Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - PREMIER EXHIBITIONS, INC. | c02930exv31w1.htm |

| EX-31.2 - EXHIBIT 31.2 - PREMIER EXHIBITIONS, INC. | c02930exv31w2.htm |

| EX-32.1 - EXHIBIT 32.1 - PREMIER EXHIBITIONS, INC. | c02930exv32w1.htm |

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

Amendment No. 1

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 28, 2010

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NO. 000-24452

PREMIER EXHIBITIONS, INC.

(Exact name of registrant as specified in its charter)

| Florida (State or other jurisdiction of incorporation or organization) |

20-1424922 (I.R.S. Employer Identification No.) |

3340 Peachtree Rd., N.E., Suite 900

Atlanta, GA 30326

(Address of principal executive offices)

Atlanta, GA 30326

(Address of principal executive offices)

Registrant’s telephone number, including area code:

404-842-2600

404-842-2600

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.0001 per share | The Nasdaq Stock Market LLC (Nasdaq Global Market) |

Securities registered pursuant to Section 12(g) of the Act:

None

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule

405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed

by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its

corporate Web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period

that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation

S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated

filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

| Large accelerated filer o | Accelerated filer þ | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of

the Exchange Act). Yes o No þ

At August 31, 2009, the aggregate market value of the registrant’s Common Stock held by

non-affiliates of the registrant was approximately $18,404,453, based upon the closing price for

such Common Stock as reported on the NASDAQ Global Market on August 31, 2009. For purposes of the

foregoing calculation only, all directors and officers of the registrant have been deemed

affiliates.

The number of shares outstanding of the registrant’s common stock, as of June 14, 2010, was

47,877,733.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

EXPLANATORY NOTE

Premier Exhibitions, Inc. is filing this Amendment No. 1 on Form 10-K/A (the “Amendment”) to

amend its Annual Report on Form 10-K for the year ended February 28, 2010 (“fiscal year 2010”),

filed with the Securities and Exchange Commission (the “SEC”) on May 14, 2010 (the “Original

10-K”).

This Amendment is being filed to amend the Original 10-K to include the information required

by Items 10 through 14 of Part III of Form 10-K and to add the stock performance graph. Also, this

Amendment amends the cover page of the Original 10-K to (i) delete the reference in the Original

10-K to the incorporation by reference of the definitive Proxy Statement for our 2010 annual

meeting of shareholders and (ii) update the number of outstanding common shares. Item 15 of Part IV

of the Original 10-K is amended to include the certifications specified in Rule 13a-14 under the

Securities Exchange Act of 1934, as amended, required to be filed with this Amendment. Except for

the addition of the Part III information, the stock performance graph, the updates to the cover

page and the filing of related certifications, no other changes have been made to the Original

10-K. This Amendment does not modify or update disclosures in the Original 10-K affected by

subsequent events.

Table of Contents

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES

Stock Performance Graph

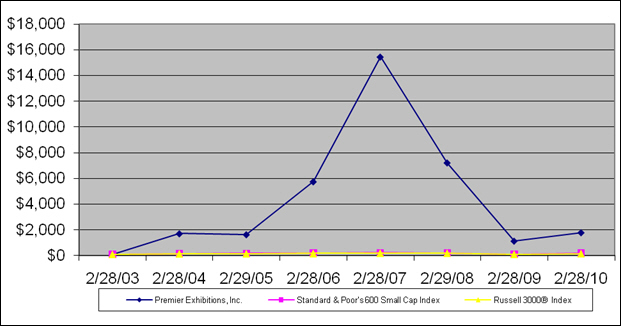

The following graph compares the yearly changes in cumulative total shareholder return on

shares of our common stock with the cumulative total return of the Standard & Poor’s 600 Small Cap

Index and the Russell 3000® Index, which we joined on June 22, 2007. In each case, we assumed an

initial investment of $100 on February 28, 2003. Each subsequent date on the chart represents the

last day of the indicated fiscal year. Total returns assume the reinvestment of all dividends.

Our stock performance may not continue into the future with the trends similar to those depicted in

this graph. We neither make nor endorse any predictions as to our future stock performance.

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||||||||||||

Premier Exhibitions, Inc. |

$ | 100 | $ | 1,714 | $ | 1,643 | $ | 5,757 | $ | 15,457 | $ | 7,229 | $ | 1,143 | $ | 1,800 | ||||||||||||||||

Standard & Poor’s 600 Small Cap Index |

$ | 100 | $ | 154 | $ | 180 | $ | 205 | $ | 221 | $ | 204 | $ | 112 | $ | 182 | ||||||||||||||||

Russell 3000® Index |

$ | 100 | $ | 141 | $ | 152 | $ | 168 | $ | 188 | $ | 185 | $ | 102 | $ | 158 | ||||||||||||||||

1

Table of Contents

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors

The following table sets forth information about our current directors. Our directors are

elected annually and serve until the next annual meeting of shareholders and until their respective

successors are elected and have been qualified or until their earlier resignation, removal or

death. At its meeting held on September 15, 2009, the Board of Directors amended our Bylaws to

increase the number of directors from seven to nine and elected Ronald C. Bernard and Stephen W.

Palley to fill the resulting vacancies at the recommendation of the Corporate Governance and

Nominating Committee. Under Florida law, the term of a director elected by the Board to fill a

vacancy expires at the next shareholders’ meeting at which directors are elected.

| Director | ||||

| Name and Background | Since | |||

William M. Adams, age 39, has served as one

of our directors since January 2009. Mr.

Adams has been a Principal with Alpine

Investors, LP since September 2001. Alpine

Investors, LP is a private equity investor

in micro-cap companies, focused on firms

with less than $100 million of revenue. The

firm currently manages $250 million. Mr.

Adams focuses primarily on managing and

monitoring the operational performance of

portfolio companies and developing and

implementing growth strategies. Leveraging

early career roles that included marketing

and sales positions at The Clorox Company

and strategic work as a management

consultant at The Mitchell Madison Group, a

global strategic consulting practice, he

works most closely with Alpine’s consumer,

retail and direct marketing oriented

businesses. Mr. Adams serves on the Boards

of Directors of Direct Marketing Solutions,

Inc., Lighting By Gregory, McKissock and

YLighting, all of which are private

companies. He received a Master of Business

Administration from the Kellogg Graduate

School of Management at Northwestern

University and a Bachelor of Arts from

Colgate University.

|

2009 | |||

The Board believes that Mr. Adams’

experience with smaller cap companies,

particularly with regard to growth

strategies, qualifies him to serve as a

member of the Board of Directors. |

||||

Douglas Banker, age 58, has served as one of

our directors since August 2000. Mr.

Banker’s more than 35 years of experience in

the entertainment industry includes

providing management services to musicians

and recording artists; marketing,

merchandising, licensing, and sales of music

media products; and the development and

management of concerts and similar events.

Mr. Banker is currently Vice President of

McGhee Entertainment, a successful artist

management company with offices in Los

Angeles and Nashville. McGhee Entertainment

has managed and marketed the careers of many

successful recording artists, including Bon

Jovi, Motley Crue, Scorpions, KISS, Hootie &

The Blowfish, Ted Nugent, Asian pop-star

Tata Young and country music stars Chris

Cagle and Darius Rucker. Mr. Banker also

served as President of the Board of the

Motor City Music Foundation in Detroit,

Michigan from 1996 to 2000.

|

2000 | |||

The Board believes that Mr. Banker’s

entertainment and marketing experience and

his experience in international markets

makes him well suited to service on the

Board of Directors of the Company. |

||||

Ronald C. Bernard, age 67, has served as one

of our directors since September 2009. Mr.

