Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - CLST HOLDINGS, INC. | a10-13297_18k.htm |

Exhibit 99.1

Cause No.10-07655

|

|

|

|

FILED |

|

|

|

|

10 JUN 23 AM 9:29 |

|

|

|

|

GARY FITZSIMMONS |

|

|

|

|

DISTRICT CLERK |

|

|

|

|

DALLAS CO., TEXAS |

|

RON PHILLIPS AND SCOTT |

§ |

IN THE DISTRICT COURT OF |

|

MOOREHEAD, Derivatively on Behalf of |

§ |

|

|

CLST HOLDINGS, INC., |

§ |

DALLAS COUNTY, TEXAS |

|

|

§ |

|

|

Plaintiffs, |

§ |

298th-M JUDICIAL DISTRICT |

|

|

§ |

|

|

vs. |

§ |

|

|

|

§ |

|

|

TIMOTHY S. DURHAM, ROBERT A. |

§ |

|

|

KAISER, and DAVID TORNEK, |

§ |

|

|

|

§ |

|

|

Defendants, |

§ |

|

|

-and- |

§ |

|

|

|

§ |

|

|

CLST HOLDINGS, INC., a Delaware |

§ |

|

|

corporation, |

§ |

|

|

|

§ |

|

|

Nominal Defendant. |

§ |

|

|

|

§ |

|

|

|

§ |

|

|

RON PHILLIPS AND SCOTT MOOREHEAD’S SHAREHOLDER DERIVATIVE PETITION BASED UPON SELF-DEALING, BREACH OF FIDUCIARY DUTY, WASTE OF CORPORATE ASSETS, AND UNJUST ENRICHMENT

|

||

Plaintiffs Ron Phillips (“Phillips”) and Scott Moorehead (“Moorehead”) (collectively, “Plaintiffs”), by their attorneys, submit this Petition based upon self-dealing, breach of fiduciary duty, waste or corporate assets, and unjust enrichment (the “Petition”) against the defendants named herein.

DISCOVERY LEVEL

1. Pursuant to Rule 190.1 of the Texas Rules of Civil Procedure, Plaintiffs would show that discovery is intended to be conducted under Level 3 of this Rule due to the complexity of the case.

RON PHILLIPS AND SCOTT MOOREHEAD’S

SHAREHOLDER DERIVATIVE PETITION

SUMMARY OF THE ACTION

2. This is a shareholder derivative action brought by Plaintiffs on behalf of CLST Holdings, Inc. (“CLST or the “Company”) against certain of the Company’s officers and/or directors, specifically defendants Robert A. Kaiser (“Kaiser”), Timothy S. Durham (“Durham”), and David Tornek (“Tornek”) (collectively, the “Director Defendants”).

3. This action arises out of a litany of self-dealing transactions that the Director Defendants caused CLST to enter into for the Director Defendants’ own benefit and at the expense of the Company and its shareholders, including causing CLST to:

(a) sell off significant corporate operations at an unfair price while some Director Defendants received millions in cash and other benefits;

(b) acquire several assets, some of which were owned by defendant Durham, using millions of dollars in Company cash that was obtained through the liquidation of CLST’s operations, as well as to issue significant amounts of CLST stock that substantially increased the Director Defendants’ control over the Company;

(c) implement the 2008 Long Term Incentive Plan (the “Long Term Incentive Plan”)(1) despite the Company’s pending dissolution, and grant hundreds of thousands of shares of restricted stock to defendants Durham, Kaiser, and Tornek pursuant thereto;

(d) initiate a poison pill in the form of a shareholders rights plan (“Rights Plan”) that succeeded in averting a potential tender offer that was in the best interest of the Company and its

(1) The Long Term Incentive Plan approved by the Board of Directors (the “Board”) in 2008 is effectively a de facto “Directors” incentive plan. Although the Long Term Incentive Plan permits various stock and stock option-based awards to the Company’s employees, officers, consultants, and advisors, the Director Defendants are the intended recipients. CLST’s public filings indicate the Company has approximately three employees, one of whom may be Kaiser. Similarly, without significant business operations, the Company should have little to no need for consultants or advisors. Moreover, it appears that Director Defendants are so far the only recipients under the plan. Thus, the Long Term Incentive Plan is merely a vehicle by which the Director Defendants have taken advantage of their positions on the Board to line their pockets and increase their power hold on the Company.

shareholders;

(e) forego an annual stockholders’ meeting for 2008; and

(f) repeatedly fail to hold any annual stockholders’ meeting in 2009 despite repeatedly announcing or agreeing to hold such meetings.

4. Among other relief sought on behalf of CLST, Plaintiffs seek rescission of some of these transactions, including Purchase Agreements I and II (as defined herein) and the Long Term Incentive Plan.

5. As the Company’s officers and directors, the Director Defendants are determined to maintain their control over the Company until their self-serving objectives are achieved. Rather than act in the best interests of CLST and its shareholders, the Director Defendants have used corporate instrumentalities to maintain their control over the Company to enable them to line their own pockets and insulate themselves from liability for their past misdeeds. As a result, they have breached their fiduciary duties owed to CLST and its shareholders.

6. Even a brief summary of CLST’s recent history reveals the Director Defendants’ elaborate scheme to entrench and enrich themselves. Since March 28, 2007, CLST has been a holding company approved for dissolution by both its Board and its shareholders. As such, the Company had very few assets, but substantial cash on hand. At the close of fiscal year 2007, CLST had approximately $11.8 million in cash, constituting almost half of the Company’s assets. Indeed, when CLST’s shareholders approved a plan for liquidation and dissolution of the Company (the “Dissolution Plan”), they understood that the proceeds from the subsequent sale of substantially all of the Company’s assets would be distributed to the shareholders. The Dissolution Plan was also endorsed by the Board as being in the best interests of CLST and its shareholders considering the Company’s financial issues. By June 11, 2007, the Company completed the sale of substantially all of its operations. But rather than act in the Company’s and its shareholders’ best interests by protecting this cash reserve and providing for its distribution to shareholders, the Director Defendants engaged in an elaborate, ongoing scheme to line their own pockets.

7. Shortly after the Company discontinued its operations, defendant Durham led the Director Defendants to pursue control of the Board. Durham and his hand-picked slate of nominees won the trust of CLST’s shareholders by pledging to carry out the Dissolution Plan. But this was merely a pretext. The Director Defendants revealed their true motive for control by approving a series of self-interested transactions and causing CLST to effectively abandon the Dissolution Plan without shareholder approval.

8. Over the span of four months alone, the Board, under the control of defendant Durham and his personally-selected directors, caused CLST to enter into three purchase agreements for the acquisitions of certain receivables dated November 10, 2008, December 12, 2008, and February 13, 2009, respectively (collectively referred to as the “Purchase Agreements”). These Purchase Agreements were entered in derogation of the Director Defendants’ fiduciary duties and the shareholder mandate to wind up the Company pursuant to the Dissolution Plan. Moreover, the identities of the parties to the transactions, or initial lack thereof, demonstrate the self-dealing nature of the asset purchases. The Director Defendants initially redacted, among other things, the identity of the seller and lender from the first two of the purchase agreements. As for the third purchase agreement dated February 13, 2009, not only was a majority of assets acquired through the transaction purchased from defendant Durham and a company he owned and operated in part, but defendant Durham was unlawfully issued a substantial amount of stock as part of the transaction, increasing his purported beneficial ownership to approximately 14.7% of the Company’s stock from approximately 4.9% before the transaction. In at least two of these purchase agreements, a company controlled by defendant Durham was significantly involved and is posed to receive substantial fees.

9. On December 1, 2008, in further disregard of their pledge to execute CLST’s Dissolution Plan, defendants Durham and Kaiser caused CLST to approve the Long Term Incentive Plan, which provided for the award of up to 20 million shares of CLST securities, and approve the grant of 300,000 shares of restricted stock to each of CLST’s directors, including Durham and Kaiser, even though CLST has little or no need to provide employees or directors long-term incentives.

10. On February 3, 2009, Red Oak Fund, LP (“RO Fund”), a fund managed by Red Oak Partners, LLC (“Red Oak”) and a shareholder of CLST, announced that it intended to commence a tender offer for CLST (the “Proposed Tender Offer”). Rather than objectively consider whether to approve or oppose the Proposed Tender Offer, the Director Defendants acted in their own personal interests and immediately caused CLST to adopt a poison pill Rights Plan. The purported purpose of the Rights Plan was to protect the Company’s deferred tax assets. But later events reveal this was merely a pretext; the Director Defendants in reality sought to maintain their control. For example, the Director Defendants caused the Company to enter into Purchase Agreement III (as defined herein) on February 13, 2009, even before receiving the fairness opinion for the transaction, in an apparent rush. Ultimately, the Rights Plan caused Red Oak to terminate its Proposed Tender Offer to the detriment of CLST, but to the benefit of the Director Defendants.

11. Around this time, serious disagreement broke out between the Company’s directors. Manoj Rajegowda (“Rajegowda”), the fourth and only independent director, disagreed with the transactions the Board was approving and the course the Board had set for the Company. Rajegowda later resigned and disclosed that he had concerns regarding potentially interested transactions, the failure by the Company to properly present Board minutes for approval, and the Board’s apparent disregard of the shareholder mandate to promptly dissolve the Company.

