Attached files

| file | filename |

|---|---|

| EX-16 - Alpine Alpha 2, Ltd. | ex16.htm |

| EX-4.1 - Alpine Alpha 2, Ltd. | ex4-1.htm |

| EX-4.2 - Alpine Alpha 2, Ltd. | ex4-2.htm |

| EX-10.4 - Alpine Alpha 2, Ltd. | ex10-4.htm |

| EX-10.2 - Alpine Alpha 2, Ltd. | ex10-2.htm |

| EX-10.6 - Alpine Alpha 2, Ltd. | ex10-6.htm |

| EX-10.5 - Alpine Alpha 2, Ltd. | ex10-5.htm |

| EX-10.3 - Alpine Alpha 2, Ltd. | ex10-3.htm |

| EX-10.1 - Alpine Alpha 2, Ltd. | ex10-1.htm |

| EX-10.7 - Alpine Alpha 2, Ltd. | ex10-7.htm |

| EX-21.1 - Alpine Alpha 2, Ltd. | ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 6, 2010

Alpine Alpha 2, Ltd.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

000-53399

|

75-3264749

|

||

|

(State or Other Jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

||

|

of Incorporation)

|

Identification No.)

|

|

China Merchants Tower, Suite 1503

161 Lujiazui East Road, Shanghai PRC 20001

|

|

(Address of Principal Executive Offices)

|

Registrant's telephone number, including area code: 011-86-21 5876 5017

|

PO Box 735, Alpine, New Jersey 07620

|

(Former name or former address if changed since the last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

TABLE OF CONTENTS

|

Item No.

|

Description of Item

|

Page No.

|

||

|

Item 1.01

|

Entry Into a Material Definitive Agreement

|

4 | ||

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

7 | ||

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

61 | ||

|

Item 4.01

|

Changes in Registrant’s Certifying Accountant

|

62 | ||

|

Item 5.01

|

Changes in Control of Registrant

|

62 | ||

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

63 | ||

|

Item 5.03

|

Amendments to Articles of Incorporation or By Laws; Change in Fiscal Year

|

63 | ||

|

Item 5.06

|

Change in Shell Company Status

|

63 | ||

|

Item 9.01

|

Financial Statements and Exhibits

|

63 |

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report on Form 8-K (the “Report”) contains some forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements include statements regarding, among other things, (a) our projected sales, profitability and cash flows, (b) our growth strategies, (c) anticipated trends in our industries, (d) our future financing plans and (e) our anticipated needs for working capital. They are generally identifiable by use of the words "may," "will," "should," "anticipate," "estimate," "plans," "potential," "projects," "continuing," "ongoing," "expects," "management believes," "we believe," "we intend" or the negative of these words or other variations on these words or comparable terminology. These statements may be found under "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business," as well as in this Report generally. In particular, these include statements relating to future actions, prospective product approvals, future performance or results of current and anticipated sales efforts, expenses, the outcome of contingencies such as legal proceedings, and financial results.

Any or all of our forward-looking statements in this Report may turn out to be inaccurate, as a result of inaccurate assumptions we might make or known or unknown risks or uncertainties. Therefore, although we believe that these statements are based upon reasonable assumptions, including projections of operating margins, earnings, cash flows, working capital, capital expenditures and other projections, no forward-looking statement can be guaranteed. Our forward-looking statements are not guarantees of future performance, and actual results or developments may differ materially from the expectations they express. You should not place undue reliance on these forward-looking statements.

Information regarding market and industry statistics contained in this Report is included based on information available to us which we believe is accurate. We have not reviewed or included data from all sources, and cannot assure stockholders of the accuracy or completeness of this data. Forecasts and other forward-looking information obtained from these sources are subject to these qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services.

These statements also represent our estimates and assumptions only as of the date that they were made and we expressly disclaim any duty to provide updates to them or the estimates and assumptions associated with them after the date of this filing to reflect events or changes in circumstances or changes in expectations or the occurrence of anticipated events.

We undertake no obligation to publicly update any predictive statement in this Report, whether as a result of new information, future events or otherwise. You are advised, however, to consult any additional disclosures we make in reports we file with the SEC on Form 10-K, Form 10-Q and Form 8-K.

Use of Defined Terms

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to "yuan" or "RMB" are to the Chinese yuan, which is also known as the renminbi. According to the currency exchange website www.xe.com, on July 8, 2010, $1.00 was equivalent to 6.7755 RMB.

References in this Report to the “PRC” or “China” are to the People’s Republic of China.

References to “Common Stock” are to the Company’s common stock, par value $0.001 per share.

References to “the Company”, “we” or “us” are to Alpine Alpha 2, Ltd., a Delaware corporation.

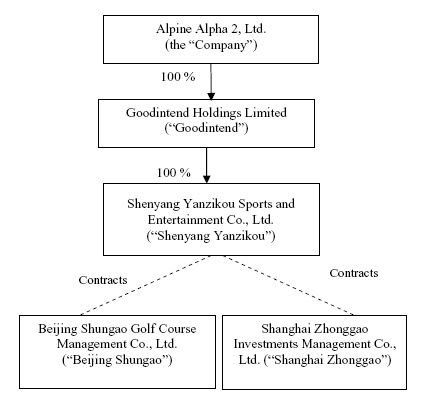

References to “Goodintend” are to Goodintend Holdings Limited, a British Virgin Islands company that is wholly owned by the Company.

3

References to “Shenyang Yanzikou” or “WFOE” are to Shenyang Yanzikou Sports and Entertainment Co., Ltd., a PRC company that is 100% owned by Goodintend.

References to “Beijing Shungao” are to Beijing Shungao Golf Course Management Co., Ltd., a PRC company that we control through a number of contractual arrangements.

References to “Shanghai Zhonggao” are to Shanghai Zhonggao Investments Management Co., Ltd., a PRC company that we control through a number of contractual arrangements.

References to “BPMT” are to Beijing Production Materials Trading Co., Ltd., a PRC company that we intend to acquire a majority interest in.

References to “Top Elect” are to Top Elect Investments Limited, a British Virgin Islands company, which prior to the Share Exchange Transaction described in Item 1.01 herein was the owner of 51.5% of Goodintend.

References to “Securities Act” are to the Securities Act of 1933, as amended.

References to “Exchange Act” are to the Securities Exchange Act of 1934, as amended.

Unless otherwise specified or required by context, references to “we,” “our” and “us” refer collectively to (i) Alpine Alpha 2, Ltd., (ii) Goodintend Holdings Limited, (iii) Shenyang Yanzikou Sports and Entertainment Co., Ltd., (iv) Beijing Shungao Golf Course Management Co., Ltd. and (v) Shanghai Zhonggao Investment and Management Co., Ltd.

Explanatory Note

This current report on Form 8-K is being filed by Alpine Alpha 2, Ltd. (“we,” “us” or the “Company”) in connection with a reverse merger transaction which closed on July 6, 2010, through which we acquired control of Beijing Shungao and Shanghai Zhonggao, operating companies based in the PRC.

This Report describes the transactions, the agreements through which such transactions were executed; the nature of the business we now conduct through Beijing Shungao and Shanghai Zhonggao, our newly-acquired PRC based operating companies.

Through the transactions described in Items 1.01 herein, we ceased to be a shell company as that term is defined in Rule 12b-2 under the Exchange Act and are now engaged in the design and construction of golf courses in the PRC.

Item 1.01. Entry into a Material Definitive Agreement

Background

In the share exchange or “reverse merger” (hereinafter referred to as the “Share Exchange Transaction” or the “Reverse Merger”) we acquired control of Goodintend Holdings Limited (“Goodintend”), a British Virgin Islands company, by issuing to the stockholders of Goodintend an aggregate of 24,737,500 shares of our Common Stock in exchange for all of the outstanding capital stock of Goodintend.

