Attached files

As

filed with the Securities and Exchange Commission on July 8, 2010

Registration

No. ___________

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

_______________________

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

______________________

FOUR

STAR HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

________________________

|

FLORIDA

(State

or other jurisdiction of

incorporation

or organization)

|

1531

(Primary

Standard Industrial

Classification

Code Number)

|

26-1427633

(I.R.S.

Employer

Identification

No.)

|

100

Four Star Lane

Odenville

AL 35120

(205) 640-3726

(Address,

including zip code, and telephone number, including area code, of registrant's

principal executive offices)

Bobby

R. Smith, Jr.

Chairman

of the Board, Chief Executive Officer, and Treasurer

100

Four Star Lane

Odenville

AL 35120

(205) 640-3726

(Name,

address, including zip code, and telephone number including area code, of agent

for service)

__________________________

With

a copy to:

Law

Offices of Joseph L. Pittera

2214

Torrance Boulevard

Suite

101

Torrance,

California 90501

Telephone

(310) 328-3588

Facsimile

(310) 328-3063

Approximate

date of commencement of proposed sale to the public: From time to

time after this Registration Statement is declared effective.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933,

check the following box.

If this

Form is filed to register additional securities for an offering pursuant to

Rule 462(b) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering.

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering.

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering.

If

delivery of the prospectus is expected to be made pursuant to Rule 434,

please check the following box.

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definitions of “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

Large

accelerated filer o Accelerated

filer

o

Non-accelerated

filer o Smaller

reporting company x

(Do not

check if a smaller reporting company)

CALCULATION

OF REGISTRATION FEE

|

|

|

Proposed

|

Proposed

Maximum

|

|

|

|

|

|

Maximum

|

Aggregate

|

Amount

of

|

|

| Title and Class of | Amount to |

Offering

Price

|

Offering

|

Registration

|

|

|

Securities

Registered

|

Be Registered |

per

Security (1)

|

Price

(1)

|

Fee | |

|

Common

Stock

|

|||||

|

No

Par Value

|

|||||

|

Prospectus

|

2,000,000

|

$5.00

|

$10,000,000

|

$7,130

|

|

|

Fran

Mize

|

3,000,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Bobby

R. Smith Jr.

|

3,000,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Superior

Hotels, Inc.

|

900,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Private

Resources, LLC

|

2,250,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Richard

Lee Barnes Esq

|

1,500,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Martin

W. Smith

|

1,500,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Joe

Pittera

|

200,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Al

Rhoney

|

590,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Doug

Drennen

|

590,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Laura

Shelton

|

590,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Kathy

Burttram

|

590,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Casie

New

|

590,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

GM

Holdings, Inc.

|

1,500,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Angelic

Holdings, LLC

|

300,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Issued

Shares

|

2,000,000

|

$5.00

|

$10,000,000

|

$7,130

|

|

| Issued Shares | 17,100,000 | $0.00 | $0.00 | $0.00 |

(1)

Estimated

solely for purposes of calculating the amount of the registration

fee.

(2) As

per officers compensation package

The

Registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the Registrant shall

file a further amendment which specifically states that this registration

statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933, or until this registration statement shall become

effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed.

We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This preliminary prospectus is

not an offer to sell, and we are not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

P R O S P E C T U S

FOUR

STAR HOLDINGS, INC.

OFFERING

OF 2,000,000 SHARES OF COMMON STOCK

The name

of our Company is Four Star Holdings, Inc. We are offering from time

to time 2,000,000 shares of our Common Stock at $5.00 per share. No

additional payment is required in connection with a conversion. We

will not pay any dividends on the Common Stock unless otherwise stated in a

resolution executed by officers/directors.

The

shares are being offered through our executive officers pursuant to an exemption

as a broker/dealer under Rule 3a 4-1 of the Securities Exchange

Act. There is no minimum offering. Proceeds from the sale

of the shares, up to $10,000,000 if all the shares offered are sold, will not be

placed in an escrow account and may be used by us upon receipt. We

are offering the shares from time to time on a continuous basis, but we may

terminate the offering at any time.

Prior to

this offering, there has been no public market for our common stock and there

can be no assurance that any such market will develop.

|

|

|

Proposed

|

Proposed

Maximum

|

|

|

|

|

|

Maximum

|

Aggregate

|

Amount

of

|

|

| Title and Class of | Amount to |

Offering

Price

|

Offering

|

Registration

|

|

|

Securities

Registered

|

Be Registered |

per

Security (1)

|

Price

(1)

|

Fee | |

|

Common

Stock

|

|||||

|

No

Par Value

|

|||||

|

Prospectus

|

2,000,000

|

$5.00

|

$10,000,000

|

$7,130

|

|

|

Fran

Mize

|

3,000,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Bobby

R. Smith Jr.

|

3,000,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Superior

Hotels, Inc.

|

900,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Private

Resources, LLC

|

2,250,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Richard

Lee Barnes Esq

|

1,500,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Martin

W. Smith

|

1,500,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Joe

Pittera

|

200,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Al

Rhoney

|

590,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Doug

Drennen

|

590,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Laura

Shelton

|

590,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Kathy

Burttram

|

590,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Casie

New

|

590,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

GM

Holdings, Inc.

|

1,500,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Angelic

Holdings, LLC

|

300,000

|

$0.00

|

$0.00

|

$0.00

|

|

|

Issued

Shares

|

2,000,000

|

$5.00

|

$10,000,000

|

$7,130

|

|

| Issued Shares | 17,100,000 | $0.00 | $0.00 | $0.00 |

The

purchase of the securities offered through this prospectus involves a high

degree of risk. You should carefully read and consider the section of this

prospectus titled “Risk Factors” beginning on page 13 before buying any of our

securities.

The

information in this prospectus is not complete and may be changed. We may not

sell or offer these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer

to sell these securities and it is not soliciting an offer to buy these

securities in any state where the offer or sale is not permitted.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or passed upon the adequacy or

accuracy of this prospectus. Any representation to the contrary is a criminal

offense.

Subject

to Completion, Dated __________, 20__

The

following table of contents has been designed to help you find important

information contained in this prospectus. We encourage you to read the entire

prospectus.

This

prospectus is part of a registration statement that we filed with the Securities

and Exchange Commission. The registration statement containing this prospectus,

including the exhibits to the registration statement, also contains additional

information about Four Star Holdings, Inc. and the securities offered under this

prospectus. That registration statement can be read at the Securities and

Exchange Commission's website (located at www.sec.gov) or at

the Securities and Exchange Commission’s Public Reference Room mentioned under

the heading “Where You Can Find More Information” of this prospectus. This

document will also register all stock issued with evidence by a certified

shareholders list.

