Attached files

| file | filename |

|---|---|

| EX-8.01 - CAMPBELL ALTERNATIVE ASSET TRUST | v188860_ex8-01.htm |

| EX-23.04 - CAMPBELL ALTERNATIVE ASSET TRUST | v188860_ex23-04.htm |

| EX-23.02 - CAMPBELL ALTERNATIVE ASSET TRUST | v188860_ex23-02.htm |

| EX-5.01(A) - CAMPBELL ALTERNATIVE ASSET TRUST | v188860_ex5-01a.htm |

| EX-5.01(B) - CAMPBELL ALTERNATIVE ASSET TRUST | v188860_ex5-01b.htm |

As

Filed with the Securities and Exchange Commission on

June

25, 2010

Registration

No. 333-[______]

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Form

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES

ACT OF 1933

Campbell Alternative Asset

Trust

(Exact

name of registrant as specified in its charter)

|

Delaware

|

6799

|

52-2238521

|

|

(State

of Organization)

|

(Primary

Standard Industrial

|

(I.R.S.

Employer Identification

|

|

Classification

Number)

|

Number)

|

c/o

Campbell & Company, Inc.

2850

Quarry Lake Drive

Baltimore,

Maryland 21209

(410)

413-2600

(Address,

including zip code, and telephone number, including area code, of registrant's

principal executive offices)

Thomas

P. Lloyd

Campbell

& Company, Inc.

2850

Quarry Lake Drive

Baltimore,

Maryland 21209

(410)

413-2600

(Name,

address, including zip code, and telephone number, including area code, of agent

for service)

Copy

to:

Michael

J. Schmidtberger

Sidley

Austin LLP

787

Seventh Avenue

New

York, New York 10019

(212)

839-5458

Approximate date of commencement of

proposed sale to the public: As soon as practicable after the effective

date of this Registration Statement.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis

pursuant to Rule 415 under the Securities Act of 1933 (the "Securities Act")

check the following box. x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

Indicate

by checkmark whether the registrant is a large accelerated filer, an accelerated

filer, a non-accelerated filer, or a smaller reporting company. See the

definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b2 of the Exchange Act.

|

Large accelerated filer

¨

|

Accelerated

filer ¨

|

|

Non-accelerated

filer (Do not check if a smaller reporting company) ¨

|

Smaller

reporting company x

|

CALCULATION

OF REGISTRATION FEE

|

Title

of Each Class of

Securities

Being Registered

|

Proposed

Maximum Aggregate

Offering

Price

|

Amount

of Registration Fee (1)

|

|

Units of Beneficial Interest

|

$5,000,000

|

$356.50

|

|

|

(1)

|

The

amount of the registration fee for Units of Beneficial Interest is

calculated in reliance upon Rule 457(o) under the Securities Act and using

the proposed maximum aggregate offering as described

above.

|

The

Registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until this registration statement shall become

effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The

information in this Prospectus is not complete and may be changed. We may not

sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This Prospectus is not an offer to sell

these securities and is not soliciting an offer to buy these securities in any

state where the offer or sale is not permitted.

Subject to

completion, dated June 25, 2010.

PART

ONE — DISCLOSURE DOCUMENT

CAMPBELL

ALTERNATIVE ASSET TRUST

$5,000,000

UNITS

OF BENEFICIAL INTEREST

The

Offering

The Trust

trades speculatively in the U.S. and international futures, forward and option

markets. Specifically, the Trust trades in a portfolio primarily focused on

financial futures and forwards, which are instruments designed to hedge or

speculate on changes in interest rates, currency exchange rates or stock index

values. A secondary emphasis is on metals and energy products, soft commodities

and other commodities. Campbell & Company, Inc., a futures fund manager,

allocates the Trust's assets across a broad spectrum of markets.

As of

April 30, 2010, the net asset value per Unit was $1,527.69. There is no fixed

termination date for the offering of the Units. The Trust offers the Units

during the continuing offering at the net asset value per Unit as of each

month-end closing date on which subscriptions are accepted, subject to the next

paragraph. Campbell & Company may suspend, limit or terminate the continuing

offering period at any time.

The Units

are no longer offered to the public generally. Units are being offered

exclusively for sale to the Campbell & Company, Inc. 401(k)

Plan.

The

Risks

These are

speculative securities. Before

you decide whether to invest, read this entire prospectus carefully and consider

"The Risks You Face" and "Conflicts of Interest."

|

•

|

The

Trust is speculative and leveraged. The Trust's assets are leveraged at a

ratio which can range from 5:1 to

30:1.

|

|

•

|

Past

results of Campbell & Company are not necessarily indicative of future

performance of the Trust, and the Trust's performance can be volatile. The

net asset value per Unit may fluctuate significantly in a single

month.

|

|

•

|

You

could lose all or a substantial amount of your investment in the

Trust.

|

|

•

|

Campbell

& Company has total trading authority over the Trust and the Trust is

dependent upon the services of Campbell & Company. The use of a single

advisor applying generally similar trading programs could mean lack of

diversification and, consequently, higher

risk.

|

|

•

|

There

is no secondary market for the Units and none is expected to develop.

While the Units have redemption rights, there are restrictions. For

example, redemptions can occur only at the end of a

month.

|

|

•

|

Transfers

of interest in the Units are subject to limitations, such as 30 days'

advance written notice of any intent to transfer. Also, Campbell &

Company may deny a request to transfer if it determines that the transfer

may result in adverse legal or tax consequences for the

Trust.

|

|

•

|

Substantial

expenses must be offset by trading profits and interest income. The Trust

must generate trading profits of 4.58% per annum to

break-even.

|

|

•

|

A

substantial portion of the trades executed for the Trust takes place on

foreign exchanges. No U.S. regulatory authority or exchange has the power

to compel the enforcement of the rules of a foreign board of trade or any

applicable foreign laws.

|

|

•

|

The

Trust is subject to conflicts of interest. There are no independent

experts representing investors.

|

Investors

are required to make representations and warranties relating to their

suitability in connection with this investment. Each investor is encouraged to

discuss the investment with his/her individual financial, legal and tax

adviser.

These securities have not been

approved or disapproved by the Securities and Exchange Commission or any state

securities commission nor has the Securities and Exchange Commission or any

state securities commission passed upon the accuracy or adequacy of this

prospectus. Any representation to the contrary is a criminal

offense.

This prospectus is in two parts: a

disclosure document and a statement of additional information. These parts are

bound together, and both contain important information.

THE COMMODITY FUTURES TRADING

COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS

THE COMMISSION PASSED UPON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE

DOCUMENT.

CAMPBELL

& COMPANY, INC.

Managing

Owner

[

], 2010

(This

page has been left blank intentionally.)

COMMODITY

FUTURES TRADING COMMISSION

RISK

DISCLOSURE STATEMENT

YOU

SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO

PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT FUTURES

AND OPTIONS TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH

TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND

CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS

ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE

POOL.

FURTHER,

COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND

ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE

SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION

OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE

DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL AT PAGE 34 AND A STATEMENT

OF THE PERCENTAGE RETURN NECESSARY TO BREAK-EVEN, THAT IS, TO RECOVER THE AMOUNT

OF YOUR INITIAL INVESTMENT, AT PAGE 4.

