Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

|

x

|

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

for the Fiscal Year Ended March 31, 2010

OR

|

o

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Commission File Number 000-26372

ADAMIS PHARMACEUTICALS CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

82-0429727

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

|

2658 Del Mar Heights Rd., #555, Del Mar, CA 19512

|

|

(Address of Principal Executive Offices) (zip code)

|

Registrant’s telephone number, including area code: (858) 401-3984

Securities registered pursuant to Section 12(b) of the Act:

|

None

|

None

|

|

|

(Title of each class)

|

(Name of each exchange on which registered)

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.0001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

YES ¨

|

NO x

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

YES o

|

NO x

|

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

YES x

|

NO o

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

YES o

|

NO x

|

The aggregate market value of the voting stock held by non-affiliates of the Registrant as of September 30, 2009 was $ 8,059,665.

At June 30, 2010, the Company had 51,447,953 shares outstanding.

Documents Incorporated by Reference: None

ADAMIS PHARMACEUTICALS CORPORATION ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED MARCH 31, 2010

|

Part I

|

||

|

Item 1.

|

BUSINESS

|

6

|

|

Item 1A.

|

RISK FACTORS

|

33

|

|

Item 1B.

|

UNRESOLVED STAFF COMMENTS

|

47

|

|

Item 2.

|

PROPERTIES

|

47

|

|

Item 3.

|

LEGAL PROCEEDINGS

|

48

|

|

Item 4.

|

(REMOVED AND RESERVED)

|

48

|

|

Part II

|

||

|

Item 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

|

49

|

|

Item 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

50

|

|

Item 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

61

|

|

Item 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

61

|

|

Item 9A(T).

|

CONTROLS AND PROCEDURES

|

61

|

|

Item 9B.

|

OTHER INFORMATION

|

62

|

|

Part III

|

||

|

Item 10.

|

DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

|

63

|

|

Item 11.

|

EXECUTIVE COMPENSATION

|

63

|

|

Item 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

63

|

|

Item 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

63

|

|

Item 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

63

|

|

Part IV

|

||

|

Item 15.

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

64

|

Information Relating to Forward-Looking Statements

This Annual Report on Form 10-K includes “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 which provides a “safe harbor” for these types of statements. These forward-looking statements are not historical facts, but are based on current expectations, estimates and projections about our industry, our beliefs and our assumptions. These forward-looking statements include statements about our strategies, objectives and our future achievement. To the extent statements in this Annual Report involve, without limitation, our expectations for growth, estimates of future revenue, our sources and uses of cash, our liquidity needs, our future products, expense, profits, cash flow balance sheet items or any other guidance on future periods, these statements are forward-looking statements. These statements are often, but not always, made through the use of word or phrases such as “believe,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” and “would.” These forward-looking statements are not guarantees of future performance and concern matters that could subsequently differ materially from those described in the forward-looking statements. Actual events or results may differ materially from those discussed in this Annual Report on Form 10-K. We undertake no obligation to release publicly the results of any revisions to these forward-looking statements or to reflect events or circumstances arising after the date of this Report. Important factors that could cause actual results to differ materially from those in these forward-looking statements are disclosed in this Annual Report on Form 10-K, including, without limitation, those discussion under “Item 1A. Risk Factors,” in “Item 1. Business” and in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as other risks identified from time to time in our filing’s with the Securities and Exchange Commission, press releases and other communications.

Unless the context otherwise requires, the terms “we,” “our,” and “the Company” refer to Adamis Pharmaceuticals Corporation, a Delaware corporation (formerly Cellegy Pharmaceuticals, Inc.), and its subsidiaries. Savvy®, Aerokid®, AeroOtic®, and Prelone® are our trademarks. We also refer to trademarks of other corporations and organizations in this document.

PART I

In the discussion below, all statements concerning market sizes, annual U.S. sales of products, U.S. prescriptions and rates of prescriptions, the incidence of diseases or conditions in the general population, and similar statistical or market information are based on data published by the following sources: IMS Health Sales Perspectives, Retail and Non-Retail Combined Report, referred to as the IMS Report; National Data Corporation’s Epinephrine Prescription and Dollar Data, referred to as the NDC Report; Commercial and Pipeline Insight: Allergic Rhinitis, published by DataMonitor, referred to as the DataMonitor Report; AAAAI — American Academy of Allergy, Asthma and Immunology Allergy Statistics for the U.S., referred to as the AAAAI Statistics; American Cancer Society, Cancer, Facts & Figures 2009, referred to as ACS Statistics; and SEER Cancer Statistics Review, 1975-2007, National Cancer Institute, referred to as the NCI Statistics.

Company Overview

Adamis Pharmaceuticals Corporation (“Adamis”) was founded in June 2006 as a Delaware corporation. Adamis has three wholly-owned subsidiaries: Cellegy Holdings, Inc.; Adamis Corporation; and Biosyn, Inc. Adamis Corporation has two wholly-owned subsidiaries: Adamis Viral Therapies, Inc. (biotechnology), or Adamis Viral; and Adamis Laboratories, Inc. (specialty pharmaceuticals), or Adamis Labs.

Adamis Labs is a specialty pharmaceutical company that Adamis acquired in April 2007. Adamis has a line of prescription products in the anti-inflammatory, allergy and respiratory field that are currently commercialized by the Company. These products generated net revenues to Adamis of approximately $290,000 and $660,000 for Adamis’ fiscal years ended March 31, 2010 and 2009, respectively. Adamis’ Epinephrine Injection USP 1:1000 (0.3mg Pre-Filled Single Dose Syringe) product, or the single dose PFS Syringe product, a pre-filled epinephrine syringe product for use in the emergency treatment of extreme acute allergic reactions, or anaphylactic shock, was launched in July 2009; however, full commercial launch has been slowed by insufficient funding. Based on Adamis’ knowledge of a previously marketed pre-filled syringe indicated for anaphylaxis, the anticipated lower price of the PFS Syringe product relative to the leading syringe products currently marketed, and the ease of use of its product, Adamis believes that the PFS Syringe product has the potential to compete successfully after full commercial introduction of the product, although there can be no assurance that this will be the case. To date, Adamis’ ability to fully execute its plan for the full commercial launch of the PFS Syringe product has been hampered because of limited funding to support the full launch.

Additional product candidates in its product pipeline include a generic inhaled nasal steroid for the treatment of seasonal and perennial allergic rhinitis, and two other respiratory products (a generic HFA albuterol inhaler and a generic HFA beclomethsone inhaler). Adamis’ goal is to commence initial commercial sales of the nasal steroid product in the third quarter of 2012 and two other respiratory products in 2013, assuming adequate funding and no unexpected delays.

Adamis recently acquired and entered into agreements to acquire exclusive license agreements covering three small molecule compounds, named CPC-100, CPC-200 and CPC-300, that Adamis believes are promising small molecule anti-inflammatory drug candidates for the potential treatment of human prostate cancer (PCa). The intellectual property covered by the agreements was licensed from the Wisconsin Alumni Research Foundation, or WARF. The company has acquired the license agreement relating to CPC-300 and will, upon completion of an equity offering of more than $2 million, acquire the agreements relating to CPC-100 and CPC-200. In 2006 and 2007, CPC-100 and CPC-200, respectively, received the National Cancer Institute's multi-year, multi-million dollar RAPID (Rapid Access to Preventative Intervention Development) Award. Each year, this award is given by the NCI Division of Cancer Prevention, under the RAPID Program, to promising new preventative/ therapeutic anti-cancer drugs. Adamis’ objective is to file an Investigational New Drug application, or IND, with the U.S. Food and

6

Drug Administration, or FDA, by the end of calendar year 2010, and to subsequently commence a Phase 1/2a prostate cancer clinical study relating to the CPC-100 product and for men who have failed-Androgen Deprivation Therapy, or ADT, assuming adequate funding and no unexpected delays.