You

should rely only on the information contained in this document or to which we

have referred you. We have not authorized anyone to provide you with information

that is different. This document may only be used where it is legal to sell

these securities. The information in this document may only be accurate on the

date of this document. Our business, financial condition or results of

operations may have changed since that date.

Except as

otherwise indicated, market data and industry statistics used throughout this

prospectus are based on independent industry statistics or other publicly

available information. We do not guarantee, and we have not independently

verified this information. Accordingly, investors should not place undue

reliance on this information.

REFERENCES

As used

in this prospectus: (i) the terms “we”, “us”, “our”, and the “Company” mean Four

Star Holdings, Inc.; (ii) “SEC” refers to the Securities and Exchange

Commission; (iii) “Securities Act” refers to the United States Securities Act of 1933, as

amended; (iv) “Exchange Act” refers to the United States Securities Exchange Act of

1934, as amended; and (v) all dollar amounts refer to United States

dollars unless otherwise indicated.

PROSPECTUS

SUMMARY OF PROSPECTUS

The

following summary highlights selected information contained in this prospectus.

This summary does not contain all the information you should consider before

investing in the securities. Before making an investment decision, you should

read the entire prospectus carefully, including the “Risk Factors” section, the

financial statements and the notes to the financial statements.

Four Star

Holdings, Inc. hereinafter referred to as “The Company”, and the term

“Management” is hereinafter referred to Bobby R. Smith, Jr. and Fran Mize,

collectively. Management has operated as one of the largest

developing and homebuilding companies in the Birmingham Alabama area. The

Company operates in four segments, Land Development, Structural Community

Planning, Homebuilding, and Realty Brokerage Services. As of March

31, 2010 the Company acquired Ridgefield Development Corporation and Four Star

Realty, LLC, owned by Smith and Mize (Management).

Four Star

Holdings, Inc sells it properties under its subsidiary Four Star Realty,

LLC. Management has been operating as officers and directors in

various real estate brokerage and development ventures since 1992. To date

Management has built over 1,100 single family homes, over 30 commercial

properties, and currently has two multifamily projects and one town home complex

under development.

In

December 2009 Management acquired majority control of a public company known as

Dragons Lair Holdings, Inc. which was founded in 2007. The result of that

transaction was the purchase of 74% of the Company’s common stock through a

Stock Purchase Agreement for the consideration of $325,000. This gave

authoritative control to Fran Mize, as President and Director and Bobby R.

Smith, Jr. its Chairman and CEO, The Company is headquartered in the Birmingham,

Alabama area.

The

banking industry, as a result of the Credit Crisis in the United States during

the last two years, has limited and in some cases discontinued funding in the

real estate development sector. Management’s solid foundation with

its lenders for over the past 15 years has enabled them to borrow over $200

million with a stellar performance in servicing this debt. However, even with

positive equity on the balance sheet Management’s primary lending institutions

shut down the majority of its available line of credit. This affected the

Company as it experienced slowed performance but did not stop the progress in

sales and/or production. This did however, trigger the Company’s interest in

going public to procure alternative financing for its expansion from other than

traditional bank financing methods.

Over the

past 18 months they have seen many of their Home Building Competitors dwindle

due to over leveraging and higher than normal carrying cost of inventory. The

Company’s conservative inventory levels have given it the ability to sell homes

at a better than average sale price compared to its competitors. To

make it possible for purchasers of some of the Company’s homes to obtain 100%

financing thru Rural Housing Development Loans, FHA-insured or VA-guaranteed

mortgages, the Company must construct these homes in compliance with regulations

promulgated by these agencies.

Today,

Birmingham ranks as one of the most important business centers in the nation and

is also home of one of the largest banking centers in the U.S. In addition, the

Birmingham area serves as headquarters to one Fortune 500 company: Regions

Financial and five Fortune 1000 companies.

Corporate

Structure

The

Land Development Subsidiary

The

acquisition and development of land has always been a primary focus of

Management and its companies. The recent acquisition of Ridgefield

Development demonstrates that management’s current holdings are poised to become

subsidiaries of The Company. All references to “inventory” or “product” are

referring to the development and/or construction of single family residences or

commercial sites that management will book into Four Star Holdings, Inc. as

revenue and/or assets.

The

intimate knowledge of the local areas enabled them to acquire parcels of land at

outstanding values before these same parcels became known to other potential

purchasers in the area. This combined with excellent working relationships

maintained with local zoning boards and County Commissioners enabled them to

develop these properties in a more efficient manner than those unfamiliar with

any local or county regulations. Of equal or greater importance in

today’s market, is Managements outstanding relationship with banks and other

lenders in the Southeast. While there are numerous opportunities

available for the purchase of distressed properties, not every “bargain”

purchase will produce profits. The ability to sift through these

opportunities requires a firsthand knowledge of “working the dirt” to know which

properties can be developed into income producing developments and which ones

will still be growing weeds for the next three to five years. Bobby

R. Smith, Jr. Four Star’s CEO owns “B & B Smith Construction” an excavation

company complete with earth moving equipment and contacts for leasing

heavier equipment as needed. The Company, through its own efforts and its

partnership interests, is involved in all phases of planning and building in its

residential communities and commercial projects including land acquisition, site

planning, preparation and improvement of land, and design, construction and

marketing of homes. The CEO, Bobby R. Smith, Jr. holds the General Contractor

license enabling B&B Smith Construction Company, Inc. to do most of the

development work in-house.

Realty

Brokerage Subsidiary:

Four Star

Realty, LLC (REALTY) is a wholly owned subsidiary of Four Star Holdings.

REALTY’s primary focus is a residential real estate Brokerage Company, providing

brokerage services to home buyers and sellers in the Birmingham Alabama area.

The Company also markets and sells its homes as well as other homes through

commissioned agents and independent outside real estate

brokers. Realty offers locality data and targeted information on new

home listings, home sales comparables and local school information through its

website images and virtual tours. The Company’s President Fran Mize

has almost 20 years in listing, marketing properties on behalf of sellers, as

well as assisting in negotiating, advising, transaction processing, and closing

activities.