Goodintend is owner of all of the registered capital of Shenyang Yanzikou, a wholly foreign owned PRC company. Shenyang Yanzikou controls Beijing Shungao and Shanghai Zhonggao, two companies that are incorporated in the PRC, through a series of contractual arrangements described in Item 2.01 herein. Beijing Shungao and Shanghai Zhonggao are each engaged in the design and construction of golf courses in the PRC.

4

Top Elect Investments Limited (“Top Elect”), a British Virgin Islands company, was the owner of 51.5% of the outstanding shares of Goodintend immediately prior to the consummation of the Share Exchange Transaction. Mr. Ye Bi, our Chief Executive Officer, is the sole director and the owner of 66.95% of Top Elect. The Goodintend stockholders with whom we completed the Share Exchange are as set forth in the Share Exchange Agreement.

Immediately prior to the Share Exchange Transaction, Goodintend stockholders purchased 96.5% of the Company’s outstanding common stock held by the then controlling stockholder, Alpine Venture Associates, LLC, in exchange for $300,000, 150,599 shares of Common Stock and warrants to purchase 142,935 shares of Common Stock. At the same time, Mr. James Hahn agreed to resign as the sole officer and director of the Company and appointed the individuals set forth in the table below as our officers and directors prior to his resignation. The appointment of new officers was effective upon the closing of the Reverse Merger. The appointment of new directors will be effective ten days after the mailing of the Company’s information statement on Schedule 14f-1 filed with the SEC on July 2, 2010.

|

Name

|

Position

|

|

|

Ye Bi

|

Chief Executive Officer and Chairman of Board of Directors

|

|

|

Zhuangyan Zou

|

Chief Financial Officer

|

|

|

Jingtong Chen

|

Director

|

|

|

Bowu Xiao

|

Director

|

Our current structure, immediately after the Share Exchange Transaction, is set forth in the diagram below:

5

On December 17, 2009, Goodintend completed a financing transaction in which it raised gross proceeds of $800,000 through a private placement of convertible promissory notes to certain accredited investors (the “December 2009 Financing”). All notes issued in connection with the December 2009 Financing were automatically converted into an aggregate of 4,000,000 shares of Common Stock upon the closing of Reverse Merger, reflecting a conversion price of $0.20 per share. The December 2009 Financing was exempt from the registration requirements of Section 4(2) of the Act as a result of our compliance with Rule 506 of Regulation D promulgated under the Act.

Share Exchange Transaction

The agreements through which the Share Exchange Transaction was carried out are described in detail below.

Share Exchange Agreement

On July 6, 2010, we entered into a share exchange agreement with the owners of all of the outstanding shares of Goodintend (the “Share Exchange Agreement”), pursuant to which we issued and delivered to the Goodintend stockholders a total of 24,737,500 shares of our Common Stock in exchange for all of the outstanding ordinary shares of Goodintend (hereinafter the “Share Exchange Transaction” or the “Reverse Merger”). As a result of the Share Exchange Transaction, Goodintend became our wholly-owned subsidiary, and the Goodintend stockholders became holders of 24,737,500 shares of our Common Stock, representing 82.12% of our then outstanding Common Stock. When we acquired direct control of Goodintend in the Reverse Merger, we acquired indirect control over two PRC-based operating companies both engaged in the design and construction of golf courses in China, namely Beijing Shungao and Shanghai Zhonggao. Beijing Yankizou and Shanghai Zhonggao are controlled by Shenyang Yankizou, the wholly-owned subsidiary of Goodintend, through a series of contractual arrangements as described below in Item 2.01of this Report.

As a result, at the closing of the Share Exchange Transaction, we ceased to be a shell company as that term is defined in Rule 12b-2 under the Exchange Act. We describe our new operating companies below in Item 2.01 of this Report.

A copy of the Share Exchange Agreement is filed herewith as Exhibit 10.1 to this Report.

Holdback Escrow Agreement

Under the terms of the Share Exchange Agreement, 1,537,500 shares out of the 24,737,500 shares of Common Stock issued were pledged by certain Goodintend Stockholders and held back in an escrow account (the “Holdback Shares”). Therefore, on July 6, 2010, the Company, Goodintend and certain Goodintend stockholders also entered into a holdback escrow agreement simultaneously with the Share Exchange Transaction (the “Holdback Escrow Agreement”). Both the Share Exchange Agreement and the Holdback Escrow Agreement provide that if the Company’s after tax net income as computed in accordance with United States generally accepted accounting principles (“GAAP”) for fiscal year 2010 is equal to or greater than 150% of the Make Good Target, as defined immediately below, for fiscal year 2010, a total of 768,750 shares will be released to certain Goodintend Stockholders. If the Company’s after tax net income for fiscal year 2011 under GAAP is equal to or greater than 150% of the Make Good Target for fiscal year 2011, the remaining 768,750 shares held in escrow will be released to certain Goodintend stockholders. In the event the Company’s after tax net income is less than the targeted income in the applicable fiscal year, the Holdback Shares of the applicable fiscal year will be canceled. The term Make Good Target for each applicable year, under the Share Exchange Agreement and the Holdback Escrow Agreement, means the targeted net income set forth in the applicable fiscal year prescribed in the transaction documents that are to be entered into in connection with the Company’s first offering of its securities after the Reverse Merger

A copy of the Holdback Escrow Agreement is filed herewith as Exhibit 10.2 to this Report.

6

December 2009 Financing

The agreements executed in connection with the December 2009 Financing are described in detail below.

Note Purchase Agreement and Amendments

Under a note purchase agreement dated as of December 17, 2009 (as amended on December 23, 2009, March 31, 2010 and June 30, 2010) (the “Note Purchase Agreement”), for aggregate proceeds of $800,000, Goodintend issued convertible promissory notes in the principal amount of $520,000 to a number of accredited investors on December 17, 2009 (“Tranche A,” the notes issued therein are referred to as the “Tranche A Notes”). Pursuant to the Note Purchase Agreement, another tranche of convertible promissory notes in the principal amount of $280,000 were supposed to issue upon the closing of the Reverse Merger (the “Tranche B Notes”).

The Note Purchase Agreement contains representations, warranties and covenants which are customary for transactions of this nature.

A copy of the Note Purchase Agreement is attached to this Report as Exhibit 10.3. Copies of Amendment No.1, Amendment No.2 and Amendment No.3 to the Note Purchase Agreement, dated December 23, 2009, March 31, 2010 and June 30, 2010, respectively, are filed herewith as Exhibit 10.4, Exhibit 10.5 and Exhibit 10.6. A form of the Tranche A Notes is filed herewith as Exhibit 4.1 to this Report.

On July 6, 2010, simultaneously with the closing of the Reverse Merger, Tranche A Notes, together with Tranche B Notes (as if such Tranche B Notes had been issued), were automatically converted into an aggregate of 4,000,000 shares of our Common Stock upon the closing of the Reverse Merger, reflecting a conversion price of $0.20 per share. The Company is required to use its commercially reasonable efforts to register such 4,000,000 shares of Common Stock for resale under the Securities Act of 1933.

Item 2.01 Completion of Acquisition or Disposition of Assets.

As a result of the Reverse Merger described in Item 1.01 above, which was completed on July 6, 2010, we became the parent company of Goodintend and the indirect parent of Goodintend’s wholly-owned subsidiary, Shenyang Yankizou. Shenyang Yankizou is a wholly-foreign owned entity, or WFOE, under PRC law and controls Beijing Shungao and Shanghai Zhonggao through a series of contractual arrangements described below. Beijing Shungao and Shanghai Zhonggao are each engaged in the business of designing and constructing golf courses in the PRC.