Bernard has been President of LWB Media

Consulting, a company that provides

consulting to private equity firms investing

in media-related companies, since 2004, and

a Managing Director of Alvarez and Marsal, a

professional services firm, since September

2009. Prior to that time Mr. Bernard served

as Chief Executive Officer of Sekani, Inc.,

a privately held media licensing and digital

media asset management company from 2000 to

2003, and as President of NFL Enterprises

from 1994 to 2000, where he focused on the

National Football League’s media businesses

and international operations. From 1987 to

1993 Mr. Bernard served as President of

Viacom Network Enterprises. He also

previously served as a director of Atari,

Inc. Mr. Bernard received a Master of

Business Administration from Columbia

University and a Bachelor of Arts from

Syracuse University. Mr. Bernard is also a

Certified Public Accountant.

|

2009 | |||

The Board believes that Mr. Bernard’s media

experience and his experience as a Certified

Public Accountant make him qualified to

serve as a director of the Company. |

||||

2

Table of Contents

| Director | ||||

| Name and Background | Since | |||

Christopher J. Davino, age 44, has served as

one of our directors since January 2009 and

as our President and Chief Executive Officer

since September 2009. From January through

August 2009, Mr. Davino served as our

interim Chief Executive Officer. From 2007

to 2009, he was a principal and head of the

Corporate Rescue Group of XRoads Solutions

Group, LLC, a corporate restructuring

management consulting company. At XRoads,

Mr. Davino oversaw a national advisory

practice of approximately 30 professionals

providing strategic, operational and

financial advice, interim and crisis

management, and transactional services to

financially distressed middle market

companies and their various creditor and

interest holder constituencies.

Transactional services included mergers and

acquisitions, debt and equity capital

raising and balance sheet recapitalizations.

From early 2006 until 2007, Mr. Davino was

President of Osprey Point Advisors, LLC, a

firm providing consulting and investment

banking services to companies, including

capital raising and mergers and acquisitions

transactional services. From July 2004

through December 2005, Mr. Davino was

President of E-Rail Logistics Inc., a

rail-based logistics company, which he

founded. Prior to that position, he worked

as a restructuring professional at Financo

Inc., an investment banking firm,

Wasserstein Perella Co., an investment

banking firm, and Zolfo Cooper & Co., an

advisory and interim management firm

providing restructuring services. Mr. Davino

was previously a member of the Board of

Directors of Hirsh International Corp., a

public company, and has recently served as

Chairman of the Board of Directors of Pendum

Inc., a national ATM servicing business and

a private company, where he directed the

company’s restructuring activities,

including the sale of the business. Mr.

Davino received his Bachelor of Science from

Lehigh University.

|

2009 | |||

The Board believes Mr. Davino is qualified

to serve as a director not only because of

his extensive executive management

experience, but also because his insight as

Chief Executive Officer of the Company is

valuable to the Board. |

||||

Jack Jacobs, age 64, has served as one of

our directors since January 2009. Mr. Jacobs

has been a principal of The Fitzroy Group,

Ltd., a firm that specializes in the

development of residential real estate in

London and invests both for its own account

and in joint ventures with other

institutions, for the past five years. He

has held the McDermott Chair of Politics at

West Point since 2005 and has served as an

NBC military analyst since 2002. Mr. Jacobs

was a co-founder and Chief Operating Officer

of AutoFinance Group Inc., one of the firms

to pioneer the securitization of debt

instruments, from 1988 to 1989; the firm was

subsequently sold to KeyBank. He was a

Managing Director of Bankers Trust

Corporation, a diversified financial

institution and investment bank, where he

ran foreign exchange options worldwide and

was a partner in the institutional hedge

fund business. He retired in 1996 to pursue

investments. Mr. Jacobs’ military career

included two tours of duty in Vietnam, where

he was among the most highly decorated

soldiers, earning three Bronze Stars, two

Silver Stars and the Medal of Honor, the

nation’s highest combat decoration. He

retired from active military duty as a

Colonel in 1987. Mr. Jacobs also serves as a

member of the Board of Directors of Xedar

Corporation and Visual Management Systems.

Mr. Jacobs earned a Bachelor of Arts and a

Master’s degree from Rutgers University.

|

2009 | |||

The Board believes Mr. Jacobs is qualified

to serve on the Board of Directors of the

Company because of his extensive executive

management experience and his leadership

skills. |

||||

Stephen W. Palley, age 65, has served as one

of our directors since September 2009. Mr.

Palley is a consultant to Consensus

Securities, LLC, a broker dealer, where he

engages in investment banking services. From

2005 to March 2010, he served as an

Executive Director of Pali Capital, an

investment bank in New York. Prior to that

time, Mr. Palley served as a consultant to

LLJ Capital, L.L.C., providing financial

advisory services, principally to distressed

companies in the telecom and media

industries. From 1999 to 2002 Mr. Palley

served as President and Chief Executive

Officer of Source Media, Inc., and from

1997 to 1999 as a consultant to media

companies through PSW Enterprises. From

1986 through 1996 Mr. Palley served as

Executive Vice President and Chief Operating

Officer of King World Productions, Inc.,

where he negotiated the syndication of

successful entertainment properties,

including the Oprah Winfrey Show. Mr.

Palley also served as General Counsel of

King World, and prior thereto practiced

media and entertainment law with Berger &

Steingut and Hardee Barovick Konecky &

Braun. Mr. Palley received a Juris Doctor

from Columbia University School of Law and a

Bachelor of Arts from American University’s

School of Government and Public

Administration. Mr. Palley previously

served as a director of The Roo Group.

|

2009 | |||

The Board believes that Mr. Palley is

qualified to serve as a director due to his

experience leading and advising media

companies. |

||||

Mark A. Sellers, age 41, has served as

Chairman of the Board since January 2009 and

as one of our directors since July 2008. Mr.

Sellers has been the founder and managing

member of Sellers Capital LLC, an investment

management firm, since 2003. Sellers Capital

LLC manages Sellers Capital Master Fund,

Ltd., a hedge fund that is our largest

shareholder. Prior to founding Sellers

Capital LLC, Mr. Sellers was the Lead Equity

Strategist for Morningstar, Inc., a provider

of investment research.

|

2008 | |||

The Board believes Mr. Sellers is qualified

to serve as a director of the Company due to

his extensive financial and investment

experience. In addition, Mr. Sellers’ role

as managing member of the Company’s largest

shareholder provides a unique shareholder

perspective to the Board. |

||||

3

Table of Contents

| Director | ||||

| Name and Background | Since | |||

Bruce Steinberg, age 53, has served as one

of our directors since January 2009. Mr.

Steinberg has over 20 years of media

industry experience. Currently he advising

Wananchi Group Holdings, a media company

with emphasis on residential and corporate

broadband, pay-tv and VoIP telephony in East

Africa. Previously, he was the Chief

Executive Officer of HIT Entertainment

Limited, which creates internationally

renowned children’s properties, including

Bob the Builder, Barney, Thomas & Friends,

Angelina Ballerina and Pingu, and which has

activities spanning television and video

production, publishing, consumer products,

licensing and live events. Prior to HIT, Mr.

Steinberg was the Chief Executive Officer of

Fox Kids Europe N.V., General Manager of

Broadcasting at BSkyB and the first Chief

Executive Officer of UK Gold and UK Living

TV from their launch in 1992 to their sale

in 1997. He began his career at MTV

Networks, where he held various positions in

New York and Europe. He is currently a

director of Arts Alliance Media, Europe’s

leading provider of digital cinema

technology, and a Board member of JDRF UK, a

charitable organization dedicated to Type 1

diabetes. Mr. Steinberg received a MBA from

Harvard Business School, a BA (Cantab) from

Cambridge University and a BA from Columbia

University.

|

2009 | |||

The Board believes that Mr. Steinberg is

qualified to serve as a director of the

Company due to his executive level

experience with entertainment and media

companies and his international experience

with media companies. |

||||

Samuel S. Weiser, age 50, served as a member

and the Chief Operating Officer of Sellers

Capital LLC, an investment management firm,

where he was responsible for all

non-investment activities, from 2007 to

2010. Mr. Weiser is also an indirect

investor in Sellers Capital Master Fund,

Ltd., an investment fund managed by Sellers

Capital LLC and Premier’s largest

shareholder. From February through October

2009, Mr. Weiser provided consulting

services to us through a consulting

agreement. From April 2005 to 2007, he was

a Managing Director responsible for the

Hedge Fund Consulting Group within Citigroup

Inc.’s Global Prime Brokerage division.