12. To avoid the legitimate concerns and protests of Rajegowda, also on February 3, 2009, the Director Defendants created an executive committee (the “Executive Committee”). They delegated all of the Board’s authority to this committee. Each and every Director Defendant was then appointed to the committee, which was also given the powers of the Board’s Audit Committee (“Audit Committee”). This establishment of the Executive Committee effectively stripped independent director Rajegowda, of any meaningful authority as a director.

13. Since Durham, Kaiser, and Rajegowda (collectively, the “Durham Nominees”) were elected on August 7, 2007, CLST has not had an annual stockholders’ meeting. None of the Director Defendants have been put to re-election since taking office in August 2007, including Kaiser who had only been elected for a one-year term.

14. On March 13, 2009, Durham, Kaiser, and Tornek, as CLST’s only officers and directors, caused CLST to announce that it would hold an annual meeting of stockholders on May 22, 2009.

15. The Director Defendants took desperate action following the April 2, 2009 record date for the announced stockholders’ meeting. The Board made a decision indicating that during the period before the record date, either the Director Defendants attempted to increase their holdings but were unable to, or they determined they had insufficient votes to maintain their positions on the Board. Regardless, the Director Defendants determined they needed more time.

16. As a result, on April 6, 2009, the CLST Board decided to postpone the Company’s annual stockholders’ meeting until September 25, 2009.

17. On April 14, 2009, the Company released its quarterly report for the first quarter of 2009 (“1Q:09 Report”). The report indicated that CLST is operating at a pre-tax loss, and that the purchase agreements were failing to live up to their purported purpose of generating additional income for the Company.

18. Moreover, the 1Q:09 Report, like the Company’s various other annual, quarterly, and current reports since November 2008, failed to provide adequate disclosures relating to the three Purchase Agreements and other self-dealing transactions. Rather than comply with the demands of the U.S. Securities & Exchange Commission (“SEC”) for full disclosure of information that shareholders would consider important, it appears that the Director Defendants, as CLST’s directors and officers, insist on causing the Company to withhold or inadequately disclose such information. As a result, CLST is being forced to needlessly expend substantial resources as it continues to amend its various filings time and time again. These repeated amendments further demonstrate that the Director Defendants are acting in bad faith and are disloyal to CLST and its shareholders.

19. Also indicative of bad faith and disloyalty, the Director Defendants, as the Company’s Board, persisted in further delaying the Company’s long-overdue annual stockholders’ meeting. Predictably, on August 14, 2009, the Board voted to once again postpone the annual stockholders’ meeting, this time until October 27, 2009. Despite entering a court-approved stipulation to hold the

annual stockholders’ meeting on October 27, 2009, defendants once again caused CLST to postpone the annual stockholders’ meeting. Once more, defendants signed a stipulation (also approved by the court) setting an annual stockholders’ meeting on December 15, 2009 and once more CLST failed to hold an annual meeting.

20. Thereafter, when faced with a motion for summary judgment to compel annual meetings for 2008, 2009, and 2010, the Director Defendants took desperate action to interfere with the Company’s ability to hold an annual meeting. They caused CLST to announce its intent to file a certificate of dissolution on February 26, 2010, the effect of which presumably would have caused CLST to immediately enter dissolution. Nonetheless, a state court in Dallas, Texas ordered on February 15, 2010, that the Company to hold an annual stockholders’ meeting on March 23, 2010. However, the Company successfully appealed the February 15, 2010 order, which an appellate court invalidated based on a procedural technicality.

21. Pursuant to a stipulated order, the Company filed its certificate of dissolution on March 26, 2010, to be effective ninety days later on June 24, 2010. But given that CLST has not announced an annual stockholders’ meeting as of the date this Petition was filed, it seems unlikely that the Director Defendants will ever face reelection (or in defendant Tornek’s case, any vote by CLST shareholders).

22. Meanwhile, CLST has issued multiple amendments to various public filings, including its quarterly reports through August 2009. These amendments likely result from pressure from the SEC for CLST to be more forthcoming with its shareholders.

23. At the same time, the Director Defendants, particularly defendant Durham, face a slew of lawsuits and government investigations as part of a litigation liquidation spree that continues to snowball without any visible end in sight. As a result, the Director Defendants, at the very least, are distracted from properly performing their fiduciary duties owed to CLST, which stands to easily fall by the wayside as a litany of legal issues preoccupies the Director Defendants. Moreover, a staggering amount of litigation now being brought against Durham and his affiliates exposes a pattern of illicit business practices pursuant to which CLST is merely one of Durham’s many victims.

Unless swift action is taken, CLST may have little chance of securing any recovery against Durham and related parties as assets are being liquidated and consumed by the array of lawsuits.

24. In pursuing these various self-dealing transactions, which were at odds with the best interests of CLST and its shareholders, and perpetrating an ongoing scheme to maintain their control over the Company, the Director Defendants have breached their fiduciary duties of loyalty, independence, due care, good faith, candor, and fair dealing, and have aided and abetted such breaches by CLST’s officers and directors. Instead of attempting to preserve the Company’s liquidated cash assets for the benefit of CLST and its shareholders, the Director Defendants caused CLST to waste tens of millions of dollars to meet the Director Defendants’ personal objectives. Likewise, at CLST’s expense, the Director Defendants have taken multiple unlawful steps to maintain – if not increase – their influence over the Company.

25. The Director Defendants dominate and control CLST’s business and corporate affairs. They have used, and will continue to use, their virtually unchecked power to engage in transactions inherently unfair for CLST, while they reap disproportionate benefits to the exclusion of the Company and its shareholders. Only after they have substantially increased their ownership in the Company will the Director Defendant consider liquidating the Company, in order to pocket a larger portion of any dividends upon dissolution.

JURISDICTION AND VENUE

26. This Court has jurisdiction over each defendant named herein because each defendant is an individual who has sufficient minimum contacts with Texas so as to render the exercise of jurisdiction by the Texas courts permissible under traditional notions of fair play and substantial justice.

27. Venue is proper in this Court because a substantial portion of the transactions and wrongs complained of herein, including the defendants’ primary participation in the wrongful acts and aiding and abetting and conspiracy in violation of fiduciary duties owed to CLST occurred in this County.

PARTIES

28. Plaintiff Phillips is, and was at times relevant hereto, an owner and holder of 418,500 shares of CLST stock. Phillips first purchased CLST common stock on February 6, 2009. Phillips has continuously held without interruption CLST stock since February 6, 2009, and intends to remain a CLST shareholder throughout the pendency of this action. Phillips did not purchase any shares of CLST common stock for the purpose of bringing a derivative action on behalf of CLST. Phillips also intends to vigorously litigate this action and fulfill his fiduciary responsibilities in representing the interests of the Company and similarly situated CLST shareholders in this action.

29. Plaintiff Moorehead is, and was at times relevant hereto, an owner and holder of at least 29,500 shares of CLST stock. Moorehead has continuously held without interruption CLST stock since at least March 2006 and intends to remain a CLST shareholder throughout the pendency of this action. Moorehead did not purchase any shares of CLST common stock for the purpose of bringing a derivative action on behalf of CLST. Moorehead also intends to vigorously litigate this action and fulfill his fiduciary responsibilities in representing the interests of the Company and similarly situated CLST shareholders in this action.

30. CLST is named as a nominal defendant for purposes of all derivative claims. CLST was formed in 1993 under the name CellStar Corporation (“CellStar”), and operated in the wireless telecommunications industry. On March 28, 2007, CellStar’s shareholders approved the liquidation and dissolution of the Company, and shortly thereafter, CellStar sold substantially all of its assets in two separate transactions. Meanwhile, CellStar changed its name to CLST Holdings, Inc. on April 3, 2007. CLST is incorporated in Delaware and its headquarters are located in Dallas, Texas. Under Article 2.11(A) of the Texas Business Corporation Act, CLST may be served with process by and through its Chairman and Chief Executive Office (“CEO”) as follows:

CLST Holdings, Inc.

c/o Robert A. Kaiser, Chairman and CEO

17304 Preston Road

Dominion Plaza

Suite 420

Dallas, Texas 75252

31. Defendant Durham is a CLST director and allegedly holds approximately 15% of CLST common stock. This lawsuit arises out of business that Durham engaged in Texas. In accordance with CPRC §17.044(b), the Texas Secretary of State is therefore the agent for service of process on defendant Durham. Durham may be served with process in accordance with CPRC §17.045(a) by serving the Texas Secretary of State, Esperanza “Hope” Andrade, at 1019 Brazos Street, Austin, Texas. The Secretary of State may serve defendant with process at his home:

Timothy S. Durham

14353 E. 113th Street

Fortville, IN 46040-9660

And

1227 Sierra Alta Way

Los Angeles, CA 90069-1731

SERVICE OF PROCESS VIA THE SECRETARY OF STATE IS HEREBY REQUESTED ON THIS DEFENDANT.

32. Defendant Kaiser is CLST’s President, CEO, Chief Financial Officer (“CFO”), Treasurer, Assistant Secretary, and Chairman. Kaiser may be served with process at 5016 Silver Lake Drive, Plano, Texas, 75093.

SERVICE OF PROCESS VIA CERTIFIED MAIL IS HEREBY REQUESTED ON THIS DEFENDANT.