As a result of the Reverse Merger, we ceased being a shell company under the definition of Rule 12b-2 of the Exchange Act.

OUR ORGANIZATIONAL HISTORY

Organizational History of the Company

The Company was incorporated on October 29, 2007 under the laws of the State of Delaware. It was formed for the purpose of seeking a merger, acquisition or other business combination transaction with a privately owned entity seeking to become a publicly-owned entity. On August 8, 2008, the Company voluntarily filed a registration statement on Form 10 to register its common stock under Section 12(g) of the Securities Exchange Act of 1934 (the “Exchange Act”) and thus became a reporting company.

Prior to the Reverse Merger, the Company had no operations or substantial assets. Accordingly, the Company was then deemed to be a "blank check" or shell company, that is, a development-stage company that has no specific business plan or purpose or has indicated that its business plan is to engage in a merger or other acquisition with an unidentified company or companies, or other entity or person.

7

Pursuant to a letter of intent dated as of December 21, 2009, between Goodintend and Alpine Venture Associates, LLC, then controlling shareholder of the Company (the “Letter of Intent”), Goodintend stockholders purchased from Alpine Venture Associates, LLC 96.5% of our Common Stock then outstanding for $300,000 in cash, 150,599 shares of Common Stock and warrants to purchase 142,935 shares of Common Stock. A form of the warrant is filed herewith as Exhibit 4.2 to this Report. Mr. Hahn appointed the following individuals as the new directors and officers, and immediately thereafter resigned himself as a director and officer.

|

Name

|

Title

|

|

|

Ye BI

|

Chief Executive Officer and Chairman of the Board of Directors

|

|

|

Zhuangyan ZOU

|

Chief Financial Officer

|

|

|

Jingtong CHEN

|

Director

|

|

|

Bowu XIAO

|

Director

|

On July 2, 2010, we filed an information statement on Schedule 14f-1 relating to the change in control in our board of directors.

Organizational History of Goodintend

Goodintend is a holding company which was incorporated in the British Virgin Islands on May 9, 2008. Prior to the Reverse Merger, Top Elect, which was incorporated in the British Virgin Islands on March 23, 2009, owned 51.51% of the outstanding ordinary shares of Goodintend. Mr. Bi Ye, our Chief Executive Officer, owns 66.95% of Top Elect.

As a result of the Reverser Merger, all of the shares of Goodintend are held by us and Goodintend is our wholly-owned subsidiary.

Organizational History of Shenyang Yanzikou, Beijing Shungao and Shanghai Zhounggao

Shenyang Yanzikou Sports and Entertainment Co., Ltd. (“Shenyang Yanzikou”) was incorporated as a wholly foreign-owned enterprise on November 20, 2008 under the laws of the PRC. Goodintend owns a 100% ownership interest of Shenyang Yanzikou.

Beijing Shungao was incorporated as a limited company on October 8, 2006 under the laws of the PRC and is solely owned by Bowu Xiao, one of our directors. Mr. Xiao is also currently acting executive director of Beijing Shungao.

Through a series of agreements entered into on September 25, 2009 between Shenyang Yanzikou and Beijing Shungao and its shareholders (the “Shungao Contractual Arrangements”), Beijing Shungao is now a variable interest entity wholly controlled by Shenyang Yanzikou.

The Shungao Contractual Arrangements consist of:

8

|

·

|

a Consulting Services Agreement, through which Shenyang Yanzikou has the right to advise, consult, manage and operate Beijing Shungao and collect and retain all income, and the obligation to bear all losses of Shungao, if any;

|

|

·

|

an Operating Agreement, through which Shenyang Yanzikou has the right to appoint director candidates and appoint the senior executives of Beijing Shungao; and the shareholders of Beijing Shungao have vested their voting control over Beijing Shungao to Shenyang Yanzikou;

|

|

·

|

an Equity Disposal Agreement, under which the shareholders of Beijing Shungao have granted the Shenyang Yanzikou the irrevocable right and option to acquire all of its equity interests in the Operating Company;

|

|

·

|

an Equity Pledge Agreement, under which the shareholders of Beijing Shungao have pledged all of their right, title and interest in Beijing Shungao to Shenyang Yanzikou to guarantee Beijing Shungao’s performance of their respective obligations under the Consulting Services Agreement, Operating Agreement and Equity Disposal Agreement.

|

Shanghai Zhonggao was incorporated as a limited liability company on May 21, 2010 under the laws of the PRC and is solely owned by Zhen Bi, the sister of Ye Bi, our Chief Executive Officer. On June 20, 2010, Shenyang Yanzikou, Shanghai Zhonggao and Zhen Bi entered into a series of agreements, pursuant to which Shenyang Yanzikou assumed the control over Shanghai Zhonggao and Shanghai Zhonggao became a variable interest entity of Shenyang Yanzikou (“Zhonggao Contractual Arrangements”).

The Zhonggao Contractual Arrangements consist of:

|

·

|

a Consulting Services Agreement, through which Shenyang Yanzikou has the right to advise, consult, manage and operate Shanghai Zhonggao and collect and retain all income, and the obligation to bear all losses from Zhonggao, if any;

|

|

·

|

an Operating Agreement, through which Shenyang Yanzikou has the right to appoint director candidates and appoint the senior executives of Shanghai Zhonggao and the shareholders of Shanghai Zhonggao have vested their voting control over Shanghai Zhonggao to Shenyang Yanzikou;

|

|

·

|

an Equity Disposal Agreement, under which the shareholders of Shanghai Zhonggao have granted the Shenyang Yanzikou the irrevocable right and option to acquire all of its equity interests in the Operating Company;

|

|

·

|

An Equity Pledge Agreement, under which Zhen Bi has pledged all her rights, title and interest in Shanghai Zhonggao to Shenyang Yanzikou to guarantee Shanghai Zhonggao’s performance of its obligations under the Consulting Services Agreement, Operating Agreement and Equity Disposal Agreement.

|

OUR BUSINESS

Overview

We design, construct and develop premium golf courses and golf communities in the PRC through our PRC based operating companies Beijing Shungao Golf Course Management Co., Ltd. (“Beijing Shungao”) and Shanghai Zhonggao Investments Management Co., Ltd. (“Shanghai Zhonggao”). We offer a full spectrum of golf course development and management services, including design, engineering, construction, and maintenance of golf courses as well as consulting and management of golf projects. Currently, we principally act as an independent contractor for various parts of golf projects, and we plan to develop and manage our own golf courses and communities in a near future through our proposed business model as described below.

9

Golf Course Design

We have a crew of 3 experienced architects that work closely with our clients. Our design expertise enables us to provide conceptual design services that align the function, scope, cost and schedule of a project with the client’s objectives in order to optimize project success. Aside from the general mapping and planning for a golf course, our design team also provides the following services involved in a golf project: project feasibility studies, project development planning, technology evaluation, risk management assessment, constructability reviews, assets optimization and 3-D modeling virtual golf course display. Our design approach is hands-on and detailed and therefore, our golf courses routing is usually worked and reworked in order to form a synthesis with the client site’s environmental sensitivity, local design requirements and the overall project parameters set forth by our clients.

Golf Course Construction and Maintenance

We act as a primary contractor on most of the golf course construction projects that we undertake. We usually complete our projects relying on our own construction crew; however, we sometimes subcontract certain parts, such as electrical and mechanical work. As the primary contractor, we are liable for subcontracted work. We have approximately 14 construction employees on the staff that execute the design and planning with a precise understanding and interpretation of the vision of our design team. Our services for golf course construction and renovation include, among other things, land clearing, bulk excavation, drainage, irrigation and the shaping and contouring of each hole.