From 2002 to April 2005, he was the

President and Chief Executive Officer of

Foxdale Management, LLC, a consulting firm

founded by Mr. Weiser that provided

operational consulting to hedge funds and

litigation support services in hedge fund

related securities disputes. Mr. Weiser

also served as Chairman of the Managed Funds

Association, a lobbying organization for the

hedge fund industry, from 2001 to 2003. Mr.

Weiser is also a former partner in Ernst &

Young. He received a Bachelor of Arts in

Economics from Colby College and a Master of

Science in Accounting from George Washington

University.

|

2009 | |||

The Board believes that Mr. Weiser’s extensive financial and operational consulting experience

makes him qualified to serve as member of the Board of Directors.

Executive Officers

We are currently served by four executive officers:

Christopher J. Davino, age 44, serves as our president and Chief Executive Officer. Further

information about Mr. Davino is set forth above.

John A. Stone, age 43, has served as our Chief Financial Officer since May 13, 2009. Prior to

Premier, Mr. Stone served at S1 Corporation, a provider of customer interaction software solutions

for financial and payment services, as Chief Financial Officer from February 2006 to August 2008;

Senior Vice President of Global Finance from October 2005 to January 2006; and Global Controller

from June 2004 until October 2005. From April 2003 to June 2004, Mr. Stone was Vice President of

Finance, Corporate Controller of EarthLink, a provider of Internet access and communication

services. Mr. Stone has a Bachelor of Business Administration degree from the University of Georgia

and is a Certified Public Accountant.

Robert A. Brandon, age 59, has served as our General Counsel, Vice President of Business

Affairs and Secretary since October 23, 2009. Mr. Brandon joined the Company as Deputy General

Counsel in June 2008. In 1984, Mr. Brandon began his legal career with Proskauer Rose, L.P. where

he was a corporate associate. From 1988 to 2007, Mr. Brandon worked in the Legal Department at

Madison Square Garden, L.P., functioning as Senior Vice President — Legal and Business Affairs for

his last ten years there, with duties that included oversight of all legal work for the Booking,

Concert Promotion and Theatrical Divisions of Madison Square Garden and Radio City Music Hall.

Thereafter, he was a self-employed legal consultant for clients in the entertainment and media

industries until joining the Company. Mr. Brandon has a Bachelor of Arts degree from Colgate

University and a Juris Doctorate from Brooklyn Law School.

4

Table of Contents

M. Kris Hart, age 44, has served as our Vice President and Chief Marketing Officer since May

13, 2010. Prior to Premier, Ms. Hart served as Vice President, Brand Management at Harrah’s

Entertainment from October 2004 to November 2009 where she played a key role with Harrah’s

acquisition of Caesars Entertainment. Before Harrah’s, Ms. Hart directed an Innovation team at

Coca-Cola focused on experiential marketing and customization packaging. Ms. Hart began her career

as an intern at Citibank, N.A. as a Business Strategy Analyst, New Product Development. Between

1992 and 2002, Ms. Hart served in various marketing roles at such companies as American Airlines,

Pagenet, Arch Communications, and Intel Corp. Ms. Hart has a Bachelor of Arts degree from Auburn

University and a Masters of Business Administration degree from Vanderbilt University.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors,

officers and greater-than-10% shareholders to file with the SEC reports of ownership and changes in

ownership regarding their holdings in the Company.

Based solely on the copies of the reports filed with the SEC, we believe that during fiscal

year 2010 all of our directors, officers and greater-than-10% shareholders timely complied with

the filing requirements of Section 16(a).

Code of Ethics

We have adopted a Code of Ethics that applies to our principal executive officer, principal

financial officer, and principal accounting officer. Our Code of Ethics also applies to all of our

other employees and to our directors. Our Code of Ethics is posted on our website at www.prxi.com

under the heading “The Company.” We intend to satisfy any disclosure

requirements pursuant to Item 5.05 of Form 8-K regarding any amendment to, or a waiver from,

certain provisions of our Code of Ethics by posting such information on our website under the

heading “The Company.”

Corporate Governance

Corporate Governance and Nominating Committee Information

Our Corporate Governance and Nominating committee was formed in April 2006. The current

members of the Corporate Governance and Nominating Committee are Mr. Banker (Chairman), Mr. Jacobs

and Mr. Sellers. The Board of Directors has determined that each member of our Corporate Governance

and Nominating Committee is independent in accordance with the listing standards of the NASDAQ

Global Market. The Corporate Governance and Nominating Committee met three times in fiscal year

2010.

Our Corporate Governance and Nominating Committee is charged with recommending the slate of

director nominees for election to the Board of Directors, identifying and recommending candidates

to fill vacancies on the Board, and reviewing, evaluating and recommending changes to our corporate

governance processes. Among its duties and responsibilities, the Corporate Governance and

Nominating Committee periodically evaluates and assesses the performance of the Board of Directors;

reviews the qualifications of candidates for director positions; assists in identifying,

interviewing and recruiting candidates for the Board; reviews the composition of each committee of

the Board and presents recommendations for committee memberships; reviews the compensation paid to

non-employee directors; and reviews and recommends changes to the charter of the Corporate

Governance and Nominating Committee and to the charters of other Board committees.

In evaluating the suitability of candidates to serve on the Board of Directors, including

shareholder nominees, the Corporate Governance and Nominating Committee seeks candidates who are

independent pursuant to the listing standards of the NASDAQ Global Market and who meet certain

selection criteria established by the Corporate Governance and Nominating Committee. The Corporate

Governance and Nominating Committee also considers an individual’s skills, character and

professional ethics, judgment, leadership experience, business experience and acumen, familiarity

with relevant industry issues, national and international experience and other relevant criteria

that may contribute to our success. This evaluation is performed in light of the skill set and

other characteristics that would most complement those of the current directors, including the

diversity, maturity, skills and experience of the board as a whole.

5

Table of Contents

Audit Committee Information and Audit Committee Financial Expert

Our Audit Committee was formed in April 2006. The current members of the Audit Committee are

Mr. Bernard (Chairman), Mr. Adams and Mr. Palley. Our Board of Directors has determined that all of

the members of the Audit Committee are independent in accordance with the listing standards of the

NASDAQ Global Market and applicable SEC rules. Our Board of Directors has designated Mr. Adams and

Mr. Bernard, the Audit Committee Chairman, as “Audit Committee financial experts” under applicable

SEC rules. See Proposal No. 1 for more information about Mr. Adams’ and Mr. Bernard’s background

and experience.

Our Audit Committee serves as an independent and objective party to monitor our financial

reporting process and internal control system; retains and pre-approves audit and any non-audit

services to be performed by our independent registered accounting firm; directly consults with our

independent registered public accounting firm; reviews and appraises the efforts of our independent

registered public accounting firm; and provides an open avenue of communication among our

independent registered public accounting firm, financial and senior management and the Board of

Directors. The Audit Committee’s report relating to fiscal year 2010 is included in this proxy

statement.

ITEM 11. EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Introduction

Our fiscal year 2010 continued to be a transition year for our Company in terms of our

executive leadership and executive compensation programs and policies.