Adamis is also focused on developing patented preventative and therapeutic vaccines. The vaccine technology is applicable for certain viral-induced diseases such as Influenza, Hepatitis B and C, known to be involved in hepatocellular carcinomas or Human Papillomavirus, known to be involved in head and neck squamous cell carcinomas, as well as prostate cancer. However, Adamis currently intends to focus initially on the development of one or more of the recently licensed prostate cancer product candidates, and as a result the timing of initiation of trials relating to viral vaccine products is subject to uncertainty and the availability of sufficient funding, and there are no assurances concerning whether such a product will be developed or launched.

Future potential disease targets might include therapeutic vaccines for Influenza, Hepatitis B and C Virus, Human Papilloma Virus, and prostate cancer.

Adamis’ general business strategy is to increase revenue through a full commercial launch of the Single Dose Epinepherine Pre-Filled Syringe and its existing and proposed allergy and respiratory products in order to generate cash flow to help support the cancer and vaccine product development efforts of Adamis Viral. Adamis believes that the potential for increased revenues of specialty pharmaceuticals will be driven by two products.

|

•

|

Commercial sales of the Single Dose-Epinephrine PFS Syringe product commenced in July 2009, although commercial launch efforts have been materially slowed by insufficient funding. The product competes in a well-established U.S. market estimated to be over $150 million in annual sales, based on industry data published in the NDC Report.

|

|

|

•

|

Adamis Labs intends to introduce an aerosolized inhaled nasal steroid that is designed to take a small share of the U.S. market for nasal steroid products, estimated by Adamis to be approximately $3 billion in annual sales, based on the NDC Report. Adamis currently believes that this product could be introduced as early as the third calendar quarter of 2012, although the actual date of introduction will depend on a number of factors and the actual launch date could be later than that date. Factors that could affect the actual launch date include the outcome of discussions with the FDA concerning the number and kind of clinical trials that the FDA will require before the FDA will consider regulatory approval of the product, any unexpected difficulties in licensing or sublicensing intellectual property rights for other components of the product such as the inhaler, any unexpected difficulties in the ability of suppliers to timely supply quantities for commercial launch of the product, any unexpected delays or difficulties in assembling and deploying an adequate sales force to market the product, and the receipt of adequate funding to support sales and marketing efforts.

|

To achieve these goals, as well as to support the overall strategy, Adamis will need to raise a substantial amount of funding and make substantial investments in equipment, new product development and working capital. Adamis estimates that approximately $1.5 million to $2 million will be required to support the continued commercial launch of the PFS Syringe product, and that approximately an additional $4 million or more must be invested in the Adamis Labs operations to support development and commercial introduction of the aerosolized nasal steroid product candidate. The capital that is expected to be provided from expected sales of these products will be important to help fund expansion of those businesses and the research and development of the cancer and vaccine technologies. If adequate funding is obtained, clinical trials proceed successfully, regulatory approvals are obtained and sales are consistent with Adamis’ current expectations, following a period of initial commercial introduction, Adamis believes that revenues generated by Adamis Viral’s cancer drug or vaccine products could exceed revenues from Adamis Labs operations.

Effective April 1, 2009, Adamis completed a business combination transaction with Cellegy Pharmaceuticals, Inc., or Cellegy. The stockholders of Cellegy and the stockholders of former Adamis Pharmaceuticals Corporation, or Old Adamis, approved a merger transaction and related matters at an annual meeting of Cellegy’s stockholders and at a special meeting of Old Adamis’ stockholders, each held on March 23, 2009. On April 1, 2009, Cellegy completed the merger transaction with Old Adamis. Before the merger, Cellegy was a public company and Old Adamis was a private company.

7

In connection with the consummation of the merger and pursuant to the terms of the definitive merger agreement relating to the transaction, Old Cellegy changed its name from Cellegy Pharmaceuticals, Inc. to Adamis Pharmaceuticals Corporation, and Old Adamis changed its corporate name to Adamis Corporation.

Pursuant to the terms of the merger agreement, Old Cellegy effected a reverse stock split of its common stock immediately before the consummation of the merger. Pursuant to this reverse stock split, each approximately 10 shares of common stock of Old Cellegy that were issued and outstanding immediately before the effective time of the merger were converted into one share of Old Cellegy common stock and any remaining fractional shares held by a stockholder (after aggregating the fractional shares) were rounded up to the nearest whole share.

As a result, the total number of shares of Old Cellegy that were outstanding immediately before the effective time of the merger were converted into approximately 3,000,000 shares of post-reverse split shares of common stock of Old Cellegy. Pursuant to the terms of the merger agreement, at the effective time of the merger each share of Old Adamis common stock that was issued and outstanding immediately before the effective time of the merger ceased to be outstanding and was converted into the right to receive one share of Adamis common stock. As a result, approximately 44,000,00 shares of Adamis common stock were issued and/or are issuable to the holders of the outstanding shares of common stock of Old Adamis before the effective time of the merger. Old Adamis, renamed Adamis Corporation, was the surviving entity as a wholly-owned subsidiary of Adamis.

Allergy and Respiratory Specialty Pharmaceutical Drug Products

On April 23, 2007, Adamis completed the acquisition of a specialty pharmaceutical drug company named Healthcare Ventures Group, Inc., or HVG. HVG had previously acquired a group of allergy and respiratory products and certain related assets from a third party company. The third party also transferred to HVG members of its sales force and management team. Adamis created the Adamis Laboratories subsidiary, which then acquired HVG in a stock-for-stock exchange. Adamis issued approximately 12.6 million new shares of Adamis common stock to the shareholders of HVG. Under the terms of the transaction agreements, approximately 6.7 million of these shares are subject to restrictions on transfer as well as repurchase by Adamis if certain performance targets based on revenue over a period of three years are not achieved by Adamis Labs and if the holders do not remain employed by Adamis during that period.

Net revenues to Adamis from sales of Adamis Labs’ allergy and respiratory products from April 23, 2007, the date on which Adamis acquired Adamis Labs, through Adamis’ fiscal year ended March 31, 2010, were approximately $1,572,000. During Adamis’ fiscal year ended March 31, 2010, two customers, McKesson and Cardinal Health, accounted for approximately 44% and 31%, respectively, of Adamis’ revenues. The products have not been heavily promoted in the past due to funding limitations and the competitive market for antihistamine/decongestant products. Adamis believes there is limited growth potential for these products, due in part to the widespread substitution of generic products at the dispensing pharmacy level for the conditions indicated for the Adamis Labs products.

Specialty Pharma Drug Product Pipeline

Adamis Labs’ product pipeline includes the Single Dose-Epinephrine PFS Syringe product and an inhaled nasal steroid product candidate. The first product, the PFS Syringe product, was commercially launched in July 2009, although full commercial launch efforts have been materially slowed by insufficient funding. The second product, an aerosolized inhaled nasal steroid product for the treatment of seasonal and perennial allergic rhinitis, is targeted for commercial availability in 2012, assuming adequate funding to support product development and launch and no unanticipated delays in obtaining regulatory approvals. Adamis Labs has an agreement with Catalent Pharma Solutions, Inc. for sterile manufacturing product supply for the PFS Syringe product and is in discussions with an aerosol inhaler supplier for the aerosolized nasal steroid product candidate.