Through our operations in the past four years, we have developed significant expertise and established an excellent reputation in the golf design and construction industry in China. We are often responsible for constructing projects in geographically or climatically challenging areas. We believe that our technical knowledge and state-of-the-art equipment enables us to build safe, beautiful and challenging courses in various types of terrain. In addition, we are frequently designated as manager for the construction of projects with multi-location club facilities, which usually require coordination of complex phases in a single project or large-scale investments in club facilities. Our design and construction contracts are obtained primarily through competitive bidding process or intense negotiation with our clients. Bidding for a golf project is usually affected by factors such as the bidder’s reputation, available personnel, current utilization of equipment and other resources, the bidder’s ability to fund the project and competing bids. With our eco-friendly design, construction expertise, strong financial position and consistent quality performance in past projects, we are often named to serve as the primary contractor in a bid project.

For our golf course maintenance services, we deliver technical support and management skills to clients on-site at their facilities, where we review, among other things, our clients’ drainage, turf, irrigation systems, soils and hazards. We focus on routine and turnaround maintenance services, general maintenance and asset management, and restorative, repair, predictive and prevention services.

Golf Course Project Management

Project management is required on every project for which we are designated as the primary contractor responsible for all aspects of a project to ensure the project is on schedule and within budget. Specifically, our project management involves designing project master plans, establishing specifications such as detailed schedules and cost estimates, as well as project progress tracking, monitoring, reviewing, reporting, and the coordination among design, engineering and construction teams.

Our Completed Projects

Since the formation of Beijing Shungao in 2006, we have completed over ten golf courses in China, including Shenyang Meteorite Mountain Golf Course and Shenyang Jiangnan Metropolitan Golf Course, both of which are located in the Shenyang. Currently, we do not own or operate any golf courses in the PRC. The following table highlights the major golf course projects that we have acted as a design or construction contractor as of June 30, 2010:

10

|

Project Name

|

Project Initiation Date

|

Project Completion Date

|

Acted as

|

Remarks

|

|

Qinhuangdao Gold Coast Beach Golf Club

|

May, 2006

|

2007

|

Constructor

|

18 holes, 72 pars and 7253 yards in Changli county, constructed 9 holes with total investment RMB 75 million;

|

|

Shenyang Jiangnan Metropolitan Golf Course

|

Design:

March 2006

Construction: September 2006

|

October 2008

|

Designer and Constructor

|

A course with 18 holes, 63 pars and 6700 yards in Shenyang City of Liaoning Province, with a total investment of RMB 60 million.

|

|

Shenyang Meteorite Mountain Golf Course

|

Design:

January 2007

Construction: April 2007

|

May 2009

|

Designer and Constructor

|

A course with 27 holes, 72 pars and 7266 yards in Shenyang City of Liaoning Province, with a total investment of RMB 150 million.

|

|

Guangxi North Sea Crown Ridge Golf Course

|

April 2007

|

July 2007

|

Designer

|

A course with 18 holes, 7,076 yards located in Beihai city of Guangxi Province, with a total investment of RMB 70 million.

|

|

Zhanjiang East Coast Golf Course

|

February 2009

|

April 2009

|

Designer

|

A course with 18 holes, 72 pars and 7,223 yards in Zhanjiang City of Guangdong Province, with a total investment of RMB 85 million.

|

|

Zhejiang Jinhua Mountain Golf Course

|

May 2009

|

November 2009

|

Designer

|

A course with 18 holes, 72 pars and 7,117 yards in Jianfeng Mountain Park of Jinhua City in Zhejiang Province, with a total investment of RMB 90 million.

|

|

Countryside International Health Resort

|

December 2009

|

March 2010

|

Designer

|

A course with 18 holes, 72 pars and 7001 yards in Liuyang City of Hunan Province, with a total investment of RMB 60 million.

|

|

Hubei Xiangfan Lumen Temple Golf Course

|

January 2010

|

March 2010

|

Designer

|

A course with 18 holes, 72 pars and 7,065 yards in a forest park of Xiangfan City of Hubei Province, with a total investment of RMB 79 million.

|

|

Shenyang Puhe Golf Course

|

January 2010

|

March 2010

|

Designer

|

A course with 18 holes, 72 pars and 7,338 yards in Shenbei City of Shenyang Province, with a total investment of RMB 40 million.

|

|

Jiangxi Dingnan Golf Course

|

February 2010

|

March 2010

|

Designer

|

A course with 36 holes in Dingnan County of Ganzhou City in Jiangxi Province, with a total investment of RMB 160 million.

|

Ongoing Contracted Golf Courses Projects

As set forth in the table below, we currently have obtained five contracts for golf course design or construction projects, the earliest of which had been launched in April 2010.

11

|

Ongoing Projects

|

|||||

|

Item

|

Project Name

|

Location

|

Description of Project

|

Projected Initiation Date

|

Expected Completion Date

|

|

1

|

Puhe Golf course

|

Shenyang, Liaoning province

|

Construction

|

April 2010

|

October 2010

|

|

2

|

Binzhou Golf course

|

Binzhou, Shandong province

|

Construction

|

May 2010

|

October 2011

|

|

3

|

Lumen Temple Golf Course

|

Xiangfan, Hubei province

|

Construction

|

May 2010

|

October 2011

|

|

4

|

Hexi Golf course

|

Changsha, Hunan province

|

Design

|

May 2010

|

July 2010

|

|

5

|

Jinan Wujiapu

Thermal Spring Project

|

Jinan, Shandong

|

Design

|

March 2010

|

July 2010

|

Growth Strategy

Our growth strategy is to

|

·

|

Expand our market share in Beijing and Northeast China, while reaching out to other regions such as Jinan and Shanghai;

|

|

·

|

Build pipelines, select and secure land rights, and obtain government approval for high quality courses;

|

|

·

|

Position to be in the low to medium range market in order to quickly obtain tracts of land for golf course development;

|

|

·

|

Capitalize on golf courses' unique location, planning , design and strategic marketing;

|

|

·

|

Develop strategic alliance with partners to increase our financial flexibility, facilitate our golf business and to realize revenues from diversified sources such as subdivided land resale; and

|

|

·

|

Manage and operate golf courses designed and constructed by the Company, which may contribute as regular and stable income to the Company’s revenue.

|

Our long term goal is to become a significant participant in the China golf market. We hope that flexibility and variety will drive customers from single location memberships to a multi-regional and nationwide golf membership where we allow our members to play at numerous courses. Our growth, however, may be restricted by our lack of funds to obtain and subdivide land as well as insufficient cash flow to complete the construction of golf courses. Therefore, we will need to raise additional capital for the development of our golf business.