During fiscal year 2009 the composition of the Board of Directors and Compensation Committee

significantly changed. In addition, the senior management team changed and Chris Davino, then a

principal and head of the corporate rescue group of XRoads Solutions Group, LLC, a corporate

restructuring management consulting company, was appointed as our interim President and Chief

Executive Officer on January 28, 2009. Our other management changes during fiscal year 2009 or

early fiscal year 2010 included Mr. Ingalls’ resignation as our Chief Financial Officer, Kelli L.

Kellar’s resignation as our acting Chief Financial Officer and Chief Accounting Officer, Brian

Wainger’s resignation as our Vice President and Chief Legal Counsel, and Thomas Zaller’s departure

as our Vice President of Exhibitions. John A. Stone, our new Chief Financial Officer, was

appointed as of May 13, 2009. On September 3, 2009, Mr. Davino was appointed as the Company’s

President and Chief Executive Officer, replacing his agreement to serve on an interim basis. On

October 23, 2009, Robert Brandon, the Company’s former Deputy General Counsel, was appointed to the

position of General Counsel and Vice President of Business Affairs and became an executive officer

of the Company. In May 2010, Kris Hart was appointed to the position of Vice President and Chief

Marketing Officer.

The consent solicitation led by Sellers Capital in 2009 involved six of our nine current

directors. In making their case to our shareholders as part of the consent solicitation, these

directors strongly criticized the compensation that we paid to our senior executives, our hiring

practices, and the governance that we followed in making compensation and hiring decisions. These

directors expressed their intent to reform our practices in these areas and to provide compensation

for our senior managers that is more clearly aligned with the interests of our shareholders. As a

result, the approach of the Compensation Committee to making executive compensation decisions in

fiscal year 2010 began to shift from prior practices toward policies that better align executive

compensation with the interests of our shareholders.

Compensation Policies and Practices for Fiscal Year 2010 and the Future

During the last fiscal year the Compensation Committee has focused on assisting the Company in

rebuilding its management team and establishing effective compensation programs for the executives

who have been appointed. While longer term compensation policies and practices of the Company

continue to evolve due to the recent changes in the Board of Directors and the management team, the

Compensation Committee continues to be guided in its decisions by the four main principles the

Committee identified in its last Compensation Discussion and Analysis. First, we are committed to

paying competitive compensation, which we believe is necessary to attract and retain qualified

executive officers, particularly in light of the company’s challenging financial circumstances.

Second, we are committed to linking pay to performance through incentive compensation that is tied

to specific performance criteria and achievement. Third, the interests of our executive officers

should be aligned with the interests of our shareholders, which we believe can be promoted through

performance-based awards tied to the achievement of our business objectives and equity-based

awards. Fourth, our most important objective is the long-term increase in shareholder value, which

in the near term involves positioning the Company for future growth and success.

6

Table of Contents

Role of Our Compensation Committee

The duties and responsibilities of our Compensation Committee are set forth in the Committee’s

charter, as adopted by our Board in April 2006. The charter of our Compensation Committee is

available on our website located at www.prxi.com under the heading “Investor Relations” under the

subheading “Corporate Governance.” We have included additional information about our Compensation

Committee in the section of this proxy statement titled “Corporate Governance — Compensation

Committee.”

Under its charter, our Compensation Committee is charged with assisting our Board in

fulfilling its responsibilities relating to the compensation of our executive officers. The

charter requires the Committee to be composed of at least three directors, all of whom must satisfy

the independence requirements under the listing rules of the NASDAQ Global Market. As of February

28, 2010, the Committee was composed of Mr. Steinberg, Chair, Mr. Adams and Mr. Jacobs, each of

whom has been determined by the committee and our Board to meet these independence requirements.

The principal responsibilities and functions of the Committee include: reviewing the

competitiveness of our executive compensation programs; reviewing

and approving the compensation structure for our executive officers; overseeing the annual

evaluations and approving the annual compensation for our executive officers; reviewing and

approving compensation packages for new executive officers; reviewing and making recommendations

regarding long-term equity-based and other incentive compensation plans; and reviewing our

employment practices.

Our Compensation Committee has not determined to recommend amendments to the Committee’s

charter at this time, although it will review the charter and consider recommending changes on an

annual basis.

Compensation Plans and Programs

Historically, the Company has entered into employment agreements with our executive officers,

and the Company entered into employment agreements with Mr. Davino and Mr. Stone in fiscal year

2010 and with Mr. Brandon and Ms. Hart in early fiscal year 2011. As we hire additional executive

officers, we expect that we will provide these new hires with employment agreements on competitive

terms as well.

Our Compensation Committee believes that equity-based awards are essential to align the

interests of our executive officers with the interests of our shareholders. At the last Annual

Meeting, the shareholders of the Company adopted the Premier Exhibitions, Inc. 2009 Equity

Incentive Plan, which provides a mechanism for making equity awards to directors, executive

officers and other employees of the Company. Currently 1,423,000 shares remain available for

future grants under the 2009 Equity Incentive Plan.

In the past, the Company has not utilized a formal peer group for consideration of our

executive compensation decisions and generally has not utilized the advice of outside compensation

consultants. In addition, the company has not had a specific policy for the allocation of

compensation between short-term and long-term compensation or between cash and equity compensation.

As we continue to review our compensation policies and programs and as we hire additional

executive officers, we will continue to consider whether one or more of these practices would be

appropriate for the Company and the Compensation Committee’s processes.

Mr. Davino’s Compensation

When our newly composed Board was recognized on January 28, 2009, it appointed Mr. Davino as

our interim President and Chief Executive Officer. Given our Company’s deteriorating financial

condition and the significant changes in the composition of our Board and management, our Board

believed that it was critical to select an interim chief executive officer with substantial

turnaround experience. Our Board also determined that it was appropriate to provide a compensation

package to Mr. Davino that would be competitive in the marketplace for turnaround specialists, who

were acknowledged to be in demand during the current economic downturn. At that time Mr. Davino’s

service with the Company was expected to be temporary in nature.

7

Table of Contents

In connection with Mr. Davino’s appointment on this interim basis, our Compensation Committee

approved compensation for Mr. Davino that included a base salary of $50,000 per month and a cash

bonus of up to $35,000 per month, based on the achievement of performance milestones that were

required to be determined by our Compensation Committee. We also agreed to reimburse Mr. Davino’s

living and commuting expenses not in excess of $9,500 per month in connection with his services in

Atlanta, Georgia, where our principal executive office is located. Mr. Davino’s compensation

package as interim President and Chief Executive Officer did not include an equity component and

did not provide any severance payments upon termination of the agreement for any reason. The terms

of this compensation package are set forth in Mr. Davino’s initial employment agreement with us,

which was approved by our Compensation Committee and Board of Directors and is summarized in the

section of this proxy statement titled “Employment Agreements.”

Mr. Davino was initially hired as a consultant through XRoads Solutions Group, LLC, and his

interim compensation was negotiated on that basis. As part of the deliberations in determining

this compensation package, our Compensation Committee considered the levels of base and incentive

compensation and reimbursements that would be necessary to recruit and retain an experienced

turnaround specialist such as Mr. Davino to our Company during a period of very challenging

circumstances. The Committee specifically considered prevailing market rates for an experienced

turnaround specialist, and sought to set Mr. Davino’s total compensation opportunity in-line with

such market rates. The committee also determined

that, although most of Mr. Davino’s compensation would be fixed, a significant portion should

be subject to the performance-based bonus, which would provide a strong incentive to Mr. Davino to

meet our short-term goals relating to stabilizing and turning-around the Company.