Single Dose Epinephrine Pre-Filled Syringe Product

There is a well-defined, growing market in the United States for patient-administered emergency epinephrine injectors used in the treatment of anaphylaxis. Based on information in the AAAAI Statistics, in the U.S., an estimated 5% of the population suffers from insect sting anaphylaxis, up to 6% are latex sensitive and up to 1.5% of adults and 5% of children under three years of age experience food related anaphylaxis. Adamis believes that anaphylaxis may be under-diagnosed. In January 2001, a published study by AAAAI revealed that up to 40 million Americans (15% of the total population) may be at risk for anaphylaxis, a significantly higher number than the

8

historically estimated at-risk population. According to information in the AAAAI Statistics, approximately 3,000 people in the U.S. die each year from anaphylaxis.

The number of prescriptions for epinephrine products has grown annually, as the risk of anaphylaxis has become more widely understood. According to the IMS Report, total prescriptions for EpiPen products more than doubled in the five year period from 2001 to 2005. Based on information in the IMS Report and more recently from NDC data, the U.S. epinephrine injector market was approximately $220 million in sales in 2008 and has historically grown at a rate of approximately 15% per year. Adamis estimates that the growth rate of annual prescriptions will decline to a growth rate of approximately 4-5% per year by 2010 consistent with IMS reports, although there are no assurances that this will be the case.

EpiPen® was originally developed by Meridian Medical Technologies, Inc. as an auto-injection system for use by military personnel. It was designed for self-administration as an antidote for chemical warfare agents and morphine. Meridian Medical Systems, which is the manufacturer of the EpiPen and EpiPen Jr., continues to focus on products for the military, and its major customer is the United States Department of Defense. The EpiPen® products were introduced to the market in 1982, and were the only epinephrine injectors for allergic emergencies that were available until 2005. In August 2005, another company introduced a competing product, Twinject ® Dual Pack, (and now Adrenaclick®) 0.3mg epinephrine auto injectors, which, Adamis believes due to pricing and ease of use issues, has enjoyed only a small market share in the United States. Twinject is currently owned by Sciele Pharma, Inc.

Adamis believes that there are barriers to market entry for new competitors based on epinephrine’s susceptibility to contamination, sensitivity to heat and light and a short shelf-life, as well as the need for a competitor to possess the expertise to overcome the packaging and delivery challenges of introducing a competing product to the market. Adamis also believes that the size of the market is too small to be a major focus of the large pharmaceutical companies, although there can be no guarantees that this will be the case.

Adamis believes that the primary opportunity lies in the 0.3 mg segment, which constitutes approximately 72% of the total market (measured as a percent of U.S. sales), based on EpiPen unit sales history and the NDC Report. When sales of dual packs of EpiPen and TwinJect/Adrenaclick are converted to single units, the total target market in the U.S. is about 2.5 million single units per year and growing.

Adamis believes that there is an opportunity for a simple, low-cost, intuitive and user-friendly pre-filled syringe to compete in this largest segment of the market. Adamis believes that its new product has the potential to compete effectively against EpiPen ® based on the following factors, among others:

|

•

|

Market Knowledge. Mr. Richard Aloi, President of Adamis Labs, is a U.S. leading authority on the commercialization of epinephrine injectors. He had responsibility for the worldwide introduction of EpiPen® and EpiPen® Jr. in 1982 and contributed to the subsequent growth of sales of the product line.

|

|

•

|

Lower Price. Adamis believes that a lower-priced option would be particularly attractive to individuals potentially susceptible to anaphylaxis as well as managed healthcare drug reimbursement plans providing patient prescription reimbursement. Adamis expects to introduce the Epi Syringe at a price point reflecting a discount to the price of the market leader, EpiPen, in part to make the product more attractive to customers. At this price Adamis believes it can still obtain significant gross margins, although there are no assurances that this will be the case.

|

|

•

|

Ease of Use. The EpiPen®, EpiPen® Jr., Twinject® and Adrenaclick® are powerful spring-loaded auto-injector devices. If not administered properly, they can misfire or be misused. Adamis’ Epi pre-filled 0.3mg syringe will allow patients to self-administer (self-inject) a pre-measured epinephrine dose quickly with a device that does not have moving parts that the user cannot control, which Adamis believes may increase product safety and sales, although there are no assurances that this will be the case.

|

There are four key supply components used in the manufacture of the PFS Syringe Product: the pre-filled single does syringe containing the epinephrine; the formulation solution; a specially designed plunger rod that expels only the appropriate emergency amount of 0.3mg of epinephrine; and the plastic carrying case.

9

Adamis believes that the market for emergency epinephrine injectors will grow, driven by increasing awareness, lower cost alternatives, and traditional or online promotions by new market entrants. Adamis expects that the total market unit growth rate will continue to grow as additional lower priced epinephrine products are introduced, but total dollar market will plateau as the market matures with multiple lower priced products. Adamis believes that the PFS Syringe product may acquire a share of the market in a manner somewhat similar to the pattern established by generic drugs, in that the price differential between the expected price of the PFS Syringe product and the price at which the market-leading product is currently sold will motivate purchasers and reimbursing payors to choose the lower cost alternative. Adamis also believes, however, that if its product competes successfully, at least one of the current competitors may introduce a competing, low-priced, pre-filled single dose syringe while maintaining the price points of its existing product lines. Adamis believes that such a competing product might have a comparable or lower price than the Adamis product. Adamis believes that the PFS Syringe product has the potential to compete successfully after full commercial activities are initiated, although there can be no assurance that this will be the case. To date, Adamis’ ability to fully execute its plan for the commercial launch of the PFS Syringe product has been materially hampered because of limited funding to support the full commercial launch.

Inhaled Nasal Steroid Product

Adamis Labs is developing an aerosolized inhaled nasal steroid for the treatment of seasonal and perennial allergic rhinitis. The active ingredient is beclomethasone diproprionate, a synthetic steroid that demonstrates potent glucocorticoid activity. Glucocorticosteroids are hormones produced by the adrenal cortex. Corticosteroids inhibit inflammation in allergic reactions by interfering with the synthesis of prostaglandins and leukotrienes, chemicals that are normally synthesized as part of the inflammatory process. Adamis refers to the product as Beclomethasone Aerosolized Nasal Steroid, or BANS.

The market for inhaled nasal steroids, or INS, as estimated by Adamis based on the DataMonitor Report, is about $3 billion annually in the U.S. and growing steadily. Although the market is dominated by two multi-national pharmaceutical companies, Adamis believes there is a niche that can be exploited, and that an Adamis product candidate can achieve a small but significant percentage share of this large market.

INS products are sold under prescription for seasonal allergic rhinitis. In addition to inhaled nasal steroids, many different types of products treat the symptoms of allergic rhinitis: oral antihistamines and decongestants are among the most popular for self-medication/patient treatment. All physician specialties report that the majority of their allergic rhinitis patients receive intranasal steroids, either alone or in combination with oral antihistamines. In general, physicians view intranasal steroids as safe and effective.

There are four major physician specialties that treat patients with allergic rhinitis: Allergists, Otolaryngologists, or ENTs; Primary Care Physicians, or PCPs; and Pediatricians. Allergists, along with ENTs, tend to be the most aggressive in terms of pharmacological treatment of allergic rhinitis. On an individual basis, the allergist is the largest prescriber of products within the INS category. ENT physicians contribute half as many prescriptions as allergists, but that is still about five times the volume of the average primary care physician.

The INS market is highly seasonal with most of the sales occurring in two periods: a spring season from April through May or June; and a fall season occurring in September and October. Based on information in the DataMonitor Report, Adamis estimates that the INS market grew at an annual rate of over 5% from 31.7 million prescriptions in 2002 to an estimated 38.7 million prescriptions in 2006. In the same period, total U.S. market sales grew from $1.89 billion in 2002 to an estimated $3 billion for 2006. This average growth rate is about 10% per year, and resulted primarily from steady price increases. Adamis expects that the growth rate in average price increases will likely decline and possibly reach zero by 2011, due to increasing competition from generic products.

