Attached files

| file | filename |

|---|---|

| EX-5.1 - AtheroNova Inc. | ex5-1.htm |

| EX-23.1 - AtheroNova Inc. | ex23-1.htm |

| EX-21.1 - AtheroNova Inc. | ex21-1.htm |

| As filed with the Securities and Exchange Commission on June 29, 2010 | Registration No. ___-____ |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

_________________

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES

ACT OF 1933

(Amendment

No. __)

_________________

ATHERONOVA

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

2834

|

20-1915083

|

|

(State

or other jurisdiction of

|

(Primary

Standard Industrial

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

Classification

Code Number)

|

Identification

No.)

|

2301

Dupont Drive, Suite 525

Irvine,

CA 92612

(949)

476-1100

(Address,

including zip code, and telephone number, including area code, of registrant’s

principal executive offices)

Mark

Selawski, Chief Financial Officer

AtheroNova

Inc.

2301

Dupont Drive, Suite 525

Irvine,

CA 92612

(949)

476-1100

(Name,

address, including zip code, and telephone number, including area code, of agent

for service)

Copy

to:

Gregory

Akselrud, Esq.

Stubbs

Alderton & Markiles, LLP

15260

Ventura Boulevard, 20th

Floor

Sherman

Oaks, California 91403

(818)

444-4500

Approximate

date of commencement of proposed sale to the public: From time to

time after the effective date of this Registration Statement.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the

following box: x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definitions of “large accelerated filer,” “accelerated

filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

|

Large

accelerated filer

|

o | Accelerated filer | o |

|

Non-accelerated

filer

|

o (Do not check if

smaller reporting company)

|

Smaller reporting company |

x

|

CALCULATION

OF REGISTRATION FEE

|

Title

of Each Class

of

Securities

to

be Registered

|

Amount

to be

Registered

(1)

|

Proposed

Maximum

Offering

Price

Per

Unit (2)

|

Proposed

Maximum

Aggregate

Offering

Price (2)

|

Amount

of

Registration

Fee

|

|

Common

Stock, par value $0.0001 per share

|

486,722

|

$30.00

|

$14,601,660.00

|

$1,041.10

|

|

Common

Stock, par value $0.0001 per share, issuable upon conversion of

convertible promissory notes

|

3,817,596

|

$30.00

|

$114,527,880.00

|

$8,165.84

|

|

TOTAL

|

4,304,318

|

$30.00

|

$129,129,540.00

|

$9,206.94

|

|

(1)

|

In

the event of a stock split, stock dividend, or other similar transaction

involving the Registrant’s common stock, in order to prevent dilution, the

number of shares registered shall automatically be increased to cover the

additional shares in accordance with Rule 416(a) under the Securities

Act.

|

|

(2)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to

Rule 457(c) under the Securities Act of 1933, using the average of the

high and low prices as reported on the OTC Bulletin Board on June 28, 2010

(accounting for a 1-for-200 reverse stock

split).

|

The

Registrant hereby amends this Registration Statement on such date or dates as

may be necessary to delay its effective date until the Registrant shall file a

further amendment which specifically states that this Registration Statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the Registration Statement shall become

effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

Subject

to Completion, Dated June 29, 2010

ATHERONOVA

INC.

4,304,318 Shares

Common

Stock

_________________

This

prospectus relates to the offer and sale from time to time of up to

4,304,318 shares of

our common stock that are held by the stockholders named in the “Principal and

Selling Stockholders” section of this prospectus. The prices at which

the selling stockholders may sell the shares in this offering will be determined

by the prevailing market price for the shares or in negotiated

transactions. We will not receive any of the proceeds from the sale

of the shares. We will bear all expenses of registration incurred in

connection with this offering. The selling stockholders whose shares

are being registered will bear all selling and other expenses.

Our

common stock is quoted on the OTC Bulletin Board under the symbol

“AHRO.” On June 23, 2010, the last reported sales price of our common

stock on the OTC Bulletin Board was $41.00 per share (accounting for a 1-for-200

reverse stock split).

Investing

in our common stock involves risks. See “Risk Factors” beginning on

page 4.

_________________

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or passed upon the adequacy or

accuracy of this prospectus. Any representation to the contrary is a

criminal offense.

_________________

The date

of this prospectus is ______________

i

TABLE

OF CONTENTS

|

Page

|

Page

|

|||||

|

Prospectus

Summary

|

1

|

Directors,

Executive Officers,

|

||||

|

Risk

Factors

|

4

|

Promoters

and Control Persons

|

35

|

|||

|

Forward-Looking

Statements

|

12

|

Executive

Compensation

|

38

|

|||

|

Use

of Proceeds

|

13

|

Principal

and Selling Stockholders

|

39

|

|||

|

Plan

of Distribution

|

13

|

Certain

Relationships and

|

||||

|

Description

of Registrant’s Securities

|

16

|

Related

Transactions

|

42

|

|||

|

Description

of Business

|

19

|

Legal

Matters

|

44

|

|||

|

Description

of Property

|

26

|

Experts

|

44

|

|||

|

Legal

Proceedings

|

26

|

Where

You Can Find More

|

||||

|

Market

Price of and Dividends on

|

Information

|

44

|

||||

|

the

Registrant’s Common Equity

|

Index

to Annual Financial

|

|||||

|

and

Related Stockholder Matters

|

27

|

Statements

|

45

|

|||

|

Management’s

Discussion and

|

Index

to Quarterly Financial

|

|||||

|

Analysis

of Financial Condition

|

Statements

|

59

|

||||

|

and

Results of

Operations

|

30

|

|||||

You

should rely only on the information contained in this prospectus or any

supplement. We have not authorized anyone to provide information that

is different from that contained in this prospectus. The information

contained in this prospectus is accurate only as of the date of this prospectus,

regardless of the time of delivery of this prospectus or of any sale of our

common stock.

Except as

otherwise indicated, information in this prospectus reflects the reverse merger

(recapitalization) that occurred on May 13, 2010 with AtheroNova Operations,

Inc. (formerly Z&Z Medical Holdings, Inc.), and a 1-for-200 reverse stock

split of our common stock which took effect on and as of June 23,

2010.

ii

PROSPECTUS

SUMMARY

This

summary highlights selected information contained in greater detail elsewhere in

this prospectus. You should read the entire prospectus carefully

before making an investment decision, including “Risk Factors” and the

consolidated financial statements and the related notes. References in this

prospectus to “AtheroNova” and “the Company” refer to AtheroNova Inc. and our

consolidated subsidiary AtheroNova Operations, Inc.