THIS

BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO

EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE

TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS

DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF

THIS INVESTMENT, AT PAGE 6.

ii

RISK

DISCLOSURE STATEMENT

YOU

SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO

PARTICIPATE IN A POOLED INVESTMENT VEHICLE. IN DOING SO, YOU SHOULD BE AWARE

THAT THIS POOL ENTERS INTO TRANSACTIONS THAT ARE NOT TRADED ON AN EXCHANGE, AND

THE FUNDS THE POOL INVESTS IN THOSE TRANSACTIONS MAY NOT RECEIVE THE SAME

PROTECTIONS AS FUNDS USED TO MARGIN OR GUARANTEE EXCHANGE-TRADED FUTURES AND

OPTIONS CONTRACTS. IF THE COUNTERPARTY BECOMES INSOLVENT AND THE POOL HAS A

CLAIM FOR AMOUNTS DEPOSITED OR PROFITS EARNED ON TRANSACTIONS WITH THE

COUNTERPARTY, THE POOL’S CLAIM MAY NOT RECEIVE A PRIORITY. WITHOUT PRIORITY, THE

POOL IS A GENERAL CREDITOR AND ITS CLAIM WILL BE PAID, ALONG WITH THE CLAIMS OF

OTHER GENERAL CREDITORS, FROM ANY MONIES STILL AVAILABLE AFTER PRIORITY CLAIMS

ARE PAID. EVEN POOL FUNDS THAT THE COUNTERPARTY KEEPS SEPARATE FROM ITS OWN

OPERATING FUNDS MAY NOT BE SAFE FROM THE CLAIMS OF OTHER GENERAL AND PRIORITY

CREDITORS.

FOREX

TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES

CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF

YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT

YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

INVESTMENTS

IN THE POOL MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, ADVISORY, AND

BROKERAGE FEE, AND THE POOL MAY NEED TO MAKE SUBSTANTIAL TRADING PROFITS TO

AVOID DEPLETING OR EXHAUSTING ITS ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A

COMPLETE DESCRIPTION OF EACH EXPENSE (SEE PAGE 34), AND A STATEMENT OF THE

PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF

YOUR INITIAL INVESTMENT (SEE PAGE 4).

THIS

BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO

EVALUATE YOUR PARTICIPATION IN THIS POOL. THEREFORE, BEFORE YOU DECIDE TO

PARTICIPATE YOU SHOULD CAREFULLY REVIEW THIS DISCLOSURE DOCUMENT, INCLUDING A

DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT (SEE PAGE

6).

YOU

SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR

OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES,

INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO

REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS

PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO

COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN

NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE

EFFECTED.

NATIONAL

FUTURES ASSOCIATION HAS NEITHER PASSED UPON THE MERITS OF PARTICIPATING IN THIS

POOL NOR THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

This

prospectus does not include all of the information or exhibits in the Trust's

registration statement. You can read and copy the entire registration statement

at the public reference facilities maintained by the Securities and Exchange

Commission in Washington, D.C.

The

Trust files monthly, quarterly and annual reports with the SEC. You can read and

copy these reports at the SEC public reference facilities in Washington, D.C.

Please call the SEC at 1-800-SEC-0330 for further information.

The

Trust's filings will be posted at the SEC website at

http://www.sec.gov.

CAMPBELL

& COMPANY, INC.

Managing

Owner

2850

Quarry Lake Drive

Baltimore,

Maryland 21209

(410)

413-2600

iii

PART

ONE — DISCLOSURE DOCUMENT

TABLE

OF CONTENTS

|

Page

|

||

|

SUMMARY

|

1

|

|

|

General

|

1

|

|

|

Plan

of Distribution

|

1

|

|

|

A

Summary of Risk Factors You Should Consider Before Investing in the

Trust

|

2

|

|

|

Investment

Factors You Should Consider Before Investing in the Trust

|

3

|

|

|

Campbell

& Company, Inc.