Currently, the INS market is dominated by aqueous solution formulations delivered by a pump. These aqueous pump spray formulations have replaced CFC propellant INS products, which once dominated the INS market. The propellant inhaled nasal steroids that were previously available have been discontinued due to CFC concerns for the environment. Based on information in the IMS Report concerning 2005 sales, the two leading products account for over 70% of total product sales in this market.

Adamis believes that, in general, prescribing physicians view all INS products as being generally similar in terms of efficacy and safety. As a result, the INS market is sensitive to promotion, and companies spend a great deal of effort and money each year in the attempt to differentiate these products from one another. Adamis believes that

10

large amounts are spent on direct-to-consumer advertising for the two largest holders of market share, Nasonex®, marketed by Schering, and Veramyst® (fluticasone) marketed by GlaxoSmithKline. In addition to direct-to-consumer advertisement, GSK and Schering also spend large amounts of dollars in personal promotion detailing physicians and distributing samples as well as journal advertisement.

Adamis does not anticipate competing directly against the two leading companies in this market by attempting to out-spend or out-promote them in the marketplace. Adamis believes that its market opportunity lies in taking a small portion of the market with a new aerosolized HFA version of a well-established product but at a substantial discount to the current prices of the leading branded products.

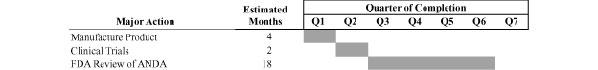

Adamis expects BANS to be considered a “new” drug by the FDA, and accordingly Adamis believes that it will be required to submit data for an application for approval to market BANS pursuant to Section 505(b)(2) of the Food Drug and Cosmetics Act, although there are no assurances that this will be the case. Total time to develop the BANS product is expected to be approximately 25 months from inception of full product development efforts, assuming sufficient funding and no unexpected delays. The table below shows the estimated development timeline for the BANS product based on the number of months from inception of full product development efforts.

Projected Developmental Timeline for BANS

(beclomethasone diproprionate)

Adamis estimates that approximately $4 million or more must be invested from the date of this Annual Report on Form 10-K in the Adamis Labs operations to support development and commercial introduction of the aerosolized nasal steroid product candidate. The capital that is expected to be provided from expected sales of these products will be important to help fund expansion of those businesses and the research and development of the anti-cancer small molecule therapeutic drugs as well as the therapeutic vaccine technology. Currently, neither manufacturing nor clinical trials have begun for that product candidate. Adamis estimates that approximately a total of $6-$9 million is required to support the development and commercial introduction of the inhaled nasal steroid product candidate and its two other respiratory products, although there are no assurances that funds for such an investment will be available. Factors that could affect the actual launch date for the nasal steroid product candidate include the outcome of discussions with the FDA concerning the number and kind of clinical trials that the FDA will require before the FDA will consider regulatory approval of the product, any unexpected difficulties in licensing or sublicensing intellectual property rights for other components of the product such as the inhaler, any unexpected difficulties in the ability of our suppliers to timely supply quantities for commercial launch of the product, any unexpected delays or difficulties in assembling and deploying an adequate sales force to market the product, and adequate funding to support sales and marketing efforts. Significant delays in obtaining funding to support the development and introduction of the steroid product could reduce revenues and income to Adamis, require additional funding from other sources, and potentially have an adverse effect on the ability to fund Adamis’ research and development efforts for tumor indications, as well as vaccine product candidates by Adamis Viral.

Factors that could affect the actual launch date for the BANS product candidate include the outcome of discussions with the FDA concerning the number and kind of clinical trials that the FDA will require before the FDA will consider regulatory approval of the product, any unexpected difficulties in licensing or sublicensing intellectual property rights for other components of the product such as the inhaler, any unexpected difficulties in the ability of suppliers to timely supply quantities for commercial launch of the product, any unexpected delays or difficulties in assembling and deploying an adequate sales force to market the product, and adequate funding to support sales and marketing efforts.

Cancer and Vaccine Product Candidates

The company’s Adamis Viral subsidiary is focused on the development of Adamis’ therapeutic vaccine product candidates and prostate cancer drugs for prostate cancer patients with unmet medical needs in the multi-billion dollar global prostate market. Adamis Viral has previously focused on vaccine technologies only, with initial emphasis on developing a novel avian influenza vaccine. However, the recent acquisition by Adamis of license agreements relating to prostate cancer therapeutic anti-inflammatory small molecule drugs that the company believes are proprietary and promising; as well as recent published information regarding the revised incidence estimates of avian influenza, which are lower than previous estimates, and the resulting decrease in the likelihood of an imminent avian influenza pandemic, have all led the company to focus their efforts on both the small molecule cancer therapeutic drugs and on therapeutic vaccine opportunities.

Prostate Cancer Technologies

On February 24, 2010, Adamis entered into a definitive agreement to acquire exclusive license agreements covering three small molecule compounds, named CPC-100, CPC-200 and CPC-300. Adamis believes these compounds to be promising drug candidates for the potential treatment of human prostate cancer, or PCa. The intellectual property covered by the agreements was licensed from the Wisconsin Alumni Research Foundation, or WARF. The company has acquired the license agreement relating to CPC-300 and will, upon completion of an equity offering of more than $2 million, acquire the license agreements and obligations relating to CPC-100 and CPC-200. In 2006 and 2007, CPC-100 and CPC-200, respectively, each received the National Cancer Institute's multi-year, multi-million dollar Rapid Access to Preventative Intervention Development, or RAPID, Award. Each year, this award is given by the NCI Division of Cancer Prevention, under the RAPID Program, to promising new

11

preventative/ therapeutic anti-cancer drugs. Collectively, more than $16 million has been spent through government and private foundation grants and private investor funding for the development of these three new small molecule drug candidates. Adamis’ objective is to file an Investigational New Drug application, or IND, with the U.S. Food and Drug Administration, or FDA, by the end of calendar year 2010, and to subsequently commence a Phase 1/2a prostate cancer clinical study relating to the CPC-100 product candidate, assuming adequate funding and no unexpected delays.

The Human Prostate and Prostate Cancer; Disease and Market Background

In the discussion below concerning prostate cancer, all statistics, data and information concerning incidence of disease or other conditions in the general population, market sizes, annual U.S. sales of products, U.S. prescriptions and rates of prescriptions, and similar statistical or market information are based on data published sources: MedTrack and IMMS data reports, American Cancer Society, or ACS, Statistics and National Cancer Institute, or NCI, Statistics.

The prostate is a walnut-sized gland located in front of the rectum and underneath the urinary bladder. It is found only in men. The prostate starts to develop before birth and continues to grow until a man reaches adulthood. This growth is fueled by male hormones, the so-called androgens. The main androgen produced by men is the hormone testosterone. Testosterone can be converted by the body into dihydrotestosterone (DHT), which in turn signals the prostate to grow. The prostate stays at adult size in adult males as long as the male hormone is present at physiological levels. In older men, the inner part of the prostate around the urethra very often keeps growing, leading to a common urological condition called benign prostatic hyperplasia (BPH). In BPH, the prostate tissue can press on the urethra, leading to flow problems in passing urine. BPH is a serious medical problem, however BPH is not prostate cancer.