33. Defendant Tornek is a CLST director. This lawsuit arises out of business that Durham engaged in Texas. In accordance with CPRC §17.044(b), the Texas Secretary of State is therefore the agent for service of process on defendant Tornek. Tornek may be served with process in accordance with CPRC §17.045(a) by serving the Texas Secretary of State, Esperanza “Hope” Andrade, at 1019 Brazos Street, Austin, Texas. The Secretary of State may serve defendant with process at his home:

David Tornek

3645 S. Dahlia Street

Englewood, Colorado, 80113

SERVICE OF PROCESS VIA THE SECRETARY OF STATE IS HEREBY REQUESTED ON THIS DEFENDANT.

DEFENDANTS’ FIDUCIARY DUTIES

34. By reason of their positions as officers, directors, and/or fiduciaries of CLST and because of their ability to control the business and corporate affairs of CLST, the Director Defendants owed CLST and its shareholders fiduciary obligations of trust, loyalty, good faith, and due care, and were and are required to use their utmost ability to control and manage CLST in a fair, just, honest, and equitable manner. The Director Defendants were and are required to act in furtherance of the best interests of CLST and its shareholders so as to benefit all shareholders equally and not in furtherance of their personal interest or benefit.

35. Each director and officer of the Company owes to CLST and its shareholders the fiduciary duty to exercise good faith and diligence in the administration of the affairs of the Company and in the use and preservation of its property and assets, and the highest obligations of fair dealing.

36. The Director Defendants, because of their positions of control and authority as directors and/or officers of CLST, were able to and did, directly and/or indirectly, exercise control over the wrongful acts complained of herein.

37. At all times relevant hereto, each of the Director Defendants was the agent of each of the other Director Defendants and of CLST, and was at all times acting within the course and scope of such agency.

38. To discharge their duties, the officers and directors of CLST were required to exercise reasonable and prudent supervision over the management, policies, practices, and controls of the financial affairs of the Company. By virtue of such duties, the officers and directors of CLST were required to, among other things:

(a) refrain from acting upon material inside corporate information to benefit themselves;

(b) conduct the affairs of the Company in an efficient, business-like manner so as to make it possible to provide the highest quality performance of its business, to avoid wasting the Company’s assets, and to maximize the value of the Company’s stock;

(c) remain informed as to how CLST conducted its operations, and, upon receipt of notice or information of imprudent or unsound conditions or practices, make reasonable inquiry in connection therewith, and take steps to correct such conditions or practices and make such disclosures as necessary to comply with securities laws; and

(d) ensure that the Company was operated in a diligent, honest, and prudent manner in compliance with all applicable laws, rules, and regulations.

39. Each Director Defendant, by virtue of his position as a director and/or officer, owed to the Company and to its shareholders the fiduciary duties of loyalty, good faith, and independence in the management and administration of the affairs of the Company, as well as in the use and preservation of its property and assets. The conduct of the Director Defendants complained of herein involves a knowing and culpable violation of their obligations as directors and officers of CLST, the absence of good faith on their part, and a reckless disregard for their duties to the Company and its shareholders that the Director Defendants were aware or should have been aware posed a risk of serious injury to the Company. The conduct of the Director Defendants who were also officers and/or directors of the Company between March 1, 2006, and the present (the Relevant Period) have been ratified by the remaining Director Defendants who collectively comprised a majority of the Board since July 31, 2007, and the entire Board since February 24, 2009.

40. In accordance with their duties of loyalty and good faith, the Director Defendants, as directors and/or officers of CLST, are obligated under Delaware law to refrain from:

(a) participating in any transaction where the directors’ or officers’ loyalties are divided;

(b) participating in any transaction where the directors or officers receive, or are entitled to receive, a personal financial benefit not equally shared by the public shareholders of the corporation; and/or

(c) unjustly enriching themselves at the expense or to the detriment of the public shareholders.

41. Plaintiffs allege herein that the Director Defendants, separately and together, in

connection with the Purchase Agreements, knowingly or recklessly violated their fiduciary duties and aided and abetted such breaches, including their duties of loyalty, good faith, and independence owed to CLST and its shareholders. Defendant Durham, if not all of the Director Defendants, stood on both sides of the transactions, engaged in self-dealing, obtained for themselves personal benefits, including personal financial benefits not shared equally by CLST and its shareholders, and avoided providing shareholders and the only independent director with all information regarding these transactions. Moreover, as a result of the Director Defendants’ self-dealing and divided loyalties, CLST did not pay fair value for the assets it acquired in the Purchase Agreements.

42. Because the Director Defendants knowingly or recklessly breached their duties of loyalty, good faith, and independence in connection with the Purchase Agreements, the burden of proving the inherent or entire fairness of the Purchase Agreements, including all aspects of its negotiation, structure, price, and terms, is placed upon Defendants as a matter of law.

43. Likewise, defendant Durham stood on both sides of some or all of the asset purchases made pursuant to the Purchase Agreements. As a corporate fiduciary standing on both sides of corporate transactions, Durham has the burden of proving the inherent or entire fairness of such asset purchases, including all aspects of their negotiation, structure, price, and terms. As part of inherent or entire fairness, Durham also owed a duty of candor, which prohibited the use of superior information or knowledge to mislead others in the performance of their own fiduciary obligations.

44. Plaintiffs also allege herein that the Director Defendants, when informed of Red Oak’s intent to make the Proposed Tender Offer, had an obligation to determine whether the Proposed Tender Offer was in the best interests of the Company and its shareholders. Moreover, because the Director Defendants chose to oppose the Proposed Tender Offer, the potential for conflict places upon the Director Defendants the burden of proving that:

(a) the Director Defendants had not acted solely or primarily out of a desire to perpetuate themselves in office;

(b) the threatened takeover posed a danger to corporate policy and effectiveness;

(c) the defensive measures adopted were reasonable in relation to the threat posed; and

(d) the Director Defendants satisfied the above prerequisites by acting in good faith at all times and conducting a reasonable and diligent investigation.

FINANCIAL ISSUES ULTIMATELY LED THE BOARD TO RECOMMEND THE COMPANY BE LIQUIDATED AND DISSOLVED

45. Through 2005 and 2006, CellStar(2) faced a series of financial and operating issues that ultimately caused the Board to conclude that the liquidation and dissolution of the Company was in the best interests of CellStar’s shareholders. Among other things, accounting errors in certain of CellStar’s accounts receivable and revenue sparked a chain of financial issues, including the restatement of its financial results for the fiscal years 2000 to 2003 and for the quarters ended February 29, 2005, May 31, 2005, and August 31, 2005. In addition, CellStar experienced a tightening of credit by its vendors, which adversely affected the Company’s liquidity and financial viability. During this time, CellStar lost customers and had difficulty securing new customers, which strained the Company’s financial resources and negatively impacted the Company’s profitability and ability to obtain additional financing. Unfortunately, CellStar’s attempts to refinance its debt were largely unsuccessful.

46. On January 22, 2007, “after evaluating various strategic alternatives and conducting an extensive review of [CellStar’s] financial condition,” CellStar’s “board of directors unanimously approved and declared advisable the liquidation and dissolution of the Company ... and determined that the Plan of Dissolution [was] in the best interests of CellStar and its stockholders.”(3)

(2) CLST did business as CellStar until March 28, 2007, when the Company’s shareholders approved a proposal to amend CellStar’s Certificate of Incorporation to change its corporate name to “CLST Holdings, Inc.”

(3) At this time, the Company’s Board was comprised of defendant Kaiser and non-defendants Dale V. Kesler, Jere W. Thompson, John L. Jackson, and Da Hsuan Feng.

47. Pursuant to the Dissolution Plan, the Board was to take all steps necessary to reduce the Company’s operating expenses, wind-up the remaining operations of the Company, satisfy the Company’s obligations, and distribute any available proceeds to CLST’s shareholders.

48. On February 20, 2007, CellStar filed a proxy statement on Form DEF14A (“CellStar’s Proxy”) with the SEC, inviting its shareholders to a special meeting to vote upon the following Board recommendations: (i) the liquidation and dissolution of CellStar as set forth in the Dissolution Plan; (ii) the sale of substantially all of the assets of CellStar’s United States and Miami-based Latin American operations (the “U.S. Sale Agreement”); (iii) the sale of all the outstanding shares of stock of CellStar’s Mexican subsidiaries (the “Mexico Sale Agreement”); and (iv) a proposal to amend CellStar’s Certificate of Incorporation to change its corporate name to “CLST Holdings, Inc.” CellStar’s Proxy explained that if CellStar “did not obtain stockholder approval of the Plan of Dissolution[, CellStar] would have to continue [its] business operations from a very difficult position ....” On March 28, 2007, CellStar’s shareholders approved the Dissolution Plan, the U.S. and Mexico Sales Agreements, and the change of the Company’s corporate name to CLST Holdings, Inc.

49. Within days of shareholder approval of the U.S. Sale Agreement, defendant Kaiser resigned as President and CEO of the Company, purportedly on the basis that the U.S. Sale Agreement required Kaiser’s termination, and received a change in control payment in the amount of $3,620,000. Defendant Kaiser later resigned as Chairman of the Board on April 17, 2007. Within four months, however, defendants Durham and Kaiser took control of the Board and began taking advantage of the Company’s liquidated cash assets. The Board proceeded to elect Kaiser as the Company’s Chairman of the Board, President, Chief Financial Officer (“CFO”), Treasurer, and Assistant Secretary. Defendant Kaiser failed to return to the Company his $3.6 million change-of-control payment that he received only four months earlier.