Our

Business

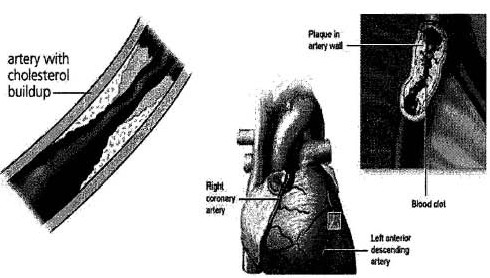

We have

developed intellectual property (“IP”), covered by our pending patent

applications, which uses certain pharmacological compounds uniquely for the

treatment of atherosclerosis, which is the primary cause of various

cardiovascular diseases. Atherosclerosis occurs when cholesterol or

fats are deposited and harden as plaques in the walls of

arteries. This hardening reduces the space within the arteries

through which blood can flow. The plaque can also rupture and greatly

restrict or block altogether blood flow. Through a process called

delipidization, such compounds dissolve the plaques so they can be eliminated

through normal body processes and avoid such rupturing. Such

compounds may be used both to treat and prevent atherosclerosis.

In the

near future, we plan to continue studies and trials to demonstrate the efficacy

our IP. Ultimately, we plan to license our technology to various

licensees throughout the world who may use it in treating or preventing

atherosclerosis and other medical conditions or sublicense the IP to other such

users. Our licensees may also produce, market or distribute products

which utilize or add our compounds and technology in such treatment or

prevention.

Our

Industry

We

compete against well-capitalized pharmacological companies as well as smaller

companies. The market for our products is highly

competitive. The pharmacological sector is evolving and growing

rapidly, and companies are continually introducing new products and

services.

Our

History and Contact Information

We were

incorporated in the State of Delaware on May 13, 1997 under the name Camryn

Information Services, Inc. We operated for a brief period of time

before we ceased operations on February 25, 1999 when we forfeited our charter

for failure to designate a registered agent. We remained dormant

until 2004 when we renewed our operations with the filing of a Certificate of

Renewal and Revival of Charter with the State of Delaware on October 29,

2004. On November 3, 2004, we filed a Certificate of Amendment and

our name was formally changed from Camryn Information Services, Inc. to iStorage

Networks, Inc. Such change became effective on November 8,

2004. On January 26, 2006, we issued 41,000 shares of our common

stock in exchange for all of the membership interests of Landbank, LLC

(“LLC”). We changed our name to Landbank Group, Inc. on January 27,

2006. LLC made bulk acquisitions of parcels of land, primarily

through the real property tax lien foreclosure process. The bulk acquisitions

were then divided into smaller parcels for resale. On December 31,

2007, we transferred all of LLC’s membership interests to Landbank Acquisition,

LLC, ceased business operations, and changed our name to Trist Holdings,

Inc. On May 13, 2010 we changed our name to AtheroNova

Inc.

From

December 31, 2007 through May 13, 2010, we were a public “shell” company with

nominal assets.

1

On March

26, 2010, we entered into an Agreement and Plan of Merger (“Merger Agreement”)

with Z&Z Merger Corporation, a Delaware corporation and our wholly-owned

subsidiary (“MergerCo”), and Z&Z Medical Holdings, Inc., a Delaware

corporation (“Z&Z”). The closing (the “Closing”) of the

transactions contemplated by the Merger Agreement (the “Merger”) occurred on May

13, 2010. At the Closing, (i) MergerCo was merged with and into

Z&Z, whose name was concurrently changed to AtheroNova Operations, Inc.

(“AtheroNova Operations”); (ii) Z&Z, as AtheroNova Operations, became our

wholly-owned subsidiary; (iii) all of AtheroNova Operations’ shares, warrants

and options outstanding prior to the Merger were exchanged (or assumed, in the

case of warrants and options) for comparable securities of our company; and (iv)

approximately 98% of our fully-diluted shares (excluding the shares issuable in

the Capital Raise Transaction (as defined below)) were owned by AtheroNova

Operations’ former stockholders, warrant holders and option

holders. At the Closing, we issued to AtheroNova Operations’ former

stockholders, in exchange for the 9,837,050 shares of AtheroNova Operations’

common stock outstanding prior to the Merger, 88,575,048 shares of our

Super-Voting Common Stock, par value $0.0001 per share (the “Super-Voting Common

Stock”), which, as a result of the approval by the holders a substantial

majority of our outstanding stock entitled to vote and the approval by our board

of directors on May 21, 2010, of amendments to our certificate of incorporation,

as amended, that (i) decreased our authorized number of shares of our common

stock to 100,000,000, (ii) designated 10,000,000 shares of blank check preferred

stock and (iii) adopted a 1-for-200 reverse stock split, on June 23, 2010

converted into 22,143,771 shares of our common stock. As a result of

the Merger we are solely engaged in AtheroNova Operations’ business, AtheroNova

Operations’ officers became our officers and three of AtheroNova Operations’

directors became members of our seven-member board of directors (which currently

has two vacancies).

The

Merger was accounted for as a reverse merger (recapitalization) with AtheroNova

Operations deemed to be the accounting acquirer, and our company deemed to be

the legal acquirer. All financial information in this document is

that of our company and AtheroNova Operations.

On May

13, 2010, we also entered into a Securities Purchase Agreement (the “Securities

Purchase Agreement”) with W-Net Fund I, L.P. (“W-Net”), Europa International,

Inc. (“Europa”) and MKM Opportunity Master Fund, Ltd. (“MKM” and together with

W-Net and Europa, the “Purchasers”), pursuant to which the Purchasers, on May

13, 2010, purchased from us (i) 2.5% Senior Secured Convertible Notes (the

“Notes”) for a cash purchase price of $1,500,000, and (ii) Common Stock Purchase

Warrants pursuant to which the Purchasers may purchase up to 1,908,798 shares of

our common stock at an exercise price of approximately $0.39 per share (the

“Warrants”) (the “Capital Raise Transaction”). The Notes, including

accrued interest through their maturity, are convertible into 4,199,358 shares

of our common stock at a conversion price of approximately $0.39 per

share. We are registering the shares of our common stock issuable

upon the conversion of the Notes.

The

address of our principal executive office is 2301 Dupont Drive, Suite 525,

Irvine, California 92612, and our telephone number is (949)

476-1100.