|

3

|

|

|

Charges

to the Trust

|

3

|

|

|

Estimate

of Break-Even Level

|

4

|

|

|

Distributions

and Redemptions

|

4

|

|

|

Federal

Income Tax Aspects

|

4

|

|

|

CAMPBELL

ALTERNATIVE ASSET TRUST ORGANIZATIONAL CHART

|

5

|

|

|

THE

RISKS YOU FACE

|

6

|

|

|

Market

Risks

|

6

|

|

|

You

Could Possibly Lose Your Total Investment in the Trust

|

6

|

|

|

The

Trust is Highly Leveraged

|

6

|

|

|

Changes

in Financing Policies or the Imposition of Other Credit Limitations or

Restrictions Could Compel the Trust to Liquidate at Disadvantageous

Prices

|

6

|

|

|

Your

Investment Could be Illiquid

|

6

|

|

|

Your

Investment in the Trust Could Be Illiquid

|

6

|

|

|

Over-the-Counter

Transactions are Subject to Little, if Any, Regulation

|

7

|

|

|

Over-the-Counter

Transactions May Be Subject to the Risk of Counterparty

Default

|

7

|

|

|

Options

on Futures and Over-the-Counter Contracts are Speculative and Highly

Leveraged

|

7

|

|

|

An

Investment in the Trust May Not Diversify an Overall

Portfolio

|

7

|

|

|

The Current Markets are

Subject to Market Disruptions that May Be a Detriment to Your

Investments

|

7

|

|

|

The

Current Markets are Subject to Governmental Intervention That May Be a

Detriment to Your Investment

|

8

|

|

|

The

Regulatory Risk Associated with Futures Contracts Could Adversely Affect

the Trust’s Operations and The Profitability of Your

Investment

|

8

|

|

|

Regulatory

Changes or Actions May Alter the Operations and Profitability of the

Trust

|

8

|

|

|

Trading

Risks

|

8

|

|

|

There

are Disadvantages to Making Trading Decisions Based Primarily on Technical

Market Data

|

8

|

|

|

Increased

Competition from Other Trend-Following Traders Could Reduce Campbell

&Company's Profitability

|

8

|

|

|

Limits

Imposed by Futures Exchanges or Other Regulatory Organizations, Such as

Speculative Position Limits and Daily Price Fluctuation Limits May Alter

Trading Decisions for the Trust

|

9

|

|

|

Increase

in Assets Under Management May Make Profitable Trading More

Difficult

|

9

|

|

|

Investors

Will Not be Able to Review the Trust's Holdings on a Daily

Basis

|

9

|

|

|

Other

Risks

|

9

|

|

|

Fees

and Commissions are Charged Regardless of Profitability and are Subject to

Change

|

9

|

|

|

The

Trust’s Service Providers Could Fail

|

9

|

|

|

Inadequate

Models Could Negatively Affect the Trust’s Portfolio

|

10

|

|

|

Investors

Must Not Rely on the Past Performance of Either Campbell & Company or

the Trust in Deciding Whether to Buy Units

|

10

|

|

|

Parties

to the Trust Have Conflicts of Interest

|

10

|

|

|

There

are No Independent Experts Representing Investors

|

10

|

|

|

The

Trust Places Significant Reliance on Campbell & Company and the

Incapacity of its Principals Could Adversely Affect the

Trust

|

11

|

|

|

The

Trust Could Terminate Before You Achieve Your Investment Objective Causing

Potential Loss of Your Investment or Upsetting Your Investment

Portfolio

|

11

|

|

|

The

Trust is Not a Regulated Investment Company and is Therefore Subject to

Different Protections Than a Regulated Investment Company

|

11

|

|

|

Recent

U.S. Legislative Efforts May Negatively Impact Your

Investment

|

11

|

|

|

Forwards,

Options, Swaps, Hybrids and Other Derivatives are Not Subject to CFTC

Regulation, Therefore, the Trust Will Not Receive the Same Protections on

These Transactions

|

11

|

|

|

The

Trust is Subject to Foreign Market Credit and Regulatory

Risk

|

11

|

|

|

The

Trust is Subject to Foreign Exchange Risk

|

11

|

iv

|

Page

|

||

|

Transfers

Could Be Restricted

|

12

|

|

|

A

Single-Advisor Fund May Be More Volatile Than a Multi-Advisor

Fund

|

12

|

|

|

The

Performance Fee Could Be an Incentive to Make Riskier

Investments

|

12

|

|

|

The

Trust May Distribute Profits to Unitholders at Inopportune

Times

|

12

|

|

|

Potential

Inability to Trade or Report Due to Systems Failure Could Adversely Affect

the Trust

|

12

|

|

|

Failure

to Receive Timely and Accurate Market Data from Third Party Vendors Could

Cause Disruptions or the Inability to Trade

|

12

|

|

|

SELECTED

FINANCIAL DATA

|

13

|

|

|

SUPPLEMENTARY

FINANCIAL INFORMATION

|

13

|

|

|

CAMPBELL

& COMPANY, INC

|

15

|

|

|

Description

|

15

|

|

|

The

Trading Advisor

|

18

|

|

|

Trading

Systems

|

18

|

|

|

Trading

Capacity

|

19

|

|

|

MANAGEMENT'S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

20

|

|

|

Introduction

|

20

|

|

|

Critical

Accounting Policies

|

20

|

|

|

Capital

Resources

|

20

|

|

|

Liquidity

|

20

|

|

|

Results

of Operations

|

21

|

|

|

Off-Balance

Sheet Risk

|

27

|

|

|

Disclosures

About Certain Trading Activities that Include Non-Exchange Traded

Contracts Accounted for at Fair Value

|

28

|

|

|

Quantitative

and Qualitative Disclosures About Market Risk

|

28

|

|

|

General

|

31

|

|

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

|

32

|

|

|

CONFLICTS

OF INTEREST

|

32

|

|

|

Campbell

& Company, Inc

|

32

|

|

|

The

Futures Broker and the Over-the-Counter Counterparty

|

33

|

|

|

Fiduciary

Duty and Remedies

|

33

|

|

|

Indemnification

and Standard of Liability

|

33

|

|

|

CHARGES

TO THE TRUST

|

34

|

|

|

Brokerage

Fee

|

34

|

|

|

Other

Trust Expenses

|

34

|

|

|

Campbell

& Company, Inc

|

35

|

|

|

The

Futures Broker

|

35

|

|

|

The

Over-the-Counter Counterparty

|

35

|

|

|

The

Cash Manager and the Custodian

|

36

|

|

|

The

Selling Agents

|

36

|

|

|

Organization

and Offering Expenses

|

36

|

|

|

Other

Expenses

|

36

|

|

|

Investments

Made by the Campbell & Company, Inc. 401(k) Plan

|

36

|

|

|

USE

OF PROCEEDS

|

36

|

|

|

THE

FUTURES BROKER

|

37

|

|

|

THE

OVER-THE-COUNTER COUNTERPARTY

|

38

|

|

|

THE

CASH MANAGER AND THE CUSTODIAN

|

38

|

|

|

CAPITALIZATION

|

39

|

|

|

DISTRIBUTIONS

AND REDEMPTIONS

|

39

|

|

|

Distributions

|

39

|

|

|

Redemptions

|

39

|

|

|

Net

Asset Value

|

39

|

|

|

DECLARATION

OF TRUST & TRUST AGREEMENT

|

40

|

|

|

Organization

and Limited Liability

|

40

|

|

|

Management

of Trust Affairs

|

40

|

|

|

The

Trustee

|

40

|

|

|

Sharing

of Profits and Losses

|

41

|

|

|

Dispositions

|

41

|

|

|

Dissolution

and Termination of the Trust

|

41

|

|

|

Amendments

and Meetings

|

42

|

v

|

Page

|

||

|

Indemnification

|

42

|

|

|

Reports

to Unitholders

|

42

|

|

|

FEDERAL

INCOME TAX ASPECTS

|

42

|

|

|

Unrelated

Business Taxable Income

|

43

|

|

|

IRS

Audits of the Trust and its Unitholders

|

43

|

|

|

INVESTMENT

BY ERISA ACCOUNTS

|

43

|

|

|

General

|

43

|

|

|

Special

Investment Consideration

|

43

|

|

|

The

Trust Should Not Be Deemed to Hold "Plan Assets"