Since Mr. Davino’s tenure as our interim President and Chief Executive Officer was initially

contemplated to be short-term in nature, the Committee did not believe that it was appropriate to

include in his compensation package an equity component, which is generally intended to provide a

long-term incentive. Similarly, the Committee believed that Mr. Davino’s contemplated short tenure

did not warrant the protection that could be provided through a severance payment obligation. With

respect to his bonus opportunity under this agreement, the Compensation Committee determined

performance milestones related to Mr. Davino’s first four months of employment with the Company,

including: developing a stabilization plan; developing a revenue architecture and go-to-market

strategy for exhibitions; reengineering the Company’s infrastructure and reducing costs; obtaining

rescue financing; renegotiating or replacing key third party contractual relationships; and

developing a long-term strategic business plan framework for approval by our Board. In setting

these milestones, our Compensation Committee believed that, in light of our current financial

circumstances and the need for the Company to be stabilized and turned-around, it was critical to

develop performance criteria focused on the Company’s short-term needs and goals. Our Compensation

Committee also recognized that Mr. Davino’s engagement was contemplated to be on a short-term

basis, and the Committee therefore sought to provide an incentive for Mr. Davino to achieve

specific results during his expected tenure with the Company. Due to our distressed financial

circumstances and the many conditions at the Company that needed to be addressed, the short-term

goals for our Company that were embodied in Mr. Davino’s performance milestones were extensive.

Effective September 3. 2009, Mr. Davino was appointed as President and Chief Executive Officer

of the Company on a permanent basis, and at that time the Compensation Committee entered into a new

employment agreement with Mr. Davino based on his change in position (the “Agreement”). Pursuant

to the Agreement, Mr. Davino receives an annual salary of $290,000, a housing stipend of $2,000 per

month and reimbursement of commuting expenses. The Agreement provides Mr. Davino with an annual

incentive bonus opportunity, with a “target” annual incentive opportunity equal to 50 percent of

his annual base salary. The Compensation Committee set performance criteria for Mr. Davino’s fiscal

year 2010 bonus opportunity, with 25% of the bonus predicated on achievement of goals related to

executive team development, 25% based on the achievement of certain financial targets and 50% based

on progress against key objectives related to the Company’s Titanic and Bodies exhibitions. With

respect to the financial goals, Mr. Davino receives 30% of the portion of the bonus paid on

achievement of the financial objectives if he meets projected Adjusted EBITDA (defined as EBITDA

plus stock compensation expense and impairment expense) and 100% of the portion of the bonus paid

on achievement of the financial objectives if Adjusted EBITDA is $1 million better than projected.

In June 2010, the Compensation Committee declared and paid a bonus of $36,250 to Mr. Davino,

representing half of his bonus opportunity for that time period.

8

Table of Contents

In connection with the entry into the Agreement, the Company made a one-time stock option

grant to Mr. Davino providing for the purchase of 1,170,000 shares of the Company’s common stock,

which has an exercise price per share equal to the closing price per share of the Company’s common

stock on the grant date and will vest one-third per year over three years. Because Mr. Davino’s

employment is now more permanent in nature, the Compensation Committee believes it is imperative

that Mr. Davino have a significant portion of his compensation in the form of equity, in order to

better align his interests with those of shareholders over the longer term.

If the Company terminates Mr. Davino without cause or elects not to renew the Agreement, or if

Mr. Davino resigns for good reason, he will be entitled to a severance payment equal to 150 percent

of his annual base salary and his annual incentive bonus for the year of termination, calculated

pursuant to the Agreement. Upon any termination that triggers severance, Mr. Davino’s stock options

will vest in full and will remain exercisable for two years following the termination. The

Committee believes that this level of severance payment is comparable to the severance agreements

of chief executive officers of other corporations of a similar size, and provides Mr. Davino with

appropriate security given the difficult financial position of the Company at the time it entered

into his employment agreement.

Compensation of Other Executive Officers

Effective as of May 13, 2009, we hired John A. Stone as our Chief Financial Officer. Mr.

Stone was most recently the Chief Financial Officer of S1 Corporation, a public company listed on

the NASDAQ Global Market that provides customer interaction software solutions for financial and

payment services.

In connection with Mr. Stone’s appointment as our Chief Financial Officer, our Compensation

Committee approved compensation for Mr. Stone that includes a base salary of $220,000 per year, a

performance bonus opportunity that will be consistent with the incentive compensation programs that

will be developed by our Compensation Committee, and a restricted stock grant of 75,000 shares of

our common stock that vest over three years. In addition, if Mr. Stone is terminated by us without

cause, he terminates his employment for good reason, or his employment is in certain circumstances

terminated after we hire a new chief executive officer or sell the Company, he will be entitled to

severance pay equal to four months of his base salary and accelerated vesting of restricted stock

that would have vested in that anniversary year. The terms of this compensation package are set

forth in Mr. Stone’s employment agreement with us, which has been approved by our Compensation

Committee and is summarized in the section of this proxy statement titled “Employment Agreements.”

Effective as of October 23, 2009, we appointed Robert A. Brandon as General Counsel and Vice

President of Business Affairs. Mr. Brandon was most recently the Deputy General Counsel of the

Company.

In connection with Mr. Brandon’s appointment as our General Counsel, our Compensation

Committee approved compensation for Mr. Brandon that includes a base salary of $240,000 per year, a

performance bonus opportunity of 25% of his base salary, and a restricted stock grant of 60,000

additional shares of our common stock that vest over three years. In accordance with the terms of

Mr. Brandon’s initial employment agreement, entered into in June 2008, if Mr. Brandon is terminated

without cause he is entitled to the remainder of his base salary through June 2011. Under the

newly approved compensation terms for Mr. Brandon, he will also be entitled to accelerated vesting

of restricted stock that would have vested in the anniversary year. The terms of this compensation

package are set forth in an amendment to Mr. Brandon’s employment agreement with us, which has been

approved by our Compensation Committee and is summarized in the section of this proxy statement

titled “Employment Agreements.”

Effective as of May 12, 2010, we hired Kris Hart as our Vice President and Chief Marketing

Officer. Ms. Hart was most recently the Vice President, Brand Management for Harrah’s

Entertainment in Las Vegas, Nevada.

In connection with Ms. Hart’s appointment as our Vice President and Chief Marketing Officer,

our Compensation Committee approved compensation for Ms. Hart that includes a base salary of

$225,000 per year, a performance bonus opportunity that will be consistent with the incentive

compensation programs that will be developed by our Compensation Committee, and a restricted stock

grant of 75,000 shares of our common stock that vest over three years. In addition, if Ms. Hart is

terminated by us without cause or she terminates her employment for good reason, she will be

entitled to severance pay equal to six months of her base salary and accelerated vesting of

restricted stock that would have vested in that anniversary year. Ms. Hart’s compensation package

is generally consistent with the form of compensation arrangement the Company provided to Mr.

Stone, and is the general format the Compensation Committee anticipates using for future executive

officers appointed by the Board of Directors. The terms of this compensation package are set forth

in Ms. Hart’s employment agreement with us, which has been approved by our Compensation Committee

and is summarized in the section of this proxy statement titled “Employment Agreements.”

9

Table of Contents

In developing the compensation of Mr. Stone, Mr. Brandon and Ms. Hart, our Compensation

Committee established a salary to provide each with a base level of compensation and a performance

bonus opportunity that will be determined pursuant to the incentive compensation programs developed

by the Committee during fiscal year 2011. The Committee also believes that an equity award, in the

form of restricted stock vesting over time, is an important component to provide the executives

with an incentive to remain with the Company over time and to provide them with an interest that is

aligned with the interests of our shareholders. In arriving at these compensation packages, our

Compensation Committee considered the past compensation levels and equity awards provided to our

other current and previous senior officers, the Committee’s knowledge of the market for similar

personnel, and, in the case of Mr. Stone and Ms. Hart, advice from the executive search firms that

assisted us in finding and recruiting each to the Company. The severance rights provided to the

executives are considered by the Committee to be a reasonable payment amounts in order to provide

the executives with some security in joining the Company at a time when our future growth and

success are uncertain.