EARLY SELF-DEALING IN THE SALE OF CLST’S U.S. ASSETS

50. Baffling events and public statements indicate that defendant Kaiser was able to pocket millions of dollars and take a de facto vacation in return for selling CLST’s (then CellStar’s)

operations on the cheap. Moreover, there are indications that other Director Defendants may have profited from this transaction as well.

51. According to the Company’s annual report for fiscal year ended November 30, 2007 (“2007 Annual Report”), defendant Kaiser served as CLST’s Senior Vice President and CFO from December 2001 until October 2, 2003. He was then named the Company’s President and Chief Operating Officer, which he served as until March 30, 2007. Kaiser also served as a director and Chairman of CLST’s Board between May 2, 2005 and April 17, 2007, when he resigned from the positions.

52. According to the 2007 Annual Report, defendant Kaiser resigned as CEO and President of CLST on March 30, 2007, “in connection with the closing of the U.S. Sale.” The sale referred to in the 2007 Annual Report was a sale of substantially all of CellStar Corporation’s United States operations (“U.S. Sale”) before the Company was renamed to CLST Holdings, Inc. The purchaser in the U.S. Sale was 2601 Metropolis Corp., a wholly-owned subsidiary of Brightpoint, Inc. (“Brightpoint”).

53. The circumstances surrounding the U.S. Sale indicate that defendants Kaiser and/or Durham may have compromised CLST’s best interests for their personal gain. According to a July 2007 proxy statement filed by Durham and others, Brightpoint “directly paid” Kaiser “on behalf of” CLST a change in control payment of $3,620,000. The proxy statement indicated that the payment was triggered by Kaiser’s resignation, which was necessary to “avoid delaying” the U.S. Sale. However, there are indications that Kaiser may not have been required to resign despite what was reported to shareholders. For example, the U.S. Sale Agreement did not expressly call for Kaiser’s resignation. In fact, a February 2007 proxy statement merely stated that pursuant to his employment agreement, Kaiser was “entitled to terminate his employment upon a change in control,” and that upon such termination, Kaiser would be “entitled to a lump sum payout of $500,000 plus three times the sum of (a) his base salary on the date of termination and (b) the greater of his bonus for the fiscal year immediately preceding the fiscal year of the termination or an average of his annual incentive payments made for each of the last three fiscal years immediately preceding the fiscal year of the

termination.” But merely because Kaiser was “entitled” to such termination and termination payment did not mean he was required to take them, especially if they posed a conflict of interest or a breach of his fiduciary duties.

54. Moreover, defendant Kaiser’s departure from the Company was short lived. At the July 2007 annual meeting of CLST’s stockholders, Kaiser was elected a Class I director, allegedly for a term of one year. The Board shortly thereafter appointed Kaiser as its Chairman. On August 28, 2007, the Board authorized CLST to retain Kaiser as a consultant for $20,000 per month. Less than a month later, on September 25, 2007, the Board elected Kaiser to be the Company’s President, Treasurer, CEO, and CFO. These events indicate that Kaiser may have been self-dealing, and that the entire fairness of the U.S. Sale is questionable.

55. The U.S. Sale is further clouded with suspicions arising from defendant Durham’s significant connections to Brightpoint. As early as August of 2002, Durham was purchasing shares of Brightpoint stock. He also formed a shareholder group, the Durham Najem Group, that further increased his influence over Brightpoint.(4)

56. Defendant Durham profited heavily from his investment in Brightpoint. But some people do not believe Durham’s profits were fortuitous. According to a March 26, 2007, Indianapolis Business Journal (“IBJ”) article entitled Texas Investment Put Durham in Middle of Brightpoint Deal (“IBJ Article”), Durham has “been dogged by speculation he had inside information when he scooped up shares five years ago in then-foundering Brightpoint Inc. - a bet he figures made him more than $30 million when the company roared back.” The speculation arose, the article stated, due to the fact that Durham was a business associate of Dan Laikin, who also happens to be the brother of Brightpoint’s CEO, Bob Laikin. In fact, according to 2007 and 2008 annual reports filed by National Lampoon, Inc. (“National Lampoon”) with the SEC, both Durham and Dan Laikin served simultaneously on National Lampoon’s Board.

(4) According to a Form SC 13D/A filed with the SEC on November 2, 2005, the Durham Najem Group was formally dissolved on November 1, 2005.

57. Further, the Chapter 7 Trustee appointed to oversee the Fair Finance Company (“FFC”) bankruptcy proceedings, Brian Bash, recently filed a suit against Dan Laikin in an attempt to untangle the array of related-party loans that drove FFC into insolvency and recoup the money owed to thousands of FFC investors. According to the suit, Dan Laikin posted stock held in one of defendant Durham’s investment accounts as collateral for insider loans taken out through DC Investments, LLC (“DC Investments”). A good portion of that collateral is Brightpoint stock worth approximately $1.7 million.

58. Defendant Durham’s initial investment in CellStar stock has likewise raised concerns that he was acting on insider information. As the IBJ Article reported, an SEC filing “shows that a Durham-led investment group was buying shares in Texas-based CellStar Corp. in February 2006 just as Plainfield-based Brightpoint Inc. submitted a secret, non-binding proposal to buy the company ... Durham hears the whispers.” The proposed sale would have offered CellStar shareholders a premium of $0.30 cents a share. Two days after Brightpoint submitted its proposal, Durham disclosed that he and his group had acquired a 6% ownership stake in CellStar. Granted, the IBJ Article explained that “the Durham group had purchased just a tiny portion of its 1.3 million shares within the prior 60 days.”

59. According to the IBJ Article, “[t]he disclosure of the Durham stake caused CellStar shares to spike, so much so that the next month Brightpoint pulled its proposal, saying it would resume discussions after the company reported its next quarterly results.” Nonetheless, the Durham Najem Group proceeded to acquire more CellStar stock, increasing their ownership percentage to around 8%.

60. Eventually a deal was struck between CellStar and Brightpoint. CellStar agreed to sell substantially all of its U.S. operations to Brightpoint for $88 million. Despite the indications that defendant Durham knew the deal would go through all along, Durham at least seemed disappointed by the consideration offered in the sale. Durham publicly opposed the sale to Brightpoint, saying it undervalued CellStar (now CLST). Commenting on the low value assigned to

CellStar’s U.S. operations, Durham reportedly said, “[o]ur initial, first-blush reaction is, this is significantly lower than we thought it was worth.”

THE DIRECTOR DEFENDANTS REPLACE A MAJORITY OF CLST’S DIRECTORS AND RISE TO POWER

61. Even before CLST’s shareholders held a special meeting on March 28, 2007, defendant Durham had commenced several efforts to replace a majority of the Company’s directors. Ultimately, he succeeded in securing himself and his hand-picked nominees’ seats on the Board.

62. Around early March of 2006, defendant Durham expanded a group of CLST shareholders he organized and/or controlled. As part of the expansion, defendant Tornek, Durham’s longtime friend, became a member of Durham’s shareholder group.

63. According to Company filings, defendant Durham and “two of his associates” met with defendant Kaiser and Sherrian Gunn (“Gunn”) on July 12, 2006, to “discuss the condition of the Company.” At the time, Kaiser was CellStar’s CEO, Chief Operating Officer, President, and Chairman of the Board, and Gunn was the Company’s Vice President of Investor Relations and Treasurer. During the meeting, Kaiser “commented that he was working with a fatigued Board.” Kaiser “also said that something may need to be done to get some of the directors off the Board and to add new Board members.” In response to a question about why the Company had not held an annual stockholder’s meeting, Kaiser said that the director acting as Chairman of the Audit Committee was up for re-election, but might not accept nomination, and thus, would likely leave a vacancy for the chairmanship. In regards to this, one of “Durham’s associates suggested the name of a potential nominee for director who could be Chairman of the Audit Committee.”

64. On March 28, 2007, CellStar held a special meeting of stockholders at which CellStar shareholders approved the U.S. Sale Agreement, the Mexico Sale Agreement, and the Dissolution Plan.

65. About two weeks later, on April 13, 2007, defendant Durham’s attorney(5) sent the Board a letter demanding that the Board call an annual stockholders’ meeting for the purposes of filling all the authorized seats on the Board and considering properly-made shareholder proposals. The letter also demanded that the Board give Durham the opportunity to propose persons for nomination by the Board to stand for election. In the event the Board did not call an annual meeting, Durham also demanded that defendant Kaiser, in his capacity as Chairman of the Board, call a special meeting of shareholders. Durham contended that the failure to call an annual stockholders’ meeting or a special meeting of stockholders was intended to keep the current Board in control beyond each director’s respective term of office.

66. The following day, defendant Kaiser called a special meeting. On April 17, 2007, the full Board held a meeting. The Board agreed to hold an annual meeting by the end of June 2007. Accordingly, Kaiser withdrew his call for the special meeting.

67. On April 26, 2007, defendant Durham, “his attorney,” and Pat O’Donnel (“O’Donnel”), a Company stockholder and member of Durham’s shareholder group, met with two of the Company’s directors, its general counsel, and its outside counsel. The purpose of the meeting was to discuss Durham’s desire that the current Board resign and the new Board be restructured to consist of five to seven directors, none of whom would be a current or former officer or director of the Company. Moreover, Durham wanted all to be nominated or otherwise be represented by the director representing the Company’s major shareholders. According to Company filings, both Durham and O’Donnel “believed that the major stockholders of the Company were better suited to conduct the Company’s business in the foreseeable future in a manner that maximizes the value of the interests of all of the Company’s stockholders than the existing Board.” Durham and O’Donnel also both stated a desire to be on the new Board.