|

43

|

|

|

Ineligible

Purchasers

|

44

|

|

|

PLAN

OF DISTRIBUTION

|

44

|

|

|

Subscription

Procedure

|

44

|

|

|

Representations

and Warranties of Investors in the Subscription Agreement

|

45

|

|

|

Investor

Suitability

|

45

|

|

|

The

Selling Agents

|

45

|

|

|

UNITHOLDER

PRIVACY NOTICE

|

46

|

|

|

LEGAL

MATTERS

|

46

|

|

|

EXPERTS

|

46

|

|

| UNAUDITED FINANCIAL INFORMATION |

46

|

|

|

PROPRIETARY

PAST PERFORMANCE OF THE CAMPBELL ALTERNATIVE ASSET TRUST

|

47 | |

|

INDEX

TO FINANCIAL STATEMENTS

|

48

|

PART

TWO — STATEMENT OF ADDITIONAL INFORMATION

TABLE

OF CONTENTS

|

The

Futures, Forward, Option and Swap Markets

|

123

|

|

|

EXHIBITS

|

||

|

EXHIBIT

A: Fourth Amended and Restated Declaration of Trust and Trust

Agreement

|

A-1

|

|

|

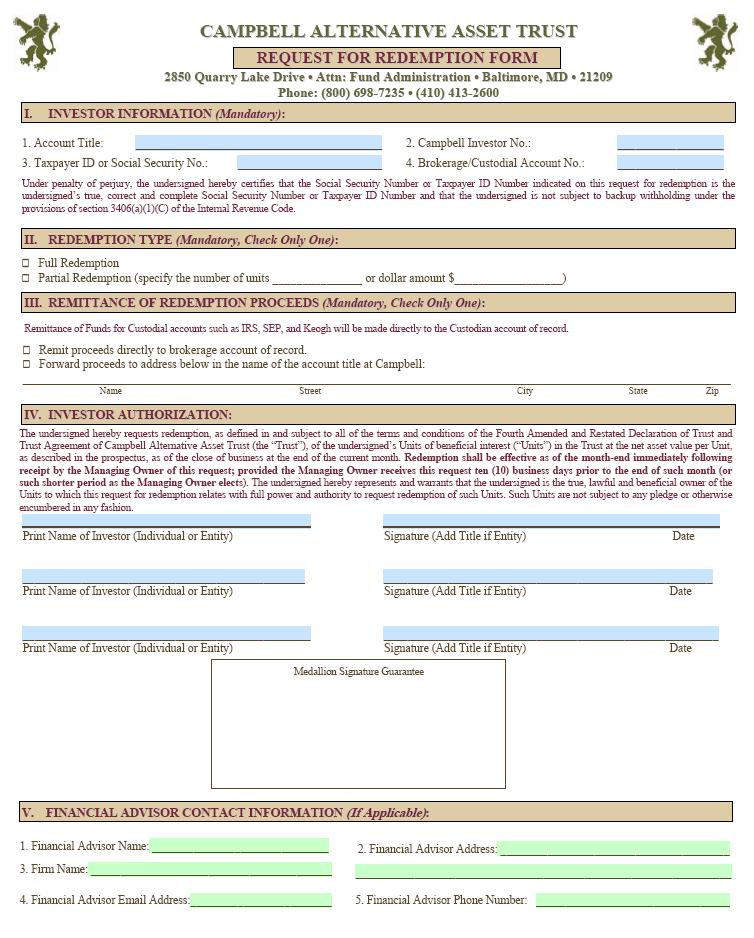

EXHIBIT

B: Request for Redemption

|

B-1

|

|

|

EXHIBIT

C: Subscription Requirements

|

C-1

|

|

|

EXHIBIT

D: Subscription Agreement and Power of Attorney

|

D-1

|

|

vi

SUMMARY

This

summary of all material information provided in this Prospectus is intended for

quick reference only. The remainder of this Prospectus contains more detailed

information; you should read the entire Prospectus, including all exhibits to

the Prospectus, before deciding to invest in any Units. This Prospectus is dated

[

], 2010.

General

Campbell

Alternative Asset Trust, or the Trust, was formed as a Delaware statutory trust

on May 3, 2000. The Trust issues Units of beneficial interest, or

Units, which represent Units of fractional undivided beneficial interests in and

ownership of the Trust. The Trust will continue in existence until

December 31, 2030 (unless terminated earlier in certain

circumstances). The principal offices of the Trust are located at c/o

Campbell & Company, Inc., 2850 Quarry Lake Drive, Baltimore, Maryland 21209,

and its telephone number is (410) 413-2600. The books and records of

the Trust are maintained at the offices of Campbell & Company,

Inc. Unitholders or their duly authorized representatives may inspect

the Trust’s books and records during normal business hours upon reasonable

written notice to Campbell & Company, Inc. and may obtain copies of such

records (including by post upon payment of reasonable mailing costs), upon

payment of reasonable reproduction costs; provided, however, upon request by

Campbell & Company, Inc., the Unitholder will represent that the inspection

and/or copies of such records will not be for commercial purposes unrelated to

such Unitholder's interest as a beneficial owner of the Trust.

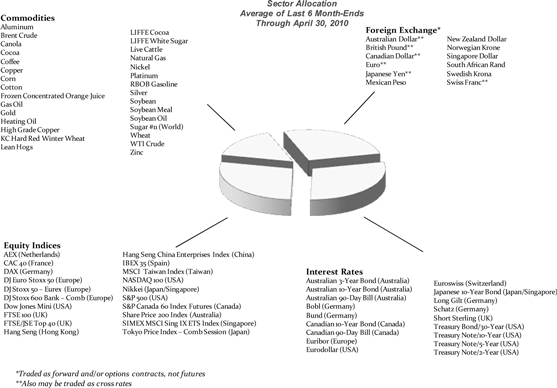

The Trust

allows you to participate in alternative or non-traditional investments, namely

the U.S. and international futures, forward and option markets. Specifically,

the Trust trades in a portfolio primarily focused on financial futures and

forwards, which are instruments designed to hedge or speculate on changes in

interest rates, currency exchange rates or stock index values. A secondary

emphasis is on metals and energy products, soft commodities and other

commodities. The Trust will attempt to generate profits through the investment

in the Financial, Metal & Energy Large Portfolio advised by Campbell &

Company, the Trust's managing owner. Campbell & Company uses its

computerized, trend-following, technical trading and risk control methods to

seek substantial medium- and long-term capital appreciation while, at the same

time, seeking to manage risk and volatility. Campbell & Company provides

advisory services to numerous other funds and individually managed accounts

similar to the services Campbell & Company provides to the Trust. Campbell

& Company has been using its technical approach since 1972 — one of the

longest performance records of any currently active futures fund manager and has

developed and refined its approach over the past 38 years. See “Proprietary

Past Performance of the Campbell Alternative Asset Trust” for the performance

data required to be disclosed for the most recent five calendar years and

year-to-date.

Futures

are standardized contracts traded on commodity exchanges that call for the

future delivery of commodities at a specified time and place. While futures

contracts are traded on a wide variety of commodities, the Trust will

concentrate its futures trading in financial instruments such as interest rates,

foreign exchange and stock index contracts, and metal and energy contracts. The

U.S. futures markets are regulated under the Commodity Exchange Act, which is

administered by the CFTC. The Trust will trade futures positions on margin,

meaning that the Trust will utilize leverage in its trading.

Currencies

and other commodities may be purchased or sold by the Trust for future delivery

or cash settlement through banks or dealers pursuant to forward and option

contracts. Unlike futures contracts, forward and option contracts are not

standardized and these markets are largely unregulated.

The

following summary provides a review in outline form of important aspects of an

investment in the Trust.

Plan

of Distribution

How

to Subscribe for Units

|

|

•

|

During

the continuing offering period, Units will be offered at a price of net

asset value per Unit. The net assets of the Trust are its assets less its

liabilities determined in accordance with the Trust Agreement. The net

asset value per Unit equals the net assets of the Trust divided by the

number of Units outstanding as of the date of

determination.

|

|

|

•

|

The

continuing offering period can be terminated by Campbell & Company at

any time. Campbell & Company has no present intention to terminate the

offering.

|

|

|

•

|

Interest

earned while subscriptions are being processed will be paid to subscribers

in the form of additional Units.

|

|

|

•

|

There

is no limit on the number of Units that may be offered by the Trust,

provided, however, that all such Units must be registered with the U.S.

Securities and Exchange Commission prior to

issuance.

|

1

Who

May Invest in the Trust

The Trust

is being offered exclusively for sale to the Campbell & Company, Inc. 401(k)

Plan.

Is

the Campbell Alternative Asset Trust a Suitable Investment for You?

An

investment in the Trust is speculative and involves a high degree of risk. The

Trust is not a complete investment program. Campbell & Company offers the

Trust as a diversification opportunity for an investor's entire investment

portfolio, and therefore an investment in the Trust should only be a limited

portion of the investor's portfolio.

A

Summary of Risk Factors You Should Consider Before Investing in the

Trust

|

|

•

|

The

Trust is a highly volatile and speculative investment. There can be no

assurance that the Trust will achieve its objectives or avoid substantial

losses. You must be prepared to lose all or a substantial amount of your

investment. Campbell & Company has from time to time in the past

incurred substantial losses in trading on behalf of its

clients.

|

|

|

•

|

Futures,

forward and option trading is a "zero-sum" economic activity in which for

every gain there is an equal and offsetting loss (disregarding

transaction

costs), as opposed to a typical securities investment, in which there is

an expectation of constant yields (in the case of debt) or participation

over time in general economic growth (in the case of equity). It is

possible that the Trust could incur major losses while stock and bond

prices rise substantially in a prospering

economy.

|

|

|

•

|

The

Trust trades in futures, forward and option contracts. Therefore, the

Trust is a party to financial instruments with elements of off-balance

sheet market risk, including market volatility and possible illiquidity.