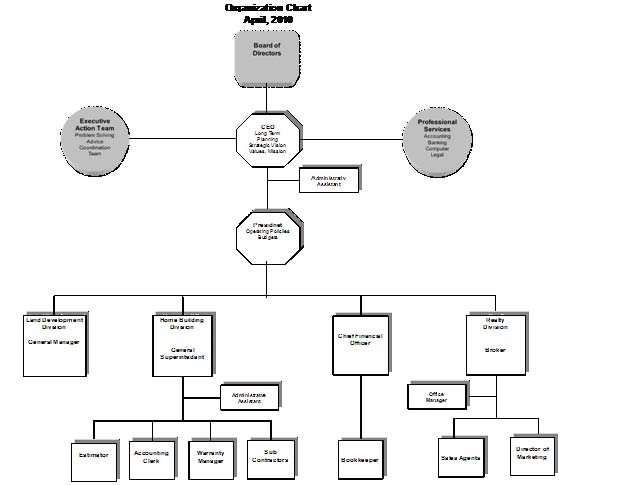

Our

corporate structure is as set forth in the following chart:

Our

executive offices are located at 100 Four Star Lane, Odenville Alabama, U.S.A.,

35120, and our telephone number is (205) 640-7821.

|

The

Issuer:

|

Four

Star Holdings, Inc.

|

|

Stock

Offered:

|

2,000,000

Common Stock

|

|

Offering

price:

|

$5.00

per share

|

|

Liquidation

Preference:

|

$5.00

per share

|

|

Dividends:

|

There

are no dividends at the time of this offering; however Management reserves

the right to declare such an action.

|

|

Optional

Conversion:

|

No

conversion is declared at this time

|

|

Voting

Rights:

|

The

Common Stock will vote, on pro-rata basis on an “as converted basis”,

based on the percentage of common stock.

|

| Adoption of Series A Super Preferred |

The

shares of such series shall be designated as the "Series A Super Preferred

Stock" and the number of shares initially constituting such series shall

be up to One Hundred (100) shares. The Series A Super Preferred

Stock shall be senior to the common stock and any other series or class of

the Company’s preferred stock. No conversion rights. Voting rights are if

at least one share of Series A Preferred Stock is issued and outstanding,

then the total aggregate issued shares of Series A Preferred Stock at any

given time, regardless of their number, shall have voting rights equal to

66.6% of the total number of shares of Common Stock, plus the total number

of shares of all other series of stock, issued and outstanding at the time

of any vote of shareholders.

|

|

Adoption

of Series B:

|

Dividend

Shares: The attributes of this class of stock has no redemption and will

be issued to investors/shareholders that will have the right to a dividend

on the profitability of certain business transactions the Company

completes. Authorized 20 million. The attributes are dividend only with no

redemption into common and nonvoting

|

| Adoption of Series C: |

Convertible

Preferred. The attributes are 2:1 conversion with 2 year redemption into

common. Authorized 100 million

|

| Adoption of Series D: |

This

Series of stock will be for the purpose of getting trading authorization

on foreign exchanges and the stock will be used for that specific foreign

exchange. Total authorized will be 100 million. No conversion into common,

this series of stock will have no voting rights, no redemption into common

and will not trade in the United States.

|

|

Prior

to Offering:

Common

Stock Outstanding:

|

22,234,228

shares

|

|

Assuming

distribution and

sale

of all common stock.

|

39,384,228

shares

|

|

Estimated

Proceeds:

|

Because

this is a self underwritten offering with no minimum, we may receive up to

$10,000,000, if all 2,000,000 shares offered are sold.

|

|

Risk

Factors:

|

See

“Risk Factors” and the other information in this prospectus for a

discussion of the factors you should consider before deciding to invest in

our securities.

|

|

Use

of Proceeds:

|

We

intend to use the net proceeds of this offering for general corporate

purposes, including working capital. See “Use of Proceeds” for

additional information.

|

An

investment in our securities involves a number of very significant risks. You

should carefully consider the following risks and uncertainties in addition to

other information in this prospectus in evaluating our Company and its business

before purchasing our securities. Our business, operating results and financial

condition could be seriously harmed due to any of the following

risks. The risks described below may not be all of the risks facing

our Company. Additional risks not presently known to us or that we currently

consider immaterial may also impair our business operations. You could lose all

or part of your investment due to any of these risks.

Traditional

banking institutions are currently not funding development

properties. Available funding is currently equity or debenture

financing. We could face a high risk of business failure due to these

factors.

Four Star

Holdings, Inc sells it properties under its subsidiary Four Star Realty,

LLC Management has been operating as officers and directors in

various real estate brokerage and development ventures since 1992. To date

Management has built over 1,100 single family homes, over 30 commercial

properties, and currently have two multifamily projects and one town home

complex under development.

In

December 2009 Management acquired majority control of a public company known as

Dragons Lair Holdings, Inc. which was founded in 2007. The result of that

transaction was the purchase of 74% of the Company’s common stock through a

Stock Purchase Agreement for the consideration of $325,000. This gave

authoritative control to Fran Mize, as President and Director and Bobby R.

Smith, Jr. its Chairman and CEO, The Company is headquartered in the Birmingham,

Alabama area.

The

banking industry, as a result of the Credit Crisis in the United States during

the last two years, has limited and in some cases discontinued funding in the

real estate development sector. Management’s solid foundation with

its lenders for over the past 15 years has enabled them to borrow over $200

million with a stellar performance in servicing this debt. However, even with

positive equity on the balance sheet Management’s primary lending institutions

shut down the majority of its available line of credit. This affected the

Company as it experienced slowed performance but did not stop the progress in

sales and/or production. This did however, trigger the Company’s interest in

going public to procure alternative financing for its expansion from other than

traditional bank financing methods.

Over the

past 18 months they have seen many of their Home Building Competitors dwindle

due to over leveraging and higher than normal carrying cost of inventory. The

Company’s conservative inventory levels have given it the ability to sell homes

at a better than average sale price compared to its competitors. To

make it possible for purchasers of some of the Company’s homes to obtain 100%

financing through Rural Housing Development loans, FHA-insured or VA-guaranteed

mortgages, the Company must construct these homes in compliance with regulations

promulgated by these agencies.

Today,

Birmingham ranks as one of the most important business centers in the nation and

is also home of one of the largest banking centers in the U.S. In addition, the

Birmingham area serves as headquarters to one Fortune 500 company: Regions

Financial and five Fortune 1000 companies.

If

we experience unfavorable publicity or consumer perception of our development,

our operating results could fluctuate and our reputation could be adversely

affected, resulting in decreased sales.

We are

highly dependent upon consumer activity in the purchase of new homes and the

ability of the consumer to obtain adequate bank financing.

If

there is a shortage in the supply of key building materials, or drastic price

increases our business could be adversely affected.

If the

prices were to increase or availability of building materials to decrease

significantly, or our sub-contractors and suppliers relationships are terminated

it greatly put The Company in a jeopardous situation.

Material

prices may increase in the future and we may not be able to recoup from such

increases to our customers. A significant increase in the price of

materials that cannot be passed on to customers could have a material adverse

effect on our results of operations and financial condition. In

addition, if we no longer are able to obtain key materials from one or more of

our suppliers on terms reasonable to us or at all, our revenues could

suffer.

If

we fail to compete effectively, our sales and growth prospects could be

adversely affected.