2

The

Offering

|

Common

stock offered

|

4,304,318 shares

by the selling stockholders

|

|

|

Common

stock outstanding

before

this offering

|

22,680,927

shares

|

|

|

Common

stock to be outstanding after

this offering

|

22,680,927

shares

|

|

|

Use

of

proceeds

|

We

will not receive any of the proceeds from the sale of shares of our common

stock by the selling stockholders. See “Use of

Proceeds.”

|

|

|

OTC

Bulletin Board

symbol

|

“AHRO”

|

|

|

Risk

Factors

|

See

“Risk Factors” beginning on page 4 for a discussion of factors that you

should consider carefully before deciding to purchase our common

stock.

|

In the

table above, the number of shares to be outstanding after this offering is based

on 22,680,927 shares of our common stock outstanding as of June 23,

2010. The number of shares of our common stock to be outstanding

after this offering does not reflect the issuance of the following

shares:

|

·

|

5,497,356

shares of our common stock issuable upon the exercise of common stock

purchase warrants outstanding as of June 23, 2010, with a weighted average

exercise price of approximately $0.28 per

share;

|

|

·

|

549,498

shares of our common stock issuable upon the exercise of stock options

outstanding as of June 23, 2010, with an exercise price of approximately

$0.22 per share;

|

|

·

|

4,199,358

shares of our common stock (including 381,762 shares accounting for

accrued interest through maturity) issuable upon the conversion of

convertible promissory notes outstanding as of June 23, 2010, at a

conversion price of approximately $0.39

and

|

|

·

|

4,362,964

additional shares of common stock reserved for issuance under our 2010

Stock Incentive Plan, as of June 23,

2010.

|

Summary

Financial Data

As of

March 31, 2010, we had an accumulated deficit of $419,531. We

incurred operating losses of $32,633 and $3,163 for the fiscal quarters ended

March 31, 2010 and 2009, respectively. We have not yet achieved

profitability and anticipate that we will continue to incur net losses for at

least the next year. We anticipate that a substantial portion of our

capital resources and efforts will be focused on research and development and

other general corporate purposes. Research and development projects

include the completion of a second animal study at the Cedars-Sinai Division of

Cardiology in conjunction with the University of California Los Angeles to

validate our initial findings and prepare for human trials. We plan

to develop multiple applications for our compounds, to be used in pharmaceutical

grade and over-the-counter grade products, for the treatment of

atherosclerosis. As of March 31, 2010 we had approximately $123,734

in cash and cash equivalents and a working capital deficit of approximately

$90,855 compared to approximately $53,314 in cash and cash equivalents and a

working capital deficit of approximately $62,586 at March 31, 2009.

3

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. You should

carefully consider the following risk factors and all other information

contained in this prospectus before purchasing shares of our common

stock. If any of the following risks occur, our business, financial

condition and/or results of operations could be materially and adversely

affected. In that case, the trading price of our common stock could

decline, and you may lose some or all of your investment.

Risks

Related to Our Business

We

will continue to need additional financing to carry out our business

plan.

The net

proceeds from the Capital Raise Transaction available to fund our business were

reduced by the required payments and reimbursements to stockholders to whom we

were indebted and other transaction costs incurred by AtheroNova

Operations. Although we estimate that the net funds from the Capital

Raise Transaction will be sufficient to fund our planned activities for up to a

year, we will need thereafter or sooner to obtain significant additional funding

successfully to continue our business. Such additional funds may not

be readily available or may not be available on terms acceptable to

us.

We

have a history of operating losses and there can be no assurance that we can

achieve or maintain profitability.

We have a

history of operating losses and may not achieve or sustain

profitability. We cannot guarantee that we will become

profitable. Even if we achieve profitability, given the competitive

and evolving nature of the industry in which we operate, we may not be able to

sustain or increase profitability and our failure to do so would adversely

affect our business, including our ability to raise additional

funds.

We

may not be able to effectively manage our growth.

Our

strategy envisions growing our business. We plan to expand our

technology, sales, administrative and marketing organizations. Any

growth in or expansion of our business is likely to continue to place a strain

on our management and administrative resources, infrastructure and

systems. As with other growing businesses, we expect that we will

need to further refine and expand our business development capabilities, our

systems and processes and our access to financing sources. We also

will need to hire, train, supervise and manage new employees. These

processes are time consuming and expensive, will increase management

responsibilities and will divert management attention. We cannot

assure you that we will be able to:

|

·

|

expand

our systems effectively or efficiently or in a timely

manner;

|

|

·

|

allocate

our human resources optimally;

|

|

·

|

meet

our capital needs;

|

|

·

|

identify

and hire qualified employees or retain valued employees;

or

|

|

·

|

incorporate

effectively the components of any business or product line that we may

acquire in our effort to achieve

growth.

|

4

Our

inability or failure to manage our growth and expansion effectively could harm

our business and materially and adversely affect our operating results and

financial condition.

Technology

changes may make the products we are planning to bring to market

obsolete.

We

believe that the methods for treating and preventing atherosclerosis of the

pharmacological compounds we intend to bring to market enjoy certain competitive

advantages, including superior performance and

cost-effectiveness. Although we are not aware of any other treatments

or methods currently being developed that would compete with the methods we

intend to employ, there can be no assurance that future developments in

technology or pharmacological compounds will not make our technology

non-competitive or obsolete, or significantly reduce our operating margins or

the demand for our offerings, or otherwise negatively impact our

profitability.

We

may not be able to protect our intellectual property.

We and

our licensees may be unable to obtain IP rights to effectively protect our

technology. Patents and other proprietary rights are an important

part of our business plans. The ability to compete effectively may be

affected by the nature and breadth of our IP rights. We intend to

rely on a combination of patents, trade secrets and licensing arrangements to

protect our technology. While we intend to defend against any threats

to our IP rights, there can be no assurance that any of our patents, patent

applications, trade secrets, licenses or other arrangements will adequately

protect our interests.

Although

we have pending patent applications in the United States and under the

international Patent Cooperation Treaty covering uses of our technology, we have

not received, and may never receive, any patent protection for our

technology. We cannot guarantee any particular result or decision by

the U.S. Patent and Trademark Office or a U.S. court of law, or by any patent

office or court of any country in which we have sought patent

protection. If we are unable to secure patent protection for our

technology, our revenue and earnings, financial condition, or results of

operations would be adversely affected. There can also be no

assurance that any patent issued to or licensed by us in the future will not be

challenged or circumvented by competitors, or that any patent issued to or

licensed by us will be found to be valid or be sufficiently broad to protect us

and our technology. A third party could also obtain a patent that may

require us to negotiate a license to conduct our business, and there can be no

assurance that the required license would be available on reasonable terms or at

all.

We do not

warrant any opinion as to patentability or validity of any pending patent

application. We do not warrant any opinion as to non-infringement of

any patent, trademark, or copyright by us or any of our affiliates, providers,

or distributors. Nor do we warrant any opinion as to invalidity of

any third-party patent or unpatentability of any third-party pending patent

application.

We may

also rely on nondisclosure and non-competition agreements to protect portions of

our technology. There can be no assurance that these agreements will

not be breached, that we will have adequate remedies for any breach, that third

parties will not otherwise gain access to our trade secrets or proprietary

knowledge, or that third parties will not independently develop the

technology.

IP

litigation would be costly and could adversely impact our business

operations.

We may

have to take legal action in the future to protect our technology or to assert

our IP rights against others. Any legal action could be costly and

time consuming to us, and no assurances can be made that any action will be

successful. The invalidation of any patent or IP rights that we may

own, or an unsuccessful outcome in lawsuits to protect our technology, could

have a material adverse effect on our business, financial position, or results

of operations.