There is also a credit risk that a counterparty will not be able to meet

its obligations to the Trust.

|

|

|

•

|

Notwithstanding

Campbell & Company’s research, risk and portfolio management efforts,

there may come a time when the combination of available markets and new

strategies may not be sufficient for Campbell & Company to add new

assets without detriment to diversification. Reduced diversification and

more concentrated portfolios may have a detrimental effect on your

investment.

|

|

|

•

|

The

Trust is subject to numerous conflicts of interest including the

following:

|

|

|

1)

|

Campbell

& Company is both the managing owner and trading advisor of the Trust

and its fees were not negotiated at arm's length. For these reasons,

Campbell & Company has a disincentive to add or replace advisors, even

if doing so may be in the best interest of the

Trust;

|

|

|

2)

|

Campbell

& Company may have incentives to favor other accounts over the

Trust;

|

|

|

3)

|

Campbell

& Company, the Trust's futures broker, over-the-counter counterparty,

cash manager, custodian and their respective principals and affiliates may

trade in the futures, forward and option markets for their own accounts

and may take positions opposite or ahead of those taken for the Trust;

and

|

|

|

4)

|

Campbell

& Company operates other commodity pool offerings which may have

materially different terms and operate at a lower overall cost

structure.

|

|

|

•

|

Unitholders

take no part in the management of the Trust and although Campbell &

Company is an experienced professional manager, past performance

is not necessarily indicative of future

results.

|

|

|

•

|

Campbell

& Company will be paid a brokerage fee of up to 3.5% annually,

irrespective of profitability. Campbell & Company will also be paid

quarterly performance fees equal to 20% of aggregate cumulative

appreciation, excluding interest income, in net asset value, if any. A

portion of these fees are rebated in the form of additional Units on

investments made by the Campbell & Company, Inc. 401(k)

Plan.

|

|

|

•

|

The

Trust is a single-advisor fund which may be inherently more volatile than

multi-advisor managed futures

products.

|

|

|

•

|

Although

the Trust is liquid compared to other alternative investments such as real

estate or venture capital, liquidity is restricted, as the Units may only

be redeemed on a monthly basis, upon ten business days' advance written

notice to Campbell & Company. You may transfer or assign your Units

after 30 days' advance written notice, and only with the consent of

Campbell & Company.

|

2

Investment

Factors You Should Consider Before Investing in the Trust

|

|

•

|

The

Trust is a leveraged investment fund managed by an experienced,

professional trading advisor and it trades in a wide range of futures,

forward and option markets.

|

|

|

•

|

Campbell

& Company utilizes several independent and different proprietary

trading systems for the Trust.

|

|

|

•

|

The

Trust has the potential to help diversify traditional securities

portfolios. A diverse portfolio consisting of assets that perform in an

unrelated manner, or non-correlated assets, has the potential to increase

overall return and/or reduce the volatility (a primary measure of risk) of

a portfolio. As a risk transfer activity, futures, forward and option

trading has no inherent correlation with any other investment. However,

non-correlation will not provide any diversification advantages unless the

non-correlated assets are outperforming other portfolio assets, and there

is no guarantee that the Trust will outperform other sectors of an

investor's portfolio or not produce losses. The Trust's profitability also

depends on the success of Campbell & Company's trading techniques. If

the Trust is unprofitable, then it will not increase the return

on an investor's portfolio or achieve its diversification

objectives.

|

|

|

•

|

Investors

in the Trust get the advantage of limited liability in highly leveraged

trading.

|

Campbell

& Company, Inc.

Campbell

& Company, the managing owner and trading advisor for the Trust, administers

the Trust and directs its trading. Campbell & Company has over 38 years of

experience trading in the futures, forward and option markets. As of April 30,

2010, Campbell & Company, and its affiliates, were managing approximately

$3.0 billion in the futures, forward and securities markets, including

approximately $2.4 billion in its Financial, Metal & Energy Large Portfolio.

The Financial, Metal & Energy Large Portfolio, to which all of the Trust’s

assets are currently allocated, seeks to generate attractive risk-adjusted

returns across a broad range of market conditions through systematic investments

in a diversified portfolio of futures, forward and option contracts in a diverse

array of global assets, including global interest rates, stock indices,

currencies and commodities. The Financial, Metal & Energy Large (“FME

Large”) Portfolio consists of underlying investment strategies that aim for low

correlation and are diversified by investment style, investment holding period

and instrument.

Two

primary portfolio sub-strategies, Diversified and Sector-Specific, look for

momentum-oriented movement across global asset classes on the basis of price or

other technical indicators, while also capturing global trends on the basis of

underlying fundamental or econometric data. Campbell & Company has sole

authority and responsibility for directing investment and reinvestment of the

Trust's assets.

Campbell

& Company uses a systematic trading approach combined with quantitative

portfolio management analysis and seeks to identify and profit from price

movements in the futures, forward and option markets. Multiple models are

utilized in most markets traded. Each model analyzes market movements and

internal market and price configurations. Campbell & Company utilizes a

proprietary, volatility-based system for allocating capital to a portfolio's

constituent markets. Each market is assigned a dollar risk value based on

contract size and volatility, which forms the basis for structuring a

risk-balanced portfolio.

Charges

to the Trust

Trust

expenses must be offset by trading gains or interest income in order to avoid

depletion of the Trust's assets. A portion of these expenses are rebated in the

form of additional Units on investments made by the Campbell & Company, Inc.

401(k) Plan. These Units will only pay up to the 0.65% which is payable to the

futures broker and the over-the-counter counterparty.

Campbell

& Company

|

|

•

|

Brokerage

fee of up to 3.5% of net assets per annum, of which up to 0.65% is paid to

the futures broker and the over-the-counter counterparty, 0.35% is paid to

the selling agents for administrative services and Campbell & Company

retains the remainder.

|

|

|

•

|

20%

of quarterly appreciation in the Trust's net assets, excluding interest

income and as adjusted for subscriptions and

redemptions.

|

|

|

•

|

Reimbursement

of organization and offering expenses incurred in the initial and

continuous offering following incurrence of each such expense, estimated

at, and not to exceed, 0.9% of net assets per

annum.

|

Dealers

and Others

|

|

•

|

"Bid-ask"

spreads and prime brokerage fees for off-exchange

contracts.

|

3

|

|

•

|

Operating

expenses such as legal, auditing, administration, printing and postage, up

to a maximum of 0.4% of net assets per

year.

|

|

|

•

|

Cash

management and custodial fees (0.10% annualized fee based on the

percentage of assets under management) for management of the Trust’s

non-margin assets.

|

Estimate

of Break-Even Level

The

estimated amount of fees and expenses which are anticipated to be incurred by a

new investor in Units of the Trust during the first twelve months of investment

is 4.88% per annum of the net asset value. Interest income is expected to be

approximately 0.30% per annum, based on current interest rates. An investor is

expected to break-even on his/her investment in the first twelve months of

trading, assuming an initial investment of $10,000, provided that the Trust

earns 4.58% per annum or $458 of the assumed initial investment. The break-even

analysis does not account for the bid-ask spreads in connection with the Trust’s

forward and option contract trading. No performance fee is included in the

break-even analysis since all operating expenses of the Trust must be offset

before a performance fee is accrued. The break-even analysis is calculated as

follows:

|

Assumed

Initial Investment

|

$ | 10,000.00 | ||

|

Brokerage

Fee (3.5%)

|

350.00 | |||

|

Organization

& Offering Expense

Reimbursement (0.9%)

|

90.00 | |||

|

Operating

Expenses (0.40%)

|

40.00 | |||

|

Cash

Management and Custodial

Fees (0.08%)*

|

8.00 | |||

|

Less:

Interest Income (0.30%)**

|

(30.00 | ) | ||

|

Amount

of Trading Income Required

to Break-Even on an Investor’s Initial Investment in The First Year of

Trading

|

$ | 458.00 | ||

|

Percentage

of Initial Investment Required

to Break-Even

|

4.58 | % |

The

maximum organization and offering expense and operating expense reimbursement is

0.9% and 0.4% of net assets per annum respectively. The estimates do

not account for the bid-ask spreads in connection with the Trust's forward and

option contract trading. No performance fee is included in the

calculation of the "break-even" level since all operating expenses of the Trust

must be offset before a performance fee is accrued.

|

*

|

The

Trust pays the cash manager and the custodian a combined annualized fee

equal to approximately 0.10% per annum of the funds they manage. Based on

the assumption that cash management constitutes 80% of the initial

investment, a fee equal to 0.08% is used for this break-even analysis (80%

of $100,000 multiplied by 0.10% equals $80 or 0.08% of the assumed initial

investment).

|

|

**

|

Variable

based on current interest rates.

|

Distributions

and Redemptions

The Trust

is intended to be a medium- to long-term, i.e., 3- to 5-year,

investment. Units are transferable, but no market exists for their sale and none

will develop. Monthly redemptions are permitted upon ten (10) business days'

advance written notice to Campbell & Company. Campbell & Company

reserves the right to make distributions of profits at any time in its sole

discretion.

Federal

Income Tax Aspects

In the

opinion of Sidley Austin LLP, counsel to Campbell & Company, the Trust is

classified as a partnership and will not be considered a publicly traded

partnership taxable as a corporation for federal income tax purposes based on

the type of income it is expected to earn. The Trust’s income from its

investments in futures contracts, options and forward contracts and its interest

income is expected to be exempt from the tax imposed on unrelated business

taxable income, and the Trust does not expect that any of its income will be

debt-financed income within the meaning of such rules. Accordingly, tax-exempt

Unitholders, including the Campbell & Company 401 (k) Plan, will not be

required to pay federal income tax on their share of the income or gains of the

Trust, provided that such Unitholders do not purchase Units with borrowed

funds.

[REMAINDER

OF THIS PAGE LEFT BLANK INTENTIONALLY.]

4

CAMPBELL

ALTERNATIVE ASSET TRUST

Organizational

Chart

The

organizational chart below illustrates the relationships among the various

service providers of this offering. Campbell & Company is both the managing

owner and trading advisor for the Trust. The selling agents (other than Campbell

Financial Services, Inc.), futures broker, over-the-counter counterparty, cash

manager and the custodian of excess collateral, are not affiliated with Campbell

& Company or the Trust.

*

Campbell & Company presently serves as commodity pool operator for six other

commodity pools.

5

THE

RISKS YOU FACE

Market

Risks

You

Could Possibly Lose Your Total Investment in the Trust

Futures,

forward and option contracts have a high degree of price variability and are

subject to occasional rapid and substantial changes. Consequently, you could

lose all or a substantial amount of your investment in the Trust.

The

Trust Is Highly Leveraged

Because

the amount of margin funds necessary to be deposited in order to enter into a

futures, forward or option contract position is typically about 2% to 10% of the

total value of the contract, Campbell & Company is able to hold positions in

the Trust's account with face values equal to several times the Trust's net

assets. The ratio of margin to equity is typically 10% to 30%. As a result of

this leveraging, even a small movement in the price of a contract can cause

major losses.

Changes

in Financing Policies or the Imposition of Other Credit Limitations or

Restrictions Could Compel the Trust to Liquidate Positions at Disadvantageous

Prices

The Trust

may utilize and may depend on the availability of credit in order to trade its

portfolio. There can be no assurance that the Trust will be able to maintain

adequate financing arrangements under all market circumstances. As a general

matter, the dealers that provide financing to the Trust can apply essentially

discretionary margin, haircut, financing security and collateral valuation

policies. Changes by dealers in such financing policies, or the imposition of

other credit limitations or restrictions, whether due to market circumstances or

governmental, regulatory or judicial action, may result in large margin calls,

loss of financing, forced liquidation of positions at disadvantageous prices,

termination of swap and repurchase agreements and cross-defaults to agreements

with other dealers. Any such adverse effects may be exacerbated in the event

that such limitations or restrictions are imposed suddenly and/or by multiple

market participants at or about the same time. The imposition of such

limitations or restrictions could compel the Trust to liquidate all or part of

its portfolio at disadvantageous prices. In 2009, banks and dealers

substantially curtailed financing activities and increased collateral

requirements, forcing many hedge funds to liquidate.

Your

Investment Could Be Illiquid

Futures,

forward and option positions cannot always be liquidated at the desired price;

this can occur when the market is thinly traded (i.e., a relatively small volume

of buy and sell orders) or in the event of disrupted markets and other

extraordinary events in which historical pricing relationships become materially

distorted. The financing available to the Trust from banks, dealers and other

counterparties is likely to be restricted in disrupted markets. The Trust may

incur material losses and the risk of loss from pricing distortions is

compounded by the fact that in disrupted markets many positions become illiquid

making it difficult or impossible to close out positions against which the

markets are moving. For example, in 1994, 1998 and again in

2007-2009 there was a sudden restriction of credit by the dealer

community that resulted in forced liquidations and major losses for a number of

private investment funds. It is possible that in the future, in such situations,

Campbell & Company may be unable for some time to liquidate certain

unprofitable positions thereby increasing the loss to the Trust from the

trade. Additionally, foreign governments may take or be subject to

political actions which disrupt the markets in their currency or major exports,

such as energy products or metals. Market disruptions caused by unexpected

political, military and terrorist events may from time to time cause dramatic

losses for the Trust, and such events can result in otherwise historically

low-risk strategies performing with unprecedented volatility and risk. Any of

these actions could also result in losses to the Trust. A subscription for Units

should be considered only by persons financially able to maintain their

investment and who can afford the loss of all or substantially all of such

investment.

Your

Investment in the Trust Could Be Illiquid

Also,

there is no secondary market for the Units and none is expected to develop.

While the Units have redemption rights, there are restrictions. For example,

redemptions can occur only at the end of a month. If a large number of

redemption requests were to be received at one time, the Trust might have to

liquidate positions to satisfy the requests. Such a forced liquidation could

adversely affect the Trust and consequently your investment.

Transfers

of interest in the Units are subject to limitations, such as 30 days' advance

written notice of any intent to transfer. Also, Campbell & Company may deny

a request to transfer if it determines that the transfer may result in adverse

legal or tax consequences for the Trust. See "Declaration of Trust and Trust

Agreement — Dispositions."

6

Over-the-Counter

Transactions are Subject to Little, if Any, Regulation

The Trust

trades forward and option contracts in foreign currencies. Such contracts are

typically traded over-the-counter through a dealer market, which is dominated by

major money center and investment banks, and is not regulated by the Commodity

Futures Trading Commission. Thus, you do not receive the protection of CFTC

regulation or the statutory scheme of the Commodity Exchange Act in connection

with this trading activity by the Trust. The market for forward and option

contracts relies upon the integrity of market participants in lieu of the

additional regulation imposed by the CFTC on participants in the futures

markets. This regulation includes, for example, trading practices and other

customer protection requirements, and minimum financial and trade reporting

requirements. The absence of regulation could expose the Trust to significant

losses in the event of trading abuses or financial failure by participants in

the forward and option markets which it might otherwise have

avoided.