A prostate cancer develops when cells in the prostate begin to grow out of control, and a cancerous tumor can form. Several types of cells are found in the prostate, but over 99% of prostate cancers develop from gland cells within the prostate. The medical term for a cancer that starts in gland cells is an “Adenocarcinoma”. As the tumor grows, it can spread to the interior of the prostate, to tissues near the prostate, to the sac-like structures attached to the prostate known as the seminal vesicles, and to distant parts of the body, such as the bones, liver lobes or lungs. Prostate cancer (PCa) is one of the most invasive malignancies and a leading cause of cancer related deaths in many countries. According to the American Cancer Society and the National Cancer Institute, prostate cancer is the second-most common cancer in American men, and the second leading cause of cancer death in American men. The latest ACS estimates for prostate cancer in the United States for 2009 indicate that about 192,280 new cases of prostate cancer will be diagnosed and 27,360 men will die of prostate cancer. The NCI has estimated that approximately 20% of patients present with locally advanced or metastatic prostate cancer at the time of diagnosis. Metastatic prostate cancer is advanced prostate cancer that has spread beyond the prostate and surrounding tissues into distant organs and tissues. The majority of men who die from prostate cancer die from the consequences of metastatic disease. According to the National Cancer Institute, the five-year survival rate of patients with prostate cancer that has metastasized to distant organs is only about 30.6%. Metastatic prostate cancer is generally divided into two states: the Androgen hormone-sensitive, Androgen-dependent or castrate sensitive PCa state (CS-PCa) and the castrate-resistant PCa state (CR-PCa), also referred to as the Androgen hormone-refractory, Androgen-independent or the Androgen Deprivation Therapy (ADT) resistant state.

Testosterone and other male sex hormones, known collectively as androgens, can fuel the growth of prostate cancer cells. Androgens exert their effects on prostate cancer cells by binding to and activating the Androgen Receptor, which is expressed in prostate cancer and other cells. When they first metastasize to distant sites, most prostate cancers depend on androgen hormone for tumor growth. These prostate cancers are CS-PCa prostate cancers. The CS-PCa tumors treated with Androgen Deprivation Therapy (ADT) are often already inflamed or can also become chronically inflamed and invariably become CR-PCa tumors.

For patients with advanced, metastatic CS-PCa prostate cancer, the standard of care is treatment with hormonal ablation therapy, also known as androgen deprivation therapy or ADT. ADT is used to suppress production or block the action of androgens. Accordingly, the leading therapies currently used for the treatment of

12

prostate cancer, after it recurs following radiation or surgery, are focused on diminishing the production of androgens, or antagonizing the effects of androgens by blocking the Androgen Ligand Binding Domain on the Androgen Receptor inside prostate cancer cells with drugs known as anti-androgens. Thus, theses two different effects are achieved through two separate therapeutical approaches. The first approach is often to reduce the amount of androgens produced in the body, primarily in the testes. This can be achieved by surgical castration by removal of both testicles, referred to as an orchiectomy, or alternatively through use of one and /or two different kinds of ADT drugs, called chemical castration.

One chemical castrating therapeutic drug is known as a luteinizing hormone-releasing hormone (LHRH) agonist drug. This type of drug is exemplified by compounds like Zolodex (AstraZeneca PLC) that lower the native production of testosterone from the adrenal gland. A second chemical castrating therapeutic approach uses a drug known as anti-androgen, which directly block the interaction of androgens from binding to the ligand binding domain of the Androgen Receptor (AR-LBD). For example, Bicalutamide (Casodex®), is an anti-androgen drug that binds to the AR-LBD and displaces or blocks androgen binding to the AR-LBD and thus inhibits normal AR function. Bicalutamide is now a generic. Additional generic anti-androgens include Flutamide (also known as Nilutamide). Bicalutamide is still one of the largest selling of the anti-androgen CS-PCa therapeutic drugs, with global annual sales of about $1B and more than $800 million in 2009 from AstraZeneca PLC, according to their own public disclosures of sales. Anti-androgens and LHRH agonists often are given in combination therapy, an approach known as a Combined Androgen Blockade (CAB). However, because these ADT therapies operate by reducing the ability of androgen hormone to bind and activate the AR to fuel the growth of prostate cancer cells, they generally are effective only on prostate cancers that remain hormone-sensitive, that is, those men with CS-PCa tumors that still depend on androgen and the AR-LBD for PCa cell growth. Adamis, collaborators, and many others now commonly recognize that androgen deprivation therapy causes prostate cancer cell programmed cell death (apoptosis) and can also contribute to pathophysiological chronic inflammation in men with CS-PCa. There is significant published data supporting the important role of chronic inflammation in the change from CS-PCa to CR-PCa.

Most animal and human prostate cancer initially is hormone-sensitive and thus initially responds to ADT. However, according to a study published in the October 7, 2004 issue of The New England Journal of Medicine, and other studies, virtually all hormone-sensitive metastatic prostate cancer (CS-PCa) are commonly believed to undergo changes that convert CS-PCa to the castration-resistant (CR-PCa) state within a median of 18-24 months after initiation of ADT. Once in this ADT resistant CR-PCa state, CR-PCa generally continues to grow even when there is a significant reduction of testosterone production. The change to the castration-resistant state is generally determined based on monitoring either rising levels of prostate-specific antigen, or PSA, in prostate patients’ blood serum, or by documented disease progression as evidenced by radiographic imaging tests (via patient MRI or bone scans) or the CR-PCa patients’ presentation of significant clinical symptoms, including pain with or without chronic fatigue. Metastatic prostate cancer that has become castration-resistant most often becomes more highly advanced, resistant to all forms of therapy, and extremely aggressive; These patients have a median survival of often only 10 to 16 months because, at present, there is no successful medium- or long-term chemotherapy or immunotherapy treatment for advanced metastatic CR-PCa. Treatment of patients with CR-PCa remains a clinical challenge.

In summary, the standard treatment for localized advanced, recurrent, and metastatic prostate cancer is ADT, which blocks the growth promoting effects of androgens and activates apoptosis. After an initial favorable response, progression to androgen-independence or castration resistance is the usual outcome, for which there are currently no curative treatment options. Some brief survival extensions can sometimes be achieved using current Taxol-based chemotherapy protocols.

Adamis believes that the recently in-licensed prostate cancer therapeutic anti-inflammatory drugs, CPC-100, -200 and -300, may offer significant new treatments for prostate cancer and inflammation. In animal studies conducted to date, all three of these compounds are found to be safe and well tolerated, and are active not only against castrate sensitive but also against castrate resistant prostate tumors.

13

Drug Product Candidates in Development

CPC-100. CPC-100 is the most advanced of the three small molecule anti-inflammatory drug candidates. In animal studies conducted to date, CPC-100 demonstrated potent anti-androgenic and anti-inflammatory activities against prostate tumors growing in animal models and showed a strong safety profile in preclinical safety studies.

To date, CPC-100 has demonstrated desirable pharmacological characteristics as an oral or injectable anti-inflammatory and anti-androgenic drug candidate with multiple mechanisms of action. CPC-100 significantly decreases secretion of human PSA (Prostate Specific Antigen) by human prostate cancer cells growing in mice and also significantly increases the time-to-tumor progression and survival of PCa mice with CS-PCa and CR-PCa tumors. In animal studies conducted to date, at the maximum tolerated oral dose, or MTD, of CPC-100 (equal to 3 milligrams of CPC-100 per kilogram of mouse body weight), approximately 90% of mice developing metastatic prostate cancer achieved a highly statistically significant and highly repeatable therapeutic benefit. This is compared with approximately 55% of mice achieving a therapeutic benefit for the leading ADT drug Casodex, also known as Biculatamide (used at the oral MTD of 5 milligrams per kilogram of mouse body weight). CPC-100 is also significantly more effective than Flutamide, another generic anti-androgen sold world-wide and, like Bicalutamide, only effective with CS-PCa and not with CR-PCa patients.