5

We

operate and compete in an industry that is characterized by extensive IP

litigation. In recent years, it has been common for companies in the

medical product and pharmaceutical businesses to aggressively file

patent-infringement and other intellectual-property litigation in order to

prevent the marketing of new or improved medical products, treatments, or

pharmaceuticals. IP litigation can be expensive, complex, and

protracted. Because of such complexity, and the vagaries of the jury

system, IP litigation may result in significant damage awards and/or injunctions

that could prevent the manufacture, use, distribution, importation, exportation,

and sale of products or require us and/or any of our licensing partners to pay

significant royalties in order to continue to manufacture, use, distribute,

import, export, or sell products. Furthermore, in the event that our

right to license or to market our technology is successfully challenged, and if

we and/or our licensing partners fail to obtain a required license or are unable

to design around a patent held by a third party, our business, financial

condition, or results of operations could be materially adversely

affected. We believe that the patents we have applied for, if

granted, would provide valuable protection for our intellectual property, but

there nevertheless could be no assurances that they would be respected or not

subject to infringement by others.

We

are operating in a highly competitive industry.

We are

involved in a highly competitive industry where we may compete with numerous

other companies who offer alternative methods or approaches, who may have far

greater resources, more experience, and personnel perhaps more qualified than we

do. There can be no assurance that we will be able to successfully

compete against these other entities.

We

and our licensees will be subject to federal and state regulation.

We and

our potential licensing partners are subject to many laws and regulations, and

any adverse regulatory action may affect our ability to exploit our

IP. Developing, manufacturing, and marketing regulated medical

products and pharmaceuticals are subject to extensive and rigorous regulation by

numerous government and regulatory agencies, including the FDA and comparable

foreign agencies. Under the Federal Food, Drug, and Cosmetic Act (the

“FDA Act”), regulated medical devices must receive FDA clearance and approval

before they can be commercially marketed in the U.S. Markets outside the U.S.

require similar clearance and approval before a medical product or

pharmaceutical can be commercially marketed. We cannot guarantee that

we will be able to obtain, directly or through our licensees, marketing

clearance from the FDA and other governing agencies for any new products, or

modifications or enhancements to existing products, which we depend on for

royalty revenues. Furthermore, if FDA clearance is obtained, such

clearance could (a) take a significant amount of time; (b) require the

expenditure of substantial resources; (c) involve rigorous pre-clinical and

clinical testing; (d) require modifications to, or replacements of products;

and/or (e) result in limitations on the proposed uses of products.

Even

after regulated medical products or pharmaceuticals have received marketing

clearance, approvals by the FDA can be withdrawn due to failure to comply with

regulatory standards or the occurrence of unforeseen issues following initial

approval. Failure to comply with regulatory standards or subsequent

discovery of unknown problems with a regulated medical product could result in

fines, suspensions of regulatory approvals, seizures or recalls of devices,

operating restrictions, and/or criminal prosecution. There can be no

assurance that any FDA approval will not be subsequently

withdrawn. Any adverse regulatory action by the FDA or another

regulatory agency may restrict us and our licensees from effectively marketing

and selling our IP applications in medical products. In addition,

foreign laws and regulations have become more stringent and regulated medical

products may become subject to increased regulation by foreign agencies in the

future. Penalties for our licensees for any of their noncompliance

with foreign governmental regulations could be severe, including revocation or

suspension of their business licenses and criminal sanctions. Any

foreign law or regulation imposed on our IP applications may materially affect

our projected operations and revenues, by adverse impact on the distribution and

sale of regulated medical products in foreign jurisdictions through our intended

licensees.

6

Our

licensees may not sustain compliance with regulatory standards and laws

applicable to medical products production, manufacturing, and quality

processes.

Our

licensees, which are manufacturers of medical products or pharmaceuticals, will

be subject to periodic inspection by the FDA for compliance with regulations

that require manufacturers to comply with certain practices and standards,

including testing, quality control and documentation procedures. In

addition, federal medical device reporting regulations require them to provide

information to the FDA whenever there is evidence that reasonably suggests that

a medical product may have caused or contributed to a death or serious injury

or, if a malfunction were to occur, could cause or contribute to a death or

serious injury. Compliance with these requirements is subject to

continual review and is rigorously monitored through periodic FDA

inspections. In foreign markets, our licensing partners are required

to obtain certain certifications in order to sell medical products and must

undergo periodic inspections by regulatory bodies to maintain these

certifications. If our licensees fail to adhere to any laws and

standards applicable to medical product manufacturers, the marketing of products

could be suspended, and such failure could, for our licensees, lead to fines,

withdrawal of regulatory clearances, product recalls, or other consequences, any

of which could in turn adversely affect our projected business operations,

financial condition, or results of operations. Our licensees will

also be subject to certain environmental laws and regulations. Our

licensing partners’ manufacturing operations may involve the use of substances

and materials regulated by various environmental protection agencies and

regulatory bodies. We cannot guarantee that any licensee will sustain

compliance with environmental laws, and that regulations will not have a

material impact on our earnings, financial condition, or business

operations.

Failure

of our licensees to comply with laws and regulations relating to reimbursement

of health care products may adversely impact our business

operations.

Medical

products are subject to regulation regarding quality and cost by the United

States Department of Health and Human Services, Centers for Medicare &

Medicaid services and comparable state and foreign agencies that are responsible

for payment and reimbursement of healthcare goods and services. In

the U.S., healthcare laws apply to our licensing partners’ business operations

when a reimbursement claim is submitted under a federal government funded

healthcare program. Federal laws and regulations prohibit the filing

of false or improper claims for federal payment and unlawful inducements for the

referral of business reimbursable under federally-funded healthcare programs

(known as the anti-kickback laws). If a governmental agency or

regulatory body were to conclude that our licensees were not in compliance with

applicable laws and regulations regarding payment or reimbursement of medical

products, they could be subject to criminal and civil penalties, including

exclusion from participation as a supplier of products to beneficiaries covered

by government healthcare programs. Such exclusions could negatively affect our

distribution channels, financial condition or results of

operations.

Quality

problems with a licensee’s manufacturing processes could harm our reputation and

affect demand for medical products using our technology.

Ensuring

the quality of products and manufacturing processes is critical for medical

product companies due to the high cost and seriousness of product failures or

malfunctions. If any of our licensees failed to meet adequate quality

standards, its and our reputations could be damaged and our revenues could

decline. In addition, production of medical products which utilize

our technology may depend on our licensees’ abilities to engineer and

manufacture precision components and assemble such components into intricate

medical products and, if they fail to meet these requirements or fail to adapt

to changing requirements, their and our reputations may suffer and demand for

products implementing our technology could decline significantly.

7

Uncertainties

regarding healthcare reimbursements may adversely affect our

business.