The

housing market is highly sensitive to the shortage of bank funding and

foreclosed homes in the competing target area. Certain of our competitors may

have significantly greater financial, technical and marketing resources than we

do. In addition, our competitors may be more effective and efficient in

introducing newly constructed homes to the market. We may not be able to compete

effectively, and any of the factors listed above may cause price reductions,

reduced margins and losses of our market share.

If

we incur material liability claims, our costs could increase and our reputation,

sales and operating income could be adversely affected.

As a

developer and direct marketer of our homes, we are subject to liability claims

if the use of our construction is alleged to have resulted in injury, loss of

property or if disclosure warnings concerning warranties are deemed

inadequate.

Currently,

we do have liability insurance, even though the same insurance may be carried by

our suppliers and sub-contractors to cover certain liability claims against us,

such as, our newly constructed homes could contain contaminants.

Because

new legislation, including the Sarbanes-Oxley Act of 2002, increases the cost of

compliance with federal securities regulations as well as the risks of liability

to officers and directors, we may find it more difficult for us to retain or

attract officers and directors.

The

Sarbanes-Oxley Act of 2002 was enacted in response to public concerns regarding

corporate accountability in connection with recent accounting scandals. The

stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility,

to provide for enhanced penalties for accounting and auditing improprieties at

publicly traded companies, and to protect investors by improving the accuracy

and reliability of corporate disclosures pursuant to the securities laws. The

Sarbanes-Oxley Act generally applies to all companies that file or are required

to file periodic reports with the Securities and Exchange Commission, under the

Securities Exchange Act of 1934, as amended. As a public company, we are

required to comply with the Sarbanes-Oxley Act of 2002 and it is costly to

remain in compliance with the federal securities

regulations. Additionally, we may be unable to attract and retain

qualified officers, directors and members of board committees required to

provide for our effective Management as a result of the Sarbanes-Oxley Act of

2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series

of rules and regulations by the SEC that increase responsibilities and

liabilities of directors and executive officers. The perceived increased

personal risk associated with these recent changes may make it more costly or

deter qualified individuals from accepting these roles. Significant costs

incurred as a result of becoming a public company could divert the use of

finances from our operations resulting in our inability to achieve

profitability.

We

may not receive enough capital from this offering to enable us to successfully

develop our properties and place newly constructed homes into the

marketplace, which means it could be difficult to continue operating our

business in a profitable manner.

We are

dependent on the availability of capital from this offering to proceed with our

plan to offer newly constructed homes to the marketplace. We are

selling the shares directly to the public without the use of a registered

broker/dealer firm. There is no minimum amount of shares which we have to sell

in this offering so we may not sell a sufficient number of shares to

successfully implement our business plan. We have no current arrangements with

respect to, or sources of additional capital, and there can be no assurance that

such additional capital will be available to us when needed. If we

are unable to obtain additional capital this could have a material adverse

effect on us.

Management

believes that we will require a minimum of $1,250,000 of available capital to

enter the marketplace with new construction. If such capital does not

become available from the proceeds of this offering or other such sources, we

cannot continue operations for the next 12 months from available cash on

hand. We have no commitments for additional capital as of the date of

this prospectus. Accordingly, investors are advised that the proceeds

of this offering may not be sufficient to enable us to maintain the existing

level of production and, if additional capital is not received within 12 months

from the date of this prospectus, we may have to curtail certain

operations.

We

have no arrangement or resources of additional capital and may have to curtail

certain operations if additional capital is not available when we need

it.

If we

succeed in our offering by 10%, we anticipate sales will generate sufficient

cash flow to support our operations for the next 24-30

months. However, this is based on our assumption of achieving

significant sales and there can be no assurance that such sales levels will be

achieved. Therefore, we may require additional financing through

loans and other arrangements, including the sale of additional common stock.

There can be no assurance that such additional financing will be available, or

if available, can be obtained on satisfactory terms. To the extent that any such

financing involves the sale of our equity securities, the interests of our then

existing shareholders, including the investors in this offering, could be

substantially diluted.

This

is a risky investment because there is no minimum number of shares that must be

sold in this offering.

Our

business is subject to changing consumer trends and preferences as well as bank

funding for new home buyers. Our failure to accurately predict or react to these

trends could negatively impact consumer opinion of us as a source for the latest

developments, which in turn could harm our customer interest in purchasing our

homes and cause us to lose market share. The success of our new home

construction depends upon a number of factors, including our ability

to:

|

•

|

anticipate

customer needs;

|

|

•

|

construct and

develop new types of homes;

|

|

•

|

successfully

build homes in a timely manner;

|

|

•

|

price

our homes and lots competitively;

|

|

•

|

construct

homes in sufficient volumes and in a timely manner

and

|

|

•

|

differentiate

our constructed homes from those of our

competitors.

|

If

a market for our common stock does not develop, shareholders may be unable to

sell their shares.

There is

presently no public market for our shares of common stock. There is no assurance

that a trading market will develop or be sustained. Accordingly, you may have to

hold the shares of common stock indefinitely and may have difficulty selling

them if an active trading market does not develop. However, our

shares of common stock may be limited in tradability on the Over-The-Counter

Bulletin Board, or, public market may not be consistent in price

and/or volume. To date we have not solicited any securities brokers

to become market makers of our common stock. If our common stock does

not develop or the market price of the common stock declines below the initial

public trading price, investors may not be able to re-sell the shares of our

common stock that they have purchased and may lose all of their

investment. The initial public trading price will be determined by

market makers independent of us.

If

shareholders sell a large number of shares all at once or in blocks after this

offering, the market price of our shares would most likely decline.

We are

offering 2,000,000 shares of our Common Stock, through this prospectus. Our

common stock is traded on the Over-the-counter-bulletin-board and our newly

appointed preferred stock is presently not traded on any market or securities

exchange, but should a market develop, shares sold at a price below the current

market price at which the common stock or preferred stock is trading will cause

that market price to decline. Moreover, the offer or sale of a large number of

shares at any price may cause the market price to fall. If all of the shares

offered in the offering are sold, the outstanding shares of common stock covered

by this prospectus will represent approximately 5% of the outstanding shares of

common stock as of the date of this prospectus.

Because

we will be subject to the “Penny Stock” rules once our shares are quoted on the

over-the-counter bulletin board, the level of trading activity in our shares of

common stock may be reduced.