Our objective is to increase long-term share value by focusing on diversified revenue streams and stable revenue growth to achieve sustained profitability. We believe that the following are key factors in our ability to achieve this objective:

|

·

|

Strategic Expansion – We approach each selected market with a local focus and we intend to continue our expansion through quality acquisitions and selectively procuring major golf course projects in the areas where we have an established presence.

|

12

|

·

|

Diversification - To mitigate the risks inherent in the golf industry, we will try to procure projects: (i) in various geographic areas, (ii) that are design-and-build projects at a fixed price with lump sum payment, (iii) of various scales, duration and complexity, and (iv) that generate revenues not directly from golf courses design and construction but related to golf resorts, such as entertainment facilities, tourism and hotel services.

|

|

·

|

Human Resource- We believe that our employees are one of the key factors to the successful implementation of our business strategies. Significant resources have been and will be employed to attract, develop and retain extraordinary talent and fully promote each employee’s capabilities.

|

|

·

|

Selective Bidding - We focus our resources on bidding projects that meet our bidding criteria by analyzing the following factors of a potential job: (i) the availability of personnel (personnel at all levels, including management, construction, maintenance) to estimate and prepare the proposed job, (ii) the availability of personnel to effectively manage and build the project, (iii) competition, (iv) our experience in a certain type of work, (v) our experience with the golf course owners, (vi) local resources and partnerships, (vii) equipment resources, (viii) the scale and complexity of the job and (ix) the profitability of the job.

|

|

·

|

Environmental Compliance - We believe it is beneficial to maintain environmentally friendly operations. We are committed to protect the environment, maintain good community relations and ensure compliance with government agency requirements. We continually monitor our performance in this area.

|

|

·

|

Quality and High Ethical Standards - We emphasize the importance of performing high quality work and maintaining high ethical standards through our code of conduct and an effective corporate compliance program.

|

|

·

|

Strategic Partnership with Beijing Capital Group, Co., Ltd.(“Beijing Capital”) – We believe our strategic alliance with Beijing Capital is one of the key factors that set us apart from our competitors and enhance our capabilities both strategically and operationally in achieving our growth objectives. More details of this alliance with Beijing Capital are discussed in “Strategic Alliance” of this Item 2.01 herein.

|

In order to become the top golf course management company and to form the largest golf chain in China, we plan to pursue a rapid expansion strategy in 2010 and beyond. Management believes that our continuous emphasis on market coverage expansion by utilizing our construction expertise and selectively pursuing strategic acquisition opportunities can solidify our competitive advantages, mitigate the risks of our business model, deliver optimal margins and increase long-term shareholder value.

Transition to New Business Model

Since our inception, we primarily focused on the design, construction and maintenance of golf course projects as a contractor for third parties. In a competitive environment, in order to become the top golf course management company and to form the largest golf course chain in China, we plan to expand our business beyond contracted services: we will start developing our own golf projects by implementing our new business model of invest-design-build-sell in the near future.

With a four-phase development approach, as detailed below, we intend to keep new golf projects rolling through land acquisition, complementary infrastructure construction, course construction and clubhouse operation outsourcing, all of which will be funded by the pre-sale of club membership interests, bank loans or other financing resources from the capital market. In addition, we plan to subdivide and resell to residential real estate developers the land that is neighboring the golf courses that we develop through this new business model. We believe the introduction of a new golf course will significantly increase the value of such land and its local community.

13

Development Phases

Our new business model of developing our own golf courses and communities in China may be divided into the following phases:

Phase 1: Land Acquisition; Permitting and Approval Process.

The land for our golf projects is usually either leased from the farmers’ collectives or acquired from the State. In China, land is either owned by the State or by farmers’ collectives. In most cases, the farmers’ collectives own the land in rural areas and the State owns the remaining lands. Only the land use right, rather than the ownership of the land, can be transferred. For the land owned by farmers’ collectives, which is not permitted to be traded in a real estate trading center, we entered into leases with the farmers’ collectives for 30-50 years with annual rent of approximately RMB1 per square meter per year, where no land acquisition payment or compensation expenses is required. For the land owned by the State, which is permitted to be traded in a real estate trading center, we will need to complete basically two levels of land development to obtain the land use right for 50-70 years, including: (i) primary development, which involves the infrastructure construction that meets the required standard set by the local municipality; and (ii) secondary development, which involves course or clubhouses construction. During the primary development, expenses related to the land acquisition compensation, the infrastructure construction, relocation of residents, forest removal are incurred. These expenses average a total of RMB 200 per square meter. During the secondary development, we will need to pay to the local government land transfer fees, which may vary based on the grading and purposes of the land. For a parcel of land in suburban Beijing, such land transfer fees are usually no more than RMB 500 per construction square meter.

In order to build an 18-hole course, a minimum of approximately one million square meters (or 250 acres) is required and an additional 100,000 square meters will be necessary to obtain planning permission from the local government to build residential villas. Generally, the governmental permitting process begins simultaneously with the land acquisition process. We are required to prepare and submit with the local government a land use plan and golf course construction documents which may include staking, clearing, grading, earthwork calculations, drainage, irrigation, greens and features, grassing, conceptual landscape and details. The whole process of acquiring the land and obtaining the blueprint or outline planning approval to develop a golf course on the land is expected to take about 6 months. Land acquisition and permitting costs typically amount to approximately $4.5 million per one million square meters (roughly 250 acres) and thus represents 20 % of the total cost of completing a golf course.

Beginning in the third quarter of fiscal year 2010, we will seek to acquire parcels of lands that have obtained local governments’ blueprint or outline planning approvals for future golf courses, recreational park or residential development. After securing the land use right, we will then begin work on essential infrastructure and club facilities construction on the land, along with the golf course construction, such as roads, wastewater systems, irrigation systems, utilities, parks, club houses, etc. On March 31, 2010, we entered into a letter of intent with Beijing Capital Group, Co., Ltd. (“Beijing Capital”) which set forth our alliance in on-going and future projects. Beijing Capital may assist us to accelerate the process of getting blueprint or outline planning approvals from local governments, and to negotiate with local government and farmers for a better purchase price or rent.

Phase 2: Design/Constructing/Budgeting/Financing/Development.

Once the land has been acquired and the permitting process has been completed, we will finalize the master plan of a golf course design and its development specifications such as work schedule and budget. Usually, immediately prior to the construction of a course, we prepare bid sheets which clearly show all the line items of work in order of construction along with the projected quantity of labor, materials and equipment to be used. This ensures accurate cost estimate which can be calculated based on the proposed construction documents. We then commence the construction along with the sale of the membership interests of such course.

14

We have a crew of approximately 17 design and construction employees on the staff to carry out the design and planning with a precise understanding and interpretation of the vision of our design team. In addition to our own construction employees, we may also hire, coordinate with and supervise contractors for the construction of our courses. A team of contractors may be engaged to conduct independent review and inspections on our on-going golf projects to ensure the quality and status of the projects at different phases.

Typically, for our own 18-hole golf courses, the construction of the first 9 holes may be completed by the end of the first year after commencement of construction, the second 9 holes within two years, and the clubhouses and other facilities within three years. After the third year, we will start development of the villas as part of a golf resort.

We plan to fund our own golf projects primarily through four sources:

|

·

|

revenue from pre-sale of membership interests;

|

|

·

|

bank loans secured by our properties;

|

|

·

|

proceeds from fund raising in capital market; and

|

|

·

|

capital contributed by our strategic alliance partners.

|

For the projects that we intend to launch in year 2010, which will be detailed below, we plan to begin development by using our working capital on hand. As the pre-sale of memberships start generating positive cash flow, these funds will be used to finance the additional developments costs. Although each course varies, we estimate the costs of building the first 9 holes to be approximately US $4 million. Since members are required to pay 20% of the initiation fee, which averages $20,000, upon joining the club and the remainder will be due upon completion of the first nine holes construction, we would need to sell 200 memberships in the first year order to complete the first 9 holes. The golf course development costs (included the construction of a club house of approximately 2,000 square meters) are estimated to be approximately $12 million for each 18-hole course.