Healthcare

cost containment pressures decrease the prices end-users are willing to pay for

medical products, which could have an adverse effect on our royalty

revenue. Products that may implement our technology may be purchased

by hospitals or physicians, which typically bill governmental programs, private

insurance plans and managed care plans for the healthcare devices and services

provided to their patients. The ability of these customers to obtain

reimbursement from private and governmental third-party payors for the products

and services they provide to patients is critical to commercial

success. The availability of reimbursement affects which products

customers purchase and the prices they are willing to

pay. Reimbursement varies from country to country and can

significantly impact the acceptance of new products and

services. Although we and our licensees may have a promising new

product, we and our licensees may find limited demand for the medical product

unless reimbursement approval is obtained from private and governmental

third-party payors. Even if reimbursement approval is obtained from

private and governmental third-party payors, we may still find limited demand

for the product for other reasons. In addition, legislative or

administrative reforms to the U.S., or to international reimbursement systems,

in a manner that significantly reduces reimbursement for products or procedures

using our technology, or denial of coverage for those products or procedures,

could have a material adverse effect on our business, financial condition or

results of operations.

Major

third-party payors for hospital services in the U.S. and abroad continue to work

to contain healthcare costs. The introduction of cost containment

incentives, combined with closer scrutiny of healthcare expenditures by both

private health insurers and employers, has resulted in increased discounts and

contractual adjustments to hospital charges for services performed and has

shifted services between inpatient and outpatient

settings. Initiatives to limit the increase of healthcare costs,

including price regulation, are also ongoing in markets in which our licensees

may do business. Hospitals or physicians may respond to these

cost-containment pressures by insisting that our licensees lower prices, which

may adversely affect our royalties.

In

response to increasing healthcare costs, there has been and may continue to be

proposals by legislators, regulators, and third-party payors to reduce these

costs. If these proposals are approved and passed, limitations and/or

reductions may be placed on the net or allowable price of products implementing

our technology or the amounts of reimbursement available for these products from

customers, governmental bodies, and third-party payors. These

limitations and reductions on prices may have a material adverse effect on our

financial position and results of operations.

We

and our licensees will be required to attract and retain top quality talent to

compete in the marketplace.

We

believe our future growth and success will depend in part on our and our

licensees’ abilities to attract and retain highly skilled managerial, product

development, sales and marketing, and finance personnel. There can be

no assurance of success in attracting and retaining such

personnel. Shortages in qualified personnel could limit our ability

to increase sales of existing products and services and launch new product and

service offerings.

8

Our

forecasts are highly speculative in nature and we cannot predict results in a

development stage company with a high degree of accuracy.

Any

financial projections, especially those based on ventures with minimal operating

history, are inherently subject to a high degree of uncertainty, and their

ultimate achievement depends on the timing and occurrence of a complex series of

future events, both internal and external to the enterprise. There

can be no assurance that potential revenues or expenses we project will, in

fact, be received or incurred.

Our

auditors have expressed going concern opinions on our financial

statements.

Primarily

as a result of our recurring losses and lack of liquidity, the reports of the

independent auditors to both our company and AtheroNova Operations regarding our

respective audited financial statements at December 31, 2009 expressed

substantial uncertainty as to our abilities to continue as going

concerns.

We

will be subject to evolving and expensive corporate governance regulations and

requirements. Our failure to adequately adhere to these requirements

or the failure or circumvention of our controls and procedures could seriously

harm our business.

As a

publicly traded company, we are subject to various federal, state and other

rules and regulations, including applicable requirements of the Sarbanes-Oxley

Act of 2002. Compliance with these evolving regulations is costly and

requires a significant diversion of management time and attention, particularly

with regard to our disclosure controls and procedures and our internal control

over financial reporting. Our internal controls and procedures may

not be able to prevent errors or fraud in the future. Faulty

judgments, simple errors or mistakes, or the failure of our personnel to adhere

to established controls and procedures, may make it difficult for us to ensure

that the objectives of the control system are met. A failure of our

controls and procedures to detect other than inconsequential errors or fraud

could seriously harm our business and results of operations.

Our

limited senior management team size may hamper our ability to effectively manage

a publicly traded company while developing our products and harm our

business.

Our

management team has experience in the management of publicly traded companies

and complying with federal securities laws, including compliance with recently

adopted disclosure requirements on a timely basis. They realize it

will take significant resources to meet these requirements while simultaneously

working on licensing, developing and protecting our IP. Our

management will be required to design and implement appropriate programs and

policies in responding to increased legal, regulatory compliance and reporting

requirements, and any failure to do so could lead to the imposition of fines and

penalties and harm our business.

We

may incur substantial liability associated with registration rights granted to

investors in the Capital Raise Transaction.

Within 60

days following the closing of the Capital Raise Transaction, we are obligated to

file with the Securities and Exchange Commission (“SEC”) a registration

statement covering the resale by investors of the shares represented by the

Notes and Warrants purchased in the Capital Raise Transaction. If we

fail to timely file this registration statement or if the registration statement

does not become effective within 180 days (or 150 days if the SEC does not fully

review the registration statement) following the closing of the Capital Raise

due to our failure to satisfy our obligations, we will be obligated to make

certain payments as liquidated damages to the investors in the Capital Raise

Transaction for each day that elapses after the closing of the Capital Raise

Transaction before the registration statement is filed or becomes effective, as

applicable. There can be no assurance that the registration statement

will be declared effective by the SEC within 180 days following the closing of

the Capital Raise Transaction. Similar penalties may apply if we are

unable to maintain the effectiveness of the registration statement.

9

The

issuance of the Notes in the Capital Raise Transaction has subjected us to

possible remedies of a secured creditor and has limited our financing

alternatives.

Our

obligations under the Notes will be debt obligations, secured by security

interests in all of the assets of our company and its subsidiaries, including

their intellectual property. If we default on our obligations under

the Notes and related agreements, the Note holders will be entitled to all the

remedies of secured creditors including (without limitation) the ability to

accelerate the due date for the entire principal amount, charge default interest

and penalties and foreclose on our assets.

Anti-dilution

adjustments under the Notes and Warrants issued in the Capital Raise Transaction

may dilute the interests of our stockholders.

If we are

forced in the future to issue shares for prices less than the conversion price

of the Notes, that may trigger anti-dilution adjustments that increase the

numbers of shares that are issuable on conversions of the Notes or exercises of

the Warrants issued in the Capital Raise Transaction. Such

adjustments, particularly possible “ratchet” adjustments not weighted by the

relative magnitude of the particular low-price share issuance, may significantly

dilute the holdings of stockholders other than the investors in the Capital

Raise Transaction.

Restrictions

in the Notes and related documents will likely restrict our ability to raise

debt funding or be acquired.