Over-the-Counter

Transactions May Be Subject to the Risk of Counterparty Default

The Trust

faces the risk of non-performance by its counterparties to forward and option

contracts and such non-performance may cause some or all of its gains to remain

unrealized. Unlike in futures contracts, the counterparty to these contracts is

generally a single bank or other financial institution, rather than a clearing

organization backed by a group of financial institutions. As a result, there

will be greater counterparty credit risk in these transactions. The clearing

member, clearing organization or other counterparty may not be able to meet its

obligations, in which case, your Units could suffer significant losses on these

contracts.

Options

on Futures and Over-the-Counter Contracts are Speculative and Highly

Leveraged

Options

on futures and over-the-counter contracts may be used by the Trust to generate

premium income or capital gains. The buyer of an option risks losing the entire

purchase price (the premium as well as any commissions and fees) of the option.

The writer (seller) of an option risks losing the difference between the premium

received for the option and the price of the commodity, futures or forward

contract underlying the option which the writer must purchase or deliver upon

exercise of the option (which losses can be unlimited). Specific market

movements of the commodity, futures or forward contracts underlying an option

cannot accurately be predicted. Successful options trading requires an accurate

assessment of near-term volatility in the underlying instruments, as that

volatility is immediately reflected in the price of the option. Correct

assessment of market volatility can therefore be of much greater significance in

trading options than it is in trading futures and forwards, where volatility may

not have as great an effect on price.

An

Investment in the Trust May Not Diversify an Overall Portfolio

Historically,

alternative investments such as managed futures funds have been generally

non-correlated to the performance of other asset classes such as stocks and

bonds. Non-correlation means that there is no statistically valid relationship

between the past performance of futures, forward and option contracts

on the one hand and stocks or bonds on the other hand. Non-correlation should

not be confused with negative correlation, where the performance of two asset

classes would be exactly opposite. Because of this non-correlation, the Trust

cannot be expected to be automatically profitable during unfavorable periods for

the stock market, or vice versa. The futures, forward and option markets are

fundamentally different from the securities markets in that for every gain made

in a futures, forward or option transaction, the opposing side of that

transaction will have an equal and off-setting loss. If the Trust does not

perform in a manner non-correlated with the general financial markets or does

not perform successfully, you will obtain no diversification benefits by

investing in the Units and the Trust may have no gains to offset your losses

from other investments.

The

Current Markets are Subject to Market Disruptions That May Be a Detriment to

Your Investment

The

global financial markets have recently undergone pervasive and fundamental

disruptions which have led to extensive and unprecedented governmental

intervention. Such intervention has, in certain cases, been implemented on an

“emergency” basis, suddenly and substantially eliminating market participants’

ability to continue to implement certain strategies or manage the risk of their

outstanding positions. In addition, as one would expect given the complexities

of the financial markets and the limited time frame within which governments

have felt compelled to take action, these interventions have typically been

unclear in scope and application, resulting in confusion and uncertainty which

in itself has been materially detrimental to the efficient functioning of the

markets as well as to previously successful investment strategies. Confusion and

uncertainty have also resulted from the apparent inconsistency which has

characterized recent governmental actions. For example, while the Federal

Reserve assisted or otherwise intervened with respect to certain distressed

financial institutions, it refused to do so for others. Such inconsistency has

caused both severe losses for a number or market participants, who assumed

either no intervention or intervention consistent with past precedent, and

contributed to the general uncertainty and resulting illiquidity of the

markets.

7

The

Current Markets are Subject to Governmental Intervention That May Be a Detriment

to Your Investment

During

the second half of 2008, losses at brokers, banks and other financial sector

companies as well as extreme volatility and disruptions in the credit markets

globally led to extensive and unprecedented governmental intervention in

worldwide financial markets. Such intervention was in certain cases implemented

on an “emergency” basis, subjecting market participants without notice to a set

of regulations which were in some cases unclear in scope and in

application.

The

managing owner believes that it is possible that emergency intervention may take

place again in the future. The trading advisor also believes that the regulation

of financial markets is likely to be increased in the future. It is impossible

to predict the impact of any such intervention and/or increased regulation on

the managing owner’s ability to trade or the fulfillment of its investment

objectives.

The

Regulatory Risk Associated with Futures Contracts Could Adversely Affect the

Trust’s Operations and The Profitability of Your Investment

The CFTC

has recently proposed and invited public comment regarding a new rule to

implement position limits on energy futures contracts such as crude oil, heating

oil, natural gas, gasoline and other energy products and has solicited public

comment regarding that advisability of imposing similar limits in the metals

futures markets. We do not anticipate these limits, if accepted, will affect the

Trust’s ability to trade, but it is possible that they may in the future if the

assets under management increase dramatically.

Regulatory

Changes or Actions May Alter the Operations and Profitability of the

Trust

Considerable

regulatory attention has been focused on non-traditional investment pools. There

is a possibility of future regulatory changes altering, perhaps to a material

extent, the nature of an investment in the Trust or the ability of the Trust to

continue to implement its investment strategies.

The

futures markets are subject to comprehensive statutes, regulations and margin

requirements. In addition, the CFTC and the exchanges are authorized to take

extraordinary actions in the event of a market emergency, including, for

example, the retroactive implementation of speculative position limits or higher

margin requirements, the establishment of daily price limits and the suspension

of trading. The regulation of swaps and futures transactions in the United

States is a rapidly changing area of law and is subject to modification by

government and judicial action. The effect of any future regulatory change on

the Trust is impossible to predict, but could be substantial and

adverse.

Trading

Risks

There

are Disadvantages to Making Trading Decisions Based Primarily on Technical

Market Data

The

trading systems used by Campbell & Company for the Trust are primarily

technical. The profitability of trading under these systems depends on, among

other things, the occurrence of significant price movements, up or down, in

futures, forward and option prices. Such price movements may not develop; there

have been periods in the past without such price movements.

The

likelihood of the Units being profitable could be materially diminished during

periods when events external to the markets themselves have an important impact

on prices. During such periods, Campbell & Company's historic price analysis

could establish positions on the wrong side of the price movements caused by

such events.

Increased

Competition from Other Trend-Following Traders Could Reduce Campbell &

Company's Profitability

There has

been a dramatic increase in the volume of assets managed by trend-following

trading systems like some of the Campbell & Company programs. For example in

1980, the assets in the managed futures industry were estimated at approximately

$300 million; by the end of 2009, this estimate had risen to approximately

$213.6 billion. Increased trading competition from other trend-following traders

could operate to the detriment of the Trust. It may become more difficult for

the Trust to implement its trading strategy if other trading advisors using

technical systems are, at the same time, also attempting to initiate or

liquidate futures, forward or option positions, or otherwise alter trading

patterns.

Limits

Imposed by Futures Exchanges or Other Regulatory Organizations, Such as

Speculative Position Limits and Daily Price Fluctuation Limits, May Alter

Trading Decisions for the Trust

The CFTC

and U.S. futures exchanges have established limits, known as speculative

position limits, on the maximum net long or net short positions which any person

may hold or control in certain futures and options on futures contracts. Most

U.S. futures exchanges also have established “daily price fluctuation limits”

which preclude the execution of trades at prices outside of the limit. Contract

prices have occasionally moved the daily limit for several consecutive days with

little or no trading. All accounts controlled by Campbell &

Company, including the account of the Trust, are combined for speculative

position limit purposes. If positions in those accounts were to approach the

level of the particular speculative position limit, or if prices were to

approach the level of the daily limit, such limits could cause a modification of

Campbell & Company's trading decisions for the Trust or force liquidation of

certain futures or options on futures positions. Either of these actions may not

be in the best interest of the investors. From time to time, the CFTC or the

exchanges may suspend trading in market disruption circumstances. In these

cases, it is possible that Campbell & Company, as trading advisor, could be

required to maintain a losing position that it otherwise would exit and incur

significant losses or be unable to establish a position and miss a profit

opportunity.