Based on studies to date, Adamis believes that the CPC-100 drug candidate may offer important advantages over existing anti-androgen standard of care drugs that are used in hormonal therapies in prostate cancer patients. CPC-100 has the potential to be used for both castrate-sensitive and castrate-resistant prostate cancer patients. Currently, there is no drug specifically approved as a second-line hormonal agent for the treatment of prostate cancer. Rather, the standard of care for second-line hormonal therapies includes using existing drugs, such as steroids (hydrocortisone, dexamethasone), hormones (estrogen, aminoglutethimide) and anti-fungal agents (ketoconazole) in “off-label” drug use settings. Each of these drugs has characteristics limiting its usefulness as a treatment for prostate cancer. We believe that CPC-100 may have potential advantages over such existing treatments, most notably due to its being anti-inflammatory, anti-androgenic and multi-targeted, as well as safe and well tolerated in animal testing.

A variety of serious side effects have been associated with the use of existing second-line hormonal treatments, which are limiting their uses. To date, however, no serious side effects appear to be associated with the use of CPC-100. Should CPC-100 continue to demonstrate a continued lack of serious side effects, we believe it would be favorably positioned against other therapeutic PCa agents. Finally, agents used as second-line hormonal PCa agents for castration resistant prostate cancer must be taken multiple times during the day. In pre-clinical testing to date, CPC-100 has shown the potential to be administered once per day as an oral drug. Such a convenient oral dosing schedule may result in better patient at home compliance, when compared to other agents that are used as second-line hormonal treatments.

In 2006, CPC-100 was awarded the National Cancer Institute (NCI) Rapid Award. The award is given for promising new drugs for the treatment of cancer and resulted in significant funding for research and development of CPC-100. The development of CPC-100 has been funded by Michael Milken's Prostate Cancer Foundation (PCF, formerly CapCure), the Department of Defense's Congressionally Directed Medical Research Programs' (CDMRP) Prostate Cancer Research Program (PCRP), as well as grants and contracts from the U.S. Public Health Service and the National Cancer Institute (NCI).

All IND enabling efficacy and toxicology studies, as well as the proposed Phase 1/2a human clinical trial protocol for both castrate sensitive (CS-PCa) and castrate-resistant prostate cancer (CR-PCa), have been completed for CPC-100, and Adamis intends to discuss and submit an Investigational New Drug Application with the FDA during the calendar year 2010, assuming adequate funding and no unexpected delays.

CPC-200. The small molecule acetyl polyamine oxidase enzyme inhibitor, or CPC-200, is a drug candidate for both castrate-sensitive and castrate resistant prostate cancer. CPC-200 is an irreversible inhibitor of the acetyl polyamine oxidase enzyme and blocks androgen-induced hydrogen peroxide production and inflammation and inhibits mouse PCa. Whereas acute inflammation is important for host defenses, for example against acute bacterial and viral infections in the prostate, chronic inflammation can contribute significantly to prostate tumor initiation, growth, progression and metastic PCa. In animal studies conducted to date, CPC-200 was an excellent inhibitor of chronic inflammation, also completely inhibiting oxidase mediated high rates of hydrogen peroxide

14

production in vivo, and significantly delaying prostate cancer progression and death in the standard mouse prostate cancer model (TRAMP - transgenic adenocarcinoma of the mouse prostate – mouse model). TRAMP mice have spontaneously developing prostate cancer, where all animals usually die from metastatic PCa at 22 weeks of age. In the TRAMP animal studies conducted to date, CPC-200 repeatedly demonstrated a statistically significant therapeutic efficacy and a strong safety profile with highly desirable pharmacological therapeutic characteristics and with the capacity to be administered as either an oral or injectable drug.

CPC-200 is being developed as an oral, injectable or implantable drug, specifically in appropriate formulations for patients with PCa for whom Androgen Deprivation Therapy, or ADT, is currently not approved or appropriate with standard-of-care therapeutics, for example prior to surgery or radiation of the primary prostate cancer. Additionally, CPC-200 may fulfill another unmet medical need for which there is no approved drug on the market, in that it might be given after surgery or radiation but before or with ADT, since it has been shown to be a potent anti-inflammatory drug in the animal studies conducted to date. CPC-200 effectively inhibits the androgen-induced oxidase-mediated increased production of hydrogen peroxide in prostate tissues and inhibits inflammation which has been recognized to be an important factor in the induction and progression of prostate cancer. In the TRAMP mouse PCa model, CPC-200 increased survival and time to tumor progression, and demonstrated inhibition of PSA secretion by human tumors and low toxicity with no pro-estrogenic or other negative side-effects. In 2007, CPC-200 was awarded the NCI Rapid Award, which is adequate for funding of all IND-enabling data including the ongoing large animal GLP toxicology measurements and with extra funds for formulation studies in development.

Approximately two-thirds of all IND enabling studies have been completed for CPC-200 to date, and Adamis anticipates being able to meet with the FDA by the end of calendar year 2010 and to subsequently file and open the Adamis-sponsored IND relating to the clinical investigation of oral CPC-200 in PCa patients pre-ADT. These studies are anticipated to be initiated sometime during the first half of calendar year 2011, assuming adequate funding and no unexpected delays.

CPC-300. CPC-300 is a multi-targeted small molecule therapeutic drug that the company believes has the potential to demonstrate anti-inflammatory, pro-apoptotic anti-cancer activities for prostate cancer patients, including men with advanced metastatic CR-PCa. In pre-clinical in vivo studies conducted to date, CPC-300 repeatedly demonstrated a significant ability to inhibit human tumor growth and kill both castrate-sensitive and castrate-resistant human prostate cancer tumors. It also materially decreased human tumor volumes and suppressed local metastasis in human xenograft models, where malignant human prostate or human melanoma tumor tissue was grafted onto athymic immunosuppressed experimental mice.

CPC-300 inhibited human androgen receptor protein production in these studies. It also inhibited PSA secretion by human PCa cells, which is a serum marker for human prostate cancer. Based on the pre-clinical studies conducted to date, CPC-300 clearly targets microtubule assembly and regulation, inhibits inflammation and is a potent pro-apoptotic therapeutic oral drug with potential for human prostate cancer patients. Based on pre-clinical studies conducted to date, CPC-300 also (i) inhibits prostate growth with simultaneous effects on the level of alpha-tubulin and beta-tubulin (the microtubule structural proteins), Stathmin (a micotubule regulating protein) and Survivin (a microtubule-regulatory down stream target/pro-survival protein), (ii) induces Fas receptor-mediated apoptotic signaling, (iii) decreases the level of the anti-apoptotic protein cFLIP, (iv) decreases transcriptional activation of Survivin and cFLIP, and (v) has a strong safety profile and desirable pharmacological characteristics with the capacity to be administered as either an oral or injectable drug or as a nutraceutical. Because of its multiple mechanisms of action, Adamis believes that CPC-300 may have potential applications in the treatment of other tumor types in which microtubule inhibitors have already been shown to be effective, including melanoma, as well as in prostate cancer.

Adamis' strategy regarding CPC-100, CPC-200 and CPC-300 is to retain United States territorial rights, while out-licensing certain rights, including those to other geographic territories.

Vaccine Technologies

Adamis Viral is also focused on developing patented vaccine technology that has the potential to provide protection against a number of different viral infectious agents. This novel vaccination strategy, which employs

15

DNA plasmids, appears, based on preclinical studies conducted to date, to have the ability to “train” a person’s immune system to recognize and mount a defense against particular aspects of a virus’ structure. If successful, Adamis believes this technology will give physicians a new tool in generating immunity against a number of viral infections that have been difficult to target in the past.