(5) Company filings, including the July 2007 proxy statement, do not specify which attorney sent the April 13, 2007, letter.

68. On April 17, 2007, Kaiser resigned as Chairman of the Board. The Board elected Dale V. Kesler (“Kesler”) to replace Kaiser as Chairman.

69. Throughout May 2007, CLST’s directors discussed the Company’s management and the makeup of the Board with several of CLST’s shareholders. A common theme throughout these discussions was that CLST’s shareholders wanted the Board to: (i) follow the Dissolution Plan approved by CLST’s shareholders; and (ii) distribute the proceeds from the asset sales as promptly as possible.

70. On May 18, 2007, Kesler, as Chairman, sent a letter to certain Company shareholders, including defendant Durham. According to the letter, the Board’s discussions regarding the Company’s management and the makeup of the Board with each of these shareholders indicated to the Board “a lack of consensus among [the shareholders] as to how the Board and the Company should proceed.” The letter disclosed that “[a]lthough the Company announced its intention to hold the annual stockholders meeting on or before June 29,” the Board did not believe it would be “feasible to do so.” But, the Board anticipated that the meeting would be held in July.

71. That same day, Jeffrey M. Sone (“Sone”) of Jackson Walker LLP (“Jackson Walker”), on defendant Durham’s behalf, sent a letter to Kesler in response to the Chairman’s May 18th, letter. In his letter, Sone indicated that the Board was tampering with the nominating process in breach of their fiduciary duties:

Our client is disappointed that the Board has placed conditions on stockholder participation in the director nominating process that are not present in the corporation’s Bylaws, Certificate of Incorporation or applicable law. Effectively, the Board has precluded meaningful participation by stockholders in the nominating process unless those stockholders can prove to the Board’s satisfaction that, among other things, election results in their favor are a forgone conclusion. Our client believes that this is unfortunate and a breach of the fiduciary duties of participating members of the Board of Directors.

72. In his May 18th letter, Sone, also asked for various documents related to director nominations on defendant Durham’s behalf. Sone first requested documents relating to concerns that Grant Thornton LLP (“Grant Thornton”), the Company’s auditors at the time, purportedly expressed

regarding their continuation as the Company’s auditors should a new Board be elected. Second, Sone requested “minutes of the meetings at which the procedures outlined in the May [18] letter were adopted, together with copies of all management recommendations, briefing books and other materials received or considered by the Board of Directors in connection therewith.” He explained that such information was “necessary to permit [his] client to participate in the nomination and election of directors under applicable law and under the requirements established by the Board in the May 18 Letter.” Sone also warned that Durham would bring a demand under Section 220 of the Delaware General Corporation Law for the same materials if the Board did not immediately cooperate.

73. In response to Sone’s May 18th letter, the Company’s outside counsel sent a letter to Sone on May 22, 2007. The letter stated that defendant Durham was free to participate in any director nominating process pursuant to the Company’s Bylaws, its Certificate of Incorporation, or applicable law. The letter also clarified that the nominating process Durham and Sone objected to in their May 18th letter was a means by which people nominated by the shareholders could become the only nominees named in the Company’s proxy statement, and thus the process did not take away any other rights the shareholders had.

74. The May 22, 2007 letter also responded to Sone’s informal request for documents. The letter first explained that there were no written communications between Grant Thornton and CLST. Additionally, in sharp contrast to what Durham and the other Director Defendants would do nearly two years later, the letter excerpted relevant portions of Board minutes relating to the letter.

75. On May 25, 2007, despite the fact that the Board had already agreed to hold an annual stockholders’ meeting by the end of the next month, defendant Durham filed a petition in Delaware Chancery Court seeking, among other things, to compel CLST to hold an annual meeting. In his complaint, Durham recognized that the Company held $60 million in cash and was “preparing to dissolve and wind up its affairs.” Durham also pointed out that in the Chairman’s May 18, 2007 letter, he noted “a lack of consensus” among stockholders about how the Company should proceed. Durham argued that this “lack of consensus,” if true, would make “it particularly important that a

stockholders’ meeting to elect directors be held promptly to assure the Board of Directors that oversees the liquidation process is representative of the majority of the Company’s stockholders.” Further, Durham noted that the Board had originally announced that the annual stockholders’ meeting would be held on June 29, 2007, but that the Board had since “delayed,” and “without explanation ... claim[ed] it is not feasible to hold the meeting as previously announced.” Durham also pointed out that despite his “demand that the Company set a new date promptly, the Board of Directors has failed to do so, except to state with uncertainty that the Company may hold a meeting sometime in July.”

76. In June 2007, the Nominating Committee of the Board contacted Durham to see if he was interested in being nominated by the Board for election as a director. Durham, however, would only accept the nomination if he was allowed to designate a majority of the persons to be nominated for election to the Board. The Company did not agree to Durham’s condition.

77. On June 20, 2007, Durham sent CLST notice that he was nominating himself, Kaiser, and Rajegowda — the Durham Nominees — to serve as directors of the Company.

78. On July 10, 2007, the SEC sent a letter to Annie LeBlanc at Jackson Walker regarding a proxy to be filed by the Durham Nominees. In the letter, the SEC stated:

In your response letter, tell us why Patrick J. O’Donnell, Henri B. Najem, Anthony P. Schlichte, David Tornek, Neil E. Lucas, Terry G. Whitesell and Jonathon B. Swain are not participants in this solicitation within the meaning of Instruction 3 to Items 4 and 5 of Schedule 14A. In this regard, these Reporting Persons (as defined in their Schedule 13D filings) met with representatives of the Company and had other contacts with it regarding the matters that are the subject of this solicitation. In addition, they are party to a Joint Filing Agreement with Mr. Durham and have filed as a group on their Schedules 13D and amendments.

79. In connection with the proxy contest, the Durham Nominees filed a proxy statement, dated July 12, 2007, which argued that they should be elected because CLST’s Board “should consist entirely of persons ... having a significant investment in the Company,” as opposed to the Company’s current management whose ownership of CLST stock is less significant. In addition, the Director Defendants claimed that “[i]f elected, [they] intend to follow the plan of liquidation

approved by the stockholders but expect to review both the manner in which the current Board of Directors has conducted the business of the company and also the implementation of the plan, to determine the most effective way to maximize stockholder value.”

80. On July 31, 2007, during the annual stockholders’ meeting, the Durham Nominees were elected as the Company’s directors, each receiving approximately 56% of the votes cast.

81. Despite the circumstances surrounding how the Durham Nominees became CLST directors, CLST has not held an annual stockholders’ meeting since the Durham Nominees were elected on July 31, 2007. Once defendants Durham and Kaiser’s positions on the Board were secured, they refused to implement the shareholder approved Dissolution Plan, and, instead, began engaging in a series of self-dealing transactions at the expense of CLST and its shareholders. Indeed, less than one month after Durham and Kaiser were elected, they approved the retention of Kaiser as a consultant to CLST for the sum of $20,000 a month.

82. On March 12, 2008, CLST filed its delinquent 2007 Annual Report with the SEC, which disclosed that CLST now has “no revenue generating operations” and the stock is “thinly traded” as a result of the Company’s discontinued operations. Nevertheless, rather than discharging the Company’s liabilities and distributing the Company’s remaining liquidated assets to its shareholders pursuant to the Dissolution Plan, the Board disclosed that they were “considering not implementing the Company’s plan of liquidation and dissolution,” and were “giving careful consideration to the strategic alternatives available to the Company.”

83. On January 16, 2009, the Board voted to increase its membership from three members to four. According to the Company’s Form 8-K Current Report filed January 23, 2009 (“January 2009 Current Report”), the Board appointed defendant Tornek as a Class III director to hold office for the remaining term of Class III directors “until the annual meeting of stockholders in 2010 and until his successor is duly elected and qualified.”

84. It seems the Board did not look far for a person to fill the vacancy it created. Tornek is a friend and business partner of Durham. Defendants Durham and Tornek are business partners and co-proprietors of Touch Restaurant, located in South Beach, Florida. Moreover, Durham and

Tornek have served together since December 2008 as members of the Board of National Lampoon. Durham is also acting as interim president and CEO of National Lampoon while the SEC investigates certain matters related to National Lampoon. Coincidentally, Durham helped Dan Laikin, the former CEO of National Lampoon, take control of the company via a voting agreement. Dan Laikin had to resign following his criminal indictment relating to the alleged manipulation of National Lampoon’s stock. Dan Laikin is also the brother of Bob Laikin, who was CEO of Brightpoint, during the times when Durham made over $30 million investing in Brightpoint and Durham was purchasing stock in CellStar before any deal with Brightpoint was publicly announced.

85. Despite their public statements regarding the importance that shareholders be properly represented and the Dissolution Plan be carried out, the Director Defendants have failed to live up to their own standards. They have not held an annual meeting since they took over CLST, depriving CLST’s shareholders of their right to elect the Company’s directors. Moreover, the Director Defendants have engaged in a series of self-dealing transactions, enriching and entrenching themselves at the Company’s expense.