Tax, Accounting and Other Considerations

Our Compensation Committee reviews and considers the deductibility of executive compensation

under Section 162(m) of the Internal Revenue Code of 1986, as amended, which limits the annual

deduction a public company can take for U.S. federal income tax purposes for compensation paid to

certain employees to $1.0 million each. Our Compensation Committee expects that all compensation

we pay to our executive officers in fiscal year 2011 will be deductible for federal income tax

purposes but our Compensation Committee reserves the discretion to approve compensation that

will not meet these requirements as necessary to ensure competitive levels of total executive

compensation for our executive officers. Although our Compensation Committee considers minimizing

federal income tax expense an important goal in our financial planning process, it does not expect

that it will be the only or even the most important goal.

When approving the terms of any equity awards, our Compensation Committee will consider the

accounting implications of a given award, including the estimated expense, and will consider the

dilution to our shareholders’ holdings. The Committee recognizes that any equity-based awards will

be dilutive to our existing shareholders, but believes that these awards are necessary to attract

and retain the talent that we need to turn the Company around.

Compensation Committee Report

The Compensation Committee, which is comprised entirely of independent directors, has reviewed

and discussed with management the Compensation Discussion and Analysis included in this proxy

statement in accordance with Item 402(b) of Regulation S-K, as promulgated by the Securities and

Exchange Commission. Based on such review and discussion, the Committee recommended to the Board of

Directors that the Compensation Discussion and Analysis be included in this proxy statement.

| Compensation Committee: | ||

| Bruce Steinberg, Chairman | ||

| Will Adams | ||

| Jack Jacobs |

2010 Summary Compensation Table

The table below presents information regarding the compensation for fiscal years 2010, 2009,

and 2008 for our President and Chief Executive Officer, our Chief Financial Officer, our former

chief financial officer, and all of our other executive officers employed by us at any time during

fiscal year 2010. The individuals listed in the Summary Compensation Table are referred to

collectively in this proxy statement as the “named executive officers.”

| Stock | Option | All Other | ||||||||||||||||||||||||||

| Fiscal | Salary | Bonus | Awards | Awards | Compensation | Total | ||||||||||||||||||||||

| Name and Principal Position(1) | Year | ($) | ($) | ($)(2) | ($)(2) | ($)(3) | ($) | |||||||||||||||||||||

Christopher J. Davino(4) |

2010 | 449,038 | 246,280 | — | 737,100 | 25,523 | 1,457,911 | |||||||||||||||||||||

President and Chief Executive Officer |

2009 | 54,839 | 35,000 | (5) | — | — | 12,470 | 102,309 | ||||||||||||||||||||

John Stone (6) |

2010 | 177,954 | 8,462 | 58,500 | — | 11,707 | 256,623 | |||||||||||||||||||||

Chief Financial Officer |

||||||||||||||||||||||||||||

Kelli L. Kellar(7) |

2010 | 31,238 | — | — | — | 144,001 | 175,239 | |||||||||||||||||||||

Former Acting Chief Financial Officer |

2009 | 152,882 | 5,000 | — | — | 11,865 | 169,747 | |||||||||||||||||||||

and Chief Accounting Officer |

2008 | 70,288 | 38,300 | 276,150 | 83,600 | 4,907 | 473,245 | |||||||||||||||||||||

Robert Brandon (8) |

2010 | 220,997 | 75,500 | — | — | 15,903 | 312,400 | |||||||||||||||||||||

General Counsel and Vice President of |

||||||||||||||||||||||||||||

Business Affairs |

||||||||||||||||||||||||||||

| (1) | Ms. Hart was appointed as our Chief Marketing Officer on May 13, 2010, after the end of fiscal year 2010, and is, therefore, not included in this table. |

10

Table of Contents

| (2) | The dollar value of restricted stock and option grants represent the grant date fair value calculated in accordance with FASB ASC Topic 718. A discussion of the assumptions used in calculating the compensation cost is set forth in Note 9 (Stock Compensation and Stock Options) to the Consolidated Financial Statements in our Annual Report on Form 10-K for fiscal year 2010. | |

| (3) | The amounts in the All Other Compensation Column for fiscal year 2010 consist of the following compensation items: |

| Medical | Living and | |||||||||||||||||||||||||||||||||||

| Insurance | Auto | Commuting | Unpaid | |||||||||||||||||||||||||||||||||

| Year | Premiums | Allowance | Allowance | Relocation | Vacation | Severance | Consulting | Total | ||||||||||||||||||||||||||||

| Name | (a) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||||||||||||||||||

Christopher J. Davino |

2010 | 9,009 | 16,514 | 25,523 | ||||||||||||||||||||||||||||||||

John Stone |

2010 | 11,707 | 11,707 | |||||||||||||||||||||||||||||||||

Kelli L. Kellar |

2010 | 14,547 | 129,454 | 144,001 | ||||||||||||||||||||||||||||||||

Robert Brandon |

2010 | 15,903 | 15,903 | |||||||||||||||||||||||||||||||||

| (a) | The table above summarizes the amounts in the All Other Compensation Column for fiscal year 2010. The All Other Compensation Column for fiscal year 2008 includes medical expenses of $4,907 for Ms. Kellar. The All Other Compensation Column for fiscal year 2009 includes medical insurance premiums of $11,865 for Ms. Kellar and $2,051 in medical insurance premiums and $10,419 in living and commuting allowances for Mr. Davino. | |

| (b) | Pursuant to her employment agreement, upon her resignation on May 15, 2009, Ms. Kellar became entitled to a severance payment of $150,000 and continued health insurance benefits. The amount in this column represents the severance payment received by Ms. Kellar during fiscal year 2010. | |

| (4) | Mr. Davino was appointed as our interim President and Chief Executive Officer on January 28, 2009, following the conclusion of Sellers Capital LLC’s consent solicitation. On the same day, he was seated as one of our directors. On September 3, 2009, Mr. Davino was appointed as our permanent President and Chief Executive Officer. | |

| (5) | Amount included in this column includes $35,000 of bonus earned for fiscal year 2009 but not determined and paid until fiscal year 2010. This bonus was not included in Mr. Davino’s 2009 compensation in the proxy statement for the 2009 annual meeting of shareholders. | |

| (6) | Mr. Stone was appointed as our Chief Financial Officer on May 13, 2009. | |

| (7) | Ms. Kellar resigned from the Company effective May 15, 2009. | |

| (8) | Mr. Brandon was appointed as our General Counsel and Vice President of Business Affairs on October 23, 2009. He was previously Deputy General Counsel for the Company. |

2010 Grants of Plan-Based Awards

The following table shows the estimated payout under Mr. Davino’s bonus arrangements, as

further described in the sections titled “Compensation Discussion and

Analysis” and “Employment Agreements” and grants of equity awards to Mr. Davino and Mr. Stone

during fiscal year 2010.