A breakdown of our estimated budget for investing in and developing a typical 18-hole golf course in China is set forth in the following table:

|

Land Acquisition and Rezoning Costs

|

|

|

Item

|

Amount ($)

|

|

Acquisition and compensation

|

4,500,000

|

|

Subdivision/rezoning

|

6,500,000

|

|

Total

|

11,000,000

|

|

Design Costs

|

|

|

Item

|

Amount ($)

|

|

Design

|

At least 150,000

|

|

Total

|

150,000

|

|

Construction Costs

|

|

|

Item

|

Amount ($)

|

|

Groundwork

|

676,000

|

|

Crude modeling project

|

500,000

|

|

Fine modeling project

|

220,000

|

15

|

Drainage works

|

176,000

|

|

Spray irrigation project

|

420,000

|

|

Green project

|

1,050,000

|

|

Tee ground

|

105,000

|

|

Bunker project

|

150,000

|

|

Artificial lake project

|

180,000

|

|

Lawn bed project

|

602,000

|

|

Turfing project

|

294,000

|

|

Maintenance project

|

190,000

|

|

Lawn maintenance equipments

|

720,000

|

|

Electric power engineering

|

830,000

|

|

Water engineering

|

130,000

|

|

Truck lane, bridge & culvert project

|

400,000

|

|

Road building

|

200,000

|

|

Public clubhouse construction

|

2,800,000

|

|

Parking and supporting facilities

|

300,000

|

|

Landscape scene project

|

680,000

|

|

Other leisure & sports facilities

|

600,000

|

|

Tree planting project

|

800,000

|

|

Total

|

12,023,000

|

Phase 3: Land Subdivision and Development.

Another important part of our new business model is to subdivide, resell or develop the land that is neighboring our developed golf courses. We initially acquire a large piece of land from the Chinese government for golf resort construction, and this phase involves obtaining the requisite governmental approval to subdivide the portions of such land and convert its purpose from farm land into residential.

Once the subdivision approval has been obtained, the land subdivision cost is anticipated be approximately $6.5 million per 100,000 square meters (or approximately 24.7 acres). We are required by the land use right acquisition agreements to undertake the infrastructure construction projects, such as the construction of roads, water and sewage systems, and electric and telecommunication systems, for such residential areas. We usually bear the costs of such infrastructure construction, which may amount to $30 per square meter on average in the case of the projects in Beijing. The cost of infrastructure, varying among different locations, landscape and local government policies, will generally be financed through various resources such as bank loans secured by our properties, proceeds from fund raising in capital market, or capital contributed by our strategic alliance partners.

16

Commercial and residential land in China has much higher value assessment than rural barren land after the completion of its infrastructure construction, subdivision approval has been obtained from local government and local government and farmers have been compensated for such land use right. Additionally, we focus on building eco-friendly golf courses and retaining the value of the land around such courses for future subdivision. We believe the completion of the construction of a new course thus enhancing the value of such subdivided land, because the addition of a golf course to a community usually results in systematic improvement of local infrastructure and rapid development of local businesses.

We may either sell the subdivided land to a real estate company or develop luxury villas on such land. The buyers of our subdivided land, usually real estate developers, will later be responsible for the residential land development activities which include overseeing the construction of residential buildings, etc. If we decide to develop and construct villas, we will work with developers that are our strategic partners (such as Beijing Capital will be our first choice). Villa facilities and amenities generally include restaurants and housekeeping service. In general, around 30 to 40 villas are planned to be built on one golf course, depending on the size and area of the land. Each villa will be customized according to its surrounding environment and catered to customers’ needs.

Phase 4: Operation.

Once the construction of our own golf course is completed, we may outsource its daily operation in return for a concession fee by retaining a percentage of the greens fees, food and beverage concessions, golf cart rentals, retail merchandise sales, driving range fees, social memberships and annual dues. As part of our growth strategy in a medium and long term, we may alternatively take on managing and operating some of the golf courses designed and constructed by ourselves, which may contribute as a stable revenue stream. In addition to membership fees, our revenue of course operations will also be derived from management of other amenities at the golf club, such as restaurants and gift shops.

Planned Projects Based on New Business Model

Our planned projects to be built based on our new business model are set forth in the following table:

|

Planned Projects Based on Our New Business Model

|

|||||

|

Item

|

Project Name

|

Location

|

Description

of Project

|

Project

Initiation Date

|

Expected

Completion Date

|

|

1

|

Miyun Golf Course

|

Beijing

|

Golf course construction and investment

|

Second Half of 2010

|

2013

|

|

2

|

Daxing Golf Course

|

Beijing

|

Golf course construction and investment

|

Second Half of 2010

|

2013

|

|

3

|

Yanqing Golf Course

|

Beijing

|

Golf course construction and investment

|

Second Half of 2010

|

2013

|

|

4

|

Shuangqiao Golf Course

|

Chengde, Hebei Province

|

Golf course design, construction and investment

|

Second Half of 2010

|

2013

|

|

5

|

Chong Ming Golf Course

|

Shanghai

|

Golf course design, construction and investment

|

Second Half of 2010

|

2013

|

|

6

|

Huashan Holiday Inn

|

Xian, Shaanxi Province

|

Construction and investment

|

Second Half of 2010

|

2011

|

|

7

|

Mao Zedong Sports Park

|

Shaoshan, Hunan Province

|

Golf course design, construction and investment

|

Second Half of 2010

|

2013

|

|

8

|

Jinan Wujiapu Thermal Spring Project

|

Jinan, Shandong Province

|

Golf course design, construction and investment

|

Second Half of 2010

|

2013

|

17

As of the date of this Report, we are in the process of acquiring land use rights to develop 7 golf courses and one hotel resort which includes a mini golf course. We will acquire the land use right in all these planned projects. For example, the Beijing Miyun Qianqi Golf Course (the “Miyun Project”) which is located near the Miyun Reservoir in Beijing, we have obtained a leased land of 600,000 square meters (or 148 acres) to build an 18-hole course and another piece of land of 100,000 square meters (or 25 acres) to build villas. The Beijing Daxing Golf Course (the “Daxing Project”), which features a 60 Celsius-degree (or 140 Fahrenheit-degree) hot spring underground, has already obtained a lease land of 600,000 square meters (or 148 acres) for the construction of an 18-hole course and another land of 218,000 square meters (or 54 acres) for the villa and residential development The Beijing Yanqing Golf Course (the “Yanqing Project”), located near the Longqingxia Gorge, has cooperated with and leased from the local farmers a land of one million square meters (or 247 acres) for an 18-hole course construction and another parcel of 133,200 square meters (or 32.1 acres) for villas.

We are also currently in negotiation with local governments to complete the acquisition of two additional parcels of land, one in Jinan City of Shandong and another in Chongming County of Shanghai, so that the two planned projects may begin by the end of 2010.

The land acquisition costs of the above mentioned three projects are being financed from working capital. The anticipated total development costs (including land acquisition cost) for the three courses which will later be funded by the cash flows from the pre-sale of membership interests, bank loans, strategic partner capital contribution or financing proceeds.

We have not begun to develop any of these five courses. Nor have we begun to raise any funds through the advance sale of memberships to fund the development of any of these planned courses. Each of our planned courses will be developed by a separately created majority owned subsidiary, which may be jointly owned by our strategic partners, depending on whether our strategic partners are willing to invest in such project.

Golf Courses Site Selection

As guided by the PRC government policy, golf courses are preferably located in popular tourist areas such as scenic spots, historical sites, famous mountains or resorts, so that the golf industry may be incorporated into the Chinese tourism industry chain. A standard 18-hole golf course occupies around 80-100 hectares. As other amenities such as club houses, restaurants, shops, hotels, sports facilities are added to a golf course, the total area of such course will expand to around an average of 133 hectares.

The actual area of the land needed for constructing a golf course depends on several factors, among other things - the topography, landscape, length of fairway, numbers and scale of trees, ponds, lakes and creeks, distance between two neighboring golf holes as well as local economy, the number of potential golfers, supportive local government policies, the real estate development potential, etc. A prime golf course should guarantee constant visitation by golf players, reduced land development and course construction costs as well as lower lawn maintenance costs once the course commences operations. Three of our five planned golf courses are located in the Beijing area which has the largest golfer population in China. In terms of land feature, the quality of soil, topography, garden or park resorts, and scenery and water resources often determines the cost of a course’s future operation.