Broker-dealer

practices in connection with transactions in “penny stocks” are regulated by

penny stock rules adopted by the Securities and Exchange Commission. Penny

stocks generally are equity securities with a price of less than $5.00 (other

than securities registered on some national securities exchanges or quoted on

Nasdaq). The penny stock rules require a broker-dealer, prior to a transaction

in a penny stock not otherwise exempt from the rules, to deliver a standardized

risk disclosure document that provides information about penny stocks and the

nature and level of risks in the penny stock market. The broker-dealer also must

provide the customer with current bid and offer quotations for the penny stock,

the compensation of the broker-dealer and its salesperson in the transaction,

and, if the broker-dealer is the sole market maker, the broker-dealer must

disclose this fact and the broker-dealers presumed control over the market, and

monthly account statements showing the market value of each penny stock held in

the customer's account. In addition, broker-dealers who sell these securities to

persons other than established customers and “accredited investors” must make a

special written determination that the penny stock is a suitable investment for

the purchaser and receive the purchaser's written agreement to the transaction.

Consequently, these requirements may have the effect of reducing the level of

trading activity, if any, in the secondary market for a security subject to the

penny stock rules, and investors in our common stock may find it difficult to

sell their shares.

If

our shares are quoted on the over-the-counter bulletin board, we will be

required to remain current in our filings with the SEC and our securities will

not be eligible for quotation if we are not current in our filings with the

SEC.

In the

event that our shares are quoted on the Over-The-Counter Bulletin Board, we will be required to

remain current in our filings with the Securities and Exchange Commission in

order for the shares of our common stock to be eligible for quotation on the

Over-The-Counter Bulletin Board. In the event that we become delinquent in our

required filings with the Securities and Exchange Commission, quotation of our

common stock will be terminated following a 30 or 60 day grace period if we do

not make our required filing during that time. If our shares are not eligible

for quotation on the Over-The-Counter Bulletin Board, investors in our common

stock may find it difficult to sell their shares.

State

blue sky laws may limit your ability to resell our stock.

The “blue

sky” laws of some states may impose restrictions upon the ability of investors

to resell our shares in those states without registration or an exemption from

the registration requirements. Accordingly, investors may have difficulty

selling our shares and should consider the secondary market for our shares to be

a limited one.

The

offering price of $5.00 per share is speculative.

The

offering price of $5.00 per share has been arbitrarily determined by our

Management and does not bear any relationship to the assets, net worth or actual

or projected earnings of the Company or any other generally accepted criteria of

value.

We

do not pay any cash dividends.

We have

not paid any cash dividends on our common stock nor do we presently contemplate

the payment of any cash dividends. Accordingly, there can be no

assurance that you will receive any return from an investment in our Common

Stock. In the absence of the payment of dividends, any return on your investment

would be realized only upon your sale of our stock. We are not making

any representations that an investment in our stock will be profitable or result

in a positive return.

FORWARD-LOOKING

STATEMENTS

This

prospectus includes forward-looking statements that reflect our expectations and

projections about our future results, performance, prospects and opportunities.

These statements can be identified by the fact that they do not relate strictly

to historical or current facts. We have tried to identify forward-looking

statements by using words such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “project,” “should,” “will,” “will be,”

“would” and similar expressions. Although we believe that our expectations are

based on reasonable assumptions, our actual results may differ materially from

those expressed in, or implied by, the forward-looking statements contained in

this prospectus as a result of various factors, including, but not limited to,

those described above under the heading "Risk Factors" and elsewhere in this

prospectus. Before you invest in the shares, you should read this prospectus

completely and with the understanding that our actual future results may be

materially different from what we expect.

Forward-looking

statements speak only as of the date of this prospectus. Except as expressly

required under the federal securities laws and the rules and regulations of the

SEC, we do not have any intention, and do not undertake, to update any

forward-looking statements to reflect events or circumstances arising after the

date of this prospectus, whether as a result of new information or future events

or otherwise. You should not place undue reliance on the forward-looking

statements included in this prospectus or that may be made elsewhere from time

to time by us, or on our behalf. All forward-looking statements attributable to

us are expressly qualified by these cautionary statements.

We

estimate that our net proceeds from the sale of the shares by us in this

offering will be up to a maximum of $10,000,000 if all 2,000,000 shares offered

by this prospectus are sold and, before deducting estimated offering

expenses.

Our

principal reasons for conducting this offering at this time are to raise capital

to expand our operations and construct new homes in our corporate owned

developments, develop our brand through increased advertising and marketing

programs, investing further resources into developing our corporate

infrastructure and hiring employees and consultants.

In

addition, although we are currently not committed to do so, we expect to spend

approximately $50,000 in the next 12 months to further develop our brand

through new advertising and marketing programs, and the remaining portion of the

offering proceeds for working capital and general corporate purposes, including

the costs associated with being a public company. We are also

conducting this offering to create a public market for our common stock, to

facilitate our access to the public equity markets and to obtain additional

capital.

If the

opportunity arises, we may use a portion of the net proceeds from this offering

designated for expansion of operations to acquire or invest in distressed

properties and distressed builders that have adequate assets. We are not

currently a party to any agreements or commitments and we have no current

understandings with respect to any acquisitions.

Except as

provided above, we cannot specify with certainty the particular uses for the net

proceeds to be received upon completion of this offering and, at the date

hereof, cannot accurately predict the amounts that we may spend for any

particular purpose. The amounts of our actual expenditures will be influenced by

several factors, including the timing and extent of our growth opportunities,

the amount of cash used by our operations and the occurrence of unforeseen

opportunities and events. Our Management team will have broad

discretion in determining the uses of the net proceeds of this

offering. Pending the use of the net proceeds, we intend to invest

the net proceeds in short-term, investment-grade, interest-bearing

instruments.

In

determining the offering price Management considered the valuation of property

on an Appraised Value “Discounted To A Single Purchaser” divided into the amount

of shares based on the Price Earnings Growth of future properties

rolled in and our business potential, and market valuation of

competing developers.

Our net

tangible book value as of March 31, 2010 was approximately $ 4,439,304 or $.20

per share of common stock. Net tangible book value per share represents total

tangible assets less total liabilities, divided by the number of shares of

common stock outstanding.

|

Public

offering price per share

|

5.00 | |||||||

|

Net

Tangible Book Value per share 3/31/2010

|

0.20 | |||||||

|

Increase

per share attributable to new investors

|

0.16 | |||||||

|

Adjusted

Net Tangible B/V after this offering

|

0.36 | |||||||

|

Dilution

per share to new investors

|

4.64 | |||||||

The

following table set forth as of March 31, 2010, on a pro forma as adjusted

basis, the differences between: (1) the number of shares of common stock

purchased from us, the total consideration paid and the average price per share

paid, in each case by existing shareholders, and (2) the number of shares

of common stock purchased from us, the total consideration paid and the average

price per share paid, in each case by investors purchasing shares in this

offering, based on the initial public offering price of $5.00 per share and

before deducting our estimated offering expenses:

|

Shares

Purchased

|

Total

Consideration

|

Average

Price

|

||||||||||||||||||

|

Number

|

Percent

|

Amount

|

Percent

|

Per

Share

|

||||||||||||||||

|

Existing

shareholders

|

22,234,228 | 91.75 | % | $ | 0 | 0 | % | 0 | ||||||||||||

|

New

investors

|

2,000,000 | 8.25 | % | $ | 10,000,000 | 100 | % | $ | 5.00 | |||||||||||

|

Total

|

24,234,228 | 100 | % | $ | 10,000,000 | 100 | % | $ | 5.00 | |||||||||||

We are

offering from time to time 2,000,000 shares of Common Stock (as per Unit) at a

price of $5.00 per share. We are offering the shares directly to the public

until such shares are sold, however, we may terminate the offering prior to that

date. There is no minimum amount of shares that must be sold before we use the

proceeds. Proceeds will not be returned to investors if we sell less

than all of the 2,000,000 shares being offered in this

prospectus. The proceeds from the sales of the shares will be paid

directly to us promptly following each sale and will not be placed in an escrow

account.