THE DIRECTOR DEFENDANTS’ SELF-DEALING

86. Over the course of approximately three months, and in direct contrast to the shareholder approved Dissolution Plan, the Director Defendants caused CLST to: (i) expend tens of millions of dollars acquiring certain receivables and installment sales contracts; (ii) adopt a long term incentive plan for the benefit of officers/and directors only, and that was not approved by shareholders; and (iii) implement a poison pill Rights Plan for themselves that was designed to deter any acquisition of the Company on terms not approved by the Director Defendants.

The First Asset Purchase Agreement

87. On November 10, 2008, defendants Durham and Kaiser caused CLST to enter into a purchase agreement with an initially unidentified “third party”(6) to acquire all the outstanding equity

(6) The Company disclosed the November 10, 2008 purchase agreement to its shareholders on its Form 8-K filed with the SEC on November 17, 2008, but defendants Durham and Kaiser caused CLST to redact the identities of both the seller and lender. On March 5, 2009, likely pursuant to pressure from the SEC, CLST disclosed that the unidentified seller in the November 10, 2008 purchase agreement was Drawbridge Special Opportunities Fund LP (“Drawbridge”).

interests of FCC Investment Trust I (“Trust I”) for approximately $41 million (“Purchase Agreement I”).(7) The portfolio of home improvement consumer receivables acquired pursuant to Purchase Agreement I consisted of approximately 6,000 accounts with an average outstanding balance of approximately $6,900 and an aggregate balance of approximately $41.5 million. The weighted average interest rate of the portfolio on the receivables’ cut-off date of October 31, 2008 was 14.4% . While Durham and Kaiser caused CLST to disclose these ballpark averages, they failed to cause CLST to disclose any information specific to any of the receivables, including the age of the outstanding receivables.

88. The $41 million in consideration for Purchase Agreement I consisted of a cash payment of $6.1 million and a term loan of approximately $34.9 million from an initially unidentified entity. (8) The term loan, which matures on November 10, 2013, bears an interest rate of 5.0% over the LIBOR Rate. In addition, Trust I is required to pay a servicer, possibly a company with strong ties to defendant Durham, a monthly servicing fee equal to 1.5% per annum of the then aggregate outstanding principal balance of the receivables.

89. CLST filed a Form 8-K on November 17, 2008, disclosing Purchase Agreement I and the related credit agreement (“Credit Agreement I”). In Credit Agreement I, multiple references are made to FFC, abbreviated in the contract to just “Fair,” and related individuals. According to the Company’s annual report for fiscal year 2008 (“2008 Annual Report”), defendant Durham is the managing member of DC Investments, LLC (“DC Investments”), of which Fair Holdings, Inc. (“Fair”) is a wholly-owned subsidiary. Durham is also Fair’s Chairman. FFC, of which Durham is

(7) Purchase Agreement I was entered into by CLST Asset I, LLC, a wholly-owned subsidiary of CLST Financo, Inc. (“CLST Financo”), a direct and wholly-owned subsidiary of CLST.

(8) On March 5, 2009, the Company belatedly disclosed that the previously unidentified lender and “Administrative Agent” in Purchase Agreement I was Fortress Credit Co. LLC.

CEO and a Director, is in turn a wholly-owned subsidiary of Fair. Durham, FFC, and FFC Chairman James F. Cochran (“Cochran”) later sold receivables, installment sales contracts and related assets to CLST in return for cash and stock pursuant to Purchase Agreement III (as defined herein). Rick D. Snow (“Snow”) is FFC’s CFO. John J. Head (“Head”) was, until recently, FFC’s registered agent.(9)

[This space has intentionally been left blank.]

(9) Head may have been at one time the President, Vice President, and a director of FFC. But Plaintiffs have reason to believe that Head, as of recently, may no longer hold a position with FFC. On January 21, 2009, FFC filed a statutory agent update with the Ohio Secretary of State replacing John J. Head as FFC’s “statutory agent.”

