls, as well as any public restrooms, elevators and exit stairwells in the Building.

7.2.2 Landlord, at its own cost and expense and not as an item of Expenses, agrees to repair and maintain the structural portions of the roof (specifically excluding the roof coverings), the foundation, the footings, the floor slab, and the load bearing walls and exterior walls of the Building (excluding any glass and any routine maintenance, including, without limitation, any painting, sealing, patching and waterproofing of such walls) (collectively, and together with the Base Building Systems, the “Base Building”).

7.2.3 Notwithstanding Section 10.5 below, if any such repair or maintenance is made necessary by the active negligence or willful misconduct of Tenant or any Tenant Party, Tenant shall pay the cost of such work, including a percentage of the cost thereof (to be uniformly established for the Project) sufficient to reimburse Landlord for all overhead, general conditions, fees and other costs or expenses arising from Landlord’s involvement with such repairs and replacements, within ten (10) days after receipt of an invoice therefor; provided, however, that, except in the event of the willful misconduct of any Tenant Party, if such work is covered by Landlord’s insurance (or the insurance required to be carried by Landlord hereunder), Tenant shall only be obligated to pay any deductible in connection therewith.

7.3 Tenant’s Right to Make Repairs. Notwithstanding any of the terms, covenants and conditions set forth in this Lease to the contrary, if Tenant provides notice (or oral notice in the event of an “Emergency,” as that term is defined, below) to Landlord of an event or circumstance which pursuant to the terms of this Lease requires the action of Landlord with respect to repair and/or maintenance required on any full floor of the Building on which Premises are leased by Tenant, and which event or circumstance materially and adversely affects the conduct of Tenant’s business from the Premises, and Landlord fails to commence corrective action within a reasonable period of time, given the circumstances, after the receipt of such Notice, but in any event not later than thirty (30) days after receipt of such Notice, then Tenant may proceed to take the required action upon delivery of an additional twenty (20) days’ Notice to Landlord specifying that Tenant is taking such required action (provided, however, that the initial thirty (30) day Notice and the subsequent twenty (20) day Notice shall not be required in the event of an Emergency) and if such action was required under the terms, covenants and conditions of this Lease to be taken by Landlord and was not commenced by Landlord within such twenty (20) day period and thereafter diligently pursued to completion, then Tenant shall be entitled to take such action on behalf of Landlord, in which case Tenant shall receive prompt reimbursement by Landlord of Tenant’s reasonable costs and expenses in taking such action, plus interest thereon at same interest rate as is applicable to late payment by Tenant under Article 26 below. In the event Tenant takes such action, Tenant shall use only those contractors used by Landlord in the Building for work unless such contractors are unwilling or unable to perform, or timely perform, such work, in which event Tenant may utilize the services of any other qualified contractor which normally and regularly performs similar work in Comparable Buildings. Promptly following completion of any work taken by Tenant pursuant to the terms, covenants and conditions of this Section 7.3, Tenant shall deliver a detailed invoice of the work completed, the materials used and the costs relating thereto. If Landlord does not deliver a detailed written objection to Tenant within thirty (30) days after receipt of an invoice from Tenant, then Tenant shall be entitled to deduct from Rent payable by Tenant under this Lease, the amount set forth in such invoice. If, however, Landlord delivers to Tenant, within thirty (30) days after receipt of Tenant’s invoice, a written objection to the payment of such invoice, setting forth with reasonable particularity Landlord’s reasons for its claim that such action did not have to be taken by Landlord pursuant to the terms, covenants, and conditions of this Lease or that the charges are excessive (in which case Landlord

-20-

shall pay the amount it contends would not have been excessive), then Tenant shall not then be entitled to such deduction from Rent, and Tenant may institute legal proceedings against Landlord to collect the amount set forth in the subject invoice; provided that under no circumstances shall Tenant be allowed to terminate this Lease based upon a such default by Landlord. If Tenant receives a final judgment against Landlord(whether by virtue of Landlord’s failure to appeal or unsuccessful appeal of such judgment), Tenant may deduct the amount of the judgment (including all fees, expenses and reasonable attorneys’ fees actually incurred by Tenant in connection with such legal proceedings, to the extent included in such judgment, such attorneys’ fees not to exceed the amount of the unpaid portion of the relevant invoice), from the Base Rent next due and owing under this Lease. For purposes of this Article 7, an “Emergency” shall mean an event threatening immediate and material danger to people located in the Building or immediate, material damage to the Building, Building Systems, Building structure, Tenant Improvements, Alterations or Tenant’s personal property valued at more than $250,000, or the immediate and material impairment of Tenant’s use of all or a substantial portion of the Premises.

7.4 Waiver. Tenant hereby waives any rights under subsection 1 of Section 1932 and Sections 1941 and 1942 of the California Civil Code or under any similar Law.

ARTICLE 8

ADDITIONS AND ALTERATIONS