The

offering will be conducted by Bobby R. Smith, Jr., our Chairman, and Chief

Executive. Under Rule 3a 4-1 of the Securities Exchange Act an issuer

may conduct a direct offering of its securities without registration as a

broker/dealer. Such offering may be conducted by officers who perform

substantial duties for or on behalf of the issuer otherwise then in connection

with securities transactions and who were not brokers or dealers or associated

persons of brokers or dealers within the preceding 12 months and who have not

participated in selling an offering of securities for any issuer more than once

every 12 months, with certain exceptions.

Furthermore,

such persons may not be subject to a statutory disqualification under Section

3(a) (39) of the Securities Exchange Act and may not be compensated in

connection with securities offerings by payment of commission or other

remuneration based either directly or indirectly on transactions in securities

and are not at the time of offering of shares associated persons of a broker or

dealer. Mr. Smith will meet these requirements.

Subscriptions

for purchase of shares offered by this prospectus can be made by completing,

signing and delivering to us, the following:

|

·

|

an

executed copy of the Subscription Agreement;

and

|

|

·

|

A

check payable to the order of Four Star Holdings, Inc. in the amount of

$5.00 for each share you want to

purchase.

|

Resale

of our Shares

There is

presently no public market for our shares of common stock or preferred stock.

There is no assurance that a trading market will develop or be sustained.

Accordingly, you may have to hold the shares indefinitely and may have

difficulty selling them if an active trading market does not

develop.

Management’s

strategy is to seek to have our common stock, but not our preferred stock, trade

on the over-the-counter market and quoted on the over-the-counter bulletin board

as soon as practicable after the termination of this

offering. However, to date, we have not solicited any securities

brokers to become market makers of our common stock. There can be no

assurance that an active trading market for the common stock will develop or be

sustained or that the market price of the common stock will not decline below

the initial public trading price. The initial public trading price

will be determined by market makers independent of

us.

Even if a

market develops for our common stock you may have difficulty selling our shares

due to the operation of the SEC’s penny stock rules. These rules regulate

broker-dealer practices in connection with transactions in “penny

stocks.” These requirements may have the effect of reducing the level

of trading activity in the secondary market for our stock.

We are

registering the Common Stock for sale only in the states that are covered by

Blue Sky. The “blue sky” laws of some states may impose restrictions upon the

ability of investors to resell our shares in those states without registration

or an exemption from the registration requirements. Accordingly,

investors may have difficulty selling our shares and should consider the

secondary market for our shares to be a limited one.

General

Matters

As of

March 31, 2010, our authorized capital stock consisted of

100,000,000 shares of common stock, no par value, and on July 1, 2010

Management adopted the Articles of Incorporation the following;

Series A Super

Preferred- Designation of Series and Rank, The shares of such series

shall be designated as the "Series A Super Preferred Stock" and the number of

shares initially constituting such series shall be up to One Hundred (100) and

on April 1, 2010 the Board of directors adopted and issued 2 shares, one share

to Bobby R. Smith, Jr. and one share to Fran Mize.

The

Series A Super Preferred Stock shall be senior to the common stock and any other

series or class of the Company’s preferred stock with no conversion rights. The

price of said shares will be $10,000,000 per share. The voting rights are if at

least one share of Series A Preferred Stock is issued and outstanding, then the

total aggregate issued shares of Series A Preferred Stock at any given time,

regardless of their number, shall have voting rights equal to 66.6%-(2/3) of the

total number of shares of Common Stock, plus the total number of shares of all

other series of stock, issued and outstanding at the time of any vote of

shareholders.

Series B: Dividend Shares: The

attributes of this class of stock has no redemption and will be issued to

investors/shareholders that will have the right to a dividend on the

profitability of certain business transactions the Company completes. Authorized

20 million. The attributes are dividend only with no redemption into common and

nonvoting, none have been issued

Series

C: Convertible Preferred. The attributes are 2:1

conversion with 2 year redemption into common. Authorized 100 million and none

have been issued

Series D: This Series of stock

will be for the purpose of getting trading authorization on foreign exchanges

and the stock will be used for that specific foreign exchange. Total authorized

will be 100 million. No conversion into common, this series of stock will have

no voting rights, no redemption into common and will not trade in the United

States. None have been issued

As of

March 31, 2010, we had outstanding 22,234,228 shares of common stock and no

shares of preferred stock. As of March 31, 2010, we had fifteen (15)

shareholders of record and 25 shareholders who hold stock in Cede and

Company.

Upon the

closing of this offering, our authorized capital stock will consist of

500,000,100 shares of common stock, 39,384,228 of which will be outstanding on

the assumption that all 2,000,000 shares of Common Stock offered will be

sold.

The

following summary describes the material provisions of our capital stock. We

urge you to read our articles of incorporation and our bylaws, which are

included as Exhibits 3.1 and 3.2 to the registration statement of which this

prospectus forms a part.

Our

amended articles of incorporation and amended bylaws contain provisions that are

intended to enhance the likelihood of continuity and stability in the

composition of the board of directors and which may have the effect of delaying,

deferring or preventing a future takeover or change in control of our Company

unless the takeover or change in control is approved by our board of

directors.

These

provisions include elimination of the ability of shareholders to call special

meetings and advance notice procedures for special meetings of shareholder

proposals.

Common

Stock

Voting

rights

Each

holder of common stock is entitled to one vote for each share held on all

matters submitted to a vote of the shareholders. The holders of common stock do

not have cumulative voting rights in the election of directors. Accordingly, the

holders of a majority of the outstanding shares of common stock entitled to vote

in any election of directors may elect all of the directors standing for

election.

Dividends

The

holders of common stock are entitled to receive ratably such dividends as may be

declared by our board of directors out of funds legally available

therefore.