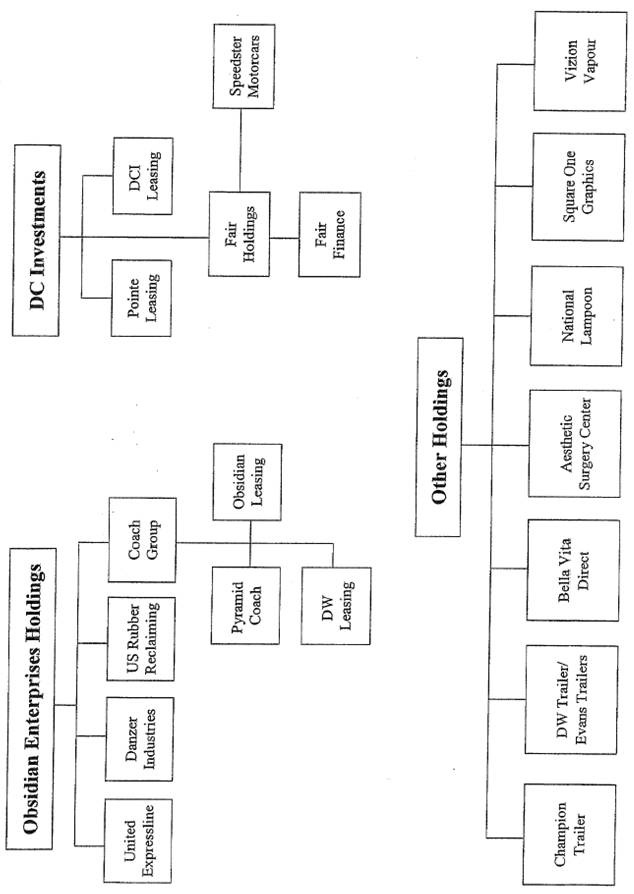

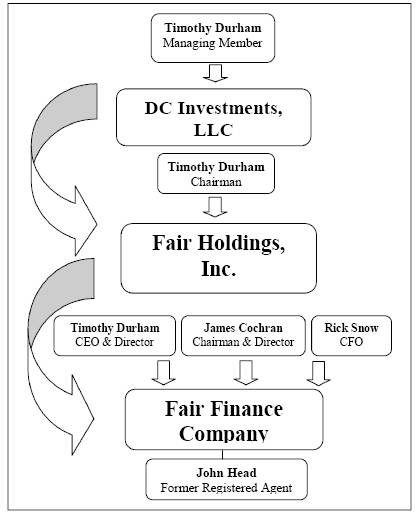

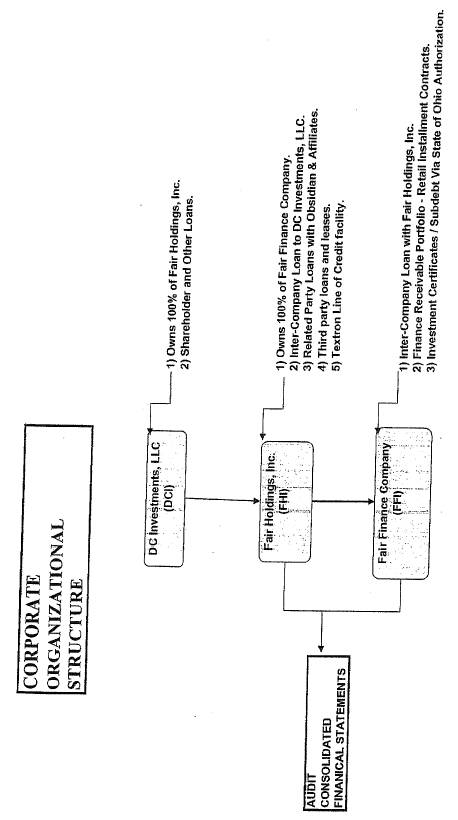

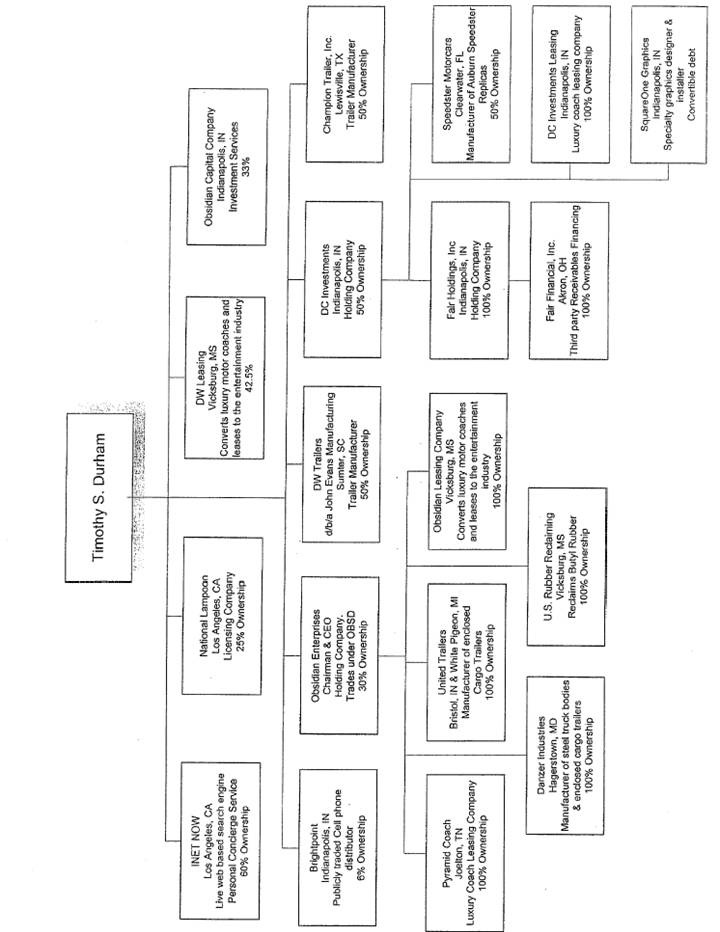

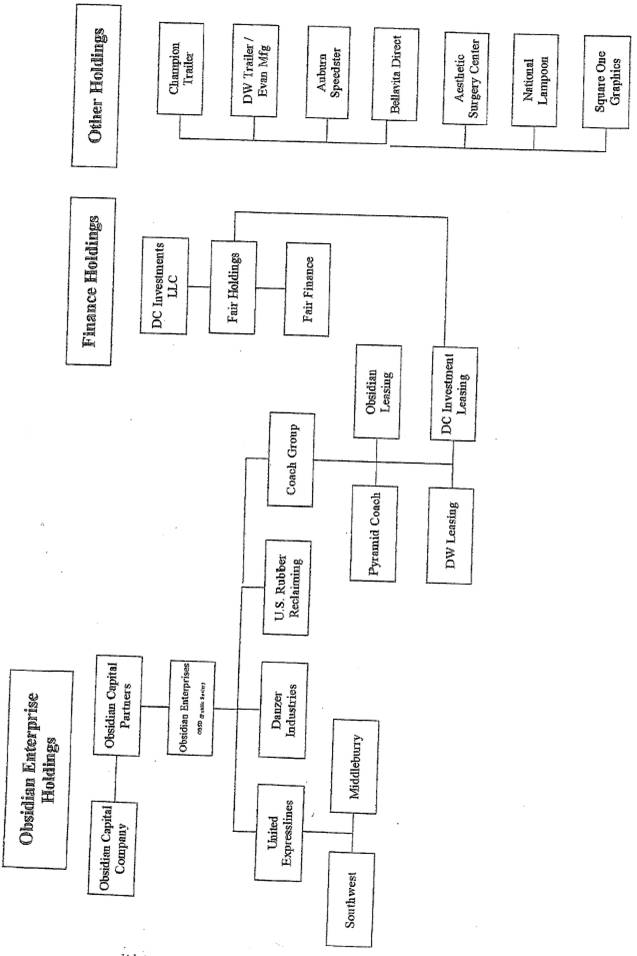

90. Below is a chart illustrating defendant Durham’s affiliations with such individuals and entities as FFC, Head, and Snow. See also organizational/ownership charts available on the website for counsel of the bankruptcy trustee of FFC at http://www.kccllc.net, charts attached hereto as Exhibits A, B, C, and D.

91. In Purchase Agreement I, a notice provision requires certain notices to purchases be sent to Head with an e-mail address at fairfinance.com and a “mandatory” copy to Sone and Jackson

Walker (which is, of course, also counsel to CLST and previously personal counsel to defendant Durham), but the notice provision to the sellers was redacted as follows:

SECTION 9.03. Notices . All notices and other communications required and permitted to be given hereunder shall be in writing and shall be delivered by hand, sent by facsimile, electronic mail or sent, postage prepaid, by registered, certified or express mail or overnight courier service and shall be deemed given when received, as follows:

(a) if to the Purchaser,

815 East Market Street

Akron, Ohio 44305

Fax No.: (330) 376-2527

Attention: John Head

Email: johnh@fairfinance.com

with a mandatory copy to:

Jackson Walker L.L.P.

901 Main Street, Suite 6000

Dallas, Texas 75202

Fax No.: (214) 661-6697

Attention: Jeffrey M. Sone

Email: jsone@jw.com

(b) if to the Seller,

*****

92. These and other references indicate that FFC was either to be a servicer or backup servicer of the loan used to fund the asset purchase pursuant to Purchase Agreement I the related and Credit Agreement I. For example, a provision of Credit Agreement I states: “With respect to the initial Servicer, the written credit policies and procedures manual of FCC Finance, LLC set forth on Schedule V ... or, with respect to the Backup Servicer or any successor Servicer, the customary collection policies and procedures of such successor Servicer (including Fair in such capacity).”

93. Another redacted provision in the Credit Agreement I states: “A condition that is satisfied if no “default”, “event of default”, or analogous event exists with respect to Fair as borrower or servicer under any credit facility to which ***** or any of its Affiliates is a party and no Change of Control of Fair has occurred.”

94. Similarly, the Credit Agreement I provides:

“ Change of Control ”: Any of the following:

***

(b) any change in the management of the Borrower, or, if Fair is the Servicer, Fair (including by resignation, termination, disability or death) the result of which is that either John Head or Rick Snow is no longer under the employ of Fair or fails to provide active and material participation in the activities of Fair (including, but not limited to, general management, underwriting and the credit approval process and credit monitoring activities), for a period of three consecutive calendar months, and in such event, a reputable, experienced individual(s), reasonably satisfactory to the Administrative Agent, has not been appointed to fulfill the duties of the departing executive within 60 days after the end of such three-month period.

95. This agreement not only potentially gives fees to FFC, but may potentially entrench the Director Defendants because of the change of control provisions. Durham and parties affiliated with him plainly sat on both sides of the transaction. As discussed below, the transaction offered no benefits to CLST, and instead has hurt the Company. It is plainly self-dealing.

The Second Purchase Agreement

96. On December 12, 2008, defendants Durham and Kaiser caused CLST to form CLST Asset Trust II (“Trust II”),(10) through which CLST entered into another purchase agreement with initially unidentified “third parties”(11) to “acquire from time to time certain receivables, installment sales contracts and related assets” (“Purchase Agreement II”). Pursuant to Purchase Agreement II, Trust II committed to purchase certain receivables of at least $2 million. Defendants Durham and

(10) Trust II is wholly owned by CLST Asset II, LLC, a wholly-owned subsidiary of CLST Financo.

(11) The Company disclosed the December 12, 2008 purchase agreement to its shareholders on its Form 8-K filed with the SEC on December 19, 2008, but defendants Durham and Kaiser caused the Company to redact the identities of both the seller and lender. On March 5, 2009, the Company belatedly disclosed that SSPE, LLC and SSPE Investment Trust I were sellers in the December 12, 2008 purchase agreement.

Kaiser, however, caused CLST to disclose little to no information concerning the balance, interest rate, or age of any of the receivables available to be purchased pursuant to Purchase Agreement II. The identities of parties involved in Purchase Agreement II were initially redacted in a similar fashion as Purchase Agreement I.

97. Pursuant to Purchase Agreement II, Trust II also became a co-borrower of an unidentified lender’s revolving credit facility (the “Revolver”) that permits borrowing of up to an aggregate amount of $50 million, of which at least $15 million could be utilized by Trust II to purchase additional receivables. Pursuant to the Revolver, however, Trust II is guaranteed to incur exorbitant fees regardless of whether it borrows against the Revolver or not. The Revolver matures on September 28, 2010, and bears an annual interest rate of 4.5% over the LIBOR Rate. In addition, Trust II is required to pay a fee to other “co-borrowers” of the Revolver equal to an annual rate of 0.5% for loans to Trust II that are equal to or below $10 million and an annual rate of 1.5% for loans to Trust II that are in excess of $10 million. Trust II must also pay a commitment fee to the lender equal to an annual rate of 0.25% of the unused portion of the maximum committed amount. In addition, Trust II is required to pay a servicer a monthly servicing fee equal to 1.5% of the then aggregate outstanding principal balance of the receivables.

The Third Purchase Agreement

98. On February 13, 2009, the Director Defendants caused CLST to form CLST Asset III, LLC(12) (“Subsidiary”), through which CLST entered into another purchase agreement to purchase certain receivables, installment sales contracts, and related assets for total consideration of $3,594,354 (“Purchase Agreement III”).(13) This time, the Director Defendants disclosed that the sellers were FFC, defendant Durham, CEO and director of FFC, and Cochran, Chairman and director of FFC. Durham is also the Chairman of Fair, of which FFC is a wholly-owned subsidiary.

(12) CLST Asset III, LLC is a wholly-owned subsidiary of CLST Financo.

(13) The $3,594,354 in consideration for Purchase Agreement III consisted of cash, stock, and promissory notes, as described in more detail herein.

Tellingly, defendant Durham and Cochran own all of the outstanding equity of FFC. Pursuant to Purchase Agreement III, FFC agreed to use its efforts to add Subsidiary or one of its affiliates as a co-borrower to one of FFC’s existing lines of credit with access to at least $15 million of credit for CLST’s own purposes.

99. The generalized nature of the public disclosures for Purchase Agreement III is just one of many factors demonstrating the self-dealing nature of the transaction. The receivables acquired pursuant to Purchase Agreement III exist in one of two portfolios: (i) Portfolio A; and (ii) Portfolio B. The portfolios collectively consist of approximately 3,000 accounts with an aggregate outstanding balance of approximately $3,709,500. The average outstanding balance per account is approximately $1,015 for Portfolio A and $5,740 for Portfolio B. The weighted average interest rate of the portfolios on February 13, 2009, exceeded 18%. While CLST disclosed this general information concerning the receivables purchased pursuant to Purchase Agreement III, the Director Defendants failed to cause CLST to disclose any information specific to any of the receivables, including the age of the outstanding receivables.