8

Increase

in Assets Under Management May Make Profitable Trading More

Difficult

Campbell

& Company has not agreed to limit the amount of additional equity which it

may manage, and is actively engaged in raising assets for existing and new

accounts. Should the amount of equity that Campbell & Company manages

increase, it may be more difficult for Campbell & Company to trade

profitably because of the difficulty of trading larger positions without

adversely affecting prices and performance. Accordingly, such increases in

equity under management may require Campbell & Company to modify its trading

decisions for the Trust which could have a detrimental effect on your

investment. Such considerations may also cause Campbell & Company to

eliminate smaller markets from consideration for inclusion in its Financial,

Metal & Energy Large Portfolio, reducing the range of markets in which

trading opportunities may be pursued. Campbell & Company reserves the right

to make distributions of profits to Unitholders in an effort to control asset

growth. In addition, Campbell & Company may have an incentive to favor other

accounts because the compensation received from some other accounts does exceed

the compensation it receives from managing the Trust's account. Because records

with respect to other accounts are not accessible to Unitholders in the Trust,

the Unitholders will not be able to determine if Campbell & Company is

favoring other accounts. See “Campbell & Company, Inc. – Trading

Capacity.”

Investors

Will Not Be Able to Review the Trust's Holdings on a Daily Basis

Campbell

& Company makes the Trust's trading decisions. While Campbell & Company

receives daily trade confirmations from the futures broker and over-the-counter

counterparty, the Trust's trading results are reported to Unitholders monthly.

Accordingly, an investment in the Trust does not offer Unitholders the same

transparency, i.e., an

ability to review all investment positions daily, that a personal trading

account offers.

Other

Risks

Fees

and Commissions are Charged Regardless of Profitability and are Subject to

Change

The Trust is subject to substantial

charges payable irrespective of profitability, in addition to performance fees

which are payable based on the Trust’s profitability. Included in these charges

are brokerage fees and operating expenses. On the Trust’s forward and option

trading, “bid-ask” spreads and prime brokerage fees are incorporated into the

pricing of the Trust’s forward and option contracts by the counterparties in

addition to the brokerage fees paid by the Trust. It is not possible to quantify

the “bid-ask” spreads paid by the Trust because the Trust cannot determine the

profit its counterparty is making on the forward and option transactions. Such

spreads can at times be significant. In addition, while currently not

contemplated, the Trust Agreement allows for changes to be made to the brokerage

fee and performance fee upon sixty days’ notice to the Unitholders.

The

Trust’s Service Providers Could Fail

The

institutions with which the Trust trades or invests may encounter financial

difficulties that impair the operational capabilities or the capital position of

the Trust. The futures broker is generally required by U.S. law to segregate all

funds received from such broker’s customers from such broker’s proprietary

assets. If the futures broker fails to do so to the full extent required by law,

the assets of the Trust might not be fully protected in the event of the

bankruptcy of the futures broker. Furthermore, in the event of the futures

broker’s bankruptcy, the Trust could lose the entire amount, or be limited to

recovering only a pro

rata share of all available funds segregated on behalf of the futures

broker’s combined customer accounts, even though certain property specifically

traceable to the Trust (for example, Treasury bills deposited by the Trust with

the futures broker as margin) was held by the futures broker. Furthermore,

dealers in forward and option contracts are not regulated by the Commodity

Exchange Act and are not obligated to segregate customer assets. The futures

broker has been the subject of regulatory and private causes of action, as

described under “The Futures Broker.”

9

Although

the managing owner regularly monitors the financial condition of the

counterparties it uses, if the Trust’s counterparties were to become insolvent

or the subject of liquidation proceedings in the United States (either under the

Securities Investor Protection Act of the United States Bankruptcy Code), there

exists the risk that the recovery of the Trust’s assets from such counterparty

will be delayed or be a value less than the value of the assets originally

entrusted to such counterparty.

Inadequate

Models Could Negatively Affect the Trust’s Portfolio

Campbell

& Company’s trading is highly model driven, and is materially subject to

possible flaws in the models. As market dynamics (for example, due to changed

market conditions and participants) shift over time, a previously highly

successful model often becomes outdated or inaccurate, sometimes without

Campbell & Company recognizing that fact before substantial losses are

incurred. In particular, the Trust may incur major losses in the event of

disrupted markets and other extraordinary events that cause Campbell &

Company’s pricing models to generate prices which deviate from the market. The

risk of loss to the Trust in the case of disrupted markets is compounded by the

number of different investment models of pricing, each of which may

independently become wholly unpredictable during market disruptions. In

addition, in disrupted derivatives markets, many positions may become illiquid,

making it difficult or impossible to close out positions against which the

markets are moving. There can be no assurance that Campbell & Company will

be successful in continuing to develop and maintain effective quantitative

models.

Investors

Must Not Rely on the Past Performance of Either Campbell & Company or the

Trust in Deciding Whether to Buy Units

The

future performance of the Trust is not predictable, and no assurance can be

given that the Trust and Campbell & Company will perform successfully in the

future in as much as past performance is not necessarily indicative of future

results. The trading advisor’s trading systems are continually evolving and the

fact that the Trust and the trading advisor may have traded successfully in the

past does not mean that they will do so in the future. Additionally, the markets

in which the Trust operates have been severely disrupted over the past year or

more, so results observed in earlier periods may have little relevance to the

results observable in the current environment.

The past

performance of the Trust may not be construed as an indication of the future

results. The personnel of Campbell & Company responsible for managing the

investment portfolio have substantial experience in managing investments and

private investment funds and have provided and continue to provide advisory and

management services to clients and private and registered investment

funds.

Parties

to the Trust Have Conflicts of Interest

Campbell

& Company has not established any formal procedures to resolve the following

conflicts of interest. Consequently, there is no independent control over how

Campbell & Company resolves these conflicts which can be relied

upon by investors as ensuring that the Trust is treated equitably with other

Campbell & Company clients.

Campbell

& Company has a conflict of interest because it acts as the managing owner

and sole trading advisor for the Trust.

Since

Campbell & Company acts as both trading advisor and managing owner for the

Trust, it is very unlikely that its advisory contract will be terminated by the

Trust. The fees payable to Campbell & Company were established by it and

were not the subject of arm's-length negotiation. These fees consist of up to a

3.5% brokerage fee (of which 2.5% is retained) and a 20% performance fee.

Campbell & Company, as managing owner, determines whether or not

distributions are made and it receives increased fees to the extent

distributions are not made. Campbell & Company has the authority to make

such distributions at any time in its sole discretion.

Other

conflicts are also present in the operation of the Trust. See "Conflicts of

Interest."

There

Are No Independent Experts Representing Investors

Campbell

& Company has consulted with counsel, accountants and other experts

regarding the formation and operation of the Trust. No counsel has been

appointed to represent the Unitholders in connection with the offering of the

Units. Accordingly, each prospective investor should consult his own legal, tax

and financial advisers regarding the desirability of an investment in the

Trust.

The