The first target indication for this technology has yet to be determined, but will be based on market, technology, and patent position considerations. Disease targets might include therapeutic vaccines for Influenza, Hepatitis B and C, Human Papillomavirus, and prostate cancer.

The technology that provides the basis of Adamis Viral’s research and development was developed by Dr. Maurizio Zanetti, M.D., a professor at the Department of Medicine at the University of California, San Diego. Dr. Zanetti has developed and patented a method of DNA vaccination by somatic transgene immunization, or STI. Adamis has entered into a world-wide exclusive license with Dr. Zanetti, through a company of which he is the sole owner, Nevagen, LLC, to utilize the technology within the field of viral infectious agents. Adamis believes that the technology has broad applications and is targeting viral disease indications for its initial proof of concept.

STI (also sometimes called TLI) has already been tested in Phase I studies in humans for other vaccine applications. An immune response was elicited in the study, and the results suggested that the procedure was safe. Testing, for instance for influenza, is currently at the preclinical stage. If successful, STI may provide a vaccine for immunity to all forms of influenza, including avian flu, although there are no guarantees that any of the trials will be successful or that a commercial product will be developed or marketed.

Many current vaccines act by giving the immune system a preview of certain protein antigens expected to be found on the target structure; Pathogens, such as influenza, however, demonstrate the limitations of this approach: the influenza virus changes its coat, often by recombination with swine or human viruses or other variation processes approximately every flu season. The changes make each year’s new version of the flu unrecognizable to the immune system, and therefore immunity to influenza viral variants must be usually reestablished with a new vaccine every fall. The following summarizes the method proposed by Adamis to develop long lasting and cross-reactive immunity against, e.g. influenza, but also against other therapeutic vaccine targets using STI:

|

•

|

Draw a small amount of blood from patient

|

|

|

•

|

Separate the white blood cells

|

|

|

•

|

Add plasmid (DNA) to the white blood cells

|

|

|

•

|

Incubate overnight to allow the plasmid to enter the white blood cells (ex vivo transgenesis)

|

|

|

•

|

Inject white blood cells back to the individual to induce immunity to the target of choice, i.e., influenza, hepatitis, HPV, and prostate cancer.).

|

There are a number of factors, including those identified in the Risk Factors section of this Annual Report of Form 10-K that could cause actual events to differ from Adamis’ expectations concerning the timeline for product development and the regulatory approval process. Adamis believes that it will be able to obtain sufficient funding for its clinical trials and product launches as discussed, but there can be no assurance that this will be the case. Similarly, there are no assurances that the clinical trials will be successful or that Adamis will be able to submit an application for, or obtain approval from the FDA for, any vaccine or therapeutic drug product.

Experiments conducted by third parties for Adamis utilizing the STI technology in mice have shown that T-cell immunity can be induced in vivo by a single intravenous inoculation of naïve B lymphocytes genetically programmed by ex vivo transgenesis. This is accomplished by administering a plasmid DNA under control of a B cell specific promoter. The process is entirely spontaneous and mimics the process of viral infection, which is intracellular replication. Results show the induction of systemic effector CD4 and CD8 T-cell responses within 14 days after administration of the transgenic B cells. Durable immunologic memory is also induced. It has been demonstrated that a single injection of 5 x 103 transgenic B lymphocyte induces complete protection from a lethal virus challenge. The following outlines the protocol used in the mouse trial:

|

•

|

A small amount of blood was drawn from mice

|

16

|

•

|

B cells were separated from the blood and transfected with DNA from flu virus

|

|

|

•

|

Transfected lymphocyctes, or priming B cells, were re-infused into the mice

|

|

|

•

|

A lethal challenge of virus was administered via aerosol 14-21 days after re-infusion

|

|

|

•

|

For controls, mice were injected with priming B cells transfected with DNA not specific for the flu

|

A single injection of transgenic B lymphocytes in this trial was sufficient to generate specific CD8 T-cell memory responses, which protected mice from a lethal viral challenge. The immune response that was induced was a reaction against the common components of the influenza virus, and was cross-reactive, meaning that it reacted against various types of flu virus (avian or any other). Thus, this type of vaccine may be utilized to protect individuals from various strains of influenza that may occur.

License Agreements

License Agreements Relating to Cancer Technologies

On February 24, 2010, Adamis entered into an agreement with Colby Pharmaceutical Company, a private corporation, to acquire three separate exclusive license agreements, covering three small molecule anti-inflammatory compounds, named CPC-100, CPC-200 and CPC-300, for the potential treatment of human prostate cancer, or PCa, in exchange for shares of Adamis common stock. Colby licensed the patents, patent applications and related intellectual property relating to the compounds pursuant to license agreements with the Wisconsin Alumni Research Foundation (WARF).

The completion of all the transactions contemplated by the agreement is subject to certain customary closing conditions. An initial closing was held on February 25, 2010, pursuant to which Colby assigned and transferred to Adamis the license agreement relating to the CPC-300 compound, in consideration of the issuance to Colby of 1,000,000 shares of Adamis common stock. The transfer of the license agreements relating to CPC-100 and CPC-200 will occur at a subsequent closing, upon satisfaction of closing conditions, which include the receipt by Adamis of equity funding after the date of the agreement in excess of $2 million. The consideration for the transfer of these additional agreements will be 7,500,000 shares of Adamis common stock to Colby. Upon the completion of an equity offering of at least $2 million, Adamis will acquire the license agreements relating to the CPC-100 and CPC-200 compounds.

The discussion below will assume that Adamis has been assigned all rights under all three license agreements, and that Adamis is the licensee under the license agreements.

The CPC-100 and CPC-200 license agreements are dated January 26, 2007. The CPC-300 license agreement is dated January 2, 2008. The licensor under the agreements is Wisconsin Alumni Research Foundation, or WARF. Under each separate agreement, the licensor grants to licensee) an exclusive right and license, with rights of sublicense, Adamis under the patents and patent applications identified in the agreement, for the fields of human nutraceuticals, preventatives, therapeutics and diagnostics and for all territories worldwide that are covered by any of the licensed patents.

If the licensee grants a sublicense, the licensee remains responsible to pay to the licensor an amount equal to what licensee would have been required to pay to licensor had licensee sold the amount of products covered by the license agreement that were sold by the licensee. In addition, if the licensee receives any fees or other payments in consideration for any rights granted under a sublicense, and the fees or payments are not based directly on the amount or value of products sold by the sublicensee or provided as reimbursement for research and development costs incurred by licensee, then licensee is obligated to pay to licensor a percentage of such payments, ranging from 10% to 40% depending on what the stage of regulatory approval and clinical trial development at the time the payments are received.

In each agreement, the licensee agrees to use reasonable efforts to diligently develop, manufacture, market and sell products in each licensed field and licensed territory. The agreements include a development plan relating to covered products, and the licensee is obligated to provide periodic updates to the licensor concerning the development plan.

17

The license agreements include milestones that licensee agrees to meet by certain dates, relating to obtaining cumulative funding by certain dates, the filing of an IND relating to a covered product, enrollment of a first patient under a Phase II clinical trial by certain dates, and filing of an NDA with the FDA relating to a covered product by certain dates. The licensor has the right to terminate the license agreement with advance notice if the licensee fails to meet any of the funding milestones or commercialization milestones.