Restrictions

and provisions in the Notes and related documents will restrict our ability to

raise additional debt financing without the Note holders’

consents. Also, financial penalties in the Notes and Warrants may

make it difficult to us to be acquired by a third party.

Our

Chief Executive Officer will not be devoting his full-time efforts to us in the

next stages of operation. His departure could be an event of default under the

Notes.

While it

is believed that Thomas Gardner’s services will be available to us, he currently

has a non-exclusive contractual agreement to perform the services of CEO of

PhyGen LLC, which designs, manufactures and sells instruments and implants for

spine surgery. He is committed to fulfill such contractual

obligations until January 1, 2011. To assist in this transitional

stage, our Chief Financial Officer, Mark Selawski, became a full-time employee

as of April 1, 2010. Mr. Selawski has over 15 years experience in the

healthcare field and has had a previous working relationship with Mr.

Gardner. To supplement this arrangement, we have secured office space

adjacent to Mr. Gardner’s current place of business in order to facilitate a

proximal work environment for him and Mr. Selawski. We feel that the

financial arrangements that we have made for Mr. Gardner, as well as our work

toward a new employment agreement for him, should be sufficient to retain his

services, but there are no assurances these arrangements will be effective and

adequate at this stage in our development. If Mr. Gardner ceases to

be an employee of our company (other than due to a termination without good

cause), that will be an event of default under the Notes unless we obtain a

reasonably acceptable full-time replacement for Mr. Gardner within 90 days after

such termination.

10

Risks

Related to our Common Stock

There

is little current trading of our shares. Our stock price is likely to

be highly volatile.

Although

prices for our shares of common stock are quoted on the OTC Bulletin Board

(“OTCBB”), there is little current trading and no assurance can be given that an

active public trading market will develop or, if developed, that it will be

sustained. The OTCBB is generally regarded as a less efficient and

less prestigious trading market than other national markets. There is

no assurance if or when our common stock will be quoted on another more

prestigious exchange or market. The market price of our stock is

likely to be highly volatile because for some time there will likely be a thin

trading market for the stock, which causes trades of small blocks of stock to

have a significant impact on the stock price.

Because

our common stock is likely to be considered a “penny stock,” our trading will be

subject to regulatory restrictions.

Our

common stock is currently, and in the near future will likely continue to be,

considered a “penny stock.” The SEC has adopted rules that regulate

broker-dealer practices in connection with transactions in “penny

stocks.” Penny stocks generally are equity securities with a price of

less than $5.00 (other than securities registered on certain national securities

exchanges or quoted on the NASDAQ system, provided that current price and volume

information with respect to transactions in such securities is provided by the

exchange or system). The penny stock rules require a broker-dealer,

prior to a transaction in a penny stock not otherwise exempt from those rules,

to deliver a standardized risk disclosure document prepared by the SEC, which

specifies information about penny stocks and the nature and significance of

risks of the penny stock market. The broker-dealer also must provide

the customer with bid and offer quotations for the penny stock, the compensation

of the broker-dealer and any salesperson in the transaction, and monthly account

statements indicating the market value of each penny stock held in the

customer’s account. In addition, the penny stock rules require that,

prior to a transaction in a penny stock not otherwise exempt from those rules,

the broker-dealer must make a special written determination that the penny stock

is a suitable investment for the purchaser and receive the purchaser’s written

agreement to the transaction. These disclosure and other requirements

may adversely affect the trading activity in the secondary market for our common

stock.

Limited

future sales of our common stock in the public market could make it difficult to

generate significant liquidity in our stock.

As noted

above, we will be obligated to file a registration statement with the SEC to

cover resales of shares underlying the Notes and Warrants issued to the

Purchasers. However, upon the effectiveness of this registration

statement, most of the stock covered under the registration may not be

immediately available for trading. Due to a limitation in the number

of shares traded on a regular basis, there may be significant swings in the bid

and ask prices of our stock or there may not be any significant volume of the

stock available to trade.

We

have not paid dividends in the past and do not expect to pay dividends for the

foreseeable future, and any return on investment may be limited to potential

future appreciation on the value of our common stock.

We

currently intend to retain any future earnings to support the development and

expansion of our business and do not anticipate paying cash dividends in the

foreseeable future. Our payment of any future dividends will be at

the discretion of our board of directors after taking into account various

factors, including without limitation, our financial condition, operating

results, cash needs, growth plans and the terms of any credit agreements that we

may be a party to at the time. To the extent we do not pay dividends,

our stock may be less valuable because a return on investment will only occur if

and to the extent our stock price appreciates, which may never

occur. In addition, investors must rely on sales of their common

stock after price appreciation as the only way to realize their investment, and

if the price of our stock does not appreciate, then there will be no return on

investment. Investors seeking cash dividends should not purchase our

common stock.

11

Our

officers, directors and principal stockholders can exert significant influence

over us and may make decisions that are not in the best interests of all

stockholders.

Our

officers, directors and principal stockholders (greater than 5% stockholders)

collectively own approximately 74% of our outstanding common stock, and

approximately 58% of our fully-diluted common stock. As a result of

such ownership and the Voting Agreement that is in place, these stockholders

will be able to affect the outcome of, or exert significant influence over, all

matters requiring stockholder approval, including the election and removal of

directors and any change in control. In particular, this

concentration of ownership of our common stock could have the effect of delaying

or preventing a change of control of us or otherwise discouraging or preventing

a potential acquirer from attempting to obtain control of us. This,

in turn, could have a negative effect on the market price of our common

stock. It could also prevent our stockholders from realizing a

premium over the market prices for their shares of common

stock. Moreover, the interests of this concentration of ownership may

not always coincide with our interests or the interests of other stockholders,

and accordingly, they could cause us to enter into transactions or agreements

that we would not otherwise consider.

Anti-takeover

provisions may limit the ability of another party to acquire us, which could

cause our stock price to decline.

Our

certificate of incorporation, as amended, our bylaws and Delaware law contain

provisions that could discourage, delay or prevent a third party from acquiring

us, even if doing so may be beneficial to our stockholders. In

addition, these provisions could limit the price investors would be willing to

pay in the future for shares of our common stock.

FORWARD-LOOKING

STATEMENTS

This

prospectus, including the sections entitled “Risk Factors,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and

“Business,” contains “forward-looking statements” that include information

relating to future events, future financial performance, strategies,

expectations, competitive environment, regulation and availability of

resources. These forward-looking statements include, without

limitation: statements regarding proposed new services; statements concerning

litigation or other matters; statements concerning projections, predictions,

expectations, estimates or forecasts for our business, financial and operating

results and future economic performance; statements of management’s goals and

objectives; and other similar expressions concerning matters that are not

historical facts. Words such as “may,” “will,” “should,” “could,”

“would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes” and “estimates,” and similar

expressions, as well as statements in future tense, identify forward-looking

statements.