11

Table of Contents

| All Other | All Other | |||||||||||||||||||||||||||||||

| Stock | Option | Exercise | Grant | |||||||||||||||||||||||||||||

| Awards: | Awards: | or Base | Date Fair | |||||||||||||||||||||||||||||

| Estimated Future Payouts | Number of | Number of | Price of | Value of | ||||||||||||||||||||||||||||

| Under Non-Equity Incentive Plan Awards | Shares of | Securities | Option | Stock and | ||||||||||||||||||||||||||||

| Grant | Threshold | Target | Maximum | Stock of | Underlying | Awards | Option | |||||||||||||||||||||||||

| Name | Date | ($) | ($) | ($) | Units: (#) | Options: (#) | ($/sh) | Awards | ||||||||||||||||||||||||

Christopher J. Davino |

1/28/2009 | $ | 210,000 | (1) | ||||||||||||||||||||||||||||

| 9/3/2009 | $ | 72,500 | (2) | |||||||||||||||||||||||||||||

| 9/3/2009 | 1,170,000 | (3) | $ | 0.69 | $ | 737,100 | ||||||||||||||||||||||||||

John Stone |

5/13/2009 | 75,000 | (4) | $ | 58,500 | |||||||||||||||||||||||||||

Kelli L. Kellar |

— | — | — | — | — | — | — | |||||||||||||||||||||||||

Robert A. Brandon |

— | — | — | — | — | — | — | |||||||||||||||||||||||||

| (1) | Represents the estimated future bonus payouts upon Mr. Davino’s satisfaction of the performance criteria established by our Compensation Committee for the period Mr. Davino served as interim president and chief executive officer. This bonus opportunity is pursuant to an employment agreement between the Company and Mr. Davino dated January 28, 2009. The actual bonus paid under this agreement was $210,000 and is included in the Summary Compensation Table. | |

| (2) | Represents the target bonus payout under Mr. Davino’s employment agreement dated September 3, 2009. Pursuant to this agreement the bonus opportunity for fiscal year 2010 is prorated from the date Mr. Davino and the Company entered into the agreement. The actual bonus paid under this agreement was $36,250, which is included in the Summary Compensation Table and represents 50% of Mr. Davino’s bonus opportunity for this time period. | |

| (3) | Stock options granted pursuant to Mr. Davino’s employment agreement dated September 3, 2009. The options vest in thirds over the first three years from the date of grant and expire ten years from the date of grant. The grant was made under the 2009 Equity Incentive Plan of the Company. | |

| (4) | Restricted stock granted pursuant to Mr. Stone’s employment agreement with the Company effective May 13, 2009. The restricted stock vests in thirds on the first three anniversary dates from the date of grant. |

Annual Base Salary as a Percent of Total Compensation

Annual base salaries paid to our named executive officers for fiscal year 2010 are shown in

the 2010 Summary Compensation Table.

For fiscal year 2010, the salary paid to each of our named executive officers constituted the

following percentage of each executive’s total compensation: Mr. Davino — 31%; Mr. Stone — 69%;

Ms. Kellar — 18%; and Mr. Brandon — 71%.

Employment Agreements

Set forth below are summaries of the key terms of our employment agreements with the named

executive officers listed in the 2010 Summary Compensation Table that are currently officers of the

Company. The persons listed in the 2010 Summary Compensation Table that are no longer employed by

the Company received compensation pursuant to employment agreements that have been summarized in

prior filings made by the Company with the SEC.

The employment agreements with our existing officers are as follows:

Christopher J. Davino. Effective as of January 28, 2009, we entered into an employment

agreement with Mr. Davino for his services as our interim President and Chief Executive Officer.

Following the expiration of the initial term on May 28, 2009, the term of the agreement

automatically extended by successive one-month periods unless either party terminated the agreement

by notifying the other party in writing at least 30 days prior to the end of the applicable renewal

term.

12

Table of Contents

Pursuant to his employment agreement, Mr. Davino received a salary of $50,000 per month. We

also reimbursed Mr. Davino’s living and commuting expenses not in excess of $9,500 per month. After

four months of employment, Mr. Davino became eligible to receive a performance-based cash bonus of

up to $35,000 per month, including for the first four months of his employment. Mr. Davino’s

employment agreement as interim president and chief executive officer did not provide any severance

payments upon termination of the agreement for any reason.

Effective September 3. 2009, the Company entered into a new employment agreement with Mr.

Davino based on his change in position to President and Chief Executive Officer (the “Agreement”).

Pursuant to the Agreement, Mr. Davino will receive an annual salary of $290,000, a housing stipend

of $2,000 per month and reimbursement of commuting expenses. The Agreement provides Mr. Davino with

an annual incentive bonus opportunity, with a “target” annual incentive opportunity equal to 50

percent of his annual base salary. The incentive payments will be based on Mr. Davino’s achievement

of performance objectives established by the Company’s Board of Directors, provided that at least

one-half of the annual incentive opportunity will be based on the Company’s achievement of

quantitative financial metrics. The Agreement also included a grant of 1,170,000 stock options to

Mr. Davino, which vest three years from the date of grant and expire ten years from the date of

grant.

If the Company terminates Mr. Davino without cause or elects not to renew the Agreement, or if

Mr. Davino resigns for good reason, he will be entitled to a severance payment equal to 150 percent

of his annual base salary and an annual incentive bonus for the entire year of termination,

calculated pursuant to the Agreement. Upon any termination that triggers severance, Mr. Davino’s

stock options will vest in full and will remain exercisable for two years following the

termination.

John A. Stone. Effective as of May 13, 2009, after the end of fiscal year 2009, Mr. Stone

became our Chief Financial Officer. We entered into an employment agreement with Mr. Stone,

pursuant to which Mr. Stone is entitled to receive a base salary of $220,000 per year, a

performance bonus opportunity pursuant to the incentive compensation programs that will be

developed by our Compensation Committee, and a restricted stock grant of 75,000 shares of our

common stock vesting over three years. In addition, if Mr. Stone is terminated by us without

cause, he terminates his employment for good reason, or his employment is in certain circumstances

terminated after we hire a new chief executive officer or sell the company, he will be entitled to

severance pay equal to four months of his base salary.

Robert A. Brandon. In connection with Mr. Brandon’s appointment as our General Counsel, our

Compensation Committee approved an amended employment agreement for Mr. Brandon that includes a

base salary of $240,00 per year, a performance bonus opportunity of 25% of his base salary, and a

restricted stock grant of 60,000 additional shares of our common stock that vest over three years.

In accordance with the terms of Mr. Brandon’s existing employment agreement, entered into in June

2008, if Mr. Brandon is terminated without cause he is entitled to the remainder of his base salary

through June 2011.

M. Kris Hart. In connection with Ms. Hart’s appointment as our Vice President and Chief

Marketing Officer, our Compensation Committee approved compensation for Ms. Hart that includes a

base salary of $225,000 per year, a performance bonus opportunity that will be consistent with the

incentive compensation programs that will be developed by our Compensation Committee, and a

restricted stock grant of 75,000 shares of our common stock that vest over three years. In

addition, if Ms. Hart is terminated by us without cause or she terminates her employment for good

reason, she will be entitled to severance pay equal to six months of her base salary.

13

Table of Contents

Outstanding Equity Awards at February 28, 2010

The following table shows information regarding our named executive officers’ outstanding

equity-based awards as of February 28, 2010.

| Option Awards | Stock Awards | |||||||||||||||||||||||

| Number of | Number of | |||||||||||||||||||||||

| Shares | Shares | Market | ||||||||||||||||||||||

| Underlying | Underlying | Number of | Value | |||||||||||||||||||||

| Unexercised | Unexercised | Option | Shares | of Shares | ||||||||||||||||||||

| Options | Options | Exercise | Option | That Have | That Have | |||||||||||||||||||

| (#) | (#) | Price | Expiration | Not Vested | Not Vested | |||||||||||||||||||

| Name | Exercisable | Unexercisable | ($) | Date | (#) | ($)(1) | ||||||||||||||||||

Christopher J. Davino |

1,170,000 | (2) | $ | 0.69 | 9/3/2019 | |||||||||||||||||||

John Stone |

75,000 | (3) | $ | 94,500 | ||||||||||||||||||||

Kelli L. Kellar |

6,663 | (4) | $ | 9.93 | 11/27/2017 | |||||||||||||||||||

Robert A. Brandon |

10,000 | (5) | $ | 12,600 | ||||||||||||||||||||

| (1) | The market value of shares reported in this column is based on the closing market price of our common stock of $1.26 per share on February 26, 2010, which was the last trading day of fiscal year 2010. | |

| (2) | These options vest in thirds on August 28, 2010, August 28, 2011 and August 28, 2012. | |

| (3) | These restricted shares vest in thirds on May 13, 2010, May 13, 2011 and May 13, 2012. | |

| (4) | Of the 6,666 options unexercisable at February 28, 2009, 3,333 options were accelerated and became exercisable and 3,333 options were forfeited in connection with Ms. Kellar’s resignation on May 15, 2009. These options had a three-year vesting period, with 33 1/3% of these options vesting on each of the first, second and third anniversaries of the November 27, 2007 grant date. | |

| (5) | These restricted shares vest one half on June 9, 2010 and one half on June 9, 2011. |