18

From the regulatory perspective, the government encourages that overflow land, beaches, barren slopes, barren mountains, barren land, woodland, green area and abandoned fish pond, even stinking ditches and tipping sites be used as sites for golf courses. Any farmland or fruit gardens with low production that is taken as part of a course may be possible but not encouraged. PRC laws also forbid the use of certain types of land, among other things, basic farmland and national public welfare forests.

A hilly landscape is usually favorable to beautiful and challenging golf courses. For instance, raised land can be used as tees, and tall and large trees can compliment visually stunning contours of a fairway. Mountainous terrain, however, usually requires land clearing and bulk excavation to form a suitable fairway. Large-scaled groundwork may increase construction costs and lead to soil structure damage, water and soil erosion, etc. Aside from the potential profits, another important criterion for us to select and build a course is water-wise and eco-friendly. Therefore, our golf courses routing is worked and reworked in order to form a synthesis with environmental sensitivity, local design requirements and the overall project parameters.

We are constantly looking for suitable land for golf projects, such as non-farming non-forest land with the local municipal planning to develop sports, entertainment and tourism industries in the future. In the third and fourth quarters of 2010, we also plan to acquire 7 golf courses land to be used to build golf course. We expect the value of the land attached to these golf courses to increase as a result of golf course and club facilities construction, land planning, subdivision and local community development, which will substantially increase the price when we sell the surrounding land for villa construction to a real estate company.

Our decision process in seleting a new golf course site typically involves (i) extensive market research by our sales department, (ii) location analysis by our design and construction team, and (iii) assessment of the local investment environment by our consultants. After the decision is made, we then contact the local governmental agencies to negotiate and sign leasing contracts and acquire the necessary permits, approvals and registrations to commence construction and operation of our golf facilities.

Strategic Alliance

To optimize the development process of our golf courses and to realize optimal value of the subdivided land, our strategy is to form strategic relationships with influential real estate developers, such as Beijing Capital, which is one of the largest Chinese state-owned real estate companies that focuses on urban real estate development, urban infrastructure construction. Beijing Capital, with an asset value of approximately RMB 75 billion and group profit of RMB 700 million as of 2006, has expressed particular interest in investing in golf industry, including undertaking the residential houses or buildings development projects.

On March 31, 2010, we entered into a letter of intent with Beijing Capital to outline our alliance in on-going and future projects. On June 21, 2010, Shenyang Yanzikou, Shanghai Zhonggao and Beijing Production Materials Trading Co., Ltd.(“BPMT”), one of the subsidiaries of Beijing Capital, entered into a Cooperation Framework Agreement (the “Framework Agreement”), where all parties will jointly invest in Beijing Chengnan Knight Real Estate Development Co., Ltd. (“Chengnan Knight”) to develop some of our future golf projects, namely the Daxing Project in Beijing and the Maozedong Sports Park Project in Hunan Province.

Under the Framework Agreement, the registered capital of Chengnan Knight will be increased to a total of RMB 42 million in the first round, where BPMT has already contributed RMB 21 million, the equivalent of 51% of the ownership interest of Chengnan Knight, in May 2010. Shenyang Yanzikou and Shanghai Zhonggao will in the first round contribute RMB 8.4 million and RMB12.18 million respectively, representing the ownership of 20% and 29% of Chengnan Knight. For the second round of increasing Chengnan Knight’s registered capital, BPMT will contribute a piece of commercial land of 17,812 square meters (with estimated value of RMB 67 million to RMB 1 billion that is subject to final appraisal), which will represent 51% of the increased registered capital of Chengnan Knight. Based on the appraised value of the contributed land from BPMT, Shenyang Yanzikou and Shanghai Zhonggao will contribute to Chengnan Knight 20% and 29% of its increased registered capital.

19

In addition, pursuant to certain memorandum between Shanghai Zhonggao and BPMT, dated June 21, 2010, Shanghai Zhonggao will acquire the majority interest in BPMT in a near future. The terms and conditions for such acquisition have not been finalized.

BPMT was established in 1998 and reorganized in December 2006. 44.67% of BPMT is currently owned by Beijing Capital and the remaining 55.33% is owned by Beijing Capital’s subsidiary, Beijing Capital Trading Co., Ltd. BPMT’s primary scope of business includes: selling cars, motorcycles, tractors, auto parts, metal, chemical, and building materials, timber, coal, hardware, paper products, crude oil, mechanical and electronic equipment; business information service; certain merchandise and technology importing and exporting; car leasing. It has an extensive sales network in different regions in China and established business relationships with its nationwide customers, business partners and affiliates. With a registered capital of RMB150 million, BPMT has equity interests, either controlling or minority, in 10 automobile sale companies in China. It is an authorized car dealer for ten car brands and operates seven sales-to-service fully integrated automobile “4S” (i.e. sale; spare parts; service; survey) brand stores. It has an extensive retail car sales network that covers Beijing, Tianjin, Shandong Yantai and Shenzhen, in addition to its distribution channels in all major auto parts and second-handed car markets in China. In 2007, BPMT sold 11,915 cars and repaired/maintained 128,491 cars. In 2008, BPMT sold 9,853 cars and repaired/maintained 135,584 cars. It achieved revenues of approximately RMB1.87 billion in 2008 and close to RMB1.8 billion in 2009 according to the latest audit report of BPMT. Its book assets was approximately RMB730 million at the end of 2008 and roughly RMB775 million at end of 2009.

If Shanghai Zhonggao acquires the majority interest of BPMT in the future, we will effectively control Chengnan Knight.

We believe that our alliance with Beijing Capital will help enhance our credibility in the golf market, increase public awareness and facilitate necessary approvals.. As a strategic partner, Beijing Capital has substantial resources, including land it already owns, which we can co-develop (such as the 17,812 square meters land to be contributed to Chengnan Knight).

Golf Club Memberships

As one of the funding resources of our new business model, we will launch pre-sale of memberships for golf courses once the construction commences.

The initiation fees of golf memberships may fund the construction of a new course. The pricing of memberships varies among different geographic areas due to the local market conditions, and the prices of memberships also increase through different stages of the construction so as to provide more incentives for early subscriptions. We plan to categorize memberships of a private golf club into several tiers at different prices as illustrated in the following table. All descriptions of memberships below are qualified in their entirety by the text of the Articles of Association for the Members of the Club which is filed herewith as Exhibit 10.7.

20

|

Membership Type*

|

Description

|

|

Individual (Lifetime)

|

This membership entitles those approved to enjoy the full use of all the facilities of a golf club with no obligation to pay greens fees or court fees and to sponsor their spouses or children as guests on the golf course. Such members shall be subject to an initiation fee of initially $20,000, if subscribed during the early stage of the new course construction and may later rise up to $30,000. An annual due of $700 will also be charged after the golf course starts operations.

|

|

Corporate (including Named and Unnamed memberships)

|

Corporate membership will allow a maximum of 4 full-time employees as corporate members. Corporate memberships offer three types of packages at different rates of initiation fees: 1. one named membership + one unnamed membership for a total cost of $50,000; 2. one named membership + two unnamed memberships for a total of $70,000; and 3. one named membership + three unnamed memberships for a total of $100,000. The annual due for all three types of corporate memberships is $1,700.

|

|

Family

|

The spouse or the children under 21 years old of an individual resident member may apply for a family membership. A family membership entitles such family member to the same right as an individual member. A family membership’s initial fee is $40,000 and required an annual due of $1,000. A family membership will cease immediately upon: (i) the second month after the children’s 21st birthday; or (ii) the failure to remit the annual due.

|

|

Annual

|

An annual membership may entitle such member to full access and use of the golf course to play golf for a period of one year.

|

|

Social

|

Social membership privileges include full access to and participation in all activities other than golfing, which include, among other things, the clubhouse, dining, and all recreational and social events.

|

* All membership types referred to in the above table are for residents within a 100-kilometer radius from our golf clubs. Non-resident memberships will entitle residents outside the 100-kilometer radius to the use of all facilities of our golf club during certain designated period. The initiation fee of a non-resident membership is initially offered at $10,000, if subscribed during the early stage of a golf course construction and may rise up to $20,000. No annual due will be charged.