Other

rights

In the

event of a liquidation, dissolution or winding up of us, holders of our common

stock are entitled to share ratably in all assets remaining after payment of

liabilities and the liquidation preference, if any, of any then outstanding

preferred stock. Holders of our common stock are not entitled to preemptive

rights and have no subscription, redemption or conversion privileges. All

outstanding shares of common stock are, and all shares of common stock issued by

us in the offering will be, fully paid and nonassessable. The rights,

preferences and privileges of holders of common stock are subject to, and may be

adversely affected by, the rights of the holders of shares of any series of

preferred stock which our board of directors may designate and that we issue in

the future.

Preferred

Stock

Our board

of directors as of July 1, 2010 have authorized issuance of preferred stock in

one or more series, with such designations, preferences and relative

participating, optional or other special rights, qualifications, limitations or

restrictions as determined by our board of directors, without any further vote

or action by our shareholders. We believe that the board of directors’ authority

to set the terms of, and our ability to issue, preferred stock will provide

flexibility in connection with possible financing transactions in the future.

The issuance of preferred stock, however, could adversely affect the voting

power of holders of common stock and the likelihood that such holders will

receive dividend payments or payments upon a liquidation, dissolution or winding

up of the Company.

Description

of Common Stock

The

shares of Common Stock, when issued and sold in the manner contemplated by this

prospectus, will be duly and validly issued, fully paid and

non-assessable. The Common Stock is not subject to any sinking

fund.

Dividends

In the

event any dividend or other distribution payable in cash or other property

(other than shares of our Common Stock) is declared on our Common Stock, each

holder of shares of Common Stock on the record date for such dividend or

distribution shall be entitled to receive per share on the date of payment or

distribution of such dividend or other distribution the amount of cash or

property equal to the cash or property which would be received by the holders of

the number of shares of Common Stock into which such share of Common Stock would

be converted pursuant immediately prior to such record date.

Conversion

into Common Stock

In the

event of a conversion from preferred Series C shares, the holder may convert the

common stock at a conversion rate that is applicable to the attributes of said

preferred share. The holder of converted shares shall pay in

connection with a conversion all Transfer Agent costs. We will not make any

adjustment to the conversion price for accrued or unpaid dividends upon

conversion. We will not issue fractional shares of common stock upon conversion.

However, we will instead pay cash for each fractional share based upon the

market price of the common stock on the last business day prior to the

conversion date.

In order

to convert your shares of Preferred Stock, you must deliver your Preferred Stock

certificate to us at our office or to the office of the transfer agent for our

common stock along with a duly signed and completed notice of

conversion.

The

conversion date will be the date you deliver your Preferred Stock certificate

and the duly signed and completed notice of conversion to us or our transfer

agent. You will not be required to pay any U.S. federal, state or local issuance

taxes or duties or costs incurred by us on conversion, but will be required to

pay any tax or duty payable as a result of the common stock upon conversion

being issued other than in your name. We will not issue common stock

certificates unless all taxes and duties, if any, have been paid by the

holder.

In the

event of a conversion, the remuneration will be considered from time to time by

management and will be paid by majority vote. The following types of

transactions, among others, would be covered by this:

(1) We

consolidate or merge into any other company, or any merger of another company

into us, except for a merger that does not result in a reclassification,

conversion, exchange or cancellation of common stock,

(2) We

sell, transfer or lease all or substantially all of our assets and holders of

our common stock become entitled to receive other securities, cash or other

property, or

(3) We

undertake any compulsory share exchange.

Ranking

Series

Preferred A, then the Common Stock will rank, with respect to dividend rights

and upon liquidation winding up.

Liquidation

Preference

Upon any

voluntary or involuntary liquidation, dissolution or winding up of our Company

or a reduction or decrease in our capital stock resulting in a distribution of

assets to the holders of any class or series of our capital stock, each holder

of shares of Common Stock will be entitled to payment out of our assets

available for distribution of an amount equal to any strike price or market

price per share of the Common Stock held by that holder, plus all accumulated

and unpaid dividends on those shares to the date of that liquidation,

dissolution, winding up or reduction or decrease in capital stock, before any

distribution is made on any junior stock, including our common stock, but after

any distributions on any of our indebtedness or shares of our senior stock.

After payment in full of the liquidation preference and all accumulated and

unpaid dividends to which holders of shares of Common Stock are entitled, the

holders will not be entitled to any further participation in any distribution of

our assets. If, upon any voluntary or involuntary liquidation, dissolution or

winding up of our Company, or a reduction or decrease in our capital stock, the

amounts payable with respect to shares of Common Stock and all other parity

stock are not paid in full, the holders of shares of Common Stock and the

holders of the parity stock will share equally and ratably in any distribution

of our assets in proportion to the full liquidation preference and all

accumulated and unpaid dividends to which each such holder is

entitled.

Neither

the voluntary sale, conveyance, exchange or transfer, for cash, shares of stock,

securities or other consideration, of all or substantially all of our property

or assets nor the consolidation, merger or amalgamation of our Company with or

into any corporation or the consolidation, merger or amalgamation of any

corporation with or into our Company will be deemed to be a voluntary or

involuntary liquidation, dissolution or winding up of our Company or a reduction

or decrease in our capital stock.

Anti-Takeover

Effects of Our Articles of Incorporation, Our Bylaws and Florida

Law

Authorized

but unissued shares

The

authorized but unissued shares of our common stock and our preferred stock will

be available for future issuance without any further vote or action by our

shareholders. These additional shares may be utilized for a variety of corporate

purposes, including future public offerings to raise additional capital,

corporate acquisitions and employee benefit plans.

The

existence of authorized but unissued shares of our common stock and our

preferred stock could render more difficult or discourage an attempt to obtain

control over us by means of a proxy contest, tender offer or merger, or

otherwise.

Shareholder

action; advance notification of shareholder nominations and

proposals

Our

articles of incorporation and bylaws provide that any action required or

permitted to be taken by our shareholders will have to be effected at a duly

called annual or special meeting of shareholders and may be effected by consent

in writing. Our articles of incorporation also require that special meetings of

shareholders be called only by our board of directors, our Chairman, our Chief

Executive Officer or our President. In addition, our bylaws generally

provide that candidates for director may be nominated and other business brought

before an annual meeting only by the board of directors or by a shareholder who

gives written notice, including certain information, to us no later than

90 days and not earlier than 120 days, prior to the first anniversary

of the date on which we first mailed our proxy materials for the preceding

year's annual meeting of shareholders. These provisions may have the effect of

deterring hostile takeovers or delaying changes in control of our Management,

which could depress the market price of our common stock.

Number,

election and removal of the board of directors

Upon the

closing of the offering, our board of directors will consist of four directors.