14

Table of Contents

2010 Option Exercises and Stock Vested

The following table shows information regarding aggregate stock option exercises and aggregate

stock awards vested, including in each case the value realized upon exercise or vesting, during

fiscal year 2009 for each of our named executive officers.

| Option Awards | Stock Awards | |||||||||||||||

| Number of | Number of | |||||||||||||||

| Shares Acquired | Value Realized | Shares Acquired | Value Realized | |||||||||||||

| on Exercise | on Exercise | on Vesting | on Vesting | |||||||||||||

| Name | (#) | ($)(1) | (#) | ($)(2) | ||||||||||||

Christopher J. Davino |

— | — | — | — | ||||||||||||

John Stone |

— | — | — | — | ||||||||||||

Kelli L. Kellar |

— | — | 8,334 | $ | 7,167 | |||||||||||

Robert A. Brandon |

— | — | 5,000 | $ | 4,000 | |||||||||||

| (1) | The value realized on the exercise of stock options is based on the difference between the exercise price and the market price of our common stock on the date of exercise, multiplied by the number of shares acquired. |

Potential Payments Upon Termination or Change-of-Control

We currently have four executive officers — Mr. Davino, Mr. Stone, Mr. Brandon and Ms. Hart.

For a description of the potential payments to each in the case of a change in control, please see

the section titled “Employment Agreements.”

Pursuant to the Company’s 2000 Stock Option Plan and Amended and Restated 2004 Stock Option

Plan, upon the effective date of a change-of-control of the Company, our Board of Directors may

declare that each option granted under these plans shall terminate as of a date fixed by the Board.

Each named executive officer would then have the right, during the period of 30 days preceding such

termination, to exercise his or her options as to all or any part of the shares of stock covered by

the options.

In addition, pursuant to our Amended and Restated 2007 Restricted Stock Plan, upon the

effective date of a change-of-control of the Company, all awards of restricted stock outstanding

under the Plan and held by our named executive officers would immediately vest in full.

Pursuant to our 2009 Equity Incentive Plan, upon the effective date of a change in control,

all awards that are not assumed, converted or replaced by the resulting entity in the change in

control will become exercisable and vest immediately, and all performance criteria will be deemed

to be satisfied at target levels. At the option of the Company, the awards may instead be

terminated and the value of each paid in cash to the grantee of the award.

Compensation Committee

Our Compensation Committee was formed in April 2006. The current members of the Compensation

Committee are Mr. Adams (chairman), Mr. Jacobs and Mr. Steinberg. Mr. Steinberg served as chair of

the Compensation Committee until June 2010. Our Board of Directors has determined that each of the

members of our Compensation Committee is independent in accordance with the listing standards of

the NASDAQ Global Market. The Compensation Committee met eleven times in fiscal year 2010.

Our Compensation Committee discharges the responsibilities of our Board of Directors relating

to the compensation of our executive officers. Among its duties, our Compensation Committee

determines the compensation and benefits paid to our executive officers, including our President

and Chief Executive Officer.

Our Compensation Committee annually reviews and determines salaries, bonuses and other forms

of compensation paid to our executive officers and management, approves recipients of stock option

awards and establishes the number of shares and other terms applicable to such awards.

Our Compensation Committee also determines the compensation paid to our Board of Directors,

including equity-based awards. More information about the compensation of our non-employee

directors is set forth in the section of this proxy statement titled “Director Compensation.”

15

Table of Contents

In addition, our Compensation Committee is responsible for reviewing and discussing with

management the Compensation Discussion and Analysis that SEC rules require be included in our

annual proxy statement, preparing the

Committee’s report that SEC rules require be included in our annual proxy statement, and

performing such other tasks that are consistent with its charter. The Compensation Committee’s

report relating to fiscal year 2010 is included herein.

Our Compensation Committee has the authority to delegate any of its responsibilities to

subcommittees that are composed entirely of independent directors, as the Chairman of the

Compensation Committee may deem appropriate.

Director Compensation

Our Compensation Committee annually reviews and approves compensation for our non-employee

directors. Generally, the Compensation Committee sets director compensation at a level that is

intended to provide an incentive for current directors to continue in their roles and for new

directors to join our Board of Directors.

New Director Compensation Plan

On April 23, 2009, our Board of Directors approved a new director compensation plan to attract

and retain qualified directors to assist us in efforts to turnaround our the performance of our

Company. Under the new plan, we pay an annual retainer of $90,000 to each of our non-employee

directors, which is paid partly in equity and partly in cash. The purpose of the equity component

is to better align the interests of our directors with those of our shareholders. The directors do

not receive additional fees for attendance at Board or Board committee meetings. Mr. Sellers does

not accept any compensation for his services as a director or chairman of our Board of Directors.

For the 2009 calendar year, due to the limited availability of shares under our 2007

Restricted Stock Plan, each non-employee director was requested to elect $20,000 of the annual

retainer to be paid in equity and $70,000 of the annual retainer to be paid in cash. Equity

compensation is in the form of restricted stock units vesting on the earlier of (i) January 1,

2010, (ii) a change-of-control, or (iii) the day when a director ceases to serve on our Board of

Directors. If a director ceased to be a member of our Board of Directors, his restricted stock

units vested immediately and proportionately to the period of time served by the director during

the year. The restricted stock units were payable to the non-employee director, in shares of our

common stock, within 20 days after becoming vested, and any units that did not vest were forfeited.

Cash compensation was paid monthly.

For the 2010 calendar year, each non-employee director could elect to receive the annual

retainer in either (a) $50,000 equity and $40,000 cash or (b) $20,000 equity and $70,000 cash.

Equity compensation is in the form of restricted stock units granted under the 2009 Equity

Incentive Plan and vesting on the earlier of (i) January 1, 2011, (ii) a change-of-control, or

(iii) the day when a director ceases to serve on our Board of Directors. If a director ceases to be

a member of our Board of Directors, his restricted stock units will vest immediately and

proportionately to the period of time served by the director during the year. The restricted stock

units will be payable to the non-employee director, in shares of our common stock, within 20 days

after becoming vested, and any units that do not vest will be forfeited. Cash compensation is paid

monthly.

16

Table of Contents

2010 Director Compensation Table

The following table sets forth information regarding the compensation of our non-employee

directors for fiscal year 2010. Information about the compensation of Mr. Davino, for his services

during fiscal year 2009 is reflected in the 2009 Summary Compensation table.

| Fees Earned | ||||||||||||||||||||

| or Paid in | Stock | Option | All Other | |||||||||||||||||

| Cash | Awards | Awards | Compensation | Total | ||||||||||||||||

| Name | ($) | ($)(1) | ($)(2) | ($)(3) | ($) | |||||||||||||||

William M. Adams |

70,000 | (5) | 20,000 | (6) | — | — | 90,000 | |||||||||||||

Douglas Banker |

71,900 | (5) | 20,000 | (6) | — | 81,187 | 173,087 | |||||||||||||

Ronald Bernard(4) |

41,667 | (5) | 3,333 | (6) | — | — | 45,000 | |||||||||||||

N. Nick Cretan(7) |

31,367 | (5) | 8,612 | (6) | — | 855 | 40,834 | |||||||||||||