Forward-looking

statements should not be read as a guarantee of future performance or results,

and will not necessarily be accurate indications of the times at, or by which,

that performance or those results will be achieved. Forward-looking

statements are based on information available at the time they are made and/or

management’s good faith belief as of that time with respect to future events,

and are subject to risks and uncertainties that could cause actual performance

or results to differ materially from those expressed in or suggested by the

forward-looking statements. Important factors that could cause these

differences include, but are not limited to:

12

|

·

|

our

failure to implement our business plan within the time period we

originally planned to accomplish;

and

|

|

·

|

other

factors discussed under the headings “Risk Factors,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations”

and “Business.”

|

Forward-looking

statements speak only as of the date they are made. You should not put undue

reliance on any forward-looking statements. We assume no obligation

to update forward-looking statements to reflect actual results, changes in

assumptions or changes in other factors affecting forward-looking information,

except to the extent required by applicable securities laws. If we do

update one or more forward-looking statements, no inference should be drawn that

we will make additional updates with respect to those or other forward-looking

statements.

USE

OF PROCEEDS

We will

not receive any proceeds from the sale of shares to be offered by the selling

stockholders. The proceeds from the sale of each selling

stockholder’s common stock will belong to that selling stockholder.

PLAN

OF DISTRIBUTION

We are

registering certain outstanding shares of our common stock and the shares of our

common stock issuable upon conversion of the Notes (including shares of our

common stock issuable upon conversion of accrued interest on the Notes) to

permit the resale of these shares of our common stock by the holders of the

outstanding shares and the Notes from time to time after the date of this

prospectus. We will not receive any of the proceeds from the sale by

the selling stockholders of the shares of our common stock. The

Purchasers will bear all fees and expenses incident to our obligation to

register the shares of our common stock.

The

selling stockholders may sell all or a portion of the shares of our common stock

beneficially owned by them and offered hereby from time to time directly or

through one or more underwriters, broker-dealers or agents. If the

shares of our common stock are sold through underwriters or broker-dealers, the

selling stockholders will be responsible for underwriting discounts or

commissions or agent’s commissions. The shares of our common stock

may be sold in one or more transactions at fixed prices, at prevailing market

prices at the time of the sale, at varying prices determined at the time of

sale, or at negotiated prices. These sales may be effected in

transactions, which may involve crosses or block transactions:

|

·

|

on

any national securities exchange or quotation service on which the

securities may be listed or quoted at the time of

sale;

|

|

·

|

in

the over-the-counter market;

|

13

|

·

|

in

transactions otherwise than on these exchanges or systems or in the

over-the-counter market;

|

|

·

|

through

the writing of options, whether such options are listed on an options

exchange or otherwise;

|

|

·

|

ordinary

brokerage transactions and transactions in which the broker-dealer

solicits purchasers;

|

|

·

|

block

trades in which the broker-dealer will attempt to sell the shares as agent

but may position and resell a portion of the block as principal to

facilitate the transaction;

|

|

·

|

purchases

by a broker-dealer as principal and resale by the broker-dealer for its

account;

|

|

·

|

an

exchange distribution in accordance with the rules of the applicable

exchange;

|

|

·

|

privately

negotiated transactions;

|

|

·

|

short

sales;

|

|

·

|

sales

pursuant to Rule 144;

|

|

·

|

broker-dealers

may agree with the selling stockholders to sell a specified number of such

shares at a stipulated price per

share;

|

|

·

|

a

combination of any such methods of sale;

and

|

|

·

|

any

other method permitted pursuant to applicable

law.

|

If the

selling stockholders effect such transactions by selling shares of our common

stock to or through underwriters, broker-dealers or agents, such underwriters,

broker-dealers or agents may receive commissions in the form of discounts,

concessions or commissions from the selling stockholders or commissions from

purchasers of the shares of our common stock for whom they may act as agent or

to whom they may sell as principal (which discounts, concessions or commissions

as to particular underwriters, broker-dealers or agents may be in excess of

those customary in the types of transactions involved). In connection

with sales of the shares of our common stock or otherwise, the selling

stockholders may enter into hedging transactions with broker-dealers, which may

in turn engage in short sales of the shares of our common stock in the course of

hedging in positions they assume. The selling stockholders may also

sell shares of our common stock short and deliver shares of our common stock

covered by this prospectus to close out short positions and to return borrowed

shares in connection with such short sales. The selling stockholders

may also loan or pledge shares of our common stock to broker-dealers that in

turn may sell such shares.

The

selling stockholders may pledge or grant a security interest in some or all of

the Notes or shares of our common stock owned by them and, if they default in

the performance of their secured obligations, the pledgees or secured parties

may offer and sell the shares of our common stock from time to time pursuant to

this prospectus or any amendment to this prospectus under Rule 424(b)(3) or

other applicable provision of the Securities Act of 1933, as amended, amending,

if necessary, the list of selling stockholders to include the pledgee,

transferee or other successors in interest as selling stockholders under this

prospectus. The selling stockholders also may transfer and donate the

shares of our common stock in other circumstances in which case the transferees,

donees, pledgees or other successors in interest will be the selling beneficial

owners for purposes of this prospectus.

14

The

selling stockholders and any broker-dealer participating in the distribution of

the shares of our common stock may be deemed to be “underwriters” within the

meaning of the Securities Act, and any commission paid, or any discounts or

concessions allowed to, any such broker-dealer may be deemed to be underwriting

commissions or discounts under the Securities Act. At the time a

particular offering of the shares of our common stock is made, a prospectus

supplement, if required, will be distributed which will set forth the aggregate

amount of shares of our common stock being offered and the terms of the

offering, including the name or names of any broker-dealers or agents, any

discounts, commissions and other terms constituting compensation from the

selling stockholders and any discounts, commissions or concessions allowed or

reallowed or paid to broker-dealers.

Under the

securities laws of some states, the shares of our common stock may be sold in

such states only through registered or licensed brokers or

dealers. In addition, in some states the shares of our common stock

may not be sold unless such shares have been registered or qualified for sale in

such state or an exemption from registration or qualification is available and

is complied with.

There can

be no assurance that any selling stockholder will sell any or all of the shares

of our common stock registered pursuant to the registration statement, of which

this prospectus forms a part.

The

selling stockholders and any other person participating in such distribution

will be subject to applicable provisions of the Securities Exchange Act of 1934,

as amended, and the rules and regulations thereunder, including, without

limitation, Regulation M of the Exchange Act, which may limit the timing of

purchases and sales of any of the shares of our common stock by the selling

stockholders and any other participating person. Regulation M may

also restrict the ability of any person engaged in the distribution of the

shares of our common stock to engage in market-making activities with respect to

the shares of our common stock. All of the foregoing may affect the

marketability of the shares of our common stock and the ability of any person or

entity to engage in market-making activities with respect to the shares of our

common stock.