A breakdown of the revenues that may be generated from the sale of our memberships is as follows:

|

Items

|

Applicable

Fees per

Member

(during construction)

|

Estimated

Subscriptions

per Course

(during construction)

|

Applicable

Fees per

Member

(after construction)

|

Estimated

Subscriptions

per Course

(after construction)

|

Total

Revenue

|

|

Membership Initiation Fee

|

$20,000

|

500

|

$30,000

|

300

|

$19,000,000

|

|

Individual Member Annual Due

|

-

|

-

|

$700

|

800

|

$560,000 / year

|

|

Annual and Social Memberships

|

-

|

-

|

-

|

-

|

$290,000 / year

|

21

Membership Initiation Fees:

Although membership is specific to one club, members may pay a premium to gain access to our other clubs around the country. There will be a limited number of members. We anticipate that each of our courses will have about 500 members during construction. We plan to increase the cost of memberships each year after completion of an 18-hole course.

Membership initiation fees will range from $10,000 to $30,000 depending on the location of the course and the nature of the membership. Twenty percent (20%) of the membership initiation fees will be payable up front, with the balance becoming payable on completion of the first nine holes.

Members have resale rights after a certain period of time.

Annual Dues

Once the golf facility commences operations, each individual member is also subject to annual dues of $700. The annual dues for family memberships are $1,000. And for corporate memberships, the annual dues are $1,700 for all three types of packages.

We anticipate approximately 500 membership subscriptions during the construction of a new course and another 300 after the completion of such construction, which may contribute an aggregate of approximately $20,000,000 to our revenue within 5 years after the initiation of the construction of a course. The revenues from the sales of our memberships consist of membership initiation fees and annual dues. For each golf course, we will limit the numbers of members to around 800 per course in order to maintain high quality services and to increase the value of such memberships. Therefore, we expect the revenue may be generated from the initiation fees of a new course for around four years, and the annual dues of the initial members and the fees from annual and social members will then continuously contribute to our revenue stream beginning in the third year and the fifth year, respectively, after the initiation of the course construction. However, once our course is outsourced to a third party for management and operations, we may not be entitled to memberships’ annual dues of such golf club.

Secondary Market Transfer Fee

Two years after the new golf club launches operations, a member may be able to transfer his/her/its own membership to a third party in an open market. We will be entitled to the remaining 10% of the transfer price if we continue to own and operate such golf club.

Golf Industry in China

History

Golf was introduced to China in early twentieth century. In 1931, a golf game center was established in Shanghai. In the same year, the Chinese, British and American businessmen founded a golf club, and opened a golf course near the stadium by Nanjing cemetery. In 1984, the first contemporary golf course in China - Guangdong Zhongshan Hot Spring Golf Club – was built and open. This represents the beginning of modern-age golf in China. In May 1985, the Chinese Golf Association was established in Beijing, China. In 1986, the Shanghai Golf Club was established in Shanghai, China.

In the following decade after 1980s, golf became a popular sport in China, with Guangdong, Shanghai, and Beijing being the centers of this new sport. The first generation of Chinese golfers also grew up during these ten years with very limited training resources, until the monumental year of 1990 when the National Sports Commission sent 11 golfers to Japan to learn and practice golf in preparation of the Beijing Asian Games Golf Tournament, who later became the major leading players of golf. (http://sports.sina.com.cn ).

22

In 1998, Golf was approved to enter to the Asian Sports Games. On October 9, 2009, Golf was approved to be included in the 2016 Olympics Games. On March 1, 2010, Golf was approved to be included in the 12th National Games of the People’s Republic of China 2013.

In 2002, China's first public golf course, Shenzhen Longgang Public Golf Course, was officially opened.

In July 2005, the General Administration of Sport of China specially set up a new “Small Ball Sports Management Center” to manage small ball sport including golf in a project-based way to better utilize resources to support the industry. This is the first time golf sport is included into an official management structure, which leads the golf sport to a historically rapid developing new stage.

Growth

According to the fifth national sports survey (http://www.sport.gov.cn), golf course development in China was very slow before the 1990s: there were a total of less than 10 courses. Since 1992, however, the golf industry experienced a very significant growth, but also demonstrated distinct geographical differences: most of the development was happening mainly in the Pearl River Delta, Yangtze River Delta, the southeast coast and the Beijing-Tianjin-wing, the economically developed regions. Among them, the Pearl River Delta region currently has 55 golf courses, ranking first nationwide, followed by Beijing, Shanghai, Shandong and Fujian. So far, China has more than 500 golf courses and driving ranges, more than 3 million golfers, at an annual growth rate of approximately 20% to 30%, according to Zhang Xiaoning, a director of State Sport General Administration Ball Sports Management Center. (http://news.xinhuanet.com).

At present, most golf courses in China implement the membership model, which account for 92.8% of total golf facilities in operating. Other non-membership business models account for only 7.2% of the total, of which there are only three municipal public golf courses. The average price of an 18-hole individual club memberships was RMB 325,000 yuan in year 2009, and the average price of daily visitors went as high as RMB 796 for every 18 holes. Recorded from 1984, 16 golf courses have been run-out-of-business. (Forward White Paper, China Golf Industry Report, 2009, Forward Group., http://www.forwardgolf.com.cn/electronic.asp).

"2011 Observation of China’s Golf Market Trends Forecast” has indicated that the United States has a population of 250 million, of which 30 million play golf; Japan has 120 million, of which 16 million play golf; Korea has 48 million, of which 5 million are golfers. In these countries, golfers represent more than 10% of the total population. China, on the other hand, currently has 3 million people playing golf, only 0.0023% of the total population. Undoubtedly, there will be a huge potential for improvement in China. The revenue of the golf industry in China in 2006 reached RMB 47.9 billion; and in 2009, it exceeded RMB60 billion. The potential golf consumers in 2008 were estimated at 20 million.

Chart: the World's Top Five Countries That Have The Most Golf Courses

| Country |

Number of Golf Courses

|

| United States |

19,800

|

| United Kingdom |

3,052

|

| Japan |

2,500

|

| Italy |

1,560

|

| Germany |

630

|

Source: 9988 China Business Information Network

23

According to a study jointly conducted by MasterCard International and Institute of China National Conditions Research, people tend to start golfing once their annual income exceeds $21,000. (www.mastercard.com /cn) Inferred from this study, China should have a much larger golfer population. This indicates that China has a huge potential for the golf consumer market development.

In 1995, the Volvo China Open debuted in China. Subsequently, various game events such as Europe Tour, Asia Tour, and Japan Tour were launched one after another. China Tour, Beijing Open, Junior Amateur and other China domestic competitions also followed. In particular, Shanghai Sheshan HSBC Championship has become worldwide golfers’ year-end finale, bringing the world golf climax to China every year at the end of season. This has put significant impact on China’s golf industry development. It has changed the world golfing map, that China and Asia has won a place in a previously Europe and the United States-dominated world game.