100. To give Purchase Agreement III the appearance that it was fair, the Director Defendants caused or allowed Purchase Agreement III to include provisions that misleadingly suggested that CLST was receiving more consideration from the transaction than it really was. For example, the Company has repeatedly stated that as “additional inducement” for entering into Purchase Agreement III, FFC promised to use best efforts to “ facilitate negotiations” to add CLST as a co-borrower under one of FFCs existing lines of credit with access to at least $15,000,000.00 of credit for the Company’s own purposes. However, not only does this language suggest that it was not even guaranteed that CLST would be able to participate in FFC’s lines of credit, but CLST, as a company slated for liquidation, should be focused on eliminated liabilities rather than taking them on.

101. As another example of misleading consideration, FFC, at least at one point, was acting as servicer for the receivables CLST acquired pursuant to Purchase Agreement III. The Company stated that FFC would receive “no additional consideration for acting as servicer.” In

other words, defendant Durham and his company, FFC, received consideration up front from CLST and thereafter had little motivation to continue servicing the agreement. Moreover, FFC now lacks the ability to service Purchase Agreement III. FFC closed for the week of Thanksgiving and has not re-opened since. As FFC is now subject to involuntary Chapter 7 bankruptcy under the care of a Trustee, the receivables are being serviced by another company, as discussed below. As the purchase price CLST paid pursuant to Purchase Agreement III took into account that FFC would service the receivables, CLST has come out the loser by paying Durham, FFC, and Cochran up front for services that the Company is no longer receiving.

102. The timing of Purchase Agreement III likewise reveals self-dealing. The Director Defendants apparently rushed to approve Purchase Agreement III. Purchase Agreement III says it is “[d]ated as of February 13, 2009.” The Company’s current report filed with the SEC on February 20, 2009, also indicated that the transaction pursuant to Purchase Agreement III was “effective” February 13, 2009. However, the fairness opinion publicly filed with Purchase Agreement III was dated as of February 17, 2009. Despite the fact that the fairness opinion was apparently not ready, the Director Defendants approved Purchase Agreement III prematurely because Durham and his various businesses, particularly FFC, were experiencing a cash flows crisis arising from Durham’s unsound (if not illicit) business practices that have come to light since Plaintiffs initiated this action.

103. Even the February 17, 2009 fairness opinion itself was fatally flawed due to its overreliance on information provided by the Director Defendants. Business Valuation Advisors LLC (“BVA”) rendered the fairness opinion for Purchase Agreement III. BVA indicated in its opinion letter that in performing its analyses and rendering its opinion, that BVA relied substantially on data (including estimates, forecasts, and assumptions) provided by the Director Defendants. The opinion letter stated in relevant part:

This Opinion is subject to the terms and conditions of our engagement letter. In performing our analyses and rendering this Opinion, BVA, with your consent:

1. Relied upon the accuracy, completeness, and fair presentation in all material respects of any and all information obtained from public sources or provided to it from private sources, including the management of CLST and Fair. BVA did not

independently verify such information;

2. Assumed that any estimates, forecasts, projections, and assumptions furnished to BVA were reasonably prepared and based upon the best currently available information and good faith judgment of the person furnishing such information and that such forecasts and projections are achievable as presented;

3. Assumed that the final versions of all documents reviewed in draft form by BVA conform in all material respects to the drafts reviewed;

4. Assumed that information supplied to BVA and representations and warranties made in the Purchase Agreement are substantially accurate;

5. Assumed that all of the conditions required to implement the Transaction will be satisfied and that the Transaction will be completed in accordance with the Purchase Agreement without any amendments thereto or any waivers of any terms or conditions thereof;

6. Relied upon the fact that the Board of Directors and CLST have been advised by counsel as to all legal matters with respect to the Transaction, including whether all procedures required by law to be taken in connection with the Transaction have been duly, validly and timely taken . . . .

104. BVA further explained that it did not independently evaluate the forecastsor projects it was provided. BVA also outright stated that its opinion should not be treated as a valuation opinion. BVA’s opinion letter stated in relevant part:

BVA did not make any independent evaluation of any of the forecasts or projections with which it was furnished. This Opinion should not be construed as a valuation opinion, credit rating, solvency opinion, an analysis of CLST’s or Fair’s credit worthiness, tax advice, or accounting advice. BVA has not been requested to, and did not, (a) initiate any discussions with, or solicit any indications of interest from, third parties with respect to the Transaction, the assets, businesses or operations of CLST, or any alternatives to the Transaction, (b) negotiate the terms of the Transaction, and therefore, BVA has assumed that such terms are the most beneficial terms, from CLST’s perspective, that could, under the circumstances, be negotiated among the parties to the Purchase Agreement and the Transaction, or (c) advise the Board of Directors or any other party with respect to alternatives to the Transaction . . . .

105. Perhaps more than anything else, the consideration paid pursuant to Purchase Agreement III establishes that the transaction was the fruit of the Director Defendants’ self-interested scheme to entrench and enrich themselves. The $3,594,354 in consideration for Purchase Agreement III consisted of: (i) cash in the amount of $1,797,178, of which $1,417,737 was paid to

FFC, $325,440 was paid to defendant Durham, and $54,000 was paid to Cochran; (ii) 2,496,077 newly issued shares of CLST common stock, of which 1,969,077 shares were issued to FFC, 452,000 shares were issued to Durham, and 75,000 shares were issued to Cochran; and (iii) six promissory notes in an aggregate original stated principal amount of $898,588,(14) of which two promissory notes in an aggregate original principal amount of $708,868 were issued to FFC, two promissory notes in an aggregate original principal amount of $162,720 were issued to Durham, and two promissory notes in an aggregate original principal amount of $27,000 were issued to Cochran.

106. Before CLST entered into Purchase Agreement III, the Company had approximately 21,453,205 shares of common stock outstanding, of which defendant Durham owned or beneficially owned 1,053,394 shares, or approximately 4.9% . As a result of the transaction pursuant to Purchase Agreement III, Durham currently controls, influences, or beneficially owns approximately 3,474,471 shares of CLST’s stock, amounting to approximately 14.7% ownership of the Company. In other words, from a single transaction alone, Durham increased his ownership of the Company by approximately 10%. This ownership increase of about 10% reflects a substantial extension of Durham’s control over CLST, as he and the other Director Defendants seek to further entrench themselves as the Company’s officers and directors. As discussed below, this plainly self-dealing transaction also calls into question the legitimacy of the Rights Plan later initiated by the Director Defendants.

Identities Revealed in First Two Purchase Agreements

107. On March 5, 2009, the Director Defendants released unredacted versions of Purchase Agreements I and II in separate 8-K/A filings. These filings revealed, in particular, the identities of the parties to the first two purchase agreements. Drawbridge was the “Seller” in Purchase

(14) The promissory notes relating to Portfolio A are payable in eleven quarterly installments, each consisting of equal principal payments, plus all interest accrued through such payment date at a rate of 4.0% plus the LIBOR Rate. The promissory notes relating to Portfolio B are payable in twenty-one quarterly installments, each consisting of equal principal payments, plus all interest accrued through such payment date at a rate of 4.0% plus the LIBOR Rate.

Agreement I, while Fortress Credit Co LLC was a “Lender” and the “Administrative Agent” in the related Credit Agreement I for Purchase Agreement I. SSPE, LLC and SSPE Investment Trust I were the Sellers in Purchase Agreement II, while Summit Consumer Receivables Fund, L.P. was the “Originator,” Summit Alternative Investments, LLC was the “Servicer,” and Fortress Credit Corp. was a “Lender” and the “Administrative Agent,” for the related revolving credit agreement. Other parties to Purchase Agreement II and/or its related agreements included SSPE, LLC, SSPE Investment Trust I, Summit Consumer Receivables Fund, L.P. (as a guarantor), and Eric J. Gangloff (also as a guarantor).

108. Below is a table of individuals and entities identified in Purchase Agreement I as unredacted, as well as their apparent involvement in Purchase Agreement I and/or related Credit Agreement I.

|

PURCHASE AGREEMENT I/CREDIT AGREEMENT I |

||

|

Party |

|

Role/Capacity |

|

CLST Asset I, LLC |

|

Purchaser in Purchase Agreement I |

|

Drawbridge Special Opportunities Fund LP |

|

Seller in Purchase Agreement I |

|

FCC Finance, LLC |

|

Servicer in Credit Agreement I |

|

FCC Investment Trust I |

|

Borrower in Credit Agreement I |

|

Fortress Credit CO LLC |

|

Lender and Administrative Agent in Credit Agreement I |

|

U.S. Bank National Association |

|

Collateral Custodian in Credit Agreement I |

|

Lyon Financial Services, Inc. (doing business as U.S. Bank Portfolio Services) |

|

Backup Servicer in Credit Agreement I |

|

John Head |

|

Unclear, perhaps as key employee of FFC and agent for receipt of notices and communications made to CLST Asset I, LLC pursuant to Purchase Agreement I |

|

Fair Finance Company |

|

Unclear, potential Servicer in Credit Agreement I |

|

Rick Snow |

|

Unclear, perhaps as key employee of FFC |

109. Below is a table of individuals and entities identified in Purchase Agreement II as unredacted, as well as their apparent involvement in the Purchase Agreement II and/or related credit agreement (“Credit Agreement II”).

|

PURCHASE AGREEMENT II/CREDIT AGREEMENT II |

||

|

Party |

|

Role/Capacity |

|

SSPE, LLC |

|

Seller in Purchase Agreement II; Borrower in Credit Agreement II |

|

SSPE Investment Trust I |

|