Our articles of incorporation authorize a board of directors consisting of at

least four, but no more than eleven, members, with the number of directors to be

fixed from time to time by our board of directors. At each annual

meeting of shareholders, directors will be elected for a one-year term to

succeed the directors whose terms are then expiring. As a result, our board of

directors will be elected each year. Between shareholder meetings,

directors may be removed by our shareholders only for cause, and the board of

directors may appoint new directors to fill vacancies or newly created

directorships. These provisions may deter a shareholder from removing incumbent

directors and from simultaneously gaining control of the board of directors by

filling the resulting vacancies with its own nominees. Consequently, the

existence of these provisions may have the effect of deterring hostile

takeovers.

Florida

Anti-Takeover Law

We are

not subject to (i) the Florida Control Share Act, which generally provides that

shares acquired in excess of thresholds equaling 20%, 33% and more than 50% of a

corporation's voting power will not possess any voting rights unless such voting

rights are approved by a majority vote of the corporation's disinterested

shareholders, and (ii) the Florida Fair Price Act, which generally requires

approval by disinterested directors or supermajority approval by shareholders

for certain specified transactions between a corporation and a holder of more

than 10% of the outstanding shares of the corporation (or its

affiliates).

No expert

or counsel named in this prospectus as having prepared or certified any part of

this prospectus or having given an opinion upon the validity of the securities

being registered or upon other legal matters in connection with the registration

or offering of the common stock offered hereby was employed on a contingency

basis, or had, or is to receive, in connection with such offering, a substantial

interest, direct or indirect, in the Company, nor was any such person connected

with the Company as a promoter, managing or principal underwriter, voting

trustee, director, officer, or employee.

We were

incorporated on October 4, 2007 under the laws of the State of

Florida.

The

Company operates in four segments, Land Development, Structural Community

Planning, Homebuilding, and Realty Brokerage Services. Four Star Holdings, Inc

sells it properties under its subsidiary, Four Star Realty,

LLC. Management has been operating as officers and directors in

various real estate brokerage and land development ventures since 1992. As our

financials indicate as March 31, 2010 we have no going concern

issues.

Our

principal offices are located at 100 Four Star Lane, Odenville, Alabama,

35120.

Our

fiscal year end is December 31.

The

Company operates in four segments, Land Development, Structural Community

Planning, Homebuilding, and Realty Brokerage Services. Four Star Holdings, Inc

sells it properties under its subsidiary, Four Star Realty,

LLC. Management has been operating as officers and directors in

various real estate brokerage and land development ventures since 1992. To date

Management has built over 1,100 single family homes, over 30 commercial

properties, and currently have two multifamily projects and one town home

complex under development.

In

December 2009 Management acquired majority control of a public company known as

Dragons Lair Holdings, Inc. which was founded in 2007. The result of that

transaction was the purchase of 74% of the Company’s common stock through a

Stock Purchase Agreement for the consideration of $325,000. This gave

authoritative control to Fran Mize, as President and Director and Bobby R.

Smith, Jr. its Chairman and CEO.

The

banking industry, as a result of the Credit Crisis in the United States during

the last two years, has limited and in some cases discontinued funding in the

real estate development sector. Management’s solid foundation with

its lenders for over the past 15 years has enabled them to borrow over $200

million with a stellar performance in servicing this debt. However, even with

positive equity on the balance sheet Management’s primary lending institutions

shut down the majority of its available line of credit. This affected the

Company as it experienced slowed performance but did not stop the progress in

sales and/or production. This did however, trigger the Company’s interest in

going public to procure alternative financing for its expansion from other than

traditional bank financing methods.

Alabama

ranks low for the percentage of homeowners who owe more on their mortgages that

their house is worth. The negative equity mortgages are below 7% of the entire

state total mortgage portfolio.

|

The

top 5 states are: Top States Negative Equity Mortgages

|

By

Percentage

|

|

Nevada

|

48%

|

|

Florida

|

39%

|

|

Arizona

|

29%

|

|

California

|

27%

|

Markets

indicated show that Birmingham’s real estate brokerage firms are

reporting that the city’s housing market has not experienced peaks and valleys

compared to the rest of the country, primarily due to the state builders

conservative approach to housing starts and relatively low inventory levels,

meaning that new home construction is not implemented until there are identified

buyers.

The

National Home Builders Association reported that the hard hit areas were the

Sunbelt/coastal states which disrupted the real estate boom. During the subprime

crisis, Birmingham home pricing experienced a moderate decrease of 5% to an

average home price of $145,000, reported on May 14, 2009. However, ahead of the

rest of the country, Birmingham recorded an early recovery in the onset of

October 2009 with area home sales rising 13% and stabilizing.

Metropolitan

Birmingham has consistently been rated as one of America's best places to work

and earn a living based on the area's competitive salary rates and relatively

low cost of living expenses. One 2006 study published at Salary.com determined

that Birmingham was second in the nation for building personal net worth, based

on local salary rates, living expenses, and unemployment rates.

The

Top 5

Fastest Growing Markets For Real Estate according to Money Magazine;

reports that despite a poor real estate market and the housing crisis certain

markets are expected to show price gains in the following months and

years. These cities and towns have been virtually uninjured by the

economy, seemingly immune to the foreclosures that have plagued the rest of the

nation. Multifamily Starts dramatically on the rise in Birmingham, compared to

the rest of the country.

|

1.)

McAllen, TX

12-month

forecast: 4%

Median

home price: $109,000

One

year price change: 2.1%

Five

year price change: 23.3%

Change

in foreclosure rate: 23%

|

2.)

Rochester, NY

12-month

forecast: 2.7%

Median

home price: $121,000

One

year price change: 3.4%

Five

year price change: 20.1%

Change

in foreclosure rate: 5%

|

|

3.)

Birmingham, AL

12-month

forecast: 2.7%

Median

home price: $156,000

One

year price change: 2.9%

Five

year price change: 29.4%

Change

in foreclosure rate: 20%

|

4.)

Syracuse, NY

12-month

forecast: 2.6%

Median

home price: $126,000

One

year price change: 0.8%

Five

year price change: 29.5%

Change

in foreclosure rate: 27%

|

|

5.)

Buffalo/Niagara Falls, NY

12-month

forecast: 2.4%

Median

home price: $105,000

One

year price change: 1.6%

Five

year price change: 24.5%

Change

in foreclosure rate: 14%

|

Source: Real

Estate Opportunity

Housing

Market

Real

Estate News

May

2009

|

On

January 7, 2010 Chief Economist Dr. David Crowe of the National Association of

Home Builders, stated in his report the real GDP Growth for Birmingham

experienced growth of negative 5% in the 3rd

quarter of 2009 to an increase of positive growth of 5%, in the 4th

quarter of 2009, making Birmingham housing market the 3rd

fastest growth in the country.