Each agreement provides that the licensee will pay the licensor minimum royalties of $25,000 per year, commencing in years 2020 under the CPC-100 and CPC-200 agreements and 2021 under the CPC-300 agreement. Under all of the agreements, the licensee agrees to pay product royalties to licensor based on net sales of covered products, at a rate of 5% of net sales. The agreements include customary stacking provisions providing for a reduction in royalties if the licensee is obligated to pay royalties to other third parties on sales of covered products, but in all events the rate will be not less than 2.5% of net sales.

Each agreement provides that the licensee will pay to licensor milestone payments as follows: (i) $25,000 upon the filing of the first IND or comparable regulatory filing for a human therapeutic product covered by the agreement; (ii) $150,000 upon the enrollment of the first patient under a full Phase II clinical trial for the covered first human therapeutic product; (iii) $200,000 upon the enrollment of the first patient under a full Phase III clinical trial for the first covered human therapeutic product; and $250,000 for the first NDA or comparable regulatory approval for a covered human therapeutic product. Licensee is obligated to make only one milestone payment under each of the milestones and will not be obligated to make a second payment for any subsequent occurrence of the same milestone.

Each agreement provides that the licensee will reimburse licensor for legal fees and other costs incurred in filing, prosecuting and maintaining the licensed patents during the term of the agreement. These amounts will accrue for a period of four years after the date of the agreement, after which time the accrued amounts will be paid in four annual installments.

Each agreement contains customary representations and warranties of licensor and licensee, record keeping obligations of licensee, inspection and audit rights of licensor, and penalties for underpayment of royalties. The licensee agrees to indemnify the licensor against any loss or expense arising out of the production, manufacture, sale, use, lease, consumption or advertisement of any covered product under the agreement.

The term of each agreement continues until the date that none of the licensed patents under the agreement remains an enforceable patent. License may terminate the agreement at any time with 90 days prior notice to the licensor. Licensor may terminate the agreement if the date of first commercial sale of a covered product does not occur by December 31, 2020 under the CPC-100 and CPC-200 agreements and December 31, 2021 under the CPC-300 agreement. Licensor may also terminate the agreement following licensee’s failure to meet a funding or commercialization milestone, fails to pay amounts when due or deliver a development report or commits a material breach of the agreement, and fails to cure the default within 90 days.

Each agreement provides that the licensee may not assign the agreement without the licensor’s consent, which shall not be unreasonably withheld, except that licensee may assign the agreement to a person or entity that acquires all or substantially all of licensee business or assets to which the agreements relate provided that the assignee agrees to be bound by the provisions of the agreement.

License Agreement Relating to Vaccine Technologies

On July 28, 2006, Adamis entered into a worldwide exclusive license agreement with Dr. Zanetti, through a company of which he is the sole owner, Nevagen, to utilize the technology within the field of viral infectious agents. The intellectual property, or IP, licensed by Adamis includes the use of the technology known as “Transgenic Lymphocyte Technology,” or TLI, covered by patent applications titled “Somatic Transgene Immunization and related methods” including but not limited to “ex vivo treatment of an individual’s lymphocytes. The vaccine is constituted of the individual’s lymphocytes harboring plasmid DNA, for example, DNA coding for selected epitopes of influenza virus. The IP includes rights under two issued U.S. patents, three U.S. patent applications and related patent applications filed in European Union, Japan and Canada. The U.S. patent was issued on October 9, 2007 and will expire on April 27, 2019, 20 years from the filing date of the earliest U.S. non-provisional application upon which the patent claims priority.

18

The field for this exclusive license is the prevention and treatment and detection of viral infectious diseases. The geographic area covered by the exclusive license is worldwide. The license will terminate with the expiration of the U.S. patent for the IP.

As part of the initial license fee Adamis granted Dr. Zanetti the right to purchase one million shares of Adamis common stock at a price of $0.001 per share, and he subsequently exercised that right. In addition, Adamis paid the licensor an initial license fee of $55,000. For the first product, Adamis will make payments upon reaching specified milestones in clinical development and submission of an application regulatory approval, potentially aggregating $900,000 if all milestone payments are made. As of the date of this Annual Report, no milestones have been achieved and no milestone payments have been made. The agreement also provides that Adamis will pay the licensor royalties, in the low single digits, payable on net sales received by Adamis of products covered by the IP. If additional technologies are required to be licensed to produce a functional product, the royalty rate will be reduced by the amount of the royalty paid to the other licensor, but not more than one-half the specified royalty rate. Royalties and incremental payments with respect to influenza will continue until reaching a cumulative total of $10 million.

Adamis and the licensor have the right to sublicense with written permission of the other party. In the event that the licensor sublicenses or sells the improved technology to a third party, then a portion of the total payments, to be decided by mutual agreement, will be due to Adamis. If Adamis sublicenses the IP for use in influenza to a third party, the licensor will be paid a fixed percentage of all license fees, royalties, and milestone payments, in addition to royalties due and payable based on net sales.

If the IP is sublicensed by Adamis to another company for any indication in the field covered by the license agreement other than with respect to influenza, the licensor will be paid a portion of all license fees, royalties and milestone payments, with the percentage declining over time based on the year in which the sublicense is granted. Certain incremental non-flu virus related sublicensing payments described in the license agreement are specifically excluded from the royalty cap.

All improvements of the IP conceived of, or reduced to practice by Adamis, or made jointly by Adamis and the licensor will be owned solely by Adamis. Adamis granted Nevagen a royalty-free nonexclusive license to use any improvements made on the existing technology for research purposes only but not for any commercial purposes of any kind. Adamis has agreed to grant to Nevagen a royalty-free license for any improvement needed for the commercialization of the IP for Nevagen’s use outside the field licensed to Adamis. If Nevagen sublicenses or sells the improved technology to a third party, then a portion of the total payments, to be decided by mutual agreement, will be due to Adamis.

Adamis will have the right of first offer to license the following additional technology from the licensor, if and when it becomes available:

|

•

|

Technology for the application of related intellectual property as a prophylactic or therapeutic cancer vaccine; and

|

|

|

•

|

Any additional technology developed by the licensor related to the IP.

|

Adamis has the right to terminate the agreement if it is determined that no viable product can come from the licensed technology. Upon such termination, Adamis would be required to transfer and assign to the licensor all filings, rights and other information in its control if termination occurs. Adamis would retain the same royalty rights for license, or sublicense, agreements if the technology is later developed into a product. Either party may terminate the license agreement in the event of a material breach of the agreement by the other party that has not been cured or corrected within 90 days of notice of the breach.

Drug Development Process

The statements below, and elsewhere in this Annual Report regarding anticipated future events concerning the development process of Adamis’ vaccine product candidates, the clinical trial process, and the regulatory approval process including the actions of the FDA, are subject to several uncertainties and contingencies that could cause actual results to differ in material respects from the results and timelines anticipated in the discussion below. Some of these uncertainties and contingencies are described herein under the heading “Risks Factors.” There is no guarantee that Adamis will be able to complete clinical development and obtain approval from the FDA for any vaccine product candidate.

19

Vaccine Development. Adamis may file for an Investigational New Drug Application, or IND, based on previously published data on this technology. Adamis believes that having this data could shorten the process of preclinical development and preparation of the IND, although there can be no assurance that this will be the case. Adamis believes that clinical trials could start within 60-90 days after acceptance of the IND by the FDA. The total time to complete an IND application is expected to be about one year following receipt of sufficient funding.

Phase 1/2a CPC-100 Prostate Cancer Trial. The Phase 1/2 clinical trial that would be specified in the IND would probably require about 18 months in total. Adamis estimates the total cost of the clinical trial to be about $2,100,000. After completion of the anticipated Phase 1/2a CPC-100 trial, Adamis expects that it would meet with the FDA to review the trial results and determine extension of the Phase 2a to Phase 2b.