The

Purchasers will pay all expenses of the registration of the shares of our common

stock estimated to be approximately $30,000 in total, including, without

limitation, SEC filing fees and expenses of compliance with state securities or

“blue sky” laws; provided, however, that a selling stockholder will pay all

underwriting discounts and selling commissions, if any. We will

indemnify the selling stockholders against liabilities, including some

liabilities under the Securities Act, or the selling stockholders will be

entitled to contribution. We may be indemnified by the selling

stockholders against civil liabilities, including liabilities under the

Securities Act, that may arise from any written information furnished to us by

the selling stockholder specifically for use in this prospectus, or we may be

entitled to contribution.

Once sold

under the registration statement, of which this prospectus forms a part, the

shares of our common stock will be freely tradable in the hands of persons other

than our affiliates.

15

DESCRIPTION

OF REGISTRANT’S SECURITIES

As of

June 23, 2010, our authorized capital stock consisted of:

|

·

|

100,000,000

shares of common stock, par value $0.0001 per share;

and

|

|

·

|

10,000,000

shares of preferred stock, par value $0.0001 per

share.

|

As of

June 23, 2010, there were outstanding:

|

·

|

22,680,927

shares of common stock held by approximately 20 stockholders of

record;

|

|

·

|

options

to purchase 549,498 shares of common

stock;

|

|

·

|

warrants

to purchase 5,497,396 shares of common

stock;

|

|

·

|

Notes

convertible into 4,199,358 shares of common stock (including 381,762

shares accounting for accrued interest through maturity);

and

|

|

·

|

no

shares preferred stock.

|

Common

Stock

Dividend

Rights

Subject

to preferences that may apply to shares of preferred stock outstanding at the

time, the holders of outstanding shares of our common stock are entitled to

receive dividends out of funds legally available at the times and in the amounts

that our board of directors may determine.

Voting

Rights

Each

holder of common stock is entitled to one vote for each share of common stock

held on all matters submitted to a vote of stockholders. Cumulative

voting for the election of directors is not provided for in our certificate of

incorporation, as amended, which means that the holders of a majority of the

voting shares voted can elect all of the directors then standing for

election.

No

Preemptive or Similar Rights

Holders

of our common stock do not have preemptive rights, and our common stock is not

convertible or redeemable.

Right

to Receive Liquidation Distributions

Upon our

dissolution, liquidation or winding-up, the assets legally available for

distribution to our stockholders are distributable ratably among the holders of

our common stock, subject to the preferential rights and payment of liquidation

preferences, if any, on any outstanding shares of preferred stock.

16

Authorized

but Undesignated Preferred Stock

We are

authorized, subject to limitations prescribed by Delaware law, to issue

preferred stock in one or more series, to establish from time to time the number

of shares to be included in each series, to fix the designation, powers,

preferences and rights of the shares of each series and any of its

qualifications, limitations or restrictions. Our board of directors

can also increase or decrease the number of shares of any series, but not below

the number of shares of that series then outstanding, by the affirmative vote of

the holders of a majority of our capital stock entitled to vote, unless a vote

of any other holders is required by our certificate of incorporation, as

amended, or the Delaware General Corporation Law. Our board of

directors may authorize the issuance of preferred stock with voting or

conversion rights that could adversely affect the voting power or other rights

of the holders of our common stock. The issuance of preferred stock,

while providing flexibility in connection with possible acquisitions and other

corporate purposes, could, among other things, have the effect of delaying,

deferring or preventing a change in control of our company and may adversely

affect the market price of our common stock and the voting and other rights of

the holders of our common stock. We have no current plan to issue any

shares of preferred stock.

Warrants,

Options and Convertible Notes

At June

23, 2010, there were outstanding warrants exercisable to purchase shares of our

common stock, as follows:

|

·

|

3,588,558

shares at an exercise price of approximately $0.22 per share, with

expiration dates ranging from February 5, 2013 through March 15, 2015;

and

|

|

·

|

1,908,798

shares at an exercise price of approximately $0.39 per share, which will

expire on May 13, 2014.

|

At June

23, 2010, there were outstanding options exercisable to purchase shares of our

common stock, as follows:

|

·

|

549,498

shares at an exercise price of approximately $0.22 per share, which will

expire on January 7, 2017.

|

At June

23, 2010, there were outstanding Notes convertible (including accrued interest

through maturity) into shares of our common stock, as follows:

|

·

|

4,199,358

shares at a conversion price of approximately $0.39 per share, which will

mature on May 13, 2014.

|

Anti-takeover

Provisions

Certain

provisions of our certificate of incorporation, as amended, and Delaware law may

have the effect of delaying, deferring or discouraging another person from

acquiring control of our company.

17

Charter

and Bylaw Provisions

Our

certificate of incorporation, as amended, allows our board of directors to issue

10,000,000 shares of preferred stock in one or more series and with such rights

and preferences including voting rights, without further stockholder

approval. In the event that our board of directors designates

additional series of preferred stock with rights and preferences, including

super-majority voting rights, and issues such preferred stock, the preferred

stock could make our acquisition by means of a tender offer, a proxy contest or

otherwise, more difficult, and could also make the removal of incumbent officers

and directors more difficult. As a result, these provisions may have

an anti-takeover

effect. The preferred stock authorized in our certificate of

incorporation, as amended, may inhibit changes of control that are not approved

by our board of directors. These provisions could limit the price

that future investors might be willing to pay for our common

stock. This could have the effect of delaying, deferring or

preventing a change in

control. The issuance of preferred stock could also

effectively limit or dilute the voting power of our

stockholders. Accordingly, such provisions of our certificate of

incorporation, as amended, may discourage or prevent an acquisition or

disposition of our business that could otherwise be in the best interest of our

stockholders.

Delaware

Law

In

addition, Delaware has enacted the following legislation that may deter or

frustrate takeovers of Delaware

corporations:

The

Delaware General Corporation Law expressly permits our board of directors, when

evaluating any proposed tender or exchange offer, any merger, consolidation or

sale of substantially all of our assets, or any similar extraordinary

transaction, to consider all relevant factors including, without limitation, the

social, legal, and economic effects on the employees, customers, suppliers, and

other constituencies of our company and its subsidiary, and on the communities

and geographical areas in which they operate. Our board of directors

may also consider the amount of consideration being offered in relation to the

then current market price for our outstanding shares of common stock and our

then current value in a freely negotiated transaction. Our board of

directors believes such provisions are in our long-term best interests and the

long-term best interests of our stockholders.

We are

subject to the Delaware control share acquisitions statute. This

statute is designed to afford stockholders of public corporations in Delaware

protection against acquisitions in which a person, entity or group seeks to gain

voting control. With enumerated exceptions, the statute provides that

shares acquired within certain specific ranges will not possess voting rights in

the election of directors unless the voting rights are approved by a majority

vote of the public corporation’s disinterested